|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California

|

94-2404110

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

One Apple Park Way

Cupertino, California

|

95014

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Common Stock, $0.00001 par value per share

1.000% Notes due 2022

1.375% Notes due 2024

0.875% Notes due 2025

1.625% Notes due 2026

2.000% Notes due 2027

1.375% Notes due 2029

3.050% Notes due 2029

3.600% Notes due 2042

|

The Nasdaq Stock Market LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

New York Stock Exchange LLC

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

|

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|||

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

|||

|

Emerging growth company

|

☐

|

|||||

|

Item 1.

|

Business

|

|

Item 1A.

|

Risk Factors

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

Item 2.

|

Properties

|

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

Mine Safety Disclosures

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

Periods

|

Total Number

of Shares Purchased

|

Average

Price

Paid Per Share

|

Total Number of Shares

Purchased as Part of Publicly

Announced Plans or Programs

|

Approximate Dollar Value of

Shares That May Yet Be Purchased

Under the Plans or Programs

(1)

|

||||||||||

|

July 1, 2018 to August 4, 2018:

|

||||||||||||||

|

Open market and privately negotiated purchases

|

26,859

|

|

$

|

192.50

|

|

26,859

|

|

|||||||

|

August 5, 2018 to September 1, 2018:

|

||||||||||||||

|

Open market and privately negotiated purchases

|

36,575

|

|

$

|

214.07

|

|

36,575

|

|

|||||||

|

September 2, 2018 to September 29, 2018:

|

||||||||||||||

|

Open market and privately negotiated purchases

|

29,029

|

|

$

|

222.07

|

|

29,029

|

|

|||||||

|

Total

|

92,463

|

|

$

|

70,970

|

|

|||||||||

|

(1)

|

On May 1, 2018, the Company announced the Board of Directors had authorized a program to repurchase up to

$100 billion

of the Company’s common stock, of which

$29.0 billion

had been utilized as of

September 29, 2018

. The remaining

$71.0 billion

in the table represents the amount available to repurchase shares under the authorized repurchase program as of

September 29, 2018

. The Company’s share repurchase program does not obligate it to acquire any specific number of shares. Under this program, shares may be repurchased in privately negotiated and/or open market transactions, including under plans complying with Rule 10b5-1 under the Exchange Act.

|

|

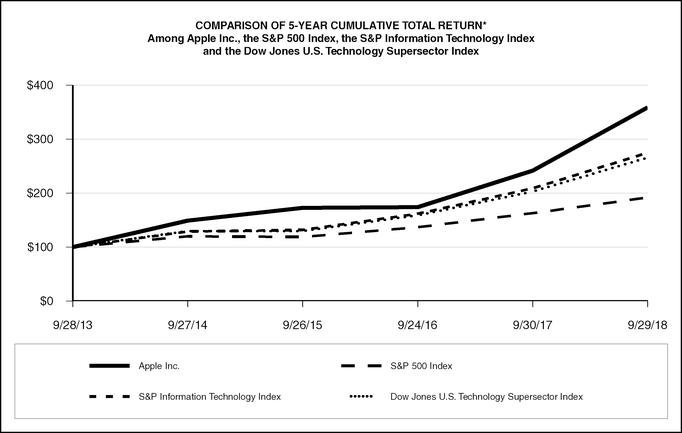

*

|

$100 invested on

September 27, 2013

in stock or index, including reinvestment of dividends. Data points are the last day of each fiscal year for the Company’s common stock and September 30th for indexes.

|

|

September

2013

|

September

2014

|

September

2015

|

September

2016

|

September

2017

|

September

2018

|

|||||||||||||||||||

|

Apple Inc.

|

$

|

100

|

|

$

|

149

|

|

$

|

173

|

|

$

|

174

|

|

$

|

242

|

|

$

|

359

|

|

||||||

|

S&P 500 Index

|

$

|

100

|

|

$

|

120

|

|

$

|

119

|

|

$

|

137

|

|

$

|

163

|

|

$

|

192

|

|

||||||

|

S&P Information Technology Index

|

$

|

100

|

|

$

|

129

|

|

$

|

132

|

|

$

|

162

|

|

$

|

209

|

|

$

|

275

|

|

||||||

|

Dow Jones U.S. Technology Supersector Index

|

$

|

100

|

|

$

|

130

|

|

$

|

130

|

|

$

|

159

|

|

$

|

203

|

|

$

|

266

|

|

||||||

|

Item 6.

|

Selected Financial Data

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Net sales

|

$

|

265,595

|

|

$

|

229,234

|

|

$

|

215,639

|

|

$

|

233,715

|

|

$

|

182,795

|

|

||||

|

Net income

|

$

|

59,531

|

|

$

|

48,351

|

|

$

|

45,687

|

|

$

|

53,394

|

|

$

|

39,510

|

|

||||

|

Earnings per share:

|

|||||||||||||||||||

|

Basic

|

$

|

12.01

|

|

$

|

9.27

|

|

$

|

8.35

|

|

$

|

9.28

|

|

$

|

6.49

|

|

||||

|

Diluted

|

$

|

11.91

|

|

$

|

9.21

|

|

$

|

8.31

|

|

$

|

9.22

|

|

$

|

6.45

|

|

||||

|

Cash dividends declared per share

|

$

|

2.72

|

|

$

|

2.40

|

|

$

|

2.18

|

|

$

|

1.98

|

|

$

|

1.82

|

|

||||

|

Shares used in computing earnings per share:

|

|||||||||||||||||||

|

Basic

|

4,955,377

|

|

5,217,242

|

|

5,470,820

|

|

5,753,421

|

|

6,085,572

|

|

|||||||||

|

Diluted

|

5,000,109

|

|

5,251,692

|

|

5,500,281

|

|

5,793,069

|

|

6,122,663

|

|

|||||||||

|

Total cash, cash equivalents and marketable securities

|

$

|

237,100

|

|

$

|

268,895

|

|

$

|

237,585

|

|

$

|

205,666

|

|

$

|

155,239

|

|

||||

|

Total assets

|

$

|

365,725

|

|

$

|

375,319

|

|

$

|

321,686

|

|

$

|

290,345

|

|

$

|

231,839

|

|

||||

|

Non-current portion of term debt

|

$

|

93,735

|

|

$

|

97,207

|

|

$

|

75,427

|

|

$

|

53,329

|

|

$

|

28,987

|

|

||||

|

Other non-current liabilities

|

$

|

45,180

|

|

$

|

40,415

|

|

$

|

36,074

|

|

$

|

33,427

|

|

$

|

24,826

|

|

||||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net Sales by Reportable Segment:

|

|||||||||||||||||

|

Americas

|

$

|

112,093

|

|

16

|

%

|

$

|

96,600

|

|

12

|

%

|

$

|

86,613

|

|

||||

|

Europe

|

62,420

|

|

14

|

%

|

54,938

|

|

10

|

%

|

49,952

|

|

|||||||

|

Greater China

|

51,942

|

|

16

|

%

|

44,764

|

|

(8

|

)%

|

48,492

|

|

|||||||

|

Japan

|

21,733

|

|

23

|

%

|

17,733

|

|

5

|

%

|

16,928

|

|

|||||||

|

Rest of Asia Pacific

|

17,407

|

|

15

|

%

|

15,199

|

|

11

|

%

|

13,654

|

|

|||||||

|

Total net sales

|

$

|

265,595

|

|

16

|

%

|

$

|

229,234

|

|

6

|

%

|

$

|

215,639

|

|

||||

|

Net Sales by Product:

|

|||||||||||||||||

|

iPhone

(1)

|

$

|

166,699

|

|

18

|

%

|

$

|

141,319

|

|

3

|

%

|

$

|

136,700

|

|

||||

|

iPad

(1)

|

18,805

|

|

(2

|

)%

|

19,222

|

|

(7

|

)%

|

20,628

|

|

|||||||

|

Mac

(1)

|

25,484

|

|

(1

|

)%

|

25,850

|

|

13

|

%

|

22,831

|

|

|||||||

|

Services

(2)

|

37,190

|

|

24

|

%

|

29,980

|

|

23

|

%

|

24,348

|

|

|||||||

|

Other Products

(1)(3)

|

17,417

|

|

35

|

%

|

12,863

|

|

16

|

%

|

11,132

|

|

|||||||

|

Total net sales

|

$

|

265,595

|

|

16

|

%

|

$

|

229,234

|

|

6

|

%

|

$

|

215,639

|

|

||||

|

Unit Sales by Product:

|

|||||||||||||||||

|

iPhone

|

217,722

|

|

—

|

%

|

216,756

|

|

2

|

%

|

211,884

|

|

|||||||

|

iPad

|

43,535

|

|

—

|

%

|

43,753

|

|

(4

|

)%

|

45,590

|

|

|||||||

|

Mac

|

18,209

|

|

(5

|

)%

|

19,251

|

|

4

|

%

|

18,484

|

|

|||||||

|

(1)

|

Includes deferrals and amortization of related software upgrade rights and non-software services.

|

|

(2)

|

Includes revenue from Digital Content and Services, AppleCare, Apple Pay, licensing and other services. Services net sales in 2018 included a favorable one-time item of $236 million in connection with the final resolution of various lawsuits. Services net sales in 2017 included a favorable one-time adjustment of $640 million due to a change in estimate based on the availability of additional supporting information.

|

|

(3)

|

Includes sales of AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories.

