|

Message from our CEO

|

|

|

Highlights

|

|

|

Management Board Report

|

|

|

Board of Management

|

|

|

The Role of Lithography

|

|

|

Our Company

|

|

|

Industry Trends and Opportunities

|

|

|

Business Strategy

|

|

|

Markets and Products

|

|

|

Products and Technology

|

|

|

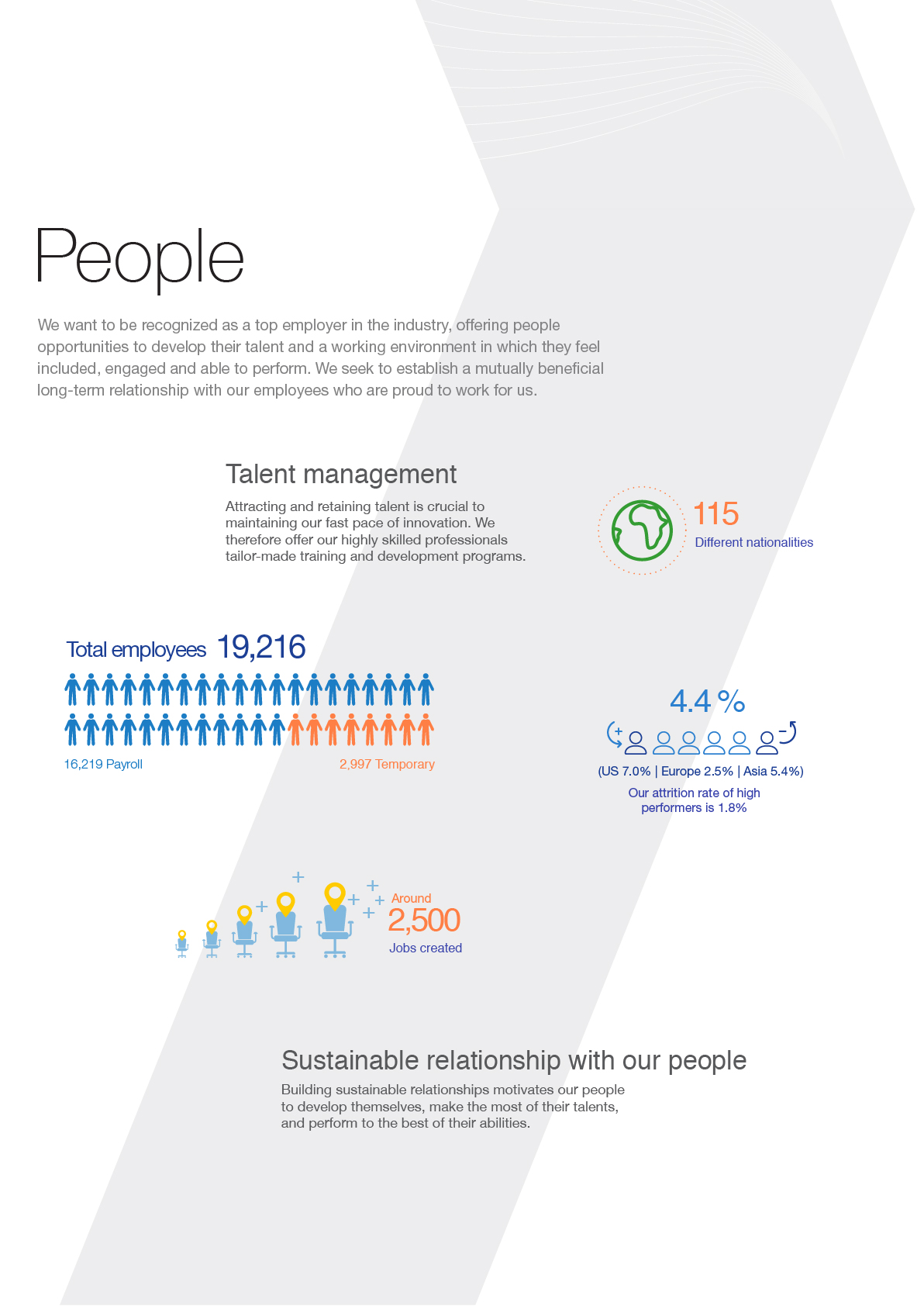

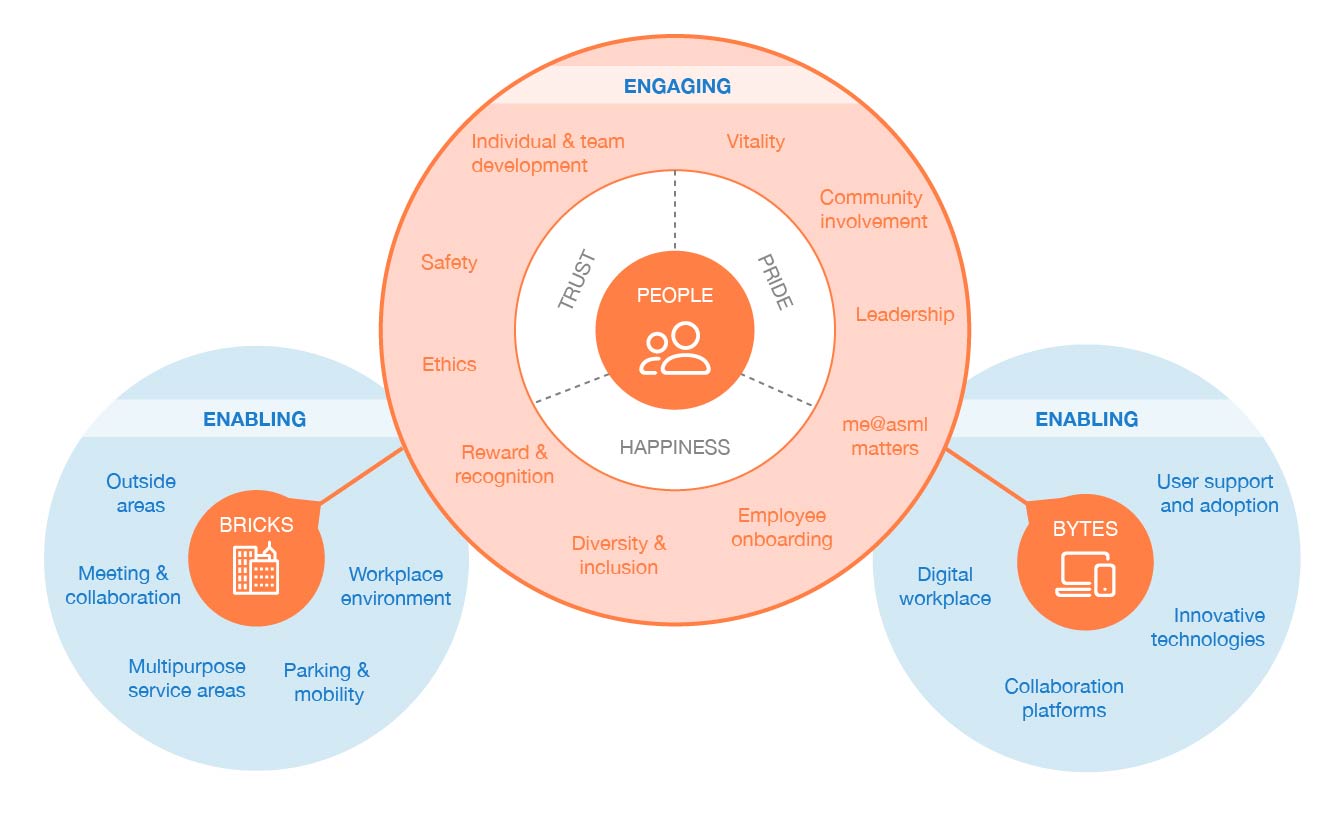

People

|

|

|

Partners

|

|

|

Operations

|

|

|

Financial Performance

|

|

|

Trend Information

|

|

|

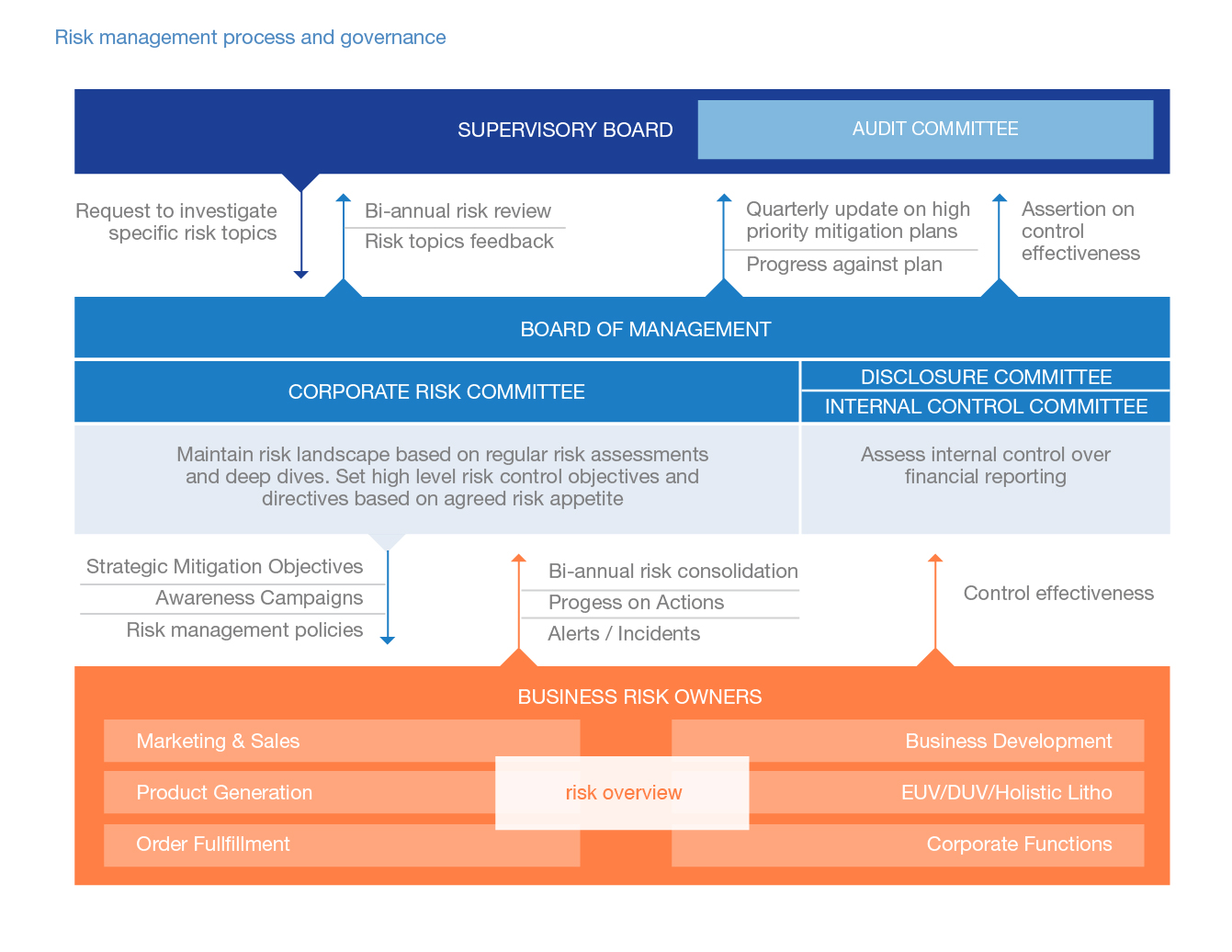

Business Risk and Continuity

|

|

|

Risk Factors

|

|

|

Materiality Assessment

|

|

|

Business Ethics and Compliance

|

|

|

Supervisory Board Report

|

|

|

Supervisory Board

|

|

|

63

|

Introduction

|

|

63

|

Activities in 2017

|

|

64

|

Meetings and Attendance

|

|

64

|

Composition, Diversity and Independence

|

|

65

|

Evaluation

|

|

65

|

Supervisory Board Committees

|

|

67

|

Remuneration of the Supervisory Board

|

|

67

|

A Word of Thanks to ASML Employees

|

|

68

|

Remuneration Report

|

|

Corporate Governance

|

|

|

General

|

|

|

Board of Management

|

|

|

Supervisory Board

|

|

|

81

|

Shareholders and General Meeting of Shareholders

|

|

83

|

The Audit of Financial Reporting and the Position of the Internal and External Auditor Function

|

|

Other Information on Governance

|

|

|

88

|

Compliance with the Corporate Governance Code

|

|

Consolidated Financial Statements

|

|

|

Consolidated Statements of Operations

|

|

|

Consolidated Statements of Comprehensive Income

|

|

|

Consolidated Balance Sheets

|

|

|

Consolidated Statements of Shareholders’ Equity

|

|

|

Consolidated Statements of Cash Flows

|

|

|

Notes to the Consolidated Financial Statements

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

Non-Financial Statements

|

|

|

About the Non-financial Information

|

|

|

Non-financial Indicators

|

|

|

Stakeholder Engagement

|

|

|

Assurance Report of the Independent Auditor

|

|

|

Other Appendices

|

|

|

Appendix - Board of Management and Supervisory Board Remuneration

|

|

|

Appendix - Selected Financial Data

|

|

|

Appendix - Results of Operations 2016 Compared to 2015

|

|

|

Appendix - Principal Accountant Fees and Services

|

|

|

Appendix - Property, Plant and Equipment

|

|

|

Appendix - Taxation

|

|

|

Appendix - Financing and Capital Return Policy

|

|

|

Appendix - Competition

|

|

|

Appendix - Government Regulation

|

|

|

Appendix - Offer and Listing Details

|

|

|

Appendix - Material Contracts

|

|

|

Appendix - Exchange Controls

|

|

|

Appendix - Documents on Display

|

|

|

Appendix - Controls and Procedures

|

|

|

Appendix - Organizational Structure

|

|

|

Appendix - Information and Investor Relations

|

|

|

Appendix - ASML Worldwide Contact Information

|

|

|

Appendix - Reference Table 20-F

|

|

|

Definitions

|

|

|

Exhibit Index

|

|

|

1.

|

We publish two versions of the Integrated Report: one version containing Financial Statements based on US GAAP and one version containing Financial Statements based on IFRS-EU.

|

|

Peter T.F.M. Wennink (1957)

Term expires 2018 President, Chief Executive Officer and Chairman of the Board of Management |

|

l

|

Mr. Wennink joined ASML in 1999 and was appointed as Executive Vice President, CFO and member of our BoM per the 1999 AGM. Mr. Wennink was appointed as President and CEO in 2013.

|

|

l

|

Mr. Wennink has an extensive background in finance and accounting. Prior to his employment with ASML, Mr. Wennink worked as a partner at Deloitte Accountants B.V., specializing in the high technology industry with an emphasis on the semiconductor equipment industry.

|

|

l

|

