|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Jersey

|

|

98-1029562

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

Title of class

|

|

Name of Each Exchange on which Registered

|

|

Ordinary Shares. $0.01 par value per share

|

|

New York Stock Exchange

|

|

Large accelerated filer

x

.

|

Accelerated filer

¨

.

|

Non-accelerated filer

¨

.

|

Smaller reporting company

¨

.

|

|

(Do not check if a smaller reporting company)

|

|||

|

|

|

Page

|

|

Part I

|

||

|

Item 1.

|

||

|

Supplementary Item.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Part II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Part III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Part IV

|

||

|

Item 15.

|

||

|

•

|

Electrical/Electronic Architecture

—This segment provides complete design of the vehicle’s electrical architecture, including connectors, wiring assemblies and harnesses, electrical centers and hybrid high voltage and safety distribution systems. Our products provide the critical electrical and electronics backbone that supports increased vehicle content and electrification, reduced emissions and higher fuel economy through weight savings.

|

|

•

|

Powertrain Systems

—This segment provides systems integration of full end-to-end gasoline and diesel engine management systems including fuel handling, fuel injection, combustion, electronic controls, test and validation capabilities, electric and hybrid electric vehicle power electronics, aftermarket, and original equipment services. We design solutions to optimize powertrain power and performance while helping our customers meet new emissions and fuel economy regulations.

|

|

•

|

Electronics and Safety

—This segment provides critical components, systems and advanced software for passenger safety, security, comfort and infotainment, as well as vehicle operation, including body controls, infotainment and connectivity systems, passive and active safety electronics, autonomous driving technologies and displays, as well as advanced development of software. Our products integrate and optimize electronic content, which improves fuel economy, reduces emissions, increases safety and provides occupant infotainment and connectivity.

|

|

|

Year Ended December 31, 2016

|

Year Ended December 31, 2015

|

Year Ended December 31, 2014

|

|||||||||||||||||

|

|

Net Sales

|

% of Total

|

Net Sales

|

% of Total

|

Net Sales

|

% of Total

|

||||||||||||||

|

|

(in millions, excluding percentages)

|

|||||||||||||||||||

|

Electrical/Electronic Architecture

|

$

|

9,316

|

|

56

|

%

|

$

|

8,180

|

|

54

|

%

|

$

|

8,274

|

|

53

|

%

|

|||||

|

Powertrain Systems

|

4,486

|

|

27

|

%

|

4,407

|

|

29

|

%

|

4,540

|

|

29

|

%

|

||||||||

|

Electronics and Safety

|

3,014

|

|

18

|

%

|

2,744

|

|

18

|

%

|

2,880

|

|

19

|

%

|

||||||||

|

Eliminations and Other

|

(155

|

)

|

(1

|

)%

|

(166

|

)

|

(1

|

)%

|

(195

|

)

|

(1

|

)%

|

||||||||

|

Total

|

$

|

16,661

|

|

$

|

15,165

|

|

$

|

15,499

|

|

|||||||||||

|

•

|

High quality connectors are engineered primarily for use in the automotive and related markets, but also have applications in the aerospace, military and telematics sectors.

|

|

•

|

Electrical centers provide centralized electrical power and signal distribution and all of the associated circuit protection and switching devices, thereby optimizing the overall vehicle electrical system.

|

|

•

|

Distribution systems, including hybrid high voltage and safety systems, are integrated into one optimized vehicle electrical system that can utilize smaller cable and gauge sizes and ultra-thin wall insulation (which product line makes up approximately 37%, 40% and 37% of our total revenue for the years ended December 31, 2016, 2015 and 2014, respectively).

|

|

•

|

The gasoline EMS portfolio features fuel injection and air/fuel control, valvetrain, ignition, sensors and actuators, transmission control products, and powertrain electronic control modules with software, algorithms and calibration.

|

|

•

|

The diesel EMS product line offers high quality common rail fuel injection system technologies including diesel injection equipment, system integration, calibration, electronics, and emission control solutions.

|

|

•

|

Electric and hybrid electric vehicle power electronics comprises power modules, inverters and converters and battery packs.

|

|

•

|

The Powertrain Systems segment also supplies integrated fuel handling systems for gasoline, diesel, flexfuel and biofuel configurations, and innovative evaporative emissions systems that are recognized as industry-leading technologies.

|

|

•

|

Electronic controls products primarily consist of body computers and security systems.

|

|

•

|

The infotainment and driver interface portfolio primarily consists of receivers, digital receivers, satellite audio receivers, navigation systems and displays (including re-configurable displays).

|

|

•

|

Passive and active safety electronics and advanced driver assistance systems primarily includes occupant detection systems, collision warning systems, advanced cruise control technologies, collision sensing and auto braking.

|

|

Segment

|

Competitors

|

|

Electrical/Electronic Architecture

|

• A Raymond Et Cie

|

|

• Lear Corporation

|

|

|

• Leoni AG

|

|

|

• Molex Inc. (a subsidiary of Koch Industries, Inc.)

|

|

|

• Panduit Corporation

|

|

|

• Sumitomo Corporation

|

|

|

• TE Connectivity, Ltd.

|

|

|

• Yazaki Corporation

|

|

|

Powertrain Systems

|

• Bosch Group

|

|

• Continental AG

|

|

|

• Denso Corporation

|

|

|

• Hitachi, Ltd.

|

|

|

• Magneti Marelli S.p.A.

|

|

|

Electronics and Safety

|

• Alpine Electronics

|

|

• Autoliv AB

|

|

|

• Bosch Group

|

|

|

• Continental AG

|

|

|

• Denso Corporation

|

|

|

• Harman International Industries

|

|

|

• Panasonic Corporation

|

|

|

• Visteon Corporation

|

|

|

• ZF Friedrichshafen AG

|

|

|

Customer

|

Percentage of Net Sales

|

|

GM

|

14%

|

|

Volkswagen Group (“VW”)

|

8%

|

|

Ford Motor Company (“Ford”)

|

6%

|

|

Fiat Chrysler Automobiles N.V. ("FCA")

|

5%

|

|

Shanghai General Motors Company Limited

|

5%

|

|

Daimler AG (“Daimler”)

|

5%

|

|

PSA Peugeot Citroën (“PSA”)

|

5%

|

|

Hyundai Motor Company

|

3%

|

|

Geely Automobile Holdings Limited

|

3%

|

|

Toyota Motor Corporation

|

2%

|

|

|

Year Ended December 31, 2016

|

Year Ended December 31, 2015

|

Year Ended December 31, 2014

|

||||||||||||||||||||

|

|

(in millions)

