|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

¨

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Delaware

|

|

25-1792394

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

|

1000 Six PPG Place, Pittsburgh, Pennsylvania

|

|

15222-5479

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.10 Par Value

|

|

New York Stock Exchange

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

|

|

Page

Number

|

|

•

|

Significantly expand our product offering capabilities, shorten manufacturing cycle times, reduce inventory requirements, and improve the cost structure of our flat rolled products business.

|

|

•

|

Provide unsurpassed manufacturing capability and versatility in the production of a wide range of flat rolled specialty metals, including ATI’s diversified product mix of nickel-based and specialty alloys, titanium and titanium alloys, zirconium alloys, Precision Rolled Strip

®

products, and stainless sheet and coiled plate products.

|

|

•

|

Produce high-strength carbon steel alloys.

|

|

•

|

Roll and process exceptional quality hot bands of up to 78.62 inches, or 2 meters, wide.

|

|

2014

|

2013

|

2012

|

|||||||

|

High Performance Materials & Components

|

48

|

%

|

48

|

%

|

50

|

%

|

|||

|

Flat Rolled Products

|

52

|

%

|

52

|

%

|

50

|

%

|

|||

|

•

|

Carpenter Technology Corporation: A

|

|

•

|

Special Metals Corporation, a Precision Castparts Corp. company: C

|

|

•

|

Haynes International, Inc.: B

|

|

•

|

VDM Metals GmbH (Germany): C

|

|

•

|

Titanium Metals Corporation, a Precision Castparts Corp. company: C

|

|

•

|

RMI Titanium, an RTI International Metals company: C

|

|

•

|

VSMPO—AVISMA (Russia): A

|

|

•

|

Precision Castparts Corp.: A

|

|

•

|

Alcoa Inc.: A

|

|

•

|

Aubert & Duval, a group member of Eramet (France): A

|

|

•

|

Cezus, a group member of AREVA (France): A

|

|

•

|

H.C. Starck: A

|

|

•

|

Western Zirconium Plant of Westinghouse Electric Company, owned by Toshiba Corporation: A

|

|

•

|

AK Steel Corporation: B

|

|

•

|

North American Stainless (NAS), owned by Acerinox S.A. (Spain): B

|

|

•

|

Outokumpu Stainless Coil Americas (Finland): B

|

|

•

|

Imports from

|

|

•

|

Aperam (formerly part of Arcelor Mittal) (France, Belgium and Germany): B

|

|

•

|

Outokumpu Oyj (Finland) including Mexinox S.A. de C.V., group member (Mexico): B

|

|

•

|

Ta Chen International Corporation (Taiwan): B

|

|

•

|

Various Chinese producers: B

|

|

(In millions)

|

|

|

|||||

|

United States

|

$

|

2,615.9

|

|

62

|

%

|

||

|

Europe

|

950.5

|

|

22

|

%

|

|||

|

Asia

|

403.8

|

|

10

|

%

|

|||

|

Canada

|

147.0

|

|

3

|

%

|

|||

|

South America, Middle East and other

|

106.2

|

|

3

|

%

|

|||

|

Total sales

|

$

|

4,223.4

|

|

100

|

%

|

||

|

(In millions)

|

2014

|

2013

|

2012

|

|||||||||

|

Company-Funded:

|

||||||||||||

|

High Performance Materials & Components

|

$

|

12.9

|

|

$

|

11.7

|

|

$

|

16.5

|

|

|||

|

Flat Rolled Products

|

4.3

|

|

4.3

|

|

5.8

|

|

||||||

|

Corporate

|

0.2

|

|

0.1

|

|

—

|

|

||||||

|

$

|

17.4

|

|

$

|

16.1

|

|

$

|

22.3

|

|

||||

|

Customer-Funded:

|

||||||||||||

|

High Performance Materials & Components

|

$

|

2.7

|

|

$

|

2.7

|

|

$

|

1.5

|

|

|||

|

Total Research and Development

|

$

|

20.1

|

|

$

|

18.8

|

|

$

|

23.8

|

|

|||

|

Name

|

Age

|

Title

|

||

|

Richard J. Harshman*

|

58

|

Chairman, President and Chief Executive Officer

|

||

|

Patrick J. DeCourcy*

|

52

|

Senior Vice President, Finance and Chief Financial Officer

|

||

|

Hunter R. Dalton*

|

60

|

Executive Vice President, ATI High Performance Specialty Materials Group

|

||

|

John D. Sims*

|

55

|

Executive Vice President, ATI High Performance Specialty Components Group

|

||

|

Robert S. Wetherbee*

|

55

|

Executive Vice President, ATI Flat Rolled Products Group

|

||

|

Elliot S. Davis*

|

53

|

Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary

|

||

|

Kevin B. Kramer*

|

55

|

Senior Vice President, Chief Commercial and Marketing Officer

|

||

|

Carl R. Moulton

|

67

|

Senior Vice President, International

|

||

|

Elizabeth C. Powers*

|

55

|

Senior Vice President, Chief Human Resources Officer

|

||

|

Karl D. Schwartz*

|

51

|

Controller and Chief Accounting Officer

|

||

|

*

|

Such individuals are subject to the reporting and other requirements of Section 16 of the Securities Exchange Act of 1934, as amended.

|

|

2014

|

March 31

|

June 30

|

September 30

|

December 31

|

||||||||||||

|

High

|

$

|

37.71

|

|

$

|

44.58

|

|

$

|

46.23

|

|

$

|

38.22

|

|

||||

|

Low

|

$

|

29.86

|

|

$

|

37.68

|

|

$

|

37.65

|

|

$

|

30.04

|

|

||||

|

2013

|

March 31

|

June 30

|

September 30

|

December 31

|

||||||||||||

|

High

|

$

|

34.18

|

|

$

|

31.92

|

|

$

|

32.74

|

|

$

|

35.89

|

|

||||

|

Low

|

$

|

28.97

|

|

$

|

25.60

|

|

$

|

25.60

|

|

$

|

29.49

|

|

||||

|

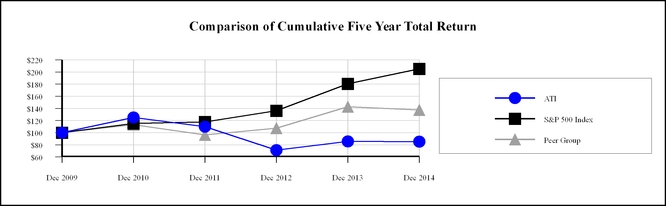

Company / Index

|

Dec 2009

|

Dec 2010

|

Dec 2011

|

Dec 2012

|

Dec 2013

|

Dec 2014

|

||||||||||||

|

ATI

|

100.00

|

|

124.96

|

|

109.77

|

|

71.23

|

|

85.62

|

|

85.09

|

|

||||||

|

S&P 500 Index

|

100.00

|

|

115.06

|

|

117.49

|

|

136.30

|

|

180.44

|

|

205.14

|

|

||||||

|

Peer Group

|

100.00

|

|

113.24

|

|

96.20

|

|

107.30

|

|

142.84

|

|

137.48

|

|

||||||

|

Source: Standard & Poor’s

|

||||||||||||||||||

|

AK Steel Holding Corporation

|

|

Materion Corp

|

|

Steel Dynamics, Inc.

