|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

FORM 10-K

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the Fiscal Year Ended December 31, 2013

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from _____ to _____

|

|

|

Bermuda

|

Not applicable

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

Waterloo House, Ground Floor

|

|

|

100 Pitts Bay Road

|

|

|

Pembroke HM 08, Bermuda

|

(441) 278-9250

|

|

(Address of principal executive offices)

|

(Registrant’s telephone number, including area code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Shares, $0.0033 par value per share

6.75% Non-Cumulative Preferred Shares, Series C, $0.01 par value per share

|

NASDAQ Stock Market (Common Shares)

New York Stock Exchange

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

|

|

Portions of Part III and Part IV

incorporate by reference our definitive proxy statement for the 2014 annual meeting of shareholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A before April 30, 2014.

|

|

|

ARCH CAPITAL GROUP LTD.

|

||

|

TABLE OF CONTENTS

|

||

|

Item

|

Page

|

|

|

PART I

|

||

|

PART II

|

||

|

PART III

|

||

|

PART IV

|

||

|

•

|

our ability to successfully implement our business strategy during “soft” as well as “hard” markets;

|

|

•

|

acceptance of our business strategy, security and financial condition by rating agencies and regulators, as well as by brokers and our insureds and reinsureds;

|

|

•

|

our ability to maintain or improve our ratings, which may be affected by our ability to raise additional equity or debt financings, by ratings agencies’ existing or new policies and practices, as well as other factors described herein;

|

|

•

|

general economic and market conditions (including inflation, interest rates, foreign currency exchange rates, prevailing credit terms and the depth and duration of a recession) and conditions specific to the reinsurance and insurance markets (including the length and magnitude of the current “soft” market) in which we operate;

|

|

•

|

competition, including increased competition, on the basis of pricing, capacity, coverage terms or other factors;

|

|

•

|

developments in the world’s financial and capital markets and our access to such markets;

|

|

•

|

our ability to successfully enhance, integrate and maintain operating procedures (including information technology) to effectively support our current and new business;

|

|

•

|

the loss of key personnel;

|

|

•

|

the integration of businesses we have acquired or may acquire into our existing operations;

|

|

•

|

accuracy of those estimates and judgments utilized in the preparation of our financial statements, including those related to revenue recognition, insurance and other reserves, reinsurance recoverables, investment valuations, intangible assets, bad debts, income taxes, contingencies and litigation, and any determination to use the deposit method of accounting, which for a relatively new insurance and reinsurance company, like our company, are even more difficult to make than those made in a mature company since relatively limited historical information has been reported to us through

December 31, 2013

;

|

|

•

|

greater than expected loss ratios on business written by us and adverse development on claim and/or claim expense liabilities related to business written by our insurance and reinsurance subsidiaries;

|

|

•

|

severity and/or frequency of losses;

|

|

•

|

claims for natural or man-made catastrophic events in our insurance or reinsurance business could cause large losses and substantial volatility in our results of operations;

|

|

•

|

acts of terrorism, political unrest and other hostilities or other unforecasted and unpredictable events;

|

|

•

|

availability to us of reinsurance to manage our gross and net exposures and the cost of such reinsurance;

|

|

•

|

the failure of reinsurers, managing general agents, third party administrators or others to meet their obligations to us;

|

|

•

|

the timing of loss payments being faster or the receipt of reinsurance recoverables being slower than anticipated by us;

|

|

•

|

our investment performance, including legislative or regulatory developments that may adversely affect the fair value of our investments;

|

|

•

|

the impact of the continued weakness of the U.S., European countries and other key economies, projected budget deficits for the U.S., European countries and other governments and the consequences associated with possible additional downgrades of securities of the U.S., European countries and other governments by credit

|

|

•

|

losses relating to aviation business and business produced by a certain managing underwriting agency for which we may be liable to the purchaser of our prior reinsurance business or to others in connection with the May 5, 2000 asset sale described in our periodic reports filed with the SEC;

|

|

•

|

changes in accounting principles or policies or in our application of such accounting principles or policies;

|

|

•

|

changes in the political environment of certain countries in which we operate or underwrite business;

|

|

•

|

statutory or regulatory developments, including as to tax policy and matters and insurance and other regulatory matters such as the adoption of proposed legislation that would affect Bermuda-headquartered companies and/or Bermuda-based insurers or reinsurers and/or changes in regulations or tax laws applicable to us, our subsidiaries, brokers or customers; and

|

|

•

|

the other matters set forth under Item 1A “Risk Factors,” Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this Annual Report on Form 10-K, as well as the other factors set forth in Arch Capital Group Ltd.’s other documents on file with the SEC, and management’s response to any of the aforementioned factors.

|

|

•

|

Capitalize on Profitable Underwriting Opportunities

. Our insurance group believes that its experienced management and underwriting teams are positioned to locate and identify business with attractive risk/reward characteristics. As profitable underwriting opportunities are identified, our insurance group will continue to seek to make additions to its product portfolio in order to take advantage of market trends. This may include adding underwriting and other professionals with specific expertise in specialty lines of insurance.

|

|

•

|

Centralize Responsibility for Underwriting

. Our insurance group consists of a range of product lines. The underwriting executive in charge of each product line oversees all aspects of the underwriting product development process within such product line. Our insurance group believes that centralizing the control of such product line with the respective underwriting executive allows for close management of underwriting and creates clear accountability for results. Our U.S. insurance group has four regional offices, and the executive in charge of each region is primarily responsible for all aspects of the marketing and distribution of our insurance group’s products, including the management of broker and other producer relationships in such executive’s respective region. In our non-U.S. offices, a similar philosophy is observed, with responsibility for the management of each product line residing with the senior underwriting executive in charge of such product line.

|

|

•

|

Maintain a Disciplined Underwriting Philosophy

. Our insurance group’s underwriting philosophy is to generate an underwriting profit through prudent risk selection and proper pricing. Our insurance group believes that the key to this approach is adherence to uniform underwriting standards across all types of business. Our insurance group’s senior management closely monitors the underwriting process.

|

|

•

|

Focus on Providing Superior Claims Management

. Our insurance group believes that claims handling is an integral component of credibility in the market for insurance products. Therefore, our insurance group believes that its ability to handle claims expeditiously and satisfactorily is a key to its success. Our insurance group

|

|

•

|

Utilize a Brokerage Distribution System

. Our insurance group believes that by utilizing a brokerage distribution system, consisting of select international, national and regional brokers, both wholesale and retail, it can efficiently access a broad customer base while maintaining underwriting control and discipline.

|

|

•

|

Casualty.

Our insurance group’s casualty unit writes primary and excess casualty insurance coverages, including railroad and middle market energy business.

|

|

•

|

Construction.

Our insurance group’s construction unit provides primary and excess casualty coverages to middle and large accounts in the construction industry.

|

|

•

|

Executive Assurance.

