|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

(State of incorporation)

|

23-1722724

(I.R.S. Employer

Identification Number)

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, $0.001 par value

|

The NASDAQ Global Select Market

|

|

|

Large accelerated filer

o

|

Accelerated filer

þ

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

(Do not check if a smaller reporting company)

|

|||

|

Page

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

Item 1.

|

Business

|

|

•

|

Designing and developing new packaging and test technologies;

|

|

•

|

Offering a broad portfolio of packaging and test technologies and services;

|

|

•

|

Cultivating long-standing relationships with our customers, which include many of the world’s leading semiconductor companies, and collaborating with original equipment manufacturers (“OEMs”) and equipment and material suppliers;

|

|

•

|

Developing a cost competitive cost structure with disciplined capital investment and building expertise in high-volume manufacturing processes and

|

|

•

|

Having a diversified operational scope with research and development, engineering and production capabilities at various facilities throughout China, Japan, Korea, the Philippines, Taiwan and the United States (“U.S.”).

|

|

•

|

An increasing demand for mobile and internet-connected devices, including world-wide adoption of mobile “smart” phones and tablets that can access the web and provide multimedia capabilities. The demand for digital video content has driven a range of higher performance internet connected home and mobile consumer electronics products including the rapidly growing smartphone and tablet categories.

|

|

•

|

Increasing mobility and connectivity capabilities and growing digital content are driving demand for new broadband wired and wireless networking equipment.

|

|

•

|

The proliferation of semiconductor devices into well established end products such as automotive systems due to increased use of electronics for safety, navigation, fuel efficiency, emission reduction and entertainment systems.

|

|

•

|

An overall increase in the semiconductor content within electronic products in order to provide greater functionality and higher levels of performance.

|

|

•

|

Offering capacity to absorb large orders and accommodate quick turn-around times;

|

|

•

|

Obtaining favorable pricing on materials and equipment, where possible, by using our purchasing power and leading industry position;

|

|

•

|

Qualifying production of customer devices at multiple manufacturing sites to mitigate the risks of supply disruptions and

|

|

•

|

Providing capabilities and solutions for customer-specific requirements.

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

2012

|

2011

|

2010

|

||||||||||||||||||

|

(In millions, except percentage of net sales)

|

||||||||||||||||||||

|

Packaging services

|

$

|

2,439

|

|

88.4

|

%

|

$

|

2,493

|

|

89.8

|

%

|

$

|

2,650

|

|

90.2

|

%

|

|||||

|

Test services

|

321

|

|

11.6

|

%

|

283

|

|

10.2

|

%

|

289

|

|

9.8

|

%

|

||||||||

|

Total net sales

|

$

|

2,760

|

|

100.0

|

%

|

$

|

2,776

|

|

100.0

|

%

|

$

|

2,939

|

|

100.0

|

%

|

|||||

|

•

|

Stacked chip scale packages that contain two or more chips placed on top of each other and are ideal for chipset and memory applications and

|

|

•

|

PoP solutions using extremely thin chip scale packages that are stacked on top of each other, enabling the integration of logic and memory in a single small footprint package, as well as multiple memory applications.

|

|

•

|

Flip chip ball grid array packages that incorporate a face down bumped die onto a substrate using a ball grid array format and are increasingly being used with advanced silicon nodes that enable our customers to implement more powerful new applications and smaller devices and

|

|

•

|

Plastic ball grid array packages that use wirebond technology in applications requiring higher pin count than chip scale or leadframe packages, but typically have lower interconnect density than flip chip.

|

|

End Market

|

Applications

|

Amkor Packaging and

Test Services

|

||||

|

Communications

|

Handsets (Cell Phones, Feature Phones, Smart Phones)

Tablets

Wireless LAN

Handheld Devices

|

Flip Chip Chip Scale Package

Flip Chip Stacked Chip Scale Package

Test Services

Fine Pitch Copper Pillar Flip Chip Chip Scale Package

Stacked Chip Scale Package

ChipArray Ball Grid Array

Micro

LeadFrame

Wafer Bumping

Wafer Level Chip Scale Package

|

||||

|

Consumer

|

Gaming

Television

Set Top Boxes

Portable Media

Digital Cameras

|

Flip Chip Ball Grid Array

Thin Quad Flat Pack

ChipArray Ball Grid Array

Test Services

Micro

LeadFrame

Plastic Ball Grid Array

|

||||

|

Computing

|

Desk Top Computer

Laptop Computer

Notebook Computer

Netbook Computer

Hard Disk Drive

Computer Server

Printers

Other Peripherals

|

Thin Quad Flat Pack

ChipArray Ball Grid Array

Micro

LeadFrame

Plastic Ball Grid Array

Test Services

Flip Chip Ball Grid Array

Small Outline Integrated Circuit

|

||||

|

Networking

|

Servers

Routers

Switches

|

Flip Chip Ball Grid Array

Plastic Ball Grid Array

Wafer Bumping

Thin Quad Flat Pack

Test Services

ChipArray Ball Grid Array

|

||||

|

Other

|

Automotive

Industrial

|

Small Outline Integrated Circuit

Plastic Ball Grid Array

Micro

LeadFrame

Thin Quad Flat Pack

Test Services

Quad Flat Pack

|

||||

|

•

|

3D packaging;

|

|

•

|

Advanced flip chip packaging;

|

|

•

|

Advanced micro-electromechanical system packaging and testing;

|

|

•

|

Copper Pillar bumping and packaging;

|

|

•

|

Copper wire interconnects;

|

|

•

|

Engineering and characterization tools;

|

|

•

|

Laminate and leadframe packaging;

|

|

•

|

Manufacturing cost reductions;

|

|

•

|

Silicon Photonics;

|

|

•

|

Silver wirebond technology;

|

|

•

|

TMV technology;

|

|

•

|

TSV technology;

|

|

•

|

Wafer Level Fan Out technology and

|

|

•

|

Wafer level processing.

|

|

•

|

Managing and coordinating ongoing manufacturing activity;

|

|

•

|

Providing information and expert advice on our portfolio of packaging and test services and related trends;

|

|

•

|

Managing the start-up of specific packaging and test programs;

|

|

•

|

Working to improve our customers’ time-to-market;

|

|

•

|

Providing a continuous flow of information to our customers regarding products and programs in process;

|

|

•

|

Partnering with customers on design solutions;

|

|

•

|

Researching and assisting in the resolution of technical and logistical issues;

|

|

•

|

Aligning our technologies and research and development activities with the needs of our customers and OEMs;

|

|

•

|

Providing guidance and solutions to customers in managing their supply chains;

|

|

•

|

Driving industry standards;

|

|

•

|

Providing design and simulation services to ensure package reliability and

|

|

•

|

Collaborating with our customers on continuous quality improvement initiatives.