|

|

Alcoa Inc.

|

|

Nucor Corp.

|

|

The Timken Company

|

|

Carpenter Technology Corporation

|

|

Precision Castparts Corp.

|

|

United States Steel Corporation

|

|

Castle (A M) & Co.

|

|

Reliance Steel & Aluminum Co.

|

|

Universal Stainless & Alloy Products, Inc.

|

|

Commercial Metals Company

|

|

RTI International Metals, Inc.

|

|

Worthington Industries, Inc.

|

|

Kennametal Inc.

|

|

Schnitzer Steel Industries, Inc.

|

|

|

|

(In millions)

|

||||||||||||||||||||

|

For the Years Ended December 31,

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||

|

Revenue by Market:

|

||||||||||||||||||||

|

Aerospace & Defense

|

$

|

1,446.3

|

|

$

|

1,394.5

|

|

$

|

1,584.5

|

|

$

|

1,441.6

|

|

$

|

998.3

|

|

|||||

|

Oil & Gas/Chemical Process Industry

|

752.3

|

|

706.8

|

|

837.6

|

|

996.0

|

|

705.1

|

|

||||||||||

|

Electrical Energy

|

430.2

|

|

459.4

|

|

571.5

|

|

741.8

|

|

645.7

|

|

||||||||||

|

Medical

|

211.0

|

|

207.7

|

|

211.5

|

|

243.6

|

|

223.7

|

|

||||||||||

|

Subtotal - Key Markets

|

2,839.8

|

|

2,768.4

|

|

3,205.1

|

|

3,423.0

|

|

2,572.8

|

|

||||||||||

|

Automotive

|

414.4

|

|

348.3

|

|

363.7

|

|

356.2

|

|

292.5

|

|

||||||||||

|

Construction/Mining

|

295.6

|

|

287.5

|

|

364.2

|

|

305.3

|

|

267.0

|

|

||||||||||

|

Food Equipment & Appliances

|

248.8

|

|

251.7

|

|

215.4

|

|

236.8

|

|

273.5

|

|

||||||||||

|

Transportation

|

172.1

|

|

136.3

|

|

196.1

|

|

209.0

|

|

153.3

|

|

||||||||||

|

Electronics/Communication/Computers

|

154.6

|

|

153.1

|

|

170.0

|

|

161.1

|

|

127.7

|

|

||||||||||

|

Conversion Services and Other

|

98.1

|

|

98.2

|

|

152.4

|

|

120.9

|

|

79.4

|

|

||||||||||

|

Total

|

$

|

4,223.4

|

|

$

|

4,043.5

|

|

$

|

4,666.9

|

|

$

|

4,812.3

|

|

$

|

3,766.2

|

|

|||||

|

(In millions, except per share amounts)

|

||||||||||||||||||||

|

For the Years Ended December 31,

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||

|

Sales:

|

||||||||||||||||||||

|

High Performance Materials & Components

|

$

|

2,006.8

|

|

$

|

1,944.8

|

|

$

|

2,314.0

|

|

$

|

2,081.0

|

|

$

|

1,422.8

|

|

|||||

|

Flat Rolled Products

|

2,216.6

|

|

2,098.7

|

|

2,352.9

|

|

2,731.3

|

|

2,343.4

|

|

||||||||||

|

Total Sales

|

$

|

4,223.4

|

|

$

|

4,043.5

|

|

$

|

4,666.9

|

|

$

|

4,812.3

|

|

$

|

3,766.2

|

|

|||||

|

Operating profit (loss):

|

||||||||||||||||||||

|

High Performance Materials & Components

|

$

|

289.6

|

|

$

|

209.1

|

|

$

|

385.4

|

|

$

|

377.1

|

|

$

|

266.0

|

|

|||||

|

Flat Rolled Products

|

(43.3

|

)

|

(44.7

|

)

|

127.8

|

|

217.6

|

|

89.0

|

|

||||||||||

|

Total operating profit

|

$

|

246.3

|

|

$

|

164.4

|

|

$

|

513.2

|

|

$

|

594.7

|

|

$

|

355.0

|

|

|||||

|

Income (loss) from continuing operations before income taxes

|

$

|

1.5

|

|

$

|

(154.8

|

)

|

$

|

232.3

|

|

$

|

322.1

|

|

$

|

124.2

|

|

|||||

|

Income tax provision (benefit)

|

(8.7

|

)

|

(63.6

|

)

|

72.4

|

|

110.4

|

|

46.5

|

|

||||||||||

|

Income (loss) from continuing operations

|

10.2

|

|

(91.2

|

)

|

159.9

|

|

211.7

|

|

77.7

|

|

||||||||||

|

Income (loss) from discontinued operations, net of tax

|

(0.6

|

)

|

252.8

|

|

7.9

|

|

11.4

|

|

1.0

|

|

||||||||||

|

Net income

|

9.6

|

|

161.6

|

|

167.8

|

|

223.1

|

|

78.7

|

|

||||||||||

|

Less: Net income attributable to noncontrolling interests

|

12.2

|

|

7.6

|

|

9.4

|

|

8.8

|

|

8.0

|

|

||||||||||

|

Net income (loss) attributable to ATI

|

$

|

(2.6

|

)

|

$

|

154.0

|

|

$

|

158.4

|

|

$

|

214.3

|

|

$

|

70.7

|

|

|||||

|

Basic net income (loss) per common share

|

||||||||||||||||||||

|

Continuing operations attributable to ATI per common share

|

$

|

(0.02

|

)

|

$

|

(0.93

|

)

|

$

|

1.42

|

|

$

|

1.98

|

|

$

|

0.72

|

|

|||||

|

Discontinued operations attributable to ATI per common share

|

(0.01

|

)

|

2.37

|

|

0.07

|

|

0.11

|

|

0.01

|

|

||||||||||

|

Basic net income (loss) attributable to ATI per common share

|

$

|

(0.03

|

)

|

$

|

1.44

|

|

$

|

1.49

|

|

$

|

2.09

|

|

$

|

0.73

|

|

|||||

|

Diluted net income (loss) per common share

|

||||||||||||||||||||

|

Continuing operations attributable to ATI per common share

|

$

|

(0.02

|

)

|

$

|

(0.93

|

)

|

$

|

1.36

|

|

$

|

1.87

|

|

$

|

0.71

|

|

|||||

|

Discontinued operations attributable to ATI per common share

|

(0.01

|

)

|

2.37

|

|

0.07

|

|

0.10

|

|

0.01

|

|

||||||||||

|

Diluted net income (loss) attributable to ATI per common share

|

$

|

(0.03

|

)

