UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| (Mark One) | |||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For

the fiscal year ended |

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from [—Date—] to [—Date—] |

Commission

File Number:

(Exact name of registrant as specified in its charter)

| Not Applicable | ||

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| | ||

| (Address of principal executive offices) | (Zip Code) |

(

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Capital Market | ||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such fi les).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ||

| Smaller

reporting company | |||

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The

registrant was

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

As of March 29, 2022, the registrant has shares of common stock, no par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| 2 |

Cautionary Note Regarding Forward-Looking Information

This report on Form 10-K contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the defense industry, all of which were subject to various risks and uncertainties.

When used in this Report on Form 10- K and other reports, statements, and information we have filed with the Securities and Exchange Commission (“Commission” or “SEC”), in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors.

We do not assume the obligation to update any forward-looking statement. You should carefully evaluate such statements in light of factors described in this annual report. In this Form 10-K, AgriFORCE Growing Systems Ltd. (“AgriFORCE”) has identified important factors that could cause actual results to differ from expected or historic results. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete list of all potential risks or uncertainties.

| 3 |

PART I

Item 1. Business

Overview

AgriFORCE Growing Systems Ltd. was incorporated as a private company by Articles of Incorporation issued pursuant to the provisions of the Business Corporations Act (British Columbia) on December 22, 2017. The Company’s registered and records office address is at 300 – 2233 Columbia Street, Vancouver, BC, Canada, V5Y 0M6. On February 13, 2018, the Company changed its name from 1146470 B.C. Ltd to Canivate Growing Systems Ltd. On November 22, 2019 the Company changed its name from Canivate Growing Systems Ltd. to AgriFORCE Growing Systems Ltd.

Our Business

AgriFORCE is dedicated to transforming modern agricultural development through our proprietary patent pending facility design and automated growing system through our AgriFORCE Solutions division. Our methods are designed to produce high-quality, pesticide-free, locally cultivated crops – cost-effectively and with the ability to quickly scale, in virtually any climate. Designed to European Union Good Manufacturing Practices and meet the United States Department of Agriculture organic equivalent standards, we intend for our platform to be utilized by our customers as an industry accepted standard for, among other things, controlled environment plant-based vaccine and crops including plant-based vaccines, pharmaceuticals, nutraceuticals, and food production.

Our AgriFORCE Brands division is focused on the development and commercialization of plant-based ingredients and products that deliver healthier and more nutritious solutions. We will market and commercialize both branded consumer product offerings and ingredient supply.

AgriFORCE Solutions

Understanding Our Approach – The AgriFORCE Precision Growth Method

Traditional farming includes three fundamental approaches: outdoor, greenhouse and indoor. AgriFORCE introduces a unique fourth method, the AgriFORCE precision growth method, which is informed by cutting-edge science and leveraging the latest advances in artificial intelligence (AI) and Internet of Things (IoT).

| 4 |

With a carefully optimized approach to facility design, IoT, AI utilization, nutrient delivery, and micro-propagation, we have devised an intricate, scientific and high success-oriented approach designed to produce much greater efficacy yields using fewer resources. This method is intended to outperform traditional growing methods using a specific combination of new and traditional techniques required to attain this efficiency. We call it precision growth. The AgriFORCE precision growth method focuses on addressing some of the most important legacy challenges in agriculture: environmental impact, operational efficiency and yield volumes.

The AgriFORCE precision growth method presents a tremendous opportunity to positively disrupt all corners of the industry. The market size of just the nutraceutical and plant-based pharmaceutical and vaccine/therapeutics market is over $500 billion. Including the traditional hydroponics high value crops and controlled-environment food markets, the addressable market approaches nearly $1 trillion. (1)(2)(3).

While our patent pending intellectual property initially targeted the hydroponics sector of our customers high value crops to showcase its efficacy in a growing market, we are currently expanding operations to refine our technology and methodology for our customers’ vegetables and fruit food crops. Hydroponics was identified as an ideal sector to demonstrate proof of concept However, management has decided that the Company focus on evolving our intellectual property and applying our precision growth method to other agricultural areas so that we can be a part of the solution in fixing the severe issues with the global food supply chain.

The AgriFORCE Model – Managing the Difficulties of Agricultural Verticals with Modern Technology and Innovation

Our intellectual property combines a uniquely engineered facility design and automated growing system to provide a clear solution to the biggest problems plaguing most agricultural verticals. It delivers a clean, self-contained environment that maximizes natural sunlight and offers near ideal supplemental lighting. It also limits human intervention and – crucially – it was designed to provide superior quality control. It was also created to drastically reduce environmental impact, substantially decrease utility demands, as well as lower production costs, while delivering customers daily harvests and higher crop yields.

Plants grow most robustly and flavorfully in full natural sunlight. While it may seem counterintuitive to some, even the clearest of glass greenhouses inhibit the full light spectrum of the sun. However, new translucent and transparent membrane materials have emerged recently that enable the near-full-transmission of the sun’s light spectrum.

(1) https://home.kpmg/pl/en/home/insights/2015/04/nutraceuticals-the-future-of-intelligent-food.html

(2) https://link.springer.com/article/10.1057/jcb.2010.37

(3) https://medium.com/artemis/lets-talk-about-market-size-316842f1ab27

Unlike plastic or glass, these new transparent membranes can help crops achieve their full genetic (and flavor) potential. Natural light also warms the microclimate when necessary, dramatically reducing heating energy requirements. And at times when the sun is not cooperating, advances in supplemental grow lighting can extend the plants’ photoperiod – even beyond natural daylight hours – to maximize crop growth, quality, and time to harvest by up to 50% or better.

Greenhouses and vertical farms are also compromised by outdoor and human-introduced contamination. The new model relies on creating a sealed, cleanroom-like microclimate that keeps pests, pesticides and other pollutants outside.

| 5 |

Thanks to artificial intelligence, the Internet of Things, and similar advances, farmers can now benefit from highly automated growing systems that reduce human intervention and its associated costs. Finely tuned convective air circulation systems enable the microclimate to remain sealed and protected. Natural temperature regulation using sunlight and organic foam-based clouds can significantly reduce air-conditioning electricity requirements. Highly automated hydration, fertilization and lighting are all continuously optimized by machine learning.

This new AgriFORCE model, which has been designed with more than four years of ongoing research and development, is set to be put into large scale practice when the first of three new grow facilities completes construction on a 41-acre site in Coachella, California we expect to purchase in the coming year. This unique approach, which included contributions from lighting experts who had previously worked at NASA sending plants into space, was developed to significantly improve local food security in an environmentally friendly way. It uses the best aspects of current our customers’ current growing methods – outdoor, greenhouse and indoor – and replaces their shortcomings with better technology and processes.

Any solution whether in agriculture, industry, or consumer goods is typically the integration of various disparate parts which, in and of themselves, require independent skill sets and levels of expertise to bring together the desired outcome. Controlled environment agriculture solutions such as our patent pending proprietary facility and automated grow system are no different. Centered around four pillars: facility and lighting; automation and AI; nutrients and fertigation and micropropagation and genetics, our business not only has a tremendous opportunity to grow organically by virtue of its existing contracts and a future pipeline of similar contracts, but also through accretive acquisitions.

