|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended September 30, 2016

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Nevada

|

20-4745737

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(IRS Employer Identification No.)

|

|

1201 North Town Center Drive

|

|

|

Las Vegas, Nevada

|

89144

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

(Do not check if a smaller reporting company)

|

|

|

PART I.

|

FINANCIAL INFORMATION

|

|

|

|

|

|

|

ITEM 1.

|

||

|

|

|

|

|

ITEM 2.

|

||

|

|

|

|

|

ITEM 3.

|

||

|

|

|

|

|

ITEM 4.

|

||

|

|

|

|

|

PART II.

|

OTHER INFORMATION

|

|

|

|

|

|

|

ITEM 1.

|

||

|

|

|

|

|

ITEM 1A.

|

||

|

|

|

|

|

ITEM 2.

|

||

|

ITEM 3.

|

||

|

ITEM 4.

|

||

|

ITEM 5.

|

||

|

|

|

|

|

ITEM 6.

|

||

|

September 30, 2016

|

December 31, 2015

|

||||||

|

(unaudited)

|

|||||||

|

CURRENT ASSETS:

|

|||||||

|

Cash and cash equivalents

|

$

|

48,718

|

|

$

|

87,112

|

|

|

|

Restricted cash

|

13,787

|

|

10,358

|

|

|||

|

Short-term investments

|

269,341

|

|

245,583

|

|

|||

|

Accounts receivable

|

28,173

|

|

15,146

|

|

|||

|

Expendable parts, supplies and fuel, net

|

16,627

|

|

15,583

|

|

|||

|

Prepaid expenses

|

15,129

|

|

18,276

|

|

|||

|

Other current assets

|

1,654

|

|

3,185

|

|

|||

|

TOTAL CURRENT ASSETS

|

393,429

|

|

395,243

|

|

|||

|

Property and equipment, net

|

1,066,108

|

|

885,942

|

|

|||

|

Long-term investments

|

65,247

|

|

64,752

|

|

|||

|

Other assets

|

10,030

|

|

5,725

|

|

|||

|

TOTAL ASSETS

|

$

|

1,534,814

|

|

$

|

1,351,662

|

|

|

|

CURRENT LIABILITIES:

|

|||||||

|

Accounts payable

|

$

|

11,021

|

|

$

|

6,801

|

|

|

|

Accrued liabilities

|

106,876

|

|

109,462

|

|

|||

|

Air traffic liability

|

220,527

|

|

198,136

|

|

|||

|

Current maturities of long-term debt, net of related costs

|

137,452

|

|

74,069

|

|

|||

|

TOTAL CURRENT LIABILITIES

|

475,876

|

|

388,468

|

|

|||

|

Long-term debt, net of current maturities and related costs

|

561,493

|

|

567,609

|

|

|||

|

Deferred income taxes

|

47,740

|

|

45,580

|

|

|||

|

Other noncurrent liabilities

|

7,417

|

|

—

|

|

|||

|

TOTAL LIABILITIES

:

|

1,092,526

|

|

1,001,657

|

|

|||

|

SHAREHOLDERS' EQUITY:

|

|||||||

|

Common stock, par value $.001

|

22

|

|

22

|

|

|||

|

Treasury stock

|

(515,821

|

)

|

(453,415

|

)

|

|||

|

Additional paid in capital

|

234,298

|

|

228,945

|

|

|||

|

Accumulated other comprehensive income, net

|

57

|

|

834

|

|

|||

|

Retained earnings

|

723,732

|

|

573,619

|

|

|||

|

TOTAL EQUITY

|

442,288

|

|

350,005

|

|

|||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$

|

1,534,814

|

|

$

|

1,351,662

|

|

|

|

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

|||||||||||||

|

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

OPERATING REVENUE:

|

|||||||||||||||

|

Scheduled service revenue

|

$

|

177,361

|

|

$

|

170,002

|

|

$

|

568,089

|

|

$

|

556,842

|

|

|||

|

Ancillary revenue:

|

|||||||||||||||

|

Air-related charges

|

127,301

|

|

107,554

|

|

376,944

|

|

326,055

|

|

|||||||

|

Third party products

|

11,259

|

|

9,890

|

|

34,482

|

|

31,663

|

|

|||||||

|

Total ancillary revenue

|

138,560

|

|

117,444

|

|

411,426

|

|

357,718

|

|

|||||||

|

Fixed fee contract revenue

|

9,183

|

|

4,640

|

|

22,690

|

|

11,993

|

|

|||||||

|

Other revenue

|

8,377

|

|

7,870

|

|

24,743

|

|

24,745

|

|

|||||||

|

Total operating revenue

|

333,481

|

|

299,956

|

|

1,026,948

|

|

951,298

|

|

|||||||

|

OPERATING EXPENSES:

|

|||||||||||||||

|

Aircraft fuel

|

69,305

|

|

68,272

|

|

182,969

|

|

216,985

|

|

|||||||

|

Salary and benefits

|

73,424

|

|

58,968

|

|

211,185

|

|

171,119

|

|

|||||||

|

Station operations

|

32,252

|

|

26,454

|

|

96,313

|

|

74,768

|

|

|||||||

|

Maintenance and repairs

|

26,263

|

|

25,369

|

|

82,016

|

|

70,488

|

|

|||||||

|

Depreciation and amortization

|

25,881

|

|

24,346

|

|

75,962

|

|

73,597

|

|

|||||||

|

Sales and marketing

|

5,650

|

|

4,053

|

|

16,774

|

|

16,907

|

|

|||||||

|

Aircraft lease rentals

|

472

|

|

695

|

|

924

|

|

2,092

|

|

|||||||

|

Other

|

23,394

|

|

14,717

|

|

58,363

|

|

47,402

|

|

|||||||

|

Total operating expenses

|

256,641

|

|

222,874

|

|

724,506

|

|

673,358

|

|

|||||||

|

OPERATING INCOME

|

76,840

|

|

77,082

|

|

302,442

|

|

277,940

|

|

|||||||

|

OTHER (INCOME) EXPENSE:

|

|||||||||||||||

|

Interest expense

|

6,938

|

|

6,687

|

|

21,567

|

|

20,531

|

|

|||||||

|

Interest income

|

(1,028

|

)

|

(301

|

)

|

(2,932

|

)

|

(948

|

)

|

|||||||

|

Other, net

|

(61

|

)

|

(67

|

)

|

(142

|

)

|

(117

|

)

|

|||||||

|

Total other expense

|

5,849

|

|

6,319

|

|

18,493

|

|

19,466

|

|

|||||||

|

INCOME BEFORE INCOME TAXES

|

70,991

|

|

70,763

|

|

283,949

|

|

258,474

|

|

|||||||

|

PROVISION FOR INCOME TAXES

|

25,538

|

|

26,305

|

|

105,669

|

|

94,853

|

|

|||||||

|

NET INCOME

|

45,453

|

|

44,458

|

|

178,280

|

|

163,621

|

|

|||||||

|

Net loss attributable to noncontrolling interest

|

—

|

|

—

|

|

—

|

|

(44

|

)

|

|||||||

|

NET INCOME ATTRIBUTABLE TO ALLEGIANT TRAVEL COMPANY

|

$

|

45,453

|

|

$

|

44,458

|

|

$

|

178,280

|

|

$

|

163,665

|

|

|||

|

Earnings per share to common stockholders:

|

|||||||||||||||

|

Basic

|

$

|

2.76

|

|

$

|

2.63

|

|

$

|

10.74

|

|

$

|

9.57

|

|

|||

|

Diluted

|

$

|

2.75

|

|

$

|

2.62

|

|

$

|

10.73

|

|

$

|

9.55

|

|

|||

|

Shares used for computation:

|

|||||||||||||||

|

Basic

|

16,389

|

|

16,831

|

|

16,493

|

|

17,010

|

|

|||||||

|

Diluted

|

16,406

|

|

16,869

|

|

16,514

|

|

17,050

|

|

|||||||

|

Cash dividend declared per share:

|

$

|

0.70

|

|

$

|

0.30

|

|

$

|

1.70

|

|

$

|

0.80

|

|

|||

|

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

|||||||||||||

|

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Net income

|

$

|

45,453

|

|

$

|

44,458

|

|

$

|

178,280

|

|

$

|

163,621

|

|

|||

|

Other comprehensive (loss) income:

|

|

|

|

|

|||||||||||

|

Change in available for sale securities, net of tax

|

(101

|

)

|

(21

|

)

|

336

|

|

377

|

|

|||||||

|

Foreign currency translation adjustment

|

238

|

|

(32

|

)

|

176

|

|

230

|

|

|||||||

|

Change in derivatives, net of tax

|

(208

|

)

|

171

|

|

(533

|

)

|

712

|

|

|||||||

|

Reclassification of derivative gains into Other revenue

|

(247

|

)

|

(260

|

)

|

(756

|

)

|

(1,003

|

)

|

|||||||

|

Total other comprehensive (loss) income

|

(318

|

)

|

(142

|

)

|

(777

|

)

|

316

|

|

|||||||

|

TOTAL COMPREHENSIVE INCOME

|

45,135

|

|

44,316

|

|

177,503

|

|

163,937

|

|

|||||||

|

Comprehensive loss attributable to noncontrolling interest

|

—

|

|

—

|

|

—

|

|

(44

|

)

|

|||||||

|

COMPREHENSIVE INCOME ATTRIBUTABLE TO ALLEGIANT TRAVEL COMPANY

|

$

|

45,135

|

|

$

|

44,316

|

|

$

|

177,503

|

|

$

|

163,981

|

|

|||

|

|

Nine Months Ended September 30,

|

||||||

|

|

2016

|

2015

|

|||||

|

OPERATING ACTIVITIES:

|

|||||||

|

Net income

|

$

|

178,280

|

|

$

|

163,621

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||

|

Depreciation and amortization

|

75,962

|

|

73,597

|

|

|||

|

Loss on aircraft and other equipment disposals

|

3,510

|

|

3,043

|

|

|||

|

Provision for obsolescence of expendable parts, supplies and fuel

|

1,803

|

|

1,183

|

|

|||

|

Amortization of deferred financing costs

|

1,154

|

|

945

|

|

|||

|

Share-based compensation expense

|

4,342

|

|

10,736

|

|

|||

|

Deferred income taxes

|

2,336

|

|

2,659

|

|

|||

|

Excess tax benefits from share-based compensation

|

—

|

|

(3,869

|

)

|

|||

|

Changes in certain assets and liabilities:

|

|||||||

|

Accounts receivable

|

(13,027

|

)

|

(1,495

|

)

