|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

94-3267295

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

¨

|

|

Emerging growth company

|

¨

|

||

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

|

|||

|

PART I

|

||

|

ITEM 1.

|

||

|

ITEM 2.

|

||

|

ITEM 3.

|

||

|

ITEM 4.

|

||

|

PART II

|

||

|

ITEM 1.

|

||

|

ITEM 1A.

|

||

|

ITEM 2.

|

||

|

ITEM 3.

|

||

|

ITEM 4.

|

||

|

ITEM 5.

|

||

|

ITEM 6.

|

||

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

||||||||||||||

|

|

2017

|

2016

|

2017

|

2016

|

|||||||||||

|

Net revenues

|

$

|

385,267

|

|

$

|

278,589

|

|

$

|

1,052,090

|

|

$

|

786,671

|

|

|||

|

Cost of net revenues

|

92,779

|

|

69,387

|

|

253,060

|

|

191,626

|

|

|||||||

|

Gross profit

|

292,488

|

|

209,202

|

|

799,030

|

|

595,045

|

|

|||||||

|

Operating expenses:

|

|||||||||||||||

|

Selling, general and administrative

|

169,524

|

|

126,708

|

|

483,636

|

|

360,385

|

|

|||||||

|

Research and development

|

24,201

|

|

20,415

|

|

71,389

|

|

54,111

|

|

|||||||

|

Total operating expenses

|

193,725

|

|

147,123

|

|

555,025

|

|

414,496

|

|

|||||||

|

Income from operations

|

98,763

|

|

62,079

|

|

244,005

|

|

180,549

|

|

|||||||

|

Interest and other income (expense), net

|

3,750

|

|

1,463

|

|

8,607

|

|

1,161

|

|

|||||||

|

Net income before provision for income taxes and equity in losses of investee

|

102,513

|

|

63,542

|

|

252,612

|

|

181,710

|

|

|||||||

|

Provision for income taxes

|

18,344

|

|

11,698

|

|

26,508

|

|

39,172

|

|

|||||||

|

Equity in losses of investee, net of tax

|

1,614

|

|

477

|

|

4,950

|

|

477

|

|

|||||||

|

Net income

|

$

|

82,555

|

|

$

|

51,367

|

|

$

|

221,154

|

|

$

|

142,061

|

|

|||

|

Net income per share:

|

|||||||||||||||

|

Basic

|

$

|

1.03

|

|

$

|

0.64

|

|

$

|

2.76

|

|

$

|

1.78

|

|

|||

|

Diluted

|

$

|

1.01

|

|

$

|

0.63

|

|

$

|

2.71

|

|

$

|

1.74

|

|

|||

|

Shares used in computing net income per share:

|

|||||||||||||||

|

Basic

|

80,163

|

|

79,977

|

|

80,086

|

|

79,920

|

|

|||||||

|

Diluted

|

81,789

|

|

81,466

|

|

81,757

|

|

81,523

|

|

|||||||

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||

|

|

2017

|

2016

|

2017

|

2016

|

||||||||||||

|

Net income

|

$

|

82,555

|

|

$

|

51,367

|

|

$

|

221,154

|

|

$

|

142,061

|

|

||||

|

Net change in foreign currency translation adjustment

|

884

|

|

(76

|

)

|

1,624

|

|

(143

|

)

|

||||||||

|

Change in unrealized gains (losses) on investments, net of tax

|

60

|

|

(437

|

)

|

102

|

|

1,038

|

|

||||||||

|

Other comprehensive income (loss)

|

944

|

|

(513

|

)

|

1,726

|

|

895

|

|

||||||||

|

Comprehensive income

|

$

|

83,499

|

|

$

|

50,854

|

|

$

|

222,880

|

|

$

|

142,956

|

|

||||

|

September 30,

2017 |

December 31,

2016 |

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

362,613

|

|

$

|

389,275

|

|

|

|

Marketable securities, short-term

|

316,454

|

|

250,981

|

|

|||

|

Accounts receivable, net of allowance for doubtful accounts and returns of $5,843 and $4,310, respectively

|

321,328

|

|

247,415

|

|

|||

|

Inventories

|

36,941

|

|

27,131

|

|

|||

|

Prepaid expenses and other current assets

|

63,667

|

|

38,176

|

|

|||

|

Total current assets

|

1,101,003

|

|

952,978

|

|

|||

|

Marketable securities, long-term

|

58,842

|

|

59,783

|

|

|||

|

Property, plant and equipment, net

|

295,901

|

|

175,167

|

|

|||

|

Equity method investments

|

52,875

|

|

45,061

|

|

|||

|

Goodwill and intangible assets, net

|

90,070

|

|

81,998

|

|

|||

|

Deferred tax assets

|

73,532

|

|

67,844

|

|

|||

|

Other assets

|

25,400

|

|

13,320

|

|

|||

|

Total assets

|

$

|

1,697,623

|

|

$

|

1,396,151

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

45,942

|

|

$

|

28,596

|

|

|

|

Accrued liabilities

|

173,851

|

|

134,332

|

|

|||

|

Deferred revenues

|

241,576

|

|

191,407

|

|

|||

|

Total current liabilities

|

461,369

|

|

354,335

|

|

|||

|

Income tax payable

|

45,375

|

|

45,133

|

|

|||

|

Other long-term liabilities

|

8,921

|

|

1,294

|

|

|||

|

Total liabilities

|

515,665

|

|

400,762

|

|

|||

|

Commitments and contingencies (Note 8 and 9)

|

|

|

|||||

|

Stockholders’ equity:

|

|||||||

|

Preferred stock, $0.0001 par value (5,000 shares authorized; none issued)

|

—

|

|

—

|

|

|||

|

Common stock, $0.0001 par value (200,000 shares authorized; 80,176 and 79,553 issued and outstanding, respectively)

|

8

|

|

8

|

|

|||

|

Additional paid-in capital

|

880,045

|

|

864,871

|

|

|||

|

Accumulated other comprehensive income (loss), net

|

788

|

|

(938

|

)

|

|||

|

Retained earnings

|

301,117

|

|

131,448

|

|

|||

|

Total stockholders’ equity

|

1,181,958

|

|

995,389

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

1,697,623

|

|

$

|

1,396,151

|

|

|

|

|

Nine Months Ended

September 30, |

||||||

|

|

2017

|

2016

|

|||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|||||||

|

Net income

|

$

|

221,154

|

|

$

|

142,061

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||

|

Deferred taxes

|

(5,481

|

)

