|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2013 |

Commission File Number 1-8787 |

American International Group, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization) |

13-2592361

(I.R.S. Employer Identification No.) |

|||||

|

|

|

180 Maiden Lane, New York, New York (Address of principal executive offices) |

|

10038 (Zip Code) |

|

|

Registrant's telephone number, including area code: (212) 770-7000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ | Accelerated filer o |

Non-accelerated filer

o

(Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of October 25, 2013, there were 1,472,346,407 shares outstanding of the registrant's common stock.

AMERICAN INTERNATIONAL GROUP, INC.

QUARTERLY REPORT ON FORM 10-Q FOR THE QUARTERLY PERIOD ENDED

SEPTEMBER 30, 2013

TABLE OF CONTENTS

1

ITEM 1. / FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

|

|

|

|

|||||

|---|---|---|---|---|---|---|---|

|

(in millions, except for share data)

|

September 30,

|

December 31,

2012 |

|||||

|

Assets: |

|

|

|

||||

|

Investments: |

|

|

|

||||

|

Fixed maturity securities: |

|

|

|

||||

|

Bonds available for sale, at fair value (amortized cost: 2013 – $249,062; 2012 – $246,149) |

$

|

259,901

|

|

$ | 269,959 | ||

|

Bond trading securities, at fair value |

|

22,884

|

|

24,584 | |||

|

Equity securities: |

|

|

|

||||

|

Common and preferred stock available for sale, at fair value (cost: 2013 – $1,626; 2012 – $1,640) |

|

3,378

|

|

3,212 | |||

|

Common and preferred stock trading, at fair value |

|

807

|

|

662 | |||

|

Mortgage and other loans receivable, net of allowance (portion measured at fair value: 2013 – $0; 2012 – $134) |

|

19,707

|

|

19,482 | |||

|

Other invested assets (portion measured at fair value: 2013 – $8,071; 2012 – $7,056) |

|

29,168

|

|

29,117 | |||

|

Short-term investments (portion measured at fair value: 2013 – $5,373; 2012 – $8,056) |

|

22,457

|

|

28,808 | |||

|

Total investments |

|

358,302

|

|

375,824 | |||

|

|

|

|

|||||

|

Cash |

|

2,058

|

|

1,151 | |||

|

Accrued investment income |

|

3,008

|

|

3,054 | |||

|

Premiums and other receivables, net of allowance |

|

13,715

|

|

13,989 | |||

|

Reinsurance assets, net of allowance |

|

26,264

|

|

25,595 | |||

|

Deferred income taxes |

|

21,671

|

|

17,466 | |||

|

Deferred policy acquisition costs |

|

9,188

|

|

8,182 | |||

|

Derivative assets, at fair value |

|

1,723

|

|

3,671 | |||

|

Other assets, including restricted cash of $902 in 2013 and $1,878 in 2012 (portion measured at fair value: |

|

|

|

||||

|

2013 – $486; 2012 – $696) |

|

8,736

|

|

10,399 | |||

|

Separate account assets, at fair value |

|

65,959

|

|

57,337 | |||

|

Assets held for sale |

|

30,120

|

|

31,965 | |||

|

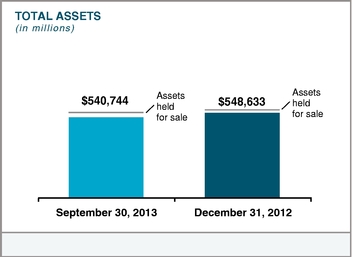

Total assets |

$

|

540,744

|

|

$ | 548,633 | ||

|

Liabilities: |

|

|

|

||||

|

Liability for unpaid claims and claims adjustment expense |

$

|

83,228

|

|

$ | 87,991 | ||

|

Unearned premiums |

|

23,606

|

|

22,537 | |||

|

Future policy benefits for life and accident and health insurance contracts |

|

40,111

|

|

40,523 | |||

|

Policyholder contract deposits (portion measured at fair value: 2013 – $387; 2012 – $1,257) |

|

121,441

|

|

122,980 | |||

|

Other policyholder funds |

|

5,115

|

|

6,267 | |||

|

Derivative liabilities, at fair value |

|

2,722

|

|

4,061 | |||

|

Other liabilities (portion measured at fair value: 2013 – $766; 2012 – $1,080) |

|

31,368

|

|

32,068 | |||

|

Long-term debt (portion measured at fair value: 2013 – $6,981; 2012 – $8,055) |

|

42,231

|

|

48,500 | |||

|

Separate account liabilities |

|

65,959

|

|

57,337 | |||

|

Liabilities held for sale |

|

25,448

|

|

27,366 | |||

|

Total liabilities |

|

441,229

|

|

449,630 | |||

|

Contingencies, commitments and guarantees (see Note 10) |

|

|

|

||||

|

|

|

|

|||||

|

Redeemable noncontrolling interests (see Note 12) |

|

66

|

|

334 | |||

|

|

|

|

|||||

|

AIG shareholders' equity: |

|

|

|

||||

|

Common stock, $2.50 par value; 5,000,000,000 shares authorized; shares issued:

|

|

4,766

|

|

4,766 | |||

|

Treasury stock, at cost; 2013 – 434,289,707; 2012 – 430,289,745 shares of common stock |

|

(14,115

|

)

|

(13,924 | ) | ||

|

Additional paid-in capital |

|

80,497

|

|

80,410 | |||

|

Retained earnings |

|

21,136

|

|

14,176 | |||

|

Accumulated other comprehensive income |

|

6,509

|

|

12,574 | |||

|

Total AIG shareholders' equity |

|

98,793

|

|

98,002 | |||

|

Non-redeemable noncontrolling interests (including $100 associated with businesses held for sale) |

|

656

|

|

667 | |||

|

Total equity |

|

99,449

|

|

98,669 | |||

|

Total liabilities and equity |

$

|

540,744

|

|

$ | 548,633 | ||

See accompanying Notes to Condensed Consolidated Financial Statements.

2

ITEM 1. / FINANCIAL STATEMENTS

AMERICAN INTERNATIONAL GROUP, INC.

|

|

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||

|

(dollars in millions, except per share data)

|

2013

|

2012

|

2013

|

2012

|

|||||||||

|

Revenues: |

|

|

|

|

|

|

|||||||

|

Premiums |

$

|

9,352

|

|

$ | 9,512 |

$

|

27,924

|

|

$ | 28,611 | |||

|

Policy fees |

|

645

|

|

580 |

|

1,883

|

|

1,731 | |||||

|

Net investment income |

|

3,573

|

|

4,650 |

|

11,581

|

|

16,236 | |||||

|

Net realized capital gains: |

|

|

|

|

|

|

|||||||

|

Total other-than-temporary impairments on available for sale securities |

|

(33

|

)

|

(34 | ) |

|

(90

|

)

|

(301 | ) | |||

|

Portion of other-than-temporary impairments on available for sale fixed maturity securities recognized in Other comprehensive income (loss) |

|

(6

|

)

|

(36 | ) |

|

(17

|

)

|

(372 | ) | |||

|

Net other-than-temporary impairments on available for sale securities recognized in net income |

|

(39

|

)

|

(70 | ) |

|

(107

|

)