Our insurance group’s executive assurance unit focuses on directors’ and officers’ liability insurance coverages for corporate, private equity, venture capital, real estate investment trust, limited partnership, financial institution and not-for-profit clients of all sizes. This unit also writes employment practices liability insurance, pension trust errors and omissions/fiduciary liability insurance, fidelity bonds, kidnap and ransom extortion insurance, representations and warranties insurance and various financial institution professional liability coverages.

|

|

•

|

Healthcare.

Our insurance group’s healthcare unit provides medical professional and general liability insurance coverages for the healthcare industry, including excess professional liability programs for large, integrated hospital systems, outpatient facilities, clinics and long-term care facilities.

|

|

•

|

Lenders products

. Our insurance group’s lenders products unit provides collateral protection, debt cancellation and service contract reimbursement products to banks, credit unions, automotive dealerships and original equipment manufacturers. The unit also underwrites other specialty programs that pertain to automotive lending and leasing.

|

|

•

|

National Accounts.

Our insurance group’s national accounts unit provides a wide range of products for middle and large accounts and specializes in loss sensitive primary casualty insurance programs, including large deductible, self-insured retention and retrospectively rated programs.

|

|

•

|

Professional Liability.

Our insurance group’s professional liability unit insures large law firms and accounting firms and professional programs, as well as miscellaneous professional liability, including coverages for consultants, network security, securities broker-dealers, wholesalers, captive agents and managing general agents. The professional liability unit also provides coverage for environmental and design professionals, including coverages for architectural and engineering firms and construction projects and pollution legal liability coverage for fixed sites.

|

|

•

|

Programs.

Our insurance group’s programs unit targets program managers with unique expertise and niche products offering general liability, commercial automobile, inland marine and property business with minimal catastrophe exposure. This unit offers primarily package policies, underwriting workers’ compensation and umbrella liability business in support of desirable package programs.

|

|

•

|

Property, Energy, Marine and Aviation.

Our insurance group’s property unit provides primary and excess general property insurance coverages, including catastrophe-exposed property coverage, for commercial clients. The property unit also provides contractors all risk, erection all risk, aviation and stand alone terrorism insurance coverage for commercial clients.

|

|

•

|

Surety.

Our insurance group’s surety unit provides contract and commercial surety coverages, including contract bonds (payment and performance bonds) primarily for medium and large contractors and commercial surety bonds for Fortune 1,000 companies and smaller transaction business programs. The surety unit also provides specialty contract bonds for homebuilders and developers.

|

|

•

|

Travel and Accident.

Our insurance group’s travel and accident unit provides specialty travel and accident and related insurance products for individual and group travelers, as well as travel agents and suppliers.

|

|

•

|

Other.

Our insurance group also includes the following units: (i) alternative market risks, including captive insurance programs; (ii) contract binding, which provides property and casualty coverage through a network of appointed agents to small and medium risks where it is cost effective to use technology to access this niche market; (iii) accident and health, which provides accident, disability and medical plan insurance coverages for employer groups, medical plan members, students and other participant groups; and (iv) excess workers’ compensation, which provides excess workers’ compensation and employer’s liability insurance coverages for qualified self-insured groups, associations and trusts in a wide range of businesses.

|

|

•

|

risk selection;

|

|

•

|

desired attachment point;

|

|

•

|

limits and retention management;

|

|

•

|

due diligence, including financial condition, claims history, management, and product, class and territorial exposure;

|

|

•

|

underwriting authority and appropriate approvals; and

|

|

•

|

collaborative decision making.

|

|

Year Ended December 31,

|

|||||||||||||||||

|

INSURANCE SEGMENT

|

2013

|

2012

|

2011

|

||||||||||||||

|

Amount

|

% of Total

|

Amount

|

% of Total

|

Amount

|

% of Total

|

||||||||||||

|

Net premiums written

|

|||||||||||||||||

|

Programs

|

$

|

419,673

|

|

22

|

$

|

340,130

|

|

19

|

$

|

290,378

|

|

17

|

|||||

|

Property, energy, marine and aviation

|

280,551

|

|

14

|

294,690

|

|

16

|

335,589

|

|

19

|

||||||||

|

Professional liability

|

222,351

|

|

11

|

260,705

|

|

14

|

237,860

|

|

14

|

||||||||

|

Executive assurance

|

213,727

|

|

11

|

250,904

|

|

14

|

231,405

|

|

13

|

||||||||

|

Construction

|

161,877

|

|

8

|

130,201

|

|

7

|

120,405

|

|

7

|

||||||||

|

Casualty

|

112,094

|

|

6

|

112,307

|

|

6

|

114,235

|

|

7

|

||||||||

|

National accounts

|

109,233

|

|

6

|

80,929

|

|

4

|

80,973

|

|

5

|

||||||||

|

Lenders products

|

101,576

|

|

5

|

99,724

|

|

5

|

94,301

|

|

5

|

||||||||

|

Surety

|

64,911

|

|

3

|

53,271

|

|

3

|

42,475

|

|

2

|

||||||||

|

Travel and accident

|

63,209

|

|

3

|

80,489

|

|

4

|

71,940

|

|

4

|

||||||||

|

Healthcare

|

40,115

|

|

2

|

36,814

|

|

2

|

35,652

|

|

2

|

||||||||

|

Other (1)

|

159,479

|

|

9

|

85,170

|

|

6

|

66,066

|

|

5

|

||||||||

|

Total

|

$

|

1,948,796

|

|

100

|

$

|

1,825,334

|

|

100

|

$

|

1,721,279

|

|

100

|

|||||

|

Net premiums written by client location

|

|||||||||||||||||

|

United States

|

$

|

1,526,156

|

|

78

|

$

|

1,314,577

|

|

72

|

$

|

1,208,007

|

|

70

|

|||||

|

Europe

|

226,254

|

|

12

|

271,278

|

|

15

|

273,578

|

|

16

|

||||||||

|

Asia and Pacific

|

95,970

|

|

5

|

120,492

|

|

7

|

119,523

|

|

7

|

||||||||

|

Other

|

100,416

|

|

5

|

118,987

|

|

6

|

120,171

|

|

7

|

||||||||

|

Total

|

$

|

1,948,796

|

|

100

|

$

|

1,825,334

|

|

100

|

$

|

1,721,279

|

|

100

|

|||||

|

Net premiums written by underwriting location

|

|||||||||||||||||

|

United States

|

$

|

1,478,930

|

|

76

|

$

|

1,254,623

|

|

69

|

$

|

1,153,834

|

|

67

|

|||||

|

Europe

|

389,763

|

|

20

|

472,132

|

|

26

|

463,855

|

|

27

|

||||||||

|

Other

|

80,103

|

|

4

|

98,579

|

|

5

|

103,590

|

|

6

|

||||||||

|

Total

|

$

|

1,948,796

|

|

100

|

$

|

1,825,334

|

|

100

|

$

|

1,721,279

|

|

100

|

|||||

|

•

|

Actively Select and Manage Risks

. Our reinsurance group only underwrites business that meets certain profitability criteria, and it emphasizes disciplined underwriting over premium growth. To this end, our reinsurance group maintains centralized control over reinsurance underwriting guidelines and authorities.