|

(17,476

|

)

|

|||

|

Depreciation and amortization

|

26,715

|

|

16,786

|

|

|||

|

Stock-based compensation

|

44,024

|

|

39,934

|

|

|||

|

Net tax benefits from stock-based awards

|

—

|

|

13,057

|

|

|||

|

Excess tax benefit from share-based payment arrangements

|

—

|

|

(13,943

|

)

|

|||

|

Equity in losses of investee

|

4,950

|

|

477

|

|

|||

|

Other non-cash operating activities

|

9,432

|

|

9,525

|

|

|||

|

Changes in assets and liabilities, net of effects of acquisitions:

|

|||||||

|

Accounts receivable

|

(84,437

|

)

|

(93,122

|

)

|

|||

|

Inventories

|

(10,709

|

)

|

(6,873

|

)

|

|||

|

Prepaid expenses and other assets

|

(5,848

|

)

|

(5,069

|

)

|

|||

|

Accounts payable

|

4,220

|

|

(4,134

|

)

|

|||

|

Accrued and other long-term liabilities

|

18,995

|

|

38,969

|

|

|||

|

Deferred revenues

|

53,198

|

|

46,482

|

|

|||

|

Net cash provided by operating activities

|

276,213

|

|

166,674

|

|

|||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|||||||

|

Acquisitions, net of cash acquired

|

(8,953

|

)

|

—

|

|

|||

|

Purchase of property, plant and equipment

|

(126,150

|

)

|

(56,368

|

)

|

|||

|

Purchase of marketable securities

|

(356,928

|

)

|

(283,797

|

)

|

|||

|

Proceeds from maturities of marketable securities

|

260,487

|

|

328,498

|

|

|||

|

Purchase of equity method investments

|

(12,764

|

)

|

(46,745

|

)

|

|||

|

Proceeds from sales of marketable securities

|

32,291

|

|

209,302

|

|

|||

|

Loan advances to equity investee

|

(23,000

|

)

|

—

|

|

|||

|

Loan repayment from equity investee

|

6,000

|

|

—

|

|

|||

|

Other investing activities

|

397

|

|

(8,031

|

)

|

|||

|

Net cash provided by (used in) investing activities

|

(228,620

|

)

|

142,859

|

|

|||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|||||||

|

Proceeds from issuance of common stock

|

13,850

|

|

12,877

|

|

|||

|

Common stock repurchases

|

(53,793

|

)

|

(58,174

|

)

|

|||

|

Excess tax benefit from share-based payment arrangements

|

—

|

|

13,943

|

|

|||

|

Employees’ taxes paid upon the vesting of restricted stock units

|

(39,093

|

)

|

(26,265

|

)

|

|||

|

Net cash used in financing activities

|

(79,036

|

)

|

(57,619

|

)

|

|||

|

Effect of foreign exchange rate changes on cash and cash equivalents

|

4,781

|

|

320

|

|

|||

|

Net increase (decrease) in cash and cash equivalents

|

(26,662

|

)

|

252,234

|

|

|||

|

Cash and cash equivalents, beginning of the period

|

389,275

|

|

167,714

|

|

|||

|

Cash and cash equivalents, end of the period

|

$

|

362,613

|

|

$

|

419,948

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

|||||||

|

Accounts payable or accrued liabilities related to property, plant and equipment

|

21,992

|

|

9,709

|

|

|||

|

September 30, 2017

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

Commercial paper

|

$

|

62,348

|

|

$

|

—

|

|

$

|

—

|

|

$

|

62,348

|

|

||||

|

Corporate bonds

|

164,661

|

|

31

|

|

(61

|

)

|

164,631

|

|

||||||||

|

U.S. government agency bonds

|

7,769

|

|

—

|

|

(8

|

)

|

7,761

|

|

||||||||

|

U.S. government treasury bonds

|

78,370

|

|

2

|

|

(33

|

)

|

78,339

|

|

||||||||

|

Certificates of deposit

|

3,375

|

|

—

|

|

—

|

|

3,375

|

|

||||||||

|

Total marketable securities, short-term

|

$

|

316,523

|

|

$

|

33

|

|

$

|

(102

|

)

|

$

|

316,454

|

|

||||

|

September 30, 2017

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

U.S. government agency bonds

|

$

|

7,990

|

|

$

|

3

|

|

$

|

—

|

|

$

|

7,993

|

|

||||

|

Corporate bonds

|

45,815

|

|

40

|

|

(18

|

)

|

45,837

|

|

||||||||

|

U.S. government treasury bonds

|

5,025

|

|

—

|

|

(13

|

)

|

5,012

|

|

||||||||

|

Total marketable securities, long-term

|

$

|

58,830

|

|

$

|

43

|

|

$

|

(31

|

)

|

$

|

58,842

|

|

||||

|

December 31, 2016

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

Commercial paper

|

$

|

42,397

|

|

$

|

—

|

|

$

|

(6

|

)

|

$

|

42,391

|

|

||||

|

Corporate bonds

|

122,788

|

|

22

|

|

(121

|

)

|

122,689

|

|

||||||||

|

Municipal securities

|

5,852

|

|

—

|

|

(5

|

)

|

5,847

|

|

||||||||

|

U.S. government agency bonds

|

28,903

|

|

9

|

|

(4

|

)

|

28,908

|

|

||||||||

|

U.S. government treasury bonds

|

45,146

|

|

7

|

|

(7

|

)

|

45,146

|

|

||||||||

|

Certificates of deposit

|

6,000

|

|

—

|

|

—

|

|

6,000

|

|

||||||||

|

Total marketable securities, short-term

|

$

|

251,086

|

|

$

|

38

|

|

$

|

(143

|

)

|

$

|

250,981

|

|

||||

|

December 31, 2016

|

Amortized

Cost

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Fair Value

|

||||||||||||

|

U.S. government agency bonds

|

$

|

6,805

|

|

$

|

—

|

|

$

|

(16

|

)

|

$

|

6,789

|

|

||||

|

Corporate bonds

|

40,889

|

|

8

|

|

(85

|

)

