|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

94-3267295

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

(Including associated Preferred Stock Purchase Rights)

|

|

The NASDAQ Stock Market LLC

(NASDAQ Global Market)

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

|

Non-accelerated filer

o

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

|

|

Page

|

|

Item 1.

|

Business

|

|

|

Executive Officers of the Registrant

|

||

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Consolidated Financial Data

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 8.

|

Consolidated Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

|

|

Signatures

|

||

|

Fiscal Year

|

||||||||

|

Percentage of Net Revenues by Product

|

2013

|

2012

|

2011

|

|||||

|

Invisalign Full

|

58

|

%

|

61

|

%

|

63

|

%

|

||

|

Invisalign Express/Lite

|

11

|

|

9

|

|

9

|

|

||

|

Invisalign Teen

|

13

|

|

12

|

|

11

|

|

||

|

Invisalign Assist

|

4

|

|

5

|

|

6

|

|

||

|

Invisalign Non-case*

|

7

|

|

5

|

|

5

|

|

||

|

Scanners**

|

4

|

|

4

|

|

3

|

|

||

|

CAD/CAM Services**

|

3

|

|

4

|

|

3

|

|

||

|

Total net revenues

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

*

|

Non-case net revenues include retainers, training revenues, and ancillary offerings under our Clear Aligner product lines

|

|

**

|

As the acquisition of Cadent Holdings, Inc. (“Cadent”) closed on April 29, 2011, the fiscal year 2011 percentages for Scanners and CAD/CAM Services only reflect eight months of net revenues.

|

|

•

|

Precision Cuts, which are custom mesial and distal hooks used to provide anchorage for elastics and button cutouts to accommodate buttons bonded to the tooth aimed to help treat patients with Class II and Class III malocclusion; and

|

|

•

|

SmartForce features engineered to achieve more predictable tooth movements using custom optimized attachments and Power Ridges designed to provide additional force in cases where certain types of root movement are prescribed.

|

|

•

|

Precision aligner bite ramps designed to disocclude the posterior teeth for improved efficiency in deep bite treatments.

|

|

1.

|

Market Expansion

. We expect to continue to grow and expand our business by investing in resources, infrastructure, and initiatives that will drive growth from both a geographic and market segment standpoint. From a geographic standpoint, we focus our efforts on expanding our sales territory coverage in all of our direct sales geographies, with particular emphasis in our highest growth areas such as Europe and the Asia Pacific region. We strive to make sure that our new geographies and our expanded territories internationally have everything they need from the products, to the support, to the people, in order to successfully establish Invisalign as the treatment of choice for orthodontics in each geographic market. From a market segment standpoint, we are focused on two important markets: adults and teenagers. We believe expansion in these two markets can be achieved through product innovations that can expand the types of indications our Invisalign products can treat, as well as by expanding the overall market for orthodontics, primarily with adults who would not otherwise seek treatment with traditional wires and brackets. We believe continued market expansion can be achieved by having the right products, services, and communications worldwide to give our doctors the confidence they need to treat with Invisalign more often and attract potential patients to their practice so they ask for Invisalign by name.

|

|

2.

|

Doctor Preference.

We want all of our doctors to have the confidence and motivation to lead with Invisalign for every patient that walks into their practice. We strive to achieve this by investing in two areas. First, continuing to improve product predictability and applicability for more complex cases thereby expanding the types of malocclusion that our Invisalign products can treat. As an example, we recently launched Invisalign G5 in February 2014, which represented our first set of features engineered specifically to treat deep bite malocclusion. We estimate that deep bite manifests itself in approximately 30% to 40% of the orthodontic cases treated worldwide depending on geography. Secondly, enhancing the customer’s experience by making it easier to treat with and integrate Invisalign into their practices. As an example, we recently launched ClinCheck Pro in February 2014, the next generation Invisalign treatment software tool, designed to simplify the treatment process and help our doctors achieve their treatment goals.

|

|

3.

|

Brand Strength.

Our goal is to make Invisalign a highly recognized name brand worldwide by creating awareness for Invisalign treatment among consumers and motiving potential patients to seek treatment from an Invisalign provider. In support of this objective, we invest in initiatives designed to strengthen our global brand name recognition and drive consumer purchase intent. We accomplish this objective through an integrated consumer marketing strategy that includes television, media, social networking and event marketing.

|

|

•

|

effectiveness of treatment;

|

|

•

|

price;

|

|

•

|

software features;

|

|

•

|

aesthetic appeal of the treatment method;

|

|

•

|

customer support;

|

|

•

|

customer online interface;

|

|

•

|

brand awareness;

|

|

•

|

innovation;

|

|

•

|

distribution network;

|

|

•

|

comfort associated with the treatment method;

|

|

•

|

oral hygiene;

|

|

•

|

ease of use; and

|

|

•

|

dental professionals’ chair time.

|

|

Name

|

Age

|

Position

|

|

Thomas M. Prescott

|

58

|

President and Chief Executive Officer

|

|

David L. White

|

58

|

Chief Financial Officer

|

|

Jennifer M. Erfurth

|

44

|

Vice President, Global Human Resources

|

|

Roger E. George

|

48

|

Vice President, Legal and Corporate Affairs General Counsel

|

|

John P. Graham

|

45

|

Vice President, Marketing and Chief Marketing Officer

|

|

Timothy A. Mack

|

55

|

Vice President, Marketing and Business Development

|

|

Raphael Pascaud

|

42

|

Vice President, International

|

|

Christopher C. Puco

|

53

|

Vice President, North American Sales

|

|

Zelko Relic

|

49

|

Vice President, Research & Development

|

|

Emory M. Wright

|

44

|

Vice President, Operations

|

|

•

|

slower adoption or lack of acceptance for intra-oral scanning products in general or our chairside features;

|

|

•

|

our inability to increase utilization by integrating Invisalign treatment more fully with intra-oral scanners;

|

|

•

|

difficulty in integrating the technology, operations, internal accounting controls or work force of the acquired business with our existing business;

|

|

•

|

diversion of management resources and focus from ongoing business matters;

|

|

•

|

retention of key employees following the acquisition;

|

|

•

|

continued changes in the competitive environment, including recent announcements from competitors of new lower-priced scanners which we expect will lengthen the customer evaluation process and may result in price reductions and/or loss of sales;

|

|

•

|

difficulty dealing with tax, employment, logistics, and other related issues unique to international operations in Israel and the Asia Pacific region;

|

|

•

|

possible impairment of relationships with employees and customers as a result of the integration;

|

|

•

|

possible inconsistencies in standards, controls, procedures and policies among the acquired businesses and Align, which may make it more difficult to implement and harmonize worldwide financial reporting, accounting, billing, information technology and other systems;

|

|

•

|

a large portion of Cadent’s operations are located in Israel, accordingly, any increase in hostilities in the Middle East involving Israel may cause interruption or suspension of business operations without warning; and

|

|

•

|

negative impact on our results of operations and financial condition from acquisition-related charges, further impairment of goodwill, impairment of intangible assets and/or asset impairment charges.

