|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

OR

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED ON DECEMBER 31, 2017

|

|

|

|

OR

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

FOR THE TRANSITION PERIOD FROM

TO

________________

|

|

|

|

OR

|

|

|

¨

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

Date of event requiring this shell company report

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Shares

|

New York Stock Exchange

|

|

Large accelerated filer

þ

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

|

|

|

Emerging growth company

¨

|

|

|

|

||

|

|

|

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

•

|

our business prospects and future results of operations;

|

|

•

|

weather and other natural phenomena;

|

|

•

|

developments in, or changes to, the laws, regulations and governmental policies governing our business, including limitations on ownership of farmland by foreign entities in certain jurisdiction in which we operate, environmental laws and regulations;

|

|

•

|

the implementation of our business strategy;

|

|

•

|

our plans relating to acquisitions, joint ventures, strategic alliances or divestitures;

|

|

•

|

the implementation of our financing strategy and capital expenditure plan;

|

|

•

|

the maintenance of our relationships with customers;

|

|

•

|

the competitive nature of the industries in which we operate;

|

|

•

|

the cost and availability of financing;

|

|

•

|

future demand for the commodities we produce;

|

|

•

|

international prices for commodities;

|

|

•

|

the condition of our land holdings;

|

|

•

|

the development of the logistics and infrastructure for transportation of our products in the countries where we operate;

|

|

•

|

the performance of the South American and world economies;

|

|

•

|

the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; and

|

|

•

|

the factors discussed under the section entitled “Risk Factors” in this annual report.

|

|

•

|

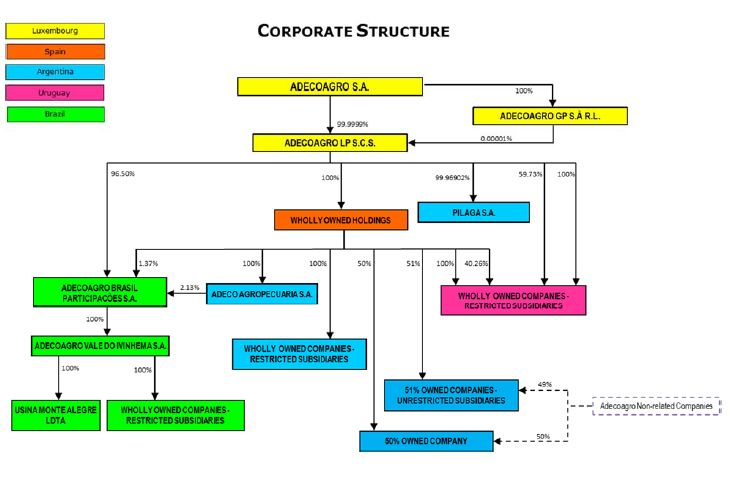

References to the terms “Adecoagro S.A.,” “Adecoagro,” “we,” “us,” “our,” “Company” and “our company” refer to, Adecoagro S.A., a corporation organized under the form of a

société anonyme

under the laws of the Grand Duchy of Luxembourg, and its subsidiaries.

|

|

•

|

References to “IFH” and “IFH LP” mean the former International Farmland Holdings, LP, a limited partnership (previously IFH LP and International Farmland Holdings, LLC, or IFH LLC).

|

|

•

|

References to “Adecoagro LP” mean Adecoagro, LP SCS, a limited partnership organized under the form of a

société comandite simple

under the laws of the Grand Duchy of Luxembourg (previously Adecoagro LP and Adecoagro, LLC).

|

|

•

|

References to “$,” “US$,” “U.S. dollars” and “dollars” are to U.S. dollars.

|

|

•

|

References to “Argentine Pesos,” “Pesos” or “Ps.” are to Argentine Pesos, the official currency of Argentina.

|

|

•

|

References to “Brazilian Real,” “Real,” “Reais” or “R$” are to the Brazilian Real, the official currency of Brazil.

|

|

•

|

Unless stated otherwise, references to “sales” are to the consolidated sales of manufactured products and services rendered plus sales of agricultural produce and biological assets.

|

|

•

|

References to “IFRS” are International Financial Reporting Standards issued by the International Accounting Standards Board (“IASB”) and the interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”), together “IFRS.”

|

|

•

|

Adjusted Consolidated EBITDA

|

|

•

|

Adjusted Segment EBITDA

|

|

•

|

Adjusted Consolidated EBIT

|

|

•

|

Adjusted Segment EBIT

|

|

•

|

Adjusted Free Cash Flow

|

|

•

|

Adjusted Free Cash Flow from Operations

|

|

•

|

Net Debt

|

|

•

|

Net Debt to Adjusted Consolidated EBITDA

|

|

Agricultural weight units and measures

|

|

|

|

1 metric ton

|

1,000 kg

|

1.102 U.S. (short) tons

|

|

1 cubic meter

|

1,000 liters

|

|

|

1 kilogram (kg)

|

2.20462 pounds

|

|

|

1 pound

|

0.45359 kg

|

|

|

1 acre

|

0.40469 hectares

|

|

|

1 hectare (ha)

