|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission

File Number

|

|

Registrant, State of Incorporation

Address, Zip Code and Telephone Number

|

|

IRS Employer

Identification No.

|

|

001-14431

|

|

American States Water Company

(Incorporated in California)

630 E. Foothill Boulevard, San Dimas, CA 91773-1212

(909) 394-3600

|

|

95-4676679

|

|

001-12008

|

|

Golden State Water Company

(Incorporated in California)

630 E. Foothill Boulevard, San Dimas, CA 91773-1212

(909) 394-3600

|

|

95-1243678

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

American States Water Company Common Shares

|

|

New York Stock Exchange

|

|

American States Water Company

|

|

Yes

x

No

¨

|

||

|

Golden State Water Company

|

|

Yes

¨

No

x

|

||

|

American States Water Company

|

|

Yes

¨

No

x

|

||

|

Golden State Water Company

|

|

Yes

¨

No

x

|

||

|

American States Water Company

|

|

Yes

x

No

¨

|

||

|

Golden State Water Company

|

|

Yes

x

No

¨

|

||

|

American States Water Company

|

|

Yes

x

No

¨

|

||

|

Golden State Water Company

|

|

Yes

x

No

¨

|

||

|

American States Water Company

|

||||||||

|

Large accelerated filer

x

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

¨

|

Emerging growth company

¨

|

|

|

Golden State Water Company

|

||||||||

|

Large accelerated filer

¨

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

x

|

|

Smaller reporting company

¨

|

Emerging growth company

¨

|

|

|

American States Water Company

|

|

Yes

¨

No

x

|

||

|

Golden State Water Company

|

|

Yes

¨

No

x

|

||

|

Subsidiary

|

Military Base

|

Type of System

|

Location

|

|||

|

FBWS

|

Fort Bliss

|

Water and Wastewater

|

Texas and New Mexico

|

|||

|

TUS

|

Joint Base Andrews

|

Water and Wastewater

|

Maryland

|

|||

|

ODUS

|

Fort Lee

|

Wastewater

|

Virginia

|

|||

|

ODUS

|

Joint-Base Langley Eustis and Joint Expeditionary Base Little Creek-Fort Story

|

Water and Wastewater

|

Virginia

|

|||

|

PSUS

|

Fort Jackson

|

Water and Wastewater

|

South Carolina

|

|||

|

ONUS

|

Fort Bragg, Pope Army Airfield and Camp Mackall

|

Water and Wastewater

|

North Carolina

|

|||

|

ECUS

|

Eglin Air Force Base

|

Water and Wastewater

|

Florida

|

|||

|

FRUS

|

Fort Riley

|

Water and Wastewater Collection and Treatment

|

Kansas

|

|||

|

•

|

the outcome of pending and future regulatory, legislative or other proceedings, investigations or audits, including decisions in GSWC's general rate cases and the results of independent audits of GSWC's construction contracting procurement practices or other independent audits of our costs;

|

|

•

|

changes in the policies and procedures of the California Public Utilities Commission ("CPUC");

|

|

•

|

timeliness of CPUC action on GSWC rates;

|

|

•

|

availability of GSWC's water supplies, which may be adversely affected by increases in the frequency and duration of droughts, changes in weather patterns, contamination, and court decisions or other governmental actions restricting the use of water from the Colorado River, the California State Water Project, and/or pumping of groundwater;

|

|

•

|

liabilities of GSWC associated with the inherent risks of damage to private property and injuries to employees and the public if our or their property should come into contact with electrical current or equipment;

|

|

•

|

the breakdown or failure of equipment at GSWC's electric division if those failures result in fires or unplanned electric outages, and whether GSWC will be subject to investigations, penalties, liabilities to customers or other third parties or other costs in connection with such events;

|

|

•

|

the potential of strict liability for damages caused by GSWC's property or equipment, even if GSWC was not negligent in the operation and maintenance of that property or equipment, under a doctrine known as inverse condemnation;

|

|

•

|

the impact of storms, high winds, earthquakes, floods, mudslides, drought, wildfires and similar natural disasters, contamination or acts of terrorism or vandalism, that affect water quality and/or supply, affect customer demand, that damage or disrupt facilities, operations or information technology systems owned by us, our customers or third parties on whom we rely or that damage the property of our customers or other third parties or cause bodily injury resulting in liabilities that we may be unable to recover from insurance, other third parties and/or the U.S. government or that the CPUC or the courts do not permit us to recover from ratepayers;

|

|

•

|

the impact on water utility operations during high fire threat conditions as a result of the Public Safety Power Shutdown (PSPS) program authorized by the CPUC and implemented by California regulated electric companies, including Southern California Edison and Pacific Gas and Electric, which serve GSWC facilities throughout the state;

|

|

•

|

increases in the cost of obtaining insurance or in uninsured losses that may not be recovered in rates, or under our contracts with the U.S. government, including increases due to difficulties in obtaining insurance for certain risks, such as wildfires and earthquakes in California;

|

|

•

|

increases in costs to reduce the risks associated with the increasing frequency of severe weather, including to improve the resiliency and reliability of our water production and delivery facilities and systems, and our electric transmission and distribution lines;

|

|

•

|

increases in service disruptions if severe weather and wildfires or threats of wildfire become more frequent as predicted by some scientists who study climate change;

|

|

•

|

our ability to efficiently manage GSWC capital expenditures and operating and maintenance expenses within CPUC authorized levels and timely recover our costs through rates;

|

|

•

|

the impact of opposition to GSWC rate increases on our ability to recover our costs through rates, including costs associated with construction and costs associated with damages to our property and that of others and injuries to persons arising out of more extreme weather events;

|

|

•

|

the impact of opposition by GSWC customers to conservation rate design, including more stringent water-use restrictions if drought in California persists due to climate change, as well as future restrictions on water use mandated in California, which may decrease adopted usage and increase customer rates;

|

|

•

|

the impact of condemnation actions on future GSWC revenues and other aspects of our business if we do not receive adequate compensation for the assets taken, or recovery of all charges associated with the condemnation of such assets, as well as the impact on future revenues if we are no longer entitled to any portion of the revenues generated from such assets;

|

|

•

|

our ability to forecast the costs of maintaining GSWC’s aging water and electric infrastructure;

