|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

95-3540776

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

One Amgen Center Drive,

|

91320-1799

|

|

|

Thousand Oaks, California

|

(Zip Code)

|

|

|

(Address of principal executive offices)

|

||

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common stock, $0.0001 par value

|

The NASDAQ Global Select Market

|

|

|

Large accelerated filer

x

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

|

(Do not check if a smaller reporting company)

|

|||

|

(A)

|

Excludes 805,131 shares of common stock held by directors and executive officers at June 30, 2014. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, directly or indirectly, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

|

|

Page No.

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

Item 1.

|

BUSINESS

|

|

•

|

In August 2014, we announced that the phase 3 YUKAWA-2 (StudY of LDL-Cholesterol Reduction Using a Monoclonal PCSK9 Antibody in Japanese Patients With Advanced Cardiovascular Risk) study evaluating evolocumab in combination with statin therapy in Japanese patients with high cardiovascular risk and high cholesterol met its co-primary endpoints.

|

|

•

|

In September 2014, we announced that we submitted a Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) for the treatment of high cholesterol.

|

|

•

|

In November 2014, we announced that the U.S. Food and Drug Administration (FDA) accepted for review our Biologics License Application (BLA) for evolocumab for the treatment of high cholesterol.

|

|

•

|

In August 2014, we announced that the FDA granted priority review designation for the treatment of chronic heart failure.

|

|

•

|

In January 2015, we announced a three-month extension of the Prescription Drug User Fee Act (PDUFA) target action date due to a request from the FDA for submission of additional existing clinical data, which has been submitted.

|

|

•

|

In April 2014, we announced the initiation of two phase 3 studies in patients with psoriatic arthritis.

|

|

•

|

In 2014, we and AstraZeneca Plc. (AstraZeneca) announced that all three phase 3 AMAGINE

™

trials evaluating brodalumab in patients with moderate-to-severe plaque psoriasis met all their primary endpoints.

|

|

•

|

In July 2014, we announced that a phase 3 study evaluating AMG 416 for the treatment of secondary hyperparathyroidism in patients with chronic kidney disease (CKD) receiving hemodialysis, met its primary and all secondary endpoints.

|

|

•

|

In August 2014, we announced that a second placebo-controlled phase 3 study evaluating AMG 416 for the treatment of secondary hyperparathyroidism in patients with CKD, receiving hemodialysis, met its primary and all secondary endpoints.

|

|

•

|

In October 2014, we announced that we submitted an MAA to the EMA for the treatment of adults with Philadelphia-negative relapsed/refractory B-precursor acute lymphoblastic leukemia (ALL), a rapidly progressing cancer of the blood and bone marrow.

|

|

•

|

In December 2014, we announced that the FDA has granted approval of BLINCYTO

™

for the treatment of patients with Philadelphia chromosome-negative (Ph-) relapsed or refractory B-cell precursor ALL. This indication is approved under accelerated approval and continued approval for this indication may be contingent upon verification of clinical benefit in subsequent trials. Commercial sales launched in December 2014.

|

|

•

|

In August 2014, we and our subsidiary Onyx Pharmaceuticals, Inc. (Onyx) announced that a planned interim analysis demonstrated that the phase 3 clinical trial ASPIRE (CArfilzomib, Lenalidomide, and DexamethaSone versus Lenalidomide and Dexamethasone for the treatment of PatIents with Relapsed Multiple MyEloma) met its primary endpoint of progression-free survival (PFS). While the data for overall survival, a secondary endpoint, are not yet mature, the analysis showed a trend in favor of

Kyprolis

®

in combination with REVLIMID

®

(lenalidomide) and low-dose dexamethasone

that did not reach statistical significance.

|

|

•

|

In August 2014, we and Onyx announced that the phase 3 clinical trial FOCUS (CarFilzOmib for AdvanCed Refractory MUltiple Myeloma European Study) did not meet its primary endpoint of improving overall survival.

|

|

•

|

In January 2015, we and Onyx announced the submission of a supplemental New Drug Application (sNDA) to the FDA and an MAA to the EMA for Kyprolis

®

to seek approval for the treatment of patients with relapsed multiple myeloma who have received at least one prior therapy. In the United States, the sNDA is designed to support the conversion of accelerated approval to full approval and expand the current approved indication. In the European Union (EU), Kyprolis

®

received orphan drug designation and the MAA has been granted accelerated assessment.

|

|

•

|

In December 2014, the FDA granted approval of the Neulasta

®

Delivery Kit, including the On-body Injector for Neulasta

®

.

|

|

•

|

In November 2014, we announced the termination of all Amgen-sponsored clinical studies of rilotumumab in advanced gastric cancer, including the phase 3 RILOMET-1 and RILOMET-2 studies.

|

|

•

|

In July 2014, we announced that we submitted a BLA in the United States for regionally and distantly metastatic melanoma.

|

|

•

|

In September 2014, we announced that we submitted an MAA to the EMA for the treatment of adults with regionally and distantly metastatic melanoma.

|

|

•

|

In January 2015, we announced a three-month extension of the PDUFA target action date for our BLA due to a request from the FDA for submission of additional existing manufacturing data, which has been submitted.

|

|

•

|

In November 2014, we announced the top-line secondary endpoint results of overall survival from the phase 3 TRINOVA-1 trial in women with recurrent platinum-resistant ovarian cancer. The study, which evaluated trebananib plus paclitaxel versus placebo plus paclitaxel, did not demonstrate a statistically significant improvement in overall survival. We have terminated the clinical development program in recurrent ovarian cancer.

|

|

•

|

In October 2014, we announced that the phase 3 study evaluating efficacy and safety of biosimilar candidate ABP 501 compared with Humira

®

(adalimumab) in patients with moderate-to-severe plaque psoriasis met its primary endpoint.

|

|

•

|

In February 2015, we announced that the phase 3 study evaluating efficacy and safety of biosimilar candidate ABP 501 compared with Humira

®

in patients with moderate-to-severe rheumatoid arthritis (RA) met its primary and key secondary endpoints.

|

|

•

|

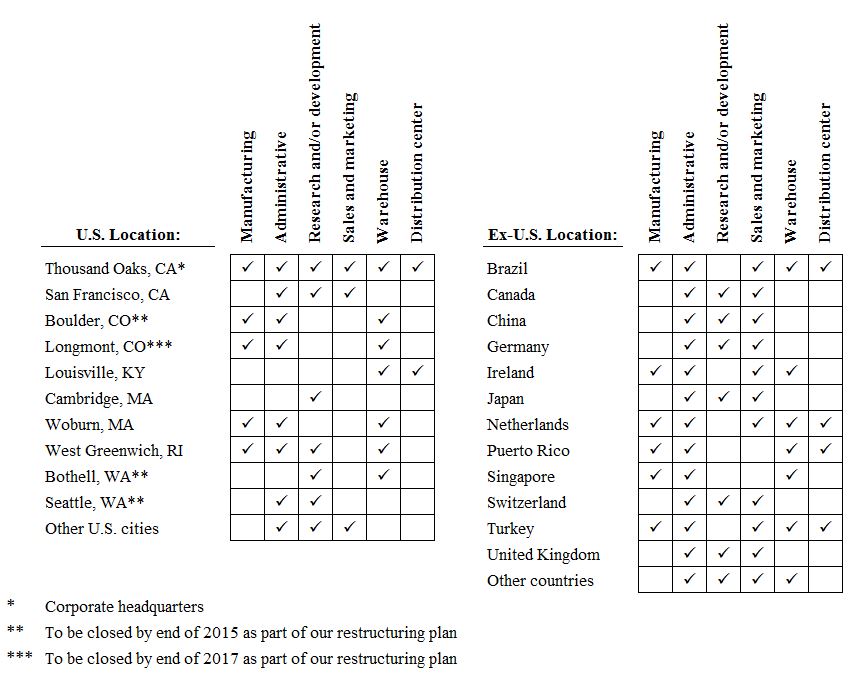

In 2014, we completed facilities construction and entered the licensure process for a Next-Generation Biomanufacturing facility in Singapore. We believe, when licensed, this facility will enable us to increase our manufacturing productivity versus conventional alternatives at lower capital costs and operating expense.