|

$

|

1.44

|

|

$

|

1.43

|

|

$

|

1.97

|

|

$

|

0.72

|

|

|||||

|

(In millions, except per share amounts and ratios)

|

|

|

|

|

|

|||||||||||||||

|

As of and for the Years Ended December 31,

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||

|

Dividends declared per common share

|

$

|

0.72

|

|

$

|

0.72

|

|

$

|

0.72

|

|

$

|

0.72

|

|

$

|

0.72

|

|

|||||

|

Ratio of earnings to fixed charges

|

—

|

|

—

|

|

2.8x

|

|

3.6x

|

|

2.2x

|

|

||||||||||

|

Working capital

|

$

|

1,522.2

|

|

$

|

1,739.8

|

|

$

|

1,639.1

|

|

$

|

1,707.7

|

|

$

|

1,324.1

|

|

|||||

|

Total assets

|

6,582.6

|

|

6,898.5

|

|

6,247.8

|

|

6,046.9

|

|

4,493.6

|

|

||||||||||

|

Long-term debt

|

1,509.1

|

|

1,527.4

|

|

1,463.0

|

|

1,482.0

|

|

921.9

|

|

||||||||||

|

Total debt

|

1,526.9

|

|

1,947.3

|

|

1,480.1

|

|

1,509.3

|

|

1,063.3

|

|

||||||||||

|

Cash and cash equivalents

|

269.5

|

|

1,026.8

|

|

304.6

|

|

380.6

|

|

432.3

|

|

||||||||||

|

Total ATI Stockholders’ equity

|

2,598.4

|

|

2,894.2

|

|

2,479.6

|

|

2,475.3

|

|

2,040.8

|

|

||||||||||

|

Noncontrolling interests

|

110.9

|

|

100.5

|

|

107.5

|

|

96.3

|

|

88.6

|

|

||||||||||

|

Total Stockholders’ equity

|

2,709.3

|

|

2,994.7

|

|

2,587.1

|

|

2,571.6

|

|

2,129.4

|

|

||||||||||

|

(In millions, except per share amounts)

|

2014

|

2013

|

2012

|

|||||||||

|

Sales

|

$

|

4,223.4

|

|

$

|

4,043.5

|

|

$

|

4,666.9

|

|

|||

|

Segment operating profit

|

$

|

246.3

|

|

$

|

164.4

|

|

$

|

513.2

|

|

|||

|

Income (loss) from continuing operations

|

$

|

10.2

|

|

$

|

(91.2

|

)

|

$

|

159.9

|

|

|||

|

Net income

|

$

|

9.6

|

|

$

|

161.6

|

|

$

|

167.8

|

|

|||

|

Amounts attributable to ATI common stockholders:

|

||||||||||||

|

Income (loss) from continuing operations

|

$

|

(2.0

|

)

|

$

|

(98.8

|

)

|

$

|

150.5

|

|

|||

|

Income (loss) from discontinued operations

|

(0.6

|

)

|

252.8

|

|

7.9

|

|

||||||

|

Net income (loss)

|

$

|

(2.6

|

)

|

$

|

154.0

|

|

$

|

158.4

|

|

|||

|

Per Diluted Share:

|

||||||||||||

|

Continuing operations

|

$

|

(0.02

|

)

|

$

|

(0.93

|

)

|

$

|

1.36

|

|

|||

|

Discontinued operations

|

$

|

(0.01

|

)

|

$

|

2.37

|

|

$

|

0.07

|

|

|||

|

Net income (loss)

|

$

|

(0.03

|

)

|

$

|

1.44

|

|

$

|

1.43

|

|

|||

|

•

|

We successfully reached several long-term agreements (LTAs) with strategic aerospace customers during 2014 and early 2015 valued at over $4 billion. These agreements secure significant growth on next-generation and legacy airplanes and are enabled by the capital investments, acquisitions, and technology innovations we have made during the past several years.

|

|

•

|

Product commissioning of our Flat Rolled Products segment Hot-Rolling and Processing Facility (HRPF) was completed at the end of 2014. The HRPF, a $1.2 billion capital investment excluding capitalized interest costs, is a critical part of our strategy to transform our flat rolled products business into a more competitive and consistently profitable business, and is designed to:

|

|

◦

|

Significantly expand our product offering capabilities, shorten manufacturing cycle times, reduce inventory requirements, and improve the cost structure of our flat rolled products business.

|

|

◦

|

Provide unsurpassed manufacturing capability and versatility in the production of a wide range of flat rolled specialty materials, including ATI’s diversified product mix of nickel-based and specialty alloys, titanium and titanium alloys, zirconium alloys, Precision Rolled Strip

®

products, and stainless sheet and coiled plate products.

|

|

◦

|

Produce high-strength carbon steel alloys.

|

|

◦

|

Roll and process exceptional quality hot bands of up to 78.62 inches, or 2 meters, wide.

|

|

•

|

Our Rowley, UT titanium sponge facility was approved as a premium-quality (PQ) aero-engine supplier in December 2014. The PQ qualification process for our products used in jet engine rotating parts made with our sponge is expected to be completed by mid-2015. Completion of the PQ qualification program is an important step in fulfilling the strategic vision and purpose of this approximately $0.5 billion capital investment to provide a secure, domestic supply source for PQ titanium sponge for use in jet engine rotating parts. We continue to achieve improvements in key operational areas and expect to steadily increase production rates, and realize lower titanium production costs per pound, as we progress through 2015.

|

|

•

|

We acquired two businesses for $92.9 million in our High Performance Materials & Components segment to expand our value-added capabilities to provide components and near-net shape parts. ATI Flowform Products, acquired in February 2014, uses precision flowforming process technologies to produce thin-walled components in net or near-net shapes across multiple alloy systems, including nickel-based alloys and superalloys, titanium and titanium alloys, zirconium alloys, and specialty and stainless alloys. This acquisition expands ATI’s capabilities to produce specialty materials parts and components, primarily in the aerospace and defense, and oil & gas/chemical process industry markets. ATI Cast Products Salem Operations, acquired in June 2014, performs precision machining on parts and components made from titanium alloys, nickel-based alloys and superalloys, aluminum, specialty steel, and other ferrous and non-ferrous metals. This acquisition expands ATI’s capabilities to produce finished specialty materials parts and components and reinforces the Company’s important aerospace supply chain role.

|

|

•

|

We made several significant changes to certain pension and other postretirement benefit programs effective in 2015 and future periods, including a defined benefit pension freeze and the elimination of Company-provided postretirement life insurance and medical coverage. These changes are part of ATI’s ongoing initiatives to create an integrated and aligned business with a market competitive, cost competitive, and consistent health, welfare and retirement benefit structure across our operations. The changes to postretirement benefits resulted in $25.5 million of pre-tax curtailment and settlement gains in the fourth quarter 2014. Also, as a result of these pension and other postretirement benefit plan changes, which are expected to gradually improve our ability to control our retirement benefit obligations, we expect to recognize lower retirement benefit expense (defined benefit pension expense and other postretirement benefit expenses; costs associated with defined contribution retirement plans are included in segment operating profit or corporate expenses, as applicable) in 2015 and future periods. Our U.S. qualified defined benefit pension was approximately 76% funded at December 31, 2014, as measured for financial reporting purposes, and there are no required contributions to this plan for 2015.

