As filed with the Securities and Exchange Commission on April 28, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

|

o |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 001-13142

|

Embotelladora Andina S.A. |

|

(Exact name of Registrant as specified in its charter) |

|

Andina Bottling Company |

|

(Translation of Registrant’s name in English) |

|

|

|

Republic of Chile |

|

(Jurisdiction of incorporation or organization) |

|

|

|

Miraflores 9153, 7th Floor

|

|

(Address of principal executive offices) |

|

|

|

Paula Vicuña, Tel. (56-2) 2338-0520 E-mail: paula.vicuna@koandina.com Miraflores 9153, 7th Floor - Renca - Santiago, Chile |

|

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

|

Name of each exchange on which registered |

|

Series A Shares, Series B Shares of Registrant represented by American Depositary Shares |

|

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

|

Series A Shares 473,289,301 |

|

|

Series B Shares 473,281,303 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer x |

|

Accelerated filer o |

|

Non-accelerated filer o |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP o |

|

International Financial Reporting Standards as issued

|

|

Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

|

|

Page |

|

|

3 |

||

|

3 |

||

|

|

||

|

6 |

||

|

6 |

||

|

6 |

||

|

30 |

||

|

Unresolved Securities and Exchange Commission Staff Comments |

59 |

|

|

59 |

||

|

82 |

||

|

92 |

||

|

94 |

||

|

95 |

||

|

98 |

||

|

107 |

||

|

108 |

||

|

|

|

|

|

110 |

||

|

Material Modifications to the Rights of Security Holders and Use of Proceeds |

110 |

|

|

110 |

||

|

111 |

||

|

111 |

||

|

111 |

||

|

112 |

||

|

112 |

||

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

113 |

|

|

113 |

||

|

113 |

||

|

115 |

||

|

|

|

|

|

115 |

||

|

115 |

||

|

115 |

||

References

Unless the context otherwise requires, as used in this annual report the following terms have the meanings set forth below:

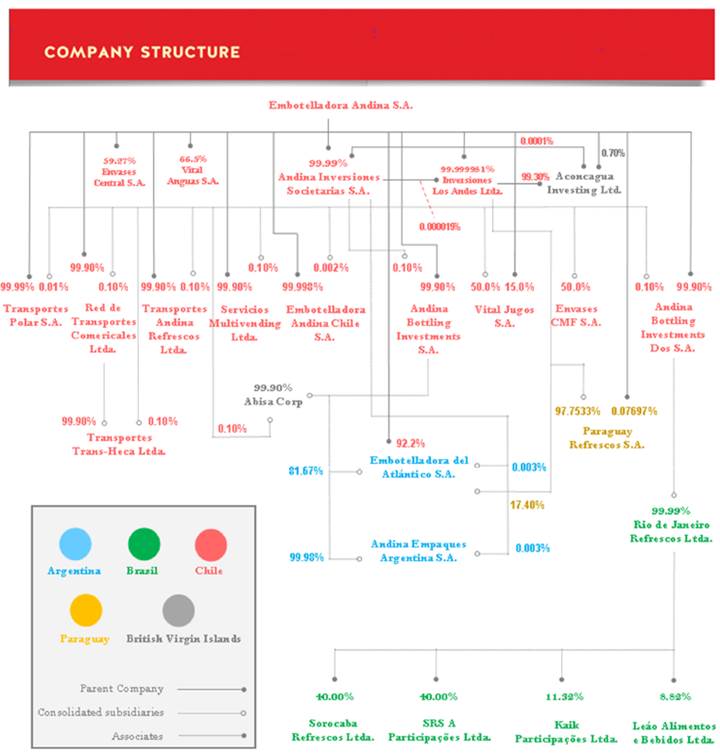

· the “Company”, “we”, “Andina” and “Coca-Cola Andina” means Embotelladora Andina S.A. and its consolidated subsidiaries;

· “Andina Brazil” means our subsidiary, Rio de Janeiro Refrescos Ltda. and its subsidiaries;

· “AESA” means our subsidiary, Andina Empaques Argentina S.A.;

· “EDASA” means our subsidiary, Embotelladora del Atlántico S.A.;

· “PARESA” means our subsidiary, Paraguay Refrescos S.A.;

· “CMF” means our affiliate, Envases CMF S.A.;

· “ECSA” means our affiliate, Envases Central S.A.;

· “Vital Jugos” means our affiliate, Vital Jugos S.A., previously known as Vital S.A.;

· “VASA” means our affiliate, Vital Aguas S.A.;

· “TAR” means our subsidiary, Transportes Andina Refrescos Ltda.;

· “TP” means our subsidiary, Transportes Polar S.A.;

· “The Coca-Cola Company” means The Coca-Cola Company or any of its subsidiaries, including without limitation Coca-Cola de Chile S.A. (“CC Chile”), which operates in Chile, Recofarma Industrias do Amazonas Ltda. (“CC Brazil”), which operates in Brazil and Servicios y Productos para Bebidas Refrescantes S.R.L. (“CC Argentina”), which operates in Argentina;

· the “Chilean territory” means the Metropolitan Region of Santiago, the Coquimbo region, and the provinces of Cachapoal, San Antonio, Antofagasta, Atacama, Aisén and Magallanes;

· the “Brazilian territory” means the majority of the State of Rio de Janeiro, and the totality of the State of Espírito Santo, part of the state of São Paulo and part of the state of Minas Gerais;

· the “Argentine territory” means the provinces of Córdoba, Mendoza, San Juan, San Luis, Entre Rios, Buenos Aires (only San Nicolás and Ramallo), La Pampa, Neuquén, Río Negro, Chubut, Santa Cruz, Tierra del Fuego and most of Santa Fe as well as part of the province of Buenos Aires; and

· the “Paraguayan territory” means the country of Paraguay.

PRESENTATION OF FINANCIAL AND CERTAIN OTHER INFORMATION

Unless otherwise specified, references herein to “dollars,” “U.S. dollars” or “US$” are to United States dollars; references to “pesos,” “Chilean pesos”, “Ch$” or “ThCh$” are to Chilean pesos; references to “Argentine pesos” or “AR$” are to Argentine pesos, references to “real” or “reais” or “R$” are to Brazilian reais and references to “guaranies” or “guarani” or “G$” are to Paraguayan Guaranies. References to “UF” are to Unidades de Fomento . The UF is an inflation-indexed Chilean monetary unit with a value in Chilean pesos that is adjusted daily to reflect changes in the official consumer price index of the Instituto Nacional de Estadísticas (the “Chilean National Institute of Statistics”). The UF is adjusted in monthly cycles. Each day in the period beginning on the tenth day of the current month through the ninth day of the succeeding month, the nominal peso value of the UF is indexed up (or down in the event of deflation) in order to reflect a proportionate amount of the change in the Chilean consumer price index during the prior calendar month. Certain percentages and amounts contained in this annual report have been rounded for ease of presentation.