|

|||

|

Prepaid expenses

|

3,147

|

|

1,489

|

|

|||

|

Accounts payable

|

4,220

|

|

(1,775

|

)

|

|||

|

Accrued liabilities

|

26,153

|

|

(2,228

|

)

|

|||

|

Air traffic liability

|

22,391

|

|

24,410

|

|

|||

|

Other, net

|

(2,178

|

)

|

(4,706

|

)

|

|||

|

Net cash provided by operating activities

|

308,093

|

|

267,610

|

|

|||

|

INVESTING ACTIVITIES:

|

|||||||

|

Purchase of investment securities

|

(291,954

|

)

|

(272,970

|

)

|

|||

|

Proceeds from maturities of investment securities

|

268,037

|

|

293,181

|

|

|||

|

Aircraft pre-delivery deposits

|

(113,771

|

)

|

—

|

|

|||

|

Purchase of property and equipment, including capitalized interest

|

(150,314

|

)

|

(173,926

|

)

|

|||

|

Other investing activities

|

3,999

|

|

687

|

|

|||

|

Net cash used by investing activities

|

(284,003

|

)

|

(153,028

|

)

|

|||

|

FINANCING ACTIVITIES:

|

|||||||

|

Cash dividends paid to shareholders

|

(55,895

|

)

|

(57,410

|

)

|

|||

|

Excess tax benefits from share-based compensation

|

—

|

|

3,869

|

|

|||

|

Proceeds from the issuance of long-term debt

|

120,410

|

|

93,000

|

|

|||

|

Repurchase of common stock

|

(63,363

|

)

|

(121,119

|

)

|

|||

|

Principal payments on long-term debt

|

(63,478

|

)

|

(46,447

|

)

|

|||

|

Other financing activities

|

(158

|

)

|

2,460

|

|

|||

|

Net cash used by financing activities

|

(62,484

|

)

|

(125,647

|

)

|

|||

|

Net change in cash and cash equivalents

|

(38,394

|

)

|

(11,065

|

)

|

|||

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD

|

87,112

|

|

89,610

|

|

|||

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD

|

$

|

48,718

|

|

$

|

78,545

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION:

|

|||||||

|

CASH PAYMENTS FOR:

|

|||||||

|

Interest paid, net of amount capitalized

|

$

|

17,070

|

|

$

|

18,568

|

|

|

|

Income taxes paid, net of refunds

|

$

|

79,818

|

|

$

|

85,996

|

|

|

|

As of September 30, 2016

|

As of December 31, 2015

|

||||||||||||||||||||||||||||||

|

Unrealized

|

Unrealized

|

||||||||||||||||||||||||||||||

|

Cost

|

Gains

|

(Losses)

|

Market Value

|

Cost

|

Gains

|

(Losses)

|

Market Value

|

||||||||||||||||||||||||

|

Commercial paper

|

$

|

128,714

|

|

$

|

8

|

|

$

|

(136

|

)

|

$

|

128,586

|

|

$

|

83,155

|

|

$

|

—

|

|

$

|

(1

|

)

|

$

|

83,154

|

|

|||||||

|

Corporate debt securities

|

107,649

|

|

10

|

|

(92

|

)

|

107,567

|

|

108,485

|

|

50

|

|

(154

|

)

|

108,381

|

|

|||||||||||||||

|

Federal agency debt securities

|

58,460

|

|

$

|

9

|

|

$

|

(38

|

)

|

$

|

58,431

|

|

73,783

|

|

—

|

|

(80

|

)

|

73,703

|

|

||||||||||||

|

Municipal debt securities

|

35,678

|

|

1

|

|

(29

|

)

|

35,650

|

|

52,669

|

|

2

|

|

(1

|

)

|

52,670

|

|

|||||||||||||||

|

US Treasury Bonds

|

4,607

|

|

3

|

|

—

|

|

4,610

|

|

1,607

|

|

—

|

|

(1

|

)

|

1,606

|

|

|||||||||||||||

|

Money market funds

|

36

|

|

—

|

|

—

|

|

36

|

|

781

|

|

—

|

|

—

|

|

781

|

|

|||||||||||||||

|

Total

|

$

|

335,144

|

|

$

|

31

|

|

$

|

(295

|

)

|

$

|

334,880

|

|

$

|

320,480

|

|

$

|

52

|

|

$

|

(237

|

)

|

$

|

320,295

|

|

|||||||

|

As of September 30, 2016

|

As of December 31, 2015

|

||||||

|

Flight equipment, including pre-delivery deposits

|

$

|

1,335,364

|

|

$

|

1,123,115

|

|

|

|

Computer hardware and software

|

96,027

|

|

78,200

|

|

|||

|

Ground property and equipment

|

78,203

|

|

72,078

|

|

|||

|

Total property and equipment

|

1,509,594

|

|

1,273,393

|

|

|||

|

Less accumulated depreciation and amortization

|

(443,486

|

)

|

(387,451

|

)

