|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

36-0848180

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

|

Emerging growth company

|

o

|

||

|

PART I

|

Page

|

|

|

PART II

|

||

|

PART III

|

||

|

PART IV

|

||

|

(in millions)

|

2018

|

2017

|

2016

|

||||||||

|

Europe

|

$

|

696.2

|

|

$

|

610.1

|

|

$

|

569.2

|

|

||

|

Asia-Pacific

|

437.0

|

|

407.9

|

|

363.1

|

|

|||||

|

Canada

|

317.3

|

|

320.3

|

|

284.6

|

|

|||||

|

Rest-of-World

|

256.8

|

|

265.8

|

|

240.1

|

|

|||||

|

Total

|

$

|

1,707.3

|

|

$

|

1,604.1

|

|

$

|

1,457.0

|

|

||

|

Total International Sales as a Percentage of Net Sales

|

33

|

%

|

33

|

%

|

35

|

%

|

|||||

|

•

|

Distribution, sales, service, engineering, or representative offices in Australia, Belgium, Brazil, Canada, China, Dubai, Finland, France, Italy, Japan, the Netherlands, New Zealand, Norway, Russia, Singapore, Sweden, and Switzerland;

|

|

•

|

Component, parts and accessories manufacturing, and light assembly facilities in Mexico, the Netherlands, New Zealand, and Northern Ireland;

|

|

•

|

An outboard engine assembly plant in Suzhou, China; and

|

|

•

|

An outboard engine assembly plant operated by a joint venture in Japan.

|

|

December 31, 2018

|

December 31, 2017

|

||||||||||

|

Total

|

Union (domestic)

|

Total

|

Union (domestic)

|

||||||||

|

Marine Engine

|

7,719

|

|

2,402

|

|

6,541

|

|

2,078

|

|

|||

|

Boat

|

4,996

|

|

—

|

|

5,365

|

|

—

|

|

|||

|

Fitness

|

2,956

|

|

170

|

|

2,854

|

|

166

|

|

|||

|

Corporate

(A)

|

367

|

|

—

|

|

356

|

|

—

|

|

|||

|

Total

(B)

|

16,038

|

|

2,572

|

|

15,116

|

|

2,244

|

|

|||

|

•

|

disruptions in core, adjacent, or acquired businesses that could make it more difficult to maintain business and operational relationships, including customer and supplier relationships;

|

|

•

|

the possibility that the expected synergies and value creation will not be realized or will not be realized within the expected time period;

|

|

•

|

the risk that unexpected costs will be incurred;

|

|

•

|

diversion of management attention; and

|

|

•

|

difficulties retaining employees.

|

|

•

|

their ability to access certain capital markets, such as the securitization and the commercial paper markets, and to fund their operations in a cost effective manner;

|

|

•

|

the performance of their overall credit portfolios;

|

|

•

|

their willingness to accept the risks associated with lending to marine dealers;

|

|

•

|

the overall creditworthiness of those dealers; and

|

|

•

|

the overall aging and level of pipeline inventories.

|

|

•

|

financial pressures on our suppliers due to a weakening economy or unfavorable conditions in other end markets;

|

|

•

|

a deterioration of our relationships with suppliers;

|

|

•

|

events such as natural disasters, power outages or labor strikes;

|

|

•

|

supplier manufacturing constraints and investment requirements; or

|

|

•

|

labor disruption at major global ports and shipping hubs.

|

|

•

|

the steps we take to protect our proprietary technology may be inadequate to prevent misappropriation of our technology;

|

|

•

|

third parties may independently develop similar technology;

|

|

•

|

agreements containing protections may be breached or terminated;

|

|

•

|

we may not have adequate remedies for breaches;

|

|

•

|

existing patent, trademark, copyright, and trade secret laws may afford limited protection;

|

|

•

|

a third party could copy or otherwise obtain and use our products or technology without authorization; or

|

|

•

|

we may be required to litigate to enforce our intellectual property rights, and we may not be successful.

|

|

•

|

unfavorable market and economic conditions;

|

|

•

|

the trading price of our common stock;

|

|

•

|

the nature of other investment opportunities available to us from time to time; and

|

|

•

|

the availability of cash.

|

|

Officer

|

Present Position

|

Age

|

||

|

David M. Foulkes

|

Chief Executive Officer

|

57

|

||

|

William L. Metzger

|

Senior Vice President and Chief Financial Officer

|

57

|

||

|

Huw S. Bower

|

Vice President and President - Brunswick Boat Group

|

44

|

||

|

Christopher F. Dekker

|

Vice President, General Counsel and Secretary

|

50

|

||

|

John C. Pfeifer

|

Senior Vice President and President - Mercury Marine

|

53

|

||

|

Brenna Preisser

|

Vice President and Chief Human Resources Officer and President, Business Acceleration

|

41

|

||

|

Daniel J. Tanner

|

Vice President and Controller

|

61

|

||

|

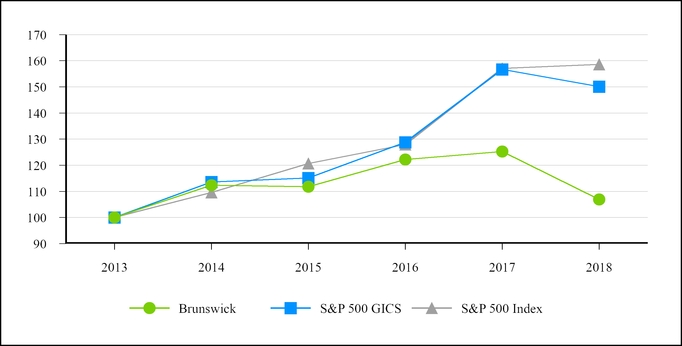

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

|||||||

|

Brunswick

|

100.00

|

|

112.32

|

|

111.82

|

|

122.15

|

|

125.22

|

|

106.95

|

|

|

S&P 500 GICS Consumer Discretionary Index

|

100.00

|

|

113.56

|

|

115.16

|

|

128.78

|

|

156.69

|

|

150.08

|

|

|

S&P 500 Index

|

100.00

|

|

109.61

|

|

120.70

|

|

127.90

|

|

157.11

|

|

158.62

|

|

|

(in millions, except per share data)

|

2018

(A) (B)

|

2017

(A)

|

2016

|

2015

|

2014

(C)