|

40,812

|

|

||||||||

|

U.S. government treasury bonds

|

12,016

|

|

5

|

|

(16

|

)

|

12,005

|

|

||||||||

|

Asset-backed securities

|

177

|

|

—

|

|

—

|

|

177

|

|

||||||||

|

Total marketable securities, long-term

|

$

|

59,887

|

|

$

|

13

|

|

$

|

(117

|

)

|

$

|

59,783

|

|

||||

|

September 30,

2017

|

December 31,

2016

|

||||||

|

One year or less

|

$

|

316,454

|

|

$

|

250,981

|

|

|

|

Due in greater than one year

|

58,842

|

|

59,783

|

|

|||

|

Total available for sale short-term and long-term marketable securities

|

$

|

375,296

|

|

$

|

310,764

|

|

|

|

Long-term Notes Receivable

|

|||

|

Balance as of December 31, 2016

|

$

|

2,047

|

|

|

Additional notes receivable issued

|

2,000

|

|

|

|

Accrued interest receivable

|

54

|

|

|

|

Change in fair value recognized in earnings

|

56

|

|

|

|

Balance as of September 30, 2017

|

$

|

4,157

|

|

|

Description

|

Balance as of

September 30, 2017

|

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

|

Significant Other

Observable Inputs

(Level 2)

|

Significant Other

Observable Inputs (Level 3) |

||||||||||||

|

Cash equivalents:

|

||||||||||||||||

|

Money market funds

|

$

|

177,486

|

|

$

|

177,486

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Commercial paper

|

13,295

|

|

—

|

|

13,295

|

|

—

|

|

||||||||

|

Short-term investments:

|

||||||||||||||||

|

Commercial paper

|

62,348

|

|

—

|

|

62,348

|

|

—

|

|

||||||||

|

Corporate bonds

|

164,631

|

|

—

|

|

164,631

|

|

—

|

|

||||||||

|

U.S. government agency bonds

|

7,761

|

|

—

|

|

7,761

|

|

—

|

|

||||||||

|

U.S. government treasury bonds

|

78,339

|

|

78,339

|

|

—

|

|

—

|

|

||||||||

|

Certificates of deposit

|

3,375

|

|

—

|

|

3,375

|

|

—

|

|

||||||||

|

Long-term investments:

|

||||||||||||||||

|

U.S. government agency bonds

|

7,993

|

|

—

|

|

7,993

|

|

—

|

|

||||||||

|

Corporate bonds

|

45,837

|

|

—

|

|

45,837

|

|

—

|

|

||||||||

|

U.S. government treasury bonds

|

5,012

|

|

5,012

|

|

—

|

|

—

|

|

||||||||

|

Prepaid expenses and other current assets:

|

||||||||||||||||

|

Israeli funds

|

3,310

|

|

—

|

|

3,310

|

|

—

|

|

||||||||

|

Other assets:

|

||||||||||||||||

|

Long-term notes receivable

|

4,157

|

|

—

|

|

—

|

|

4,157

|

|

||||||||

|

$

|

573,544

|

|

$

|

260,837

|

|

$

|

308,550

|

|

$

|

4,157

|

|

|||||

|

Description

|

Balance as of

December 31, 2016

|

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

|

Significant Other

Observable Inputs

(Level 2)

|

Significant Other

Observable Inputs (Level 3) |

||||||||||||

|

Cash equivalents:

|

||||||||||||||||

|

Money market funds

|

$

|

87,179

|

|

$

|

87,179

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Commercial paper

|

2,499

|

|

—

|

|

2,499

|

|

—

|

|

||||||||

|

Corporate bonds

|

750

|

|

—

|

|

750

|

|

—

|

|

||||||||

|

Short-term investments:

|

||||||||||||||||

|

Commercial paper

|

42,391

|

|

—

|

|

42,391

|

|

—

|

|

||||||||

|

Corporate bonds

|

122,689

|

|

—

|

|

122,689

|

|

—

|

|

||||||||

|

Municipal securities

|

5,847

|

|

—

|

|

5,847

|

|

—

|

|

||||||||

|

U.S. government agency bonds

|

28,908

|

|

—

|

|

28,908

|

|

—

|

|

||||||||

|

U.S. government treasury bonds

|

45,146

|

|

45,146

|

|

—

|

|

—

|

|

||||||||

|

Certificates of deposit

|

6,000

|

|

—

|

|

6,000

|

|

—

|

|

||||||||

|

Long-term investments:

|

||||||||||||||||

|

U.S. government agency bonds

|

6,789

|

|

—

|

|

6,789

|

|

—

|

|

||||||||

|

Corporate bonds

|

40,812

|

|

—

|

|

40,812

|

|

—

|

|

||||||||

|

U.S. government treasury bonds

|

12,005

|

|

12,005

|

|

—

|

|

—

|

|

||||||||

|

Asset-backed securities

|

177

|

|

—

|

|

177

|

|

—

|

|

||||||||

|

Prepaid expenses and other current assets:

|

||||||||||||||||

|

Israeli funds

|

2,956

|

|

—

|

|

2,956

|

|

—

|

|

||||||||

|

Other assets:

|

||||||||||||||||

|

Long-term notes receivable

|

2,047

|

|

—

|

|

—

|

|

2,047

|

|

||||||||

|

$

|

406,195

|

|

$

|

144,330

|

|

$

|

259,818

|

|

$

|

2,047

|

|

|||||

|

September 30,

2017 |

December 31,

2016 |

||||||

|

Raw materials

|

$

|

15,666

|

|

$

|

9,793

|

|

|

|

Work in process

|

12,819

|

|

10,773

|

|

|||

|

Finished goods

|

8,456

|

|

6,565

|

|

|||

|

Total inventories

|

$

|

36,941

|

|

$

|

27,131

|

|

|

|

September 30,

2017 |

December 31,

2016 |

||||||

|

Accrued payroll and benefits

|

$

|

84,418

|

|

$

|

79,214

|

|

|

|

Accrued expenses

|

38,983

|

|

21,811

|

|

|||

|

Accrued income taxes

|

10,486

|

|

4,210

|

|

|||

|

Accrued sales rebate

|

9,293

|

|

10,342

|

|

|||

|

Accrued sales tax and value added tax

|

8,693

|

|

5,032

|

|

|||

|

Accrued professional fees

|

8,181

|

|

3,604

|

|

|||

|

Accrued warranty

|

5,055

|

|

3,841

|

|

|||

|

Other accrued liabilities

|

8,742

|

|

6,278

|

|

|||

|

Total accrued liabilities

|

$

|

173,851

|

|

$

|

134,332

|

|

|

|

Nine Months Ended

September 30, |

|||||||

|

|

2017

|

2016

|

|||||

|

Balance at beginning of period

|

$

|

3,841

|

|

$

|

2,638

|

|

|

|

Charged to cost of revenues

|

5,201

|

|

3,440

|

|

|||

|

Actual warranty expenditures

|

(3,987

|

)