Our Position in the Ag-Tech Sector

The Ag-Tech sector is severely underserved by the capital markets, and we see an opportunity to acquire global companies who have provided solutions to the industry and are leading innovation moving forward. We are creating a separate corporate office to aggressively pursue such acquisitions. The robustness of our engagement with potential targets has confirmed our belief and desire to be part of a larger integrated Ag-Tech solutions provider, where each separate element of the business has its existing legacy business and can leverage across areas of expertise to expand their business footprint. We believe that there is currently no one that we are aware of who is pursuing this model in the US capital markets environment at this time.

| 6 |

The AgriFORCE Grow House

The Company is an agriculture-focused technology company that delivers innovative and reliable, financially robust solutions for high value crops through our proprietary facility design and automation IP to businesses and enterprises globally. The Company intends to operate in the plant based pharmaceutical, nutraceutical, and high value crop markets using its unique proprietary facility design and hydroponics based automated growing system that enable cultivators to effectively grow crops in a controlled environment. The Company calls its facility design and automated growing system the “AgriFORCE grow house”. The Company has designed its AgriFORCE grow house to produce in virtually any environmental condition and to optimize crop yields to as near their full genetic potential possible while substantially eliminating the need for the use of pesticides, fungicides and/or irradiation. The Company is positioning itself to deliver solutions to a growing industry where end users are demanding environmentally friendly and sustainable, controlled growing environments and processes. The initial market focus is the cultivation of food and other high value crops in California, and proof of concept will be to apply the IP to biomass production of plant based vaccine materials. The Company believes that its IP will provide a lower cost cultivation solution for the indoor production of crops due to a combination of higher crop quality and yields, and reduced operating costs. The Company has designed its AgriFORCE grow house as a modular growing facility that it plans to build and license to licensed operators for the cultivation of food and high value crops. The AgriFORCE grow house incorporates a design and technology that is the subject of a provisional patent that the Company has submitted to the United States Patent and Trademark Office on March 7, 2019. On March 6, 2020, a New International Patent Application No. PCT/CA2020/050302 Priority Claim United States 62/815, 131 was filed. The Company’s IP can be adapted to a multitude of crops and required growing conditions where exacting environmental control and pharma grade equivalent cleanliness and processes are required to meet the highest cultivation standards. By delivering the first facility, the Company will be in a position to demonstrate the performance and to target Good Manufacturing Practices standards compliance necessary to engage the pharma industry as it moves into modifying its IP to meet the particular plant biomass requirements for vaccines and other pharma biomass.

As the Company commences construction of its micropropagation facility and grow house, it will start to develop its solution for fruits and vegetables focusing on the integration of its current structure with a new form of vertical grow technology. Although many of the components and elements will be the same or similar in nature, the automation and integration for going vertical and accommodating lighting, circulation, climate control and humidity control will be somewhat different. Therefore, the Company intends to develop a small working commercial facility as it moves to finalize design and engineering. The Company believes it can deliver new IP for vertical farming with a view to constructing its first commercial facility to serve the Southern California market for fresh local leafy greens (first crop) before rolling out its solution to address other crops and other local markets in the United States and internationally.

Our Intellectual Property Strategy

The Company’s IP and business is focused on four (4) key elements:

| 1) | FACILITY AND LIGHTING DESIGN |

-the facility utilizes a proprietary building envelope system that allows virtually the full light spectrum and substantial portions of the UV light spectrum through it. It is fully sealed and utilizes positive air pressure exchange to create a microclimate that optimizes temperature, humidity, CO2, air velocity, filtration, and sanitation through the process of biomimicry.

-Advanced proprietary supplemental grow lighting technologies achieving optimal luminous efficacy, spectrum, distribution characteristics, automated DLI management and fixture architecture.

| 7 |

| 2) | AUTOMATION AND ARTIFICIAL INTELLIGENCE |

-Proprietary automated grow system(s) and technology integrated through IOT and artificial intelligence.

-Self learning input factors to create the highest yield, lowest impact cultivation.

| 3) | FERTIGATION AND NUTRIENTS |

-white label and proprietary organic based blends/products tailored and focused on improved yields and reduced impact cultivation.

| 4) | MICROPROPAGATION AND GENETICS |

Optimized cellular cloning and tissue culture process tailored to facility environment optimization to ensure enhanced solution specific genetic outcomes.

To maximize the AgriFORCE grow house’s production capacity, each AgriFORCE grow house will incorporate its own tissue culture laboratory for micropropagation into the Company’s proprietary mechanized and automated growing system. AgriFORCE micropropagation laboratories will enable the micropropagation of healthy plantlets that will then be transplanted and grown to maturity in its facilities.

Our Business Plan

The Company plans to develop its business by focusing on both an organic growth plan and through MA. The Company’s organic growth plan is focused on four distinct phases:

PHASE 1: COMPLETED: 2017-2021

| ● | Conceptualization, engineering, and design of facility and systems. | |

| ● | Completed selection process of key environmental systems with preferred vendors. | |

| ● | The signing of revenue contracts with the Exclusive Independent Operator (EIO) for the first three facilities completed. | |

| ● | The arrangement of three offtake agreements signed with Exclusive Independent Operator (EIO) for those three facilities when complete. (Subsequently these agreements were terminated in Q2 2021) | |

| ● | Selection and Land Purchase agreement in Coachella, CA for 41.37-acre parcel subject to financing. | |

| ● | ForceFilm material ordered. |

PHASE 2: 2022-2023:

| ● | Complete the financing for, and purchase of, the 41.37-acre parcel in Coachella, CA | |

| ● | Complete new contracts’ structures for those first three facilities with new independent operators. | |

| ● | Site preparation and utilities infrastructure build out for the campus (up to eight facilities). | |

| ● | Fit out and complete genetics lab for micropropagation, breeding, and RD to achieve near term revenue (8 months) of the sale of tissue culture clones for variant crops. | |

| ● | Additional raw materials procurement of AgriFORCE IP specific automated grow system, supplemental grow lighting and controls systems, and manufacture of the building envelope materials. | |

| ● | Conceptualization and design of vertical grow solutions in order to develop a small-scale vertical grow house. | |

| ● | Focus on the delivery and installation of the first facility. | |

| ● | Initiate the design of a RD facility for food solutions and plant-based pharma. |

| 8 |

PHASE 3: 2023-2025:

| ● | Focus on the delivery and installation of the second and third facilities. Proof of quantitative and qualitative benefits will drive both sales pipeline acceleration for subsequent years. | |

| ● | Complete the design and construction of a RD facility for food solutions and plant-based pharma. Commence engagement with universities and pharmaceutical companies. | |

| ● | Construct small scale vertical grow house and operate successfully. | |

| ● | Finalize the design and engineering of vertical grow solution with construction commencement late in the third year. Commence engagement with local restaurants and grocery stores and develop a vertical grow house branding strategy. |

PHASE 4: 2026:

| ● | Focus on delivery and installation of additional facilities. | |

| ● | Expand geographic presence into other states whilst also introducing the grow house to other international markets with a view to securing additional locations and markets by year four. | |

| ● | Targeted additional contracts of three facilities. | |

| ● | Commence and complete first vertical grow commercial facility to serve Southern California market by end of year 4. |

The Company’s initial AgriFORCE grow houses are planned to be constructed in California.

AgriFORCE Brands

The Company purchased Intellectual Property (“IP”) from Manna Nutritional Group, LLC (“MNG”), a privately held firm based in Boise, Idaho on September 10, 2021. The IP encompasses patent-pending technologies to naturally process and convert grain, pulses and root vegetables, resulting in low-starch, low-sugar, high-protein, fiber-rich baking flour produces as well as wide range of breakfast cereals, juices, natural sweeteners and baking enhancers. The core process is covered under a pending patent application in the U.S. and key international markets. The all-natural process is designed to unlock nutritional properties, flavor and other qualities in a range of modern, ancient and heritage grains, pulses and root vegetables to create specialized All-Natural baking and all-purpose flours, sweeteners, juices, naturally sweet cereals and other valuation products, providing numerous opportunities for dietary nutritional, performance and culinary applications.