|

||||||||||||||

|

Results of operations data

|

|||||||||||||||||||

|

Net sales

|

$

|

5,159.2

|

|

$

|

4,835.9

|

|

$

|

4,488.5

|

|

$

|

4,105.7

|

|

$

|

3,838.7

|

|

||||

|

Restructuring, exit, integration and impairment charges

|

80.9

|

|

81.3

|

|

15.6

|

|

12.4

|

|

4.2

|

|

|||||||||

|

Operating earnings

|

367.0

|

|

398.3

|

|

479.5

|

|

414.0

|

|

356.4

|

|

|||||||||

|

Pension settlement charge

|

—

|

|

96.6

|

|

55.1

|

|

82.3

|

|

27.9

|

|

|||||||||

|

Earnings before interest and income taxes

|

370.4

|

|

305.0

|

|

415.4

|

|

340.8

|

|

316.6

|

|

|||||||||

|

Earnings before income taxes

|

322.2

|

|

281.2

|

|

389.7

|

|

315.2

|

|

287.9

|

|

|||||||||

|

Net earnings from continuing operations

|

263.1

|

|

146.4

|

|

274.4

|

|

227.4

|

|

194.9

|

|

|||||||||

|

Net earnings from discontinued operations, net of tax

|

2.2

|

|

—

|

|

1.6

|

|

14.0

|

|

50.8

|

|

|||||||||

|

Net earnings

|

$

|

265.3

|

|

$

|

146.4

|

|

$

|

276.0

|

|

$

|

241.4

|

|

$

|

245.7

|

|

||||

|

Basic earnings per common share

|

|||||||||||||||||||

|

Earnings from continuing operations

|

$

|

3.00

|

|

$

|

1.64

|

|

$

|

3.01

|

|

$

|

2.45

|

|

$

|

2.08

|

|

||||

|

Net earnings from discontinued operations, net of tax

|

0.03

|

|

—

|

|

0.02

|

|

0.15

|

|

0.55

|

|

|||||||||

|

Net earnings

|

$

|

3.03

|

|

$

|

1.64

|

|

$

|

3.03

|

|

$

|

2.60

|

|

$

|

2.63

|

|

||||

|

Average shares used for computation of basic earnings per share

|

87.6

|

|

89.4

|

|

91.2

|

|

93.0

|

|

93.6

|

|

|||||||||

|

Diluted earnings per common share

|

|||||||||||||||||||

|

Earnings from continuing operations

|

$

|

2.98

|

|

$

|

1.62

|

|

$

|

2.98

|

|

$

|

2.41

|

|

$

|

2.05

|

|

||||

|

Net earnings from discontinued operations, net of tax

|

0.03

|

|

—

|

|

0.02

|

|

0.15

|

|

0.53

|

|

|||||||||

|

Net earnings

|

$

|

3.01

|

|

$

|

1.62

|

|

$

|

3.00

|

|

$

|

2.56

|

|

$

|

2.58

|

|

||||

|

Average shares used for computation of diluted earnings per share

|

88.2

|

|

90.1

|

|

92.0

|

|

94.3

|

|

95.1

|

|

|||||||||

|

(A)

|

Refer to

Note 23 –

Quarterly Data (unaudited)

, for further details on certain unusual items which impacted 2018 and 2017 results.

|

|

(B)

|

2018 Earnings before income taxes includes transaction financing charges of

$5.1 million

.

|

|

(C)

|

2014 Earnings before interest and income taxes includes a $20.2 million impairment charge related to an equity investment.

|

|

(in millions, except per share and other data)

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Balance sheet data

|

|||||||||||||||||||

|

Total assets of continuing operations

|

$

|

4,285.7

|

|

$

|

3,358.2

|

|

$

|

3,284.7

|

|

$

|

3,152.5

|

|

$

|

3,087.9

|

|

||||

|

Debt

|

|||||||||||||||||||

|

Short-term

|

$

|

41.3

|

|

$

|

5.6

|

|

$

|

5.9

|

|

$

|

6.0

|

|

$

|

5.5

|

|

||||

|

Long-term

|

1,179.5

|

|

431.8

|

|

436.5

|

|

442.5

|

|

446.3

|

|

|||||||||

|

Total debt

|

1,220.8

|

|

437.4

|

|

442.4

|

|

448.5

|

|

451.8

|

|

|||||||||

|

Common shareholders' equity

|

1,582.6

|

|

1,482.9

|

|

1,440.1

|

|

1,281.3

|

|

1,171.5

|

|

|||||||||

|

Total capitalization

|

$

|

2,803.4

|

|

$

|

1,920.3

|

|

$

|

1,882.5

|

|

$

|

1,729.8

|

|

$

|

1,623.3

|

|

||||

|

Cash flow data

|

|||||||||||||||||||

|

Net cash provided by operating activities of continuing operations

|

$

|

337.0

|

|

$

|

401.6

|

|

$

|

439.1

|

|

$

|

345.3

|

|

$

|

255.3

|

|

||||

|

Depreciation and amortization

|

149.6

|

|

110.8

|

|

103.9

|

|

88.9

|

|

81.2

|

|

|||||||||

|

Capital expenditures

|

193.4

|

|

203.2

|

|

193.9

|

|

132.5

|

|

124.8

|

|

|||||||||

|

Investments

|

(10.8

|

)

|

(3.2

|

)

|

5.1

|

|

0.9

|

|

0.2

|

|

|||||||||

|

Cash dividends paid

|

67.8

|

|

60.6

|

|

55.4

|

|

48.3

|

|

41.7

|

|

|||||||||

|

Other data

|

|||||||||||||||||||

|

Dividends declared per share

|

$

|

0.78

|

|

$

|

0.685

|

|

$

|

0.615

|

|

$

|

0.525

|

|

$

|

0.45

|

|

||||

|

Book value per share

|

18.23

|

|

16.95

|

|

15.77

|

|

14.11

|

|

12.64

|

|

|||||||||

|

Return on beginning shareholders' equity

|

17.9

|

%

|

10.2

|

%

|

21.5

|

%

|

20.6

|

%

|

23.7

|

%

|

|||||||||

|

Effective tax rate from continuing operations

|

18.3

|

%

|

47.9

|

%

|

29.6

|

%

|

27.9

|

%

|

32.3

|

%

|

|||||||||

|

Debt-to-capitalization rate

|

43.5

|

%

|

22.8

|

%

|

23.5

|

%

|

25.9

|

%

|

27.8

|

%

|

|||||||||

|

Number of employees

|

16,038

|

|

15,116

|

|

14,415

|

|

12,745

|

|

12,165

|

|

|||||||||

|

Number of shareholders of record

|

7,823

|

|

8,247

|

|

8,683

|

|

9,009

|

|

9,488

|

|

|||||||||

|

Common stock price (NYSE)

|

|||||||||||||||||||

|

High

|

$

|

69.82

|

|

$

|

63.82

|

|

$

|

56.30

|

|

$

|

56.63

|

|

$

|

51.94

|

|

||||

|

Low

|

41.92

|

|

48.04

|

|

36.05

|

|

46.08

|

|

38.95

|

|

|||||||||

|

Close (last trading day)

|

46.45

|

|

55.22

|

|

54.54

|

|

50.51

|

|

51.26

|

|

|||||||||

|

•

|

Deliver revenue growth;

|

|

•

|

Increase earnings before income taxes, as well as deliver improvements in both gross margin and operating margin percentages; and

|

|

•

|

Continue to generate strong free cash flow and execute against the Company's capital strategy.

