|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

||

|

x

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the fiscal year ended October 31, 2017

|

|

or

|

||

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the transition period from to

|

|

Delaware

|

|

77-0518772

|

|

State or other jurisdiction of

Incorporation or organization

|

|

I.R.S. Employer

Identification No.

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock

par value $0.01 per share

|

|

New York Stock Exchange

|

|

Large accelerated filer

x

|

|

Accelerated filer

¨

|

|

Smaller reporting company

¨

|

|

Emerging growth company

¨

|

|

Non-accelerated filer

¨

(Do not check if a smaller reporting company)

|

|

|

||||

|

Document Description

|

|

10-K Part

|

|

Portions of the Proxy Statement for the Annual Meeting of Stockholders (the "Proxy Statement") to be held on March 21, 2018, and to be filed pursuant to Regulation 14A within 120 days after registrant's fiscal year ended October 31, 2017 are incorporated by reference into Part III of this Report

|

|

III

|

|

|

|

Page

|

|

•

|

properly identify customer needs and predict future needs;

|

|

•

|

innovate and develop new technologies, services and applications;

|

|

•

|

appropriately allocate our research and development spending to products and services with higher growth prospects;

|

|

•

|

successfully commercialize new technologies in a timely manner;

|

|

•

|

manufacture and deliver new products in sufficient volumes and on time;

|

|

•

|

differentiate our offerings from our competitors' offerings;

|

|

•

|

price our products competitively;

|

|

•

|

anticipate our competitors' development of new products, services or technological innovations; and

|

|

•

|

control product quality in our manufacturing process.

|

|

•

|

reduced demand for our products, delays in the shipment of orders, or increases in order cancellations;

|

|

•

|

increased risk of excess and obsolete inventories;

|

|

•

|

increased price pressure for our products and services; and

|

|

•

|

greater risk of impairment to the value, and a detriment to the liquidity, of our investment portfolio.

|

|

•

|

interruption to transportation flows for delivery of parts to us and finished goods to our customers;

|

|

•

|

changes in a specific country's or region's political, economic or other conditions;

|

|

•

|

trade protection measures and import or export licensing requirements;

|

|

•

|

negative consequences from changes in tax laws;

|

|

•

|

difficulty in staffing and managing widespread operations;

|

|

•

|

differing labor regulations;

|

|

•

|

differing protection of intellectual property;

|

|

•

|

unexpected changes in regulatory requirements; and

|

|

•

|

geopolitical uncertainty or turmoil, including terrorism and war.

|

|

•

|

increasing our vulnerability to downturns in our business, to competitive pressures and to adverse economic and industry conditions;

|

|

•

|

requiring the dedication of an increased portion of our expected cash flows from operations to service our indebtedness, thereby reducing the amount of expected cash flows available for other purposes, including capital expenditures, acquisitions, stock repurchases and dividends; and

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business and our industry.

|

|

Fiscal 2016

|

High

|

Low

|

Dividends

|

|||||||||

|

First Quarter (ended January 31, 2016)

|

$

|

42.48

|

|

$

|

36.01

|

|

$

|

0.115

|

|

|||

|

Second Quarter (ended April 30, 2016)

|

$

|

42.00

|

|

$

|

34.15

|

|

$

|

0.115

|

|

|||

|

Third Quarter (ended July 31, 2016)

|

$

|

48.18

|

|

$

|

40.39

|

|

$

|

0.115

|

|

|||

|

Fourth Quarter (ended October 31, 2016)

|

$

|

48.63

|

|

$

|

43.11

|

|

$

|

0.115

|

|

|||

|

Fiscal 2017

|

High

|

Low

|

Dividends

|

|||||||||

|

First Quarter (ended January 31, 2017)

|

$

|

49.48

|

|

$

|

42.92

|

|

$

|

0.132

|

|

|||

|

Second Quarter (ended April 30, 2017)

|

$

|

55.51

|

|

$

|

48.47

|

|

$

|

0.132

|

|

|||

|

Third Quarter (ended July 31, 2017)

|

$

|

61.84

|

|

$

|

55.36

|

|

$

|

0.132

|

|

|||

|

Fourth Quarter (ended October 31, 2017)

|

$

|

68.52

|

|

$

|

58.22

|

|

$

|

0.132

|

|

|||

|

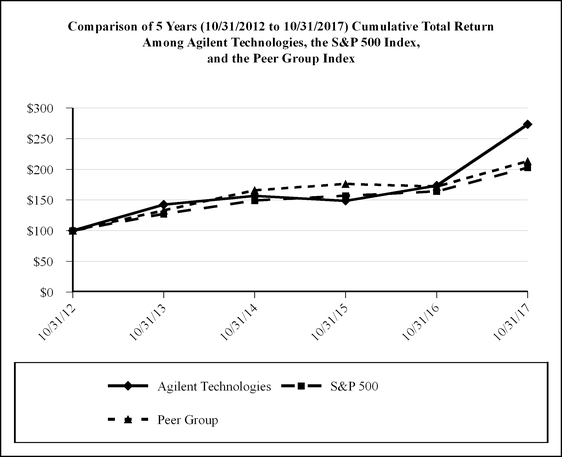

INDEXED RETURNS

|

|||||||||||

|

Base

|

Years Ending

|

||||||||||

|

Period

|

|||||||||||

|

Company Name / Index

|

10/31/2012

|

10/31/2013

|

|

10/31/2014

|

|

10/31/2015

|

|

10/31/2016

|

|

10/31/2017

|

|

|

Agilent Technologies

|

100

|

142.52

|

|

156.67

|

|

148.68

|

|

173.38

|

|

273.31

|

|

|

S&P 500

|

100

|

127.18

|

|

149.14

|

|

156.89

|

|

163.97

|

|

202.72

|

|

|

Peer Group

|

100

|

133.00

|

|

165.85

|

|

176.13

|

|

171.91

|

|

213.11

|

|

|

Period

|

Total Number of

Shares of Common

Stock Purchased(1)

|

Weighted Average

Price Paid per Share of

Common Stock(2)