|

2.47105 acres

|

|

|

Soybean and Wheat

|

|

|

|

1 bushel of soybean

|

60 pounds

|

27.2155 kg

|

|

1 bag of soybean

|

60 kg

|

2.20462 bushels

|

|

1 bushel/acre

|

67.25 kg/ha

|

|

|

1.00 U.S. dollar/bushel

|

2.2046 U.S. dollar/bag

|

|

|

Corn

|

|

|

|

1 bushel of corn

|

56 pounds

|

25.4012 kg

|

|

1 bag of corn

|

60 kg

|

2.36210 bushels

|

|

1 bushel/acre

|

62.77 kg/ha

|

|

|

1.00 U.S. dollar/bushel

|

2.3621 U.S. dollar/bag

|

|

|

Cotton

|

|

|

|

1 bale

|

480 pounds

|

217.72 kg

|

|

1 arroba

|

14.68 kg

|

|

|

Coffee

|

|

|

|

1 bag of coffee

|

60 kg

|

132.28 pounds

|

|

1.00 US$ cents/pound

|

1.3228 U.S. dollar/bag

|

|

|

Dairy

|

|

|

|

1 liter

|

0.264 gallons

|

2.273 pounds

|

|

1 gallon

|

3.785 liters

|

8.604 pounds

|

|

1 lbs

|

0.440 liters

|

0.116 gallons

|

|

1.00 U.S. dollar/liter

|

43.995 U.S. dollar/cwt

|

3.785 U.S. dollar/gallon

|

|

1.00 U.S. dollar/cwt

|

0.023 U.S. dollar/liter

|

0.086 U.S. dollar/gallon

|

|

1.00 U.S. dollar/gallon

|

0.264 U.S. dollar/liter

|

11.622 U.S. dollar/cwt

|

|

Sugar & Ethanol

|

|

|

|

1 kg of TRS equivalent

|

0.95 kg of VHP Sugar

|

0.59 liters of Hydrated Ethanol

|

|

1.00 US$ cents/pound

|

22.04 U.S. dollar/ton

|

|

|

|

For the years ended December 31,

|

|||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

|

(In thousands of $)

|

|||||||||||||

|

Statements of Income Data:

|

|

|

|

|

|

|

|

|

|

|

||||

|

Sale of goods and services rendered

|

933,178

|

|

869,235

|

|

674,314

|

|

722,966

|

|

644,624

|

|

||||

|

Cost of goods sold and services rendered

|

(766,727

|

)

|

(678,581

|

)

|

(557,786

|

)

|

(605,325

|

)

|

(491,578

|

)

|

||||

|

Initial recognition and changes in fair value of biological assets and agricultural produce

|

63,220

|

|

125,456

|

|

54,528

|

|

100,216

|

|

(39,123

|

)

|

||||

|

Changes in net realizable value of agricultural produce after harvest

|

8,852

|

|

(5,841

|

)

|

14,691

|

|

3,401

|

|

12,875

|

|

||||

|

Margin on manufacturing and agricultural activities before operating expenses

|

238,523

|

|

310,269

|

|

185,747

|

|

221,258

|

|

126,798

|

|

||||

|

General and administrative expenses

|

(57,299

|

)

|

(50,750

|

)

|

(48,425

|

)

|

(52,695

|

)

|

(53,352

|

)

|

||||

|

Selling expenses

|

(95,399

|

)

|

(80,673

|

)

|

(70,268

|

)

|

(78,864

|

)

|

(68,069

|

)

|

||||

|

Other operating income, net

|

39,461

|

|

(8,297

|

)

|

31,066

|

|

11,977

|

|

49,650

|

|

||||

|

Share of loss of joint ventures

|

—

|

|

—

|

|

(2,685

|

)

|

(924

|

)

|

(219

|

)

|

||||

|

Profit from operations before financing and taxation

|

125,286

|

|

170,549

|

|

95,435

|

|

100,752

|

|

54,808

|

|

||||

|

Finance income

|

11,744

|

|

7,957

|

|

9,150

|

|

7,291

|

|

7,234

|

|

||||

|

Finance costs

|

(131,349

|

)

|

(165,380

|

)

|

(116,890

|

)

|

(86,472

|

)

|

(98,916

|

)

|

||||

|

Financial results, net

|

(119,605

|

)

|

(157,423

|

)

|

(107,740

|

)

|

(79,181

|

)

|

(91,682

|

)

|

||||

|

Profit / (Loss) before income tax

|

5,681

|

|

13,126

|

|

(12,305

|

)

|

21,571

|

|

(36,874

|

)

|

||||

|

Income tax benefit / (expense)

|

6,068

|

|

(9,387

|

)

|

7,954

|

|

(10,535

|

)

|

9,277

|

|

||||

|

Profit / (Loss) for the year from continuing operations

|

11,749

|

|

3,739

|

|

(4,351

|

)

|

11,036

|

|

(27,597

|

)

|

||||

|

Profit for the year from discontinued operations

(1)

|

—

|

|

—

|

|

—

|

|

—

|

|

1,767

|

|

||||

|

Profit / (Loss) for the year

|

11,749

|

|

3,739

|

|

(4,351

|

)

|

11,036

|

|

(25,830

|

)

|

||||

|

Attributable to:

|

|

|

|

|

|

|

|

|

||||||

|

Equity holders of the parent

|

9,972

|

|

2,039

|

|

(5,593

|

)

|

11,116

|

|

(25,828

|

)

|

||||

|

Non-controlling interest

|

1,777

|

|

1,700

|

|

1,242

|

|

(80

|

)

|

(2

|

)

|

||||

|

Earnings/(Loss) per share from continuing and discontinued operations attributable to the equity holders of the parent during the year:

|

|

|

|

|

|

|

|

|

||||||

|

Basic earnings/(loss) per share

|

|

|

|

|

|

|

|

|

||||||

|

From continuing operations

|

0.083

|

|

0.017

|

|

(0.046

|

)

|

0.092

|

|

(0.226

|

)

|

||||

|

From discontinued operations

|

—

|

|

—

|

|

—

|

|

—

|

|

0.014

|

|

||||

|

Diluted earnings/(loss) per share

|

|

|

|

|

|

|

|

|

||||||

|

From continuing operations

|

0.082

|

|

0.017

|

|

(0.046

|

)

|

0.091

|

|

(0.226

|

)

|

||||

|

From discontinued operations

|

—

|

|

—

|

|

—

|

|

—

|

|

0.014

|

|

||||

|

|

For the Year Ended December 31,

|

|||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

Cash Flow Data:

|

|

|

|

|

|

|

|

|

|

|

||||

|

Net cash generated from operating activities

|

237,105

|

|

255,401

|

|

145,186

|

|

120,151

|

|

102,080

|

|

||||

|

Net cash used in investing activities

|

(188,335

|

)

|

(122,014

|

)

|

(125,051

|

)

|

(300,472

|

)

|

(161,536

|

)

|

||||

|

Net cash generated from financing activities

|

70,194

|

|

(181,682

|

)

|

92,413

|

|

73,289

|

|

104,671

|

|

||||

|

Other Financial Data:

|

|

|

|

|

|

|

|

|

||||||

|

Adjusted Segment EBITDA (unaudited)