|

|

•

|

Ended the year with a 7 percent increase in net sales when compared with

2017

on a GAAP basis as well as on a constant currency basis excluding the impact of acquisitions along with Sea Ray Sport Yacht and Yacht operations, due to the following:

|

|

•

|

The Company's combined Marine segments reported strong growth in the Marine Engine segment and solid growth in the Boat segment;

|

|

▪

|

Marine Engine segment sales benefited from significant growth in propulsion, primarily as a result of organic growth in the outboard engine business, as well as steady growth in the marine parts and accessories businesses;

|

|

▪

|

Boat segment sales decreased slightly as a result of the winding down of Sport Yacht and Yacht operations during 2018. Excluding the impact of Sport Yacht and Yacht operations, sales increased across all three primary boat categories, with strong growth in the saltwater fishing category, primarily driven by Boston Whaler, and solid growth in the recreational fiberglass and aluminum fishing categories;

|

|

•

|

The U.S. marine market, which comprised 71 percent of the Company's marine sales, performed in line with expectations in 2018, with industry unit volume growing 3 percent. Outboard boats and engines drove industry growth, with increases in aluminum fishing boats and pontoons outpacing overall industry performance;

|

|

•

|

Fitness segment net sales were flat in 2018 compared with 2017 as growth in international markets was offset by declines in domestic sales, particularly of Cybex branded cardio product; and

|

|

•

|

International sales for the Company increased 6 percent in

2018

when compared with

2017

on a GAAP basis and increased 4 percent on a constant currency basis, excluding the impact of acquisitions and Sport Yacht and Yacht operations; the increase was driven by Asia-Pacific, Europe and Canada, while Rest-of-World regions declined slightly.

|

|

•

|

Reported earnings before income taxes of

$322.2 million

in

2018

compared with earnings before income taxes of

$281.2 million

in

2017

; adjusted earnings before income taxes were $530.4 million in

2018

versus $504.5 million in

2017

;

|

|

•

|

Gross margin declined 50 basis points when compared with

2017

, resulting from the wind-down of Sport Yacht and Yacht operations as well as purchase accounting amortization associated with the Power Products acquisition. Additionally, several unfavorable factors in the Fitness segment contributed to gross margin declines. Partially offsetting these factors were volume benefits and a favorable impact from changes in sales mix, including benefits from new products in the marine businesses. Gross margin, as adjusted, also declined 50 basis points from the prior year; and

|

|

•

|

Operating margin declined by 110 basis points when compared with the prior year due to the factors affecting gross margin percentage discussed above, as well as costs associated with the planned Fitness business separation and acquisition-related costs. Operating margin, as adjusted, was flat versus 2017.

|

|

•

|

Generated free cash flow of $208.8 million in

2018

, enabling the Company to continue executing its capital strategy as follows:

|

|

•

|

Funded investments in growth:

|

|

•

|

Through the acquisition of Power Products for $909.6 million during

2018

; and

|

|

•

|

Organically through capital expenditures, which included investments in new products as well as capacity expansions, primarily within the Marine Engine segment.

|

|

•

|

Contributed $163.8 million to the Company's qualified and nonqualified defined benefit pension plans; and

|

|

•

|

Enhanced shareholder returns in

2018

by repurchasing $75.0 million of common stock under the Company’s share repurchase program and increased cash dividends paid to shareholders to $67.8 million.

|

|

•

|

Ended the year with $304.2 million of cash and marketable securities.

|

|

Net Sales

|

2018 vs. 2017

|

||||||||||||||

|

(in millions)

|

2018

|

2017

|

GAAP

|

Currency

Impact

|

Acquisition Impact

|

Impact of Sport Yacht and Yacht

|

|||||||||

|

Marine Engine

|

$

|

2,993.6

|

|

$

|

2,631.8

|

|

13.7%

|

0.1%

|

4.0%

|

—

|

|||||

|

Boat

|

1,471.3

|

|

1,490.6

|

|

(1.3)%

|

0.5%

|

—

|

(7.5)%

|

|||||||

|

Marine eliminations

|

(344.0

|

)

|

(320.2

|

)

|

|||||||||||

|

Total Marine

|

4,120.9

|

|

3,802.2

|

|

8.4%

|

0.3%

|

2.8%

|

(3.1)%

|

|||||||

|

Fitness

|

1,038.3

|

|

1,033.7

|

|

0.4%

|

0.3%

|

—

|

—

|

|||||||

|

Total

|

$

|

5,159.2

|

|

$

|

4,835.9

|

|

6.7%

|

0.3%

|

2.2%

|

(2.3)%

|

|||||

|

Net Sales

|

2017 vs. 2016

|

||||||||||||||

|

(in millions)

|

2017

|

2016

|

GAAP

|

Currency

Impact

|

Acquisition Impact

|

Impact of Sport Yacht and Yacht

|

|||||||||

|

Marine Engine

|

$

|

2,631.8

|

|

$

|

2,441.1

|

|

7.8%

|

0.2%

|

1.0%

|

—

|

|||||

|

Boat

|

1,490.6

|

|

1,369.9

|

|

8.8%

|

0.2%

|

0.7%

|

(5.0)%

|

|||||||

|

Marine eliminations

|

(320.2

|

)

|

(302.9

|

)

|

|||||||||||

|

Total Marine

|

3,802.2

|

|

3,508.1

|

|

8.4%

|

0.2%

|

1.0%

|

(1.7)%

|

|||||||

|

Fitness

|

1,033.7

|

|

980.4

|

|

5.4%

|

(0.0)%

|

3.1%

|

—

|

|||||||

|

Total

|

$

|

4,835.9

|

|

$

|

4,488.5

|

|

7.7%

|

0.2%

|

1.4%

|

(1.3)%

|

|||||

|

Year Ended

|

|||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

||||||||

|

Net sales

(A)

|

$

|

49.4

|

|

$

|

151.6

|

|

$

|

194.4

|

|

||

|

Gross margin

(A)

|

(39.7

|

)

|

(12.4

|

)

|

12.6

|

|

|||||

|

Restructuring, exit, integration and impairment charges

|

49.4

|

|

23.3

|

|

—

|

|

|||||

|

Operating loss

(A)

|

(107.8

|

)

|

(55.2

|

)

|

(9.5

|

)

|

|||||

|

(in millions)

|

2018

|

2017

|

2016

|

||||||||

|

Cash charges:

|

|||||||||||

|

Boat

(A)

|

$

|

27.5

|

|

$

|

5.4

|

|

$

|

0.6

|

|

||

|

Fitness

(B)