|

|

•

|

our ability to recover increases in permitting costs and costs associated with negotiating and complying with the terms of our franchise agreements with cities and counties and other demands made upon us by the cities and counties in which GSWC operates;

|

|

•

|

changes in accounting valuations and estimates, including changes resulting from our assessment of anticipated recovery of GSWC's regulatory assets, settlement of liabilities and revenues subject to refund or regulatory disallowances and the timing of such recovery, and the amounts set aside for uncollectible accounts receivable, inventory obsolescence, pension and post-retirement liabilities, taxes and uninsured losses and claims, including general liability and workers' compensation claims;

|

|

•

|

changes in environmental laws, health and safety laws, and water and recycled water quality requirements, and increases in costs associated with complying with these laws and requirements, including costs associated with GSWC's upgrading and building new water treatment plants, GSWC's disposing of residuals from our water treatment plants, more stringent rules regarding pipeline repairs and installation, handling and storing hazardous chemicals, upgrading electrical equipment to make it more resistant to extreme weather events, removal of vegetation near power lines, compliance-monitoring activities and GSWC's securing alternative water supplies when necessary;

|

|

•

|

our ability to obtain adequate, reliable and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for our water and wastewater operations;

|

|

•

|

our ability to attract, retain, train, motivate, develop and transition key employees;

|

|

•

|

our ability to recover the costs associated with any contamination of GSWC’s groundwater supplies from parties responsible for the contamination or through the ratemaking process, and the time and expense incurred by us in obtaining recovery of such costs;

|

|

•

|

adequacy of GSWC's electric division's power supplies and the extent to which we can manage and respond to the volatility of electricity and natural gas prices;

|

|

•

|

GSWC's electric division's ability to comply with the CPUC’s renewable energy procurement requirements;

|

|

•

|

changes in GSWC's long-term customer demand due to changes in customer usage patterns as a result of conservation efforts, regulatory changes affecting demand such as mandatory restrictions on water use, new landscaping or irrigation requirements, recycling of water by customers or purchase of recycled water supplied by other parties, unanticipated population growth or decline, changes in climate conditions, general economic and financial market conditions and cost increases, which may impact our long-term operating revenues if we are unable to secure rate increases in an amount sufficient to offset reduced demand;

|

|

•

|

changes in accounting treatment for regulated utilities;

|

|

•

|

effects of changes in or interpretations of tax laws, rates or policies;

|

|

•

|

changes in estimates used in ASUS’s cost-to-cost method for revenue recognition of certain construction activities;

|

|

•

|

termination, in whole or in part, of one or more of ASUS's military utility privatization contracts to provide water and/or wastewater services at military bases for the convenience of the U.S. government or for default;

|

|

•

|

suspension or debarment of ASUS for a period of time from contracting with the government due to violations of laws or regulations in connection with military utility privatization activities;

|

|

•

|

delays by the U.S. government in making timely payments to ASUS for water and/or wastewater services or construction activities at military bases because of fiscal uncertainties over the funding of the U.S. government or otherwise;

|

|

•

|

delays in ASUS obtaining economic price or equitable adjustments to our prices on one or more of our contracts to provide water and/or wastewater services at military bases;

|

|

•

|

disallowance of costs on any of ASUS's contracts to provide water and/or wastewater services at military bases because of audits, cost reviews or investigations by contracting agencies;

|

|

•

|

inaccurate assumptions used by ASUS in preparing bids in our contracted services business;

|

|

•

|

failure of wastewater systems that ASUS operates on military bases resulting in untreated wastewater or contaminants spilling into nearby properties, streams or rivers, the likelihood of which could increase from climate-change-induced flooding and rainfall events;

|

|

•

|

failure to comply with the terms of our military privatization contracts;

|

|

•

|

failure of any of our subcontractors to perform services for ASUS in accordance with the terms of our military privatization contracts;

|

|

•

|

competition for new military privatization contracts;

|

|

•

|

issues with the implementation, maintenance or upgrading of our information technology systems;

|

|

•

|

general economic conditions which may impact our ability to recover infrastructure investments and operating costs from customers;

|

|

•

|

explosions, fires, accidents, mechanical breakdowns, the disruption of information technology and telecommunication systems, human error and similar events that may occur while operating and maintaining water and electric systems in California or operating and maintaining water and wastewater systems on military bases under varying geographic conditions;

|

|

•

|

potential costs, lost revenues, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption due to a cyber-attack or other cyber incident;

|

|

•

|

restrictive covenants in our debt instruments or changes to our credit ratings on current or future debt that may increase our financing costs or affect our ability to borrow or make payments on our debt; and

|

|

•

|

our ability to access capital markets and other sources of credit in a timely manner on acceptable terms.

|

|

•

|

rainfall, basin replenishment, flood control, snow pack levels in California and the West, reservoir levels and availability of reservoir storage;

|

|

•

|

availability of Colorado River water and imported water from the State Water Project;

|

|

•

|

the amount of usable water stored in reservoirs and groundwater basins;

|

|

•

|

the amount of water used by our customers and others;

|

|

•

|

water quality;

|

|

•

|

legal limitations on production, diversion, storage, conveyance and use; and

|

|

•

|

climate change.

|

|

•

|

adversely affect our supply mix, for instance, by causing increased reliance upon more expensive water sources;

|

|

•

|

adversely affect our operating costs, for instance, by increasing the cost of producing water from more highly contaminated aquifers or requiring us to transport water over longer distances, truck water to water systems or adopt other emergency measures to enable us to continue to provide water service to our customers;

|

|

•

|

result in an increase in our capital expenditures over the long term, for example, by requiring future construction of pipelines to connect to alternative sources of supply, new wells to replace those that are no longer in service or are otherwise inadequate to meet the needs of our customers, and other facilities to conserve or reclaim water;

|

|

•

|

adversely affect the volume of water sold as a result of such factors as mandatory or voluntary conservation efforts by customers, changes in customer conservation patterns, recycling of water by customers and imposition of new regulations impacting such things as landscaping and irrigation patterns;

|

|

•

|

adversely affect aesthetic water quality if we are unable to flush our water systems as frequently due to water shortages or drought restrictions; and

|

|

•

|

result in customer dissatisfaction and harm to our reputation if water service is reduced, interrupted or otherwise adversely affected as a result of drought, water contamination or other causes.