|

||||||||||||||||||||||

|

|

Net Sales

|

Net

Property (1)

|

Net Sales

|

Net

Property (1)

|

Net Sales

|

Net

Property (1)

|

|||||||||||||||||

|

United States (2)

|

$

|

6,037

|

|

$

|

980

|

|

$

|

5,536

|

|

$

|

898

|

|

$

|

5,160

|

|

$

|

675

|

|

|||||

|

Other North America

|

143

|

|

171

|

|

146

|

|

147

|

|

208

|

|

135

|

|

|||||||||||

|

Europe, Middle East & Africa (3)

|

5,871

|

|

1,435

|

|

5,275

|

|

1,469

|

|

5,940

|

|

1,395

|

|

|||||||||||

|

Asia Pacific (4)

|

4,274

|

|

858

|

|

3,839

|

|

809

|

|

3,552

|

|

732

|

|

|||||||||||

|

South America

|

336

|

|

71

|

|

369

|

|

54

|

|

639

|

|

84

|

|

|||||||||||

|

Total

|

$

|

16,661

|

|

$

|

3,515

|

|

$

|

15,165

|

|

$

|

3,377

|

|

$

|

15,499

|

|

$

|

3,021

|

|

|||||

|

(1)

|

Net property data represents property, plant and equipment, net of accumulated depreciation.

|

|

(2)

|

Includes net sales and machinery, equipment and tooling that relate to the Company's maquiladora operations located in Mexico. These assets are utilized to produce products sold to customers located in the United States.

|

|

(3)

|

Includes our country of domicile, Jersey, and the country of our principal executive offices, the United Kingdom. We had no sales in Jersey in any period. We had net sales of

$827 million

,

$834 million

and

$892 million

in the United Kingdom for the years ended

December 31, 2016

,

2015

and

2014

, respectively. We had net property in the United Kingdom of

$230 million

,

$276 million

and

$231 million

as of

December 31, 2016

,

2015

and

2014

, respectively. The largest portion of net sales in the Europe, Middle East & Africa region was

$959 million

in Germany,

$834 million

in the United Kingdom and

$892 million

in the United Kingdom for the years ended

December 31, 2016

,

2015

and

2014

, respectively.

|

|

(4)

|

Net sales and net property in Asia Pacific are primarily attributable to China.

|

|

•

|

exposure to local economic, political and labor conditions;

|

|

•

|

unexpected changes in laws, regulations, trade or monetary or fiscal policy, including interest rates, foreign currency exchange rates and changes in the rate of inflation in the U.S. and other foreign countries;

|

|

•

|

tariffs, quotas, customs and other import or export restrictions and other trade barriers;

|

|

•

|

expropriation and nationalization;

|

|

•

|

difficulty of enforcing agreements, collecting receivables and protecting assets through non-U.S. legal systems;

|

|

•

|

reduced intellectual property protection;

|

|

•

|

limitations on repatriation of earnings;

|

|

•

|

withholding and other taxes on remittances and other payments by subsidiaries;

|

|

•

|

investment restrictions or requirements;

|

|

•

|

export and import restrictions;

|

|

•

|

violence and civil unrest in local countries; and

|

|

•

|

compliance with the requirements of an increasing body of applicable anti-bribery laws, including the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and similar laws of various other countries.

|

|

•

|

lose net revenue;

|

|

•

|

incur increased costs such as warranty expense and costs associated with customer support;

|

|

•

|

experience delays, cancellations or rescheduling of orders for our products;

|

|

•

|

experience increased product returns or discounts; or

|

|

•

|

damage our reputation,

|

|

•

|

the generation, storage, handling, use, transportation, presence of, or exposure to hazardous materials;

|

|

•

|

the emission and discharge of hazardous materials into the ground, air or water;

|

|

•

|

the incorporation of certain chemical substances into our products, including electronic equipment; and

|

|

•

|

the health and safety of our employees.

|

|

North America

|

Europe,

Middle East

& Africa

|

Asia Pacific

|

South America

|

Total

|

||||||||||

|

Electrical/Electronic Architecture

|

32

|

|

34

|

|

25

|

|

5

|

|

96

|

|

||||

|

Powertrain Systems

|

4

|

|

8

|

|

5

|

|

1

|

|

18

|

|

||||

|

Electronics and Safety

|

3

|

|

6

|

|

3

|

|

—

|

|

12

|

|

||||

|

Total

|

39

|

|

48

|

|

33

|

|

6

|

|

126

|

|

||||

|

Price Range of Ordinary Shares

|

|||||||

|

|

High

|

Low

|

|||||

|

2015

|

|||||||

|

Period from January 1 through March 31, 2015

|

$

|

82.24

|

|

$

|

66.10

|

|

|

|

Period from April 1 through June 30, 2015

|

90.57

|

|

78.17

|

|

|||

|

Period from July 1 through September 30, 2015

|

86.31

|

|

66.27

|

|

|||

|

Period from October 1 through December 31, 2015

|

88.89

|

|

75.18

|

|

|||

|

2016

|

|||||||

|

Period from January 1 through March 31, 2016

|

$

|

84.80

|

|

$

|

55.59

|

|

|

|

Period from April 1 through June 30, 2016

|

78.00

|

|

58.04

|

|

|||

|

Period from July 1 through September 30, 2016

|

72.13

|

|

58.97

|

|

|||

|

Period from October 1 through December 31, 2016

|

71.95

|

|

60.50

|

|

|||

|

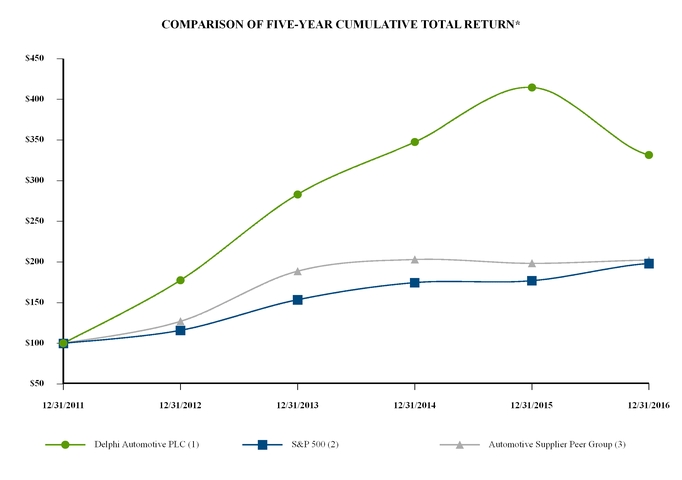

(1)