|

|||

|

Property and equipment, net

|

$

|

1,066,108

|

|

$

|

885,942

|

|

|

|

|

As of September 30, 2016

|

As of December 31, 2015

|

|||||

|

Fixed-rate notes payable due through 2020

|

$

|

334,951

|

|

$

|

341,738

|

|

|

|

Variable-rate notes payable due through 2021

|

363,994

|

|

299,940

|

|

|||

|

Total long-term debt, net of related costs

|

698,945

|

|

641,678

|

|

|||

|

Less current maturities

|

137,452

|

|

74,069

|

|

|||

|

Long-term debt, net of current maturities and related costs

|

$

|

561,493

|

|

$

|

567,609

|

|

|

|

As of September 30, 2016

|

|||

|

Remaining in 2016

|

$

|

59,723

|

|

|

2017

|

99,952

|

|

|

|

2018

|

145,152

|

|

|

|

2019

|

350,973

|

|

|

|

2020

|

35,374

|

|

|

|

Thereafter

|

7,771

|

|

|

|

Total

|

$

|

698,945

|

|

|

As of September 30, 2016

|

As of December 31, 2015

|

||||||||||||||||||||||

|

Total

|

Level 1

|

Level 2

|

Total

|

Level 1

|

Level 2

|

||||||||||||||||||

|

Cash equivalents

|

|

|

|

||||||||||||||||||||

|

Municipal debt securities

|

$

|

256

|

|

$

|

—

|

|

$

|

256

|

|

$

|

754

|

|

$

|

—

|

|

$

|

754

|

|

|||||

|

Money market funds

|

36

|

|

36

|

|

—

|

|

781

|

|

781

|

|

—

|

|

|||||||||||

|

Commercial paper

|

—

|

|

—

|

|

—

|

|

8,426

|

|

—

|

|

8,426

|

|

|||||||||||

|

Total cash equivalents

|

292

|

|

36

|

|

256

|

|

9,961

|

|

781

|

|

9,180

|

|

|||||||||||

|

Short-term

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Commercial paper

|

128,586

|

|

—

|

|

128,586

|

|

74,728

|

|

—

|

|

74,728

|

|

|||||||||||

|

Corporate debt securities

|

95,479

|

|

—

|

|

95,479

|

|

80,957

|

|

—

|

|

80,957

|

|

|||||||||||

|

Federal agency debt securities

|

21,914

|

|

—

|

|

21,914

|

|

42,825

|

|

—

|

|

42,825

|

|

|||||||||||

|

Municipal debt securities

|

21,757

|

|

—

|

|

21,757

|

|

47,073

|

|

—

|

|

47,073

|

|

|||||||||||

|

US Treasury Bonds

|

1,605

|

|

—

|

|

1,605

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Total short-term

|

269,341

|

|

—

|

|

269,341

|

|

245,583

|

|

—

|

|

245,583

|

|

|||||||||||

|

Long-term

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Federal agency debt securities

|

36,517

|

|

—

|

|

36,517

|

|

30,878

|

|

—

|

|

30,878

|

|

|||||||||||

|

Municipal debt securities

|

13,637

|

|

—

|

|

13,637

|

|

4,843

|

|

—

|

|

4,843

|

|

|||||||||||

|

Corporate debt securities

|

12,088

|

|

—

|

|

12,088

|

|

27,425

|

|

—

|

|

27,425

|

|

|||||||||||

|

US Treasury Bonds

|

3,005

|

|

—

|

|

3,005

|

|

1,606

|

|

—

|

|

1,606

|

|

|||||||||||

|

Derivative instruments

|

1,487

|

|

—

|

|

1,487

|

|

2,480

|

|

—

|

|

2,480

|

|

|||||||||||

|

Total long-term

|

66,734

|

|

—

|

|

66,734

|

|

67,232

|

|

—

|

|

67,232

|

|

|||||||||||

|

Total financial instruments

|

$

|

336,367

|

|

$

|

36

|

|

$

|

336,331

|

|

$

|

322,776

|

|

$

|

781

|

|

$

|

321,995

|

|

|||||

|

As of September 30, 2016

|

As of December 31, 2015

|

||||||||||||||||

|

Carrying Value

|

Estimated Fair Value

|

Carrying Value

|

Estimated Fair Value

|

Hierarchy Level

|

|||||||||||||

|

Publicly held debt

|

$

|

300,000

|

|

$

|

312,750

|

|

$

|

300,000

|

|

$

|

299,250

|

|

2

|

||||

|

Non-publicly held debt

|

403,101

|

|

378,445

|

|

346,179

|

|

327,321

|

|

3

|

||||||||

|

Total long-term debt

|

$

|

703,101

|

|

$

|

691,195

|

|

$

|

646,179

|

|

$

|

626,571

|

|

|||||

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

||||||||||

|

2016

|

2015

|

2016

|

2015

|

||||||||

|

Shares repurchased (not in thousands)

|

—

|

|

175,142

|

|

369,997

|

|

644,603

|

|

|||

|

Average price per share

|

—

|

|

$218.67

|

$166.70

|

$185.43

|

||||||

|

Total (in thousands)

|

—

|

|

$38,298

|

$61,679

|

$119,530

|

||||||

|

1.

|

Assume vesting of restricted stock using the treasury stock method.

|

|

2.

|

Assume unvested restricted stock awards are not vested, and allocate earnings to common shares and unvested restricted stock awards using the two-class method.