|

|

•

|

limited visibility into and difficulty predicting the level of activity in our customers’ practices from quarter to quarter;

|

|

•

|

weakness in consumer spending as a result of the slowdown in the U.S. economy and global economies;

|

|

•

|

changes in relationships with our distributors;

|

|

•

|

changes in the timing of receipt of Invisalign case product orders during a given quarter which, given our cycle time and the delay between case receipts and case shipments, could have an impact on which quarter revenue can be recognized;

|

|

•

|

fluctuations in currency exchange rates against the U.S. dollar;

|

|

•

|

changes in product mix;

|

|

•

|

our inability to predict from period to period the number of trainers or the availability of doctors required to complete intra-oral scanner installations, which may impact the timing of when revenue is recognized;

|

|

•

|

if participation in our customer rebate program increases our average selling price will be adversely affected;

|

|

•

|

seasonal fluctuations in the number of doctors in their offices and their availability to take appointments;

|

|

•

|

success of or changes to our marketing programs from quarter to quarter;

|

|

•

|

our reliance on our contract manufacturers for the production of sub-assemblies for our intra-oral scanners;

|

|

•

|

timing of industry tradeshows;

|

|

•

|

changes in the timing of when revenue is recognized, including as a result of the introduction of new products or promotions or as a result of changes to critical accounting estimates or new accounting pronouncements;

|

|

•

|

changes to our effective tax rate;

|

|

•

|

unanticipated delays in production caused by insufficient capacity or availability of raw materials;

|

|

•

|

any disruptions in the manufacturing process, including unexpected turnover in the labor force or the introduction of new production processes, power outages or natural or other disasters beyond our control;

|

|

•

|

the development and marketing of directly competitive products by existing and new competitors;

|

|

•

|

major changes in available technology or the preferences of customers may cause our current product offerings to become less competitive or obsolete;

|

|

•

|

aggressive price competition from competitors;

|

|

•

|

costs and expenditures in connection with litigation;

|

|

•

|

the timing of new product introductions by us and our competitors, as well as customer order deferrals in anticipation of enhancements or new products;

|

|

•

|

disruptions to our business due to political, economic or other social instability, including the impact of an epidemic any of which results in changes in consumer spending habits, consumers unable or unwilling to visit the orthodontist or general practitioners office, as well as any impact on workforce absenteeism;

|

|

•

|

inaccurate forecasting of net revenues, production and other operating costs; and

|

|

•

|

investments in research and development to develop new products and enhancements.

|

|

•

|

correctly identify customer needs and preferences and predict future needs and preferences;

|

|

•

|

include functionality and features that address customer requirements;

|

|

•

|

ensure compatibility of our computer operating systems and hardware configurations with those of our customers;

|

|

•

|

allocate our research and development funding to products with higher growth prospects;

|

|

•

|

anticipate and respond to our competitors’ development of new products and technological innovations;

|

|

•

|

differentiate our offerings from our competitors’ offerings;

|

|

•

|

innovate and develop new technologies and applications;

|

|

•

|

the availability of third-party reimbursement of procedures using our products;

|

|

•

|

obtain adequate intellectual property rights; and

|

|

•

|

encourage customers to adopt new technologies.

|

|

•

|

difficulties in hiring and retaining employees generally, as well as difficulties in hiring and retaining employees with the necessary skills to perform the more technical aspects of our operations;

|

|

•

|

difficulties in managing international operations;

|

|

•

|

fluctuations in currency exchange rates;

|

|

•

|

increased income taxes, and other restrictions and limitations, if we were to decide to repatriate any of our foreign cash balances back to the U.S.;

|

|

•

|

import and export license requirements and restrictions;

|

|

•

|

controlling production volume and quality of the manufacturing process;

|

|

•

|

political, social and economic instability, including as a result of increased levels of violence in Juarez, Mexico or the Middle East;

|

|

•

|

acts of terrorism and acts of war;

|

|

•

|

interruptions and limitations in telecommunication services;

|

|

•

|

product or material transportation delays or disruption, including as a result of health epidemics restricting travel to and from our international locations or as a result of natural disasters, such as earthquakes or volcanic eruptions;

|

|

•

|

burdens of complying with a wide variety of local country and regional laws;

|

|

•

|

trade restrictions and changes in tariffs; and

|

|

•

|

potential adverse tax consequences.

|

|

•

|

local political and economic instability;

|

|

•

|

the engagement of activities by our employees, contractors, partners and agents, especially in countries with developing economies, that are prohibited by international and local trade and labor laws and other laws prohibiting corrupt payments to government officials, including the Foreign Corrupt Practices Act, the UK Bribery Act of 2010 and export control laws, in spite of our policies and procedures designed to ensure compliance with these laws;

|

|

•

|

although it is our intention to permanently reinvest earnings outside the U.S., restrictions on the transfer of funds held by our foreign subsidiaries, including with respect to restrictions on our ability to repatriate foreign cash to the U.S at favorable tax rates;

|

|

•

|

fluctuations in currency exchange rates; and

|

|

•

|

increased expense of developing, testing and making localized versions of our products.

|

|

•

|

agreements with distributors may terminate prematurely due to disagreements or may result in litigation between the partners;

|

|

•

|

we may not be able to renew existing distributor agreements on acceptable terms;

|

|

•

|

our distributors may not devote sufficient resources to the sale of products;

|

|

•

|

our distributors may be unsuccessful in marketing our products;

|

|

•

|

our existing relationships with distributors may preclude us from entering into additional future arrangements with other distributors; and

|

|

•

|

we may not be able to negotiate future distributor agreements on acceptable terms.