|

Total

Number of

Shares of Common

Stock Purchased as

Part of Publicly

Announced Plans or

Programs(1)

|

Maximum

Approximate Dollar

Value of Shares of

Common Stock that

May Yet Be

Purchased Under the

Plans or Programs

(in millions)(1)

|

||||||||||

|

|

||||||||||||||

|

Aug. 1, 2017 through

Aug. 31, 2017 |

—

|

|

—

|

|

—

|

|

$

|

610

|

|

|||||

|

Sep. 1, 2017 through

Sep. 30, 2017 |

—

|

|

—

|

|

—

|

|

$

|

610

|

|

|||||

|

Oct. 1, 2017 through

Oct. 31, 2017 |

—

|

|

$

|

—

|

|

—

|

|

$

|

610

|

|

||||

|

Total

|

—

|

|

$

|

—

|

|

—

|

|

|

|

|||||

|

(1)

|

On May 28, 2015, we announced that our board of directors had approved a new share repurchase program (the "2015 repurchase program"). The 2015 repurchase program authorizes the purchase of up to $1.14 billion of our common stock through and including November 1, 2018. The 2015 repurchase program does not require the company to acquire a specific number of shares and may be suspended or discontinued at any time. As of October 31, 2017, all repurchased shares have been retired.

|

|

(2)

|

The weighted average price paid per share of common stock does not include the cost of commissions.

|

|

|

Years Ended October 31,

|

||||||||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||

|

|

(in millions, except per share data)

|

||||||||||||||||||

|

Consolidated Statement of Operations Data:

|

|||||||||||||||||||

|

Net revenue

|

$

|

4,472

|

|

$

|

4,202

|

|

$

|

4,038

|

|

$

|

4,048

|

|

$

|

3,894

|

|

||||

|

Income from continuing operations before taxes

|

$

|

803

|

|

$

|

544

|

|

$

|

480

|

|

$

|

229

|

|

$

|

293

|

|

||||

|

Income from continuing operations

|

$

|

684

|

|

$

|

462

|

|

$

|

438

|

|

$

|

232

|

|

$

|

225

|

|

||||

|

Income (loss) from discontinued operations, net of taxes

|

$

|

—

|

|

$

|

—

|

|

$

|

(37

|

)

|

$

|

317

|

|

$

|

509

|

|

||||

|

Net income

|

$

|

684

|

|

$

|

462

|

|

$

|

401

|

|

$

|

549

|

|

$

|

734

|

|

||||

|

Net income per share — basic:

|

|||||||||||||||||||

|

Income from continuing operations

|

$

|

2.12

|

|

$

|

1.42

|

|

$

|

1.32

|

|

$

|

0.70

|

|

$

|

0.66

|

|

||||

|

Income (loss) from discontinued operations, net of taxes

|

—

|

|

—

|

|

(0.12

|

)

|

0.95

|

|

1.49

|

|

|||||||||

|

Net income per share - basic

|

$

|

2.12

|

|

$

|

1.42

|

|

$

|

1.20

|

|

$

|

1.65

|

|

$

|

2.15

|

|

||||

|

Net income per share — diluted:

|

|||||||||||||||||||

|

Income from continuing operations

|

$

|

2.10

|

|

$

|

1.40

|

|

$

|

1.31

|

|

$

|

0.69

|

|

$

|

0.65

|

|

||||

|

Income (loss) from discontinued operations, net of taxes

|

—

|

|

—

|

|

(0.11

|

)

|

0.93

|

|

1.48

|

|

|||||||||

|

Net income per share - diluted

|

$

|

2.10

|

|

$

|

1.40

|

|

$

|

1.20

|

|

$

|

1.62

|

|

$

|

2.13

|

|

||||

|

Weighted average shares used in computing basic net income per share

|

322

|

|

326

|

|

333

|

|

333

|

|

341

|

|

|||||||||

|

Weighted average shares used in computing diluted net income per share

|

326

|

|

329

|

|

335

|

|

338

|

|

345

|

|

|||||||||

|

Cash dividends declared per common share

|

$

|

0.528

|

|

$

|

0.460

|

|

0.400

|

|

$

|

0.528

|

|

$

|

0.460

|

|

|||||

|

|

October 31,

|

||||||||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||

|

|

(in millions)

|

||||||||||||||||||

|

Consolidated Balance Sheet Data:

|

(1)

|

(1)

|

|||||||||||||||||

|

Cash and cash equivalents

|

$

|

2,678

|

|

$

|

2,289

|

|

$

|

2,003

|

|

$

|

2,218

|

|

$

|

2,675

|

|

||||

|

Working capital

|

$

|

2,906

|

|

$

|

2,690

|

|

$

|

2,710

|

|

$

|

3,817

|

|

$

|

3,392

|

|

||||

|

Total assets

|

$

|

8,426

|

|

$

|

7,794

|

|

$

|

7,479

|

|

$

|

10,815

|

|

$

|

10,608

|

|

||||

|

Long-term debt

|

$

|

1,801

|

|

$

|

1,904

|

|

$

|

1,655

|

|

$

|

1,663

|

|

$

|

2,699

|

|

||||

|

Stockholders' equity

|

$

|

4,831

|

|

$

|

4,243

|

|

$

|

4,167

|

|

$

|

5,301

|

|

$

|

5,297

|

|

||||

|

(1) The above consolidated balance sheet includes Keysight which is presented as a discontinued operation until October 31, 2014.

