|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

¨

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Delaware

|

|

27-5403694

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

11 Penn Plaza, New York, NY

|

|

10001

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.01 per share

|

|

The NASDAQ Stock Market LLC

|

|

Large accelerated filer

|

þ

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

Class A Common Stock par value $0.01 per share

|

60,813,360

|

|

|

Class B Common Stock par value $0.01 per share

|

11,484,408

|

|

|

|

|

Page

|

|

Part I

|

||

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

Part II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

|

Part IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

|

|

SIGNATURES

|

||

|

•

|

intense competition in the markets in which we operate;

|

|

•

|

a limited number of distributors for our programming networks;

|

|

•

|

continuing availability of desirable programming;

|

|

•

|

integration of Chellomedia; and

|

|

•

|

significant levels of debt and leverage, as a result of the debt financing agreements described under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

|

|

2013

|

2012

|

2011

|

|||||||

|

|

(in millions)

|

||||||||

|

Nielsen Subscribers (at year-end)

|

97.4

|

|

98.9

|

|

96.3

|

|

|||

|

Growth from Prior Year-end

|

(2

|

)%

|

3

|

%

|

—

|

%

|

|||

|

2013

|

2012

|

2011

|

|||||||

|

|

(in millions)

|

||||||||

|

Nielsen Subscribers (at year-end)

|

84.0

|

|

81.5

|

|

76.1

|

|

|||

|

Growth from Prior Year-end

|

3

|

%

|

7

|

%

|

(1

|

)%

|

|||

|

2013

|

2012

|

2011

|

|||||||

|

|

(in millions)

|

||||||||

|

Nielsen Subscribers (at year-end)

|

69.9

|

|

69.6

|

|

65.3

|

|

|||

|

Growth from Prior Year-end

|

—

|

%

|

7

|

%

|

4

|

%

|

|||

|

2013

|

2012

|

2011

|

|||||||

|

|

(in millions)

|

||||||||

|

Nielsen Subscribers (at year-end)

|

56.2

|

|

54.1

|

|

41.8

|

|

|||

|

Growth from Prior Year-end

|

4

|

%

|

29

|

%

|

5

|

%

|

|||

|

•

|

laws and policies affecting trade and taxes, including laws and policies relating to the repatriation of funds and withholding taxes, and changes in these laws;

|

|

•

|

changes in local regulatory requirements, including restrictions on content, imposition of local content quotas and restrictions on foreign ownership;

|

|

•

|

differing degrees of protection for intellectual property and varying attitudes towards the piracy of intellectual property;

|

|

•

|

the instability of foreign economies and governments;

|

|

•

|

exchange controls;

|

|

•

|

war and acts of terrorism;

|

|

•

|

anti-corruption laws and regulations such as the Foreign Corrupt Practices Act and the U.K. Bribery Act that impose stringent requirements on how we conduct our foreign operations and changes in these laws and regulations;

|

|

•

|

foreign privacy and data protection laws and regulation and changes in these laws; and

|

|

•

|

shifting consumer preferences regarding the viewing of video programming.

|

|

•

|

borrow money or guarantee debt;

|

|

•

|

create liens;

|

|

•

|

pay dividends on or redeem or repurchase stock;

|

|

•

|

make specified types of investments;

|

|

•

|

enter into transactions with affiliates; and

|

|

•

|

sell assets or merge with other companies.

|

|

•

|

Class B Common Stock, which is generally entitled to ten votes per share and is entitled collectively to elect 75% of our Board of Directors, and

|

|

•

|

Class A Common Stock, which is entitled to one vote per share and is entitled collectively to elect the remaining 25% of our Board of Directors.

|

|

•

|

the authorization or issuance of any additional shares of Class B Common Stock, and

|

|

•

|

any amendment, alteration or repeal of any of the provisions of our certificate of incorporation that adversely affects the powers, preferences or rights of the Class B Common Stock.

|

|

|

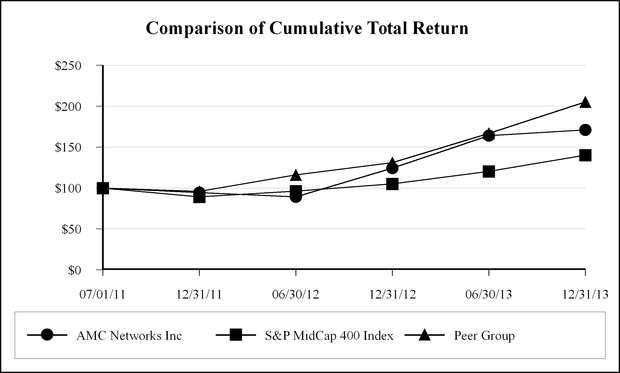

INDEXED RETURNS

Period Ending

|

|||||||||||

|

Company Name / Index

|

Base Period 7/01/11

|

12/31/11

|

6/30/12

|

12/31/12

|

6/30/13

|

12/31/13

|

||||||

|

AMC Networks Inc.

|

100

|

94.30

|

89.21

|

124.22

|

163.94

|

170.92

|

||||||

|

S&P MidCap 400 Index

|

100

|

89.03

|

96.06

|

104.94

|

120.25

|

140.10

|

||||||

|

Peer Group

|

100

|

95.90

|

115.98

|

131.07

|

166.78

|

205.10

|

||||||

|

Year Ended December 31, 2013

|

High

|

Low

|

||||||

|

First Quarter

|

$

|

63.26

|

|

$

|

49.97

|

|

||

|

Second Quarter

|

$

|

70.65

|

|

$

|

59.56

|

|

||

|

Third Quarter

|

$

|

72.46

|

|

$

|

61.05

|

|

||

|

Fourth Quarter

|

$

|

73.39

|

|

$

|

61.69

|

|

||

|

Year Ended December 31, 2012

|

High

|

Low

|

||||||

|

First Quarter

|

$

|

46.69

|

|

$

|

36.98

|

|

||

|

Second Quarter

|

$

|

46.00

|

|

$

|

34.78

|

|

||

|

Third Quarter

|

$

|

45.09

|

|

$

|

35.30

|

|

||

|

Fourth Quarter

|

$

|

55.38

|

|

$

|

40.75

|

|

||

|

Period

|

(a) Total Number of Shares

(or Units) Purchased

|

(b) Average Price Paid per Share (or Unit)

