|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York

|

22-2448962

|

|||

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|||

|

250 GLEN STREET, GLENS FALLS, NEW YORK 12801

|

||||

|

(Address of principal executive offices) (Zip Code)

|

||||

|

Registrant’s telephone number, including area code: (518) 745-1000

|

||||

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: NONE

|

||||

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

|

||||

|

Common Stock, Par Value $1.00

|

||||

|

(Title of Class)

|

||||

|

Large accelerated filer

|

Accelerated filer

x

|

Non-accelerated filer

|

Smaller reporting company

|

||||||||||||||

|

Class

|

Outstanding as of February 28, 2017

|

|

|

Common Stock, par value $1.00 per share

|

13,510,698

|

|

|

Page

|

|

|

|

Note on Terminology

|

3

|

|

|

The Company and Its Subsidiaries

|

3

|

|

|

Forward-Looking Statements

|

3

|

|

|

Use of Non-GAAP Financial Measures

|

4

|

|

|

PART I

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

PART II

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

PART III

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

PART IV

|

||

|

|

||

|

|

||

|

|

||

|

Topic

|

Section

|

Page

|

Location

|

|

Dividend Capacity

|

Part I, Item 1.C.

|

8

|

First paragraph under "Dividend Restrictions; Other Regulatory Sanctions"

|

|

Part II, Item 7.E.

|

48

|

First paragraph under "Dividends"

|

|

|

Impact of Legislative Developments

|

Part I, Item 1.D.

|

10

|

Last paragraph in Section D

|

|

Part II, Item 7.A.

|

11

|

Paragraph in "Health Care Reform"

|

|

|

Visa Stock

|

Part II, Item 7.A.

|

28

|

Paragraph under "Visa Class B Common Stock"

|

|

Impact of Changing Interest Rates on Earnings

|

Part II, Item 7.C.II.a.

|

41

|

Last paragraph under “Automobile Loans”

|

|

Part II, Item 7.C.II.a.

|

40

|

Last two paragraphs

|

|

|

Part II, Item 7A.

|

52

|

Last four paragraphs

|

|

|

Adequacy of the Allowance for Loan

Losses

|

Part II, Item 7.B.II.

|

33

|

First paragraph under

“

II. Provision For Loan Losses and Allowance For Loan Losses

”

|

|

Noninterest Income

|

Part II, Item 7.C.III

|

34

|

Paragraphs four and five under "2016 Compared to 2015"

|

|

Expected Level of Real Estate Loans

|

Part II, Item 7.C.II.a.

|

40

|

Paragraphs under

“

Residential Real Estate Loans

”

|

|

Expected Level of Commercial Loans

|

Part II, Item 7.C.II.a.

|

41

|

Paragraphs under “Commercial, Commercial Real Estate and Construction and Land Development Loans”

|

|

Expected Level of Nonperforming

Assets

|

Part II, Item 7.C.II.c.

|

43

|

Last two paragraphs under "Potential Problem Loans"

|

|

Liquidity

|

Part II, Item 7.D.

|

47

|

Last two paragraphs under "Liquidity"

|

|

Commitments to Extend Credit

|

Part II, Item 8

|

81

|

Last two paragraphs in Note 8

|

|

Pension plan return on assets

|

Part II, Item 8

|

96

|

Second to last paragraph in Note 13

|

|

Realization of recognized net

deferred tax assets

|

Part II, Item 8

|

97

|

Second to last paragraph in Note 15

|

|

a.

|

rapid and dramatic changes in economic and market conditions, such as the U.S. economy experienced during the financial crisis of 2008-2010;

|

|

d.

|

significant changes in banking or other laws and regulations, including both enactment of new legal or regulatory measures (e.g., the Dodd-Frank Act) or the modification or elimination of pre-existing measures

|

|

e.

|

significant changes in U.S. monetary or fiscal policy, including new or revised monetary programs or targets adopted or announced by the Federal Reserve ("monetary tightening or easing") or significant new federal legislation materially affecting the federal budget ("fiscal tightening or expansion");

|

|

f.

|

enhanced competition from unforeseen sources (e.g., so-called Fintech enterprises); and

|

|

g.

|

similar uncertainties inherent in banking operations or business generally, including technological developments and changes.

|

|

Subsidiary Banks

(dollars in thousands)

|

|||||||

|

Glens Falls National

|

Saratoga National

|

||||||

|

Total Assets at Year-End

|

$

|

2,158,385

|

|

$

|

443,258

|

|

|

|

Trust Assets Under Administration and

Investment Management at Year-End

(Not Included in Total Assets)

|

$

|

1,217,312

|

|

$

|

84,096

|

|

|

|

Date Organized

|

1851

|

|

1988

|

|

|||

|

Employees (full-time equivalent)

|

473

|

|

51

|

|

|||

|

Offices

|

30

|

|

9

|

|

|||

|

Counties of Operation

|

Warren, Washington,

Saratoga, Essex &

Clinton

|

Saratoga, Albany &

Rensselaer

|

|||||

|

Main Office

|

250 Glen Street

Glens Falls, NY

|

171 So. Broadway

Saratoga Springs, NY

|

|||||

|

Year, as of January 1

|

2016

|

2017

|

2018

|

2019

|

||||

|

Minimum CET1 Ratio

|

4.500

|

%

|

4.500

|

%

|

4.500

|

%

|

4.500

|

%

|

|

Capital Conservation Buffer ("Buffer")

|

0.625

|

%

|

1.250

|

%

|

1.875

|

%

|

2.500

|

%

|

|

Minimum CET1 Ratio Plus Buffer

|

5.125

|

%

|

5.750

|

%

|

6.375

|

%

|

7.000

|

%

|

|

Minimum Tier 1 Risk-Based Capital Ratio

|

6.000

|

%

|

6.000

|

%

|

6.000

|

%

|

6.000

|

%

|

|

Minimum Tier 1 Risk-Based Capital Ratio Plus Buffer

|

6.625

|

%

|

7.250

|

%

|

7.875

|

%

|

8.500

|

%

|

|

Minimum Total Risk-Based Capital Ratio

|

8.000

|

%

|

8.000

|

%

|

8.000

|

%

|

8.000

|

%

|

|

Minimum Total Risk-Based Capital Ratio Plus Buffer

|

8.625

|

%

|

9.250

|

%

|

9.875

|

%

|

10.500

|

%

|

|

Minimum Leverage Ratio

|

4.000

|

%

|

4.000

|

%

|

4.000

|

%

|

4.000

|

%

|

|

Required Information

|

Location in Report

|

|

Distribution of Assets, Liabilities and Stockholders' Equity; Interest Rates and Interest Differential

|

|

|

Investment Portfolio

|

|

|

Loan Portfolio

|

|

|

Summary of Loan Loss Experience

|

|

|

Deposits

|

|

|

Return on Equity and Assets

|

|

|

Short-Term Borrowings

|

|

|

Name

|

Age

|

Positions Held and Years from Which Held

|

|

Thomas J. Murphy, CPA

|

58

|

President and Chief Executive Officer of Arrow since January 1, 2013. He has been a director of Arrow since July 2012. Mr. Murphy served as a Vice President of Arrow from 2009 to 2012, and as Corporate Secretary from 2009 to 2012. Mr. Murphy also has been the President and Chief Executive Officer of GFNB since January 1, 2013. Prior to that date he served as Senior Executive Vice President of Arrow and President of GFNB commencing July 1, 2011. Prior to July 1, 2011, Mr. Murphy served as Senior Trust Officer of GFNB (since 2010) and Cashier of GFNB (since 2009). Mr. Murphy previously served as Assistant Corporate Secretary of Arrow (2008-2009), Senior Vice President of GFNB (2008-2011) and Manager of the Personal Trust Department of GFNB (2004-2011). Mr. Murphy started with the Company in 2004.