|

(673 | ) | |||

|

Other realized capital gains |

|

291

|

|

716 |

|

2,250

|

|

1,467 | |||||

|

Total net realized capital gains |

|

252

|

|

646 |

|

2,143

|

|

794 | |||||

|

Other income |

|

1,004

|

|

1,334 |

|

4,498

|

|

3,068 | |||||

|

Total revenues |

|

14,826

|

|

16,722 |

|

48,029

|

|

50,440 | |||||

|

Benefits, claims and expenses: |

|

|

|

|

|

|

|||||||

|

Policyholder benefits and claims incurred |

|

7,416

|

|

8,002 |

|

22,234

|

|

22,910 | |||||

|

Interest credited to policyholder account balances |

|

924

|

|

1,189 |

|

2,913

|

|

3,305 | |||||

|

Amortization of deferred acquisition costs |

|

1,220

|

|

1,522 |

|

3,859

|

|

4,341 | |||||

|

Other acquisition and insurance expenses |

|

2,251

|

|

2,214 |

|

6,734

|

|

6,736 | |||||

|

Interest expense |

|

516

|

|

602 |

|

1,628

|

|

1,734 | |||||

|

Loss on extinguishment of debt |

|

81

|

|

– |

|

459

|

|

9 | |||||

|

Other expenses |

|

1,239

|

|

635 |

|

3,044

|

|

2,712 | |||||

|

Total benefits, claims and expenses |

|

13,647

|

|

14,164 |

|

40,871

|

|

41,747 | |||||

|

Income from continuing operations before income tax expense |

|

1,179

|

|

2,558 |

|

7,158

|

|

8,693 | |||||

|

Income tax expense (benefit) |

|

(993

|

)

|

734 |

|

123

|

|

1,324 | |||||

|

Income from continuing operations |

|

2,172

|

|

1,824 |

|

7,035

|

|

7,369 | |||||

|

Income (loss) from discontinued operations, net of income tax expense |

|

(42

|

)

|

37 |

|

84

|

|

280 | |||||

|

Net income |

|

2,130

|

|

1,861 |

|

7,119

|

|

7,649 | |||||

|

Less: |

|

|

|

|

|

|

|||||||

|

Net income (loss) from continuing operations attributable to noncontrolling interests: |

|

|

|

|

|

|

|||||||

|

Nonvoting, callable, junior and senior preferred interests |

|

–

|

|

– |

|

–

|

|

208 | |||||

|

Other |

|

(40

|

)

|

5 |

|

12

|

|

45 | |||||

|

Total net income (loss) from continuing operations attributable to noncontrolling interests |

|

(40

|

)

|

5 |

|

12

|

|

253 | |||||

|

Net income attributable to AIG |

$

|

2,170

|

|

$ | 1,856 |

$

|

7,107

|

|

$ | 7,396 | |||

|

Income (loss) per common share attributable to AIG: |

|

|

|

|

|

|

|||||||

|

Basic: |

|

|

|

|

|

|

|||||||

|

Income from continuing operations |

$

|

1.50

|

|

$ | 1.11 |

$

|

4.76

|

|

$ | 4.05 | |||

|

Income (loss) from discontinued operations |

$

|

(0.03

|

)

|

$ | 0.02 |

$

|

0.06

|

|

$ | 0.16 | |||

|

Net Income attributable to AIG |

$

|

1.47

|

|

$ | 1.13 |

$

|

4.82

|

|

$ | 4.21 | |||

|

Diluted: |

|

|

|

|

|

|

|||||||

|

Income from continuing operations |

$

|

1.49

|

|

$ | 1.11 |

$

|

4.74

|

|

$ | 4.05 | |||

|

Income (loss) from discontinued operations |

$

|

(0.03

|

)

|

$ | 0.02 |

$

|

0.06

|

|

$ | 0.16 | |||

|

Net Income attributable to AIG |

$

|

1.46

|

|

$ | 1.13 |

$

|

4.80

|

|

$ | 4.21 | |||

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|||||||

|

Basic |

|

1,475,053,126

|

|

1,642,472,814 |

|

1,476,007,034

|

|

1,757,955,937 | |||||

|

Diluted |

|

1,485,322,858

|

|

1,642,502,251 |

|

1,481,410,873

|

|

1,757,984,154 | |||||

|

Dividends declared per common share |

$

|

0.10

|

|

$ | – |

$

|

0.10

|

|

$ | – | |||

See accompanying Notes to Condensed Consolidated Financial Statements.

3

ITEM 1. / FINANCIAL STATEMENTS

AMERICAN INTERNATIONAL GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited)

|

|

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||

|

(in millions)

|

2013

|

2012

|

2013

|

2012

|

|||||||||

|

Net income |

$

|

2,130

|

|

$ | 1,861 |

$

|

7,119

|

|

$ | 7,649 | |||

|

Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|||||||

|

Change in unrealized appreciation (depreciation) of fixed maturity investments on which other-than-temporary credit impairments were taken |

|

(23

|

)

|

497 |

|

172

|

|

1,127 | |||||

|

Change in unrealized appreciation (depreciation) of all other investments |

|

(434

|

)

|

2,331 |

|

(5,668

|

)

|

4,617 | |||||

|

Change in foreign currency translation adjustments |

|

(49

|

)

|

240 |

|

(627

|

)

|

(96 | ) | ||||

|

Change in net derivative gains arising from cash flow hedging activities |

|

–

|

|

2 |

|

–

|

|

25 | |||||

|

Change in retirement plan liabilities adjustment |

|

(26

|

)

|

29 |

|

35

|

|

61 | |||||

|

Other comprehensive income (loss) |

|

(532

|

)

|

3,099 |

|

(6,088

|

)

|

5,734 | |||||

|

Comprehensive income |

|

1,598

|

|

4,960 |

|

1,031

|

|

13,383 | |||||

|

Comprehensive income attributable to noncontrolling nonvoting, callable, junior and senior preferred interests |

|

–

|

|

– |

|

–

|

|

208 | |||||

|

Comprehensive income (loss) attributable to other noncontrolling interests |

|

(42

|

)

|

8 |

|

(11

|

)

|

45 | |||||

|

Total comprehensive income (loss) attributable to noncontrolling interests |

|

(42

|

)

|

8 |

|

(11

|

)

|

253 | |||||

|

Comprehensive income attributable to AIG |

$

|

1,640

|

|

$ | 4,952 |

$

|

1,042

|

|

$ | 13,130 | |||

See accompanying Notes to Condensed Consolidated Financial Statements.

4

ITEM 1. / FINANCIAL STATEMENTS

AMERICAN INTERNATIONAL GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF EQUITY

(unaudited)

|

Nine Months Ended

September 30, 2013 (in millions) |

Common

Stock |

Treasury

Stock |

Additional

Paid-in Capital |

Retained

Earnings |

Accumulated

Other Comprehensive Income |

Total AIG

Share- holders' Equity |

Non-

redeemable Non- controlling Interests |

Total

Equity |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Balance, beginning of year |

$ | 4,766 | $ | (13,924 | ) | $ | 80,410 | $ | 14,176 | $ | 12,574 | $ | 98,002 | $ | 667 | $ | 98,669 | ||||||||

|

Purchase of common stock |

– | (192 | ) | – | – | – | (192 | ) | – | (192 | ) | ||||||||||||||

|

Net income attributable to AIG or other noncontrolling interests |

– | – | – | 7,107 | – | 7,107 | 12 | 7,119 | |||||||||||||||||

|

Dividends |

– | – | – | (147 | ) | – | (147 | ) | – | (147 | ) | ||||||||||||||

|

Other comprehensive loss |

– | – | – | – | (6,065 | ) | (6,065 | ) | (6 | ) | (6,071 | ) | |||||||||||||

|

Deferred income taxes |

– | – | (9 | ) | – | – | (9 | ) | – | (9 | ) | ||||||||||||||

|

Net increase due to consolidation |

– | – | – | – | – | – | 1 | 1 | |||||||||||||||||

|

Contributions from noncontrolling interests |

– | – | – | – | – | – | 25 | 25 | |||||||||||||||||

|

Distributions to noncontrolling interests |

– | – | – | – | – | – | (37 | ) | (37 | ) | |||||||||||||||

|

Other |

– | 1 | 96 | – | – | 97 | (6 | ) | 91 | ||||||||||||||||

|

Balance, end of period |

$ | 4,766 | $ | (14,115 | ) | $ | 80,497 | $ | 21,136 | $ | 6,509 | $ | 98,793 | $ | 656 | $ | 99,449 | ||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

