|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

New York

|

11-1806155

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification Number)

|

|

|

|

|

7459 S. Lima Street, Englewood, Colorado

|

80112

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $1 par value

|

New York Stock Exchange

|

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

PART I

|

|||

|

|

Item 1.

|

Business.

|

3

|

|

|

Item 1A.

|

Risk Factors.

|

9

|

|

|

Item 1B.

|

Unresolved Staff Comments.

|

15

|

|

|

Item 2.

|

Properties.

|

15

|

|

|

Item 3.

|

Legal Proceedings.

|

15

|

|

|

|||

|

PART II

|

|||

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

18

|

|

|

Item 6.

|

Selected Financial Data.

|

21

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

23

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

38

|

|

|

Item 8.

|

Financial Statements and Supplementary Data.

|

40

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

83

|

|

|

|

Item 9A.

|

Controls and Procedures.

|

83

|

|

|

Item 9B.

|

Other Information.

|

85

|

|

|

|||

|

PART III

|

|||

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

86

|

|

|

Item 11.

|

Executive Compensation.

|

86

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

86

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

86

|

|

|

Item 14.

|

Principal Accounting Fees and Services.

|

86

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules.

|

87

|

|

|

Signatures

|

95

|

||

|

•

|

In December 2009, it acquired A.E. Petsche Company, Inc. ("Petsche"), a leading provider of interconnect products, including specialty wire, cable, and harness management solutions, to the aerospace and defense market. This acquisition expanded the company's product offerings in specialty wire and cable and provided a variety of cross-selling opportunities with the company's existing business as well as other emerging markets.

|

|

•

|

In April 2010, it acquired Verical Incorporated ("Verical"), an ecommerce business geared towards meeting the end-of-life components and parts shortage needs of customers. This acquisition strengthened the company's ecommerce capabilities.

|

|

•

|

In June 2010, it acquired PCG Parent Corp., doing business as Converge ("Converge"), a global provider of reverse logistics services. This acquisition builds on the company's global capabilities as a supply chain and logistics leader.

|

|

•

|

In August 2010, it acquired Transim Technology Corporation ("Transim"), a service provider of online component design and engineering solutions for technology manufacturers. This acquisition builds on the company's service offerings and diversifies the company into markets that complement its existing businesses.

|

|

•

|

In October 2010, it acquired Eshel Technology Group, Inc. ("ETG"), a solid-state lighting distributor and value-added service provider. This acquisition expands the company's portfolio and builds on its strategic capabilities, such as value-added services.

|

|

•

|

In December 2010, it acquired all of the assets and operations of INT Holdings, LLC, doing business as Intechra ("Intechra"), a leading EAD company, offering comprehensive, end-to-end services. This acquisition expands the company's EAD services portfolio and aligns with the company's strategy to provide comprehensive services across the entire product lifecycle.

|

|

•

|

In January 2011, it acquired Nu Horizons Electronics Corp. ("Nu Horizons"), a leading global distributor of advanced technology semiconductor, display, illumination, and power solutions to a wide variety of commercial OEMs and electronic manufacturing services providers. This acquisition builds on the company's strategy to expand its global capabilities, particularly in the Asia Pacific region.

|

|

•

|

In March 2011, it acquired all of the assets and operations of the RF, Wireless and Power Division ("RFPD") of Richardson Electronics, Ltd. ("Richardson"). Richardson RFPD is a leading value-added global component distributor and provider of engineered solutions serving the global radio frequency and wireless communications market. This acquisition supports the company's strategy to expand its portfolio of products, as well as expand its global capabilities, particularly in the Asia Pacific region.

|

|

•

|

In April 2011, it acquired Pansystem S.r.l. ("Pansystem"), a distributor of high-performance wire, cable and interconnect products serving the aerospace and defense market in Italy. This acquisition increases the company's presence and strength in the Italy market, one of the largest wire and cable market opportunities in Europe.

|

|

•

|

In September 2011, it acquired Chip One Stop, Inc. ("C1S"). Through its online portal, C1S provides a comprehensive offering of electronic components to design engineers across Japan. This acquisition significantly enhances the company's ecommerce presence and expands the company's reach in Japan, one of the largest electronics markets in the world.

|

|

•

|

In December 2011, it acquired Flection Group, B.V. ("Flection"), a provider of EAD services in Europe. This acquisition builds on the company's strategy to provide comprehensive services across the entire technology product lifecycle.

|

|

•

|

Effective January 1, 2012, it acquired all of the assets and operations of the distribution business of Seed International Ltd., a value-added distributor of embedded products in China. This acquisition expands the company’s presence in the Asia Pacific region and strengthens the company’s relationship with Texas Instruments, a key supplier.

|

|

•

|

On January 18, 2012, it announced an agreement to acquire TechTurn, Ltd., a leading provider of EAD services that specializes in the processing and sale of technology devices that are returned or recycled from businesses and consumers. This acquisition will strengthen our existing portfolio of services and is a continuation of the company's global strategy to expand into faster growing services that span the full life cycle of technology and complement the company's core businesses. This acquisition is subject to customary regulatory approvals and is expected to be completed in the first quarter of 2012.

|

|

•

|

In June 2010, it acquired Sphinx Group Limited ("Sphinx"), a United Kingdom-based value-added distributor of security and networking products. This acquisition increased the global ECS business segment's scale in Europe and expertise in the high-growth security and networking information technology markets.

|

|

•

|

In September 2010, it acquired Shared Technologies Inc. ("Shared"), which sells, installs, and maintains communications equipment in North America, including the latest in unified communications, voice and data technologies, contact center, network security, and traditional telephony. This acquisition builds on the company's strategy to diversify into profitable, fast-growing markets that complement its existing businesses and to continue expanding its portfolio of products and services.

|

|

•

|

In December 2010, it acquired Diasa Informática, S.A. ("Diasa"), a leading European value-added distributor of servers, storage, software, and networking products in Spain and Portugal. This acquisition complements the company's existing portfolio of hardware and storage offerings and also broadens its line card with key suppliers in the EMEA region.

|

|

•

|

In May 2011, it acquired Cross Telecom Corporation ("Cross"), a North American service provider of converged and Internet protocol technologies and unified communications

.