|

|||||||||||||||||||

|

|

Years Ended October 31,

|

2017 over 2016

% Change |

2016 over 2015 % Change

|

||||||||||||

|

|

2017

|

2016

|

2015

|

||||||||||||

|

|

(in millions)

|

|

|

||||||||||||

|

Net revenue:

|

|

|

|

|

|

||||||||||

|

Products

|

$

|

3,410

|

|

$

|

3,227

|

|

$

|

3,146

|

|

6%

|

3%

|

||||

|

Services and other

|

$

|

1,062

|

|

$

|

975

|

|

$

|

892

|

|

9%

|

9%

|

||||

|

Total net revenue

|

$

|

4,472

|

|

$

|

4,202

|

|

$

|

4,038

|

|

6%

|

4%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

ppts Change |

2016 over 2015

ppts Change |

|||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

% of total net revenue:

|

|

|

|

|

|

|||||||

|

Products

|

76

|

%

|

77

|

%

|

78

|

%

|

(1) ppt

|

(1) ppt

|

||||

|

Services and other

|

24

|

%

|

23

|

%

|

22

|

%

|

1 ppt

|

1 ppt

|

||||

|

Total

|

100

|

%

|

100

|

%

|

100

|

%

|

|

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

% Change |

2016 over 2015 % Change

|

||||||||||||

|

|

2017

|

2016

|

2015

|

||||||||||||

|

|

(in millions)

|

|

|

||||||||||||

|

Net revenue by segment:

|

|

|

|

|

|

||||||||||

|

Life sciences and applied markets

|

$

|

2,169

|

|

$

|

2,073

|

|

$

|

2,046

|

|

5%

|

1%

|

||||

|

Diagnostics and genomics

|

$

|

772

|

|

$

|

709

|

|

$

|

662

|

|

9%

|

7%

|

||||

|

Agilent CrossLab

|

$

|

1,531

|

|

$

|

1,420

|

|

$

|

1,330

|

|

8%

|

7%

|

||||

|

Total net revenue

|

$

|

4,472

|

|

$

|

4,202

|

|

$

|

4,038

|

|

6%

|

4%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

|||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Gross margin on products

|

56.9

|

%

|

54.6

|

%

|

52.5

|

%

|

2 ppts

|

2 ppts

|

||||

|

Gross margin on services and other

|

44.1

|

%

|

44.5

|

%

|

43.8

|

%

|

—

|

1 ppt

|

||||

|

Total gross margin

|

53.9

|

%

|

52.3

|

%

|

50.5

|

%

|

2 ppts

|

2 ppts

|

||||

|

Operating margin

|

18.8

|

%

|

14.6

|

%

|

12.9

|

%

|

4 ppts

|

2 ppts

|

||||

|

(in millions)

|

|

|

|

|

|

||||||||||

|

Research and development

|

$

|

339

|

|

$

|

329

|

|

$

|

330

|

|

3%

|

—

|

||||

|

Selling, general and administrative

|

$

|

1,229

|

|

$

|

1,253

|

|

$

|

1,189

|

|

(2)%

|

5%

|

||||

|

|

Years Ended October 31,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

|

(in millions)

|

||||||||||

|

Provision for income taxes

|

$

|

119

|

|

$

|

82

|

|

$

|

42

|

|

||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

||||||||||||

|

|

2017

|

2016

|

2015

|

||||||||||||

|

|

(in millions)

|

|

|

||||||||||||

|

Net revenue

|

$

|

2,169

|

|

$

|

2,073

|

|

$

|

2,046

|

|

5%

|

1%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

|||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Total gross margin

|

60.1

|

%

|

58.6

|

%

|

56.2

|

%

|

2 ppts

|

2 ppts

|

||||

|

Operating margin

|

22.5

|

%

|

20.7

|

%

|

18.6

|

%

|

2 ppts

|

2 ppts

|

||||

|

(in millions)

|

|

|

|

|

|

||||||||||

|

Research and development

|

$

|

206

|

|

$

|

195

|

|

$

|

192

|

|

6%

|

2%

|

||||

|

Selling, general and administrative

|

$

|

610

|

|

$

|

590

|

|

$

|

576

|

|

3%

|

2%

|

||||

|

Income from operations

|

$

|

487

|

|

$

|

429

|

|

$

|

380

|

|

13%

|

13%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

||||||||||||

|

|

2017

|

2016

|

2015

|

||||||||||||

|

|

(in millions)

|

|

|

||||||||||||

|

Net revenue

|

$

|

772

|

|

$

|

709

|

|

$

|

662

|

|

9%

|

7%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

|||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Total gross margin

|

55.1

|

%

|

54.6

|

%

|

54.4

|

%

|

1 ppt

|

—

|

||||

|

Operating margin

|

19.3

|

%

|

16.0

|

%

|

13.3

|

%

|

3 ppts

|

3 ppts

|

||||

|

(in millions)

|

|

|

|

|

|

||||||||||

|

Research and development

|

$

|

84

|

|

$

|

83

|

|

$

|

78

|

|

1%

|

6%

|

||||

|

Selling, general and administrative

|

$

|

193

|

|

$

|

190

|

|

$

|

195

|

|

1%

|

(2)%

|

||||

|

Income from operations

|

$

|

149

|

|

$

|

114

|

|

$

|

88

|

|

31%

|

29%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

||||||||||||

|

|

2017

|

2016

|

2015

|

||||||||||||

|

|

(in millions)

|

|

|

||||||||||||

|

Total net revenue

|

$

|

1,531

|

|

$

|

1,420

|

|

$

|

1,330

|

|

8%

|

7%

|

||||

|

|

Years Ended October 31,

|

2017 over 2016

Change |

2016 over 2015

Change |

|||||||||

|

|

2017

|

2016

|

2015

|

|||||||||

|

Total gross margin

|

49.5

|

%

|

49.4

|

%

|

49.6

|

%

|

—

|

—

|

||||

|

Operating margin

|

22.1

|

%

|

22.3

|

%

|

22.5

|

%

|

—

|

—

|

||||

|

(in millions)

|

|

|

|

|

|

||||||||||

|

Research and development

|

$

|

49

|

|

$

|

46

|

|

$

|

46

|

|

7%

|

—

|

||||

|

Selling, general and administrative

|

$

|

370

|

|

$

|

339

|

|

$

|

315

|

|

9%

|

7%

|

||||

|

Income from operations

|

$

|

338

|

|

$

|

316

|

|

$

|

299

|

|

7%

|

6%

|

||||

|

Less than one

year

|

One to three years

|

Three to five years

|

More than five years

|

||||||||||||

|

Operating leases

|

$

|

42

|

|

$

|

52

|

|

$

|

16

|

|

$

|

26

|

|

|||

|

Commitments to contract manufacturers and suppliers

|

384

|

|

4

|

|

—

|

|

—

|

|

|||||||

|

Other purchase commitments

|

40

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Retirement plans

|

22

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Transitional pension contributions to our U.S. 401(k) plan

