|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2010

|

|

or

|

|

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Commission file number 1-1043

|

|

Delaware

|

36-0848180

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

1 N. Field Court, Lake Forest, Illinois

|

60045-4811

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

(847) 735-4700

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

Title of each class

|

Name of each exchange

on which registered

|

|

|

Common Stock ($0.75 par value)

|

New York and Chicago

|

|

|

|

Stock Exchanges

|

|

|

|

Page

|

|

PART I

|

||

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk Factors

|

7

|

|

Item 1B.

|

Unresolved Staff Comments

|

13

|

|

Item 2.

|

Properties

|

14

|

|

Item 3.

|

Legal Proceedings

|

14

|

|

Item 4.

|

(Removed and Reserved)

|

15

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities

|

16

|

|

Item 6.

|

Selected Financial Data

|

17

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

|

19

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

37

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

37

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting

and Financial Disclosure

|

37

|

|

Item 9A.

|

Controls and Procedures

|

37

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

38

|

|

Item 11.

|

Executive Compensation

|

38

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters

|

38

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director

Independence

|

38

|

|

Item 14.

|

Principal Accounting Fees and Services

|

38

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

38

|

|

(in millions)

|

2010

|

2009

|

2008

|

||||||

|

Europe

|

$ | 601.2 | $ | 518.1 | $ | 1,024.1 | |||

|

Pacific Rim

|

268.4 | 235.8 | 318.1 | ||||||

|

Canada

|

246.8 | 178.1 | 346.7 | ||||||

|

Latin America

|

194.6 | 157.9 | 247.8 | ||||||

|

Africa & Middle East

|

92.3 | 78.8 | 121.8 | ||||||

|

Total

|

$ | 1,403.3 | $ | 1,168.7 | $ | 2,058.5 | |||

|

|

•

|

Sales offices and distribution centers in Australia, Belgium, Brazil, Canada, China, Malaysia, Mexico, New Zealand and Singapore;

|

|

|

•

|

Sales offices in Dubai, Finland, France, Italy, Norway, Sweden and Switzerland;

|

|

|

•

|

Boat manufacturing plants in New Zealand and Portugal, and boat plants in Poland and Vietnam that perform contract manufacturing for the Company;

|

|

|

•

|

An outboard engine assembly plant in Suzhou, China; and

|

|

|

•

|

An outboard engine assembly plant joint venture in Japan.

|

|

(in millions)

|

2010

|

2009

|

2008

|

||||||

|

Marine Engine

|

$ | 53.7 | $ | 50.1 | $ | 61.3 | |||

|

Boat

|

17.8 | 19.6 | 38.6 | ||||||

|

Fitness

|

16.7 | 14.9 | 17.4 | ||||||

|

Bowling & Billiards

|

3.8 | 3.9 | 4.9 | ||||||

|

Total

|

$ | 92.0 | $ | 88.5 | $ | 122.2 | |||

|

December 31, 2010

|

December 31, 2009

|

||||||||||||||

|

Total

|

Union

(domestic)

|

Total

|

Union

(domestic)

|

||||||||||||

|

Marine Engine

|

4,612 | 975 | 3,683 | 958 | |||||||||||

|

Boat

|

4,143 | — | 4,744 | — | |||||||||||

|

Fitness

|

1,668 | 132 | 1,668 | 135 | |||||||||||

|

Bowling & Billiards

|

4,707 | 57 | 4,756 | 99 | |||||||||||

|

Corporate

|

160 | — | 152 | — | |||||||||||

|

Total

|

15,290 | 1,164 | 15,003 | 1,192 | |||||||||||

The violatility and price of the Company ’s common stock may be affected by numerous factors, including changes to generally accepted accounting principles and financial reporting standards. Such developments could materially affect the Company ’s financial results and the way that investors perceive the Company ’s performance.

|

Officer

|

Present Position

|

Age

|

||

|

Dustan E. McCoy

|

Chairman and Chief Executive Officer

|

61

|

||

|

Peter B. Hamilton

|

Senior Vice President and Chief Financial Officer

|

64

|

||

|

Christopher E. Clawson

|

Vice President and President – Life Fitness

|

47

|

||

|

Kristin M. Coleman

|

Vice President, General Counsel and Secretary

|

42

|

||

|

Andrew E. Graves

|

Vice President and President – Brunswick Boat Group

|

51

|

||

|

Kevin S. Grodzki

|

Vice President and President – Mercury Marine Sales,

|

55

|

||

|

Marketing and Commercial Operations

|

||||

|

Warren N. Hardie

|

Vice President and President – Brunswick Bowling & Billiards

|

60

|

||

|

B. Russell Lockridge

|

Vice President and Chief Human Resources Officer

|

61

|

||

|

Alan L. Lowe

|

Vice President and Controller

|

59

|

||

|

John C. Pfeifer

|

Vice President, President – Brunswick Marine in EMEA and

|

45

|

||

|

President – Brunswick Global Structure

|

||||

|

Mark D. Schwabero

|

Vice President and President – Mercury Marine

|

58

|

|

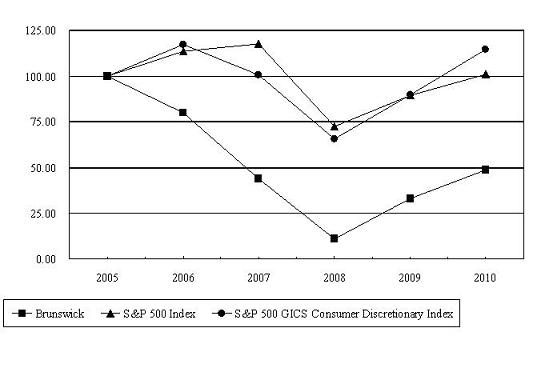

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

|

Brunswick

|

100.00

|

79.75

|

43.67

|

10.83

|

32.90

|

48.67

|

|

S&P 500 Index

|

100.00

|

113.62

|

117.63

|

72.36

|

89.33

|

100.75

|

|

S&P 500 GICS Consumer Discretionary Index

|

100.00

|

117.23

|

100.45

|

65.57

|

89.66

|

114.35

|

|

(in millions, except per share data)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Results of operations data

|

||||||||||||||||||||

|

Net sales

|

$ | 3,403.3 | $ | 2,776.1 | $ | 4,708.7 | $ | 5,671.2 | $ | 5,665.0 | ||||||||||

|

Operating earnings (loss)

(A)

|

16.3 | (570.5 | ) | (611.6 | ) | 107.2 | 341.2 | |||||||||||||

|

Earnings (loss) before interest, loss on early

|

||||||||||||||||||||

|

extinguishment of debt and income taxes

(A)

|

11.8 | (588.7 | ) | (584.7 | ) | 136.3 | 354.2 | |||||||||||||

|

Earnings (loss) before income taxes

(A)

|

(84.7 | ) | (684.7 | ) | (632.2 | ) | 92.7 | 309.7 | ||||||||||||

|

Net earnings (loss) from continuing operations

(A)

|

(110.6 | ) | (586.2 | ) | (788.1 | ) | 79.6 | 263.2 | ||||||||||||

|

Discontinued operations:

|

||||||||||||||||||||

|

Earnings (loss) from discontinued

|

||||||||||||||||||||

|

operations, net of tax

(B)

|

— | — | — | 32.0 | (129.3 | ) | ||||||||||||||

|

Net earnings (loss)

(A) (B)

|

$ | (110.6 | ) | $ | (586.2 | ) | $ | (788.1 | ) | $ | 111.6 | $ | 133.9 | |||||||

|

Basic earnings (loss) per common share:

|

||||||||||||||||||||

|

Earnings (loss) from continuing operations

(A)

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | $ | 0.88 | $ | 2.80 | |||||||

|

Discontinued operations:

|

||||||||||||||||||||

|

Earnings (loss) from discontinued

|

||||||||||||||||||||

|

operations, net of tax

(B)

|

— | — | — | 0.36 | (1.38 | ) | ||||||||||||||

|

Net earnings (loss)

(A) (B)

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | $ | 1.24 | $ | 1.42 | |||||||

|

Average shares used for computation of

|

||||||||||||||||||||

|

basic earnings (loss) per share

|

88.7 | 88.4 | 88.3 | 89.8 | 94.0 | |||||||||||||||

|

Diluted earnings (loss) per common share:

|

||||||||||||||||||||

|

Earnings (loss) from continuing operations

(A)

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | $ | 0.88 | $ | 2.78 | |||||||

|

Discontinued operations:

|

||||||||||||||||||||

|

Earnings (loss) from discontinued

|

||||||||||||||||||||

|

operations, net of tax

(B)

|

— | — | — | 0.36 | (1.37 | ) | ||||||||||||||

|

Net earnings (loss)

(A) (B)