|

|

Terry R. Goodemote, CPA

|

53

|

Chief Financial Officer of Arrow since January 1, 2007. He also has been Executive Vice President of Arrow (since January 1, 2013); prior to that, he was Senior Vice President of Arrow (since 2008). Mr. Goodemote also serves as Chief Financial Officer of GFNB (since January 1, 2007) and as Senior Executive Vice President of GFNB (since July 1, 2011). Before that he was Executive Vice President of GFNB (since 2008). Prior to becoming Chief Financial Officer, Mr. Goodemote served as Senior Vice President and Head of the Accounting Division of GFNB. Mr. Goodemote started with the Company in 1992. On February 7, 2017, the company announced Mr. Goodemote's intention is to retire from the company. He intends to continue in his current role until his successor is chosen.

|

|

David S. DeMarco

|

55

|

Senior Vice President of Arrow since May 1, 2009. Mr. DeMarco has been the President and Chief Executive Officer of SNB since January 1, 2013. Prior to that date, Mr. DeMarco served as Executive Vice President and Head of the Branch, Corporate Development, Financial Services & Marketing Division of GFNB since January 1, 2003. Mr. DeMarco started with the Company in 1987.

|

|

David D. Kaiser

|

56

|

Senior Vice President of Arrow since February 1, 2015. Mr. Kaiser has also served as Executive Vice President of GFNB since 2012 and as Chief Credit Officer of GFNB and SNB since 2011. Previously, he served as the Corporate Banking Manager for GFNB from 2005 to 2011. Mr. Kaiser started with the Company in 2000.

|

|

Item 1B.

|

Unresolved Staff Comments

- None

|

|

2016

|

2015

|

||||||||||||||||||

|

Market Price

|

Cash Dividends Declared

|

Market Price

|

Cash Dividends Declared

|

||||||||||||||||

|

Low

|

High

|

Low

|

High

|

||||||||||||||||

|

First Quarter

|

$

|

23.83

|

|

$

|

26.74

|

|

$

|

0.243

|

|

$24.32

|

$26.20

|

$

|

0.238

|

|

|||||

|

Second Quarter

|

25.16

|

|

29.51

|

|

0.243

|

|

24.06

|

26.65

|

0.238

|

||||||||||

|

Third Quarter

|

28.62

|

|

34.08

|

|

0.243

|

|

25.30

|

27.18

|

0.238

|

||||||||||

|

Fourth Quarter

|

30.56

|

|

41.70

|

|

0.250

|

|

25.07

|

28.39

|

0.243

|

|

|||||||||

|

Plan Category

|

(a)

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

|

(b)

Weighted-Average

Exercise Price of Outstanding Options, Warrants and Rights

|

(c)

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)

|

||||||

|

Equity Compensation Plans Approved by Security Holders

(1)(2)

|

355,651

|

|

$

|

22.52

|

|

511,293

|

|

||

|

Equity Compensation Plans Not Approved by Security Holders

|

—

|

|

—

|

|

|||||

|

Total

|

355,651

|

|

511,293

|

|

|||||

|

(1)

|

All 355,651 shares of common stock listed in column (a) are issuable pursuant to outstanding stock options granted under the LTIP or its predecessor plans.

|

|

(2)

|

The total of 511,293 shares listed in column (c) includes (i) 367,775 shares of common stock available for future award grants under the LTIP, (ii) 115,554 shares of common stock available for future issuance under the ESPP, and (iii) 27,964 shares of common stock available for future issuance under the DSP.

|

|

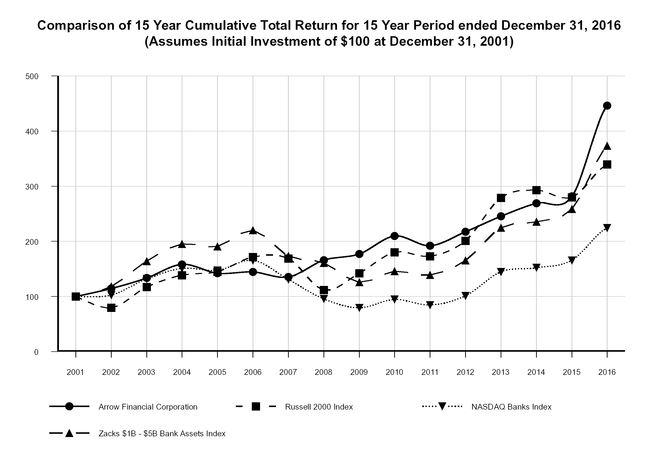

TOTAL RETURN PERFORMANCE

Period Ending

|

|||||||||||||||||

|

Index

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|||||||||||

|

Arrow Financial Corporation

|

100.00

|

|

113.12

|

|

127.72

|

|

140.05

|

|

146.51

|

|

232.25

|

|

|||||

|

Russell 2000 Index

|

100.00

|

|

116.35

|

|

161.52

|

|

169.42

|

|

161.95

|

|

196.45

|

|

|||||

|

NASDAQ Banks Index

|

100.00

|

|

119.64

|

|

171.23

|

|

179.93

|

|

195.98

|

|

265.31

|

|

|||||

|

Zacks $1B - $5B Bank Assets Index

|

100.00

|

|

118.73

|

|

161.37

|

|

169.29

|

|

185.89

|

|

267.98

|

|

|||||

|

TOTAL RETURN PERFORMANCE

Period Ending |

|||||||||||||||||||||||

|

Index

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

|||||||||||||||

|

Arrow Financial

Corporation |

100.00

|

|

114.37

|

|

133.42

|

|

158.20

|

|

142.19

|

|

144.44

|

|

135.32

|

|

165.76

|

|

|||||||

|

Russell 2000 Index

|

100.00

|

|

79.52

|

|

117.09

|

|

138.68

|

|

144.93

|

|

171.55

|

|

168.87

|

|

111.81

|

|

|||||||

|

NASDAQ Banks

Index |

100.00

|

|

102.37

|

|

131.69

|

|

150.81

|

|

147.31

|

|

165.41

|

|

130.91

|

|

95.44

|

|

|||||||

|

Zacks $1B - $5B Bank

Assets Index |

100.00

|

|

118.21

|

|

164.17

|

|

195.13

|

|

190.45

|

|

220.30

|

|

173.64

|

|

160.60

|

|

|||||||

|

TOTAL RETURN PERFORMANCE (Cont'd.)