|

|

•

|

During the second half of 2014, we announced a restructuring plan which will reduce staff by between 3,500 and 4,000 positions by the end of 2015. In addition, we will close our facilities in the states of Washington and Colorado, and will reduce the number of buildings at our headquarters in Thousand Oaks, California. The total pre-tax restructuring charges are expected to range between approximately $935 million and $1,035 million. As of December 31, 2014, $558 million of these charges have been incurred.

|

|

•

|

moderately to severely active RA,

|

|

•

|

chronic moderate-to-severe plaque psoriasis patients who are candidates for systemic therapy or phototherapy, and

|

|

•

|

active psoriatic arthritis.

|

|

Product

|

Territory

|

General Subject Matter

|

Expiration

|

|||

|

Neulasta

®

(pegfilgrastim)

|

U.S.

|

Pegylated G-CSF

|

10/20/2015

|

|||

|

Europe

|

Pegylated G-CSF

(1)

|

2/8/2015

|

||||

|

Enbrel

®

(etanercept)

|

U.S.

|

Methods of treating psoriasis

|

8/13/2019

|

|||

|

U.S.

|

Aqueous formulation and methods of treatment using the formulation

(2)

|

6/8/2023

|

||||

|

U.S.

|

Fusion protein, and pharmaceutical compositions

|

11/22/2028

|

||||

|

U.S.

|

DNA encoding fusion protein, and methods of making fusion protein

|

4/24/2029

|

||||

|

Prolia

®

/

XGEVA ® (denosumab) |

U.S.

|

RANKL antibodies; and methods of use

(3)

|

12/22/2017

|

|||

|

U.S.

|

Methods of treatment

|

6/25/2022

|

||||

|

U.S.

|

Nucleic acids encoding RANKL antibodies, and methods of producing RANKL antibodies

|

11/30/2023

|

||||

|

U.S.

|

RANKL antibodies including sequences

|

2/19/2025

|

||||

|

Europe

|

RANKL antibodies

(1)

|

12/22/2017

|

||||

|

Europe

|

Medical use of RANKL antibodies

(1)

|

4/15/2018

|

||||

|

Europe

|

RANKL antibodies including epitope binding

|

2/23/2021

|

||||

|

Europe

|

RANKL antibodies including sequences

(1)

|

6/25/2022

|

||||

|

EPOGEN

®

(epoetin alfa)

|

U.S.

|

Cells that make certain levels of erythropoietin

|

5/26/2015

|

|||

|

Aranesp

®

(darbepoetin alfa)

|

U.S.

|

Glycosylation analogs of erythropoietin proteins

|

5/15/2024

|

|||

|

Europe

|

Glycosylation analogs of erythropoietin proteins

(1)

|

8/16/2014

|

||||

|

Sensipar

®

/

Mimpara ® (cinacalcet) |

U.S.

|

Calcium receptor-active molecules including species

|

10/23/2015

|

|||

|

U.S.

|

Methods of treatment

|

12/14/2016

|

||||

|

U.S.

|

Calcium receptor-active molecules

|

3/8/2018

|

||||

|

Europe

|

Calcium receptor-active molecules

(1)

|

10/23/2015

|

||||

|

Vectibix

®

(panitumumab)

|

U.S.

|

Human monoclonal antibodies to epidermal growth factor receptor (EGFr)

|

4/8/2020

|

|||

|

Europe

|

Human monoclonal antibodies to EGFr

(1)

|

5/5/2018

|

||||

|

Nplate

®

(romiplostim)

|

U.S.

|

Thrombopoietic compounds

|

1/19/2022

|

|||

|

Europe

|

Thrombopoietic compounds

(1)

|

10/22/2019

|

||||

|

Kyprolis

®

(carfilzomib)

|

U.S.

|

Compositions, and methods of treatment

(4)

|

4/14/2025

|

|||

|

Europe

|

Compositions

|

8/8/2025

|

||||

|

BLINCYTO

™

(blinatumomab)

|

U.S.

|

Bifunctional polypeptides

(4)

|

4/21/2019

|

|||

|

U.S.

|

Method of administration

|

9/28/2027

|

||||

|

Europe

|

Bifunctional polypeptides

|

4/21/2019

|

||||

|

Europe

|

Method of administration

|

11/29/2026

|

||||

|

(1)

|

A European patent with this subject matter may also be entitled to supplemental protection in one or more countries in Europe and the length of any such extension will vary by country. For example, supplementary protection certificates have been issued related to the indicated products for patents in at least the following countries:

|

|

•

|

pegfilgrastim - France, Germany, Italy, Spain, and the United Kingdom, expiring in 2017

|

|

•

|

darbepoetin alfa - France, Germany, Italy, Spain, and the United Kingdom, expiring in 2016

|

|

•

|

denosumab - France, Italy and Spain

, expiring in

2025

|

|

•

|

cinacalcet - France, Germany, Italy, Spain, and the United Kingdom, expiring in 2019

|

|

•

|

panitumumab - France, Germany, Italy, Spain, and the United Kingdom, expiring in 2022

|

|

•

|

romiplostim - France, Italy, Spain, and the United Kingdom, expiring in 2024

|

|

(2)

|

This formulation patent relates to the currently approved liquid formulation of ENBREL, which formulation accounts for the majority of ENBREL sales in the United States. However, ENBREL is also sold as an alternative lyophilized formulation that requires reconstituting before it can be administered to the patient.

|

|

(3)

|

The U.S. Patent and Trademark Office has issued a Notice of Final Determination that a patent with this subject matter is eligible for patent term extension with an expiry of September 17, 2021.

|

|

(4)

|

A patent with this subject matter may be entitled to patent term extension in the United States.

|

|

Product

|

Territory

|

Competitor Marketed Product

|

Competitors

|

|||

|

Neulasta

®

/

NEUPOGEN

®

|

U.S.

|

Granix

®(1)

|

Teva Pharmaceutical Industries Ltd. (Teva)

|

|||

|

Europe

|

Lonquex

®(2)

|

Teva

|

||||

|

Europe

|

Filgrastim biosimilars

(3)

|

Various

|

||||

|

ENBREL

|

U.S. & Canada

|

REMICADE

®

|

Janssen Biotech, Inc. (Janssen)

(8)

/Merck & Company, Inc.