In this annual report certain (local currency) amounts have been converted into United States dollars at the rate of Ch$654.66 to the dollar when it is average exchange rate and Ch$710.16 to the dollar when it is year end exchange rate. Such conversions should not be construed as representations that the (local currency) amounts represent, or have been or could be converted into, United States dollars at that or any other rate.

The Company’s Consolidated Financial Statements for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 were prepared in accordance with International Financial Reporting Standards (hereinafter “IFRS”) issued by the International Accounting Standards Board (hereinafter “IASB”).

Special Note Regarding Non-IFRS Financial Measures

This annual report makes reference to certain non-IFRS measures, namely EBIT, EBITDA and Adjusted EBITDA. These non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.

EBIT represents profit attributable to controlling shareholders before net interest expense and income taxes. EBITDA represents EBIT plus depreciation and amortization expense. Adjusted EBITDA represents EBITDA plus other expenses (income), net. We have included EBIT, EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of our operating performance.

We believe EBIT, EBITDA and Adjusted EBITDA are an important supplemental measure of operating performance because they eliminate items that have less bearing on our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. We also believe that securities analysts, investors and other interested parties frequently use EBITDA in the evaluation of issuers, many of which present EBITDA when reporting their results.

Our management also uses EBITDA and Adjusted EBITDA in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets, assess our ability to meet our future debt service, capital expenditure and working capital requirements and assess our ability to pay dividends on our capital stock.

EBIT, EBITDA and Adjusted EBITDA have important limitations as analytical tools. For example, neither EBIT, EBITDA nor Adjusted EBITDA reflect (a) our cash expenditures or future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) significant interest expense or the cash requirements necessary to service interest or principal payments on our debt; and (d) tax payments or distributions to our parent to make payments with respect to taxes attributable to us that represent a reduction in cash available to us. Although we consider the items excluded in the calculation of non-IFRS measures to be less relevant to evaluate our performance, some of these items may continue to take place and accordingly may reduce the cash available to us.

We believe that the presentation of the non-IFRS measures described above is appropriate. However, these non-IFRS measures have important limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under IFRS. Because of these limitations, we primarily rely on our results as reported in accordance with IFRS and use EBIT, EBITDA and Adjusted EBITDA only complementarily. In addition, because other companies may calculate EBITDA and Adjusted EBITDA differently than we do, EBITDA may not be, and Adjusted EBITDA as presented in this report is not, comparable to similarly titled measures reported by other companies.

Forward-Looking Statements

This annual report includes forward looking statements, principally under the captions, “Item 4. Information on the Company—Business Overview,” “Item 3. Key Information—Part D. Risk Factors,” and “Item 5. Operating and Financial Review and Prospects.” We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting our business. Examples of such forward-looking statements include:

· statements of our plans, objectives or goals, including those related to anticipated trends, competition or regulation;

· statements about our future economic performance and that of Chile or other countries in which we operate;

· statements about our exposure to market risks, including interest rate risks, foreign exchange risk and equity price risk; and

· statements of assumptions underlying such statements.

Words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “could,” “may,” “seeks,” “aim,” “combined,” “estimates,” “probability,” “risk,” “target,” “goal,” “objective,” “future” or similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These statements may relate to (i) our asset growth and financing plans, (ii) trends affecting our financial condition or results of operations and (iii) the impact of competition and regulations, but are not limited to such topics. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially and adversely from those described in such forward-looking statements included in this annual report as a result of various factors (including, without limitation, the actions of competitors, future global economic conditions, market conditions, foreign exchange rates and operating and financial risks), many of which are beyond our control. The occurrence of any such factors not currently expected by us would significantly alter the results set forth in these statements.

You should understand that the following important factors, in addition to those discussed elsewhere in this annual report, could affect our future results and could cause those results or other outcomes to differ materially and adversely from those expressed in our forward-looking statements:

· changes in general economic, business, political or other conditions in the regions where we operate;

· changes in the legal and regulatory framework of the beverage sector in the regions where we operate;

· the monetary and interest rate policies of the central banks of the countries in which we operate;

· unanticipated movements or volatility in interest rates, foreign exchange rates, equity prices or other rates or prices;

· changes in, or our failure to comply with, laws and regulations in the countries where we operate and applicable foreign laws;

· changes in taxes;

· changes in competition and pricing environments;

· our inability to hedge certain risks economically;

· potential effects of weather conditions, earthquakes, tsunamis or other natural disasters;

· the outcome of litigation against us;

· the nature and extent of competition in the beverage industry in Latin America and the effect of competition on the prices we are able to charge for our products;

· volatility and fluctuations in demand for our products and the effect of such changes on the prices that we are able to charge for our products;

· capital and credit market conditions, including the availability of credit and changes in interest rates;

· delays in the development of our projects, changes to our investment plans due to changes in demand, authorizations, expropriations, etc.;

· actions of our shareholders;

· unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms if at all; and

· the factors described under “Risk Factors” beginning on page 8.

The forward-looking statements contained in this document speak only as of the date of this annual report, and we do not undertake to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events .

Market Data

We have computed the information contained in this annual report regarding annual volume and per capita growth rates and levels, and market share, product segment, and population data in our bottling territories, based upon accumulated statistics developed by us. Market share information presented with respect to soft drinks, juices, waters and beer is based on data supplied by A.C. Nielsen Company.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

The following tables present certain summary consolidated and other financial and operating information of Andina at the dates and for the periods indicated. This information should be read in conjunction with, and is qualified in its entirety by reference to our consolidated financial statements, including the notes thereto, included elsewhere in this annual report and our consolidated financial statements, including the notes thereto, included herein.

The summary consolidated financial information as of December 31, 2014 and 2015 and for the years ended December 31, 2013, 2014 and 2015 has been derived from our audited consolidated financial statements as of December 31, 2015 and 2014. The summary consolidated financial information as of December 31, 2011, 2012 and 2013 and for the year ended December 31, 2011 and 2012 has been derived from our audited consolidated financial statements as of and for the years then ended not included herein.

On October 1, 2012, we consummated the acquisition of Polar, which significantly enhanced the size and scope of our company. We began consolidating the results of operations of Polar into our consolidated financial statements as of October 1, 2012. As a result, our consolidated results of operations for the year ended December 31, 2012 are not fully comparable to our consolidated results of operations for previous periods.

On October 11, 2013, Andina Brazil consummated its acquisition of Ipiranga in an all-cash transaction. We began consolidating the results of operations of Ipiranga into our consolidated financial statements as of October 1, 2013. As a result, our consolidated results of operations for the year ended December 31, 2013 are not fully comparable to our consolidated results of operations for previous periods.

Our consolidated financial statements reflect the results of our subsidiaries located in Brazil, Argentina and Paraguay, converted to Chilean pesos (our functional and reporting currency) and are presented in accordance with IFRS. IFRS requires assets and liabilities to be converted from the functional currency of our subsidiaries outside Chile to our reporting currency (Chilean peso) at the end of period exchange rates and income and expense accounts to be converted at the average monthly exchange rate for the month in which income or expense is recognized. Unless otherwise specified, our financial data is presented herein in Chilean pesos and U.S. dollars.