(1)

|

|

|

|

|

|

|

|

|

||||||

|

Crops

|

25,678

|

|

27,462

|

|

33,211

|

|

36,671

|

|

36,720

|

|

||||

|

Rice

|

12,179

|

|

11,698

|

|

6,274

|

|

14,198

|

|

12,902

|

|

||||

|

Dairy

|

12,243

|

|

5,717

|

|

6,356

|

|

9,663

|

|

9,801

|

|

||||

|

All Other segments

|

556

|

|

9,085

|

|

677

|

|

686

|

|

1,347

|

|

||||

|

Farming subtotal

|

50,656

|

|

53,962

|

|

46,518

|

|

61,218

|

|

60,770

|

|

||||

|

Ethanol, sugar and energy

|

247,301

|

|

265,044

|

|

167,180

|

|

200,441

|

|

115,239

|

|

||||

|

Land transformation

|

—

|

|

—

|

|

23,980

|

|

25,508

|

|

28,172

|

|

||||

|

Corporate

|

(21,664

|

)

|

(20,957

|

)

|

(21,776

|

)

|

(23,233

|

)

|

(23,478

|

)

|

||||

|

Adjusted Consolidated EBITDA (unaudited)

(1)

|

276,293

|

|

298,049

|

|

215,902

|

|

263,934

|

|

180,703

|

|

||||

|

(1)

|

See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBITDA and Adjusted Consolidated EBITDA and the reconciliation in the table below.

|

|

|

As of December 31,

|

|||||||||||||

|

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

|

(In thousands of $)

|

|||||||||||||

|

Statement of Financial Position Data:

|

|

|

|

|

|

|

|

|

|

|

||||

|

Biological assets

|

167,994

|

|

145,404

|

|

111,818

|

|

124,736

|

|

292,144

|

|

||||

|

Inventories

|

108,919

|

|

111,754

|

|

85,286

|

|

117,106

|

|

108,389

|

|

||||

|

Property, plant and equipment, net

|

820,931

|

|

802,608

|

|

696,889

|

|

991,581

|

|

790,520

|

|

||||

|

Total assets

|

1,607,201

|

|

1,455,766

|

|

1,355,394

|

|

1,646,164

|

|

1,711,476

|

|

||||

|

Non-current borrowings

|

663,060

|

|

430,304

|

|

483,651

|

|

491,324

|

|

512,164

|

|

||||

|

Total borrowings

|

817,958

|

|

635,396

|

|

723,339

|

|

698,506

|

|

660,131

|

|

||||

|

Share Capital

|

183,573

|

|

183,573

|

|

183,573

|

|

183,573

|

|

183,573

|

|

||||

|

Equity attributable to equity holders of the parent

|

639,714

|

|

664,091

|

|

520,084

|

|

769,638

|

|

854,304

|

|

||||

|

Non-controlling interest

|

5,417

|

|

7,582

|

|

7,335

|

|

7,589

|

|

45

|

|

||||

|

Number of shares (including treasury shares)

|

122,382

|

|

122,382

|

|

122,382

|

|

122,382

|

|

122,382

|

|

||||

|

|

For the year ended December 31, 2017

|

|||||||||||||||||||||||||

|

|

Crops

|

Rice

|

Dairy

|

All other

segments

|

Farming

Subtotal

|

Sugar,

Ethanol

and

Energy

|

Land

Trans-

formation

|

Corporate

|

Total

|

|||||||||||||||||

|

|

(In thousands of $)

|

|||||||||||||||||||||||||

|

Adjusted Segment EBITDA

(unaudited)

|

||||||||||||||||||||||||||

|

Profit/(Loss) from

Operations Before Financing and Taxation

|

24,167

|

|

8,328

|

|

11,206

|

|

397

|

|

44,098

|

|

102,852

|

|

—

|

|

(21,664

|

)

|

125,286

|

|

||||||||

|

Adjusted Segment EBIT (unaudited)

(1)

|

24,167

|

|

8,328

|

|

11,206

|

|

397

|

|

44,098

|

|

|

102,852

|

|

—

|

|

(21,664

|

)

|

125,286

|

|

|||||||

|

Depreciation and amortization

|

1,511

|

|

3,851

|

|

1,037

|

|

159

|

|

6,558

|

|

144,449

|

|

—

|

|

—

|

|

151,007

|

|

||||||||

|

Adjusted Segment EBITDA (unaudited)

(1)

|

25,678

|

|

12,179

|

|

12,243

|

|

556

|

|

50,656

|

|

247,301

|

|

—

|

|

(21,664

|

)

|

276,293

|

|

||||||||

|

Reconciliation to Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Profit for the year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,749

|

|

||||||||

|

Income tax (benefit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,068

|

)

|

||||||||

|

Interest expense, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41,078

|

|

||||||||

|

Foreign exchange, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38,708

|

|

||||||||

|

Other financial results, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39,819

|

|

||||||||

|

Adjusted Consolidated EBIT (unaudited)

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

125,286

|

|

||||||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

151,007

|

|

||||||||

|

Adjusted Consolidated EBITDA (unaudited)

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

276,293

|

|

||||||||

|

(1)

|

See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

|

For the year ended December 31, 2016

|

|||||||||||||||||||||||||

|

|

Crops

|

Rice

|

Dairy

|

All other

segments

|

Farming

Subtotal

|

Sugar,

Ethanol

and

Energy

|

Land

Trans-

formation

|

Corporate

|

Total

|

|||||||||||||||||

|

|

(In thousands of $)

|

|||||||||||||||||||||||||

|

Adjusted Segment EBITDA

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Profit/(Loss) from

Operations Before Financing and Taxation

|

26,093

|

|

8,932

|

|

4,753

|

|

8,893

|

|

48,671

|

|

142,835

|

|

—

|

|

(20,957

|

)

|

170,549

|

|

||||||||

|

Adjusted Segment EBIT (unaudited)