|

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs

|

(d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs

|

|||||||

|

October 1, 2013 to October 31, 2013

|

—

|

|

$

|

—

|

|

N/A

|

N/A

|

||||

|

November 1, 2013 to November 30, 2013

|

26

|

|

$

|

65.95

|

|

N/A

|

N/A

|

||||

|

December 1, 2013 to December 31, 2013

|

2,031

|

|

$

|

65.54

|

|

N/A

|

N/A

|

||||

|

Total

|

2,057

|

|

$

|

65.54

|

|

N/A

|

|||||

|

|

Years Ended December 31,

|

||||||||||||||||||

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

|

(Dollars in thousands, except per share amounts)

|

||||||||||||||||||

|

Operating Data:

|

|||||||||||||||||||

|

Revenues, net

|

$

|

1,591,858

|

|

$

|

1,352,577

|

|

$

|

1,187,741

|

|

$

|

1,078,300

|

|

$

|

973,644

|

|

||||

|

Operating expenses:

|

|||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization shown below)

|

662,233

|

|

507,436

|

|

425,961

|

|

366,093

|

|

310,365

|

|

|||||||||

|

Selling, general and administrative

|

425,735

|

|

396,926

|

|

335,656

|

|

328,134

|

|

313,904

|

|

|||||||||

|

Restructuring (credit) expense (a)

|

—

|

|

(3

|

)

|

(240

|

)

|

(2,218

|

)

|

5,162

|

|

|||||||||

|

Depreciation and amortization

|

54,667

|

|

85,380

|

|

99,848

|

|

106,455

|

|

106,504

|

|

|||||||||

|

Litigation settlement gain

|

(132,944

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

1,009,691

|

|

989,739

|

|

861,225

|

|

798,464

|

|

735,935

|

|

||||||||||

|

Operating income

|

582,167

|

|

362,838

|

|

326,516

|

|

279,836

|

|

237,709

|

|

|||||||||

|

Other income (expense)

|

(113,166

|

)

|

(140,564

|

)

|

(115,906

|

)

|

(73,574

|

)

|

(78,755

|

)

|

|||||||||

|

Income from continuing operations before income taxes

|

469,001

|

|

222,274

|

|

210,610

|

|

206,262

|

|

158,954

|

|

|||||||||

|

Income tax expense

|

(178,841

|

)

|

(86,058

|

)

|

(84,248

|

)

|

(88,073

|

)

|

(70,407

|

)

|

|||||||||

|

Income from continuing operations

|

290,160

|

|

136,216

|

|

126,362

|

|

118,189

|

|

88,547

|

|

|||||||||

|

Income (loss) from discontinued operations, net of income taxes

|

—

|

|

314

|

|

92

|

|

(38,090

|

)

|

(34,791

|

)

|

|||||||||

|

Net income including noncontrolling interests

|

290,160

|

|

136,530

|

|

126,454

|

|

80,099

|

|

53,756

|

|

|||||||||

|

Net loss attributable to noncontrolling interests

|

578

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Net income attributable to AMC Networks' stockholders

|

$

|

290,738

|

|

$

|

136,530

|

|

$

|

126,454

|

|

$

|

80,099

|

|

$

|

53,756

|

|

||||

|

Income from continuing operations per share:

|

|||||||||||||||||||

|

Basic (b)

|

$

|

4.06

|

|

$

|

1.94

|

|

$

|

1.82

|

|

$

|

1.71

|

|

$

|

1.28

|

|

||||

|

Diluted (b)

|

$

|

4.00

|

|

$

|

1.89

|

|

$

|

1.79

|

|

$

|

1.71

|

|

$

|

1.28

|

|

||||

|

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

521,951

|

|

$

|

610,970

|

|

$

|

215,836

|

|

$

|

79,960

|

|

$

|

29,828

|

|

||||

|

Total assets

|

2,636,689

|

|

2,596,219

|

|

2,183,934

|

|

1,853,896

|

|

1,934,362

|

|

|||||||||

|

Total debt (including capital leases) (c)

|

2,171,288

|

|

2,168,977

|

|

2,306,957

|

|

1,118,875

|

|

1,417,711

|

|

|||||||||

|

Stockholders’ (deficiency) equity (c)

|

(571,519

|

)

|

(882,352

|

)

|

(1,036,995

|

)

|

24,831

|

|

(236,992

|

)

|

|||||||||

|

(a)

|

In December 2008, we decided to discontinue funding the domestic programming business of VOOM HD. In connection with this decision, we recorded restructuring expense (credit) in each of the years 2009 to 2012.

|

|

(b)

|

Common shares assumed to be outstanding during the years ended December 31, 2010 and 2009 totaled 69,161,000, representing the number of shares of AMC Networks common stock issued to Cablevision shareholders on the Distribution date, and excludes unvested outstanding restricted shares, based on a distribution ratio of one share of AMC Networks common stock for every four shares of Cablevision common stock outstanding.

|

|

(c)

|

In 2011, as part of the Distribution, we incurred $2,425,000 of debt (the “Distribution Debt”), consisting of $1,725,000 aggregate principal amount of senior secured term loans and $700,000 aggregate principal amount of 7.75% senior unsecured notes. Approximately $1,063,000 of the proceeds of the Distribution Debt was used to repay all pre-Distribution outstanding Company debt (excluding capital leases), including principal and accrued and unpaid interest to the date of repayment, and, as partial consideration for Cablevision’s contribution of the membership interests in RMH to the Company, $1,250,000, net of discount, of Distribution Debt was issued to CSC Holdings, a wholly-owned subsidiary of Cablevision, which is reflected as a deemed capital distribution in the consolidated statement of stockholders’ deficiency for the year ended December 31, 2011. See Note 1 to the accompanying consolidated financial statements.

