UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ___________

Commission file number:

| (Exact Name of Registrant as Specified in Its Charter) |

| N/A |

| (Translation of Registrant’s Name Into English) |

| (Jurisdiction of Incorporation or Organization) |

| (Address of Principal Executive Offices) |

Chief Executive Officer |

| People’s Republic of China |

| E-mail: |

| (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| None |

| Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: |

| None |

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or ordinary shares as of the close of the period covered by the annual report:

As of December 31, 2022, there were ordinary shares issued and outstanding, par value $0.01 per ordinary share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes ☒

i

INTRODUCTION

Unless otherwise indicated or the context otherwise requires, references in this annual report on Form 20-F to:

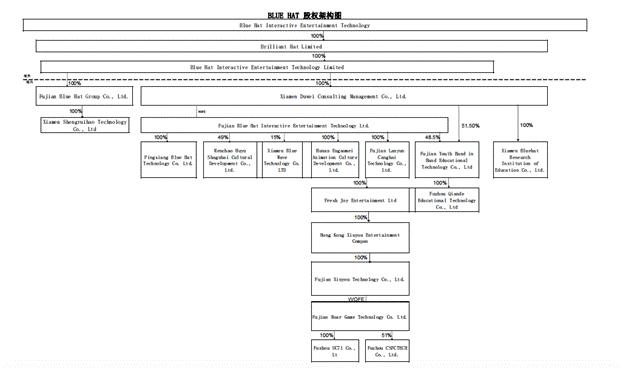

“Blue Hat,” the “Company,” “we,” “us” and “our” refer to Blue Hat Interactive Entertainment Technology and its subsidiaries, its variable interest entities and the subsidiaries of its variable interest entity.

“Blue Hat BVI” refers to Brilliant Hat Limited, a holding company holding all of the outstanding equity of Blue Hat Interactive Entertainment Technology Limited (“Blue Hat HK”) which was established under the laws of the British Virgin Islands in Hong Kong on June 26, 2018.

“Blue Hat Chongqing” refers to Chongqing Lanhui Technology Co. Ltd which was deregistered on December 24, 2020.

“Blue Hat Fujian” refers to Fujian Blue Hat Interactive Entertainment Technology Ltd., which is considered a VIE for accounting purposes.

“Blue Hat HK” refers to Blue Hat Interactive Entertainment Technology Ltd. which was established in Hong Kong on June 26, 2018.

“Blue Hat Hunan” refers to Hunan Engaomei Animation Culture Development Co. Ltd., a PRC limited liability company incorporated on October 19, 2017.

“Blue Hat Pingxiang” refers to Pingxiang Blue Hat Technology Co. Ltd., a PRC limited liability company incorporated on September 10, 2018

“Blue Hat Shenyang” refers to Shenyang Qimengxing Trading Co., Ltd., a PRC limited liability company incorporated on October 19, 2017 and deregistered on October 17, 2021.

“Blue Hat WFOE” refers to Xiamen Duwei Consulting Management Co. Ltd., a PRC limited liability company incorporated on October 19, 2017.

“Fresh Joy” refers to Fresh Joy Entertainment Ltd, a holding company 100% owned by Blue Hat Interactive Entertainment Technology Limited.

“Fujian Blue Hat” refers to Fujian Blue Hat Group CO. Ltd which was established on August 23, 2021.

“Fujian Lanyun” refers to Fujian Lanyun Canghai Technology Co. Ltd., which was incorporated on June 29, 2021.

“Fujian Roar Game” refers to Fujian Roar Game Technology Co., Ltd., which was incorporated on December 6, 2019.

“Fujian Xinyou” refers to Fujian Xinyou Technology Co., Ltd., which was incorporated on September 29, 2020.

“Fujian Youth” refers to Fujian Youth Hand in Hand Educational Technology Co. Ltd., a PRC limited liability company incorporated on September 18, 2017.

“Fuzhou CSFC” refers to Fuzhou CSFCTECH Co., Ltd, a PRC limited liability company incorporated on August 5, 2011, which is 51% controlled by Fujian Roar Game via VIE.

“Fuzhou UC71” refers to Fuzhou UC71 Co. Ltd, a PRC limited liability company 100% controlled by Fujian Roar Game via VIE.

“Jiuqiao” refers to Xiamen Jiuqiao Technology Co. Ltd., a PRC company which we sold to a third party on December 20, 2021.

“PRC” or “China” refers to the People’s Republic of China, excluding, for the purpose of this annual report, Taiwan, Hong Kong and Macau. “RMB” or “Renminbi” refers to the legal currency of China and “$”, “US$” or “U.S. Dollars” refers to the legal currency of the United States.

“Qiande” refers to Fuzhou Qiande Educational Technology Co., Ltd. which was incorporated on March 24, 2021.

“Renchao Huyu” refers to Renchao Huyu (Shanghai) Culture Development Co. Ltd.

“Xiamen Blue Wave” refers to Xiamen Blue Wave Technology Co. Ltd., a PRC company.

“Xiamen Bluehat Research” refers to Xiamen Bluehat Research Institution of Education Co. Ltd., which was incorporated on February 20, 2021.

“Xunpusen” refers to Xunpusen (Xiamen) Technology Co. Ltd., a PRC limited liability company 60% controlled by Fujian Blue Hat Interactive Entertainment Technology Ltd which was sold to a third party on September 20, 2021.

“Shengruihao” refers to Xiamen Shengruihao Technology Co., Ltd, a PRC company established on June 30, 2021, which was 100% controlled by Blue Hat Group.

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Our functional currency is Renminbi, or RMB. Our consolidated financial statements are presented in U.S. dollars. We use U.S. dollars as the reporting currency in our consolidated financial statements and in this annual report. Assets and liabilities denominated in Renminbi are translated into U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at historical exchange rates, and revenues and expenses are translated using the average rate of exchange in effect during the reporting period. With respect to amounts not recorded in our consolidated financial statements included elsewhere in this annual report, unless otherwise stated, the average translation rates applied to statement of income accounts for the periods ended December 31, 2022 and 2021 were RMB6.72 and RMB 6.45 to $1.00, respectively. The balance sheet amounts as of December 31, 2022 and 2021 were translated at RMB 6.96 and RMB 6.38, respectively.

ii

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. Known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information-D. Risk Factors”, may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. Factors that could cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements, include, but are not limited to, the factors summarized below:

We depend upon Blue Hat Fujian, and Fujian Roar Game to conduct our business in China and entered into a series of contracts with each of such entity, pursuant to which each of them is deemed as a variable interest entity under the U.S. GAAP (the “Contractual Arrangements”), which may not be as effective as direct ownership;

We face risks related to health epidemics, severe weather conditions and other outbreaks, in particular, the coronavirus pandemic.