|

|

•

|

Achieve near real time and automated communications of order fulfillment information, such as inventory control, production schedules and engineering data, including production yields, device specifications and quality indices and

|

|

•

|

Connect our customers to our sales and marketing personnel world-wide and to our factories.

|

|

Altera Corporation

|

ON Semiconductor Corporation

|

|

Analog Devices, Inc.

|

Panasonic Corporation

|

|

Atmel Corporation

|

Qualcomm Incorporated

|

|

Broadcom Corporation

|

Renesas Electronics Corporation

|

|

Entropic Communications, Inc.

|

RF Micro Devices, Inc.

|

|

Freescale Semiconductor, Ltd.

|

Samsung Electronics Co., Ltd.

|

|

GLOBALFOUNDRIES Inc.

|

Sony Corporation

|

|

Infineon Technologies AG

|

STMicroelectronics N.V.

|

|

Intel Corporation

|

Taiwan Semiconductor Manufacturing Company Limited

|

|

International Business Machines Corporation (“IBM”)

|

Texas Instruments Incorporated

|

|

LSI Corporation

|

Toshiba Corporation

|

|

Maxim Integrated Products, Inc.

|

Xilinx, Inc.

|

|

Micron Technology, Inc.

|

|

|

•

|

Advanced Semiconductor Engineering, Inc.,

|

|

•

|

Siliconware Precision Industries Co., Ltd. and

|

|

•

|

STATS ChipPAC Ltd.

|

|

•

|

technical competence;

|

|

•

|

quality;

|

|

•

|

price;

|

|

•

|

breadth of packaging and test services offered, including turnkey services;

|

|

•

|

new package and test design, technology innovation and implementation;

|

|

•

|

cycle times;

|

|

•

|

customer service and

|

|

•

|

available capacity and ability to invest in capacity, geographic location and scale of manufacturing.

|

|

Item 1A.

|

Risk Factors

|

|

•

|

fluctuation in demand for semiconductors and conditions in the semiconductor industry;

|

|

•

|

changes in our capacity utilization rates;

|

|

•

|

changes in average selling prices;

|

|

•

|

changes in the mix of semiconductor packages;

|

|

•

|

evolving packaging and test technology;

|

|

•

|

absence of backlog and the short-term nature of our customers’ commitments and the impact of these factors on the timing and volume of orders relative to our production capacity;

|

|

•

|

changes in costs, availability and delivery times of raw materials and components;

|

|

•

|

changes in labor costs to perform our services;

|

|

•

|

wage and commodity price inflation, including precious metals;

|

|

•

|

the timing of expenditures in anticipation of future orders;

|

|

•

|

changes in effective tax rates;

|

|

•

|

the availability and cost of financing;

|

|

•

|

intellectual property transactions and disputes;

|

|

•

|

high leverage and restrictive covenants;

|

|

•

|

warranty and product liability claims and the impact of quality excursions and customer disputes and returns;

|

|

•

|

costs associated with litigation judgments, indemnification claims and settlements;

|

|

•

|

international events, political instability, civil disturbances or environmental or natural events, such as earthquakes, that impact our operations;

|

|

•

|

pandemic illnesses that may impact our labor force and our ability to travel;

|

|

•

|

difficulties integrating acquisitions and the failure of our joint ventures to operate in accordance with business plans;

|

|

•

|

our ability to attract and retain qualified employees to support our global operations;

|

|

•

|

loss of key personnel or the shortage of available skilled workers;

|

|

•

|

fluctuations in foreign exchange rates and the cost of materials used in our packaging services such as gold and copper;

|

|

•

|

delay, rescheduling and cancellation of large orders;

|

|

•

|

fluctuations in our manufacturing yields and

|

|

•

|

dependence on key customers or concentration of customers in certain market segments, such as mobile communications.

|

|

•

|

their desire to realize higher utilization of their existing packaging and test capacity, especially during downturns in the semiconductor industry;

|

|

•

|

their unwillingness to disclose proprietary technology;

|

|

•

|

their possession of more advanced packaging and test technologies and

|

|

•

|

the guaranteed availability of their own packaging and test capacity.

|

|

•

|

make it more difficult for us to satisfy our obligations with respect to our indebtedness, including our obligations under our indentures to purchase notes tendered as a result of a change in control of Amkor;

|

|

•

|

increase our vulnerability to general adverse economic and industry conditions;

|

|

•

|

limit our ability to fund future working capital, capital expenditures, research and development and other business opportunities;

|

|

•

|

require us to dedicate a substantial portion of our cash flow from operations to service payments on our debt;

|

|

•

|

increase the volatility of the price of our common stock;

|

|

•

|

limit our flexibility to react to changes in our business and the industry in which we operate;

|

|

•

|

place us at a competitive disadvantage to any of our competitors that have less debt and

|

|

•

|

limit, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds.

|

|

•

|

changes in consumer demand resulting from deteriorating conditions in local economies;

|

|

•

|

regulations imposed by foreign governments, including limitations or taxes imposed on the payment of dividends and other payments by non-U.S. subsidiaries;

|

|

•

|

fluctuations in currency exchange rates;

|

|

•

|

political, military, civil unrest and terrorist risks, particularly an increase in tensions between North Korea and South Korea;

|

|

•

|

disruptions or delays in shipments caused by customs brokers or government agencies;

|

|

•

|

changes in regulatory requirements, tariffs, customs, duties and other restrictive trade barriers or policies;

|

|

•

|

difficulties in staffing, retention and employee turnover and managing foreign operations, including foreign labor disruptions;

|

|

•

|

difficulty in enforcing contractual rights and protecting our intellectual property rights and

|

|

•

|

potentially adverse tax consequences resulting from changes in tax laws in the foreign jurisdictions in which we operate.

|

|

•

|

we may face delays in the design and implementation of the system;

|

|

•

|

the cost of the system may exceed our plans and expectations and

|

|

•

|

disruptions resulting from the implementation of the system may impact our ability to process transactions and delay shipments to customers, impact our results of operations or financial condition or harm our control environment.

|

|

•

|

increasing the scope, geographic diversity and complexity of our operations;

|

|

•

|

conforming an acquired company's standards, practices, systems and controls with our operations;

|

|

•

|

increasing complexity from combining recent acquisitions of an acquired business;

|

|

•

|

unexpected losses of key employees or customers of an acquired business; other difficulties in the assimilation of acquired operations, technologies or products and

|

|

•

|

diversion of management and other resources from other parts of our operations and adverse effects on existing business relationships with customers.