(1)

|

26,093

|

|

8,932

|

|

4,753

|

|

8,893

|

|

48,671

|

|

142,835

|

|

—

|

|

(20,957

|

)

|

170,549

|

|

||||||||

|

Depreciation and amortization

|

1,369

|

|

2,766

|

|

964

|

|

192

|

|

5,291

|

|

122,209

|

|

—

|

|

—

|

|

127,500

|

|

||||||||

|

Adjusted Segment EBITDA (unaudited)

(1)

|

27,462

|

|

11,698

|

|

5,717

|

|

9,085

|

|

53,962

|

|

265,044

|

|

—

|

|

(20,957

|

)

|

298,049

|

|

||||||||

|

Reconciliation to Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Profit for the year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,739

|

|

||||||||

|

Income tax expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,387

|

|

||||||||

|

Interest expense, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,527

|

|

||||||||

|

Foreign exchange, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,062

|

|

||||||||

|

Other financial results, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

97,834

|

|

||||||||

|

Adjusted Consolidated EBIT (unaudited)

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

170,549

|

|

||||||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

127,500

|

|

||||||||

|

Adjusted Consolidated EBITDA (unaudited)

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

298,049

|

|

||||||||

|

(1)

|

See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

|

For the year ended December 31, 2015

|

|||||||||||||||||||||||||

|

|

Crops

|

Rice

|

Dairy

|

All other

segments

|

Farming

Subtotal

|

Sugar,

Ethanol

and

Energy

|

Land

Trans-

formation

|

Corporate

|

Total

|

|||||||||||||||||

|

|

(In thousands of $)

|

|||||||||||||||||||||||||

|

Adjusted Segment EBITDA

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Profit/(Loss) from

Operations Before Financing and Taxation

|

30,784

|

|

3,287

|

|

4,900

|

|

401

|

|

39,372

|

|

69,925

|

|

7,914

|

|

(21,776

|

)

|

95,435

|

|

||||||||

|

Reserve from the sale of non-controlling interests in subsidiaries

(2)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

16,066

|

|

—

|

|

16,066

|

|

||||||||

|

Adjusted Segment EBIT (unaudited)

(1)

|

30,784

|

|

3,287

|

|

4,900

|

|

401

|

|

39,372

|

|

69,925

|

|

23,980

|

|

|

(21,776

|

)

|

111,501

|

|

|||||||

|

Depreciation and amortization

|

2,427

|

|

2,987

|

|

1,456

|

|

276

|

|

7,146

|

|

97,255

|

|

—

|

|

—

|

|

104,401

|

|

||||||||

|

Adjusted Segment EBITDA (unaudited)

(1)

|

33,211

|

|

6,274

|

|

6,356

|

|

677

|

|

46,518

|

|

167,180

|

|

23,980

|

|

(21,776

|

)

|

215,902

|

|

||||||||

|

Reconciliation to Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Loss for the year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4,351

|

)

|

||||||||

|

Income tax (benefit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7,954

|

)

|

||||||||

|

Interest expense, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49,491

|

|

||||||||

|

Foreign exchange, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,423

|

|

||||||||

|

Other financial results, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,826

|

|

||||||||

|

Reserve from the sale of non-controlling interests in subsidiaries

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,066

|

|

||||||||

|

Adjusted Consolidated EBIT (unaudited)

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

111,501

|

|

||||||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104,401

|

|

||||||||

|

Adjusted Consolidated EBITDA (unaudited)

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

215,902

|

|

||||||||

|

(1)

|

See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

(2)

|

This corresponds to an equity line item in our consolidated statements of financial position. See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

|

For the year ended December 31, 2014

|

|||||||||||||||||||||||||

|

|

Crops

|

Rice

|

Dairy

|

All other

segment

|

Farming

Subtotal

|

Sugar,

Ethanol

and

Energy

|

Land

Trans-

formation

|

Corporate

|

Total

|

|||||||||||||||||

|

|

(In thousands of $)

|

|||||||||||||||||||||||||

|

Adjusted Segment EBITDA

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Profit/(Loss) from

Operations Before Financing and Taxation

|

34,745

|

|

10,937

|

|

8,112

|

|

288

|

|

54,082

|

|

69,903

|

|

—

|

|

(23,233

|

)

|

100,752

|

|

||||||||

|

Reserve from the sale of non-controlling interests in subsidiaries (2)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

25,508

|

|

—

|

|

25,508

|

|

||||||||

|

Adjusted Segment EBIT (unaudited)

(2)

|

34,745

|

|

10,937

|

|

8,112

|

|

288

|

|

54,082

|

|

69,903

|

|

25,508

|

|

|

(23,233

|

)

|

126,260

|

|

|||||||

|

Depreciation and amortization

|

1,926

|

|

3,261

|

|

1,551

|

|

398

|

|

7,136

|

|

130,538

|

|

—

|

|

—

|

|

137,674

|

|

||||||||

|

Adjusted Segment EBITDA (unaudited)

(2)

|

36,671

|

|

14,198

|

|

9,663

|

|

686

|

|

61,218

|

|

200,441

|

|

25,508

|

|

(23,233

|

)

|

263,934

|

|

||||||||

|

Reconciliation to Profit

|

||||||||||||||||||||||||||

|

Profit for the year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,036

|

|

||||||||

|

Income tax expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,535

|

|

||||||||

|

Interest expense, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47,847

|

|

||||||||

|

Foreign exchange, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,246

|

|

||||||||

|

Other financial results, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,088

|

|

||||||||

|

Reserve from the sale of non-controlling interest in subsidiaries)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,508

|

|

||||||||

|

Adjusted Consolidated EBIT (unaudited)

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

126,260

|

|

||||||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

137,674

|

|

||||||||

|

Adjusted Consolidated EBITDA (unaudited)