Our income and cash flow accounts have been converted according to the average exchange rate during the relevant periods, using the average of monthly averages, and therefore may differ from a daily average of the observed exchange rate. Balance sheet accounts have been converted using the exchange rate at the end of the relevant period.

|

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2011 |

|

2012(2) |

|

2013(3) |

|

2014 |

|

2015 |

|

2015 |

|

|

|

|

(in millions of Ch$ and millions of US$) |

|

||||||||||

|

|

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

982,864 |

|

1,172,293 |

|

1,521,681 |

|

1,797,200 |

|

1,877,394 |

|

2,868 |

|

|

Cost of sales |

|

(578,581 |

) |

(698,955 |

) |

(914,818 |

) |

(1,081,243 |

) |

(1,106,706 |

) |

(1,691 |

) |

|

Gross profit |

|

404,283 |

|

473,338 |

|

606,863 |

|

715,957 |

|

770,688 |

|

1,177 |

|

|

Other income |

|

2,125 |

|

2,518 |

|

4,386 |

|

3,971 |

|

472 |

|

1 |

|

|

Distribution expenses |

|

(98,808 |

) |

(122,819 |

) |

(163,023 |

) |

(187,043 |

) |

(202,491 |

) |

(309 |

) |

|

Administrative expenses |

|

(163,051 |

) |

(196,355 |

) |

(272,556 |

) |

(342,141 |

) |

(352,601 |

) |

(539 |

) |

|

Other expenses |

|

(11,915 |

) |

(15,420 |

) |

(30,462 |

) |

(18,591 |

) |

(21,983 |

) |

(34 |

) |

|

Other (expense) income, net(4) |

|

1,495 |

|

(2,336 |

) |

740 |

|

(4,392 |

) |

(6,301 |

) |

(10 |

) |

|

Financial income |

|

3,182 |

|

2,728 |

|

4,973 |

|

8,656 |

|

10,118 |

|

15 |

|

|

Financial expenses |

|

(7,235 |

) |

(11,173 |

) |

(28,944 |

) |

(65,081 |

) |

(55,669 |

) |

(85 |

) |

|

Share of (loss) profit of investments accounted for using the equity method |

|

2,026 |

|

1,770 |

|

783 |

|

1,191 |

|

(2,328 |

) |

(4 |

) |

|

Foreign exchange differences |

|

3 |

|

(4,471 |

) |

(7,695 |

) |

(2,676 |

) |

(2,856 |

) |

(4 |

) |

|

Loss from differences in indexed financial assets and liabilities |

|

(393 |

) |

(1,006 |

) |

(1,832 |

) |

(12,463 |

) |

(7,308 |

) |

(10 |

) |

|

Net income before income taxes |

|

131,712 |

|

126,774 |

|

113,233 |

|

97,388 |

|

129,741 |

|

198 |

|

|

Income tax expense |

|

(34,685 |

) |

(38,505 |

) |

(22,966 |

) |

(45,354 |

) |

(41,643 |

) |

(63 |

) |

|

Net income |

|

97,027 |

|

88,269 |

|

90,267 |

|

52,034 |

|

88,098 |

|

135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

31,298 |

|

55,522 |

|

79,976 |

|

79,514 |

|

129,160 |

|

182 |

|

|

Other financial assets |

|

15,661 |

|

129 |

|

36,472 |

|

106,577 |

|

87,492 |

|

123 |

|

|

Other non-financial assets |

|

14,761 |

|

18.203 |

|

9,696 |

|

7,787 |

|

8,686 |

|

12 |

|

|

Trade and other accounts receivable, net |

|

107,443 |

|

152,817 |

|

195,434 |

|

198,110 |

|

176,386 |

|

248 |

|

|

Accounts receivable from related parties |

|

6,419 |

|

5,324 |

|

8,029 |

|

5,994 |

|

4,611 |

|

6 |

|

|

Inventories |

|

57,487 |

|

89,320 |

|

125,854 |

|

149,728 |

|

133,333 |

|

188 |

|

|

Current tax assets |

|

2,463 |

|

2,879 |

|

3,990 |

|

6,026 |

|

7,742 |

|

12 |

|

|

Non-current assets classified as available for sale |

|

— |

|

2,978 |

|

1,133 |

|

— |

|

— |

|

— |

|

|

Total current assets |

|

235,532 |

|

327,172 |

|

460,584 |

|

553,736 |

|

547,410 |

|

771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financial assets |

|

— |

|

— |

|

7,922 |

|

51,027 |

|

181,491 |

|

256 |

|

|

Other non-financial assets |

|

30,194 |

|

26,927 |

|

28,796 |

|

33,057 |

|

18,290 |

|

26 |

|

|

Trade and other receivables |

|

7,176 |

|

6,724 |

|

7,631 |

|

7,098 |

|

5,932 |

|

8 |

|

|

Accounts receivable from related parties |

|

11 |

|

7 |

|

19 |

|

25 |

|

15 |

|

— |

|

|

Investments accounted for under the equity method |

|

60,291 |

|

73,080 |

|

68,673 |

|

66,050 |

|

54,191 |

|

76 |

|

|

Intangible assets other than goodwill |

|

1,139 |

|

464,582 |

|

700,606 |

|

728,181 |

|

665,666 |

|

937 |

|

|

Goodwill |

|

57,552 |

|

64,793 |

|

115,779 |

|

116,924 |

|

95,836 |

|

135 |

|

|

Property, plant and equipment |

|

350,064 |

|

576,551 |

|

692,950 |

|

713,075 |

|

640,530 |

|

902 |

|

|

Total non-current assets |

|

506,427 |

|

1,212,664 |

|

1,622,377 |

|

1,715,437 |

|

1,661,951 |

|

2,340 |

|

|

Total assets |

|

741,959 |

|

1,539,836 |

|

2,082,961 |

|

2,269,173 |

|

2,209,361 |

|

3,111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financial liabilities |

|

23,093 |

|

106,248 |

|

106,877 |

|

83,402 |

|

62,218 |

|

88 |

|

|

Trade and other accounts payable |

|

127,941 |

|

184,318 |

|

210,446 |

|

228,179 |

|

212,526 |

|

299 |

|

|

Accounts payable to related parties |

|

11,359 |

|

32,727 |

|

43,425 |

|

55,967 |

|

48,653 |

|

69 |

|

|

Provisions |

|

88 |

|

593 |

|

270 |

|

366 |

|

326 |

|

— |

|

|

Income taxes payable |

|

3,821 |

|

1,115 |

|

3,679 |

|

2,931 |

|

7,495 |

|

11 |

|

|

Employee benefits current provisions |

|

14,079 |

|

19,633 |

|

21,440 |

|

27,747 |

|

31,791 |

|

45 |

|

|

Other non-financial liabilities |

|

16,263 |

|

737 |

|

16,007 |

|

11,620 |

|

17,565 |

|

24 |

|

|

Total current liabilities |

|

196,644 |

|

345,371 |

|

402,144 |

|

410,212 |

|

380,574 |

|

536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other long-term current financial liabilities |