|

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

166,699

|

|

18

|

%

|

$

|

141,319

|

|

3

|

%

|

$

|

136,700

|

|

||||

|

Percentage of total net sales

|

63

|

%

|

|

|

62

|

%

|

63

|

%

|

|||||||||

|

Unit sales

|

217,722

|

|

—

|

%

|

216,756

|

|

2

|

%

|

211,884

|

|

|||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

18,805

|

|

(2

|

)%

|

$

|

19,222

|

|

(7

|

)%

|

$

|

20,628

|

|

||||

|

Percentage of total net sales

|

7

|

%

|

8

|

%

|

10

|

%

|

|||||||||||

|

Unit sales

|

43,535

|

|

—

|

%

|

43,753

|

|

(4

|

)%

|

45,590

|

|

|||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

25,484

|

|

(1

|

)%

|

$

|

25,850

|

|

13

|

%

|

$

|

22,831

|

|

||||

|

Percentage of total net sales

|

10

|

%

|

11

|

%

|

11

|

%

|

|||||||||||

|

Unit sales

|

18,209

|

|

(5

|

)%

|

19,251

|

|

4

|

%

|

18,484

|

|

|||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

37,190

|

|

24

|

%

|

$

|

29,980

|

|

23

|

%

|

$

|

24,348

|

|

||||

|

Percentage of total net sales

|

14

|

%

|

13

|

%

|

11

|

%

|

|||||||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

112,093

|

|

16

|

%

|

$

|

96,600

|

|

12

|

%

|

$

|

86,613

|

|

||||

|

Percentage of total net sales

|

42

|

%

|

42

|

%

|

40

|

%

|

|||||||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

62,420

|

|

14

|

%

|

$

|

54,938

|

|

10

|

%

|

$

|

49,952

|

|

||||

|

Percentage of total net sales

|

24

|

%

|

24

|

%

|

23

|

%

|

|||||||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

51,942

|

|

16

|

%

|

$

|

44,764

|

|

(8

|

)%

|

$

|

48,492

|

|

||||

|

Percentage of total net sales

|

20

|

%

|

20

|

%

|

22

|

%

|

|||||||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

21,733

|

|

23

|

%

|

$

|

17,733

|

|

5

|

%

|

$

|

16,928

|

|

||||

|

Percentage of total net sales

|

8

|

%

|

8

|

%

|

8

|

%

|

|||||||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Net sales

|

$

|

17,407

|

|

15

|

%

|

$

|

15,199

|

|

11

|

%

|

$

|

13,654

|

|

||||

|

Percentage of total net sales

|

7

|

%

|

7

|

%

|

6

|

%

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

Net sales

|

$

|

265,595

|

|

$

|

229,234

|

|

$

|

215,639

|

|

||

|

Cost of sales

|

163,756

|

|

141,048

|

|

131,376

|

|

|||||

|

Gross margin

|

$

|

101,839

|

|

$

|

88,186

|

|

$

|

84,263

|

|

||

|

Gross margin percentage

|

38.3

|

%

|

38.5

|

%

|

39.1

|

%

|

|||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Research and development

|

$

|

14,236

|

|

23

|

%

|

$

|

11,581

|

|

15

|

%

|

$

|

10,045

|

|

||||

|

Percentage of total net sales

|

5

|

%

|

5

|

%

|

5

|

%

|

|||||||||||

|

Selling, general and administrative

|

$

|

16,705

|

|

9

|

%

|

$

|

15,261

|

|

8

|

%

|

$

|

14,194

|

|

||||

|

Percentage of total net sales

|

6

|

%

|

7

|

%

|

7

|

%

|

|||||||||||

|

Total operating expenses

|

$

|

30,941

|

|

15

|

%

|

$

|

26,842

|

|

11

|

%

|

$

|

24,239

|

|

||||

|

Percentage of total net sales

|

12

|

%

|

12

|

%

|

11

|

%

|

|||||||||||

|

2018

|

Change

|

2017

|

Change

|

2016

|

|||||||||||||

|

Interest and dividend income

|

$

|

5,686

|

|

$

|

5,201

|

|

$

|

3,999

|

|

||||||||

|

Interest expense

|

(3,240

|

)

|

(2,323

|

)

|

(1,456

|

)

|

|||||||||||

|

Other expense, net

|

(441

|

)

|

(133

|

)

|

(1,195

|

)

|

|||||||||||

|

Total other income/(expense), net

|

$

|

2,005

|

|

(27

|

)%

|

$

|

2,745

|

|

104

|

%

|

$

|

1,348

|

|

||||

|

2018

|

2017

|

2016

|

|||||||||

|

Provision for income taxes

|

$

|

13,372

|

|

$

|

15,738

|

|

$

|

15,685

|

|

||

|

Effective tax rate

|

18.3

|

%

|

24.6

|

%

|

25.6

|

%

|

|||||

|

2018

|

2017

|

2016

|

|||||||||

|

Cash, cash equivalents and marketable securities

(1)

|

$

|

237,100

|

|

$

|

268,895

|

|

$

|

237,585

|

|

||

|

Property, plant and equipment, net

|

$

|

41,304

|

|

$

|

33,783

|

|

$

|

27,010

|

|

||

|

Commercial paper

|

$

|

11,964

|

|

$

|

11,977

|

|

$

|

8,105

|

|

||

|

Total term debt

|

$

|

102,519

|

|

$

|

103,703

|

|

$

|

78,927

|

|

||

|

Working capital

|

$

|

14,473

|

|

$

|

27,831

|

|

$

|

27,863

|

|

||

|

Cash generated by operating activities

(2)

|

$

|

77,434

|

|

$

|

64,225

|

|

$

|

66,231

|

|

||

|

Cash generated by/(used in) investing activities

|

$

|

16,066

|

|

$

|

(46,446

|

)

|

$

|

(45,977

|

)

|

||

|

Cash used in financing activities

(2)

|

$

|

(87,876

|

)

|

$

|

(17,974

|

)

|

$

|

(20,890

|

)

|

||

|

(1)

|

As of

September 29, 2018

, total cash, cash equivalents and marketable securities included

$20.3 billion

that was restricted from general use, related to the State Aid Decision and other agreements.

|

|

(2)

|

Refer to Note 1, “Summary of Significant Accounting Polices” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this Form 10-K for more information on the prior period reclassification related to the Company’s adoption of ASU 2016-09.

|

|

Payments Due

in 2019

|

Payments Due

in 2020–2021

|

Payments Due

in 2022–2023

|

Payments Due

After 2023

|

Total

|

|||||||||||||||

|

Term debt

|

$

|

8,797

|

|

$

|

18,933

|

|

$

|

17,978

|

|

$

|

58,485

|

|

$

|

104,193

|

|

||||

|

Operating leases

|

1,298

|

|

2,507

|

|

1,838

|

|

3,984

|

|

9,627

|

|

|||||||||

|

Manufacturing purchase obligations

(1)

|

41,548

|

|

2,469

|

|

1,183

|

|

—

|

|

45,200

|

|

|||||||||

|

Other purchase obligations

|

3,784

|

|

2,482

|

|

681

|

|

66

|

|

7,013

|

|

|||||||||

|

Deemed repatriation tax payable

|

—

|

|

5,366

|

|

5,942

|

|

22,281

|

|

33,589

|

|

|||||||||

|

Total

|

$

|

55,427

|

|

$

|

31,757

|

|

$

|

27,622

|

|

$

|

84,816

|

|

$

|

199,622

|

|

||||

|

(1)

|

Represents amount expected to be paid under manufacturing-related supplier arrangements, substantially all of which is noncancelable.

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

Index to Consolidated Financial Statements

|

Page

|

|

|

Years ended

|

|||||||||||

|

September 29,

2018 |

September 30,

2017 |

September 24,

2016 |

|||||||||

|

Net sales

|

$

|

265,595

|

|

$

|

229,234

|

|

$

|

215,639

|

|

||

|

Cost of sales

|

163,756

|

|

141,048

|

|

131,376

|

|

|||||

|

Gross margin

|

101,839

|

|

|

88,186

|

|

|

84,263

|

|

|||

|

Operating expenses:

|

|||||||||||

|

Research and development

|

14,236

|

|

11,581

|

|

10,045

|

|

|||||

|

Selling, general and administrative

|

16,705

|

|

15,261

|

|

14,194

|

|

|||||

|

Total operating expenses

|

30,941

|

|

|

26,842

|

|

|

24,239

|

|

|||

|

Operating income

|

70,898

|

|

61,344

|

|

60,024

|

|

|||||

|

Other income/(expense), net

|

2,005

|

|

2,745

|

|

1,348

|

|

|||||

|

Income before provision for income taxes

|

72,903

|

|

|

64,089

|

|

|

61,372

|

|

|||

|

Provision for income taxes

|

13,372

|

|

15,738

|

|

15,685

|

|

|||||

|

Net income

|

$

|

59,531

|

|

|

$

|

48,351

|

|

|

$

|

45,687

|

|

|

Earnings per share:

|

|||||||||||

|

Basic

|

$

|

12.01

|

|

$

|

9.27

|

|

$

|

8.35

|

|

||

|

Diluted

|

$

|

11.91

|

|

$

|

9.21

|

|

$

|

8.31

|

|

||

|

Shares used in computing earnings per share:

|

|||||||||||

|

Basic

|

4,955,377

|

|

5,217,242

|

|

5,470,820

|

|

|||||

|

Diluted

|

5,000,109

|

|

5,251,692

|

|

5,500,281

|

|

|||||

|

Years ended

|

|||||||||||

|

September 29,

2018 |

September 30,

2017 |

September 24,

2016 |

|||||||||

|

Net income

|

$

|

59,531

|

|

$

|

48,351

|

|

$

|

45,687

|

|

||

|

Other comprehensive income/(loss):

|

|||||||||||

|

Change in foreign currency translation, net of tax effects of $(1), $(77) and $8, respectively

|

(525

|

)

|

224

|

|

75

|

|

|||||

|

Change in unrealized gains/losses on derivative instruments:

|

|||||||||||

|

Change in fair value of derivatives, net of tax benefit/(expense) of $(149), $(478) and $(7), respectively

|

523

|

|

1,315

|

|

7

|

|

|||||

|

Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $(104), $475 and $131, respectively

|

382

|

|

(1,477

|

)

|

(741

|

)

|

|||||

|

Total change in unrealized gains/losses on derivative instruments, net of tax

|

905

|

|

|

(162

|

)

|

|

(734

|

)

|

|||

|

Change in unrealized gains/losses on marketable securities:

|

|||||||||||

|

Change in fair value of marketable securities, net of tax benefit/(expense) of $1,156, $425 and $(863), respectively

|

(3,407

|

)

|

(782

|

)

|

1,582

|

|

|||||

|

Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $21, $35 and $(31), respectively

|

1

|

|

(64

|

)

|

56

|

|

|||||

|

Total change in unrealized gains/losses on marketable securities, net of tax

|

(3,406

|

)

|

|

(846

|

)

|

|

1,638

|

|

|||

|

Total other comprehensive income/(loss)

|

(3,026

|

)

|

|

(784

|

)

|

|

979

|

|

|||

|

Total comprehensive income

|

$

|

56,505

|

|

|

$

|

47,567

|

|

|

$

|

46,666

|

|

|

September 29,

2018 |

September 30,

2017 |

||||||

|

ASSETS:

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

25,913

|

|

$

|

20,289

|

|

|

|

Marketable securities

|

40,388

|

|

53,892

|

|

|||

|

Accounts receivable, net

|

23,186

|

|

17,874

|

|

|||

|

Inventories

|

3,956

|

|

4,855

|

|

|||

|

Vendor non-trade receivables

|

25,809

|

|

17,799

|

|

|||

|

Other current assets

|

12,087

|

|

13,936

|

|

|||

|

Total current assets

|

131,339

|

|

128,645

|

|

|||

|

Non-current assets:

|

|||||||

|

Marketable securities

|

170,799

|

|

194,714

|

|

|||

|

Property, plant and equipment, net

|

41,304

|

|

33,783

|

|

|||

|

Other non-current assets

|

22,283

|

|

18,177

|

|

|||

|

Total non-current assets

|

234,386

|

|

246,674

|

|

|||

|

Total assets

|

$

|

365,725

|

|

$

|

375,319

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY:

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

55,888

|

|

$

|

44,242

|

|

|

|

Other current liabilities

|

32,687

|

|

30,551

|

|

|||

|

Deferred revenue

|

7,543

|

|

7,548

|

|

|||

|

Commercial paper

|

11,964

|

|

11,977

|

|

|||

|

Term debt

|

8,784

|

|

6,496

|

|

|||

|

Total current liabilities

|

116,866

|

|

100,814

|

|

|||

|

Non-current liabilities:

|

|||||||

|

Deferred revenue

|

2,797

|

|

2,836

|

|

|||

|

Term debt

|

93,735

|

|

97,207

|

|

|||

|

Other non-current liabilities

|

45,180

|

|

40,415

|

|

|||

|

Total non-current liabilities

|

141,712

|

|

140,458

|

|

|||

|

Total liabilities

|

258,578

|

|

241,272

|

|

|||

|

Commitments and contingencies

|

|

|

|||||

|

Shareholders’ equity:

|

|||||||

|

Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 4,754,986 and 5,126,201 shares issued and outstanding, respectively

|

40,201

|

|

35,867

|

|

|||

|

Retained earnings

|

70,400

|

|

98,330

|

|

|||

|

Accumulated other comprehensive income/(loss)

|

(3,454

|

)

|

(150

|

)

|

|||

|

Total shareholders’ equity

|

107,147

|

|

134,047

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

365,725

|

|

|

$

|

375,319

|

|

|

Common Stock and

Additional Paid-In Capital

|

Retained Earnings

|

Accumulated Other

Comprehensive Income/(Loss)

|

Total Shareholders’ Equity

|

|||||||||||||||

|

Shares

|

Amount

|

|||||||||||||||||

|

Balances as of September 26, 2015

|

5,578,753

|

|

$

|

27,416

|

|

$

|

92,284

|

|

$

|

(345

|

)

|

$

|

119,355

|

|

||||

|

Net income

|

—

|

|

—

|

|

45,687

|

|

—

|

|

45,687

|

|

||||||||

|

Other comprehensive income/(loss)

|

—

|

|

—

|

|

—

|

|

979

|

|

979

|

|

||||||||

|

Dividends and dividend equivalents declared at $2.18 per share or RSU

|

—

|

|

—

|

|

(12,188

|

)

|

—

|

|

(12,188

|

)

|

||||||||

|

Repurchase of common stock

|

(279,609

|

)

|

—

|

|

(29,000

|

)

|

—

|

|

(29,000

|

)

|

||||||||

|

Share-based compensation

|

—

|

|

4,262

|

|

—

|

|

—

|

|

4,262

|

|

||||||||

|

Common stock issued, net of shares withheld for employee taxes

|

37,022

|

|

(806

|

)

|

(419

|

)