|

|

•

|

product design, development, manufacturing and testing;

|

|

•

|

product labeling;

|

|

•

|

product storage;

|

|

•

|

pre-market clearance or approval;

|

|

•

|

complaint handling and corrective actions;

|

|

•

|

advertising and promotion; and

|

|

•

|

product sales and distribution.

|

|

•

|

warning letters, fines, injunctions, consent decrees and civil penalties;

|

|

•

|

repair, replacement, refunds, recall or seizure of our products;

|

|

•

|

operating restrictions or partial suspension or total shutdown of production;

|

|

•

|

refusing our requests for 510(k) clearance or pre-market approval of new products, new intended uses, or modifications to existing products;

|

|

•

|

withdrawing clearance or pre-market approvals that have already been granted; and

|

|

•

|

criminal prosecution.

|

|

•

|

storage, transmission and disclosure of medical information and healthcare records;

|

|

•

|

prohibitions against the offer, payment or receipt of remuneration to induce referrals to entities providing healthcare services or goods or to induce the order, purchase or recommendation of our products; and

|

|

•

|

the marketing and advertising of our products.

|

|

•

|

quarterly variations in our results of operations and liquidity;

|

|

•

|

changes in recommendations by the investment community or in their estimates of our net revenues or operating results;

|

|

•

|

speculation in the press or investment community concerning our business and results of operations;

|

|

•

|

strategic actions by our competitors, such as product announcements or acquisitions;

|

|

•

|

announcements of technological innovations or new products by us, our customers or competitors; and

|

|

•

|

general economic market conditions.

|

|

•

|

revenue recognition; and

|

|

•

|

leases.

|

|

Location

|

Lease/Own

|

Primary Use

|

Segment

|

Expiration of lease

|

|

San Jose, California

|

Lease

|

Office for headquarters, research & development, administrative personnel

|

Clear Aligner and SCCS

|

September 2017

|

|

San Jose, Costa Rica

|

Lease

|

Office for administrative personnel, manufacturing personnel, and customer care

|

Clear Aligner and SCCS

|

November 2017

|

|

Juarez, Mexico

|

Own

|

Manufacturing and office facility for manufacturing and administrative personnel

|

Clear Aligner and SCCS

|

N/A

|

|

Or Yehuda, Israel

|

Lease

|

Manufacturing and office for manufacturing, administrative personnel, and research and development

|

SCCS

|

October 2017

|

|

Moscow, Russia

|

Lease

|

Office for research and development

|

Clear Aligner and SCCS

|

April 1, 2017

|

|

High

|

Low

|

||||||

|

Year Ended December 31, 2013:

|

|||||||

|

Fourth quarter

|

$

|

60.00

|

|

$

|

41.83

|

|

|

|

Third quarter

|

$

|

49.08

|

|

$

|

36.92

|

|

|

|

Second quarter

|

$

|

38.74

|

|

$

|

29.53

|

|

|

|

First quarter

|

$

|

33.70

|

|

$

|

25.61

|

|

|

|

Year Ended December 31, 2012:

|

|||||||

|

Fourth quarter

|

$

|

39.39

|

|

$

|

23.45

|

|

|

|

Third quarter

|

$

|

39.82

|

|

$

|

30.02

|

|

|

|

Second quarter

|

$

|

35.15

|

|

$

|

26.06

|

|

|

|

First quarter

|

$

|

28.69

|

|

$

|

22.39

|

|

|

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

|||||||||||||||||||

|

Net revenues

1

|

$

|

660,206

|

|

$

|

560,041

|

|

$

|

479,741

|

|

$

|

387,126

|

|

$

|

312,333

|

|

||||

|

Gross profit

2

|

$

|

498,106

|

|

$

|

416,388

|

|

$

|

361,283

|

|

$

|

303,417

|

|

$

|

233,492

|

|

||||

|

Income (loss) from operations

3

|

94,212

|

|

85,592

|

|

90,360

|

|

102,734

|

|

(34,012

|

)

|

|||||||||

|

Other income (expense), net

|

(1,073

|

)

|

(1,296

|

)

|

(419

|

)

|

(731

|

)

|

119

|

|

|||||||||

|

Net income (loss) before provision for (benefit from) income taxes

3

|

93,139

|

|

84,296

|

|

89,941

|

|

102,003

|

|

(33,893

|

)

|

|||||||||

|

Provision for (benefit from) income taxes

|

28,844

|

|

25,605

|

|

23,225

|

|

27,750

|

|

(2,624

|

)

|

|||||||||

|

Net income (loss)

3

|

$

|

64,295

|

|

$

|

58,691

|

|

$

|

66,716

|

|

$

|

74,253

|

|

$

|

(31,269

|

)

|

||||

|

Net income (loss) per share

|

|||||||||||||||||||

|

Basic

|

$

|

0.80

|

|

$

|

0.73

|

|

$

|

0.86

|

|

$

|

0.98

|

|

$

|

(0.45

|

)

|

||||

|

Diluted

|

$

|

0.78

|

|

$

|

0.71

|

|

$

|

0.83

|

|

$

|

0.95

|

|

$

|

(0.45

|

)

|

||||

|

Shares used in computing net income (loss) per share:

|

|||||||||||||||||||

|

Basic

|

80,551

|

|

80,529

|

|

77,988

|

|

75,825

|

|

69,094

|

|

|||||||||

|

Diluted

|

82,589

|

|

83,040

|

|

80,294

|

|

78,080

|

|

69,094

|

|

|||||||||

|

|

December 31,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

|||||||||||||||||||

|

Working capital

4

|

$

|

369,338

|

|

$

|

330,022

|

|

$

|

236,699

|

|

$

|

295,637

|

|

$

|

180,056

|

|

||||

|

Total assets

|

832,147

|

|

756,312

|

|

649,264

|

|

476,943

|

|

355,240

|

|

|||||||||

|

Total long-term liabilities

|

22,839

|

|

19,224

|

|

10,366

|

|

6,222

|

|

961

|

|

|||||||||

|

Stockholders’ equity

|

$

|

633,970

|

|

$

|

581,317

|

|

$

|

490,781

|

|

$

|

377,747

|

|

$

|

273,036

|

|

||||

|

1

|

Net revenues for the year ended December 31, 2011 include eight months of revenues from our Scanners and CAD/CAM Services segment of approximately $28.0 million as a result of our acquisition of Cadent Holdings, Inc. on April 29, 2011. Net revenues for the year ended December 31, 2010 includes a $14.3 million release of previously deferred revenue for Invisalign Teen replacement aligners.