|

|

Three Months Ended September 30,

|

Nine Months Ended September 30,

|

||||||||||||||

|

2016

|

2015

|

2016

|

2015

|

||||||||||||

|

Basic:

|

|

|

|||||||||||||

|

Net income attributable to Allegiant Travel Company

|

$

|

45,453

|

|

$

|

44,458

|

|

$

|

178,280

|

|

$

|

163,665

|

|

|||

|

Less net income allocated to participating securities

|

(298

|

)

|

(199

|

)

|

(1,074

|

)

|

(802

|

)

|

|||||||

|

Net income attributable to common stock

|

$

|

45,155

|

|

$

|

44,259

|

|

$

|

177,206

|

|

$

|

162,863

|

|

|||

|

Net income per share, basic

|

$

|

2.76

|

|

$

|

2.63

|

|

$

|

10.74

|

|

$

|

9.57

|

|

|||

|

Weighted-average shares outstanding

|

16,389

|

|

16,831

|

|

16,493

|

|

17,010

|

|

|||||||

|

Diluted:

|

|

|

|

|

|

|

|

|

|||||||

|

Net income attributable to Allegiant Travel Company

|

$

|

45,453

|

|

$

|

44,458

|

|

$

|

178,280

|

|

$

|

163,665

|

|

|||

|

Less net income allocated to participating securities

|

(297

|

)

|

(198

|

)

|

(1,073

|

)

|

(800

|

)

|

|||||||

|

Net income attributable to common stock

|

$

|

45,156

|

|

$

|

44,260

|

|

$

|

177,207

|

|

$

|

162,865

|

|

|||

|

Net income per share, diluted

|

$

|

2.75

|

|

$

|

2.62

|

|

$

|

10.73

|

|

$

|

9.55

|

|

|||

|

Weighted-average shares outstanding

|

16,389

|

|

16,831

|

|

16,493

|

|

17,010

|

|

|||||||

|

Dilutive effect of stock options and restricted stock

|

26

|

|

68

|

|

34

|

|

68

|

|

|||||||

|

Adjusted weighted-average shares outstanding under treasury stock method

|

16,415

|

|

16,899

|

|

16,527

|

|

17,078

|

|

|||||||

|

Participating securities excluded under two-class method

|

(9

|

)

|

(30

|

)

|

(13

|

)

|

(28

|

)

|

|||||||

|

Adjusted weighted-average shares outstanding under two-class method

|

16,406

|

|

16,869

|

|

16,514

|

|

17,050

|

|

|||||||

|

Aircraft Type

|

Number of Aircraft Under Contract

|

|

|

Airbus A319

|

6

|

|

|

Airbus A320

|

27

|

|

|

As of September 30, 2016

|

|||

|

Remaining in 2016

|

$

|

34,860

|

|

|

2017

|

397,691

|

|

|

|

2018

|

116,962

|

|

|

|

2019

|

78,932

|

|

|

|

2020

|

41,473

|

|

|

|

Thereafter

|

3,613

|

|

|

|

Total commitments

|

$

|

673,531

|

|

|

•

|

Total operating revenue increase of

$33.5 million

over

third

quarter 2015,

|

|

•

|

operating margin of

23.0 percent

,

|

|

•

|

$2.75

earnings per share (fully diluted),

|

|

•

|

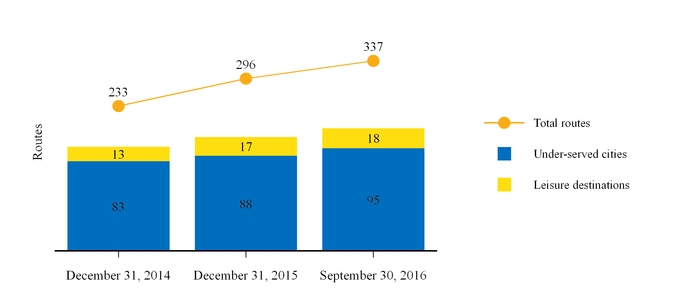

operating 337 routes as of quarter end versus 271 at the same point in 2015, and 29 new routes currently scheduled to begin within the next two quarters,

|

|

•

|

payment of quarterly recurring cash dividends of

$11.5 million

during the quarter,

$28.2 million

year to date

|

|

September 30, 2016

|

December 31, 2015

|

September 30, 2015

|

||||||

|

MD83/88

|

48

|

|

51

|

|

51

|

|

||

|

B757-200

|

4

|

|

5

|

|

6

|

|

||

|

A319 (1)

|

15

|

|

10

|

|

7

|

|

||

|

A320

|

16

|

|

14

|

|

10

|

|

||

|

Total

|

83

|

|

80

|

|

74

|

|

||

|

As of December 31, 2016

|

||

|

MD-80

|

48

|

|

|

B757-200

|

4

|

|

|

A319

|

17

|

|

|

A320

|

16

|

|

|

Total

|

85

|

|

|

|

Three Months Ended September 30,

|

Percent

|

||||||||

|

(dollars in thousands)

|

2016

|

2015

|

Change

|

|||||||

|

Gross ancillary revenue - third party products

|

$

|

36,701

|

|

$

|

31,319

|

|

17.2

|

%

|

||

|

Cost of goods sold

|

(25,163

|

)

|

(21,148

|

)

|

19.0

|

|

||||

|

Transaction costs (1)

|

(279

|

)

|

(281

|

)

|

(0.7

|

)