The Company will rebrand the consumer products and innovative ingredient offering for food manufacturers under the brand (un)Think foods.

Wheat and Flour Market

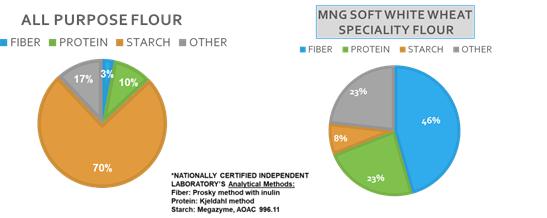

Modern diet is believed to be a contributor to health risks such as heart disease, cancer, diabetes and obesity, due in part to the consumption of highly processed foods that are low in natural fiber, protein and nutrition; and extremely high in simple starch, sugar and calories. These “empty carbs” produce glycemic swings that may cause overeating by triggering cravings for food high in sugar, salt and starch. As an example, conventional baking flour is low in natural fiber (about 2-3%), low-to-average in protein (about 9%), and very high in starch (about 75%). Whole wheat flour is only marginally better. Similarly, gluten-free products are often produced with sugar and starches such as potato flour, rice flour, tapioca, etc. Gluten-free products are typically low-fiber, low-nutrition, high-starch and high-calorie.

| 9 |

In contrast, foods high in fiber help to satiate hunger, suppress cravings, raise metabolism and require more calories to digest. They also assist in weight loss, lower cholesterol, and may reduce the risk of cancer, heart disease and diabetes.

Advantages of the MNG IP

The CERES-MNG process allows for the development and manufacturing of All-natural Fours that are significantly higher in Fibers, Nutrients and Proteins and significantly lower in Carbohydrates and Calories than Standard Baking Flour.

As shown in the graph below, MNG Baking Flour produced from Soft White Wheat has 30 time more fiber, 3 times more protein, 80% less starch and 50-60% less calories as compared to standard all- purpose baking flour.

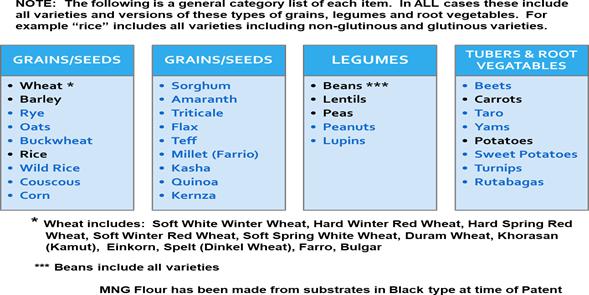

The CERES-MNG patent pending process will help develop new flours and products from modern, ancient and heritage grains, seeds, legumes and tubers/root vegetables.

Why Manna NG versus Keto or Low Carb Flours and Sprouted Grains Flours?

| 10 |

| - | Versus Keto/Low Carb Flours, Manna NG has some clear positive distinctions: |

| ○ | Simple and clean ingredient list | |

| ○ | Significantly higher protein values | |

| ○ | Materially Higher Fiber content | |

| ○ | Significantly lower carb content | |

| ○ | More palatable and natural flavor without any additives | |

| ○ | Works and tastes like All Purpose Wheat Baking Flour |

| - | Versus Sprouted Grains Flours |

| ○ | Like Sprouted Grains Flours, Manna NG Nutrients are metabolized better; | |

| ○ | Significantly Higher Protein content | |

| ○ | Materially Higher Fiber content | |

| ○ | Significantly Lower Carb content |

Finally, the CERES-MNG Process creates a Liquid by-product which is a High Fiber, High Protein, Maltose Sweet Juice (Power Juice) from which we intend to develop Liquid and Crystallized Sweeteners, Juices etc.

Products that AgriFORCE intends to develop for commercialization from the CERES/MNG Process:

| - | High protein, High Fiber, Low Carb Modern, Heritage and Ancient grain flours (for use in breads, baked goods, doughs, pastry, snacks, and pasta) | |

| - | Protein Flours and Protein Additives | |

| - | High Protein, High Fiber, Low Carb cereals and snacks | |

| - | High Protein, High Fiber, Low Carb oat based dairy alternatives | |

| - | Better Tasting, Cleaner Label High Protein, High Fiber, Low Carb nutrition bars | |

| - | High Protein, High Fiber Low Carb nutrition juices | |

| - | Sweeteners – Liquid, Granulated | |

| - | High Protein, High Fiber, Low Carb pet foods and snacks |

We intend to commercialize these products behind 3 main Go-to-Market strategies:

| - | Ingredients | |

| - | Branded Ingredients | |

| - | Consumer Brand |

The Business Opportunity for AgriFORCE to successfully commercialize Premium Specialized Products from the Manna IP - by capturing a conservatively very small percentage share of the category it is targeting to enter in the premium segments. We estimate these revenues to be between $500 million and $1 Billion by 2025 (excluding any potential revenues from the Maltose-Power Juice applications).

| Breads Bakery | Functional Flours | Pulse Flours | Dairy Alternatives | Nutrition Bars | TOTAL | |||||||||||||||||||

| Global Market Size of Target Categories | $ | 222B | $ | 48B | $ | 17B | $ | 6B | $ | 45B | ||||||||||||||

| Potential Market Share | 0.1 | % | 1 | % | 1 | % | 1 | % | 0.1 | % | ||||||||||||||

| AgriFORCE Potential Net Revenues | $ | 100-200M | $ | 200-480M | $ | 100- 170M | $ | 30-60M | $ | 20-40M | $ | 450-950M | ||||||||||||

Sources: Grand View Research Reports, San Francisco CA, 2018 Estimates.

Products from the MANNA IP address Consumer Trends in Health, Nutrition and Diet

The benefits of plant-based proteins, low-carbohydrates (particularly “empty” carbs) and natural high- fiber diets are key to good health and nutrition and are critically important in combating cancer, diabetes, digestive disorders, high-cholesterol, obesity and heart disease.

| 11 |

The High-Protein, High Fiber, Low Carb products from the CERES-MNG Process, allows to address these growing consumer needs.

Importantly, the Manna IP products would target primarily Millennials and Boomers, that increasingly look for healthier food alternatives.

Long-Term Future Applications – Product Development; Medical Research Development

The following outlines future applications, research and development. This will include controlled studies on Type II Diabetes, in addition to a dedicated and completely independent Medical Research Organization (MRO) and research laboratory, supported by private and public research grants.

| 12 |

BUSINESS PLAN

AgriFORCE’s organic growth plan to actively establish and deploy the commercialization of products, following the acquisition of the MNG IP, is focused on four distinct phases:

PHASE 1: COMPLETED: 2017-2020

| ● | Product and Process Testing and Validation (Completed) | |

| ● | Filing of US and International Patent (Completed) | |

| ● | Conceptual Engineering and Preliminary Budgeting on Commercial Pilot Plant (Completed) |

PHASE 2: 2021-2022

| ● | Design, Build, Start-up and Operation of the Pilot Plant | |

| ● | Develop Range of Finished Products in Grain Flours, Protein Flours, Cereals and Juices | |

| ● | Collaborate with Nutritional Flour Medical Research Institute (an IRS section 501(c)(3) Medical Research Organization) funded by private public research grants |

PHASE 3: 2022-2023

| ● | Launch First Range of Products in US/Canada | |

| ● | Drive Business with Finished Products in direct to consumer (“D2C”), Retail, Food Service | |

| ● | Drive Business as Ingredients for Bakery, Snack and Plant Based Protein Products Manufacturers | |

| ● | Develop Manufacturing Base through Partnerships and Licensing | |

| ● | Conceptual Engineering and Preliminary Budgeting on Large-Scale Processing Plant |

