|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

06-1119097

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

300 Phillipi Road, P.O. Box 28512, Columbus, Ohio

|

|

43228-5311

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(614) 278-6800

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Shares $0.01 par value

|

New York Stock Exchange

|

|

|

Large accelerated filer

þ

|

Accelerated filer

o

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

|

Part I

|

Page

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

|

Part II

|

|

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

|

Part III

|

|

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

|

|

|

|

Part IV

|

||

|

Item 15.

|

||

|

Fiscal Year

|

Number of Weeks

|

Year Begin Date

|

Year End Date

|

|||

|

2012

|

53

|

January 29, 2012

|

February 2, 2013

|

|||

|

2011

|

52

|

January 30, 2011

|

January 28, 2012

|

|||

|

2010

|

52

|

January 31, 2010

|

January 29, 2011

|

|||

|

2009

|

52

|

February 1, 2009

|

January 30, 2010

|

|||

|

2008

|

52

|

February 3, 2008

|

January 31, 2009

|

|||

|

2007

|

52

|

February 4, 2007

|

February 2, 2008

|

|||

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||

|

U.S.

|

|

|

|

|

|

||||||||||

|

Stores open at the beginning of the year

|

1,398

|

|

1,361

|

|

1,339

|

|

1,353

|

|

1,375

|

|

|||||

|

Stores opened during the year

|

92

|

|

80

|

|

52

|

|

21

|

|

7

|

|

|||||

|

Stores acquired during the year

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores closed during the year

|

(39

|

)

|

(43

|

)

|

(30

|

)

|

(35

|

)

|

(29

|

)

|

|||||

|

Stores open at the end of the year

|

1,451

|

|

1,398

|

|

1,361

|

|

1,339

|

|

1,353

|

|

|||||

|

Canada

|

|||||||||||||||

|

Stores open at the beginning of the year

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores opened during the year

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores acquired during the year

|

89

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores closed during the year

|

(7

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores open at the end of the year

|

82

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Consolidated

|

|||||||||||||||

|

Stores open at the beginning of the year

|

1,398

|

|

1,361

|

|

1,339

|

|

1,353

|

|

1,375

|

|

|||||

|

Stores opened during the year

|

92

|

|

80

|

|

52

|

|

21

|

|

7

|

|

|||||

|

Stores acquired during the year

|

89

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores closed during the year

|

(46

|

)

|

(43

|

)

|

(30

|

)

|

(35

|

)

|

(29

|

)

|

|||||

|

Stores open at the end of the year

|

1,533

|

|

1,398

|

|

1,361

|

|

1,339

|

|

1,353

|

|

|||||

|

Alabama

|

28

|

|

Maine

|

7

|

|

Ohio

|

108

|

|

||

|

Arizona

|

36

|

|

Maryland

|

19

|

|

Oklahoma

|

17

|

|

||

|

Arkansas

|

13

|

|

Massachusetts

|

20

|

|

Oregon

|

13

|

|

||

|

California

|

174

|

|

Michigan

|

48

|

|

Pennsylvania

|

70

|

|

||

|

Colorado

|

20

|

|

Minnesota

|

7

|

|

Rhode Island

|

1

|

|

||

|

Connecticut

|

11

|

|

Mississippi

|

14

|

|

South Carolina

|

34

|

|

||

|

Delaware

|

4

|

|

Missouri

|

28

|

|

South Dakota

|

1

|

|

||

|

Florida

|

109

|

|

Montana

|

2

|

|

Tennessee

|

47

|

|

||

|

Georgia

|

60

|

|

Nebraska

|

4

|

|

Texas

|

117

|

|

||

|

Idaho

|

6

|

|

Nevada

|

12

|

|

Utah

|

11

|

|

||

|

Illinois

|

34

|

|

New Hampshire

|

7

|

|

Vermont

|

4

|

|

||

|

Indiana

|

46

|

|

New Jersey

|

18

|

|

Virginia

|

37

|

|

||

|

Iowa

|

3

|

|

New Mexico

|

12

|

|

Washington

|

23

|

|

||

|

Kansas

|

9

|

|

New York

|

54

|

|

West Virginia

|

18

|

|

||

|

Kentucky

|

40

|

|

North Carolina

|

68

|

|

Wisconsin

|

10

|

|

||

|

Louisiana

|

23

|

|

North Dakota

|

2

|

|

Wyoming

|

2

|

|

||

|

Total stores

|

1,451

|

|

||||||||

|

Number of states

|

48

|

|

||||||||

|

Alberta

|

13

|

|

New Brunswick

|

2

|

|

Saskatchewan

|

6

|

|

||

|

British Columbia

|

16

|

|

Nova Scotia

|

4

|

|

|

|

|

||

|

Manitoba

|

4

|

|

Ontario

|

37

|

|

|

|

|

||

|

Total stores

|

82

|

|

||||||||

|

Number of provinces

|

7

|

|

||||||||

|

•

|

Fluctuating commodity prices, including but not limited to diesel fuel and other fuels used to generate power by utilities, may affect our gross profit and operating profit margins.

|

|

•

|

Our expectations regarding the demand for our merchandise may be inaccurate, which could cause us to under buy or over buy certain categories or departments of merchandise, which could result in customer dissatisfaction or require excessive markdowns to sell through the merchandise.

|

|

•

|

The reaction of our competitors to the marketplace, including the level of liquidations occurring at bankrupt retailers, may drive our competitors, some of whom are better capitalized than us, to offer significant discounts or promotions on their merchandise, which could negatively affect our sales and profit margins.