|

—

|

|

(1,225

|

)

|

||||||||

|

Tax benefit from equity awards, including transfer pricing adjustments

|

—

|

|

379

|

|

—

|

|

—

|

|

379

|

|

||||||||

|

Balances as of September 24, 2016

|

5,336,166

|

|

31,251

|

|

96,364

|

|

634

|

|

128,249

|

|

||||||||

|

Net income

|

—

|

|

—

|

|

48,351

|

|

—

|

|

48,351

|

|

||||||||

|

Other comprehensive income/(loss)

|

—

|

|

—

|

|

—

|

|

(784

|

)

|

(784

|

)

|

||||||||

|

Dividends and dividend equivalents declared at $2.40 per share or RSU

|

—

|

|

—

|

|

(12,803

|

)

|

—

|

|

(12,803

|

)

|

||||||||

|

Repurchase of common stock

|

(246,496

|

)

|

—

|

|

(33,001

|

)

|

—

|

|

(33,001

|

)

|

||||||||

|

Share-based compensation

|

—

|

|

4,909

|

|

—

|

|

—

|

|

4,909

|

|

||||||||

|

Common stock issued, net of shares withheld for employee taxes

|

36,531

|

|

(913

|

)

|

(581

|

)

|

—

|

|

(1,494

|

)

|

||||||||

|

Tax benefit from equity awards, including transfer pricing adjustments

|

—

|

|

620

|

|

—

|

|

—

|

|

620

|

|

||||||||

|

Balances as of September 30, 2017

|

5,126,201

|

|

35,867

|

|

98,330

|

|

(150

|

)

|

134,047

|

|

||||||||

|

Cumulative effect of change in accounting principle

|

—

|

|

—

|

|

278

|

|

(278

|

)

|

—

|

|

||||||||

|

Net income

|

—

|

|

—

|

|

59,531

|

|

—

|

|

59,531

|

|

||||||||

|

Other comprehensive income/(loss)

|

—

|

|

—

|

|

—

|

|

(3,026

|

)

|

(3,026

|

)

|

||||||||

|

Dividends and dividend equivalents declared at $2.72 per share or RSU

|

—

|

|

—

|

|

(13,735

|

)

|

—

|

|

(13,735

|

)

|

||||||||

|

Repurchase of common stock

|

(405,549

|

)

|

—

|

|

(73,056

|

)

|

—

|

|

(73,056

|

)

|

||||||||

|

Share-based compensation

|

—

|

|

5,443

|

|

—

|

|

—

|

|

5,443

|

|

||||||||

|

Common stock issued, net of shares withheld for employee taxes

|

34,334

|

|

(1,109

|

)

|

(948

|

)

|

—

|

|

(2,057

|

)

|

||||||||

|

Balances as of September 29, 2018

|

4,754,986

|

|

$

|

40,201

|

|

$

|

70,400

|

|

$

|

(3,454

|

)

|

$

|

107,147

|

|

||||

|

Years ended

|

|||||||||||

|

September 29,

2018 |

September 30,

2017 |

September 24,

2016 |

|||||||||

|

Cash and cash equivalents, beginning of the year

|

$

|

20,289

|

|

$

|

20,484

|

|

$

|

21,120

|

|

||

|

Operating activities:

|

|||||||||||

|

Net income

|

59,531

|

|

48,351

|

|

45,687

|

|

|||||

|

Adjustments to reconcile net income to cash generated by operating activities:

|

|||||||||||

|

Depreciation and amortization

|

10,903

|

|

10,157

|

|

10,505

|

|

|||||

|

Share-based compensation expense

|

5,340

|

|

4,840

|

|

4,210

|

|

|||||

|

Deferred income tax expense/(benefit)

|

(32,590

|

)

|

5,966

|

|

4,938

|

|

|||||

|

Other

|

(444

|

)

|

(166

|

)

|

486

|

|

|||||

|

Changes in operating assets and liabilities:

|

|||||||||||

|

Accounts receivable, net

|

(5,322

|

)

|

(2,093

|

)

|

527

|

|

|||||

|

Inventories

|

828

|

|

(2,723

|

)

|

217

|

|

|||||

|

Vendor non-trade receivables

|

(8,010

|

)

|

(4,254

|

)

|

(51

|

)

|

|||||

|

Other current and non-current assets

|

(423

|

)

|

(5,318

|

)

|

1,055

|

|

|||||

|

Accounts payable

|

9,175

|

|

8,966

|

|

2,117

|

|

|||||

|

Deferred revenue

|

(44

|

)

|

(626

|

)

|

(1,554

|

)

|

|||||

|

Other current and non-current liabilities

|

38,490

|

|

1,125

|

|

(1,906

|

)

|

|||||

|

Cash generated by operating activities

|

77,434

|

|

|

64,225

|

|

|

66,231

|

|

|||

|

Investing activities:

|

|||||||||||

|

Purchases of marketable securities

|

(71,356

|

)

|

(159,486

|

)

|

(142,428

|

)

|

|||||

|

Proceeds from maturities of marketable securities

|

55,881

|

|

31,775

|

|

21,258

|

|

|||||

|

Proceeds from sales of marketable securities

|

47,838

|

|

94,564

|

|

90,536

|

|

|||||

|

Payments for acquisition of property, plant and equipment

|

(13,313

|

)

|

(12,451

|

)

|

(12,734

|

)

|

|||||

|

Payments made in connection with business acquisitions, net

|

(721

|

)

|

(329

|

)

|

(297

|

)

|

|||||

|

Purchases of non-marketable securities

|

(1,871

|

)

|

(521

|

)

|

(1,388

|

)

|

|||||

|

Proceeds from non-marketable securities

|

353

|

|

126

|

|

—

|

|

|||||

|

Other

|

(745

|

)

|

(124

|

)

|

(924

|

)

|

|||||

|

Cash generated by/(used in) investing activities

|

16,066

|

|

|

(46,446

|

)

|

|

(45,977

|

)

|

|||

|

Financing activities:

|

|||||||||||

|

Proceeds from issuance of common stock

|

669

|

|

555

|

|

495

|

|

|||||

|

Payments for taxes related to net share settlement of equity awards

|

(2,527

|

)