|

74,641 |

|

173,880 |

|

605,362 |

|

726,616 |

|

765,299 |

|

1,078 |

|

|

Trade and other payables |

|

164 |

|

1,930 |

|

1,262 |

|

1,216 |

|

9,303 |

|

13 |

|

|

Provisions |

|

7,883 |

|

6,422 |

|

77,542 |

|

77,447 |

|

63,976 |

|

90 |

|

|

Deferred income tax liabilities |

|

35,245 |

|

111,415 |

|

105,537 |

|

126,126 |

|

130,202 |

|

183 |

|

|

Post-employment benefit liabilities |

|

5,130 |

|

7,037 |

|

8,759 |

|

8,125 |

|

8,230 |

|

12 |

|

|

Other non-financial liabilities |

|

273 |

|

176 |

|

922 |

|

433 |

|

243 |

|

— |

|

|

Total Non-Current Liabilities |

|

123,336 |

|

300,860 |

|

799,384 |

|

939,963 |

|

977,253 |

|

1,376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued capital |

|

230,892 |

|

270,737 |

|

270,737 |

|

270,737 |

|

270,737 |

|

381 |

|

|

Retained earnings |

|

208,102 |

|

239,845 |

|

243,193 |

|

247,818 |

|

274,755 |

|

387 |

|

|

Other reserves |

|

(17,024 |

) |

363,582 |

|

346,739 |

|

378,739 |

|

284,982 |

|

401 |

|

|

Equity attributable to equity holders of the parent |

|

421,970 |

|

874,164 |

|

860,669 |

|

897,294 |

|

830,474 |

|

1,169 |

|

|

Non-controlling interests |

|

9 |

|

19,441 |

|

20,764 |

|

21,703 |

|

21,060 |

|

30 |

|

|

Total equity |

|

421,979 |

|

893,605 |

|

881,433 |

|

918,998 |

|

851,534 |

|

1,199 |

|

|

Total liabilities and equity |

|

741,959 |

|

1,539,836 |

|

2,082,961 |

|

2,269,173 |

|

2,209,361 |

|

3,111 |

|

|

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2011 |

|

2012(2) |

|

2013(3) |

|

2014 |

|

2015 |

|

2015 |

|

|

|

|

(in millions of Ch$ and millions of US$) |

|

||||||||||

|

|

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

US$ |

|

|

CASH FLOW DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flows generated from Operating Activities |

|

138,950 |

|

188,857 |

|

172,085 |

|

215,514 |

|

264,909 |

|

405 |

|

|

Net cash flows used in investing activities |

|

(89,621 |

) |

(156,170 |

) |

(447,550 |

) |

(166,776 |

) |

(103,131 |

) |

(158 |

) |

|

Net cash flows provided by (used in) financing activities |

|

(67,159 |

) |

(3,551 |

) |

303,106 |

|

(46,920 |

) |

(98,560 |

) |

(151 |

) |

|

Net increase in cash and cash equivalents before exchange differences |

|

(17,830 |

) |

29,136 |

|

27,641 |

|

1,818 |

|

63,218 |

|

96 |

|

|

Effects of exchange differences on cash and cash equivalents |

|

865 |

|

(4,912 |

) |

(3,187 |

) |

(2,280 |

) |

(13,571 |

) |

(21 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

(16,965 |

) |

24,224 |

|

24,454 |

|

(462 |

) |

49,647 |

|

75 |

|

|

Cash and cash equivalents - beginning of year |

|

48,263 |

|

31,298 |

|

55,522 |

|

79,976 |

|

79,514 |

|

112 |

|

|

Cash and cash equivalents - end of year |

|

31,298 |

|

55,522 |

|

79,976 |

|

79,514 |

|

129,161 |

|

182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER FINANCIAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(5) |

|

181,922 |

|

207,988 |

|

254,621 |

|

289,740 |

|

316,229 |

|

483 |

|

|

Adjusted EBITDA margin(6) |

|

18,5 |

% |

17,7 |

% |

16,7 |

% |

16,1 |

% |

16,8 |

% |

16,8 |

% |

|

Adjusted EBITDA/net financial expense(7) |

|

44,9 |

|

24,6 |

|

10,6 |

|

5,1 |

|

6,9 |

|

6,9 |

|

|

Net debt(8) |

|

50,776 |

|

224,477 |

|

587,869 |

|

572,901 |

|

429,373 |

|

656 |

|

|

Net debt/Adjusted EBITDA(9) |

|

0,3 |

|

1,1 |

|

2,3 |

|

2,0 |

|

1,4 |

|

1,4 |

|

|

Depreciation and amortization |

|

39,498 |

|

53,824 |

|

83,337 |

|

102,967 |

|

100,632 |

|

154 |

|

|

Capital expenditures |

|

126,931 |

|

143,764 |

|

183,697 |

|

114,217 |

|

112,400 |

|

172 |

|

|

Dividends paid |

|

70,906 |

|

69,766 |

|

73,041 |

|

52,269 |

|

53,671 |

|

82 |

|

|

Basic and diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A(13) |

|

121,54 |

|

104,12 |

|

89,53 |

|

52,19 |

|

88,40 |

|

0,14 |

|

|

Series B(13) |

|

133,69 |

|

114,53 |

|

98,48 |

|

57,41 |

|

97,24 |

|

0,15 |

|

|

Basic and diluted earnings per ADR:(14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A(13) |

|

729,24 |

|

624,72 |

|

537,18 |

|

313,16 |

|

530,40 |

|

0,81 |

|

|

Series B(13) |

|

802,14 |

|

687,18 |

|

590,88 |

|

344,48 |

|

583,44 |

|

0,89 |

|

|

Capital Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A |

|

380,137,271 |

|

473,289,368 |

|

473,289,301 |

|

473,289,301 |

|

473,289,301 |

|

473,289,301 |

|

|

Series B |

|

380,137,271 |

|

473,289,368 |

|

473,281,303 |

|

473,281,303 |

|

473,281,303 |

|

473,281,303 |

|

|

Issued Capital |

|

230,892 |

|

270,759 |

|

270,738 |

|

270,738 |

|

270,738 |

|

414 |

|

|

Total dividends declared: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Series A Shares |

|

33.809 |

|

34.018 |

|

33.888 |

|

24.800 |

|

29.344 |

|

45 |

|

|

Total Series B Shares |

|

37.190 |

|

37.420 |

|

37.276 |

|

27.283 |

|

32.278 |

|

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER OPERATING DATA (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales volume |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coca-Cola trade brand soft drinks (millions of UCs)(10) |

|

448.2 |

|

517.6 |

|

633.5 |

|

671.6 |

|

653.8 |

|

653.8 |

|

|

Other beverages (millions of UCs) (2)(3)(10)(11) |

|

53.3 |

|

78.6 |

|

129.5 |

|

159.0 |

|

166.1 |

|

166.1 |

|

(1) Conversion to U.S. dollars are solely for the convenience of the reader.