|

|

•

|

conservation efforts to reduce costs;

|

|

•

|

drought conditions resulting in additional water conservation;

|

|

•

|

the use of more efficient household fixtures and appliances by consumers to save water;

|

|

•

|

voluntary or mandatory changes in landscaping and irrigation patterns;

|

|

•

|

recycling of water by our customers; and

|

|

•

|

mandated water-use restrictions.

|

|

•

|

our legal exposure and the appropriate accrual for claims, including general liability and workers' compensation claims;

|

|

•

|

computer viruses;

|

|

•

|

malware;

|

|

•

|

hacking; and

|

|

•

|

denial of service actions.

|

|

Pumps

|

Distribution Facilities

|

Reservoirs

|

||||||||||||||||||

|

Well

|

Booster

|

Mains*

|

Services

|

Hydrants

|

Tanks

|

Capacity*

|

||||||||||||||

|

235

|

|

387

|

|

2,789

|

|

259,986

|

|

26,235

|

|

142

|

|

113.8

|

|

(1)

|

||||||

|

|

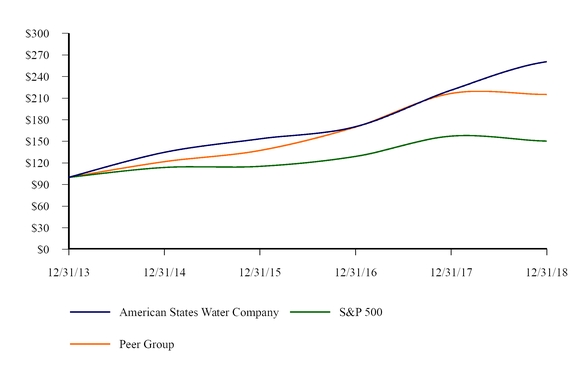

12/2013

|

12/2014

|

12/2015

|

12/2016

|

12/2017

|

12/2018

|

|||||||||||||||||

|

American States Water Company

|

$

|

100.00

|

|

$

|

134.70

|

|

$

|

153.44

|

|

$

|

170.32

|

|

$

|

221.02

|

|

$

|

260.61

|

|

|||||

|

S&P 500

|

$

|

100.00

|

|

$

|

113.69

|

|

$

|

115.26

|

|

$

|

129.05

|

|

$

|

157.22

|

|

$

|

150.33

|

|

|||||

|

Peer Group

|

$

|

100.00

|

|

$

|

121.74

|

|

$

|

137.31

|

|

$

|

169.86

|

|

$

|

216.46

|

|

$

|

215.01

|

|

|||||

|

|

Stock Prices

|

||||||

|

|

High

|

Low

|

|||||

|

2018

|

|

|

|||||

|

First Quarter

|

$

|

60.00

|

|

$

|

50.16

|

|

|

|

Second Quarter

|

$

|

58.82

|

|

$

|

51.30

|

|

|

|

Third Quarter

|

$

|

61.66

|

|

$

|

57.13

|

|

|

|

Fourth Quarter

|

$

|

69.61

|

|

$

|

58.48

|

|

|

|

2017

|

|

|

|

|

|||

|

First Quarter

|

$

|

45.92

|

|

$

|

41.14

|

|

|

|

Second Quarter

|

$

|

50.86

|

|

$

|

43.08

|

|

|

|

Third Quarter

|

$

|

51.78

|

|

$

|

46.62

|

|

|

|

Fourth Quarter

|

$

|

58.44

|

|

$

|

49.55

|

|

|

|

|

2018

|

2017

|

|||||

|

First Quarter

|

$

|

0.255

|

|

$

|

0.242

|

|

|

|

Second Quarter

|

$

|

0.255

|

|

$

|

0.242

|

|

|

|

Third Quarter

|

$

|

0.275

|

|

$

|

0.255

|

|

|

|

Fourth Quarter

|

$

|

0.275

|

|

$

|

0.255

|

|

|

|

Total

|

$

|

1.060

|

|

$

|

0.994

|

|

|

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share

|

Total Number of

Shares Purchased as Part of Publicly Announced Plans or Programs (1) |

Maximum Number

of Shares That May Yet Be Purchased under the Plans or Programs (1)(3) |

|||||||||

|

October 1 - 31, 2018

|

43,380

|

|

$

|

59.96

|

|

—

|

|

—

|

|

||||

|

November 1 - 30, 2018

|

12,409

|

|

$

|

64.70

|

|

—

|

|

—

|

|

||||

|

December 1 - 31, 2018

|

19,059

|

|

$

|

65.55

|

|

—

|

|

—

|

|

||||

|

Total

|

74,848

|

|

(2)

|

$

|

62.17

|

|

—

|

|

|

|

|||

|

(in thousands, except per share amounts)

|

2018

|

2017 (1)

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Income Statement Information:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Total Operating Revenues

|

$

|

436,816

|

|

$

|

440,603

|

|

$

|

436,087

|

|

$

|

458,641

|

|

$

|

465,791

|

|

|||||

|

Total Operating Expenses

(2)

|

335,833

|

|

313,508

|

|

321,895

|

|

339,721

|

|

347,027

|

|

||||||||||

|

Operating Income

(2)

|

100,983

|

|

127,095

|

|

114,192

|

|

118,920

|

|

118,764

|

|

||||||||||

|

Interest Expense

|

23,433

|

|

22,582

|

|

21,992

|

|

21,088

|

|

21,617

|

|

||||||||||

|

Interest Income

|

3,578

|

|

1,790

|

|

757

|

|

458

|

|

927

|

|

||||||||||

|

Net Income

|

$

|

63,871

|

|

$

|

69,367

|

|

$

|

59,743

|

|

$

|

60,484

|

|

$

|

61,058

|

|

|||||

|

Basic Earnings per Common Share

|

$

|

1.73

|

|

$

|

1.88

|

|

$

|

1.63

|

|

$

|

1.61

|

|

$

|

1.57

|

|

|||||

|

Fully Diluted Earnings per Common Share

|

$

|

1.72

|

|

$

|

1.88

|

|

$

|

1.62

|

|

$

|

1.60

|

|

$

|

1.57

|

|

|||||

|

Average Shares Outstanding

|

36,733

|

|

36,638

|

|

36,552

|

|

37,389

|

|

38,658

|

|

||||||||||

|

Average number of Diluted Shares Outstanding

|

36,936

|

|

36,844

|

|

36,750

|

|

37,614

|

|

38,880

|

|

||||||||||

|

Dividends paid per Common Share

|

$

|

1.060

|

|

$

|

0.994

|

|

$

|

0.914

|

|

$

|

0.874

|

|

$

|

0.831

|

|

|||||

|

Balance Sheet Information:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Total Assets