|

(1,874

|

)

|

(1,570

|

)

|

|||||

|

Payments for dividends and dividend equivalents

|

(13,712

|

)

|

(12,769

|

)

|

(12,150

|

)

|

|||||

|

Repurchases of common stock

|

(72,738

|

)

|

(32,900

|

)

|

(29,722

|

)

|

|||||

|

Proceeds from issuance of term debt, net

|

6,969

|

|

28,662

|

|

24,954

|

|

|||||

|

Repayments of term debt

|

(6,500

|

)

|

(3,500

|

)

|

(2,500

|

)

|

|||||

|

Change in commercial paper, net

|

(37

|

)

|

3,852

|

|

(397

|

)

|

|||||

|

Cash used in financing activities

|

(87,876

|

)

|

|

(17,974

|

)

|

|

(20,890

|

)

|

|||

|

Increase/(Decrease) in cash and cash equivalents

|

5,624

|

|

(195

|

)

|

(636

|

)

|

|||||

|

Cash and cash equivalents, end of the year

|

$

|

25,913

|

|

|

$

|

20,289

|

|

|

$

|

20,484

|

|

|

Supplemental cash flow disclosure:

|

|||||||||||

|

Cash paid for income taxes, net

|

$

|

10,417

|

|

$

|

11,591

|

|

$

|

10,444

|

|

||

|

Cash paid for interest

|

$

|

3,022

|

|

$

|

2,092

|

|

$

|

1,316

|

|

||

|

2018

|

2017

|

2016

|

|||||||||

|

Numerator:

|

|||||||||||

|

Net income

|

$

|

59,531

|

|

$

|

48,351

|

|

$

|

45,687

|

|

||

|

Denominator:

|

|||||||||||

|

Weighted-average basic shares outstanding

|

4,955,377

|

|

5,217,242

|

|

5,470,820

|

|

|||||

|

Effect of dilutive securities

|

44,732

|

|

34,450

|

|

29,461

|

|

|||||

|

Weighted-average diluted shares

|

5,000,109

|

|

5,251,692

|

|

|

5,500,281

|

|

||||

|

Basic earnings per share

|

$

|

12.01

|

|

$

|

9.27

|

|

$

|

8.35

|

|

||

|

Diluted earnings per share

|

$

|

11.91

|

|

$

|

9.21

|

|

$

|

8.31

|

|

||

|

2018

|

|||||||||||||||||||||||||||

|

Adjusted

Cost

|

Unrealized

Gains

|

Unrealized

Losses

|

Fair

Value

|

Cash and

Cash

Equivalents

|

Short-Term

Marketable

Securities

|

Long-Term

Marketable

Securities

|

|||||||||||||||||||||

|

Cash

|

$

|

11,575

|

|

$

|

—

|

|

$

|

—

|

|

$

|

11,575

|

|

$

|

11,575

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Level 1

(1)

:

|

|||||||||||||||||||||||||||

|

Money market funds

|

8,083

|

|

—

|

|

—

|

|

8,083

|

|

8,083

|

|

—

|

|

—

|

|

|||||||||||||

|

Mutual funds

|

799

|

|

—

|

|

(116

|

)

|

683

|

|

—

|

|

683

|

|

—

|

|

|||||||||||||

|

Subtotal

|

8,882

|

|

—

|

|

(116

|

)

|

8,766

|

|

8,083

|

|

683

|

|

—

|

|

|||||||||||||

|

Level 2

(2)

:

|

|||||||||||||||||||||||||||

|

U.S. Treasury securities

|

47,296

|

|

—

|

|

(1,202

|

)

|

46,094

|

|

1,613

|

|

7,606

|

|

36,875

|

|

|||||||||||||

|

U.S. agency securities

|

4,127

|

|

—

|

|

(48

|

)

|

4,079

|

|

1,732

|

|

360

|

|

1,987

|

|

|||||||||||||

|

Non-U.S. government securities

|

21,601

|

|

49

|

|

(250

|

)

|

21,400

|

|

—

|

|

3,355

|

|

18,045

|

|

|||||||||||||

|

Certificates of deposit and time deposits

|

3,074

|

|

—

|

|

—

|

|

3,074

|

|

1,247

|

|

1,330

|

|

497

|

|

|||||||||||||

|

Commercial paper

|

2,573

|

|

—

|

|

—

|

|

2,573

|

|

1,663

|

|

910

|

|

—

|

|

|||||||||||||

|

Corporate securities

|

123,001

|

|

152

|

|

(2,038

|

)

|

121,115

|

|

—

|

|

25,162

|

|

95,953

|

|

|||||||||||||

|

Municipal securities

|

946

|

|

—

|

|

(12

|

)

|

934

|

|

—

|

|

178

|

|

756

|

|

|||||||||||||

|

Mortgage- and asset-backed securities

|

18,105

|

|

8

|

|

(623

|

)

|

17,490

|

|

—

|

|

804

|

|

16,686

|

|

|||||||||||||

|

Subtotal

|

220,723

|

|

209

|

|

(4,173

|

)

|

216,759

|

|

6,255

|

|

39,705

|

|

170,799

|

|

|||||||||||||

|

Total

(3)

|

$

|

241,180

|

|

$

|

209

|

|

$

|

(4,289

|

)

|

$

|

237,100

|

|

$

|

25,913

|

|

$

|

40,388

|

|

$

|

170,799

|

|

||||||

|

2017

|

|||||||||||||||||||||||||||

|

Adjusted

Cost

|

Unrealized

Gains

|

Unrealized

Losses

|

Fair

Value

|

Cash and

Cash

Equivalents

|

Short-Term

Marketable

Securities

|

Long-Term

Marketable

Securities

|

|||||||||||||||||||||

|

Cash

|

$

|

7,982

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7,982

|

|

$

|

7,982

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Level 1

(1)

:

|

|||||||||||||||||||||||||||

|

Money market funds

|

6,534

|

|

—

|

|

—

|

|

6,534

|

|

6,534

|

|

—

|

|

—

|

|

|||||||||||||

|

Mutual funds

|

799

|

|

—

|

|

(88

|

)

|

711

|

|

—

|

|

711

|

|

—

|

|

|||||||||||||

|

Subtotal

|

7,333

|

|

—

|

|

(88

|

)

|

7,245

|

|

6,534

|

|

711

|

|

—

|

|

|||||||||||||

|

Level 2

(2)