(2) Due to Polar’s merger with and into us on October 1, 2012, data for the year ended December 31, 2012 includes the operations of Polar (as well as the operations of Vital Aguas, Vital Jugos and Envases Central (together, the “Joint Ventures”)) for the period from October 1, 2012 to December 31, 2012. Prior to our merger with Polar the Joint Ventures were held, in part, by each of Andina, Polar and Embonor S.A., respectively, and the Joint Ventures’ operations were not consolidated in the financial and other data of Andina or Polar. Upon consummation of our merger with Polar, and our increased ownership interest in the Joint Ventures that resulted from such merger, the Joint Ventures became our subsidiaries for accounting purposes and are therefore consolidated into our financial and other data for periods subsequent to such merger.

(3) Due to the acquisition of Ipiranga consummated on October 11, 2013, data for the year ended December 31, 2013 includes the operations of Ipiranga for the period from October 1, 2013 to December 31, 2013.

(4) Includes other expenses, other income (expense), share in profit of investees accounted under the equity method, foreign exchange gains (losses) and gains (losses) from indexed financial assets and liabilities.

(5) Adjusted EBITDA is a non-IFRS financial measure, does not represent cash flows from operations for the periods indicated and should not be considered an alternative to net income as an indicator of our results of operations or as an alternative to cash flows from operations as an indicator of liquidity. Adjusted EBITDA does not have a standardized meaning and, accordingly, our definition of Adjusted EBITDA may not be comparable to Adjusted EBITDA as used by other companies. See “Presentation of Financial and Other Information —Non-IFRS Financial Information”. We define Adjusted EBITDA as net income plus income taxes, other expenses (income), depreciation and amortization (which includes only the amortization of information technology software). A reconciliation of our net income to our Adjusted EBITDA is set forth below:

|

|

|

Year Ended December 31, |

|

||||||||||

|

|

|

2011 |

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2015 |

|

|

|

|

(in millions of Ch$ and US$) |

|

||||||||||

|

|

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

Ch$ |

|

US$ |

|

|

Net income |

|

97,027 |

|

88,269 |

|

90,267 |

|

52,034 |

|

88,098 |

|

135 |

|

|

Add : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

34,685 |

|

38,505 |

|

22,966 |

|

45,354 |

|

41,643 |

|

64 |

|

|

Finance costs |

|

7,235 |

|

11,173 |

|

28,944 |

|

65,082 |

|

55,669 |

|

85 |

|

|

Finance income |

|

(3,182 |

) |

(2,728 |

) |

(4,973 |

) |

(8,656 |

) |

(10,118 |

) |

(15 |

) |

|

Depreciation and amortization(5) |

|

39,498 |

|

53,824 |

|

83,337 |

|

102,967 |

|

100,632 |

|

154 |

|

|

Share of profit of investments using equity method of accounting |

|

(2,026 |

) |

(1,770 |

) |

(783 |

) |

(1,191 |

) |

2,328 |

|

4 |

|

|

Foreign exchange difference |

|

(3 |

) |

4,471 |

|

7,695 |

|

2,675 |

|

2,856 |

|

4 |

|

|

Gain (loss) from indexed financial assets and liabilities |

|

1,178 |

|

1,754 |

|

1,833 |

|

12,462 |

|

7,308 |

|

11 |

|

|

Other income |

|

(2,909 |

) |

(3,266 |

) |

(4,386 |

) |

(3,971 |

) |

(472 |

) |

(1 |

) |

|

Other expenses |

|

11,915 |

|

15,420 |

|

30,462 |

|

18,591 |

|

21,983 |

|

34 |

|

|

Other income (expenses) |

|

(1,496 |

) |

2,336 |

|

(741 |

) |

4,392 |

|

6,301 |

|

10 |

|

|

Adjusted EBITDA(14) |

|

181,922 |

|

207,988 |

|

254,621 |

|

289,740 |

|

316,229 |

|

483 |

|

(6) Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales, expressed as a percentage.

(7) Adjusted EBITDA / net financial expense is defined as Adjusted EBITDA divided by total financial expense (which includes expenses for hedging purposes) minus total financial income.

(8) Net debt is defined as the sum of (i) other current financial liabilities and (ii) other noncurrent financial liabilities, minus the sum of (i) cash and cash equivalents, (ii) other current financial assets and (iii) other non-current financial assets.

(9) Net debt / Adjusted EBITDA ratio is the ratio of our net debt (defined as the sum of (i) other current financial liabilities and (ii) other noncurrent financial liabilities, minus the sum of (i) cash and cash equivalents and (ii) other financial assets) as of the end of the applicable period divided by our Adjusted EBITDA for the last 12 months ended as of the end of the applicable period.

(10) Calculation of profits per share considers the average amount of outstanding shares existing at each date.

(11) Each ADR represents six shares of common stock of the corresponding series of Shares.

(12) Unit cases refer to 192 ounces of finished beverage product (24 eight-ounce servings) or 5.69 liters.

(13) Includes waters, juices, beer and other spirits.

(14) Totals may not sum due to rounding.

Exchange Rates

Chile

Chile has two currency markets, the Mercado Cambiario Formal (the “Formal Exchange Market”) and the Mercado Cambiario Informal (the “Informal Exchange Market”). The Formal Exchange Market is comprised of banks and other entities authorized by the Chilean Central Bank. The Informal Exchange Market is comprised of entities that are not expressly authorized to operate in the Formal Exchange Market, such as certain foreign exchange houses and travel agencies, among others. The Chilean Central Bank is empowered to require that certain purchases and sales of foreign currencies be carried out on the Formal Exchange Market. See also “Item 10. Additional Information—D. Exchange Controls—Foreign Exchange Controls—Chile.”

Both the Formal and Informal Exchange Markets are driven by free market forces. Current regulations require that the Chilean Central Bank be informed of certain transactions and that they be effected through the Formal Exchange Market.

The U.S. dollar observed exchange rate ( dólar observado ), which is reported by the Chilean Central Bank and published daily in the Official Gazette ( Diario Oficial ), is the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market. The Chilean Central Bank has the power to intervene by buying or selling foreign currency on the Formal Exchange Market to attempt to maintain the observed exchange rate within a desired range. During the past few years the Chilean Central Bank has attempted to keep the observed exchange rate within a certain range only under special circumstances. Although the Chilean Central Bank is not required to purchase or sell dollars at any specific exchange rate, it generally uses spot rates for its transactions. Other banks generally carry out authorized transactions at spot rates as well.

The Informal Exchange Market reflects transactions carried out at the informal exchange rate. There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the observed exchange rate. In recent years, the variation between the observed exchange rate and the informal exchange rate has not been significant.