|

$

|

8

|

|

$

|

15

|

|

$

|

12

|

|

$

|

—

|

|

|||

|

Total

|

$

|

496

|

|

$

|

71

|

|

$

|

28

|

|

$

|

26

|

|

|||

|

Less than one

year

|

One to three years

|

Three to five years

|

More than five years

|

||||||||||||

|

Senior notes

|

$

|

100

|

|

$

|

500

|

|

$

|

400

|

|

$

|

900

|

|

|||

|

Credit facility

(1)

|

110

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Interest expense

|

74

|

|

141

|

|

90

|

|

61

|

|

|||||||

|

Total

|

$

|

284

|

|

$

|

641

|

|

$

|

490

|

|

$

|

961

|

|

|||

|

Index to Consolidated Financial Statements

|

Page

|

|

|

|

||

|

Consolidated Financial Statements:

|

|

|

|

/s/ PRICEWATERHOUSECOOPERS LLP

|

|

|

San Jose, California

|

|

|

December 21, 2017

|

|

|

|

Years Ended October 31,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

|

(in millions, except per

share data)

|

||||||||||

|

Net revenue:

|

|

|

|

||||||||

|

Products

|

$

|

3,410

|

|

$

|

3,227

|

|

$

|

3,146

|

|

||

|

Services and other

|

1,062

|

|

975

|

|

892

|

|

|||||

|

Total net revenue

|

4,472

|

|

4,202

|

|

4,038

|

|

|||||

|

Costs and expenses:

|

|

|

|

||||||||

|

Cost of products

|

1,469

|

|

1,464

|

|

1,496

|

|

|||||

|

Cost of services and other

|

594

|

|

541

|

|

501

|

|

|||||

|

Total costs

|

2,063

|

|

2,005

|

|

1,997

|

|

|||||

|

Research and development

|

339

|

|

329

|

|

330

|

|

|||||

|

Selling, general and administrative

|

1,229

|

|

1,253

|

|

1,189

|

|

|||||

|

Total costs and expenses

|

3,631

|

|

3,587

|

|

3,516

|

|

|||||

|

Income from operations

|

841

|

|

615

|

|

522

|

|

|||||

|

Interest income

|

22

|

|

11

|

|

7

|

|

|||||

|

Interest expense

|

(79

|

)

|

(72

|

)

|

(66

|

)

|

|||||

|

Other income (expense), net

|

19

|

|

(10

|

)

|

17

|

|

|||||

|

Income from continuing operations before taxes

|

803

|

|

544

|

|

480

|

|

|||||

|

Provision for income taxes

|

119

|

|

82

|

|

42

|

|

|||||

|

Income from continuing operations

|

684

|

|

462

|

|

438

|

|

|||||

|

Loss from discontinued operations, net of tax benefit of $0, $0, and $2

|

$

|

—

|

|

$

|

—

|

|

$

|

(37

|

)

|

||

|

Net income

|

$

|

684

|

|

$

|

462

|

|

$

|

401

|

|

||

|

Net income per share - basic:

|

|

|

|

||||||||

|

Income from continuing operations

|

$

|

2.12

|

|

$

|

1.42

|

|

$

|

1.32

|

|

||

|

Loss from discontinued operations

|

—

|

|

—

|

|

(0.12

|

)

|

|||||

|

Net income per share - basic

|

$

|

2.12

|

|

$

|

1.42

|

|

$

|

1.20

|

|

||

|

Net income per share - diluted:

|

|||||||||||

|

Income from continuing operations

|

$

|

2.10

|

|

$

|

1.40

|

|

$

|

1.31

|

|

||

|

Loss from discontinued operations

|

—

|

|

—

|

|

(0.11

|

)

|

|||||

|

Net income per share - diluted

|

$

|

2.10

|

|

$

|

1.40

|

|

$

|

1.20

|

|

||

|

Weighted average shares used in computing net income per share:

|

|

|

|

||||||||

|

Basic

|

322

|

|

326

|

|

333

|

|

|||||

|

Diluted

|

326

|

|

329

|

|

335

|

|

|||||

|

Cash dividends declared per common share

|

$

|

0.528

|

|

$

|

0.460

|

|

$

|

0.400

|

|

||

|

Years Ended October 31,

|

|||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

Net income

|

$

|

684

|

|

$

|

462

|

|

$

|

401

|

|

||

|

Other comprehensive income (loss):

|

|

|

|

||||||||

|

Gain (loss) on derivative instruments, net of tax expense (benefit) of $0, $(4) and $3

|

—

|

|

(6

|

)

|

8

|

|

|||||

|

Amounts reclassified into earnings related to derivative instruments, net of tax expense (benefit) of $0, $0 and $(6)

|

(1

|

)

|

3

|

|

(12

|

)

|

|||||

|

Foreign currency translation, net of tax expense (benefit) of $3, $3 and $(24)

|

41

|

|

(8

|

)

|

(336

|

)

|

|||||

|

Net defined benefit pension cost and post retirement plan costs:

|

|

|

|

||||||||

|

Change in actuarial net loss, net of tax expense (benefit) of $52, $(42), and $(17)

|

123

|

|

(86

|

)

|

(38

|

)

|

|||||

|

Change in net prior service benefit, net of tax benefit of $(3), $(8), and $(6)

|

(6

|

)

|

(15

|

)

|

(11

|

)

|

|||||

|

Other comprehensive income (loss)

|

157

|

|

(112

|

)

|

(389

|

)

|

|||||

|

Total comprehensive income

|

$

|

841

|

|

$

|

350

|

|

$

|

12

|

|

||

|

|

October 31,

|

||||||

|

|

2017

|

2016

|

|||||

|

|

(in millions, except

par value and

share data)