This acquisition continues the company's global strategy to expand into faster growing, high-margin services that complement the company's core businesses.

|

|

•

|

In August 2011, it acquired the North American IT consulting and professional services division of InScope International, Inc. and INSI Technology Innovation, Inc. (collectively "InScope"). InScope provides managed services, enterprise storage management, IT virtualization, disaster recovery, data center migration and consolidation, and cloud computing services. This acquisition expands the company's capabilities and scale with NetApp Inc., an important storage supplier. In addition, it expands the company's knowledge and depth in the growing area of cloud computing infrastructures and services.

|

|

•

|

In September 2011, it acquired LWP GmbH ("LWP"), a value-added distributor of computing solutions and services in Germany. This acquisition increases the company's presence and strength in the German market as well as strengthening the company's portfolio by expanding the company's European relationship with Citrix Systems, Inc.

|

|

Name

|

Age

|

Position

|

|

Michael J. Long

|

53

|

Chairman, President, and Chief Executive Officer

|

|

Peter S. Brown

|

61

|

Senior Vice President, General Counsel, and Secretary

|

|

Andrew S. Bryant

|

56

|

President, Arrow Global Enterprise Computing Solutions

|

|

Peter T. Kong

|

61

|

President, Arrow Global Components

|

|

Vincent P. Melvin

|

48

|

Vice President, Chief Information Officer

|

|

M. Catherine Morris

|

53

|

Senior Vice President, Chief Strategy Officer

|

|

Paul J. Reilly

|

55

|

Executive Vice President, Finance and Operations, and Chief Financial Officer

|

|

Gretchen K. Zech

|

42

|

Senior Vice President, Human Resources

|

|

•

|

grant liens on assets;

|

|

•

|

make restricted payments (including paying dividends on capital stock or redeeming or repurchasing capital stock);

|

|

•

|

make investments;

|

|

•

|

merge, consolidate, or transfer all or substantially all of its assets;

|

|

•

|

incur additional debt; or

|

|

•

|

engage in certain transactions with affiliates.

|

|

•

|

import and export regulations that could erode profit margins or restrict exports;

|

|

•

|

the burden and cost of compliance with international laws, treaties, and technical standards and changes in those regulations;

|

|

•

|

potential restrictions on transfers of funds;

|

|

•

|

import and export duties and value-added taxes;

|

|

•

|

transportation delays and interruptions;

|

|

•

|

uncertainties arising from local business practices and cultural considerations;

|

|

•

|

enforcement of the Foreign Corrupt Practices Act, or similar laws of other jurisdictions;

|

|

•

|

foreign laws that potentially discriminate against companies which are headquartered outside that jurisdiction;

|

|

•

|

recent volatility associated with sovereign debt of certain international economies;

|

|

•

|

potential military conflicts and political risks; and

|

|

•

|

currency fluctuations, which the company attempts to minimize through traditional hedging instruments.

|

|

•

|

problems combining the acquired operations, technologies, or products;

|

|

•

|

unanticipated costs or assumed liabilities, including those associated with regulatory actions or investigations;

|

|

•

|

diversion of management's attention;

|

|

•

|

negative effects on existing customer and supplier relationships; and

|

|

•

|

potential loss of key employees, especially those of the acquired companies.

|

|

•

|

result in substantial cost to the company;

|

|

•

|

divert management's attention and resources;

|

|

•

|

be time consuming to defend;

|

|

•

|

result in substantial damage awards; or

|

|

•

|

cause product shipment delays.

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

.

|

|

Year

|

High

|

Low

|

||||||

|

2011:

|

||||||||

|

Fourth Quarter

|

$

|

38.66

|

|

$

|

25.71

|

|

||

|

Third Quarter

|

42.14

|

|

27.39

|

|

||||

|

Second Quarter

|

47.50

|

|

36.21

|

|

||||

|

First Quarter

|

42.90

|

|

34.08

|

|

||||

|

2010:

|

||||||||

|

Fourth Quarter

|

$

|

34.99

|

|

$

|

25.84

|

|

||

|

Third Quarter

|

27.66

|

|

21.76

|

|

||||

|

Second Quarter

|

32.50

|

|

21.79

|

|

||||

|

First Quarter

|

30.85

|

|

25.80

|

|

||||

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

|

Weighted Average Exercise Price of Outstanding Options, Warrants and Rights

|

Number of Securities Remaining Available for Future Issuance

|

|||||||

|

Equity compensation plans approved by security holders

|

6,031,965

|

|

$

|

29.68

|

|

7,602,876

|

|

|||

|

Equity compensation plans not approved by security holders

|

—

|

|

—

|

|

—

|

|

||||

|

Total

|

6,031,965

|

|

$

|

29.68

|

|

7,602,876

|

|

|||

|

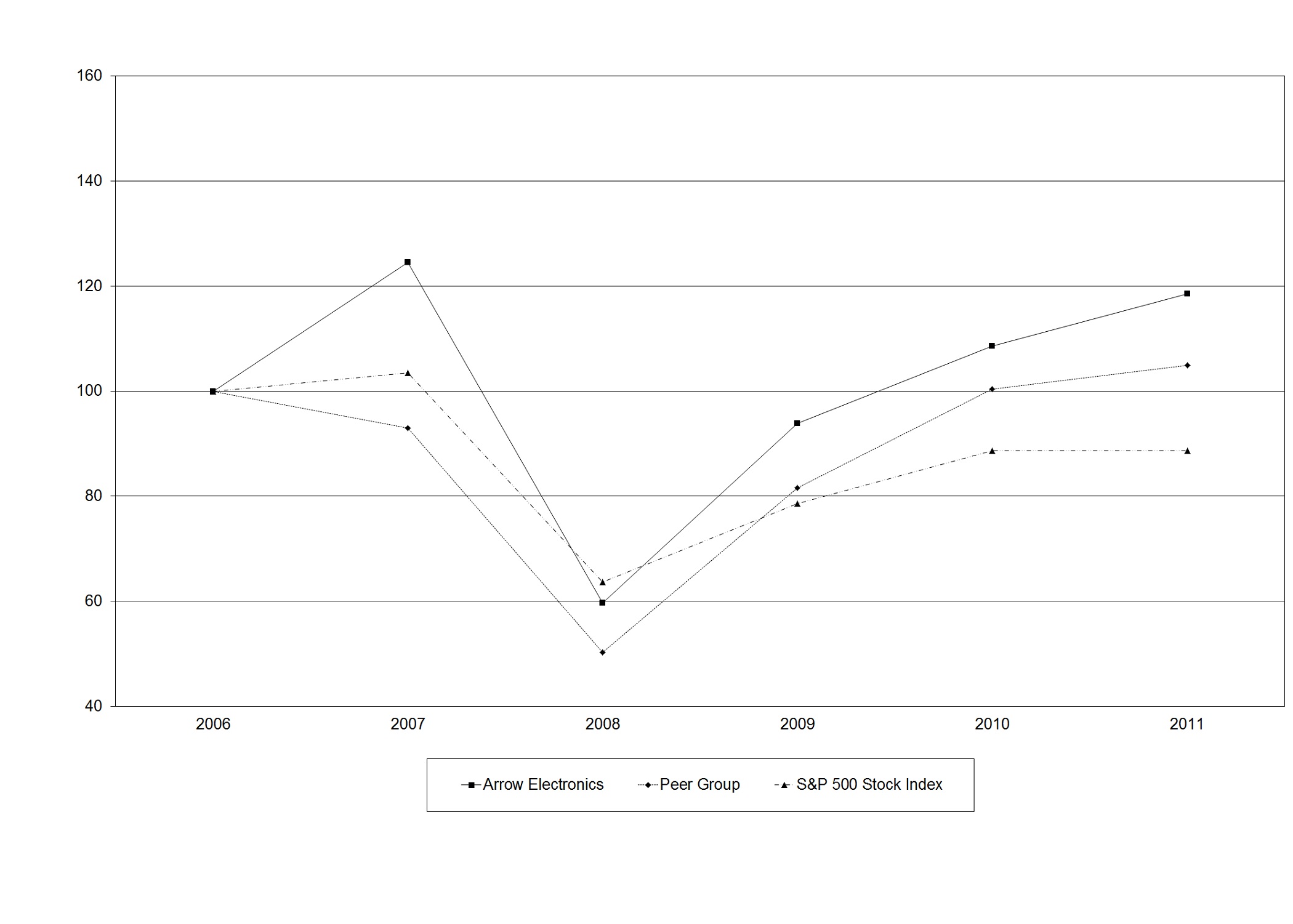

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

|

Arrow Electronics

|

100

|

125

|

60

|

94

|

109

|

119

|

|

Peer Group

|

100

|

93

|

50

|

82

|

100

|

105

|

|

S&P 500 Stock Index

|

100

|

104

|

64

|

79

|

89

|

89

|

|

Month

|

Total

Number of

Shares

Purchased

(a)

|

Average

Price Paid

per Share

|

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Program

(b)

|

Approximate

Dollar Value of

Shares that May

Yet be

Purchased

Under the

Program

|

||||||||||

|

October 2 through 31, 2011

|

2,047

|

|

$

|

37.77

|

|

—

|

|

$

|

150,300,608

|

|

||||

|

November 1 through 30, 2011

|

2,843

|

|

34.51

|

|

—

|

|

150,300,608

|

|

||||||

|

December 1 through 31, 2011

|

1,902

|

|

35.48

|

|

—

|

|

150,300,608

|

|

||||||

|

Total

|

6,792

|

|

|

|

—

|

|

|

|

||||||

|

(a)

|

Includes share repurchases under the 2011 Share-Repurchase Programs and those associated with shares withheld from employees for stock-based awards, as permitted by the Omnibus Incentive Plan, in order to satisfy the required tax withholding obligations.

|

|

(b)

|

The difference between the "total number of shares purchased" and the "total number of shares purchased as part of publicly announced program" for the quarter ended

December 31, 2011

is

6,792

shares, which relate to shares withheld from employees for stock-based awards, as permitted by the Omnibus Incentive Plan, in order to satisfy the required tax withholding obligations. The purchase of these shares were not made pursuant to any publicly announced repurchase plan.

|

|

For the years ended December 31:

|

2011

(a)

|

2010

(b)

|

2009

(c)

|

2008

(d)

|

2007

(e)

|

||||||||||||||

|

Sales

|

$

|

21,390,264

|

|

$

|

18,744,676

|

|

$

|

14,684,101

|

|

$

|

16,761,009

|

|

$

|

15,984,992

|

|

||||

|

Operating income (loss)

|

$

|

908,843

|

|

$

|

750,775

|

|

$

|

272,787

|

|

$

|

(493,569

|

)

|

$

|

686,905

|

|

||||

|

Net income (loss) attributable to shareholders

|

$

|

598,810

|

|

$

|

479,630

|

|

$

|

123,512

|

|

$

|

(613,739

|

)

|

$

|

407,792

|

|

||||

|

Net income (loss) per share:

|

|||||||||||||||||||

|

Basic

|

$

|

5.25

|

|

$

|

4.06

|

|

$

|

1.03

|

|

$

|

(5.08

|

)

|

$

|

3.31

|

|

||||

|

Diluted

|

$

|

5.17

|

|

$

|

4.01

|

|

$

|

1.03

|

|

$

|

(5.08

|

)

|

$

|

3.28

|

|

||||

|

At December 31:

|

|||||||||||||||||||

|

Accounts receivable and inventories

|

$

|

6,446,027

|

|

$

|

6,011,823

|

|

$

|

4,533,809

|

|

$

|

4,713,849

|

|

$

|

4,961,035

|

|

||||

|

Total assets

|

9,829,079

|

|

9,600,538

|

|

7,762,366

|

|

7,118,285

|

|

8,059,860

|

|

|||||||||

|

Long-term debt

|

1,927,823

|

|

1,761,203

|

|

1,276,138

|

|

1,223,985

|

|

1,223,337

|

|

|||||||||

|

Shareholders' equity

|

3,668,812

|

|

3,251,195

|

|

2,916,960

|

|

2,676,698

|

|

3,551,860

|

|

|||||||||

|

(a)

|

Operating income and net income attributable to shareholders include restructuring, integration, and other charges of

$37.8 million

(

$28.1 million

net of related taxes or

$.25

and

$.24

per share on a basic and diluted basis, respectively) and a charge of

$5.9 million

(

$3.6 million

net of related taxes or $

.03

per share on both a basic and diluted basis) related to the settlement of a legal matter. Net income attributable to shareholders also includes a gain on bargain purchase of

$1.1 million

(

$.7 million

net of related taxes or $

.01

per share on both a basic and diluted basis), a loss on prepayment of debt of

$.9 million

(

$.5 million

net of related taxes), and a net reduction in the provision for income taxes of

$28.9 million

(

$.25

per share on both a basic and diluted basis) principally due to a reversal of a valuation allowance on certain international deferred tax assets.

|

|

(b)

|

Operating income and net income attributable to shareholders include restructuring, integration, and other charges of $

33.5 million

($

24.6 million

net of related taxes or $

.21

per share on both a basic and diluted basis). Net income attributable to shareholders also includes a loss on prepayment of debt of $

1.6 million

($

1.0 million

net of related taxes or $

.01

per share on both a basic and diluted basis), as well as a net reduction of the provision for income taxes of $

9.4 million

($

.08

per share on both a basic and diluted basis) and a reduction of interest expense of $

3.8 million

($

2.3 million

net of related taxes or $

.02

per share on both a basic and diluted basis) primarily related to the settlement of certain income tax matters covering multiple years.

|

|

(c)

|

Operating income and net income attributable to shareholders include restructuring, integration, and other charges of $