|

|||

|

U.S. & Canada

|

HUMIRA

®

|

AbbVie Inc.

|

||||

|

U.S. & Canada

|

STELARA

®(4)

|

Janssen

(8)

|

||||

|

XGEVA

®

|

U.S. & Europe

|

Zometa

®

|

Novartis AG (Novartis)

|

|||

|

U.S. & Europe

|

Zoledronate generics

|

Various

|

||||

|

Prolia

®

|

U.S. & Europe

|

Alendronate generics

|

Various

|

|||

|

U.S. & Europe

|

Raloxifene generics

|

Various

|

||||

|

U.S. & Europe

|

Zoledronate generics

|

Various

|

||||

|

EPOGEN

®

|

U.S.

|

MIRCERA

®(5)

|

F. Hoffmann-La Roche Ltd. (Roche)

|

|||

|

Aranesp

®

|

U.S.

|

PROCRIT

®(6)

|

Janssen

(8)

|

|||

|

Europe

|

EPREX

®

/ERYPO

®

|

Janssen-Cilag

(8)

|

||||

|

Europe

|

Epoetin alfa biosimilars

(3)

|

Various

|

||||

|

Europe

|

MIRCERA

®(5)

|

Roche

|

||||

|

Product

|

Territory

|

Competitor Marketed Product

|

Competitors

|

|||

|

Sensipar

®(7)

/

Mimpara

®

|

U.S. & Europe

|

Active Vitamin D analogs

|

Various

|

|||

|

Vectibix

®

|

U.S. & Europe

|

Erbitux

®

|

Eli Lilly/Bristol-Myers Squibb Company (BMS); Merck KGaA

|

|||

|

U.S. & Europe

|

Avastin

®

|

Genentech, Inc. (a Member of the Roche Group)

|

||||

|

Nplate

®

|

U.S. & Europe

|

Promacta

®

/Revolade

®

|

GlaxoSmithKline plc

|

|||

|

Kyprolis

®

|

U.S.

|

VELCADE

®

|

Millennium Pharmaceuticals, Inc.

(9)

|

|||

|

U.S.

|

REVLIMID

®

|

Celgene Corporation

|

||||

|

U.S.

|

POMALYST

®

|

Celgene Corporation

|

||||

|

(1)

|

Granix

®

launched at the end of 2013 and could have an impact over time on sales of NEUPOGEN

®

and, to a lesser extent, Neulasta

®

.

|

|

(2)

|

Lonquex

®

is a long-acting filgrastim product launched in Europe.

|

|

(3)

|

Approved via the EU biosimilar regulatory pathway.

|

|

(4)

|

Dermatology only.

|

|

(5)

|

MIRCERA

®

has been approved by the FDA for the treatment of anemia associated with chronic renal failure in patients on and not on dialysis. Roche began selling MIRCERA

®

in October 2014 in the United States under terms of a limited patent license obtained from Amgen in connection with the settlement of patent litigation. It competes with Aranesp

®

in the nephrology segment only.

|

|

(6)

|

PROCRIT

®

competes with Aranesp

®

in the supportive cancer care and pre-dialysis settings.

|

|

(7)

|

Teva and Barr Pharmaceuticals have received tentative approval from the FDA for generic versions of Sensipar

®

that could compete with Sensipar

®

in the future. There is an injunction prohibiting them from commercializing in the United States until expiration of the patents.

|

|

(8)

|

A subsidiary of Johnson & Johnson (J&J).

|

|

(9)

|

A wholly-owned subsidiary of Takeda Pharmaceutical Company Limited.

|

|

•

|

to manufacture Sensipar

®

/Mimpara

®

, except for certain fill and finish activities performed by us in Puerto Rico;

|

|

•

|

to supplement commercial bulk manufacturing, as needed, for ENBREL, Prolia

®

, XGEVA

®

and Vectibix

®

;

|

|

•

|

to supplement certain portions of fill and finish for ENBREL; and

|

|

•

|

to supplement formulation, fill and finish of Nplate

®

.

|

|

•

|

In phase 1, we conduct small clinical trials to investigate the safety and proper dose ranges of our product candidates in a small number of human subjects.

|

|

•

|

In phase 2, we conduct clinical trials to investigate side effect profiles and the efficacy of our product candidates in a larger number of patients who have the disease or condition under study.

|

|

•

|

In phase 3, we conduct clinical trials to investigate the safety and efficacy of our product candidates in a large number of patients who have the disease or condition under study.

|

|

Molecule

|

Disease/Condition

|

|

|

Phase 3 Programs

|

||

|

AMG 416

|

Secondary hyperparathyroidism in patients with CKD receiving dialysis

|

|

|

Aranesp

®

|

Myelodysplastic syndromes

|

|

|

BLINCYTO

™

|

ALL

|

|

|

Brodalumab

|

Psoriasis;

Psoriatic arthritis

|

|

|

Evolocumab

|

Dyslipidemia

|

|

|

Kyprolis

®

*

|

Multiple myeloma

|

|

|

Prolia

®

|

Glucocorticoid-induced osteoporosis

|

|

|

Romosozumab

|

Postmenopausal osteoporosis

Male osteoporosis

|

|

|

Talimogene laherparepvec

|

Metastatic melanoma

|

|

|

Trebananib

|

First-line ovarian cancer

|

|

|

Vectibix

®

|

Metastatic colorectal cancer (mCRC) (US only)

|

|

|

XGEVA

®

|

Delay or prevention of bone metastases in breast cancer;

Cancer-related bone damage in patients with multiple myeloma

|

|

|

Phase 2 Programs

|

||

|

AMG 139

|

Inflammatory diseases

|

|

|

AMG 157

|

Asthma

|

|

|

AMG 181

|

Inflammatory bowel diseases

|

|

|

AMG 334

|

Migraine

|

|

|

AMG 337

|

Gastric cancer

|

|

|

BLINCYTO

™

|

Diffuse Large B-Cell Lymphoma (DLBCL)

|

|

|

Brodalumab

|

Inflammatory diseases

|

|

|

Kyprolis

®

*

|

Small-cell lung cancer

|

|

|

Omecamtiv mecarbil

|

Heart failure

|

|

|

Oprozomib*

|

Hematologic malignancies

|

|

|

XGEVA

®

|

Metastatic non-small cell lung cancer (NSCLC)

|

|

|

Phase 1 Programs

|

||

|

AMG 172

|

Renal cell carcinoma

|

|

|

AMG 208

|

Various cancer types

|

|

|

AMG 211

|

Various cancer types

|

|

|

AMG 232

|

Various cancer types

|

|

|

AMG 282

|

Asthma

|

|

|

AMG 319

|

Hematologic malignancies

|

|

|

AMG 357

|

Autoimmune diseases

|

|

|

AMG 557

|

Systemic lupus erythematosus

|

|

|

AMG 581

|

Schizophrenia

|

|

|

AMG 595

|

Glioblastoma

|

|

|

AMG 780

|

Various cancer types

|

|

|

AMG 811

|

Systemic lupus erythematosus

|

|

|

AMG 820

|

Various cancer types

|

|

|

AMG 876

|

Type 2 diabetes

|

|

|

AMG 900

|

Various cancer types

|

|

|

Oprozomib*

|

Solid tumors

|

|

|

*

|

Being developed by Onyx, an Amgen subsidiary.