|

||||

|

Ancillary revenue - third party products

|

$

|

11,259

|

|

$

|

9,890

|

|

13.8

|

|

||

|

As percent of gross ancillary revenue - third party

|

30.7

|

%

|

31.6

|

%

|

(0.9) pp

|

|

||||

|

Hotel room nights

|

114,185

|

|

103,750

|

|

10.1

|

|

||||

|

Rental car days

|

399,859

|

|

305,750

|

|

30.8

|

%

|

||||

|

|

Three Months Ended September 30,

|

Percent

|

||||||||

|

|

2016

|

2015

|

Change

|

|||||||

|

Aircraft fuel

|

$

|

23.58

|

|

$

|

28.20

|

|

(16.4

|

)%

|

||

|

Salaries and benefits

|

24.98

|

|

24.36

|

|

2.5

|

|

||||

|

Station operations

|

10.97

|

|

10.93

|

|

0.4

|

|

||||

|

Maintenance and repairs

|

8.94

|

|

10.48

|

|

(14.7

|

)

|

||||

|

Depreciation and amortization

|

8.81

|

|

10.06

|

|

(12.4

|

)

|

||||

|

Sales and marketing

|

1.92

|

|

1.67

|

|

15.0

|

|

||||

|

Aircraft lease rentals

|

0.16

|

|

0.29

|

|

(44.8

|

)

|

||||

|

Other

|

7.96

|

|

6.08

|

|

30.9

|

|

||||

|

Operating expense per passenger

|

$

|

87.32

|

|

$

|

92.07

|

|

(5.2

|

)%

|

||

|

Operating expense per passenger, excluding fuel

|

$

|

63.74

|

|

$

|

63.87

|

|

(0.2

|

)%

|

||

|

|

Three Months Ended September 30,

|

Percent

|

||||||||

|

|

2016

|

2015

|

Change

|

|||||||

|

Aircraft fuel

|

|

2.22

|

¢

|

|

2.63

|

¢

|

(15.6

|

)%

|

||

|

Salaries and benefits

|

2.35

|

|

2.27

|

|

3.5

|

|

||||

|

Station operations

|

1.03

|

|

1.02

|

|

1.0

|

|

||||

|

Maintenance and repairs

|

0.84

|

|

0.98

|

|

(14.3

|

)

|

||||

|

Depreciation and amortization

|

0.83

|

|

0.94

|

|

(11.7

|

)

|

||||

|

Sales and marketing

|

0.18

|

|

0.16

|

|

12.5

|

|

||||

|

Aircraft lease rentals

|

0.02

|

|

0.03

|

|

(33.3

|

)

|

||||

|

Other

|

0.75

|

|

0.55

|

|

36.4

|

|

||||

|

CASM

|

|

8.22

|

¢

|

|

8.58

|

¢

|

(4.2

|

)%

|

||

|

Operating CASM, excluding fuel

|

|

6.00

|

¢

|

|

5.95

|

¢

|

0.8

|

%

|

||

|

|

Nine Months Ended September 30,

|

Percent

|

||||||||

|

(dollars in thousands)

|

2016

|

2015

|

Change

|

|||||||

|

Gross ancillary revenue - third party products

|

$

|

112,309

|

|

$

|

104,612

|

|

7.4

|

%

|

||

|

Cost of goods sold

|

(76,915

|

)

|

(71,798

|

)

|

7.1

|

|

||||

|

Transaction costs (1)

|

(912

|

)

|

(1,151

|

)

|

(20.8

|

)

|

||||

|

Ancillary revenue - third party products

|

$

|

34,482

|

|

$

|

31,663

|

|

8.9

|

|

||

|

As percent of gross ancillary revenue - third party

|

30.7

|

%

|

30.3

|

%

|

0.4 pp

|

|

||||

|

Hotel room nights

|

339,504

|

|

362,592

|

|

(6.4

|

)

|

||||

|

Rental car days

|

1,168,544

|

|

939,888

|

|

24.3

|

%

|

||||

|

|

Nine Months Ended September 30,

|

Percent

|

||||||||

|

|

2016

|

2015

|

Change

|

|||||||

|

Aircraft fuel*

|

$

|

21.76

|

|

$

|

30.39

|

|

(28.4

|

)%

|

||

|

Salaries and benefits

|

25.11

|

|

23.97

|

|

4.8

|

|

||||

|

Station operations

|

11.45

|

|

10.47

|

|

9.4

|

|

||||

|

Maintenance and repairs

|

9.75

|

|

9.87

|

|

(1.2

|

)

|

||||

|

Depreciation and amortization

|

9.03

|

|

10.31

|

|

(12.4

|

)

|

||||

|

Sales and marketing

|

1.99

|

|

2.37

|

|

(16.0

|

)

|

||||

|

Aircraft lease rentals

|

0.11

|

|

0.29

|

|

(62.1

|

)

|

||||

|

Other

|

6.94

|

|

6.64

|

|

4.5

|

|

||||

|

Operating expense per passenger*

|

$

|

86.14

|

|

$

|

94.31

|

|

(8.7

|

)%

|

||

|

Operating expense per passenger, excluding fuel

|

$

|

64.38

|

|

$

|

63.92

|

|

0.7

|

%

|

||

|

|

Nine Months Ended September 30,

|

Percent

|

||||||||

|

|

2016

|

2015

|

Change

|

|||||||

|

Aircraft fuel*

|

|

1.97

|

¢

|

|

2.78

|

¢

|

(29.1

|

)%

|

||

|

Salaries and benefits

|

2.27

|

|

2.19

|

|

3.7

|

|

||||

|

Station operations

|

1.04

|

|

0.96

|

|

8.3

|

|

||||

|

Maintenance and repairs

|

0.88

|

|

0.90

|

|

(2.2

|

)

