|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

04-3512838

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

111 Speen Street, Suite 410

Framingham, Massachusetts

|

|

01701

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Class A Common Stock,

par value $0.0001 per share

|

New York Stock Exchange

|

|

Large Accelerated Filer

o

|

Accelerated Filer

þ

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

(Do not check if a smaller reporting company)

|

|||

|

Class

|

Shares outstanding as of February 29, 2012

|

|

Class A Common Stock, $0.0001 par value per share

|

26,119,303

|

|

Class B Common Stock, $0.0001 par value per share

|

18,000,000

|

|

|

|

Page

|

|

|

||

|

|

||

|

|

||

|

•

|

Boilers and Furnaces.

We replace low efficiency boilers and furnaces with higher efficiency equipment. In addition, to reduce emissions, we can install emissions controls or either modify existing equipment or install new equipment to use cleaner fuels. We can also install biomass boilers for customers that have access to organic materials, such as wood, waste from agricultural or food processing activities or animal waste.

|

|

•

|

Chillers.

Small buildings are cooled by air conditioners and large buildings are cooled by chillers. We replace older low efficiency chillers with new higher efficiency chillers capable of delivering the same cooling with less energy input, often eliminating the use of atmospheric ozone depleting chlorofluorocarbon based refrigerants in the process. We retrofit existing chillers with new, more sophisticated, automated controls, high efficiency motors and variable speed drives to improve efficiency in cases where complete equipment replacement is not necessary. If the customer has an on-site source of recoverable waste heat, we may replace an electric chiller with an absorption chiller that can utilize the waste heat to directly produce cooling with reduced need to purchase energy for chiller operation.

|

|

•

|

Central Plants.

Customers that have multiple buildings in close proximity on a site may benefit from installation of a single central plant to provide power, heat or cooling to these buildings. The central plant typically contains multiple large boilers, chillers or combined heat and power, or CHP, systems to handle the combined requirements of all site buildings. Pipes are installed to distribute steam, hot water or chilled water from the central plant to the individual buildings. Any centrally generated power is delivered via interconnection with the existing site-wide electrical distribution system. A central plant allows the multiple smaller and less energy efficient individual building heating and cooling plants to be decommissioned. In addition to improved energy efficiency, centralization can create other scale benefits in operating labor, equipment maintenance and operating reliability. Where a customer already has a central plant, we can improve the efficiency of the plant by implementing improved equipment controls and by retrofit or replacement of existing equipment for enhanced energy efficiency.

|

|

•

|

Cogeneration or Combined Heat and Power.

CHP systems produce both heat and power simultaneously at a customer site, displacing power purchases from the utility grid and conventional sources of heat generation at the customer facility. When utilities produce power at large central station plants, the heat produced as a byproduct of the power generation process is typically wasted via disposal to the atmosphere or a nearby waterway. This wasted heat is generally a majority of the energy value of the input fuel to the power generation process. With on site power generation, the waste heat can be recovered from the power generation process and used as a substitute for heat that would otherwise be generated using site purchased fuels. Through use of heat driven chillers, also known as absorption chillers, this recovered heat can also be employed to provide building cooling. For facilities with large and relatively constant needs for power and heat or cooling, the cost of fuel for the cogeneration system operation can often be less than the cost of the purchased utility power and conventional heating fuel that is displaced. Installing a CHP that uses a lower cost fossil fuel or a renewable fuel source can create further economic benefits.

|

|

•

|

Energy Management Systems.

Automating building system adjustments for optimum performance under changing building operating conditions is one of the most cost-effective energy saving strategies. We install energy management system, or EMS, projects consisting of small computers, wiring or wireless communication systems, and sensors and controllers located at energy using equipment and at locations that need monitoring for such conditions as temperature and flow. Equipment that may be controlled through an energy management system includes lights, boilers, chillers, and fans and pumps that move energy throughout a building. We program the computers to automatically turn the equipment on and off or to adjust equipment operating setpoints for lower energy use in response to monitored conditions. For example, when the outdoor air is cool and the building requires cooling, instead of turning on the chillers to cool the building, the EMS may turn on building fans to draw the cool outside air into the building and significantly reduce the energy use under that condition. Both we and the customer can access the EMS information through a personal computer and reprogram the energy saving strategies through secure, hardwired or web-based communications systems.

|

|

•

|

Lighting.

We replace lighting system components with more efficient components in both indoor and outdoor lighting systems. We may alternatively redesign and install a new lighting system. Typical measures include replacing incandescent lighting with compact fluorescent lighting, metal halide lighting with fluorescent lighting and low efficiency fluorescent lighting with higher efficiency fluorescent lighting. Also, lighting controls may be installed to turn off lights when the lit space is unoccupied or if natural light through windows or skylights is adequate.

|

|

•

|

Retro-commissioning.

Over time, the performance of building systems can degrade due to a variety of factors, such as a failure of dampers, actuators and switches to operate in accordance with the building control system or modifications to equipment without taking into account their interaction with other building systems. Cumulatively, these factors can lead to significant increased energy consumption and reduce the quality of the indoor environment. Through a retro-commissioning process, we systematically repair and restore building equipment and systems so that they function together in an optimal manner to enhance overall building performance.

|

|

•

|

Motors.

The energy cost over the life of a motor is often many times the original cost of the motor. We replace older low efficiency motors with new higher efficiency motors. Often, motors are over sized for the application and additional savings can be attained by replacing an existing motor with an appropriately sized motor. We may also replace the sheave and belt drives associated with motors so that the motor output is transmitted to the driven device with reduced energy loss.

|

|

•

|

Variable Speed Drives or Variable Frequency Drives.

Motors driving building equipment such as fans, pumps, chillers and elevators are typically selected and operated at the size and speed necessary to deliver services under worst case or peak load conditions. This causes inefficiencies when operating at less than peak load conditions. We install electronic devices called variable speed drives, or VSDs, that automatically adjust the characteristics of the power supplied to a motor so that the motor is operated at only the speed necessary to meet the load conditions at any time.

|

|

•

|

Electric Load Shaping.

Many customers pay an energy charge per kWh of electricity used and a demand charge based on their highest or peak use of electricity in a 15 minute period during the month. By installing an EMS or an on-site generator and controlling the system using our monitoring and analysis of the customer’s electricity use, we can reduce the customer’s peak electricity use and thus its demand charge. We may also shift energy use from expensive on-peak (weekday) periods to less expensive off-peak periods (nights and weekends). For example, by adding chilled water storage tanks to a facility, cooling systems can be operated at night to generate stored chilled water and the chilled

|

|

•

|

Utility Rate Reductions.