|

|

Phase 3

|

clinical trials investigate the safety and efficacy of a product candidate in a large number of patients who have the disease or condition under study.

|

|

Phase 2

|

clinical trials investigate side effect profiles and efficacy of a product candidate in a large number of patients who have the disease or condition under study.

|

|

Phase 1

|

clinical trials investigate safety and proper dose ranges of a product candidate in a small number of human subjects.

|

|

Molecule

|

Disease / Condition

|

Program Change

|

||

|

Brodalumab

|

Psoriatic arthritis

|

Advanced to phase 3

|

||

|

Prolia

®

|

Male osteoporosis (EU only)

|

Approved by EMA

|

||

|

Rilotumumab

|

Gastric cancer

|

Terminated

|

||

|

Romosozumab

|

Male osteoporosis

|

Advanced to phase 3

|

||

|

Sensipar

®

/ Mimpara

®

|

Post renal transplant

|

Concluded - No longer pursuing indication

|

||

|

Molecule

|

Territory

|

General Subject Matter

|

Estimated Expiration*

|

|||

|

Brodalumab

|

U.S.

|

Polynucleotides and polypeptides

|

2027

|

|||

|

Europe

|

Polynucleotides and polypeptides

|

2027

|

||||

|

Evolocumab

|

U.S.

|

Polypeptides

|

2029

|

|||

|

Romosozumab

|

U.S.

|

Polypeptides

|

2026

|

|||

|

Europe

|

Polypeptides

|

2026

|

||||

|

Talimogene laherparepvec

|

U.S.

|

Modified HSV-1 compounds and strains

|

2021

|

|||

|

Europe

|

Modified HSV-1 compounds and strains

|

2021

|

||||

|

Trebananib

|

U.S.

|

Polynucleotides and polypeptides

|

2025

|

|||

|

Europe

|

Polynucleotides and polypeptides

|

2022

|

||||

|

AMG 416

|

U.S.

|

Compound

|

2030

|

|||

|

*

|

Patent expiration estimates are based on issued patents, which may be challenged, invalidated, or circumvented by competitors. The patent expiration estimates do not include any term adjustments, extensions or supplemental protection certificates that may be obtained in the future and extend these dates. Corresponding patent applications are pending in other jurisdictions. Additional patents may be filed or issued and may provide additional exclusivity for the product candidate or its use.

|

|

Biosimilar

|

Status

|

|

|

adalimumab (HUMIRA

®

)

|

Phase 3 psoriasis study met primary endpoint

Phase 3 RA study met primary and key secondary endpoints

|

|

|

trastuzumab (Herceptin

®

)

|

Phase 3 breast cancer

|

|

|

bevacizumab (Avastin

®

)

|

Phase 3 NSCLC

|

|

|

infliximab (REMICADE

®

)

|

Phase 1

|

|

|

Item 1A.

|

RISK FACTORS

|

|

•

|

requirement of risk management activities or other regulatory agency compliance actions related to the promotion and sale of our products;

|

|

•

|

revocation of approval for our products from the market completely, or within particular therapeutic areas or patient types;

|

|

•

|

the product candidate did not demonstrate acceptable clinical trial results even though it demonstrated positive preclinical trial results, for reasons that could include changes in the standard of care of medicine;

|

|

•

|

the product candidate was not effective or more effective than currently available therapies in treating a specified condition or illness;

|

|

•

|

the biosimilar product candidate fails to demonstrate the requisite biosimilarity to the applicable reference product, or is otherwise determined to be unacceptable for purposes of safety or efficacy, to gain approval;

|

|

•

|

other parties have or may have proprietary rights relating to our product candidate, such as patent rights, and will not let us sell it on reasonable terms, or at all;

|

|

•

|

we and certain of our licensees, partners or independent investigators may fail to effectively conduct clinical development or clinical manufacturing activities; and

|

|

•

|

render the product candidate commercially unfeasible or limit our ability to market existing products completely or in certain therapeutic areas.

|

|

•

|

failure to comply with our quality standards which results in quality and product failures, product contamination and/or recall;

|

|

•

|

a material shortage, contamination, recall and/or restrictions on the use of certain biologically derived substances or other raw materials;

|

|

Item 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

Item 2.

|

PROPERTIES

|

|

Item 3.

|

LEGAL PROCEEDINGS

|

|

Item 4.

|

MINE SAFETY DISCLOSURES

|

|

Item 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

Year ended December 31, 2014

|

High

|

Low

|

||||||

|

Fourth quarter

|

$

|

171.64

|

|

$

|

130.45

|

|

||

|

Third quarter

|

144.01

|

|

115.39

|

|

||||

|

Second quarter

|

126.07

|

|

110.29

|

|

||||

|

First quarter

|

127.47

|

|

113.48

|

|

||||

|

Year ended December 31, 2013

|

||||||||

|

Fourth quarter

|

$

|

118.69

|

|

$

|

106.28

|

|

||

|

Third quarter

|

117.52

|

|

95.81

|

|

||||

|

Second quarter

|

113.42

|

|

94.60

|

|

||||

|

First quarter

|

102.51

|

|

82.08

|

|

||||

|

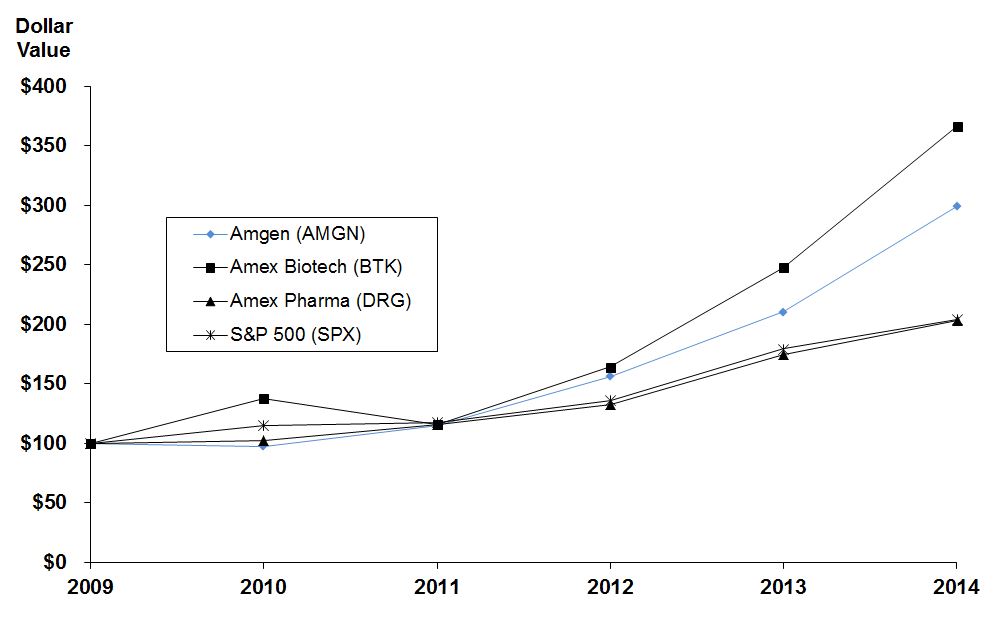

Amgen vs. Amex Biotech, Amex Pharmaceutical and S&P 500 Indices

|

|

Comparison of Five-Year Cumulative Total Return

|

|

Value of Investment of $100 on December 31, 2009

|

|

12/31/2009

|

12/31/2010

|

12/31/2011

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

||||||||||||

|

Amgen (AMGN)