|

||||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

2,678

|

|

$

|

2,289

|

|

|

|

Accounts receivable, net

|

724

|

|

631

|

|

|||

|

Inventory

|

575

|

|

533

|

|

|||

|

Other current assets

|

192

|

|

182

|

|

|||

|

Total current assets

|

4,169

|

|

3,635

|

|

|||

|

Property, plant and equipment, net

|

757

|

|

639

|

|

|||

|

Goodwill

|

2,607

|

|

2,517

|

|

|||

|

Other intangible assets, net

|

361

|

|

416

|

|

|||

|

Long-term investments

|

138

|

|

135

|

|

|||

|

Other assets

|

394

|

|

452

|

|

|||

|

Total assets

|

$

|

8,426

|

|

$

|

7,794

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|||||

|

Current liabilities:

|

|

|

|||||

|

Accounts payable

|

$

|

305

|

|

$

|

257

|

|

|

|

Employee compensation and benefits

|

276

|

|

235

|

|

|||

|

Deferred revenue

|

291

|

|

269

|

|

|||

|

Short-term debt

|

210

|

|

—

|

|

|||

|

Other accrued liabilities

|

181

|

|

184

|

|

|||

|

Total current liabilities

|

1,263

|

|

945

|

|

|||

|

Long-term debt

|

1,801

|

|

1,904

|

|

|||

|

Retirement and post-retirement benefits

|

234

|

|

360

|

|

|||

|

Other long-term liabilities

|

293

|

|

339

|

|

|||

|

Total liabilities

|

3,591

|

|

3,548

|

|

|||

|

Commitments and contingencies (Note 15)

|

|

|

|

|

|||

|

Total equity:

|

|

|

|||||

|

Stockholders' equity:

|

|

|

|||||

|

Preferred stock; $0.01 par value; 125 million shares authorized; none issued and outstanding

|

—

|

|

—

|

|

|||

|

Common stock; $0.01 par value; 2 billion shares authorized; 322 million shares at October 31, 2017 and 614 million shares at October 31, 2016 issued

|

3

|

|

6

|

|

|||

|

Treasury stock at cost; zero shares at October 31, 2017 and 290 million shares at October 31, 2016

|

—

|

|

(10,508

|

)

|

|||

|

Additional paid-in-capital

|

5,300

|

|

9,159

|

|

|||

|

Retained earnings (accumulated deficit)

|

(126

|

)

|

6,089

|

|

|||

|

Accumulated other comprehensive loss

|

(346

|

)

|

(503

|

)

|

|||

|

Total stockholders' equity

|

4,831

|

|

4,243

|

|

|||

|

Non-controlling interest

|

4

|

|

3

|

|

|||

|

Total equity

|

4,835

|

|

4,246

|

|

|||

|

Total liabilities and equity

|

$

|

8,426

|

|

$

|

7,794

|

|

|

|

|

Years Ended October 31,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

|

(in millions)

|

||||||||||

|

Cash flows from operating activities:

|

|

|

|

||||||||

|

Net income

|

$

|

684

|

|

$

|

462

|

|

$

|

401

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

||||||||

|

Depreciation and amortization

|

212

|

|

246

|

|

253

|

|

|||||

|

Share-based compensation

|

60

|

|

58

|

|

54

|

|

|||||

|

Deferred taxes

|

102

|

|

3

|

|

70

|

|

|||||

|

Excess and obsolete inventory related charges

|

24

|

|

20

|

|

30

|

|

|||||

|

Asset impairment charges

|

—

|

|

4

|

|

3

|

|

|||||

|

Impairment of equity method investment and loans

|

—

|

|

25

|

|

—

|

|

|||||

|

Other

|

7

|

|

15

|

|

16

|

|

|||||

|

Changes in assets and liabilities:

|

|||||||||||

|

Accounts receivable, net

|

(81

|

)

|

(33

|

)

|

(24

|

)

|

|||||

|

Inventory

|

(61

|

)

|

(7

|

)

|

(24

|

)

|

|||||

|

Accounts payable

|

2

|

|

(15

|

)

|

(26

|

)

|

|||||

|

Employee compensation and benefits

|

38

|

|

15

|

|

8

|

|

|||||

|

Interest rate swap payments

|

—

|

|

(10

|

)

|

—

|

|

|||||

|

Other assets and liabilities

|

(98

|

)

|

10

|

|

(249

|

)

|

|||||

|

Net cash provided by operating activities

|

889

|

|

793

|

|

512

|

|

|||||

|

Cash flows from investing activities:

|

|

|

|

||||||||

|

Investments in property, plant and equipment

|

(176

|

)

|

(139

|

)

|

(98

|

)

|

|||||

|

Proceeds from the sale of property, plant and equipment

|

—

|

|

—

|

|

12

|

|

|||||

|

Proceeds from the sale of investment securities

|

—

|

|

1

|

|

—

|

|

|||||

|

Proceeds from divestitures

|

2

|

|

—

|

|

3

|

|

|||||

|

Payment to acquire cost method investment

|

(1

|

)

|

(80

|

)

|

—

|

|

|||||

|

Payment to acquire equity method investment

|

—

|

|

—

|

|

(1

|

)

|

|||||

|

Payment in exchange for convertible note

|

(1

|

)

|

(1

|

)

|

(2

|

)

|

|||||

|

Loan to equity method investment

|

—

|

|

(3

|

)

|

—

|

|

|||||

|

Change in restricted cash, cash equivalents and investments, net

|

(1

|

)

|

245

|

|

(240

|

)

|

|||||

|

Acquisitions of businesses and intangible assets, net of cash acquired

|

(128

|

)

|

(261

|

)

|

(74

|

)

|

|||||

|

Net cash used in investing activities

|

(305

|

)

|

(238

|

)

|

(400

|

)

|

|||||

|

Cash flows from financing activities:

|

|

|

|

||||||||

|

Issuance of common stock under employee stock plans

|

66

|

|

62

|

|

58

|

|

|||||

|

Payment of taxes related to net share settlement of equity awards

|

(14

|

)

|

(6

|

)

|

(13

|

)

|

|||||

|

Treasury stock repurchases

|

(194

|

)

|

(434

|

)

|

(267

|

)

|

|||||

|

Payment of dividends

|

(170

|

)

|

(150

|

)

|

(133

|

)

|

|||||

|

Issuance of senior notes

|

—

|

|

299

|

|

—

|

|

|||||

|

Debt issuance costs

|

—

|

|

(2

|

)

|

—

|

|

|||||

|

Proceeds from debts and credit facility

|

400

|

|

255

|

|

—

|

|

|||||

|

Repayment of debts and credit facility

|

(290

|

)

|

(292

|

)

|

—

|

|

|||||

|

Net transfer of cash and cash equivalents to Keysight

|

—

|

|

—

|

|

(734

|

)

|

|||||

|

Net cash used in financing activities

|

(202

|

)

|

(268

|

)

|

(1,089

|

)

|

|||||

|

Effect of exchange rate movements

|

7

|

|

(1

|

)

|

(48

|

)

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

389

|

|

286

|

|

(1,025

|

)

|

|||||

|

Change in cash and cash equivalents within current assets of discontinued operations

|

—

|

|

—

|

|

810

|

|

|||||

|

Cash and cash equivalents at beginning of year

|

2,289

|

|

2,003

|

|

2,218

|

|

|||||

|

Cash and cash equivalents at end of year

|

$

|

2,678

|

|

$

|

2,289

|

|

$

|

2,003

|

|

||

|

Supplemental cash flow information:

|

|||||||||||

|

Income tax payments, net

|

$

|

63

|

|

$

|

67

|

|

$

|

129

|

|

||

|

Interest payments

|

$

|

82

|

|

$

|

73

|

|

$

|

71

|

|

||

|

|

Common Stock

|

Treasury Stock

|

|

Accumulated

Other

Comprehensive

Income/(Loss)

|

|

|

|

||||||||||||||||||||||||||||||

|

|

Number

of

Shares

|

Par

Value

|

Additional

Paid-in

Capital

|

Number

of

Shares

|

Treasury

Stock at

Cost

|

Retained

Earnings

(Accumulated Deficit)

|

Total Stockholders' Equity

|

Non-

Controlling

Interest

|

Total

Equity

|

||||||||||||||||||||||||||||

|

|

(in millions, except number of shares in thousands)

|

||||||||||||||||||||||||||||||||||||

|

Balance as of October 31, 2014

|

607,890

|

|

$

|

6

|

|

$

|

8,967

|

|

(272,924

|

)

|

$

|

(9,807

|

)

|

$

|

6,469

|

|

$

|

(334

|

)

|

$

|

5,301

|

|

$

|

3

|

|

$

|

5,304

|

|

|||||||||

|

Components of comprehensive income, net of tax:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

401

|

|

—

|

|

401

|

|

—

|

|

401

|

|

|||||||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(389

|

)

|

(389

|

)

|

—

|

|

(389

|

)

|

|||||||||||||||||

|

Total comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

|

|

|

12

|

|

||||||||||||||||||

|

Cash dividends declared ($0.40 per common share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(133

|

)

|

—

|

|

(133

|

)

|

—

|

|

(133

|

)

|

|||||||||||||||||

|

Distribution of Keysight

|

—

|

|

—

|

|

(28

|

)

|

—

|

|

—

|

|

(1,156

|

)

|

332

|

|

(852

|

)

|

—

|

|

(852

|

)

|

|||||||||||||||||

|

Share-based awards issued

|

2,964

|

|

—

|

|

44

|

|

—

|

|

—

|

|

—

|

|

—

|

|

44

|

|

—

|

|

44

|

|

|||||||||||||||||

|

Tax benefits from share-based awards issued

|

—

|

|

—

|

|

8

|

|

—

|

|

—

|

|

—

|

|

—

|

|

8

|

|

—

|

|

8

|

|

|||||||||||||||||

|

Repurchase of common stock

|

—

|

|

—

|

|

—

|

|

(6,471

|

)

|

(267

|

)

|

—

|

|

—

|

|

(267

|

)

|

—

|

|

(267

|

)

|

|||||||||||||||||

|

Share-based compensation

|

—

|

|

—

|

|

54

|

|

—

|

|

—

|

|

—

|

|

—

|

|

54

|

|

—

|

|

54

|

|

|||||||||||||||||

|

Balance as of October 31, 2015

|

610,854

|

|

$

|

6

|

|

$

|

9,045

|

|

(279,395

|

)

|

$

|

(10,074

|

)

|

$

|

5,581

|

|

$

|

(391

|

)

|

$

|

4,167

|

|

$

|

3

|

|

$

|

4,170

|

|

|||||||||

|

Adjustment due to adoption of ASU 2016-09

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

196

|

|

—

|

|

196

|

|

—

|

|

196

|

|

|||||||||||||||||

|

Components of comprehensive income, net of tax:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

462

|

|

—

|

|

462

|

|

—

|

|

462

|

|

|||||||||||||||||

|

Other comprehensive loss

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(112

|

)

|

(112

|

)

|

—

|

|

(112

|

)

|

|||||||||||||||||

|

Total comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

350

|

|

350

|

|

|||||||||||||||||||

|

Cash dividends declared ($0.46 per common share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(150

|

)

|

—

|

|

(150

|

)

|

—

|

|

(150

|

)

|

|||||||||||||||||

|

Share-based awards issued

|

2,682

|

|

—

|

|

56

|

|

—

|

|

—

|

|

—

|

|

—

|

|

56

|

|

—

|

|

56

|

|

|||||||||||||||||

|

Repurchase of common stock

|

—

|

|

—

|

|

—

|

|

(10,680

|

)

|

(434

|

)

|

—

|

|

—

|

|

(434

|

)

|

—

|

|

(434

|

)

