|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES |

|||||||||||||||||

|

SECURITIES AND EXCHANGE COMMISSION |

|||||||||||||||||

|

Washington, D.C. 20549 |

|||||||||||||||||

|

FORM 10-Q |

|||||||||||||||||

|

(Mark One) |

|||||||||||||||||

|

[x] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||||||||||||||

|

For the quarterly period ended June 30, 2017 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||||||||||||||

|

For the transition period from to |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission file number 001-09712 |

|||||||||||||||||

|

|

|

(Exact name of Registrant as specified in its charter) |

|||||||||||||||||

|

Delaware |

|

|

62-1147325 |

||||||||||||||

|

(State or other jurisdiction of incorporation or organization) |

|

|

(IRS Employer Identification No.) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8410 West Bryn Mawr, Chicago, Illinois 60631 |

|||||||||||||||||

|

(Address of principal executive offices) (Zip code) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (773) 399-8900 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subj ect to such filing requirements for the past 90 days. |

[x] |

[ ] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

[x] |

[ ] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth comp any” in Rule 12b-2 of the Exchange Act. |

|||||||||||||||||

|

Large accelerated filer |

[ ] |

|

|

|

|

|

|

|

Accelerated filer |

[x] |

|||||||

|

Non-accelerated filer |

[ ] |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

[ ] |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

[ ] |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

[ ] |

||||||||||||||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

[ ] |

[x] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class |

|

|

Outstanding at June 30, 2017 |

||||||||||||||

|

Common Shares, $1 par value |

|

|

52,107,327 Shares |

||||||||||||||

|

Series A Common Shares, $1 par value |

|

|

33,005,877 Shares |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

United States Cellular Corporation |

||

|

|

|

|

|

Quarterly Report on Form 10-Q |

||

|

For the Period Ended June 30, 2017 |

||

|

|

|

|

|

Index |

Page No. |

|

|

|

|

|

|

|

Management Discussion and Analysis of Financial Condition and Results of Operations |

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

Supplemental Information Relating to Non-GAAP Financial Measures |

|

|

|

||

|

|

||

|

|

||

|

|

Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

United States Cellular Corporation Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The following discussion and analysis compares United States Cellular Corporation ’s ( U.S. Cellular) financial results for the three and six months ended June 30, 2017 , to the three and six months ended June 30, 2016 . It should be read in conjunction with U.S. Cellular’s interim consolidated financial statements and notes included herein , and with the des cription of U.S. Cellular’s business, its audited consolidated financial statements and Management's Discussion and Analysis ( MD&A ) of Financial Condition and Results of Operations included in U.S. Cellular’s Annual Report on Form 10-K (Form 10-K ) for the year ended December 31, 2016 . Certain numbers included herein are rounded to millions for ease of presentation; however, calculated amounts and percentages are determined using the unrounded numbers .

This report contains statements that are not based on historical facts, including the words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions . These statements constitute and represent “forward looking statemen ts” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement for additional information.

U.S. Cellular uses certa in “non-GAAP financial measures” and each such measure is identified in the MD&A. A discussion of the reason U.S. Cellular determines these metrics to be useful and a reconciliation of these measures to their most directly comparable measures determined i n accordance with accounting principles generally accepted in the Unit ed States of America (GAAP) are included in the Supplemental Information Relating to Non-GAAP Financial Measures section w ithin the MD&A of this Form 10-Q Report.

|

|

U.S. Cellular owns, operates, and invests in wireless markets throughout the United States. U.S. Cellular is an 83% -owned subs idiary of Telephone and Data Systems , Inc. (TDS). U.S. Cellular’s strategy is to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans, and prici ng, all provided with a local focus.

|

OPERATIONS |

|

|

|

|

|

U.S. Cellular Mission and Strategy

U.S. Cellular’s mission is to provide exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the mid-sized and rural markets served.

In 2017, U.S. Cellular continues to execute on its strategies to protect its current customer base, grow revenues by attracting new customers through economical offerings and identifying new revenue opportunities, and drive improvement s in its overall cost structure. Strategic efforts include:

- U.S. Cellular continues to devote efforts to enhance its network capabilities. During the second quarter of 2017, U.S. Cellular commercially deployed VoLTE technology for the first time in one key market and will continue to build out VoLTE services over the next few years. The next commercial launch is expected to occur in several additional operating markets in early 2018. VoLTE technology allows customers to utilize a 4G LTE network for bot h voice and data services, and offers enhanced services such as high definition voice, video calling and simultaneous voice and data session s. In addition, the deployment of VoLTE technology expands U.S. Cellular’s ability to offer roaming services to oth er carriers.

- U.S. Cellular continues to enhance its spectrum position and monetize non-strategic assets by participating in auctions and entering into agreements with third parties. In April 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an aggregate purchase price of $329 million in the forward auction of 600 MHz spectrum licenses, referred to as Auction 1002. U.S. Cellular made an upfront payment of $143 million to the FCC in June 201 6 and paid the remaining balance of $186 million and was granted these licenses during the second quarter of 2017. In addition, U.S. Cellular closed on certain license exchange agreement s in the six months ended June 30, 2017 , and received $15 million of cash and recognized gains of $19 million. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additio nal information related to th ese transactions .

- U.S. Cellular is focused on expanding its solutions available to business and government customers, including a growing suite of connected machine-to-machine solutions and software applications across various categories. U.S. Cellular will continue to enhance its advanced wireless services and connected solutions for consumer, business and government customers.

|

|

The following is a list of definitions of certain industry terms that are used throughout this document:

- 4G LTE – fourth generation Long-Term Evolution which is a wireless broadband technology.