We operate in a highly competitive market and the size and resources of many of our competitors may allow them to compete more effectively than we can, preventing us from achieving profitability;

Issues with products may lead to product liability, personal injury or property damage claims, recalls, withdrawals, replacements of products, or regulatory actions by governmental authorities that could divert resources, affect business operations, decrease sales, increase costs, and put us at a competitive disadvantage, any of which could have a significant adverse effect on our financial condition;

As a developer and seller of consumer products, we are subject to various government regulations and may be subject to additional regulations in the future, violation of which could subject us to sanctions or otherwise harm our business;

If we are not able to adequately protect our proprietary intellectual property and information, and protect against third party claims that we are infringing on their intellectual property rights, our results of operations could be adversely affected; and

Uncertainties with respect to China’s legal system and governmental policies could adversely affect us.

You should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

iii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following table presents the selected consolidated financial information for our business. You should read the following information in conjunction with Item 5 “Operating and Financial Review and Prospects” below. The following data for the years ended December 31, 2020, 2021 and 2022 and as of December 31, 2020, 2021 and 2022 have been derived from our audited consolidated financial statements for those years, which were prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP, and should be read in conjunction with those statements, which are included in this annual report beginning on page F-1.

| Selected Consolidated Balance Sheet Data: | December 31, | December 31, | December 31, | |||||||||

| 2022 | 2021 | 2020 | ||||||||||

| Total current assets | $ | 21,532,070 | $ | 21,704,144 | $ | 50,692,085 | ||||||

| Total assets | 34,276,858 | 36,511,577 | 75,691,260 | |||||||||

| Total current liabilities | 17,408,208 | 18,281,724 | 16,235,797 | |||||||||

| Total liabilities | 19,747,519 | 18,861,371 | 16,741,552 | |||||||||

| Total shareholders’ equity | 14,529,339 | 17,650,206 | 58,949,708 | |||||||||

| Total liabilities and shareholders’ equity | $ | 34,276,858 | $ | 36,511,577 | 75,691,260 | |||||||

| Selected Consolidated Statements of Operations Data: |

| For the Years Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| REVENUES | $ | 7,376,009 | $ | 15,155,074 | $ | 24,599,923 | ||||||

| COST OF REVENUES | (3,377,660 | ) | (8,672,150 | ) | (11,179,903 | ) | ||||||

| GROSS PROFIT | 3,998,349 | 6,482,924 | 13,420,020 | |||||||||

| OPERATING EXPENSES: | ||||||||||||

| Selling | (1,133,625 | ) | (3,799,640 | ) | (480,368 | ) | ||||||

| General and administrative | (6,369,245 | ) | (32,032,186 | ) | (2,488,320 | ) | ||||||

| Research and development | (4,461,888 | ) | (13,169,157 | ) | (246,923 | ) | ||||||

| Impairment Losses | (33,397 | ) | (18,439,524 | ) | — | |||||||

| Total operating expenses | (11,998,155 | ) | (67,440,507 | ) | (3,215,611 | ) | ||||||

| INCOME FROM OPERATIONS | (7,999,806 | ) | (60,957,583 | ) | 10,204,409 | |||||||

| OTHER INCOME (EXPENSE) | ||||||||||||

| Interest income | 374 | 156,038 | 147,820 | |||||||||

| Interest expense | (331,277 | ) | (398,963 | ) | (439,607 | ) | ||||||

| Other finance expenses | (15,565 | ) | (66,233 | ) | (82,311 | ) | ||||||

| Other (expense) income, net | 39,080 | (143,763 | ) | (109,490 | ) | |||||||

| Total other income, net | (307,388 | ) | (452,921 | ) | (483,588 | ) | ||||||

| LOSS/INCOME BEFORE INCOME TAXES | (8,307,194 | ) | (61,410,504 | ) | 9,720,821 | |||||||

| PROVISION FOR INCOME TAXES | (1,097,888 | ) | (138,061 | ) | (1,672,957 | ) | ||||||

| LOSS/INCOME FROM CONTINUING OPERATION | (9,405,082 | ) | (61,548,565 | ) | 8,047,864 | |||||||

| DISCONTINUED OPERATIONS | ||||||||||||

| Gain on disposal of discontinued operations | — | 1,493,945 | — | |||||||||

| Income (loss) from discontinued operations | — | 233,153 | ||||||||||

| NET INCOME (LOSS) | (9,405,082 | ) | (60,054,620 | ) | 8,281,017 | |||||||

| OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||||||

| Net (loss)/ Income from continued operations | (9,405,082 | ) | (61,548,565 | ) | 8,047,864 | |||||||

| Foreign currency translation adjustment - continued operation | (1,624,743 | ) | 717,560 | 3,220,363 | ||||||||

| COMPREHENSIVE INCOME (LOSS) - CONTINUED OPERATION | $ | (11,029,825 | ) | $ | (60,831,005 | ) | $ | 11,268,227 | ||||

| Income from discontinued operation | — | 1,493,945 | 233,153 | |||||||||

| Foreign currency translation adjustment - discontinued operation | — | — | — | |||||||||

| COMPREHENSIVE INCOME - DISCONTINUED OPERATION | $ | — | $ | 1,493,945 | $ | 233,153 | ||||||

| COMPREHENSIVE INCOME (LOSS) | $ | (11,029,825 | ) | $ | (59,337,060 | ) | $ | 11,501,380 | ||||

| Less: Net income (loss) attributable to non-controlling interests | (40,025 | ) | (2,918,680 | ) | 111,404 | |||||||

| Comprehensive (loss) income attributable to Blue Hat Interactive Entertainment shareholders | (10,989,800 | ) | (56,418,380 | ) | 11,389,976 | |||||||

| Basic | 7,639,482 | 5,053,727 | 3,853,369 | |||||||||

| Diluted | 8,565,163 | 5,800,049 | 3,985,907 | |||||||||

| Earnings per share | ||||||||||||

| Basic earnings per share from continued operation | $ | (1.23 | ) | $ | (11.6 | ) | $ | 2.09 | ||||

| Basic earnings per share from discontinued operation | — | 0.30 | 0.06 | |||||||||

| Diluted Earnings per share | ||||||||||||

| Diluted earnings per share from continued operation | $ | (1.09 | ) | $ | (10.1 | ) | $ | 2.02 | ||||

| Diluted earnings per share from discontinued operation | — | 0.26 | 0.06 | |||||||||