|

3.5

|

|

13.7

|

|

12.7

|

|

|||||

|

Corporate

|

1.5

|

|

1.6

|

|

—

|

|

|||||

|

Total cash charges

|

32.5

|

|

20.7

|

|

13.3

|

|

|||||

|

Non-cash charges:

|

|||||||||||

|

Boat

(A)

|

26.6

|

|

43.2

|

|

—

|

|

|||||

|

Fitness

(B)

|

21.8

|

|

16.6

|

|

—

|

|

|||||

|

Corporate

|

—

|

|

0.8

|

|

2.3

|

|

|||||

|

Total non-cash charges

|

48.4

|

|

60.6

|

|

2.3

|

|

|||||

|

Total restructuring, exit, integration and impairment charges

|

$

|

80.9

|

|

$

|

81.3

|

|

$

|

15.6

|

|

||

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||||

|

(in millions, except per share data)

|

2018

|

2017

|

2016

|

$

|

%

|

$

|

%

|

||||||||||||||||||

|

Net sales

|

$

|

5,159.2

|

|

$

|

4,835.9

|

|

$

|

4,488.5

|

|

$

|

323.3

|

|

6.7

|

%

|

$

|

347.4

|

|

7.7

|

%

|

||||||

|

Gross margin

(A) (B)

|

1,321.0

|

|

1,262.1

|

|

1,232.4

|

|

58.9

|

|

4.7

|

%

|

29.7

|

|

2.4

|

%

|

|||||||||||

|

Restructuring, exit, integration and impairment charges

|

80.9

|

|

81.3

|

|

15.6

|

|

(0.4

|

)

|

(0.5

|

)%

|

65.7

|

|

NM

|

|

|||||||||||

|

Operating earnings

(B)

|

367.0

|

|

398.3

|

|

479.5

|

|

(31.3

|

)

|

(7.9

|

)%

|

(81.2

|

)

|

(16.9

|

)%

|

|||||||||||

|

Pension settlement charge

|

—

|

|

96.6

|

|

55.1

|

|

(96.6

|

)

|

(100.0

|

)%

|

41.5

|

|

75.3

|

%

|

|||||||||||

|

Transaction financing charges

|

5.1

|

|

—

|

|

—

|

|

5.1

|

|

NM

|

|

—

|

|

NM

|

|

|||||||||||

|

Net earnings from continuing operations

(B)

|

263.1

|

|

146.4

|

|

274.4

|

|

116.7

|

|

79.7

|

%

|

(128.0

|

)

|

(46.6

|

)%

|

|||||||||||

|

Diluted earnings per share from continuing operations

|

$

|

2.98

|

|

$

|

1.62

|

|

$

|

2.98

|

|

$

|

1.36

|

|

84.0

|

%

|

$

|

(1.36

|

)

|

(45.6

|

)%

|

||||||

|

Expressed as a percentage of Net sales:

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Gross margin

|

25.6

|

%

|

26.1

|

%

|

27.5

|

%

|

|

|

(50) bpts

|

|

(140) bpts

|

|

|||||||||||||

|

Selling, general and administrative expense

|

14.0

|

%

|

13.2

|

%

|

13.3

|

%

|

|

|

80 bpts

|

|

(10) bpts

|

|

|||||||||||||

|

Research and development expense

|

2.9

|

%

|

3.0

|

%

|

3.1

|

%

|

|

|

(10) bpts

|

|

(10) bpts

|

|

|||||||||||||

|

Operating margin

|

7.1

|

%

|

8.2

|

%

|

10.7

|

%

|

|

|

(110) bpts

|

|

(250) bpts

|

|

|||||||||||||

|

(A)

|

Gross margin is defined as Net sales less Cost of sales as presented in the Consolidated Statements of Operations.

|

|

(B)

|

Refer to

Note 23 –

Quarterly Data (unaudited)

, for further details on certain unusual items which impacted 2018 and 2017 results.

|

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

$

|

%

|

$

|

%

|

||||||||||||||||||

|

Net sales

|

$

|

2,993.6

|

|

$

|

2,631.8

|

|

$

|

2,441.1

|

|

$

|

361.8

|

|

13.7

|

%

|

$

|

190.7

|

|

7.8

|

%

|

||||||

|

Operating earnings

(A)

|

454.4

|

|

411.3

|

|

378.4

|

|

43.1

|

|

10.5

|

%

|

32.9

|

|

8.7

|

%

|

|||||||||||

|

Operating margin

(A)

|

15.2

|

%

|

15.6

|

%

|

15.5

|

%

|

|

|

(40) bpts

|

|

10 bpts

|

|

|||||||||||||

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

$

|

%

|

$

|

%

|

||||||||||||||||||

|

Boat segment:

|

|||||||||||||||||||||||||

|

Net sales

|

$

|

1,471.3

|

|

$

|

1,490.6

|

|

$

|

1,369.9

|

|

$

|

(19.3

|

)

|

(1.3

|

)%

|

$

|

120.7

|

|

8.8

|

%

|

||||||

|

Restructuring, exit, integration and impairment charges

(A)

|

54.1

|

|

48.6

|

|

0.6

|

|

5.5

|

|

11.3

|

%

|

48.0

|

|

NM

|

|

|||||||||||

|

Operating earnings (loss)

|

(12.5

|

)

|

5.3

|

|

60.8

|

|

(17.8

|

)

|

NM

|

|

(55.5

|

)

|

(91.3

|

)%

|

|||||||||||

|

Operating margin

|

(0.8

|

)%

|

0.4

|

%

|

4.4

|

%

|

|

|

(120) bpts

|

|

(400) bpts

|

|

|||||||||||||

|

Sport Yacht and Yacht operations:

|

|||||||||||||||||||||||||

|

Net sales

|

49.4

|

|

151.6

|

|

194.4

|

|

(102.2

|

)

|

(67.4

|

)%

|

(42.8

|

)

|

(22.0

|

)%

|

|||||||||||

|

Restructuring, exit, integration and impairment charges

(A)

|

49.4

|

|

23.3

|

|

—

|

|

26.1

|

|

NM

|

|

23.3

|

|

NM

|

|

|||||||||||

|

Operating loss

|

(107.8

|

)

|

(55.2

|

)

|

(9.5

|

)

|

(52.6

|

)

|

(95.3

|

)%

|

(45.7

|

)

|

NM

|

|

|||||||||||

|

Operating margin

|

NM

|

|

(36.4

|

)%

|

(4.9

|

)%

|

NM

|

|

NM

|

|

|||||||||||||||

|

(A)

|

Restructuring charges in 2018 and 2017 primarily relate to the wind-down of Sport Yacht and Yacht operations. See

Note 4 –

Restructuring, Exit, Integration and Impairment Activities

in the Notes to Consolidated Financial Statements for further details.