|

|

•

|

the demand for our programming among cable and other multichannel video programming distributors and our ability to maintain and renew affiliation agreements with multichannel video programming distributors;

|

|

•

|

the cost of, and our ability to obtain or produce, desirable programming content for our networks and independent film distribution businesses;

|

|

•

|

market demand for our services internationally and for our independent film distribution business, and our ability to profitably provide those services;

|

|

•

|

whether pending uncompleted transactions are completed on the terms and at the times set forth (if at all);

|

|

•

|

financial community and rating agency perceptions of our business, operations, financial condition and the industry in which we operate, and the additional factors described herein; and

|

|

•

|

National Networks:

Principally includes our four nationally distributed programming networks: AMC, WE tv, IFC and SundanceTV. These programming networks are distributed throughout the United States via multichannel video programming distributors;

|

|

•

|

International and Other:

Principally includes AMC/Sundance Channel Global, our international programming business; IFC Films, our independent film distribution business; AMC Networks Broadcasting & Technology, our network technical services business, which primarily services the programming networks of the Company; and various developing online content distribution initiatives. AMC and Sundance Channel are distributed in Canada, Sundance Channel is also distributed in Europe, Asia and Latin America and WE tv is distributed in Asia. The International and Other operating segment also includes VOOM HD.

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Revenues, net

|

|||||||||||

|

National Networks

|

$

|

1,485,016

|

|

$

|

1,254,186

|

|

$

|

1,082,358

|

|

||

|

International and Other

|

122,429

|

|

114,541

|

|

125,573

|

|

|||||

|

Inter-segment eliminations

|

(15,587

|

)

|

(16,150

|

)

|

(20,190

|

)

|

|||||

|

Consolidated revenues, net

|

$

|

1,591,858

|

|

$

|

1,352,577

|

|

$

|

1,187,741

|

|

||

|

Operating income (loss)

|

|||||||||||

|

National Networks

|

$

|

501,825

|

|

$

|

408,117

|

|

$

|

349,272

|

|

||

|

International and Other (a)

|

76,598

|

|

(48,607

|

)

|

(21,890

|

)

|

|||||

|

Inter-segment eliminations

|

3,744

|

|

3,328

|

|

(866

|

)

|

|||||

|

Consolidated operating income

|

$

|

582,167

|

|

$

|

362,838

|

|

$

|

326,516

|

|

||

|

AOCF (deficit)

|

|||||||||||

|

National Networks

|

$

|

555,911

|

|

$

|

492,129

|

|

$

|

447,555

|

|

||

|

International and Other

|

(35,466

|

)

|

(30,040

|

)

|

(4,976

|

)

|

|||||

|

Inter-segment eliminations

|

3,744

|

|

3,328

|

|

(866

|

)

|

|||||

|

Consolidated AOCF

|

$

|

524,189

|

|

$

|

465,417

|

|

$

|

441,713

|

|

||

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Operating income

|

$

|

582,167

|

|

$

|

362,838

|

|

$

|

326,516

|

|

||

|

Share-based compensation expense

|

20,299

|

|

17,202

|

|

15,589

|

|

|||||

|

Depreciation and amortization

|

54,667

|

|

85,380

|

|

99,848

|

|

|||||

|

Litigation settlement gain

|

(132,944

|

)

|

—

|

|

—

|

|

|||||

|

Restructuring credit

|

—

|

|

(3

|

)

|

(240

|

)

|

|||||

|

AOCF

|

$

|

524,189

|

|

$

|

465,417

|

|

$

|

441,713

|

|

||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2013

|

2012

|

|

|

||||||||||||||||

|

|

Amount

|

% of

Revenues,

net

|

Amount

|

% of

Revenues,

net

|

$ change

|

%

change

|

||||||||||||||

|

Revenues, net

|

$

|

1,591,858

|

|

100.0

|

%

|

$

|

1,352,577

|

|

100.0

|

%

|

$

|

239,281

|

|

17.7

|

%

|

|||||

|

Operating expenses:

|

||||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization)

|

662,233

|

|

41.6

|

|

507,436

|

|

37.5

|

|

154,797

|

|

30.5

|

|

||||||||

|

Selling, general and administrative

|

425,735

|

|

26.7

|

|

396,926

|

|

29.3

|

|

28,809

|

|

7.3

|

|

||||||||

|

Restructuring credit

|

—

|

|

—

|

|

(3

|

)

|

—

|

|

3

|

|

(100.0

|

)

|

||||||||

|

Depreciation and amortization

|

54,667

|

|

3.4

|

|

85,380

|

|

6.3

|

|

(30,713

|

)

|

(36.0

|

)

|

||||||||

|

Litigation settlement gain

|

(132,944

|

)

|

(8.4

|

)

|

—

|

|

—

|

|

(132,944

|

)

|

n/m

|

|

||||||||

|

Total operating expenses

|

1,009,691

|

|

63.4

|

|

989,739

|

|

73.2

|

|

19,952

|

|

2.0

|

|

||||||||

|

Operating income

|

582,167

|

|

36.6

|

|

362,838

|

|

26.8

|

|

219,329

|

|

60.4

|

|

||||||||

|

Other income (expense):

|

||||||||||||||||||||

|

Interest expense, net

|

(115,041

|

)

|

(7.2

|

)

|

(127,276

|

)

|

(9.4

|

)

|

12,235

|

|

(9.6

|

)

|

||||||||

|

Write-off of deferred financing costs

|

(4,007

|

)

|

(0.3

|

)

|

(1,862

|

)

|

(0.1

|

)

|

(2,145

|

)

|

115.2

|

|

||||||||

|

Loss on extinguishment of debt

|

(1,087

|

)

|

(0.1

|

)

|

(10,774

|

)

|

(0.8

|

)

|

9,687

|

|

(89.9

|

)

|

||||||||

|

Miscellaneous, net

|

6,969

|

|

0.4

|

|

(652

|

)