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

263,934

|

|

||||||||

|

(1)

|

See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

(2)

|

This corresponds to an equity line item in our consolidated statements of financial position. See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

|

For the year ended December 31, 2013 (*)

|

|||||||||||||||||||||||||

|

|

Crops

|

Rice

|

Dairy

|

All other

segments

|

Farming

Subtotal

|

Sugar,

Ethanol

and

Energy

|

Land

Trans-

formation

|

Corporate

|

Total

|

|||||||||||||||||

|

|

(In thousands of $)

|

|||||||||||||||||||||||||

|

Adjusted Segment EBITDA

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Profit/(Loss) from

Operations Before Financing and Taxation

|

34,549

|

|

8,171

|

|

6,714

|

|

(7,238

|

)

|

42,196

|

|

7,918

|

|

28,172

|

|

(23,478

|

)

|

54,808

|

|

||||||||

|

Profit from discontinued operations

|

—

|

|

—

|

|

1,767

|

|

—

|

|

1,767

|

|

—

|

|

—

|

|

—

|

|

1,767

|

|

||||||||

|

Initial recognition and changes in fair value of “long term” biological assets(l) (unrealized)

|

—

|

|

—

|

|

234

|

|

8,121

|

|

8,355

|

|

47,341

|

|

—

|

|

—

|

|

55,696

|

|

||||||||

|

Adjusted Segment EBIT (unaudited)

(2)

|

34,549

|

|

8,171

|

|

8,715

|

|

883

|

|

52,318

|

|

55,259

|

|

28,172

|

|

(23,478

|

)

|

112,271

|

|

||||||||

|

Depreciation and amortization

|

2,171

|

|

4,731

|

|

1,086

|

|

464

|

|

8,452

|

|

59,980

|

|

—

|

|

—

|

|

68,432

|

|

||||||||

|

Adjusted Segment EBITDA (unaudited)

(2)

|

36,720

|

|

12,902

|

|

9,801

|

|

1,347

|

|

60,770

|

|

115,239

|

|

28,172

|

|

(23,478

|

)

|

180,703

|

|

||||||||

|

Reconciliation to Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Loss for the year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(25,830

|

)

|

||||||||

|

Initial recognition and changes in fair value of “long term” biological assets(l) (unrealized)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55,696

|

|

||||||||

|

Income tax (benefit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9,277

|

)

|

||||||||

|

Interest expense, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42,367

|

|

||||||||

|

Foreign exchange losses, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,087

|

|

||||||||

|

Other financial results, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,228

|

|

||||||||

|

Adjusted Consolidated EBIT (unaudited)

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

112,271

|

|

||||||||

|

Depreciation and amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68,432

|

|

||||||||

|

Adjusted Consolidated EBITDA (unaudited)

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

180,703

|

|

||||||||

|

(1)

|

Long-term biological assets were sugarcane, coffee, dairy and cattle.

|

|

(2)

|

See “Presentation of Financial and Other Information” for the definitions of Adjusted Segment EBIT, Adjusted Consolidated EBIT, Adjusted Segment EBITDA and Adjusted Consolidated EBITDA.

|

|

Adjusted Free Cash Flow

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

Net cash generated from operating activities

|

237,105

|

|

255,401

|

|

145,186

|

|

120,151

|

|

102,080

|

|

||||

|

Net cash used in investing activities

|

(188,335

|

)

|

(122,014

|

)

|

(125,051

|

)

|

(300,472

|

)

|

(161,536

|

)

|

||||

|

Interest paid

|

(41,612

|

)

|

(48,400

|

)

|

(48,438

|

)

|

(48,899

|

)

|

(45,972

|

)

|

||||

|

Proceeds from the sale of non-controlling interest in subsidiaries

|

—

|

|

—

|

|

21,964

|

|

49,343

|

|

—

|

|

||||

|

Expansion Capital expenditures reversal (unaudited)

|

70,804

|

|

48,295

|

|

87,956

|

|

237,277

|

|

166,494

|

|

||||

|

Adjusted Free Cash Flow from Operations (unaudited)

|

77,962

|

|

133,282

|

|

81,617

|

|

57,400

|

|

61,066

|

|

||||

|

Expansion Capital expenditures (unaudited)

|

(70,804

|

)

|

(48,295

|

)

|

(87,956

|

)

|

(237,277

|

)

|

(166,494

|

)

|

||||

|

Adjusted Free Cash Flow (unaudited)

|

7,158

|

|

84,987

|

|

(6,339

|

)

|

(179,877

|

)

|

(105,428

|

)

|

||||

|

Indebtedness

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

Net Debt (unaudited)

|

548,763

|

|

|

476,828

|

|

|

524,445

|

|

|

584,711

|

|

|

427,984

|

|

|

Net Debt / Adjusted Consolidated EBITDA (unaudited)

|

1.98

|

x

|

1.60

|

x

|

2.43

|

x

|

2.22

|

x

|

2.37

|

x

|

||||

|

Reconciliation - Net Debt

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

Total Borrowings

|

817,958

|

|

635,396

|

|

723,339

|

|

698,506

|

|

660,131

|

|

||||

|

Cash and cash equivalents

|

(269,195

|

)

|

(158,568

|

)

|

(198,894

|

)

|

(113,795

|

)

|

(232,147

|

)

|

||||

|

Net Debt (unaudited)

|

548,763

|

|

476,828

|

|

524,445

|

|

584,711

|

|

427,984

|

|

||||

|

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

Net increase/(decrease) in cash and cash equivalents

|

118,964

|

|

(48,295

|

)

|

112,548

|

|

(107,032

|

)

|

45,215

|

|

||||

|

Proceeds from the sale of minority interest in subsidiaries

|

—

|

|

—

|

|

21,964

|

|

49,343

|

|

—

|

|

||||

|

Interest Paid

|

(41,612

|

)

|

(48,400

|

)

|

(48,438

|

)

|

(48,899

|

)

|

(45,972

|

)

|

||||

|

Net cash generated from financing activities

|

(70,194

|

)

|

181,682

|

|

(92,413

|

)

|

(73,289

|

)

|

(104,671

|

)

|

||||

|

Adjusted Free Cash Flow (unaudited)

|

7,158

|

|

84,987

|

|

(6,339

|

)

|

(179,877

|

)

|

(105,428

|

)

|

||||

|

|

2017

|

2016

|

2015

|

2014

|

2013 (*)