Period Ending |

|||||||||||||||||||||||

|

Index

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|||||||||||||||

|

Arrow Financial

Corporation |

177.11

|

|

209.52

|

|

192.14

|

|

217.34

|

|

245.41

|

|

269.08

|

|

281.50

|

|

446.24

|

|

|||||||

|

Russell 2000 Index

|

142.19

|

|

180.38

|

|

172.85

|

|

201.11

|

|

279.18

|

|

292.85

|

|

279.92

|

|

339.57

|

|

|||||||

|

NASDAQ Banks

Index |

79.42

|

|

94.44

|

|

84.46

|

|

101.05

|

|

144.63

|

|

151.98

|

|

165.53

|

|

224.09

|

|

|||||||

|

Zacks $1B - $5B Bank

Assets Index |

125.68

|

|

145.68

|

|

139.24

|

|

165.32

|

|

224.69

|

|

235.72

|

|

258.83

|

|

373.14

|

|

|||||||

|

Fourth Quarter 2016

Calendar Month

|

(a) Total Number of

Shares Purchased

1

|

(b) Average Price Paid Per Share

1

|

(c) Total Number of

Shares Purchased as

Part of Publicly

Announced

Plans or Programs

2

|

(d) Maximum

Approximate Dollar

Value of Shares that

May Yet be

Purchased Under the

Plans or Programs

2

|

|||||||||

|

October

|

3,979

|

|

$

|

32.40

|

|

—

|

|

$

|

4,505,130

|

|

|||

|

November

|

7,035

|

|

35.82

|

|

—

|

|

4,505,130

|

|

|||||

|

December

|

14,603

|

|

40.10

|

|

—

|

|

4,505,130

|

|

|||||

|

Total

|

25,617

|

|

37.73

|

|

—

|

|

|||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Interest and Dividend Income

|

$

|

76,915

|

|

$

|

70,738

|

|

$

|

66,861

|

|

$

|

64,138

|

|

$

|

69,379

|

|

||||

|

Interest Expense

|

5,356

|

|

4,813

|

|

5,767

|

|

7,922

|

|

11,957

|

|

|||||||||

|

Net Interest Income

|

71,559

|

|

65,925

|

|

61,094

|

|

56,216

|

|

57,422

|

|

|||||||||

|

Provision for Loan Losses

|

2,033

|

|

1,347

|

|

1,848

|

|

200

|

|

845

|

|

|||||||||

|

Net Interest Income After Provision

for Loan Losses

|

69,526

|

|

64,578

|

|

59,246

|

|

56,016

|

|

56,577

|

|

|||||||||

|

Noninterest Income

|

27,854

|

|

27,995

|

|

28,206

|

|

27,521

|

|

26,234

|

|

|||||||||

|

Net (Losses) Gains on Securities Transactions

|

(22

|

)

|

129

|

|

110

|

|

540

|

|

865

|

|

|||||||||

|

Noninterest Expense

|

(59,609

|

)

|

(57,430

|

)

|

(54,028

|

)

|

(53,203

|

)

|

(51,836

|

)

|

|||||||||

|

Income Before Provision for Income Taxes

|

37,749

|

|

35,272

|

|

33,534

|

|

30,874

|

|

31,840

|

|

|||||||||

|

Provision for Income Taxes

|

11,215

|

|

10,610

|

|

10,174

|

|

9,079

|

|

9,661

|

|

|||||||||

|

Net Income

|

$

|

26,534

|

|

$

|

24,662

|

|

$

|

23,360

|

|

$

|

21,795

|

|

$

|

22,179

|

|

||||

|

Per Common Share:

1

|

|||||||||||||||||||

|

Basic Earnings

|

$

|

1.98

|

|

$

|

1.86

|

|

$

|

1.76

|

|

$

|

1.65

|

|

$

|

1.69

|

|

||||

|

Diluted Earnings

|

1.97

|

|

1.85

|

|

1.76

|

|

1.65

|

|

1.69

|

|

|||||||||

|

Per Common Share:

1

|

|||||||||||||||||||

|

Cash Dividends

|

$

|

0.98

|

|

$

|

0.96

|

|

$

|

0.94

|

|

$

|

0.92

|

|

$

|

0.90

|

|

||||

|

Book Value

|

17.27

|

|

16.05

|

|

15.16

|

|

14.50

|

|

13.38

|

|

|||||||||

|

Tangible Book Value

2

|

15.45

|

|

14.18

|

|

13.22

|

|

12.53

|

|

11.36

|

|

|||||||||

|

|

|||||||||||||||||||

|

Total Assets

|

$

|

2,605,242

|

|

$

|

2,446,188

|

|

$

|

2,217,420

|

|

$

|

2,163,698

|

|

$

|

2,022,796

|

|

||||

|

Securities Available-for-Sale

|

346,996

|

|

402,309

|

|

366,139

|

|

457,606

|

|

478,698

|

|

|||||||||

|

Securities Held-to-Maturity

|

345,427

|

|

320,611

|

|

302,024

|

|

299,261

|

|

239,803

|

|

|||||||||

|

Loans

|

1,753,268

|

|

1,573,952

|

|

1,413,268

|

|

1,266,472

|

|

1,172,641

|

|

|||||||||

|

Nonperforming Assets

3

|

7,186

|

|

8,924

|

|

8,162

|

|

7,916

|

|

9,070

|

|

|||||||||

|

Deposits

|

2,116,546

|

|

2,030,423

|

|

1,902,948

|

|

1,842,330

|

|

1,731,155

|

|

|||||||||

|

Federal Home Loan Bank Advances

|

178,000

|

|

137,000

|

|

51,000

|

|

73,000

|

|

59,000

|

|

|||||||||

|

Other Borrowed Funds

|

55,836

|

|

43,173

|

|

39,421

|

|

31,777

|

|

32,678

|

|

|||||||||

|

Stockholders

’