|

(2,681

|

)

|

|||

|

Balance at end of period

|

$

|

5,055

|

|

$

|

3,397

|

|

|

|

Total

|

|||

|

Balance as of December 31, 2016

|

$

|

61,044

|

|

|

Goodwill from distributor acquisitions

|

3,247

|

|

|

|

Adjustments

1

|

324

|

|

|

|

Balance as of September 30, 2017

|

$

|

64,615

|

|

|

Weighted Average Amortization Period (in years)

|

Gross Carrying Amount as of

September 30, 2017 |

Accumulated

Amortization

|

Accumulated

Impairment Loss

|

Net Carrying

Value as of September 30, 2017 |

|||||||||||||

|

Trademarks

|

15

|

$

|

7,100

|

|

$

|

(1,734

|

)

|

$

|

(4,179

|

)

|

$

|

1,187

|

|

||||

|

Existing technology

|

13

|

12,600

|

|

(4,563

|

)

|

(4,328

|

)

|

3,709

|

|

||||||||

|

Customer relationships

|

11

|

33,500

|

|

(14,216

|

)

|

(10,751

|

)

|

8,533

|

|

||||||||

|

Reacquired rights

1

|

3

|

7,500

|

|

(749

|

)

|

—

|

|

6,751

|

|

||||||||

|

Patents

|

8

|

6,316

|

|

(1,307

|

)

|

—

|

|

5,009

|

|

||||||||

|

Other

|

2

|

618

|

|

(352

|

)

|

—

|

|

266

|

|

||||||||

|

Total intangible assets

|

$

|

67,634

|

|

$

|

(22,921

|

)

|

$

|

(19,258

|

)

|

$

|

25,455

|

|

|||||

|

Weighted Average Amortization Period (in years)

|

Gross Carrying

Amount as of

December 31, 2016

|

Accumulated

Amortization

|

Accumulated Impairment Loss

|

Net Carrying

Value as of

December 31, 2016

|

|||||||||||||

|

Trademarks

|

15

|

$

|

7,100

|

|

$

|

(1,631

|

)

|

$

|

(4,179

|

)

|

$

|

1,290

|

|

||||

|

Existing technology

|

13

|

12,600

|

|

(4,141

|

)

|

(4,328

|

)

|

4,131

|

|

||||||||

|

Customer relationships

|

11

|

33,500

|

|

(12,819

|

)

|

(10,751

|

)

|

9,930

|

|

||||||||

|

Patents

|

8

|

6,316

|

|

(713

|

)

|

—

|

|

5,603

|

|

||||||||

|

Total intangible assets

|

$

|

59,516

|

|

$

|

(19,304

|

)

|

$

|

(19,258

|

)

|

$

|

20,954

|

|

|||||

|

|

|||

|

Remainder of 2017

|

$

|

2,215

|

|

|

2018

|

6,002

|

|

|

|

2019

|

5,887

|

|

|

|

2020

|

3,772

|

|

|

|

2021

|

3,349

|

|

|

|

Thereafter

|

4,230

|

|

|

|

Total

|

$

|

25,455

|

|

|

Fiscal Year Ending December 31,

|

Operating Leases

|

|||

|

Remainder of 2017

|

$

|

3,072

|

|

|

|

2018

|

12,785

|

|

||

|

2019

|

11,164

|

|

||

|

2020

|

8,503

|

|

||

|

2021

|

7,435

|

|

||

|

Thereafter

|

13,558

|

|

||

|

Total minimum future lease payments

|

$

|

56,517

|

|

|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2017

|

2016

|

2017

|

2016

|

|||||||||||

|

Cost of net revenues

|

$

|

833

|

|

$

|

995

|

|

$

|

2,526

|

|

$

|

2,888

|

|

|||

|

Selling, general and administrative

|

11,880

|

|

10,797

|

|

34,814

|

|

31,474

|

|

|||||||

|

Research and development

|

2,254

|

|

1,919

|

|

6,684

|

|

5,572

|

|

|||||||

|

Total stock-based compensation

|

$

|

14,967

|

|

$

|

13,711

|

|

$

|

44,024

|

|

$

|

39,934

|

|

|||

|

Number of Shares

Underlying

Stock Options

|

Weighted

Average

Exercise

Price per Share

|

Weighted Average

Remaining

Contractual Term (in Years)

|

Aggregate

Intrinsic

Value

|

|||||||||

|

Outstanding as of December 31, 2016

|

222

|

|

$

|

14.90

|

|

|||||||

|

Exercised

|

(110

|

)

|

16.19

|

|

||||||||

|

Cancelled or expired

|

(4

|

)

|

18.16

|

|

||||||||

|

Outstanding as of September 30, 2017

|

108

|

|

$

|

13.47

|

|

0.90

|

$

|

18,711

|

|

|||

|

Vested and expected to vest at September 30, 2017

|

108

|

|

$

|

13.47

|

|

0.90

|

$

|

18,711

|

|

|||

|

Exercisable at September 30, 2017

|

108

|

|

$

|

13.47

|

|

0.90

|

$

|

18,711

|

|

|||

|

Shares

Underlying RSUs

|

Weighted Average Grant Date Fair Value

|

Weighted

Remaining

Vesting

Period (in years)

|

Aggregate

Intrinsic

Value

|

|||||||||

|

Nonvested as of December 31, 2016

|

1,789

|

|

$

|

58.39

|

|

|||||||

|

Granted

|

456

|

|

110.40

|

|

||||||||

|

Vested and released

|

(785

|

)