|

|||||||||

|

Net increase/(decrease) in cash and cash equivalents

|

118,964

|

|

(48,295

|

)

|

112,548

|

|

(107,032

|

)

|

45,215

|

|

||||

|

Expansion Capital Expenditures (unaudited)

|

71,891

|

|

48,295

|

|

87,956

|

|

237,277

|

|

166,494

|

|

||||

|

Proceeds from the sale of minority interest in subsidiaries

|

—

|

|

—

|

|

21,964

|

|

49,343

|

|

—

|

|

||||

|

Interest Paid

|

(41,612

|

)

|

(48,400

|

)

|

(48,438

|

)

|

(48,899

|

)

|

(45,972

|

)

|

||||

|

Net cash (used)/generated from financing activities

|

(70,194

|

)

|

181,682

|

|

(92,413

|

)

|

(73,289

|

)

|

(104,671

|

)

|

||||

|

Adjusted Free Cash Flow from operations (unaudited)

|

79,049

|

|

133,282

|

|

81,617

|

|

57,400

|

|

61,066

|

|

||||

|

•

|

prevailing world commodity prices, which historically have been subject to significant fluctuations over relatively short periods of time, depending on worldwide demand and supply;

|

|

•

|

changes in the agricultural subsidy levels of certain important producers (mainly the U.S. and the European Union (“E.U.”) and the adoption of other government policies affecting industry market conditions and prices;

|

|

•

|

changes to trade barriers of certain important consumer markets (including China, India, the U.S. and the E.U.) and the adoption of other governmental policies affecting industry market conditions and prices;

|

|

•

|

changes in government policies for biofuels;

|

|

•

|

world inventory levels, i.e., the supply of commodities carried over from year to year;

|

|

•

|

climatic conditions and natural disasters in areas where agricultural products are cultivated;

|

|

•

|

the production capacity of our competitors; and

|

|

•

|

demand for and supply of competing commodities and substitutes.

|

|

•

|

labor laws;

|

|

•

|

economic growth;

|

|

•

|

currency fluctuations;

|

|

•

|

inflation;

|

|

•

|

exchange and capital control policies;

|

|

•

|

interest rates;

|

|

•

|

liquidity of domestic capital and lending markets;

|

|

•

|

monetary policy;

|

|

•

|

liquidity and solvency of the financial system;

|

|

•

|

limitations on ownership of rural land by foreigners;

|

|

•

|

developments in trade negotiations through the World Trade Organization or other international organizations;

|

|

•

|

environmental regulations;

|

|

•

|

tax laws, including royalties and the effect of tax laws on distributions from our subsidiaries;

|

|

•

|

restrictions on repatriation of investments and on the transfer of funds abroad;

|

|

•

|

expropriation or nationalization;

|

|

•

|

import/export restrictions or other laws and policies affecting foreign trade and investment;

|

|

•

|

price controls or price fixing regulations;

|

|

•

|

restrictions on land acquisition or use or agricultural commodity production; and

|

|

•

|

other political, social and economic developments, including political, social or economic instability, in or affecting the country where each business is based.

|

|

•

|

INDEC Reforms: On January 8, 2016, based on the determination that the INDEC has failed to produce reliable statistical information, particularly with respect to the CPI, GDP, poverty and foreign trade data, the Macri administration declared the national statistical system and the INDEC in a state of administrative emergency. As a

|

|

•

|

Agreement with holdout creditors: The Macri administration settled the substantial majority of outstanding claims brought by holdout creditors and issued sovereign bonds in the international financial markets passed by Congress through Law No. 27,249. Although the size of the claims involved has decreased significantly, litigation initiated by bondholders that have not accepted Argentina’s settlement offer continues in several jurisdictions.

|

|

•

|

Foreign Exchange Reforms: The elected government eliminated most foreign exchange restrictions, including certain currency controls, which were imposed by the previous administration. See “—Risks related to Argentina—Exchange controls could restrict the inflow and outflow of funds in Argentina”.

|

|

•

|

Foreign trade reforms. The Macri administration eliminated export duties on wheat, corn, beef and regional products, and reduced the duty on soybeans from 35% to 30%. Further, the 5% export duty on most industrial and mining exports was eliminated. With respect to payments for imports of goods and services, the Macri administration announced the elimination of limitations for access to the Foreign Exchange Market for any new transactions as of December 17, 2015, and for existing debts incurred in connection with imports of goods and services as of April 22, 2016. On January 2, 2017, the federal government enacted a further reduction of the export duties rate set for soybean and soybean products, setting a monthly 0.5% cut on the export duties rate beginning on January 2018 and until December 2019.

|

|

•

|

Fiscal policy: The Macri administration took steps to anchor fiscal accounts, reduce the primary fiscal deficit, eliminate subsidies, reorganize certain expenditures and generate increased revenue through a tax amnesty program. The fiscal deficit for 2016 was approximately 4.6% of GDP, 0.2% lower than expected; reducing fiscal deficit is one of the most important objectives for the administration in the coming years.

|

|

•

|

Infrastructure state of emergency and reforms. The Macri administration issued Resolution No. 6/2016 of the Ministerio de Energía y Minería de la Nación (National Ministry of Energy and Mining) and Resolution No. 1/2016 of the Ente Nacional Regulador de la Electricidad (National Electricity Regulatory Agency), through which the Macri administration announced the elimination of some energy subsidies currently in effect and a substantial increase in electricity rates. Additionally, the government declared a state of emergency with respect to the national electrical system, which remained effective until December 31, 2017. Under this state of emergency, the Macri administration will be permitted to take actions designed to guarantee the supply of electricity.In addition, the Macri administration announced the elimination of certain natural gas subsidies and adjustments to natural gas rates.

|

|

•

|

Correction of monetary imbalances: The Argentine administration has adopted an inflation targeting regime in parallel with the floating exchange rate regime and set inflation targets for the next few years. The Central Bank has increased stabilization efforts to reduce excess monetary imbalances and raised peso interest rates to offset inflationary pressure. The Central Bank also announced inflation target ranges of 15% for 2018 and 10% for 2019.