|

|

2

|

Gross profit for the year ended December 31, 2013 included an out of period adjustment of $1.7 million (See Note 1). Gross profit for the year ended December 31, 2012 included acquisition and integration related costs of $0.2 million, amortization of intangible assets of $0.9 million, and exit costs of $0.5 million. Gross profit for the year ended December 31, 2011 included acquisition and integration related costs of $0.4 million, amortization of intangible assets of $0.7 million, and exit costs of $0.8 million. For years ended December 31, 2010 and 2009, gross profit included amortization of prepaid royalties of $0.8 million and $6.2 million, respectively, related to the litigation settlement with Ormco. In addition, 2010 gross profit also included the $14.3 million release of previously deferred revenue for Invisalign Teen replacement aligners.

|

|

3

|

Income (loss) from operations, net income (loss) before provision for (benefit from) income taxes, and net income (loss) included the following, net of taxes:

|

|

•

|

$40.7 million and $26.3 million of goodwill and long-lived asset impairment, respectively, in 2013.

|

|

•

|

$1.9 million, net of tax, out of period adjustment in 2013 (see Note 1).

|

|

•

|

$36.6 million of goodwill impairment, $1.3 million acquisition and integration related costs, $4.5 million of amortization of intangible assets, and $0.8 million of exit costs in 2012.

|

|

•

|

$14.3 million release of previously deferred revenue for Invisalign Teen replacement aligners in 2010.

|

|

•

|

$10.0 million acquisition and integration related costs, $3.2 million of amortization of intangible assets, and exit costs of $1.1 million in 2011.

|

|

•

|

$0.8 million and $6.2 million of amortization of prepaid royalties related to the litigation settlement with Ormco in 2010 and 2009, respectively.

|

|

•

|

$4.5 million related to the class action litigation settlement with Leiszler in 2010.

|

|

•

|

$8.7 million benefit related to an insurance settlement over a disputed coverage under our general liability umbrella that was not previously reimbursed by our insurer related to the OrthoClear litigation in 2010.

|

|

•

|

Litigation settlement charge of $69.7 million related to Ormco in 2009.

|

|

•

|

Restructuring charges of $1.3 million in 2009.

|

|

4

|

Working capital is calculated as the difference between total current assets and total current liabilities.

|

|

•

|

New Products, Feature Enhancements and Technology Innovation

. Product innovation drives greater treatment predictability and clinical applicability, and ease of use for our customers, which supports adoption of Invisalign in their practices. Increasing applicability and treating more complex cases requires that we move away from individual features to comprehensive solutions so that Invisalign providers can more predictably treat the whole case, such as with Invisalign G5 for deep bite treatment. Launched in February 2014, Invisalign G5 was engineered to treat deep bite malocclusion in its entirety, making it easier for our customers to treat one of the most common malocclusions. In addition, in February 2014, we launched ClinCheck Pro, the next generation Invisalign treatment software tool, designed to provide more precise control over final tooth position and to help Invisalign providers achieve their treatment goals. We believe that over the long-term, clinical solutions and treatment tools will increase adoption of Invisalign; however, it is difficult to predict the rate of adoption which may vary by region and channel.

|

|

•

|

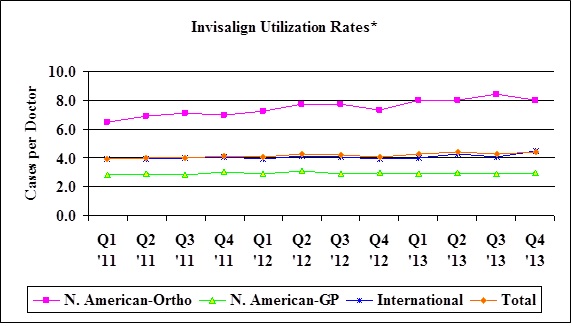

Invisalign Utilization rates.

Our goal is to establish Invisalign as the treatment of choice for treating malocclusion ultimately driving increased product adoption and frequency of use by dental professionals, also known as "utilization rates". Our quarterly utilization rates for the previous 12 quarters are as follows:

|

* Invisalign Utilization rates = # of cases shipped divided by # of doctors cases were shipped to

* Invisalign Utilization rates = # of cases shipped divided by # of doctors cases were shipped to

|

•

|

Number of new Invisalign doctors trained.

We continue to expand our Invisalign customer base through the training of new doctors. In 2013, Invisalign growth was driven primarily by increased utilization by our orthodontist customers as well as by the continued expansion of our customer base as we trained a total of 8,065 new Invisalign doctors. GPs are one of the keys to driving growth in the adult segment and in 2014 we launched a new CE I training course, now called Invisalign Fundamentals, designed to improve practice integration and increase utilization for newly trained doctors. We are implementing this new Invisalign Fundamentals program across North America and will look for opportunities to adjust our international training programs as we work to help our GP practices worldwide more successfully adopt Invisalign into their practices. We believe that this new training approach will increase the number of doctors submitting cases 90-days post-training, as well as the number of cases submitted per doctor.

|

|

•

|

International Clear Aligner.

We will continue to focus our efforts towards increasing adoption of our products by dental professionals in our direct international markets. On a year over year basis, international volume increased 25%, driven primarily by growth in Europe as well as by strong performance in the Asia-Pacific region. In 2014, we will continue to expand in our existing markets through targeted investments in sales coverage and professional marketing and education programs, along with consumer marketing in selected country markets. In addition, given the significant long term potential this extensive geography represents and the support we can now provide by utilizing our direct coverage model in Europe, beginning in February 2014, we will transition a small number of those countries into direct sales regions. We expect to leverage our existing infrastructure and resources to bring sales coverage and customer support to these countries, most of which are adjacent to our directly covered European countries. Due to the small volume of business from our EMEA distributor, we do not anticipate that this transition will have a material effect on our financial results in the next several years.

|

|

•

|

Foreign exchange rates.