|

Delphi Automotive PLC

|

|

(2)

|

S&P 500 – Standard & Poor’s 500 Total Return Index

|

|

(3)

|

Automotive Supplier Peer Group – Russell 3000 Auto Parts Index, including American Axle & Manufacturing, BorgWarner Inc., Cooper Tire & Rubber Company, Dana Inc., Delphi Automotive PLC, Dorman Products Inc., Federal-Mogul Corp., Ford Motor Co., General Motors Co., Gentex Corp., Gentherm Inc., Genuine Parts Co., Goodyear Tire & Rubber Co., Johnson Controls International PLC, Lear Corp., LKQ Corp., Meritor Inc., Standard Motor Products Inc., Stoneridge Inc., Superior Industries International, Tenneco Inc., Tesla Motors Inc., Tower International Inc., Visteon Corp., and WABCO Holdings Inc.

|

|

Company Index

|

December 31, 2011

|

December 31, 2012

|

December 31, 2013

|

December 31, 2014

|

December 31, 2015

|

December 31, 2016

|

||||||||||||||||||

|

Delphi Automotive PLC (1)

|

$

|

100.00

|

|

$

|

177.58

|

|

$

|

283.02

|

|

$

|

347.40

|

|

$

|

414.58

|

|

$

|

331.43

|

|

||||||

|

S&P 500 (2)

|

100.00

|

|

116.00

|

|

153.58

|

|

174.60

|

|

177.01

|

|

198.18

|

|

||||||||||||

|

Automotive Supplier Peer Group (3)

|

100.00

|

|

127.04

|

|

188.67

|

|

203.06

|

|

198.34

|

|

202.30

|

|

||||||||||||

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options, Restricted Common Stock Warrants and Rights (a)

|

Weighted-Average Exercise Price of Outstanding Options, Restricted Common Stock Warrants and Rights (b)

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) (c)

|

||||||||||

|

Equity compensation plans approved by security holders

|

1,768,365

|

|

(1)

|

$

|

—

|

|

(2)

|

15,991,300

|

|

(3)

|

|||

|

Equity compensation plans not approved by security holders

|

—

|

|

—

|

|

—

|

|

|||||||

|

Total

|

1,768,365

|

|

—

|

|

15,991,300

|

|

|||||||

|

(1)

|

Includes (a) 26,474 outstanding restricted stock units granted to our Board of Directors and (b) 1,741,891 outstanding time- and performance-based restricted stock units granted to our executives. All grants were made under the Delphi Automotive PLC Long Term Incentive Plan, as amended and restated effective April 23, 2015 (the "PLC LTIP"). Includes accrued dividend equivalents.

|

|

(2)

|

The restricted stock units have no exercise price.

|

|

(3)

|

Remaining shares available under the PLC LTIP.

|

|

Period

|

Total Number of Shares Purchased (1)

|

Average Price Paid per Share (2)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Approximate Dollar Value of Shares that May Yet be Purchased Under the Program (in millions) (3)

|

||||||||||

|

October 1, 2016 to October 31, 2016

|

450,272

|

|

$

|

66.63

|

|

450,272

|

|

$

|

1,442

|

|

||||

|

November 1, 2016 to November 30, 2016

|

1,019,678

|

|

66.61

|

|

1,019,678

|

|

1,374

|

|

||||||

|

December 1, 2016 to December 31, 2016

|

31,671

|

|

65.21

|

|

31,671

|

|

1,372

|

|

||||||

|

Total

|

1,501,621

|

|

66.58

|

|

1,501,621

|

|

|

|

||||||

|

(1)

|

The total number of shares purchased under the Board authorized plans described below.

|

|

(2)

|

Excluding commissions.

|

|

(3)

|

In April 2016, the Board of Directors authorized a share repurchase program of up to $1.5 billion. This program follows the completion of the previously announced share repurchase program of $1.5 billion, which was approved by the Board of Directors in January 2015. The timing of repurchases is dependent on price, market conditions and applicable regulatory requirements.

|

|

|

Year Ended December 31,

|

||||||||||||||||||

|

2016

|

2015 (1)

|

2014

|

2013

|

2012 (2)

|

|||||||||||||||

|

|

(dollars and shares in millions, except per share data)

|

||||||||||||||||||

|

|

|||||||||||||||||||

|

Net sales

|

$

|

16,661

|

|

$

|

15,165

|

|

$

|

15,499

|

|

$

|

15,051

|

|

$

|

14,070

|

|

||||

|

Depreciation and amortization (3)

|

704

|

|

540

|

|

540

|

|

499

|

|

445

|

|

|||||||||

|

Operating income

|

1,947

|

|

1,723

|

|

1,758

|

|

1,627

|

|

1,390

|

|

|||||||||

|

Interest expense

|

(156

|

)

|

(127

|

)

|

(135

|

)

|

(143

|

)

|

(136

|

)

|

|||||||||

|

Income from continuing operations

|

1,218

|

|

1,261

|

|

1,380

|

|

1,241

|

|

1,095

|

|

|||||||||

|

Income from discontinued operations, net of tax

|

108

|

|

274

|

|

60

|

|

60

|

|

65

|

|

|||||||||

|

Net income

|

1,326

|

|

1,535

|

|

1,440

|

|

1,301

|

|

1,160

|

|

|||||||||

|

Net income attributable to noncontrolling interest

|

69

|

|

85

|

|

89

|

|

89

|

|

83

|

|

|||||||||

|

Net income attributable to Delphi

|

1,257

|

|

1,450

|

|

1,351

|

|

1,212

|

|

1,077

|

|

|||||||||

|

Net income per share data:

|

|||||||||||||||||||

|

Basic net income per share:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

4.22

|

|

$

|

4.16

|

|

$

|

4.36

|

|

$

|

3.76

|

|

$

|

3.19

|

|

||||

|

Discontinued operations

|

0.38

|

|

0.92

|

|

0.14

|

|

0.14

|

|

0.15

|

|

|||||||||

|

Basic net income per share attributable to Delphi

|

$

|

4.60

|

|

$

|

5.08

|

|

$

|

4.50

|

|

$

|

3.90

|

|

$

|

3.34

|

|

||||

|

Diluted net income per share:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