PHASE 4: 2024-2025

| ● | Expand Product Range in US/Canada | |

| ● | Expand Business to other Geographies (select Markets in Europe, Asia, Latin America) | |

| ● | Design, Build Start-up and Operation of Large-Scale Processing Plan |

Merger and Acquisition (“MA”)

With respect to MA growth, the Company is creating a separate corporate office to aggressively pursue acquisitions. The Company will focus on identifying target companies in the key four pillars of its platform where each separate element of the business has its existing legacy business and can leverage across areas of expertise to expand their business footprint. The Company believes that a buy and build strategy will provide unique opportunities for innovation across each segment of the Ag-Tech market we serve. Our unique IP combined with the know-how and IP of acquired companies will create additional value if the way we grow or produce crops. The Company believes there is currently no other public traded publicly in the United States pursing this model.

| 13 |

Below is a diagram of the intended strategy with respect to the Company’s MA strategy:

Delphy Groep BV Acquisition

On February 10, 2022, the Company signed a definitive agreement to acquire Delphy Groep BV (“Delphy”), a Netherlands-based AgTech consultancy firm, for $26 million through a combination of cash and stock. The closing of the transaction is expected to occur within 60 days of the signing date. The definitive agreement follows the binding letter of intent (“LOI”) as previously announced in the Company’s press release in October 2021. Delphy, which optimizes production of plant-based foods and flowers, has multinational operations in Europe, Asia, Russia, Kazakhstan, and Africa, with approximately 200 employees and consultants. Delphy’s client list includes agriculture companies, governments, universities, and leading AgTech suppliers, who turn to the company to drive agricultural innovation, solutions, and operational expertise.

Deroose Plants NV Binding Letter of Intent

On February 23, 2022, the Company signed a binding letter of intent (the “LOI”) with Deroose Plants NV (“Deroose”), one of the largest tissue culture propagation companies in the world with a leadership position in horticulture, plantation crops, and fruit and vegetables. Founded in 1980, Deroose has multi-national operations in Europe, North America, and Asia, and over 800 employees.

The LOI is subject to completion of standard due diligence and entry into a definitive purchase agreement, which shall include commercially standard terms and conditions, including, but not limited to, representations and warranties, covenants, events of default and conditions to closing.

The net purchase price by the Company is expected to be approximately US$69 million. The purchase price represents approximately $46.4 million for the Deroose business on a cash and debt free basis and $22.6 million for the genetic IP portfolio.

Corporate Structure

The Company currently has the following wholly-owned subsidiaries, which perform the following functions – AgriFORCE Investments will handle any investments in the U.S., West Pender Holdings will hold real estate assets, West Pender Management will manage those assets and AGI IP will hold intellectual property in the U.S. and DayBreak is dormant:

| Name of Subsidiary | Jurisdiction of Incorporation | Date of Incorporation | ||

| AgriFORCE Investments Inc. (US) | Delaware | April 9, 2019 | ||

| West Pender Holdings, Inc. | Delaware | September 1, 2018 | ||

| AGI IP Co. | Nevada | March 5, 2020 | ||

| West Pender Management Co. | Nevada | July 9, 2019 | ||

| DayBreak Ag Systems Ltd. | British Columbia | December 4, 2019 |

Summary Three Year History

From the date of Incorporation (December 22, 2017) to the date of this filing, the Company has largely been engaged in completion of its initial corporate organization, assembling its management team, completing the design and engineering of its IP and filing the appropriate intellectual property protection and taking the initial steps to implement its business plan through the commencement of initial operations in California. Significant milestones during this period are as follows:

| ● | The Company completed its initial seed round financings in early 2018. | |

| ● | From November 2018 to August 2019, the Company engaged architectural, lighting design, engineering and tensile structure engineering consultants to advance “Concept Solution” to an “Engineered Solution” for the AgriFORCE grow houses, and the Company’s consultants completed testing and verification of its proprietary solutions, as described below in detail under “Advancement from Concept Solution to Engineered Solution”. |

| 14 |

| ● | In December 2018, the Company selected FabriTec as its primary contractor for the growing portion of the AgriFORCE grow houses, which will be constructed of tensile steel and the high strength flexible covering material. | |

| ● | In January 2019, the Company received from FabriTec the initial engineering drawings for the greenhouse enclosure for the AgriFORCE grow house. | |

| ● | In February 2019, the Company arranged for PharmHaus, as its initial EIO, to enter into three offtake agreements with well-known California high value crop producers for the potential offtake purchase of an aggregate of 19,500 kilograms of production, which has since been increased to 21,878 kilograms of production per year under a replacement offtake agreement executed in September 2019 (terminated in April 2021 as per the below description). | |

| ● | On March 7, 2019, the Company filed an initial provisional patent application for the original concept related to the AgriFORCE grow house. | |

| ● | In July 2019, the Company entered into a master “Design/ Build” construction contract with FabriTec for the construction of the greenhouse enclosure (subject to final agreement on pricing). | |

| ● | In August 2019, the Company submitted an amended provisional patent application for its Structure Technology that reflects the “engineered solution” and related technology and intellectual property developed by the Company through the testing and verification process with FabriTec and the Company’s other architectural, engineering and technical consultants. | |

| ● | On March 6, 2020, a New International Patent Application No. PCT/CA2020/050302 Priority Claim United States 62/815, 131 was filed. The Company’s IP can be adapted to a multitude of crops and required growing conditions where exacting environmental control and pharma grade equivalent cleanliness and processes are required to meet the highest cultivation standards. | |

| ● | On April 22, 2021, the Company terminated its agreement with PharmHaus, its initial exclusive Independent Operator, as PharmHaus failed to demonstrate the business wherewithal to serve in its capacity as an exclusive Independent Operator. | |

| ● | The Company has substantially finalized the final design and engineering drawings for the AgriFORCE grow house. | |

| ● | On November 30, 2021, the Company signed an offtake agreement with Humboldt Bliss, Ltd., a Barbadian limited company (“Humboldt”). Under the terms of the contract, AgriFORCE is responsible for constructing its proprietary facility and providing the full Standard Operating Procedures (SOPs) of the AgriFORCE Grow House and Humboldt is responsible for securing the project’s land as well as operating the facility. Upon production, Humboldt has committed to remit an IP licensing, management services and equipment leasing fee to AgriFORCE for up to 14,300 pounds (6,500 kgs) of high value medical and agricultural crops per year. David Welch, a director of the Company, owns a controlling interest in Humboldt am dos this a related party. Mr. Welch recused himself from the final deliberation and approval of the agreement by the board. | |

| ● | On February 18, 2022, the Company signed a license agreement with Radical Clean Solutions Ltd (“Radical”), a New York corporation that has development an advanced product line consisting of “smart hydroxyl generation systems” focused on numerous industry verticals that is proven to eliminate 99.99+% of all pathogens, virus, mold, volatile organic compounds (VOCs) and allergy triggers, to commercialize their new proprietary hydroxyl generating devices within the controller environment agriculture (“CEA”)and food manufacturing industries. The patent pending system seeks out and destroys both airborne and surface-based mold, bacteria, virus, odorous and volatile organic compounds and allergy triggers, as well as other pathogens and pollutants in real-time. The license grants the rights to AgriFORCE in perpetuity as well as joint patent ownership rights for CEA. |