Mr. Wennink is a member of the Dutch Institute of Registered Accountants, a member of the supervisory board of the Eindhoven University of Technology, and a member of the Advisory Board of the Investment Committee of Stichting Pensioenfonds ABP (Dutch pension fund for government employees). Mr. Wennink further serves on the board of the FME-CWM (the employers’ organization for the technology industry in the Netherlands).

|

|

|

|

|

Martin A. van den Brink (1957)

Term expires 2018 President, Chief Technology Officer and Vice Chairman of the Board of Management |

|

l

|

Mr. Van den Brink joined ASML when the company was founded in 1984. Mr. Van den Brink held several positions in engineering and from 1995 he served as Vice President Technology. Mr. Van den Brink was appointed as Executive Vice President Product & Technology and member of the BoM per the 1999 AGM. Mr. Van den Brink was appointed as President and CTO in 2013.

|

|

l

|

Mr. Van den Brink earned a degree in Electrical Engineering from HTS Arnhem (HAN University), and a degree in Physics (1984) from the University of Twente, the Netherlands.

|

|

l

|

Mr. Van den Brink was awarded an honorary doctorate in physics by the University of Amsterdam, the Netherlands in 2012.

|

|

Frédéric J.M. Schneider-Maunoury (1961)

Term expires 2018 Executive Vice President and Chief Operations Officer |

|

l

|

Mr. Schneider-Maunoury joined ASML in December, 2009, as Executive Vice President and COO and was appointed to our BoM per the 2010 AGM.

|

|

l

|

Prior to joining ASML, Mr. Schneider-Maunoury served as Vice President Thermal Products Manufacturing of the power generation and rail transport equipment group ALSTOM. Previously, Mr. Schneider-Maunoury was general manager of the worldwide Hydro Business of ALSTOM. Further, Mr. Schneider-Maunoury held various positions at the French Ministry of Trade and Industry.

|

|

l

|

Mr. Schneider-Maunoury is a graduate of Ecole Polytechnique (1985) and Ecole Nationale Supérieure des Mines (1988) in Paris.

|

|

|

|

|

Frits J. van Hout (1960)

Term expires 2021 Executive Vice President and Chief Program Officer |

|

l

|

Mr. Van Hout joined ASML in 1984 and rejoined ASML in 2001, after an eight year absence. He was appointed as Executive Vice President and Chief Marketing Officer and became a member of our BoM per the 2009 AGM. Mr. Van Hout was appointed as Executive Vice President and Chief Program Officer on July 1, 2013. Prior to his BoM membership, Mr. Van Hout served as ASML’s Executive Vice President Integral Efficiency, Senior Vice President Customer Support and held various other positions.

|

|

l

|

Mr. Van Hout served as CEO of the Beyeler Group and held various management positions at Datacolor International from 1992 until 2001.

|

|

l

|

Mr. Van Hout earned a Master’s degree in Theoretical Physics (1981), University of Oxford; and a Master’s degree in Applied Physics (1984), Eidgenössische Technische Hochschule, Zürich.

|

|

l

|

Mr. Van Hout is a member of the Board of the Stichting Brainport, the Eindhoven Region Economic Development Board.

|

|

|

|

|

Wolfgang U. Nickl (1969)

Term expires 2018 Executive Vice President and Chief Financial Officer |

|

l

|

Mr. Nickl joined ASML in December, 2013, as Executive Vice President and CFO and was appointed as a member of our BoM per the 2014 AGM.

|

|

l

|

Prior to joining ASML, Mr. Nickl served as Executive Vice President and CFO at Western Digital Corporation, a US-headquartered, NASDAQ-listed developer and manufacturer of storage devices, where he held several financial and operational leadership roles. Before Western Digital, Mr. Nickl gained experience in finance and IT consulting.

|

|

l

|

Mr. Nickl earned a Bachelor of Arts in Business from the University of Cooperative Education in Stuttgart, Germany, and a Master of Business Administration from the University of Southern California’s Marshall School of Business in Los Angeles, United States.

|

|

l

|

Mr. Nickl will step down from his position with ASML as per the 2018 AGM, completing his current term.