5

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|||||

|---|---|---|---|---|---|---|---|

|

Nine Months Ended September 30,

(in millions) |

2013

|

2012

|

|||||

|

Cash flows from operating activities: |

|

|

|

||||

|

Net income |

$

|

7,119

|

|

$ | 7,649 | ||

|

Income from discontinued operations |

|

(84

|

)

|

(280 | ) | ||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

||||

|

Noncash revenues, expenses, gains and losses included in income: |

|

|

|

||||

|

Net gains on sales of securities available for sale and other assets |

|

(2,164

|

)

|

(2,813 | ) | ||

|

Net losses on extinguishment of debt |

|

459

|

|

9 | |||

|

Unrealized gains in earnings — net |

|

(1,771

|

)

|

(4,590 | ) | ||

|

Equity in income from equity method investments, net of dividends or distributions |

|

(945

|

)

|

(527 | ) | ||

|

Depreciation and other amortization |

|

3,510

|

|

4,019 | |||

|

Impairments of assets |

|

408

|

|

1,150 | |||

|

Changes in operating assets and liabilities: |

|

|

|

||||

|

Property casualty and life insurance reserves |

|

768

|

|

(1,119 | ) | ||

|

Premiums and other receivables and payables — net |

|

(137

|

)

|

1,022 | |||

|

Reinsurance assets and funds held under reinsurance treaties |

|

(336

|

)

|

272 | |||

|

Capitalization of deferred policy acquisition costs |

|

(4,412

|

)

|

(4,260 | ) | ||

|

Current and deferred income taxes — net |

|

(255

|

)

|

948 | |||

|

Other, net |

|

(236

|

)

|

(890 | ) | ||

|

Total adjustments |

|

(5,111

|

)

|

(6,779 | ) | ||

|

Net cash provided by operating activities — continuing operations |

|

1,924

|

|

590 | |||

|

Net cash provided by operating activities — discontinued operations |

|

2,024

|

|

2,249 | |||

|

Net cash provided by operating activities |

|

3,948

|

|

2,839 | |||

|

Cash flows from investing activities: |

|

|

|

||||

|

Proceeds from (payments for) |

|

|

|

||||

|

Sales or distribution of: |

|

|

|

||||

|

Available for sale investments |

|

27,961

|

|

30,070 | |||

|

Trading securities |

|

4,174

|

|

15,704 | |||

|

Other invested assets |

|

3,942

|

|

10,770 | |||

|

Maturities of fixed maturity securities available for sale |

|

19,907

|

|

16,179 | |||

|

Principal payments received on and sales of mortgage and other loans receivable |

|

2,688

|

|

2,214 | |||

|

Purchases of: |

|

|

|

||||

|

Available for sale investments |

|

(50,639

|

)

|

(38,869 | ) | ||

|

Trading securities |

|

(1,880

|

)

|

(11,844 | ) | ||

|

Other invested assets |

|

(3,585

|

)

|

(3,225 | ) | ||

|

Mortgage and other loans receivable |

|

(3,109

|

)

|

(2,110 | ) | ||

|

Net change in restricted cash |

|

977

|

|

651 | |||

|

Net change in short-term investments |

|

6,801

|

|

1,800 | |||

|

Other, net |

|

(869

|

)

|

(177 | ) | ||

|

Net cash provided by investing activities — continuing operations |

|

6,368

|

|

21,163 | |||

|

Net cash provided by (used in) investing activities — discontinued operations |

|

150

|

|

(2,005 | ) | ||

|

Net cash provided by investing activities |

|

6,518

|

|

19,158 | |||

|

Cash flows from financing activities: |

|

|

|

||||

|

Proceeds from (payments for) |

|

|

|

||||

|

Policyholder contract deposits |

|

11,348

|

|

10,092 | |||

|

Policyholder contract withdrawals |

|

(12,481

|

)

|

(10,426 | ) | ||

|

Issuance of long-term debt |

|

1,742

|

|

4,504 | |||

|

Repayments of long-term debt |

|

(7,381

|

)

|

(6,171 | ) | ||

|

Repayment of Department of the Treasury SPV Preferred Interests |

|

–

|

|

(8,636 | ) | ||

|

Purchase of Common Stock |

|

(192

|

)

|

(13,000 | ) | ||

|

Dividends paid |

|

(147

|

)

|

– | |||

|

Other, net |

|

(195

|

)

|

2,055 | |||

|

Net cash used in financing activities — continuing operations |

|

(7,306

|

)

|

(21,582 | ) | ||

|

Net cash used in financing activities — discontinued operations |

|

(2,166

|

)

|

(272 | ) | ||

|

Net cash used in financing activities |

|

(9,472

|

)

|

(21,854 | ) | ||

|

Effect of exchange rate changes on cash |

|

(79

|

)

|

(9 | ) | ||

|

Net increase in cash |

|

915

|

|

134 | |||

|

Cash at beginning of year |

|

1,151

|

|

1,474 | |||

|

Change in cash of businesses held for sale |

|

(8

|

)

|

– | |||

|

Cash at end of period |

$

|

2,058

|

|

$ | 1,608 | ||

|

|

|

|

|||||

|

Supplementary Disclosure of Condensed Consolidated Cash Flow Information |

|

|

|

||||

|

Cash paid during the period for: |

|

|

|

||||

|

Interest |

$

|

2,951

|

|

$ | 3,056 | ||

|

Taxes |

$

|

378

|

|

$ | 403 | ||

|

Non-cash investing/financing activities: |

|

|

|

||||

|

Interest credited to policyholder contract deposits included in financing activities |

$

|

2,977

|

|

$ | 3,375 | ||

See accompanying Notes to Condensed Consolidated Financial Statements.

6

ITEM 1 / NOTE 1. BASIS OF PRESENTATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

American International Group, Inc. (AIG) is a leading international insurance organization serving customers in more than 130 countries. AIG companies serve commercial, institutional and individual customers through one of the most extensive worldwide property-casualty networks of any insurer. In addition, AIG companies are leading providers of life insurance and retirement services in the United States. AIG Common Stock, par value $2.50 per share (AIG Common Stock), is listed on the New York Stock Exchange (NYSE: AIG) and the Tokyo Stock Exchange. Unless the context indicates otherwise, the terms "AIG," "we," "us" or "our" mean American International Group, Inc. and its consolidated subsidiaries and the term "AIG Parent" means American International Group, Inc. and not any of its consolidated subsidiaries.

These unaudited condensed consolidated financial statements do not include all disclosures that are normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States (GAAP) and should be read in conjunction with the audited consolidated financial statements and the related notes included in our Annual Report on Form 10-K for the year ended December 31, 2012 (2012 Annual Report). The condensed consolidated financial information as of December 31, 2012 included herein has been derived from audited consolidated financial statements in the 2012 Annual Report.

Certain of our foreign subsidiaries included in the condensed consolidated financial statements report on different fiscal-period bases. The effect on our condensed consolidated financial condition and results of operations of all material events occurring at these subsidiaries through the date of each of the periods presented in these condensed consolidated financial statements has been recorded. In the opinion of management, these condensed consolidated financial statements contain normal recurring adjustments, including eliminations of material intercompany accounts and transactions, necessary for a fair statement of the results presented herein.

Interim period operating results may not be indicative of the operating results for a full year. We evaluated the need to recognize or disclose events that occurred subsequent to September 30, 2013 and prior to the issuance of these condensed consolidated financial statements.

Presentation Changes

Advisory fee income, and the related commissions and advisory fee expenses of AIG Life and Retirement's broker dealer business, are now being presented on a gross basis within Other income and Other expenses, respectively. Previously, these amounts were included on a net basis within Policy fees in AIG's Condensed Consolidated Statements of Income and in AIG Life and Retirement's segment results.