Debt Financing

The Company signed a Term Sheet with Capital Funding Group on April 8, 2020 for the provision of debt related to the potential purchase of a property in Coachella, CA and all site improvements and infrastructure. The Term Sheet was further renewed on February 5, 2021. The terms of the debt are to provide 50% of the value of the land purchase price and 80% of the value of the site improvements and infrastructure. The value of the debt is expected to be approximately $12,000,000. The interest rate applicable to the land purchase is 10.5% per annum and for the site improvements and infrastructure it is 15.5% annum. In order to complete the debt facility agreement, the Company will need to raise approximately $4,500,000 in equity by February 1, 2021. The term of the loan is eighteen months. The Company expects to re-finance at the completion of the improvements and infrastructure through traditional lending sources. The Company is also in discussions with respect to debt financing for the grow house structure as well as the associated equipment including but not limited to the HVAC system and the automated growing system through the same debt broker used to secure the Capital Funding Group loan facility term sheet. Capital Funding Group has agreed to provide such debt financing subject to the completion of a development appraisal and final approval by its board of directors. There can be no assurance as to whether the Company will be able to secure further debt or secure such debt on commercially reasonable terms.

| 15 |

On March 24, 2021, the Company entered into a securities purchase agreement with certain accredited investors for the purchase of $750,000 in principal amount ($600,000 subscription amount) of senior secured debentures originally due June 24, 2021 (the “Bridge Loan”). On June 24, 2021, the due date was extended to July 12, 2021. The imputed interest rate is encompassed within the original issue discount of the debentures and no additional cash interest shall be due. The debentures were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, to certain purchasers who are accredited investors within the meaning of Rule 501 under the Securities Act of 1933, as amended. Each debenture holder will receive a warrant to purchase shares of common stock in an amount equal to 50% of the principal amount divided by 80% of the initial public offering price of the Company’s common stock. The warrants are exercisable at 80% of the initial public offering price. Transaction costs of $69,000 have been recorded in connection with the Bridge Loan. The Bridge Loan was fully repaid on July 13, 2021.

The Company’s Initial California EIO (Exclusive Independent Operator)

The Company has terminated its EIO agreements (the “PharmHaus Agreements”) with PharmHaus, a private company that is arms-length to AgriFORCE. The Company had entered into each of the following agreements, on the terms outlined above, with PharmHaus as the EIO (the “PharmHaus Agreements”):

| ● | Cultivation Facility Lease Agreement; | |

| ● | IP License Agreement; and | |

| ● | Management Services Agreement. |

PharmHaus required additional financing in order to achieve its business plan and objectives and in order to perform its contractual obligations under the Company’s agreements with PharmHaus. There was no assurance that PharmHaus would be able to obtain such funding. As a result of PharmHaus’ inability to secure funding and the Company’s focus on food and pharma applications of its IP as well as acquisition opportunities outside of the cannabis market, the Company chose to terminate its contract with PharmHaus on April 22, 2021.

Micropropagation Laboratories

The Company has undertaken the steps described below in connection with the design and deployment of the Company’s micropropagation laboratories. These laboratories will ultimately be deployed at the Company’s AgriFORCE grow houses. However, the Company has identified a business opportunity through a current micropropagation lab which requires additional capacity for deployment of the micropropagation laboratories for plantlet growth in advance of the completion of the initial AgriFORCE grow houses. The advantage of the Company for pursuing this opportunity is that it enables the Company to achieve initial revenues in advance of incurring the full construction expenditure required for the initial AgriFORCE grow houses, thereby providing internally generated funding for the Company’s expenditures and tests of the micropropagation process with the selected crops:

| ● | the Company has completed the evaluation of options for construction of the micropropagation facility; | |

| ● | the Company has completed the determination of the most suitable low capital expenditure option providing flexibility; | |

| ● | Acquired in-house expertise through Dr. Laila Benkrima, the Company’s Chief Scientific Officer, who has a PhD from the University of Paris in horticulture with a specialization in tissue culture and the hybridization and selection of plant varietals; | |

| ● | completed the design of full facility and equipment scope and layout; | |

| ● | identified potential vendors and received final quotations; and | |

| ● | Research and preparation for permitting and licensing requirements. |

| 16 |

The Company is presently proceeding with selecting vendors from whom we obtained quotations for the fit out of the micropropagation laboratories in order that these laboratories can be constructed. Concurrently, the Company is engaging in discussions with respect to the commercial arrangement of providing micropropagation services for another micropropagation lab’s excess volume requirements as well as exploring opportunities to provide such services to potential customers.

Intellectual Property

The Company’s intellectual property rights are important to its business. In accordance with industry practice, the Company protects its proprietary products, technology and its competitive advantage through a combination of contractual provisions and trade secret, copyright and trademark laws in Canada, the United States and in other jurisdictions in which it conducts its business. The Company also has confidentiality agreements, assignment agreements and license agreements with employees and third parties, which limit access to and use of its intellectual property.

Patent Applications

| Date

filed or Information received | Registration Date | Title | Serial # | Registration# | Prov. Patent | PCT Patent Application | Patent # | Comment | Expiry Date for Either Application or Registration | Applicant | ||||||||||

| 7/Mar/2019 | Structures For Growing Plants and Related Apparatus and Methods | 62/815,131 | Expired replaced with 56288979- 7PCT | Canivate Growing Systems Ltd | ||||||||||||||||

| 26/Aug/2019 | AUTOMATED GROWING SYSTEMS | 62/891,562 | Expired replaced with 56288979- 10PCT | |||||||||||||||||

| 6/Mar/2020 | Structures For Growing Plants | 56288979-7PCT | PCT/CA2020/ 050302 | Published: 10/Feb/2022 | 5/Sep/2022 | AgriFORCE Growing Systems Ltd. | ||||||||||||||

| 26/Aug/2020 | AUTOMATED GROWING SYSTEMS | 56288979-10PCT | PCT/CA2020/ 051161 | Prior Claim date: 08/26/2019 - Pending | 25/Feb/2022 | AgriFORCE Growing Systems Ltd. |

| 17 |

Trademarks

| Date

filed or Information received | Registration Date | Title | Serial # | US

Trade Mark Application # | CDN

Trade Mark Application #2 | Trademark International Registration # | US Trade Mark # | Comment | Expiry Date | Owner | ||||||||||

| 24/Jan/2019 | PLANET LOVE | 1942554 | ISEDC | 25/Jul/2029 | Canivate Growing Systems Ltd | |||||||||||||||

| 19/Dec/2019 | PLANET LOVE | 79274347 | 1504091 | Awaiting examination in US | Canivate Growing Systems Ltd | |||||||||||||||

| 21/Jan/2020 | 25/Jul/2019 | PLANET LOVE | 806/1273879901 | 1504091 | 25/Jul/2029 | AgriFORCE Growing Systems Ltd. | ||||||||||||||

| 24/Jan/2019 | HYDROFILM | 1942547 | ISEDC | Formalized; awaiting examination | Canivate Growing Systems Ltd | |||||||||||||||

| 21/Jan/2020 | 24/Jul/2019 | HYDROFILM | 1506916 | AgriFORCE Growing Systems Ltd. | ||||||||||||||||

| 7/Dec/2018 | HYDROHAUS | 1934896 | ISEDC | Formalized; awaiting examination | Canivate Growing Systems Ltd | |||||||||||||||

| 7/Dec/2018 | HYDROHOUSE | 1934895 | ISEDC | Formalized; awaiting examination | Canivate Growing Systems Ltd | |||||||||||||||