1

|

|

|

|

|

1.

|

On January 17, 2018, we announced that the SB intends to appoint Roger Dassen as Executive Vice President and CFO to the BoM, effective June 1, 2018, subject to notification of the 2018 AGM.

|

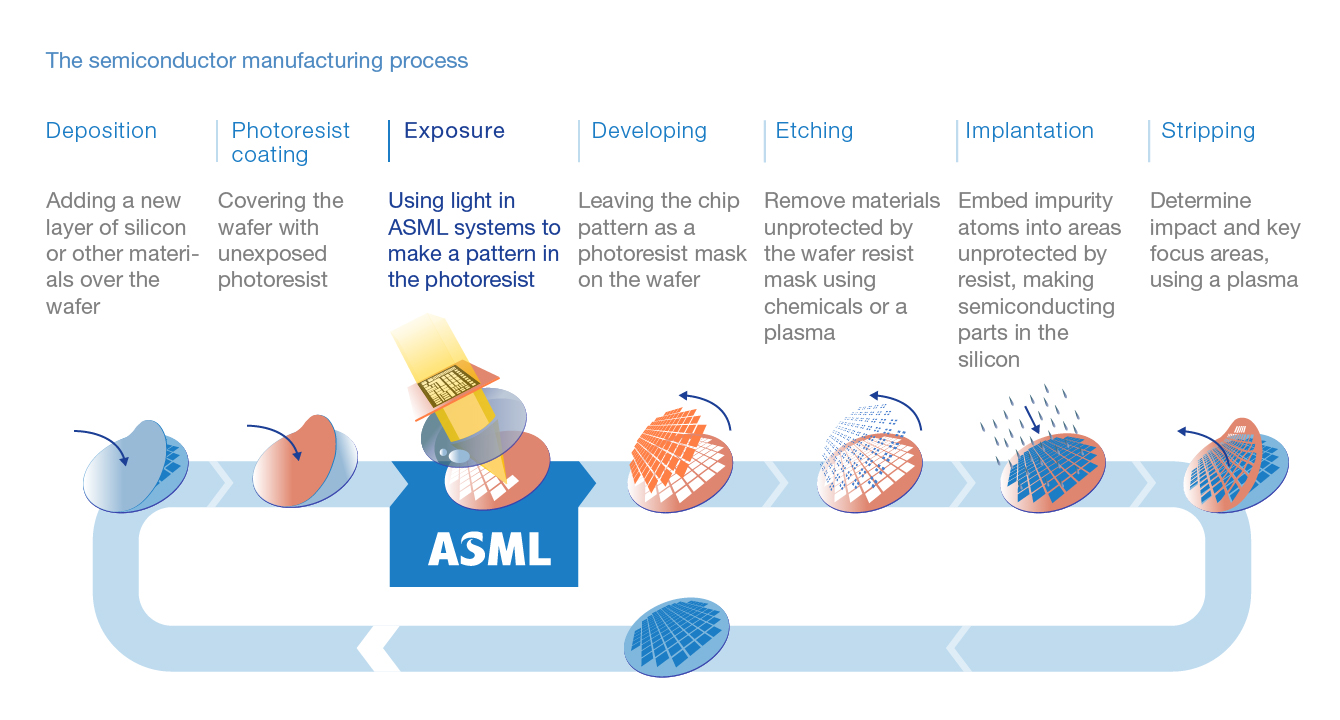

Lithography is the critical process step in the production of microchips. Our systems are essentially projection systems, comparable to a slide projector, using laser light to lay out the transistors - the ‘brain cells’ of a microchip. The light is projected using a so-called mask (also known as a reticle), containing the blueprint of the pattern that will be printed. A lens or mirror focuses the pattern onto the wafer - a thin, round slice of semiconductor material - which is coated with a light-sensitive material. When the unexposed parts are etched away, the pattern is revealed. Because lithography patterns the structures on a microchip, lithography plays an important role in determining how small the features on the chip can be and how densely chip makers can pack transistors together.

Lithography is the critical process step in the production of microchips. Our systems are essentially projection systems, comparable to a slide projector, using laser light to lay out the transistors - the ‘brain cells’ of a microchip. The light is projected using a so-called mask (also known as a reticle), containing the blueprint of the pattern that will be printed. A lens or mirror focuses the pattern onto the wafer - a thin, round slice of semiconductor material - which is coated with a light-sensitive material. When the unexposed parts are etched away, the pattern is revealed. Because lithography patterns the structures on a microchip, lithography plays an important role in determining how small the features on the chip can be and how densely chip makers can pack transistors together.

|

1.

|

Source: BI Intelligence, CCS Insights, Gartner.

|

|

|

|

|

|

||||||

|

Corporate

Priorities |

|

Corporate

Priority 1: |

Corporate

Priority 2: |

Corporate

Priority 3: |

Corporate

Priority 4: |

Corporate

Priority 5: |

||||

|

|

||||||||||

|

|

Execute the product and installed base services roadmap in EUV, DUV and Holistic Lithography.

|

Deliver quality products and services that consistently meet or exceed the expectations as agreed with customers, reinforced by an ASML quality culture.

|

Drive the patterning ecosystem with customers, suppliers and peers in target market segments.

|

Improve return on investments for ASML and its stakeholders, with a focus on cost of ownership and cost awareness.

|

Develop our people and processes to support the growth of the organization towards a EUR 11 billion revenue company by 2020.

|

|||||

|

|

|

|||||||||

|

Related material themes

1

|

•

•

|

Innovation

Knowledge management

|

•

•

|

Sustainable relationships with customers

Operational excellence

|

•

•

•

|

Sustainable relationships with suppliers

Sustainable relationships with customers

Innovation

|

•

|

Financial performance

|

•

•

•

•

•

|

Employee safety

Business ethics & compliance

Talent management

Sustainable relationships with our people

Business risk & continuity

|

|

|

|

|

|

|

|

|

||||

|

Key related risks

2

|

•

•

|

Rapid and complex technological changes

Ability to execute our R&D programs

|

•

|

Managing product industrialization

|

•

•

•

|

Supplier dependency

Rapid and complex technological changes

Managing product industrialization

|

•

•

•

•

•

|

Success of new product introductions

High cyclicality of the semiconductor industry

Competition

High % of net sales derived from few customers

Revenues derived from a small number of products

|

•

•

|

Attraction and retention of adequately skilled people

Use of hazardous substances

|

|

|

|

|

|

|

|

|

||||

|

Related KPIs

|

•

•

•

•

|

R&D expenses

Technology Leadership Index

Technical Competence and Functional Ownership maturity

Number of technical training hours

|

•

|

Customer Loyalty Survey Score

|

•

•

|

Supplier Relationship Satisfaction Survey Score

VLSI Survey Results

|

•

•

•

•

•

|

Total net sales

Gross margin

EPS

Cash flow

ROAIC

|

•

•

•

•

|

Employee engagement

Employee attrition rate (overall, high performers)

Promotion rate of high performers

Recordable incident rate

|

|

|

|

|

|

|

|

|

||||

|

Related impact areas

3

|

•

•

•

•

|

Affordable technology

Knowledge creation & sharing

Resource efficient chips

Financial performance

|

•

•

|

Affordable technology

Financial performance

|

•

•

•

•

•

|

Employment creation

Affordable technology

Knowledge creation & sharing

Resource efficient chips

Financial performance

|

•

|

Financial performance

|

•

•

•

|

Employment creation

Employees welfare

Financial performance

|

|

1.

|

See

Management Board Report - Materiality Assessment

.

|

|

2.

|

See

Management Board Report - Risk Factors

.

|

|

3.

|

See

Management Board Report - Business Strategy - How we create value

.