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | $ | 1.24 | $ | 1.41 | |||||||

|

Average shares used for computation of

|

||||||||||||||||||||

|

diluted earnings per share

|

88.7 | 88.4 | 88.3 | 90.2 | 94.7 | |||||||||||||||

| (A) |

2010

results include $62.3 million of pretax trade name impairment charges and restructuring, exit and impairment charges. 2009 results include $172.5 million of pretax restructuring, exit and

impairment

charges. 2008 results include $688.4 million of pretax goodwill impairment charges, trade name impairment charges and restructuring, exit and impairment charges. 2007 results include

$88.6 million of

pretax trade name impairment charges and restructuring, exit and impairment charges. 2006 results include $17.1 million of pretax restructuring, exit and impairment charges.

|

| (B) |

Earnings (loss) from discontinued operations in 2007 include net gains of $29.8 million related to the sales of the discontinued businesses. Earnings (loss) from discontinued operations in 2006

include $85.6 million of impairment charges ($73.9 million pretax) related to the Company’s announcement in December 2006 that proceeds from the sale of BNT were expected to be less

than its book value.

|

|

(in millions, except per share and other data)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Balance sheet data

|

||||||||||||||||||||

|

Total assets of continuing operations

|

$ | 2,678.0 | $ | 2,709.4 | $ | 3,223.9 | $ | 4,365.6 | $ | 4,312.0 | ||||||||||

|

Debt

|

||||||||||||||||||||

|

Short-term

|

$ | 2.2 | $ | 11.5 | $ | 3.2 | $ | 0.8 | $ | 0.7 | ||||||||||

|

Long-term

|

828.4 | 839.4 | 728.5 | 727.4 | 725.7 | |||||||||||||||

|

Total debt

|

830.6 | 850.9 | 731.7 | 728.2 | 726.4 | |||||||||||||||

|

Common shareholders’ equity

(A) (B)

|

70.4 | 210.3 | 729.9 | 1,892.9 | 1,871.8 | |||||||||||||||

|

Total capitalization

(A) (B)

|

$ | 901.0 | $ | 1,061.2 | $ | 1,461.6 | $ | 2,621.1 | $ | 2,598.2 | ||||||||||

|

Cash flow data

|

||||||||||||||||||||

|

Net cash provided by (used for)

|

||||||||||||||||||||

|

operating activities of continuing operations

|

$ | 205.4 | $ | 125.5 | $ | (12.1 | ) | $ | 344.1 | $ | 351.0 | |||||||||

|

Depreciation and amortization

|

129.3 | 157.3 | 177.2 | 180.1 | 167.3 | |||||||||||||||

|

Capital expenditures

|

57.2 | 33.3 | 102.0 | 207.7 | 205.1 | |||||||||||||||

|

Acquisitions of businesses

|

— | — | — | 6.2 | 86.2 | |||||||||||||||

|

Investments

|

7.2 | (6.2 | ) | (20.0 | ) | (4.1 | ) | (6.1 | ) | |||||||||||

|

Stock repurchases

|

— | — | — | 125.8 | 195.6 | |||||||||||||||

|

Cash dividends paid

|

4.4 | 4.4 | 4.4 | 52.6 | 55.0 | |||||||||||||||

|

Other data

|

||||||||||||||||||||

|

Dividends declared per share

|

$ | 0.05 | $ | 0.05 | $ | 0.05 | $ | 0.60 | $ | 0.60 | ||||||||||

|

Book value per share

(

A) (B)

|

0.79 | 2.38 | 8.27 | 20.99 | 19.76 | |||||||||||||||

|

Return on beginning shareholders’ equity

(A) (B)

|

(52.6 | )% | (80.3 | )% | (41.6 | )% | 6.0 | % | 6.8 | % | ||||||||||

|

Effective tax rate

|

(30.6 | )% | 14.4 | % | (24.7 | )% | 14.1 | % | 15.0 | % | ||||||||||

|

Debt-to-capitalization rate

(A) (B)

|

92.2 | % | 80.2 | % | 50.1 | % | 27.8 | % | 28.0 | % | ||||||||||

|

Number of employees

|

15,290 | 15,003 | 19,760 | 27,050 | 28,000 | |||||||||||||||

|

Number of shareholders of record

|

12,134 | 12,602 | 12,842 | 13,052 | 13,695 | |||||||||||||||

|

Common stock price (NYSE)

|

||||||||||||||||||||

|

High

|

$ | 22.62 | $ | 13.11 | $ | 19.28 | $ | 34.80 | $ | 42.30 | ||||||||||

|

Low

|

10.34 | 2.18 | 2.01 | 17.05 | 27.56 | |||||||||||||||

|

Close (last trading day)

|

18.74 | 12.71 | 4.21 | 17.05 | 31.90 | |||||||||||||||

|

(A)

|

Effective December 31, 2006, the Company adopted changes to the Compensation – Retirement Benefits topic of the ASC, which resulted in a $60.7 million decrease to Shareholders’ equity. The Company adopted changes to the Income Taxes topic of the ASC effective on January 1, 2007, which resulted in an $8.7 million decrease in the net liability for unrecognized tax benefits. This charge was accounted for as an increase to the January 1, 2007 opening retained earnings.

|

|

(B)

|

2010 results include $62.3 million of pretax trade name impairment charges and restructuring, exit and impairment charges. 2009 results include $172.5 million of pretax restructuring, exit and impairment charges. 2008 results include $688.4 million of pretax goodwill impairment charges, trade name impairment charges and restructuring, exit and impairment charges. 2007 results include $88.6 million of pretax trade name impairment charges and restructuring, exit and impairment charges. 2006 results include $17.1 million of pretax restructuring, exit and impairment charges.

|

|

•

|

Generating positive free cash flow;

|

|

•

|

Demonstrating outstanding operating leverage; and

|

|

•

|

Performing better than the markets in which it competes.

|

|

Generating Positive Free Cash Flow:

|

|

•

|

Ended the year with $657.1 million of cash and marketable securities, compared with $527.4 million at the end of 2009;

|

|

•

|

Cash flows from operations totaled $205.4 million during 2010, supported by improved operating results and a federal tax refund of $109.5 million received during 2010; and

|

|

•

|

Selectively increased capital expenditures for profit-maintaining investments.

|

|

Demonstrating Outstanding Operating Leverage:

|

|

•

|

Reported operating earnings of $16.3 million in 2010 compared with operating losses of $570.5 million in 2009. On a sales increase of 23 percent, the Company experienced operating leverage, defined as the change in Operating earnings (loss) divided by the change in Net sales, of 94 percent;

|

|

•

|

A significant component of the Company’s cost-reduction efforts has been a focus on reducing its manufacturing footprint by consolidating boat and engine production into fewer plants. Since January 1, 2007, the Company has closed 17 of its boat manufacturing facilities and has announced plans to consolidate engine production by transferring sterndrive engine manufacturing operations from its Stillwater, Oklahoma plant to its Fond du Lac, Wisconsin plant;

|

|

•

|

Reduced selling, general and administrative expenses by 12 percent; and

|

|

•

|

Reported restructuring, exit and impairment charges and trade name impairment charges of $62.3 million in 2010; down by $110.2 million when compared with 2009.

|

|

Performing Better than the Markets in Which it Competes:

|

|

•

|

Sales improved $627.2 million or 23 percent during 2010. Our Marine Engine, Boat and Fitness segments reported sales increases of 27 percent, 48 percent and 9 percent, respectively; and

|

|

•

|

The Company was able to increase sales at its marine segments by 31 percent. This was largely due to increased wholesale shipments to boat builders and boat engine dealers as a result of inventory reduction actions taken in 2009. In 2010, the Company has achieved its objective to more closely align the Company’s wholesale shipments with domestic retail demand.