|

|

•

|

Maintain Flexibility and Respond to Changing Market Conditions

. Our reinsurance group’s organizational structure and philosophy allows it to take advantage of increases or changes in demand or favorable pricing trends. Our reinsurance group believes that its existing platforms in Bermuda, the U.S., Europe and Canada, broad underwriting expertise and substantial capital facilitates adjustments to its mix of business geographically and by line and type of coverage. Our reinsurance group believes that this flexibility allows it to participate in those market opportunities that provide the greatest potential for underwriting profitability.

|

|

•

|

Maintain a Low Cost Structure

. Our reinsurance group believes that maintaining tight control over its staffing level and operating primarily as a broker market reinsurer permits it to maintain low operating costs relative to its capital and premiums.

|

|

•

|

Casualty.

Our reinsurance group reinsures third party liability and workers’ compensation exposures from ceding company clients primarily on a treaty basis. The exposures that it reinsures include, among others, executive assurance, professional liability, workers’ compensation, excess and umbrella liability and healthcare business. Our reinsurance group writes this business on a proportional and non-proportional basis. On proportional and non-proportional “working casualty business,” which is treated separately from casualty clash business, our reinsurance group prefers to write treaties where there is a meaningful amount of actuarial data and where loss activity is more predictable.

|

|

•

|

Marine and Aviation.

Our reinsurance group writes marine business, which includes coverages for energy, hull, cargo, specie, liability and transit, and aviation business, which includes coverages for airline and general

|

|

•

|

Other Specialty.

Our reinsurance group writes other specialty lines, including U.K. motor primarily emanating from one significant client, surety, accident and health, private passenger auto, workers’ compensation catastrophe, agriculture, trade credit and political risk.

|

|

•

|

Property Catastrophe

. Our reinsurance group reinsures catastrophic perils for our reinsureds on a treaty basis. Treaties in this type of business provide protection for most catastrophic losses that are covered in the underlying policies written by our reinsureds. The primary perils in our reinsurance group’s portfolio include hurricane, earthquake, flood, tornado, hail and fire. Our reinsurance group may also provide coverage for other perils on a case-by-case basis. Property catastrophe reinsurance provides coverage on an excess of loss basis when aggregate losses and loss adjustment expense from a single occurrence of a covered peril exceed the retention specified in the contract. The multiple claimant nature of property catastrophe reinsurance requires careful monitoring and control of cumulative aggregate exposure.

|

|

•

|

Property Excluding Property Catastrophe.

Our reinsurance group’s treaty reinsurance operations reinsure individual property risks of a ceding company. Property per risk treaty and pro rata reinsurance contracts written by our treaty reinsurance group cover claims from individual insurance policies issued by reinsureds and include both personal lines and commercial property exposures (principally covering buildings, structures, equipment and contents). The primary perils in this business include fire, explosion, collapse, riot, vandalism, wind, tornado, flood and earthquake. Our reinsurance group’s property facultative operations focus on commercial property risks on an excess of loss basis.

|

|

•

|

Other.

Our reinsurance group writes mortgage reinsurance on both a proportional and non-proportional basis on a global basis and direct mortgage insurance in Europe along with life reinsurance business on both a proportional and non-proportional basis. Besides death risk, the portfolio may include short and long-term disability risk from accident or natural causes. In addition, our reinsurance group writes casualty clash business and, in limited instances, writes non-traditional business which is intended to provide insurers with risk management solutions that complement traditional reinsurance.

|

|

•

|

adequacy of underlying rates for a specific class of business and territory;

|

|

•

|

the reputation of the proposed cedent and the likelihood of establishing a long-term relationship with the cedent, the geographic area in which the cedent does business, together with its catastrophe exposures, and our aggregate exposures in that area;

|

|

•

|

historical loss data for the cedent and, where available, for the industry as a whole in the relevant regions, in order to compare the cedent’s historical loss experience to industry averages;

|

|

•

|

projections of future loss frequency and severity; and

|

|

•

|

the perceived financial strength of the cedent.

|

|

Year Ended December 31,

|

|||||||||||||||||

|

REINSURANCE SEGMENT

|

2013

|

2012

|

2011

|

||||||||||||||

|

Amount

|

% of Total

|

Amount

|

% of Total

|

Amount

|

% of Total

|

||||||||||||

|

Net premiums written

|

|||||||||||||||||

|

Other specialty (1)

|

$

|

417,865

|

|

30

|

$

|

308,104

|

|

25

|

$

|

219,632

|

|

23

|

|||||

|

Casualty (2)

|

306,304

|

|

22

|

205,925

|

|

17

|

173,344

|

|

18

|

||||||||

|

Property excluding property catastrophe (3)

|

292,536

|

|

21

|

265,783

|

|

22

|

226,013

|

|

24

|

||||||||

|

Property catastrophe

|

220,749

|

|

16

|

283,677

|

|

23

|

246,793

|

|

26

|

||||||||

|

Marine and aviation

|

64,380

|

|

5

|

84,649

|

|

7

|

77,309

|

|

8

|

||||||||

|

Other (4)

|

100,737

|

|

6

|

78,763

|

|

6

|

8,956

|

|

1

|

||||||||

|

Total

|

$

|

1,402,571

|

|

100

|

$

|

1,226,901

|

|

100

|

$

|

952,047

|

|

100

|

|||||

|

Net premiums written by client location

|

|||||||||||||||||

|

United States

|

$

|

770,080

|

|

55

|

$

|

629,614

|

|

51

|

$

|

512,319

|

|

54

|

|||||

|

Europe

|

327,172

|

|

23

|

341,674

|

|

28

|

250,809

|

|

26

|

||||||||

|

Asia and Pacific

|

120,017

|

|

9

|

104,398

|

|

8

|

75,590

|

|

8

|

||||||||

|

Bermuda

|

87,047

|

|

6

|

72,864

|

|

6

|

60,246

|

|

6

|

||||||||

|

Other

|

98,255

|

|

7

|

78,351

|

|

7

|

53,083

|

|

6

|

||||||||

|

Total

|

$

|

1,402,571

|

|

100

|

$

|

1,226,901

|

|

100

|

$

|

952,047

|

|

100

|

|||||

|

Net premiums written by underwriting location

|

|||||||||||||||||

|

Bermuda

|

$

|

548,924

|

|

39

|

$

|

595,999

|

|

49

|

$

|

531,254

|

|

56

|

|||||

|

United States

|

507,183

|

|

36

|

379,239

|

|

31

|

323,731

|

|

34

|

||||||||

|

Europe

|

309,242

|

|

22

|

225,491

|

|

18

|

84,919

|

|

9

|

||||||||

|

Other

|

37,222

|

|

3

|

26,172

|

|

2

|

12,143

|

|

1

|

||||||||

|

Total

|

$

|

1,402,571

|

|

100

|

$

|

1,226,901

|

|

100

|

$

|

952,047

|

|

100

|

|||||

|

(1)

|

Includes U.K. motor, trade credit, surety, workers’ compensation catastrophe, accident and health, private passenger auto and other.