|

|

Lighthouse project seeks to use accidental discovery for good

We occasionally invent things we don’t need for our own operations, but that can be of value to society. One example of such serendipity is the Lighthouse project. While researching a possible new light source for our new EUV systems, we discovered that a high-energy electron beam we were working with could also be used to produce the medical isotope ‘Mo-99’. This isotope is essential for diagnosing cancer. Currently, it is mainly produced from enriched uranium in nuclear plants that require extensive maintenance and produce radioactive waste. We are exploring opportunities to use our invention in alternative ways to produce medical isotopes. |

|

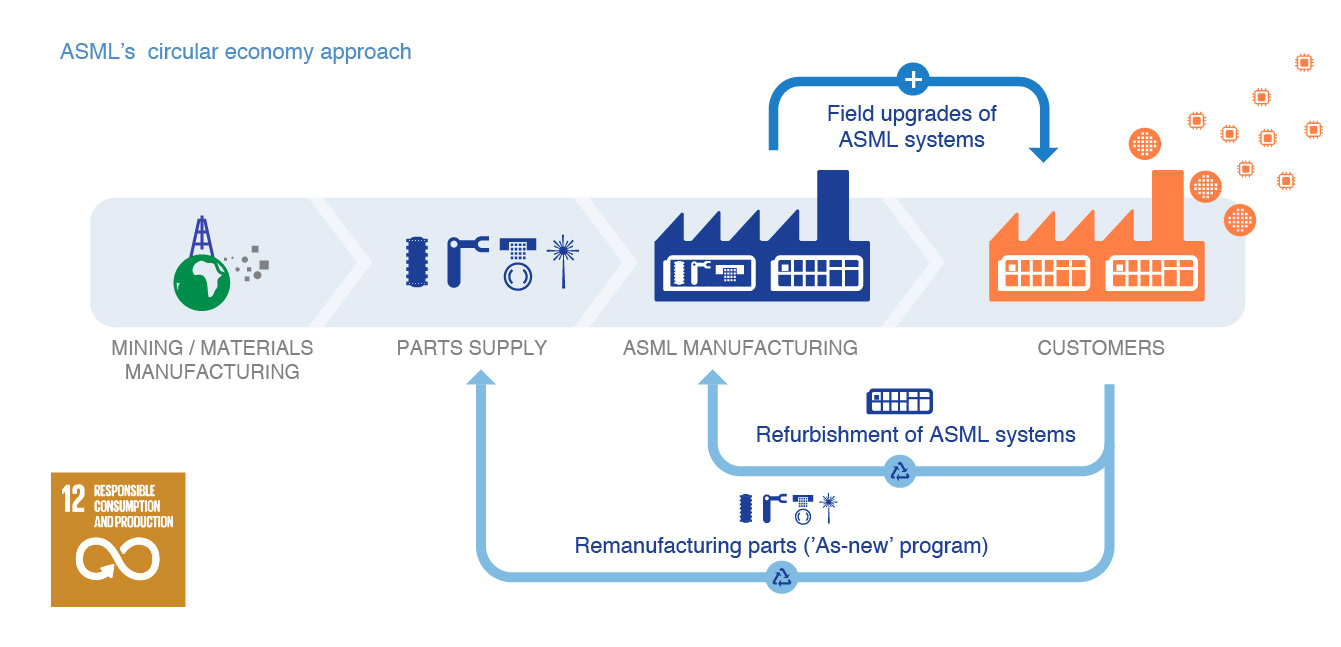

Extending our systems’ lifetime

Our Mature Products and Services business refurbishes older lithography systems and offers associated services. A well-maintained ASML lithography system has a useful life that is measured in decades. Typically, an ASML lithography system will be used in a leading-edge Fab for many years, and will then be given a second life with, for example, a manufacturer that makes specialized devices, such as accelerometers, radio frequency chips, thin-film heads for hard disk drives, or LEDs, which require relatively less sophisticated chips. |

|

Theme

|

|

Objective

|

Target year

|

How we did

|

|

|

|

|

|

|

|

|

|

Innovation

|

Realize the following as part of our Technology Leadership Index:

a) Enable DUV immersion / dry performance to produce 10 nm production and 7 nm R&D node.

b) Drive economics and enhance capability to extend EUV.

c) Enable enhanced product performance through improved metrology.

|

2016-2017

1

|

|

See Innovation is our lifeblood above.

|

|

|

|

Realize the following as part of our Technology Leadership Index:

a) DUV performance enabling memory 1x and 7/5 nm logic nodes.

b) Enable on product performance.

c) Drive economics and extendibility of EUV.

|

2018

1

|

|

|

|

|

|

|

|

|

|

|

Knowledge management

|

Increase the Technical Competence and Functional Ownership maturity score to 3.6.

|

2017

|

|

See Products and technology KPIs in the table below - we achieved a maturity score of 3.7 for Technical Competence and 4.0 for Functional Ownership, exceeding our 2017 target.

|

|

|

|

|

|

|

|

|

|

|

Maintain the Technical Competence and Functional Ownership maturity score at a level around 3.8.

|

2020

|

|

We shall continue to focus on Technical Competence and Functional Ownership maturity.

|

|

|

|

|

|

||

|

Each year have on average 15 hours of technical training per FTE (D&E employees).

|

2016-2017

|

|

See Products and technology KPIs in the table below - the number of training hours was 18.2, exceeding our 2017 target.

|

||

|

|

|

|

|

|

|

|

Product stewardship

|

Annual reduction of RoHS non-compliant parts by 15%.

2

|

2016 and beyond

|

|

In 2017, we have assessed that 89% of the parts in scope are RoHS compliant (with 1% non-compliant and 10% unknown). We have therefore reduced the RoHS non-compliant parts by 21%, thus exceeding our annual target of 15% reduction. We will continue to investigate unknown parts and further reduce the RoHS non-compliant parts.

|

|

|

|

|

|

|

|

|

|

|||||

|

1.

|

In 2017, we fine-tuned the definition of objective a) Enable DUV performance to produce 1x memory and 7/5 nm logic nodes.

|

|

2.

|

Due to our change in methodology as reported in 2016, we re-assessed our annual reduction target from 30 percent to 15 percent.

|

|

KPI

|

2015

|

|

2016

|

|

2017

|

|

|

R&D expenses (in million EUR)

|

1,068.1

|

|

1,105.8

|

|

1,259.7

|

|

|

Technical Competence maturity score

1

|

3.0

|

|

3.4

|

|

3.7

|

|

|

Function Ownership maturity score

1

|

3.2

|

|

3.6

|

|

4.0

|

|

|

Number of technical training hours per FTE

|

14.4

|

|

15.9

|

|

18.2

|

|

|

Sales of lithography systems (in units)

2

|

169

|

|

157

|

|

198

|

|

|

1.

|

Measured on a scale from 0 to 5.

|

|

2.

|

Lithography systems do not include metrology and inspection systems.

See

Management Board Report - Financial Performance - Operating results - Total net sales and gross profit

.

|

|

•

|

Internal talent - We assess the development potential of our employees for new roles and identify candidates for critical positions. Employees discuss their career ambitions with managers, jointly considering next steps. Employees can pursue opportunities themselves or be approached within the organization. We also have internal career fairs to provide information on internal career opportunities.

|

|

•

|

External talent - We cooperate closely with universities in Europe, the US, and Asia to attract highly talented staff, including offering internships and scholarships. For positions that cannot be developed and filled internally, we scan the labor market for the skills we need and run targeted recruitment campaigns.

|

|

•

|

Making the local communities we operate in attractive places to live for our (international) employees and their families.

|

|

•

|

Promoting and providing technical education in local communities to strengthen the knowledge infrastructure.

|

|

•

|

Being a good corporate citizen and giving back to communities by supporting local charities and global education projects.

|

|

Pillars

|

Key programs

|

Results

|

||

|

Making communities attractive places to live

|

•

•

|

Together with our partners in the Brainport Eindhoven region and key public stakeholders in The Hague, we developed the Brainport National Action Agenda, which invites the Dutch government to invest more in our high-tech region. An important part of this is creating a pleasant environment to live in, as we need to be able to attract talented employees from all over the world.

Through our sponsorship program, we support several local organizations, such as The Hub and the Expat Center in Eindhoven, the Netherlands. We also support local events such as Veldhoven Tasting in Veldhoven, the Netherlands, Habitat for Humanity in San Diego, California in the US and Community Food events in Wilton, Connecticut and San Diego, California, both in the US.

|

•

•

|

The Dutch government has recognized the unique and valuable contribution of the Brainport Eindhoven region. In collaboration with the new government, the Brainport National Action Agenda will be developed further, moving a step closer towards realization.

We provided funds to PSV Eindhoven football club, the GLOW light art exhibition and the Muziekgebouw concert hall in Eindhoven. Approximately 3,000 ASML employees visit the PSV football stadium or Muziekgebouw every year. In 2017, we committed EUR 620,000 to our sponsorship program.

|

|

Strengthening knowledge infrastructure in local communities

|

•

•

•

|

We run an intensive technology promotion program to boost interest in technology among young people and increase the local and regional talent pool. As such, we also raise the awareness of career opportunities in a well-paid and fulfilling sector.

We help technology startups through our active role in the Eindhoven Startup Alliance, mostly supporting high-tech business initiatives.

We grant ASML Makers Awards to help develop good ideas into concrete prototypes and prototypes into products that can be produced locally.

|

•

•

•

•

•

•

•

|

The Science Camp in Korea is a three-year program run by 30 employees, aimed at providing science education to underprivileged children.

To inspire young people with a talent for engineering, ASML China sponsored the Future Engineer Competition in Shanghai. This competition attracts around 1,500 elementary school and junior high school students.

In the Netherlands, we organized Girls Day and the Dutch Technology Week.

Middle school students from San Diego county joined us on-campus for half a day of technology-related experiments and activities.

We have seen several high-tech hardware startups thrive and some scale up to become more mature businesses. We organized two Get in the Ring events, attracting startups from all over the world. Five winners were selected and will get support from ASML to develop their activities.

At least four ideas that won an ASML Makers Award were brought to the next level, and one has been made ready for market introduction and production.

ASML supports Eindhoven University of Technology’s research activities in the new and highly innovative field of integrated or smart photonics with an annual donation of EUR 122,000 for 5 years, ending in 2021.

|

|

||||

|

Being a good corporate citizen and giving back to communities

|

•

•

|

Our volunteer work policy allows ASML employees to do eight hours of volunteer work annually during working hours.

We provide financial support to projects related to education for underprivileged children and teenagers, mostly through the ASML Foundation.

|

•

•

•

•

•

•

|

ASML employees in the Netherlands completed a total of 4,545 hours of volunteer work in 2017.