(3) (4)

|

$

|

1,501,433

|

|

$

|

1,416,734

|

|

$

|

1,470,493

|

|

$

|

1,343,959

|

|

$

|

1,373,316

|

|

|||||

|

Common Shareholders’ Equity

|

558,223

|

|

529,945

|

|

494,297

|

|

465,945

|

|

506,801

|

|

||||||||||

|

Long-Term Debt

(4)

|

281,087

|

|

321,039

|

|

320,981

|

|

320,900

|

|

320,816

|

|

||||||||||

|

Total Capitalization

|

$

|

839,310

|

|

$

|

850,984

|

|

$

|

815,278

|

|

$

|

786,845

|

|

$

|

827,617

|

|

|||||

|

(in thousands)

|

2018

|

2017 (1)

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Income Statement Information:

|

|

|

|

|

|

|||||||||||||||

|

Total Operating Revenues

|

$

|

329,608

|

|

$

|

340,301

|

|

$

|

338,702

|

|

$

|

364,550

|

|

$

|

361,059

|

|

|||||

|

Total Operating Expenses

(2)

|

249,046

|

|

234,430

|

|

243,515

|

|

263,887

|

|

261,698

|

|

||||||||||

|

Operating Income

(2)

|

80,562

|

|

105,871

|

|

95,187

|

|

100,663

|

|

99,361

|

|

||||||||||

|

Interest Expense

|

22,621

|

|

22,055

|

|

21,782

|

|

20,998

|

|

21,524

|

|

||||||||||

|

Interest Income

|

2,890

|

|

1,766

|

|

749

|

|

440

|

|

894

|

|

||||||||||

|

Net Income

|

$

|

48,012

|

|

$

|

53,757

|

|

$

|

46,969

|

|

$

|

47,591

|

|

$

|

47,857

|

|

|||||

|

Balance Sheet Information:

|

|

|

|

|

||||||||||||||||

|

Total Assets

(3) (4)

|

$

|

1,389,222

|

|

$

|

1,326,823

|

|

$

|

1,384,178

|

|

$

|

1,271,879

|

|

$

|

1,277,392

|

|

|||||

|

Common Shareholder’s Equity

|

503,575

|

|

474,374

|

|

446,770

|

|

423,730

|

|

435,190

|

|

||||||||||

|

Long-Term Debt

(4)

|

281,087

|

|

321,039

|

|

320,981

|

|

320,900

|

|

320,816

|

|

||||||||||

|

Total Capitalization

|

$

|

784,662

|

|

$

|

795,413

|

|

$

|

767,751

|

|

$

|

744,630

|

|

$

|

756,006

|

|

|||||

|

|

Diluted Earnings per Share

|

||||||||||

|

|

Year Ended

|

|

|||||||||

|

|

12/31/2018

|

12/31/2017

|

CHANGE

|

||||||||

|

Water, excluding one-time gain on sale of Ojai water system

|

$

|

1.19

|

|

$

|

1.22

|

|

$

|

(0.03

|

)

|

||

|

Electric

|

0.11

|

|

0.11

|

|

—

|

|

|||||

|

Contracted services

|

0.42

|

|

0.37

|

|

0.05

|

|

|||||

|

AWR (parent)

|

—

|

|

0.05

|

|

(0.05

|

)

|

|||||

|

Consolidated diluted earnings per share, adjusted

|

1.72

|

|

1.75

|

|

(0.03

|

)

|

|||||

|

Gain on sale of Ojai water system

|

—

|

|

0.13

|

|

(0.13

|

)

|

|||||

|

Totals from operations, as reported

|

$

|

1.72

|

|

$

|

1.88

|

|

$

|

(0.16

|

)

|

||

|

•

|

An overall increase in the water gross margin of $0.03 per share, largely due to revenues generated from CPUC-approved third-year rate increases effective January 1, 2018, partially offset by the effect of the cessation of the Ojai operations in June of 2017 and the revenue impact from the lower authorized return on rate base in the cost of capital proceeding approved by the CPUC and effective in 2018. The lower return on rate base decreased GSWC’s 2018 adopted annual water revenue requirement by approximately $3.6 million, or $0.07 per share.

|

|

•

|

An increase in operating expenses (excluding supply costs) decreased earnings by approximately $0.04 per share due, in large part, to a reduction in legal costs of $1.8 million, or $0.03 per share, recorded in December 2017 for amounts received from the City of Claremont pursuant to a settlement agreement, with no similar item in the fourth quarter of 2018. Excluding this item, overall recurring operating expenses increased by approximately $0.01 per share due mostly to higher depreciation and property tax expenses, both of which are due to plant additions.

|

|

•

|

Excluding gains and losses from investments, there was an increase in interest and other income (net of interest expense), which increased earnings by approximately $0.01 per share due, in part, to interest income related to a federal tax refund recorded during the fourth quarter of 2018, partially offset by an increase in interest expense resulting from higher short-term borrowings to fund operations and a portion of GSWC's capital expenditures.

|

|

•

|

An overall decrease in the water segment's effective income tax rate ("ETR"), which positively impacted earnings by approximately $0.04 per share. The decrease in the ETR was due, in large part, to the unfavorable remeasurement adjustment recorded in December 2017 at the water segment related to certain non-rate-regulated deferred tax assets (primarily compensation- and benefit-related items) in connection with the Tax Act. The one-time remeasurement negatively impacted water net earnings in 2017 by approximately $0.03 per share. There was no similar adjustment in 2018. In addition, the water ETR was favorably impacted in 2018 by changes in flow-through adjustments recorded in accordance with regulatory requirements (primarily related to plant and compensation-related items).