A customer’s cost of gas and electricity is a function of how much energy is used and what rate the customer is charged for the energy. We analyze a customer’s energy use and the various utility rates that the customer is eligible to select. By switching a customer to the optimal rate, the customer can typically save energy costs. We may be able to switch a customer into a better rate by installing an EMS or an on-site generator.

|

|

•

|

Geothermal Heat Pumps.

Heat pumps are designed to efficiently provide both heat and cooling to a facility. The geothermal heat pump system works to store and recapture energy from the ground on a seasonally advantageous basis. Beneath the surface, the earth is warmer than the air in winter and cooler than the air in summer. Using the heat pump, heat removed from a building to cool it during the summer can be stored in the ground. This stored heat can then be withdrawn by the heat pump in the winter to provide necessary building heating. We install piping loops in the ground and heat pumps in buildings. Water piped underground captures the stored geothermal energy and heat pumps deliver the energy efficiently to the building interior.

|

|

•

|

Window Replacement.

Existing windows are often the most inefficient component of a building envelope. We may replace existing inefficient windows with new windows with features that more effectively control the sources of window heat transfer.

|

|

•

|

Roofs.

An existing roof with inadequate insulation levels or with water damage compromising the effectiveness of insulation is a source of unnecessary energy waste. We replace existing roofs with new roofs with higher insulation levels to reduce heat losses in winter and heat gains in summer. We may employ membrane roof technology for better protection of the insulation against degradation.

|

|

•

|

Insulation.

Insulating materials reduce unwanted transfer of heat that can increase energy usage. We apply additional insulation to building shell components, such as walls, ceilings, floors and foundations, to reduce heat loss in winter and heat gain in summer. We may add to or fully replace existing insulation on equipment such as piping, storage tanks and heat exchangers to reduce energy losses and the equipment inefficiency that results from these losses.

|

|

•

|

Asset Planning.

Asset planning tools enable organizations to identify and prioritize current and future facility renewal requirements and associated capital investment needs. We have developed software that helps organizations measure the condition of their facilities, the costs necessary to improve the facilities and make them more energy efficient and the funding alternatives for any such improvements. Our asset planning tools enable customers to develop facility renewal plans that will effectively leverage their available sources of capital and meet their future needs.

|

|

•

|

Demand Response and Demand Side Management.

Electric utilities and regional or independent system operators, or ISOs, are responsible for ensuring that power is available at all times throughout a region’s electrical transmission and distribution system. It is expensive to provide power during peak times such as a hot summer afternoon when customers are turning on their air conditioners and chillers. Utilities and ISOs seek to reduce the peak load demand and are willing to pay customers to reduce their power usage at these times, either during pre-arranged hours or in response to a call to reduce power. We help utilities and ISOs to attract customers to their programs and coordinate the customers’ participation in the programs.

|

|

•

|

Utility Data Management.

We have developed proprietary software and systems that allow us to efficiently collect, optically scan, enter into a data base and perform analysis on information from customer utility bills. Using these systems, we can deliver a variety of services, including centralized and automated collection, processing and preparation for payment of utility billing information; identification of errors in utility metering or billings; aggregation of multiple location billings from a single utility to facilitate payment; modeling of available utility tariff rates against a database of historical energy use to identify the most economical rate; and analysis of utility use data in multiple ways to identify and report usage and cost trends, variances and performance relative to benchmarks.

|

|

•

|

Carbon Emissions Tracking.

Our carbon management program provides greenhouse gas, or GHG, emissions accounting and reporting services to our customers. With an international, multi-tiered approach, we can support a wide variety of GHG accounting and reporting standards, including utility based GHG and full ISO 14064 compliance reporting. This service helps customers, for example, to develop corporate social responsibility reports and prepare for an audit of their GHG emissions.

|

|

Name

|

Age

|

Position (s)

|

|||

|

George P. Sakellaris

|

65

|

|

Chairman of the Board of Directors, President and Chief Executive Officer

|

||

|

David J. Anderson

|

51

|

|

Executive Vice President, Business Development and Director

|

||

|

Michael T. Bakas

|

43

|

|

Senior Vice President, Renewable Energy

|

||

|

David J. Corrsin

|

53

|

|

Executive Vice President, General Counsel and Secretary and Director

|

||

|

William J. Cunningham

|

52

|

|

Senior Vice President, Corporate Government Relations

|

||

|

Joseph P. DeManche

|

55

|

|

Executive Vice President, Engineering and Operations

|

||

|

Keith A. Derrington

|

51

|

|

Executive Vice President and General Manager, Federal Operations

|

||

|

Mario Iusi

|

53

|

|

President, Ameresco Canada

|

||

|

Louis P. Maltezos

|

45

|

|

Executive Vice President and General Manager, Central Region

|

||

|

Andrew B. Spence

|

55

|

|

Vice President, Chief Financial Officer and Treasurer

|

||

|

•

|

our ability to arrange financing for projects;

|

|

•

|

changes in federal state and local government policies and programs related to, or a reduction in governmental support for, energy efficiency and renewable energy;

|

|

•

|

the timing of work we do on projects where we recognize revenue on a percentage of completion basis;

|

|

•

|

seasonality in construction and in demand for our products and services;

|

|

•

|

a customer’s decision to delay our work on, or other risks involved with, a particular project;

|

|

•

|

availability and costs of labor and equipment;

|

|

•

|

the addition of new customers or the loss of existing customers;

|

|

•

|

the size and scale of new customer projects;

|

|

•

|

the availability of bonding for our projects;

|

|

•

|

our ability to control costs, including operating expenses;

|

|

•

|

changes in the mix of our products and services;

|

|

•

|

the rates at which customers renew their O&M contracts with us;

|

|

•

|

the length of our sales cycle;

|

|

•

|

the productivity and growth of our sales force;

|

|

•

|

the timing of opening of new offices or making other significant investments in the growth of our business, as the revenue we hope to generate from those expenses often lags several quarters behind those expenses;

|

|

•

|

changes in pricing by us or our competitors, or the need to provide discounts to win business;

|

|

•

|

costs related to the acquisition and integration of companies or assets;

|

|

•

|

general economic trends, including changes in energy efficiency spending or geopolitical events such as war or incidents of terrorism; and

|

|

•

|

future accounting pronouncements and changes in accounting policies.

|

|

•

|

failure to receive critical components and equipment that meet our design specifications and can be delivered on schedule;

|

|

•

|

failure to obtain all necessary rights to land access and use;

|

|

•

|

failure to receive quality and timely performance of third-party services;

|

|

•

|

increases in the cost of labor, equipment and commodities needed to construct or operate projects;

|

|

•

|

permitting and other regulatory issues, license revocation and changes in legal requirements;

|

|

•

|

shortages of equipment or skilled labor;

|

|

•

|

unforeseen engineering problems;

|

|

•

|

failure of a customer to accept or pay for renewable energy that we supply;

|

|

•

|

weather interferences, catastrophic events including fires, explosions, earthquakes, droughts and acts of terrorism; and accidents involving personal injury or the loss of life;

|

|

•

|

labor disputes and work stoppages;

|

|

•

|

mishandling of hazardous substances and waste; and

|

|

•

|

other events outside of our control.