| 1/Mar/2019 | CANIVATE | 1949210 | 1494234 | CLASS 6: Greenhouses of metal, CLASS 19: Greenhouses of plastic, CLASS 44: Greenhouse services; horticultural services | Formalized; awaiting examination | Canivate Growing Systems Ltd | ||||||||||||||

| 21/Jan/2020 | 30/Aug/2019 | CANIVATE | 1494234 | AgriFORCE Growing Systems Ltd. | ||||||||||||||||

| 1/Mar/2019 | THE CANIVATE WAY | 1949209 | ISEDC | Formalized; awaiting examination | Canivate Growing Systems Ltd | |||||||||||||||

| 1/Mar/2019 | 27/Oct/2020 | THE CANIVATE WAY | 79-270,261 | 1494231 | 6,182,017 | CLASS 6: Greenhouses of metal, CLASS 19: Greenhouses of plastic, CLASS 44: Greenhouse services; horticultural services | 26/Oct/2030 | AgriFORCE Growing Systems Ltd. | ||||||||||||

| 26/Nov/2019 | AgriFORCE Trademark application | 1997835 | CLASS 6: Greenhouses of metal, CLASS 19: Greenhouses of plastic, CLASS 44: Greenhouse services; horticultural services | Formalized; awaiting examination | AgriFORCE Growing Systems Ltd. | |||||||||||||||

| 22/May/2020 | AgriFORCE Trademark application | 88930218 | 88930218 | CLASS 6: Greenhouses of metal, CLASS 19: Greenhouses of plastic, CLASS 44: Greenhouse services; horticultural services | Awaiting examination in US | AgriFORCE Growing Systems Ltd. | ||||||||||||||

| 18/Sep/2020 | AgriFORCE Trademark application | 18243244 | CLASS 6: Greenhouses of metal, CLASS 19: Greenhouses of plastic, CLASS 44: Greenhouse services; horticultural services | 22/May/2030 | AgriFORCE Growing Systems Ltd. | |||||||||||||||

| 19/Aug/2020 | FORCEFILM Trademark application | 90124842 | 90/124842 | Awaiting examination in US | AgriFORCE Growing Systems Ltd. | |||||||||||||||

| 7/Aug/2020 | FORCEFILM Trademark application | 2044675 | Formalized; awaiting examination | AgriFORCE Growing Systems Ltd. |

| 18 |

Our Competitive Conditions

Both indoor and greenhouse growing facilities have come to the forefront in recent years. With the advent of new business opportunities and the necessity and demand for increasing efficiency and yields, the facility design for both indoor and greenhouse has been significantly improved through advancing technologies and operational procedures, even more importantly in hybrid facility environments.

In recent decades, the greenhouse industry has been transforming from small scale facilities used primarily for research and aesthetic purposes (i.e. botanic gardens) to significantly more large-scale facilities that compete directly with land-based conventional food and ornamental plant production. While indoor growing allows production throughout the year and in most geographical locations, the energy used for lighting and climate control is costly while those systems are critical to the success, efficiency and yield of the operation. In large part due to the recent improvements in growing technology, the industry is witnessing a blossoming like no time before. Greenhouses today are increasingly emerging that are large-scale, capital-infused, more resource conscientious and urban-centered.

A major part of this recent transformation in the greenhouse industry has been the rise of a technology-infused Smart Greenhouse Market. Smart Greenhouses feature new levels of technology and automated control systems that allow for further optimization of growing conditions. These technologies include LED grow-lights that provide energy efficient supplemental lighting during cloudy conditions and at night, as well as an array of smart sensors that can detect issues with plants or the growing environment as they arise and trigger responses from different control systems.

No matter the country or region, one universal trend is that modern greenhouses are being built closer to metropolitan areas and large transportation hubs. One reason for this shift is to locate greenhouses closer to universities where research opportunities and skilled labor abound. As greenhouses become more tech-heavy, having this close proximity to research institutions will continue to be an important factor in location.

| 19 |

As the market has grown dramatically, it has also experienced clear trends in recent years. Modern greenhouses are becoming increasingly tech-intensive, using LED lights and automated control systems to tailor optimal growing environments. Successful greenhouse companies are scaling significantly and locating their growing facilities near urban hubs to capitalize on the ever-increasing demand for local (sustainable, conscientious, nutritious) food, no matter the season. To accomplish these feats, the greenhouse industry is also becoming increasingly capital-infused, using venture funding and other sources to build out the infrastructure necessary to compete in the current market.

As the smart greenhouse market continues to expand, new technologies are also coming online that will shape the future of production. Like before, many of these technologies are being developed for the greenhouse industry in particular. However, perhaps recently more than ever, innovation is also coming from other sectors. From artificial intelligence to Solar PV, new technologies from a wide range of industries are now finding their way into the modern greenhouse.

Past and current deficiencies with indoor farming in general have already signaled two important messages. First, there is logical reasoning to support the argument that indoor agriculture will become the norm and play a vital role to our current food (water intensive, non-grain) landscape. It will not be an easy journey, but the industry is growing and evolving at a fascinating speed. Second, technology advancements play a key role in leading the industry to continue to mature and reach greater efficiencies, production, and profitability.

As the global population continues to grow, and resources like land and water become more restricted, greenhouse (and hybrid) farming will be a dominant contributor for feeding global population that is just as important as land-based farming.

As a whole, the solutions provided to the agriculture industry have been driven by the integration of disparate components predominately lead by the client / farmer, major greenhouse vendors such as Kubo, Van der Hoeven, Certhon and Havecon or by major automation vendors such as Codema Systems or Ridder Group. This has resulted in fragmentation and sub-optimal IP that has not been fully integrated in a form as the Company is endeavoring to provide. Additionally, many solutions often are an amalgamation of disparate parts and vendors that are not necessarily optimized for a particular crop. In the indoor growing space, this is even more pronounced as the facility is often a simple warehouse which is in and of itself suboptimal and the draw backs are more pronounced. Often the integration is led by the cultivators themselves, who often do not possess the necessary skills to effectively manage such a process or it is led by one of the main vendors.

Technology

The future: hardware, software, plant physiology

Currently innovation is steered by three main drivers: in-house development within companies, technology providers, and “cross-industry pollination”. New and upcoming companies have great potential to create innovative products. When companies showcase how their innovative technology can be applied, other companies can either adapt or further develop these ideas. There are also technology providers who specialize in specific areas of Ag-Tech. Through cross-industry pollination, we can acquire existing technology from other industries for use in greenhouse application.

Lighting/materials

Energy costs—primarily associated with lighting—are of major significance in the operation of a greenhouse facility. Lighting is a critical component for growing plants in fully closed environments because it is the primary energy input used by plants for photosynthesis. Light-emitting diodes (LEDs) were first adopted for indoor growing in the 1970s to supplement natural sunlight more efficiently than previously used incandescent bulbs. With the advancement of LED technology, the cost has dropped significantly over the last 10 years—specifically, LED lighting costs have halved, while their efficacy, or light energy, has more than doubled. We can expect costs to continue to drop as technology develops and this trend continues. Additionally, precise control of lighting can enable the discovery and dissemination of reproducible “light recipes” that are tailored to crops specifically grown indoors. These light recipes are being developed and used by cultivators to manipulate how plants grow, what they taste like, and their nutrient composition.

| 20 |

In addition to lighting, improvements related to materials can also help further efficiency. Companies like Soliculture, are paving the way for a revolution of greenhouse materials. Their LUMO solar panel contains a low density of silicon photovoltaic (PV) strips arranged with space in between to allow light to transmit between the strips. A thin layer of luminescent material is adhered to the backside of the glass, enhancing light quality by converting green light to red light. Red light has the highest efficiency for photosynthesis in plants, and therefore this optimized light spectrum increases yield faster maturation rate, and has proven to contribute to more disease resistant plants.