| 1 |

Selected Consolidated Cash Flow Data:

| For the Years Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| Net cash (used in) generated from operating activities - continued operation | $ | (1,598,493 | ) | $ | (22,284,750 | ) | $ | 5,052,415 | ||||

| Net cash (used in) generated from operating activities -discontinued operation | — | 2,477,398 | (8,692 | ) | ||||||||

| Net cash used in investing activities | 6,336 | (4,498,355 | ) | (10,761,890 | ) | |||||||

| Net cash generated from financing activities | 2,530,674 | 7,574,848 | 2,493,110 | |||||||||

| EFFECT OF EXCHANGE RATE ON CASH | (997,544 | ) | 1,113,717 | 3,547,033 | ||||||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS | (59,027 | ) | (15,617,142 | ) | 321,976 | |||||||

| Cash paid for income tax | 1,097,888 | 1,529,850 | 779,459 | |||||||||

| Cash paid for interest | 33,542 | 398,963 | 439,607 | |||||||||

| Cash and cash equivalents | 76,535 | 135,562 | 15,752,704 | |||||||||

| Restricted cash | 1,129 | — | — | |||||||||

| Total cash, cash equivalents, and restricted cash shown in the consolidated statements of cash flows | $ | 77,664 | $ | 135,562 | $ | 15,752,704 | ||||||

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Related to Our Business

Risk Factor Summary

The following summary highlights some of the principal risks that could adversely affect our business, financial condition or results of operations. This summary is not complete and the risks summarized below are not the only risks we face. These risks are discussed more fully further below in this section entitled “Risk Factors.” These risks include, but are not limited to, the following:

| ● | We have a limited operating history. There is no assurance that our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations. |

| ● | We operate in a highly competitive market and the size and resources of many of our competitors may allow them to compete more effectively than we can, preventing us from achieving profitability. |

| ● | Our business depends significantly on our ability to maintain an efficient distribution network for our products and our failure to do so could adversely affect our financial condition, competitiveness and growth prospects. |

| ● | Our business is seasonal and therefore our annual operating results will depend, in large part, on our sales during the relatively brief holiday shopping season. |

| ● | We will need to expand our organization, and we may experience difficulties in realizing or managing this growth. |

| ● | Failure to adequately contribute to employee benefits plans required by PRC regulations. |

| ● | We depend upon the Contractual Arrangements in conducting our business in China, which may not be as effective as direct ownership. |

| ● | We may not be able to consolidate the financial results of some of our affiliated companies or such consolidation could materially adversely affect our operating results and financial condition. |

| ● | Contractual arrangements in relation to our VIEs may be subject to scrutiny by the PRC tax authorities and they may determine that we or our VIEs owe additional taxes. |

| 2 |

| ● | We conduct most of our business through Blue Hat Fujian and Fujian Roar Game Technology Co., Ltd. (“Fujian Roar Game”) (collectively, “VIEs”) by means of Contractual Arrangements. If the PRC courts or administrative authorities determine that these contractual arrangements do not comply with applicable regulations, we could be subject to severe penalties. |

| ● | The shareholders of the VIEs may have actual or potential conflicts of interest with us. |

| ● | Our current corporate structure and business operations may be affected by the Foreign Investment Law. |

| ● | We face risks related to health epidemics, severe weather conditions and other outbreaks, including COVID-19. |

| ● | We may not be able to adequately protect our proprietary intellectual property and information, and protect against third party claims that we are infringing on their intellectual property rights. |

| ● | We may be unable to adequately protect our intellectual property rights, or we may be accused of infringing on the intellectual property rights of others. |

| ● | Litigation or other proceedings or third parties claims of intellectual property infringement could require us to spend significant time and money and could prevent us from selling our products or affect our stock price. |

| ● | Third parties may assert that our employees or consultants have wrongfully used or disclosed confidential information or misappropriated trade secrets. |

| ● | Changes in China’s economic, political or legal system or social conditions or government policies could have a material adverse effect on our business and operations. |

| ● | The economy of China had experienced unprecedented growth. This growth has slowed in the recent years, and if the growth of the economy continues to slow or if the economy contracts, our financial condition may be materially and adversely affected. |

| ● | Compliance with China’s new Data Security Law, Measures on Cybersecurity Review (revised draft for public consultation), Personal Information Protection Law (second draft for consultation), regulations and guidelines relating to the multi-level protection scheme and any other future laws and regulations may entail significant expenses and could materially affect our business. |

| ● | Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business. |

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the annual report based on foreign laws. |

| ● | We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business. |

| ● | Fluctuations in exchange rates could have a material and adverse effect on our operations. |

| ● | Governmental control of currency conversion may limit our ability to utilize our net revenues effectively. |

| ● | PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident beneficial owners or our PRC subsidiaries to liability or penalties, limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us. |

| ● | Failure to comply with PRC regulations regarding the registration requirements for employee equity incentive plans may subject our PRC citizen employees or us to fines and other legal or administrative sanctions. |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay us from using the proceeds of offerings from the U.S. to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business. |

| ● | We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. |

| ● | Our use of third parties manufacturers to produce our products presents risks to our business. |

| ● | Our auditor, Audit Alliance LLP is headquartered in Singapore, and is subject to inspection by the PCAOB on a regular basis. To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for our company become located in China, the PCAOB may not be able inspect such audit documentation and, as such, you may be deprived of the benefits of such inspection and our ordinary shares could be delisted from the stock exchange pursuant to the Holding Foreign Companies Accountable Act. |

| ● | An active trading market for our ordinary shares may not be sustained. |

| 3 |

| ● | Our ordinary shares are considered to be penny stock. |

| ● | Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud. |

| ● | We have identified material weaknesses in our internal control over financial reporting. |

|

●

|

Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain. |

| ● | Securities analysts may not publish favorable research or reports about our business or may publish no information at all, which could cause our stock price or trading volume to decline. |

| ● | Recently introduced economic substance legislation of the Cayman Islands may impact us and our operations. |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable. |

Risk Factors

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information appearing elsewhere in this annual report, before deciding to invest in our ordinary shares. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. In these circumstances, the market price of our ordinary shares could decline, and you may lose all or part of your investment.

We have a limited operating history. There is no assurance that our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations.

Given our limited operating history, there can be no assurance that we can build our business such that we can earn a significant profit or any profit at all. The future of our business will depend upon our ability to obtain and retain customers and when needed, obtain sufficient financing and support from creditors, while we strive to achieve and maintain profitable operations. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we undertake. There is no history upon which to base any assumption that our business will prove to be successful, and there is significant risk that we will not be able to generate the sales volumes and revenues necessary to achieve profitable operations. To the extent that we cannot achieve our plans and generate revenues which exceed expenses on a consistent basis, our business, results of operations, financial condition and prospects will be materially adversely affected.