|

|

(2)

|

Includes professional liability, executive assurance and healthcare business.

|

|

(3)

|

Includes facultative business.

|

|

(4)

|

Includes mortgage, life, casualty clash and other.

|

|

Development of GAAP Reserves

|

|||||||||||||||||||||||||||||||||

|

Cumulative Redundancy (Deficiency)

|

|||||||||||||||||||||||||||||||||

|

(U.S. dollars in millions)

|

Year Ended December 31,

|

||||||||||||||||||||||||||||||||

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

|||||||||||||||||||||||

|

Reserve for losses and loss adjustment expenses, net of reinsurance recoverables

|

$

|

1,543

|

|

$

|

2,875

|

|

$

|

4,063

|

|

$

|

4,911

|

|

$

|

5,483

|

|

$

|

5,938

|

|

$

|

6,214

|

|

$

|

6,395

|

|

$

|

6,638

|

|

$

|

7,104

|

|

$

|

7,076

|

|

|

Cumulative net paid losses as of:

|

|||||||||||||||||||||||||||||||||

|

One year later

|

278

|

|

449

|

|

745

|

|

843

|

|

954

|

|

1,167

|

|

1,106

|

|

1,127

|

|

1,169

|

|

1,351

|

|

|||||||||||||

|

Two years later

|

437

|

|

811

|

|

1,332

|

|

1,486

|

|

1,817

|

|

2,114

|

|

1,943

|

|

1,938

|

|

2,096

|

|

|||||||||||||||

|

Three years later

|

596

|

|

1,110

|

|

1,688

|

|

2,040

|

|

2,308

|

|

2,768

|

|

2,561

|

|

2,613

|

|

|||||||||||||||||

|

Four years later

|

706

|

|

1,300

|

|

1,993

|

|

2,375

|

|

2,755

|

|

3,222

|

|

3,070

|

|

|||||||||||||||||||

|

Five years later

|

787

|

|

1,478

|

|

2,249

|

|

2,680

|

|

3,023

|

|

3,596

|

|

|||||||||||||||||||||

|

Six years later

|

853

|

|

1,629

|

|

2,447

|

|

2,867

|

|

3,254

|

|

|||||||||||||||||||||||

|

Seven years later

|

930

|

|

1,740

|

|

2,603

|

|

3,005

|

|

|||||||||||||||||||||||||

|

Eight years later

|

967

|

|

1,797

|

|

2,684

|

|

|||||||||||||||||||||||||||

|

Nine years later

|

993

|

|

1,829

|

|

|||||||||||||||||||||||||||||

|

Ten years later

|

1,009

|

|

|||||||||||||||||||||||||||||||

|

Net re-estimated reserve as of:

|

|||||||||||||||||||||||||||||||||

|

One year later

|

1,444

|

|

2,756

|

|

3,986

|

|

4,726

|

|

5,173

|

|

5,749

|

|

6,067

|

|

6,110

|

|

6,416

|

|

6,840

|

|

|||||||||||||

|

Two years later

|

1,353

|

|

2,614

|

|

3,809

|

|

4,387

|

|

4,959

|

|

5,620

|

|

5,826

|

|

5,927

|

|

6,160

|

|

|||||||||||||||

|

Three years later

|

1,259

|

|

2,487

|

|

3,541

|

|

4,164

|

|

4,849

|

|

5,466

|

|

5,711

|

|

5,748

|

|

|||||||||||||||||

|

Four years later

|

1,237

|

|

2,353

|

|

3,381

|

|

4,107

|

|

4,740

|

|

5,403

|

|

5,570

|

|

|||||||||||||||||||

|

Five years later

|

1,187

|

|

2,305

|

|

3,359

|

|

4,026

|

|

4,680

|

|

5,308

|

|

|||||||||||||||||||||

|

Six years later

|

1,183

|

|

2,291

|

|

3,301

|

|

3,989

|

|

4,604

|

|

|||||||||||||||||||||||

|

Seven years later

|

1,191

|

|

2,255

|

|

3,327

|

|

3,944

|

|

|||||||||||||||||||||||||

|

Eight years later

|

1,177

|

|

2,271

|

|

3,280

|

|

|||||||||||||||||||||||||||

|

Nine years later

|

1,201

|

|

2,247

|

|

|||||||||||||||||||||||||||||

|

Ten years later

|

1,198

|

|

|||||||||||||||||||||||||||||||

|

Cumulative net redundancy

|

$

|

345

|

|

$

|

628

|

|

$

|

783

|

|

$

|

967

|

|

$

|

879

|

|

$

|

630

|

|

$

|

644

|

|

$

|

647

|

|

$

|

478

|

|

$

|

264

|

|

|||

|

|

|

||||||||||||||||||||||||||||||||

|

Cumulative net redundancy as a percentage of net reserves

|

22.4

|

%

|

21.8

|

%

|

19.3

|

%

|

19.7

|

%

|

16.0

|

%

|

10.6

|

%

|

10.4

|

%

|

10.1

|

%

|

7.2

|

%

|

3.7

|

%

|

|||||||||||||

|

Gross reserve for losses and loss adjustment expenses

|

$

|

1,912

|

|

$

|

3,493

|

|

$

|

5,453

|

|

$

|

6,463

|

|

$

|

7,092

|

|

$

|

7,667

|

|

$

|

7,873

|

|

$

|

8,098

|

|

$

|

8,456

|

|

$

|

8,933

|

|

$

|

8,824

|

|

|

Reinsurance recoverable

|

(369

|

)

|

(618

|

)

|

(1,390

|

)

|

(1,552

|

)

|

(1,609

|

)

|

(1,729

|

)

|

(1,659

|

)

|

(1,703

|

)

|

(1,818

|

)

|

(1,829

|

)

|

(1,748

|

)