|

100.00

|

|

97.05

|

|

114.74

|

|

156.35

|

|

210.32

|

|

299.33

|

|

|||||

|

Amex Biotech (BTK)

|

100.00

|

|

137.73

|

|

115.91

|

|

164.13

|

|

247.47

|

|

366.04

|

|

|||||

|

Amex Pharmaceutical (DRG)

|

100.00

|

|

102.51

|

|

115.75

|

|

133.00

|

|

174.52

|

|

203.45

|

|

|||||

|

S&P 500 (SPX)

|

100.00

|

|

114.82

|

|

117.23

|

|

135.75

|

|

179.25

|

|

203.77

|

|

|||||

|

Total

number of

shares

purchased

|

Average

price paid

per share

(1)

|

Total number

of shares

purchased as

publicly

announced

program

|

Maximum dollar

value that may

yet be purchased

under the

program

(2)

|

|||||||||||

|

January 1 - September 30

|

—

|

|

$

|

—

|

|

—

|

|

$

|

1,559,838,541

|

|

||||

|

October 1 - October 31

|

—

|

|

—

|

|

—

|

|

4,000,000,000

|

|

||||||

|

November 1 - November 30

|

223,000

|

|

162.67

|

|

223,000

|

|

3,963,725,678

|

|

||||||

|

December 1 - December 31

|

714,209

|

|

163.77

|

|

714,209

|

|

3,846,756,797

|

|

||||||

|

January 1 - December 31

|

937,209

|

|

$

|

163.51

|

|

937,209

|

|

|||||||

|

(1)

|

Average price paid per share includes related expenses.

|

|

(2)

|

In October 2014, our Board of Directors authorized an increase that resulted in a total of $4.0 billion available under the stock repurchase program.

|

|

Item 6.

|

SELECTED FINANCIAL DATA

|

|

|

Years ended December 31,

|

||||||||||||||||||

|

Consolidated Statement of Income Data:

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||

|

|

(In millions, except per share data)

|

||||||||||||||||||

|

Revenues:

|

|||||||||||||||||||

|

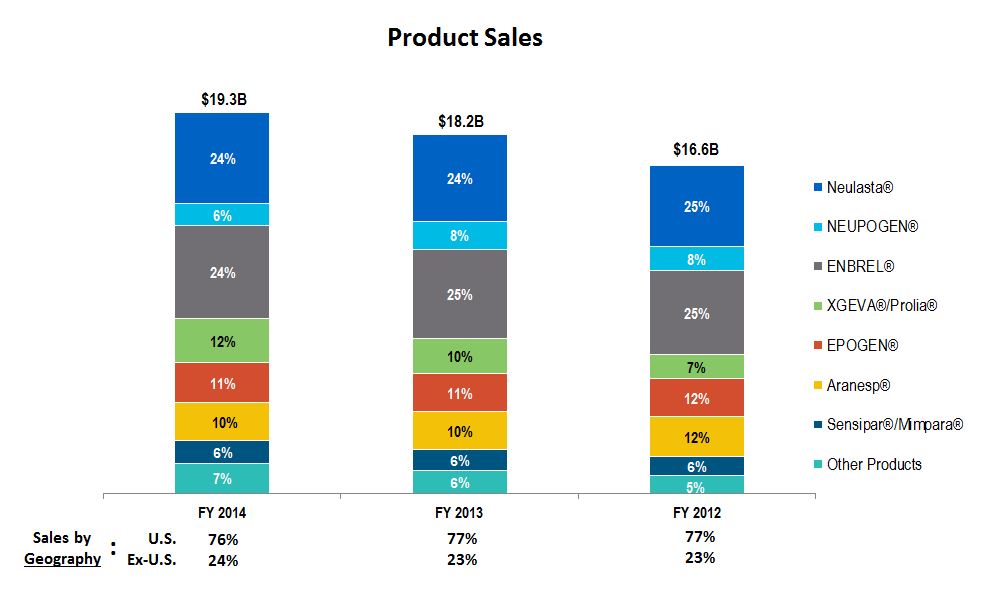

Product sales

|

$

|

19,327

|

|

$

|

18,192

|

|

$

|

16,639

|

|

$

|

15,295

|

|

$

|

14,660

|

|

||||

|

Other revenues

|

736

|

|

484

|

|

626

|

|

287

|

|

393

|

|

|||||||||

|

Total revenues

|

20,063

|

|

18,676

|

|

17,265

|

|

15,582

|

|

15,053

|

|

|||||||||

|

Operating expenses:

|

|||||||||||||||||||

|

Cost of sales

|

4,422

|

|

3,346

|

|

3,199

|

|

2,708

|

|

2,501

|

|

|||||||||

|

Research and development

|

4,297

|

|

4,083

|

|

3,380

|

|

3,167

|

|

2,894

|

|

|||||||||

|

Selling, general and administrative

|

4,699

|

|

5,184

|

|

4,814

|

|

4,499

|

|

3,996

|

|

|||||||||

|

Other

(1)

|

454

|

|

196

|

|

295

|

|

896

|

|

117

|

|

|||||||||

|

Net income

|

5,158

|

|

5,081

|

|

4,345

|

|

3,683

|

|

4,627

|

|

|||||||||

|

Diluted earnings per share

|

6.70

|

|

6.64

|

|

5.52

|

|

4.04

|

|

4.79

|

|

|||||||||

|

Dividends paid per share

|

2.44

|

|

1.88

|

|

1.44

|

|

0.56

|

|

—

|

|

|||||||||

|

|

As of December 31,

|

||||||||||||||||||

|

Consolidated Balance Sheet Data:

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||

|

|

(In millions)

|

||||||||||||||||||

|

Total assets

|

$

|

69,009

|

|

$

|

66,125

|

|

$

|

54,298

|

|

$

|

48,871

|

|

$

|

43,486

|

|

||||

|

Total debt

(2)

|

30,715

|

|

32,128

|

|

26,529

|

|

21,428

|

|

13,362

|

|

|||||||||

|

Total stockholders’ equity

(3)

|

25,778

|

|

22,096

|

|

19,060

|

|

19,029

|

|

23,944

|

|

|||||||||

|

(1)

|

In 2011, we recorded a $780 million legal settlement charge ($705 million, net of tax) in connection with an agreement in principle to settle allegations related to our sales and marketing practices.

|

|

(2)

|

See Part IV—Note 14, Financing arrangements, to the Consolidated Financial Statements for discussion of our financing arrangements. In addition, in 2011 and 2010, we issued $10.5 billion and $2.5 billion, respectively, aggregate principal amount of notes. In 2011, we repaid our 0.125% Convertible Notes of $2.5 billion. No debt was due or repaid in 2010.

|

|

(3)

|

Throughout the five years ended December 31, 2014, we had a stock repurchase program authorized by the Board of Directors through which we repurchased

$0.2 billion

,

$0.8 billion

,

$4.7 billion

, $8.3 billion and $3.8 billion, respectively, of Amgen common stock.