- Account – represents an individual or business finan cially responsible for one or m ultiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

- Auctions 1000, 1001, and 1002 – Auction 1000 is an FCC auction of 600 MHz spectrum licenses tha t started in 2016 and continued into 2017 involving: (1) a “reverse auction” in which broadcast television licensees submit bids to voluntarily relinquish spectrum usage rights in exchange for payments (referred to as Auction 1001); (2 ) a “repacking” of t he broadcas t television bands in order to free up certain broadcast spectrum for other uses; and (3) a “forward auction” of licenses for spectrum cleared through this process to be used for wireless communications (referred to as Auction 1002).

- Churn Rate – represents the percentage of the c onnections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

- Connections – individual line s of service associated with each device activated by a custome r . This includes smartphones, feature phones, tablets, modems, and machine-to-machine devices.

- EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this d ocument.

- FCC – Fe deral Communications Commission .

- Gross Additions – represents the to tal number of new connections a dded during the p eriod , without regard to connections that wer e terminated during that period.

- Machine-to-Machin e or M2M – technology that involves the transmission of data between networked devices, as well as the performance of actions by devices without human intervention. U.S. Cell ular sells and supports M2M sol utions to customers, provides connectivity for M2M solutions via the U.S. Cel lular network, and has agreements with device manufacturers and software developers which offer M2M solutions.

- Net Additions – represents the tota l number of new connections add ed during the period, net of connections that were terminated during that perio d .

- OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document.

- Postpaid Average Bil lings per Account (Postpaid AB PA) – non-GAAP metric is calculated by div iding total postpaid service revenues plus equipment installment plan billings by the average number of postpaid accounts and by the number of months in the period.

- Postpaid Average Billings per User (Postpaid ABPU ) – non-GAAP metric is calculated by divid ing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid connections and by the number of months in the period.

- Postpaid Average Revenue per Account (Postpaid ARPA ) – metric is calculated by dividing to tal postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

- Postpaid Average R evenue per User (Postpaid ARPU ) – met ric is calculated by dividing total postpaid service revenue s by the average number o f postpaid connections and by the number of months in the period.

- Re tail Connections – the sum of postpaid connections and prepaid connections.

- Universal Service Fund (USF ) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

- VoLTE – Voice over Long-Term Evolution is a technology specification that defines the standards and procedures for delivering voice communications and relate d services over 4G LTE networks.

|

|

|

|

|

|

|

||

|

|

YTD 2017 |

YTD 2016 |

|||

|

Postpaid Connections |

|

|

|||

|

|

Gross Additions : |

320,000 |

412,000 |

||

|

|

|

Handsets |

218,000 |

249,000 |

|

|

|

|

Connected Devices |

102,000 |

163,000 |

|

|

|

Net Additions (Losses): |

(4,000) |

81,000 |

||

|

|

|

Handsets |

(9,000) |

(17,000) |

|

|

|

|

Connected Devices |

5,000 |

98,000 |

|

|

|

Churn: |

1.21% |

1.24% |

||

|

|

|

Handsets |

0.99% |

1.14% |

|

|

|

|

Connected Devices |

2.45% |

1.92% |

|

|

|

Connections – end of period |

4,478,000 |

4,490,000 |

||

|

Prepaid connections – end of period |

484,000 |

413,000 |

|||

|

Retail connections – end of period |

4,962,000 |

4,903,000 |

|||

|

The decrease in postpaid net additions for the six months ended June 30, 2017, when compared to the same period last year, was a result of lower handset s and tablet gross additions, partially offset by a decline in postpaid handsets churn due to improvements in both v o luntary and involuntary churn.

|

|||||

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

||||||||

|

|

|

June 30, |

|

|

June 30, |

|||||||

|

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||

|

Average Revenue Per User (ARPU) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average Billings Per User (ABPU) 1 |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

Average Revenue Per Account (ARPA) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average Billings Per Account (ABPA) 1 |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Postpaid ABPU and Postpaid ABPA are non-GAAP financial measures. Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of these measures. |

|||||||||||

Postpaid ARPU and Postpaid ARPA decreased for the three a nd six months ended June 30, 2017, due primarily to industry-wide price competition resulting in overall price reductions on plan offerings.

Equipment installment plans increase equipment sales revenue as customers pay for their wireless devices in instal lments at a total device price that is generally higher than the device price offered to customers in conjunction with alternative plans that are subject to a service contract. Equipment installment plans also have the impact of reducing service revenues as certain equipment installment plans provide for reduced monthly access charges. In order to show the trends in total service and equipment revenues received, U.S. Cellular has presented Postpaid ABPU and Postpaid ABPA, which are calculated as Postpaid ARPU and Postpaid ARPA plus average monthly equipment installment plan billings per connection and account, respectively.

Equipment installment plan billings increased for the three and six months ended June 30, 2017, due to increased adoption of equipment installment plans by postpaid customers. Postpaid ABPU decreased for the three and six months ended June 30, 2017, as the increase in equipment installment plan billings was more than offset by the decline in Postpaid ARPU discussed above. Postpaid ABPA , however, increased slightly for the three months ended June 30, 2017, and to a greater extent for the six months ended June 30, 2017, as the increase in equipment installment plan billings more than offset the decline in Postpaid ARPA discussed above. U .S. Cellular expects the penetration of equipment installment plans to continue to increase over time due to the fact that, effective in September 2016, all equipment sales to retail customers are made under installment plans.