4.21

|

|

$

|

4.14

|

|

$

|

4.34

|

|

$

|

3.75

|

|

$

|

3.18

|

|

||||

|

Discontinued operations

|

0.38

|

|

0.92

|

|

0.14

|

|

0.14

|

|

0.15

|

|

|||||||||

|

Diluted net income per share attributable to Delphi

|

$

|

4.59

|

|

$

|

5.06

|

|

$

|

4.48

|

|

$

|

3.89

|

|

$

|

3.33

|

|

||||

|

Weighted average shares outstanding

|

273

|

|

285

|

|

300

|

|

311

|

|

323

|

|

|||||||||

|

Cash dividends declared and paid

|

$

|

1.16

|

|

$

|

1.00

|

|

$

|

1.00

|

|

$

|

0.68

|

|

$

|

—

|

|

||||

|

Other financial data:

|

|||||||||||||||||||

|

Capital expenditures

|

$

|

828

|

|

$

|

704

|

|

$

|

779

|

|

$

|

605

|

|

$

|

642

|

|

||||

|

Adjusted operating income (4)

|

2,223

|

|

1,971

|

|

1,925

|

|

1,779

|

|

1,577

|

|

|||||||||

|

Adjusted operating income margin (5)

|

13.3

|

%

|

13.0

|

%

|

12.4

|

%

|

11.8

|

%

|

11.2

|

%

|

|||||||||

|

Net cash provided by operating activities (6)

|

$

|

1,941

|

|

$

|

1,703

|

|

$

|

2,135

|

|

$

|

1,750

|

|

$

|

1,478

|

|

||||

|

Net cash used in investing activities (6)

|

(578

|

)

|

(1,699

|

)

|

(1,186

|

)

|

(655

|

)

|

(1,631

|

)

|

|||||||||

|

Net cash used in financing activities (6)

|

(1,081

|

)

|

(284

|

)

|

(1,398

|

)

|

(822

|

)

|

(105

|

)

|

|||||||||

|

As of December 31,

|

|||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

(in millions, except employee data)

|

|||||||||||||||||||

|

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

838

|

|

$

|

535

|

|

$

|

859

|

|

$

|

1,337

|

|

$

|

1,019

|

|

||||

|

Total assets (7)

|

$

|

12,292

|

|

$

|

11,973

|

|

$

|

10,721

|

|

$

|

11,016

|

|

$

|

10,126

|

|

||||

|

Total debt (7)

|

$

|

3,971

|

|

$

|

4,008

|

|

$

|

2,426

|

|

$

|

2,381

|

|

$

|

2,414

|

|

||||

|

Working capital, as defined (8)

|

$

|

1,607

|

|

$

|

1,390

|

|

$

|

1,135

|

|

$

|

1,152

|

|

$

|

1,213

|

|

||||

|

Shareholders’ equity

|

$

|

2,763

|

|

$

|

2,733

|

|

$

|

3,013

|

|

$

|

3,434

|

|

$

|

2,830

|

|

||||

|

Global employees (9)

|

145,000

|

|

139,000

|

|

127,000

|

|

117,000

|

|

118,000

|

|

|||||||||

|

(1)

|

On December 18, 2015, we completed the acquisition of HellermannTyton Group PLC, a leading global manufacturer of high-performance and innovative cable management solutions. Given the timing of the acquisition it is not fully reflected in our 2015 results and impacts comparability to 2016 results.

|

|

(2)

|

On October 26, 2012, we completed the acquisition of the Motorized Vehicles Division of FCI (“MVL”), a leading global manufacturer of automotive connection systems with a focus on high-value, leading technology applications. Given the timing of the acquisition it is not fully reflected in our 2012 results and impacts comparability to 2013 results.

|

|

(3)

|

Includes long-lived asset and goodwill impairments.

|

|

(4)

|

Adjusted Operating Income represents net income before interest expense, other income (expense), net, income tax expense, equity income (loss), net of tax, income (loss) from discontinued operations, net of tax, restructuring, other acquisition and portfolio project costs (which includes costs incurred to integrate acquired businesses and to plan and execute product portfolio transformation actions, including business and product acquisitions and divestitures), asset impairments and gains (losses) on business divestitures. Adjusted Operating Income is presented as a supplemental measure of the Company's financial performance which management believes is useful to investors in assessing the Company’s ongoing financial performance that, when reconciled to the corresponding U.S. GAAP measure, provides improved comparability between periods through the exclusion of certain items that management believes are not indicative of the Company’s core operating performance and which may obscure underlying business results and trends. Our management utilizes Adjusted Operating Income in its financial decision making process, to evaluate performance of the Company and for internal reporting, planning and forecasting purposes. Management also utilizes Adjusted Operating Income as the key performance measure of segment income or loss and for planning and forecasting purposes to allocate resources to our segments, as management also believes this measure is most reflective of the operational profitability or loss of our operating segments. Adjusted Operating Income should not be considered a substitute for results prepared in accordance with U.S. GAAP and should not be considered an alternative to net income attributable to Delphi, which is the most directly comparable financial measure to Adjusted Operating Income that is in accordance with U.S. GAAP. Adjusted Operating Income, as determined and measured by Delphi, should also not be compared to similarly titled measures reported by other companies.

|

|

The reconciliation of Adjusted Operating Income to Operating Income includes restructuring, other acquisition and portfolio project costs (which includes costs incurred to integrate acquired businesses and to plan and execute product portfolio transformation actions, including business and product acquisitions and divestitures), asset impairments and gains (losses) on business divestitures. The reconciliation of Adjusted Operating Income to net income (loss) attributable to the Company is as follows:

|

|

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

(in millions)

|

|||||||||||||||||||

|

Adjusted operating income

|

$

|

2,223

|

|

$

|

1,971

|

|

$

|

1,925

|

|

$

|

1,779

|

|

$

|

1,577

|

|

||||

|

Restructuring

|

(328

|

)

|

(177

|

)

|

(140

|

)

|

(137

|

)

|

(163

|

)

|

|||||||||

|

Other acquisition and portfolio project costs

|

(59

|

)

|

(47

|

)

|

(20

|

)

|

(15

|

)

|

(9

|

)

|

|||||||||

|

Asset impairments

|

(30

|

)

|

(16

|

)

|

(7

|

)

|

—

|

|

(15

|

)