Although the U.S. dollar is our reporting currency, a portion of our net revenues and income are generated in foreign currencies. Net revenues and income generated by subsidiaries operating outside of the U.S. are translated into U.S. dollars using exchange rates effective during the respective period and as a result are affected by changes in exchange rates. We have generally accepted the exposure to exchange rate movements without using derivative financial instruments to manage this risk; therefore, both positive and negative movements in currency exchange rates against the U.S. dollar will continue to affect the reported amount of net revenues and income in our consolidated financial statements.

|

|

•

|

Our Clear Aligner segment consists of our Invisalign System which includes Invisalign Full, Express/Lite, Teen, Assist, Vivera Retainers, along with our training and ancillary products for treating malocclusion.

|

|

•

|

Our SCCS segment consists of intra-oral scanning systems, and additional services available with the intra-oral scanners, that provide digital alternatives to the traditional cast models. This segment includes our iTero scanner and OrthoCAD services.

|

|

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

2013

|

Net

Change

|

%

Change

|

2012

|

Net

Change

|

%

Change

|

2011

|

|||||||||||||||||||

|

Clear Aligner

|

|||||||||||||||||||||||||

|

Region and Channel

|

|||||||||||||||||||||||||

|

North America

|

|||||||||||||||||||||||||

|

Orthodontist

|

$

|

203.9

|

|

$

|

31.4

|

|

18.2

|

%

|

$

|

172.5

|

|

$

|

25.0

|

|

16.9

|

%

|

$

|

147.5

|

|

||||||

|

GP

|

204.3

|

|

15.7

|

|

8.3

|

%

|

188.6

|

|

20.7

|

|

12.3

|

%

|

167.9

|

|

|||||||||||

|

Total North America

|

408.2

|

|

47.1

|

|

13.0

|

%

|

361.1

|

|

45.7

|

|

14.5

|

%

|

315.4

|

|

|||||||||||

|

International

|

161.7

|

|

36.9

|

|

29.6

|

%

|

124.8

|

|

13.3

|

|

11.9

|

%

|

111.5

|

|

|||||||||||

|

Invisalign non-case net revenues

|

44.7

|

|

14.0

|

|

45.6

|

%

|

30.7

|

|

6.0

|

|

24.3

|

%

|

24.7

|

|

|||||||||||

|

Total Clear Aligner net revenues

1

|

$

|

614.6

|

|

$

|

98.0

|

|

19.0

|

%

|

$

|

516.6

|

|

$

|

65.0

|

|

14.4

|

%

|

$

|

451.6

|

|

||||||

|

Product

|

|||||||||||||||||||||||||

|

Invisalign Full

|

$

|

382.0

|

|

$

|

43.4

|

|

12.8

|

%

|

$

|

338.6

|

|

$

|

36.3

|

|

12.0

|

%

|

$

|

302.3

|

|

||||||

|

Invisalign Express/Lite

|

72.4

|

|

20.9

|

|

40.6

|

%

|

51.5

|

|

8.9

|

|

20.9

|

%

|

42.6

|

|

|||||||||||

|

Invisalign Teen

|

84.9

|

|

17.8

|

|

26.5

|

%

|

67.1

|

|

12.6

|

|

23.1

|

%

|

54.5

|

|

|||||||||||

|

Invisalign Assist

|

30.6

|

|

1.9

|

|

6.6

|

%

|

28.7

|

|

1.3

|

|

4.7

|

%

|

27.4

|

|

|||||||||||

|

Invisalign non-case net revenues

|

44.7

|

|

14.0

|

|

45.6

|

%

|

30.7

|

|

5.9

|

|

23.8

|

%

|

24.8

|

|

|||||||||||

|

Total Clear Aligner net revenues

|

$

|

614.6

|

|

$

|

98.0

|

|

19.0

|

%

|

$

|

516.6

|

|

$

|

65.0

|

|

14.4

|

%

|

$

|

451.6

|

|

||||||

|

SCCS Services

2

:

|

|||||||||||||||||||||||||

|

Region

|

|||||||||||||||||||||||||

|

North America

|

$

|

45.3

|

|

$

|

3.1

|

|

7.3

|

%

|

$

|

42.2

|

|

$

|

18.2

|

|

75.8

|

%

|

$

|

24.0

|

|

||||||

|

International

|

0.3

|

|

(0.9

|

)

|

(75.0

|

)%

|

1.2

|

|

(2.9

|

)

|

(70.7

|

)%

|

4.1

|

|

|||||||||||

|

Total SCCS net revenues

|

$

|

45.6

|

|

$

|

2.2

|

|

5.1

|

%

|

$

|

43.4

|

|

$

|

15.3

|

|

54.4

|

%

|

$

|

28.1

|

|

||||||

|

Product

|

|||||||||||||||||||||||||

|

Scanners

|

$

|

23.7

|

|

$

|

3.7

|

|

18.5

|

%

|

$

|

20.0

|

|

$

|

6.7

|

|

50.4

|

%

|

$

|

13.3

|

|

||||||

|

CAD/CAM Services

|

21.9

|

|

(1.5

|

)

|

(6.4

|

)%

|

23.4

|

|

8.6

|

|

58.1

|

%

|

14.8

|

|

|||||||||||

|

Total SCCS net revenues

|

$

|

45.6

|

|

$

|

2.2

|

|

5.1

|

%

|

$

|

43.4

|

|

$

|

15.3

|

|

54.4

|

%

|

$

|

28.1

|

|

||||||

|

Total net revenues

|

$

|

660.2

|

|

$

|

100.2

|

|

17.9

|

%

|

$

|

560.0

|

|

$

|

80.3

|

|

16.7

|

%

|

$

|

479.7

|

|

||||||

|

1

|

In the fourth quarter of 2012, we identified an error that the actual case refinement usage rate was lower than our estimate and, as a result, we recorded a net revenue release of $4.9 million previously deferred for case refinement of which $5.2 million was a correction of an error of which $4.5 million related to the first three quarters for the fiscal year 2012 and $0.7 million related to the fiscal year 2011. The adjustment was not material to any quarter within 2012. The net amount of $4.9 million is not material to the results of operations for twelve months ended December 31, 2012.

|

|

2

|

As the acquisition of Cadent closed on April 29, 2011, the year ended December 31, 2011 balances for SCCS Services only reflect eight months of revenues.