The following table sets forth the annual low, high, average and period end observed exchange rate for U.S. dollars for the periods presented, as reported by the Chilean Central Bank. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos.

|

|

|

Daily observed exchange rate Ch$ per U.S.$ |

|

||||||

|

|

|

High(1) |

|

Low(1) |

|

Average(2) |

|

Period end (3) |

|

|

Year ended December 31, |

|

|

|

|

|

|

|

|

|

|

2011 |

|

533.74 |

|

455.91 |

|

483.57 |

|

519.20 |

|

|

2012 |

|

519.69 |

|

469.65 |

|

486.59 |

|

479.96 |

|

|

2013 |

|

533.95 |

|

466.50 |

|

495.18 |

|

524.61 |

|

|

2014 |

|

621.41 |

|

527.53 |

|

570.33 |

|

606.75 |

|

|

2015 |

|

715.66 |

|

597.10 |

|

654.66 |

|

710.16 |

|

|

Month end |

|

|

|

|

|

|

|

|

|

|

October 31, 2015 |

|

695.53 |

|

673.91 |

|

684.91 |

|

690.32 |

|

|

November 30, 2015 |

|

715.66 |

|

688.94 |

|

705.00 |

|

711.20 |

|

|

December 31, 2015 |

|

711.52 |

|

693.72 |

|

704.19 |

|

710.16 |

|

|

January 31, 2016 |

|

730.31 |

|

710.37 |

|

721.96 |

|

710.37 |

|

|

February 29, 2016 |

|

715.41 |

|

689.18 |

|

703.31 |

|

694.17 |

|

|

March 31, 2016 |

|

694.82 |

|

669.80 |

|

680.96 |

|

669.80 |

|

|

April 2016 (through April 22, 2016) |

|

682.45 |

|

657.90 |

|

670.60 |

|

666.80 |

|

Source: Chilean Central Bank.

(1) Exchange rates are the actual low and high, on a daily basis for each period.

(2) The yearly average rate is calculated as the average of the exchange rates on the last day of each month during the period.

(3) Each year period ends on December 31, and the respective period-end exchange rate is published by the Chilean Central Bank on the first business day of the following year. Each month period ends on the last calendar day of such month, and the respective period end exchange rate is published by the Chilean Central Bank on the first business day of the following month.

Argentina

From April 1, 1991 until the end of 2001, the Convertibility Law No. 23,928 and Regulatory Decree No. 529/91 (together, the “Convertibility Law”) established a fixed exchange rate under which the Central Bank of Argentina was obliged to sell U.S. dollars at a fixed rate of one Argentine peso per U.S. dollar. On January 6, 2002, the Argentine Congress enacted the Public Emergency Law, which suspended certain provisions of the Convertibility Law, including the fixed exchange rate of Ar$1.00 to U.S.$1.00, and granted the executive branch of the Argentine government the power to set the exchange rate between the Argentine peso and foreign currencies and to issue regulations related to the foreign exchange market. Following a brief period during which the Argentine government established a temporary dual exchange rate system, pursuant to the Public Emergency Law, the Argentine peso has been allowed to float freely against other currencies since February 2002. For the last few years the Argentine government has maintained a policy of intervention in foreign exchange markets, conducting periodic transactions for the sale and purchase of U.S. dollars. There is no way to foresee if this could continue in the future. See also “Item 10. Additional Information—D. Exchange Controls—Foreign Exchange Controls—Argentina.”

The following table sets forth the annual high, low, average and period-end exchange rates for the periods indicated, expressed in Argentine pesos per U.S. dollar and not adjusted for inflation as reported by the Central Bank of Argentina. The Federal Reserve Bank of New York does not report a noon buying rate for Argentine pesos.

|

|

|

High |

|

Low |

|

Average(1) |

|

Period end |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, |

|

|

|

|

|

|

|

|

|

|

2011 |

|

4.304 |

|

3.972 |

|

4.131 |

|

4.304 |

|

|

2012 |

|

4.917 |

|

4.304 |

|

4.552 |

|

4.917 |

|

|

2013 |

|

6.518 |

|

4.923 |

|

5.479 |

|

6.518 |

|

|

2014 |

|

8.556 |

|

6.543 |

|

8.119 |

|

8.552 |

|

|

2015 |

|

13.005 |

|

8.554 |

|

9.269 |

|

13.005 |

|

|

Month end |

|

|

|

|

|

|

|

|

|

|

October 31, 2015 |

|

9.546 |

|

9.427 |

|

9.490 |

|

9.546 |

|

|

November 30, 2015 |

|

9.688 |

|

9.554 |

|

9.627 |

|

9.688 |

|

|

December 31, 2015 |

|

13.005 |

|

9.698 |

|

11.428 |

|

13.005 |

|

|

January 31, 2016 |

|

13.960 |

|

13.200 |

|

13.654 |

|

13.960 |

|

|

February 29, 2016 |

|

15.800 |

|

14.130 |

|

14.852 |

|

15.800 |

|

|

March 31, 2016 |

|

15.800 |

|

14.390 |

|

14.954 |

|

14.700 |

|

|

April 2016 (through April 22, 2016) |

|

14.790 |

|

14.050 |

|

14.416 |

|

14.330 |

|

Source: Central Bank of Argentina. (“A” 3500 Report — Wholesale)

(1) Represents the daily average exchange rate during each of the relevant periods.

Brazil

The Central Bank of Brazil allows the real/U.S. dollar exchange rate to float freely and has intervened occasionally to control unstable fluctuations in foreign exchange rates. We cannot predict whether the Central Bank of Brazil or the Brazilian government will continue to let the real float freely or will intervene in the exchange rate market through a currency band system or otherwise. The Brazilian real may depreciate or appreciate substantially against the U.S. dollar in the future. Exchange rate fluctuations may adversely affect our financial condition. See also “Item 10. Additional Information—D. Exchange Controls—Foreign Exchange Controls—Brazil.”

Prior to March 14, 2005, under Brazilian regulations, foreign exchange transactions were carried out on either the commercial rate exchange market or the floating rate exchange market. Rates in the two markets were generally the same. On March 14, 2005, the National Monetary Council of Brazil ( Conselho Monetário Nacional ) unified the two markets.

The following table sets forth the exchange selling rates expressed in Brazilian reais per U.S. dollar for the periods indicated, as reported by the Central Bank of Brazil through the Central Bank System (Sistema do Banco Central) using PTAX 800, option 5.

|

|

|

Daily observed exchange rate R$ per U.S.$ |

|

||||||

|

|

|

High |

|

Low |

|

Average |

|

Period end |

|

|

Year ended December 31, |

|

|

|

|

|

|

|

|

|

|

2011 |

|

1.8811 |

|

1.6554 |

|

1.7593 |

|

1.6662 |

|

|

2012 |

|

1.9016 |

|

1.5345 |

|

1.6746 |

|

1.8758 |

|

|

2013 |

|

2.1121 |

|

1.7024 |

|

1.9550 |

|

2.0435 |

|

|

2014 |

|

2.7403 |

|

2.1974 |

|

2.3547 |

|

2.6562 |

|

|

2015 |

|

4.1949 |

|

2.5754 |

|

3.3314 |

|

3.9048 |

|

|

Month end |

|

|

|

|

|

|

|

|

|

|

October 31, 2015 |

|

4.0010 |

|

3.7386 |

|

3.8801 |

|

3.8589 |

|

|

November 30, 2015 |

|

3.8506 |

|

3.7010 |

|

3.7765 |

|

3.8506 |

|

|

December 31, 2015 |

|

3.9831 |

|

3.7476 |

|

3.8711 |

|

3.9048 |

|

|

January 31, 2016 |

|

4.1558 |

|

3.9863 |

|

4.0524 |

|

4.0428 |

|

|

February 29, 2016 |

|

4.0492 |

|

3.8653 |

|

3.9737 |

|

3.9796 |

|

|

March 31, 2016 |

|

3.9913 |

|

3.5589 |

|

3.7039 |

|

3.5589 |

|

|

April 2016 (through April 22, 2016) |

|

3.6921 |

|

3.5126 |

|

3.5817 |

|

3.5472 |

|

Source: Central Bank of Brazil.