|

|

Item 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

Clinical Program

|

Lead Indication

|

Milestone

|

||

|

Repatha

™

|

Dyslipidemia

|

US submission

|

||

|

EU submission

|

||||

|

Corlanor

®

|

Chronic heart failure

|

US submission

|

||

|

Kyprolis

®*

|

Multiple myeloma

|

Phase 3 ASPIRE data

|

||

|

Talimogene laherparepvec

|

Metastatic melanoma

|

US submission

|

||

|

EU submission

|

||||

|

BLINCYTO

™

|

Relapsed/refractory ALL

|

US approval

|

||

|

EU submission

|

||||

|

Brodalumab

**

|

Moderate-to-severe plaque psoriasis

|

Phase 3 data

|

||

|

AMG 416

|

Secondary hyperparathyroidism

|

Phase 3 data

|

||

|

AMG 334

|

Migraine prophylaxis

|

Phase 2b data (episodic)

|

||

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||

|

2014

|

Change

|

2013

|

||||||||

|

Product sales:

|

||||||||||

|

U.S.

|

$

|

14,732

|

|

5

|

%

|

$

|

14,045

|

|

||

|

ROW

|

4,595

|

|

11

|

%

|

4,147

|

|

||||

|

Total product sales

|

19,327

|

|

6

|

%

|

18,192

|

|

||||

|

Other revenues

|

736

|

|

52

|

%

|

484

|

|

||||

|

Total revenues

|

$

|

20,063

|

|

7

|

%

|

$

|

18,676

|

|

||

|

Operating expenses

|

$

|

13,872

|

|

8

|

%

|

$

|

12,809

|

|

||

|

Operating income

|

$

|

6,191

|

|

6

|

%

|

$

|

5,867

|

|

||

|

Net income

|

$

|

5,158

|

|

2

|

%

|

$

|

5,081

|

|

||

|

Diluted EPS

|

$

|

6.70

|

|

1

|

%

|

$

|

6.64

|

|

||

|

Diluted shares

|

770

|

|

1

|

%

|

765

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

Neulasta

®

/NEUPOGEN

®

|

$

|

5,755

|

|

(1

|

)%

|

$

|

5,790

|

|

8

|

%

|

$

|

5,352

|

|

||||

|

ENBREL

|

4,688

|

|

3

|

%

|

4,551

|

|

7

|

%

|

4,236

|

|

|||||||

|

XGEVA

®

|

1,221

|

|

20

|

%

|

1,019

|

|

36

|

%

|

748

|

|

|||||||

|

Prolia

®

|

1,030

|

|

38

|

%

|

744

|

|

58

|

%

|

472

|

|

|||||||

|

EPOGEN

®

|

2,031

|

|

4

|

%

|

1,953

|

|

1

|

%

|

1,941

|

|

|||||||

|

Aranesp

®

|

1,930

|

|

1

|

%

|

1,911

|

|

(6

|

)%

|

2,040

|

|

|||||||

|

Sensipar

®

/Mimpara

®

|

1,158

|

|

6

|

%

|

1,089

|

|

15

|

%

|

950

|

|

|||||||

|

Other products

|

1,514

|

|

33

|

%

|

1,135

|

|

26

|

%

|

900

|

|

|||||||

|

Total product sales

|

$

|

19,327

|

|

6

|

%

|

$

|

18,192

|

|

9

|

%

|

$

|

16,639

|

|

||||

|

Total U.S.

|

$

|

14,732

|

|

5

|

%

|

$

|

14,045

|

|

10

|

%

|

$

|

12,815

|

|

||||

|

Total ROW

|

4,595

|

|

11

|

%

|

4,147

|

|

8

|

%

|

3,824

|

|

|||||||

|

Total product sales

|

$

|

19,327

|

|

6

|

%

|

$

|

18,192

|

|

9

|

%

|

$

|

16,639

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

Neulasta

®

— U.S.

|

$

|

3,649

|

|

4

|

%

|

$

|

3,499

|

|

9

|

%

|

$

|

3,207

|

|

||||

|

Neulasta

®

— ROW

|

947

|

|

6

|

%

|

893

|

|

1

|

%

|

885

|

|

|||||||

|

Total Neulasta

®

|

4,596

|

|

5

|

%

|

4,392

|

|

7

|

%

|

4,092

|

|

|||||||

|

NEUPOGEN

®

— U.S.

|

839

|

|

(28

|

)%

|

1,169

|

|

16

|

%

|

1,007

|

|

|||||||

|

NEUPOGEN

®

— ROW

|

320

|

|

40

|

%

|

229

|

|

(9

|

)%

|

253

|

|

|||||||

|

Total NEUPOGEN

®

|

1,159

|

|

(17

|

)%

|

1,398

|

|

11

|

%

|

1,260

|

|

|||||||

|

Total Neulasta

®

/NEUPOGEN

®

|

$

|

5,755

|

|

(1

|

)%

|

$

|

5,790

|

|

8

|

%

|

$

|

5,352

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

ENBREL — U.S.

|

$

|

4,404

|

|

3

|

%

|

$

|

4,256

|

|

7

|

%

|

$

|

3,967

|

|

||||

|

ENBREL — Canada

|

284

|

|

(4

|

)%

|

295

|

|

10

|

%

|

269

|

|

|||||||

|

Total ENBREL

|

$

|

4,688

|

|

3

|

%

|

$

|

4,551

|

|

7

|

%

|

$

|

4,236

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

XGEVA

®

— U.S.

|

$

|

857

|

|

12

|

%

|

$

|

764

|

|

19

|

%

|

$

|

644

|

|

||||

|

XGEVA

®

— ROW

|

364

|

|

43

|

%

|

255

|

|

*

|

|

104

|

|

|||||||

|

Total XGEVA

®

|

1,221

|

|

20

|

%

|

1,019

|

|

36

|

%

|

748

|

|

|||||||

|

Prolia

®

— U.S.

|

625

|

|

35

|

%

|

462

|

|

58

|

%

|

292

|

|

|||||||

|

Prolia

®

— ROW

|

405

|

|

44

|

%

|

282

|

|

57

|

%

|

180

|

|

|||||||

|

Total Prolia

®

|

1,030

|

|

38

|

%

|

744

|

|

58

|

%

|

472

|

|

|||||||

|

Total XGEVA

®

/Prolia

®

|

$

|

2,251

|

|

28

|

%

|

$

|

1,763

|

|

45

|

%

|

$

|

1,220

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

EPOGEN

®

— U.S.

|

$

|

2,031

|

|

4

|

%

|

$

|

1,953

|

|

1

|

%

|

$

|

1,941

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

Aranesp

®

— U.S.

|

$

|

794

|

|

6

|

%

|

$

|

747

|

|

(4

|

)%

|

$

|

782

|

|

||||

|

Aranesp

®

— ROW

|

1,136

|

|

(2

|

)%

|

1,164

|

|

(7

|

)%

|

1,258

|

|

|||||||

|

Total Aranesp

®

|

$

|

1,930

|

|

1

|

%

|

$

|

1,911

|

|

(6

|

)%

|

$

|

2,040

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

Sensipar

®

— U.S.