In addition, policyholder benefits related to certain payout annuities, primarily with life contingent features, are now being presented in the Condensed Consolidated Balance Sheets as Future policy benefits for life and accident and health insurance contracts instead of as Policyholder contract deposits.

Prior period amounts were conformed to the current period presentation. These changes did not affect Income from continuing operations before income tax expense, Net income attributable to AIG or Total liabilities.

Use of Estimates

The preparation of financial statements in accordance with GAAP requires the application of accounting policies that often involves a significant degree of judgment. Accounting policies that are most dependent on the application of estimates and assumptions are considered our critical accounting estimates and are related to the determination of:

- •

-

classification of International Lease Finance Corporation (ILFC) as held for sale and related fair value measurement;

- •

-

insurance liabilities, including property casualty and mortgage guaranty unpaid claims and claims adjustment expense and

future policy benefits for life and accident and health contracts;

- •

-

income tax assets and liabilities, including recoverability of our net deferred tax asset and the predictability of future

tax operating profitability of the character necessary to realize the net deferred tax asset;

- •

- recoverability of assets, including reinsurance assets;

7

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

- •

-

estimated gross profits for investment-oriented products;

- •

-

other-than-temporary impairments of financial instruments;

- •

-

liabilities for legal contingencies; and

- •

- fair value measurements of certain financial assets and liabilities.

These accounting estimates require the use of assumptions about matters, some of which are highly uncertain at the time of estimation. To the extent actual experience differs from the assumptions used, our consolidated financial condition, results of operations and cash flows could be materially affected.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Accounting Standards Adopted During 2013

Testing Indefinite-Lived Intangible Assets for Impairment

In July 2012, the Financial Accounting Standards Board (FASB) issued an accounting standard that allows a company, as a first step in an impairment review, to assess qualitatively whether it is more likely than not that an indefinite-lived intangible asset is impaired. We are not required to calculate the fair value of an indefinite-lived intangible asset and perform a quantitative impairment test unless we determine, based on the results of the qualitative assessment, that it is more likely than not the asset is impaired.

The standard became effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. We adopted the standard on its required effective date of January 1, 2013. The adoption of this standard had no material effect on our consolidated financial condition, results of operations or cash flows.

Disclosures about Offsetting Assets and Liabilities

In January 2013, the FASB issued an accounting standard that clarifies the scope of transactions subject to disclosures about offsetting assets and liabilities. The standard applies to derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and securities lending transactions that are offset either in accordance with specific criteria contained in the FASB Accounting Standards Codification or subject to a master netting arrangement or similar agreement.

The standard became effective for fiscal years and interim periods beginning on or after January 1, 2013. We adopted the standard on its required effective date of January 1, 2013 and applied it retrospectively to all comparative periods presented. The adoption of this standard had no material effect on our consolidated financial condition, results of operations or cash flows.

Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income

In February 2013, the FASB issued an accounting standard requiring us to disclose the effect of reclassifying significant items out of accumulated other comprehensive income on the respective line items of net income or to provide a cross-reference to other disclosures required under GAAP.

The standard became effective for annual and interim reporting periods beginning after December 15, 2012. We adopted the standard on its required effective date of January 1, 2013. The adoption of this standard had no effect on our consolidated financial condition, results of operations or cash flows.

Inclusion of the Federal Funds Effective Swap Rate as a Benchmark Interest Rate for Hedge Accounting Purposes

In July 2013, the FASB issued an accounting standard that permits the Federal Funds Effective Swap Rate (or Overnight Index Swap Rate) to be used as a U.S. benchmark interest rate for hedge accounting purposes in addition to U.S. Treasury rates and LIBOR. The standard also removes the prohibition on the use of differing benchmark rates when entering into similar hedging relationships.

The standard became effective on a prospective basis for qualifying new or redesignated hedging relationships entered into on or after July 17, 2013 to the extent the Federal Funds Effective Swap Rate is used as a U.S. benchmark interest rate for hedge accounting purposes. We adopted the standard on its effective date of July 17, 2013. The adoption of this standard had no material effect on our consolidated financial condition, results of operations or cash flows.

8

ITEM 1 / NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Future Application of Accounting Standards

Certain Obligations Resulting from Joint and Several Liability Arrangements

In February 2013, the FASB issued an accounting standard that requires us to measure obligations resulting from joint and several liability arrangements for which the total amount of the obligation is fixed at the reporting date as the sum of (i) the amount we agreed to pay on the basis of our arrangement among our co-obligors and (ii) any additional amount we expect to pay on behalf of our co-obligors.

The standard is effective for fiscal years and interim periods beginning after December 15, 2013, but earlier adoption is permitted. Upon adoption, the standard should be applied retrospectively to all prior periods presented. We plan to adopt the standard on its required effective date of January 1, 2014 and do not expect the adoption of the standard to have a material effect on our consolidated financial condition, results of operations or cash flows.

Parent's Accounting for the Cumulative Translation Adjustment upon Derecognition of an Investment within a Foreign Entity or of an Investment in a Foreign Entity

In March 2013, the FASB issued an accounting standard addressing whether consolidation guidance or foreign currency guidance applies to the release of the cumulative translation adjustment into net income when a parent sells all or a part of its investment in a foreign entity or no longer holds a controlling financial interest in a subsidiary or net assets that are a business (other than a sale of in-substance real estate) within a foreign entity. The guidance also resolves the diversity in practice for the cumulative translation adjustment treatment in business combinations achieved in stages involving foreign entities.

Under this standard, the entire amount of the cumulative translation adjustment associated with the foreign entity should be released into earnings when there has been: (i) a sale of a subsidiary or group of net assets within a foreign entity and the sale represents a complete or substantially complete liquidation of the foreign entity in which the subsidiary or the net assets had resided; (ii) a loss of a controlling financial interest in an investment in a foreign entity; or (iii) a change in accounting method from applying the equity method to an investment in a foreign entity to consolidating the foreign entity.

The standard is effective for fiscal years and interim periods beginning after December 15, 2013, and will be applied prospectively. We plan to adopt the standard on its required effective date of January 1, 2014 and do not expect the adoption of the standard to have a material effect on our consolidated financial condition, results of operations or cash flows.

Investment Company Guidance

In June 2013, the FASB issued an accounting standard that amends the criteria a company must meet to qualify as an investment company, clarifies the measurement guidance, and requires new disclosures for investment companies. An entity that is regulated by the Securities and Exchange Commission under the Investment Company Act of 1940 (the 1940 Act) qualifies as an investment company. Entities that are not regulated under the 1940 Act must have certain fundamental characteristics and must consider other characteristics to determine whether they qualify as investment companies. An entity's purpose and design should be considered when making the assessment.

The standard is effective for fiscal years and interim periods beginning after December 15, 2013. Earlier adoption is prohibited. An entity that no longer meets the requirements to be an investment company as a result of this standard should present the change in its status as a cumulative-effect adjustment to retained earnings as of the beginning of the period of adoption. An entity that is an investment company should apply the guidance prospectively as an adjustment to opening net assets as of the effective date. The adjustment to net assets represents both the difference between the fair value and the carrying amount of the entity's investments and any amount previously recognized in accumulated other comprehensive income. We plan to adopt the standard on its required effective date of January 1, 2014 and do not expect the adoption of the standard to have a material effect on our consolidated financial condition, results of operations or cash flows.

9

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Presentation of Unrecognized Tax Benefits

In July 2013, the FASB issued an accounting standard that requires a liability related to unrecognized tax benefits to be presented as a reduction to the related deferred tax asset for a net operating loss carryforward or a tax credit carryforward (the Carryforwards). When the Carryforwards are not available at the reporting date under the tax law of the applicable jurisdiction or the tax law of the applicable jurisdiction does not require, and the entity does not intend to use, the deferred tax asset for such purpose, the unrecognized tax benefit will be presented in the financial statements as a liability and will not be combined with the related deferred tax asset.