|

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

Region and Channel

|

2013

|

Net

Change

|

%

Change

|

2012

|

Net

Change

|

%

Change

|

2011

|

|||||||||||||

|

North America:

|

||||||||||||||||||||

|

Orthodontist

|

159.6

|

|

22.6

|

|

16.5

|

%

|

137.0

|

|

21.6

|

|

18.7

|

%

|

115.4

|

|

||||||

|

GP

|

154.3

|

|

14.6

|

|

10.5

|

%

|

139.7

|

|

16.5

|

|

13.4

|

%

|

123.2

|

|

||||||

|

Total North American Invisalign

|

313.9

|

|

37.2

|

|

13.4

|

%

|

276.7

|

|

38.1

|

|

16.0

|

%

|

238.6

|

|

||||||

|

International Invisalign

|

108.5

|

|

21.7

|

|

25.0

|

%

|

86.8

|

|

16.0

|

|

22.6

|

%

|

70.8

|

|

||||||

|

Total Invisalign case volume

|

422.4

|

|

58.9

|

|

16.2

|

%

|

363.5

|

|

54.1

|

|

17.5

|

%

|

309.4

|

|

||||||

|

Product

|

||||||||||||||||||||

|

Invisalign Full

|

262.4

|

|

27.4

|

|

11.7

|

%

|

235.0

|

|

28.7

|

|

13.9

|

%

|

206.3

|

|

||||||

|

Invisalign Express/Lite

|

79.0

|

|

20.3

|

|

34.6

|

%

|

58.7

|

|

14.5

|

|

32.8

|

%

|

44.2

|

|

||||||

|

Invisalign Teen

|

59.6

|

|

11.3

|

|

23.4

|

%

|

48.3

|

|

10.3

|

|

27.1

|

%

|

38.0

|

|

||||||

|

Invisalign Assist

|

21.4

|

|

(0.1

|

)

|

(0.5

|

)%

|

21.5

|

|

0.6

|

|

2.9

|

%

|

20.9

|

|

||||||

|

Total Invisalign case volume

|

422.4

|

|

58.9

|

|

16.2

|

%

|

363.5

|

|

54.1

|

|

17.5

|

%

|

309.4

|

|

||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Clear Aligner

|

|||||||||||||||||||

|

Cost of revenues

|

$

|

129.8

|

|

$

|

19.4

|

|

$

|

110.6

|

|

$

|

13.5

|

|

$

|

97.1

|

|

||||

|

% of net segment revenues

|

21.1

|

%

|

21.4

|

%

|

21.5

|

%

|

|||||||||||||

|

Gross profit

|

$

|

484.8

|

|

$

|

78.8

|

|

$

|

406.0

|

|

$

|

51.3

|

|

$

|

354.7

|

|

||||

|

Gross margin %

|

78.9

|

%

|

78.6

|

%

|

78.5

|

%

|

|||||||||||||

|

Scanners and CAD/CAM Services

1

|

|||||||||||||||||||

|

Cost of revenues

|

$

|

32.3

|

|

$

|

(0.7

|

)

|

$

|

33.0

|

|

$

|

11.6

|

|

$

|

21.4

|

|

||||

|

% of net segment revenues

|

70.9

|

%

|

75.9

|

%

|

76.3

|

%

|

|||||||||||||

|

Gross profit

|

$

|

13.3

|

|

$

|

2.9

|

|

$

|

10.4

|

|

$

|

3.9

|

|

$

|

6.5

|

|

||||

|

Gross margin %

|

29.1

|

%

|

24.1

|

%

|

23.7

|

%

|

|||||||||||||

|

Total cost of revenues

|

$

|

162.1

|

|

$

|

18.5

|

|

$

|

143.6

|

|

$

|

25.1

|

|

$

|

118.5

|

|

||||

|

% of net revenues

|

24.6

|

%

|

25.7

|

%

|

24.7

|

%

|

|||||||||||||

|

Gross profit

|

$

|

498.1

|

|

$

|

81.7

|

|

$

|

416.4

|

|

$

|

55.2

|

|

$

|

361.2

|

|

||||

|

Gross margin %

|

75.4

|

%

|

74.3

|

%

|

75.3

|

%

|

|||||||||||||

|

1

|

The Scanners and CAD/CAM services segment was created as a result of our acquisition of Cadent on April 29, 2011 and the financial results for that segment reflect the activity since that date.

|

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Sales and marketing

|

$

|

180.0

|

|

$

|

28.0

|

|

$

|

152.0

|

|

$

|

9.8

|

|

$

|

142.2

|

|

||||

|

% of net revenues

|

27.3

|

%

|

27.1

|

%

|

29.6

|

%

|

|||||||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

General and administrative

|

$

|

112.8

|

|

$

|

13.5

|

|

$

|

99.3

|

|

$

|

7.7

|

|

$

|

91.6

|

|

||||

|

% of net revenues

|

17.1

|

%

|

17.7

|

%

|

19.1

|

%

|

|||||||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Research and development

|

$

|

44.1

|

|

$

|

1.2

|

|

$

|

42.9

|

|

$

|

5.7

|

|

$

|

37.2

|

|

||||

|

% of net revenues

|

6.7

|

%

|

7.7

|

%

|

7.7

|

%

|

|||||||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Impairment of goodwill

|

$

|

40.7

|

|

$

|

4.1

|

|

$

|

36.6

|

|

$

|

36.6

|

|

$

|

—

|

|

||||

|

% of net revenues

|

6.2

|

%

|

6.5

|

%

|

—

|

%

|

|||||||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Impairment of long-lived assets

|

$

|

26.3

|

|

$

|

26.3

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

% of net revenues

|

4.0

|

%

|

—

|

%

|

—

|

%

|

|||||||||||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Other income (expense), net

|

$

|

(1.1

|

)

|

$

|

0.2

|

|

$

|

(1.3

|

)

|

$

|

(0.9

|

)

|

$

|

(0.4

|

)

|

||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2013

|

Change

|

2012

|

Change

|

2011

|

||||||||||||||

|

Provision for income taxes

|

$

|

28.8

|

|

$

|

3.2

|

|

$

|

25.6

|

|

$

|

2.4

|

|

$

|

23.2

|

|

||||

|

Effective tax rates

|

31.0

|

%

|

30.4

|

%

|

25.8

|

%

|

|||||||||||||

|

|

Year Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Cash and cash equivalents

|

$

|

242,953

|

|

$

|

306,386

|

|

$

|

240,675

|

|

||

|

Short-term investments

|

127,040

|

|

28,485

|

|

7,395

|

|

|||||

|

Long-term investments

|

101,978

|

|

21,252

|

|

—

|

|

|||||

|

Total

|

$

|

471,971

|

|

$

|

356,123

|

|

$

|

248,070

|

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net cash flow provided by (used in):

|

|||||||||||

|

Operating activities

|

$

|

185,976

|

|

$

|

133,778

|

|

$

|

130,469

|

|

||

|

Investing activities

|

(210,734

|

)

|

(78,300

|

)

|

(211,606

|

)

|

|||||

|

Financing activities

|

(38,171

|

)

|

10,205

|

|

27,241

|

|

|||||

|

Effects of exchange rate changes on cash and cash equivalents

|

(504

|

)

|

28

|

|

(93

|

)