|

—

|

|

7,621

|

|

n/m

|

|

||||||||

|

Total other income (expense)

|

(113,166

|

)

|

(7.1

|

)

|

(140,564

|

)

|

(10.4

|

)

|

27,398

|

|

(19.5

|

)

|

||||||||

|

Income from continuing operations before income taxes

|

469,001

|

|

29.5

|

|

222,274

|

|

16.4

|

|

246,727

|

|

111.0

|

|

||||||||

|

Income tax expense

|

(178,841

|

)

|

(11.2

|

)

|

(86,058

|

)

|

(6.4

|

)

|

(92,783

|

)

|

107.8

|

|

||||||||

|

Income from continuing operations

|

290,160

|

|

18.2

|

|

136,216

|

|

10.1

|

|

153,944

|

|

113.0

|

|

||||||||

|

Income from discontinued operations, net of income taxes

|

—

|

|

—

|

|

314

|

|

—

|

|

(314

|

)

|

(100.0

|

)

|

||||||||

|

Net income including noncontrolling interests

|

290,160

|

|

18.2

|

%

|

136,530

|

|

10.1

|

%

|

153,630

|

|

112.5

|

%

|

||||||||

|

Net loss attributable to noncontrolling interests

|

578

|

|

—

|

%

|

—

|

|

—

|

%

|

578

|

|

n/m

|

|

||||||||

|

Net income attributable to AMC Networks’ stockholders

|

$

|

290,738

|

|

18.3

|

%

|

$

|

136,530

|

|

10.1

|

%

|

$

|

154,208

|

|

112.9

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2013

|

2012

|

$ change

|

% change

|

||||||||||

|

Operating income

|

$

|

582,167

|

|

$

|

362,838

|

|

$

|

219,329

|

|

60.4

|

%

|

|||

|

Share-based compensation expense

|

20,299

|

|

17,202

|

|

3,097

|

|

18.0

|

|

||||||

|

Depreciation and amortization

|

54,667

|

|

85,380

|

|

(30,713

|

)

|

(36.0

|

)

|

||||||

|

Litigation settlement gain

|

(132,944

|

)

|

—

|

|

(132,944

|

)

|

n/m

|

|

||||||

|

Restructuring credit

|

—

|

|

(3

|

)

|

3

|

|

(100.0

|

)

|

||||||

|

Consolidated AOCF

|

$

|

524,189

|

|

$

|

465,417

|

|

$

|

58,772

|

|

12.6

|

%

|

|||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2013

|

2012

|

|

|

||||||||||||||||

|

|

Amount

|

% of

Revenues,

net

|

Amount

|

% of

Revenues,

net

|

$ change

|

%

change

|

||||||||||||||

|

Revenues, net

|

$

|

1,485,016

|

|

100.0

|

%

|

$

|

1,254,186

|

|

100.0

|

%

|

$

|

230,830

|

|

18.4

|

%

|

|||||

|

Operating expenses:

|

||||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization)

|

592,587

|

|

39.9

|

|

450,124

|

|

35.9

|

|

142,463

|

|

31.6

|

|

||||||||

|

Selling, general and administrative

|

352,731

|

|

23.8

|

|

325,509

|

|

26.0

|

|

27,222

|

|

8.4

|

|

||||||||

|

Depreciation and amortization

|

37,873

|

|

2.6

|

|

70,436

|

|

5.6

|

|

(32,563

|

)

|

(46.2

|

)

|

||||||||

|

Operating income

|

$

|

501,825

|

|

33.8

|

%

|

$

|

408,117

|

|

32.5

|

%

|

$

|

93,708

|

|

23.0

|

%

|

|||||

|

Share-based compensation expense

|

16,213

|

|

1.1

|

|

13,576

|

|

1.1

|

|

2,637

|

|

19.4

|

|

||||||||

|

Depreciation and amortization

|

37,873

|

|

2.6

|

|

70,436

|

|

5.6

|

|

(32,563

|

)

|

(46.2

|

)

|

||||||||

|

AOCF

|

$

|

555,911

|

|

37.4

|

%

|

$

|

492,129

|

|

39.2

|

%

|

$

|

63,782

|

|

13.0

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2013

|

2012

|

|

|

||||||||||||||||

|

|

Amount

|

% of

Revenues,

net

|

Amount

|

% of

Revenues,

net

|

$ change

|

%

change

|

||||||||||||||

|

Revenues, net

|

$

|

122,429

|

|

100.0

|

%

|

$

|

114,541

|

|

100.0

|

%

|

$

|

7,888

|

|

6.9

|

%

|

|||||

|

Operating expenses:

|

||||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization)

|

88,665

|

|

72.4

|

|

76,468

|

|

66.8

|

|

12,197

|

|

16.0

|

|

||||||||

|

Selling, general and administrative

|

73,316

|

|

59.9

|

|

71,739

|

|

62.6

|

|

1,577

|

|

2.2

|

|

||||||||

|

Restructuring credit

|

—

|

|

—

|

|

(3

|

)

|

—

|

|

3

|

|

(100.0

|

)

|

||||||||

|

Depreciation and amortization

|

16,794

|

|

13.7

|

|

14,944

|

|

13.0

|

|

1,850

|

|

12.4

|

|

||||||||

|

Litigation settlement gain

|

(132,944

|

)

|

(108.6

|

)%

|

—

|

|

—

|

%

|

(132,944

|

)

|

n/m

|

|

||||||||

|

Operating income (loss)

|

$

|

76,598

|

|

62.6

|

%

|

$

|

(48,607

|

)

|

(42.4

|

)%

|

$

|

125,205

|

|

(257.6

|

)%

|

|||||

|

Share-based compensation expense

|

4,086

|

|

3.3

|

|

3,626

|

|

3.2

|

|

460

|

|

12.7

|

|

||||||||

|

Depreciation and amortization

|

16,794

|

|

13.7

|

|

14,944

|

|

13.0

|

|

1,850

|

|

12.4

|

|

||||||||

|

Litigation settlement gain

|

(132,944

|

)