|

|||||||||||||||||

|

Share-based compensation

|

—

|

|

—

|

|

58

|

|

—

|

|

—

|

|

—

|

|

—

|

|

58

|

|

—

|

|

58

|

|

|||||||||||||||||

|

Balance as of October 31, 2016

|

613,536

|

|

$

|

6

|

|

$

|

9,159

|

|

(290,075

|

)

|

$

|

(10,508

|

)

|

$

|

6,089

|

|

$

|

(503

|

)

|

$

|

4,243

|

|

$

|

3

|

|

$

|

4,246

|

|

|||||||||

|

Components of comprehensive income, net of tax:

|

|||||||||||||||||||||||||||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

684

|

|

—

|

|

684

|

|

—

|

|

684

|

|

|||||||||||||||||

|

Other comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

157

|

|

157

|

|

—

|

|

157

|

|

|||||||||||||||||

|

Total comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

841

|

|

841

|

|

|||||||||||||||||||

|

Non-controlling interest

|

1

|

|

1

|

|

|||||||||||||||||||||||||||||||||

|

Cash dividends declared ($0.528 per common share)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(170

|

)

|

—

|

|

(170

|

)

|

—

|

|

(170

|

)

|

|||||||||||||||||

|

Share-based awards issued

|

2,621

|

|

—

|

|

51

|

|

—

|

|

—

|

|

—

|

|

—

|

|

51

|

|

—

|

|

51

|

|

|||||||||||||||||

|

Repurchase of common stock

|

—

|

|

—

|

|

—

|

|

(4,107

|

)

|

(194

|

)

|

—

|

|

—

|

|

(194

|

)

|

—

|

|

(194

|

)

|

|||||||||||||||||

|

Retirement of treasury stock

|

(294,182

|

)

|

(3

|

)

|

(3,970

|

)

|

294,182

|

|

10,702

|

|

(6,729

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||||||

|

Share-based compensation

|

—

|

|

—

|

|

60

|

|

—

|

|

—

|

|

—

|

|

—

|

|

60

|

|

—

|

|

60

|

|

|||||||||||||||||

|

Balance as of October 31, 2017

|

321,975

|

|

$

|

3

|

|

$

|

5,300

|

|

—

|

|

$

|

—

|

|

$

|

(126

|

)

|

$

|

(346

|

)

|

$

|

4,831

|

|

$

|

4

|

|

$

|

4,835

|

|

|||||||||

|

Year Ended October 31,

|

|||

|

2015

|

|||

|

(in millions)

|

|||

|

Net revenue

|

$

|

—

|

|

|

Costs and expenses

|

39

|

|

|

|

Operating loss

|

(39

|

)

|

|

|

Other income (expense), net

|

—

|

|

|

|

Loss from discontinued operations before tax

|

(39

|

)

|

|

|

Benefit for income taxes

|

(2

|

)

|

|

|

Net loss from discontinued operations

|

$

|

(37

|

)

|

|

Years Ended October 31,

|

|||||||||||

|

2017

|

2016

|

2015

|

|||||||||

|

(in millions)

|

|||||||||||

|

Cost of products and services

|

$

|

15

|

|

$

|

14

|

|

$

|

11

|

|

||

|

Research and development

|

6

|

|

6

|

|

5

|

|

|||||

|

Selling, general and administrative

|

40

|

|

40

|

|

39

|

|

|||||

|

Total share-based compensation expense

|

$

|

61

|

|

$

|

60

|

|

$

|

55

|

|

||

|

|

Years Ended October 31,

|

||||

|

|

2017

|

2016

|

2015

|

||

|

Stock Option Plans:

|

|

|

|

||

|

Weighted average risk-free interest rate

|

—

|

—

|

1.75%

|

||

|

Dividend yield

|

—

|

—

|

1%

|

||

|

Weighted average volatility

|

—

|

—

|

28%

|

||

|

Expected life

|

—

|

—

|

5.5 years

|

||

|

LTPP:

|

|

|

|

||

|

Volatility of Agilent shares

|

23%

|

24%

|

25%

|

||

|

Volatility of selected peer-company shares

|

15%-63%

|

14%-50%

|

12%-57%

|

||

|

Price-wise correlation with selected peers

|

36%

|

35%

|

37%

|

||

|

Post-vest restriction discount for all executive awards

|

5.3%

|

5.5%

|

—

|

||

|

Options

Outstanding

|

Weighted

Average

Exercise Price

|

|||||

|

|

(in thousands)

|

|

||||

|

Outstanding at October 31, 2016

|

4,106

|

|

$

|

33

|

|

|

|

Granted

|

—

|

|

$

|

—

|

|

|

|

Exercised

|

(1,343

|

)

|

$

|

30

|

|

|

|

Cancelled/Forfeited/Expired

|

(2

|

)

|

$

|

41

|

|

|

|

Outstanding at October 31, 2017

|

2,761

|

|

$

|

34

|

|

|

|

Options

Cancelled

|

Weighted

Average

Exercise Price

|

|||||

|

|

(in thousands)

|

|

||||

|

Forfeited

|

2

|

|

$

|

41

|

|

|

|

Expired

|

—

|

|

$

|

—

|

|

|

|

Total options cancelled during 2017

|

2

|

|

$

|

41

|

|

|

|

|

Options Outstanding

|

Options Exercisable

|

|||||||||||||||||||||||

|

Range of

Exercise Prices

|

Number

Outstanding

|

Weighted

Average

Remaining

Contractual

Life

|

Weighted

Average

Exercise

Price

|

Aggregate

Intrinsic

Value

|

Number

Exercisable

|

Weighted

Average

Remaining

Contractual

Life

|

Weighted

Average

Exercise

Price

|

Aggregate

Intrinsic

Value

|

|||||||||||||||||

|

|

(in thousands)

|

(in years)

|

|

(in thousands)

|

(in thousands)

|

(in years)

|

|

(in thousands)