Our management team has limited public company experience. Several of our senior management positions are currently held by employees who have been with us for a short period of time. Our entire management team, as well as other company personnel, will need to devote substantial time to compliance, and may not effectively or efficiently manage a public company. If we are unable to effectively comply with the regulations applicable to public companies or if we are unable to produce accurate and timely financial statements, which may result in material misstatements in our financial statements or possible restatement of financial results, our stock price may be materially adversely affected, and we may be unable to maintain compliance with the listing requirements of Nasdaq. Any such failures could also result in litigation or regulatory actions by the SEC or other regulatory authorities, loss of investor confidence, delisting of our securities, harm to our reputation and diversion of financial and management resources from the operation of our business, any of which could materially adversely affect our business, financial condition, results of operations and growth prospects. Additionally, the failure of a key employee to perform in his or her current position could result in our inability to continue to grow our business or to implement our business strategy.

| 4 |

We operate in a highly competitive market and the size and resources of many of our competitors may allow them to compete more effectively than we can, preventing us from achieving profitability.

The market for animated toys is highly competitive, particularly in China, where our operations are located. Competition may result in pricing pressures, reduced profit margins or lost market share, or a failure to grow our market share, any of which could substantially harm the business and results of operations. We compete directly against games developer and manufacturers of toys, including large, diversified entertainment companies with substantial market share. In addition, we compete with other companies who focus on building their brands across multiple product and consumer categories. Across our business, we face competitors who are constantly monitoring and attempting to anticipate consumer tastes and trends, seeking ideas which will appeal to consumers and introducing new products that compete with our products for consumer acceptance and purchase. Many of our competitors have significant competitive advantages, including longer operating histories, larger and broader customer bases, less-costly production, more established relationships with a broader set of suppliers, greater brand recognition and greater financial, research and development, marketing, distribution and other resources than we do.

In addition to existing competitors, the barriers to entry for new participants in the entertainment industry and in the consumer products industry are low, and the increasing importance of digital media, the heightened connection between digital media and consumer interest, have further increased the ability for new participants to enter our markets, and has broadened the array of companies we may compete with. New participants with a popular product idea or entertainment property can gain access to consumers and become a significant source of competition for our products in a very short period of time. These existing and new competitors may be able to respond more rapidly than us to changes in consumer preferences. Our competitors’ products may achieve greater market acceptance than our products and potentially reduce demand for our products, lower our revenues and lower our profitability.

Our business depends significantly on our ability to maintain an efficient distribution network for our products. Failure by us to maintain such distribution network could adversely affect our financial condition, competitiveness and growth prospects.

Our success depends on our ability to maintain efficient distribution methods for our products. We primarily sell our products in China through local China-based distributors. In 2022, we primarily relied on five Chinese distributors for the sale of our products, which accounted for 62.6% of our total revenue. In 2022, 100% of our products were sold in China and, of these sales in China, approximately 99% were generated from Chinese distributors.

The impact of economic conditions on any of our distributors, such as bankruptcy, could result in sales channel disruption. In the event our distributors fail to sell our products in sufficient amounts, such failure could have a material adverse effect on our revenue. We intend to expand our distribution network; however, we cannot make any assurances that we will be successful in doing so or if such relationships will be on favorable terms. Moreover, the functioning of our products distribution could be disrupted for reasons either within or beyond our control, including: extremes of weather or longer-term climatic changes; accidental damage; disruption to the supply of material or services; product quality and safety issues; systems failure; workforce actions; or environmental contamination. Such disruption or failures may materially adversely affect our ability to sell products and therefore materially adversely affect our financial condition, competitiveness and growth prospects.

Our business depends in large part on the success of our vendors and outsourcers, and our brand and reputation may be harmed by actions taken by third parties that are outside of our control. In addition, any material failure, inadequacy, or interruption resulting from such vendors or outsourcings could harm our ability to effectively operate our business.

We rely on vendors and outsourcing relationships with third parties for services and systems including manufacturing, transportation and logistics. Any shortcoming of a vendor or outsourcer, particularly an issue affecting the quality of these services or systems, may be attributed by customers to us, thus damaging our reputation and brand value, and potentially affecting our results of operations. In addition, problems with transitioning these services and systems to or operating failures with these vendors and outsourcers could cause delays in product sales, and reduce efficiency of our operations, and significant capital investments could be required to remediate the problem.

| 5 |

Issues with products may lead to product liability, personal injury or property damage claims, recalls, withdrawals, replacements of products, or regulatory actions by governmental authorities that could divert resources, affect business operations, decrease sales, increase costs, and put us at a competitive disadvantage, any of which could have a significant adverse effect on our financial condition.

We may experience issues with products that may lead to product liability, personal injury or property damage claims, recalls, withdrawals, replacements of products, or regulatory actions by governmental authorities. Any of these activities could result in increased governmental scrutiny, harm to our reputation, reduced demand by consumers for products, decreased willingness by retailer customers to purchase or provide marketing support for those products, adverse impacts on our ability to enter into licensing agreements for products on competitive terms, absence or increased cost of insurance, or additional safety and testing requirements. Such results could divert development and management resources, adversely affect our business operations, decrease sales, increase legal fees and other costs, and put us at a competitive disadvantage compared to other companies not affected by similar issues with products, any of which could have a significant adverse effect on our financial condition and results of operations.

Our business is seasonal and therefore our annual operating results will depend, in large part, on our sales during the relatively brief holiday shopping season.

Sales of our toys are seasonal, with a majority of sales occurring during the period from August through December in anticipation of the holiday season. This seasonality in our industry has increased over time, as retailers become more efficient in their control of inventory levels through quick response inventory management techniques. The majority of retail sales of toys generally occur in the fourth quarter, close to the holiday season.

If we or our customers determine that one of our products is more popular at retail than was originally anticipated, there may not be sufficient time to produce enough additional products to fully meet consumer demand. Additionally, the logistics of supplying more and more product within shorter time periods increase the risk that we, or our third party providers, will fail to achieve tight and compressed shipping schedules, which also may reduce our sales and harm our financial performance. This seasonal pattern requires accurate forecasting of demand for products during the holiday season in order to avoid losing potential sales of popular products or producing excess inventory of products that are less popular with consumers. Our failure to accurately predict and respond to consumer demand, resulting in our under producing popular items and/or overproducing less popular items, would reduce our total sales and harm our results of operations. In addition, as a result of the seasonal nature of our business, we would be significantly and adversely affected, in a manner disproportionate to the impact on a company with sales spread more evenly throughout the year, by unforeseen events such as a terrorist attack or economic shock that harm the retail environment or consumer buying patterns during our key selling season, or by events such as strikes or port delays that interfere with the shipment of goods during the critical months leading up to the holiday shopping season.