|

(108.6

|

)

|

—

|

|

—

|

|

(132,944

|

)

|

n/m

|

|

||||||||

|

Restructuring credit

|

—

|

|

—

|

|

(3

|

)

|

—

|

|

3

|

|

(100.0

|

)

|

||||||||

|

AOCF deficit

|

$

|

(35,466

|

)

|

(29.0

|

)%

|

$

|

(30,040

|

)

|

(26.2

|

)%

|

$

|

(5,426

|

)

|

18.1

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2013

|

% of

total

|

2012

|

% of

total

|

$ change

|

%

change

|

||||||||||||||

|

National Networks

|

$

|

1,485,016

|

|

93.3

|

%

|

$

|

1,254,186

|

|

92.7

|

%

|

$

|

230,830

|

|

18.4

|

%

|

|||||

|

International and Other

|

122,429

|

|

7.7

|

|

114,541

|

|

8.5

|

|

7,888

|

|

6.9

|

|

||||||||

|

Inter-segment eliminations

|

(15,587

|

)

|

(1.0

|

)

|

(16,150

|

)

|

(1.2

|

)

|

563

|

|

(3.5

|

)

|

||||||||

|

Consolidated revenues, net

|

$

|

1,591,858

|

|

100.0

|

%

|

$

|

1,352,577

|

|

100.0

|

%

|

$

|

239,281

|

|

17.7

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2013

|

% of

total

|

2012

|

% of

total

|

$ change

|

%

change

|

||||||||||||||

|

Advertising

|

$

|

662,789

|

|

44.6

|

%

|

$

|

522,917

|

|

41.7

|

%

|

$

|

139,872

|

|

26.7

|

%

|

|||||

|

Distribution

|

822,227

|

|

55.4

|

|

731,269

|

|

58.3

|

|

90,958

|

|

12.4

|

|

||||||||

|

$

|

1,485,016

|

|

100.0

|

%

|

$

|

1,254,186

|

|

100.0

|

%

|

$

|

230,830

|

|

18.4

|

%

|

||||||

|

•

|

Advertising revenues increased

$139,872

across all of our networks, with the largest increase attributable to AMC. This increase resulted from higher pricing per unit sold due to an increased demand for our programming by advertisers, led by

The Walking Dead,

and an increased number of original programming series that aired on AMC as compared to the number of original programming series that aired on AMC during 2012. This increase was also impacted by a decrease in advertising revenues in the 2012 associated with the temporary DISH Network carriage termination of all our networks for approximately four months in 2012. As previously discussed, most of our advertising revenues vary based on the timing of our original programming series and the popularity of our programming as measured by Nielsen. Due to these factors, we expect advertising revenues to vary from quarter to quarter; and

|

|

•

|

Distribution revenues increased

$90,958

principally due to an increase of $55,645 in affiliation fee revenues resulting from an increase in rates, primarily at AMC. As previously discussed, affiliation fee revenues and subscribers were negatively impacted in 2012 due to the temporary DISH Network carriage termination of all our networks for approximately four months in 2012. Distribution revenues increased $35,312 principally from licensing and digital distribution revenues derived from our original programming, primarily at AMC and IFC. In addition, distribution revenues vary based on the timing of availability of our programming to distributors. Because of these factors, we expect distribution revenues to vary from quarter to quarter.

|

|

|

Estimated Domestic

Subscribers

(1)

|

||||

|

|

December 31, 2013

|

December 31, 2012

|

|||

|

National Programming Networks:

|

|||||

|

AMC

|

97,400

|

|

98,900

|

|

|

|

WE tv

|

84,000

|

|

81,500

|

|

|

|

IFC

|

69,900

|

|

69,600

|

|

|

|

SundanceTV

|

56,200

|

|

54,100

|

|

|

|

(1)

|

Estimated U.S. subscribers as measured by Nielsen.

|

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2013

|

% of

total |

2012

|

% of

total |

$ change

|

%

change |

||||||||||||||

|

Advertising

|

$

|

—

|

|

—

|

%

|

$

|

147

|

|

0.1

|

%

|

$

|

(147

|

)

|

(100.0

|

)%

|

|||||

|

Distribution

|

122,429

|

|

100.0

|

|

114,394

|

|

99.9

|

|

8,035

|

|

7.0

|

|

||||||||

|

$

|

122,429

|

|

100.0

|

%

|

$

|

114,541

|

|

100.0

|

%

|

$

|

7,888

|

|

6.9

|

%

|

||||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2013

|

2012

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

592,587

|

|

$

|

450,124

|

|

$

|

142,463

|

|

31.6

|

%

|

|||

|

International and Other

|

88,665

|

|

76,468

|

|

12,197

|

|

16.0

|

|

||||||

|

Inter-segment eliminations

|

(19,019

|

)

|

(19,156

|

)

|

137

|

|

(0.7

|

)

|

||||||

|

Total

|

$

|

662,233

|

|

$

|

507,436

|

|

$

|

154,797

|

|

30.5

|

%

|

|||

|

Percentage of revenues, net

|

41.6

|

%

|

37.5

|

%

|

||||||||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2013

|

2012

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

352,731

|

|

$

|

325,509

|

|

$

|

27,222

|

|

8.4

|

%

|

|||

|

International and Other

|

73,316

|

|

71,739

|

|

1,577

|

|

2.2

|

|

||||||

|

Inter-segment eliminations

|

(312

|

)

|

(322

|

)

|

10

|

|

(3.1

|

)

|

||||||

|

Total

|

$

|

425,735

|

|

$

|

396,926

|

|

$

|

28,809

|

|

7.3

|

%

|

|||

|

Percentage of revenues, net

|

26.7

|

%

|

29.3

|

%

|

||||||||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2013

|

2012

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

37,873

|

|

$

|

70,436

|

|

$

|

(32,563

|

)