|

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

$

|

%

|

$

|

%

|

||||||||||||||||||

|

Net sales

|

$

|

1,038.3

|

|

$

|

1,033.7

|

|

$

|

980.4

|

|

$

|

4.6

|

|

0.4

|

%

|

$

|

53.3

|

|

5.4

|

%

|

||||||

|

Restructuring, exit, integration and impairment charges

(A)

|

25.3

|

|

30.3

|

|

12.7

|

|

(5.0

|

)

|

(16.5

|

)%

|

17.6

|

|

NM

|

|

|||||||||||

|

Operating earnings

(B)

|

22.4

|

|

64.1

|

|

117.3

|

|

(41.7

|

)

|

(65.1

|

)%

|

(53.2

|

)

|

(45.4

|

)%

|

|||||||||||

|

Operating margin

(B)

|

2.2

|

%

|

6.2

|

%

|

12.0

|

%

|

|

|

(400) bpts

|

|

(580) bpts

|

|

|||||||||||||

|

(A)

|

Includes $22.1 million and $13.9 million in 2018 and 2017, respectively, related to Cybex trade name impairments. See

Note 4 –

Restructuring, Exit, Integration and Impairment Activities

in the Notes to Consolidated Financial Statements for further details.

|

|

2018 vs. 2017

|

2017 vs. 2016

|

||||||||||||||||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

$

|

%

|

$

|

%

|

||||||||||||||||||

|

Restructuring, exit, integration and impairment charges

(A)

|

$

|

1.5

|

|

$

|

2.4

|

|

$

|

2.3

|

|

$

|

(0.9

|

)

|

(37.5

|

)%

|

$

|

0.1

|

|

4.3

|

%

|

||||||

|

Operating loss

(B)

|

(97.3

|

)

|

(82.4

|

)

|

(77.0

|

)

|

(14.9

|

)

|

(18.1

|

)%

|

(5.4

|

)

|

(7.0

|

)%

|

|||||||||||

|

(A)

|

See

Note 4 –

Restructuring, Exit, Integration and Impairment Activities

in the Notes to Consolidated Financial Statements for further details.

|

|

(B)

|

Includes $17.1 million of costs related to the planned Fitness business separation.

|

|

(in millions)

|

2018

|

2017

|

2016

|

||||||||

|

Net cash provided by operating activities of continuing operations

|

$

|

337.0

|

|

$

|

401.6

|

|

$

|

439.1

|

|

||

|

Net cash provided by (used for):

|

|

|

|

|

|

|

|||||

|

Plus: Capital expenditures

|

(193.4

|

)

|

(203.2

|

)

|

(193.9

|

)

|

|||||

|

Plus: Proceeds from the sale of property, plant and equipment

|

6.7

|

|

8.5

|

|

1.9

|

|

|||||

|

Plus: Effect of exchange rate changes on cash and cash equivalents

|

(5.0

|

)

|

6.9

|

|

0.1

|

|

|||||

|

Less: Cash paid for Fitness business separation costs, net of tax

|

(9.8

|

)

|

—

|

|

—

|

|

|||||

|

Less: Cash impact of Sport Yacht and Yacht operations, net of tax

|

(53.7

|

)

|

(10.9

|

)

|

(20.6

|

)

|

|||||

|

Total free cash flow from continuing operations

(A)

|

$

|

208.8

|

|

$

|

224.7

|

|

$

|

267.8

|

|

||

|

(in millions)

|

2018

|

2017

|

|||||

|

Cash and cash equivalents

|

$

|

294.4

|

|

$

|

448.8

|

|

|

|

Short-term investments in marketable securities

|

0.8

|

|

0.8

|

|

|||

|

Total cash, cash equivalents and marketable securities

|

$

|

295.2

|

|

$

|

449.6

|

|

|

|

(in millions)

|

2018

|

2017

|

|||||

|

Cash, cash equivalents and marketable securities

|

$

|

295.2

|

|

$

|

449.6

|

|

|

|

Amounts available under lending facilities

(A)

|

396.1

|

|

295.7

|

|

|||

|

Total liquidity

(B)

|

$

|

691.3

|

|

$

|

745.3

|

|

|

|

Payments due by period

|

|||||||||||||||||||

|

(in millions)

|

Total

|

Less than 1 year

|

1-3 years

|

3-5 years

|

More than 5 years

|

||||||||||||||

|

Contractual Obligations

|

|||||||||||||||||||

|

Debt

(A)

|

$

|

1,240.5

|

|

$

|

41.3

|

|

$

|

383.4

|

|

$

|

340.5

|

|

$

|

475.3

|

|

||||

|

Interest payments on long-term debt

|

163.5

|

|

26.2

|

|

52.3

|

|

38.5

|

|

46.5

|

|

|||||||||

|

Operating leases

(B)

|

153.4

|

|

40.3

|

|

58.8

|

|

31.4

|

|

22.9

|

|

|||||||||

|

Purchase obligations

(C)

|

211.6

|

|

209.1

|

|

2.4

|

|

0.1

|

|

—

|

|

|||||||||

|

Deferred management compensation

(D)

|

37.2

|

|

9.7

|

|

8.0

|

|

6.0

|

|

13.5

|

|

|||||||||

|

Other long-term liabilities

(E)

|

154.9

|

|

15.7

|

|

85.3

|

|

32.7

|

|

21.2

|

|

|||||||||

|

Total contractual obligations

|

$

|

1,961.1

|

|

$

|

342.3

|

|

$

|

590.2

|

|

$

|

449.2

|

|

$

|

579.4

|

|

||||

|

(A)

|

See

Note 17 –

Debt

in the Notes to Consolidated Financial Statements for additional information on the Company's debt. “Debt” refers to future cash principal payments. Debt also includes the Company's capital leases as discussed in

Note 22 –

Leases

in the Notes to Consolidated Financial Statements.

|

|

(B)

|

See

Note 22 –

Leases

in the Notes to Consolidated Financial Statements for additional information.

|

|

(C)

|

Purchase obligations represent agreements with suppliers and vendors as part of the normal course of business.

|

|

(D)

|

Amounts primarily represent long-term deferred compensation plans for Company management.

|

|

(E)

|

Other long-term liabilities primarily includes deferred revenue and future projected payments related to the Company's nonqualified pension plans. The Company is not required to make contributions to the qualified pension plan in 2019.

|

|

(in millions)

|

2018

|

2017

|

|||||

|

Risk Category

|

|||||||

|

Foreign exchange

|

$

|

46.9

|

|

$

|

47.8

|

|

|

|

Interest rates

|

1.5

|

|

1.5

|

|

|||

|

See Index to Financial Statements and Financial Statement Schedule on page

52

.

|

|

The financial statements and schedule filed as part of this Annual Report on Form 10-K are listed in the accompanying Index to Financial Statements and Financial Statement Schedule on page