|

|

•

|

We maintained a solid liquidity position, with approximately $270 million in cash on hand and no borrowings outstanding under our $400 million domestic borrowing facility at the end of the year. We paid down $414.9 million of debt, including $397.5 million paid at maturity on our 2014 convertible notes, and payments on debt assumed in the 2011 Ladish acquisition. Total debt to total capital was 37.0% at December 31, 2014, compared to 40.2% at the end of 2013. We have no significant debt maturities for the next four years.

|

|

•

|

Capital expenditures in 2014, the majority of which related to the HRPF, were approximately $226 million. This amount was lower than our 2014 estimate of $250 million because some HRPF payments are now scheduled to be made in 2015. We are near the end of a multi-year cycle of capital expenditures on major strategic investments.

|

|

•

|

Our safety focus continued across all of ATI’s operations. Our 2014 OSHA Total Recordable Incident Rate was 2.07 and our Lost Time Case Rate was 0.39 per 200,000 hours worked, which we believe to be competitive with world class performance for our industry.

|

|

|

2014

|

2013

|

2012

|

|||||||||||||||

|

|

Revenue

|

Operating Profit (Loss)

|

Revenue

|

Operating

Profit (Loss) |

Revenue

|

Operating

Profit |

||||||||||||

|

High Performance Materials & Components

|

48

|

%

|

118

|

%

|

48

|

%

|

127

|

%

|

50

|

%

|

75

|

%

|

||||||

|

Flat Rolled Products

|

52

|

%

|

(18

|

)%

|

52

|

%

|

(27

|

)%

|

50

|

%

|

25

|

%

|

||||||

|

Market

|

2014

|

2013

|

2012

|

||||||||||||||||||

|

Aerospace & Defense

|

$

|

1,446.3

|

|

34

|

%

|

$

|

1,394.5

|

|

35

|

%

|

$

|

1,584.5

|

|

34

|

%

|

||||||

|

Oil & Gas/Chemical Process Industry

|

752.3

|

|

18

|

%

|

706.8

|

|

17

|

%

|

837.6

|

|

18

|

%

|

|||||||||

|

Electrical Energy

|

430.2

|

|

10

|

%

|

459.4

|

|

11

|

%

|

571.5

|

|

12

|

%

|

|||||||||

|

Medical

|

211.0

|

|

5

|

%

|

207.7

|

|

5

|

%

|

211.5

|

|

5

|

%

|

|||||||||

|

Subtotal - Key Markets

|

2,839.8

|

|

67

|

%

|

2,768.4

|

|

68

|

%

|

3,205.1

|

|

69

|

%

|

|||||||||

|

Automotive

|

414.4

|

|

10

|

%

|

348.3

|

|

9

|

%

|

363.7

|

|

8

|

%

|

|||||||||

|

Construction/Mining

|

295.6

|

|

7

|

%

|

287.5

|

|

7

|

%

|

364.2

|

|

8

|

%

|

|||||||||

|

Food Equipment & Appliances

|

248.8

|

|

6

|

%

|

251.7

|

|

6

|

%

|

215.4

|

|

4

|

%

|

|||||||||

|

Transportation

|

172.1

|

|

4

|

%

|

136.3

|

|

3

|

%

|

196.1

|

|

4

|

%

|

|||||||||

|

Electronics/Computers/Communication

|

154.6

|

|

4

|

%

|

153.1

|

|

4

|

%

|

170.0

|

|

4

|

%

|

|||||||||

|

Conversion Services and Other

|

98.1

|

|

2

|

%

|

98.2

|

|

3

|

%

|

152.4

|

|

3

|

%

|

|||||||||

|

Total

|

$

|

4,223.4

|

|

100

|

%

|

$

|

4,043.5

|

|

100

|

%

|

$

|

4,666.9

|

|

100

|

%

|

||||||

|

For the Years Ended December 31,

|

2014

|

2013

|

2012

|

||||||

|

High-Value Products

|

|||||||||

|

Nickel-based alloys and specialty alloys

|

26

|

%

|

25

|

%

|

27

|

%

|

|||

|

Titanium and titanium alloys

|

15

|

%

|

16

|

%

|

14

|

%

|

|||

|

Precision forgings, castings and components

|

13

|

%

|

13

|

%

|

14

|

%

|

|||

|

Precision and engineered strip

|

13

|

%

|

13

|

%

|

12

|

%

|

|||

|

Zirconium and related alloys

|

6

|

%

|

6

|

%

|

6

|

%

|

|||

|

Grain-oriented electrical steel

|

4

|

%

|

5

|

%

|

5

|

%

|

|||

|

Total High-Value Products

|

77

|

%

|

78

|

%

|

78

|

%

|

|||

|

Standard Products

|

|||||||||

|

Specialty stainless sheet

|

10

|

%

|

10

|

%

|

10

|

%

|

|||

|

Stainless steel sheet

|

9

|

%

|

9

|

%

|

9

|

%

|

|||

|

Stainless steel plate and other

|

4

|

%

|

3

|

%

|

3

|

%

|

|||

|

Total Standard Products

|

23

|

%

|

22

|

%

|

22

|

%

|

|||

|

Grand Total

|

100

|

%

|

100

|

%

|

100

|

%

|

|||

|

(In millions)

|

2014

|

% Change

|

2013

|

% Change

|

2012

|

|||||||||||||

|

Sales to external customers

|

$

|

2,006.8

|

|

3

|

%

|

$

|

1,944.8

|

|

(16

|

)%

|

$

|

2,314.0

|

|

|||||

|

Operating profit

|

289.6

|

|

38

|

%

|

209.1

|

|

(46

|

)%

|

385.4

|

|

||||||||

|

Operating profit as a percentage of sales

|

14.4

|

%

|

10.8

|

%

|

16.7

|

%

|

||||||||||||

|

Direct international sales as a percentage of sales

|

41.2

|

%

|

43.3

|

%

|

43.5

|

%

|

||||||||||||

|

Market

|

2014

|

2013

|

Change

|

||||||||||||||||||

|

Aerospace:

|

|||||||||||||||||||||

|

Jet Engines

|

$

|

632.9

|

|

32

|

%

|

$

|

591.4

|

|

30

|

%

|

$

|

41.5

|

|

7

|

%

|

||||||

|

Airframes

|

376.1

|

|

19

|

%

|

370.5

|

|

19

|

%

|

5.6

|

|

2

|

%

|

|||||||||

|

Government

|

182.4

|

|

9

|

%

|

195.5

|

|

10

|

%

|

(13.1

|

)