|

|

•

|

use a significant portion of our available cash;

|

|

•

|

issue equity securities, which may dilute the ownership of current stockholders;

|

|

•

|

incur substantial debt;

|

|

•

|

incur or assume known or unknown contingent liabilities and

|

|

•

|

incur large, immediate accounting write-offs and face antitrust or other regulatory inquiries or actions.

|

|

•

|

our future financial condition, results of operations and cash flows;

|

|

•

|

general market conditions for financing;

|

|

•

|

volatility in fixed income, credit and equity markets and

|

|

•

|

economic, political and other global conditions.

|

|

•

|

discontinue the use of certain processes;

|

|

•

|

cease to provide the services at issue;

|

|

•

|

pay substantial damages;

|

|

•

|

develop non-infringing technologies or

|

|

•

|

acquire licenses to such technology.

|

|

•

|

contaminants in the manufacturing environment;

|

|

•

|

human error;

|

|

•

|

equipment malfunction;

|

|

•

|

changing processes to address environmental requirements;

|

|

•

|

defective raw materials or

|

|

•

|

defective plating services.

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

Item 2.

|

Properties

|

|

Location

|

Approximate

Factory Size

(Square Feet)

|

Services

|

|||

|

Korea

|

|||||

|

Gwangju, Korea (1)

|

1,218,000

|

|

Packaging and test services; wafer bump services

|

||

|

Seoul, Korea (1)

|

698,000

|

|

Packaging services; package and process development

|

||

|

Pupyong, Korea (1)

|

404,000

|

|

Packaging and test services

|

||

|

Philippines

|

|||||

|

Muntinlupa, Philippines (2)

|

749,000

|

|

Packaging and test services; package and process development

|

||

|

Province of Laguna, Philippines (2)

|

625,000

|

|

Packaging and test services

|

||

|

China

|

|||||

|

Shanghai, China (3)

|

993,000

|

|

Packaging and test services; wafer bump services

|

||

|

Taiwan

|

|||||

|

Hsinchu, Taiwan (1)

|

496,000

|

|

Packaging and test services; wafer bump services

|

||

|

Lung Tan, Taiwan (1)

|

353,000

|

|

Packaging and test services; wafer bump services

|

||

|

Japan

|

|||||

|

Kitakami, Japan (4)

|

211,000

|

|

Packaging and test services

|

||

|

United States

|

|||||

|

Chandler, AZ (4)

|

6,000

|

|

Package and process development

|

||

|

(1)

|

Owned facility and land.

|

|

(2)

|

As a result of foreign ownership restrictions in the Philippines, the land associated with our Philippine factories is leased from realty companies in which we own a

40%

interest. We own buildings comprising

1,223,000

square feet and lease the remaining

151,000

square feet from one of the aforementioned realty companies.

|

|

(3)

|

We own buildings comprising

993,000

square feet, of which approximately

738,000

square feet were facilitized as of

December 31, 2012

. All land is leased.

|

|

(4)

|

Leased facility.

|

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

High

|

Low

|

||||||||||

|

2012

|

|||||||||||

|

First Quarter

|

$

|

6.78

|

|

$

|

4.46

|

|

|||||

|

Second Quarter

|

6.25

|

|

4.29

|

|

|||||||

|

Third Quarter

|

5.58

|

|

4.36

|

|

|||||||

|

Fourth Quarter

|

4.60

|

|

3.65

|

|

|||||||

|

2011

|

|||||||||||

|

First Quarter

|

$

|

8.49

|

|

$

|

6.30

|

|

|||||

|

Second Quarter

|

7.00

|

|

5.64

|

|

|||||||

|

Third Quarter

|

6.59

|

|

3.81

|

|

|||||||

|

Fourth Quarter

|

5.17

|

|

4.06

|

|

|||||||

|

Period

|

Total Number of Shares Purchased (a)

|

Average Price Paid Per Share ($)

|

Total Number of Shares Purchased as part of Publicly Announced Plans or Programs (b)

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs ($) (b)

|

||||||

|

October 1-October 31

|

2,362

|

|

$

|

4.44

|

|

—

|

|

$

|

91,586,032

|

|

|

November 1-November 30

|

11,167

|

|

4.03

|

|

—

|

|

91,586,032

|

|

||

|

December 1-December 31

|

1,716

|

|

4.32

|

|

—

|

|

91,586,032

|

|

||

|

Total

|

15,245

|

|

$

|

4.13

|

|

—

|

|

|||

|

(a)

|

Represents shares of common stock surrendered to us to satisfy tax withholding obligations associated with the vesting of restricted shares issued to employees.

|

|

(b)

|

Our Board of Directors previously authorized the repurchase of up to

$300.0 million

of our common stock, $150.0 million in August 2011 and $150.0 million in February 2012, exclusive of any fees, commissions or other expenses. During 2012, we purchased

16.5 million

shares of common stock for an aggregate purchase price of

$79.5 million

, net of

$0.3 million

of commissions, for an average price of

$4.83

. At

December 31, 2012

, approximately

$91.6 million

was available to repurchase common stock pursuant to the stock repurchase program.

|

|

(1)

|

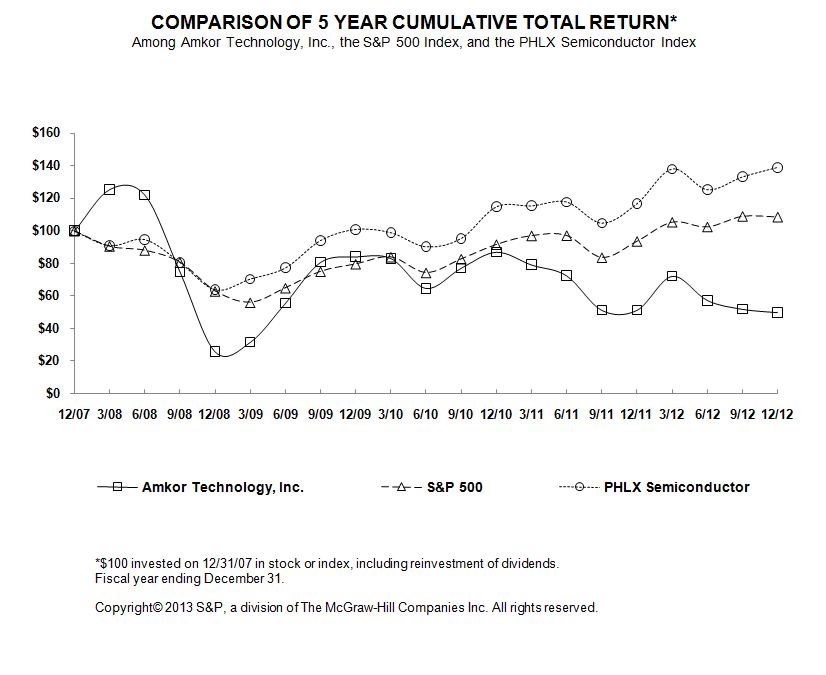

The preceding Stock Performance Graph is not deemed filed with the Securities and Exchange Commission and shall not be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

|

Item 6.