:

|

|||||||||||||||||||||||||||

|

U.S. Treasury securities

|

55,254

|

|

58

|

|

(230

|

)

|

55,082

|

|

865

|

|

17,228

|

|

36,989

|

|

|||||||||||||

|

U.S. agency securities

|

5,162

|

|

2

|

|

(9

|

)

|

5,155

|

|

1,439

|

|

2,057

|

|

1,659

|

|

|||||||||||||

|

Non-U.S. government securities

|

7,827

|

|

210

|

|

(37

|

)

|

8,000

|

|

9

|

|

123

|

|

7,868

|

|

|||||||||||||

|

Certificates of deposit and time deposits

|

5,832

|

|

—

|

|

—

|

|

5,832

|

|

1,142

|

|

3,918

|

|

772

|

|

|||||||||||||

|

Commercial paper

|

3,640

|

|

—

|

|

—

|

|

3,640

|

|

2,146

|

|

1,494

|

|

—

|

|

|||||||||||||

|

Corporate securities

|

152,724

|

|

969

|

|

(242

|

)

|

153,451

|

|

172

|

|

27,591

|

|

125,688

|

|

|||||||||||||

|

Municipal securities

|

961

|

|

4

|

|

(1

|

)

|

964

|

|

—

|

|

114

|

|

850

|

|

|||||||||||||

|

Mortgage- and asset-backed securities

|

21,684

|

|

35

|

|

(175

|

)

|

21,544

|

|

—

|

|

656

|

|

20,888

|

|

|||||||||||||

|

Subtotal

|

253,084

|

|

1,278

|

|

(694

|

)

|

253,668

|

|

5,773

|

|

53,181

|

|

194,714

|

|

|||||||||||||

|

Total

|

$

|

268,399

|

|

$

|

1,278

|

|

$

|

(782

|

)

|

$

|

268,895

|

|

$

|

20,289

|

|

$

|

53,892

|

|

$

|

194,714

|

|

||||||

|

(1)

|

Level 1 fair value estimates are based on quoted prices in active markets for identical assets or liabilities.

|

|

(2)

|

Level 2 fair value estimates are based on observable inputs other than quoted prices in active markets for identical assets and liabilities, quoted prices for identical or similar assets or liabilities in inactive markets, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

|

|

(3)

|

As of

September 29, 2018

, total cash, cash equivalents and marketable securities included

$20.3 billion

that was restricted from general use, related to the State Aid Decision (refer to Note 4, “Income Taxes”) and other agreements.

|

|

2018

|

|||||||||||

|

Continuous Unrealized Losses

|

|||||||||||

|

Less than 12 Months

|

12 Months or Greater

|

Total

|

|||||||||

|

Fair value of marketable securities

|

$

|

126,238

|

|

$

|

60,599

|

|

$

|

186,837

|

|

||

|

Unrealized losses

|

$

|

(2,400

|

)

|

$

|

(1,889

|

)

|

$

|

(4,289

|

)

|

||

|

2017

|

|||||||||||

|

Continuous Unrealized Losses

|

|||||||||||

|

Less than 12 Months

|

12 Months or Greater

|

Total

|

|||||||||

|

Fair value of marketable securities

|

$

|

101,986

|

|

$

|

8,290

|

|

$

|

110,276

|

|

||

|

Unrealized losses

|

$

|

(596

|

)

|

$

|

(186

|

)

|

$

|

(782

|

)

|

||

|

2018

|

|||||||||||

|

Fair Value of

Derivatives Designated

as Hedge Instruments

|

Fair Value of

Derivatives Not Designated

as Hedge Instruments

|

Total

Fair Value

|

|||||||||

|

Derivative assets

(1)

:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

1,015

|

|

$

|

259

|

|

$

|

1,274

|

|

||

|

Derivative liabilities

(2)

:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

543

|

|

$

|

137

|

|

$

|

680

|

|

||

|

Interest rate contracts

|

$

|

1,456

|

|

$

|

—

|

|

$

|

1,456

|

|

||

|

2017

|

|||||||||||

|

Fair Value of

Derivatives Designated

as Hedge Instruments

|

Fair Value of

Derivatives Not Designated

as Hedge Instruments

|

Total

Fair Value

|

|||||||||

|

Derivative assets

(1)

:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

1,049

|

|

$

|

363

|

|

$

|

1,412

|

|

||

|

Interest rate contracts

|

$

|

218

|

|

$

|

—

|

|

$

|

218

|

|

||

|

Derivative liabilities

(2)

:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

759

|

|

$

|

501

|

|

$

|

1,260

|

|

||

|

Interest rate contracts

|

$

|

303

|

|

$

|

—

|

|

$

|

303

|

|

||

|

(1)

|

The fair value of derivative assets is measured using Level 2 fair value inputs and is recorded as other current assets and other non-current assets in the Consolidated Balance Sheets.

|

|

(2)

|

The fair value of derivative liabilities is measured using Level 2 fair value inputs and is recorded as other current liabilities and other non-current liabilities in the Consolidated Balance Sheets.

|

|

2018

|

2017

|

2016

|

|||||||||

|

Gains/(Losses) recognized in OCI – effective portion:

|

|||||||||||

|

Cash flow hedges:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

682

|

|

$

|

1,797

|

|

$

|

109

|

|

||

|

Interest rate contracts

|

1

|

|

7

|

|

(57

|

)

|

|||||

|

Total

|

$

|

683

|

|

|

$

|

1,804

|

|

|

$

|

52

|

|

|

Net investment hedges:

|

|||||||||||

|

Foreign currency debt

|

$

|

4

|

|

$

|

67

|

|

$

|

(258

|

)

|

||

|

Gains/(Losses) reclassified from AOCI into net income – effective portion:

|

|||||||||||

|

Cash flow hedges:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

(482

|

)

|

$

|

1,958

|

|

$

|

885

|

|

||

|

Interest rate contracts

|

1

|

|

(2

|

)

|

(11

|

)