|

(7

|

)%

|

|||||||||

|

Total Aerospace

|

1,191.4

|

|

60

|

%

|

1,157.4

|

|

59

|

%

|

34.0

|

|

3

|

%

|

|||||||||

|

Oil & Gas/Chemical Process Industry

|

189.1

|

|

9

|

%

|

172.8

|

|

9

|

%

|

16.3

|

|

9

|

%

|

|||||||||

|

Medical

|

187.6

|

|

9

|

%

|

183.5

|

|

9

|

%

|

4.1

|

|

2

|

%

|

|||||||||

|

Electrical Energy

|

124.0

|

|

6

|

%

|

133.1

|

|

7

|

%

|

(9.1

|

)

|

(7

|

)%

|

|||||||||

|

Defense

|

102.6

|

|

5

|

%

|

95.6

|

|

5

|

%

|

7.0

|

|

7

|

%

|

|||||||||

|

Construction/Mining

|

64.3

|

|

3

|

%

|

61.4

|

|

3

|

%

|

2.9

|

|

5

|

%

|

|||||||||

|

Transportation

|

47.8

|

|

3

|

%

|

49.7

|

|

3

|

%

|

(1.9

|

)

|

(4

|

)%

|

|||||||||

|

Other

|

100.0

|

|

5

|

%

|

91.3

|

|

5

|

%

|

8.7

|

|

10

|

%

|

|||||||||

|

Total

|

$

|

2,006.8

|

|

100

|

%

|

$

|

1,944.8

|

|

100

|

%

|

$

|

62.0

|

|

3

|

%

|

||||||

|

For the Years Ended December 31,

|

2014

|

2013

|

||||

|

High-Value Products

|

||||||

|

Nickel-based alloys and specialty alloys

|

32

|

%

|

30

|

%

|

||

|

Titanium and titanium alloys

|

28

|

%

|

28

|

%

|

||

|

Precision forgings, castings and components

|

27

|

%

|

29

|

%

|

||

|

Zirconium and related alloys

|

13

|

%

|

13

|

%

|

||

|

Total High-Value Products

|

100

|

%

|

100

|

%

|

||

|

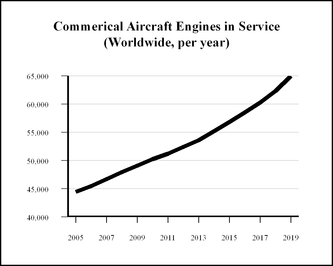

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|||||||||||||||||||||||||||||

|

44,446

|

|

45,476

|

|

46,705

|

|

47,915

|

|

49,063

|

|

50,216

|

|

51,186

|

|

52,415

|

|

53,593

|

|

55,167

|

|

56,833

|

|

58,515

|

|

60,275

|

|

62,295

|

|

64,934

|

|

||||||||||||||

|

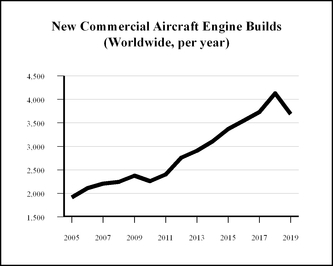

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|||||||||||||||||||||||||||||

|

1,918

|

|

2,114

|

|

2,208

|

|

2,244

|

|

2,380

|

|

2,258

|

|

2,404

|

|

2,760

|

|

2,906

|

|

3,102

|

|

3,370

|

|

3,550

|

|

3,730

|

|

4,130

|

|

3,690

|

|

||||||||||||||

|

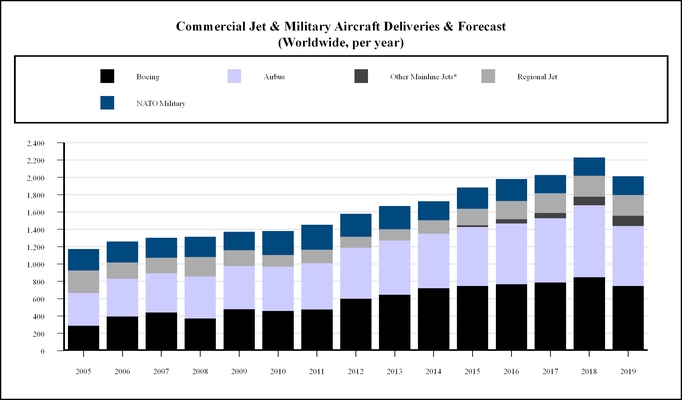

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|||||||||||||||||||||||||||||||

|

Boeing

|

290

|

|

398

|

|

443

|

|

375

|

|

481

|

|

462

|

|

477

|

|

601

|

|

648

|

|

723

|

|

750

|

|

770

|

|

790

|

|

850

|

|

750

|

|

|||||||||||||||

|

Airbus

|

378

|

|

434

|

|

453

|

|

483

|

|

498

|

|

510

|

|

534

|

|

588

|

|

626

|

|

629

|

|

680

|

|

700

|

|

740

|

|

830

|

|

690

|

|

|||||||||||||||

|

Other Mainline Jets*

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

20

|

|

50

|

|

60

|

|

100

|

|

120

|

|

|||||||||||||||

|

Regional Jet

|

261

|

|

187

|

|

180

|

|

225

|

|

183

|

|

135

|

|

156

|

|

128

|

|

130

|

|

157

|

|

190

|

|

210

|

|

230

|

|

240

|

|

240

|

|

|||||||||||||||

|

NATO Military

|

243

|

|

241

|

|

226

|

|

231

|

|

211

|

|

275

|

|

287

|

|

263

|

|

265

|

|

215

|

|

244

|

|

250

|

|

206

|

|

210

|

|

213

|

|

|||||||||||||||

|

Total Deliveries

|

1,172

|

|

1,260

|

|

1,302

|

|

1,314

|

|

1,373

|

|

1,382

|

|

1,454

|

|

1,580

|

|

1,669

|

|

1,724

|

|

1,884

|

|

1,980

|

|

2,026

|

|

2,230

|

|

2,013

|

|

|||||||||||||||

|

•

|

Boeing 737MAX, $1.1 million

|

|

•

|

Boeing 787, $2.8 million

|

|

•

|

Airbus 350, $1.5 million

|

|

Market

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Aerospace:

|

|||||||||||||||||||||

|

Jet Engines

|

$

|

591.4

|

|

30

|

%

|

$

|

725.3

|

|

31

|

%

|

$

|

(133.9

|

)

|

(18

|

)%

|

||||||

|

Airframes

|

370.5

|

|

19

|

%

|

388.6

|

|

17

|

%

|

(18.1

|

)

|

(5

|

)%

|

|||||||||

|

Government

|

195.5

|

|

10

|

%

|

198.6

|

|

9

|

%

|

(3.1

|

)

|

(2

|

)%

|

|||||||||

|

Total Aerospace

|

1,157.4

|

|

59

|

%

|

1,312.5

|

|

57

|

%

|

(155.1

|

)

|

(12

|

)%

|

|||||||||

|

Medical

|

183.5

|

|

9

|

%

|

188.4

|

|

8

|

%

|

(4.9

|

)