(1) Represents the daily average exchange rate during each of the relevant periods.

B.

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D. RISK FACTORS

We are subject to various economic, political, social and competitive conditions. Any of the following risks, if they materialize, could materially and adversely affect our business, results of operations, prospects and financial condition.

Risks Relating to Our Company

We rely heavily on our relationship with The Coca-Cola Company, which has substantial influence over our business and operations.

The Coca-Cola Company has substantial influence on the conduct of our business. The interests of The Coca-Cola Company may be different from the interests of our remaining shareholders, which may result in us taking actions contrary to the interests of our remaining shareholders.

76% of our net sales for the year ended December 31, 2015 were derived from the distribution of soft drinks under The Coca-Cola Company trademarks, and an additional 19% was derived from the distribution of other beverages also bearing trademarks owned by The Coca-Cola Company. We produce, market and distribute Coca-Cola products through standard bottler agreements between our bottler subsidiaries and , in each case, The Coca-Cola Company’s local subsidiary or The Coca-Cola Company, or, in the case of juices and nectars, The Minute Maid Company, a subsidiary of The Coca-Cola Company. The Coca-Cola Company has the ability to exercise substantial influence over our business through its rights under these bottler agreements. Under these bottler agreements, The Coca-Cola Company unilaterally sets the prices for Coca-Cola soft drink concentrate sold to us. The Coca-Cola Company also monitors our prices and has the right to review and approve our marketing, operational and advertising plans. In addition, The Coca-Cola Company may unilaterally set the price for its concentrate, and it may in the future increase the price we pay for concentrate, increasing our costs. These factors may impact our profit margins, which could adversely affect our net income and results of operations.

Our marketing campaigns for Coca-Cola products are designed and controlled by The Coca-Cola Company. The Coca-Cola Company also makes significant contributions to our marketing expenses, although it is not required to contribute a particular amount. Accordingly, The Coca-Cola Company may discontinue or reduce such contribution at any time. Pursuant to the bottler agreements, we are required to submit a business plan to The Coca-Cola Company for prior approval on a yearly basis. In accordance with our bottler agreements, The Coca-Cola Company may, among other things, require that we demonstrate the financial ability to meet our business plan, and if we are not able to demonstrate our financial capacity, The Coca-Cola Company may terminate our rights to produce, market and distribute Coca-Cola soft drinks or other Coca-Cola beverages in territories where we have such approval. Under these bottler agreements, we are prohibited from producing, bottling, distributing or selling any products that could be substituted for, be confused with or be considered an imitation of, Coca-Cola soft drinks or other Coca-Cola beverages and products.

We depend on The Coca-Cola Company to renew our bottler agreements, which are subject to termination by The Coca-Cola Company in the event we default or upon expiration of their respective terms. We currently are party to five bottler agreements: two agreements for Chile, which expire in 2018 and 2019, one agreement for Brazil, which expires in 2017, one agreement for Argentina, which expires in 2017, and one agreement for Paraguay, which expires in 2020. We cannot provide any assurance that our bottler agreements will be maintained or extended upon their termination. Even if they are renewed, we cannot provide any assurance that renewal will be granted on the same terms as those currently in effect. Termination, non-extension or non-renewal of any of our bottler agreements would have a material adverse effect on our business, financial condition and results of operation.

In addition, any acquisition we make of bottlers of Coca-Cola products in other territories may require, among other things, the consent of The Coca-Cola Company under bottler agreements to which such other bottlers are subject. We cannot assure you that The Coca-Cola Company will consent to any future geographic expansion of our Coca-Cola beverage business. In addition, we cannot assure you that our relationship with The Coca-Cola Company will not deteriorate or otherwise undergo significant changes in the future. If such changes do occur, our operations and financial results and condition could be materially affected.

The nonalcoholic beverage business environment is changing rapidly, including as a result of increased obesity and other health concerns, which could have a material adverse effect on demand for our products, and consequently on our financial performance.

Consumers, public health officials and government officials in the majority of our markets, are increasingly concerned with public health consequences associated with obesity, particularly among young people. Some researchers, health advocates and dietary guidelines are encouraging consumers to reduce consumption of sugar-sweetened beverages and beverages sweetened with High Fructose Corn Syrup, nutritive or alternative sweeteners. Increasing public concern about these issues, the possibility of taxes on sugar-sweetened beverages, additional governmental regulations concerning the marketing, labeling, packaging or sale of our beverages and any negative publicity resulting from actual or threatened legal actions against nonalcoholic beverage companies relating to the marketing, labeling or sale of beverages may reduce demand for our products, which could adversely affect our profitability.

In addition, concerns over the environmental impact of plastic may reduce the consumption of our products sold in plastic bottles or result in additional taxes that would adversely affect consumer demand.

The nonalcoholic beverage business environment in our territories is dynamic and constantly evolving rapidly as a result of, among other things, changes in consumer preferences, including changes based on health and nutrition considerations and obesity concerns; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing pressures. If we are unable to adapt successfully to the changing environment and retail landscape, our share of nonalcoholic beverage sales, volume growth and overall financial results will be adversely affected.

Our business is highly competitive, including with respect to price competition, which may adversely affect our net profits and margins.

The soft drink and nonalcoholic beverage businesses are highly competitive in each of the territories in which we operate. We compete with bottlers of local and regional brands, including low cost beverages and Pepsi products. In Argentina and Brazil, we compete with Companhia de Bebidas das Americas, commonly referred to as AmBev, the largest brewer in Latin America and a subsidiary of InBev S.A., which sells Pepsico trademark products, in addition to a portfolio that includes local brands with flavors such as Guaraná. In Chile, our main competitor is Compañía de Cervecerías Unidas, which sells Pepsico trademark products as well as a portfolio that includes juices and waters. In Paraguay, our main competitor is Embotelladora Central with Niki and De la Costa trademarks (which are low cost “B-brands”), followed by AV S.A. a bottler of the Pepsico trademark. This competition in each of the regions where we operate is likely to continue, and we cannot assure you that it will not intensify in the future, which could materially and adversely affect our financial condition and results of operations.

Raw material prices may be subject to U.S. dollar/local currency exchange risk and price volatility, which could increase our costs of operations.