|

Selected Consolidated Financial Data

|

|

For the Year Ended December 31,

|

|||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

(In thousands, except per share data)

|

|||||||||||||||||||

|

Statement of Operations Data:

|

|||||||||||||||||||

|

Net sales

|

$

|

2,759,546

|

|

$

|

2,776,359

|

|

$

|

2,939,483

|

|

$

|

2,179,109

|

|

$

|

2,658,602

|

|

||||

|

Cost of sales (a)

|

2,335,736

|

|

2,285,790

|

|

2,275,727

|

|

1,698,713

|

|

2,096,864

|

|

|||||||||

|

Gross profit

|

423,810

|

|

490,569

|

|

663,756

|

|

480,396

|

|

561,738

|

|

|||||||||

|

Operating expenses:

|

|||||||||||||||||||

|

Selling, general and administrative

|

217,000

|

|

246,555

|

|

242,424

|

|

210,907

|

|

251,756

|

|

|||||||||

|

Research and development

|

54,118

|

|

50,386

|

|

47,534

|

|

44,453

|

|

56,227

|

|

|||||||||

|

Goodwill impairment (b)

|

—

|

|

—

|

|

—

|

|

—

|

|

671,117

|

|

|||||||||

|

Gain on sale of real estate and specialty test operations (c)

|

—

|

|

(42

|

)

|

—

|

|

(281

|

)

|

(9,856

|

)

|

|||||||||

|

Total operating expenses

|

271,118

|

|

296,899

|

|

289,958

|

|

255,079

|

|

969,244

|

|

|||||||||

|

Operating income (loss)

|

152,692

|

|

193,670

|

|

373,798

|

|

225,317

|

|

(407,506

|

)

|

|||||||||

|

Other expense (income):

|

|||||||||||||||||||

|

Interest expense (a)

|

83,974

|

|

74,212

|

|

85,595

|

|

102,396

|

|

118,729

|

|

|||||||||

|

Interest expense, related party

|

13,969

|

|

12,394

|

|

15,250

|

|

13,000

|

|

6,250

|

|

|||||||||

|

Interest income

|

(3,160

|

)

|

(2,749

|

)

|

(2,950

|

)

|

(2,367

|

)

|

(8,749

|

)

|

|||||||||

|

Foreign currency loss (gain) (d)

|

4,185

|

|

2,178

|

|

13,756

|

|

3,339

|

|

(61,057

|

)

|

|||||||||

|

Loss (gain) on debt retirement, net (e)

|

1,199

|

|

15,531

|

|

18,042

|

|

(15,088

|

)

|

(35,987

|

)

|

|||||||||

|

Equity in earnings of unconsolidated affiliates (f)

|

(5,592

|

)

|

(7,085

|

)

|

(6,435

|

)

|

(2,373

|

)

|

—

|

|

|||||||||

|

Other income, net

|

(1,586

|

)

|

(1,030

|

)

|

(619

|

)

|

(113

|

)

|

(1,004

|

)

|

|||||||||

|

Total other expense, net

|

92,989

|

|

93,451

|

|

122,639

|

|

98,794

|

|

18,182

|

|

|||||||||

|

Income (loss) before income taxes

|

59,703

|

|

100,219

|

|

251,159

|

|

126,523

|

|

(425,688

|

)

|

|||||||||

|

Income tax expense (benefit) (g)

|

17,001

|

|

7,124

|

|

19,012

|

|

(29,760

|

)

|

31,788

|

|

|||||||||

|

Net income (loss)

|

42,702

|

|

93,095

|

|

232,147

|

|

156,283

|

|

(457,476

|

)

|

|||||||||

|

Net (income) loss attributable to noncontrolling interests

|

(884

|

)

|

(1,287

|

)

|

(176

|

)

|

(303

|

)

|

781

|

|

|||||||||

|

Net income (loss) attributable to Amkor

|

$

|

41,818

|

|

$

|

91,808

|

|

$

|

231,971

|

|

$

|

155,980

|

|

$

|

(456,695

|

)

|

||||

|

Net income (loss) attributable to Amkor per common share:

|

|||||||||||||||||||

|

Basic

|

$

|

0.26

|

|

0.48

|

|

1.26

|

|

0.85

|

|

(2.50

|

)

|

||||||||

|

Diluted

|

$

|

0.24

|

|

0.39

|

|

0.91

|

|

0.67

|

|

(2.50

|

)

|

||||||||

|

Shares used in computing per common share amounts:

|

|||||||||||||||||||

|

Basic (h)

|

160,105

|

|

190,829

|

|

183,312

|

|

183,067

|

|

182,734

|

|

|||||||||

|

Diluted

|

243,004

|

|

273,686

|

|

282,602

|

|

263,379

|

|

182,734

|

|

|||||||||

|

Other Financial Data:

|

|||||||||||||||||||

|

Depreciation and amortization

|

$

|

370,479

|

|

$

|

335,644

|

|

$

|

323,608

|

|

$

|

305,510

|

|

$

|

309,920

|

|

||||

|

Purchases of property, plant and equipment

|

533,512

|

|

466,694

|

|

445,669

|

|

173,496

|

|

386,239

|

|

|||||||||

|

Year Ended December 31,

|

|||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

(In thousands)

|

|||||||||||||||||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

413,048

|

|

$

|

434,631

|

|

$

|

404,998

|

|

$

|

395,406

|

|

$

|

424,316

|

|

||||

|

Working capital

|

438,781

|

|

354,644

|

|

289,859

|

|

327,088

|

|

306,174

|

|

|||||||||

|

Total assets

|

3,025,215

|

|

2,773,047

|

|

2,736,822

|

|

2,432,909

|

|

2,383,993

|

|

|||||||||

|

Total long-term debt

|

1,545,000

|

|

1,287,256

|

|

1,214,219

|

|

1,345,241

|

|

1,438,751

|

|

|||||||||

|

Total debt, including short-term borrowings and current portion of long-term debt