|

|

•

|

Tax Amnesty Law: On June 29, 2016, the Argentine Congress passed Law No. 27,260, which became effective on July 22, 2016 and provides for a tax amnesty regime and tax reform. This regime allowed individuals and entities to disclose undeclared assets both abroad and in Argentina, under the conditions set forth in the law and within a period extending from its effectiveness until March 31, 2017, without the need to repatriate such assets to Argentina and without penalty (other than charges described below) or the need to explain the source of the funds, among other benefits. The law also provides that there will be no charge on assets worth up to US$25,000, and a discounted applicable tax of 5% on property and assets worth up to US$80,000. Above that threshold, the applicable tax was 10% until the end of 2016 and 15% until the end of March 2017, when the amnesty window closed.

|

|

•

|

Corporate Criminal Liability Law (

Ley de Responsabilidad Penal Empresaria

): On November 8, 2017, the Argentine Congress passed Law No. 27,401 which provides for the criminal liability of corporate entities when the following crimes are committed, directly or indirectly: (a) local or international bribery and influence peddling, (b) negotiations that are incompatible with public office, (c) illegal payments made to public officials under the appearance of taxes or fees owed to the relevant government agency (concusión), (d) illegal enrichment of public officers and employees, and (e) producing knowingly false balance sheets and reports to cover up local or international bribery or influence peddling. Companies found liable for committing such crimes may be subject to various sanctions and penalties,

|

|

•

|

Amendment to Labor Risks Law: On February 15, 2017, the Argentine congress passed Law 27,348, which amends and complements Labor Risks Law No. 24,557, or the Labor Risks Law, and aims to reduce litigation arising from accidents at work. Under the new regime, prior to filing a lawsuit resulting from work-related accidents, affected workers must go through jurisdictional medical commissions, in order to assess the impact of any accident and to assign benefits provided for under the Labor Risks Law.

|

|

•

|

Draft Bill for Productive Financing: On November 13, 2017, the Argentine Administration submitted to the Argentine congress a draft bill that aims to develop Argentina’s capital markets. The draft bill amends and updates the Argentine Capital Markets Law, the Mutual Funds Law and the Argentine Negotiable Obligations Law, among others. Furthermore, the bill amends certain tax provisions, regulates relating to derivatives and promotes a financial inclusion program. On November 22, 2017, the draft bill was passed by the lower chamber of the Argentine congress and was sent to the Argentine senate. The Argentine senate approved the bill with certain amendments on March 21, 2018, and it will therefore be re-approved by the Argentine lower chamber. The draft bill has not yet been approved.

|

|

•

|

Social Security Reform Law: On December 28, 2017 Argentine Law No. 27,426 was promulgated. The law provides for modifications to the method of calculation of increases of social security benefits.

|

|

•

|

Labor Reform Draft Bill: The Argentine administration recently announced a draft bill to reform labor and social security which was sent to the Argentine congress for debate on November 21, 2017. On November 29, 2017, the draft bill was passed by the Argentine senate, and sent to the Argentine congress. The draft bill aims to improve competitiveness and efficiency of various sectors, increase employment, attract investment and reduce labor costs.

|

|

•

|

Tax Regime: On December 27, 2017, a draft bill proposing a series of tax and social security reforms was approved by the Argentine congress by means of Law No. 27,430. The law provides for a series of tax and social security reforms intended to eliminate certain existing complexities and inefficiencies of the Argentine tax regime, reduce tax evasion, increase the coverage of income tax as applied to individuals and encourage investment while sustaining the Argentine administration’s medium- and long-term efforts aimed at restoring fiscal balance.

|

|

•

|

Limitation of Bureaucracy and Simplification: On January 11, 2018, Decree No. 27/2018, or Decree 27/2018, was published in the Argentine Official Gazette, with the objective to reduce government bureaucracy and approve new practices which reduce costs and boost competitiveness.

|

|

•

|

economic and social instability;

|

|

•

|

increase in interest rates;

|

|

•

|

exchange controls and restrictions on remittances abroad;

|

|

•

|

restrictions and taxes on agricultural exports;

|

|

•

|

exchange rate fluctuations;

|

|

•

|

inflation;

|

|

•

|

volatility and liquidity in domestic capital and credit markets;

|

|

•

|

expansion or contraction of the Brazilian economy, as measured by GDP growth rates;

|

|

•

|

allegations of corruption against political parties, elected officials or other public officials, including allegations made in relation to the ”Car Wash Operation” (

Operação Lava-Jato)

investigation;

|

|

•

|

government policies related to our sector;

|

|

•

|

fiscal or monetary policy and amendments to tax legislation; and

|

|

•

|

other political, diplomatic, social or economic developments in or affecting Brazil.

|

|

•

|

the judgment of the U.S. court is final and duly enforceable (

exécutoire

) in the United States;

|

|

•

|

the U.S. court had jurisdiction over the subject matter leading to the judgment (that is, its jurisdiction was established in compliance both with Luxembourg private international law rules and with the applicable domestic U.S. federal or state jurisdictional rules);

|

|

•

|

the U.S. court has applied to the dispute the substantive law which would have been applied by Luxembourg courts;

|

|

•

|

the judgment was granted following proceedings where the counterparty had the opportunity to appear, and if it appeared, to present a defense;

|

|

•

|

the U.S. court has acted in accordance with its own procedural laws; and

|

|

•

|

the judgment of the U.S. court does not contravene Luxembourg international public policy.

|

|

•

|

one of the largest owners of productive farmland in South America, with more than 203,620 owned productive hectares as of December 31, 2017 (excluding legal land reserves pursuant to local regulations and other land reserves) located in Argentina, Brazil and Uruguay, producing a wide range of agricultural products.

|

|

•

|

a leading producer of grains and oilseeds in South America. During the 2016/2017 harvest year, we harvested 185,149 hectares (including 62,545 leased hectares and 39,220 second crop hectares) and produced 654,872 tons of grains, including soybeans, corn, wheat, sunflower and cotton;

|

|

•

|

one of the largest fully integrated producers of rough (unprocessed) rice in the world, planting 39,728 hectares (including 1,700 leased hectares) and producing 234,831 tons during the 2016/2017 harvest year, which accounted for 21% of the total Argentine production according to the