|

53.61

|

|

||||||||

|

Forfeited

|

(71

|

)

|

67.22

|

|

||||||||

|

Nonvested as of September 30, 2017

|

1,389

|

|

77.72

|

|

1.34

|

$

|

258,838

|

|

||||

|

Number of Shares

Underlying MSUs

|

Weighted Average Grant Date Fair Value

|

Weighted Average

Remaining

Vesting Period (in years)

|

Aggregate

Intrinsic

Value

|

|||||||||

|

Nonvested as of December 31, 2016

|

520

|

|

$

|

60.49

|

|

|||||||

|

Granted

|

201

|

|

88.80

|

|

||||||||

|

Vested and released

|

(283

|

)

|

53.11

|

|

||||||||

|

Forfeited

|

(10

|

)

|

64.50

|

|

||||||||

|

Nonvested as of September 30, 2017

|

428

|

|

78.53

|

|

1.22

|

$

|

79,742

|

|

||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2017

|

2016

|

2017

|

2016

|

|||||||||||

|

Expected term (in years)

|

1.2

|

|

1.2

|

|

1.2

|

|

1.2

|

|

|||||||

|

Expected volatility

|

28.8

|

%

|

27.4

|

%

|

26.8

|

%

|

30.5

|

%

|

|||||||

|

Risk-free interest rate

|

1.2

|

%

|

0.5

|

%

|

1.0

|

%

|

0.7

|

%

|

|||||||

|

Expected dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||

|

Weighted average fair value at grant date

|

$

|

47.02

|

|

$

|

24.44

|

|

$

|

31.36

|

|

$

|

22.23

|

|

|||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2017

|

2016

|

2017

|

2016

|

|||||||||||

|

Numerator:

|

|||||||||||||||

|

Net income

|

$

|

82,555

|

|

$

|

51,367

|

|

$

|

221,154

|

|

$

|

142,061

|

|

|||

|

Denominator:

|

|||||||||||||||

|

Weighted-average common shares outstanding, basic

|

80,163

|

|

79,977

|

|

80,086

|

|

79,920

|

|

|||||||

|

Dilutive effect of potential common stock

|

1,626

|

|

1,489

|

|

1,671

|

|

1,603

|

|

|||||||

|

Total shares, diluted

|

81,789

|

|

81,466

|

|

81,757

|

|

81,523

|

|

|||||||

|

Net income per share, basic

|

$

|

1.03

|

|

$

|

0.64

|

|

$

|

2.76

|

|

$

|

1.78

|

|

|||

|

Net income per share, diluted

|

$

|

1.01

|

|

$

|

0.63

|

|

$

|

2.71

|

|

$

|

1.74

|

|

|||

|

•

|

Our Clear Aligner segment consists of Comprehensive Products, Non-Comprehensive Products and Non-Case revenues as defined below:

|

|

◦

|

Comprehensive Products include our Invisalign Full, Teen and Assist products.

|

|

◦

|

Non-Comprehensive Products include our Express/Lite products in addition to revenues from the sale of aligners to SmileDirectClub (“SDC”) under our supply agreement, which commenced in the fourth quarter of 2016. Revenue from SDC is recorded after eliminating outstanding intercompany transactions.

|

|

◦

|

Non-Case includes our Vivera retainers along with our training and ancillary products for treating malocclusion.

|

|

•

|

Our Scanner segment consists of intraoral scanning systems and additional services available with the intraoral scanners that provide digital alternatives to the traditional cast models. This segment includes our iTero scanner and OrthoCAD services.

|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

Net revenues

|

2017

|

2016

|

2017

|

2016

|

|||||||||||

|

Clear Aligner

|

$

|

341,611

|

|

$

|

243,668

|

|

$

|

945,046

|

|

$

|

706,802

|

|

|||

|

Scanner

|

43,656

|

|

34,921

|

|

107,044

|

|

79,869

|

|

|||||||

|

Total net revenues

|

$

|

385,267

|

|

$

|

278,589

|

|

$

|

1,052,090

|

|

$

|

786,671

|

|

|||

|

Gross profit

|

|||||||||||||||

|

Clear Aligner

|

$

|

266,285

|

|

$

|

189,270

|

|

$

|

737,046

|

|

$

|

552,663

|

|

|||

|

Scanner

|

26,203

|

|

19,932

|

|

61,984

|

|

42,382

|

|

|||||||

|

Total gross profit

|

$

|

292,488

|

|

$

|

209,202

|

|

$

|

799,030

|

|

$

|

595,045

|

|

|||

|

Income from operations

|

|||||||||||||||

|

Clear Aligner

|

$

|

154,614

|

|

$

|

102,431

|

|

$

|

403,264

|

|

$

|

306,789

|

|

|||

|

Scanner

|

13,525

|

|

11,977

|

|

28,324

|

|

20,333

|

|

|||||||

|

Unallocated corporate expenses

|

(69,376

|

)

|

(52,329

|

)

|

(187,583

|

)

|

(146,573

|

)

|

|||||||

|

Total income from operations

|

$

|

98,763

|

|

$

|

62,079

|

|

$

|

244,005

|

|

$

|

180,549

|

|

|||

|

Depreciation and amortization

|

|||||||||||||||

|

Clear Aligner

|

$

|

5,643

|

|

$

|

3,541

|

|

$

|

15,607

|

|

$

|

10,163

|

|

|||

|

Scanner

|

1,130

|

|

761

|

|

3,248

|

|

2,853

|

|

|||||||

|

Unallocated corporate expenses

|

3,199

|

|

2,599

|

|

7,860

|

|

3,770

|

|

|||||||

|

Total depreciation and amortization

|

$

|

9,972

|

|

$

|

6,901

|

|

$

|

26,715

|

|

$

|

16,786

|

|

|||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

2017

|

2016

|

2017

|

2016

|

||||||||||||

|

Total segment income from operations

|

$

|

168,139

|

|

$

|

114,408

|

|

$

|

431,588

|

|

$

|

327,122

|

|

|||

|

Unallocated corporate expenses

|

(69,376

|

)

|

(52,329

|

)

|

(187,583

|

)

|

(146,573

|

)

|

|||||||

|

Total income from operations

|

98,763

|

|

62,079

|

|

244,005

|

|

180,549

|

|

|||||||

|

Interest and other income (expense), net

|

3,750

|

|

1,463

|

|

8,607

|

|

1,161

|

|

|||||||

|

Net income before provision for income taxes and equity in losses of investee

|

$

|

102,513

|

|

$

|

63,542

|

|

$

|

252,612

|

|

$

|

181,710

|

|

|||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||

|

|

2017

|

2016

|

2017

|

2016

|

|||||||||||

|

Net revenues

(1)