|

|

(in millions)

|

2010

|

2009

|

2008

|

||||||||

|

Marine Engine

|

$ | 13.6 | $ | 48.3 | $ | 32.4 | |||||

|

Boat

|

44.9 | 107.8 | 98.7 | ||||||||

|

Fitness

|

0.2 | 2.1 | 3.3 | ||||||||

|

Bowling & Billiards

|

1.8 | 5.3 | 21.7 | ||||||||

|

Corporate

|

0.7 | 9.0 | 21.2 | ||||||||

|

Total

|

$ | 61.2 | $ | 172.5 | $ | 177.3 | |||||

|

2010 vs. 2009

|

2009 vs. 2008

|

||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

||||||||||||||||||||||||||

|

(in millions, except per share data)

|

2010

|

2009

|

2008

|

$ | % | $ | % | ||||||||||||||||||||

|

Net sales

|

$ | 3,403.3 | $ | 2,776.1 | $ | 4,708.7 | $ | 627.2 | 22.6 | % | $ | (1,932.6 | ) | (41.0 | ) % | ||||||||||||

|

Gross margin

(A)

|

720.0 | 315.6 | 867.4 | 404.4 |

NM

|

(551.8 | ) | (63.6 | ) % | ||||||||||||||||||

|

Goodwill impairment charges

|

— | — | 377.2 | — | — | % | (377.2 | ) |

NM

|

||||||||||||||||||

|

Trade name impairment charges

|

1.1 | — | 133.9 | 1.1 |

NM

|

(133.9 | ) |

NM

|

|||||||||||||||||||

|

Restructuring, exit and impairment charges

|

61.2 | 172.5 | 177.3 | (111.3 | ) | (64.5 | ) % | (4.8 | ) | (2.7 | ) % | ||||||||||||||||

|

Operating earnings (loss)

|

16.3 | (570.5 | ) | (611.6 | ) | 586.8 |

NM

|

41.1 | 6.7 | % | |||||||||||||||||

|

Net loss

|

(110.6 | ) | (586.2 | ) | (788.1 | ) | (475.6 | ) | (81.1 | ) % | (201.9 | ) | (25.6 | ) % | |||||||||||||

|

Diluted loss per share

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | $ | (5.38 | ) |

NM

|

$ | (2.30 | ) |

NM

|

||||||||||

|

Expressed as a percentage of Net sales

|

|||||||||||||||||||||||||||

|

Gross margin

|

21.2 | % | 11.4 | % | 18.4 | % |

980 bpts

|

(700) bpts

|

|||||||||||||||||||

|

Selling, general and administrative

expense

|

16.1 | % | 22.5 | % | 14.2 | % |

(640) bpts

|

830 bpts

|

|||||||||||||||||||

|

Research & development expense

|

2.7 | % | 3.2 | % | 2.6 | % |

(50) bpts

|

60 bpts

|

|||||||||||||||||||

|

Goodwill impairment charges

|

— | % | — | % | 8.0 | % |

NM

|

(800) bpts

|

|||||||||||||||||||

|

Trade name impairment charges

|

— | % | — | % | 2.8 | % |

NM

|

(280) bpts

|

|||||||||||||||||||

|

Restructuring, exit and impairment

charges

|

1.8 | % | 6.2 | % | 3.8 | % |

(440) bpts

|

240 bpts

|

|||||||||||||||||||

|

Operating margin

|

0.5 | % | (20.6 | ) % | (13.0 | ) % |

NM

|

(760) bpts

|

|||||||||||||||||||

During 2010, the Company incurred trade name impairment charges of $1.1 million related to the divestiture of the Company’s Triton fiberglass boat brand. The Company did not incur impairment charges related to its trade names in 2009. See Note 3 – Goodwill and Trade Name Impairments in the Notes to Consolidated Financial Statements for further details.

|

2010 vs. 2009

|

2009 vs. 2008

|

|||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

|||||||||||||||||||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

$ | % | $ | % | |||||||||||||||||||||

|

Net sales

|

$ | 1,807.4 | $ | 1,425.0 | $ | 2,207.6 | $ | 382.4 | 26.8 | % | $ | (782.6 | ) | (35.5 | ) % | |||||||||||||

|

Trade name impairment charges

|

— | — | 4.5 | — | — | % | (4.5 | ) |

NM

|

|||||||||||||||||||

|

Restructuring, exit and

|

||||||||||||||||||||||||||||

|

impairment charges

|

13.6 | 48.3 | 32.4 | (34.7 | ) | (71.8 | ) % | 15.9 | 49.1 | % | ||||||||||||||||||

|

Operating earnings (loss)

|

147.3 | (131.2 | ) | 69.9 | 278.5 |

NM

|

(201.1 | ) |

NM

|

|||||||||||||||||||

|

Operating margin

|

8.1 | % | (9.2 | ) % | 3.2 | % |

NM

|

NM

|

||||||||||||||||||||

|

Capital expenditures

|

$ | 30.8 | $ | 12.3 | $ | 23.5 | $ | 18.5 |

NM

|

$ | (11.2 | ) | (47.7 | ) % | ||||||||||||||

|

2010 vs. 2009

|

2009 vs. 2008

|

|||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

|||||||||||||||||||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

$ | % | $ | % | |||||||||||||||||||||

|

Net sales

|

$ | 913.0 | $ | 615.7 | $ | 1,719.5 | $ | 297.3 | 48.3 | % | $ | (1,103.8 | ) | (64.2 | ) % | |||||||||||||

|

Goodwill impairment charges

|

— | — | 362.8 | — | — | % | (362.8 | ) |

NM

|

|||||||||||||||||||

|

Trade name impairment charges

|

1.1 | — | 120.9 | 1.1 |

NM

|

(120.9 | ) |

NM

|

||||||||||||||||||||

|

Restructuring, exit and

impairment charges

|

44.9 | 107.8 | 98.7 | (62.9 | ) | (58.3 | )% | 9.1 | 9.2 | % | ||||||||||||||||||

|

Operating loss

|

(145.9 | ) | (398.5 | ) | (655.3 | ) | (252.6 | ) | (63.4 | ) % | (256.8 | ) | (39.2 | ) % | ||||||||||||||

|

Operating margin

|

(16.0 | ) % | (64.7 | ) % | (38.1 | ) % |

NM

|

NM

|

||||||||||||||||||||

|

Capital expenditures

|

$ | 17.2 | $ | 15.5 | $ | 40.8 | $ | 1.7 | 11.0 | % | $ | (25.3 | ) | (62.0 | ) % | |||||||||||||

|

2010 vs. 2009

|

2009 vs. 2008

|

|||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

|||||||||||||||||||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

$ | % | $ | % | |||||||||||||||||||||

|

Net sales

|

$ | 541.9 | $ | 496.8 | $ | 639.5 | $ | 45.1 | 9.1 | % | $ | (142.7 | ) | (22.3 | ) % | |||||||||||||

|

Restructuring, exit and

|

||||||||||||||||||||||||||||

|

impairment charges

|

0.2 | 2.1 | 3.3 | (1.9 | ) | (90.5 | ) % | (1.2 | ) | (36.4 | ) % | |||||||||||||||||

|

Operating earnings

|

59.6 | 33.5 | 52.2 | 26.1 | 77.9 | % | (18.7 | ) | (35.8 | ) % | ||||||||||||||||||

|

Operating margin

|

11.0 | % | 6.7 | % | 8.2 | % |

430 bpts

|

(150) bpts

|

||||||||||||||||||||

|

Capital expenditures

|

$ | 3.7 | $ | 2.2 | $ | 4.5 | $ | 1.5 | 68.2 | % | $ | (2.3 | ) | (51.1 | ) % | |||||||||||||

|

2010 vs. 2009

|

2009 vs. 2008

|

|||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

|||||||||||||||||||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

$ | % | $ | % | |||||||||||||||||||||

|

Net sales

|

$ | 323.3 | $ | 337.0 | $ | 448.3 | $ | (13.7 | ) | (4.1 | ) % | $ | (111.3 | ) | (24.8 | ) % | ||||||||||||

|

Goodwill impairment charges

|

— | — | 14.4 | — | — | % | (14.4 | ) |

NM

|

|||||||||||||||||||

|

Trade name impairment charges

|

— | — | 8.5 | — | — | % | (8.5 | ) |

NM

|

|||||||||||||||||||

|

Restructuring, exit and

|

||||||||||||||||||||||||||||

|

impairment charges

|

1.8 | 5.3 | 21.7 | (3.5 | ) | (66.0 | ) % | (16.4 | ) | (75.6 | ) % | |||||||||||||||||

| Operating earnings (loss) | 12.5 | 3.1 | (12.7 | ) | 9.4 | NM | 15.8 | NM | ||||||||||||||||||||

| Operating margin | 3.9 | % | 0.9 | % | (2.8 | )% | 300 bpts | 370 bpts | ||||||||||||||||||||

|

Capital expenditures

|

$ | 4.9 | $ | 3.3 | $ | 26.9 | $ | 1.6 | 48.5 | % | $ | (23.6 | ) | (87.7 | ) % | |||||||||||||

|

2010 vs. 2009

|

2009 vs. 2008

|

||||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

||||||||||||||||||||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

$ | % | $ | % | ||||||||||||||||||||||

|

Restructuring, exit and impairment charges

|

$ | 0.7 | $ | 9.0 | $ | 21.2 | $ | (8.3 | ) | (92.2 | )% | $ | (12.2 | ) | (57.5 | )% | |||||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

|||||||||

|

Net cash provided by (used for) operating activities

|

$ | 205.4 | $ | 125.5 | $ | (12.1 | ) | |||||

|

Net cash provided by (used for):

|

||||||||||||

|

Capital expenditures

|

(57.2 | ) | (33.3 | ) | (102.0 | ) | ||||||

|

Proceeds from investment sales

|

— | — | 45.5 | |||||||||

|

Proceeds from the sale of property, plant and equipment

|

6.7 | 13.0 | 28.3 | |||||||||

|

Other, net

|

8.3 | 1.8 | 17.2 | |||||||||

|

Free cash flow

(A)

|

$ | 163.2 | $ | 107.0 | $ | (23.1 | ) | |||||

|

(

A)

|

The Company defines Free cash flow as cash flow from operating and investing activities (excluding cash provided by (used for) acquisitions, investments, and purchases or sales of marketable securities). Free cash flow is not intended as an alternative measure of cash flow from operations, as determined in accordance with generally accepted accounting principles (GAAP) in the United States. The Company uses this financial measure, both in presenting its results to shareholders and the investment community and in its internal evaluation and management of its businesses. Management believes that this financial measure and the information it provides are useful to investors because it permits investors to view the Company’s performance using the same tool that management uses to gauge progress in achieving its goals. Management believes that the non-GAAP financial measure “Free cash flow” is also useful to investors because it is an indication of cash flow that may be available to fund investments in future growth initiatives