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|||||||||||||

|

|

|

|

|

|

June 30, |

|

June 30, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

2017 vs. |

|||||

|

|

|

|

|

|

2017 |

|

2016 |

|

2016 |

|

2017 |

|

2016 |

|

2016 |

||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Retail service |

|

$ |

|

$ |

|

(5)% |

|

$ |

|

$ |

|

(4)% |

|||||||

|

Inbound roaming |

|

|

|

|

|

(18)% |

|

|

|

|

|

(22)% |

|||||||

|

Other 1 |

|

|

|

|

|

9% |

|

|

|

|

|

13% |

|||||||

|

|

Service revenues 1 |

|

|

|

|

|

(4)% |

|

|

|

|

|

(4)% |

||||||

|

Equipment sales |

|

|

|

|

|

2% |

|

|

|

|

|

(1)% |

|||||||

|

|

Total operating revenues 1 |

|

|

|

|

|

(3)% |

|

|

|

|

|

(3)% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

System operations (excluding Depreciation, amortization and accretion reported below) |

|

|

|

|

|

(2)% |

|

|

|

|

|

(3)% |

|||||||

|

Cost of equ ipment sold |

|

|

|

|

|

(1)% |

|

|

|

|

|

(6)% |

|||||||

|

Selling, general and administrative |

|

|

|

|

|

(2)% |

|

|

|

|

|

(4)% |

|||||||

|

Depreciation, amortization and accretion |

|

|

|

|

|

- |

|

|

|

|

|

- |

|||||||

|

(Gain) loss on asset disposals, net |

|

|

|

|

|

6% |

|

|

|

|

|

(12)% |

|||||||

|

(Gain) loss on license sales and exchanges, net |

|

|

|

|

|

81% |

|

|

|

|

|

>(100)% |

|||||||

|

|

Total operating expenses |

|

|

|

|

|

(1)% |

|

|

|

|

|

(4)% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Operating income¹ |

|

$ |

|

$ |

|

(82)% |

|

$ |

|

$ |

|

45% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Net income |

|

$ |

|

$ |

|

(57)% |

|

$ |

|

$ |

|

8% |

|||||||

|

Adjusted OIBDA (Non-GAAP) 1,2 |

|

$ |

|

$ |

|

(9)% |

|

$ |

|

$ |

|

2% |

|||||||

|

Adjusted EBI TDA (Non-GAAP) 2 |

|

$ |

|

$ |

|

(9)% |

|

$ |

|

$ |

|

1% |

|||||||

|

Capital expenditures |

|

$ |

|

$ |

|

(9)% |

|

$ |

|

$ |

|

(16)% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with an accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD& A for a reconciliation of this measure. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

S ervice revenues consist of:

Equipment revenues consist of:

|

|

Total operating revenues

On January 1, 2017, U.S. Cellular elected to change the classification of interest income on equipment installment plan contracts from Interest and dividend income to Service revenues in the Consolidated Statement of Operations. All pri or period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details.

Service revenues decreased for the three and six months ended June 30, 2017, as a result of (i) a decrease in retail service revenues primarily driven by industry-wide price competition resulting in overall price reductions on plan offerings ; and (ii) a decrease in inbound roaming reve nues primarily driven by lower roaming rates. Such reductions were partially offset by an increase in imputed interest income due to an increase in the total number of active equipment installment plans.

Federal USF revenue remained flat at $23 million and $46 million for the three and six months ended June 30, 2017, respectively, when compared to the same periods last year. See the Regulatory Matters section in this MD&A for a description of the FCC’s Reform Order (Reform Order) and its expected impact s on U.S. Cellular’s current Federal USF support.

Equipment sales revenues increased for the three months ended June 30, 2017, when compared to the same period last year, due to a mix shift from connected devices to smartphones and an increase in the proportion of new device sales made under equipment installment plans versus subsidy plans. These impacts were partially offset by a reduction in guarantee liability amortization for equipment installment contracts as a result of changes in plan offerings and a reduction in device activation fees.

Equipment sales revenues decreased for the six months ended June 30, 2017, when compared to the same period last year, as a result of an overall reduction in the number of devices sold, along with the related im pact on accessories revenues, as well as reductions in device activation fees and guarantee liability amortization for equipment installment contracts as a result of changes in plan offerings. These impacts were partially offset by an increase in the prop ortion of new device sales made under equipment installment plans and, to a lesser extent, a mix shift from connected devices to smartphones.

|

|

System operations expenses decreased for the six months ended June 30, 2017, when c ompared to the same period last year, as a result of (i) a decrease in roaming expenses driven primarily by lower rates for both data and voice traffic, partially offset by increased data roaming usage; and (ii) a decrease in customer usage expenses primar ily driven by decreased circuit costs.

Cost of equipment sold

The decrease in Cost of equipment sold for the six months ended June 30, 2017, when compared to the same period last year, was mainly due to a reduction in the number of devices sold, partially offset by a shift in sales from connected devices to higher cost smartphones. Cost of equipment sold included $200 million and $174 million related to equipment installment plan sales for the three months ended June 30, 2017 and 2 016, respectively, and $368 million and $334 million for the six months ended June 30, 2017 and 2016, respectively. Loss on equipment, defined as Equipment sales revenues less Cost of equipment sold, was $37 million and $44 million for the three months en ded June 30, 2017 and 2016, respectively, and $75 million and $101 million for the six months ended June 30, 2017 and 2016, respectively.

Selling, general and administrative expenses

Selling, general and administrative expenses decreased for the six months ended June 30, 2017, due to lower advertising expenses, lower agent commission expenses driven by fewer activations and renewals, lower phone program expenses and the aggregate impact of modest reductions in numerous other general and ad ministrative categories.

(Gain) loss on license sales and exchanges , net

Net gains in 2017 and 2016 were due to gains recognized on license exchange transac tions with third parties. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information.