Equity

|

232,852

|

|

213,971

|

|

200,926

|

|

192,154

|

|

175,825

|

|

|||||||||

|

Selected Key Ratios:

|

|||||||||||||||||||

|

Return on Average Assets

|

1.06

|

%

|

1.05

|

%

|

1.07

|

%

|

1.04

|

%

|

1.11

|

%

|

|||||||||

|

Return on Average Equity

|

11.79

|

|

11.86

|

|

11.79

|

|

12.11

|

|

12.88

|

|

|||||||||

|

Dividend Payout

4

|

49.75

|

|

51.89

|

|

53.41

|

|

55.76

|

|

53.25

|

|

|||||||||

|

Average Equity to Average Assets

|

8.95

|

|

8.88

|

|

9.05

|

|

8.56

|

|

8.62

|

|

|||||||||

|

Selected Quarterly Information

Dollars in thousands, except per share amounts

Share and per share amounts have been restated for the September 2016 3% stock dividend

|

|||||||||||||||||||

|

Quarter Ended

|

12/31/2016

|

|

9/30/2016

|

|

6/30/2016

|

|

3/31/2016

|

|

12/31/2015

|

|

|||||||||

|

Net Income

|

$

|

6,600

|

|

$

|

6,738

|

|

$

|

6,647

|

|

$

|

6,549

|

|

$

|

6,569

|

|

||||

|

Transactions Recorded in Net Income (Net of Tax):

|

|

|

|

|

|

||||||||||||||

|

Net (Loss) Gain on Securities Transactions

|

(101

|

)

|

—

|

|

88

|

|

—

|

|

14

|

|

|||||||||

|

Period End Shares Outstanding

|

13,483

|

|

13,426

|

|

13,388

|

|

13,361

|

|

13,328

|

|

|||||||||

|

Basic Average Shares Outstanding

|

13,441

|

|

13,407

|

|

13,372

|

|

13,343

|

|

13,306

|

|

|||||||||

|

Diluted Average Shares Outstanding

|

13,565

|

|

13,497

|

|

13,429

|

|

13,379

|

|

13,368

|

|

|||||||||

|

Basic Earnings Per Share

|

$

|

0.49

|

|

$

|

0.50

|

|

$

|

0.50

|

|

$

|

0.49

|

|

$

|

0.49

|

|

||||

|

Diluted Earnings Per Share

|

0.49

|

|

0.50

|

|

0.49

|

|

0.49

|

|

0.49

|

|

|||||||||

|

Cash Dividend Per Share

|

0.250

|

|

0.243

|

|

0.243

|

|

0.243

|

|

0.243

|

|

|||||||||

|

Selected Quarterly Average Balances

:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Interest-Bearing Deposits at Banks

|

$

|

34,731

|

|

$

|

21,635

|

|

$

|

22,195

|

|

$

|

21,166

|

|

$

|

44,603

|

|

||||

|

Investment Securities

|

684,906

|

|

696,712

|

|

701,526

|

|

716,523

|

|

716,947

|

|

|||||||||

|

Loans

|

1,726,738

|

|

1,680,850

|

|

1,649,401

|

|

1,595,018

|

|

1,556,234

|

|

|||||||||

|

Deposits

|

2,160,156

|

|

2,063,832

|

|

2,082,449

|

|

2,069,964

|

|

2,075,825

|

|

|||||||||

|

Other Borrowed Funds

|

157,044

|

|

209,946

|

|

165,853

|

|

143,274

|

|

127,471

|

|

|||||||||

|

Shareholders’ Equity

|

230,198

|

|

228,048

|

|

223,234

|

|

218,307

|

|

213,219

|

|

|||||||||

|

Total Assets

|

2,572,425

|

|

2,528,124

|

|

2,496,795

|

|

2,456,431

|

|

2,442,964

|

|

|||||||||

|

Return on Average Assets

|

1.02

|

%

|

1.06

|

%

|

1.07

|

%

|

1.07

|

%

|

1.07

|

%

|

|||||||||

|

Return on Average Equity

|

11.41

|

%

|

11.75

|

%

|

11.98

|

%

|

12.07

|

%

|

12.22

|

%

|

|||||||||

|

Return on Tangible Equity

2

|

12.77

|

%

|

13.18

|

%

|

13.47

|

%

|

13.62

|

%

|

13.86

|

%

|

|||||||||

|

Average Earning Assets

|

$

|

2,446,375

|

|

$

|

2,399,197

|

|

$

|

2,373,122

|

|

$

|

2,332,707

|

|

$

|

2,317,784

|

|

||||

|

Average Paying Liabilities

|

1,933,974

|

|

1,892,583

|

|

1,891,017

|

|

1,867,455

|

|

1,854,549

|

|

|||||||||

|

Interest Income, Tax-Equivalent

|

20,709

|

|

20,222

|

|

20,154

|

|

19,549

|

|

19,422

|

|

|||||||||

|

Interest Expense

|

1,404

|

|

1,405

|

|

1,284

|

|

1,263

|

|

1,231

|

|

|||||||||

|

Net Interest Income, Tax-Equivalent

|

19,305

|

|

18,817

|

|

18,870

|

|

18,286

|

|

18,191

|

|

|||||||||

|

Tax-Equivalent Adjustment

|

939

|

|

940

|

|

917

|

|

923

|

|

912

|

|

|||||||||

|

Net Interest Margin

3

|

3.14

|

%

|

3.12

|

%

|

3.20

|

%

|

3.15

|

%

|

3.11

|

%

|

|||||||||

|

Efficiency Ratio Calculation

:

|

|

|

|

|

|

||||||||||||||

|

Noninterest Expense

|

$

|

15,272

|

|

$

|

15,082

|

|

$

|

14,884

|

|

$

|

14,370

|

|

$

|

14,242

|

|

||||

|

Less: Intangible Asset Amortization

|

73

|

|

74

|

|

74

|

|

75

|

|

78

|

|

|||||||||

|

Net Noninterest Expense

|

$

|

15,199

|

|

$

|

15,008

|

|

$

|

14,810

|

|

$

|

14,295

|

|

$

|

14,164

|

|

||||

|

Net Interest Income, Tax-Equivalent

|

$

|

19,305

|

|

$

|

18,817

|

|

$

|

18,870

|

|

$

|

18,286

|

|

$

|

18,191

|

|

||||

|

Noninterest Income

|

6,648

|

|

7,114

|

|

7,194

|

|

6,875

|

|

6,687

|

|

|||||||||

|

Less: Net Securities (Losses) Gains

|

(166

|

)

|

—

|

|

144

|

|

—

|

|

23

|

|

|||||||||

|

Net Gross Income

|

$

|

26,119

|

|

$

|

25,931

|

|

$

|

25,920

|

|

$

|

25,161

|

|

$

|

24,855

|

|

||||

|

Efficiency Ratio

|

58.19

|

%

|

57.88

|

%

|

57.14

|

%

|

56.81

|

%

|

56.99

|

%

|

|||||||||

|

Period-End Capital Information

:

|

|

|

|

|

|

||||||||||||||

|

Total Stockholders’ Equity (i.e. Book Value)

|

$

|

232,852

|

|

$

|

229,208

|

|

$

|

225,373

|

|

$

|

220,703

|

|

$

|

213,971

|

|

||||

|

Book Value per Share

|

17.27

|

|

17.07

|

|

16.83

|

|

16.52

|

|

16.05

|

|

|||||||||

|

Intangible Assets

|

24,569

|

|

24,675

|

|

24,758

|

|

24,872

|

|

24,980

|

|

|||||||||

|

Tangible Book Value per Share

2

|

15.45

|

|

15.23

|

|

14.98

|

|

14.66

|

|

14.18

|

|

|||||||||

|

Capital Ratios:

|

|

|

|

|

|

||||||||||||||

|

Tier 1 Leverage Ratio

|

9.47

|

%

|

9.44

|

%

|

9.37

|

%

|

9.36

|

%

|

9.25

|

%

|

|||||||||

|

Common Equity Tier 1 Capital Ratio

|

12.97

|

%

|

12.80

|

%

|

12.74

|

%

|

12.84

|

%

|

12.82

|

%

|

|||||||||

|

Tier 1 Risk-Based Capital Ratio

|

14.14

|

%

|

13.98

|

%

|

13.95

|

%

|

14.08

|

%

|

14.08

|

%

|

|||||||||

|

Total Risk-Based Capital Ratio

|

15.15

|

%

|

14.99

|

%

|

14.96

|

%

|

15.09

|

%

|

15.09

|

%

|

|||||||||

|

Assets Under Trust Administration

and Investment Management |

$

|

1,301,408

|

|

$

|

1,284,051

|

|

$

|

1,250,770

|

|

$

|

1,231,237

|

|

$

|

1,232,890

|

|

||||

|

Selected Twelve-Month Information

Dollars in thousands, except per share amounts

Share and per share amounts have been restated for the September 2016 3% stock dividend

|

|||||||||||

|

2016

|

2015

|

2014

|

|||||||||

|

Net Income

|

$

|

26,534

|

|

$

|

24,662

|

|

$

|

23,360

|

|

||

|

Transactions Recorded in Net Income (Net of Tax):

|

|||||||||||

|

Net Securities (Losses) Gains

|

$

|

(13

|

)

|

$

|

78

|

|

$

|

67

|

|

||

|

Period End Shares Outstanding

|

13,483

|

|

13,328

|

|

13,260

|

|

|||||

|

Basic Average Shares Outstanding

|

13,391

|

|

13,281

|

|

13,242

|

|

|||||

|

Diluted Average Shares Outstanding

|

13,476

|

|

13,330

|

|

13,272

|

|

|||||

|

Basic Earnings Per Share

|

$

|

1.98

|

|

$

|

1.86

|

|

$

|

1.76

|

|

||

|

Diluted Earnings Per Share

|

1.97

|

|

1.85

|

|

1.76

|

|

|||||

|

Cash Dividends Per Share

|

0.98

|

|

0.96

|

|

0.94

|

|

|||||

|

Average Assets

|

$

|

2,513,645

|

|

$

|

2,341,467

|

|

$

|

2,190,480

|

|

||

|

Average Equity

|

224,969

|

|

208,017

|

|

198,208

|

|

|||||

|

Return on Average Assets

|

1.06

|

%

|

1.05

|

%

|

1.07

|

%

|

|||||

|

Return on Average Equity

|

11.79

|

|

11.86

|

|

11.79

|

|

|||||

|

Average Earning Assets

|

$

|

2,388,042

|

|

$

|

2,218,440

|

|

$

|

2,068,611

|

|

||

|

Average Interest-Bearing Liabilities

|

1,896,351

|

|

1,777,867

|

|

1,675,285

|

|

|||||

|

Interest Income, Tax-Equivalent

1

|

80,636

|

|

74,227

|

|

70,188

|

|

|||||

|

Interest Expense

|

5,356

|

|

4,813

|

|

5,767

|

|

|||||

|

Net Interest Income, Tax-Equivalent

1

|

75,280

|

|

69,414

|

|

64,421

|

|

|||||

|

Tax-Equivalent Adjustment

|

3,721

|

|

3,489

|

|

3,327

|

|

|||||

|

Net Interest Margin

1

|

3.15

|

%

|

3.13

|

%

|

3.11

|

%

|

|||||

|

Efficiency Ratio Calculation

1

|

|||||||||||

|

Noninterest Expense

|

$

|

59,609

|

|

$

|

57,430

|

|

$

|

54,028

|

|

||

|

Less: Intangible Asset Amortization

|

297

|

|

327

|

|

387

|

|

|||||

|

Net Noninterest Expense

|

$

|

59,312

|

|

$

|

57,103

|

|

$

|

53,641

|

|

||

|

Net Interest Income, Tax-Equivalent

1

|

$

|

75,280

|

|

$

|

69,414

|

|

$

|

64,421

|

|

||

|

Noninterest Income

|

27,832

|

|

28,124

|

|

28,316

|

|

|||||

|

Less: Net Securities (Losses) Gains

|

(22

|

)

|

129

|

|

110

|

|

|||||

|

Net Gross Income, Adjusted

|

$

|

103,134

|

|

$

|

97,409

|

|

$

|

92,627

|

|

||

|

Efficiency Ratio

1

|

57.51

|

%

|

58.62

|

%

|

57.91

|

%

|

|||||

|

Period-End Capital Information

:

|

|||||||||||

|

Tier 1 Leverage Ratio

|

9.47

|

%

|

9.25

|

%

|

9.44

|

%

|

|||||

|

Total Stockholders

’

Equity (i.e. Book Value)

|

$

|

232,852

|

|

$

|

213,971

|

|

$

|

200,926

|

|

||

|

Book Value per Share

|

17.27

|

|

16.05

|

|

15.15

|

|

|||||

|

Intangible Assets

|

24,569

|

|

24,980

|

|

25,628

|

|

|||||

|

Tangible Book Value per Share

1

|

15.45

|

|

14.18

|

|

13.22

|

|

|||||

|

Asset Quality Information:

|

|||||||||||

|

Net Loans Charged-off as a Percentage of Average Loans

|

0.06

|

%

|

0.06

|

%

|

0.05

|

%

|

|||||

|

Provision for Loan Losses as a Percentage of Average Loans

|

0.12

|

%

|

0.09

|

%

|

0.14

|

%

|

|||||

|

Allowance for Loan Losses as a Percentage of Period-End Loans

|

0.97

|

%

|

1.02

|

%

|

1.10

|

%

|

|||||

|

Allowance for Loan Losses as a Percentage of Nonperforming Loans

|

309.31

|

%

|

232.24

|

%

|

200.41

|

%

|

|||||

|

Nonperforming Loans as a Percentage of Period-End Loans

|

0.31

|

%

|

0.44

|

%

|

0.55

|

%

|

|||||

|

Nonperforming Assets as a Percentage of Total Assets

|

0.28

|

%

|

0.36

|

%

|

0.37

|

%

|

|||||

|

Footnotes:

|

||||||||||||||||||||

|

1.

|

Share and Per Share Data have been restated for the September 29, 2016 3% stock dividend.

|

|||||||||||||||||||

|

2.

|

Tangible Book Value, Tangible Equity, and Return on Tangible Equity exclude goodwill and other intangible assets, net from total equity. These are non-GAAP financial measures which we believe provide investors with information that is useful in understanding our financial performance.