|

|||||||||||

|

Net reserve for losses and loss adjustment expenses

|

$

|

1,543

|

|

$

|

2,875

|

|

$

|

4,063

|

|

$

|

4,911

|

|

$

|

5,483

|

|

$

|

5,938

|

|

$

|

6,214

|

|

$

|

6,395

|

|

$

|

6,638

|

|

$

|

7,104

|

|

$

|

7,076

|

|

|

Gross re-estimated reserve

|

$

|

1,453

|

|

$

|

2,704

|

|

$

|

4,568

|

|

$

|

5,242

|

|

$

|

5,977

|

|

$

|

6,754

|

|

$

|

6,999

|

|

$

|

7,193

|

|

$

|

7,739

|

|

$

|

8,633

|

|

|||

|

Re-estimated reinsurance recoverable

|

(255

|

)

|

(457

|

)

|

(1,288

|

)

|

(1,298

|

)

|

(1,373

|

)

|

(1,446

|

)

|

(1,429

|

)

|

(1,445

|

)

|

(1,579

|

)

|

(1,793

|

)

|

|||||||||||||

|

Net re-estimated reserve

|

1,198

|

|

2,247

|

|

3,280

|

|

3,944

|

|

4,604

|

|

5,308

|

|

5,570

|

|

5,748

|

|

6,160

|

|

6,840

|

|

|||||||||||||

|

Gross re-estimated redundancy

|

$

|

459

|

|

$

|

789

|

|

$

|

885

|

|

$

|

1,221

|

|

$

|

1,115

|

|

$

|

913

|

|

$

|

874

|

|

$

|

905

|

|

$

|

717

|

|

$

|

300

|

|

|||

|

Year Ended December 31,

|

|||||||||||

|

2013

|

2012

|

2011

|

|||||||||

|

Reserve for losses and loss adjustment expenses at beginning of year

|

$

|

8,933,292

|

|

$

|

8,456,210

|

|

$

|

8,098,454

|

|

||

|

Unpaid losses and loss adjustment expenses recoverable

|

1,829,070

|

|

1,818,047

|

|

1,703,201

|

|

|||||

|

Net reserve for losses and loss adjustment expenses at beginning of year

|

7,104,222

|

|

6,638,163

|

|

6,395,253

|

|

|||||

|

Net incurred losses and loss adjustment expenses relating to losses occurring in:

|

|||||||||||

|

Current year

|

1,943,466

|

|

2,082,805

|

|

2,012,569

|

|

|||||

|

Prior years

|

(264,042

|

)

|

(221,528

|

)

|

(285,016

|

)

|

|||||

|

Total net incurred losses and loss adjustment expenses

|

1,679,424

|

|

1,861,277

|

|

1,727,553

|

|

|||||

|

Net losses and loss adjustment expense reserves of acquired business

|

—

|

|

31,977

|

|

—

|

|

|||||

|

Foreign exchange losses (gains)

|

1,617

|

|

38,184

|

|

(32,020

|

)

|

|||||

|

Net paid losses and loss adjustment expenses relating to losses occurring in:

|

|||||||||||

|

Current year

|

(288,114

|

)

|

(295,984

|

)

|

(325,273

|

)

|

|||||

|

Prior years

|

(1,420,703

|

)

|

(1,169,395

|

)

|

(1,127,350

|

)

|

|||||

|

Total net paid losses and loss adjustment expenses

|

(1,708,817

|

)

|

(1,465,379

|

)

|

(1,452,623

|

)

|

|||||

|

Net reserve for losses and loss adjustment expenses at end of year

|

7,076,446

|

|

7,104,222

|

|

6,638,163

|

|

|||||

|

Unpaid losses and loss adjustment expenses recoverable

|

1,748,250

|

|

1,829,070

|

|

1,818,047

|

|

|||||

|

Reserve for losses and loss adjustment expenses at end of year

|

$

|

8,824,696

|

|

$

|

8,933,292

|

|

$

|

8,456,210

|

|

||

|

December 31, 2013

|

December 31, 2012

|

||||||||||||

|

Amount

|

% of

Total

|

Amount

|

% of

Total

|

||||||||||

|

Fixed maturities available for sale, at fair value

|

$

|

9,571,776

|

|

68.1

|

|

$

|

9,839,988

|

|

75.4

|

|

|||

|

Fixed maturities, at fair value (1)

|

448,254

|

|

3.2

|

|

363,541

|

|

2.8

|

|

|||||

|

Fixed maturities pledged under securities lending agreements, at fair value (2)

|

105,081

|

|

0.7

|

|

42,600

|

|

0.3

|

|

|||||

|

Total fixed maturities

|

10,125,111

|

|

72.1

|

|

10,246,129

|

|

78.5

|

|

|||||

|

Short-term investments available for sale, at fair value

|

1,478,367

|

|

10.5

|

|

722,121

|

|

5.5

|

|

|||||

|

Short-term investments pledged under securities lending agreements, at fair

value (2)

|

—

|

|

—

|

|

8,248

|

|

0.1

|

|

|||||

|

Cash

|

434,057

|

|

3.1

|

|

371,041

|

|

2.8

|

|

|||||

|

Equity securities available for sale, at fair value

|

496,824

|

|

3.5

|

|

312,749

|

|

2.4

|

|

|||||

|

Equity securities, at fair value (1)

|

—

|

|

—

|

|

25,954

|

|

0.2

|

|

|||||

|

Other investments available for sale, at fair value

|

498,310

|

|

3.5

|

|

549,280

|

|

4.2

|

|

|||||

|

Other investments, at fair value (1)

|

773,280

|

|

5.5

|

|

527,971

|

|

4.0

|

|

|||||

|

Investments accounted for using the equity method (3)

|

244,339

|

|

1.7

|

|

307,105

|

|

2.4

|

|

|||||

|

Total cash and investments

|

14,050,288

|

|

100.0

|

|

13,070,598

|

|

100.2

|

|

|||||

|

Securities sold but not yet purchased (4)

|

—

|

|

—

|

|

(6,924

|

)

|

(0.1

|

)

|

|||||

|

Securities transactions entered into but not settled at the balance sheet date

|

(763

|

)

|

—

|

|

(18,540

|

)

|

(0.1

|

)

|

|||||

|

Total investable assets

|

$

|

14,049,525

|

|

100.0

|

|

$

|

13,045,134

|

|

100.0

|

|

|||

|

(1)

|

Represents securities which are carried at fair value under the fair value option and reflected as “investments accounted for using the fair value option” on our balance sheet. Changes in the carrying value of such securities are recorded in net realized gains or losses.

|

|

(2)

|

This table excludes the collateral received and reinvested and includes the fixed maturities and short-term investments pledged under securities lending agreements, at fair value.

|

|

(3)

|

Changes in the carrying value of investment funds accounted for using the equity method are recorded as “equity in net income (loss) of investments funds accounted for using the equity method” rather than as an unrealized gain or loss component of accumulated other comprehensive income.

|

|

(4)

|

Represents our obligation to deliver equity securities that we did not own at the time of sale. Such amounts are included in “other liabilities” on our balance sheet.