|

|||||||||

|

Gain (loss) on business divestitures, net

|

141

|

|

(8

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Operating income

|

$

|

1,947

|

|

$

|

1,723

|

|

$

|

1,758

|

|

$

|

1,627

|

|

$

|

1,390

|

|

||||

|

Interest expense

|

$

|

(156

|

)

|

$

|

(127

|

)

|

$

|

(135

|

)

|

$

|

(143

|

)

|

$

|

(136

|

)

|

||||

|

Other (expense) income, net

|

(366

|

)

|

(88

|

)

|

(8

|

)

|

(18

|

)

|

5

|

|

|||||||||

|

Income from continuing operations before income taxes and equity income

|

1,425

|

|

1,508

|

|

1,615

|

|

1,466

|

|

1,259

|

|

|||||||||

|

Income tax expense

|

(242

|

)

|

(263

|

)

|

(255

|

)

|

(240

|

)

|

(174

|

)

|

|||||||||

|

Equity income, net of tax

|

35

|

|

16

|

|

20

|

|

15

|

|

10

|

|

|||||||||

|

Income from continuing operations

|

1,218

|

|

1,261

|

|

1,380

|

|

1,241

|

|

1,095

|

|

|||||||||

|

Income from discontinued operations, net of tax

|

108

|

|

274

|

|

60

|

|

60

|

|

65

|

|

|||||||||

|

Net income

|

1,326

|

|

1,535

|

|

1,440

|

|

1,301

|

|

1,160

|

|

|||||||||

|

Net income attributable to noncontrolling interest

|

69

|

|

85

|

|

89

|

|

89

|

|

83

|

|

|||||||||

|

Net income attributable to Delphi

|

$

|

1,257

|

|

$

|

1,450

|

|

$

|

1,351

|

|

$

|

1,212

|

|

$

|

1,077

|

|

||||

|

(5)

|

Adjusted operating income margin is defined as adjusted operating income as a percentage of Net sales.

|

|

(6)

|

Includes amounts attributable to discontinued operations.

|

|

(7)

|

Prior year amounts have been recast to reflect the adoption of ASU 2015-03,

Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs

in 2015, as further described in Note 2. Significant Accounting Policies to the audited consolidated financial statements included herein.

|

|

(8)

|

Working capital is calculated herein as accounts receivable plus inventories less accounts payable.

|

|

(9)

|

Excludes temporary and contract workers. As of December 31, 2016, we employed approximately 21,000 temporary and contract workers. Periods prior to December 31, 2015 include employees of discontinued operations.

|

|

•

|

Executive Overview

|

|

•

|

Consolidated Results of Operations

|

|

•

|

Results of Operations by Segment

|

|

•

|

Liquidity and Capital Resources

|

|

•

|

Off-Balance Sheet Arrangements and Other Matters

|

|

•

|

Significant Accounting Policies and Critical Accounting Estimates

|

|

•

|

Recently Issued Accounting Pronouncements

|

|

•

|

Generating gross business bookings of $25.6 billion, based upon expected volumes and pricing;

|

|

•

|

Generating

$1.9 billion

of cash from continuing operations and net income of

$1.3 billion

;

|

|

•

|

Continuing our focus on diversifying our geographic, product and customer mix, resulting in

37%

of our

2016

net sales generated in the North American market,

26%

generated from the Asia Pacific region, which we have identified as a key market likely to experience long term growth, and

14%

generated from our largest customer;

|

|

•

|

Continuing to strategically position the Company's product portfolio in high-growth spaces to meet consumer preferences for products that address the industry mega-trends of Safe, Green and Connected, including

$1.5 billion

invested in research & development in

2016

, which includes approximately

$300 million

of co-investment by customers and government agencies, and through value enhancing portfolio modifications and agreements, which included:

|

|

•

|

Enhancing our leading automated driving capabilities by entering into a collaborative arrangement with Mobileye N.V. to jointly develop a complete turn-key fully autonomous driving platform, and through an additional strategic investment in Quanergy Systems, Inc.;

|

|

•

|

Complementing and enhancing our fully-reconfigurable digital display product offerings by acquiring PureDepth, Inc. ("PureDepth"), a leading provider of multi-layer display technology that enables glasses-less 3D for cluster and other applications;

|

|

•

|

Completing the final step of our strategy to divest our former Thermal Systems business through the sale of our ownership interest in the SDAAC joint venture for net cash proceeds of $62 million; and

|

|

•

|

Completing the divestiture of our non-core Mechatronics business for net cash proceeds of

$197 million

.

|

|

•

|

Maximizing our operational flexibility and profitability at all points in the normal automotive business cycle, by having approximately

95%

of our hourly workforce based in low cost countries and approximately

14%

of our hourly workforce composed of temporary employees; and

|

|

•

|

Leveraging our investment grade credit metrics to further refine our capital structure and increase our financial flexibility by successfully issuing €500 million of 12-year, 1.60% Euro-denominated senior unsecured notes and $300 million of 30-year, 4.40% senior unsecured notes, utilizing the combined proceeds to redeem our $800 million, 5.00% senior notes.

|

|

•

|

Volume, net of contractual price reductions—changes in volume offset by contractual price reductions (which typically range from 1% to 3% of net sales) and changes in mix;

|

|

•

|

Operational performance—changes to costs for materials and commodities or manufacturing variances; and

|

|

•

|

Other—including restructuring costs and any remaining variances not included in Volume, net of contractual price reductions or Operational performance.

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

|

2015

|

|

Favorable/

(unfavorable)

|

||||||

|

|

(dollars in millions)

|

||||||||||

|

Net sales

|

$

|

16,661

|

|

$

|

15,165

|

|

$

|

1,496

|

|

||

|

Cost of sales

|

13,107

|

|

12,155

|

|

(952

|

)

|

|||||

|

Gross margin

|

3,554

|

|

21.3%

|

3,010

|

|

19.8%

|

544

|

|

|||

|

Selling, general and administrative

|

1,145

|

|

1,017

|

|

(128

|

)

|

|||||

|

Amortization

|

134

|

|

93

|

|

(41

|

)

|

|||||

|

Restructuring

|

328

|

|

177

|

|

(151

|

)

|

|||||

|

Operating income

|

1,947

|

|

1,723

|

|

224

|

|

|||||

|

Interest expense

|

(156

|

)

|

(127

|

)

|

(29

|

)

|

|||||

|

Other expense, net

|

(366

|

)

|

(88

|

)