|

(46.2

|

)%

|

|||

|

International and Other

|

16,794

|

|

14,944

|

|

1,850

|

|

12.4

|

|

||||||

|

$

|

54,667

|

|

$

|

85,380

|

|

$

|

(30,713

|

)

|

(36.0

|

)%

|

||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2013

|

2012

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

555,911

|

|

$

|

492,129

|

|

$

|

63,782

|

|

13.0

|

%

|

|||

|

International and Other

|

(35,466

|

)

|

(30,040

|

)

|

(5,426

|

)

|

18.1

|

|

||||||

|

Inter-segment eliminations

|

3,744

|

|

3,328

|

|

416

|

|

12.5

|

|

||||||

|

AOCF

|

$

|

524,189

|

|

$

|

465,417

|

|

$

|

58,772

|

|

12.6

|

%

|

|||

|

Change in fair value of interest rate swap contracts (a)

|

$

|

(11,660

|

)

|

|

Increase in interest income

|

(317

|

)

|

|

|

Other

|

(258

|

)

|

|

|

$

|

(12,235

|

)

|

|

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2012

|

2011

|

|

|

||||||||||||||||

|

|

Amount

|

% of

Revenues,

net

|

Amount

|

% of

Revenues,

net

|

$ change

|

%

change

|

||||||||||||||

|

Revenues, net

|

$

|

1,352,577

|

|

100.0

|

%

|

$

|

1,187,741

|

|

100.0

|

%

|

$

|

164,836

|

|

13.9

|

%

|

|||||

|

Operating expenses:

|

||||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization)

|

507,436

|

|

37.5

|

|

425,961

|

|

35.9

|

|

81,475

|

|

19.1

|

|

||||||||

|

Selling, general and administrative

|

396,926

|

|

29.3

|

|

335,656

|

|

28.3

|

|

61,270

|

|

18.3

|

|

||||||||

|

Restructuring credit

|

(3

|

)

|

—

|

|

(240

|

)

|

—

|

|

237

|

|

(98.8

|

)

|

||||||||

|

Depreciation and amortization

|

85,380

|

|

6.3

|

|

99,848

|

|

8.4

|

|

(14,468

|

)

|

(14.5

|

)

|

||||||||

|

Total operating expenses

|

989,739

|

|

73.2

|

|

861,225

|

|

72.5

|

|

128,514

|

|

14.9

|

|

||||||||

|

Operating income

|

362,838

|

|

26.8

|

|

326,516

|

|

27.5

|

|

36,322

|

|

11.1

|

|

||||||||

|

Other income (expense):

|

|

|||||||||||||||||||

|

Interest expense, net

|

(127,276

|

)

|

(9.4

|

)

|

(94,796

|

)

|

(8.0

|

)

|

(32,480

|

)

|

34.3

|

|

||||||||

|

Write-off of deferred financing costs

|

(1,862

|

)

|

(0.1

|

)

|

(6,247

|

)

|

(0.5

|

)

|

4,385

|

|

—

|

|

||||||||

|

Loss on extinguishment of debt

|

(10,774

|

)

|

(0.8

|

)

|

(14,726

|

)

|

(1.2

|

)

|

3,952

|

|

—

|

|

||||||||

|

Miscellaneous, net

|

(652

|

)

|

—

|

|

(137

|

)

|

—

|

|

(515

|

)

|

375.9

|

|

||||||||

|

Total other income (expense)

|

(140,564

|

)

|

(10.4

|

)

|

(115,906

|

)

|

(9.8

|

)

|

(24,658

|

)

|

21.3

|

|

||||||||

|

Income from continuing operations before income taxes

|

222,274

|

|

16.4

|

|

210,610

|

|

17.7

|

|

11,664

|

|

5.5

|

|

||||||||

|

Income tax expense

|

(86,058

|

)

|

(6.4

|

)

|

(84,248

|

)

|

(7.1

|

)

|

(1,810

|

)

|

2.1

|

|

||||||||

|

Income from continuing operations

|

136,216

|

|

10.1

|

|

126,362

|

|

10.6

|

|

9,854

|

|

7.8

|

|

||||||||

|

Income from discontinued operations, net of income taxes

|

314

|

|

—

|

|

92

|

|

—

|

|

222

|

|

241.3

|

|

||||||||

|

Net income attributable to AMC Networks’ stockholders

|

$

|

136,530

|

|

10.1

|

%

|

$

|

126,454

|

|

10.6

|

%

|

$

|

10,076

|

|

8.0

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2012

|

2011

|

$ change

|

% change

|

||||||||||

|

Operating income

|

$

|

362,838

|

|

$

|

326,516

|

|

$

|

36,322

|

|

11.1

|

%

|

|||

|

Share-based compensation expense

|

17,202

|

|

15,589

|

|

1,613

|

|

10.3

|

|

||||||

|

Depreciation and amortization

|

85,380

|

|

99,848

|

|

(14,468

|

)

|

(14.5

|

)

|

||||||

|

Restructuring credit

|

(3

|

)

|

(240

|

)

|

237

|

|

(98.8

|

)

|

||||||

|

Consolidated AOCF

|

$

|

465,417

|

|

$

|

441,713

|

|

$

|

23,704

|

|

5.4

|

%

|

|||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2012

|

2011

|

|

|

||||||||||||||||

|

|

Amount

|

% of

Revenues,

net

|

Amount

|

% of

Revenues,

net

|

$ change

|

%

change

|

||||||||||||||

|

Revenues, net

|

$

|

1,254,186

|

|

100.0

|

%

|

$

|

1,082,358

|

|

100.0

|

%

|

$

|

171,828

|

|

15.9

|

%

|

|||||

|

Operating expenses:

|

|

|

||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization)

|

450,124

|

|

35.9

|

|

366,998

|

|

33.9

|

|

83,126

|

|

22.7

|

|

||||||||

|

Selling, general and administrative

|

325,509

|

|

26.0

|

|

280,387

|

|

25.9

|

|

45,122

|

|

16.1

|

|

||||||||

|

Depreciation and amortization

|

70,436

|

|

5.6

|

|

85,701

|

|

7.9

|

|

(15,265

|

)