|

(3

|

)%

|

|||||||||

|

Oil & Gas/Chemical Process Industry

|

172.8

|

|

9

|

%

|

235.8

|

|

10

|

%

|

(63.0

|

)

|

(27

|

)%

|

|||||||||

|

Electrical Energy

|

133.1

|

|

7

|

%

|

166.3

|

|

7

|

%

|

(33.2

|

)

|

(20

|

)%

|

|||||||||

|

Defense

|

95.6

|

|

5

|

%

|

111.4

|

|

5

|

%

|

(15.8

|

)

|

(14

|

)%

|

|||||||||

|

Construction/Mining

|

61.4

|

|

3

|

%

|

109.6

|

|

5

|

%

|

(48.2

|

)

|

(44

|

)%

|

|||||||||

|

Transportation

|

49.7

|

|

3

|

%

|

75.8

|

|

3

|

%

|

(26.1

|

)

|

(34

|

)%

|

|||||||||

|

Other

|

91.3

|

|

5

|

%

|

114.2

|

|

5

|

%

|

(22.9

|

)

|

(20

|

)%

|

|||||||||

|

Total

|

$

|

1,944.8

|

|

100

|

%

|

$

|

2,314.0

|

|

100

|

%

|

$

|

(369.2

|

)

|

(16

|

)%

|

||||||

|

For the Years Ended December 31,

|

|

2013

|

|

2012

|

||

|

High-Value Products

|

|

|

|

|

||

|

Nickel-based alloys and specialty alloys

|

|

30

|

%

|

|

34

|

%

|

|

Precision forgings, castings and components

|

|

29

|

%

|

|

29

|

%

|

|

Titanium and titanium alloys

|

|

28

|

%

|

|

25

|

%

|

|

Zirconium and related alloys

|

|

13

|

%

|

|

12

|

%

|

|

Total High-Value Products

|

|

100

|

%

|

|

100

|

%

|

|

(In millions)

|

2014

|

% Change

|

2013

|

% Change

|

2012

|

|||||||||||||

|

Sales to external customers

|

$

|

2,216.6

|

|

6

|

%

|

$

|

2,098.7

|

|

(11

|

)%

|

$

|

2,352.9

|

|

|||||

|

Operating profit (loss)

|

(43.3

|

)

|

3

|

%

|

(44.7

|

)

|

(135

|

)%

|

127.8

|

|

||||||||

|

Operating profit (loss) as a percentage of sales

|

(2.0

|

)%

|

(2.1

|

)%

|

5.4

|

%

|

||||||||||||

|

Direct international sales as a percentage of sales

|

35.2

|

%

|

35.4

|

%

|

32.0

|

%

|

||||||||||||

|

Market

|

2014

|

2013

|

Change

|

||||||||||||||||||

|

Oil & Gas/Chemical Process Industry

|

$

|

563.1

|

|

25

|

%

|

$

|

534.0

|

|

25

|

%

|

$

|

29.1

|

|

5

|

%

|

||||||

|

Automotive

|

395.7

|

|

18

|

%

|

335.3

|

|

16

|

%

|

60.4

|

|

18

|

%

|

|||||||||

|

Electrical Energy

|

306.2

|

|

14

|

%

|

326.3

|

|

16

|

%

|

(20.1

|

)

|

(6

|

)%

|

|||||||||

|

Food Equipment & Appliances

|

245.7

|

|

11

|

%

|

249.7

|

|

12

|

%

|

(4.0

|

)

|

(2

|

)%

|

|||||||||

|

Construction/Mining

|

231.3

|

|

10

|

%

|

226.1

|

|

11

|

%

|

5.2

|

|

2

|

%

|

|||||||||

|

Aerospace & Defense

|

152.4

|

|

7

|

%

|

141.4

|

|

7

|

%

|

11.0

|

|

8

|

%

|

|||||||||

|

Electronics/Computers/Communication

|

151.4

|

|

7

|

%

|

149.0

|

|

7

|

%

|

2.4

|

|

2

|

%

|

|||||||||

|

Transportation

|

124.3

|

|

6

|

%

|

86.6

|

|

4

|

%

|

37.7

|

|

44

|

%

|

|||||||||

|

Medical

|

23.4

|

|

1

|

%

|

24.2

|

|

1

|

%

|

(0.8

|

)

|

(3

|

)%

|

|||||||||

|

Other

|

23.1

|

|

1

|

%

|

26.1

|

|

1

|

%

|

(3.0

|

)

|

(11

|

)%

|

|||||||||

|

Total

|

$

|

2,216.6

|

|

100

|

%

|

$

|

2,098.7

|

|

100

|

%

|

$

|

117.9

|

|

6

|

%

|

||||||

|

For the Years Ended December 31,

|

2014

|

2013

|

||||

|

High-Value Products

|

||||||

|

Precision and engineered strip

|

26

|

%

|

26

|

%

|

||

|

Nickel-based alloys and specialty alloys

|

21

|

%

|

20

|

%

|

||

|

Grain-oriented electrical steel

|

8

|

%

|

8

|

%

|

||

|

Titanium and titanium alloys

|

4

|

%

|

5

|

%

|

||

|

Total High-Value Products

|

59

|

%

|

59

|

%

|

||

|

Standard Products

|

||||||

|

Specialty stainless sheet

|

19

|

%

|

19

|

%

|

||

|

Stainless steel sheet

|

17

|

%

|

18

|

%

|

||

|

Stainless steel plate

|

5

|

%

|

4

|

%

|

||

|

Total Standard Products

|

41

|

%

|

41

|

%

|

||

|

Grand Total

|

100

|

%

|

100

|

%

|

||

|

|

2014

|

2013

|

% change

|

||||||||

|

Volume (000’s pounds):

|

|||||||||||

|

High-value

|

508,753

|

|

468,551

|

|

9

|

%

|

|||||

|

Standard

|

678,022

|

|

665,977

|

|

2

|

%

|

|||||

|

Total

|

1,186,775

|

|

1,134,528

|

|

5

|

%

|

|||||

|

Average prices (per lb.):