|

|

|

December 31, 2013

|

December 31, 2012

|

||||||||||||

|

Rating (1)

|

Fair Value

|

% of

Total

|

Fair Value

|

% of

Total

|

||||||||||

|

U.S. government and government agencies (2)

|

$

|

2,284,053

|

|

22.6

|

|

$

|

2,523,212

|

|

24.6

|

|

||||

|

AAA

|

3,709,872

|

|

36.6

|

|

3,413,431

|

|

33.3

|

|

||||||

|

AA

|

1,720,605

|

|

17.0

|

|

1,563,846

|

|

15.3

|

|

||||||

|

A

|

1,359,193

|

|

13.4

|

|

1,501,156

|

|

14.7

|

|

||||||

|

BBB

|

304,543

|

|

3.0

|

|

538,140

|

|

5.3

|

|

||||||

|

BB

|

180,125

|

|

1.8

|

|

174,527

|

|

1.7

|

|

||||||

|

B

|

188,119

|

|

1.9

|

|

220,772

|

|

2.2

|

|

||||||

|

Lower than B

|

241,463

|

|

2.4

|

|

175,866

|

|

1.7

|

|

||||||

|

Not rated

|

137,138

|

|

1.3

|

|

135,179

|

|

1.2

|

|

||||||

|

Total

|

$

|

10,125,111

|

|

100.0

|

|

$

|

10,246,129

|

|

100.0

|

|

||||

|

(1)

|

For individual fixed maturities, S&P ratings are used. In the absence of an S&P rating, ratings from Moody’s are used, followed by ratings from Fitch Ratings.

|

|

(2)

|

Includes U.S. government-sponsored agency mortgage backed securities and agency commercial mortgage backed securities.

|

|

Arch

|

Benchmark

|

||||

|

Portfolio (1)

|

Return

|

||||

|

Pre-tax total return (before investment expenses):

|

|||||

|

Year ended December 31, 2013

|

1.28

|

%

|

0.85

|

%

|

|

|

Year ended December 31, 2012

|

5.88

|

%

|

4.90

|

%

|

|

|

Year ended December 31, 2011

|

3.81

|

%

|

4.80

|

%

|

|

|

•

|

ensure that operational and oversight responsibilities of the group are clearly defined and documented and that the reporting of material deficiencies and fraudulent activities are transparent and devoid of conflicts of interest;

|

|

•

|

establish systems for identifying on a risk sensitive basis those policies and procedures that must be reviewed annually and those policies and procedures that must be reviewed at other regular intervals;

|

|

•

|

establish a risk management and internal controls framework and ensure that it is assessed regularly and such assessment is reported to the Parent Board and the chief and senior executives;

|

|

•

|

establish and maintain sound accounting and financial reporting procedures and practices for the group; and

|

|

•

|

establish and keep under review group functions relating to actuarial, compliance, internal audit and risk management functions which must address certain specific requirements as set out in the Group Rules.

|

|

•

|

if the reinsurer is licensed in the state in which the primary insurer is domiciled;

|

|

•

|

if the reinsurer is an “accredited” or otherwise approved reinsurer in the state in which the primary insurer is domiciled;

|

|

•

|

in some instances, if the reinsurer (a) is domiciled in a state that is deemed to have substantially similar credit for reinsurance standards as the state in which the primary insurer is domiciled and (b) meets certain financial requirements; or

|

|

•

|

if none of the above applies, to the extent that the reinsurance obligations of the reinsurer are collateralized appropriately, typically through the posting of a letter of credit for the benefit of the primary insurer or the deposit of assets into a trust fund established for the benefit of the primary insurer.

|

|

•

|

underwriting, which encompasses the risk of adverse loss developments and inadequate pricing;

|

|

•

|

declines in asset values arising from credit risk; and

|

|

•

|

declines in asset values arising from investment risks.

|

|

•

|

insurer is required to submit a plan for corrective action;

|

|

•

|

insurer is subject to examination, analysis and specific corrective action;

|

|

•

|

regulators may place insurer under regulatory control; and

|

|

•

|

regulators are required to place insurer under regulatory control.

|

|

•

|

the term of the mortgage is 30 years or less;

|

|

•

|

there is no negative amortization, interest only or balloon features;

|

|

•

|

the lender documents the loan in accordance with requirements;

|

|

•

|

the total "points and fees" do not exceed certain thresholds, generally 3%; and

|

|

•

|

the total debt-to-income ratio does not exceed 43%.

|

|

•

|

maintain, through December 31, 2016, minimum capital funding of $400 million which may consist of statutory capital (policyholders’ surplus plus contingency reserves) of no less than $200 million, dedicated reinsurance trust assets for any primary business reinsured and the value of purchased technology assets;

|

|

•

|

maintain minimum statutory capital (defined as policyholders’ surplus plus contingency reserves) of no less than $260 million;

|

|

•

|

maintain a risk-to-capital ratio of no greater than 18 to 1;

|

|

•

|

refrain from paying dividends to affiliates for three years commencing February 2014;

|

|

•

|

insure only (i) GSE-eligible loans, (ii) loans that are GSE-eligible, other than as related to loan amount, (iii) loans originated under a state housing finance agency program, (iv) loans that meet the requirements of a “Qualified Mortgage” under federal regulation, or (v) other loans not included in (i) through (iv) provided that such loans in aggregate not constitute more than 2% of Arch MI U.S.’s total outstanding risk in force with a coverage effective date on or after December 31, 2003;

|

|

•

|

obtain prior written approval to enter into transactions involving the issuance of insurance on other than an individual loan “flow” basis;

|

|

•

|

not enter into reinsurance or other risk share arrangements without prior written approval; and

|

|

•

|

re-domicile from Wisconsin to another state if requested by Fannie Mae.

|

|

•

|

net income for the calendar year preceding the date of the dividend, minus realized capital gains for that calendar year; or

|

|

•

|

aggregate net income for the 3 calendar years preceding the date of the dividend, less realized capital gains for those calendar years and less dividends paid or credited and distributions made within the first 2 of the preceding 3 calendar years.

|

|

•

|

a citizen or resident of the United States,

|

|

•

|

a corporation or entity treated as a corporation created or organized in or under the laws of the United States, any state thereof, or the District of Columbia,

|

|

•

|

an estate the income of which is subject to United States federal income taxation regardless of its source,

|

|

•

|

a trust if either (x) a court within the United States is able to exercise primary supervision over the administration of such trust and one or more United States persons have the authority to control all substantial decisions of such trust or (y) the trust has a valid election in effect to be treated as a United States person for U.S. federal income tax purposes or

|

|

•

|

any other person or entity that is treated for U.S. federal income tax purposes as if it were one of the foregoing.

|

|

•

|

For any year in which ACGL is not a PFIC, no income tax consequences would result.