|

(278

|

)

|

|||||

|

Income from continuing operations before income taxes and equity income

|

1,425

|

|

1,508

|

|

(83

|

)

|

|||||

|

Income tax expense

|

(242

|

)

|

(263

|

)

|

21

|

|

|||||

|

Income from continuing operations before equity income

|

1,183

|

|

1,245

|

|

(62

|

)

|

|||||

|

Equity income, net of tax

|

35

|

|

16

|

|

19

|

|

|||||

|

Income from continuing operations

|

1,218

|

|

1,261

|

|

(43

|

)

|

|||||

|

Income from discontinued operations, net of tax

|

108

|

|

274

|

|

(166

|

)

|

|||||

|

Net income

|

1,326

|

|

1,535

|

|

(209

|

)

|

|||||

|

Net income attributable to noncontrolling interest

|

69

|

|

85

|

|

(16

|

)

|

|||||

|

Net income attributable to Delphi

|

$

|

1,257

|

|

$

|

1,450

|

|

$

|

(193

|

)

|

||

|

|

Year Ended December 31,

|

Variance Due To:

|

||||||||||||||||||||||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

Volume, net of

contractual

price

reductions

|

FX

|

Commodity

pass-

through

|

Other

|

Total

|

||||||||||||||||||||||||

|

|

(in millions)

|

(in millions)

|

||||||||||||||||||||||||||||||

|

Total net sales

|

$

|

16,661

|

|

$

|

15,165

|

|

$

|

1,496

|

|

$

|

1,213

|

|

$

|

(292

|

)

|

$

|

(127

|

)

|

$

|

702

|

|

$

|

1,496

|

|

||||||||

|

|

Year Ended December 31,

|

Variance Due To:

|

||||||||||||||||||||||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

Volume (a)

|

FX

|

Operational

performance

|

Other

|

Total

|

||||||||||||||||||||||||

|

|

(dollars in millions)

|

(in millions)

|

||||||||||||||||||||||||||||||

|

Cost of sales

|

$

|

13,107

|

|

$

|

12,155

|

|

$

|

(952

|

)

|

$

|

(1,158

|

)

|

$

|

265

|

|

$

|

282

|

|

$

|

(341

|

)

|

$

|

(952

|

)

|

||||||||

|

Gross margin

|

$

|

3,554

|

|

$

|

3,010

|

|

$

|

544

|

|

$

|

55

|

|

$

|

(27

|

)

|

$

|

282

|

|

$

|

234

|

|

$

|

544

|

|

||||||||

|

Percentage of net sales

|

21.3

|

%

|

19.8

|

%

|

||||||||||||||||||||||||||||

|

(a)

|

Presented net of contractual price reductions for gross margin variance.

|

|

•

|

Net increased costs of $419 million resulting from the operations of the businesses acquired and divested, primarily HellermannTyton, as further described in Note 20. Acquisitions and Divestitures;

|

|

•

|

Increased warranty costs of

$60 million

, which includes increased reserves for expected future claims on products sold, our estimated obligations for warranty matters based on information received from, and discussions with, our customers, as well as

$25 million

pursuant to a settlement agreement reached in 2016 with one of our OEM customers regarding warranty claims related to certain components supplied by Delphi’s Powertrain Systems segment, partially offset by

|

|

•

|

The

$141 million

pre-tax gain on the divestiture of the Mechatronics business recorded during the year ended December 31, 2016, as further described in Note 20. Acquisitions and Divestitures.

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(dollars in millions)

|

||||||||||

|

Selling, general and administrative expense

|

$

|

1,145

|

|

$

|

1,017

|

|

$

|

(128

|

)

|

||

|

Percentage of net sales

|

6.9

|

%

|

6.7

|

%

|

|||||||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Amortization

|

$

|

134

|

|

$

|

93

|

|

$

|

(41

|

)

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(dollars in millions)

|

||||||||||

|

Restructuring

|

$

|

328

|

|

$

|

177

|

|

$

|

(151

|

)

|

||

|

Percentage of net sales

|

2.0

|

%

|

1.2

|

%

|

|||||||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Interest expense

|

$

|

156

|

|

$

|

127

|

|

$

|

(29

|

)

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Other expense, net

|

$

|

(366

|

)

|

$

|

(88

|

)

|

$

|

(278

|

)

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Income tax expense

|

$

|

242

|

|

$

|

263

|

|

$

|

21

|

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Equity income, net of tax

|

$

|

35

|

|

$

|

16

|

|

$

|

19

|

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Income from discontinued operations, net of tax

|

$

|

108

|

|

$

|

274

|

|

$

|

(166

|

)

|

||

|

•

|

Electrical/Electronic Architecture, which includes complete electrical architecture and component products.

|

|

•

|

Powertrain Systems, which includes extensive systems integration expertise in gasoline, diesel and fuel handling and full end-to-end systems including fuel injection, combustion, electronic controls, test and validation capabilities, electric and hybrid electric vehicle power electronics, aftermarket, and original equipment service.

|

|

•

|

Electronics and Safety, which includes component and systems integration expertise in infotainment and connectivity, body controls and security systems, displays and passive and active safety electronics, as well as advanced development of software.

|

|

•

|

Eliminations and Other, which includes i) the elimination of inter-segment transactions, and ii) certain other expenses and income of a non-operating or strategic nature.

|

|

Electrical/Electronic Architecture

|

Powertrain Systems

|

Electronics and Safety

|

Eliminations and Other

|

Total

|

|||||||||||||||

|

|

(in millions)

|

||||||||||||||||||

|

For the Year Ended December 31, 2016:

|

|||||||||||||||||||

|

Adjusted operating income

|

$

|

1,344

|

|

$

|

511

|

|

$

|

368

|

|

$

|

—

|

|

$

|

2,223

|

|

||||

|

Restructuring

|

(117

|

)

|

(172

|

)

|

(39

|

)

|

—

|

|

(328

|

)

|

|||||||||

|

Other acquisition and portfolio project costs

|

(41

|

)

|

(10

|

)

|

(8

|

)

|

—

|

|

(59

|

)

|

|||||||||

|

Asset impairments

|

—

|

|

(29

|

)

|

(1

|

)

|

—

|

|

(30

|

)

|

|||||||||

|

Gain (loss) on business divestitures, net

|

—

|

|

—

|

|

141

|

|

—

|

|

141

|

|

|||||||||

|

Operating income

|

$

|

1,186

|

|

$

|

300

|

|

$

|

461

|

|

$

|

—

|

|

1,947

|

|

|||||

|

Interest expense

|

(156

|

)