|

(17.8

|

)

|

||||||||

|

Operating income

|

$

|

408,117

|

|

32.5

|

%

|

$

|

349,272

|

|

32.3

|

%

|

$

|

58,845

|

|

16.8

|

%

|

|||||

|

Share-based compensation expense

|

13,576

|

|

1.1

|

|

12,582

|

|

1.2

|

|

994

|

|

7.9

|

|

||||||||

|

Depreciation and amortization

|

70,436

|

|

5.6

|

|

85,701

|

|

7.9

|

|

(15,265

|

)

|

(17.8

|

)

|

||||||||

|

AOCF

|

$

|

492,129

|

|

39.2

|

%

|

$

|

447,555

|

|

41.3

|

%

|

$

|

44,574

|

|

10.0

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2012

|

2011

|

|

|

||||||||||||||||

|

|

Amount

|

% of

Revenues,

net

|

Amount

|

% of

Revenues,

net

|

$ change

|

%

change

|

||||||||||||||

|

Revenues, net

|

$

|

114,541

|

|

100.0

|

%

|

$

|

125,573

|

|

100.0

|

%

|

$

|

(11,032

|

)

|

(8.8

|

)%

|

|||||

|

Operating expenses:

|

||||||||||||||||||||

|

Technical and operating (excluding depreciation and amortization)

|

76,468

|

|

66.8

|

|

77,485

|

|

61.7

|

|

(1,017

|

)

|

(1.3

|

)%

|

||||||||

|

Selling, general and administrative

|

71,739

|

|

62.6

|

|

56,071

|

|

44.7

|

|

15,668

|

|

27.9

|

%

|

||||||||

|

Restructuring credit

|

(3

|

)

|

—

|

|

(240

|

)

|

(0.2

|

)

|

237

|

|

(98.8

|

)%

|

||||||||

|

Depreciation and amortization

|

14,944

|

|

13.0

|

|

14,147

|

|

11.3

|

|

797

|

|

5.6

|

%

|

||||||||

|

Operating loss

|

$

|

(48,607

|

)

|

(42.4

|

)%

|

$

|

(21,890

|

)

|

(17.4

|

)%

|

$

|

(26,717

|

)

|

122.1

|

%

|

|||||

|

Share-based compensation expense

|

3,626

|

|

3.2

|

|

3,007

|

|

2.4

|

|

619

|

|

20.6

|

|

||||||||

|

Depreciation and amortization

|

14,944

|

|

13.0

|

|

14,147

|

|

11.3

|

|

797

|

|

5.6

|

|

||||||||

|

Restructuring credit

|

(3

|

)

|

—

|

|

(240

|

)

|

(0.2

|

)

|

237

|

|

(98.8

|

)

|

||||||||

|

AOCF deficit

|

$

|

(30,040

|

)

|

(26.2

|

)%

|

$

|

(4,976

|

)

|

(4.0

|

)%

|

$

|

(25,064

|

)

|

503.7

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2012

|

% of

total

|

2011

|

% of

total

|

$ change

|

%

change

|

||||||||||||||

|

National Networks

|

$

|

1,254,186

|

|

92.7

|

%

|

$

|

1,082,358

|

|

91.1

|

%

|

$

|

171,828

|

|

15.9

|

%

|

|||||

|

International and Other

|

114,541

|

|

8.5

|

|

125,573

|

|

10.6

|

|

(11,032

|

)

|

(8.8

|

)

|

||||||||

|

Inter-segment eliminations

|

(16,150

|

)

|

(1.2

|

)

|

(20,190

|

)

|

(1.7

|

)

|

4,040

|

|

(20.0

|

)

|

||||||||

|

Consolidated revenues, net

|

$

|

1,352,577

|

|

100.0

|

%

|

$

|

1,187,741

|

|

100.0

|

%

|

$

|

164,836

|

|

13.9

|

%

|

|||||

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2012

|

% of

total

|

2011

|

% of

total

|

$ change

|

%

change

|

||||||||||||||

|

Advertising

|

$

|

522,917

|

|

41.7

|

%

|

$

|

447,449

|

|

41.3

|

%

|

$

|

75,468

|

|

16.9

|

%

|

|||||

|

Distribution

|

731,269

|

|

58.3

|

|

634,909

|

|

58.7

|

|

96,360

|

|

15.2

|

|

||||||||

|

$

|

1,254,186

|

|

100.0

|

%

|

$

|

1,082,358

|

|

100.0

|

%

|

$

|

171,828

|

|

15.9

|

%

|

||||||

|

•

|

Advertising revenues increased

$75,468

resulting from higher pricing per unit sold due to an increased demand for our programming by advertisers, primarily at AMC and an increased number of original programming series aired on AMC during 2012 as compared to 2011. These increases were partially offset by decreases in advertising revenues associated with the temporary DISH Network carriage termination of all of our networks for approximately four months in 2012; and

|

|

•

|

Distribution revenues increased

$96,360

primarily due to an increase of $65,918 from digital, licensing, international and home video distribution revenues derived from our National Networks original programming, primarily at AMC and an increase in affiliation fee revenues primarily attributable to an increase in rates, including the impact of lower amortization of deferred carriage fees. These increases were partially offset by a decrease associated with the temporary DISH Network carriage termination and a contractual adjustment from a distributor that increased revenue in 2011.

|

|

|

Estimated Domestic

Subscribers (1) |

||||

|

|

December 31, 2012

|

December 31, 2011

|

|||

|

National Programming Networks:

|

|||||

|

AMC

|

98,900

|

|

96,300

|

|

|

|

WE tv

|

81,500

|

|

76,100

|

|

|

|

IFC

|

69,600

|

|

65,300

|

|

|

|

SundanceTV

|

54,100

|

|

41,800

|

|

|

|

(1)

|

Estimated U.S. subscribers as measured by Nielsen.