|

|||||||||||||||||||

|

12/31/2016

|

9/30/2016

|

6/30/2016

|

3/31/2016

|

12/31/2015

|

||||||||||||||||

|

Total Stockholders' Equity (GAAP)

|

$

|

232,852

|

|

$

|

229,208

|

|

$

|

225,373

|

|

$

|

220,703

|

|

$

|

213,971

|

|

|||||

|

Less: Goodwill and Other Intangible assets, net

|

24,569

|

|

24,675

|

|

24,758

|

|

24,872

|

|

24,980

|

|

||||||||||

|

Tangible Equity (Non-GAAP)

|

$

|

208,283

|

|

$

|

204,533

|

|

$

|

200,615

|

|

$

|

195,831

|

|

$

|

188,991

|

|

|||||

|

Period End Shares Outstanding

|

13,483

|

|

13,426

|

|

13,388

|

|

13,361

|

|

13,328

|

|

||||||||||

|

Tangible Book Value per Share (Non-GAAP)

|

$

|

15.45

|

|

$

|

15.23

|

|

$

|

14.98

|

|

$

|

14.66

|

|

$

|

14.18

|

|

|||||

|

Net Income

|

6,600

|

|

6,738

|

|

6,647

|

|

6,549

|

|

6,569

|

|

||||||||||

|

Return on Tangible Equity (Net Income/Tangible Equity - Annualized)

|

12.77

|

%

|

13.18

|

%

|

13.47

|

%

|

13.62

|

%

|

13.86

|

%

|

||||||||||

|

3.

|

Net Interest Margin is the ratio of our annualized tax-equivalent net interest income to average earning assets. This is also a non-GAAP financial measure which we believe provides investors with information that is useful in understanding our financial performance.

|

|||||||||||||||||||

|

12/31/2016

|

9/30/2016

|

6/30/2016

|

3/31/2016

|

12/31/2015

|

||||||||||||||||

|

Interest Income (GAAP)

|

$

|

19,770

|

|

$

|

19,282

|

|

$

|

19,237

|

|

$

|

18,626

|

|

$

|

18,510

|

|

|||||

|

Add: Tax Equivalent Adjustment (Non-GAAP)

|

939

|

|

940

|

|

917

|

|

923

|

|

912

|

|

||||||||||

|

Interest Income - Tax Equivalent (Non-GAAP)

|

$

|

20,709

|

|

$

|

20,222

|

|

$

|

20,154

|

|

$

|

19,549

|

|

$

|

19,422

|

|

|||||

|

Net Interest Income (GAAP)

|

$

|

18,366

|

|

$

|

17,877

|

|

$

|

17,953

|

|

$

|

17,363

|

|

$

|

17,279

|

|

|||||

|

Add: Tax-Equivalent adjustment (Non-GAAP)

|

939

|

|

940

|

|

917

|

|

923

|

|

912

|

|

||||||||||

|

Net Interest Income - Tax Equivalent (Non-GAAP)

|

$

|

19,305

|

|

$

|

18,817

|

|

$

|

18,870

|

|

$

|

18,286

|

|

$

|

18,191

|

|

|||||

|

Average Earning Assets

|

2,446,375

|

|

2,399,197

|

|

2,373,122

|

|

2,332,707

|

|

2,317,784

|

|

||||||||||

|

Net Interest Margin (Non-GAAP)

|

3.14

|

%

|

3.12

|

%

|

3.20

|

%

|

3.15

|

%

|

3.11

|

%

|

||||||||||

|

4.

|

Financial Institutions often use the "efficiency ratio", a non-GAAP ratio, as a measure of expense control. We believe the efficiency ratio provides investors with information that is useful in understanding our financial performance. We define our efficiency ratio as the ratio of our noninterest expense to our net gross income (which equals our tax-equivalent net interest income plus noninterest income, as adjusted).

|

|||||||||||||||||||

|

5.

|

For the current quarter, all of the regulatory capital ratios in the table above, as well as the Total Risk-Weighted Assets and Common Equity Tier 1 Capital amounts listed in the table below, are estimates based on, and calculated in accordance with bank regulatory capital rules. All prior quarters reflect actual results. The December 31, 2016 CET1 ratio listed in the tables (i.e., 12.92%) exceeds the sum of the required minimum CET1 ratio plus the fully phased-in Capital Conservation Buffer (i.e., 7.00%).

|

|||||||||||||||||||

|

12/31/2016

|

9/30/2016

|

6/30/2016

|

3/31/2016

|

12/31/2015

|

||||||||||||||||

|

Total Risk Weighted Assets

|

1,707,829

|

|

1,690,646

|

|

1,662,381

|

|

1,617,957

|

|

1,590,129

|

|

||||||||||

|

Common Equity Tier 1 Capital

|

221,472

|

|

216,382

|

|

211,801

|

|

207,777

|

|

203,848

|

|

||||||||||

|

Common Equity Tier 1 Ratio

|

12.97

|

%

|

12.80

|

%

|

12.74

|

%

|

12.84

|

%

|

12.82

|

%

|

||||||||||

|

◦

|

Commercial Loans:

These loans comprise approximately

6%

of our loan portfolio. The business sector in our service area, including small- and mid-sized businesses with headquarters in the area, continued to be in reasonably good financial condition at period-end, and some lines of business appear to be experiencing modest improvement during the year.

|

|

◦

|

Commercial Real Estate Loans:

These loans comprise approximately

25%

of our loan portfolio. Commercial property values in our region have remained stable in recent periods, although it should be noted such values did not show significant deterioration even in the worst phases of the financial crisis. We update the appraisals on our nonperforming and watched commercial properties as deemed necessary, usually when the loan is downgraded or when we perceive significant market deterioration since our last appraisal.

|

|

◦

|

Residential Real Estate Loans:

These loans, including home equity loans, make up approximately

39%

of our portfolio. We have not experienced any significant increase in our delinquency and foreclosure rates, primarily due to the fact that we not have originated or participated in underwriting high-risk mortgage loans, such as so called "Alt A," "negative amortization," "option ARM's" or "negative equity" loans. We originate all of the residential real estate loans held in our portfolio and apply conservative underwriting standards to all of our originations. The residential real estate market in our service area has been stable in recent periods. If long-term interest rates, which decreased during the second quarter of 2016 before rebounding modestly during the third quarter, do not increase significantly above their period-end levels, we may continue to experience a modest volume of mortgage refinancings. We typically sell a portion, sometimes a significant portion, of our residential real estate mortgage originations to the secondary market, although our sales of originations as a portion of our total originations have diminished somewhat in recent periods.

|

|

◦

|

Consumer Loans (Primarily Indirect Automobile Loans):

These loans comprise approximately

31%

of our loan portfolio. Throughout the past three years we did not experience any significant change in our level of charge-offs on these loans or in our overall average delinquency rate for automobile loans. Employment in our service area continues to expand modestly, and unemployment rates remain low, well off their post-crisis levels.