:

|

|||||||||||||||

|

United States

(2)

|

$

|

217,758

|

|

$

|

168,501

|

|

$

|

608,052

|

|

$

|

516,924

|

|

|||

|

The Netherlands

(2)

|

127,307

|

|

87,051

|

|

357,278

|

|

191,049

|

|

|||||||

|

Other International

|

40,202

|

|

23,037

|

|

86,760

|

|

78,698

|

|

|||||||

|

Total net revenues

|

$

|

385,267

|

|

$

|

278,589

|

|

$

|

1,052,090

|

|

$

|

786,671

|

|

|||

|

|

September 30,

2017 |

December 31, 2016

|

|||||

|

Long-lived assets

(1)

:

|

|||||||

|

The Netherlands

|

$

|

142,591

|

|

$

|

111,515

|

|

|

|

United States

|

125,172

|

|

43,278

|

|

|||

|

Mexico

|

21,537

|

|

17,918

|

|

|||

|

Other International

|

6,601

|

|

2,456

|

|

|||

|

Total long-lived assets

|

$

|

295,901

|

|

$

|

175,167

|

|

|

|

•

|

New Products, Feature Enhancements and Technology Innovation

. Product innovation drives greater treatment predictability and clinical applicability and ease of use for our customers which supports adoption of Invisalign treatment in their practices. Our focus is to develop solutions and features to treat a wide range of cases - from simple to complex. Most recently, in March 2017, we announced Invisalign Teen with mandibular advancement, the first clear aligner solution for Class II correction in growing tween and teen patients. This new offering combines the benefits of the most advanced clear aligner system in the world with features for moving the lower jaw forward while simultaneously aligning the teeth. Invisalign Teen with mandibular advancement is now available in Canada, and select Europe, Middle East and Africa ("EMEA") countries, Asia Pacific ("APAC") countries and Latin America ("LATAM") countries. Invisalign Teen with mandibular advancement is pending 510(k) clearance and is not yet available in the United States. We believe that over the long-term, clinical solutions and treatment tools will increase adoption of Invisalign and increase sales of our intraoral scanners; however, it is difficult to predict the rate of adoption which may vary by region and channel.

|

|

•

|

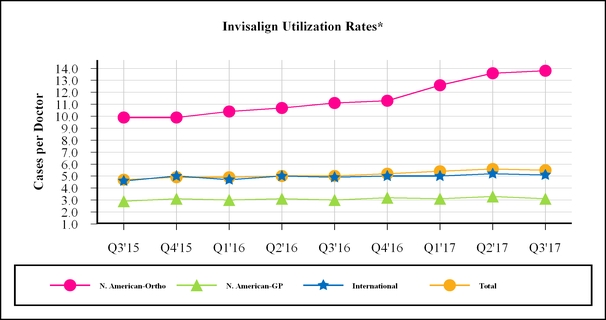

Invisalign Adoption.

Our goal is to establish Invisalign as the treatment of choice for treating malocclusion ultimately driving increased product adoption and frequency of use by dental professionals, also known as "utilization rates." Our quarterly utilization rates for the last 9 quarters are as follows:

|

|

◦

|

Total utilization in the third quarter of 2017 increased to 5.5 cases per doctor compared to 5.0 in the third quarter of 2016.

|

|

▪

|

North America:

Utilization among our North American orthodontist customers reached an all time high in the third quarter of 2017 at 13.8 cases per doctor. Compared to 11.1 cases per doctor utilized in the third quarter of 2016, the increase in North America orthodontist utilization in the third quarter of 2017 reflects improvements in product and technology which continues to strengthen our doctors’ clinical confidence such that they now utilize Invisalign more often and on more complex cases, including their teenage patients.

|

|

▪

|

International:

International doctor utilization is 5.1 cases per doctor in the third quarter of 2017 compared to 4.9 in the third quarter of 2016. The International utilization reflects growth in both the EMEA and APAC regions due to increasing adoption of the product due in part to its ability to treat more complex cases.

|

|

•

|

Number of New Invisalign-Trained Doctors.

We continue to expand our Invisalign customer base through the training of new doctors. In 2016, Invisalign clear aligner growth was driven primarily by increased utilization across all regions as well as by the continued expansion of our customer base as we trained a total of 11,680 new Invisalign doctors, of which 60% were trained internationally. During the third quarter of 2017, we trained 4,280

new Invisalign doctors of which

1,460

were trained in North America and

2,820

in our International regions.

|

|

•

|

International Invisalign Growth.

We will continue to focus our efforts towards increasing Invisalign clear aligner adoption by dental professionals in our direct international markets. On a year over year basis, international Invisalign volume increased 47.4% driven primarily by strong performance in our APAC and EMEA regions. We believe that the introduction of Invisalign treatment with Mandibular Advancement is helping to raise visibility for Invisalign treatment of teenagers and contributed to some of the growth in the APAC market. In 2017, we are continuing to expand in our existing markets through targeted investments in sales coverage and professional marketing and education programs, along with consumer marketing in selected country markets. We expect international Invisalign clear aligner revenues to continue to grow at a faster rate than North America for the foreseeable future due to our continued investment in international market expansion, the size of the market opportunity, and our relatively low market penetration of these regions (

Refer to Item 1A Risk Factors

- “We are exposed to fluctuations in currency exchange rates, which could negatively affect our financial condition and results of operations.”

for information on related risk factors).

|

|

•

|

Regional Order Acquisition and Treatment Planning Facilities:

We will continue to establish and expand additional order acquisition and treatment planning facilities closer to our international customers in order to improve our operational efficiency and to provide doctors confidence in using Invisalign clear aligners to treat more patients and more often. In June 2017, we opened a new treatment planning facility in Chengdu, China which services and supports our customers within China. It also serves as a clinical education and training center for all of our customers across Asia Pacific. In July 2017, we entered into a Purchase and Sale Agreement with Belen Business Center CR, S.A. to purchase a new Costa Rica treatment planning facility for $26.1 million. In addition, we opened a treatment planning facility in Cologne, Germany to support our EMEA customers in August 2017. (

Refer to Item 1A Risk Factors - “As we continue to grow, we are subject to growth related risks, including risks related to excess or constrained capacity at our existing facilities.”

for information on related risk factors and

Refer to Note 9 "Commitments and Contingencies" of the Notes of Condensed Consolidated Financial Statements

for more information on the Purchase Agreement).

|

|

•

|

Operating Expenses.