|

||||

|

Depreciation and amortization

|

0.82

|

|

0.94

|

|

(12.8

|

)

|

||||

|

Sales and marketing

|

0.18

|

|

0.22

|

|

(18.2

|

)

|

||||

|

Aircraft lease rentals

|

0.01

|

|

0.03

|

|

(66.7

|

)

|

||||

|

Other

|

0.62

|

|

0.60

|

|

3.3

|

|

||||

|

CASM*

|

|

7.79

|

¢

|

|

8.62

|

¢

|

(9.6

|

)%

|

||

|

Operating CASM, excluding fuel

|

|

5.82

|

¢

|

|

5.84

|

¢

|

(0.3

|

)%

|

||

|

Three Months Ended September 30,

|

Percent

|

Nine Months Ended September 30,

|

Percent

|

||||||||||||||||||

|

2016

|

2015

|

Change*

|

2016

|

2015

|

Change*

|

||||||||||||||||

|

Operating statistics (unaudited):

|

|

|

|

|

|

|

|||||||||||||||

|

Total system statistics:

|

|

|

|

|

|

|

|||||||||||||||

|

Passengers

|

2,939,055

|

|

2,420,819

|

|

21.4

|

|

8,410,422

|

|

7,139,876

|

|

17.8

|

|

|||||||||

|

Revenue passenger miles (RPMs) (thousands)

|

2,645,533

|

|

2,235,683

|

|

18.3

|

|

7,831,436

|

|

6,734,217

|

|

16.3

|

|

|||||||||

|

Available seat miles (ASMs) (thousands)

|

3,121,762

|

|

2,597,658

|

|

20.2

|

|

9,302,051

|

|

7,814,146

|

|

19.0

|

|

|||||||||

|

Load factor

|

84.7

|

%

|

86.1

|

%

|

(1.4

|

)

|

84.2

|

%

|

86.2

|

%

|

(2.0

|

)

|

|||||||||

|

Operating expense per ASM (CASM) (cents)***

|

8.22

|

|

8.58

|

|

(4.2

|

)

|

7.79

|

|

8.62

|

|

(9.6

|

)

|

|||||||||

|

Fuel expense per ASM (cents)***

|

2.22

|

|

2.63

|

|

(15.6

|

)

|

1.97

|

|

2.78

|

|

(29.1

|

)

|

|||||||||

|

Operating CASM, excluding fuel (cents)

|

6.00

|

|

5.95

|

|

0.8

|

|

5.82

|

|

5.84

|

|

(0.3

|

)

|

|||||||||

|

ASMs per gallon of fuel

|

70.6

|

|

69.2

|

|

2.0

|

|

71.6

|

|

69.8

|

|

2.6

|

|

|||||||||

|

Departures

|

21,384

|

|

17,330

|

|

23.4

|

|

61,271

|

|

50,976

|

|

20.2

|

|

|||||||||

|

Block hours

|

47,739

|

|

39,347

|

|

21.3

|

|

142,515

|

|

118,999

|

|

19.8

|

|

|||||||||

|

Average stage length (miles)

|

864

|

|

878

|

|

(1.6

|

)

|

896

|

|

900

|

|

(0.4

|

)

|

|||||||||

|

Average number of operating aircraft during period

|

84.0

|

|

74.7

|

|

12.4

|

|

83.4

|

|

73.6

|

|

13.3

|

|

|||||||||

|

Average block hours per aircraft per day

|

6.2

|

|

5.7

|

|

8.8

|

|

6.2

|

|

5.9

|

|

5.1

|

|

|||||||||

|

Full-time equivalent employees at end of period

|

3,287

|

|

2,654

|

|

23.9

|

|

3,287

|

|

2,654

|

|

23.9

|

|

|||||||||

|

Fuel gallons consumed (thousands)

|

44,187

|

|

37,518

|

|

17.8

|

|

129,862

|

|

111,881

|

|

16.1

|

|

|||||||||

|

Average fuel cost per gallon***

|

$

|

1.57

|

|

$

|

1.82

|

|

(13.7

|

)

|

$

|

1.41

|

|

$

|

1.94

|

|

(27.3

|

)

|

|||||

|

Scheduled service statistics:

|

|

|

|||||||||||||||||||

|

Passengers

|

2,904,295

|

|

2,383,556

|

|

21.8

|

|

8,321,716

|

|

7,034,244

|

|

18.3

|

|

|||||||||

|

Revenue passenger miles (RPMs) (thousands)

|

2,603,849

|

|

2,204,760

|

|

18.1

|

|

7,714,172

|

|

6,647,978

|

|

16.0

|

|

|||||||||

|

Available seat miles (ASMs) (thousands)

|

2,997,529

|

|

2,526,292

|

|

18.7

|

|

8,967,614

|

|

7,612,202

|

|

17.8

|

|

|||||||||

|

Load factor

|

86.9

|

%

|

87.3

|

%

|

(0.4

|

)

|

86.0

|

%

|

87.3

|

%

|

(1.3

|

)

|

|||||||||

|

Departures

|

20,398

|

|

16,563

|

|

23.2

|

|

58,744

|

|

48,833

|

|

20.3

|

|

|||||||||

|

Block hours

|

45,740

|

|

38,094

|

|

20.1

|

|

137,066

|

|

115,434

|

|

18.7

|

|

|||||||||

|

Total scheduled service revenue per ASM (TRASM) (cents)**

|

10.54

|

|

11.38

|

|

(7.4

|

)