105.5 million

($

75.7 million

net of related taxes or $

.63

per share on both a basic and diluted basis). Net income attributable to shareholders also includes a loss on prepayment of debt of $

5.3 million

($

3.2 million

net of related taxes or $

.03

per share on both a basic and diluted basis).

|

|

(d)

|

Operating loss and net loss attributable to shareholders include a non-cash impairment charge associated with goodwill of $

1.02 billion

($

905.1 million

net of related taxes or $

7.49

per share on both a basic and diluted basis) and restructuring, integration, and other charges of $

81.0 million

($

61.9 million

net of related taxes or $

.51

per share on both a basic and diluted basis). Net loss attributable to shareholders also includes a loss of $

10.0 million

($

.08

per share on both a basic and diluted basis) on the write-down of an investment, as well as a reduction of the provision for income taxes of $

8.5 million

($

.07

per share on both a basic and diluted basis) and an increase in interest expense of $

1.0 million

($

1.0 million

net of related taxes or $

.01

per share on both a basic and diluted basis) primarily related to the settlement of certain international income tax matters covering multiple years.

|

|

(e)

|

Operating income and net income attributable to shareholders include restructuring, integration, and other charges of $

11.7 million

($

7.0 million

net of related taxes or $

.06

per share on both a basic and diluted basis). Net income attributable to shareholders also includes an income tax benefit of $

6.0 million

, net, ($

.05

per share on both a basic and diluted basis) principally due to a reduction in deferred income taxes as a result of the statutory tax rate change in Germany.

|

|

•

|

restructuring, integration, and other charges of

$37.8 million

(

$28.1 million

net of related taxes) in

2011

and

$33.5 million

(

$24.6 million

net of related taxes) in

2010

;

|

|

•

|

a charge of

$5.9 million

(

$3.6 million

net of related taxes) related to the settlement of a legal matter in

2011

;

|

|

•

|

a gain on bargain purchase of

$1.1 million

(

$.7 million

net of related taxes) in

2011

;

|

|

•

|

a loss on prepayment of debt of

$.9 million

(

$.5 million

net of related taxes) in 2011 and

$1.6 million

(

$1.0 million

net of related taxes) in

2010

;

|

|

•

|

a net reduction in the provision for income taxes of

$28.9 million

principally due to a reversal of a valuation allowance on certain international deferred tax assets in 2011; and

|

|

•

|

a net reduction of the provision for income taxes of $9.4 million and a reduction in interest expense of $3.8 million ($2.3 million net of related taxes) primarily related to the settlement of certain income tax matters in 2010 covering multiple years.

|

|

|

2011

|

2010

|

% Change

|

||||||||

|

Global components

|

$

|

14,854

|

|

$

|

13,169

|

|

12.8

|

%

|

|||

|

Global ECS

|

6,536

|

|

5,576

|

|

17.2

|

%

|

|||||

|

Consolidated

|

$

|

21,390

|

|

$

|

18,745

|

|

14.1

|

%

|

|||

|

2010

|

2009

|

% Change

|

|||||||||

|

Global components

|

$

|

13,169

|

|

$

|

9,751

|

|

35.0

|

%

|

|||

|

Global ECS

|

5,576

|

|

4,933

|

|

13.0

|

%

|

|||||

|

Consolidated

|

$

|

18,745

|

|

$

|

14,684

|

|

27.7

|

%

|

|||

|

Within 1 Year

|

1-3 Years

|

4-5 Years

|

After 5 Years

|

Total

|

|||||||||||||||

|

Debt

|

$

|

33,417

|

|

$

|

647,339

|

|

$

|

334,535

|

|

$

|

945,752

|

|

$

|

1,961,043

|

|

||||

|

Interest on long-term debt

|

96,758

|

|

158,525

|

|

127,954

|

|

281,990

|

|

665,227

|

|

|||||||||

|

Capital leases

|

426

|

|

174

|

|

19

|

|

4

|

|

623

|

|

|||||||||

|

Operating leases

|

61,749

|

|

82,494

|

|

38,690

|

|

26,555

|

|

209,488

|

|

|||||||||

|

Purchase obligations (a)

|

2,372,162

|

|

27,002

|

|

2,594

|

|

—

|

|

2,401,758

|

|

|||||||||

|

Other (b)

|

15,093

|

|

16,520

|

|

11,260

|

|

4,225

|

|

47,098

|

|

|||||||||

|

$

|

2,579,605

|

|

$

|

932,054

|

|

$

|

515,052

|

|

$

|

1,258,526

|

|

$

|

5,285,237

|

|

|||||

|

(a)

|

Amounts represent an estimate of non-cancelable inventory purchase orders and other contractual obligations related to information technology and facilities as of

December 31, 2011

. Most of the company's inventory purchases are pursuant to authorized distributor agreements, which are typically cancelable by either party at any time or on short notice, usually within a few months.

|

|

(b)

|

Includes estimates of contributions required to meet the requirements of several defined benefit plans. Amounts are subject to change based upon the performance of plan assets, as well as the discount rate used to determine the obligation. The company does not anticipate having to make required contributions to the plans beyond

2018

. Also included are amounts relating to personnel, facilities, and certain other costs resulting from restructuring and integration activities.

|

|

•

|

broad economic factors impacting the investee's industry;

|

|

•

|

publicly available forecasts for sales and earnings growth for the industry and investee; and

|

|

•

|

the cyclical nature of the investee's industry.

|

|

Years Ended December 31,

|

||||||||||||

|

|

2011

|

2010

|

2009

|

|||||||||

|

Sales

|

$

|

21,390,264

|

|

$

|

18,744,676

|

|

$

|

14,684,101

|

|

|||

|

Costs and expenses:

|

|

|

||||||||||

|

Cost of sales

|

18,441,661

|

|

16,326,069

|

|

12,933,207

|

|

||||||

|

Selling, general and administrative expenses

|

1,892,592

|

|

1,556,986

|

|

1,305,566

|

|

||||||

|

Depreciation and amortization

|

103,482

|

|

77,352

|

|

67,027

|

|

||||||

|

Restructuring, integration, and other charges

|

37,811

|

|

33,494

|

|

105,514

|

|

||||||

|

Settlement of legal matter

|

5,875

|

|

—

|

|

—

|

|

||||||

|

|

20,481,421

|

|

17,993,901

|

|

14,411,314

|

|

||||||

|

Operating income

|

908,843

|

|

750,775

|

|

272,787

|

|

||||||

|

Equity in earnings of affiliated companies

|

6,736

|

|

6,369

|

|

4,731

|

|

||||||

|

Gain on bargain purchase

|

1,088

|

|

—

|

|

—

|

|

||||||

|

Loss on prepayment of debt

|

895

|

|

1,570

|

|

5,312

|

|

||||||

|

Interest and other financing expense, net

|

105,971

|

|

76,571

|

|

83,285

|

|

||||||

|

Income before income taxes

|

809,801

|

|

679,003

|

|

188,921

|

|

||||||

|

Provision for income taxes

|

210,485

|

|

199,378

|

|

65,416

|

|

||||||

|

Consolidated net income

|

599,316

|

|

479,625

|

|

123,505

|

|

||||||

|

Noncontrolling interests

|

506

|

|

(5

|

)