Employees, family and friends got together on the San Diego campus to pack food for underprivileged families in San Diego and Haiti. The team packed 50,000 meals.

The ASML Foundation is sponsoring the Hope Project - One Day Parent Program, an annual event organized by the YMCA Social Welfare Foundation, for a three-year period, providing financial support, and after-school and vacation classes to prevent underprivileged children from dropping out of school.

In China, ASML Foundation sponsors the Shanghai Technology Innovator Program through the local charity A-dream, which helps implement the program. Targeting junior high-school students, this program aims to boost enthusiasm for optics technology through a 16-hour course on this topic.

|

|

||||

|

The ASML Foundation

The ASML Foundation focuses on the UN’s fourth Sustainable Development Goal: to ensure inclusive and quality education for all and promote lifelong learning. The ASML Foundation aims to increase the self-sufficiency of disadvantaged children through educational initiatives that develop their talents and help unlock their potential. Although closely linked to our company, the ASML Foundation operates independently. It is our charity of choice and in 2017, we donated EUR 650,000 to the foundation. The ASML Foundation mainly supports projects in the regions where ASML operates: Asia, Europe and the US. The projects it supports in the US mainly focus on preventing school drop-outs in underprivileged areas, while projects in Asia focus on education for girls to prevent child marriages and on vocational training for young people to help increase their self-sufficiency. In Europe, the foundation focuses on education for disadvantaged children and children lacking in education that suits their specific needs. In 2017, the ASML Foundation supported 9 projects in 6 countries. We encourage our employees to support the ASML Foundation, either financially or through volunteer work. For more information, see www.asmlfoundation.org. |

|

Theme

|

|

Objective

|

Target year

|

How we did

|

|

|

|

|

|

|

|

|

|

Talent management

|

2017 focus areas:

a. Develop our employees to their full potential by having 100% individual targets defined, mid-year reviews performed and updated high quality Development Action Plans.

|

2017

|

|

The majority of employees have defined individual targets (as demonstrated by the 98% of completed People Performance Management reviews) and Development Action Plans (89% completed).

|

|

|

|

|

b. Develop our employees to their full potential and enable them to contribute to our success by having individual targets aligned with the business priorities.

|

|

Business priorities were sufficiently cascaded down from senior management to employees.

|

|

|

|

|

c. Systematically identify and develop future leadership through succession management, cross-sector / regional career moves and leadership development programs.

|

|

For details about succession management see Talent management above.

|

|

|

|

|

|

|

|

|

|

|

|

Attrition rate high performers < overall employee attrition.

|

2017 - 2020

|

|

See People KPIs in the table below - our attrition rate of high performers is 1.8%, lower than our overall attrition rate of 4.4%.

|

|

|

|

|

|

|

|

|

|

Promotion rate of high performers > overall promotion rate.

|

2017 - 2020

|

|

See People KPIs in the table below - our promotion rate of high performers is 37%, well above the overall promotion rate of 13%.

|

|

|

|

|

|

|

|

|

|

2018 focus areas:

a. Secure Workforce Management and Workforce Planning to support future growth.

b. Execute recruitment strategy by implementing the new Applicant Tracking System, focused communication strategy on labor market and deploying a strengthening selection process.

c. Strengthen onboarding activities on a global scale by further roll out of our pre-onboarding app, develop a social onboarding program and further deployment of the buddy program.

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

Sustainable relationship with our people

|

Achieve an employee engagement score from our me@ASML engagement survey at least equal to the peer benchmark group score.

|

2017

|

|

We are slightly below the peer group benchmark. Seeking improvement, we discuss the me@asml results at team level across the company and define team specific action plans.

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

KPI

|

2015

|

|

2016

|

|

2017

|

|

|

Average engagement score me@ASML survey

1

|

n/a

|

|

7.0

|

|

7.0

|

|

|

Employee Attrition (in %)

|

4.2

|

|

3.9

|

|

4.4

|

|

|

Attrition rate of high performers (in %)

|

1.7

|

|

1.7

|

|

1.8

|

|

|

Promotion rate of high performers

2

|

n/a

|

|

35

|

%

|

37

|

%

|

|

Promotion rate - Overall

2

|

n/a

|

|

12

|

%

|

13

|

%

|

|

% of

People Performance Management process

completion

|

98

|

%

|

98

|

%

|

98

|

%

|

|

% of Development Action Plan completion

|

91

|

%

|

92

|

%

|

89

|

%

|

|

1.

|

Measured on a scale from 0 to 10. No survey was held in 2015.

|

|

2.

|

The promotion rate was measured for the first time in 2016.

|

|

Responsible Business Alliance

Responsible Business Alliance members commit and are held accountable to a common Code of Conduct and utilize a range of Responsible Business Alliance training and assessment tools to support continuous improvement in the social, environmental and ethical responsibility of their supply chains. The Responsible Business Alliance used to be known as the Electronic Industry Citizenship Coalition and was renamed in 2017. See also www.responsiblebusiness.org. |

|

‘As-new’ program helps cut waste

As part of our commitment to the circular economy, we work together with customers and suppliers to remanufacture used system parts so that they can be reused as if they were new parts, see also Management Board Report - Products and Technology - Product stewardship. Our first pilot scheme under this ‘As-new’ program, conducted in collaboration with our customers and suppliers, demonstrated the positive environmental impact: waste was cut by 450,000 kilograms or 44 percent of materials. In addition, we were able to re-use packaging material. We discussed the program with more than 20 suppliers and decided to expand it to boost the circular economy model even further.

|

|

Theme

|

|

Objective

|

Target year

|

How we did

|

|

|

|

|

|

|

|

|

|

Sustainable relationships with customers

|

Respond to customer feedback by improving the quality of spare parts upon arrival and addressing cost of ownership issues.

|

2015 - 2020

|

|

We continued initiatives taken at various levels within the organization to increase quality and address cost of ownership issues (e.g. Account teams have received / are receiving training on Cost of Ownership, Voice of the customer sessions, Quality as one of our Corporate Priorities).

|

|

|

|

|

|

|

|

|

|

|

|

Continue to strengthen executive alignment.

|

2016-2020

|

|

In 2017, 15 Executive Review, 12 Technology Review and 33 face-to-face meetings took place in which members of our (technology) senior management, including board members, discussed business and general issues with customers.

|

|

|

|

|

|

|

|

|

|

|

Additional emphasis on account teams driving customer quality issues through the organization.

|

2016-2020

|

|

Account teams are supporting the Voice of the Customer sessions to ensure customer feedback is widely shared at ASML.

|

|

|

|

|

|

|

|

|

|

|

Achieve top 3 ranking among large suppliers of semiconductor equipment.

|

2016-2020

|

|

ASML ranked 3rd on the list of best suppliers.

|

|

|

|

|

|

|

|

|

Sustainable relationships with suppliers

|

Supplier due diligence for business critical and new suppliers.

|

2016-2017

|

|

A new risk profile has been rolled-out to all suppliers in scope. We will actively monitor adherence in 2018.

|

|

|

|

|

|

|

|

|

|

|

More extensive review of sustainability efforts at our business critical suppliers.

|

2016-2018

|

|

10 additional theme audits covering sustainability in 2017 took place.

|

|

|

|

|

|

|

|

|

|

Introduce revised supplier profiling to separate out performance, capability and risk indicators.

|

2017-2018

|

|

Guiding principles for new supplier profile defined, agreed and communicated to suppliers. Phased roll–out starting Q1 2018.

|

|

|

|

|

|

|

|

|

|

|||||

|

KPI

|

2015

|

|

2016

|

|

2017

|

|

|

Supplier Relationship Satisfaction Survey (overall rating score)

1

|

77.5

|

%

|

77.4

|

%

|

77.0

|

%

|

|

Supplier Relationship Satisfaction Survey (overall rating score)

Product related suppliers 1 |

77.0

|

%

|

77.5

|

%

|

79.7

|

%

|

|

Supplier Relationship Satisfaction Survey (overall rating score)

Non-product related suppliers 1 |

80.3

|

%

|

77.1

|

%

|

74.9

|

%

|

|

Overall Loyalty Score (Customer Loyalty Survey)

2

|

n/a

|

|

75.4

|

%

|

n/a

|

|

|

VLSI Survey results

3

|

||||||

|

Large suppliers of chip-making equipment - score

|

9.0

|

|

8.9

|

|

9.0

|

|

|

Suppliers of Fab equipment - score

|

9.0

|

|

8.9

|

|

9.0

|

|

|

Technical leadership for lithography equipment - score

|

9.5

|

|

9.6

|

|

9.4

|

|

|

1.

|

The number of questions in the 2017 Supplier Relationship Satisfaction Survey was reduced from 44 to 26. We recalibrated the scores from 2015 and 2016 to match the 2017 structure, so that the results could be compared. The overall rating score covers both product related suppliers and non-product related suppliers.

|

|

2.

|

The Customer Loyalty Survey is held every two years.

|

|

3.

|

Measured on a scale from 0 to 10.

|

|

Theme

|

|

Objective

|

Target year

|

How we did

|

|

|

|

|

|

|

|

|

|

Employee safety

|

Reduce recordable incident rate by 15% compared to average of previous 3 years (which results in a target for 2017 of 0.32).