|

|

•

|

For any year in which ACGL is a PFIC, the shareholder would include in its taxable income a proportionate share of the net ordinary income and net capital gains of ACGL and certain of its non-U.S. subsidiaries.

|

|

•

|

a reduction in the premiums charged for government mortgage insurance or a loosening of underwriting guidelines;

|

|

•

|

imposition of additional loan level fees by the government sponsored entities (“GSEs”), Fannie Mae and Freddie Mac, on loans that require mortgage insurance;

|

|

•

|

increases in GSE guaranty fees and the difference in the spread between Fannie Mae mortgage-backed securities (“MBS”) and Ginnie Mae MBS; and

|

|

•

|

the implementation of new regulations under the Dodd-Frank Act and the Basel III Rules.

|

|

•

|

state-supported mortgage insurance funds in several states;

|

|

•

|

lenders and other investors holding mortgages in portfolio and self-insuring;

|

|

•

|

investors using credit enhancements other than mortgage insurance, using other credit enhancements in conjunction with reduced levels of mortgage insurance coverage, or accepting credit risk without credit enhancement; and

|

|

•

|

lenders originating mortgages using “piggy-back” structures to avoid mortgage insurance, such as a first mortgage with an 80% LTV and a second mortgage with a 10%, 15% or 20% LTV (referred to as 80-10-10, 80-15-5 or 80-20 loans, respectively) rather than a first mortgage with a 90%, 95% or 100% LTV that has mortgage insurance.

|

|

•

|

actual or anticipated variations in our quarterly results, including as a result of catastrophes or our investment performance;

|

|

•

|

our share repurchase program;

|

|

•

|

changes in market valuation of companies in the insurance and reinsurance industry;

|

|

•

|

changes in expectations of future financial performance or changes in estimates of securities analysts;

|

|

•

|

fluctuations in stock market processes and volumes;

|

|

•

|

issuances or sales of common shares or other securities in the future;

|

|

•

|

the addition or departure of key personnel; and

|

|

•

|

announcements by us or our competitors of acquisitions, investments or strategic alliances.

|

|

•

|

current mortgage interest rates compared to those rates on our insurance in force, which affects the likelihood of the insurance in force to be subject to borrower refinance;

|

|

•

|

the amount of home equity, as homeowners with more equity in their homes can generally more readily move to a new residence or refinance their existing mortgage; and

|

|

•

|

Mortgage insurance cancellation policies of mortgage investors and the cancellation of borrower-paid mortgage insurance, either upon request of the borrower or as required by law based upon the amortization schedule of the loan.

|

|

•

|

develop business relationships with national and regional mortgage banks and originators and obtain their approvals as an authorized mortgage insurance provider;

|

|

•

|

develop and implement necessary e-commerce connectivity with new customers’ mortgage origination systems;

|

|

•

|

maintain and expand business relationships with existing credit union customers;

|

|

•

|

integrate various technology systems of Arch MI U.S. into our existing operating and technology systems; and

|

|

•

|

retain and attract talent at Arch MI U.S. necessary to implement our U.S. mortgage insurance strategy.

|

|

•

|

integrating financial and operational reporting systems and establishing satisfactory budgetary and other financial controls;

|

|

•

|

funding increased capital needs, overhead expenses or cash flow shortages that may occur if anticipated sales and revenues are not realized or are delayed, whether by general economic or market conditions or unforeseen internal difficulties;

|

|

•

|

obtaining management personnel required for expanded operations;

|

|

•

|

obtaining necessary regulatory permissions;

|

|

•

|

the value of assets acquired may be lower than expected or may diminish due to credit defaults or changes in interest rates and liabilities assumed may be greater than expected;

|

|

•

|

the assets and liabilities we may acquire may be subject to foreign currency exchange rate fluctuation; and

|

|

•

|

financial exposures in the event that the sellers of the entities we acquire are unable or unwilling to meet their indemnification, reinsurance and other obligations to us.

|

|

•

|

restrictions on mortgage credit due to stringent underwriting standards and liquidity issues affecting lenders;

|

|

•

|

changes in mortgage interest rates and home prices, and other economic conditions in the U.S. and regional economies;

|

|

•

|

population trends, including the rate of household formation; and

|

|

•

|

U.S. government housing policy.

|

|

•

|

the amount of loans purchased by the GSEs that require mortgage insurance;

|

|

•

|

the level of private mortgage insurance coverage lenders select when private mortgage insurance is used as the required credit enhancement on low down payment mortgages;

|

|

•

|

GSE pricing, including the amount of loan level fees that the GSEs assess on loans that require mortgage insurance, which could reduce the demand for our products;

|

|

•

|

loan eligibility standards for loans purchased by the GSEs, which impact the conforming mortgage loan origination market, including loan quality and availability;

|

|

•

|

terms on which mortgage insurance coverage can be canceled before reaching the cancellation thresholds required by law;

|

|

•

|

purchases by the GSEs of credit enhancements other than mortgage insurance;

|

|

•

|

whether the GSEs influence mortgage lenders’ selection of mortgage insurers providing coverage; and

|

|

•

|

the size of loans that are eligible for purchase or guaranty by the GSEs.

|

|

•

|

for a classified board of directors, in which the directors of the class elected at each annual general meeting holds office for a term of three years, with the term of each class expiring at successive annual general meetings of shareholders;

|

|

•

|

that the number of directors is determined by the board from time to time by a vote of the majority of our board;

|

|

•

|

that directors may only be removed for cause, and cause removal shall be deemed to exist only if the director whose removal is proposed has been convicted of a felony or been found by a court to be liable for gross negligence or misconduct in the performance of his or her duties;

|

|

•

|

that our board has the right to fill vacancies, including vacancies created by an expansion of the board; and

|

|

•

|

for limitations on shareholders' right to raise proposals or nominate directors at general meetings.

|

|

•

|

merger or consolidation of the company into a 15% Holder;

|

|

•

|

sale of any or all of our assets to a 15% Holder;

|

|

•

|

the issuance of voting securities to a 15% Holder; or

|

|

•

|

amendment of these provisions;

|

|

•

|

establish solvency requirements, including minimum reserves and capital and surplus requirements;

|

|

•

|

limit the amount of dividends, tax distributions, intercompany loans and other payments our insurance subsidiaries can make without prior regulatory approval;

|

|

•

|

impose restrictions on the amount and type of investments we may hold;

|

|

•

|

require assessments through guaranty funds to pay claims of insolvent insurance companies; and

|

|

•

|

require participation in state-assigned risk plans which may take the form of reinsuring a portion of a pool of policies or the direct issuance of policies to insureds.