|

(7

|

)

|

||||||

|

Net income attributable to shareholders

|

$

|

598,810

|

|

$

|

479,630

|

|

$

|

123,512

|

|

|||

|

Net income per share:

|

|

|

||||||||||

|

Basic

|

$

|

5.25

|

|

$

|

4.06

|

|

$

|

1.03

|

|

|||

|

Diluted

|

$

|

5.17

|

|

$

|

4.01

|

|

$

|

1.03

|

|

|||

|

Average number of shares outstanding:

|

|

|

||||||||||

|

Basic

|

114,025

|

|

117,997

|

|

119,800

|

|

||||||

|

Diluted

|

115,932

|

|

119,577

|

|

120,489

|

|

||||||

|

December 31,

|

||||||||

|

|

2011

|

2010

|

||||||

|

ASSETS

|

|

|

||||||

|

Current assets:

|

|

|

||||||

|

Cash and cash equivalents

|

$

|

396,887

|

|

$

|

926,321

|

|

||

|

Accounts receivable, net

|

4,482,117

|

|

4,102,870

|

|

||||

|

Inventories

|

1,963,910

|

|

1,908,953

|

|

||||

|

Other current assets

|

181,677

|

|

147,690

|

|

||||

|

Total current assets

|

7,024,591

|

|

7,085,834

|

|

||||

|

Property, plant and equipment, at cost:

|

|

|

|

|

||||

|

Land

|

23,790

|

|

24,213

|

|

||||

|

Buildings and improvements

|

147,215

|

|

136,732

|

|

||||

|

Machinery and equipment

|

934,558

|

|

863,773

|

|

||||

|

|

1,105,563

|

|

1,024,718

|

|

||||

|

Less: Accumulated depreciation and amortization

|

(549,334

|

)

|

(519,178

|

)

|

||||

|

Property, plant and equipment, net

|

556,229

|

|

505,540

|

|

||||

|

Investments in affiliated companies

|

60,579

|

|

59,455

|

|

||||

|

Intangible assets, net

|

392,763

|

|

310,847

|

|

||||

|

Cost in excess of net assets of companies acquired

|

1,473,333

|

|

1,336,351

|

|

||||

|

Other assets

|

321,584

|

|

302,511

|

|

||||

|

Total assets

|

$

|

9,829,079

|

|

$

|

9,600,538

|

|

||

|

LIABILITIES AND EQUITY

|

|

|

|

|

||||

|

Current liabilities:

|

|

|

|

|

||||

|

Accounts payable

|

$

|

3,264,088

|

|

$

|

3,644,988

|

|

||

|

Accrued expenses

|

660,996

|

|

637,045

|

|

||||

|

Short-term borrowings, including current portion of long-term debt

|

33,843

|

|

61,210

|

|

||||

|

Total current liabilities

|

3,958,927

|

|

4,343,243

|

|

||||

|

Long-term debt

|

1,927,823

|

|

1,761,203

|

|

||||

|

Other liabilities

|

267,069

|

|

244,897

|

|

||||

|

Equity:

|

|

|

|

|

||||

|

Shareholders' equity:

|

|

|

|

|

||||

|

Common stock, par value $1:

|

|

|

|

|

||||

|

Authorized - 160,000 shares in 2011 and 2010

|

|

|

|

|

||||

|

Issued - 125,382 and 125,337 shares in 2011 and 2010, respectively

|

125,382

|

|

125,337

|

|

||||

|

Capital in excess of par value

|

1,076,275

|

|

1,063,461

|

|

||||

|

Treasury stock (13,568 and 10,690 shares in 2011 and 2010, respectively), at cost

|

(434,959

|

)

|

(318,494

|

)

|

||||

|

Retained earnings

|

2,772,957

|

|

2,174,147

|

|

||||

|

Foreign currency translation adjustment

|

158,550

|

|

207,914

|

|

||||

|

Other

|

(29,393

|

)

|

(1,170

|

)

|

||||

|

Total shareholders' equity

|

3,668,812

|

|

3,251,195

|

|

||||

|

Noncontrolling interests

|

6,448

|

|

—

|

|

||||

|

Total equity

|

3,675,260

|

|

3,251,195

|

|

||||

|

Total liabilities and equity

|

$

|

9,829,079

|

|

$

|

9,600,538

|

|

||

|

|

Years Ended December 31,

|

|||||||||||

|

|

2011

|

2010

|

2009

|

|||||||||

|

Cash flows from operating activities:

|

|

|||||||||||

|

Consolidated net income

|

$

|

599,316

|

|

$

|

479,625

|

|

$

|

123,505

|

|

|||

|

Adjustments to reconcile consolidated net income to net cash provided by operations:

|

|

|||||||||||

|

Depreciation and amortization

|

103,482

|

|

77,352

|

|

67,027

|

|

||||||

|

Amortization of stock-based compensation

|

39,225

|

|

34,613

|

|

33,017

|

|

||||||

|

Equity in earnings of affiliated companies

|

(6,736

|

)

|

(6,369

|

)

|

(4,731

|

)

|

||||||

|

Deferred income taxes

|

(11,377

|

)

|

17,133

|

|

19,313

|

|

||||||

|

Restructuring, integration, and other charges

|

28,054

|

|

24,605

|

|

75,720

|

|

||||||

|

Settlement of legal matter

|

3,609

|

|

—

|

|

—

|

|

||||||

|

Non-cash impact of tax matters

|

—

|

|

(11,716

|

)

|

—

|

|

||||||

|

Excess tax benefits from stock-based compensation arrangements

|

(7,956

|

)

|

(1,922

|

)

|

1,731

|

|

||||||

|

Other

|

700

|

|

3,302

|

|

5,541

|

|

||||||

|

Change in assets and liabilities, net of effects of acquired businesses:

|

|

|||||||||||

|

Accounts receivable

|

(193,492

|

)

|

(805,637

|

)

|

2,302

|

|

||||||

|

Inventories

|

105,150

|

|

(497,294

|

)

|

286,626

|

|

||||||

|

Accounts payable

|

(465,603

|

)

|

799,142

|

|

304,295

|

|

||||||

|

Accrued expenses

|

(74,236

|

)