Our future success depends on our ability to retain key executives and to attract, retain and motivate qualified personnel.

We are highly dependent on the principal members of our executive team listed in the section entitled “Directors, Senior Management and Employees” located elsewhere in this annual report, the loss of whose services may adversely impact the achievement of our objectives. Recruiting and retaining other qualified employees for our business, including scientific and technical personnel, will also be critical to our success. Competition for skilled personnel is intense and the turnover rate can be high. We may not be able to attract and retain personnel on acceptable terms given the competition among numerous companies for individuals with similar skill sets. The inability to recruit or loss of the services of any executive or key employee could adversely affect our business.

We will need to expand our organization, and we may experience difficulties in realizing or managing this growth, which could disrupt our operations.

As of December 31, 2022, we had 40 employees, all of which were full-time employees. As our company matures, we expect to expand our employee base to increase our sales and marketing department. Future growth would impose significant additional responsibilities on our management, including the need to identify, recruit, maintain, motivate and integrate additional employees, consultants and contractors. Also, our management may need to divert a disproportionate amount of its attention away from our day-to-day activities and devote a substantial amount of time to realizing or managing these growth activities. We may not be able to realize such growth or expansion at all. We may not be able to effectively manage the expansion of our operations, even if we realize such expansion which may result in weaknesses in our infrastructure, give rise to operational mistakes, loss of business opportunities, loss of employees and reduced productivity among remaining employees. Future growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of our existing or future product candidates. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and grow revenue could be reduced, and we may not be able to implement our business strategy. Our future financial performance and our ability to commercialize our product candidates, if approved, and compete effectively will depend, in part, on our ability to effectively realize and manage future growth.

| 6 |

Failure to make adequate contributions to various employee benefits plans as required by PRC regulations may subject us to penalties.

Companies operating in China are required to participate in various government sponsored employee benefit plans, including certain social insurance, housing funds and other welfare-oriented payment obligations, and contribute to the plans in amounts equal to certain percentages of salaries, including bonuses and allowances, of employees up to a maximum amount specified by the local government from time to time at locations where they operate their businesses. The requirement of employee benefit plans has not been implemented consistently by the local governments in China given the different levels of economic development in different locations. If we fail to make contributions to various employee benefit plans and to comply with applicable PRC labor-related laws in the future, we may be subject to late payment penalties. We may be required to make up the contributions for these plans as well as to pay late fees and fines. If we are subject to late fees or fines in relation to the underpaid employee benefits, our financial condition and results of operations may be adversely affected.

Risks Relating to Our Corporate Structure

We depend upon the Contractual Arrangements in conducting our business in China, which may not be as effective as direct ownership.

Our affiliation with VIEs are managed through contractual arrangements, or the Contractual Arrangements, which may not be as effective in providing us with management power over VIEs as direct ownership. The Contractual Arrangements are governed by and would be interpreted in accordance with the laws of the People’s Republic of China, or the PRC. If the VIEs fail to perform the obligations under the Contractual Arrangements, we may have to rely on legal remedies under the laws of the PRC, including seeking specific performance or injunctive relief, and claiming damages. There is a risk that we may be unable to obtain any of these remedies. The legal environment in the PRC is not as developed as in other jurisdictions. As a result, uncertainties in the PRC legal system could limit our ability to enforce the Contractual Arrangements, or could affect the validity of the Contractual Arrangements.

We may not be able to consolidate the financial results of some of our affiliated companies or such consolidation could materially adversely affect our operating results and financial condition.

Most of our business are conducted through Blue Hat Fujian and Fujian Roar Game, which are considered VIEs for accounting purposes, and we, through Blue Hat WFOE, and Fresh Joy Entertainment Ltd. (“Fresh Joy”), are considered the primary beneficiary, thus enabling us to consolidate our financial results in our consolidated financial statements. In the event that in the future the companies we hold as VIEs no longer meet the definition of VIEs under applicable accounting rules, or we are not deemed to be the primary beneficiary, we would not be able to consolidate line by line those entities’ financial results in our consolidated financial statements for reporting purposes. Also, if in the future other affiliate companies become VIEs and we become the primary beneficiary, we would be required to consolidate those entities’ financial results in our consolidated financial statements for accounting purposes. If such entities’ financial results were negative, this would have a corresponding negative impact on our operating results for reporting purposes.

| 7 |

Contractual arrangements in relation to the VIEs may be subject to scrutiny by the PRC tax authorities and they may determine that we or the VIEs owe additional taxes, which could negatively affect our financial condition and the value of your investment.

Under applicable PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities within ten years after the taxable year when the transactions are conducted. We could face material and adverse tax consequences if the PRC tax authorities determine that the VIEs contractual arrangements were not entered into on an arm’s-length basis in such a way as to result in an impermissible reduction in taxes under applicable PRC laws, rules and regulations, and adjust the income of the VIEs in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction of expense deductions recorded by the VIEs for PRC tax purposes, which could in turn increase its tax liabilities without reducing our subsidiaries’ tax expenses. In addition, the PRC tax authorities may impose late payment fees and other penalties on the VIEs for the adjusted but unpaid taxes according to the applicable regulations. Our financial position could be materially and adversely affected if the VIEs’ tax liabilities increase or if it is required to pay late payment fees and other penalties.

Most of our business is conducted by means of Contractual Arrangements. If the PRC courts or administrative authorities determine that these contractual arrangements do not comply with applicable regulations, we could be subject to severe penalties and our business could be adversely affected. In addition, changes in such PRC laws and regulations may materially and adversely affect our business.