|

|

•

|

terminate existing contracts, in whole or in part, for any reason or no reason;

|

|

•

|

reduce or modify contracts or subcontracts;

|

|

•

|

decline to award future contracts if actual or apparent organizational conflicts of interest are discovered, or to impose organizational conflict mitigation measures as a condition of eligibility for an award;

|

|

•

|

suspend or debar the contractor from doing business with the government or a specific government agency; and

|

|

•

|

pursue criminal or civil remedies under the False Claims Act, False Statements Act and similar remedy provisions unique to government contracting.

|

|

•

|

specialized accounting systems unique to government contracting, which may include mandatory compliance with federal Cost Accounting Standards;

|

|

•

|

mandatory financial audits and potential liability for adjustments in contract prices;

|

|

•

|

public disclosure of contracts, which may include pricing information;

|

|

•

|

mandatory socioeconomic compliance requirements, including small business promotion, labor, environmental and U.S. manufacturing requirements; and

|

|

•

|

requirements for maintaining current facility and/or personnel security clearances to access certain government facilities or to maintain certain records, and related industrial security compliance requirements.

|

|

•

|

the purchase price we pay could significantly deplete our cash reserves or result in dilution to our existing stockholders;

|

|

•

|

we may find that the acquired company or assets do not improve our customer offerings or market position as planned;

|

|

•

|

we may have difficulty integrating the operations and personnel of the acquired company;

|

|

•

|

key personnel and customers of the acquired company may terminate their relationships with the acquired company as a result of the acquisition;

|

|

•

|

we may experience additional financial and accounting challenges and complexities in areas such as tax planning and financial reporting;

|

|

•

|

we may assume or be held liable for risks and liabilities (including for environmental-related costs) as a result of our acquisitions, some of which we may not discover during our due diligence or adequately adjust for in our acquisition arrangements;

|

|

•

|

our ongoing business and management’s attention may be disrupted or diverted by transition or integration issues and the complexity of managing geographically or culturally diverse enterprises;

|

|

•

|

we may incur one-time write-offs or restructuring charges in connection with the acquisition;

|

|

•

|

we may acquire goodwill and other intangible assets that are subject to amortization or impairment tests, which could result in future charges to earnings; and

|

|

•

|

we may not be able to realize the cost savings or other financial benefits we anticipated.

|

|

•

|

building and managing highly experienced foreign workforces and overseeing and ensuring the performance of foreign subcontractors;

|

|

•

|

increased travel, infrastructure and legal and compliance costs associated with multiple international locations;

|

|

•

|

additional withholding taxes or other taxes on our foreign income, and tariffs or other restrictions on foreign trade or investment;

|

|

•

|

imposition of, or unexpected adverse changes in, foreign laws or regulatory requirements, many of which differ from those in the United States;

|

|

•

|

increased exposure to foreign currency exchange rate risk;

|

|

•

|

longer payment cycles for sales in some foreign countries and potential difficulties in enforcing contracts and collecting accounts receivable;

|

|

•

|

difficulties in repatriating overseas earnings;

|

|

•

|

general economic conditions in the countries in which we operate; and

|

|

•

|

political unrest, war, incidents of terrorism, or responses to such events.

|

|

•

|

incur additional debt, or debt related to federal projects in excess of specified limits;

|

|

•

|

pay cash dividends and make distributions;

|

|

•

|

make certain investments and acquisitions;

|

|

•

|

guarantee the indebtedness of others or our subsidiaries;

|

|

•

|

redeem or repurchase capital stock;

|

|

•

|

create liens;

|

|

•

|

enter into transactions with affiliates;

|

|

•

|

engage in new lines of business;

|

|

•

|

sell, lease or transfer certain parts of our business or property;

|

|

•

|

enter into sale-leaseback arrangements; and

|

|

•

|

merge or consolidate.

|

|

•

|

fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us;

|

|

•

|

changes in estimates of our future financial results or recommendations by securities analysts;

|

|

•

|

investors’ general perception of us; and

|

|

•

|

changes in general economic, industry and market conditions.

|

|

•

|

provide for a dual class capital structure that allows our founder, principal stockholder, president and chief executive officer, Mr. Sakellaris, to control the outcome of the voting on virtually all matters requiring stockholder approval, including the election of directors and significant corporate transactions such as an acquisition of our company;

|

|

•

|

authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to thwart a takeover attempt;

|

|

•

|

establish a classified board of directors, as a result of which only approximately one-third of our directors are presented to a stockholder vote for re-election at any annual meeting of stockholders;

|

|

•

|

provide that directors may be removed from office only for cause and only upon a supermajority stockholder vote;

|

|

•

|

provide that vacancies on our board of directors, including newly created directorships, may be filled only by a majority vote of directors then in office;

|

|

•

|

do not permit stockholders to call special meetings of stockholders;

|

|

•

|

prohibit stockholder action by written consent, requiring all actions to be taken at a meeting of the stockholders;

|

|

•

|

establish advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted upon by stockholders at stockholder meetings; and

|

|

•

|

require a supermajority stockholder vote to effect certain amendments to our restated certificate of incorporation and by-laws.

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

2010

|

2011

|

||||||||||||

|

High

|

Low

|

High

|

Low

|

||||||||||

|

First Quarter

|

$

|

—

|

|

$

|

—

|

|

$

|

17.46

|

|

$

|

12.65

|

|

|

|

Second Quarter

|

—

|

|

—

|

|

17.09

|

|

12.31

|

|

|||||

|

Third Quarter (beginning July 22, 2010)

|

14.17

|

|

9.34

|

|

15.12

|

|

9.52

|

|

|||||

|

Fourth Quarter

|

14.88

|

|

11.51

|

|

13.74

|

|

8.60

|

|

|||||

|

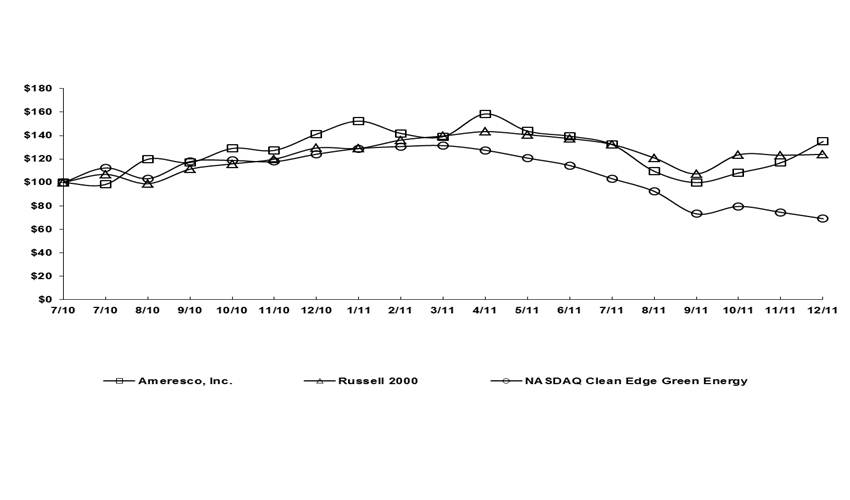

7/22/2010

|

12/31/2010

|

12/31/2011

|

|

|

Ameresco, Inc.