The standard is effective for fiscal years and interim periods beginning after December 15, 2013, but earlier adoption is permitted. Upon adoption, the standard should be applied prospectively to unrecognized tax benefits that existed at the effective date. Retrospective application is permitted. We plan to adopt the standard prospectively on its required effective date of January 1, 2014 and do not expect the adoption of the standard to have a material effect on our consolidated financial condition, results of operations or cash flows.

We report the results of our operations through two reportable segments: AIG Property Casualty and AIG Life and Retirement. We evaluate performance based on revenues and pre-tax income (loss), excluding results from discontinued operations, because we believe this provides more meaningful information on how our operations are performing.

AIG Property Casualty Investment Income Allocation

Investment income is allocated to the Commercial Insurance and Consumer Insurance operating segments based on an internal investment income allocation model. The model estimates investable funds based primarily on loss reserves and allocated capital. Commencing in the first quarter of 2013, AIG Property Casualty began applying similar duration and risk-free yields (plus an illiquidity premium) to the allocated capital of Commercial Insurance and Consumer Insurance as is applied to reserves.

AIG Life and Retirement Operating Segment Change

In 2012, AIG Life and Retirement announced several key organizational structure and management changes intended to better serve the organization's distribution partners and customers. Key aspects of the new structure include distinct product manufacturing divisions, shared annuity and life operations platforms and a unified all-channel distribution organization with access to all AIG Life and Retirement products.

AIG Life and Retirement fully implemented these changes during the first quarter of 2013 and now presents its operating results in the following two operating segments:

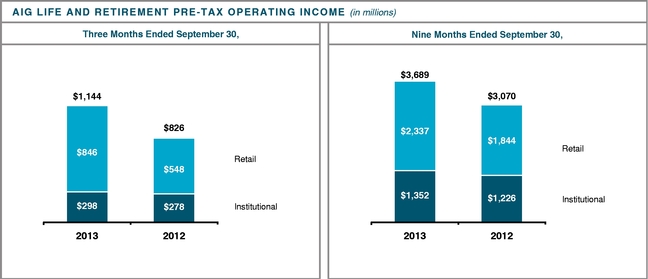

Retail - product lines include life insurance and accident and health (A&H), fixed annuities, retirement income solutions (including variable and indexed annuities), brokerage services and retail mutual funds.

Institutional - product lines include group retirement, group benefits and institutional markets. The institutional markets product line consists of stable value wrap products, structured settlement and terminal funding annuities, high net worth products, guaranteed investment contracts (GICs), and corporate- and bank-owned life insurance.

These changes align financial reporting with the manner in which AIG's chief operating decision makers review the business to assess performance and to allocate resources. Prior period amounts have been revised to reflect the new structure, which did not affect previously reported pre-tax income from continuing operations for AIG Life and Retirement. Prior to the first quarter of 2013, AIG Life and Retirement was presented as two operating segments: Life Insurance and Retirement Services.

10

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

The following table presents AIG's operations by reportable segment:

|

|

|

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2013 | 2012 | |||||||||||

|

Three Months Ended September 30,

(in millions) |

Total Revenues

|

Pre-tax Income

|

Total Revenues

|

Pre-tax Income

(Loss) from continuing operations |

|||||||||

|

AIG Property Casualty |

|

|

|

|

|

|

|||||||

|

Commercial Insurance |

$

|

5,760

|

|

$

|

610

|

|

$ | 5,927 | $ | 371 | |||

|

Consumer Insurance |

|

3,359

|

|

|

93

|

|

3,582 | 152 | |||||

|

Other |

|

489

|

|

|

326

|

|

640 | 426 | |||||

|

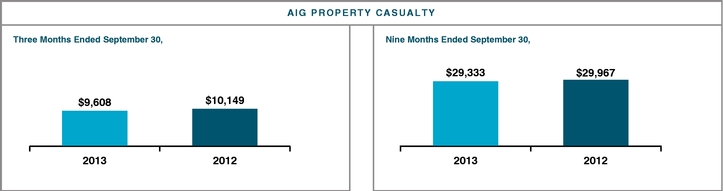

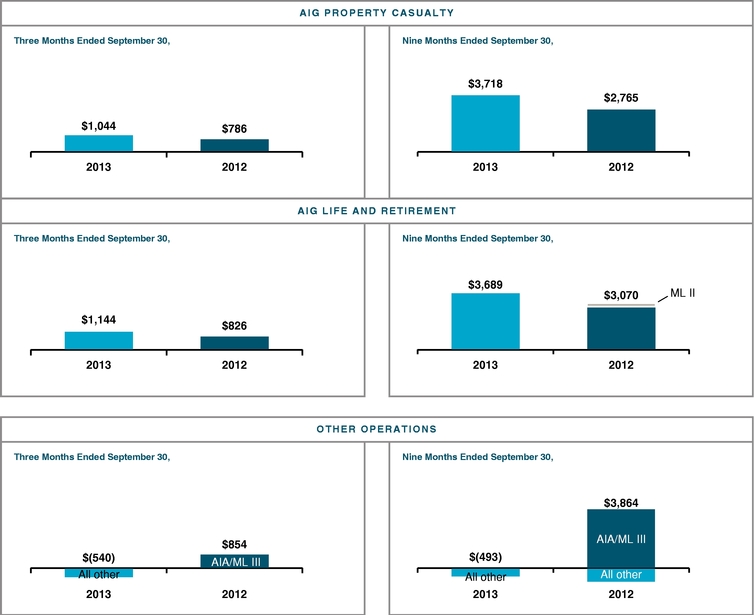

Total AIG Property Casualty |

|

9,608

|

|

|

1,029

|

|

10,149 | 949 | |||||

|

AIG Life and Retirement |

|

|

|

|

|

|

|||||||

|

Retail |

|

2,884

|

|

|

941

|

|

2,747 | 531 | |||||

|

Institutional |

|

1,760

|

|

|

300

|

|

2,000 | 358 | |||||

|

Total AIG Life and Retirement |

|

4,644

|

|

|

1,241

|

|

4,747 | 889 | |||||

|

Other Operations |

|

|

|

|

|

|

|||||||

|

Mortgage Guaranty |

|

236

|

|

|

43

|

|

218 | 6 | |||||

|

Global Capital Markets |

|

87

|

|

|

29

|

|

235 | 190 | |||||

|

Direct Investment book |

|

147

|

|

|

52

|

|

506 | 406 | |||||

|

Retained Interests |

|

–

|

|

|

–

|

|

857 | 857 | |||||

|

Corporate & Other |

|

217

|

|

|

(1,250

|

)

|

412 | (566 | ) | ||||

|

Consolidation and elimination |

|

(9

|

)

|

|

1

|

|

(15 | ) | (2 | ) | |||

|

Total Other Operations |

|

678

|

|

|

(1,125

|

)

|

2,213 | 891 | |||||

|

AIG Consolidation and elimination |

|

(104

|

)