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Three Months Ended |

Six Months Ended |

|||||||||||||

|

|

|

|

|

|

June 30, |

|

June 30, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

|

|

2017 |

|

2016 |

|

2016 |

|

2017 |

|

2016 |

|

2016 |

||||

|

(Doll ars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Operating income¹ |

|

$ |

|

$ |

|

(82)% |

$ |

|

$ |

|

45% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Equity in earnings of unconsolidated entities |

|

|

|

|

|

(9)% |

|

|

|

|

(8)% |

||||||||

|

Interest and dividend income 1 |

|

|

|

|

|

29% |

|

|

|

|

38% |

||||||||

|

Interest expense |

|

|

|

|

|

(1)% |

|

|

|

|

(1)% |

||||||||

|

Other, net |

|

|

|

|

|

(56)% |

|

|

|

|

(23)% |

||||||||

|

Total investment and other i ncome 1 |

|

|

|

|

|

(32)% |

|

|

|

|

(27)% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Income before income taxes |

|

|

|

|

|

(70)% |

|

|

|

|

22% |

||||||||

|

Income tax expense |

|

|

|

|

|

(97)% |

|

|

|

|

43% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Net income |

|

|

|

|

|

(57)% |

|

|

|

|

8% |

||||||||

|

Less: Net income attributable to noncontrolling interests, net of tax |

|

|

|

|

|

>100% |

|

|

|

|

>100% |

||||||||

|

Net income attributable to U.S. Cellular shareholders |

|

$ |

|

$ |

|

(58)% |

$ |

|

$ |

|

5% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with an accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details. |

||||||||||||||||||

|

|

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities r epresents U.S. Cellular’s share of net income from entities in which it has a noncontrolling interest and that are accounted for by the equity method. U.S. Cellular’s investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed $ 17 million and $ 20 million to Equity in earnings of unconsolidated entities for the three months ended June 2017 and 2016, respectively, and $ 33 million and $ 40 million for the six months ended June 2017 and 2016, respectively. See Note 7 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for add itional information .

Income tax expense

The effective tax rate on Income before income taxes for the three and six months ended June 30, 2017, was 2.7% and 45.6%, respectively, and for the three and six months ended June 30, 2016, was 31.8% and 38.9%, r espectively. The effective rate for the three months ended June 30, 2017, is not meaningful, due primarily to the relatively low pretax income for the quarter combined with adjustments to the estimated annual tax rate, resulting in a distortive impact on the tax rate for the quarter. Due to difficulty in reliably projecting an annual tax rate, U.S. Cellular calculated income taxes for the six months ended June 30, 2017, based on an estimated year-to-date tax rate.

The lower effective tax rate for the six months ended June 30, 2016, resulted from a decrease in unrecognized tax benefits due to the expiration of statutes of limitation in certain states in t he prior year.

|

|

Liquidity and Capital Resources

Sources of Liquidity

U.S. Cellular operates a capital-intensive business. Historically, U.S. Cellular has used internally-generated funds and also has obtained substantial funds from external sources for gene ral corporate purposes. In the past, U.S. Cellular’s existing cash and investment balances, funds available under its revolving credit facility, funds from other financing sources, including a term loan and other long-term debt, and cash flows from operat ing, certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for U.S. Cellular to meet its normal day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund acquisitions, primarily of spectrum licenses. There is no assurance that this will be the case in the future. See Market Risk for additional information regarding maturities of long-term debt.

Although U. S. Cellular currently has a significant cash balance, in certain recent periods, U.S. Cellular has incurred negative free cash flow (non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipme nt) and this will continue in the future if operating results do not improve or capital expenditures are not reduced. U.S. Cellular currently expects to have negative free cash flow in 2017. However, U.S. Cellular believes that existing cash and investme nt balances, funds available under its revolving credit facility, and expected cash flows from operating and investing activities provide liquidity for U.S. Cellular to meet its normal day-to-day operating needs and debt service requirements for the coming year.

U.S. Cellular may require substantial additional capital for, among other uses, funding day-to-day operating needs including working capital, acquisitions of providers of wireless telecommunications services, spectrum license or system acquisitions, system development and network capacity expansion, debt service requirements, the repurchase of shares, the payment of dividends, or making additional investments. It may be necessary from time to time to increase the size of the existing re volving credit facility, to put in place a new credit facility, or to obtain other forms of financing in order to fund potential expenditures. U.S. Cellular is exploring a potential securitized borrowing using its equipment installment plan receivables, w hich may occur later in 2017. U.S. Cellular’s liquidity would be adversely affected if, among other things, U.S. Cellular is unable to obtain short or long-term financing on acceptable terms, U.S. Cellular makes significant spectrum license purchases, the LA Partnership discontinues or reduces distributions compared to historical levels, or Federal USF and/or other regulatory support payments decline. In addition, although sales of assets or businesses by U.S. Cellular have been an important source of liq uidity in prior periods, U.S. Cellular does not expect a similar level of such sales in the future.

U.S. Cellular’s credit rating has been sub-investment grade since 2014. There can be no assurance that sufficient funds will continue to be available to U.S. Cellular or its subsidiaries on terms or at prices acceptable to U.S. Cellular. Insufficient cash flows from operating activities, changes in its credit ratings, defaults of the terms of debt or credit agreements, uncertainty of access to capital, deterioration in the capital markets, reduced regulatory capital at banks which in turn limits their ability to borrow and lend, other changes in the performance of U.S. Cellular or in market conditions or other factors could limit or restrict the availab ility of financing on terms and prices acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its acquisition, capital expenditure and business development programs, reduce the acquisition of spectrum licenses, and/or reduce or cease shar e repurchases and/or the payment of dividends. U.S. Cellular cannot provide assurance that circumstances that could have a material adverse effect on its liquidity or capital resources will not occur. Any of the foregoing would have an adverse impact on U.S. Cellular’s businesses, financial condition or results of operations.

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments . The primary objective of U.S. Cellular’s Cash and cash equivalents is for use in its o perations and acquisition, capital expenditure and business development programs .

|

|

A t June 30, 2017 , U.S. Cellular’s cash and cash equivalents totaled $ 472 million compared to $ 586 million at December 31, 2016 . T he majority of U.S. Cellular’s Cash and cash equivalents w as held in bank deposit accounts and in money market funds that invest exclusive ly in U.S. Treasury Notes or in repurchase agreements fully collateralized by such obligations. U.S. Cellular monitors the financial viability of the money market funds and direct investments in which it invests and believes that the credit risk associate d with these investments is low. |

|

|

U.S. Cellular has a revolving credit facility available for general corporate purposes, including spectrum purchases and capital expenditures. This credit facility matures in June 2021.