|

$100.00

|

$141.20

|

$134.91

|

|

Russell 2000 Index

|

$100.00

|

$129.38

|

$123.98

|

|

NASDAQ Clean Edge

Green Energy Index

|

$100.00

|

$123.01

|

$69.12

|

|

|

|

|||||||||||||||||||

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

|

2007

|

2008

|

2009

|

2010

|

2011

|

|||||||||||||||

|

|

(In thousands, except share and per share data)

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Revenue(1):

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Energy efficiency revenue

|

$

|

345,936

|

|

$

|

325,032

|

|

$

|

340,635

|

|

|

$

|

455,329

|

|

$

|

551,324

|

|

||||

|

Renewable energy revenue

|

32,541

|

|

70,822

|

|

87,882

|

|

|

162,897

|

|

176,876

|

|

|||||||||

|

|

378,477

|

|

395,854

|

|

428,517

|

|

618,226

|

|

728,200

|

|

||||||||||

|

Direct expenses:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Energy efficiency expenses

|

285,966

|

|

259,019

|

|

282,345

|

|

|

378,084

|

|

|

446,963

|

|

||||||||

|

Renewable energy expenses

|

26,072

|

|

59,551

|

|

66,472

|

|

|

129,440

|

|

|

146,191

|

|

||||||||

|

|

312,038

|

|

318,570

|

|

348,817

|

|

507,524

|

|

593,154

|

|

||||||||||

|

Gross profit

|

66,439

|

|

77,284

|

|

79,700

|

|

110,702

|

|

135,046

|

|

||||||||||

|

Operating expenses

|

47,042

|

|

52,608

|

|

54,406

|

|

64,710

|

|

84,360

|

|

||||||||||

|

Operating income

|

19,397

|

|

24,676

|

|

25,294

|

|

45,992

|

|

50,686

|

|

||||||||||

|

Other (expense) income, net

|

(3,138

|

)

|

(5,188

|

)

|

1,563

|

|

(5,080

|

)

|

(5,192

|

)

|

||||||||||

|

Income before provision for income taxes

|

16,259

|

|

19,488

|

|

26,857

|

|

40,912

|

|

45,494

|

|

||||||||||

|

Income tax provision

|

(5,714

|

)

|

(1,215

|

)

|

(6,950

|

)

|

(12,186

|

)

|

(10,767

|

)

|

||||||||||

|

Net income

|

$

|

10,545

|

|

$

|

18,273

|

|

$

|

19,907

|

|

$

|

28,726

|

|

$

|

34,727

|

|

|||||

|

Net income per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basic(2)

|

$

|

0.95

|

|

$

|

1.71

|

|

$

|

1.99

|

|

$

|

1.12

|

|

$

|

0.82

|

|

|||||

|

Diluted

|

$

|

0.28

|

|

$

|

0.54

|

|

$

|

0.61

|

|

$

|

0.69

|

|

$

|

0.78

|

|

|||||

|

Weighted-average number of common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basic(2)

|

11,121,022

|

|

10,678,110

|

|

9,991,912

|

|

25,728,314

|

|

42,587,818

|

|

||||||||||

|

Diluted

|

37,552,953

|

|

33,990,547

|

|

32,705,617

|

|

41,513,482

|

|

44,707,132

|

|

||||||||||

|

Other Operating Data:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Adjusted EBITDA(3)

|

$

|

27,974

|

|

$

|

29,045

|

|

$

|

35,097

|

|

$

|

59,910

|

|

$

|

67,560

|

|

|||||

|

|

As of December 31,

|

|||||||||||||||||||

|

|

2007

|

2008

|

2009

|

2010

|

2011

|

|||||||||||||||

|

|

(In thousands)

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Cash and cash equivalents

|

$

|

40,892

|

|

$

|

18,149

|

|

$

|

47,928

|

|

$

|

44,691

|

|

$

|

26,277

|

|

|||||

|

Current assets

|

154,036

|

|

131,432

|

|

171,772

|

|

211,710

|

|

283,062

|

|

||||||||||

|

Total assets

|

262,224

|

|

292,027

|

|

375,545

|

|

584,407

|

|

645,597

|

|

||||||||||

|

Current liabilities

|

108,011

|

|

90,967

|

|

132,330

|

|

142,587

|

|

148,268

|

|

||||||||||

|

Long-term debt, less current portion(4)

|

39,316

|

|

90,980

|

|

102,807

|

|

202,409

|

|

196,402

|

|

||||||||||

|

Subordinated debt

|

2,999

|

|

2,999

|

|

2,999

|

|

—

|

|

—

|

|

||||||||||

|

Total stockholders’ equity

|

70,776

|

|

74,086

|

|

102,770

|

|

195,052

|

|

236,421

|

|

||||||||||

|

(1)

|

"Revenue" for 2011 reflects approximately $8.9 million and $27.8 million attributable to our acquisitions in the third quarter of 2011 of AEG and Ameresco Southwest, respectively.

|

|

(2)

|

"Net income per share attributable to common shareholders - basic" and "weighted average number of common shares outstanding - basic" for 2010 reflect (i) our issuance of 405,286 shares of Common Stock upon the June 2010 exercise of a warrant at an exercise price of $0.005 per share, (ii) the reclassification of all outstanding shares of our Common Stock as Class A common stock, (iii) the conversion of all shares of our Series A Preferred Stock, other than those held by Mr. Sakellaris, into shares of our Class A common stock, (iv) the conversion of all other outstanding shares of our Series A Preferred Stock into shares of our Class B common stock, (v) the issuance of 932,500 shares of our Class A common stock upon the exercise of vested stock options by certain selling stockholders in connection with our initial public offering in July 2010 at a weighted-average exercise price of $1.94, and (vi) the issuance of an aggregate of 6,342,889 shares of our Class A common stock in connection with our initial public offering in July 2010.