|

2017

|

|

Our recordable incident rate of 0.26 is better than our target of 0.32. We have an ambition to have zero incidents and will continue to take necessary action to improve safety.

|

|

|

|

|

|

|

|

|

|

Environmental efficiency own operations

|

100% Renewable electricity.

|

2020

|

|

We are on track. We achieved a 70.2% renewable electricity level in 2017 and have a plan in place to meet our 2020 target.

|

|

|

|

|

|

|

|

|

|

|

|

10% Energy savings through projects.

|

2020

|

|

We are on track based on energy efficiency initiatives launched in prior years however work still needs to be done to identify further opportunities to meet our target for 2020 of achieving an energy saving of 111 TJ (10% of our 2015 energy consumption).

|

|

|

|

|

|

|

|

|

|

5% Waste savings through projects.

|

2020

|

|

We ran some waste reduction initiatives though more needs to be done since we have only achieved 1.2% (since 2016) of our targeted waste savings (of 5% of our waste generated in 2015).

|

|

|

|

|

|

|

|

|

|||||

|

KPI

|

2015

|

2016

|

|

2017

|

|

|

ASML recordable incident rate

1

|

n/a

|

0.44

|

|

0.26

|

|

|

Renewable electricity (of total electricity purchased)

2

|

n/a

|

71

|

%

|

70.2

|

%

|

|

Energy savings world wide through projects (in TJ)

3

|

n/a

|

35.1

|

|

48.8

|

|

|

Waste savings world wide through projects

3

|

n/a

|

1.2

|

%

|

1.2

|

%

|

|

1.

|

The number of work-related injuries and illnesses, per 100 full-time workers. As from 2016 we use OHSA guidelines and therefore data previously reported in 2015 is not comparable and not included here.

|

|

2.

|

This was a new indicator in 2016.

|

|

3.

|

In 2016 we started a new master plan period which terminates in 2020. The savings reported are cumulated compared to base year 2015.

|

|

Year ended December 31

|

2016

|

|

|

2017

|

|

|

|

(in millions, unless otherwise indicated)

|

EUR

|

|

%

1

|

EUR

|

|

%

1

|

|

|

|

|

|

|

||

|

Sales

|

|

|

|

|

||

|

Total net sales

|

6,794.8

|

|

|

9,052.8

|

|

|

|

Increase in total net sales (%)

|

8.1

|

|

|

33.2

|

|

|

|

Net system sales

2

|

4,672.0

|

|

|

6,373.7

|

|

|

|

Net service and field option sales

2

|

2,122.8

|

|

|

2,679.1

|

|

|

|

Sales of lithography systems (in units)

3

|

157

|

|

|

198

|

|

|

|

Profitability

|

|

|

|

|

||

|

Gross profit

|

3,044.5

|

|

44.8

|

4,076.7

|

|

45.0

|

|

Income from operations

|

1,657.7

|

|

24.4

|

2,496.2

|

|

27.6

|

|

Net income

|

1,471.9

|

|

21.7

|

2,118.5

|

|

23.4

|

|

Liquidity

|

|

|

|

|

||

|

Cash and cash equivalents

|

2,906.9

|

|

|

2,259.0

|

|

|

|

Short-term investments

|

1,150.0

|

|

|

1,029.3

|

|

|

|

Net cash provided by operating activities

|

1,665.9

|

|

1,798.6

|

|

||

|

Free cash flow

4

|

1,341.2

|

|

|

1,440.6

|

|

|

|

1.

|

As a percentage of total net sales.

|

|

2.

|

As per January 1, 2017, ASML presents net sales with respect to metrology and inspection systems as part of net system sales instead of net service and field option sales.

The comparative numbers have been adjusted to reflect this change in accounting policy.

|

|

3.

|

Lithography systems do not include metrology and inspection systems.

|

|

4.

|

Free cash flow is a non-GAAP measure and is defined as net cash provided by operating activities

(

2017

:

EUR 1,798.6 million

and

2016

:

EUR 1,665.9 million

)

minus purchase of property, plant and equipment

(

2017

:

EUR 338.9 million

and

2016

:

EUR 316.3 million

) and purchase of intangible assets (

2017

:

EUR 19.1 million

and

2016

:

EUR 8.4 million

). We believe that free cash flow is an important liquidity metric, reflecting cash that is available for acquisitions, to repay debt and to return money to our shareholders by means of dividends and share buybacks. Property, plant and equipment and purchase of intangible assets are deducted from net cash provided by operating activities because these payments are necessary to support the maintenance and investments in our assets to maintain the current asset base. Free cash flow therefore provides an alternative measure (in addition to net cash provided by operating activities) for investors to assess our ability to generate cash from our business. For further details about the purchase of property, plant and equipment and the purchase of intangible assets see

Consolidated Financial Statements - Consolidated Statements of Cash Flows

.

|

|

Year ended December 31

|

2016

|

|

2017

|

|

|

(in millions)

|

EUR

|

|

EUR

|

|

|

Total net sales

|

6,794.8

|

|

9,052.8

|

|

|

Total cost of sales

|

(3,750.3

|

)

|

(4,976.1

|

)

|

|

Gross profit

|

3,044.5

|

|

4,076.7

|

|

|

Other income

|

93.8

|

|

95.8

|

|

|

Research and development costs

|

(1,105.8

|

)

|

(1,259.7

|

)

|

|

Selling, general and administrative costs

|

(374.8

|

)

|

(416.6

|

)

|

|

Income from operations

|

1,657.7

|

|

2,496.2

|

|

|

Interest and other, net

|

33.7

|

|

(50.3

|

)

|

|

Income before income taxes

|

1,691.4

|

|

2,445.9

|

|

|

Provision for income taxes

|

(219.5

|

)

|

(310.7

|

)

|

|

Income after income taxes

|

1,471.9

|

|

2,135.2

|

|

|

Profit (loss) related to equity method investments

|

—

|

|

(16.7

|

)

|

|

Net income

|

1,471.9

|

|

2,118.5

|

|

|

Year ended December 31

|

2016

|

|

2017

|

|

|

Total net sales

|

100.0

|

|

100.0

|

|

|

Total cost of sales

|

(55.2

|

)

|

(55.0

|

)

|

|

Gross profit

|

44.8

|

|

45.0

|

|

|

Other income

|

1.4

|

|

1.1

|

|

|

Research and development costs

|

(16.3

|

)

|

(13.9

|

)

|

|

Selling, general and administrative costs

|

(5.5

|

)

|

(4.6

|

)

|

|

Income from operations

|

24.4

|

|

27.6

|

|

|

Interest and other, net

|

0.5

|

|

(0.6

|

)

|

|

Income before income taxes

|

24.9

|

|

27.0

|

|

|

Provision for income taxes

|

(3.2

|

)

|

(3.4

|

)

|

|

Income after income taxes

|

21.7

|

|

23.6

|

|

|

Profit (loss) related to equity method investments

|

—

|

|

(0.2

|

)

|

|

Net income

|

21.7

|

|

23.4

|

|

|

Year ended December 31

|

2016

|

|

2017

|

|

|

(in millions, unless otherwise indicated)

|

EUR

|

|

EUR

|

|

|

Total net sales

|

6,794.8

|

|

9,052.8

|

|

|

Net system sales

1

|

4,672.0

|

|

6,373.7

|

|

|

Net service and field option sales

1

|

2,122.8

|

|

2,679.1

|

|

|

Sales of lithography systems (in units)

2

|

157

|

|

198

|

|

|

Gross margin

|

44.8

|

|

45.0

|

|

|

1.

|

As per January 1, 2017, ASML presents net sales with respect to metrology and inspection systems as part of net system sales instead of net service and field option sales.

The comparative numbers have been adjusted to reflect this change in accounting policy.

|

|

2.

|

Lithography systems do not include metrology and inspection systems.

|

|

•

|

An increase from

4

EUV systems recognized in net system sales in 2016 to

11

EUV systems recognized in 2017.

|

|

•

|

An increase from

153

DUV systems recognized in net system sales in 2016 to

187

DUV systems recognized in 2017.

|

|

•

|

The inclusion of 12 months HMI net system sales in 2017, whereas 2016 only included 2 months.

|

|

•

|

EUV - Further improving availability and productivity focused on the final stages of development related to our NXE:3400B system, of which we shipped our first systems in 2017. In addition, we are extending our road map by including High-NA to support our customers with 3 nm logic.

|

|

•

|

DUV immersion - Mainly dedicated to the development of our next generation Immersion system NXT:2000i.

|

|

•

|

Holistic Lithography - HMI expansion and further development of YieldStar and process window control solutions.

|

|

•

|

EUR 500 million in 2022.

|

|

•

|

EUR 750 million in 2023.

|

|

•

|

EUR 1,000 million in 2026.

|

|

•

|

EUR 750 million in 2027.

|

|

•

|

Total net sales of

around EUR 2.2 billion

.

|

|

•

|

Gross margin of

between 47 and 48 percent

.

|

|

•

|

R&D costs of

about EUR 350 million

. The increase in R&D costs

reflects continued accelerated investments in our portfolio.

|

|

•

|

SG&A costs of

about EUR 115 million

.

|

|

•

|

Effective annualized tax rate of

around 14 percent

.

|

|

•

|

Quarterly senior management meetings, which are conducted to assess ASML’s corporate initiatives which are launched in order to execute ASML’s strategy.