U.S. Cellular’s unused capacity under its revolving credit facility was $ 298 million as of June 30, 2017 . U.S. Cellular believes it was in compliance with all of the financial covenants and requirement s set forth in its revolving credit facility as of that date.

U.S. Cellular has in place an effective shelf registration statement on Form S-3 to issue senior or subordinated debt securities.

Long-term debt payments due for the remainder of 2017 and the next four years represent less than 4% of U.S. Cellular’s total long-term debt obligation as of June 30, 2017 .

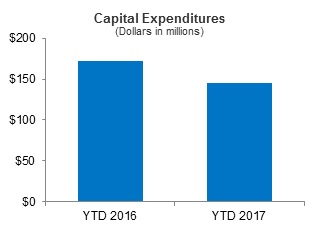

Capital Expenditures

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures), which in clude the effects of accruals and capitalized interest , in 2017 and 2016 were as follows:

|

|

U.S. Cellular’s capital expenditures for 2017 are expected to be approximately $ 500 million . These expenditures are expected to be for the following gen eral purposes:

|

U.S. Cellular plans to finance its capital expenditures program for 2017 using primarily Cash flows from operating activities, existing cash balances, borrowings under its revolving credit agreement and/or other long-term debt.

Acquisitions, Divestitures and Exchanges

U .S. Cellu lar may be engaged from time to time in negotiations (subject to all applicable regulations) relating to the acquisition, divestiture or exchange of companies, properties or wireless spectrum. In general, U.S. Cellular may not disclose such transactions until there is a definitive agreement. U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy, U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets a nd wireless spectrum, including pursuant to FCC auctions. U.S. Cellular also may seek to divest outright or include in exchanges for other wireless interests those interests that are not strategic to its long-term success.

I n July 2016, the FCC announced U.S. Cellular as a qualified bidder in the FCC’s forward auction of 600 MHz spectrum licenses, referred to as Auction 1002 . In April 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an aggregat e purchase price of $ 329 million. Prior to commencement of the forward auction , U.S. Cellular made an upfront payment to the FCC of $ 143 million in June 2016. U.S. Cellular paid the remaining $ 186 million to the FCC and was granted the licenses during the second quarter of 2017.

In February 2016, U.S. Cellular entered into an agreement with a third party to exchange certain 700 MHz licenses for certain AWS and PCS licenses a nd $ 28 million of cash. This license exchange was accomplished in two closings. The first closing occurred in the second quarter of 2016, at which time U.S. Cellular received $ 13 million of cash and r ecorded a gain of $ 9 million. The second closing occurred in the first quarter of 2017, at which time U.S. Cellular received $ 15 million of cash and recorded a gain of $ 17 mi llion.

|

|

U.S. Cellular consolidates certain “variable interest entities” as defined under GAAP. See Note 8 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. U.S. Cellular may elect to make additional capital contributions and/or advances to these variable interest entities in future perio ds in order to fund their operations.

During the first quarter of 2017, U.S. Cellular formed USCC EIP LLC, a special purpose entity (SPE), to facilitate a potential securitized borrowing using its equipment installment plan receivables in the future. Duri ng the six months ended June 30, 2017, net equipment installment plan receivables totaling $ 883 million were transferred to the newly formed SPE from affiliated entities. On a consolidated basis, the transfer of receivables into this SPE did not have a material impact to the financial condition of U.S. Cellular.

Common Share Repurchase Program

U.S. Cellular has repurchased and expects to continue to repurchase its Common Shares, subject to its repurchase program. Share repurch ases made under this program in 2017 and 2016 were as follows:

|

|

Six Months Ended |

|||||

|

|

|

June 30, |

||||

|

|

|

2017 |

|

2016 |

||

|

Number of shares |

|

|

||||

|

Average cost per share |

$ |

|

$ |

|||

|

Dollar amount (in millions) |

$ |

|

$ |

|||

For additional information related to the current repurchase authorization , see Unregistered Sales of Equity Securities and U se of Proceeds.

Contractual and Other Obligations

There w ere no material change s outside the ordinary course of business between December 31, 2016 and June 30, 2017 , to the Contractual and Other Obligations disclosed in Management’s Discussion and Analysis of Financial Condition and Results of Operations included in U.S. Cellular’s Form 10-K for the year ended December 31, 2016 .

Off-Balance Sheet Arrangements

U.S. Cellular had no transactions, agreements or other contractual arrangements with unconsolidated entities involving “off-balance sheet arrangements,” as defined by SEC rules, that had or are reasonably likely to have a material current or future effect on its financial cond ition, results of operations, liquidity, capital expenditures or capital resources.

|

|

Consolidated Cash Flow Analysis

U.S. Cellular operates a capital- and marketing-intensive business. U.S. Cellular makes substantial investments to acquire wireless licenses and properties and to construct and upgrade wireless telecommunications networks and facilities as a basis for creating long-term value for shareholders . In recent years, rapid changes in technology and new opportunities have required substantial investments in potentially revenue ‑ enhancing and cost-reducing upgrades to U.S. Cellular’s networks. U.S. Cellular utilizes cash on hand, cash from operating activities, cash proceeds from divestitures and dispositions of investments, short-term credit facilities and long-term debt financing to fund its acquisitions (including spectrum licenses), construction costs, operating expenses and share repurchases. Ca sh flows may fluctuate from quarter to quarter and year to year due to seasonality, the timing of acquisitions and divestitures, capital expenditures and other factors. The following discussion summarizes U.S. Cellular's cash flow activities for the six months ended June 30, 2017 and 2016 .