|

$

|

796

|

|

5

|

%

|

$

|

757

|

|

18

|

%

|

$

|

639

|

|

||||

|

Sensipar

®

/Mimpara

®

— ROW

|

362

|

|

9

|

%

|

332

|

|

7

|

%

|

311

|

|

|||||||

|

Total Sensipar

®

/Mimpara

®

|

$

|

1,158

|

|

6

|

%

|

$

|

1,089

|

|

15

|

%

|

$

|

950

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

Vectibix

®

— U.S.

|

$

|

168

|

|

33

|

%

|

$

|

126

|

|

3

|

%

|

$

|

122

|

|

||||

|

Vectibix

®

— ROW

|

337

|

|

28

|

%

|

263

|

|

11

|

%

|

237

|

|

|||||||

|

Nplate

®

— U.S.

|

260

|

|

8

|

%

|

241

|

|

13

|

%

|

214

|

|

|||||||

|

Nplate

®

— ROW

|

209

|

|

12

|

%

|

186

|

|

21

|

%

|

154

|

|

|||||||

|

Kyprolis

®

— U.S.

|

306

|

|

*

|

|

71

|

|

N/A

|

|

—

|

|

|||||||

|

Kyprolis

®

— ROW

|

25

|

|

*

|

|

2

|

|

N/A

|

|

—

|

|

|||||||

|

BLINCYTO

™

— U.S.

|

3

|

|

N/A

|

|

—

|

|

N/A

|

|

—

|

|

|||||||

|

Other — ROW

|

206

|

|

(16

|

)%

|

246

|

|

42

|

%

|

173

|

|

|||||||

|

Total other product sales

|

$

|

1,514

|

|

33

|

%

|

$

|

1,135

|

|

26

|

%

|

$

|

900

|

|

||||

|

Total U.S. — other products

|

$

|

737

|

|

68

|

%

|

$

|

438

|

|

30

|

%

|

$

|

336

|

|

||||

|

Total ROW — other products

|

777

|

|

11

|

%

|

697

|

|

24

|

%

|

564

|

|

|||||||

|

Total other product sales

|

$

|

1,514

|

|

33

|

%

|

$

|

1,135

|

|

26

|

%

|

$

|

900

|

|

||||

|

Year ended December 31,

|

Year ended December 31,

|

Year ended December 31,

|

|||||||||||||||

|

2014

|

Change

|

2013

|

Change

|

2012

|

|||||||||||||

|

Operating expenses:

|

|||||||||||||||||

|

Cost of sales

|

$

|

4,422

|

|

32

|

%

|

$

|

3,346

|

|

5

|

%

|

$

|

3,199

|

|

||||

|

% of product sales

|

22.9

|

%

|

18.4

|

%

|

19.2

|

%

|

|||||||||||

|

% of total revenues

|

22.0

|

%

|

17.9

|

%

|

18.5

|

%

|

|||||||||||

|

Research and development

|

$

|

4,297

|

|

5

|

%

|

$

|

4,083

|

|

21

|

%

|

$

|

3,380

|

|

||||

|

% of product sales

|

22.2

|

%

|

22.4

|

%

|

20.3

|

%

|

|||||||||||

|

% of total revenues

|

21.4

|

%

|

21.9

|

%

|

19.6

|

%

|

|||||||||||

|

Selling, general and administrative

|

$

|

4,699

|

|

(9

|

)%

|

$

|

5,184

|

|

8

|

%

|

$

|

4,814

|

|

||||

|

% of product sales

|

24.3

|

%

|

28.5

|

%

|

28.9

|

%

|

|||||||||||

|

% of total revenues

|

23.4

|

%

|

27.8

|

%

|

27.9

|

%

|

|||||||||||

|

Other

|

$

|

454

|

|

*

|

|

$

|

196

|

|

(34

|

)%

|

$

|

295

|

|

||||

|

Category

|

Description

|

|

|

DRTS

|

R&D expenses incurred in activities substantially in support of early research through the completion of phase 1 clinical trials. These activities encompass our DRTS functions, including drug discovery, toxicology, pharmacokinetics and drug metabolism, and process development.

|

|

|

Later stage clinical programs

|

R&D expenses incurred in or related to phase 2 and phase 3 clinical programs intended to result in registration of a new product or a new indication for an existing product in the United States or the EU.

|

|

|

Marketed products

|

R&D expenses incurred in support of the Company’s marketed products that are authorized to be sold in the United States or the EU. Includes clinical trials designed to gather information on product safety (certain of which may be required by regulatory authorities) and their product characteristics after regulatory approval has been obtained, as well as the costs of obtaining regulatory approval of a product in a new market after approval in either the United States or the EU has been obtained.

|

|

|

Years ended December 31,

|

|||||||||||

|

2014

|

2013

|

2012

|

|||||||||

|

DRTS

|

$

|

1,212

|

|

$

|

1,233

|

|

$

|

1,137

|

|

||

|

Later stage clinical programs

|

2,287

|

|

1,950

|

|

1,285

|

|

|||||

|

Marketed products

|

798

|

|

900

|

|

958

|

|

|||||

|

Total R&D expense

|

$

|

4,297

|

|

$

|

4,083

|

|

$

|

3,380

|

|

||

|

Years ended December 31,

|

|||||||||||

|

2014

|

2013

|

2012

|

|||||||||

|

Interest expense, net

|

$

|

1,071

|

|

$

|

1,022

|

|

$

|

1,053

|

|

||

|

Interest and other income, net

|

$

|

465

|

|

$

|

420

|

|

$

|

485

|

|

||

|

Provision for income taxes

|

$

|

427

|

|

$

|

184

|

|

$

|

664

|

|

||

|

Effective tax rate

|

7.6

|

%

|

3.5

|

%

|

13.3

|

%

|

|||||

|

December 31,

|

|||||||

|

2014

|

2013

|

||||||

|

Cash, cash equivalents and marketable securities

|

$

|

27,026

|

|

$

|

19,401

|

|

|

|

Restricted investments

|

—

|

|

3,412

|

|

|||

|

Total cash, cash equivalents, marketable securities and restricted investments

|

$

|

27,026

|

|

$

|

22,813

|

|

|

|

Total assets

|

69,009

|

|

66,125

|

|

|||

|

Current portion of long-term debt

|

500

|

|

2,505

|

|

|||

|

Long-term debt

|

30,215

|

|

29,623

|

|

|||

|

Stockholders’ equity

|

25,778

|

|

22,096

|

|

|||

|

Years ended December 31,

|

|||||||||||

|

2014

|

2013

|

2012

|

|||||||||

|

Net cash provided by operating activities

|

$

|

8,555

|

|

$

|

6,291

|

|

$

|

5,882

|

|

||

|

Net cash used in investing activities

|

(5,752

|

)

|

(8,469

|

)

|

(9,990

|

)

|

|||||

|

Net cash (used in) provided by financing activities

|

(2,877

|

)

|

2,726

|

|

419

|

|

|||||

|

|

Payments due by period as of December 31, 2014

|

||||||||||||||||||

|

|

|

Year

|

Years

|

Years

|

Years

|

||||||||||||||

|

Contractual obligations

|

Total

|

1

|

2 and 3

|

4 and 5

|

6 and beyond

|

||||||||||||||

|

Long-term debt obligations

(1) (2) (3) (4)