.

|

|

(in millions)

|

2010

|

2009

|

|||||

|

Cash and cash equivalents

|

$ | 551.4 | $ | 526.6 | |||

|

Short-term investments in marketable securities

|

84.7 | 0.8 | |||||

|

Long-term investments in marketable securities

|

21.0 | — | |||||

|

Total cash, cash equivalents and marketable securities

|

$ | 657.1 | $ | 527.4 | |||

|

(in millions)

|

2010

|

2009

|

||||

|

Short-term debt, including current maturities of long-term debt

|

$ | 2.2 | $ | 11.5 | ||

|

Long-term debt

|

828.4 | 839.4 | ||||

|

Total debt

|

830.6 | 850.9 | ||||

|

Less: Cash, cash equivalents and marketable securities

|

657.1 | 527.4 | ||||

|

Net debt

(A)

|

$ | 173.5 | $ | 323.5 | ||

|

(A)

|

The Company defines Net debt as Short-term and long-term Debt, less Cash and cash equivalents, Short-term investments in marketable securities and Long-term investments in marketable securities, as presented in the Consolidated Balance Sheets. Net debt is not intended as an alternative measure to debt, as determined in accordance with GAAP in the United States. The Company uses this financial measure, both in presenting its results to shareholders and the investment community and in its internal evaluation and management of its businesses. Management believes that this financial measure and the information it provides are useful to investors because it permits investors to view the Company’s performance using the same tool that management uses to gauge progress in achieving its goals. Management believes that the non-GAAP financial measure “Net debt” is also useful to investors because it is an indication of the Company’s ability to repay its outstanding debt using its current cash, cash equivalents and marketable securities.

|

|

(in millions)

|

2010

|

2009

|

||||

|

Cash, cash equivalents and marketable securities

|

$ | 657.1 | $ | 527.4 | ||

|

Amounts available under its asset-based lending facilities

(B)

|

162.1 | 88.5 | ||||

|

Total liquidity

(A)

|

$ | 819.2 | $ | 615.9 | ||

|

(

A)

|

The Company defines Total liquidity as Cash and cash equivalents, Short-term investments in marketable securities and Long-term investments in marketable securities as presented in the Consolidated Balance Sheets, plus amounts available under its asset-based lending facilities. Total liquidity is not intended as an alternative measure to Cash and cash equivalents, Short-term investments in marketable securities and Long-term investments in marketable securities as determined in accordance with GAAP in the United States. The Company uses this financial measure, both in presenting its results to shareholders and the investment community and in its internal evaluation and management of its businesses. Management believes that this financial measure and the information it provides are useful to investors because it permits investors to view the Company’s performance using the same tool that management uses to gauge progress in achieving its goals. Management believes that the non-GAAP financial measure “Total liquidity” is also useful to investors because it is an indication of the Company’s available highly liquid assets and immediate sources of financing.

|

|

(B)

|

Represents the sum of (1) $129.8 million and $106.3 million, as of December 31, 2010 and 2009, respectively, of unused borrowing capacity under the Company’s Revolving Credit Facility discussed below, reduced by the $60.0 million minimum availability requirement, as of December 31, 2009, and (2) the available borrowing capacity of $32.3 million and $42.2 million, as of December 31, 2010 and December 31, 2009, respectively, under the Company’s Mercury Receivables ABL Facility as discussed below.

|

|

Payments due by Period

|

||||||||||||||||||

|

Less than

|

More than

|

|||||||||||||||||

|

(in millions)

|

Total

|

1 year

|

1-3 years

|

3-5 years

|

5 years

|

|||||||||||||

|

Contractual Obligations

|

||||||||||||||||||

|

Debt

(1)

|

$ | 848.3 | $ | 2.2 | $ | 130.1 | $ | 11.0 | $ | 705.0 | ||||||||

|

Interest payments on long-term debt

|

625.4 | 67.8 | 150.1 | 127.3 | 280.2 | |||||||||||||

|

Operating leases

(2)

|

131.4 | 34.8 | 43.9 | 23.2 | 29.5 | |||||||||||||

|

Purchase obligations

(3)

|

134.6 | 134.6 | — | — | — | |||||||||||||

|

Deferred management compensation

(4)

|

42.7 | 8.1 | 12.2 | 5.2 | 17.2 | |||||||||||||

|

Other tax liabilities

(5)

|

4.8 | 4.8 | — | — | — | |||||||||||||

|

Other long-term liabilities

(6)

|

234.5 | 74.8 | 111.2 | 19.9 | 28.6 | |||||||||||||

|

Total contractual obligations

|

$ | 2,021.7 | $ | 327.1 | $ | 447.5 | $ | 186.6 | $ | 1,060.5 | ||||||||

|

|

(1)

|

See

Note 14 – Debt

in the Notes to Consolidated Financial Statements for additional information on the Company’s debt. “Debt” refers to future cash principal payments.

|

|

|

(2)

|

See

Note 18 – Leases

in the Notes to Consolidated Financial Statements for additional information on the Company’s operating leases.

|

|

|

(3)

|

Purchase obligations represent agreements with suppliers and vendors at the end of 2010 for raw materials and other supplies as part of the normal course of business.

|

|

|

(4)

|

Amounts primarily represent long-term deferred compensation plans for Company management. Payments are assumed to be equal to the remaining liability.

|

|

|

(5)

|

Represents the expected cash obligations related to the Company’s liability for uncertain income tax positions. As of December 31, 2010, the Company’s total liability for uncertain tax positions including interest was $36.9 million. Due to the high degree of uncertainty regarding the timing of potential future cash outflows associated with these liabilities, other than the items included in the table above, the Company was unable to make a reasonably reliable estimate of the amount and period in which these remaining liabilities might be paid.

|

|

|

(6)

|

Other long-term liabilities include amounts reflected on the balance sheet, which primarily include certain agreements that provide for the assignment of lease and other long-term receivables originated by the Company to third parties and are treated as a secured obligation. Amounts above also include obligations under deferred revenue arrangements and future projected payments related to the Company’s nonqualified pension plans. Other long-term liabilities also include $44.0 million of required qualified pension plan contributions to be paid in 2011, as well as $10.4 million of scheduled retiree health care and life insurance benefit plan payments. Due to the high degree of uncertainty regarding the potential future cash outflows associated with these plans, the Company is unable to provide a reasonably reliable estimate of the amounts and periods in which any additional liabilities might be paid.

|

|

(in millions)

|

2010

|

2009

|

||||

|

Risk Category

|

||||||

|

Foreign exchange

|

$ | 15.4 | $ | 11.5 | ||

|

Commodity prices

|

$ | 1.4 | $ | 2.1 | ||

|

|

Page

|

|

Financial Statements:

|

|

|

Report of Management on Internal Control over Financial Reporting

|

40

|

|

Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting

|

41

|

|

Report of Independent Registered Public Accounting Firm

|

42

|

|

Consolidated Statements of Operations for the Years Ended December 31, 2010, 2009 and 2008

|

43

|

|

Consolidated Balance Sheets as of December 31, 2010 and 2009

|

44

|

|

Consolidated Statements of Cash Flows for the Years Ended December 31, 2010, 2009 and 2008

|

46

|

|

Consolidated Statements of Shareholders’ Equity for the Years Ended December 31, 2010, 2009 and 2008

|

47

|

|

Notes to Consolidated Financial Statements

|

48

|

|

Financial Statement Schedule:

|

|

|

Schedule II - Valuation and Qualifying Accounts

|

88

|

|

/s/ DUSTAN E. McCOY

|

/s/ PETER B. HAMILTON

|

|

Dustan E. McCoy

|

Peter B. Hamilton

|

|

Chairman and Chief Executive Officer

|

Senior Vice President and Chief Financial Officer

|

|

BRUNSWICK CORPORATION

|

|

|

|

For the Years Ended December 31

|

|||||||||||

|

(in millions, except per share data)