2017 Commentary

U.S. Cellula r’s Cash and cash equiva lents de creased $ 114 million in 2017 . Net cash provided by operating activities was $ 220 million in 201 7 due to net income of $ 40 mi llion plus non-cash items of $ 266 million and distributions received from unconsolidated entities of $ 65 million, including $ 30 million in distributions from the LA Partnershi p. This was partially offset by c hanges in working capital items which decreased net cash by $ 151 million. The decrease resulting from changes in working capital items was due in part to a $ 107 million increase in equipment installment plan receivables, which are expected to continue to increase and further require the use of working capital in the near term. The decrease was also a result of a $ 53 million decrease in accounts payable.

The net cash provided by operating activities was offset by Cash flows used for investing activities of $ 327 million. Cash paid in 201 7 for additions to property, plant and equipm ent totaled $ 155 million. Cash paid for acquisitions and licenses was $ 189 million which included the remaining $ 186 million due to the FCC for licenses U.S. Cellu lar won in Auction 1002. This was partially offset by Cash received from divestitures and exchanges of $ 17 million. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to these transactions.

2016 Commentary

U.S. Cellula r’s Cash and cash equivalents de creased $ 94 million in 2016. Net cash provided by operating activities w as $ 261 million in 2016 due to net income of $ 37 million plus non-cash items of $ 298 million and distributions received from unconsolidated entities of $ 30 million. This was partially offset by c hanges in working capital items which decreased net cash by $ 104 million. U.S. Cellular received a federal tax refund of $ 28 million related to an overpayment of the 2015 expected tax liability , which resulted from the enactment of federal bonus depreciation in December 2015 . This was offset by a use of cash of $ 94 million due to an increase in equipment installment plan receivables .

The net cash provided by operating activities was offset by Cash flows used for investing activities of $ 350 million. Cash paid in 2016 for additions to property, plant and equipment totaled $ 1 77 million . In June 2016, U.S. Cellular made a deposit of $ 143 million to the FCC for its participation in Auction 1002. Cash paid for acquisitions and licenses in 2016 was $ 46 million p artially offset by Cash received from divestitures and exchanges of $ 17 million.

|

|

The following discussion addresses certain captions in the consolidated balance sheet and changes therein. This discussion is intended to highlight the significant changes and is not intended to fully reconcile the changes. Changes in financial condition during 2017 are as follows:

Licenses

Licenses increased $ 340 million due primarily to an aggregate winning bid of $ 329 million in FCC Auction 1002. These licenses were granted by the FCC in the second quarter of 2017. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for more information about this transaction.

Other assets and deferred charges

Other assets and deferred char ges decreased $ 86 million due primarily to the $ 143 million deposit paid to the FCC in June 2016 for participation in Auction 1002, being applied to total amounts due for the licenses won in said auction in the second quarter of 2017. This was partially offset by a $ 59 million increase in the long-term portion of unbilled equipment installment plan receivables, net, due to the offering of longer term equipment installment plan cont racts and the overall increase in the number of such contracts outstanding . See Note 3 — Equipment Installment Plans and Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to these balances.

Accounts p ayable — Trade

Accounts payable — Trade decreased $ 59 million due primarily to reduction of expenses in 2017 as well as payment timing differences.

Accrued t axes

Accrued taxes increased $ 40 million due primarily to the excess of current income tax expense over federal estimated payments made during the six months ended June 30, 2017 .

Accrued c ompensation

Accrued compensation decreased $ 27 million due primarily to employee bonus payments in March 2017 .

|

|

Supplemental Information Relating to Non-GAAP Financial Measures

U.S. Cellular sometimes uses information derived from consolidated financial information but not presented in its financial statements prepared in accordance with U.S. GAAP to evaluate the performance of its business. Certain of these measures are considered “non-GAAP financial measures” under U.S. Securities and Exchange Commissi on Rules. Specifically, U.S. Cellular has referred to the following measures in this Form 10-Q Report:

- EBITDA

- Adjusted EBITDA

- Adjusted OIBDA

- Free cash flow

- Postpaid ABPU

- Postpaid ABPA

Following are explanations of each of these measures.

Adjusted EBITDA and Adjusted OIBDA

Adjusted EBITDA is defined as net income adjusted for the items set forth in the reconciliation below. Adjusted OIBDA is defined as net income adjusted for the items set forth in the reconciliation below. Adjusted EBITDA and Adjusted O IBDA are not measures of financial performance under GAAP and should not be considered as alternatives to Net income or Cash flows from operating activities, as indicators of cash flows or as measures of liquidity. U.S. Cellular does not intend to imply t hat any such items set forth in the reconciliation below are non-recurring, infrequent or unusual; such items may occur in the future.

Management uses Adjusted EBITDA and Adjusted OIBDA as measurements of profitability and, therefore, reconciliations to Ne t income are deemed appropriate. Management believes Adjusted EBITDA and Adjusted OIBDA are useful measures of U.S. Cellular’s operating results before significant recurring non-cash charges, gains and losses, and other items as presented below as they pr ovide additional relevant and useful information to investors and other users of U.S. Cellular’s financial data in evaluating the effectiveness of its operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. Adjusted EBITDA shows adjusted earnings before interest, taxes, depreciation, amortization and accretion, and gains and losses, while Adjusted OIBDA reduces this measure further to exclude Equity in earnings of unconsolidated entitie s and Interest and dividend income in order to more effectively show the performance of operating activities excluding investment activities. The following table reconciles Adjusted EBITDA and Adjusted OIBDA to the corresponding GAAP measure, Net income.