|

|

•

|

Monthly operational review meetings of the BoM with ASML’s senior management on financial performance and realization of operational objectives and responses to emerging issues.

|

|

•

|

Quarterly review of key operational risk areas by the Corporate Risk Committee.

|

|

•

|

ASML’s Anti-Fraud Policy, which facilitates the development of controls which will aid in prevention, deterrence and detection of fraud against ASML.

|

|

•

|

Internal control assessments performed by Internal Audit.

|

|

•

|

On a semi-annual basis, letters of representation are signed by ASML’s key senior management members. They confirm, among other, the following:

|

|

–

|

Compliance with local laws and regulations.

|

|

–

|

Enable preparation of US GAAP Consolidated Financial Statements.

|

|

–

|

Compliance with our Code of Conduct, Business Principles and related Corporate Policies.

|

|

–

|

Any material weaknesses and / or deficiencies (if applicable) in design and operation of internal controls over (non) financial reporting.

|

|

•

|

To address the rapid commercial and technological changes in the semiconductor industry as well as the increasing complexity in executing our product introduction roadmap we focus on partnerships, collaboration and sharing knowledge with our customers and suppliers. We work closely to align roadmaps, oversee execution and ensure we maximize customer value. See

Management Board Report - Products and Technology

and

Partners

.

|

|

•

|

To address our dependence on a limited number of suppliers we nurture high quality and collaborative relationships with our suppliers. We share our expert knowledge, including risks and rewards, so we all work together to achieve cost-effective shrink, boost innovation and enable our industry to grow. See

Management Board Report - Partners

.

|

|

•

|

To address risks related to intellectual property rights we have developed an intellectual property rights management mechanism to protect our intellectual property rights and to respect the intellectual property of other parties. To protect ourselves from incidents related to cyber security we have also set up a broad information security program addressing preventive, detective and responsive measures to security threats. See

Management Board Report - Products and Technology

.

|

|

•

|

To address the scarcity of staff with specific technical expertise we put effort into educating, training and retaining talent. In addition we promote initiatives that encourage young people to study science, technology and engineering. See

Management Board Report - People

.

|

|

•

|

Intellectual property laws may not sufficiently support our proprietary rights or may change in the future in a manner adverse to us.

|

|

•

|

Patent rights may not be granted or interpreted as we expect.

|

|

•

|

Patents will expire which may result in key technology becoming widely available that may hurt our competitive position.

|

|

•

|

The steps we take to prevent misappropriation or infringement of our proprietary rights may not be successful.

|

|

•

|

Third parties may be able to develop or obtain patents for broadly similar or similar competing technology.

|

|

•

|

Unfavorable political, geopolitical or economic environments;

|

|

•

|

Increased exposure to natural hazards;

|

|

•

|

Potentially adverse tax consequences;

|

|

•

|

Unexpected legal or regulatory changes;

|

|

•

|

Failure to comply with regulatory requirements, including anti-corruption, anti-bribery and human rights standards;

|

|

•

|

Our inability to attract and retain sufficiently qualified personnel;

|

|

•

|

Our inability to protect of our intellectual property and information technology systems; and

|

|

•

|

Adverse effects of foreign currency fluctuations.

|

|

|

Relevant United Nations Sustainable Development Goal

|

ASML Theme

|

Contribution to the United Nations Sustainable Development Goal

|

Section in this report

|

|||

|

|

|

|

|

|

|||

|

Ensure inclusive and quality education for all and promote lifelong learning

|

•

•

•

|

Talent management

Community involvement

Knowledge management

|

•

•

•

|

People development & training

Technology promotion program & ASML Foundation

Technical training

|

•

•

•

|

People

People

Products & Technology

|

|

|

|

|

|

|

|||

|

Promote inclusive and sustainable economic growth, employment and decent work for all

|

•

•

•

|

Sustainable relationship with suppliers

Responsible supply chain

Sustainable relationship with our people

|

•

•

•

•

|

Co-development with business critical suppliers

Responsible Business Alliance (formerly Electronic Industry Citizenship Coalition) membership

Place to Work, Meet, Learn and Share

Employment creation

|

•

•

•

•

|

Partners

Partners

People

Highlights

|

|

|

|

|

|

|

|||

|

Build resilient infrastructure, promote sustainable industrialization and foster innovation

|

•

•

•

|

Innovation

Knowledge management

Community involvement

|

•

•

•

|

ASML’s ‘open innovation’ concept

Knowledge creation and sharing

Strengthening local knowledge infrastructure

|

•

•

•

|

Products & Technology

How We Create Value

People

|

|

|

|

|

|

|

|||

|

Ensure sustainable consumption and production patterns

|

•

•

|

Product stewardship

Environmental efficiency own operations

|

•

•

|

Circular economy approach

Waste savings

|

•

•

|

Products & Technology

Operations

|

|

|

|

|

|

|

|||

|

Take urgent action to combat climate change and its impacts

|

•

•

|

Product stewardship

Environmental efficiency own operations

|

•

•

|

Energy efficiency products

Renewable electricity

|

•

•

|

Products & Technology

Operations

|

|

|

|

|

|

|

|||

Our whistleblower Speak Up policy and our internal Ethics Investigation Procedure outline the steps employees are encouraged to take if they experience or suspect a breach of our business ethics. These documents also reassure employees that they can report a breach without fear of repercussions. For employees or external stakeholders who feel more comfortable remaining anonymous, we have a Speak Up system, which is run by an independent external service company. Like our Code of Conduct and Business Principles, our Speak Up policy is available on our Website for external stakeholders.

Our whistleblower Speak Up policy and our internal Ethics Investigation Procedure outline the steps employees are encouraged to take if they experience or suspect a breach of our business ethics. These documents also reassure employees that they can report a breach without fear of repercussions. For employees or external stakeholders who feel more comfortable remaining anonymous, we have a Speak Up system, which is run by an independent external service company. Like our Code of Conduct and Business Principles, our Speak Up policy is available on our Website for external stakeholders.

|

Gerard J. Kleisterlee (1946, Dutch)

Member of the SB since 2015; first term expires in 2019 Chairman of the SB, Chairman of the Selection and Nomination Committee and member of the Technology Committee |

|

l

|

Mr. Kleisterlee was the President and CEO of the Board of Management of Royal Philips N.V. from 2001 until 2011, after having worked at Philips from 1974 onwards.

|

|

l

|

Currently, Mr. Kleisterlee is the Chairman of the Board of Vodafone Group Plc. and Non-Executive Director of Royal Dutch Shell Plc.

|

|

|

|

|

Antoinette (Annet) P. Aris (1958, Dutch)

Member of the SB since 2015; first term expires in 2019 Member of Technology Committee and Remuneration Committee |

|

l

|

Ms. Aris is Adjunct Professor of Strategy at INSEAD, France, a position she has held since 2003.

|

|

l

|

From 1994 to 2003 Ms. Aris was a partner at McKinsey & Company in Germany.

|

|

l

|

Currently, Ms. Aris is a Non-Executive Director of Thomas Cook Plc. and a member of the supervisory boards of ProSiebenSat.1 AG, Jungheinrich AG and ASR Nederland N.V.

|

|

|

|

|

Clara (Carla) M.S. Smits-Nusteling (1966, Dutch)

Member of the SB since 2013; second term expires in 2021 Chairperson of the Audit Committee |

|

l

|

Ms. Smits-Nusteling was CFO and a member of the Board of Management of Royal KPN N.V. from 2009 until 2012.

|

|

l

|

Prior to that, Ms. Smits-Nusteling held several finance and business related positions at Royal KPN N.V. and PostNL.

|

|

l

|

Currently, Ms. Smits-Nusteling is a Non-Executive Director of the Board of Tele2 AB, a member of the Management Board of the Foundation Unilever N.V. Trust Office, Non-Executive Director of the Board of Directors of Nokia Corporation and lay judge of the Enterprise Court of the Amsterdam Court of Appeal.

|

|

|

|

|

Douglas A. Grose (1950, American)

Member of the SB since 2013, second term expires 2021 Vice Chairman of the SB, Chairman of the Technology Committee and member of the Selection and Nomination Committee |

|

l

|

Mr. Grose was CEO of GlobalFoundries from 2009 until 2011.

|

|

l

|

Prior to that, Mr. Grose served as senior vice president of technology development, manufacturing and supply chain for Advanced Micro Devices, Inc. Mr. Grose also spent 25 years at IBM as General Manager of technology development and manufacturing for the systems and technology group.

|

|

l

|

Currently, Mr. Grose is a member of the Board of Directors of SBA Materials, Inc.

|

|

|

|

|

Johannes (Hans) M.C. Stork (1954, American)

Member of the SB since 2014; first term expires in 2018 Member of the Technology Committee and the Remuneration Committee |

|

l

|

Mr. Stork is Senior Vice President and CTO of ON Semiconductor Corporation, a position he has held since 2011.

|

|

l

|

Prior to that, Mr. Stork held various management positions at IBM Corporation, Hewlett Packard Company, Texas Instruments, Inc. and Applied Materials, Inc., including Senior Vice President and CTO of Texas Instruments, Inc. and Group Vice President and CTO of Applied Materials, Inc. Further, Mr. Stork was a member of the Board of Sematech.

|

|

l

|

Currently, Mr. Stork is a member of the Scientific Advisory Board of imec.

|

|

Pauline F.M. van der Meer Mohr (1960, Dutch)