|

10.92

|

|

12.01

|

|

(9.1

|

)

|

|||||||||

|

Average fare - scheduled service

|

$

|

61.07

|

|

$

|

71.32

|

|

(14.4

|

)

|

$

|

68.27

|

|

$

|

79.16

|

|

(13.8

|

)

|

|||||

|

Average fare - ancillary air-related charges

|

$

|

43.83

|

|

$

|

45.12

|

|

(2.9

|

)

|

$

|

45.30

|

|

$

|

46.35

|

|

(2.3

|

)

|

|||||

|

Average fare - ancillary third party products

|

$

|

3.88

|

|

$

|

4.15

|

|

(6.5

|

)

|

$

|

4.14

|

|

$

|

4.50

|

|

(8.0

|

)

|

|||||

|

Average fare - total

|

$

|

108.78

|

|

$

|

120.59

|

|

(9.8

|

)

|

$

|

117.71

|

|

$

|

130.01

|

|

(9.5

|

)

|

|||||

|

Average stage length (miles)

|

869

|

|

894

|

|

(2.8

|

)

|

901

|

|

915

|

|

(1.5

|

)

|

|||||||||

|

Fuel gallons consumed (thousands)

|

42,439

|

|

36,458

|

|

16.4

|

|

125,291

|

|

108,837

|

|

15.1

|

|

|||||||||

|

Average fuel cost per gallon***

|

$

|

1.59

|

|

$

|

1.83

|

|

(13.1

|

)

|

$

|

1.41

|

|

$

|

1.96

|

|

(28.1

|

)

|

|||||

|

Percent of sales through website during period

|

94.6

|

%

|

95.2

|

%

|

(0.6

|

)

|

94.3

|

%

|

95.1

|

%

|

(0.8

|

)

|

|||||||||

|

Period

|

Total Number of Shares Purchased (1)

|

Average Price Paid per Share

|

Total Number of

Shares Purchased as Part of our Publicly Announced Plan |

Approximate Dollar Value of Shares that

May Yet be Purchased Under the Plans or Programs (in thousands) (2) |

||||||||||

|

July

|

315

|

|

$

|

139.26

|

|

None

|

|

|||||||

|

August

|

—

|

|

—

|

|

None

|

|

||||||||

|

September

|

—

|

|

—

|

|

None

|

|

||||||||

|

Total

|

315

|

|

$

|

139.26

|

|

—

|

|

$

|

92,330

|

|

||||

|

(1)

|

Total number of shares purchased during the quarter represents shares repurchased from employees who vested a portion of their restricted stock grants. These share repurchases were made at the election of each employee pursuant to an offer to repurchase by us. In each case, the shares repurchased constituted the portion of vested shares necessary to satisfy income tax withholding requirements.

|

|

(2)

|

Represents the remaining dollar amount of open market purchases of our common stock which has been authorized by the Board under a share repurchase program.

|

|

3.1

|

Articles of Incorporation. (1)

|

|

3.2

|

Bylaws of the Company as amended on February 17, 2015.

|

|

10.1

|

Purchase Agreement dated July 26, 2016 between Allegiant Air, LLC and Airbus S.A.S. and related Letter Agreements. (2)

|

|

10.2

|

General Terms Agreement dated July 26, 2016, among CFM International, Inc., Allegiant Air, LC and Sunshine Asset Management, LLC and related Letter Agreement No. 3. (2)

|

|

10.3

|

Employment Agreement dated as of September 9, 2016, between the Company and John Redmond.

|

|

10.4

|

Stock Appreciation Rights Agreement dated September 9, 2016, between the Company and John Redmond.

|

|

10.5

|

Restricted Stock Agreement dated September 9, 2016, between the Company and John Redmond.

|

|

10.6

|

2016 Long-Term Incentive Plan.

|

|

10.7

|

Form of Restricted Stock Agreement used for Directors of the Company.

|

|

10.8

|

Form of Stock Option Agreement used for Employees of the Company.

|

|

10.9

|

Form of Restricted Stock Agreement used for Employees of the Company.

|

|

10.10

|

Form of Stock Appreciation Rights Agreement used for Employees of the Company.

|

|

12

|

Calculation of Ratio of Earnings to Fixed Charges of Allegiant Travel Company.

|

|

31.1

|

Rule 13a - 14(a) / 15d - 14(a) Certification of Principal Executive Officer

|

|

31.2

|

Rule 13a - 14(a) / 15d - 14(a) Certification of Principal Financial Officer

|

|

32

|

Section 1350 Certifications

|

|

101.INS

|

XBRL Instance Document

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

XBRL Taxonomy Extension Labels Linkbase Document

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

(1)

|

Incorporated by reference to Exhibit filed with Registration Statement #333-134145 filed by the Company with the Commission and amendments thereto.

|

|

(2)

|

Portions of the indicated document have been omitted pursuant to a request for confidential treatment and the document indicated has been filed separately with the Commission as required by Rule 24b-2 of the Securities Exchange Act of 1934, as amended.

|

|

ALLEGIANT TRAVEL COMPANY

|

|||

|

Date:

|

November 1, 2016

|

By:

|

/s/ Scott Sheldon

|

|

Scott Sheldon, as duly authorized officer of the Company (Chief Financial Officer) and as Principal Financial Officer

|

|||