|

|

(3)

|

We define adjusted EBITDA as operating income before depreciation, amortization and impairment expenses, share-based compensation expense and a non-recurring, non-cash recovery of a contingency in 2008. Adjusted EBITDA is a non-GAAP financial measure and should not be considered as an alternative to operating income or any other measure of financial performance calculated and presented in accordance with GAAP.

|

|

•

|

adjusted EBITDA and similar non-GAAP measures are widely used by investors to measure a company’s operating performance without regard to items that can vary substantially from company to company depending upon financing and accounting methods, book values of assets, capital structures and the methods by which assets were acquired;

|

|

•

|

securities analysts often use adjusted EBITDA and similar non-GAAP measures as supplemental measures to evaluate the overall operating performance of companies; and

|

|

•

|

by comparing our adjusted EBITDA in different historical periods, our investors can evaluate our operating results without the additional variations of depreciation and amortization expense, stock-based compensation expense and the non-recurring non-cash recovery of a contingency in 2008.

|

|

•

|

as a measure of operating performance, because it does not include the impact of items that we do not consider indicative of our core operating performance;

|

|

•

|

for planning purposes, including the preparation of our annual operating budget;

|

|

•

|

to allocate resources to enhance the financial performance of our business;

|

|

•

|

to evaluate the effectiveness of our business strategies; and

|

|

•

|

in communications with our board of directors and investors concerning our financial performance.

|

|

•

|

adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or other contractual commitments;

|

|

•

|

adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

|

|

•

|

adjusted EBITDA does not reflect stock-based compensation expense;

|

|

•

|

adjusted EBITDA does not reflect cash requirements for income taxes;

|

|

•

|

adjusted EBITDA does not reflect net interest income (expense);

|

|

•

|

although depreciation, amortization and impairment are non-cash charges, the assets being depreciated, amortized or impaired will often have to be replaced in the future, and adjusted EBITDA does not reflect any cash requirements for these replacements; and

|

|

•

|

other companies in our industry may calculate adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

|

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

|

2007

|

2008

|

2009

|

2010

|

2011

|

|||||||||||||||

|

|

(In thousands)

|

|||||||||||||||||||

|

Operating income

|

$

|

19,397

|

|

$

|

24,676

|

|

$

|

25,294

|

|

$

|

45,992

|

|

$

|

50,686

|

|

|||||

|

Depreciation, amortization and impairment

|

5,898

|

|

7,278

|

|

6,634

|

|

11,419

|

|

14,008

|

|

||||||||||

|

Stock-based compensation

|

2,679

|

|

2,941

|

|

3,169

|

|

2,499

|

|

2,866

|

|

||||||||||

|

Recovery of contingency

|

—

|

|

(5,850

|

)

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Adjusted EBITDA

|

$

|

27,974

|

|

$

|

29,045

|

|

$

|

35,097

|

|

$

|

59,910

|

|

$

|

67,560

|

|

|||||

|

(4)

|

Long-term debt, less current portion as of December 31, 2011 reflects a $49.6 million reduction in Federal ESPC receivable financing attributable primarily to acceptance of the Savannah River Site project in December 2011 and includes approximately $37.1 million outstanding with respect to the term loan portion of our senior secured credit facility.

|

|

•

|

installation or construction of energy efficiency measures, facility upgrades and/or a renewable energy plant to be owned by the customer;

|

|

•

|

sale and delivery, under long-term agreements, of electricity, gas, heat, chilled water or other output of a renewable energy or central plant that we own and operate;

|

|

•

|

sale and delivery of photovoltaic, or PV, equipment and other renewable energy products for which we are a distributor, whether under our own brand name or for others; and

|

|

•

|

O&M services provided under long-term O&M agreements, as well as consulting services.

|

|

|

Years Ended December 31,

|

|||||

|

|

2009

|

2010

|

2011

|

|||

|

Future dividends

|

$ -

|

$ -

|

$ -

|

|||

|

Risk-free interest rate

|

2.00-2.94%

|

2.59-3.11%

|

1.35-2.58%

|

|||

|

Expected volatility

|

57%-59%

|

57%-59%

|

32%-33%

|

|||

|

Expected life

|

6.5 years

|

6.5 years

|

6.0-6.5 years

|

|||

|

•

|

our results of operations and financial condition during the most recently completed period;

|

|

•

|

forecasts of our financial results and market conditions affecting our business; and

|

|

•

|

developments in our business.

|

|

|

Number of Shares of

|

|

|||||

|

|

Common Stock

|

|

|||||

|

|

Subject to Option

|

Exercise Price

|

|||||

|

Grant Date or Period

|

Grants

|

per Share

|

|||||

|

January 24, 2007

|

500,000

|

|

$

|

3.410

|

|

||

|

July 25, 2007 to January 30, 2008

|

982,000

|

|

4.220

|

|

|||

|

April 30, 2008 to January 28, 2009

|

248,000

|

|

6.055

|

|

|||

|

July 22, 2009 to September 30, 2009

|

842,000

|

|

6.055

|

|

|||

|

April 26, 2010 to May 28, 2010

|

856,000

|

|

13.045

|

|

|||

|

•

|

the liquidation preferences of our preferred stock, including any financing and repurchase activities that may have occurred in the relevant period;

|

|

•

|

the illiquid nature of our common stock, including the opportunity and timing for any expected liquidity events;

|

|

•

|

our size and historical operating and financial performance, including our recent operating and financial projections as of each grant date;

|

|

•

|

our existing backlog;

|

|

•

|

important events in the development of our business; and

|

|

•

|

the market performance of a peer group comprised of selected publicly-traded companies we identified as being guidelines for us.

|

|

•

|

continued challenges during 2008 in the U.S. economy and decreased valuations of comparable companies; and

|

|

•

|

concerns about liquidity during the upcoming fiscal quarters.

|

|

•

|

we were notified in March 2009 that the U.S. Department of Energy had lifted restrictions on its ability to enter into ESPCs, which permitted us to proceed with the execution of larger federal contracts;

|

|

•

|

in May 2009, we executed a contract for our large U.S. Department of Energy Savannah River Site renewable energy project; however, we had not yet secured the financing necessary to complete this project; and

|

|

•

|

improvement in general economic and market conditions in the first half of 2009.

|

|

•

|

our backlog under signed customer contracts increased from July 2009 to September 2009;

|

|

•

|

in August 2009, we secured the financing necessary to complete our large U.S. Department of Energy Savannah River Site renewable energy project, the contract for which had been executed in May 2009 but was subject to our securing that financing. Securing this financing represented a significant milestone for us, particularly in light of its size and the significant disruptions in the credit and capital markets in the preceding several years; and

|

|

•

|

improvement in general economic and market conditions in the third quarter of 2009.