|

2010

|

2009

|

2008

|

||||||||

|

Net sales

|

$ | 3,403.3 | $ | 2,776.1 | $ | 4,708.7 | |||||

|

Cost of sales

|

2,683.3 | 2,460.5 | 3,841.3 | ||||||||

|

Selling, general and administrative expense

|

549.4 | 625.1 | 668.4 | ||||||||

|

Research and development expense

|

92.0 | 88.5 | 122.2 | ||||||||

|

Goodwill impairment charges

|

— | — | 377.2 | ||||||||

|

Trade name impairment charges

|

1.1 | — | 133.9 | ||||||||

|

Restructuring, exit and impairment charges

|

61.2 | 172.5 | 177.3 | ||||||||

|

Operating earnings (loss)

|

16.3 | (570.5 | ) | (611.6 | ) | ||||||

|

Equity earnings (loss)

|

(3.0 | ) | (15.7 | ) | 6.5 | ||||||

|

Investment sale gains

|

— | — | 23.0 | ||||||||

|

Other expense, net

|

(1.5 | ) | (2.5 | ) | (2.6 | ) | |||||

|

Earnings (loss) before interest, loss on early

|

11.8 | (588.7 | ) | (584.7 | ) | ||||||

|

extinguishment of debt and income taxes

|

|||||||||||

|

Interest expense

|

(94.4 | ) | (86.1 | ) | (54.2 | ) | |||||

|

Interest income

|

3.6 | 3.2 | 6.7 | ||||||||

|

Loss on early extinguishment of debt

|

(5.7 | ) | (13.1 | ) | — | ||||||

|

Loss before income taxes

|

(84.7 | ) | (684.7 | ) | (632.2 | ) | |||||

|

Income tax provision (benefit)

|

25.9 | (98.5 | ) | 155.9 | |||||||

|

Net loss

|

$ | (110.6 | ) | $ | (586.2 | ) | $ | (788.1 | ) | ||

|

Loss per common share:

|

|||||||||||

|

Basic

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | ||

|

Diluted

|

$ | (1.25 | ) | $ | (6.63 | ) | $ | (8.93 | ) | ||

|

Weighted average shares used for computation of:

|

|||||||||||

|

Basic loss per share

|

88.7 | 88.4 | 88.3 | ||||||||

|

Diluted loss per share

|

88.7 | 88.4 | 88.3 | ||||||||

|

Cash dividends declared per common share

|

$ | 0.05 | $ | 0.05 | $ | 0.05 | |||||

|

The Notes to Consolidated Financial Statements are an integral part of these consolidated statements.

|

|||||||||||

|

BRUNSWICK CORPORATION

|

|

|

|

As of December 31

|

||||||

|

(in millions)

|

2010

|

2009

|

||||

|

Assets

|

||||||

|

Current assets

|

||||||

|

Cash and cash equivalents, at cost, which approximates market

|

$ | 551.4 | $ | 526.6 | ||

|

Short-term investments in marketable securities

|

84.7 | 0.8 | ||||

|

Total cash, cash equivalents and short-term investments in

|

636.1 | 527.4 | ||||

|

marketable securities

|

||||||

|

Accounts and notes receivable, less allowances of $38.0 and $47.7

|

327.3 | 332.4 | ||||

|

Inventories

|

||||||

|

Finished goods

|

276.9 | 234.4 | ||||

|

Work-in-process

|

164.0 | 174.3 | ||||

|

Raw materials

|

86.6 | 76.2 | ||||

|

Net inventories

|

527.5 | 484.9 | ||||

|

Deferred income taxes

|

17.0 | 79.3 | ||||

|

Prepaid expenses and other

|

27.9 | 34.7 | ||||

|

Current assets

|

1,535.8 | 1,458.7 | ||||

|

Property

|

||||||

|

Land

|

88.9 | 100.0 | ||||

|

Buildings and improvements

|

651.3 | 678.3 | ||||

|

Equipment

|

1,079.3 | 1,078.9 | ||||

|

Total land, buildings and improvements and equipment

|

1,819.5 | 1,857.2 | ||||

|

Accumulated depreciation

|

(1,250.3 | ) | (1,221.8 | ) | ||

|

Net land, buildings and improvements and equipment

|

569.2 | 635.4 | ||||

|

Unamortized product tooling costs

|

61.0 | 88.9 | ||||

|

Net property

|

630.2 | 724.3 | ||||

|

Other assets

|

||||||

|

Goodwill

|

290.9 | 292.5 | ||||

|

Other intangibles, net

|

56.7 | 75.6 | ||||

|

Long-term investments in marketable securities

|

21.0 | — | ||||

|

Equity investments

|

53.7 | 56.7 | ||||

|

Other long-term assets

|

89.7 | 101.6 | ||||

|

Other assets

|

512.0 | 526.4 | ||||

|

Total assets

|

$ | 2,678.0 | $ | 2,709.4 | ||

|

The Notes to Consolidated Financial Statements are an integral part of these consolidated statements.

|

||||||

|

BRUNSWICK CORPORATION

|

|

Consolidated Balance Sheets

|

|

As of December 31

|

||||||

|

(in millions, except share data)

|

2010

|

2009

|

||||

|

Liabilities and shareholders’ equity

|

||||||

|

Current liabilities

|

||||||

|

Short-term debt, including $1.7 and $1.8 of current maturities of long-term debt

|

$ | 2.2 | $ | 11.5 | ||

|

Accounts payable

|

288.2 | 261.2 | ||||

|

Accrued expenses

|

661.2 | 633.9 | ||||

|

Current liabilities

|

951.6 | 906.6 | ||||

|

Long-term liabilities

|

||||||

|

Debt

|

828.4 | 839.4 | ||||

|

Deferred income taxes

|

71.6 | 10.1 | ||||

|

Postretirement benefits

|

548.9 | 535.7 | ||||

|

Other

|

207.1 | 207.3 | ||||

|

Long-term liabilities

|

1,656.0 | 1,592.5 | ||||

|

Shareholders’ equity

|

||||||

|

Common stock; authorized: 200,000,000 shares,

|

||||||

|

$0.75 par value; issued: 102,538,000 shares

|

76.9 | 76.9 | ||||

|

Additional paid-in capital

|

424.6 | 415.1 | ||||

|

Retained earnings

|

390.3 | 505.3 | ||||

|

Treasury stock, at cost: 13,877,000 and 14,220,000 shares

|

(405.9 | ) | (412.2 | ) | ||

|

Accumulated other comprehensive income (loss), net of tax:

|

||||||

|

Foreign currency translation

|

32.4 | 39.7 | ||||

|

Defined benefit plans:

|

||||||

|

Prior service credits

|

11.5 | 15.5 | ||||

|

Net actuarial losses

|

(459.8 | ) | (438.8 | ) | ||

|

Unrealized investment gains

|

0.7 | 2.6 | ||||

|

Unrealized gains (losses) on derivatives

|

(0.3 | ) | 6.2 | |||

|

Total accumulated other comprehensive loss

|

(415.5 | ) | (374.8 | ) | ||

|

Shareholders’ equity

|

70.4 | 210.3 | ||||

|

Total liabilities and shareholders’ equity

|

$ | 2,678.0 | $ | 2,709.4 | ||

|

The Notes to Consolidated Financial Statements are an integral part of these consolidated statements.