|

|||||||||||

|

High-value

|

$

|

2.53

|

|

$

|

2.63

|

|

(4

|

)%

|

|||

|

Standard

|

$

|

1.35

|

|

$

|

1.28

|

|

5

|

%

|

|||

|

Combined Average

|

$

|

1.86

|

|

$

|

1.84

|

|

1

|

%

|

|||

|

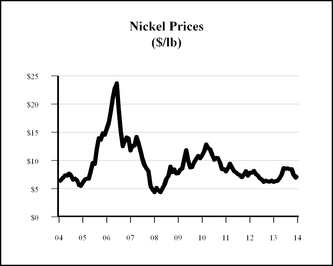

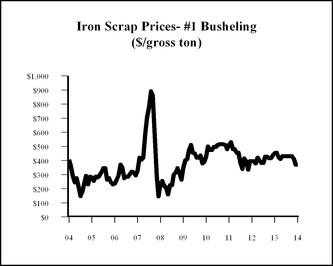

04

|

05

|

06

|

07

|

08

|

09

|

10

|

11

|

12

|

13

|

14

|

04

|

05

|

06

|

07

|

08

|

09

|

10

|

11

|

12

|

13

|

14

|

|||||||||||||||||||||||

|

6.25

|

|

6.09

|

|

15.68

|

|

11.79

|

|

4.39

|

|

7.74

|

|

10.94

|

|

8.05

|

|

7.82

|

|

6.22

|

|

7.37

|

|

405

|

|

280

|

|

235

|

|

325

|

|

235

|

|

345

|

|

430

|

|

510

|

|

395

|

|

452

|

|

371

|

|

|

|

Source: London Metals Exchange

|

Source: American Metals Market

|

|||||||||||||||||||||||||||||||||||||||||||

|

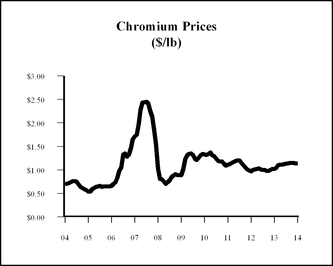

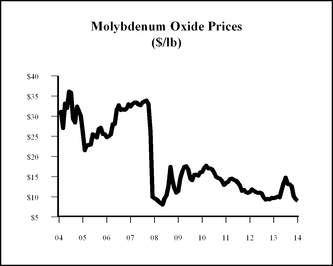

04

|

05

|

06

|

07

|

08

|

09

|

10

|

11

|

12

|

13

|

14

|

04

|

05

|

06

|

07

|

08

|

09

|

10

|

11

|

12

|

13

|

14

|

|||||||||||||||||||||||

|

0.69

|

|

0.54

|

|

0.66

|

|

1.71

|

|

1.03

|

|

0.89

|

|

1.33

|

|

1.11

|

|

0.97

|

|

1.02

|

|

1.14

|

|

30.30

|

|

25.95

|

|

24.78

|

|

32.38

|

|

9.60

|

|

11.38

|

|

16.19

|

|

13.45

|

|

11.20

|

|

9.67

|

|

9.01

|

|

|

|

Source: Platts Metals Week

|

Source: Platts Metals Week

|

|||||||||||||||||||||||||||||||||||||||||||

|

Market

|

2013

|

2012

|

Change

|

||||||||||||||||||

|

Oil & Gas/Chemical Process Industry

|

$

|

534.0

|

|

25

|

%

|

$

|

601.9

|

|

25

|

%

|

$

|

(67.9

|

)

|

(11

|

)%

|

||||||

|

Automotive

|

335.3

|

|

16

|

%

|

352.4

|

|

15

|

%

|

(17.1

|

)

|

(5

|

)%

|

|||||||||

|

Electrical Energy

|

326.3

|

|

16

|

%

|

405.2

|

|

17

|

%

|

(78.9

|

)

|

(19

|

)%

|

|||||||||

|

Food Equipment & Appliances

|

249.7

|

|

12

|

%

|

212.6

|

|

9

|

%

|

37.1

|

|

17

|

%

|

|||||||||

|

Construction/Mining

|

226.1

|

|

11

|

%

|

254.6

|

|

11

|

%

|

(28.5

|

)

|

(11

|

)%

|

|||||||||

|

Electronics/Computers/Communication

|

149.0

|

|

7

|

%

|

161.0

|

|

7

|

%

|

(12.0

|

)

|

(7

|

)%

|

|||||||||

|

Aerospace & Defense

|

141.4

|

|

7

|

%

|

160.7

|

|

7

|

%

|

(19.3

|

)

|

(12

|

)%

|

|||||||||

|

Transportation

|

86.6

|

|

4

|

%

|

120.3

|

|

5

|

%

|

(33.7

|

)

|

(28

|

)%

|

|||||||||

|

Medical

|

24.2

|

|

1

|

%

|

23.1

|

|

1

|

%

|

1.1

|

|

5

|

%

|

|||||||||

|

Other

|

26.1

|

|

1

|

%

|

61.1

|

|

3

|

%

|

(35.0

|

)

|

(57

|

)%

|

|||||||||

|

Total

|

$

|

2,098.7

|

|

100

|

%

|

$

|

2,352.9

|

|

100

|

%

|

$

|

(254.2

|

)

|

(11

|

)%

|

||||||

|

For the Years Ended December 31,

|

2013

|

2012

|

||||

|

High-Value Products

|

||||||

|

Precision and engineered strip

|

26

|

%

|

24

|

%

|

||

|

Nickel-based alloys and specialty alloys

|

20

|

%

|

21

|

%

|

||

|

Grain-oriented electrical steel

|

8

|

%

|

10

|

%

|

||

|

Titanium and titanium alloys

|

5

|

%

|

4

|

%

|

||

|

Total High-Value Products

|

59

|

%

|

59

|

%

|

||

|

Standard Products

|

||||||

|

Specialty stainless sheet

|

19

|

%

|

19

|

%

|

||

|

Stainless steel sheet

|

18

|

%

|

17

|

%

|

||

|

Stainless steel plate

|

4

|

%

|

5

|

%

|

||

|

Total Standard Products

|

41

|

%

|

41

|

%

|

||

|

Grand Total

|

100

|

%

|

100

|

%

|

||

|

|

2013

|

2012

|

% change

|

||||||

|

Volume (000’s pounds):

|

|||||||||

|

High-value

|

468,551

|

|

475,808

|

|

(2

|

)%

|

|||

|

Standard

|

665,977

|

|

656,285

|

|

1

|

%

|

|||

|

Total

|

1,134,528

|

|

1,132,093

|

|

—

|

%

|

|||

|

Average prices (per lb.):

|

|||||||||

|

High-value

|

$2.63

|

$2.89

|

(9

|

)%

|

|||||

|

Standard

|

$1.28

|

$1.46

|

(12

|

)%

|

|||||

|

Combined Average

|

$1.84

|

$2.06

|

(11

|

)%

|

|||||

|

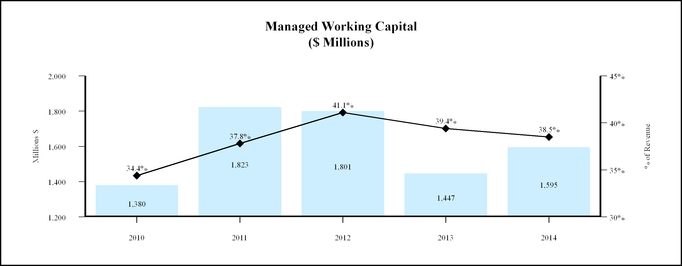

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||

|

Millions/$

|

1,380

|

|

1,823

|

|

1,801

|

|

1,447

|

|

1,595

|

|

|

|

% of Annualized Sales

|

34.4

|

%

|

37.8

|

%

|

41.1

|

%

|

39.4

|

%

|

38.5

|

%

|

|

|

(In millions)