|

|||||||||||||||||

|

$0 - 25

|

170

|

|

1.6

|

$

|

18

|

|

$

|

8,561

|

|

170

|

|

1.6

|

$

|

18

|

|

$

|

8,561

|

|

|||||||

|

$25.01 - 30

|

957

|

|

4.3

|

$

|

26

|

|

39,804

|

|

957

|

|

4.3

|

$

|

26

|

|

39,804

|

|

|||||||||

|

$30.01 - 40

|

528

|

|

6.1

|

$

|

39

|

|

15,258

|

|

296

|

|

6.1

|

$

|

39

|

|

8,566

|

|

|||||||||

|

$40.01 - over

|

1,106

|

|

7.0

|

$

|

41

|

|

30,035

|

|

493

|

|

7.0

|

$

|

41

|

|

13,396

|

|

|||||||||

|

2,761

|

|

5.6

|

$

|

34

|

|

$

|

93,658

|

|

1,916

|

|

5.0

|

$

|

31

|

|

$

|

70,327

|

|

||||||||

|

Aggregate

Intrinsic Value

|

Weighted

Average

Exercise

Price

|

Per Share Value Using

Black-Scholes

Model

|

|||||||||

|

|

(in thousands)

|

|

|

||||||||

|

Options exercised in fiscal 2015

|

$

|

33,258

|

|

$

|

24

|

|

|

|

|||

|

Black-Scholes per share value of options granted during fiscal 2015

|

|

|

|

|

$

|

11

|

|

||||

|

Options exercised in fiscal 2016

|

$

|

26,913

|

|

$

|

25

|

|

|

|

|||

|

Options exercised in fiscal 2017

|

$

|

36,175

|

|

$

|

30

|

|

|

|

|||

|

Shares

|

Weighted

Average

Grant Price

|

|||||

|

|

(in thousands)

|

|

||||

|

Non-vested at October 31, 2016

|

3,062

|

|

$

|

40

|

|

|

|

Granted

|

1,405

|

|

$

|

47

|

|

|

|

Vested

|

(1,068

|

)

|

$

|

39

|

|

|

|

Forfeited

|

(84

|

)

|

$

|

42

|

|

|

|

Change in LTPP shares in the year due to not meeting performance conditions

|

(13

|

)

|

$

|

—

|

|

|

|

Non-vested at October 31, 2017

|

3,302

|

|

$

|

43

|

|

|

|

|

Years Ended October 31,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

|

(in millions)

|

||||||||||

|

U.S. operations

|

$

|

116

|

|

$

|

27

|

|

$

|

77

|

|

||

|

Non-U.S. operations

|

687

|

|

517

|

|

403

|

|

|||||

|

Total income from continuing operations before taxes

|

$

|

803

|

|

$

|

544

|

|

$

|

480

|

|

||

|

|

Years Ended October 31,

|

||||||||||

|

|

2017

|

2016

|

2015

|

||||||||

|

|

(in millions)

|

||||||||||

|

U.S. federal taxes:

|

|

|

|

||||||||

|

Current

|

$

|

15

|

|

$

|

(1

|

)

|

$

|

(91

|

)

|

||

|

Deferred

|

110

|

|

19

|

|

97

|

|

|||||

|

Non-U.S. taxes:

|

|

|

|

||||||||

|

Current

|

1

|

|

77

|

|

62

|

|

|||||

|

Deferred

|

(7

|

)

|

(14

|

)

|

(27

|

)

|

|||||

|

State taxes, net of federal benefit:

|

|

|

|

||||||||

|

Current

|

1

|

|

3

|

|

1

|

|

|||||

|

Deferred

|

(1

|

)

|

(2

|

)

|

—

|

|

|||||

|

Total provision

|

$

|

119

|

|

$

|

82

|

|

$

|

42

|

|

||

|

|

October 31,

|

||||||||||||||

|

|

2017

|

2016

|

|||||||||||||

|

|

Deferred

Tax Assets

|

Deferred Tax

Liabilities

|

Deferred

Tax Assets

|

Deferred Tax

Liabilities

|

|||||||||||

|

|

(in millions)

|

||||||||||||||

|

Inventory

|

$

|

16

|

|

$

|

—

|

|

$

|

13

|

|

$

|

—

|

|

|||

|

Intangibles

|

—

|

|

93

|

|

—

|

|

92

|

|

|||||||

|

Property, plant and equipment

|

12

|

|

—

|

|

16

|

|

—

|

|

|||||||

|

Warranty reserves

|

12

|

|

—

|

|

14

|

|

—

|

|

|||||||

|

Pension benefits and retiree medical benefits

|

70

|

|

—

|

|

136

|

|

—

|

|

|||||||

|

Employee benefits, other than retirement

|

28

|

|

—

|

|

28

|

|

—

|

|

|||||||

|

Net operating loss, capital loss, and credit carryforwards

|

328

|

|

—

|

|

293

|

|

—

|

|

|||||||

|

Unremitted earnings of foreign subsidiaries

|

—

|

|

163

|

|

—

|

|

53

|

|

|||||||

|

Share-based compensation

|

45

|

|

—

|

|

41

|

|

—

|

|

|||||||

|

Deferred revenue

|

45

|

|

—

|

|

42

|

|

—

|

|

|||||||

|

Other

|

1

|

|

—

|

|

12

|

|

—

|

|

|||||||

|

Subtotal

|

557

|

|

256

|

|

595

|

|

145

|

|

|||||||

|

Tax valuation allowance

|

(138

|

)

|

—

|

|

(129

|

)

|

—

|

|

|||||||

|

Total deferred tax assets or deferred tax liabilities

|

$

|

419

|

|

$

|

256

|

|

$

|

466

|

|

$

|

145

|

|

|||

|

|

October 31,

|

||||||

|

|

2017

|

2016

|

|||||

|

|

(in millions)

|

||||||

|

Long-term deferred tax assets (included within other assets)

|

$

|

240

|

|

$

|

386

|

|

|

|

Long-term deferred tax liabilities (included within other long-term liabilities)

|

(77

|

)

|

(65

|

)

|

|||

|

Total

|

$

|

163

|

|

$

|

321

|

|

|

|

|

Years Ended October 31,

|