|

|

Years Ended December 31,

|

Change From Prior Year

|

||||||||||||||||||||||||

|

2015 to 2016

|

2014 to 2015

|

||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

Amount

|

%

|

Amount

|

%

|

|||||||||||||||||||

|

Interest and Dividend Income

|

$

|

80,636

|

|

$

|

74,227

|

|

$

|

70,188

|

|

$

|

6,409

|

|

8.6

|

%

|

$

|

4,039

|

|

5.8

|

%

|

||||||

|

Interest Expense

|

5,356

|

|

4,813

|

|

5,767

|

|

543

|

|

11.3

|

|

(954

|

)

|

(16.5

|

)

|

|||||||||||

|

Net Interest Income

|

$

|

75,280

|

|

$

|

69,414

|

|

$

|

64,421

|

|

$

|

5,866

|

|

8.5

|

|

$

|

4,993

|

|

7.8

|

|

||||||

|

2016 Compared to 2015 Change in Net Interest Income Due to:

|

2015 Compared to 2014 Change in Net Interest Income Due to:

|

||||||||||||||||||||||

|

Interest and Dividend Income:

|

Volume

|

Rate

|

Total

|

Volume

|

Rate

|

Total

|

|||||||||||||||||

|

Interest-Bearing Bank Balances

|

$

|

(26

|

)

|

$

|

85

|

|

$

|

59

|

|

$

|

12

|

|

$

|

2

|

|

$

|

14

|

|

|||||

|

Investment Securities:

|

|||||||||||||||||||||||

|

Fully Taxable

|

(199

|

)

|

88

|

|

(111

|

)

|

428

|

|

(337

|

)

|

91

|

|

|||||||||||

|

Exempt from Federal Taxes

|

306

|

|

91

|

|

397

|

|

(536

|

)

|

731

|

|

195

|

|

|||||||||||

|

Loans

|

6,808

|

|

(744

|

)

|

6,064

|

|

5,455

|

|

(1,716

|

)

|

3,739

|

|

|||||||||||

|

Total Interest and Dividend Income

|

6,889

|

|

(480

|

)

|

6,409

|

|

5,359

|

|

(1,320

|

)

|

4,039

|

|

|||||||||||

|

Interest Expense:

|

|||||||||||||||||||||||

|

Deposits:

|

|||||||||||||||||||||||

|

Interest-Bearing Checking Accounts

|

3

|

|

—

|

|

3

|

|

103

|

|

(549

|

)

|

(446

|

)

|

|||||||||||

|

Savings Deposits

|

86

|

|

104

|

|

190

|

|

50

|

|

(148

|

)

|

(98

|

)

|

|||||||||||

|

Time Deposits of $100,000 or More

|

60

|

|

37

|

|

97

|

|

(102

|

)

|

(312

|

)

|

(414

|

)

|

|||||||||||

|

Other Time Deposits

|

(38

|

)

|

(46

|

)

|

(84

|

)

|

(170

|

)

|

(442

|

)

|

(612

|

)

|

|||||||||||

|

Total Deposits

|

111

|

|

95

|

|

206

|

|

(119

|

)

|

(1,451

|

)

|

(1,570

|

)

|

|||||||||||

|

Short-Term Borrowings

|

182

|

|

83

|

|

265

|

|

44

|

|

17

|

|

61

|

|

|||||||||||

|

Long-Term Debt

|

203

|

|

(131

|

)

|

72

|

|

797

|

|

(242

|

)

|

555

|

|

|||||||||||

|

Total Interest Expense

|

496

|

|

47

|

|

543

|

|

722

|

|

(1,676

|

)

|

(954

|

)

|

|||||||||||

|

Net Interest Income

|

$

|

6,393

|

|

$

|

(527

|

)

|

$

|

5,866

|

|

$

|

4,637

|

|

$

|

356

|

|

$

|

4,993

|

|

|||||

|

Years Ended:

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||

|

Interest

|

Rate

|

Interest

|

Rate

|

Interest

|

Rate

|

|||||||||||||||||||||||||||

|

Average

|

Income/

|

Earned/

|

Average

|

Income/

|

Earned/

|

Average

|

Income/

|

Earned/

|

||||||||||||||||||||||||

|

Balance

|

Expense

|

Paid

|

Balance

|

Expense

|

Paid

|

Balance

|

Expense

|

Paid

|

||||||||||||||||||||||||

|

Interest-Bearing Deposits at

Banks

|

$

|

24,950

|

|

$

|

153

|

|

0.61

|

%

|

$

|

32,562

|

|

$

|

94

|

|

0.29

|

%

|

$

|

28,266

|

|

$

|

80

|

|

0.28

|

%

|

||||||||

|

Investment Securities:

|

||||||||||||||||||||||||||||||||

|

Fully Taxable

|

420,885

|

|

7,950

|

|

1.89

|

%

|

431,445

|

|

8,061

|

|

1.87

|

%

|

408,989

|

|

7,970

|

|

1.95

|

%

|

||||||||||||||

|

Exempt from Federal

Taxes

|

278,982

|

|

9,187

|

|

3.29

|

%

|

269,667

|

|

8,790

|

|

3.26

|

%

|

286,929

|

|

8,595

|

|

3.00

|

%

|

||||||||||||||

|

Loans

|

1,663,225

|

|

63,346

|

|

3.81

|

%

|

1,484,766

|

|

57,282

|

|

3.86

|

%

|

1,344,427

|

|

53,543

|

|

3.98

|

%

|

||||||||||||||

|

Total Earning Assets

|

2,388,042

|

|

80,636

|

|

3.38

|

%

|

2,218,440

|

|

74,227

|

|

3.35

|

%

|

2,068,611

|

|

70,188

|

|

3.39

|

%

|

||||||||||||||

|

Allowance for Loan Losses

|

(16,449

|

)

|

(15,595

|

)

|

(14,801

|

)