Data/AI

Artificial intelligence (“AI”) is expected to grow significantly in the coming years, where humans are certainly not obsolete but essential in leading innovation to significantly enhance results. AI-powered tools are gaining popularity across several industries including agriculture. In the future, we expect AI to be used in operations by means of automation and for predictive analytics.

Robots are increasingly replacing humans as we see more fully automated operations. Robots excel at repetitive, precision mundane tasks such as seeding, weeding, and harvesting. Start-up Iron Ox uses robots every step of the way from seed to harvest.

This allows allocation of resources elsewhere to focus on their overall production. Robotics also reduce labor costs while increasing efficiency. Currently farming is facing a labor shortage for reasons ranging from immigration policy to a lack of desire to work in the industry. Robots can help fill in the gaps in missing labor.

AI and machine learning technologies are developed to integrate and deliver more precise control of comprehensive growing operations. Ag-Tech company, Autogrow, provides intelligent automation systems including pH sensors, irrigation, and climate control products. Both hardware and software are improving to become more analytical and help detect and solve problems such as pest management, nutrient solution maintenance, and disease prevention.

Automation will become more feasible and available as AI technology improves and becomes less expensive. Reduced labor costs will allow product prices to decrease, making local food more accessible.

Biological Development

While improved environmental control and cultivation practices will undoubtedly lead to greater crop yields, biological alterations can more specifically tailor plants to growing environments and consumer needs. Indoor growing environments and processing facilities reduce the need for plant traits which provide stability in the face of environmental fluctuations, pests, pathogens, and post-harvest injury. New plant breeding techniques and genome-editing technologies such as CRISPR/Cas9 can be used to promote new plant traits focused on rapid plant growth, performance in low-light environments, plant stature, nutrition, and flavor. Coupling heightened environmental control with biological control also opens the door for variable gene expression under different growing conditions. This could lead to crop varieties that are distinct from their outdoor counterparts for new culinary applications and create unique markets for produce grown indoors.

Industrial synergies

With the rise of abundant tech providers and cross-disciplinary innovators, we can expect collaboration and knowledge sharing to become more common. In addition to delivering more effective indoor growing technologies, collaboration may also substantiate partnerships between companies which reduce their ecological footprints. For instance, co-locating greenhouses with industrial power plants can divert carbon dioxide and heat—by products of combustion—from the atmosphere to crops for photosynthesis enhancement and climate control. Furthermore, composted food waste may be diverted from landfills to fertilize crops in soil-based greenhouses. In the other direction, transparent solar panels may enable greenhouses to become net producers of energy to supply nearby buildings without sacrificing crop performance.

| 21 |

New technologies and ideas will better integrate agricultural businesses with the world around them, helping urban and industrial communities become more productive and sustainable.

Innovation in technology and practice will be the key drivers of new developments in indoor and greenhouse ag businesses. While these developments will be diverse and multidimensional, their effects will be focused on improvements to the potential scale and efficiency of, and quality of food from, indoor agriculture. Following the greenhouse’s historical trajectory, we believe it is safe to assume its relevance to global food systems will continue to expand as we progress into the future.

Competitor Comparison

The Company believes that it has no direct competitors who provide a proprietary facility design and automated grow system as well as a system of operational processes designed to optimize the performance of the Company’s grow houses. On a broader basis, the competitive landscape includes greenhouse vendors, agriculture systems providers, automated grow system vendors, and system/solutions consultants.

Competitive Differentiation

The Company believes it has developed one of the world’s most technologically advanced indoor agriculture systems by focusing on competitive differentiators to deliver vastly improved results beyond conventional indoor approaches. By conceiving new IP, as well as utilizing tried trued tested existing Ag-Tech and Bio-Tech solutions, the Company delivers integrated unique architectural design, intelligent automation and advanced growing processes to create precisely controlled growing environments optimized for each nominated crop variety. These precision ecosystems should enable the Company to cost-effectively produce the cleanest, greenest and most flavorful produce, as well as consistent medical-grade plant-based nutraceuticals and pharmaceuticals, available. The key points of differentiation are as follows:

| Crops | Ops | |||

| ● | Optimized genetics through advanced tissue culture and micropropagation. | ● | Advanced propagation/cultivation/harvest SOP’s. | |

| ● | Higher yields. | ● | Minimal workforce. | |

| ● | Improved nutrition/efficacy values. | ● | Enhanced automation. | |

| ● | Lower production costs. | ● | Substantive capital, resource, and operational savings. | |

| ● | Patents, future pending and provisional. | ● | Reduced ecological impacts. | |

| ● | Trade-marks, EU registered and Canada + US pending. | |||

| ● | Patents, pending and provisional. | |||

| 22 |

| Facilities | Systems | Environment | |||||

| ● | High-tech high efficiency building envelope. | ● | IoT to AI integrated facility/systems controls. | ● | High efficiency climate control equipment. | ||

| ● | Proprietary building engineering and materials. | ● | Critical sensing and monitoring interface equipment. | ● | Micro-climate delivery materials and systems. | ||

| ● | Natural sunlight, indoors. | ● | Advanced Ag-tech Automated Grow Systems. | ● | Automated chronological/meteorological/biological integrated controls. | ||

| ● | Proprietary supplemental grow lighting. Dynamic foam solar gain control. Significantly reduced utility demands. Alternative clean energy sourcing. Green Building Initiative/Green Globe certification. Patents, pending and provisional. | ● | Proprietary high efficiency grow channels.

|

● | Sealed environment.

| ||

| ● | Hybrid hydroponic-aeroponic nutrient systems.

|

● | Herbicide and pesticide free cultivation. Patents, pending and provisional. | ||||

| ● | Patents, pending and provisional. | ||||||

Employees

As of March 29, 2022, the Company has 13 employees and five consultants. The Company also relies on consultants and contractors to conduct its operations. The Company anticipates that it will be hiring additional employees to support its planned activities.

Operations

The Company primary operating activities are in California. The Company’s head office is located in Vancouver, British Columbia, Canada with a second office in the Rotterdam, Netherlands. The Company intends to open a project office near Coachella, CA and maintain an administrative office in Los Angeles. The Company also plans to construct its initial AgriFORCE micropropagation laboratories and its initial AgriFORCE grow houses in the State of California.

Description of Property

The Company currently leases office space at 2233 Colombia Street, Suite 300, Vancouver, B.C., V5Y 0M6 as its principal office. The Company believes the office is in good condition and satisfy its current operational requirements. The Company also leases an office space at Weena 505 Rotterdam, Netherlands

Litigation

We are subject to the legal proceeding and claims described in detail in “Note 16. Commitments and Contingencies” to the audited financial statements included in this filing. Although the results of litigation and claims cannot be predicted with certainty, as of the date of this filing, we do not believe the outcome of such legal proceeding and claims, if determined adversely to us, would be reasonably expected to have a material adverse effect on our business. Regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors.

| 23 |

Item 1A. Risk Factors

Risks Relating to the Company’s Business

The Company is an early stage company with little operating history, a history of losses and the Company cannot assure profitability.

The Company currently has no revenues and does not have any history of revenue generating operations. The Company has been involved to date in the design and development of its AgriFORCE grow house which incorporates the Company’s AgriFORCE micropropagation laboratories. While the Company has invested considerably in this development and design process, no AgriFORCE grow house has been constructed to date and accordingly, the commercial or operating viability of the AgriFORCE grow house has not been proven, or when, if ever, the Company will generate revenue from its operations, and if those revenues, when and if generated, will be sufficient to sustain operations, nonetheless achieve profitability.