|

|

Year Ended

|

Year Ended

|

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

OPERATING REVENUES

|

|

|

|

|

|

|

|

|

||||||

|

Water

|

$

|

295,258

|

|

$

|

306,332

|

|

$

|

(11,074

|

)

|

-3.6

|

%

|

|||

|

Electric

|

34,350

|

|

33,969

|

|

381

|

|

1.1

|

%

|

||||||

|

Contracted services

|

107,208

|

|

100,302

|

|

6,906

|

|

6.9

|

%

|

||||||

|

Total operating revenues

|

436,816

|

|

440,603

|

|

(3,787

|

)

|

-0.9

|

%

|

||||||

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

||||||

|

Water purchased

|

68,904

|

|

68,302

|

|

602

|

|

0.9

|

%

|

||||||

|

Power purchased for pumping

|

8,971

|

|

8,518

|

|

453

|

|

5.3

|

%

|

||||||

|

Groundwater production assessment

|

19,440

|

|

18,638

|

|

802

|

|

4.3

|

%

|

||||||

|

Power purchased for resale

|

11,590

|

|

10,720

|

|

870

|

|

8.1

|

%

|

||||||

|

Supply cost balancing accounts

|

(15,649

|

)

|

(17,939

|

)

|

2,290

|

|

-12.8

|

%

|

||||||

|

Other operation

|

31,650

|

|

29,994

|

|

1,656

|

|

5.5

|

%

|

||||||

|

Administrative and general

|

82,595

|

|

81,643

|

|

952

|

|

1.2

|

%

|

||||||

|

Depreciation and amortization

|

40,425

|

|

39,031

|

|

1,394

|

|

3.6

|

%

|

||||||

|

Maintenance

|

15,682

|

|

15,176

|

|

506

|

|

3.3

|

%

|

||||||

|

Property and other taxes

|

18,404

|

|

17,905

|

|

499

|

|

2.8

|

%

|

||||||

|

ASUS construction

|

53,906

|

|

49,838

|

|

4,068

|

|

8.2

|

%

|

||||||

|

Gain on sale of assets

|

(85

|

)

|

(8,318

|

)

|

8,233

|

|

-99.0

|

%

|

||||||

|

Total operating expenses

|

335,833

|

|

313,508

|

|

22,325

|

|

7.1

|

%

|

||||||

|

OPERATING INCOME

|

100,983

|

|

127,095

|

|

(26,112

|

)

|

-20.5

|

%

|

||||||

|

OTHER INCOME AND EXPENSES

|

|

|

|

|

|

|

|

|

||||||

|

Interest expense

|

(23,433

|

)

|

(22,582

|

)

|

(851

|

)

|

3.8

|

%

|

||||||

|

Interest income

|

3,578

|

|

1,790

|

|

1,788

|

|

99.9

|

%

|

||||||

|

Other, net

|

760

|

|

2,038

|

|

(1,278

|

)

|

-62.7

|

%

|

||||||

|

|

(19,095

|

)

|

(18,754

|

)

|

(341

|

)

|

1.8

|

%

|

||||||

|

INCOME FROM OPERATIONS BEFORE INCOME TAX EXPENSE

|

81,888

|

|

108,341

|

|

(26,453

|

)

|

-24.4

|

%

|

||||||

|

Income tax expense

|

18,017

|

|

38,974

|

|

(20,957

|

)

|

-53.8

|

%

|

||||||

|

NET INCOME

|

$

|

63,871

|

|

$

|

69,367

|

|

$

|

(5,496

|

)

|

-7.9

|

%

|

|||

|

Basic earnings per Common Share

|

$

|

1.73

|

|

$

|

1.88

|

|

$

|

(0.15

|

)

|

-8.0

|

%

|

|||

|

Fully diluted earnings per Common Share

|

$

|

1.72

|

|

$

|

1.88

|

|

$

|

(0.16

|

)

|

-8.5

|

%

|

|||

|

Year Ended

|

Year Ended

|

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

WATER OPERATING REVENUES

(1)

|

$

|

295,258

|

|

$

|

306,332

|

|

$

|

(11,074

|

)

|

-3.6

|

%

|

|||

|

WATER SUPPLY COSTS:

|

|

|

||||||||||||

|

Water purchased

(1)

|

68,904

|

|

68,302

|

|

602

|

|

0.9

|

%

|

||||||

|

Power purchased for pumping

(1)

|

8,971

|

|

8,518

|

|

453

|

|

5.3

|

%

|

||||||

|

Groundwater production assessment

(1)

|

19,440

|

|

18,638

|

|

802

|

|

4.3

|

%

|

||||||

|

Water supply cost balancing accounts

(1)

|

(17,116

|

)

|

(20,289

|

)

|

3,173

|

|

-15.6

|

%

|

||||||

|

TOTAL WATER SUPPLY COSTS

|

$

|

80,199

|

|

$

|

75,169

|

|

$

|

5,030

|

|

6.7

|

%

|

|||

|

WATER GROSS MARGIN

(2)

|

$

|

215,059

|

|

$

|

231,163

|

|

$

|

(16,104

|

)

|

-7.0

|

%

|

|||

|

|

|

|||||||||||||

|

ELECTRIC OPERATING REVENUES

(1)

|

$

|

34,350

|

|

$

|

33,969

|

|

$

|

381

|

|

1.1

|

%

|

|||

|

ELECTRIC SUPPLY COSTS:

|

|

|

||||||||||||

|

Power purchased for resale

(1)

|

11,590

|

|

10,720

|

|

870

|

|

8.1

|

%

|

||||||

|

Electric supply cost balancing accounts

(1)

|

1,467

|

|

2,350

|

|

(883

|

)

|

-37.6

|

%

|

||||||

|

TOTAL ELECTRIC SUPPLY COSTS

|

$

|

13,057

|

|

$

|

13,070

|

|

$

|

(13

|

)

|

-0.1

|

%

|

|||

|

ELECTRIC GROSS MARGIN

(2)