We are a holding company and most of our business operations are conducted via the VIEs through the Contractual Arrangements. There are uncertainties regarding the interpretation and application of PRC laws, rules and regulations, including the laws, rules and regulations governing the validity and enforcement of the contractual arrangements between Blue Hat WFOE and Blue Hat Fujian, between Fresh Joy and Fujian Roar Game. based on management’s understanding of the current PRC laws, rules and regulations, that (i) the structure for operating our business in China (including our corporate structure and contractual arrangements with VIEs and their shareholders) will not result in any violation of PRC laws or regulations currently in effect; and (ii) the contractual arrangements among Blue Hat WFOE, Blue Hat Fujian and its shareholders, among Fresh Joy, Fujian Roar Game and its shareholders, governed by PRC law are valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect. While we are currently not aware of any event or reason that may cause the Contractual Arrangements to terminate, we cannot assure you that such an event or reason will not occur in the future. There are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations concerning foreign investment in the PRC, and their application to and effect on the legality, binding effect and enforceability of the contractual arrangements. In particular, we cannot rule out the possibility that PRC regulatory authorities, courts or arbitral tribunals may in the future adopt a different or contrary interpretation or take a view that is inconsistent with the opinion of our PRC legal counsel. In the event that the Contractual Arrangements are terminated, this would have a severe and detrimental effect on our continuing business viability under our current corporate structure, which, in turn, may affect the value of your investment.

If any of our PRC entities or their ownership structure or the Contractual Arrangements are determined to be in violation of any existing or future PRC laws, rules or regulations, or any of our PRC entities fail to obtain or maintain any of the required governmental permits or approvals, the relevant PRC regulatory authorities would have broad discretion in dealing with such violations, including:

| ● | revoking the business and operating licenses; |

| ● | discontinuing or restricting the operations; |

| ● | imposing conditions or requirements with which the PRC entities may not be able to comply; |

| ● | requiring us and our PRC entities to restructure the relevant ownership structure or operations; |

| ● | restricting or prohibiting our use of proceeds from our initial public offering to finance our business and operations in China; or |

| ● | imposing fines. |

The imposition of any of these penalties would severely disrupt our ability to conduct business and have a material adverse effect on our financial condition, results of operations and prospects.

| 8 |

The shareholders of the VIEs may have actual or potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.

The shareholders of the VIEs may have actual or potential conflicts of interest with us. These shareholders may refuse to sign or breach, or cause our VIEs to breach, or refuse to renew, the existing contractual arrangements we have with them and the VIEs, which would have a material and adverse effect on our ability to effectively control the VIEs and receive economic benefits from it. For example, the shareholders may be able to cause our agreements with the VIEs to be performed in a manner adverse to us by, among other things, failing to remit payments due under the contractual arrangements to us on a timely basis. We cannot assure you that when conflicts of interest arise any or all of these shareholders will act in the best interests of our company or such conflicts will be resolved in our favor. Currently, we do not have any arrangements to address potential conflicts of interest between these shareholders and our company. If we cannot resolve any conflict of interest or dispute between us and these shareholders, we would have to rely on legal proceedings, which could result in disruption of our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings.

Our current corporate structure and business operations may be affected by the newly enacted Foreign Investment Law.

On March 15, 2019, the National People’s Congress, or the NPC, approved the Foreign Investment Law, which took effect on January 1, 2020. Since it is relatively new, uncertainties exist in relation to its interpretation and its implementation rules that are yet to be issued. The Foreign Investment Law does not explicitly classify whether variable interest entities that are controlled through contractual arrangements would be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors. However, it has a catch-all provision under definition of “foreign investment” that includes investments made by foreign investors in China through other means as provided by laws, administrative regulations or the State Council. Therefore, it still leaves leeway for future laws, administrative regulations or provisions of the State Council to provide for contractual arrangements as a form of foreign investment. Therefore, there can be no assurance that our control over our VIEs through contractual arrangements will not be deemed as foreign investment in the future.

On December 28, 2020, the National Development and Reform Commission and the Ministry of Commerce publicly released the Directory of Industries to Encourage Foreign Investment (Encouraged Catalogue) (2020 Edition). On December 27, 2021, the National Development and Reform Commission of China (“NDRC”) and the Ministry of Commerce (“MOFCOM”) jointly issued the Special Administrative Measures for Foreign Investment Access (Negative List) (2021 Edition), and the Special Administrative Measures for Foreign Investment Access in Pilot Free Trade Zones (Negative List) (2021 Edition), effective January 1, 2022. Industries listed in the 2021 Negative List are subject to special management measures. For example, establishment of wholly foreign-owned enterprises is generally allowed in industries outside of the 2021 Negative List. Also, foreign investors are not allowed to invest in industries that are expressly prohibited in the 2021 Negative List. The industries that are not expressly prohibited in the Negative List are still subject to government approvals and certain special requirements.

The Foreign Investment Law provides that foreign-invested entities operating in “restricted” or “prohibited” industries will require market entry clearance and other approvals from relevant PRC government authorities. Currently our business does not fall in any of these categories. Currently our business does not fall in any of these categories. However, if our management over the VIEs through contractual arrangements are deemed as foreign investment in the future, and any business of the VIEs are “restricted” or “prohibited” from foreign investment under the “negative list” effective at the time, we may be deemed to be in violation of the Foreign Investment Law, the contractual arrangements that allow us to have management power over the VIEs may be deemed as invalid and illegal, and we may be required to unwind such contractual arrangements and/or restructure our business operations, any of which may have a material adverse effect on our business operations.

Furthermore, if future laws, administrative regulations or provisions mandate further actions to be taken by companies with respect to existing contractual arrangements, we may face substantial uncertainties as to whether we can complete such actions in a timely manner, or at all. Failure to take timely and appropriate measures to cope with any of these or similar regulatory compliance challenges could materially and adversely affect our current corporate structure and business operations.

| 9 |

We face risks related to health epidemics, severe weather conditions and other outbreaks, including the coronavirus pandemic.

In recent years, there have been outbreaks of epidemics in various countries, including China. Recently, there was an outbreak of a novel strain of coronavirus (COVID-19) in China, which has spread rapidly to many parts of the world. The outbreak resulted in quarantines, travel restrictions, and the temporary closure of stores and facilities throughout the world. In March 2020, the World Health Organization declared COVID-19 a pandemic.

Substantially all of our revenues and our workforce are concentrated in China. As China has officially terminated its zero-case policy, and isolated preventive measures such as quarantine and shut down, we may face resurgences in many cities from time to time. Consequently, our results of operations may be adversely affected. Although we are positive to our business operations in China, the resurgence of COVID-19 globally, if any, or any other global epidemics may materially harm the Chinese and global economy in general, therefore we cannot assure that our operating results will not be negatively influenced. Any potential impact to our results will depend on, to a large extent, the duration and severity of the epidemics and the actions taken by government authorities and other entities to contain the spread, almost all of which are beyond our control.

Historically, due to the COVID-19, our business was adversely impacted in late 2021 and the first few months of 2022. Our total revenue in 2021 and first few months of 2022 decreased, mainly due to the random lockdown due to the frequent resurgence of COVID-19 in China.