|

|

•

|

a 30% increase in our next 12 months projected adjusted EBITDA between September 25, 2009 and the two relevant dates in 2010, due to growth in our backlog and several, previously-contracted, large efficiency and renewable energy projects entering major construction phases;

|

|

•

|

our expectation that we would conduct an initial public offering within the next three months; and

|

|

•

|

our preliminary estimates of our valuation for purposes of this offering.

|

|

Years Ended December 31,

|

||||||||

|

2009

|

2010

|

2011

|

||||||

|

Revenue:

|

||||||||

|

Energy efficiency revenue

|

79.5

|

%

|

73.7

|

%

|

75.7

|

%

|

||

|

Renewable energy revenue

|

20.5

|

%

|

26.3

|

%

|

24.3

|

%

|

||

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||

|

Direct expenses:

|

||||||||

|

Energy efficiency expenses

|

65.9

|

%

|

61.2

|

%

|

61.4

|

%

|

||

|

Renewable energy expenses

|

15.5

|

%

|

20.9

|

%

|

20.1

|

%

|

||

|

81.4

|

%

|

82.1

|

%

|

81.5

|

%

|

|||

|

Gross profit

|

18.6

|

%

|

17.9

|

%

|

18.5

|

%

|

||

|

Total operating expenses

|

12.7

|

%

|

10.5

|

%

|

11.6

|

%

|

||

|

Operating income

|

5.9

|

%

|

7.4

|

%

|

6.9

|

%

|

||

|

Other income (expenses), net

|

0.4

|

%

|

(0.8

|

)%

|

(0.7

|

)%

|

||

|

Income before provision for income taxes

|

6.3

|

%

|

6.6

|

%

|

6.2

|

%

|

||

|

Income tax provision

|

(1.6

|

)%

|

(2.0

|

)%

|

(1.5

|

)%

|

||

|

Net income

|

4.7

|

%

|

4.6

|

%

|

4.7

|

%

|

||

|

Years Ended December 31,

|

|||||||||||||||||

|

2009

|

2010

|

% change

|

2011

|

% change

|

|||||||||||||

|

(in $'000s)

|

(a)

|

(b)

|

((b-a)/a)

|

(c)

|

((c-b)/b)

|

||||||||||||

|

Revenue:

|

|||||||||||||||||

|

Energy efficiency revenue

|

$

|

340,635

|

|

$

|

455,329

|

|

33.7

|

%

|

$

|

551,324

|

|

21.1

|

%

|

||||

|

Renewable energy revenue

|

87,882

|

|

162,897

|

|

85.4

|

%

|

176,876

|

|

8.6

|

%

|

|||||||

|

$

|

428,517

|

|

$

|

618,226

|

|

44.3

|

%

|

$

|

728,200

|

|

17.8

|

%

|

|||||

|

Years Ended December 31,

|

|||||||||||||||||

|

2009

|

2010

|

% change

|

2011

|

% change

|

|||||||||||||

|

(in $'000s)

|

(a)

|

(b)

|

((b-a)/a)

|

(c)

|

((c-b)/b)

|

||||||||||||

|

U.S. Federal

|

$

|

87,580

|

|

$

|

177,522

|

|

102.7

|

%

|

$

|

145,199

|

|

(18.2

|

)%

|

||||

|

Central U.S. Region

|

88,068

|

|

100,327

|

|

13.9

|

%

|

86,376

|

|

(13.9

|

)%

|

|||||||

|

Other U.S. Regions

|

77,828

|

|

142,457

|

|

83.0

|

%

|

268,211

|

|

88.3

|

%

|

|||||||

|

Canada

|

83,633

|

|

101,408

|

|

21.3

|

%

|

106,531

|

|

5.1

|

%

|

|||||||

|

All Other

|

91,408

|

|

96,512

|

|

5.6

|

%

|

121,883

|

|

26.3

|

%

|

|||||||

|

Total

|

$

|

428,517

|

|

$

|

618,226

|

|

44.3

|

%

|

$

|

728,200

|

|

17.8

|

%

|

||||

|

•

|

Total revenue for the U.S. federal segment decreased from

2010

to

2011

by

$32.3 million

, or

18.2%

, to

$145.2 million

primarily due to decreases in revenues from installation activity on ongoing projects, as a number of projects began nearing completion, combined with a decline in the velocity of converting awarded projects to signed contracts beginning in late 2010 through the first half of 2011. Total revenue for the U.S. federal segment increased from 2009 to 2010 by $89.9 million, or 102.7%, to $177.5 million, primarily due to an increase in the number of projects being installed primarily for the U.S. federal government. During 2010, revenue recognized on the continued installation of a large renewable energy project for the U.S. Department of Energy, Savannah River Site, accounted for a significant portion of our revenue for this segment.

|

|

•

|

Total revenue for the central U.S. region segment decreased from

2010

to

2011

by

$14.0 million

, or

13.9%

, to

$86.4 million

primarily due to a lengthening of the sales cycle, which has resulted in fewer signed contracts to replace installation activity as projects are completed. Total revenue for the central U.S. region segment increased from 2009 to 2010 by $12.3 million, or 13.9%, to $100.3 million, primarily due to an increase in the number of energy efficiency projects in construction.

|

|

•

|

Total revenue for the other U.S. regions segment increased from

2010

to

2011

by

$125.8 million

, or

88.3%

, to

$268.2 million

primarily due to an increase in the size and number of projects under construction in the northeast, southeast and northwest; total revenue for this segment in 2011 includes $27.8 million attributable to our acquisition of Ameresco Southwest in the third quarter of 2011. Total revenue for the other U.S. regions segment increased from 2009 to 2010 by $64.6 million, or 83.0%, to $142.5 million, primarily due to an increase in the size, and to some degree due to the number, of projects under construction.

|

|

•

|

Total revenue for the Canada segment increased from

2010

to

2011

by

$5.1 million

, or

5.1%

, to

$106.5 million

primarily due to a larger volume of construction activity related to the installation of energy efficiency measures. Total revenue for the Canada segment increased from 2009 to 2010 by $17.8 million, or 21.3%, to $101.4 million, primarily due to a larger volume of construction activity related to the installation of energy efficiency measures, particularly two large projects for housing authorities, and, to a lesser extent, revenues generated from an acquisition in 2009.

|

|

•

|

Total revenue not allocated to segments and presented as all other, increased from