52

. The exhibits filed as a part of this Annual Report are listed in the Exhibit Index below.

|

|

Exhibit No.

|

Description

|

|

2.1

|

|

|

3.1

|

Restated Certificate of Incorporation of the Company, dated July 22, 1987, filed as Exhibit 19.2 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 1987, as filed with the Securities and Exchange Commission, and hereby incorporated by reference.

|

|

3.2

|

|

|

3.3

|

Certificate of Designation, Preferences and Rights of Series A Junior Participating Preferred Stock, filed as Exhibit 3.2 to the Company's Annual Report on Form 10-K for 1995 as filed with the Securities and Exchange Commission on March 23, 1995, and hereby incorporated by reference.

|

|

3.4

|

|

|

4.1

|

|

|

4.2

|

|

|

4.3

|

|

|

4.4

|

|

|

4.5

|

|

|

4.6

|

Indenture, dated as of March 15, 1987, between the Company and Continental Illinois National Bank and Trust Company of Chicago, filed as Exhibit 4.1 to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 1987, and hereby incorporated by reference.

|

|

4.7

|

Officers' Certificate setting forth terms of the Company's $125,000,000 principal amount of 7 3/8% Debentures due September 1, 2023, filed as Exhibit 4.3 to the Company's Annual Report on Form 10-K for 1993 as filed with the Securities and Exchange Commission on March 29, 1994, and hereby incorporated by reference.

|

|

4.8

|

Form of the Company's $200,000,000 principal amount of 7 1/8% Notes due August 1, 2027, filed as Exhibit 4.1 to the Company's Current Report on Form 8-K as filed with the Securities and Exchange Commission on August 21, 1997, and hereby incorporated by reference.

|

|

4.9

|

The Company's agreement to furnish additional debt instruments upon request by the Securities and Exchange Commission, filed as Exhibit 4.10 to the Company's Annual Report on Form 10-K for 1980, and hereby incorporated by reference.

|

|

4.10

|

|

|

4.11

|

|

|

4.12

|

|

|

10.1

|

|

|

10.2

|

|

|

10.3

|

|

|

10.4*

|

|

|

10.5*

|

|

|

10.6*

|

|

|

10.7*

|

|

|

10.8*

|

|

|

10.9*

|

|

|

10.10*

|

1997 Stock Plan for Non-Employee Directors, filed as Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 1998, as filed with the Securities and Exchange Commission on November 13, 1998, and hereby incorporated by reference.

|

|

10.11*

|

|

|

10.12*

|

|

|

10.13*

|

|

|

10.14*

|

|

|

10.15*

|

|

|

10.16*

|

|

|

10.17*

|

|

|

10.18*

|

|

|

10.19*

|

|

|

10.20*

|

|

|

10.21*

|

|

|

10.22*

|

|

|

10.23*

|

|

|

10.24*

|

|

|

10.25*

|

|

|

10.26*

|

|

|

10.27*

|

|

|

10.28*

|

|

|

10.29*

|

|

|

10.30*

|

|

|

10.31*

|

|

|

10.32*

|

|

|

10.33*

|

|

|

21.1

|

|

|

23.1

|

|

|

24.1

|

|

|

31.1

|

|

|

31.2

|

|

|

32.1

|

|

|

32.2

|

|

|

101.INS

|

XBRL Instance Document

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

Page

|

|

|

Financial Statements:

|

|

|

Financial Statement Schedule:

|

|

|

BRUNSWICK CORPORATION

Consolidated Statements of Operations

|

|||||||||||

|

|

For the Years Ended December 31

|

||||||||||

|

(in millions, except per share data)

|

2018

|

2017

|

2016

|

||||||||

|

Net sales

|

$

|

5,159.2

|

|

$

|

4,835.9

|

|

$

|

4,488.5

|

|

||

|

Cost of sales

|

3,838.2

|

|

3,573.8

|

|

3,256.1

|

|

|||||

|

Selling, general and administrative expense

|

724.3

|

|

636.1

|

|

598.1

|

|

|||||

|

Research and development expense

|

148.8

|

|

146.4

|

|

139.2

|

|

|||||

|

Restructuring, exit, integration and impairment charges

|

80.9

|

|

81.3

|

|

15.6

|

|

|||||

|

Operating earnings

|

367.0

|

|

398.3

|

|

479.5

|

|

|||||

|

Equity earnings

|

7.7

|

|

6.1

|

|

4.3

|

|

|||||

|

Pension settlement charge

|

—

|

|

(96.6

|

)

|

(55.1

|

)

|

|||||

|

Other expense, net

|

(4.3

|

)

|

(2.8

|

)

|

(13.3

|

)

|

|||||

|

Earnings before interest and income taxes

|

370.4

|

|

305.0

|

|

415.4

|

|

|||||

|

Interest expense

|

(46.0

|

)

|

(26.4

|

)

|

(27.5

|

)

|

|||||

|

Interest income

|

2.9

|

|

2.6

|

|

1.8

|

|

|||||

|

Transaction financing charges

|

(5.1

|

)

|

—

|

|

—

|

|

|||||

|

Earnings before income taxes

|

322.2

|

|

281.2

|

|

389.7

|

|

|||||

|

Income tax provision

|

59.1

|

|

134.8

|

|

115.3

|

|

|||||

|

Net earnings from continuing operations

|

263.1

|

|

|

146.4

|

|

274.4

|

|

||||

|

Net earnings from discontinued operations, net of tax

|

2.2

|

|

—

|

|

1.6

|

|

|||||

|

Net earnings

|

$

|

265.3

|

|

$

|

146.4

|

|

$

|

276.0

|

|

||

|

Earnings per common share:

|

|

|

|

|

|

|

|||||

|

Basic

|

|||||||||||

|

Earnings from continuing operations

|

$

|

3.00

|

|

$

|

1.64

|

|

$

|

3.01

|

|

||

|

Earnings from discontinued operations

|

0.03

|

|

—

|

|

0.02

|

|

|||||

|

Net earnings

|

$

|

3.03

|

|

$

|

1.64

|

|

$

|

3.03

|

|

||

|

Diluted

|

|||||||||||

|

Earnings from continuing operations

|

$

|

2.98

|

|

$

|

1.62

|

|

$

|

2.98

|

|

||

|

Earnings from discontinued operations

|

0.03

|

|

—

|

|

0.02

|

|

|||||

|

Net earnings

|

$

|

3.01

|

|

$

|

1.62

|

|

$

|

3.00

|

|

||

|

Weighted average shares used for computation of:

|

|

|

|

|

|||||||

|

Basic earnings per common share

|

87.6

|

|

89.4

|

|

91.2

|

|

|||||

|

Diluted earnings per common share

|

88.2

|

|

90.1

|

|

92.0

|

|

|||||

|

Cash dividends declared per common share

|

$

|

0.78

|

|

$

|

0.685

|

|

$

|

0.615

|

|

||

|

BRUNSWICK CORPORATION

Consolidated Statements of Comprehensive Income

|

|||||||||||

|

|

For the Years Ended December 31

|

||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

||||||||

|

Net earnings

|

$

|

265.3

|

|

$

|

146.4

|

|

$

|

276.0

|

|

||

|

Other comprehensive income (loss), net of tax:

|

|||||||||||

|

Foreign currency translation:

|

|||||||||||

|

Foreign currency translation adjustments

(A)

|

(17.3

|

)

|

20.3

|

|

4.5

|

|

|||||

|

Net foreign currency translation

|

(17.3

|

)

|

20.3

|

|

4.5

|

|

|||||

|

Defined benefit plans:

|

|||||||||||

|

Net actuarial losses

(A)

|

(3.3

|

)

|

(8.1

|

)

|

(10.2

|

)

|

|||||

|

Amortization of prior service credits

(B)

|

(0.5

|

)

|

(0.5

|

)

|

(0.4

|

)

|

|||||

|

Amortization of net actuarial losses

(B)

|

7.9

|

|

69.3

|

|

45.3

|

|

|||||

|

Net defined benefit plans

|

4.1

|

|

60.7

|

|

34.7

|

|

|||||

|

Derivatives:

|

|||||||||||

|

Net deferred gains (losses) on derivatives

(A)

|

7.3

|

|

(7.5

|

)

|

2.1

|

|

|||||

|

Net (gains) losses reclassified into earnings

(B)

|

2.6

|

|

1.3

|

|

(1.8

|

)

|

|||||

|

Net deferred gains (losses) on derivatives

|

9.9

|

|

(6.2

|

)

|

0.3

|

|

|||||

|

Other comprehensive income (loss)

|

(3.3

|

)

|

74.8

|

|

39.5

|

|

|||||

|

Comprehensive income

|

$

|

262.0

|

|

$

|

221.2

|

|

$

|

315.5

|

|

||

|

BRUNSWICK CORPORATION

Consolidated Balance Sheets

|

|||||||

|

As of December 31

|

|||||||

|

(in millions)

|

2018

|

2017

|

|||||

|

Assets

|

|

|

|||||

|

Current assets

|

|

|

|||||

|

Cash and cash equivalents, at cost, which approximates fair value

|

$

|

294.4

|

|

$

|

448.8

|

|

|

|

Restricted cash

|

9.0

|

|

9.4

|

|

|||

|

Short-term investments in marketable securities

|

0.8

|

|

0.8

|

|

|||

|

Total cash and short-term investments in marketable securities

|

304.2

|

|

459.0

|

|

|||

|

Accounts and notes receivable, less allowances of $11.3 and $9.2

|

550.7

|

|

485.3

|

|

|||

|

Inventories

|

|

|

|

|

|||

|

Finished goods

|

614.2

|

|

521.3

|

|

|||

|

Work-in-process

|

106.1

|

|

119.3

|

|

|||

|

Raw materials

|

223.4

|

|

187.1

|

|

|||

|

Net inventories

|

943.7

|

|

827.7

|

|

|||

|

Prepaid expenses and other

|

81.6

|

|

74.7

|

|

|||

|

Current assets

|

1,880.2

|

|

1,846.7

|

|

|||

|

Property

|

|

|

|

|

|||

|

Land

|

24.0

|

|

25.1

|

|

|||

|

Buildings and improvements

|

469.7

|

|

412.8

|

|

|||

|

Equipment

|

1,128.9

|

|

1,027.7

|

|

|||

|

Total land, buildings and improvements and equipment

|

1,622.6

|

|

1,465.6

|

|

|||

|

Accumulated depreciation

|

(952.4

|

)

|

(895.8

|

)

|

|||

|

Net land, buildings and improvements and equipment

|

670.2

|

|

569.8

|

|

|||

|

Unamortized product tooling costs

|

135.1

|

|

136.2

|

|

|||

|

Net property

|

805.3

|

|

706.0

|

|

|||

|

Other assets

|

|

|

|

|

|||

|

Goodwill

|

767.1

|

|

425.3

|

|

|||

|

Other intangibles, net

|

646.4

|

|

149.1

|

|

|||

|

Equity investments

|

34.6

|

|

25.1

|

|

|||

|

Deferred income tax asset

|

96.1

|

|

165.6

|

|

|||

|

Other long-term assets

|

56.0

|

|

40.4

|

|

|||

|

Other assets

|

1,600.2

|

|

805.5

|

|

|||

|

Total assets

|

$

|

4,285.7

|

|

$

|

3,358.2

|

|

|

|

BRUNSWICK CORPORATION

Consolidated Balance Sheets

|

|||||||

|

As of December 31

|

|||||||

|

(in millions)

|

2018

|

2017

|

|||||

|

Liabilities and shareholders’ equity

|

|

|

|||||

|

Current liabilities

|

|

|

|||||

|

Short-term debt and current maturities of long-term debt

|

$

|

41.3

|

|

$

|

5.6

|

|

|

|

Accounts payable

|

527.8

|

|

420.5

|

|

|||

|

Accrued expenses

|

687.4

|

|

609.0

|

|

|||

|

Current liabilities

|

1,256.5

|

|

1,035.1

|

|

|||

|

Long-term liabilities

|

|

|

|

|

|||

|

Debt

|

1,179.5

|

|

431.8

|

|

|||

|

Postretirement benefits

|

71.6

|

|

220.8

|

|

|||

|

Other

|

195.5

|

|

187.6

|

|

|||

|

Long-term liabilities

|

1,446.6

|

|

840.2

|

|

|||

|

Shareholders’ equity

|

|

|

|

|

|||

|

Common stock; authorized: 200,000,000 shares, $0.75 par value; issued: 102,538,000 shares; outstanding: 86,757,000 and 87,537,000 shares

|

76.9

|

|

76.9

|

|

|||

|

Additional paid-in capital

|

371.1

|

|

374.4

|

|

|||

|

Retained earnings

|

2,135.7

|

|

1,966.8

|

|

|||

|

Treasury stock, at cost: 15,781,000 and 15,001,000 shares

|

(638.0

|

)

|

(575.4

|

)

|

|||

|

Accumulated other comprehensive loss, net of tax:

|

|||||||

|

Foreign currency translation

|

(48.9

|

)

|

(31.6

|

)

|

|||

|

Defined benefit plans:

|

|||||||

|

Prior service credits

|

(6.1

|

)

|

(5.6

|

)

|

|||

|

Net actuarial losses

|

(306.2

|

)

|

(310.8

|

)

|

|||

|

Unrealized losses on derivatives

|

(1.9

|

)