In general, our business could be adversely affected by the effects of epidemics, including, but not limited to, COVID-19, avian influenza, severe acute respiratory syndrome (SARS), the influenza A virus, Ebola virus, severe weather conditions such as a snowstorm, flood or hazardous air pollution, or other outbreaks. In response to an epidemic, severe weather conditions, or other outbreaks, government and other organizations may adopt regulations and policies that could lead to severe disruption to our daily operations, including temporary closure of our offices and other facilities. These severe conditions may cause us and/or our partners to make internal adjustments, including but not limited to, temporarily closing down business, limiting business hours, and setting restrictions on travel and/or visits with clients and partners for a prolonged period of time. Various impacts arising from severe conditions may cause business disruption, resulting in material, adverse impact to our financial condition and results of operations.

| 10 |

Risks Related to Intellectual Property

If we are not able to adequately protect our proprietary intellectual property and information, and protect against third party claims that we are infringing on their intellectual property rights, our results of operations could be adversely affected.

The value of our business depends on our ability to protect our intellectual property and information, including our trademarks, copyrights, patents, trade secrets, and rights under agreements with third parties, in China and around the world, as well as our customer, employee, and consumer data. Third parties may try to challenge our ownership of our intellectual property in China and around the world. In addition, our business is subject to the risk of third parties counterfeiting our products or infringing on our intellectual property rights. The steps we have taken may not prevent unauthorized use of our intellectual property. We may need to resort to litigation to protect our intellectual property rights, which could result in substantial costs and diversion of resources. If we fail to protect our proprietary intellectual property and information, including with respect to any successful challenge to our ownership of intellectual property or material infringements of our intellectual property, this failure could have a significant adverse effect on our business, financial condition, and results of operations.

If we are unable to adequately protect our intellectual property rights, or if we are accused of infringing on the intellectual property rights of others, our competitive position could be harmed or we could be required to incur significant expenses to enforce or defend our rights.

Our commercial success will depend in part on our success in obtaining and maintaining issued patents, trademarks and other intellectual property rights in China and elsewhere and protecting our proprietary technology. If we do not adequately protect our intellectual property and proprietary technology, competitors may be able to use our technologies or the goodwill we have acquired in the marketplace and erode or negate any competitive advantage we may have, which could harm our business and ability to achieve profitability.

We cannot provide any assurances that any of our patents has, or that any of our pending patent applications that mature into issued patents will include, claims with a scope sufficient to protect our products, any additional features we develop for our products or any new products. Other parties may have developed technologies that may be related or competitive to our system, may have filed or may file patent applications and may have received or may receive patents that overlap or conflict with our patent applications, either by claiming the same methods or devices or by claiming subject matter that could dominate our patent position. Our patent position may involve complex legal and factual questions, and, therefore, the scope, validity and enforceability of any patent claims that we may obtain cannot be predicted with certainty. Patents, if issued, may be challenged, deemed unenforceable, invalidated or circumvented. Proceedings challenging our patents could result in either loss of the patent or denial of the patent application or loss or reduction in the scope of one or more of the claims of the patent or patent application. In addition, such proceedings may be costly. Thus, any patents that we may own may not provide any protection against competitors. Furthermore, an adverse decision in an interference proceeding can result in a third party receiving the patent right sought by us, which in turn could affect our ability to commercialize our products.

Though an issued patent is presumed valid and enforceable, its issuance is not conclusive as to its validity or its enforceability and it may not provide us with adequate proprietary protection or competitive advantages against competitors with similar products. Competitors could purchase our products and attempt to replicate some or all of the competitive advantages we derive from our development efforts, willfully infringe our intellectual property rights, design around our patents, or develop and obtain patent protection for more effective technologies, designs or methods. We may be unable to prevent the unauthorized disclosure or use of our technical knowledge or trade secrets by consultants, suppliers, vendors, former employees and current employees.

Our ability to enforce our patent rights depends on our ability to detect infringement. It may be difficult to detect infringers who do not advertise the components that are used in their products. Moreover, it may be difficult or impossible to obtain evidence of infringement in a competitor’s or potential competitor’s product. We may not prevail in any lawsuits that we initiate and the damages or other remedies awarded if we were to prevail may not be commercially meaningful.

In addition, proceedings to enforce or defend our patents could put our patents at risk of being invalidated, held unenforceable or interpreted narrowly. Such proceedings could also provoke third parties to assert claims against us, including that some or all of the claims in one or more of our patents are invalid or otherwise unenforceable. If any of our patents covering our products are invalidated or found unenforceable, or if a court found that valid, enforceable patents held by third parties covered one or more of our products, our competitive position could be harmed or we could be required to incur significant expenses to enforce or defend our rights.

| 11 |

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

| ● | any of our patents, or any of our pending patent applications, if issued, will include claims having a scope sufficient to protect our products; | |

| ● | any of our pending patent applications will issue as patents; | |

| ● | we will be able to successfully commercialize our products on a substantial scale, if approved, before our relevant patents we may have expire; | |

| ● | we were the first to make the inventions covered by each of our patents and pending patent applications; | |

| ● | we were the first to file patent applications for these inventions; | |

| ● | others will not develop similar or alternative technologies that do not infringe our patents; any of our patents will be found to ultimately be valid and enforceable; | |

| ● | any patents issued to us will provide a basis for an exclusive market for our commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties; | |

| ● | we will develop additional proprietary technologies or products that are separately patentable; or | |

| ● | our commercial activities or products will not infringe upon the patents of others. |

We rely, in part, upon unpatented trade secrets, unpatented know-how and continuing technological innovation to develop and maintain our competitive position. Further, our trade secrets could otherwise become known or be independently discovered by our competitors.

Litigation or other proceedings or third party claims of intellectual property infringement could require us to spend significant time and money and could prevent us from selling our products or affect our stock price.

Our commercial success will depend in part on not infringing the patents or violating the other proprietary rights of others. Significant litigation regarding patent rights occurs in our industry. Our competitors in both China and abroad, many of which have substantially greater resources and have made substantial investments in patent portfolios and competing technologies, may have applied for or obtained or may in the future apply for and obtain, patents that will prevent, limit or otherwise interfere with our ability to make, use and sell our products. We do not always conduct independent reviews of patents issued to third parties. In addition, patent applications in China and elsewhere can be pending for many years before issuance, or unintentionally abandoned patents or applications can be revived, so there may be applications of others now pending or recently revived patents of which we are unaware. These applications may later result in issued patents, or the revival of previously abandoned patents, that will prevent, limit or otherwise interfere with our ability to make, use or sell our products. Third parties may, in the future, assert claims that we are employing their proprietary technology without authorization, including claims from competitors or from non-practicing entities that have no relevant product revenue and against whom our own patent portfolio may have no deterrent effect. As we continue to commercialize our products in their current or updated forms, launch new products and enter new markets, we expect competitors may claim that one or more of our products infringe their intellectual property rights as part of business strategies designed to impede our successful commercialization and entry into new markets. The large number of patents, the rapid rate of new patent applications and issuances, the complexities of the technology involved, and the uncertainty of litigation may increase the risk of business resources and management’s attention being diverted to patent litigation. We have, and we may in the future, receive letters or other threats or claims from third parties inviting us to take licenses under, or alleging that we infringe, their patents.