In addition to water, our most significant raw materials are (1) concentrate, which we acquire from affiliates of The Coca-Cola Company, (2) sweeteners and (3) packaging materials. Our most significant packaging raw material costs arise from the purchase of resin and plastic preforms to make plastic bottles and from the purchase of finished plastic bottles, the prices of which are related to crude oil prices and global resin supply. Prices for concentrate are determined by The Coca-Cola Company and the Coca-Cola Company has unilaterally increased concentrate prices in the past and may do so again in the future. We cannot assure you that The Coca-Cola Company will not increase the price of the concentrate for Coca-Cola trademark beverages or change the manner in which such price will be calculated in the future. We may not be successful in negotiating or implementing measures to mitigate the negative effect this may have in the pricing of our products or our results. The prices for our remaining raw materials are driven by market prices and local availability, the imposition of import duties and restrictions and fluctuations in exchange rates.

We purchase our raw materials from both domestic and international suppliers, some of which must be approved by The Coca-Cola Company, which may limit the number of suppliers available to us. Because the prices of the main raw materials are denominated in U.S. dollars, we are subject to local currency risk with respect to each of our operations. If any of the Chilean peso, Brazilian real, Argentine peso, or Paraguayan guaraní were to depreciate significantly against the U.S. dollar, the cost of certain raw materials in our respective territories could rise significantly, which could have an adverse effect on our financial condition and results of operations. We cannot assure you that these currencies will not lose value against the U.S. dollar in the future. Additionally, some raw material prices are subject to high volatility, which could also have a material adverse effect on our profitability. The supply or cost of specific raw materials could be adversely affected by domestic or global price changes, strikes, weather conditions, governmental controls or other factors. Any sustained interruption in the supply of these raw materials or any significant increase in their price could have a material adverse effect on our financial performance.

Instability in the supply of utility services and oil prices may adversely impact our results of operations.

Our operations depend on a stable supply of utilities and fuel in the countries where we operate. Electrical power outages could lead to increased energy prices and possible service interruptions. Interruptions in the supply of water could also generate an increase of our production costs and possible service interruptions. We cannot assure you that in the future we will not experience energy or water supply interruptions that could materially and adversely affect our business. In addition, a significant increase in energy prices would raise our costs, which could materially impact our results of operations. Fluctuations in oil prices have adversely affected our cost of energy and transportation in the regions where we operate and we expect that they will continue to do so in the future. We cannot assure you that fuel prices will not increase in the future, and a significant increase in fuel price may have a significant effect on our financial performance.

Water scarcity and poor water quality could adversely impact our production costs and capacity.

Water is the main ingredient in substantially all of our products. It is also a limited resource in many parts of the world, facing unprecedented challenges from overexploitation, increasing pollution and poor management. As demand for water continues to increase around the world, and as the quality of available water deteriorates, we may incur increasing production costs or face capacity constraints that could adversely affect our profitability or net operating revenues. We obtain water from various sources in our territories, including springs, wells, rivers and municipal and state water companies pursuant to either concessions granted by governments in our various territories or pursuant to contracts. We are also subject to uncertainty regarding the interpretation of the laws of the countries in which we operate, and any ambiguity or uncertainty regarding the interpretation or application of regulations can result in increased production costs or penalties for non-compliance, which are impossible or difficult to predict. We also anticipate discussions on new regulations on ownership and water usage in Chile and Paraguay. Additionally, water supply in the São Paulo region has been recently affected by low rainfall, which has affected the main water reservoir that serves the greater São Paulo area. Water shortages or changes in governmental regulations aimed at rationing water in the region could affect our water supply.

We cannot assure you that water will be available in sufficient quantities to meet our future production needs or will prove sufficient to meet our water supply needs.

Significant additional labeling or warning requirements may inhibit sales of our products.

The countries in which we operate may adopt significant advertising restrictions as well as additional product labeling or warning requirements relating to the chemical content or perceived adverse health consequences of certain of our Coca-Cola products or other products. In addition, the Chilean congress recently passed a new law which will become effective on June 27, 2016, with respect to labeling of certain consumer products, including soft drinks and bottled juices and waters such as ours. In October 2015 we instituted a plan to adjust our labels to the new requirements of this law in order to be able to comply with its requirements once it becomes effective. Due to the difficulty of determining the future scope and interpretation of the requirements of this law we may be subject to ambiguity or uncertainty with respect to its interpretation and application which could result in non-compliance and associated costs and penalties, which are impossible or difficult to predict. These requirements may adversely affect sales of our products.

Our business may be adversely affected if we are unable to maintain brand image and product quality.

Our beverage business is highly dependent on maintaining the reputation of our products in the countries where we operate. If we fail to maintain high standards for product quality, our reputation and ability to remain a distributor of Coca-Cola beverages in the countries where we operate could be jeopardized. Negative publicity or incidents related to our products may reduce their demand and could have a material adverse effect on our financial performance. If any of our products is defective or found to contain contaminants, or causes injury or illness, we may be subject to product recalls or other liabilities.

We take precautions to ensure that our beverage products are free from contaminants and that our packaging materials (such as bottles, crowns, cans and other containers) are free of defects. Such precautions include quality-control programs for primary materials, the production process and our final products.

We have established procedures to correct problems detected.

In the event that contamination or a defect does occur in the future, it may lead to business interruptions, product recalls or liability, each of which could have an adverse effect on our business, reputation, prospects, financial condition and results of operations.

Although we maintain insurance policies against certain product liability risks, we may not be able to enforce our rights in respect of these policies, and, in the event that a defect occurs, any amounts that we recover may not be sufficient to offset any damage we may suffer, which could adversely impact our business, results of operations and financial condition.

Trademark infringement could adversely impact our beverage business.

A significant portion of our sales derives from sales of soft drinks branded with Coca-Cola trademarks, as well as other trademarks. If other parties attempt to misappropriate trademarks we use, we may be unable to protect these trademarks. The maintenance of the reputation of these brands is essential for the future success of our beverage business. Misappropriation of trademarks we use, or challenges thereto, could have a material adverse effect on our financial performance.

Weather conditions or natural disasters may adversely affect our business.

Lower temperatures and higher rainfall may negatively impact consumer patterns, which may result in lower per capita consumption of our beverage offerings. Additionally, adverse weather conditions or natural disasters may affect road infrastructure in the countries in which we operate and limit our ability to sell and distribute our products. For example, in February of 2010 our business experienced a temporary interruption in our production as a result of the 8.8 magnitude earthquake in central Chile; and in March 2015, flash floods in the north of Chile interrupted our production and distribution in such territory.

Our insurance coverage may not adequately cover losses resulting from the risks for which we are insured.

We maintain insurance for our principal facilities and other assets. Our insurance coverage protects us in the event we suffer certain losses resulting from theft, fraud, expropriation, business interruption, natural disasters or other similar events or from business interruptions caused by such events. In addition, we maintain insurance policies for our directors and officers. We cannot assure you that our insurance coverage will be sufficient or will provide adequate compensation for losses that we may incur.

If we are unable to protect our information systems against data corruption, cyber-based attacks or network security breaches, our operations could be disrupted.