|

1,545,000

|

|

1,346,651

|

|

1,364,300

|

|

1,434,185

|

|

1,493,360

|

|

|||||||||

|

Additional paid-in capital

|

1,614,143

|

|

1,611,242

|

|

1,504,927

|

|

1,500,246

|

|

1,496,976

|

|

|||||||||

|

Accumulated deficit

|

(756,644

|

)

|

(798,462

|

)

|

(890,270

|

)

|

(1,122,241

|

)

|

(1,278,221

|

)

|

|||||||||

|

Total Amkor stockholders’ equity

|

657,955

|

|

693,266

|

|

630,013

|

|

383,209

|

|

237,139

|

|

|||||||||

|

(a)

|

During 2012, we recorded a charge of

$50.0 million

to cost of sales and

$6.0 million

to interest expense relating to

our pending patent license arbitration

. During 2008, we recorded a charge of $61.4 million to cost of sales and $3.3 million to interest expense related to a prior patent license dispute, of which $49.0 million related to royalties for periods prior to 2008.

|

|

(b)

|

At December 31, 2008, we recorded a non-cash charge of $671.1 million to write off our remaining goodwill.

|

|

(c)

|

During 2011, we sold real property in Singapore used for operations that were exited as of December 31, 2010. The gain on the sale of the real property was less than $0.1 million. During 2009, we sold land and dormitory buildings in Korea and recorded a gain of $0.3 million. During 2008, we sold land and a warehouse in Korea and recorded a gain of $9.9 million.

|

|

(d)

|

We recognize foreign currency losses (gains) due to the remeasurement of certain of our foreign currency denominated monetary assets and liabilities. During 2008, the net foreign currency gain of $61.1 million is primarily attributable to the significant depreciation of the Korean won and the impact on the remeasurement of our Korean severance obligation.

|

|

(e)

|

During 2012, we recorded a net loss of

$1.2 million

related to the repayment of subsidiary debt with the proceeds from the issuance of

$300.0 million

of our 6.375% Senior Notes due 2022. During 2011, we recorded a net loss of

$15.5 million

related to the tender and call of our 9.25% Senior Notes due 2016 and the write-off of the associated unamortized deferred debt issuance costs. During 2010, we recorded a net loss of $18.0 million related to several debt transactions. These transactions included recording a net loss of $17.7 million related to the tender offer to purchase $125.7 million principal amount of our 9.25% Senior Notes due 2016 and the repurchase of an aggregate $411.8 million principal amount of our 7.125% Senior Notes due in 2011 and our 7.75% Senior Notes due in 2013. During 2009, we recorded a net gain of $15.1 million related to the repurchase of an aggregate $289.3 million principal amount of our 7.125% Senior Notes and 2.5% Convertible Senior Subordinated Notes due in 2011 and our 7.75% Senior Notes due in 2013. During 2008, we recorded a gain of $36.0 million related to the repurchase of an aggregate $118.3 million principal amount of our 7.125% senior notes and 2.5% convertible senior subordinated notes due 2011.

|

|

(f)

|

During 2009, we made a 30% equity investment in J-Devices, which was accounted for using the equity method.

|

|

(g)

|

Generally, our effective tax rate is substantially below the U.S. federal tax rate of 35% because we have experienced taxable losses in the U.S. and our income is taxed in foreign jurisdictions where we benefit from tax holidays or tax rates lower than the U.S. statutory rate. In 2009, a $25.6 million benefit for the release of a valuation allowance in Korea was included in the income tax benefit. In 2008, the $671.1 million goodwill impairment charge did not have a significant income tax benefit. Also, the 2008 income tax provision included a charge of $8.3 million for the establishment of a valuation allowance in Japan.

|

|

(h)

|

In 2012, we repurchased

16.5 million

shares under the Stock Repurchase Program. In 2011, we repurchased

28.6 million

shares under the Stock Repurchase Program. In addition, the entire

$100.0 million

aggregate principal amount of the December 2013 Notes was converted into

13.4 million

shares of common stock.

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

Year Ended December 31,

|

||||||||

|

2012

|

2011

|

2010

|

||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Gross margin

|

15.4

|

%

|

17.7

|

%

|

22.6

|

%

|

||

|

Depreciation and amortization

|

13.4

|

%

|

12.1

|

%

|

11.0

|

%

|

||

|

Operating income

|

5.5

|

%

|

7.0

|

%

|

12.7

|

%

|

||

|

Income before income taxes

|

2.2

|

%

|

3.6

|

%

|

8.5

|

%

|

||

|

Net income attributable to Amkor

|

1.5

|

%

|

3.3

|

%

|

7.9

|

%

|

||

|

Change

|

|||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||||||||

|

Net sales

|

$

|

2,759,546

|

|

$

|

2,776,359

|

|

$

|

2,939,483

|

|

$

|

(16,813

|

)

|

(0.6

|

)%

|

$

|

(163,124

|

)

|

(5.5

|

)%

|

||||||

|

Packaging net sales

|

2,438,572

|

|

2,493,283

|

|

2,650,257

|

|

(54,711

|

)

|

(2.2

|

)%

|

(156,974

|

)

|

(5.9

|

)%

|

|||||||||||

|

Test net sales

|

320,974

|

|

282,942

|

|

288,871

|

|

38,032

|

|

13.4

|

%

|

(5,929

|

)

|

(2.1

|

)%

|

|||||||||||

|

Change

|

|||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||||||||

|

Cost of sales

|

$

|

2,335,736

|

|

$

|

2,285,790

|

|

$

|

2,275,727

|

|

$

|

49,946

|

|

2.2

|

%

|

$

|

10,063

|

|

0.4

|

%

|

||||||

|

Change

|

|||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||

|

Gross profit

|

$

|

423,810

|

|

$

|

490,569

|

|

$

|

663,756

|

|

$

|

(66,759

|

)

|

$

|

(173,187

|

)

|

||||

|

Gross margin

|

15.4

|

%

|

17.7

|

%

|

22.6

|

%

|

(2.3

|

)%

|

(4.9

|

)%

|

|||||||||

|

Change

|

|||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||

|

Packaging gross profit

|

$

|

334,968

|

|

$

|

425,878

|

|

$

|

584,190

|

|

$

|

(90,910

|

)

|

$

|

(158,312

|

)

|

||||

|

Packaging gross margin

|

13.7

|

%

|

17.1

|

%

|

22.0

|

%

|

(3.4

|

)%

|

(4.9

|

)%

|

|||||||||

|

Change

|

|||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||

|

Test gross profit

|

$

|

88,842

|

|

$

|

65,719

|

|

$

|

79,621

|

|

$

|

23,123

|

|

$

|

(13,902

|

)