|

$

|

21,293

|

|

$

|

20,899

|

|

$

|

394

|

|

1.9

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

22,525

|

|

$

|

22,189

|

|

$

|

336

|

|

1.5

|

%

|

|||

|

Electric Services

|

2,809

|

|

2,688

|

|

121

|

|

4.5

|

%

|

||||||

|

Contracted Services

|

6,316

|

|

5,117

|

|

1,199

|

|

23.4

|

%

|

||||||

|

Total other operation

|

$

|

31,650

|

|

$

|

29,994

|

|

$

|

1,656

|

|

5.5

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

54,212

|

|

$

|

55,471

|

|

$

|

(1,259

|

)

|

-2.3

|

%

|

|||

|

Electric Services

|

7,944

|

|

6,937

|

|

1,007

|

|

14.5

|

%

|

||||||

|

Contracted Services

|

20,446

|

|

19,139

|

|

1,307

|

|

6.8

|

%

|

||||||

|

AWR (parent)

|

(7

|

)

|

96

|

|

(103

|

)

|

-107.3

|

%

|

||||||

|

Total administrative and general

|

$

|

82,595

|

|

$

|

81,643

|

|

$

|

952

|

|

1.2

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

36,137

|

|

$

|

35,706

|

|

$

|

431

|

|

1.2

|

%

|

|||

|

Electric Services

|

2,258

|

|

2,146

|

|

112

|

|

5.2

|

%

|

||||||

|

Contracted Services

|

2,030

|

|

1,179

|

|

851

|

|

72.2

|

%

|

||||||

|

Total depreciation and amortization

|

$

|

40,425

|

|

$

|

39,031

|

|

$

|

1,394

|

|

3.6

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

12,102

|

|

$

|

12,101

|

|

$

|

1

|

|

—

|

%

|

|||

|

Electric Services

|

1,002

|

|

869

|

|

133

|

|

15.3

|

%

|

||||||

|

Contracted Services

|

2,578

|

|

2,206

|

|

372

|

|

16.9

|

%

|

||||||

|

Total maintenance

|

$

|

15,682

|

|

$

|

15,176

|

|

$

|

506

|

|

3.3

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

15,750

|

|

$

|

15,336

|

|

$

|

414

|

|

2.7

|

%

|

|||

|

Electric Services

|

1,059

|

|

1,066

|

|

(7

|

)

|

-0.7

|

%

|

||||||

|

Contracted Services

|

1,595

|

|

1,503

|

|

92

|

|

6.1

|

%

|

||||||

|

Total property and other taxes

|

$

|

18,404

|

|

$

|

17,905

|

|

$

|

499

|

|

2.8

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

21,212

|

|

$

|

20,670

|

|

$

|

542

|

|

2.6

|

%

|

|||

|

Electric Services

|

1,409

|

|

1,385

|

|

24

|

|

1.7

|

%

|

||||||

|

Contracted Services

|

362

|

|

269

|

|

93

|

|

34.6

|

%

|

||||||

|

AWR (parent)

|

450

|

|

258

|

|

192

|

|

74.4

|

%

|

||||||

|

Total interest expense

|

$

|

23,433

|

|

$

|

22,582

|

|

$

|

851

|

|

3.8

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

2,809

|

|

$

|

1,761

|

|

$

|

1,048

|

|

59.5

|

%

|

|||

|

Electric Services

|

81

|

|

5

|

|

76

|

|

*

|

|

||||||

|

Contracted Services

|

689

|

|

14

|

|

675

|

|

*

|

|

||||||

|

AWR (parent)

|

(1

|

)

|

10

|

|

(11

|

)

|

*

|

|

||||||

|

Total interest income

|

$

|

3,578

|

|

$

|

1,790

|

|

$

|

1,788

|

|

99.9

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2018

|

12/31/2017

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

12,391

|

|

$

|

32,212

|

|

$

|

(19,821

|

)

|

-61.5

|

%

|

|||

|

Electric Services

|

1,212

|

|

1,847

|

|

(635

|

)

|

-34.4

|

%

|

||||||

|

Contracted Services

|

4,939

|

|

7,136

|

|

(2,197

|

)

|

-30.8

|

%

|

||||||

|

AWR (parent)

|

(525

|

)

|

(2,221

|

)

|

1,696

|

|

-76.4

|

%

|

||||||

|

Total income tax expense

|

$

|

18,017

|

|

$

|

38,974

|

|

$

|

(20,957

|

)

|

-53.8

|

%

|

|||

|

Year Ended

|

Year Ended

|

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

OPERATING REVENUES

|

|

|

|

|

|

|

|

|

||||||

|

Water

|

$

|

306,332

|

|

$

|

302,931

|

|

$

|

3,401

|

|

1.1

|

%

|

|||

|

Electric

|

33,969

|

|

35,771

|

|

(1,802

|

)

|

-5.0

|

%

|

||||||

|

Contracted services

|

100,302

|

|

97,385

|

|

2,917

|

|

3.0

|

%

|

||||||

|

Total operating revenues

|

440,603

|

|

436,087

|

|

4,516

|

|

1.0

|

%

|

||||||

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

||||||

|

Water purchased

|

68,302

|

|

64,442

|

|

3,860

|

|

6.0

|

%

|

||||||

|

Power purchased for pumping

|

8,518

|

|

8,663

|

|

(145

|

)

|

-1.7

|

%

|

||||||

|

Groundwater production assessment

|

18,638

|

|

14,993

|

|

3,645

|

|

24.3

|

%

|

||||||

|

Power purchased for resale

|

10,720

|

|

10,387

|

|

333

|

|

3.2

|

%

|

||||||

|

Supply cost balancing accounts

|

(17,939

|

)

|

(12,206

|

)

|

(5,733

|

)

|

47.0

|

%

|

||||||

|

Other operation

|

29,994

|

|

28,257

|

|

1,737

|

|

6.1

|

%

|

||||||

|

Administrative and general

|

81,643

|

|

81,518

|

|

125

|

|

0.2

|

%

|

||||||

|

Depreciation and amortization

|

39,031

|

|

38,850

|

|

181

|

|

0.5

|

%

|

||||||

|

Maintenance

|

15,176

|

|

16,470

|

|

(1,294

|

)

|

-7.9

|

%

|

||||||

|

Property and other taxes

|

17,905

|

|

16,801

|

|

1,104

|

|

6.6

|

%

|

||||||

|

ASUS construction

|

49,838

|

|

53,720

|

|

(3,882

|

)