|

|||||

|

Total

|

$

|

(481

|

)

|

|

$

|

1,956

|

|

|

$

|

874

|

|

|

Gains/(Losses) on derivative instruments:

|

|||||||||||

|

Fair value hedges:

|

|||||||||||

|

Foreign exchange contracts

|

$

|

(168

|

)

|

$

|

—

|

|

$

|

—

|

|

||

|

Interest rate contracts

|

(1,363

|

)

|

(810

|

)

|

341

|

|

|||||

|

Total

|

$

|

(1,531

|

)

|

$

|

(810

|

)

|

$

|

341

|

|

||

|

Gains/(Losses) related to hedged items:

|

|||||||||||

|

Fair value hedges:

|

|||||||||||

|

Marketable securities

|

$

|

167

|

|

$

|

—

|

|

$

|

—

|

|

||

|

Fixed-rate debt

|

1,363

|

|

810

|

|

(341

|

)

|

|||||

|

Total

|

$

|

1,530

|

|

$

|

810

|

|

$

|

(341

|

)

|

||

|

2018

|

2017

|

||||||||||||||

|

Notional

Amount

|

Credit Risk

Amount

|

Notional

Amount

|

Credit Risk

Amount

|

||||||||||||

|

Instruments designated as accounting hedges:

|

|||||||||||||||

|

Foreign exchange contracts

|

$

|

65,368

|

|

$

|

1,015

|

|

$

|

56,156

|

|

$

|

1,049

|

|

|||

|

Interest rate contracts

|

$

|

33,250

|

|

$

|

—

|

|

$

|

33,000

|

|

$

|

218

|

|

|||

|

Instruments not designated as accounting hedges:

|

|||||||||||||||

|

Foreign exchange contracts

|

$

|

63,062

|

|

$

|

259

|

|

$

|

69,774

|

|

$

|

363

|

|

|||

|

2018

|

2017

|

||||||

|

Land and buildings

|

$

|

16,216

|

|

$

|

13,587

|

|

|

|

Machinery, equipment and internal-use software

|

65,982

|

|

54,210

|

|

|||

|

Leasehold improvements

|

8,205

|

|

7,279

|

|

|||

|

Gross property, plant and equipment

|

90,403

|

|

75,076

|

|

|||

|

Accumulated depreciation and amortization

|

(49,099

|

)

|

(41,293

|

)

|

|||

|

Total property, plant and equipment, net

|

$

|

41,304

|

|

$

|

33,783

|

|

|

|

2018

|

2017

|

||||||

|

Long-term taxes payable

|

$

|

33,589

|

|

$

|

257

|

|

|

|

Deferred tax liabilities

|

426

|

|

31,504

|

|

|||

|

Other non-current liabilities

|

11,165

|

|

8,654

|

|

|||

|

Total other non-current liabilities

|

$

|

45,180

|

|

$

|

40,415

|

|

|

|

2018

|

2017

|

2016

|

|||||||||

|

Interest and dividend income

|

$

|

5,686

|

|

$

|

5,201

|

|

$

|

3,999

|

|

||

|

Interest expense

|

(3,240

|

)

|

(2,323

|

)

|

(1,456

|

)

|

|||||

|

Other expense, net

|

(441

|

)

|

(133

|

)

|

(1,195

|

)

|

|||||

|

Total other income/(expense), net

|

$

|

2,005

|

|

$

|

2,745

|

|

$

|

1,348

|

|

||

|

2018

|

2017

|

2016

|

|||||||||

|

Federal:

|

|||||||||||

|

Current

|

$

|

41,425

|

|

$

|

7,842

|

|

$

|

7,652

|

|

||

|

Deferred

|

(33,819

|

)

|

5,980

|

|

5,043

|

|

|||||

|

Total

|

7,606

|

|

|

13,822

|

|

|

12,695

|

|

|||

|

State:

|

|||||||||||

|

Current

|

551

|

|

259

|

|

990

|

|

|||||

|

Deferred

|

48

|

|

2

|

|

(138

|

)

|

|||||

|

Total

|

599

|

|

|

261

|

|

|

852

|

|

|||

|

Foreign:

|

|||||||||||

|

Current

|

3,986

|

|

1,671

|

|

2,105

|

|

|||||

|

Deferred

|

1,181

|

|

(16

|

)

|

33

|

|

|||||

|

Total

|

5,167

|

|

|

1,655

|

|

|

2,138

|

|

|||

|

Provision for income taxes

|

$

|

13,372

|

|

|

$

|

15,738

|

|

|

$

|

15,685

|

|

|

2018

|

2017

|

2016

|

|||||||||

|

Computed expected tax

|

$

|

17,890

|

|

$

|

22,431

|

|

$

|

21,480

|

|

||

|

State taxes, net of federal effect

|

271

|

|

185

|

|

553

|

|

|||||

|

Impacts of the Act

|

1,515

|

|

—

|

|

—

|

|

|||||

|

Earnings of foreign subsidiaries

|

(5,606

|

)

|

(6,135

|

)

|

(5,582

|

)

|

|||||

|

Domestic production activities deduction

|

(195

|

)

|

(209

|

)

|

(382

|

)

|

|||||

|

Research and development credit, net

|

(560

|

)

|

(678

|

)

|

(371

|

)

|

|||||

|

Other

|

57

|

|

144

|

|

(13

|

)

|

|||||

|

Provision for income taxes

|

$

|

13,372

|

|

|

$

|

15,738

|

|

|

$

|

15,685

|

|

|

Effective tax rate

|

18.3

|

%

|

24.6

|

%

|

25.6

|

%

|

|||||

|

2018

|

2017

|

||||||

|

Deferred tax assets:

|

|||||||

|

Accrued liabilities and other reserves

|

$

|

3,151

|

|

$

|

4,019

|

|

|

|

Basis of capital assets

|

137

|

|

1,230

|

|

|||

|

Deferred revenue

|

1,141

|

|

1,521

|

|

|||

|

Deferred cost sharing

|

—

|

|

667

|

|

|||

|

Share-based compensation

|

513

|

|

703

|

|

|||

|

Unrealized losses

|

871

|

|

—

|

|

|||

|

Other

|

797

|

|