|

|

•

|

maintain a minimum level of capital and surplus on both an individual and group basis;

|

|

•

|

maintain an individual (for its general business) enhanced capital requirement, general and long-term business solvency margins on an individual and group basis and a minimum liquidity ratio (for its general business);

|

|

•

|

restrict dividends and distributions;

|

|

•

|

obtain prior approval regarding the ownership and transfer of shares;

|

|

•

|

maintain a principal office and appoint and maintain a principal representative in Bermuda;

|

|

•

|

file annual financial statements, an annual statutory financial return and an annual capital and solvency return; and

|

|

•

|

allow for the performance of certain period examinations of Arch Re Bermuda and its financial condition and that of the group insurance companies.

|

|

•

|

the court which gave the judgment had proper jurisdiction over the parties to such judgment;

|

|

•

|

such court did not contravene the rules of natural justice of Bermuda;

|

|

•

|

such judgment was not obtained by fraud;

|

|

•

|

the enforcement of the judgment would not be contrary to the public policy of Bermuda;

|

|

•

|

no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of Bermuda; and

|

|

•

|

there is due compliance with the correct procedures under Bermuda law.

|

|

•

|

whether dividends have been declared and are likely to be declared on any series of our preferred shares from time to time;

|

|

•

|

our creditworthiness, financial condition, performance and prospects;

|

|

•

|

whether the ratings on any series of our preferred shares provided by any ratings agency have changed;

|

|

•

|

the market for similar securities; and

|

|

•

|

economic, financial, geopolitical, regulatory or judicial events that affect us and/or the insurance or financial markets generally.

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

Three Months Ended

|

|||||||||||||||

|

December 31, 2013

|

|

September 30, 2013

|

|

June 30, 2013

|

|

March 31, 2013

|

|

||||||||

|

High

|

|

$59.78

|

|

|

$55.87

|

|

|

$54.64

|

|

|

$52.59

|

|

|||

|

Low

|

|

$53.85

|

|

|

$51.00

|

|

|

$49.46

|

|

|

$44.00

|

|

|||

|

Close

|

|

$59.69

|

|

|

$54.13

|

|

|

$51.41

|

|

|

$52.57

|

|

|||

|

Three Months Ended

|

|||||||||||||||

|

December 31, 2012

|

|

September 30, 2012

|

|

June 30, 2012

|

|

March 31, 2012

|

|

||||||||

|

High

|

|

$45.16

|

|

|

$41.71

|

|

|

$40.42

|

|

|

$38.60

|

|

|||

|

Low

|

|

$41.71

|

|

|

$38.07

|

|

|

$36.80

|

|

|

$35.49

|

|

|||

|

Close

|

|

$44.02

|

|

|

$41.64

|

|

|

$39.69

|

|

|

$37.24

|

|

|||

|

Issuer Purchases of Equity Securities

|

|||||||||||||

|

Period

|

Total Number of Shares Purchased (1)

|

Average Price Paid per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Approximate Dollar Value of Shares that May Yet be Purchased Under the Plan or Programs (2)

|

|||||||||

|

10/1/2013-10/31/2013

|

6,767

|

$

|

55.62

|

|

—

|

|

$

|

712,115

|

|

||||

|

11/1/2013-11/30/2013

|

4,357

|

$

|

58.34

|

|

—

|

|

$

|

712,115

|

|

||||

|

12/1/2013-12/31/2013

|

4,117

|

$

|

58.11

|

|

—

|

|

$

|

712,115

|

|

||||

|

Total

|

15,241

|

$

|

57.07

|

|

—

|

|

$

|

712,115

|

|

||||

|

(1)

|

Includes repurchases by ACGL of shares, from time to time, from employees in order to facilitate the payment of withholding taxes on restricted shares granted and the exercise of stock appreciation rights. We purchased these shares at their fair market value, as determined by reference to the closing price of our common shares on the day the restricted shares vested or the stock appreciation rights were exercised.

|

|

(2)

|

Remaining amount available at

December 31, 2013

under ACGL’s share repurchase authorization, under which repurchases may be effected from time to time in open market or privately negotiated transactions through December 2014.

|

|

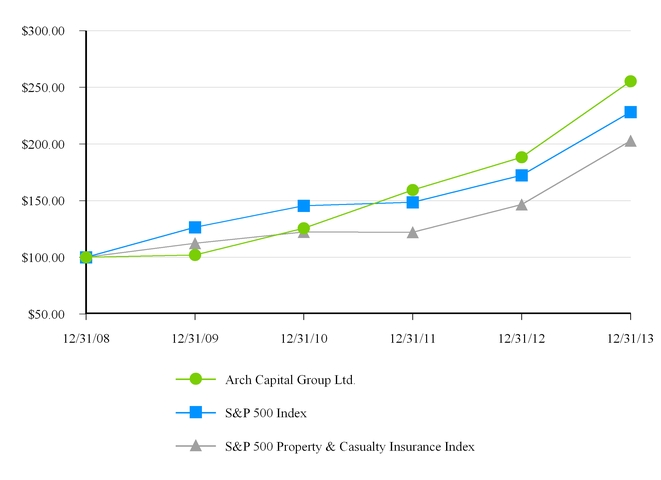

Base Period

|

|||||||||||||||||||

|

Company Name/Index

|

12/31/08

|

12/31/09

|

|

12/31/10

|

|

12/31/11

|

|

12/31/12

|

|

12/31/13

|

|

||||||||

|

l

|

Arch Capital Group Ltd.

|

|

$100.00

|

|

|

$102.07

|

|

|

$125.61

|

|

|

$159.33

|

|

|

$188.39

|

|

|

$255.45

|

|

|

n

|

S&P 500 Index

|

|

$100.00

|

|

|

$126.46

|

|

|

$145.51

|

|

|

$148.59

|

|

|

$172.37

|

|

|

$228.19

|

|

|

p

|

S&P 500 Property & Casualty Insurance Index

|

|

$100.00

|

|

|

$112.35

|

|

|

$122.38

|

|

|

$122.08

|

|

|

$146.63

|

|

|

$202.78

|

|

|

(1)

|

Stock price appreciation plus dividends.

|

|

(2)

|

The above graph assumes that the value of the investment was $100 on December 31, 2008.

|

|

(3)

|

This graph is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any filing by us under the Securities Act of 1933 or the Securities and Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

|

(U.S. dollars in thousands except share data)

|

Year Ended December 31,

|

||||||||||||||||||

|

2013

|

2012

|

2011

|

2010

|

2009

|

|||||||||||||||

|

Statement of Income Data:

|

|||||||||||||||||||

|

Revenues:

|

|||||||||||||||||||

|

Net premiums written

|

$

|

3,351,367

|

|

$

|

3,052,235

|

|

$

|

2,673,326

|

|

$

|

2,511,040

|

|

$

|

2,763,112

|

|

||||

|

Net premiums earned

|

3,145,952

|

|

2,935,140

|

|

2,631,815

|

|

2,552,483

|

|

2,842,745

|

|

|||||||||

|

Net investment income

|

267,219

|

|

294,895