There is no assurance that the Company’s AgriFORCE grow houses or micropropagation laboratories will operate as intended.

The Company’s initial state of its business operations will be to construct and deploy its initial AgriFORCE grow house and micropropagation laboratories. However, the Company has yet to complete construction of any laboratories. Accordingly, this component of the Company’s business plan is subject to considerable risks, including:

| ● | there is no assurance that the laboratories will achieve the intended plantlet production rates; | |

| ● | the costs of constructing and operating the laboratories may be greater than anticipated; | |

| ● | the potential offtake partners who have indicated a willingness to deploy the laboratories at their existing cultivation operations may withdraw and determine not to deploy the laboratories; | |

| ● | there is no assurance that the facilities will deliver the intended benefits of high production yields, lower crop losses and reduced operation costs; | |

| ● | if the company is not able to fully develop the grow house or it does not operate as intended, it could prevent the company from realizing any of its business goals or achieving profitability; | |

| ● | the costs of constructing the AgriFORCE grow houses may be greater than anticipated and the Company may not be able to recover these greater costs through increases in the lease rates, license fees and services fees that it charges to its customers; and | |

| ● | the costs of operating the AgriFORCE grow house may be greater than anticipated. |

COVID-19 or any pandemic, epidemic or outbreak of an infectious disease in the United States or elsewhere may adversely affect our business.

The COVID-19 virus has had unpredictable and unprecedented impacts in the United States and around the world. The World Health Organization has declared the outbreak of COVID-19 as a “pandemic,” or a worldwide spread of a new disease. Many countries around the world have imposed quarantines and restrictions on travel and mass gatherings to slow the spread of the virus. In the United States, federal, state and local governments have enacted restrictions on travel, gatherings, and workplaces, with exceptions made for essential workers and businesses. As of the date of this filing, we have not been declared an essential business. As a result, we may be required to substantially reduce or cease operations in response to governmental action or decree as a result of COVID-19. We are still assessing the effect on our business from COVID-19 and any actions implemented by the federal, state and local governments. We have implemented safety protocols to protect our staff, but we cannot offer any assurance that COVID-19 or any other pandemic, epidemic or outbreak of an infectious disease in the United States or elsewhere, will not materially and adversely affect our business.

Fluctuations in the exchange rate of foreign currencies could result in losses.

We incur a portion of our operating expenses in Canadian dollars, and in the future, as we expand into other foreign countries, we expect to incur operating expenses in other foreign currencies. We are exposed to foreign exchange rate fluctuations as the financial results of our international operations are translated from the local functional currency into U.S. dollars upon consolidation. A decline in the U.S. dollar relative to foreign functional currencies would increase our non-U.S. revenue and improve our operating results. Conversely, if the U.S. dollar strengthens relative to foreign functional currencies, our revenue and operating results would be adversely affected. We have not previously engaged in foreign currency hedging. If we decide to hedge our foreign currency exchange rate exposure, we may not be able to hedge effectively due to lack of experience, unreasonable costs or illiquid markets.

| 24 |

The Company will require additional financing and there is no assurance that additional financing will be available when required.

The Company will require substantial additional capital in order to acquire or lease the Coachella land, develop the Coachella lands for use, develop the micropropagation laboratories and operate them, and complete construction of its initial AgriFORCE grow house which is anticipated to be commenced in the second quarter of 2022. The funds raised in this offering will not be sufficient and additional financing will be needed for this purpose and for other purposes. The Company plans to achieve this additional financing through equity and/ or debt financing which will likely be dilutive to the position of then current shareholders. However, there is no assurance that this financing will be available when required. Specifically, there is no assurance that the Company will be able to raise any additional equity financing through its shares given that the viability of the Company’s AgriFORCE grow houses will not be demonstrated until after construction is complete. In addition, there is no assurance that the Company will be able to secure debt financing given its low asset base and its current lack of revenues.

The Company had negative cash flow for the year ended December 31, 2021.

The Company had negative cash flows from operating activities for year ended December 31, 2021. To the extent that the Company has negative cash flows from operating activities in future periods, it may need to allocate a portion of its cash reserves to fund such negative cash flow. The Company may also be required to raise additional funds through the issuance of equity or debt securities. There can be no assurance that the Company will be able to generate a positive cash flow from operating activities, that additional capital or other types of financing will be available when needed or that these financings will be on terms favorable to the Company. The Company’s actual financial position and results of operations may differ materially from the expectations of the Company’s management.

The Company’s actual financial position and results of operations may differ materially from the expectations of the Company’s management.

The Company’s actual financial position and results of operations may differ materially from management’s expectations. The process for estimating the Company’s revenue, net income and cash flow requires the use of judgment in determining the appropriate assumptions and estimates. These estimates and assumptions may be revised as additional information becomes available and as additional analyses are performed. In addition, the assumptions used in planning may not prove to be accurate, and other factors may affect the Company’s financial condition or results of operations. As a result, the Company’s revenue, net income and cash flow may differ materially from the Company’s projected revenue, net income and cash flow.

The Company expects to incur significant ongoing costs and obligations related to its investment in infrastructure, growth, regulatory compliance and operations.

The Company expects to incur significant ongoing costs and obligations related to its investment in its initial AgriFORCE grow houses. To the extent that these costs may be greater than anticipated or the Company may not be able to generate revenues or raise additional financing to cover these costs, these operating expenses could have a material adverse impact on the Company’s results of operations, financial condition and cash flows. In addition, future changes in regulations, more vigorous enforcement thereof or other unanticipated events could require extensive changes to the design and operation of the Company’s AgriFORCE grow houses, which could increase construction costs and have a material adverse effect on the business, results of operations and financial condition of the Company. The Company’s efforts to construct its AgriFORCE grow houses and grow its business may be costlier than the Company expects, and the Company may not be able to recover sufficient revenues to offset its higher operating expenses. The Company may incur significant losses in the future for a number of reasons, including, unforeseen expenses, difficulties, complications and delays, and other unknown events. If the Company is unable to achieve and sustain profitability, the market price of our securities may significantly decrease.

| 25 |

There is no assurance the Company will be able to repatriate or distribute funds for investment from the United States to Canada or elsewhere.

In the event that any of the Company’s investments, or any proceeds thereof, any dividends or distributions there from, or any profits or revenues accruing from such investments in the United States were found to be in violation of money laundering legislation or otherwise, such transactions may be viewed as proceeds of crime under applicable federal laws, rules and regulations or any other applicable legislation. This could restrict or otherwise jeopardize the ability of the Company to declare or pay dividends, effect other distributions or subsequently repatriate such funds back to Canada or elsewhere.

The Company may not be able to effectively manage its growth and operations, which could materially and adversely affect its business.

If the Company implements it business plan as intended, it may in the future experience rapid growth and development in a relatively short period of time. The management of this growth will require, among other things, continued development of the Company’s financial and management controls and management information systems, stringent control of costs, the ability to attract and retain qualified management personnel and the training of new personnel. The Company intends to utilize outsourced resources, and hire additional personnel, to manage its expected growth and expansion. Failure to successfully manage its possible growth and development could have a material adverse effect on the Company’s business and the value of the Shares.

The Company may face significant competition from other facilities.

Many other businesses in California engage in similar activities to the Company, leasing commercial space to agricultural producers generally, and providing additional products and services to similar customers. The Company cannot assure you that it will be able to compete successfully against current and future competitors. Competitive pressures faced by the Company could have a material adverse effect on its business, operating results and financial condition.

If we are unable to protect our intellectual property, our business may be adversely affected.