|

|||||||||||||||||

|

Other expense, net

|

(366

|

)

|

|||||||||||||||||

|

Income from continuing operations before income taxes and equity income

|

1,425

|

|

|||||||||||||||||

|

Income tax expense

|

(242

|

)

|

|||||||||||||||||

|

Equity income, net of tax

|

35

|

|

|||||||||||||||||

|

Income from continuing operations

|

1,218

|

|

|||||||||||||||||

|

Income from discontinued operations, net of tax

|

108

|

|

|||||||||||||||||

|

Net income

|

1,326

|

|

|||||||||||||||||

|

Net income attributable to noncontrolling interest

|

69

|

|

|||||||||||||||||

|

Net income attributable to Delphi

|

$

|

1,257

|

|

||||||||||||||||

|

Electrical/Electronic Architecture

|

Powertrain Systems

|

Electronics and Safety

|

Eliminations and Other

|

Total

|

|||||||||||||||

|

|

(in millions)

|

||||||||||||||||||

|

For the Year Ended December 31, 2015:

|

|||||||||||||||||||

|

Adjusted operating income

|

$

|

1,095

|

|

$

|

524

|

|

$

|

352

|

|

$

|

—

|

|

$

|

1,971

|

|

||||

|

Restructuring

|

(37

|

)

|

(115

|

)

|

(25

|

)

|

—

|

|

(177

|

)

|

|||||||||

|

Other acquisition and portfolio project costs

|

(26

|

)

|

(12

|

)

|

(9

|

)

|

—

|

|

(47

|

)

|

|||||||||

|

Asset impairments

|

(4

|

)

|

(9

|

)

|

(3

|

)

|

—

|

|

(16

|

)

|

|||||||||

|

Gain (loss) on business divestitures, net

|

(14

|

)

|

—

|

|

6

|

|

—

|

|

(8

|

)

|

|||||||||

|

Operating income

|

$

|

1,014

|

|

$

|

388

|

|

$

|

321

|

|

$

|

—

|

|

1,723

|

|

|||||

|

Interest expense

|

(127

|

)

|

|||||||||||||||||

|

Other expense, net

|

(88

|

)

|

|||||||||||||||||

|

Income from continuing operations before income taxes and equity income

|

1,508

|

|

|||||||||||||||||

|

Income tax expense

|

(263

|

)

|

|||||||||||||||||

|

Equity income, net of tax

|

16

|

|

|||||||||||||||||

|

Income from continuing operations

|

1,261

|

|

|||||||||||||||||

|

Income from discontinued operations, net of tax

|

274

|

|

|||||||||||||||||

|

Net income

|

1,535

|

|

|||||||||||||||||

|

Net income attributable to noncontrolling interest

|

85

|

|

|||||||||||||||||

|

Net income attributable to Delphi

|

$

|

1,450

|

|

||||||||||||||||

|

|

Year Ended December 31,

|

Variance Due To:

|

||||||||||||||||||||||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

Volume, net of contractual price reductions

|

FX

|

Commodity Pass-through

|

Other

|

Total

|

||||||||||||||||||||||||

|

|

(in millions)

|

(in millions)

|

||||||||||||||||||||||||||||||

|

Electrical/Electronic Architecture

|

$

|

9,316

|

|

$

|

8,180

|

|

$

|

1,136

|

|

$

|

626

|

|

$

|

(137

|

)

|

$

|

(127

|

)

|

$

|

774

|

|

$

|

1,136

|

|

||||||||

|

Powertrain Systems

|

4,486

|

|

4,407

|

|

79

|

|

218

|

|

(132

|

)

|

—

|

|

(7

|

)

|

79

|

|

||||||||||||||||

|

Electronics and Safety

|

3,014

|

|

2,744

|

|

270

|

|

363

|

|

(26

|

)

|

—

|

|

(67

|

)

|

270

|

|

||||||||||||||||

|

Eliminations and Other

|

(155

|

)

|

(166

|

)

|

11

|

|

6

|

|

3

|

|

—

|

|

2

|

|

11

|

|

||||||||||||||||

|

Total

|

$

|

16,661

|

|

$

|

15,165

|

|

$

|

1,496

|

|

$

|

1,213

|

|

$

|

(292

|

)

|

$

|

(127

|

)

|

$

|

702

|

|

$

|

1,496

|

|

||||||||

|

|

Year Ended December 31,

|

||||

|

|

2016

|

2015

|

|||

|

Electrical/Electronic Architecture

|

22.3

|

%

|

19.8

|

%

|

|

|

Powertrain Systems

|

17.8

|

%

|

19.3

|

%

|

|

|

Electronics and Safety (1)

|

22.7

|

%

|

19.7

|

%

|

|

|

Eliminations and Other

|

—

|

%

|

—

|

%

|

|

|

Total

|

21.3

|

%

|

19.8

|

%

|

|

|

(1)

|

Includes a pre-tax gain of

$141 million

recognized on the divestiture of the Company's Mechatronics business during the year ended

December 31, 2016

.

|

|

|

Year Ended December 31,

|

Variance Due To:

|

||||||||||||||||||||||||||

|

|

2016

|

2015

|

Favorable/

(unfavorable)

|

Volume, net of contractual price reductions

|

Operational performance

|

Other

|

Total

|

|||||||||||||||||||||

|

|

(in millions)

|

(in millions)

|

||||||||||||||||||||||||||

|

Electrical/Electronic Architecture

|

$

|

1,344

|

|

$

|

1,095

|

|

$

|

249

|

|

$

|

105

|

|

$

|

65

|

|

$

|

79

|

|

$

|

249

|

|

|||||||

|

Powertrain Systems

|

511

|

|

524

|

|

(13

|

)

|

(34

|

)

|

128

|

|

(107

|

)

|

(13

|

)

|

||||||||||||||

|

Electronics and Safety

|

368

|

|

352

|

|

16

|

|

(16

|

)

|

89

|

|

(57

|

)

|

16

|

|

||||||||||||||

|

Eliminations and Other

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||||

|

Total

|

$

|

2,223

|

|

$

|

1,971

|

|

$

|

252

|

|

$

|

55

|

|

$

|

282

|

|

$

|

(85

|

)

|

$

|

252

|

|

|||||||

|

•

|

Increased warranty costs of

$60 million

, which includes increased reserves for expected future claims on products sold, our estimated obligations for warranty matters based on information received from, and discussions with, our customers, as well as

$25 million

pursuant to a settlement agreement reached in 2016 with one of our OEM customers regarding warranty claims related to certain components supplied by Delphi’s Powertrain Systems segment, and

|

|

•

|

$70 million of increased depreciation and amortization, not including depreciation and amortization of businesses acquired and divested; partially offset by

|

|

•

|

Net increased adjusted operating income of $95 million resulting from the operations of the businesses acquired and divested, primarily resulting from the operations of HellermannTyton, partially offset by a reduction resulting from the divestiture of our Reception Systems business in 2015.