|

||||||

|

BRUNSWICK CORPORATION

|

|

|

|

For the Years Ended December 31

|

|||||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

||||||||

|

Cash flows from operating activities

|

|||||||||||

|

Net loss

|

$ | (110.6 | ) | $ | (586.2 | ) | $ | (788.1 | ) | ||

|

Depreciation and amortization

|

129.3 | 157.3 | 177.2 | ||||||||

|

Deferred income taxes

|

5.6 | (99.2 | ) | 236.2 | |||||||

|

Pension expense, net of contributions

|

1.7 | 74.6 | 11.3 | ||||||||

|

Goodwill, trade name, and other long-lived asset impairment charges

|

23.2 | 63.0 | 564.3 | ||||||||

|

Provision for doubtful accounts

|

3.3 | 49.7 | 32.3 | ||||||||

|

Equity in loss of unconsolidated affiliates, net of dividends

|

5.4 | 16.0 | 1.3 | ||||||||

|

Loss on early extinguishment of debt

|

5.7 | 13.1 | — | ||||||||

|

Changes in certain current assets and current liabilities

|

|||||||||||

|

Change in accounts and notes receivable

|

2.4 | 159.9 | 91.1 | ||||||||

|

Change in inventory

|

(49.2 | ) | 325.1 | 81.7 | |||||||

|

Change in prepaid expenses and other

|

6.9 | 12.5 | (2.3 | ) | |||||||

|

Change in accounts payable

|

27.0 | (39.9 | ) | (135.0 | ) | ||||||

|

Change in accrued expenses

|

27.4 | (56.8 | ) | (167.8 | ) | ||||||

|

Income taxes

|

112.8 | 91.2 | (72.5 | ) | |||||||

|

Repurchase of accounts receivable

|

— | (84.2 | ) | — | |||||||

|

Other, net

|

14.5 | 29.4 | (41.8 | ) | |||||||

|

Net cash provided by (used for) operating activities

|

205.4 | 125.5 | (12.1 | ) | |||||||

|

Cash flows from investing activities

|

|||||||||||

|

Capital expenditures

|

(57.2 | ) | (33.3 | ) | (102.0 | ) | |||||

|

Purchases of marketable securities

|

(105.8 | ) | — | — | |||||||

|

Investments

|

(7.2 | ) | 6.2 | 20.0 | |||||||

|

Proceeds from investment sales

|

— | — | 45.5 | ||||||||

|

Proceeds from the sale of property, plant and equipment

|

6.7 | 13.0 | 28.3 | ||||||||

|

Other, net

|

8.3 | 1.8 | 17.2 | ||||||||

|

Net cash provided by (used for) investing activities

|

(155.2 | ) | (12.3 | ) | 9.0 | ||||||

|

Cash flows from financing activities

|

|||||||||||

|

Net issuances (payments) of short-term debt

|

(8.6 | ) | 7.7 | (7.4 | ) | ||||||

|

Initial proceeds from asset based lending facility

|

— | 81.1 | — | ||||||||

|

Net payments related to asset based lending facility

|

— | (81.1 | ) | — | |||||||

|

Net proceeds from issuance of long-term debt

|

30.1 | 353.7 | 252.0 | ||||||||

|

Payments of long-term debt including current maturities

|

(38.2 | ) | (247.9 | ) | (251.0 | ) | |||||

|

Payments of premium on early extinguishment of debt

|

(5.6 | ) | (13.2 | ) | — | ||||||

|

Cash dividends paid

|

(4.4 | ) | (4.4 | ) | (4.4 | ) | |||||

|

Net proceeds from stock compensation activity

|

1.3 | — | — | ||||||||

|

Net cash provided by (used for) financing activities

|

(25.4 | ) | 95.9 | (10.8 | ) | ||||||

|

Net increase (decrease) in cash and cash equivalents

|

24.8 | 209.1 | (13.9 | ) | |||||||

|

Cash and cash equivalents at January 1

|

526.6 | 317.5 | 331.4 | ||||||||

|

Cash and cash equivalents at December 31

|

$ | 551.4 | $ | 526.6 | $ | 317.5 | |||||

|

Supplemental cash flow disclosures:

|

|||||||||||

|

Interest paid

|

$ | 102.0 | $ | 96.3 | $ | 48.3 | |||||

|

Income taxes paid (received), net

|

$ | (92.5 | ) | $ | (90.6 | ) | $ | (7.8 | ) | ||

|

The Notes to Consolidated Financial Statements are an integral part of these consolidated statements.

|

|||||||||||

|

BRUNSWICK CORPORATION

|

|

Consolidated Statements of Shareholders’ Equity

|

|

Accumulated

|

|||||||||||||||||||||||

|

Additional

|

Other

|

||||||||||||||||||||||

|

Common

|

Paid-in

|

Retained

|

Treasury

|

Comprehensive

|

|||||||||||||||||||

|

(in millions, except per share data)

|

Stock

|

Capital

|

Earnings

|

Stock

|

Income (Loss)

|

Total

|

|||||||||||||||||

|

Balance, December 31, 2007

|

$ | 76.9 | $ | 409.0 | $ | 1,888.4 | $ | (428.7 | ) | $ | (52.7 | ) | $ | 1,892.9 | |||||||||

|

Net loss

|

— | — | (788.1 | ) | — | — | (788.1 | ) | |||||||||||||||

|

Translation adjustments, net of tax

|

— | — | — | — | (22.0 | ) | (22.0 | ) | |||||||||||||||

|

Unrealized investment losses, net of tax

|

— | — | — | — | (4.0 | ) | (4.0 | ) | |||||||||||||||

|

Unrealized gains on derivatives, net of tax

|

— | — | — | — | 5.6 | 5.6 | |||||||||||||||||

|

Defined benefit plans:

|

|||||||||||||||||||||||

|

Prior service credits, net of tax

|

— | — | — | — | 11.1 | 11.1 | |||||||||||||||||

|

Net actuarial losses, net of tax

|

— | — | — | — | (370.3 | ) | (370.3 | ) | |||||||||||||||

|

Comprehensive loss

|

— | — | (788.1 | ) | — | (379.6 | ) | (1,167.7 | ) | ||||||||||||||

|

Dividends ($0.05 per common share)

|

— | — | (4.4 | ) | — | — | (4.4 | ) | |||||||||||||||

|

Compensation plans and other

|

— | 3.3 | — | 5.8 | — | 9.1 | |||||||||||||||||

|

Balance, December 31, 2008

|

76.9 | 412.3 | 1,095.9 | (422.9 | ) | (432.3 | ) | 729.9 | |||||||||||||||

|

Net loss

|

— | — | (586.2 | ) | — | — | (586.2 | ) | |||||||||||||||

|

Translation adjustments, net of tax

|

— | — | — | — | 10.9 | 10.9 | |||||||||||||||||

|

Unrealized investment gains, net of tax

|

— | — | — | — | 5.1 | 5.1 | |||||||||||||||||

|

Unrealized gains on derivatives, net of tax

|

— | — | — | — | 3.8 | 3.8 | |||||||||||||||||

|

Defined benefit plans:

|

|||||||||||||||||||||||

|

Prior service credits, net of tax

|

— | — | — | — | 13.6 | 13.6 | |||||||||||||||||

|

Net actuarial gains, net of tax

|

— | — | — | — | 24.1 | 24.1 | |||||||||||||||||

|

Comprehensive income (loss)

|

— | — | (586.2 | ) | — | 57.5 | (528.7 | ) | |||||||||||||||

|

Dividends ($0.05 per common share)

|

— | — | (4.4 | ) | — | — | (4.4 | ) | |||||||||||||||

|

Compensation plans and other

|

— | 2.8 | — | 10.7 | — | 13.5 | |||||||||||||||||

|

Balance, December 31, 2009

|

76.9 | 415.1 | 505.3 | (412.2 | ) | (374.8 | ) | 210.3 | |||||||||||||||

|

Net loss

|

— | — | (110.6 | ) | — | — | (110.6 | ) | |||||||||||||||

|

Translation adjustments, net of tax

|

— | — | — | — | (7.3 | ) | (7.3 | ) | |||||||||||||||

|

Unrealized investment losses, net of tax

|

— | — | — | — | (1.9 | ) | (1.9 | ) | |||||||||||||||

|

Unrealized losses on derivatives, net of tax

|

— | — | — | — | (6.5 | ) | (6.5 | ) | |||||||||||||||

|

Defined benefit plans:

|

|||||||||||||||||||||||

|

Prior service costs, net of tax

|

— | — | — | — | (4.0 | ) | (4.0 | ) | |||||||||||||||

|

Net actuarial losses, net of tax

|

— | — | — | — | (21.0 | ) | (21.0 | ) | |||||||||||||||

|

Comprehensive loss

|

— | — | (110.6 | ) | — | (40.7 | ) | (151.3 | ) | ||||||||||||||

|

Dividends ($0.05 per common share)

|

— | — | (4.4 | ) | — | — | (4.4 | ) | |||||||||||||||

|

Compensation plans and other

|

— | 9.5 | — | 6.3 | — | 15.8 | |||||||||||||||||

|

Balance, December 31, 2010

|

$ | 76.9 | $ | 424.6 | $ | 390.3 | $ | (405.9 | ) | $ | (415.5 | ) | $ | 70.4 | |||||||||

|

(in millions)

|

2010

|

2009

|

2008

|

||||||||

|

Gains on the sale of property

|

$ | 4.9 | $ | 6.0 | $ | 4.2 | |||||

|

Losses on the sale and disposal of property

|

(9.9 | ) | (11.9 | ) | (4.4 | ) | |||||

|

Net gains (losses) on sale and disposal of property

|

$ | (5.0 | ) | $ | (5.9 | ) | $ | (0.2 | ) | ||

|

·

|

Employee termination and other benefits

|

|

·

|

Costs to retain and relocate employees

|

|

·

|

Consulting costs

|

|

·

|

Consolidation of manufacturing footprint

|

|

·

|

Employee termination and other benefits

|

|

·

|

Lease exit costs

|

|

·

|

Inventory write-downs

|

|

·

|

Facility shutdown costs

|

|

·

|

Fixed assets

|

|

·

|

Tooling

|

|

·

|

Patents and proprietary technology

|

|

·

|

Dealer networks

|

|

(in millions)

|

2010

|

2009

|

2008

|

||||||||

|

Restructuring activities

|

|||||||||||

|

Employee termination and other benefits

|

$ | 12.7 | $ | 44.1 | $ | 44.2 | |||||

|

Current asset write-downs

|

2.9 | 6.4 | 5.9 | ||||||||

|

Transformation and other costs:

|

|||||||||||

|

Consolidation of manufacturing footprint

|

17.8 | 49.9 | 58.8 | ||||||||

|

Retention and relocation costs

|

0.7 | 0.1 | 5.5 | ||||||||

|

Consulting costs

|

— | 0.3 | 5.4 | ||||||||

|

Exit activities

|

|||||||||||

|

Employee termination and other benefits

|

0.8 | 0.8 | 3.3 | ||||||||

|

Current asset write-downs

|

1.0 | 1.4 | 8.8 | ||||||||

|

Transformation and other costs:

|

|||||||||||

|

Consolidation of manufacturing footprint

|

3.4 | 1.4 | 4.8 | ||||||||

|

Loss (gain) on sale of non-strategic assets

|

3.6 | — | (12.6 | ) | |||||||

|

Asset disposition actions:

|

|||||||||||

|

Definite-lived asset impairments and loss on disposal

|

18.3 | 68.1 | 59.9 | ||||||||

|

Gain on sale of non-strategic assets

|

— | — | (6.7 | ) | |||||||

|

Total restructuring, exit and impairment charges

|

$ | 61.2 | $ | 172.5 | $ | 177.3 | |||||

|

(in millions)

|

2010

|

|

|

Marine Engine

|

$ | 3.7 |

|

Boat

|

31.1 | |

|

Fitness

|

0.1 | |

|

Bowling & Billiards

|

1.5 | |

|

Total

|

$ | 36.4 |

|

(in millions)

|

2010

|

|

|

Restructuring activities

|

||

|

Employee termination and other benefits

|

$ | 4.2 |

|

Current asset write-downs

|

2.0 | |

|

Transformation and other costs:

|

||

|

Consolidation of manufacturing footprint

|

5.5 | |

|

Retention and relocation costs

|

0.5 | |

|

Exit activities

|

||

|

Employee termination and other benefits

|

0.8 | |

|

Current asset write-downs

|

1.0 | |

|

Transformation and other costs:

|

||

|

Consolidation of manufacturing footprint

|

3.5 | |

|

Loss on sale of non-strategic assets

|

3.6 | |

|

Asset disposition actions:

|

||

|

Definite-lived asset impairments

|

15.3 | |

|

Total restructuring, exit and impairment charges

|

$ | 36.4 |

|

(in millions)

|

Marine Engine

|

Boat

|

Fitness

|

Bowling & Billiards

|

Total

|

|||||||||||||

|

Employee termination and other benefits

|

$ | 2.8 | $ | 1.7 | $ | 0.1 | $ | 0.4 | $ | 5.0 | ||||||||

|

Current asset write-downs

|

0.3 | 2.5 | — | 0.2 | 3.0 | |||||||||||||

|

Transformation and other costs

|

0.6 | 11.6 | — | 0.9 | 13.1 | |||||||||||||

|

Asset disposition actions

|

— | 15.3 | — | — | 15.3 | |||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 3.7 | $ | 31.1 | $ | 0.1 | $ | 1.5 | $ | 36.4 | ||||||||

|

(in millions)

|

Costs Recognized in 2010

|

Non-cash Charges

|

Net Cash Payments

|

Accrued

Costs as of

Dec. 31,

2010

|

||||||||||

|

Employee termination and other benefits

|

$ | 5.0 | $ | — | $ | (4.2 | ) | $ | 0.8 | |||||

|

Current asset write-downs

|

3.0 | (3.0 | ) | — | — | |||||||||

|

Transformation and other costs:

|

||||||||||||||

|

Consolidation of manufacturing footprint

|

9.0 | — | (7.6 | ) | 1.4 | |||||||||

|

Retention and relocation costs

|

0.5 | — | — | 0.5 | ||||||||||

|

Loss on sale of non-strategic assets

|

3.6 | (3.6 | ) | — | — | |||||||||

|

Asset disposition actions:

|

||||||||||||||

|

Definite-lived asset impairments

|

15.3 | (15.3 | ) | — | — | |||||||||

|

Total restructuring, exit and impairment charges

|

$ | 36.4 | $ | (21.9 | ) | $ | (11.8 | ) | $ | 2.7 | ||||

|

(in millions)

|

2010

|

2009

|

||||

|

Marine Engine

|

$ | 9.9 | $ | 45.0 | ||

|

Boat

|

7.3 | 72.0 | ||||

|

Fitness

|

0.1 | 2.1 | ||||

|

Bowling & Billiards

|

0.3 | 1.1 | ||||

|

Corporate

|

0.3 | 5.6 | ||||

|

Total

|

$ | 17.9 | $ | 125.8 | ||

|

(

in millions)

|

2010

|

2009

|

|||||

|

Restructuring activities

|

|||||||

|

Employee termination and other benefits

|

$ | 8.0 | $ | 35.6 | |||

|

Current asset write-downs

|

— | 4.0 | |||||

|

Transformation and other costs:

|

|||||||

|

Consolidation of manufacturing footprint

|

8.9 | 28.8 | |||||

|

Retention and relocation costs

|

0.2 | 0.1 | |||||

|

Consulting costs

|

— | 0.3 | |||||

|

Exit activities

|

|||||||

|

Transformation and other costs (gains):

|

|||||||

|

Consolidation of manufacturing footprint

|

(0.1 | ) | (1.9 | ) | |||

|

Asset disposition actions:

|

|||||||

|

Definite-lived asset impairments and loss on disposal

|

0.9 | 58.9 | |||||

|

Total restructuring, exit and impairment charges

|

$ | 17.9 | $ | 125.8 | |||

|

(in millions)

|

Marine

Engine

|

Boat

|

Fitness

|

Bowling & Billiards

|

Corporate

|

Total

|

||||||||||||||||

|

Employee termination and other benefits

|

$ | 2.8 | $ | 4.5 | $ | 0.1 | $ | 0.3 | $ | 0.3 | $ | 8.0 | ||||||||||

|

Transformation and other costs

|

7.1 | 1.9 | — | — | — | 9.0 | ||||||||||||||||

|

Asset disposition actions

|

— | 0.9 | — | — | — | 0.9 | ||||||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 9.9 | $ | 7.3 | $ | 0.1 | $ | 0.3 | $ | 0.3 | $ | 17.9 | ||||||||||

|

(in millions)

|

Marine

Engine

|

Boat

|

Fitness

|

Bowling & Billiards

|

Corporate

|

Total

|

||||||||||||||||

|

Employee termination and other benefits

|

$ | 19.5 | $ | 10.7 | $ | 2.0 | $ | 0.8 | $ | 2.6 | $ | 35.6 | ||||||||||

|

Current asset write-downs

|

0.7 | 3.3 | — | — | — | 4.0 | ||||||||||||||||

|

Transformation and other costs

|

20.6 | 3.4 | 0.1 | 0.2 | 3.0 | 27.3 | ||||||||||||||||

|

Asset disposition actions

|

4.2 | 54.6 | — | 0.1 | — | 58.9 | ||||||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 45.0 | $ | 72.0 | $ | 2.1 | $ | 1.1 | $ | 5.6 | $ | 125.8 | ||||||||||

|

(in millions)

|

Accrued

Costs as of

Jan. 1,

2010

|

Costs

Recognized

in 2010

|

Non-cash Charges

|

Net Cash Payments

|

Accrued

Costs as of

Dec. 31,

2010

|

|||||||||||||

|

Employee termination and other benefits

|

$ | 8.5 | $ | 8.0 | $ | — | $ | (9.7 | ) | $ | 6.8 | |||||||

|

Transformation and other costs:

|

||||||||||||||||||

|

Consolidation of manufacturing footprint

|

2.0 | 8.8 | — | (9.3 | ) | 1.5 | ||||||||||||

|

Retention and relocation costs

|

— | 0.2 | — | (0.2 | ) | — | ||||||||||||

|

Asset disposition actions:

|

||||||||||||||||||

|

Definite-lived asset impairments and loss on disposal

|

— | 0.9 | (0.9 | ) | — | — | ||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 10.5 | $ | 17.9 | $ | (0.9 | ) | $ | (19.2 | ) | $ | 8.3 | ||||||

|

(in millions)

|

2010

|

2009

|

2008

|

|||||||

|

Marine Engine

|

$ | — | $ | 3.3 | $ | 32.4 | ||||

|

Boat

|

6.5 | 35.8 | 98.7 | |||||||

|

Fitness

|

— | — | 3.3 | |||||||

|

Bowling & Billiards

|

— | 4.2 | 21.7 | |||||||

|

Corporate

|

0.4 | 3.4 | 21.2 | |||||||

|

Total

|

$ | 6.9 | $ | 46.7 | $ | 177.3 | ||||

|

(in millions)

|

2010

|

2009

|

2008

|

|||||||

|

Restructuring activities:

|

||||||||||

|

Employee termination and other benefits

|

$ | 0.5 | $ | 8.5 | $ | 44.2 | ||||

|

Current asset write-downs

|

0.9 | 2.4 | 5.9 | |||||||

|

Transformation and other costs:

|

||||||||||

|

Consolidation of manufacturing footprint

|

3.4 | 21.1 | 58.8 | |||||||

|

Retention and relocation costs

|

— | — | 5.5 | |||||||

|

Consulting costs

|

— | — | 5.4 | |||||||

|

Exit activities:

|

||||||||||

|

Employee termination and other benefits

|

— | 0.8 | 3.3 | |||||||

|

Current asset write-downs

|

— | 1.4 | 8.8 | |||||||

|

Transformation and other costs:

|

||||||||||

|

Consolidation of manufacturing footprint

|

— | 3.3 | 4.8 | |||||||

|

Gain on sale of non-strategic assets

|

— | — | (12.6 | |||||||

|

Asset disposition actions:

|

||||||||||

|

Definite-lived asset impairments and loss on disposal

|

2.1 | 9.2 | 59.9 | |||||||

|

Gain on sale of non-strategic assets

|

— | — | (6.7 | |||||||

|

Total restructuring, exit and impairment charges

|

$ | 6.9 | $ | 46.7 | $ | 177.3 | ||||

|

(in millions)

|

Boat

|

Corporate

|

Total

|

|||||||

|

Employee termination and other benefits

|

$ | 0.5 | $ | — | $ | 0.5 | ||||

|

Current asset write-downs

|

0.9 | — | 0.9 | |||||||

|

Transformation and other costs

|

3.4 | — | 3.4 | |||||||

|

Asset disposition actions

|

1.7 | 0.4 | 2.1 | |||||||

|

Total restructuring, exit and impairment charges

|

$ | 6.5 | $ | 0.4 | $ | 6.9 | ||||

|

(in millions)

|

Marine Engine

|

Boat

|

Bowling & Billiards

|

Corporate

|

Total

|

|||||||||||||

|

Employee termination and other benefits

|

$ | 0.9 | $ | 6.8 | $ | 1.2 | $ | 0.4 | $ | 9.3 | ||||||||

|

Current asset write-downs

|

0.8 | 1.9 | 1.1 | — | 3.8 | |||||||||||||

|

Transformation and other costs

|

1.6 | 20.8 | 1.9 | 0.1 | 24.4 | |||||||||||||

|

Asset disposition actions

|

— | 6.3 | — | 2.9 | 9.2 | |||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 3.3 | $ | 35.8 | $ | 4.2 | $ | 3.4 | $ | 46.7 | ||||||||

|

(in millions)

|

Marine Engine

|

Boat

|

Fitness

|

Bowling & Billiards

|

Corporate

|

Total

|

||||||||||||||||

|

Employee terminations and other benefits

|

$ | 19.2 | $ | 19.7 | $ | 1.3 | $ | 4.4 | $ | 2.9 | $ | 47.5 | ||||||||||

|

Current asset write-downs

|

2.9 | 6.2 | 2.0 | 3.6 | — | 14.7 | ||||||||||||||||

|

Transformation and other costs

|

1.0 | 45.8 | — | 1.4 | 13.7 | 61.9 | ||||||||||||||||

|

Asset disposition actions

|

9.3 | 27.0 | — | 12.3 | 4.6 | 53.2 | ||||||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 32.4 | $ | 98.7 | $ | 3.3 | $ | 21.7 | $ | 21.2 | $ | 177.3 | ||||||||||

|

(in millions)

|

Accrued

Costs as of

Jan. 1,

2010

|

Costs

Recognized

in 2010

|

Non-cash Charges

|

Net Cash Payments

|

Accrued

Costs as of

Dec. 31,

2010

|

|||||||||||||

|

Employee termination and other benefits

|

$ | 1.2 | $ | 0.5 | $ | — | $ | (1.0 | ) | $ | 0.7 | |||||||

|

Current asset write-downs

|

— | 0.9 | (0.9 | ) | — | — | ||||||||||||

|

Transformation and other costs:

|

||||||||||||||||||

|

Consolidation of manufacturing footprint

|

1.9 | 3.4 | — | (3.8 | ) | 1.5 | ||||||||||||

|

Asset disposition actions:

|

||||||||||||||||||

|

Definite-lived asset impairments and loss on disposal

|

— | 2.1 | (2.1 | ) | — | — | ||||||||||||

|

Total restructuring, exit and impairment charges

|

$ | 3.1 | $ | 6.9 | $ | (3.0 | ) | $ | (4.8 | ) | $ | 2.2 | ||||||

|

(in millions)

|

2010

|

2009

|

2008

|

|||||||

|

Boat

|

$ | — | $ | — | $ | 362.8 | ||||

|

Bowling & Billiards

|

— | — | 14.4 | |||||||

|

Total

|

$ | — | $ | — | $ | 377.2 | ||||

|

(

in millions)

|

2010

|

2009

|

2008

|

|||||||

|

Marine Engine

|

$ | — | $ | — | $ | 4.5 | ||||

|

Boat

|

1.1 | — | 120.9 | |||||||

|

Bowling & Billiards

|

— | — | 8.5 | |||||||

|

Total

|

$ | 1.1 | $ | — | $ | 133.9 | ||||

|

December

31,

|

December 31,

|

|||||||||||||||||

|

(

in millions)

|

2009

|

Acquisitions

|

Impairments

|

Adjustments

|

2010

|

|||||||||||||

|

Marine Engine

|

$ | 20.3 | $ | — | $ | — | $ | (0.1 | ) | $ | 20.2 | |||||||

|

Fitness

|

272.2 | — | — | (1.5 | ) | 270.7 | ||||||||||||

|

Total

|

$ | 292.5 | $ | — | $ | — | $ | (1.6 | ) | $ | 290.9 | |||||||

|

December 31,

|

December 31,

|

|||||||||||||||||

|

(in millions)

|

2008

|

Acquisitions

|

Impairments

|

Adjustments

|

2009

|

|||||||||||||

|

Marine Engine

|

$ | 18.8 | $ | — | $ | — | $ | 1.5 | $ | 20.3 | ||||||||

|

Fitness

|

272.1 | — | — | 0.1 | 272.2 | |||||||||||||

|

Total

|

$ | 290.9 | $ | — | $ | — | $ | 1.6 | $ | 292.5 | ||||||||

|

December 31,

|

December 31,

|

|||||||||||||||||

|

(in millions)

|

2009

|

Acquisitions

|

Impairments

|

Adjustments

|

2010

|

|||||||||||||

|

Marine Engine

|

$ | 20.3 | $ | — | $ | — | $ | (0.5 | ) | $ | 19.8 | |||||||

|

Boat

|

12.2 | — | (1.1 | ) | — | 11.1 | ||||||||||||

|

Fitness

|

0.5 | — | — | — | 0.5 | |||||||||||||

|

Total

|

$ | 33.0 | $ | — | $ | (1.1 | ) | $ | (0.5 | ) | $ | 31.4 | ||||||

|

December 31,

|

December 31,

|

|||||||||||||||||

|

(in millions)

|

2008

|

Acquisitions

|

Impairments

|

Adjustments

|

2009

|

|||||||||||||

|

Marine Engine

|

$ | 20.0 | $ | — | $ | — | $ | 0.3 | $ | 20.3 | ||||||||

|

Boat

|

12.2 | — | — | — | 12.2 | |||||||||||||

|

Fitness

|

0.6 | — | — | (0.1 | ) | 0.5 | ||||||||||||

|

Total

|

$ | 32.8 | $ | — | $ | — | $ | 0.2 | $ | 33.0 | ||||||||

|

December 31, 2010

|

December 31, 2009

|

||||||||||||||

|

Gross

|

Accumulated

|

Gross

|

Accumulated

|

||||||||||||

|

(in millions)

|

Amount

|

Amortization

|

Amount

|

Amortization

|

|||||||||||

|

Amortized intangible assets:

|

|||||||||||||||

|

Customer relationships

|

$ | 243.2 | $ | (221.8 | ) | $ | 253.6 | $ | (219.6 | ) | |||||

|

Other

|

23.0 | (19.1 | ) | 34.8 | (26.2 | ) | |||||||||

|

Total

|

$ | 266.2 | $ | (240.9 | ) | $ | 288.4 | $ | (245.8 | ) | |||||

|

(in millions, except per share data)

|

2010

|

2009

|

2008

|

||||||||

|

Net loss

|

$ | (110.6 | ) | $ | (586.2 | ) | $ | (788.1 | ) | ||

|

Weighted average outstanding shares – basic

|

88.7 | 88.4 | 88.3 | ||||||||

|

Dilutive effect of common stock equivalents

|

— | — | — | ||||||||

|

Weighted average outstanding shares – diluted

|

88.7 | 88.4 | 88.3 | ||||||||

|

Basic loss per common share

|