|

88,675

|

|

(92,587

|

)

|

||||||

|

Other assets and liabilities

|

747

|

|

19,263

|

|

28,096

|

|

||||||

|

Net cash provided by operating activities

|

120,883

|

|

220,772

|

|

849,855

|

|

||||||

|

Cash flows from investing activities:

|

|

|||||||||||

|

Cash consideration paid for acquired businesses

|

(532,568

|

)

|

(587,087

|

)

|

(170,064

|

)

|

||||||

|

Acquisition of property, plant and equipment

|

(113,941

|

)

|

(112,254

|

)

|

(121,516

|

)

|

||||||

|

Proceeds from sale of properties

|

—

|

|

16,971

|

|

1,153

|

|

||||||

|

Other

|

—

|

|

—

|

|

(272

|

)

|

||||||

|

Net cash used for investing activities

|

(646,509

|

)

|

(682,370

|

)

|

(290,699

|

)

|

||||||

|

Cash flows from financing activities:

|

|

|||||||||||

|

Change in short-term and other borrowings

|

(6,172

|

)

|

9,775

|

|

(48,144

|

)

|

||||||

|

Proceeds from long-term bank borrowings, net

|

354,000

|

|

—

|

|

—

|

|

||||||

|

Repayment of bank term loan

|

(200,000

|

)

|

—

|

|

—

|

|

||||||

|

Net proceeds from note offering

|

—

|

|

494,325

|

|

297,430

|

|

||||||

|

Repurchase/repayment of senior notes

|

(19,324

|

)

|

(69,545

|

)

|

(135,658

|

)

|

||||||

|

Proceeds from exercise of stock options

|

46,665

|

|

8,057

|

|

4,234

|

|

||||||

|

Excess tax benefits from stock-based compensation arrangements

|

7,956

|

|

1,922

|

|

(1,731

|

)

|

||||||

|

Repurchases of common stock

|

(197,044

|

)

|

(173,650

|

)

|

(2,478

|

)

|

||||||

|

Net cash provided by (used for) financing activities

|

(13,919

|

)

|

270,884

|

|

113,653

|

|

||||||

|

Effect of exchange rate changes on cash

|

10,111

|

|

(19,972

|

)

|

12,926

|

|

||||||

|

Net increase (decrease) in cash and cash equivalents

|

(529,434

|

)

|

(210,686

|

)

|

685,735

|

|

||||||

|

Cash and cash equivalents at beginning of year

|

926,321

|

|

1,137,007

|

|

451,272

|

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

396,887

|

|

$

|

926,321

|

|

$

|

1,137,007

|

|

|||

|

Common Stock at Par Value

|

Capital in Excess of Par Value

|

Treasury Stock

|

Retained Earnings

|

Foreign Currency Translation Adjustment

|

Other Comprehensive Income (Loss)

|

Noncontrolling Interests

|

Total

|

||||||||||||||||||||||||

|

Balance at December 31, 2008

|

$

|

125,048

|

|

$

|

1,035,302

|

|

$

|

(190,273

|

)

|

$

|

1,571,005

|

|

$

|

172,528

|

|

$

|

(36,912

|

)

|

$

|

352

|

|

$

|

2,677,050

|

|

|||||||

|

Consolidated net income (loss)

|

—

|

|

—

|

|

—

|

|

123,512

|

|

—

|

|

—

|

|

(7

|

)

|

123,505

|

|

|||||||||||||||

|

Translation adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

56,491

|

|

—

|

|

(8

|

)

|

56,483

|

|

|||||||||||||||

|

Unrealized gain on investment securities, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

22,844

|

|

—

|

|

22,844

|

|

|||||||||||||||

|

Unrealized gain on interest rate swaps designated as cash flow hedges, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,132

|

|

—

|

|

1,132

|

|

|||||||||||||||

|

Other employee benefit plan items, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

3,521

|

|

—

|

|

3,521

|

|

|||||||||||||||

|

Comprehensive income

|

207,485

|

|

|||||||||||||||||||||||||||||

|

Amortization of stock-based compensation

|

—

|

|

33,017

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

33,017

|

|

|||||||||||||||

|

Shares issued for stock-based compensation awards

|

239

|

|

(9,604

|

)

|

13,599

|

|

—

|

|

—

|

|

—

|

|

—

|

|

4,234

|

|

|||||||||||||||

|

Tax benefits related to stock-based compensation awards

|

—

|

|

(2,011

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(2,011

|

)

|

|||||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

(2,478

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(2,478

|

)

|

|||||||||||||||

|

Balance at December 31, 2009

|

125,287

|

|

1,056,704

|

|

(179,152

|

)

|

1,694,517

|

|

229,019

|

|

(9,415

|

)

|

337

|

|

2,917,297

|

|

|||||||||||||||

|

Consolidated net income (loss)

|

—

|

|

—

|

|

—

|

|

479,630

|

|

—

|

|

—

|

|

(5

|

)

|

479,625

|

|

|||||||||||||||

|

Translation adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

(21,105

|

)

|

—

|

|

(5

|

)

|

(21,110

|

)

|

|||||||||||||||

|

Unrealized gain on investment securities, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

5,501

|

|

—

|

|

5,501

|

|

|||||||||||||||

|

Other employee benefit plan items, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,744

|

|

—

|

|

2,744

|

|

|||||||||||||||

|

Comprehensive income

|

466,760

|

|

|||||||||||||||||||||||||||||

|

Amortization of stock-based compensation

|

—

|

|

34,613

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

34,613

|

|

|||||||||||||||

|

Shares issued for stock-based compensation awards

|

50

|

|

(26,301

|

)

|

34,308

|

|

—

|

|

—

|

|

—

|

|

—

|

|

8,057

|

|

|||||||||||||||

|

Tax benefits related to stock-based compensation awards

|

—

|

|

1,178

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,178

|

|

|||||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

(173,650

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(173,650

|

)

|

|||||||||||||||

|

Purchase of subsidiary shares from noncontrolling interest

|

—

|

|

(2,733

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(327

|

)

|

(3,060

|

)

|

|||||||||||||||

|

Balance at December 31, 2010

|

$

|

125,337

|

|

$

|

1,063,461

|

|

$

|

(318,494

|

)

|

$

|

2,174,147

|

|

$

|

207,914

|

|

$

|

(1,170

|

)

|

$

|

—

|

|

$

|

3,251,195

|

|

|||||||

|

Common Stock at Par Value

|

Capital in Excess of Par Value

|

Treasury Stock

|

Retained Earnings

|

Foreign Currency Translation Adjustment

|

Other Comprehensive Income (Loss)