Confederacion de Molinos Arroceros del Mercosur

(“Conmasur”). We are also a large processor and exporter of white rice (processed) in Argentina, accounting for 19%

of total white rice production capacity in Argentina and 25% of total Argentine white rice exports during 2017, according to

Camara de Industriales Arroceros de Entre Ríos (Federacion de Entidades

Arroceras)

.

|

|

•

|

a leading dairy producer in South America in terms of our cutting-edge technology, productivity per cow and grain conversion efficiencies, producing 93.2 million liters of raw milk during 2017.

|

|

•

|

a growing producer of sugar and ethanol in Brazil, where we currently own three sugar and ethanol mills, with an aggregate installed capacity of 12.3 million tons per year and full cogeneration capacity (the generation of electricity from sugarcane bagasse, the fiber portion of sugarcane that remains after the extraction of sugarcane juice) of 232 MW as of December 31, 2017. Our operation is highly integrated, meaning that 89% of the sugarcane crushed at our mills is supplied from our own plantations. As of December 31, 2017, our sugarcane plantation consisted of 137,697 hectares; and.

|

|

•

|

one of the leading companies in South America involved in the acquisition and transformation of undermanaged land to more productive uses, generating higher cash yields. During the last twelve fiscal years, we have consistently sold a portion of our fully mature farmland every year. In aggregate, we have sold over 77,000 hectares generating capital gains of approximately $210 million.

|

|

•

|

Crop business

: We produce a wide range of agricultural commodities including soybeans, corn, wheat, sunflower and cotton, among others. In Argentina, our farming activities are conducted mainly in the Argentine humid pampas region, where agro-ecological conditions are optimal for low-cost production. Since 2004, we have expanded our operations throughout the center-west region of Uruguay and the western part of the state of Bahia, Brazil, as well as in the northern region of Argentina. During the 2016/2017 harvest year, we planted approximately

190,325

hectares of crops, including second harvests, producing 654,872 tons of grains, including soybeans, wheat and corn, sunflower and cotton. We also planted an additional

5,177

hectares where we produced over 155,300 tons of forage that we used for cow feed in our dairy operation. During the current 2017/18 harvest year, we planted approximately 189,918 hectares of crops, including second harvest, and also planted an additional 5,470 hectares of forage.

|

|

•

|

Rice business

: We own a fully-integrated rice operation in Argentina. We produce irrigated rice in the northeast provinces of Argentina, where the availability of water, sunlight, and fertile soil results in one of the most ideal regions in the world for producing rice at low cost. We believe that we are one of the largest producers of rough (unprocessed) rice in Argentina, producing 234,831 tons during the 2016/2017 harvest year, which accounted for 21% of the total Argentine production according to Conmasur. We own three rice mills that process our own production, as well as rice purchased from third parties. We produce different types of white and brown rice that are sold both in the domestic Argentine retail market under our own brand; and exported. During the current 2017/18 harvest year, we planted 40,729 hectares of rice.

|

|

•

|

Dairy business

: We believe that we are a leading dairy producer in South America in terms of our utilization of cutting-edge technology, productivity per cow and grain conversion efficiencies. Through the production of raw milk, we are able to transform forage and grains into value-added animal protein. Our “free-stall” dairies in Argentina allow us to optimize our use of resources (land, dairy cow feed and capital), increase our productivity and maximize the conversion of forage and grain into raw milk. We produced 93.2 million liters of raw milk during 2017, with a daily average of 6,967 milking cows, delivering an average of 36.6 liters of milk per cow per day. On October, 2017 we completed the construction of our first bio-digestor with a 1.4MWH of intalled capacity. The facility generates electricity by burning biogas extracted from the effluents produced by our seven thousand milking cows. On November 3, 2017, we began the energy generation and the delivery of electricity to the local power grid. In addition to increasing revenues and securing our energy requirements, this facility enhances the sustainability of our free stall dairy operation by reducing greenhouse gas emissions, improving the effluent management and concentrating valuable nutrients which are applied back to the fields.

|

|

•

|

All Other Segments business

: Our all other segments business consists of leasing pasture land to cattle farmers in Argentina and leasing our coffee plantation in the Rio de Janeiro farm, located in Western Bahia, Brazil, to a third party. We lease over 27,216 hectares of pasture land which is not suitable for crop production to third party cattle farmers.

|

|

|

Year Ended December 31,

|

||||||||

|

2017

|

2016

|

2015

|

|||||||

|

Sales

|

(in thousands of $)

|

||||||||

|

Crops (1)

|

197,222

|

|

142,124

|

|

154,741

|

|

|||

|

Rice (2)

|

86,478

|

|

96,562

|

|

84,668

|

|

|||

|

Dairy

|

37,523

|

|

32,897

|

|

32,981

|

|

|||

|

All Other Segments (3)

|

1,336

|

|

960

|

|

1,302

|

|

|||

|

Total

|

322,559

|

|

272,543

|

|

273,692

|

|

|||

|

Harvest year

|

|||||||||

|

2016/2017

|

2015/2016

|

2014/2015

|

|||||||

|

Production

|

(in tons)

|

||||||||

|

Crops (tons)

(4)

|

652,201

|

|

583,639

|

|

627,824

|

|

|||

|

Rice (tons)

(5)

|

234,831

|

|

220,758

|

|

180,149

|

|

|||

|

Total

|

887,032

|

|

804,397

|

|

807,973

|

|

|||

|

|

Year Ended December 31

|

||||||||

|

|

2017

|

2016

|

2015

|

||||||

|

Dairy (thousands of liters)

(6)

|

93,168

|

|

|

92,395

|

|

|

88,556

|

|

|

|

Harvest year

|

||||||||||||

|

|

2017/2018

|

2016/2017

|

2015/2016

|

2014/2015

|

||||||||

|

Planted Area

|

(in hectares, including second harvest)

|

|||||||||||

|

Crops

(7)

|

189,757

|

|