|

|

34

|

|

(387 | ) | (171 | ) | |||

|

Total AIG Consolidated |

$

|

14,826

|

|

$

|

1,179

|

|

$ | 16,722 | $ | 2,558 | |||

|

|

|

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2013 | 2012 | |||||||||||

|

Nine Months Ended September 30,

(in millions) |

Total Revenues

|

Pre-tax Income

|

Total Revenues

|

Pre-tax Income

(Loss) from continuing operations |

|||||||||

|

AIG Property Casualty |

|

|

|

|

|

|

|||||||

|

Commercial Insurance |

$

|

17,229

|

|

$

|

2,186

|

|

$ | 17,871 | $ | 1,761 | |||

|

Consumer Insurance |

|

10,212

|

|

|

337

|

|

10,758 | 578 | |||||

|

Other |

|

1,892

|

|

|

1,278

|

|

1,338 | 481 | |||||

|

Total AIG Property Casualty |

|

29,333

|

|

|

3,801

|

|

29,967 | 2,820 | |||||

|

AIG Life and Retirement |

|

|

|

|

|

|

|||||||

|

Retail |

|

9,326

|

|

|

3,114

|

|

7,647 | 1,356 | |||||

|

Institutional |

|

6,106

|

|

|

1,416

|

|

5,430 | 1,172 | |||||

|

Total AIG Life and Retirement |

|

15,432

|

|

|

4,530

|

|

13,077 | 2,528 | |||||

|

Other Operations |

|

|

|

|

|

|

|||||||

|

Mortgage Guaranty |

|

710

|

|

|

162

|

|

642 | 62 | |||||

|

Global Capital Markets |

|

592

|

|

|

431

|

|

405 | 253 | |||||

|

Direct Investment book |

|

1,373

|

|

|

1,084

|

|

1,434 | 1,139 | |||||

|

Retained Interests |

|

–

|

|

|

–

|

|

4,717 | 4,717 | |||||

|

Corporate & Other |

|

1,030

|

|

|

(2,949

|

)

|

925 | (2,659 | ) | ||||

|

Consolidation and elimination |

|

(28

|

)

|

|

3

|

|

(38 | ) | (1 | ) | |||

|

Total Other Operations |

|

3,677

|

|

|

(1,269

|

)

|

8,085 | 3,511 | |||||

|

AIG Consolidation and elimination |

|

(413

|

)

|

|

96

|

|

(689 | ) | (166 | ) | |||

|

Total AIG Consolidated |

$

|

48,029

|

|

$

|

7,158

|

|

$ | 50,440 | $ | 8,693 | |||

11

ITEM 1 / NOTE 4. HELD-FOR-SALE CLASSIFICATION AND DISCONTINUED OPERATIONS

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

4. HELD-FOR-SALE CLASSIFICATION AND DISCONTINUED OPERATIONS

International Lease Finance Corporation Sale

On December 9, 2012, AIG Parent, AIG Capital Corporation (Seller), a wholly-owned direct subsidiary of AIG Parent and the sole shareholder of ILFC, and Jumbo Acquisition Limited (Purchaser) entered into a definitive agreement (the Share Purchase Agreement) for the sale of 80.1 percent of the common stock of ILFC for approximately $4.2 billion in cash (the ILFC Transaction). The Share Purchase Agreement permits the Purchaser to elect to purchase an additional 9.9 percent of the common stock of ILFC for $522.5 million (the Option). On June 15, 2013, AIG Parent, Seller and Purchaser entered into an amendment (the Amendment) to the Share Purchase Agreement, as amended by Amendment No. 1, dated May 10, 2013. The Amendment extended to July 31, 2013, the date on which any of AIG Parent, Seller or Purchaser may terminate the Share Purchase Agreement, as amended, if the closing of the ILFC Transaction had not yet occurred. Under the Amendment, AIG Parent and Seller may pursue (but not enter into definitive documentation for, or consummate) other offers for ILFC and may continue to pursue (but not engage in widespread solicitation of orders for, or request effectiveness of) the alternative of a public offering.

On July 15, 2013, the Purchaser delivered notice that it intended to exercise the Option, raising the size of the total purchase to 90 percent of the common stock of ILFC.

As of October 31, 2013, the closing of the ILFC Transaction has not occurred. As a result, no assurance can be given that the Share Purchase Agreement will not be terminated. We continue to consider ILFC as a non-core business and we are continuing to pursue other options including an alternative sale or an initial public offering. We determined ILFC met the criteria for held for sale and discontinued operations accounting at September 30, 2013 and December 31, 2012.

The following table summarizes the components of assets and liabilities held-for sale:

|

|

|

|

|||||

|---|---|---|---|---|---|---|---|

|

(in millions)

|

September 30,

|

December 31,

2012 |

|||||

|

Assets: |

|

|

|

||||

|

Equity securities |

$

|

2

|

|

$ | 1 | ||

|

Mortgage and other loans receivable, net |

|

178

|

|

117 | |||

|

Flight equipment primarily under operating leases, net of accumulated depreciation |

|

35,256

|

|

34,468 | |||

|

Short-term investments |

|

548

|

|

1,861 | |||

|

Cash |

|

71

|

|

63 | |||

|

Premiums and other receivables, net of allowance |

|

300

|

|

308 | |||

|

Other assets |

|

2,238

|

|

1,864 | |||

|

Assets held for sale |

|

38,593

|

|

38,682 | |||

|

Less: Loss accrual |

|

(8,473

|

)

|

(6,717 | ) | ||

|

Total assets held for sale |

$

|

30,120

|

|

$ | 31,965 | ||

|

Liabilities: |

|

|

|

||||

|

Other liabilities |

$

|

3,195

|

|

$ | 3,043 | ||

|

Long-term debt |

|

22,253

|

|

24,323 | |||

|

Total liabilities held for sale |

$

|

25,448

|

|

$ | 27,366 | ||

12

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

The following table summarizes income from discontinued operations:

|

|

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||

|

(in millions)

|

2013

|

2012

|

2013

|

2012

|

|||||||||

|

Revenues: |

|

|

|

|

|

|

|||||||

|

Aircraft leasing revenue |

$

|

1,120

|

|

$ | 1,147 |

$

|

3,313

|

|

$ | 3,426 | |||

|

Net realized capital gains |

|

1

|

|

1 |

|

–

|

|

– | |||||

|

Other income (loss) |

|

(3

|

)

|

(5 | ) |

|

(10

|

)

|

(14 | ) | |||

|

Total revenues |

|

1,118

|

|

1,143 |

|

3,303

|

|

3,412 | |||||

|

Benefits, claims and expenses, excluding Aircraft leasing expenses |

|

341

|

|

386 |

|

1,112

|

|

1,184 | |||||

|

Aircraft leasing expenses |

|

196

|

|

720 |

|

376

|

|

1,991 | |||||

|

Income from discontinued operations |

|

581

|

|

37 |

|

1,815

|

|

237 | |||||

|

Gain (loss) on sale |

|

(609

|

)

|

– |

|

(1,636

|

)

|

12 | |||||

|

Income (loss) from discontinued operations, before income tax (benefit) expense |

|

(28

|

)

|

37 |

|

179

|

|

249 | |||||

|

Income tax (benefit) expense |

|

14

|

|

– |

|

95

|

|

(31 | ) | ||||

|

Income (loss) from discontinued operations, net of income tax |

$

|

(42

|

)

|

$ | 37 |

$

|

84

|

|

$ | 280 | |||

We recorded a $6.7 billion pre-tax loss and a $4.4 billion after-tax loss on the sale of ILFC for the year ended December 31, 2012. In the three- and nine-month periods ended September 30, 2013, we recorded additional pre-tax losses of $582 million and $1.8 billion, respectively, on the sale, largely offsetting ILFC operating results for the periods. ILFC operating results did not include depreciation and amortization expense as a result of its classification as held for sale, because depreciation and amortization expense is not recorded on the assets of a business after the business is classified as held-for-sale.

Impairment in ILFC Separate-Company Financial Statements

ILFC recognized a $1.1 billion impairment charge related to flight equipment held for use in their separate-company financial statements for the three- and nine-month periods ended September 30, 2013. ILFC concluded that the net book value of certain four-engine widebody aircraft in their fleet is no longer supportable based upon the latest cash flow estimates because the estimated holding period is not likely to be as long as previously anticipated. Sustained high fuel prices, the introduction of more fuel-efficient aircraft, and the success of competing aircraft models have resulted in a shrinking operator base for these aircraft types. These factors along with the latest updates to airline fleet plans and recent efforts to remarket these aircraft resulted in the impairment charge. Approximately $1.0 billion of the $1.1 billion in the impairment charges recorded in the three months ended September 30, 2013, resulted from the four-engine widebody aircraft and in particular the Airbus A340-600s. This had no effect on AIG's consolidated financial condition, results of operations, or cash flows as a result of the loss on sale AIG recognized for the year ended December 31, 2012.