|

Noncontrolling Interests

|

Total

|

||||||||||||||||||||||||

|

Balance at December 31, 2010

|

$

|

125,337

|

|

$

|

1,063,461

|

|

$

|

(318,494

|

)

|

$

|

2,174,147

|

|

$

|

207,914

|

|

$

|

(1,170

|

)

|

$

|

—

|

|

$

|

3,251,195

|

|

|||||||

|

Consolidated net income

|

—

|

|

—

|

|

—

|

|

598,810

|

|

—

|

|

—

|

|

506

|

|

599,316

|

|

|||||||||||||||

|

Translation adjustments

|

—

|

|

—

|

|

—

|

|

—

|

|

(49,364

|

)

|

—

|

|

(20

|

)

|

(49,384

|

)

|

|||||||||||||||

|

Unrealized loss on investment securities, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(11,886

|

)

|

—

|

|

(11,886

|

)

|

|||||||||||||||

|

Unrealized gain on interest rate swaps designated as cash flow hedges, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,855

|

)

|

—

|

|

(1,855

|

)

|

|||||||||||||||

|

Other employee benefit plan items, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(14,482

|

)

|

—

|

|

(14,482

|

)

|

|||||||||||||||

|

Comprehensive income

|

521,709

|

|

|||||||||||||||||||||||||||||

|

Amortization of stock-based compensation

|

—

|

|

39,225

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

39,225

|

|

|||||||||||||||

|

Shares issued for stock-based compensation awards

|

45

|

|

(33,959

|

)

|

80,579

|

|

—

|

|

—

|

|

—

|

|

—

|

|

46,665

|

|

|||||||||||||||

|

Tax benefits related to stock-based compensation awards

|

—

|

|

7,548

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

7,548

|

|

|||||||||||||||

|

Repurchases of common stock

|

—

|

|

—

|

|

(197,044

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(197,044

|

)

|

|||||||||||||||

|

Acquisition of noncontrolling interests

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

5,962

|

|

5,962

|

|

|||||||||||||||

|

Balance at December 31, 2011

|

$

|

125,382

|

|

$

|

1,076,275

|

|

$

|

(434,959

|

)

|

$

|

2,772,957

|

|

$

|

158,550

|

|

$

|

(29,393

|

)

|

$

|

6,448

|

|

$

|

3,675,260

|

|

|||||||

|

1.

|

Summary of Significant Accounting Policies

|

|

•

|

broad economic factors impacting the investee's industry;

|

|

•

|

publicly available forecasts for sales and earnings growth for the industry and investee; and

|

|

•

|

the cyclical nature of the investee's industry.

|

|

Accounts receivable, net

|

$

|

194,312

|

|

|

Inventories

|

169,881

|

|

|

|

Property, plant and equipment

|

11,278

|

|

|

|

Other assets

|

6,965

|

|

|

|

Identifiable intangible assets

|

90,900

|

|

|

|

Cost in excess of net assets of companies acquired

|

31,951

|

|

|

|

Accounts payable

|

(98,967

|

)

|

|

|

Accrued expenses

|

(18,900

|

)

|

|

|

Other liabilities

|

(4,080

|

)

|

|

|

Noncontrolling interest

|

(3,239

|

)

|

|

|

Fair value of net assets acquired

|

380,101

|

|

|

|

Gain on bargain purchase

|

(1,088

|

)

|

|

|

Cash consideration paid, net of cash acquired

|

$

|

379,013

|

|

|

Weighted-Average Life

|

||||

|

Customer relationships

|

8 years

|

$

|

35,400

|

|

|

Trade names

|

indefinite

|

49,000

|

|

|

|

Other intangible assets

|

(a)

|

6,500

|

|

|

|

Total identifiable intangible assets

|

$

|

90,900

|

|

|

|

(a)

|

Consists of non-competition agreements and sales backlog with useful lives ranging from

one

to

three

years.

|

|

For the Years Ended December 31,

|

||||||||||||||||

|

|

2011

|

2010

|

||||||||||||||

|

|

As Reported

|

Pro Forma

|

As Reported

|

Pro Forma

|

||||||||||||

|

Sales

|

$

|

21,390,264

|

|

$

|

21,573,260

|

|

$

|

18,744,676

|

|

$

|

20,082,596

|

|

||||

|

Net income attributable to shareholders

|

598,810

|

|

603,243

|

|

479,630

|

|

497,415

|

|

||||||||

|

Net income per share:

|

|

|

||||||||||||||

|

Basic

|

$

|

5.25

|

|

$

|

5.29

|

|

$

|

4.06

|

|

$

|

4.22

|

|

||||

|

Diluted

|

$

|

5.17

|

|

$

|

5.20

|

|

$

|

4.01

|

|

$

|

4.16

|

|

||||

|

Accounts receivable, net

|

$

|

91,001

|

|

|

Inventories

|

11,785

|

|

|

|

Property, plant and equipment

|

11,187

|

|

|

|

Other assets

|

8,615

|

|

|

|

Identifiable intangible assets

|

146,200

|

|

|

|

Cost in excess of net assets of companies acquired

|

342,446

|

|

|

|

Accounts payable

|

(38,961

|

)

|

|

|

Accrued expenses

|

(46,328

|

)

|

|

|

Other liabilities

|

(38,552

|

)

|

|

|

Cash consideration paid, net of cash acquired

|

$

|

487,393

|

|

|

Weighted-Average Life

|

||||

|

Customer relationships

|

10 years

|

$

|

59,800

|

|

|

Trade names

|

indefinite

|

78,000

|

|

|

|

Developed technology

|

10 years

|

1,700

|

|

|

|

Other intangible assets

|

(a)

|

6,700

|

|

|

|

Total identifiable intangible assets

|

$

|

146,200

|

|

|

|

(a)

|

Consists of non-competition agreements and sales backlog with useful lives ranging from

one

to

two

years.