|

(11.8

|

)

|

|||

|

Accumulated other comprehensive loss, net of tax

|

(363.1

|

)

|

(359.8

|

)

|

|||

|

Shareholders’ equity

|

1,582.6

|

|

1,482.9

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

4,285.7

|

|

$

|

3,358.2

|

|

|

|

BRUNSWICK CORPORATION

Consolidated Statements of Cash Flows

|

|||||||||||

|

|

For the Years Ended December 31

|

||||||||||

|

(in millions)

|

2018

|

2017

|

2016

|

||||||||

|

Cash flows from operating activities

|

|

|

|

|

|||||||

|

Net earnings

|

$

|

265.3

|

|

$

|

146.4

|

|

$

|

276.0

|

|

||

|

Less: net earnings from discontinued operations, net of tax

|

2.2

|

|

—

|

|

1.6

|

|

|||||

|

Net earnings from continuing operations

|

263.1

|

|

146.4

|

|

274.4

|

|

|||||

|

Depreciation and amortization

|

149.6

|

|

110.8

|

|

103.9

|

|

|||||

|

Stock compensation expense

|

19.2

|

|

18.3

|

|

16.1

|

|

|||||

|

Pension expense including settlement charges, net of (funding)

|

(156.1

|

)

|

32.2

|

|

(4.8

|

)

|

|||||

|

Asset impairment charges

|

59.1

|

|

54.7

|

|

2.4

|

|

|||||

|

Deferred income taxes

|

25.1

|

|

104.2

|

|

62.5

|

|

|||||

|

Changes in certain current assets and current liabilities

|

|||||||||||

|

Change in accounts and notes receivable

|

(27.3

|

)

|

(57.2

|

)

|

(1.1

|

)

|

|||||

|

Change in inventory

|

(84.2

|

)

|

(69.7

|

)

|

(48.2

|

)

|

|||||

|

Change in prepaid expenses and other, excluding income taxes

|

(8.6

|

)

|

4.4

|

|

0.5

|

|

|||||

|

Change in accounts payable

|

49.3

|

|

31.0

|

|

39.2

|

|

|||||

|

Change in accrued expenses

|

13.7

|

|

47.1

|

|

(20.8

|

)

|

|||||

|

Long-term extended warranty contracts and other deferred revenue

|

15.1

|

|

17.1

|

|

10.3

|

|

|||||

|

Fitness business separation costs

|

19.3

|

|

—

|

|

—

|

|

|||||

|

Cash paid for Fitness business separation costs

|

(12.7

|

)

|

—

|

|

—

|

|

|||||

|

Income taxes

|

12.3

|

|

(43.1

|

)

|

20.2

|

|

|||||

|

Other, net

|

0.1

|

|

5.4

|

|

(15.5

|

)

|

|||||

|

Net cash provided by operating activities of continuing operations

|

337.0

|

|

401.6

|

|

439.1

|

|

|||||

|

Net cash used for operating activities of discontinued operations

|

—

|

|

(1.3

|

)

|

(3.8

|

)

|

|||||

|

Net cash provided by operating activities

|

337.0

|

|

400.3

|

|

435.3

|

|

|||||

|

Cash flows from investing activities

|

|

|

|

|

|||||||

|

Capital expenditures

|

(193.4

|

)

|

(203.2

|

)

|

(193.9

|

)

|

|||||

|

Purchases of marketable securities

|

—

|

|

—

|

|

(35.0

|

)

|

|||||

|

Sales or maturities of marketable securities

|

—

|

|

35.0

|

|

10.7

|

|

|||||

|

Investments

|

(10.8

|

)

|

(3.2

|

)

|

5.1

|

|

|||||

|

Acquisition of businesses, net of cash acquired

|

(909.6

|

)

|

(15.5

|

)

|

(276.1

|

)

|

|||||

|

Proceeds from the sale of property, plant and equipment

|

6.7

|

|

8.5

|

|

1.9

|

|

|||||

|

Other, net

|

(0.2

|

)

|

(0.5

|

)

|

1.3

|

|

|||||

|

Net cash used for investing activities

|

(1,107.3

|

)

|

(178.9

|

)

|

(486.0

|

)

|

|||||

|

Cash flows from financing activities

|

|

|

|

|

|||||||

|

Net proceeds from issuances of short-term debt

|

298.9

|

|

—

|

|

—

|

|

|||||

|

Repayment of short-term debt

|

(300.0

|

)

|

—

|

|

—

|

|

|||||

|

Net proceeds from issuances of long-term debt

|

794.6

|

|

—

|

|

1.0

|

|

|||||

|

Payments of long-term debt including current maturities

|

(12.6

|

)

|

(4.5

|

)

|

(3.2

|

)

|

|||||

|

Common stock repurchases

|

(75.0

|

)

|

(130.0

|

)

|

(120.3

|

)

|

|||||

|

Cash dividends paid

|

(67.8

|

)

|

(60.6

|

)

|

(55.4

|

)

|

|||||

|

Proceeds from share-based compensation activity

|

1.4

|

|

6.2

|

|

14.9

|

|

|||||

|

Tax withholding associated with shares issued for share-based compensation

|

(12.5

|

)

|

(14.8

|

)

|

(20.9

|

)

|

|||||

|

Other, net

|

(6.5

|

)

|

—

|

|

(1.9

|

)

|

|||||

|

Net cash provided by (used for) financing activities

|

620.5

|

|

(203.7

|

)

|

(185.8

|

)

|

|||||

|

Effect of exchange rate changes

|

(5.0

|

)

|

6.9

|

|

0.1

|

|

|||||

|

Net increase (decrease) in Cash and cash equivalents and Restricted cash

|

(154.8

|

)

|

24.6

|

|

(236.4

|

)

|

|||||

|

Cash and cash equivalents and Restricted cash at beginning of period

|

458.2

|

|

433.6

|

|

670.0

|

|

|||||

|

Cash and cash equivalents and Restricted cash at end of period

|

303.4

|

|

458.2

|

|

433.6

|

|

|||||

|

Less: Restricted cash

|

9.0

|

|

9.4

|

|

11.2

|

|

|||||

|

Cash and cash equivalents at end of period

|

$

|

294.4

|

|

$

|

448.8

|

|

$

|

422.4

|

|

||

|

Supplemental cash flow disclosures:

|

|||||||||||

|

Interest paid

|

$

|

46.8

|

|

$

|

33.0

|

|

$

|

30.1

|

|

||

|

Income taxes paid, net

|

$

|

21.7

|

|

$

|

73.5

|

|

$

|

32.6

|

|

||

|

BRUNSWICK CORPORATION

Consolidated Statements of Shareholders' Equity

|

|||||||||||||||||||||||

|

(in millions, except per share data)

|

Common Stock

|

Additional Paid-in Capital

|

Retained Earnings