|

December 31,

2014 |

December 31,

2013 |

December 31,

2012 |

|||||||||

|

Accounts receivable

|

$

|

603.6

|

|

$

|

528.2

|

|

$

|

613.3

|

|

|||

|

Inventory

|

1,472.8

|

|

1,322.1

|

|

1,536.6

|

|

||||||

|

Accounts payable

|

(556.7

|

)

|

(471.8

|

)

|

(499.9

|

)

|

||||||

|

Subtotal

|

1,519.7

|

|

1,378.5

|

|

1,650.0

|

|

||||||

|

Allowance for doubtful accounts

|

4.8

|

|

5.3

|

|

5.5

|

|

||||||

|

LIFO reserve

|

(4.8

|

)

|

(29.4

|

)

|

76.9

|

|

||||||

|

Inventory reserves

|

68.8

|

|

84.3

|

|

63.1

|

|

||||||

|

Corporate and other

|

6.0

|

|

2.7

|

|

5.3

|

|

||||||

|

Managed working capital of discontinued operations

|

—

|

|

5.1

|

|

—

|

|

||||||

|

Managed working capital

|

$

|

1,594.5

|

|

$

|

1,446.5

|

|

$

|

1,800.8

|

|

|||

|

Annualized prior 2 months sales

|

$

|

4,144.5

|

|

$

|

3,675.0

|

|

$

|

4,380.8

|

|

|||

|

Managed working capital as a % of annualized sales

|

38.5

|

%

|

39.4

|

%

|

41.1

|

%

|

||||||

|

December 31, 2014 change in managed working capital

|

$

|

148.0

|

|

|||||||||

|

•

|

Product commissioning of our Flat Rolled Products segment HRPF was completed at the end of 2014. The HRPF, a $1.2 billion capital investment excluding capitalized interest costs, is a critical part of our strategy to transform our flat rolled products business into a more competitive and consistently profitable business and is designed to:

|

|

◦

|

Significantly expand our product offering capabilities, shorten manufacturing cycle times, reduce inventory requirements, and improve the cost structure of our flat rolled products business.

|

|

◦

|

Provide unsurpassed manufacturing capability and versatility in the production of a wide range of flat rolled specialty materials, including ATI’s diversified product mix of nickel-based and specialty alloys, titanium and titanium alloys, zirconium alloys, Precision Rolled Strip

®

products, and stainless sheet and coiled plate products.

|

|

◦

|

Produce high-strength carbon steel alloys.

|

|

◦

|

Roll and process exceptional quality hot bands of up to 78.62 inches, or 2 meters, wide.

|

|

•

|

The expansion of ATI’s aerospace quality titanium sponge production capabilities in the High Performance Materials & Components segment. Titanium sponge is an important raw material used to produce our titanium mill products. Our greenfield premium-grade titanium sponge (jet engine rotating parts) facility in Rowley, UT, which started operations in 2009 with a total cost of approximately $0.5 billion, began the PQ qualification program in the 2013 fourth quarter and was approved as a premium-quality (PQ) aero-engine supplier in December 2014. The PQ qualification process for our products used in jet engine rotating parts made with our sponge is expected to be completed by mid-2015. We continue

|

|

•

|

The acquisition in 2014 of two businesses for $92.9 million to expand our value-added capabilities to provide components and near-net shape parts. ATI Flowform Products adds precision flowforming process technologies to ATI’s capabilities. ATI Cast Products Salem Operations adds precision machining capability.

|

|

(In millions)

|

December 31,

2014 |

December 31,

2013 |

||||||

|

Total debt

|

$

|

1,526.9

|

|

$

|

1,947.3

|

|

||

|

Less: Cash

|

(269.5

|

)

|

(1,026.8

|

)

|

||||

|

Net debt

|

$

|

1,257.4

|

|

$

|

920.5

|

|

||

|

Total ATI stockholders’ equity

|

2,598.4

|

|

2,894.2

|

|

||||

|

Net ATI capital

|

$

|

3,855.8

|

|

$

|

3,814.7

|

|

||

|

Net debt to ATI capital

|

32.6

|

%

|

24.1

|

%

|

||||

|

(In millions)

|

December 31,

2014 |

December 31,

2013 |

||||||

|

Total debt

|

$

|

1,526.9

|

|

$

|

1,947.3

|

|

||

|

Total ATI stockholders’ equity

|

2,598.4

|

|

2,894.2

|

|

||||

|

Total ATI capital

|

$

|

4,125.3

|

|

$

|

4,841.5

|

|

||

|

Total debt to ATI capital

|

37.0

|

%

|

40.2

|

%

|

||||

|

(In millions)

|

Total

|

Less than 1

year

|

1-3

years

|

4-5

years

|

After 5

years

|

|||||||||||||||

|

Contractual Cash Obligations

|

||||||||||||||||||||

|

Total Debt including Capital Leases (A)

|

$

|

1,526.2

|

|

$

|

17.8

|

|

$

|

8.2

|

|

$

|

350.3

|

|

$

|

1,149.9

|

|

|||||

|

Operating Lease Obligations

|

98.0

|

|

19.2

|

|

33.0

|

|

21.5

|

|

24.3

|

|

||||||||||

|

Other Long-term Liabilities (B)

|

156.2

|

|

—

|

|

98.1

|

|

12.1

|

|

46.0

|

|

||||||||||

|

Unconditional Purchase Obligations

|

|

|

||||||||||||||||||

|

Raw Materials (C)

|

358.6

|

|

138.1

|

|

67.8

|

|

38.2

|

|

114.5

|

|

||||||||||

|

Capital expenditures

|

118.0

|

|

109.8

|

|

8.2

|

|

—

|

|

—

|

|

||||||||||

|

Other (D)

|

200.9

|

|

95.3

|

|

72.9

|

|

17.4

|

|

15.3

|

|

||||||||||

|

Total

|

$

|

2,457.9

|

|

$

|

380.2

|

|

$

|

288.2

|

|

$

|

439.5

|

|

$

|

1,350.0

|

|

|||||

|

Other Financial Commitments

|

||||||||||||||||||||

|

Lines of Credit (E)

|

$

|

508.7

|

|

$

|

108.7

|

|

$

|

—

|

|

$

|

400.0

|

|

$

|

—

|

|

|||||

|

Guarantees

|

$

|

20.4

|

|

|||||||||||||||||

|

(A)

|

Debt and capital leases exclude acquisition fair value adjustments.

|

|

(B)

|

Other long-term liabilities exclude pension liabilities and accrued postretirement benefits. See Note 11. Pension Plans and Other Postretirement Benefits of the notes to the 2014 consolidated financial statements for further information on these obligations.

|

|

(C)

|

We have contracted for physical delivery for certain of our raw materials to meet a portion of our needs. These contracts are based upon fixed or variable price provisions. We used current market prices as of December 31, 2014, for raw material obligations with variable pricing.

|

|

(D)

|

We have various contractual obligations that extend through 2026 for services involving production facilities and administrative operations. Our purchase obligation as disclosed represents the estimated termination fees payable if we were to exit these contracts.

|

|

(E)

|