ALICO

In connection with the sale of American Life Insurance Company (ALICO) to MetLife, Inc. (MetLife), we recognized a pre-tax loss of $27 million and pre-tax gain of $118 million for the three- and nine-month periods ended September 30, 2013, respectively, primarily attributable to the refund of taxes, interest and penalties, together with other matters.

13

ITEM 1 / NOTE 5. FAIR VALUE MEASUREMENTS

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Fair Value Measurements on a Recurring Basis

We carry certain of our financial instruments at fair value. We define the fair value of a financial instrument as the amount that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. You should read the following in conjunction with Note 6 to the Consolidated Financial Statements in the 2012 Annual Report for a complete discussion of our accounting policies and procedures regarding fair value measurements.

Assets and liabilities recorded at fair value in the Condensed Consolidated Balance Sheets are classified in accordance with a fair value hierarchy consisting of three "levels" based on the observability of inputs available in the marketplace used to measure the fair values as discussed below:

- •

-

Level 1:

Fair value

measurements based on quoted prices (unadjusted) in active markets that we have the ability to access for identical assets or liabilities. Market price data generally is obtained from exchange or

dealer markets. We do not adjust the quoted price for such instruments.

- •

-

Level 2:

Fair value

measurements based on inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted

prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted prices that are

observable for the asset or liability, such as interest rates and yield curves that are observable at commonly quoted intervals.

- •

- Level 3: Fair value measurements based on valuation techniques that use significant inputs that are unobservable. Both observable and unobservable inputs may be used to determine the fair values of positions classified in Level 3. The circumstances for using these measurements include those in which there is little, if any, market activity for the asset or liability. Therefore, we must make certain assumptions as to the inputs a hypothetical market participant would use to value that asset or liability. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In those cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

14

ITEM 1 / NOTE 5. FAIR VALUE MEASUREMENTS

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table presents information about assets and liabilities measured at fair value on a recurring basis and indicates the level of the fair value measurement based on the observability of the inputs used:

|

September 30, 2013

(in millions) |

Level 1

|

Level 2

|

Level 3

|

Counterparty

Netting (a) |

Cash

Collateral (b) |

Total

|

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Assets: |

|||||||||||||||||||

|

Bonds available for sale: |

|||||||||||||||||||

|

U.S. government and government sponsored entities |

$ | 100 | $ | 3,335 | $ | – | $ | – | $ | – | $ | 3,435 | |||||||

|

Obligations of states, municipalities and political subdivisions |

– | 29,827 | 1,054 | – | – | 30,881 | |||||||||||||

|

Non-U.S. governments |

424 | 22,589 | 21 | – | – | 23,034 | |||||||||||||

|

Corporate debt |

– | 142,726 | 1,442 | – | – | 144,168 | |||||||||||||

|

RMBS |

– | 22,390 | 14,086 | – | – | 36,476 | |||||||||||||

|

CMBS |

– | 5,896 | 5,616 | – | – | 11,512 | |||||||||||||

|

CDO/ABS |

– | 3,744 | 6,651 | – | – | 10,395 | |||||||||||||

|

Total bonds available for sale |

524 | 230,507 | 28,870 | – | – | 259,901 | |||||||||||||

|

Bond trading securities: |

|||||||||||||||||||

|

U.S. government and government sponsored entities |

83 | 5,784 | – | – | – | 5,867 | |||||||||||||

|

Obligations of states, municipalities and political subdivisions |

– | 181 | – | – | – | 181 | |||||||||||||

|

Non-U.S. governments |

– | 2 | – | – | – | 2 | |||||||||||||

|

Corporate debt |

– | 1,147 | – | – | – | 1,147 | |||||||||||||

|

RMBS |

– | 1,363 | 815 | – | – | 2,178 | |||||||||||||

|

CMBS |

– | 623 | 831 | – | – | 1,454 | |||||||||||||

|

CDO/ABS |

– | 3,174 | 8,881 | – | – | 12,055 | |||||||||||||

|

Total bond trading securities |

83 | 12,274 | 10,527 | – | – | 22,884 | |||||||||||||

|

Equity securities available for sale: |

|||||||||||||||||||

|

Common stock |

2,991 | – | 27 | – | – | 3,018 | |||||||||||||

|

Preferred stock |

– | 29 | 48 | – | – | 77 | |||||||||||||

|

Mutual funds |

276 | 7 | – | – | – | 283 | |||||||||||||

|

Total equity securities available for sale |

3,267 | 36 | 75 | – | – | 3,378 | |||||||||||||

|

Equity securities trading |

721 | 86 | – | – | – | 807 | |||||||||||||

|

Mortgage and other loans receivable |

– | – | – | – | – | – | |||||||||||||

|

Other invested assets |

5 | 2,318 | 5,748 | – | – | 8,071 | |||||||||||||

|

Derivative assets: |

|||||||||||||||||||

|

Interest rate contracts |

5 | 3,970 | 38 | – | – | 4,013 | |||||||||||||

|

Foreign exchange contracts |

– | 41 | – | – | – | 41 | |||||||||||||

|

Equity contracts |

113 | 57 | 83 | – | – | 253 | |||||||||||||

|

Commodity contracts |

– | – | 1 | – | – | 1 | |||||||||||||

|

Credit contracts |

– | 1 | 55 | – | – | 56 | |||||||||||||

|

Other contracts |

– | – | 33 | – | – | 33 | |||||||||||||

|

Counterparty netting and cash collateral |

– | – | – | (1,863 | ) | (811 | ) | (2,674 | ) | ||||||||||

|

Total derivative assets |

118 | 4,069 | 210 | (1,863 | ) | (811 | ) | 1,723 | |||||||||||

|

Short-term investments |

339 | 5,034 | – | – | – | 5,373 | |||||||||||||

|

Separate account assets |

62,944 | 3,015 | – | – | – | 65,959 | |||||||||||||

|

Other assets |

– | 486 | – | – | – | 486 | |||||||||||||

|

Total |

$ | 68,001 | $ | 257,825 | $ | 45,430 | $ | (1,863 | ) | $ | (811 | ) | $ | 368,582 | |||||

|

Liabilities: |

|||||||||||||||||||

|

Policyholder contract deposits |

$ | – | $ | – | $ | 387 | $ | – | $ | – | $ | 387 | |||||||

|

Derivative liabilities: |

|||||||||||||||||||

|

Interest rate contracts |

– | 3,960 | 165 | – | – | 4,125 | |||||||||||||

|

Foreign exchange contracts |

– | 275 | – | – | – | 275 | |||||||||||||

|

Equity contracts |

– | 94 | 1 | – | – | 95 | |||||||||||||

|

Commodity contracts |

– | 4 | – | – | – | 4 | |||||||||||||

|

Credit contracts |

– | – | 1,561 | – | – | 1,561 | |||||||||||||

|

Other contracts |

– | 25 | 164 | – | – | 189 | |||||||||||||

|

Counterparty netting and cash collateral |

– | – | – | (1,863 | ) | (1,664 | ) | (3,527 | ) | ||||||||||

|

Total derivative liabilities |

– | 4,358 | 1,891 | (1,863 | ) | (1,664 | ) | 2,722 | |||||||||||

|

Long-term debt |

– | 6,538 | 443 | – | – | 6,981 | |||||||||||||

|

Other liabilities |

73 | 693 | – | – | – | 766 | |||||||||||||

|

Total |

$ | 73 | $ | 11,589 | $ | 2,721 | $ | (1,863 | ) | $ | (1,664 | ) | $ | 10,856 | |||||