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2015

|

|

2014

|

|

Favorable/

(unfavorable)

|

||||||

|

|

(dollars in millions)

|

||||||||||

|

Net sales

|

$

|

15,165

|

|

$

|

15,499

|

|

$

|

(334

|

)

|

||

|

Cost of sales

|

12,155

|

|

12,471

|

|

316

|

|

|||||

|

Gross margin

|

3,010

|

|

19.8%

|

3,028

|

|

19.5%

|

(18

|

)

|

|||

|

Selling, general and administrative

|

1,017

|

|

1,036

|

|

19

|

|

|||||

|

Amortization

|

93

|

|

94

|

|

1

|

|

|||||

|

Restructuring

|

177

|

|

140

|

|

(37

|

)

|

|||||

|

Operating income

|

1,723

|

|

1,758

|

|

|

(35

|

)

|

||||

|

Interest expense

|

(127

|

)

|

(135

|

)

|

8

|

|

|||||

|

Other expense, net

|

(88

|

)

|

(8

|

)

|

(80

|

)

|

|||||

|

Income from continuing operations before income taxes and equity income

|

1,508

|

|

1,615

|

|

(107

|

)

|

|||||

|

Income tax expense

|

(263

|

)

|

(255

|

)

|

(8

|

)

|

|||||

|

Income from continuing operations before equity income

|

1,245

|

|

1,360

|

|

(115

|

)

|

|||||

|

Equity income, net of tax

|

16

|

|

20

|

|

(4

|

)

|

|||||

|

Income from continuing operations

|

1,261

|

|

1,380

|

|

(119

|

)

|

|||||

|

Income from discontinued operations, net of tax

|

274

|

|

60

|

|

214

|

|

|||||

|

Net income

|

1,535

|

|

1,440

|

|

95

|

|

|||||

|

Net income attributable to noncontrolling interest

|

85

|

|

89

|

|

(4

|

)

|

|||||

|

Net income attributable to Delphi

|

$

|

1,450

|

|

$

|

1,351

|

|

$

|

99

|

|

||

|

|

Year Ended December 31,

|

Variance Due To:

|

||||||||||||||||||||||||||||||

|

|

2015

|

2014

|

Favorable/

(unfavorable)

|

Volume, net of contractual price reductions

|

FX

|

Commodity pass-through

|

Other

|

Total

|

||||||||||||||||||||||||

|

|

(in millions)

|

(in millions)

|

||||||||||||||||||||||||||||||

|

Total net sales

|

$

|

15,165

|

|

$

|

15,499

|

|

$

|

(334

|

)

|

$

|

900

|

|

$

|

(1,153

|

)

|

$

|

(140

|

)

|

$

|

59

|

|

$

|

(334

|

)

|

||||||||

|

|

Year Ended December 31,

|

Variance Due To:

|

||||||||||||||||||||||||||||||

|

|

2015

|

2014

|

Favorable/

(unfavorable)

|

Volume (a)

|

FX

|

Operational

performance

|

Other

|

Total

|

||||||||||||||||||||||||

|

|

(dollars in millions)

|

(in millions)

|

||||||||||||||||||||||||||||||

|

Cost of sales

|

$

|

12,155

|

|

$

|

12,471

|

|

$

|

316

|

|

$

|

(956

|

)

|

$

|

897

|

|

$

|

321

|

|

$

|

54

|

|

$

|

316

|

|

||||||||

|

Gross margin

|

$

|

3,010

|

|

$

|

3,028

|

|

$

|

(18

|

)

|

$

|

(56

|

)

|

$

|

(256

|

)

|

$

|

321

|

|

$

|

(27

|

)

|

$

|

(18

|

)

|

||||||||

|

Percentage of net sales

|

19.8

|

%

|

19.5

|

%

|

||||||||||||||||||||||||||||

|

(a)

|

Presented net of contractual price reductions for gross margin variance.

|

|

•

|

A decrease of $140 million in commodity costs; partially offset by

|

|

•

|

Net increased costs of $38 million resulting from the operations of the businesses acquired and divested, as further described in Note 20. Acquisitions and Divestitures;

|

|

•

|

An increase of $12 million in warranty costs; and

|

|

•

|

The net loss of $8 million recorded on business divestitures in 2015, comprised of $47 million in losses incurred on the exit of our Argentina businesses, partially offset by the $39 million gain resulting from the sale of the Reception Systems businesses, as further described in Note 20. Acquisitions and Divestitures.

|

|

|

Year Ended December 31,

|

||||||||||

|

|

2015

|

2014

|

Favorable/

(unfavorable)

|

||||||||

|

|

(dollars in millions)

|

||||||||||

|

Selling, general and administrative expense

|

$

|

1,017

|

|

$

|

1,036

|

|

$

|

19

|

|

||

|

Percentage of net sales

|

6.7

|

%

|

6.7

|

%

|

|||||||

|

|

Year Ended December 31,

|

||||||||||

|

|

2015

|

2014

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Amortization

|

$

|

93

|

|

$

|

94

|

|

$

|

1

|

|

||

|

|

Year Ended December 31,

|

||||||||||

|

|

2015

|

2014

|

Favorable/

(unfavorable)

|

||||||||

|

|

(dollars in millions)

|

||||||||||

|

Restructuring

|

$

|

177

|

|

$

|

140

|

|

$

|

(37

|

)

|

||

|

Percentage of net sales

|

1.2

|

%

|

0.9

|

%

|

|||||||

|

|

Year Ended December 31,

|

||||||||||

|

|

2015

|

2014

|

Favorable/

(unfavorable)

|

||||||||

|

|

(in millions)

|

||||||||||

|

Interest expense

|

$

|

127

|

|

$

|

135

|

|

$

|

8

|

|

||

|

|

Year Ended December 31,

|