|

||||||||||||||||||||||||||

|

Cash and Due From Banks

|

33,207

|

|

31,007

|

|

30,383

|

|

||||||||||||||||||||||||||

|

Other Assets

|

108,845

|

|

107,615

|

|

106,287

|

|

||||||||||||||||||||||||||

|

Total Assets

|

$

|

2,513,645

|

|

$

|

2,341,467

|

|

$

|

2,190,480

|

|

|||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||||||||||

|

Interest-Bearing Checking Accounts

|

$

|

912,461

|

|

1,279

|

|

0.14

|

%

|

$

|

915,565

|

|

1,276

|

|

0.14

|

%

|

$

|

861,457

|

|

1,722

|

|

0.20

|

%

|

|||||||||||

|

Savings Deposits

|

616,208

|

|

931

|

|

0.15

|

%

|

554,330

|

|

741

|

|

0.13

|

%

|

521,595

|

|

839

|

|

0.16

|

%

|

||||||||||||||

|

Time Deposits of $100,000

Or More

|

69,489

|

|

453

|

|

0.65

|

%

|

59,967

|

|

356

|

|

0.59

|

%

|

70,475

|

|

770

|

|

1.09

|

%

|

||||||||||||||

|

Other Time Deposits

|

129,084

|

|

658

|

|

0.51

|

%

|

136,396

|

|

742

|

|

0.54

|

%

|

158,592

|

|

1,354

|

|

0.85

|

%

|

||||||||||||||

|

Total Interest-

Bearing Deposits

|

1,727,242

|

|

3,321

|

|

0.19

|

%

|

1,666,258

|

|

3,115

|

|

0.19

|

%

|

1,612,119

|

|

4,685

|

|

0.29

|

%

|

||||||||||||||

|

Short-Term Borrowings

|

94,109

|

|

393

|

|

0.42

|

%

|

45,595

|

|

128

|

|

0.28

|

%

|

29,166

|

|

67

|

|

0.23

|

%

|

||||||||||||||

|

FHLBNY Term Advances and

Other Long-Term Debt

|

75,000

|

|

1,642

|

|

2.19

|

%

|

66,014

|

|

1,570

|

|

2.38

|

%

|

34,000

|

|

1,015

|

|

2.99

|

%

|

||||||||||||||

|

Total Interest-

Bearing Liabilities

|

1,896,351

|

|

5,356

|

|

0.28

|

%

|

1,777,867

|

|

4,813

|

|

0.27

|

%

|

1,675,285

|

|

5,767

|

|

0.34

|

%

|

||||||||||||||

|

Demand Deposits

|

366,956

|

|

329,017

|

|

290,922

|

|

||||||||||||||||||||||||||

|

Other Liabilities

|

25,369

|

|

26,566

|

|

26,065

|

|

||||||||||||||||||||||||||

|

Total Liabilities

|

2,288,676

|

|

2,133,450

|

|

1,992,272

|

|

||||||||||||||||||||||||||

|

Stockholders’ Equity

|

224,969

|

|

208,017

|

|

198,208

|

|

||||||||||||||||||||||||||

|

Total Liabilities and

Stockholders’ Equity

|

$

|

2,513,645

|

|

$

|

2,341,467

|

|

$

|

2,190,480

|

|

|||||||||||||||||||||||

|

Net Interest Income

(Tax-equivalent Basis)

|

75,280

|

|

69,414

|

|

64,421

|

|

||||||||||||||||||||||||||

|

Reversal of Tax

Equivalent Adjustment

|

(3,721

|

)

|

0.16

|

%

|

(3,489

|

)

|

0.16

|

%

|

(3,327

|

)

|

0.16

|

%

|

||||||||||||||||||||

|

Net Interest Income

|

$

|

71,559

|

|

$

|

65,925

|

|

$

|

61,094

|

|

|||||||||||||||||||||||

|

Net Interest Spread

|

3.10

|

%

|

3.08

|

%

|

3.05

|

%

|

||||||||||||||||||||||||||

|

Net Interest Margin

|

3.15

|

%

|

3.13

|

%

|

3.11

|

%

|

||||||||||||||||||||||||||

|

YIELD ANALYSIS (Tax-equivalent basis)

|

December 31,

|

|||||||

|

2016

|

2015

|

2014

|

||||||

|

Yield on Earning Assets

|

3.38

|

%

|

3.35

|

%

|

3.39

|

%

|

||

|

Cost of Interest-Bearing Liabilities

|

0.28

|

|

0.27

|

|

0.34

|

|

||

|

Net Interest Spread

|

3.10

|

%

|

3.08

|

%

|

3.05

|

%

|

||

|

Net Interest Margin

|

3.15

|

%

|

3.13

|

%

|

3.11

|

%

|

||

|

Years Ended December 31,

|

Change From Prior Year

|

||||||||||||||||||||||||

|

2015 to 2016

|

2014 to 2015

|

||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

Amount

|

%

|

Amount

|

%

|

|||||||||||||||||||

|

Earning Assets

|

$

|

2,388,042

|

|

$

|

2,218,440

|

|

$

|

2,068,611

|

|

$

|

169,602

|

|

7.6

|

%

|

$

|

149,829

|

|

7.2

|

%

|

||||||

|

Interest-Bearing Liabilities

|

1,896,351

|

|

1,777,867

|

|

1,675,285

|

|

118,484

|

|

6.7

|

|

102,582

|

|

6.1

|

|

|||||||||||

|

Demand Deposits

|

366,956

|

|

329,017

|

|

290,922

|

|

37,939

|

|

11.5

|

|

38,095

|

|

13.1

|

|

|||||||||||

|

Total Assets

|

2,513,645

|

|

2,341,467

|

|

2,190,480

|

|

172,178

|

|

7.4

|

|

150,987

|

|

6.9

|

|

|||||||||||

|

Earning Assets to Total Assets

|

95.00

|

%

|

94.75

|

%

|

94.44

|

%

|

|||||||||||||||||||

|

Years-Ended December 31,

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Period-End Loans

|

$

|

1,753,268

|

|

$

|

1,573,952

|

|

$

|

1,413,268

|

|

$

|

1,266,472

|

|

$

|

1,172,341

|

|

||||

|

Average Loans

|

1,663,225

|

|

1,484,766

|

|

1,344,427

|

|

1,208,954

|

|

1,147,286

|

|

|||||||||

|

Period-End Assets

|

2,605,242

|

|

2,446,188

|

|

2,217,420

|

|

2,163,698

|

|

2,022,796

|

|

|||||||||

|

Nonperforming Assets, at Period-End:

|

|||||||||||||||||||

|

Nonaccrual Loans:

|

|||||||||||||||||||

|

Commercial Real Estate

|

875

|

|

2,402

|

|

2,071

|

|

2,048

|

|

2,026

|

|

|||||||||

|

Commercial Loans

|

155

|

|

387

|

|

473

|

|

352

|

|

1,787

|

|

|||||||||

|

Residential Real Estate Loans

|

2,574

|

|

3,195

|

|

3,940

|

|

3,860

|

|

2,400

|

|

|||||||||

|

Consumer Loans

|

589

|

|

449

|

|

415

|

|

219

|

|

420

|

|

|||||||||

|

Total Nonaccrual Loans

|

4,193

|

|

6,433

|

|

6,899

|

|

6,479

|

|

6,633

|

|

|||||||||

|

Loans Past Due 90 or More Days and

|

|||||||||||||||||||

|

Still Accruing Interest

|

1,201

|

|

187

|

|

537

|

|

652

|

|

920

|

|

|||||||||

|

Restructured

|

106

|

|

286

|

|

333

|

|

641

|

|

483

|

|

|||||||||

|

Total Nonperforming Loans

|

5,500

|

|

6,906

|

|

7,769

|

|

7,772

|

|

8,036

|

|

|||||||||

|

Repossessed Assets

|

101

|

|

140

|

|

81

|

|

63

|

|

64

|

|

|||||||||

|

Other Real Estate Owned

|

1,585

|

|

1,878

|

|

312

|

|

81

|

|

970

|

|

|||||||||

|

Total Nonperforming Assets

|

$

|

7,186

|

|

$

|

8,924

|

|

$

|

8,162

|

|

$

|

7,916

|

|

$

|

9,070

|

|

||||

|

Allowance for Loan Losses:

|

|||||||||||||||||||

|

Balance at Beginning of Period

|

$

|

16,038

|

|

$

|

15,570

|

|

$

|

14,434

|

|

$

|

15,298

|

|

$

|

15,003

|

|

||||

|

Loans Charged-off:

|