We expect operating expenses to increase in fiscal year 2017 due in part to:

|

|

◦

|

investments in international expansion in new country markets particularly in the APAC, Latin America and Middle East regions;

|

|

◦

|

investments in manufacturing to enhance our regional order acquisition and treatment planning capabilities;

|

|

◦

|

increases in legal expenses primarily related to the continued protection of our intellectual property rights, including our patents;

|

|

◦

|

increases in sales and customer support resources; and

|

|

◦

|

product and technology innovation to address such things as treatment times, indications unique to teens and predictability.

|

|

•

|

Stock Repurchases: April 2016 Repurchase Program.

On April 28, 2016, we announced that our Board of Directors had authorized a plan to repurchase up to $300.0 million of our stock. On May 2, 2017, we entered into an accelerated share repurchase ("ASR") to repurchase

$50.0 million

of our common stock ("2017 ASR"). The 2017 ASR was completed on August 3, 2017. The final number of shares repurchased was based on our volume-weighted average stock price during the term of the transaction, less an agreed upon discount. We received a total of approximately 0.4 million shares at a weighted average share price of $146.48 under the 2017 ASR. All repurchased shares were retired. As of September 30, 2017, we have

$250.0 million

remaining under the April 2016 Repurchase Plan.

|

|

•

|

SmileDirectClub.

On July 24, 2017, we increased the revolving line of credit to SmileDirectClub, LLC ("SDC") from $15.0 million to $30.0 million. As of September 30, 2017, $17.0 million under the Loan Facility was outstanding. On July 24, 2017, we purchased an additional 2% equity interest in SDC for $12.8 million. As a result of this purchase, we hold a 19% equity interest in SDC on a fully diluted basis (

Refer to Note 4 "Equity Method Investments" of the Notes to Condensed Consolidated Financial Statement

s for details on accounting treatment). Additionally, we expect the supply agreement to be incremental to revenue growth in 2017.

|

|

•

|

New Corporate Headquarters Office Purchase.

We completed the purchase of our new headquarters on January 26, 2017 for the purchase price of $44.1 million. In addition, we incurred $29.7 million in building improvements during 2017 and moved into the facility in August 2017.

|

|

•

|

Our Clear Aligner segment consists of Comprehensive Products, Non-Comprehensive Products and Non-Case revenues as defined below:

|

|

◦

|

Comprehensive Products include our Invisalign Full, Teen and Assist products.

|

|

◦

|

Non-Comprehensive Products include our Express/Lite products in addition to revenues from the sale of aligners to SmileDirectClub (“SDC”) under our supply agreement, which commenced in the fourth quarter of 2016. Revenue from SDC is recorded after eliminating outstanding intercompany transactions.

|

|

◦

|

Non-Case includes our Vivera retainers along with our training and ancillary products for treating malocclusion.

|

|

•

|

Our Scanner segment consists of intraoral scanning systems and additional services available with the intraoral scanners that provide digital alternatives to the traditional cast models. This segment includes our iTero scanner and OrthoCAD services.

|

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||||||||

|

Net Revenues

|

2017

|

2016

|

Net

Change

|

%

Change

|

2017

|

2016

|

Net

Change

|

%

Change

|

|||||||||||||||||||||

|

Clear Aligner revenues:

|

|||||||||||||||||||||||||||||

|

North America

|

$

|

193.8

|

|

$

|

143.8

|

|

$

|

50.0

|

|

34.8

|

%

|

$

|

545.1

|

|

$

|

423.4

|

|

$

|

121.7

|

|

28.7

|

%

|

|||||||

|

International

|

126.6

|

|

84.3

|

|

42.3

|

|

50.2

|

%

|

340.2

|

|

237.9

|

|

102.3

|

|

43.0

|

%

|

|||||||||||||

|

Non-case

|

21.2

|

|

15.6

|

|

5.6

|

|

35.9

|

%

|

59.7

|

|

45.5

|

|

14.2

|

|

31.2

|

%

|

|||||||||||||

|

Total Clear Aligner net revenues

|

$

|

341.6

|

|

$

|

243.7

|

|

$

|

97.9

|

|

40.2

|

%

|

$

|

945.0

|

|

$

|

706.8

|

|

$

|

238.2

|

|

33.7

|

%

|

|||||||

|

Scanner net revenues

|

43.7

|

|

34.9

|

|

8.8

|

|

25.2

|

%

|

107.0

|

|

79.9

|

|

27.1

|

|

33.9

|

%

|

|||||||||||||

|

Total net revenues

|

$

|

385.3

|

|

$

|

278.6

|

|

$

|

106.7

|

|

38.3

|

%

|

$

|

1,052.1

|

|

$

|

786.7

|

|

$

|

265.4

|

|

33.7

|

%

|

|||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

Region

|

2017

|

2016

|

Net

Change

|

%

Change

|

2017

|

2016

|

Net

Change

|

%

Change

|

|||||||||||||||

|

North America

|

164.2

|

|

115.9

|

|

48.3

|

|

41.7

|

%

|

455.0

|

|

341.3

|

|

113.7

|

|

33.3

|

%

|

|||||||

|

International

|

91.2

|

|

61.9

|

|

29.3

|

|

47.3

|

%

|

251.8

|

|

177.2

|

|

74.6

|

|

42.1

|

%

|

|||||||

|

Total case volume

|

255.4

|

|

177.8

|

|

77.6

|

|

43.6

|

%

|

706.7

|

|

518.5

|

|

188.2

|

|

36.3

|

%

|

|||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Clear Aligner

|

|||||||||||||||||||||||

|

Cost of net revenues

|

$

|

75.3

|

|

$

|

54.4

|

|

$

|

20.9

|

|

$

|

208.0

|

|

$

|

154.1

|

|

$

|

53.9

|

|

|||||

|

% of net segment revenues

|

22.1

|

%

|

22.3

|

%

|

22.0

|

%

|

21.8

|

%

|

|||||||||||||||

|

Gross profit

|

$

|

266.3

|

|

$

|

189.3

|

|

$

|

77.0

|

|

$

|

737.0

|

|

$

|

552.6

|

|

$

|

184.4

|

|

|||||

|

Gross margin %

|

77.9

|

%

|

77.7

|

%

|

78.0

|

%

|

78.2

|

%

|

|||||||||||||||

|

Scanner

|

|||||||||||||||||||||||

|

Cost of net revenues

|

$

|

17.5

|

|

$

|

15.0

|

|

$

|

2.5

|

|

$

|

45.1

|

|

$

|

37.5

|

|

$

|

7.6

|

|

|||||

|

% of net segment revenues

|

40.0

|

%

|

42.9

|

%

|

42.1

|

%

|

46.9

|

%

|

|||||||||||||||

|

Gross profit

|

$

|

26.2

|

|

$

|

20.0

|

|

$

|

6.2

|

|

$

|

62.0

|

|

$

|

42.4

|

|

$

|

19.6

|

|

|||||

|

Gross margin %

|

60.0

|

%

|

57.1

|

%

|

57.9

|

%

|

53.1

|

%

|

|||||||||||||||

|

Total cost of net revenues

|

$

|

92.8

|

|

$

|

69.4

|

|

$

|

23.4

|

|

$

|

253.1

|

|

$

|

191.6

|

|

$

|

61.5

|

|

|||||

|

% of net revenues

|

24.1

|

%

|

24.9

|

%

|

24.1

|

%

|

24.4

|

%

|

|||||||||||||||

|

Gross profit

|

$

|

292.5

|

|

$

|

209.2

|

|

$

|

83.3

|

|

$

|

799.0

|

|

$

|

595.0

|

|

$

|

204.0

|

|

|||||

|

Gross margin %

|

75.9

|

%

|

75.1

|

%

|

75.9

|

%

|

75.6

|

%

|

|||||||||||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Selling, general and administrative

|

$

|

169.5

|

|

$

|

126.7

|

|

$

|

42.8

|

|

$

|

483.6

|

|

$

|

360.4

|

|

$

|

123.2

|

|

|||||

|

% of net revenues

|

44.0

|

%

|

45.5

|

%

|

46.0

|

%

|

45.8

|

%

|

|||||||||||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Research and development

|

$

|

24.2

|

|

$

|

20.4

|

|

$

|

3.8

|

|

$

|

71.4

|

|

$

|

54.1

|

|

$

|

17.3

|

|

|||||

|

% of net revenues

|

6.3

|

%

|

7.3

|

%

|

6.8

|

%

|

6.9

|

%

|

|||||||||||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Clear Aligner

|

|||||||||||||||||||||||

|

Income from operations

|

$

|

154.6

|

|

$

|

102.4

|

|

$

|

52.2

|

|

$

|

403.3

|

|

$

|

306.8

|

|

$

|

96.5

|

|

|||||

|

Operating margin %

|

45.3

|

%

|

42.0

|

%

|

42.7

|

%

|

43.4

|

%

|

|||||||||||||||

|

Scanner

|

|||||||||||||||||||||||

|

Income from operations

|

$

|

13.5

|

|

$

|

12.0

|

|

$

|

1.5

|

|

$

|

28.3

|

|

$

|

20.3

|

|

$

|

8.0

|

|

|||||

|

Operating margin %

|

31.0

|

%

|

34.3

|

%

|

26.5

|

%

|

25.5

|

%

|

|||||||||||||||

|

Total income from operations

(1)

|

$

|

98.8

|

|

$

|

62.1

|

|

$

|

36.7

|

|

$

|

244.0

|

|

$

|

180.5

|

|

$

|

63.5

|

|

|||||

|

Operating margin %

|

25.6

|

%

|

22.3

|

%

|

23.2

|

%

|

23.0

|

%

|

|||||||||||||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Interest and other income (expenses), net

|

$

|

3.8

|

|

$

|

1.5

|

|

$

|

2.3

|

|

$

|

8.6

|

|

$

|

1.2

|

|

$

|

7.4

|

|

|||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Equity in losses of investee, net of tax

|

$

|

1.6

|

|

$

|

0.5

|

|

$

|

1.1

|

|

$

|

5.0

|

|

$

|

0.5

|

|

$

|

4.5

|

|

|||||

|

|

Three Months Ended

September 30, |

Nine Months Ended

September 30, |

|||||||||||||||||||||

|

|

2017

|

2016

|

Change

|

2017

|

2016

|

Change

|

|||||||||||||||||

|

Provision for income taxes

|

$

|

18.3

|

|

$

|

11.7

|

|

$

|

6.6

|

|

$

|

26.5

|

|

$

|

39.2

|

|

$

|

(12.7

|

)

|

|||||

|

Effective tax rates

|

17.9

|

%

|

18.4

|

%

|

10.5

|

%

|

21.6

|

%

|

|||||||||||||||

|

September 30,

|

December 31,

|

|||||||

|

2017

|

2016

|

|||||||

|

Cash and cash equivalents

|

$

|

362,613

|

|

$

|

389,275

|

|

||

|

Short-term marketable securities

|

316,454

|

|

250,981

|

|

||||

|

Long-term marketable securities

|

58,842

|

|

59,783

|

|

||||

|

Total

|

$

|

737,909

|

|

$

|

700,039

|

|

||

|

|

Nine Months Ended

September 30, |

|||||||

|

|

2017

|

2016

|

||||||

|

Net cash flow provided by (used in):

|

||||||||

|

Operating activities

|

$

|

276,213

|

|

$

|

166,674

|

|

||

|

Investing activities

|

(228,620

|

)

|

142,859

|

|

||||

|

Financing activities

|

(79,036

|

)

|

(57,619

|

)

|

||||

|

Effect of exchange rate changes on cash and cash equivalents

|

4,781

|

|

320

|

|

||||

|

Net increase (decrease) in cash and cash equivalents

|

$

|

(26,662

|