2010

to

2011

by

$25.4 million

,

or

26.3%

, to

$121.9 million

due primarily to our recent acquisition of AEG, as well as to increases in revenue from small scale infrastructure, developing renewable energy plants for our customers and integrated-PV. Total revenue not allocated to segments and presented as all other, increased from 2009 to 2010 by $5.1 million, or 5.6%, to $96.5

|

|

Years ended December 31,

|

|||||||||||

|

(in $'000s)

|

2009

|

2010

|

2011

|

||||||||

|

Revenue:

|

|||||||||||

|

Energy efficiency revenue

|

$

|

340,635

|

|

$

|

455,329

|

|

$

|

551,324

|

|

||

|

Renewable energy revenue

|

87,882

|

|

162,897

|

|

176,876

|

|

|||||

|

428,517

|

|

618,226

|

|

728,200

|

|

||||||

|

Direct expenses:

|

|||||||||||

|

Energy efficiency expenses

|

282,345

|

|

378,084

|

|

446,963

|

|

|||||

|

Renewable energy expenses

|

66,472

|

|

129,440

|

|

146,191

|

|

|||||

|

348,817

|

|

507,524

|

|

593,154

|

|

||||||

|

Gross profit:

|

$

|

79,700

|

|

$

|

110,702

|

|

$

|

135,046

|

|

||

|

Energy efficiency gross margin

|

17.1

|

%

|

17.0

|

%

|

18.9

|

%

|

|||||

|

Renewable energy gross margin

|

24.4

|

%

|

20.5

|

%

|

17.3

|

%

|

|||||

|

Gross profit %

|

18.6

|

%

|

17.9

|

%

|

18.5

|

%

|

|||||

|

Years Ended December 31,

|

||||||||||||||||||||

|

2009

|

% of

|

2010

|

% of

|

2011

|

% of

|

|||||||||||||||

|

(in $'000s)

|

Revenue

|

Revenue

|

Revenue

|

|||||||||||||||||

|

Revenue

|

$

|

428,517

|

|

$

|

618.226

|

|

$

|

728,200

|

|

|||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Salaries and benefits

|

$

|

28,274

|

|

6.6

|

%

|

$

|

30,721

|

|

5.0

|

%

|

40,746

|

|

5.6

|

%

|

||||||

|

Project development costs

|

9,600

|

|

2.2

|

%

|

13,677

|

|

2.2

|

%

|

18,282

|

|

2.5

|

%

|

||||||||

|

General, administrative and other

|

16,532

|

|

3.9

|

%

|

20,312

|

|

3.3

|

%

|

25,332

|

|

3.5

|

%

|

||||||||

|

$

|

54,406

|

|

12.7

|

%

|

$

|

64,710

|

|

10.5

|

%

|

$

|

84,360

|

|

11.6

|

%

|

||||||

|

Years Ended December 31,

|

|||||||||||

|

(in $'000s)

|

2009

|

2010

|

|

2011

|

|||||||

|

Gain realized from derivative

|

$

|

2,494

|

|

$

|

—

|

|

$

|

—

|

|

||

|

Unrealized gain (loss) from derivatives

|

2,264

|

|

(134

|

)

|

—

|

|

|||||

|

Interest expense, net of interest income

|

(2,993

|

)

|

(4,380

|

)

|

(4,130

|

)

|

|||||

|

Amortization of deferred financing costs

|

(202

|

)

|

(567

|

)

|

(1,062

|

)

|

|||||

|

|

$

|

1,563

|

|

$

|

(5,081

|

)

|

$

|

(5,192

|

)

|

||

|

|

|||||||||||||||||

|

2009

|

2010

|

% change

|

2011

|

% change

|

|||||||||||||

|

(in $'000s)

|

(a)

|

(b)

|

((b-a)/a

|

(c)

|

((b-a)/a)

|

||||||||||||

|

U.S. Federal

|

$

|

11,276

|

|

$

|

21,444

|

|

90.2

|

%

|

$

|

19,252

|

|

(10.2

|

)%

|

||||

|

Central U.S. Region

|

10,121

|

|

10,379

|

|

2.5

|

%

|

5,643

|

|

(45.6

|

)%

|

|||||||

|

Other U.S. Regions

|

5,077

|

|

25,583

|

|

403.9

|

%

|

47,074

|

|

84.0

|

%

|

|||||||

|

Canada

|

4,155

|

|

4,352

|

|

4.7

|

%

|

1,976

|

|

(54.6

|

)%

|

|||||||

|

All Other

|

(3,772

|

)

|

(20,846

|

)

|

(452.7

|

)%

|

(28,451

|

)

|

(36.5

|

)%

|

|||||||

|

Total

|

$

|

26,857

|

|

$

|

40,912

|

|

52.3

|

%

|

$

|

45,494

|

|

11.2

|

%

|

||||

|

•

|

Income before taxes for the U.S. federal segment decreased from

2010

to

2011

by

$2.2 million

, or

10.2%

, to

$19.3 million

. The decrease was primarily due to the decline in revenue described above. Income before taxes for the U.S. federal segment increased from 2009 to 2010 by $10.2 million, or 90.2%, to $21.4 million. The increase was primarily due to increased revenue and higher margins recognized on project installations.

|

|

•

|

Income before taxes for the central U.S. region segment decreased from

2010

to

2011

by

$4.7 million

, or

45.6%

, to

$5.6 million

due primarily to decreased revenue as described above and a greater portion of lower margin projects within the segments revenue mix. Income before taxes for the central U.S. region segment increased from 2009 to 2010 by $0.3 million, or 2.5%, to $10.4 million. The increase was primarily due to higher revenue.

|

|

•

|

Income before taxes for the other U.S. regions segment increased from

2010

to

2011

by

84.0%

, or

$21.5 million

, to

$47.1 million

due primarily to increased revenue as described above, but also reflecting improved operating leverage. Income before taxes for the other U.S. regions segment increased from 2009 to 2010 by $20.5 million, or 403.9%, to $25.6 million, primarily due to increased revenue and higher margins.

|

|

•

|

Income before taxes for the Canada segment decreased from

2010

to

2011

by

$2.4 million

, or

54.6%

, to

$2.0 million

due to a greater portion of lower gross margin projects in its revenue mix and to higher operating expenses. Income before taxes for the Canada segment increased from 2009 to 2010 by $0.2 million, or 4.7%, to $4.4 million. The increase was primarily due to higher revenue.

|

|

•

|

The loss before taxes not allocated to segments and presented as all other, increased from

2010

to

2011

by

$7.6 million

, or

36.5%

, to

$28.5 million

primarily due to increases in corporate overhead partially offset by higher revenue. The changes in the expense allocation to all other increased from 2009 to 2010 by $17.1 million, or 452.7%, to $20.8 million were consistent with the overall change in consolidated expenses discussed above.