|

||||

|

Test gross margin

|

27.7

|

%

|

23.2

|

%

|

27.6

|

%

|

4.5

|

%

|

(4.4

|

)%

|

|||||||||

|

Change

|

|||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||||||||

|

Selling, general and administrative

|

$

|

217,000

|

|

$

|

246,513

|

|

$

|

242,424

|

|

$

|

(29,513

|

)

|

(12.0

|

)%

|

$

|

4,089

|

|

1.7

|

%

|

||||||

|

Change

|

|||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||||||||

|

Research and development

|

$

|

54,118

|

|

$

|

50,386

|

|

$

|

47,534

|

|

$

|

3,732

|

|

7.4

|

%

|

$

|

2,852

|

|

6.0

|

%

|

||||||

|

Change

|

|||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||||||||

|

Interest expense, net

|

$

|

94,783

|

|

$

|

83,857

|

|

$

|

97,895

|

|

$

|

10,926

|

|

13.0

|

%

|

$

|

(14,038

|

)

|

(14.3

|

)%

|

||||||

|

Foreign currency loss

|

4,185

|

|

2,178

|

|

13,756

|

|

2,007

|

|

92.1

|

%

|

(11,578

|

)

|

(84.2

|

)%

|

|||||||||||

|

Loss on debt retirement, net

|

1,199

|

|

15,531

|

|

18,042

|

|

(14,332

|

)

|

(92.3

|

)%

|

(2,511

|

)

|

(13.9

|

)%

|

|||||||||||

|

Equity in earnings of unconsolidated affiliate

|

(5,592

|

)

|

(7,085

|

)

|

(6,435

|

)

|

1,493

|

|

(21.1

|

)%

|

(650

|

)

|

10.1

|

%

|

|||||||||||

|

Other income, net

|

(1,586

|

)

|

(1,030

|

)

|

(619

|

)

|

(556

|

)

|

54.0

|

%

|

(411

|

)

|

66.4

|

%

|

|||||||||||

|

Total other expense, net

|

$

|

92,989

|

|

$

|

93,451

|

|

$

|

122,639

|

|

$

|

(462

|

)

|

(0.5

|

)%

|

$

|

(29,188

|

)

|

(23.8

|

)%

|

||||||

|

Change

|

|||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

2012 over 2011

|

2011 over 2010

|

|||||||||||||||||||||

|

(In thousands, except percentages)

|

|||||||||||||||||||||||||

|

Income tax expense

|

$

|

17,001

|

|

$

|

7,124

|

|

$

|

19,012

|

|

$

|

9,877

|

|

138.6

|

%

|

$

|

(11,888

|

)

|

(62.5

|

)%

|

||||||

|

For the Quarter Ended

|

|||||||||||||||||||||||||||||||

|

Dec. 31,

2012 |

Sept. 30,

2012 |

June 30,

2012 |

Mar. 31,

2012 |

Dec. 31,

2011 |

Sept. 30,

2011 |

June 30,

2011 |

Mar. 31,

2011 |

||||||||||||||||||||||||

|

(In thousands, except per share data)

|

|||||||||||||||||||||||||||||||

|

Net sales

|

$

|

722,656

|

|

$

|

695,353

|

|

$

|

686,527

|

|

$

|

655,010

|

|

$

|

683,769

|

|

$

|

740,007

|

|

$

|

687,633

|

|

$

|

664,950

|

|

|||||||

|

Cost of sales

|

609,934

|

|

578,566

|

|

597,207

|

|

550,029

|

|

571,942

|

|

617,768

|

|

557,816

|

|

538,264

|

|

|||||||||||||||

|

Gross profit

|

112,722

|

|

116,787

|

|

89,320

|

|

104,981

|

|

111,827

|

|

122,239

|

|

129,817

|

|

126,686

|

|

|||||||||||||||

|

Operating expenses:

|

|||||||||||||||||||||||||||||||

|

Selling, general and administrative

|

56,959

|

|

49,297

|

|

53,489

|

|

57,255

|

|

55,660

|

|

65,011

|

|

61,284

|

|

64,558

|

|

|||||||||||||||

|

Research and development

|

13,354

|

|

13,472

|

|

13,867

|

|

13,425

|

|

12,465

|

|

13,233

|

|

12,559

|

|

12,129

|

|

|||||||||||||||

|

Total operating expenses

|

70,313

|

|

62,769

|

|

67,356

|

|

70,680

|

|

68,125

|

|

78,244

|

|

73,843

|

|

76,687

|

|

|||||||||||||||

|

Operating income

|

42,409

|

|

54,018

|

|

21,964

|

|

34,301

|

|

43,702

|

|

43,995

|

|

55,974

|

|

49,999

|

|

|||||||||||||||

|

Other expense, net

|

26,745

|

|

21,904

|

|

24,983

|

|

19,357

|

|

20,492

|

|

14,173

|

|

37,935

|

|

20,851

|

|

|||||||||||||||

|

Income before income taxes

|

15,664

|

|

32,114

|

|

(3,019

|

)

|

14,944

|

|

23,210

|

|

29,822

|

|

18,039

|

|

29,148

|

|

|||||||||||||||

|

Income tax expense (benefit)

|

7,992

|

|

9,538

|

|

(3,891

|

)

|

3,362

|

|

(2,351

|

)

|

2,499

|

|

3,594

|

|

3,382

|

|

|||||||||||||||

|

Net income

|

7,672

|

|

22,576

|

|

872

|

|

11,582

|

|

25,561

|

|

27,323

|

|

14,445

|

|

25,766

|

|

|||||||||||||||

|

Net (income) loss attributable to noncontrolling interests

|

(526

|

)

|

(259

|

)

|

(291

|

)

|

192

|

|

(711

|

)

|

44

|

|

43

|

|

(663

|

)

|

|||||||||||||||

|

Net income attributable to Amkor

|

$

|

7,146

|

|

$

|

22,317

|

|

$

|

581

|

|

$

|

11,774

|

|

$

|

24,850

|

|

$

|

27,367

|

|

$

|

14,488

|

|

$

|

25,103

|

|

|||||||

|

Net income attributable to Amkor per common share:

|

|||||||||||||||||||||||||||||||

|

Basic

|

$

|

0.05

|

|

$

|

0.14

|

|

$

|

—

|

|

$

|

0.07

|

|

$

|

0.14

|

|

$

|

0.14

|

|

$

|

0.07

|

|

$

|

0.13

|

|

|||||||

|

Diluted

|

0.05

|

|

0.11

|

|

—

|

|

0.06

|

|

0.11

|

|

0.11

|

|

0.07

|

|

0.10

|

|

|||||||||||||||

|

For the Year Ended December 31,

|

|||||||||||

|

2012

|

2011

|

2010

|

|||||||||

|

(In thousands)

|

|||||||||||

|

Property, plant and equipment additions

|

$

|

533,177

|

|

$

|

452,989

|

|

$

|

504,463

|

|

||

|

Net change in related accounts payable and deposits

|

335

|

|

13,705

|

|

(58,794

|

)

|

|||||

|

Purchases of property, plant and equipment

|

$

|

533,512

|

|

$

|

466,694

|

|

$

|

445,669

|

|

||

|

For the Year Ended December 31,

|

|||||||||||

|

2012

|

2011

|

2010

|

|||||||||

|

(In thousands)

|

|||||||||||

|

Operating activities

|

$

|

389,063

|

|

$

|

516,832

|

|

$

|

542,595

|

|

||

|

Investing activities

|

(520,121

|

)

|

(430,534

|

)

|

(444,921

|

)

|

|||||

|

Financing activities

|

110,032

|

|

(58,877

|

)

|

(89,857

|

)

|

|||||

|

For the Year Ended December 31,

|

|||||||||||

|

2012

|

2011

|

2010

|

|||||||||

|

(In thousands)

|

|||||||||||

|

Net cash provided by operating activities

|

$

|

389,063

|

|

$

|

516,832

|

|

$

|

542,595

|

|

||

|

Less purchases of property, plant and equipment

|

533,512

|

|

466,694

|

|

445,669

|

|

|||||

|

Free cash flow

|

$

|

(144,449

|

)

|

$

|

50,138

|

|

$

|

96,926

|

|

||

|

Payments Due for Year Ending December 31,

|

|||||||||||||||||||||||||||

|

Total

|

2013

|

2014

|

2015

|

2016

|

2017

|

Thereafter

|

|||||||||||||||||||||

|

(In thousands)

|

|||||||||||||||||||||||||||

|

Total debt

|

$

|

1,545,000

|

|

$

|

—

|

|

$

|

250,000

|

|

$

|

100,000

|

|

$

|

—

|

|

$

|

137,000

|

|

$

|

1,058,000

|

|

||||||

|

Scheduled interest payment obligations (1)

|

618,182

|

|

96,638

|

|

89,138

|

|

78,350

|

|

77,428

|

|

74,509

|

|

202,119

|

|

|||||||||||||

|

Purchase obligations (2)

|

118,341

|

|

118,341

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Operating lease obligations

|

29,036

|

|

11,671

|

|

7,926

|

|

5,517

|

|

953

|

|

860

|

|

2,109

|

|

|||||||||||||

|

Severance obligations (3)

|

126,513

|

|

9,516

|

|

8,785

|

|

8,132

|

|

7,517

|

|

6,959

|

|

85,604

|

|

|||||||||||||

|

Total contractual obligations

|

$

|

2,437,072

|

|

$

|

236,166

|

|

$

|

355,849

|

|

$

|

191,999

|

|

$

|

85,898

|

|

$

|

219,328

|

|

$

|

1,347,832

|

|

||||||

|

(1)

|

Scheduled interest payment obligations were calculated using stated coupon rates for fixed rate debt and interest rates applicable at

December 31, 2012

, for variable rate debt.

|

|

(2)

|

Represents capital-related purchase obligations outstanding at

December 31, 2012

.

|

|

(3)

|

Represents estimated benefit payments for our Korean subsidiary severance plan.

|

|

•

|

$22.4 million

of net foreign pension plan obligations for which the timing and actual amount of funding required is uncertain. We expect to contribute

$2.4 million

to the plans during

2013

.

|

|

•

|

$2.1 million net liability associated with unrecognized tax benefits. Due to the uncertainty regarding the amount and the timing of any future cash outflows associated with our unrecognized tax benefits, we are unable to reasonably estimate the amount and period of ultimate settlement, if any, with the various taxing authorities.

|

|

Land use rights

|

50 years

|

|

Buildings and improvements

|

10 to 25 years

|

|

Machinery and equipment

|

2 to 7 years

|

|

Software and computer equipment

|

3 to 5 years

|

|

Furniture, fixtures and other equipment

|

4 to 10 years

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

Thereafter

|

Total

|

Fair Value

|

||||||||||||||||||||||||

|

Long term debt:

|

|||||||||||||||||||||||||||||||

|

Fixed rate debt (In thousands)

|

$

|

—

|

|

$

|

250,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1,045,000

|

|

$

|

1,295,000

|

|

$

|

1,433,920

|

|

|||||||

|

Average interest rate

|

—

|

%

|

6.0

|

%

|

—

|

%

|

—

|

%

|

—

|

%

|

6.8

|

%

|

6.6

|

%

|

|||||||||||||||||

|

Variable rate debt (In thousands)

|

$

|

—

|

|

$

|

—

|

|

$

|

100,000

|

|

$

|

—

|

|

$

|

137,000

|

|

$

|

13,000

|

|

$

|

250,000

|

|

$

|

269,200

|

|

|||||||

|

Average interest rate

|

—

|

%

|

—

|

%

|

4.2

|

%

|

—

|

%

|

4.3

|

%

|

4.0

|

%

|

4.2

|

%

|

|||||||||||||||||

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

Page

|

|

|

For the Year Ended December 31,

|

|||||||||||

|

2012

|

2011

|

2010

|

|||||||||

|

(In thousands, except per share data)

|

|||||||||||

|

Net sales

|

$

|

2,759,546

|

|

$

|

2,776,359

|

|

$

|

2,939,483

|

|

||

|

Cost of sales

|

2,335,736

|

|

2,285,790

|

|

2,275,727

|

|

|||||

|

Gross profit

|

423,810

|

|

490,569

|

|

663,756

|

|

|||||

|

Operating expenses:

|

|||||||||||

|

Selling, general and administrative

|

217,000

|

|

246,513

|

|

242,424

|

|

|||||

|

Research and development

|

54,118

|

|

50,386

|

|

47,534

|

|

|||||

|

Total operating expenses

|

271,118

|

|

296,899

|

|

289,958

|

|

|||||

|

Operating income

|

152,692

|

|

193,670

|

|

373,798

|

|

|||||

|

Other expense (income):