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

$

|

(63,433

|

)

|

$

|

65,711

|

|

$

|

(53,989

|

)

|

||

|

•

|

Impairment of goodwill related to our SCCS reporting unit was

$40.7 million

.

|

|

•

|

Impairment of long-lived assets related to our SCCS reporting unit was

$26.3 million

.

|

|

•

|

Excess tax benefits from our share-based compensation arrangements of

$27.1 million

.

|

|

•

|

Stock-based compensation was

$26.4 million

related to our equity incentive compensation granted to employees.

|

|

•

|

Depreciation and amortization of

$16.8 million

related to our fixed assets and acquired intangible assets.

|

|

•

|

Deferred taxes of

$21.2 million

primarily due to the utilization of deferred tax assets.

|

|

•

|

Accounts receivable increased by

$12.0 million

due to increases in net revenues, reducing our cash flow from operations.

|

|

•

|

Accrued and other long-term liabilities increased by

$9.7 million

due to compensation and bonuses accruals along with higher sales rebates increasing our cash flow from operating activities.

|

|

•

|

Deferred revenue increased by

$14.9 million

primarily due to higher product sales along with additional deferrals as a result of our mid-course correction policy change in June 2013, increasing our cash inflow from operating activities.

|

|

•

|

Impairment of goodwill related to our SCCS reporting unit was $36.6 million.

|

|

•

|

Stock-based compensation was $21.5 million related to our equity incentive compensation granted to employees.

|

|

•

|

Depreciation and amortization of $17.8 million related to our fixed assets and acquired intangible assets.

|

|

•

|

Deferred taxes of $17.8 million primarily due to the utilization of deferred tax assets.

|

|

•

|

Excess tax benefits from our share-based payments were $17.2 million.

|

|

•

|

Accounts receivable increased by $11.7 million due to the increase in revenues during 2012, reducing our cash flow from operating activities.

|

|

•

|

Inventories increased by $5.7 million which was primarily due to increased production volumes for our intra-oral scanner products in anticipation of the move to our new facility in Israel as well as procuring the new SmartTrack material for our clear aligners, increasing our cash flow from operating activities.

|

|

•

|

Prepaid expenses and other assets increased $3.9 million primarily due to the timing of software license and insurance policy renewals, increasing our cash flow from operations.

|

|

•

|

Accrued and other long-term liabilities increased by $2.9 million primarily due to higher deferred tax liabilities, decreasing our cash flow from operations.

|

|

•

|

Deferred revenue increased by $12.4 million primarily due to higher sales with deferred revenue components in 2012, increasing our cash flow from operations.

|

|

•

|

Stock-based compensation of $19.1 million related to our equity incentive compensation granted to employees.

|

|

•

|

Other non-cash activities including depreciation and amortization, deferred taxes, allowances for doubtful accounts and returns, amortization of intangible assets, benefits from tax provision for our share-based payments, and loss on the retirement/disposal of our fixed assets of $14.5 million.

|

|

•

|

Accrued and other long-term liabilities increased by $37.1 million primarily due to the an increase of compensation and related employee benefits, income tax payable and other sales and marketing costs, decreasing our cash flow from operations.

|

|

•

|

Deferred revenue increased by $16.3 million primarily due to higher sales with deferred revenue components in 2011, increasing our cash flow from operations.

|

|

•

|

Accounts receivable increased by $24.1 million due to the increase in revenues during 2011, reducing our cash flow from operating activities.

|

|

•

|

Other working capital comprising of inventories, prepaid expenses and other assets, and accounts payable, resulted in a net decrease of $0.8 million, increasing our cash flow from operations.

|

|

|

|

Payments Due by Period

|

|||||||||||||||||

|

|

Total

|

Less than

1 Year

|

1-2

Years

|

3-5

Years

|

More than

5 Years

|

||||||||||||||

|

Operating lease obligations

|

$

|

28,273

|

|

$

|

7,878

|

|

$

|

14,171

|

|

$

|

6,224

|

|

$

|

—

|

|

||||

|

Unconditional purchase obligations

|

12,807

|

|

12,807

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total contractual cash obligations

|

$

|

41,080

|

|

$

|

20,685

|

|

$

|

14,171

|

|

$

|

6,224

|

|

$

|

—

|

|

||||

|

•

|

VSOE – In most instances, products are sold separately in stand-alone arrangements. Services are also sold separately through renewals of contracts with varying periods. We determine VSOE based on its pricing and discounting practices for the specific product or service when sold separately, considering geographical, customer, and other economic or marketing variables, as well as renewal rates or stand-alone prices for the service element(s).

|

|

•

|

TPE – If we cannot establish VSOE of selling price for a specific product or service included in a multiple-element arrangement, we use third-party evidence of selling price. We determine TPE based on sales of comparable amount of similar products or service offered by multiple third parties considering the degree of customization and similarity of product or service sold.

|

|

•

|

BESP – The best estimated selling price represents the price at which we would sell a product or service if it were sold on a stand-alone basis. When VSOE or TPE do not exist for all elements, we determine BESP for the arrangement element based on sales, cost and margin analysis, as well as other inputs based on its pricing practices. Adjustments for other market and Company-specific factors are made as deemed necessary in determining BESP

.

|

|

|

Three Months Ended

|

||||||||||||||||||||||||||||||

|

|

2013

|

2012

|

|||||||||||||||||||||||||||||

|

|

31-Dec

|

30-Sept

|

30-June

|

31-Mar

|

31-Dec

|

30-Sept

|

30-June

|

31-Mar

|

|||||||||||||||||||||||

|

(in thousands, except per share data )