|

|

Fiscal Years Ended December 31,

|

|||||||||||

|

(in $'000s)

|

2009

|

2010

|

2011

|

||||||||

|

Cash and cash equivalents

|

$

|

47,928

|

|

$

|

44,691

|

|

$

|

26,277

|

|

||

|

Book overdraft

|

—

|

|

—

|

|

(7,297

|

)

|

|||||

|

Net cash available

|

$

|

47,928

|

|

$

|

44,691

|

|

$

|

18,980

|

|

||

|

Fiscal Years Ended December 31,

|

|||||||||||

|

(in $'000s)

|

2009

|

2010

|

2011

|

||||||||

|

Net cash provided by operating activities

|

$

|

45,296

|

|

$

|

20,850

|

|

$

|

30,146

|

|

||

|

Net cash used in investing activities

|

(22,314

|

)

|

(45,930

|

)

|

(105,601

|

)

|

|||||

|

Net cash provided by financing activities

|

4,129

|

|

20,505

|

|

58,076

|

|

|||||

|

Effect of exchange rate changes on cash

|

2,667

|

|

1,338

|

|

(1,035

|

)

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

$

|

29,778

|

|

$

|

(3,237

|

)

|

$

|

(18,414

|

)

|

||

|

|

Payments due by Period

|

|||||||||||||||||||

|

|

|

Less than

|

One to

|

Three to

|

More than

|

|||||||||||||||

|

(in $'000s)

|

Total

|

One Year

|

Three Years

|

Five Years

|

Five Years

|

|||||||||||||||

|

Senior Secured Credit Facility:

|

||||||||||||||||||||

|

Revolver(1)

|

$

|

5,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

5,000

|

|

$

|

—

|

|

|||||

|

Term Loan

|

37,143

|

|

5,714

|

|

17,143

|

|

14,286

|

|

—

|

|

||||||||||

|

Project Financing:

|

||||||||||||||||||||

|

Construction and term loans

|

56,175

|

|

5,850

|

|

9,843

|

|

8,698

|

|

31,784

|

|

||||||||||

|

Federal ESPC receivable financing(2)

|

109,648

|

|

—

|

|

109,648

|

|

—

|

|

—

|

|

||||||||||

|

Interest obligations(3)

|

28,673

|

|

4,955

|

|

8,383

|

|

6,186

|

|

9,149

|

|

||||||||||

|

Operating leases

|

9,220

|

|

3,235

|

|

3,597

|

|

2,124

|

|

264

|

|

||||||||||

|

Total

|

$

|

245,859

|

|

$

|

19,754

|

|

$

|

148,614

|

|

$

|

36,294

|

|

$

|

41,197

|

|

|||||

|

(1

|

)

|

For our revolving senior secured credit facility, the table above assumes that the variable interest rate in effect as of December 31, 2011 remains constant for the term of the facility.

|

|

|

(2

|

)

|

Federal ESPC receivable financing arrangements relate to the installation and construction of projects for certain customers, typically federal governmental entities, where we assign to the lenders our right to customer receivables. We are relieved of the financing liability when the project is completed and accepted by the customer. We typically expect to be relieved of the financing liability between one and three years from the date of project construction commencement. The table does not include, for our federal ESPC receivable financing arrangements, the difference between the aggregate amount of the long-term customer receivables sold by us to the lender and the amount received by us from the lender for such sale.

|

|

|

|

|||

|

(3

|

)

|

For the term loan portion of our senior secured credit facility, the table above assumes that the variable interest rate in effect at December 31, 2011 remains constant for the term of the facility.

|

|

|

December 31,

|

|||||||

|

2010

|

2011

|

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

44,691,021

|

|

$

|

26,277,366

|

|

|

|

Restricted cash

|

9,197,447

|

|

12,372,356

|

|

|||

|

Accounts receivable, net

|

68,584,304

|

|

109,296,773

|

|

|||

|

Accounts receivable retainage

|

18,452,777

|

|

26,089,216

|

|

|||

|

Costs and estimated earnings in excess of billings

|

35,556,425

|

|

69,251,022

|

|

|||

|

Inventory, net

|

6,780,092

|

|

8,635,633

|

|

|||

|

Prepaid expenses and other current assets

|

8,471,628

|

|

8,992,963

|

|

|||

|

Income tax receivable

|

2,511,542

|

|

9,662,771

|

|

|||

|

Deferred income taxes

|

9,908,240

|

|

6,456,671

|

|

|||

|

Project development costs

|

7,556,345

|

|

6,027,689

|

|

|||

|

Total current assets

|

211,709,821

|

|

283,062,460

|

|

|||

|

Federal ESPC receivable

|

193,551,495

|

|

110,212,186

|

|

|||

|

Property and equipment, net

|

5,406,387

|

|

7,086,164

|

|

|||

|

Project assets, net

|

145,147,475

|

|

177,854,734

|

|

|||

|

Deferred financing fees, net

|

3,412,186

|

|

2,994,692

|

|

|||

|

Goodwill

|

20,580,995

|

|

47,881,346

|

|

|||

|

Intangible assets, net

|

—

|

|

12,727,528

|

|

|||

|

Other assets

|

4,598,980

|

|

3,778,357

|

|

|||

|

|

372,697,518

|

|

362,535,007

|

|

|||

|

|

$

|

584,407,339

|

|

$

|

645,597,467

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Current portion of long-term debt

|

$

|

4,722,118

|

|

$

|

11,563,983

|

|

|

|

Accounts payable

|

95,302,897

|

|

93,506,089

|

|

|||

|

Accrued expenses and other current liabilities

|

12,517,671

|

|

8,917,723

|

|

|||

|

Book overdraft

|

—

|

|

7,297,122

|

|

|||

|

Billings in excess of cost and estimated earnings

|

27,555,894

|

|

26,982,858

|

|

|||

|

Income taxes payable

|

2,488,672

|

|

—

|

|

|||

|

Total current liabilities

|

142,587,252

|

|

148,267,775

|

|

|||

|

Long-term debt, less current portion

|

202,409,484

|

|

196,401,588

|

|

|||

|

Deferred income taxes

|

12,013,799

|

|

29,953,103

|

|

|||

|

Deferred grant income

|

4,200,929

|

|

6,024,099

|

|

|||

|

Other liabilities

|

28,144,144

|

|

28,529,867

|

|

|||

|

|

$

|

246,768,356

|

|

$

|

260,908,657

|

|

|

|

Commitments and contingencies (Note 14)

|

|

|

|||||

|

The accompanying notes are an integral part of these consolidated financial statements.

|

|||||||

|

AMERESCO, INC.

|

||||||||

|

CONSOLIDATED BALANCE SHEETS — (Continued)

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2011

|

|||||||

|

Stockholders’ equity:

|

||||||||

|

Preferred stock, $0.0001 par value, 5,000,000 shares authorized, no shares issued and outstanding at December 31, 2010 and 2011

|

$

|

—

|

|

$

|

—

|

|

||

|