15

ITEM 1 / NOTE 5. FAIR VALUE MEASUREMENTS

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

|

December 31, 2012

(in millions) |

Level 1

|

Level 2

|

Level 3

|

Counterparty

Netting (a) |

Cash

Collateral (b) |

Total

|

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Assets: |

|||||||||||||||||||

|

Bonds available for sale: |

|||||||||||||||||||

|

U.S. government and government sponsored entities |

$ | – | $ | 3,483 | $ | – | $ | – | $ | – | $ | 3,483 | |||||||

|

Obligations of states, municipalities and political subdivisions |

– | 34,681 | 1,024 | – | – | 35,705 | |||||||||||||

|

Non-U.S. governments |

1,004 | 25,782 | 14 | – | – | 26,800 | |||||||||||||

|

Corporate debt |

– | 149,625 | 1,487 | – | – | 151,112 | |||||||||||||

|

RMBS |

– | 22,730 | 11,662 | – | – | 34,392 | |||||||||||||

|

CMBS |

– | 5,010 | 4,905 | – | – | 9,915 | |||||||||||||

|

CDO/ABS |

– | 3,492 | 5,060 | – | – | 8,552 | |||||||||||||

|

Total bonds available for sale |

1,004 | 244,803 | 24,152 | – | – | 269,959 | |||||||||||||

|

Bond trading securities: |

|||||||||||||||||||

|

U.S. government and government sponsored entities |

266 | 6,528 | – | – | – | 6,794 | |||||||||||||

|

Non-U.S. governments |

– | 2 | – | – | – | 2 | |||||||||||||

|

Corporate debt |

– | 1,320 | – | – | – | 1,320 | |||||||||||||

|

RMBS |

– | 1,331 | 396 | – | – | 1,727 | |||||||||||||

|

CMBS |

– | 1,424 | 803 | – | – | 2,227 | |||||||||||||

|

CDO/ABS |

– | 3,969 | 8,545 | – | – | 12,514 | |||||||||||||

|

Total bond trading securities |

266 | 14,574 | 9,744 | – | – | 24,584 | |||||||||||||

|

Equity securities available for sale: |

|||||||||||||||||||

|

Common stock |

3,002 | 3 | 24 | – | – | 3,029 | |||||||||||||

|

Preferred stock |

– | 34 | 44 | – | – | 78 | |||||||||||||

|

Mutual funds |

83 | 22 | – | – | – | 105 | |||||||||||||

|

Total equity securities available for sale |

3,085 | 59 | 68 | – | – | 3,212 | |||||||||||||

|

Equity securities trading |

578 | 84 | – | – | – | 662 | |||||||||||||

|

Mortgage and other loans receivable |

– | 134 | – | – | – | 134 | |||||||||||||

|

Other invested assets |

125 | 1,542 | 5,389 | – | – | 7,056 | |||||||||||||

|

Derivative assets: |

|||||||||||||||||||

|

Interest rate contracts |

2 | 5,521 | 956 | – | – | 6,479 | |||||||||||||

|

Foreign exchange contracts |

– | 104 | – | – | – | 104 | |||||||||||||

|

Equity contracts |

104 | 63 | 54 | – | – | 221 | |||||||||||||

|

Commodity contracts |

– | 144 | 1 | – | – | 145 | |||||||||||||

|

Credit contracts |

– | – | 60 | – | – | 60 | |||||||||||||

|

Other contracts |

– | – | 38 | – | – | 38 | |||||||||||||

|

Counterparty netting and cash collateral |

– | – | – | (2,467 | ) | (909 | ) | (3,376 | ) | ||||||||||

|

Total derivative assets |

106 | 5,832 | 1,109 | (2,467 | ) | (909 | ) | 3,671 | |||||||||||

|

Short-term investments |

285 | 7,771 | – | – | – | 8,056 | |||||||||||||

|

Separate account assets |

54,430 | 2,907 | – | – | – | 57,337 | |||||||||||||

|

Other assets |

– | 696 | – | – | – | 696 | |||||||||||||

|

Total |

$ | 59,879 | $ | 278,402 | $ | 40,462 | $ | (2,467 | ) | $ | (909 | ) | $ | 375,367 | |||||

|

Liabilities: |

|||||||||||||||||||

|

Policyholder contract deposits |

$ | – | $ | – | $ | 1,257 | $ | – | $ | – | $ | 1,257 | |||||||

|

Derivative liabilities: |

|||||||||||||||||||

|

Interest rate contracts |

– | 5,582 | 224 | – | – | 5,806 | |||||||||||||

|

Foreign exchange contracts |

– | 174 | – | – | – | 174 | |||||||||||||

|

Equity contracts |

– | 114 | 7 | – | – | 121 | |||||||||||||

|

Commodity contracts |

– | 146 | – | – | – | 146 | |||||||||||||

|

Credit contracts |

– | – | 2,051 | – | – | 2,051 | |||||||||||||

|

Other contracts |

– | 6 | 200 | – | – | 206 | |||||||||||||

|

Counterparty netting and cash collateral |

– | – | – | (2,467 | ) | (1,976 | ) | (4,443 | ) | ||||||||||

|

Total derivative liabilities |

– | 6,022 | 2,482 | (2,467 | ) | (1,976 | ) | 4,061 | |||||||||||

|

Long-term debt |

– | 7,711 | 344 | – | – | 8,055 | |||||||||||||

|

Other liabilities |

30 | 1,050 | – | – | – | 1,080 | |||||||||||||

|

Total |

$ | 30 | $ | 14,783 | $ | 4,083 | $ | (2,467 | ) | $ | (1,976 | ) | $ | 14,453 | |||||

(a) Represents netting of derivative exposures covered by a qualifying master netting agreement.

(b) Represents cash collateral posted and received. Securities collateral posted for derivative transactions that is reflected in Fixed maturity securities in the Condensed Consolidated Balance Sheets, and collateral received, not reflected in the Condensed Consolidated Balance Sheets, was $1.4 billion and $160 million, respectively, at September 30, 2013 and $1.9 billion and $299 million, respectively, at December 31, 2012.

16

ITEM 1 / NOTE 5. FAIR VALUE MEASUREMENTS

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Transfers of Level 1 and Level 2 Assets and Liabilities

Our policy is to record transfers of assets and liabilities between Level 1 and Level 2 at their fair values as of the end of each reporting period, consistent with the date of the determination of fair value. Assets are transferred out of Level 1 when they are no longer transacted with sufficient frequency and volume in an active market. Conversely, assets are transferred from Level 2 to Level 1 when transaction volume and frequency are indicative of an active market. During the three- and nine-month periods ended September 30, 2013, we transferred $174 million and $731 million of securities issued by Non-U.S. government entities from Level 1 to Level 2, respectively, as they are no longer considered actively traded. For similar reasons, during the three- and nine-month periods ended September 30, 2013, we transferred $263 million and $356 million, respectively, of securities issued by the U.S. government and U.S. government-sponsored entities from Level 1 to Level 2. We had no material transfers from Level 2 to Level 1 during the three- and nine-month periods ended September 30, 2013.

During the three- and nine-month periods ended September 30, 2012, we transferred $148 million and $284 million of investments in securities issued by Non-U.S. governments from Level 1 to Level 2, respectively, as they were no longer considered actively traded. We had no material transfers from Level 2 to Level 1 during the three- and nine-month periods ended September 30, 2012.

17

ITEM 1 / NOTE 5. FAIR VALUE MEASUREMENTS

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Changes in Level 3 Recurring Fair Value Measurements

The following tables present changes during the three- and nine-month periods ended September 30, 2013 and 2012 in Level 3 assets and liabilities measured at fair value on a recurring basis, and the realized and unrealized gains (losses) related to the Level 3 assets and liabilities in the Condensed Consolidated Balance Sheets at September 30, 2013 and 2012:

|

(in millions)

|

Fair Value

Beginning of Period (a) |

Net

Realized and Unrealized Gains (Losses) Included in Income |

Other

Comprehensive Income (Loss) |

Purchases,

Sales, Issues and Settlements, Net |