|

|||||||||||

|

Interest expense

|

83,974

|

|

74,212

|

|

85,595

|

|

|||||

|

Interest expense, related party

|

13,969

|

|

12,394

|

|

15,250

|

|

|||||

|

Interest income

|

(3,160

|

)

|

(2,749

|

)

|

(2,950

|

)

|

|||||

|

Foreign currency loss

|

4,185

|

|

2,178

|

|

13,756

|

|

|||||

|

Loss on debt retirement, net

|

1,199

|

|

15,531

|

|

18,042

|

|

|||||

|

Equity in earnings of unconsolidated affiliate

|

(5,592

|

)

|

(7,085

|

)

|

(6,435

|

)

|

|||||

|

Other income, net

|

(1,586

|

)

|

(1,030

|

)

|

(619

|

)

|

|||||

|

Total other expense, net

|

92,989

|

|

93,451

|

|

122,639

|

|

|||||

|

Income before income taxes

|

59,703

|

|

100,219

|

|

251,159

|

|

|||||

|

Income tax expense

|

17,001

|

|

7,124

|

|

19,012

|

|

|||||

|

Net income

|

42,702

|

|

93,095

|

|

232,147

|

|

|||||

|

Net income attributable to noncontrolling interests

|

(884

|

)

|

(1,287

|

)

|

(176

|

)

|

|||||

|

Net income attributable to Amkor

|

$

|

41,818

|

|

$

|

91,808

|

|

$

|

231,971

|

|

||

|

Net income attributable to Amkor per common share:

|

|||||||||||

|

Basic

|

$

|

0.26

|

|

$

|

0.48

|

|

$

|

1.26

|

|

||

|

Diluted

|

$

|

0.24

|

|

$

|

0.39

|

|

$

|

0.91

|

|

||

|

Shares used in computing per common share amounts:

|

|||||||||||

|

Basic

|

160,105

|

|

190,829

|

|

183,312

|

|

|||||

|

Diluted

|

243,004

|

|

273,686

|

|

282,602

|

|

|||||

|

For the Year Ended December 31,

|

|||||||||||

|

2012

|

2011

|

2010

|

|||||||||

|

(In thousands)

|

|||||||||||

|

Net income

|

$

|

42,702

|

|

$

|

93,095

|

|

$

|

232,147

|

|

||

|

Other comprehensive income (loss), net of tax:

|

|||||||||||

|

Adjustments to unrealized components of defined benefit pension plans, net of tax of ($35), $362 and $208

|

5,137

|

|

(5,800

|

)

|

2,270

|

|

|||||

|

Cumulative translation adjustment, net of tax of $1,552, ($1,754) and $0

|

(4,745

|

)

|

1,192

|

|

8,166

|

|

|||||

|

Total other comprehensive income (loss)

|

392

|

|

(4,608

|

)

|

10,436

|

|

|||||

|

Comprehensive income

|

43,094

|

|

88,487

|

|

242,583

|

|

|||||

|

Comprehensive income attributable to noncontrolling interests

|

(884

|

)

|

(1,287

|

)

|

(176

|

)

|

|||||

|

Comprehensive income attributable to Amkor

|

$

|

42,210

|

|

$

|

87,200

|

|

$

|

242,407

|

|

||

|

December 31,

|

|||||||

|

2012

|

2011

|

||||||

|

(In thousands,

except per share data)

|

|||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

413,048

|

|

$

|

434,631

|

|

|

|

Restricted cash

|

2,680

|

|

2,680

|

|

|||

|

Accounts receivable:

|

|||||||

|

Trade, net of allowances

|

389,699

|

|

298,543

|

|

|||

|

Other

|

13,098

|

|

27,197

|

|

|||

|

Inventories

|

227,439

|

|

198,427

|

|

|||

|

Other current assets

|

45,444

|

|

35,352

|

|

|||

|

Total current assets

|

1,091,408

|

|

996,830

|

|

|||

|

Property, plant and equipment, net

|

1,819,969

|

|

1,656,214

|

|

|||

|

Intangibles, net

|

4,766

|

|

8,382

|

|

|||

|

Investments

|

38,690

|

|

36,707

|

|

|||

|

Restricted cash

|

2,308

|

|

4,001

|

|

|||

|

Other assets

|

68,074

|

|

70,913

|

|

|||

|

Total assets

|

$

|

3,025,215

|

|

$

|

2,773,047

|

|

|

|

LIABILITIES AND EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Short-term borrowings and current portion of long-term debt

|

$

|

—

|

|

$

|

59,395

|

|

|

|

Trade accounts payable

|

439,663

|

|

424,504

|

|

|||

|

Accrued expenses

|

212,964

|

|

158,287

|

|

|||

|

Total current liabilities

|

652,627

|

|

642,186

|

|

|||

|

Long-term debt

|

1,320,000

|

|

1,062,256

|

|

|||

|

Long-term debt, related party

|

225,000

|

|

225,000

|

|

|||

|

Pension and severance obligations

|

139,379

|

|

129,096

|

|

|||

|

Other non-current liabilities

|

21,415

|

|

13,288

|

|

|||

|

Total liabilities

|

2,358,421

|

|

2,071,826

|

|

|||

|

Commitments and contingencies (Note 16)

|

|

|

|

|

|||

|

Equity:

|

|||||||

|

Amkor stockholders’ equity:

|

|||||||

|

Preferred stock, $0.001 par value, 10,000 shares authorized, designated Series A, none issued

|

—

|

|

—

|

|

|||

|

Common stock, $0.001 par value, 500,000 shares authorized, 197,709 and 197,359 shares issued, and 152,397 and 168,628 shares outstanding, in 2012 and 2011, respectively

|

198

|

|

197

|

|

|||

|

Additional paid-in capital

|

1,614,143

|

|

1,611,242

|

|

|||

|

Accumulated deficit

|

(756,644

|

)

|

(798,462

|

)

|

|||

|

Accumulated other comprehensive income

|

11,241

|

|

10,849

|

|

|||

|

Treasury stock, at cost, 45,312 and 28,731 shares in 2012 and 2011, respectively

|

(210,983

|

)

|

(130,560

|

)

|

|||

|

Total Amkor stockholders’ equity

|

657,955

|

|

693,266

|

|

|||

|

Noncontrolling interests in subsidiaries

|

8,839

|

|

7,955

|

|

|||

|

Total equity

|

666,794

|

|

701,221

|

|

|||

|

Total liabilities and equity

|

$

|

3,025,215

|

|

$

|

2,773,047

|

|

|

|

Additional Paid-

In Capital

|

Accumulated

Deficit

|

Accumulated

Other

Comprehensive

Income

|

Total Amkor

Stockholders'