|

|

|

Years Ended December 31,

|

|

|

|||||||||||||||||

|

|

2012

|

% of

total

|

2011

|

% of

total

|

$ change

|

%

change

|

||||||||||||||

|

Advertising

|

$

|

147

|

|

0.1

|

%

|

$

|

177

|

|

0.1

|

%

|

$

|

(30

|

)

|

(16.9

|

)%

|

|||||

|

Distribution

|

114,394

|

|

99.9

|

|

125,396

|

|

99.9

|

|

(11,002

|

)

|

(8.8

|

)

|

||||||||

|

$

|

114,541

|

|

100.0

|

%

|

$

|

125,573

|

|

100.0

|

%

|

$

|

(11,032

|

)

|

(8.8

|

)%

|

||||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2012

|

2011

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

450,124

|

|

$

|

366,998

|

|

$

|

83,126

|

|

22.7

|

%

|

|||

|

International and Other

|

76,468

|

|

77,485

|

|

(1,017

|

)

|

(1.3

|

)

|

||||||

|

Inter-segment eliminations

|

(19,156

|

)

|

(18,522

|

)

|

(634

|

)

|

3.4

|

|

||||||

|

Total

|

$

|

507,436

|

|

$

|

425,961

|

|

$

|

81,475

|

|

19.1

|

%

|

|||

|

Percentage of revenues, net

|

37.5

|

%

|

35.9

|

%

|

||||||||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2012

|

2011

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

325,509

|

|

$

|

280,387

|

|

$

|

45,122

|

|

16.1

|

%

|

|||

|

International and Other

|

71,739

|

|

56,071

|

|

15,668

|

|

27.9

|

|

||||||

|

Inter-segment eliminations

|

(322

|

)

|

(802

|

)

|

480

|

|

(59.9

|

)

|

||||||

|

Total

|

$

|

396,926

|

|

$

|

335,656

|

|

$

|

61,270

|

|

18.3

|

%

|

|||

|

Percentage of revenues, net

|

29.3

|

%

|

28.3

|

%

|

||||||||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2012

|

2011

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

70,436

|

|

$

|

85,701

|

|

$

|

(15,265

|

)

|

(17.8

|

)%

|

|||

|

International and Other

|

14,944

|

|

14,147

|

|

797

|

|

5.6

|

|

||||||

|

$

|

85,380

|

|

$

|

99,848

|

|

$

|

(14,468

|

)

|

(14.5

|

)%

|

||||

|

|

Years Ended December 31,

|

|

|

|||||||||||

|

|

2012

|

2011

|

$ change

|

% change

|

||||||||||

|

National Networks

|

$

|

492,129

|

|

$

|

447,555

|

|

$

|

44,574

|

|

10.0

|

%

|

|||

|

International and Other

|

(30,040

|

)

|

(4,976

|

)

|

(25,064

|

)

|

503.7

|

|

||||||

|

Inter-segment eliminations

|

3,328

|

|

(866

|

)

|

4,194

|

|

(484.3

|

)

|

||||||

|

AOCF

|

$

|

465,417

|

|

$

|

441,713

|

|

$

|

23,704

|

|

5.4

|

%

|

|||

|

Indebtedness incurred in connection with the Distribution

|

$

|

49,329

|

|

|

Repayment of the Rainbow National Services LLC ("RNS") senior notes in May 2011 and the RNS credit facility and the RNS senior subordinated notes in June 2011

|

(31,036

|

)

|

|

|

Interest rate swap contracts (a)

|

13,743

|

|

|

|

Decrease in interest income

|

572

|

|

|

|

Other

|

(128

|

)

|

|

|

$

|

32,480

|

|

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Continuing operations:

|

|||||||||||

|

Cash flow (used in) provided by operating activities

|

$

|

(49,463

|

)

|

$

|

569,132

|

|

$

|

255,233

|

|

||

|

Cash flow used in investing activities

|

(26,146

|

)

|

(19,392

|

)

|

(15,691

|

)

|

|||||

|

Cash flow used in financing activities

|

(19,953

|

)

|

(155,087

|

)

|

(104,057

|

)

|

|||||

|

Net (decrease) increase in cash from continuing operations

|

(95,562

|

)

|

394,653

|

|

135,485

|

|

|||||

|

Discontinued operations:

|

|||||||||||

|

Net increase in cash flow from discontinued operations

|

$

|

—

|

|

$

|

481

|

|

$

|

391

|

|

||

|

Payments due by period

|

|||||||||||||||||||

|

Total

|

Year 1

|

Years

2 - 3

|

Years

4 - 5

|

More than

5 years

|

|||||||||||||||

|

Debt obligations:

|

|

|

|||||||||||||||||

|

Principal payments (1)

|

$

|

2,180,000

|

|

$

|

—

|

|

$

|

132,000

|

|

$

|

308,000

|

|

$

|

1,740,000

|

|

||||

|

Interest payments (1) (2)

|

811,947

|

|

109,588

|

|

214,409

|

|

208,741

|

|

279,209

|

|

|||||||||

|

Program rights obligations

|

659,777

|

|

210,190

|

|

300,746

|

|

105,248

|

|

43,593

|

|

|||||||||

|

Purchase obligations (3)

|

173,816

|

|

122,560

|

|

24,963

|

|

14,355

|

|

11,938

|

|

|||||||||

|

Operating lease obligations

|

76,750

|

|

17,739

|

|

35,761

|

|

16,066

|

|

7,184

|

|

|||||||||

|

Guarantees (4)

|

60,179

|

|

60,179

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Contract obligations (5)

|

51,745

|

|

33,549

|

|

12,471

|

|

3,165

|

|

2,560

|

|

|||||||||

|

Capital lease obligations (6)

|

19,076

|

|

3,036

|

|

6,072

|

|

6,072

|

|

3,896

|

|

|||||||||

|

Total

|

$

|

4,033,290

|

|

$

|

556,841

|

|

$

|

726,422

|

|

$

|

661,647

|

|

$

|

2,088,380

|

|

||||

|

(1)

|