(unaudited )

|

|||||||||||||||||||||||||||||||

|

Net revenues

1

|

$

|

178,292

|

|

$

|

164,506

|

|

$

|

163,828

|

|

$

|

153,580

|

|

$

|

142,840

|

|

$

|

136,496

|

|

$

|

145,626

|

|

$

|

135,079

|

|

|||||||

|

Gross profit

2

|

136,476

|

|

125,090

|

|

123,691

|

|

112,849

|

|

106,478

|

|

100,350

|

|

108,800

|

|

100,760

|

|

|||||||||||||||

|

Income (loss) from operations

3

|

52,923

|

|

41,464

|

|

37,901

|

|

(38,075

|

)

|

17,071

|

|

4,503

|

|

36,012

|

|

28,006

|

|

|||||||||||||||

|

Net income (loss)

3 4

|

42,422

|

|

34,537

|

|

29,320

|

|

(41,983

|

)

|

9,559

|

|

(344

|

)

|

28,492

|

|

20,984

|

|

|||||||||||||||

|

Net income (loss) per share:

|

|||||||||||||||||||||||||||||||

|

Basic

|

$

|

0.53

|

|

$

|

0.43

|

|

$

|

0.36

|

|

$

|

(0.52

|

)

|

$

|

0.12

|

|

$

|

—

|

|

$

|

0.35

|

|

$

|

0.26

|

|

|||||||

|

Diluted

|

$

|

0.51

|

|

$

|

0.42

|

|

$

|

0.36

|

|

$

|

(0.52

|

)

|

$

|

0.12

|

|

$

|

—

|

|

$

|

0.34

|

|

$

|

0.26

|

|

|||||||

|

Shares used in computing net income per share:

|

|||||||||||||||||||||||||||||||

|

Basic

|

80,432

|

|

79,967

|

|

80,576

|

|

81,248

|

|

81,043

|

|

81,437

|

|

80,384

|

|

79,235

|

|

|||||||||||||||

|

Diluted

|

82,438

|

|

81,848

|

|

82,149

|

|

81,248

|

|

82,981

|

|

81,437

|

|

82,954

|

|

81,856

|

|

|||||||||||||||

|

1

|

In the fourth quarter of 2012, we identified an error that the actual case refinement usage rate was lower than our estimate and, as a result, we recorded a net revenue release of $4.9 million previously deferred for case refinement of which $5.2 million was a correction of an error of which $4.5 million relates to the first three quarters for the fiscal year 2012 and $0.7 million relates to the fiscal year 2011. The adjustment was not material to any quarter within 2012. The net amount of $4.9 million is not material to the results of operations for twelve months ended December 31, 2012.

|

|

2

|

Gross profit for the quarter ended March 2012 included acquisition and integration related costs of $0.1 million, amortization of intangible assets of $0.3 million, and exit costs of $0.3 million. Gross profit for the quarter ended June 2012 included acquisition and integration related costs of $0.1 million, amortization of intangible assets of $0.2 million, and exit costs of $0.1 million. Gross profit for the quarter ended September 2012 included acquisition and integration related costs of $0.1 million, amortization of intangible assets of $0.2 million, and exit costs of $0.1 million. Gross profit for the quarter ended December 2012 amortization of intangible assets of $0.2 million.

|

|

3

|

Income (loss) from operations and net income (loss) included, net of taxes,:

|

|

•

|

$40.7 million and $26.3 million of goodwill and long-lived asset impairment, respectively, in March 2013.

|

|

•

|

Impairment of goodwill of $24.7 million for the quarter ended September 2012 and $11.9 million for the quarter ended December 2012.

|

|

•

|

Acquisition and integration related costs of $0.7 million for the quarter ended March 2012, $0.3 million for the quarter ended June 2012, and $0.2 million for the quarter ended September 2012.

|

|

•

|

Exit costs of $0.5 million for the quarter ended March 2012, $0.2 million for the quarter ended June 2012, and $0.1 million for the quarter ended September 2012.

|

|

4

|

In the fourth quarter of 2013, we recorded an out of period correction that resulted in decreases in cost of net revenues of approximately $1.3 million and operating expense of $1.5 million offset in part by an increase in the provision for income taxes of $0.6 million. The overall increase of $2.2 million in net income related to the out of period correction was not material to the consolidated financial statements for any quarter within 2012 or 2013.

|

|

|

Page

|

|

Report of Management on Internal Control over Financial Reporting

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

Consolidated Statements of Operations

|

|

|

Consolidated Statements of Comprehensive Income

|

|

|

Consolidated Balance Sheets

|

|

|

Consolidated Statements of Stockholders’ Equity

|

|

|

Consolidated Statements of Cash Flows

|

|

|

Notes to Consolidated Financial Statements

|

|

|

•

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of Align;

|

|

•

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of Align are being made only in accordance with authorizations of management and directors of Align; and

|

|

•

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of Align's assets that could have a material effect on the financial statements.

|

|

/

S

/ THOMAS M. PRESCOTT

|

|

Thomas M. Prescott

|

|

President and Chief Executive Officer

|

|

February 28, 2014

|

|

/S/ DAVID L. WHITE

|

|

David L. White

|

|

Chief Financial Officer

|

|

February 28, 2014

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net revenues

|

$

|

660,206

|

|

$

|

560,041

|

|

$

|

479,741

|

|

||

|

Cost of net revenues

|

162,100

|

|

143,653

|

|

118,458

|

|

|||||

|

Gross profit

|

498,106

|

|

416,388

|

|

361,283

|

|

|||||

|

Operating expenses:

|

|||||||||||

|

Sales and marketing

|

180,046

|

|

152,041

|

|

142,174

|

|

|||||

|

General and administrative

|

112,752

|

|

99,295

|

|

91,595

|

|

|||||

|

Research and development

|

44,083

|

|

42,869

|

|

37,154

|

|

|||||

|

Impairment of goodwill

|

40,693

|

|

36,591

|

|

—

|

|

|||||

|

Impairment of long lived assets

|

26,320

|

|

—

|

|

—

|

|

|||||

|

Total operating expenses

|

403,894

|

|

330,796

|

|

270,923

|

|

|||||

|

Income from operations

|

94,212

|

|

85,592

|

|

90,360

|

|

|||||

|

Other income (expense), net

|

(1,073

|

)

|

(1,296

|

)

|

(419

|

)

|

|||||

|

Net income before provision for income taxes

|

93,139

|

|

84,296