|

$

|

48,262

|

|

$

|

1,611

|

|

$

|

8,985

|

|

$

|

9,579

|

|

$

|

28,087

|

|

||||

|

Operating lease obligations

|

1,034

|

|

135

|

|

323

|

|

282

|

|

294

|

|

|||||||||

|

Purchase obligations

(5)

|

3,398

|

|

1,377

|

|

811

|

|

401

|

|

809

|

|

|||||||||

|

UTBs

(6)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total contractual obligations

|

$

|

52,694

|

|

$

|

3,123

|

|

$

|

10,119

|

|

$

|

10,262

|

|

$

|

29,190

|

|

||||

|

(1)

|

Long-term debt obligations include future interest payments which are included in our financing arrangements at the fixed contractual coupon rates. To achieve a desired mix of fixed and floating interest rate debt, we enter into interest rate swap contracts that effectively convert a fixed rate interest coupon for certain of our debt issuances to a floating LIBOR-based coupon over the life of the respective note. We used an interest rate forward curve at December 31, 2014, in computing net amounts to be paid or received under our interest rate swap contracts which resulted in an aggregate net increase in future interest payments of $272 million. See Part IV—Note 14, Financing arrangements,

to the Consolidated Financial Statements for further discussion of our interest swap contracts.

|

|

(2)

|

Long-term debt obligations include future interest payments under our Term Loan at LIBOR-based variable rates of interest. We used an interest rate forward curve at December 31, 2014, in computing interest payments on this debt obligation. See Part IV—Note 14, Financing arrangements,

to the Consolidated Financial Statements for further discussion of this debt obligation.

|

|

(3)

|

Long-term debt obligations include contractual interest payments and principal repayment of our foreign denominated debt obligations. In order to hedge our exposure to foreign currency exchange rate risk associated with certain of our pound sterling and euro denominated long-term debt, we entered into cross-currency swap contracts that effectively convert interest payments and principal repayment on this debt from euros/pounds sterling to U.S. dollars. For purposes of this table, we used the contracted exchange rates in the cross-currency swap contracts to compute the net amounts of future interest payments and principal repayments on this debt. See Part IV—Note 17, Derivative instruments, to the Consolidated Financial Statements for further discussion of our cross-currency swap contracts.

|

|

(4)

|

Interest payments and the repayment of principal on our 4.375% 2018 euro Notes were translated into U.S. dollars at the foreign currency exchange rate in effect at December 31, 2014. See Part IV—Note 14, Financing arrangements, to the Consolidated Financial Statements for further discussion of our long-term debt obligations.

|

|

(5)

|

Purchase obligations relate primarily to: (i) R&D commitments (including those related to clinical trials) for new and existing products; (ii) capital expenditures; (iii) open purchase orders for the acquisition of goods and services in the ordinary course of business; and (iv) a $225 million payment due to the former shareholders of Proteolix, Inc. in settlement of contingent consideration assumed in the acquisition of Onyx (see Note 16, Fair value measurement to the Consolidated Financial Statements). Our obligation to pay certain of these amounts may be reduced based on certain future events.

|

|

(6)

|

Liabilities for UTBs (net of foreign tax credits and federal tax benefit of state taxes) and related accrued interest and penalties totaling approximately $1.7 billion at

December 31, 2014

, are not included in the table above because, due to their nature, there is a high degree of uncertainty regarding the timing of future cash outflows and other events that extinguish these liabilities.

|

|

Rebates

|

Chargebacks

|

Other deductions

|

Total

|

||||||||||||

|

Balance as of January 1, 2012

|

$

|

1,047

|

|

$

|

199

|

|

$

|

80

|

|

$

|

1,326

|

|

|||

|

Amounts charged against product sales

|

1,480

|

|

2,709

|

|

659

|

|

4,848

|

|

|||||||

|

Payments

|

(1,680

|

)

|

(2,741

|

)

|

(624

|

)

|

(5,045

|

)

|

|||||||

|

Balance as of December 31, 2012

|

847

|

|

167

|

|

115

|

|

1,129

|

|

|||||||

|

Amounts charged against product sales

|

1,784

|

|

3,008

|

|

669

|

|

5,461

|

|

|||||||

|

Payments

|

(1,736

|

)

|

(2,924

|

)

|

(682

|

)

|

(5,342

|

)

|

|||||||

|

Balance as of December 31, 2013

|

895

|

|

251

|

|

102

|

|

1,248

|

|

|||||||

|

Amounts charged against product sales

|

2,499

|

|

3,399

|

|

688

|

|

6,586

|

|

|||||||

|

Payments

|

(2,274

|

)

|

(3,454

|

)

|

(727

|

)

|

(6,455

|

)

|

|||||||

|

Balance as of December 31, 2014

|

$

|

1,120

|

|

$

|

196

|

|

$

|

63

|

|

$

|

1,379

|

|

|||

|

•

|

determining the timing and expected costs to complete in-process projects taking into account the stage of completion at the acquisition date;

|

|

•

|

projecting the probability and timing of obtaining marketing approval from the FDA and other regulatory agencies for product candidates;

|

|

•

|

estimating the timing of and future net cash flows from product sales resulting from completed products and in-process projects; and

|

|

•

|

developing appropriate discount rates to calculate the present values of the cash flows.

|

|

Item 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

Item 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

Item 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

|

|

Item 9A.

|

CONTROLS AND PROCEDURES

|

|

Item 9B.

|

OTHER INFORMATION

|

|

Item 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE OF THE REGISTRANT

|

|

Item 11.

|

EXECUTIVE COMPENSATION

|

|

Item 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

|

(a)

|

(b)

|

(c)

|

||||||||

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options and Rights

|

Weighted Average Exercise Price Outstanding Options and Rights

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

|

|||||||

|

Equity compensation plans approved by Amgen security holders:

|

||||||||||

|

Amended and Restated 2009 Equity Incentive Plan

(1)

|

16,045,767

|

|

$

|

57.37

|

|

51,960,037

|

|

|||

|

Amended and Restated 1991 Equity Incentive Plan

(2)

|

1,201,310

|

|

$

|

48.50

|

|

—

|

|

|||

|

Amended and Restated Employee Stock Purchase Plan

|

—

|

|

—

|

|

5,205,930

|

|

||||

|

Total Approved Plans

|

17,247,077

|

|

$

|

54.76

|

|

57,165,967

|

|

|||

|

Equity compensation plans not approved by Amgen security holders:

|

||||||||||

|

Amended and Restated 1999 Equity Incentive Plan

(3)

|

123,406

|

|

$

|

46.12

|

|

—

|

|

|||

|

Amended and Restated 1999 Incentive Stock Plan

(4)

|

10,077

|

|

$

|

51.75

|

|

—

|

|

|||

|

Amended and Restated Assumed Avidia Incentive Equity Plan

(5)

|

1,328

|

|

$

|

1.91

|

|

—

|

|

|||

|

Amgen Profit Sharing Plan for Employees in Ireland

(6)

|

—

|

|

—

|

|

143,220

|

|

||||

|

Total Unapproved Plans

|

134,811

|

|

$

|

46.10

|

|

143,220

|

|

|||

|

Total All Plans

|

17,381,888

|

|

$

|

54.48

|

|

57,309,187

|

|

|||

|

(1)

|