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|||||||||

|

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

||

|

N et income (GAAP) |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Add back: |

|

|

|

|

|

|

|

||||||

|

|

Income tax expense |

|

|

|

|

|

|

|

|||||

|

|

I nterest expense |

|

|

|

|

|

|

|

|||||

|

|

D epreciation, amortization and accretion |

|

|

|

|

|

|

|

|||||

|

EBITDA (Non-GAAP) |

|

|

|

|

|

|

|

||||||

|

Add back or deduct: |

|

|

|

|

|

|

|

||||||

|

|

(Gain) loss on license sales and exchanges, net |

|

|

|

|

|

|

|

|||||

|

|

( Gain) loss on asset disposals, net |

|

|

|

|

|

|

|

|||||

|

Adjusted EBITDA (Non-GAAP) |

|

|

|

|

|

|

|

||||||

|

Deduct: |

|

|

|

|

|

|

|

||||||

|

|

Equity in earnings of unconsolidated entities |

|

|

|

|

|

|

|

|||||

|

|

Interest and dividend income 1 |

|

|

|

|

|

|

|

|||||

|

|

O ther, net |

|

|

|

|

|

|

|

|||||

|

Adjusted OIBDA (Non-GAAP) 1 |

|

|

|

|

|

|

|

||||||

|

Deduct: |

|

|

|

|

|

|

|

||||||

|

|

Depreciation, amortization and accretion |

|

|

|

|

|

|

|

|||||

|

|

( Gain) loss on license sales and exchanges, net |

|

|

|

|

|

|

|

|||||

|

|

( Gain) loss on asset disposals, net |

|

|

|

|

|

|

|

|||||

|

Operating income (GAAP)¹ |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with the accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for addi tional details. |

||||||||||||

|

|

The following table presents Free cash flow. Management uses Free cash flow as a liquidity measure and it is defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment. Free cash flow is a non-GAAP financial measure which U.S. Cellular believes may be useful to investors and other users of its financial information in evaluating liquidity, specifically, the amount of net cash generated by business operations after deducti ng Cash paid for additions to property, plant and equipment.

|

|

Six Months Ended June 30, |

|||||

|

|

|

2017 |

|

2016 |

||

|

(Dollars in millions) |

|

|

|

|

|

|

|

Cash flows from operating activities (GAAP) |

$ |

|

$ |

|||

|

Less: Cash paid for additions to property, plant and equipment |

|

|

|

|||

|

|

Free cash flow (Non-GAAP) |

$ |

|

$ |

||

Postpaid ABPU and Postpaid ABPA

U.S. Cellular presents Postpaid ABPU and Postpaid ABPA to reflect the revenue shift from Service revenues to Equipment sales resulting from the increased adoption of equipment installment plans. Postpaid ABPU and Postpaid ABPA, as previously defined, are non-GAAP financial measures which U.S. Cellular believes are useful to investors and other users of its financial information in showing trends in both service and equipment sales revenues received from customers.

|

|

|

Three Months Ended June 30, |

|

Six Mont hs Ended June 30, |

|||||||||

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||||

|

(Dollars and connection counts in millions) |

|

|

|

|

|

|

|

|

|

|

|

||

|

C alculation of Postpaid ARPU |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Average number of postpaid connections |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ARPU (GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Postpaid ABPU |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Equipment installment plan billings |

|

|

|

|

|

|

|

||||||

|

|

Total billings to postpaid connections |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Av erage number of postpaid connections |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ABPU (Non-GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Postpaid ARPA |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Average number of postpaid accounts |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ARPA (GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Postpaid ABPA |

|

|

|

|

|

|

|

||||||

|

Postpaid service revenues |

$ |

|

$ |

|

$ |

|

$ |

||||||

|

Equipment installment plan billings |

|

|

|

|

|

|

|

||||||

|

|

Total billings to postpaid accounts |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Av erage number of postpaid accounts |

|

|

|

|

|

|

|

||||||

|

Number of months in period |

|

|

|

|

|

|

|

||||||

|

|

Postpaid ABPA (Non-GAAP metric) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

Application of Critical Accounting Policies a nd Estimates

U.S. Cellular prepares its consolidated financial statemen ts in accordance with GAAP. U.S. Cellular’s significant accounting policies are discussed in detail in Note 1 — Summ ary of Significant Accounting Policies and Recent Accounting Pronouncements in the Notes to Consolidat ed Financial Statements and U.S. Cellular’s Application of Critical Accounting Policies and Estimates is discussed in detail in Management’s Discussion an d Analysis of Financial Condition and Results of Operations, b oth of which are included in U.S. Cellular ’ s Form 10-K for the year ended December 31, 2016 .

Effective January 1, 2017, U.S. Cellular elected to chang e the classification of interest income on equipment installment plan contracts from Interest and dividend income to Service revenues in the Consolidated Statement of Operations. All prior period numbers have been recast to conform to the current year pre sentation. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional information regarding this accounting change. There were no other material chan ges to U.S. Cellular’s application of critical accounting policies and estimates during the six months ended June 30, 2017 .

With respect to U.S. Cellular’s critical accounting policy governing intangible asset impairment, management continues to monitor industry market conditions and changes in interest rates for significant negative trends. Given limited excess of estimated fair value over carrying value of its repo rting unit as determined in the 2016 annual impairment test, such trends, if identified, could adversely influence future forecasted cash flows and discounted cash flow calculations which could result in possible impairment in future periods.

Recent Accounting Pronouncements

See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for information on recent accounting pronouncements.

|

|

FCC Auction 1002

U.S. Cellular w as a bidder in the FCC’s forward auction of 600 MHz spectrum licenses, referred to as Auction 1002 , which concluded in March 2017 . In April 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an a ggregate pu rchase price of $329 million. Prior to commencement of the forward auction, U.S. Cellular made an upfront payment to the FCC of $143 million in June 2016. U.S. Cellular paid the remaining $186 million to the FCC and was granted the licenses du ring the second quarter of 2017.