|

|

For the Years Ended December 31,

|

||||||||||||||||

|

|

2010

|

2009

|

||||||||||||||

|

|

As Reported

|

Pro Forma

|

As Reported

|

Pro Forma

|

||||||||||||

|

Sales

|

$

|

18,744,676

|

|

$

|

19,326,092

|

|

$

|

14,684,101

|

|

$

|

15,566,217

|

|

||||

|

Net income attributable to shareholders

|

479,630

|

|

491,688

|

|

123,512

|

|

130,633

|

|

||||||||

|

Net income per share:

|

|

|

||||||||||||||

|

Basic

|

$

|

4.06

|

|

$

|

4.17

|

|

$

|

1.03

|

|

$

|

1.09

|

|

||||

|

Diluted

|

$

|

4.01

|

|

$

|

4.11

|

|

$

|

1.03

|

|

$

|

1.08

|

|

||||

|

For the Year Ended

|

||||||||||||

|

December 31, 2009

|

||||||||||||

|

As Reported

|

Pro Forma

|

|||||||||||

|

Sales

|

$

|

14,684,101

|

|

$

|

14,867,421

|

|

||||||

|

Net income attributable to shareholders

|

123,512

|

|

133,568

|

|

||||||||

|

Net income per share:

|

||||||||||||

|

Basic

|

$

|

1.03

|

|

$

|

1.11

|

|

||||||

|

Diluted

|

$

|

1.03

|

|

$

|

1.11

|

|

||||||

|

|

Global

Components

|

Global ECS

|

Total

|

|||||||||

|

December 31, 2009

|

$

|

473,421

|

|

$

|

452,875

|

|

$

|

926,296

|

|

|||

|

Acquisitions

|

197,465

|

|

221,781

|

|

419,246

|

|

||||||

|

Other (primarily foreign currency translation)

|

(15

|

)

|

(9,176

|

)

|

(9,191

|

)

|

||||||

|

December 31, 2010

|

670,871

|

|

665,480

|

|

1,336,351

|

|

||||||

|

Acquisitions

|

94,837

|

|

50,685

|

|

145,522

|

|

||||||

|

Other (primarily foreign currency translation)

|

(1,756

|

)

|

(6,784

|

)

|

(8,540

|

)

|

||||||

|

December 31, 2011

|

$

|

763,952

|

|

$

|

709,381

|

|

$

|

1,473,333

|

|

|||

|

Weighted-Average Life

|

Gross Carrying Amount

|

Accumulated Amortization

|

Net

|

||||||||||

|

Trade names

|

indefinite

|

$

|

179,000

|

|

$

|

—

|

|

$

|

179,000

|

|

|||

|

Customer relationships

|

11 years

|

267,729

|

|

(69,762

|

)

|

197,967

|

|

||||||

|

Developed technology

|

6 years

|

11,029

|

|

(693

|

)

|

10,336

|

|

||||||

|

Procurement agreement

|

5 years

|

12,000

|

|

(11,400

|

)

|

600

|

|

||||||

|

Other intangible assets

|

(a)

|

14,573

|

|

(9,713

|

)

|

4,860

|

|

||||||

|

$

|

484,331

|

|

$

|

(91,568

|

)

|

$

|

392,763

|

|

|||||

|

Weighted-Average Life

|

Gross Carrying Amount

|

Accumulated Amortization

|

Net

|

||||||||||

|

Trade names

|

indefinite

|

$

|

130,000

|

|

$

|

—

|

|

$

|

130,000

|

|

|||

|

Customer relationships

|

12 years

|

217,294

|

|

(47,336

|

)

|

169,958

|

|

||||||

|

Developed technology

|

10 years

|

1,700

|

|

(57

|

)

|

1,643

|

|

||||||

|

Procurement agreement

|

5 years

|

12,000

|

|

(9,000

|

)

|

3,000

|

|

||||||

|

Other intangible assets

|

(a)

|

8,099

|

|

(1,853

|

)

|

6,246

|

|

||||||

|

$

|

369,093

|

|

$

|

(58,246

|

)

|

$

|

310,847

|

|

|||||

|

(a)

|

Consists of non-competition agreements and sales backlog with useful lives ranging from

one

to

three

years.

|

|

|

2011

|

2010

|

||||||

|

Marubun/Arrow

|

$

|

45,626

|

|

$

|

41,971

|

|

||

|

Altech Industries

|

14,953

|

|

17,484

|

|

||||

|

|

$

|

60,579

|

|

$

|

59,455

|

|

||

|

|

2011

|

2010

|

2009

|

|||||||||

|

Marubun/Arrow

|

$

|

5,338

|

|

$

|

5,185

|

|

$

|

3,745

|

|

|||

|

Altech Industries

|

1,398

|

|

1,184

|

|

1,004

|

|

||||||

|

Other

|

—

|

|

—

|

|

(18

|

)

|

||||||

|

|

$

|

6,736

|

|

$

|

6,369

|

|

$

|

4,731

|

|

|||

|

|

2011

|

2010

|

||||||

|

Accounts receivable

|

$

|

4,530,242

|

|

$

|

4,140,868

|

|

||

|

Allowances for doubtful accounts

|

(48,125

|

)

|

(37,998

|

)

|

||||

|

Accounts receivable, net

|

$

|

4,482,117

|

|

$

|

4,102,870

|

|

||

|

|

2011

|

2010

|

||||||

|

Revolving credit facility

|

$

|

74,000

|

|

$

|

—

|

|

||

|

Asset securitization program

|

280,000

|

|

—

|

|

||||

|

Bank term loan, due 2012

|

—

|

|

200,000

|

|

||||

|

6.875% senior notes, due 2013

|

341,937

|

|

349,833

|

|

||||

|

3.375% notes, due 2015

|

260,461

|

|

249,155

|

|

||||

|

6.875% senior debentures, due 2018

|

198,660

|

|

198,450

|

|

||||

|

6.00% notes, due 2020

|

299,927

|

|

299,918

|

|

||||

|

5.125% notes, due 2021

|

249,278

|

|

249,199

|

|

||||

|

7.5% senior debentures, due 2027

|

197,890

|

|

197,750

|

|

||||

|

Interest rate swaps designated as fair value hedges

|

—

|

|

14,082

|

|

||||

|

Other obligations with various interest rates and due dates

|

25,670

|

|

2,816

|

|

||||

|

|

$

|

1,927,823

|

|

$

|

1,761,203

|

|

||

|

|

2011

|

2010

|

||||||

|

6.875% senior notes, due 2013

|

$

|

352,000

|

|

$

|

385,000

|

|

||

|

3.375% notes, due 2015

|

250,000

|

|

243,000

|

|

||||

|

6.875% senior debentures, due 2018

|

216,000

|

|

218,000

|

|

||||

|

6.00% notes, due 2020

|

315,000

|

|

306,000

|

|

||||

|

5.125% notes, due 2021

|

247,500

|

|

238,000

|

|

||||

|

7.5% senior debentures, due 2027

|

244,000

|

|

204,000

|

|

||||

|

Level 1

|

Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

|

|

Level 2

|

Quoted prices in markets that are not active; or other inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability.

|

|

Level 3

|

Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable.

|

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Cash equivalents

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Available-for-sale securities

|

45,421

|

|

—

|

|

—

|

|

45,421

|

|

||||||||

|

Interest rate swaps

|

—

|

|

(3,009

|

)

|

—

|

|

(3,009

|

)

|

||||||||

|

Foreign exchange contracts

|

—

|

|

(649

|

)

|

—

|

|

(649

|

)

|

||||||||

|

|

$