|

-7.2

|

%

|

||||||

|

Gain on sale of assets

|

(8,318

|

)

|

—

|

|

(8,318

|

)

|

*

|

|

||||||

|

Total operating expenses

|

313,508

|

|

321,895

|

|

(8,387

|

)

|

-2.6

|

%

|

||||||

|

OPERATING INCOME

|

127,095

|

|

114,192

|

|

12,903

|

|

11.3

|

%

|

||||||

|

OTHER INCOME AND EXPENSES

|

|

|

|

|

|

|

|

|

||||||

|

Interest expense

|

(22,582

|

)

|

(21,992

|

)

|

(590

|

)

|

2.7

|

%

|

||||||

|

Interest income

|

1,790

|

|

757

|

|

1,033

|

|

136.5

|

%

|

||||||

|

Other, net

|

2,038

|

|

1,521

|

|

517

|

|

34.0

|

%

|

||||||

|

|

(18,754

|

)

|

(19,714

|

)

|

960

|

|

-4.9

|

%

|

||||||

|

INCOME FROM OPERATIONS BEFORE INCOME TAX EXPENSE

|

108,341

|

|

94,478

|

|

13,863

|

|

14.7

|

%

|

||||||

|

Income tax expense

|

38,974

|

|

34,735

|

|

4,239

|

|

12.2

|

%

|

||||||

|

NET INCOME

|

$

|

69,367

|

|

$

|

59,743

|

|

$

|

9,624

|

|

16.1

|

%

|

|||

|

Basic earnings per Common Share

|

$

|

1.88

|

|

$

|

1.63

|

|

$

|

0.25

|

|

15.3

|

%

|

|||

|

Fully diluted earnings per Common Share

|

$

|

1.88

|

|

$

|

1.62

|

|

$

|

0.26

|

|

16.0

|

%

|

|||

|

|

Diluted Earnings per Share

|

||||||||||

|

|

Year Ended

|

|

|||||||||

|

|

12/31/2017

|

12/31/2016

|

CHANGE

|

||||||||

|

Water, excluding one-time gain on sale of Ojai water system

|

$

|

1.22

|

|

$

|

1.17

|

|

$

|

0.05

|

|

||

|

Electric

|

0.11

|

|

0.10

|

|

0.01

|

|

|||||

|

Contracted services

|

0.37

|

|

0.33

|

|

0.04

|

|

|||||

|

AWR (parent)

|

0.05

|

|

0.02

|

|

0.03

|

|

|||||

|

Consolidated diluted earnings per share, adjusted

|

1.75

|

|

1.62

|

|

0.13

|

|

|||||

|

Gain on sale of Ojai water system

|

0.13

|

|

—

|

|

0.13

|

|

|||||

|

Totals from operations, as reported

|

$

|

1.88

|

|

$

|

1.62

|

|

$

|

0.26

|

|

||

|

•

|

A decrease in operating expenses (excluding supply costs) increased earnings by approximately $0.05 per share due, in large part, to a reduction in legal costs of $1.8 million, or $0.03 per share, recorded in December 2017 for amounts received from the City of Claremont pursuant to a settlement agreement. Excluding this item, overall operating expenses decreased by $0.02 per share due mostly to lower maintenance costs, and incurring only a partial year of Ojai-related operating expenses as a result of the sale. These decreases were partially offset by higher medical insurance costs, conservation costs, general rate-case-related expenses and property and other taxes, as well as an $800,000 reduction in operating expenses recorded in the fourth quarter of 2016 as a result of the CPUC's water general rate case decision, which granted recovery of previously incurred costs tracked in memorandum accounts.

|

|

•

|

Excluding gains and losses on investments, there was an increase in interest and other income (net of interest expense), which increased earnings by approximately $0.01 per share, due primarily to (i) higher interest income on GSWC's regulatory assets resulting mostly from an increase in the 90-day commercial paper rate, and (ii) amounts collected from developers on certain outstanding balances owed to GSWC.

|

|

•

|

An overall decrease in the water gross margin of $2.3 million, or $0.03 per share, largely due to the cessation of Ojai operations in June 2017. This was partially offset by revenues generated from CPUC-approved second-year rate increases effective January 1, 2017.

|

|

•

|

An overall increase in the water segment's effective income tax rate ("ETR"), which negatively impacted water earnings by approximately $0.02 per share. The increase in the ETR was due, in large part, to the remeasurement of certain non-rate-regulated deferred tax assets (primarily compensation- and benefit-related items) in connection with the Tax Act, which negatively impacted water earnings by approximately $0.03 per share. This was partially offset by changes in flow-through and permanent items at the water segment.

|

|

Year Ended

|

Year Ended

|

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

WATER OPERATING REVENUES

(1)

|

$

|

306,332

|

|

$

|

302,931

|

|

$

|

3,401

|

|

1.1

|

%

|

|||

|

WATER SUPPLY COSTS:

|

|

|

||||||||||||

|

Water purchased

(1)

|

68,302

|

|

64,442

|

|

3,860

|

|

6.0

|

%

|

||||||

|

Power purchased for pumping

(1)

|

8,518

|

|

8,663

|

|

(145

|

)

|

-1.7

|

%

|

||||||

|

Groundwater production assessment

(1)

|

18,638

|

|

14,993

|

|

3,645

|

|

24.3

|

%

|

||||||

|

Water supply cost balancing accounts

(1)

|

(20,289

|

)

|

(14,813

|

)

|

(5,476

|

)

|

37.0

|

%

|

||||||

|

TOTAL WATER SUPPLY COSTS

|

$

|

75,169

|

|

$

|

73,285

|

|

$

|

1,884

|

|

2.6

|

%

|

|||

|

WATER GROSS MARGIN

(2)

|

$

|

231,163

|

|

$

|

229,646

|

|

$

|

1,517

|

|

0.7

|

%

|

|||

|

ELECTRIC OPERATING REVENUES

(1)

|

$

|

33,969

|

|

$

|

35,771

|

|

$

|

(1,802

|

)

|

-5.0

|

%

|

|||

|

ELECTRIC SUPPLY COSTS:

|

||||||||||||||

|

Power purchased for resale

(1)

|

10,720

|

|

10,387

|

|

333

|

|

3.2

|

%

|

||||||

|

Electric supply cost balancing accounts

(1)