FCC Reform Order

Pursuant to the Reform Order, U.S. Cellular’s current Federal USF support was to be phased down at the rate of 20% per year beginning July 1, 2012. The Reform Order contemplated the establishment of a ne w program and provided for a pause in the phase down if that program was not timely implemented by July 2014. The Phase II Connect America Mobility Fund (MF2) was not operational as of July 2014 and, therefore, as provided by the Reform Order, the phase d own was suspended at 60% of the baseline amount until such time as the FCC had taken steps to establish the MF2. In February 2017, the FCC adopted an Order concerning MF2 and the resumption of the phase down. The Order establishes a MF2 support fund of $ 453 million annually for ten years to be distributed through a market-based, multi-round reverse auction. The Order further states that the phase down of legacy support for areas that do not receive support under MF2 will commence on the first day of the month following the completion of the auction and will conclude two years later. U.S. Cellular cannot predict at this time when the MF2 auction will occur, when the phase down period for its existing legacy support from the Federal USF will commence, or w hether the MF2 auction will provide opportunities to U.S. Cellular to offset any loss in existing support. However, U.S. Cellular currently expects that its legacy support will continue at the current level for 2017.

FCC Notice of Proposed Rulemaking

In May 2017, the FCC adopted a Notice of Proposed Rulemaking (NPRM) proposing to revise decisions made in the FCC’s 2015 Open Internet and Title II Order . If adopted as proposed, the item would reverse the FCC’s decision to reclassify Broadband Internet Acc ess Services as telecommunications services subject to regulation under Title II of the Telecommunications Act. The NPRM would also seek comment on blocking, throttling, paid prioritization, and transparency rules adopted as part of the FCC’s previous rul emaking.

T he NPRM is subject to public comment and further action by the FCC, and any final rules adopted may differ from those proposed in the NPRM. Also, there may be legal proceedings challenging any rule changes that are ultimately adopted. U.S. Cellular cannot predict the outcome of these proceedings or the impact on its business.

Other Regulatory Matters

In March 2017, both the U.S. Senate and U.S. House of Representatives approved a joint resolution under the Congressional Review Act to repeal regulations approved by the FCC in October 2016 governing consumer privacy by broadband Internet service provider s. The President approved the resolution in April 2017. The repeal removed the pending FCC rules, which would have gone into effect later in 2017. The rules would have prohibited broadband internet service providers from sharing certain sensitive custom er information unless customers opted in and expressly agreed to share such information. U.S. Cellular will continue to protect customer information in accordance with Section 222 of the Telecommunications Act and its publicly available Privacy Statement until such time as regulators adopt other privacy requirements.

|

|

Private Securities Litigation Reform Act of 1995

Safe Harbor Cautionary Statement

This Form 10-Q, including exhibits, contains statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of h istorical facts, that address activities, events or developments that U.S. Cellular intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward-looking statements. Such risks, uncertainties and oth er factors include those set forth below, as more fully described under “Risk Factors” in U.S. Cellular’s Form 10-K for the year ended December 31, 2016 . Each of the following risks could have a material adverse e ffect on U.S. Cellular’s business, financial condition or results of operations. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. U.S. Cellular undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the Risk Factors in U.S. Cellular’s Form 10-K for the year ended December 31, 2016 , the following factors and other information contained in, or incorporated by reference into, this Form 10-Q to understand the material risks relating to U.S. Cellular’s business, financial condition or results of operations.

- Intense competition i n the markets in which U.S. Cellular operates could adversely affect U.S. Cellular’s revenues or increase its costs to compete.

- A failure by U.S. Cellular to successfully execute its business strategy (including planned acquisitions, spectrum acquisitions, divestitures and exchanges) or allocate resources or capital could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- Uncertainty in U.S. Cellular’s future cash flow and liquidity or in the ability to access capital, deterioration in the capital markets, other changes in U.S. Cellular’s performance or market conditions, changes in U.S. Cellular’s credit ratings or other factors could limit or restrict the availability of financing on term s and prices acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its construction, development or acquisition programs , reduce the acquisition of spectrum licenses, and/or reduce or cease share repurchases .

- U.S. Cellular has a signific ant amount of indebtedness which could adversely affect its financial performance and in turn adversely affect its ability to make payments on its indebtedness, comply with terms of debt covenants and incur additional debt.

- Changes in roaming practices or other factors could cause U.S. Cellular's roaming revenues to decline from current levels , roaming expenses to increase from current levels and/or impact U.S. Cellular's ability to service its customers in geographic areas where U.S. Cellular does not have its own network, which could have an adverse effect on U.S. Cellular's business, financial condition or results of operations.

- A failure by U.S. Cellular to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to acc urately predict future needs for radio spectrum could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- To the extent conducted by the FCC, U.S. Cellular may participate in FCC auctions of additional spectrum in the future directly or indirectly and, during certain periods, will be subject to the FCC’s anti-collusion rules, which could have an adverse effect on U.S. Cellular.

- F ailure by U.S. Cellular to timely or fully comply with any existing applicable legis lative and/or regulatory requirements or changes thereto could adversely affect U.S. Cellular’s business, financial condition or results of operations.

- An inability to attract people of outstanding potential, to develop their potential through education an d assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on U.S. Cellular's business, financial condition or results of operations.

- U.S. Cellular’s assets are concentrated in the U.S. wireless telecommunications industry. Consequently , its operating results may fluctuate based on factors related primarily to conditions in this industry.

- U.S. Cellular’s smaller scale relative to larger competitors that may have greater financial and other resou rces than U.S. Cellular could cause U.S. Cellular to be unable to compete successfully, which could adversely affect its business, financial condition or results of operations.

|

|

- Changes in various business factors , including changes in demand, customer pref erences and perceptions, price competition, churn from customer switching activity and other factors, could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- Advances or changes in technology could render ce rtain technologies used by U.S. Cellular obsolete, could put U.S. Cellular at a competitive disadvantage, could reduce U.S. Cellular’s revenues or could increase its costs of doing business.

- Complexities associated with deploying new technologies present s ubstantial risk and U.S. Cellular investments in unproven technologies may not produce the benefits that U.S. Cellular expects .

- U.S. Cellular receives regulatory support and is subject to numerous surcharges and fees from federal, state and local governmen ts, and the applicability and the amount of the support and fees are subject to great uncertainty , which could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations .

- Performance under device purchase agreements c ould have a material adverse impact on U.S. Cellular's business, financial condition or results of operations.