Member of the SB since 2009; third term expires in 2018 Member of the Audit Committee and Selection and Nomination Committee |

|

l

|

Ms. Van der Meer Mohr was President of the Executive Board of the Erasmus University Rotterdam, the Netherlands from 2010 up until and including 2015.

|

|

l

|

Prior to that, Ms. Van der Meer Mohr was managing partner of the Amstelbridge Group, Senior Executive Vice President at ABN AMRO Bank, Head of Group Human Resources at TNT N.V., and has held several senior executive roles at the Royal/Dutch Shell group of companies in various areas.

|

|

l

|

Currently, Ms. Van der Meer Mohr is the Chairperson of the supervisory board of EY Netherlands LLP, a member of the supervisory board of Royal DSM N.V., Non-Executive Director of HSBC Holdings Plc, and Chairperson of the supervisory board of Nederlands Danstheater.

|

|

|

|

|

Rolf-Dieter Schwalb (1952, German)

Member of the SB since 2015; first term expires in 2019 Chairman of the Remuneration Committee and member of the Audit Committee |

|

l

|

Mr. Schwalb was CFO and member of the Board of Management of Royal DSM N.V. from 2006 to 2014.

|

|

l

|

Prior to that, Mr. Schwalb was CFO and member of the Executive Board of Beiersdorf AG and he held a variety of management positions in Finance, IT and Internal Audit at Beiersdorf AG and Procter & Gamble Co.

|

|

|

|

|

Wolfgang H. Ziebart (1950, German)

Member of the SB since 2009; third term expires in 2019 Member of the Technology Committee and the Remuneration Committee |

|

l

|

Mr. Ziebart was President and CEO of Infineon Technologies A.G. from 2004 until 2008.

|

|

l

|

Prior to that, Mr. Ziebart was on the Boards of Management of car components manufacturer Continental A.G. and automobile producer BMW A.G.

|

|

l

|

Currently, Mr. Ziebart is the Chairman of the supervisory board of Nordex SE and a member of the Board of Autoliv, Inc.

|

|

|

|

|

SB member

|

SB

|

Audit Committee

|

Remuneration Committee

|

Selection and Nomination Committee

|

Technology Committee

|

|

|

|

|

|

|

|

|

Annet Aris

|

8/8

|

n/a

|

5/5

|

n/a

|

5/5

|

|

Douglas Grose

|

8/8

|

n/a

|

n/a

|

4/4

|

5/5

|

|

Gerard Kleisterlee

1

|

8/8

|

7/9

|

n/a

|

4/4

|

5/5

|

|

Pauline van der Meer Mohr

|

7/8

|

8/9

|

n/a

|

4/4

|

n/a

|

|

Hans Stork

|

7/8

|

n/a

|

5/5

|

n/a

|

5/5

|

|

Rolf-Dieter Schwalb

|

8/8

|

9/9

|

5/5

|

n/a

|

n/a

|

|

Carla Smits-Nusteling

|

8/8

|

9/9

|

n/a

|

n/a

|

n/a

|

|

Wolfgang Ziebart

|

8/8

|

n/a

|

5/5

|

n/a

|

5/5

|

|

|

|

|

|

|

|

|

1.

|

Mr. Kleisterlee is not a member of the Audit Committee, but attends the Audit Committee meetings whenever possible.

|

|

•

|

Transparent - The policy and its execution are clear and practical;

|

|

•

|

Aligned - The Remuneration Policy is aligned with the policy for ASML senior management and other ASML employees;

|

|

•

|

Long term oriented - The incentives focus on long-term value creation;

|

|

•

|

Compliant - ASML adopts the highest standards of good corporate governance; and

|

|

•

|

Simple - The policy and its execution are as simple as possible and easily understandable to all stakeholders.

|

|

Reference group composition

|

|

|

|

|

|

AkzoNobel

|

Leonardo-Finmeccanica

|

|

Alstom

|

Linde

|

|

Continental

|

Nokia

|

|

Covestro

|

Philips Healthcare and Consumer Electronics

|

|

DSM

|

Schindler

|

|

Essilor

|

Shire

|

|

Evonik

|

Smith & Nephew

|

|

Gemalto

|

Solvay

|

|

Givaudan

|

UCB

|

|

Infineon Technologies

|

Yara International

|

|

Legrand

|

|

|

|

|

|

Variable compensation (on-target)

|

Presidents

|

Other Board members

|

|

|

|

|

|

STI

|

65%

|

65%

|

|

LTI

|

100%

|

85%

|

|

Total variable compensation as % of base salary

|

165%

|

150%

|

|

|

|

|

|

Performance Measure

|

Weight

|

|

|

|

|

Qualitative

|

|

|

Technology Leadership Index

|

20%

|

|

Market position

|

20%

|

|

|

|

|

Financial

1

|

60%

|

|

Total

|

100%

|

|

|

|

|

1.

|

Every year, prior to the performance period, the SB chooses several financial measures, depending on business challenges and circumstances, with a total weight of 60 percent.

|

|

Measure

|

Description

|

|

|

|

|

Sales

|

Total net sales as included in the US GAAP Consolidated Financial Statements

|

|

Gross Margin

|

Gross Profit as a percentage of total net sales

|

|

R&D opex

|

R&D costs as included in the US GAAP Consolidated Financial Statements

|

|

SG&A opex

|

SG&A costs as included in the US GAAP Consolidated Financial Statements

|

|

EBITDA Margin %

|

Income from operations (plus depreciation and amortization) as percentage of total net sales

|

|

EBIT Margin %

|

Income from operations as percentage of total net sales

|

|

Net Margin %

|

Net income as a percentage of total net sales

|

|

Free Cash Flow

|

Cash flow from operations minus purchases of property, plant and equipment and intangible fixed assets

|

|

Cash Conversion Cycle

1

|

Days Inventory Outstanding + Days Sales Outstanding -/- Days Payable Outstanding

|

|

Capital Expenditures

|

Investment in property, plant and equipment

|

|

|

|

|

1.

|

The SB could also decide to focus on certain elements of Cash Conversion Cycle in any year, i.e. Days Inventory Outstanding, Days Sales Outstanding and / or Days Payable Outstanding, instead of Cash Conversion Cycle only.

|

|

•

|

ASML’s total shareholder return compared to a reference index.

|

|

•

|

ASML’s ROAIC compared to a pre-defined target to be set by the SB prior to the performance period.

|

|

•

|

Long-term strategic qualitative targets to ensure ASML’s ability to keep performing at high standards. Depending on the strategic requirements the definition and relative weight may change upon the discretion of the SB:

|

|

•

|

ASML’s relative change in share price, plus dividends paid over the relevant performance period. The total shareholder return is calculated as the difference between (i) the average (closing) share price during the last quarter of the performance period and (ii) the average (closing) share price during the quarter preceding the performance period; in the calculation, dividends are re-invested at the ex-dividend date. The total shareholder return of ASML (calculated with the ASML New York share) is compared to the PHLX Semiconductor Sector Index. This NASDAQ index is designed to track the performance of a set of companies engaged in the design, distribution, manufacture, and sale of semiconductors. There are two versions of this index, a price return index and a total return index, the latter of which is chosen (NASDAQ: X.SOX), since this index reinvests cash dividends, equivalent to the total shareholder return definition described above).

|

|

•

|

ASML’s rate of return on capital it has put to work, regardless of the capital structure of the company. It is used as a fundamental metric to measure value creation of the company. The ROAIC is calculated by dividing the Net Operating Profit After Tax by the Average Invested Capital.

|

|

LTI performance measures

|

Weight

|

|

|

|

|

ROAIC

|

40%

|

|

Total shareholder return

|

30%

|

|

Technology Leadership Index

|

20%

|

|

Sustainability

|

10%

|

|

Total

|

100%

|

|

|

|

|

Performance ASML vs PHLX Index

(total shareholder return ASML -/- total shareholder return X.SOX) |

Pay-out as a % of target

|

|

|

|

|

≥ 20%

|

200%

|

|

Between 0% and 20%

|

Linear between 100% and 200%

|

|

Between -20% and 0%

|

Linear between 50% and 100%

|

|

< -20%

|

0%

|

|

|

|

|

•

|

ASML’s operational and financial objectives;

|

|

•

|

The strategy designed to achieve the objectives;

|

|

•

|

The parameters to be applied in relation to the strategy designed to achieve the objectives; and

|

|

•

|

Corporate responsibility issues that are relevant to ASML.

|

|

•

|

A narrative explanation of ASML’s financial statements.

|

|

•

|

The context within which financial information should be analyzed.

|

|

•

|

Information about the quality, and variability, of our earnings and cash flow.

|

|

•

|

We respect people and planet

.

|

|

•

|

We operate with integrity

.

|

|

•

|

We preserve our assets.

|

|

•

|

We manage professionally.

|

|

•

|

We encourage Speak Up.

|

|

•

|

The achievement of ASML’s objectives.

|

|

•

|

ASML’s corporate strategy and the management of risks inherent to ASML’s business activities.

|

|

•

|

The structure and operation of internal risk management and control systems.

|

|

•

|

The financial reporting process.

|

|

•

|

ASML’s culture and the activities of the BoM in that regard.

|

|

•

|

Compliance with applicable legislation and regulations.

|

|

•

|

The relationship with shareholders.

|

|

•

|