|

2,350

|

|

2,607

|

|

(257

|

)

|

-9.9

|

%

|

||||||

|

TOTAL ELECTRIC SUPPLY COSTS

|

$

|

13,070

|

|

$

|

12,994

|

|

$

|

76

|

|

0.6

|

%

|

|||

|

ELECTRIC GROSS MARGIN

(2)

|

$

|

20,899

|

|

$

|

22,777

|

|

$

|

(1,878

|

)

|

-8.2

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

22,189

|

|

$

|

21,649

|

|

$

|

540

|

|

2.5

|

%

|

|||

|

Electric Services

|

2,688

|

|

3,122

|

|

(434

|

)

|

-13.9

|

%

|

||||||

|

Contracted Services

|

5,117

|

|

3,486

|

|

1,631

|

|

46.8

|

%

|

||||||

|

Total other operation

|

$

|

29,994

|

|

$

|

28,257

|

|

$

|

1,737

|

|

6.1

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

55,471

|

|

$

|

56,745

|

|

$

|

(1,274

|

)

|

-2.2

|

%

|

|||

|

Electric Services

|

6,937

|

|

7,953

|

|

(1,016

|

)

|

-12.8

|

%

|

||||||

|

Contracted Services

|

19,139

|

|

16,801

|

|

2,338

|

|

13.9

|

%

|

||||||

|

AWR (parent)

|

96

|

|

19

|

|

77

|

|

405.3

|

%

|

||||||

|

Total administrative and general

|

$

|

81,643

|

|

$

|

81,518

|

|

$

|

125

|

|

0.2

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

35,706

|

|

$

|

35,777

|

|

$

|

(71

|

)

|

-0.2

|

%

|

|||

|

Electric Services

|

2,146

|

|

2,027

|

|

119

|

|

5.9

|

%

|

||||||

|

Contracted Services

|

1,179

|

|

1,046

|

|

133

|

|

12.7

|

%

|

||||||

|

Total depreciation and amortization

|

$

|

39,031

|

|

$

|

38,850

|

|

$

|

181

|

|

0.5

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

12,101

|

|

$

|

13,783

|

|

$

|

(1,682

|

)

|

-12.2

|

%

|

|||

|

Electric Services

|

869

|

|

736

|

|

133

|

|

18.1

|

%

|

||||||

|

Contracted Services

|

2,206

|

|

1,951

|

|

255

|

|

13.1

|

%

|

||||||

|

Total maintenance

|

$

|

15,176

|

|

$

|

16,470

|

|

$

|

(1,294

|

)

|

-7.9

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

15,336

|

|

$

|

14,362

|

|

$

|

974

|

|

6.8

|

%

|

|||

|

Electric Services

|

1,066

|

|

1,082

|

|

(16

|

)

|

-1.5

|

%

|

||||||

|

Contracted Services

|

1,503

|

|

1,357

|

|

146

|

|

10.8

|

%

|

||||||

|

Total property and other taxes

|

$

|

17,905

|

|

$

|

16,801

|

|

$

|

1,104

|

|

6.6

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

20,670

|

|

$

|

20,430

|

|

$

|

240

|

|

1.2

|

%

|

|||

|

Electric Services

|

1,385

|

|

1,352

|

|

33

|

|

2.4

|

%

|

||||||

|

Contracted Services

|

269

|

|

76

|

|

193

|

|

253.9

|

%

|

||||||

|

AWR (parent)

|

258

|

|

134

|

|

124

|

|

92.5

|

%

|

||||||

|

Total interest expense

|

$

|

22,582

|

|

$

|

21,992

|

|

$

|

590

|

|

2.7

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

1,761

|

|

$

|

734

|

|

$

|

1,027

|

|

139.9

|

%

|

|||

|

Electric Services

|

5

|

|

15

|

|

(10

|

)

|

-66.7

|

%

|

||||||

|

Contracted Services

|

14

|

|

8

|

|

6

|

|

75.0

|

%

|

||||||

|

AWR (parent)

|

10

|

|

—

|

|

10

|

|

—

|

%

|

||||||

|

Total interest income

|

$

|

1,790

|

|

$

|

757

|

|

$

|

1,033

|

|

136.5

|

%

|

|||

|

Year

Ended |

Year

Ended |

$

|

%

|

|||||||||||

|

12/31/2017

|

12/31/2016

|

CHANGE

|

CHANGE

|

|||||||||||

|

Water Services

|

$

|

32,212

|

|

$

|

25,894

|

|

$

|

6,318

|

|

24.4

|

%

|

|||

|

Electric Services

|

1,847

|

|

2,715

|

|

(868

|

)

|

-32.0

|

%

|

||||||

|

Contracted Services

|

7,136

|

|

6,672

|

|

464

|

|

7.0

|

%

|

||||||

|

AWR (parent)

|

(2,221

|

)

|

(546

|

)

|

(1,675

|

)

|

306.8

|

%

|

||||||

|

Total income tax expense

|

$

|

38,974

|

|

$

|

34,735

|

|

$

|

4,239

|

|

12.2

|

%

|

|||

|

|

Payments/Commitments Due by Period (1)

|

|||||||||||||||||||

|

($ in thousands)

|

Total

|

Less than 1

Year

|

1-3 Years

|

4-5 Years

|

After 5 Years

|

|||||||||||||||

|

Notes/Debentures (2)

|

$

|

187,000

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

187,000

|

|

|||||

|

Private Placement Notes (3)

|

123,000

|

|

40,000

|

|

—

|

|

—

|

|

83,000

|

|

||||||||||

|

Tax-Exempt Obligations (4)

|

11,397

|

|

145

|

|

323

|

|

363

|

|

10,566

|

|

||||||||||

|

Other Debt Instruments (5)

|

3,581

|

|

175

|

|

387

|

|

431

|

|

2,588

|

|

||||||||||

|

Total AWR Long-Term Debt

|

$

|

324,978

|

|

$

|

40,320

|

|

710

|

|

$

|

794

|

|

$

|

283,154

|

|

||||||

|

Interest on Long-Term Debt (6)

|

$

|

254,380

|

|

$

|

19,413

|

|

$

|

37,776

|

|

$

|

37,708