Moreover, we may become a party to future adversarial proceedings regarding our patent portfolio or the patents of third parties. Patents may be subjected to opposition, post-grant review or comparable proceedings lodged in various foreign, both national and regional, patent offices. The legal threshold for initiating litigation or contested proceedings may be low, so that even lawsuits or proceedings with a low probability of success might be initiated. Litigation and contested proceedings can also be expensive and time-consuming, and our adversaries in these proceedings may have the ability to dedicate substantially greater resources to prosecuting these legal actions than we can. We may also occasionally use these proceedings to challenge the patent rights of others. We cannot be certain that any particular challenge will be successful in limiting or eliminating the challenged patent rights of the third party.

| 12 |

Any lawsuits resulting from such allegations could subject us to significant liability for damages and invalidate our proprietary rights. Any potential intellectual property litigation also could force us to do one or more of the following:

| ● | stop making, selling or using products or technologies that allegedly infringe the asserted intellectual property; | |

| ● | lose the opportunity to license our technology to others or to collect royalty payments based upon successful protection and assertion of our intellectual property rights against others; incur significant legal expenses; | |

| ● | pay substantial damages or royalties to the party whose intellectual property rights we may be found to be infringing; | |

| ● | pay the attorney’s fees and costs of litigation to the party whose intellectual property rights we may be found to be infringing; | |

| ● | redesign those products that contain the allegedly infringing intellectual property, which could be costly, disruptive and infeasible; and | |

| ● | attempt to obtain a license to the relevant intellectual property from third parties, which may not be available on reasonable terms or at all, or from third parties who may attempt to license rights that they do not have. |

Any litigation or claim against us, even those without merit, may cause us to incur substantial costs, and could place a significant strain on our financial resources, divert the attention of management from our core business and harm our reputation. If we are found to infringe the intellectual property rights of third parties, we could be required to pay substantial damages (which may be increased up to three times of awarded damages) and/or substantial royalties and could be prevented from selling our products unless we obtain a license or are able to redesign our products to avoid infringement. Any such license may not be available on reasonable terms, if at all, and there can be no assurance that we would be able to redesign our products in a way that would not infringe the intellectual property rights of others. We could encounter delays in product introductions while we attempt to develop alternative methods or products. If we fail to obtain any required licenses or make any necessary changes to our products or technologies, we may have to withdraw existing products from the market or may be unable to commercialize one or more of our products.

If we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed.

In addition to patent protection, we also rely upon copyright and trade secret protection, as well as non-disclosure agreements with our employees, consultants and third parties, to protect our confidential and proprietary information. In addition to contractual measures, we try to protect the confidential nature of our proprietary information using commonly accepted physical and technological security measures. Such measures may not, for example, in the case of misappropriation of a trade secret by an employee or third party with authorized access, provide adequate protection for our proprietary information. Our security measures may not prevent an employee or consultant from misappropriating our trade secrets and providing them to a competitor, and recourse we take against such misconduct may not provide an adequate remedy to protect our interests fully. Unauthorized parties may also attempt to copy or reverse engineer certain aspects of our products that we consider proprietary. Enforcing a claim that a party illegally disclosed or misappropriated a trade secret can be difficult, expensive and time-consuming, and the outcome is unpredictable. Even though we use commonly accepted security measures, trade secret violations are often a matter of state law, and the criteria for protection of trade secrets can vary among different jurisdictions. In addition, trade secrets may be independently developed by others in a manner that could prevent legal recourse by us. If any of our confidential or proprietary information, such as our trade secrets, were to be disclosed or misappropriated, or if any such information was independently developed by a competitor, our business and competitive position could be harmed.

Third parties may assert ownership or commercial rights to inventions we develop.

We may face claims by third parties that our agreements with employees, contractors or consultants obligating them to assign intellectual property to us are ineffective or in conflict with prior or competing contractual obligations of assignment, which could result in ownership disputes regarding intellectual property we have developed or will develop and interfere with our ability to capture the commercial value of such intellectual property. Litigation may be necessary to resolve an ownership dispute, and if we are not successful, we may be precluded from using certain intellectual property or may lose our exclusive rights in that intellectual property. Either outcome could harm our business and competitive position.

| 13 |

Third parties may assert that our employees or consultants have wrongfully used or disclosed confidential information or misappropriated trade secrets.

We may employ individuals who previously worked with other companies, including our competitors or potential competitors. Although we try to ensure that our employees and consultants do not use the proprietary information or know-how of others in their work for us, we may be subject to claims that we or our employees, consultants or independent contractors have inadvertently or otherwise used or disclosed intellectual property or personal data, including trade secrets or other proprietary information, of a former employer or other third party. Litigation may be necessary to defend against these claims. If we fail in defending any such claims or settling those claims, in addition to paying monetary damages or a settlement payment, we may lose valuable intellectual property rights or personnel. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

Our computer systems and operations may be vulnerable to security breaches.

We expect that the cloud-based applications embedded in our toys will be an important foundation for establishing our company as a leading source of technology. For that reason, among others, the safety of our network and our secure transmission of information over the internet will be essential to our operations and our services. Our network and our computer infrastructure are potentially vulnerable to physical breaches or to the introduction of computer viruses, abuse of use and similar disruptive problems and security breaches that could cause loss (both economic and otherwise), interruptions, delays or loss of services to our users. We have been the target of attempted cyber-security breaches in the past and expect that we will continue to be subject to such attempts in the future. It is possible that advances in computer capabilities or new technologies could result in a compromise or breach of the technology we use to protect user transaction data. A party that is able to circumvent our security systems could misappropriate proprietary information, cause interruptions in our operations or utilize our network without authorization. Security breaches also could damage our reputation and expose us to a risk of loss, litigation and possible liability. We cannot guarantee you that our security measures will prevent security breaches.

Risks Related to Doing Business in China

Changes in China’s economic, political or legal system or social conditions or government policies could have a material adverse effect on our business and operations.