|

|

•

|

Our vendors may be negatively impacted by current economic conditions due to insufficient availability of credit to fund their operations or insufficient demand for their products, which may affect their ability to fulfill their obligations to us.

|

|

•

|

A downgrade in our credit rating could negatively affect our ability to access capital or could increase the borrowing rates we pay.

|

|

•

|

Changes in governmental laws and regulations;

|

|

•

|

Events or circumstances could occur which could create bad publicity for us or for types of merchandise offered in our stores which may negatively impact our business results including sales;

|

|

•

|

Infringement of our intellectual property, including the Big Lots trademarks, could dilute our value;

|

|

•

|

Our ability to establish effective advertising, marketing, and promotional programs; and

|

|

•

|

Other risks described from time to time in our filings with the SEC.

|

|

State

|

Stores Owned

|

|

|

Arizona

|

3

|

|

|

California

|

39

|

|

|

Colorado

|

3

|

|

|

Florida

|

2

|

|

|

Louisiana

|

1

|

|

|

New Mexico

|

2

|

|

|

Ohio

|

1

|

|

|

Texas

|

3

|

|

|

Total

|

54

|

|

|

Fiscal Year:

|

Expiring Leases

|

Leases Without Options

|

||

|

2012

|

247

|

|

39

|

|

|

2013

|

303

|

|

41

|

|

|

2014

|

287

|

|

31

|

|

|

2015

|

229

|

|

27

|

|

|

2016

|

241

|

|

35

|

|

|

Thereafter

|

208

|

|

8

|

|

|

Square Footage

|

||||||

|

State / Province

|

Owned

|

Leased

|

Total

|

Owned

|

Leased

|

Total

|

|

(Square footage in thousands)

|

||||||

|

U.S. segment:

|

||||||

|

Ohio

|

1

|

—

|

1

|

3,559

|

—

|

3,559

|

|

California

|

1

|

—

|

1

|

1,423

|

—

|

1,423

|

|

Alabama

|

1

|

—

|

1

|

1,411

|

—

|

1,411

|

|

Oklahoma

|

1

|

—

|

1

|

1,297

|

—

|

1,297

|

|

Pennsylvania

|

1

|

—

|

1

|

1,295

|

—

|

1,295

|

|

Sub-total

|

5

|

—

|

5

|

8,985

|

—

|

8,985

|

|

Canadian segment:

|

||||||

|

British Columbia

|

—

|

1

|

1

|

—

|

105

|

105

|

|

Ontario

|

—

|

1

|

1

|

—

|

261

|

261

|

|

Sub-total

|

—

|

2

|

2

|

—

|

366

|

366

|

|

Total

|

5

|

2

|

7

|

8,985

|

366

|

9,351

|

|

Name

|

Age

|

Offices Held

|

Officer Since

|

|

Steven S. Fishman

|

60

|

Chairman, Chief Executive Officer and President

|

2005

|

|

Lisa M. Bachmann

|

50

|

Executive Vice President, Supply Chain Management and Chief Information Officer

|

2002

|

|

Joe R. Cooper

|

54

|

Executive Vice President and Chief Financial Officer; President of Big Lots Canada, Inc.

|

2000

|

|

Charles W. Haubiel II

|

46

|

Executive Vice President, Legal and Real Estate, General Counsel and Corporate Secretary

|

1999

|

|

John C. Martin

|

61

|

Executive Vice President, Administration

|

2003

|

|

Douglas N. Wurl

|

50

|

Executive Vice President, Merchandising

|

2011

|

|

Robert C. Claxton

|

57

|

Senior Vice President, Marketing

|

2005

|

|

Timothy A. Johnson

|

44

|

Senior Vice President, Finance

|

2004

|

|

Norman J. Rankin

|

55

|

Senior Vice President, Big Lots Capital and Wholesale

|

1998

|

|

Robert S. Segal

|

57

|

Senior Vice President, General Merchandise Manager

|

2005

|

|

Steven R. Smart

|

52

|

Senior Vice President, General Merchandise Manager

|

2003

|

|

Paul A. Schroeder

|

46

|

Vice President, Controller

|

2005

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

2011

|

2010

|

||||||||||||||

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

First Quarter

|

$

|

44.44

|

|

$

|

31.57

|

|

$

|

41.42

|

|

$

|

28.51

|

|

|||

|

Second Quarter

|

41.42

|

|

30.83

|

|

38.92

|

|

31.27

|

|

|||||||

|

Third Quarter

|

38.91

|

|

28.89

|

|

35.25

|

|

30.02

|

|

|||||||

|

Fourth Quarter

|

$

|

41.81

|

|

$

|

35.65

|

|

$

|

32.78

|

|

$

|

27.82

|

|

|||

|

(In thousands, except price per share data)

|

|||||||||||

|

Period

|

(a) Total Number of Shares Purchased

|

(b) Average Price Paid per Share

|

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

(d) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs

|

|||||||

|

October 30, 2011 - November 26, 2011

|

—

|

|

$

|

—

|

|

—

|

|

$

|

144,737

|

|

|

|

November 27, 2011 - December 24, 2011

|

1,257

|

|

36.79

|

|

1,257

|

|

98,501

|

|

|||

|

December 25, 2011 - January 28, 2012

|

—

|

|

|

—

|

|

—

|

|

98,501

|

|

||

|

Total

|

1,257

|

|

$

|

36.79

|

|

1,257

|

|

$

|

98,501

|

|

|

|

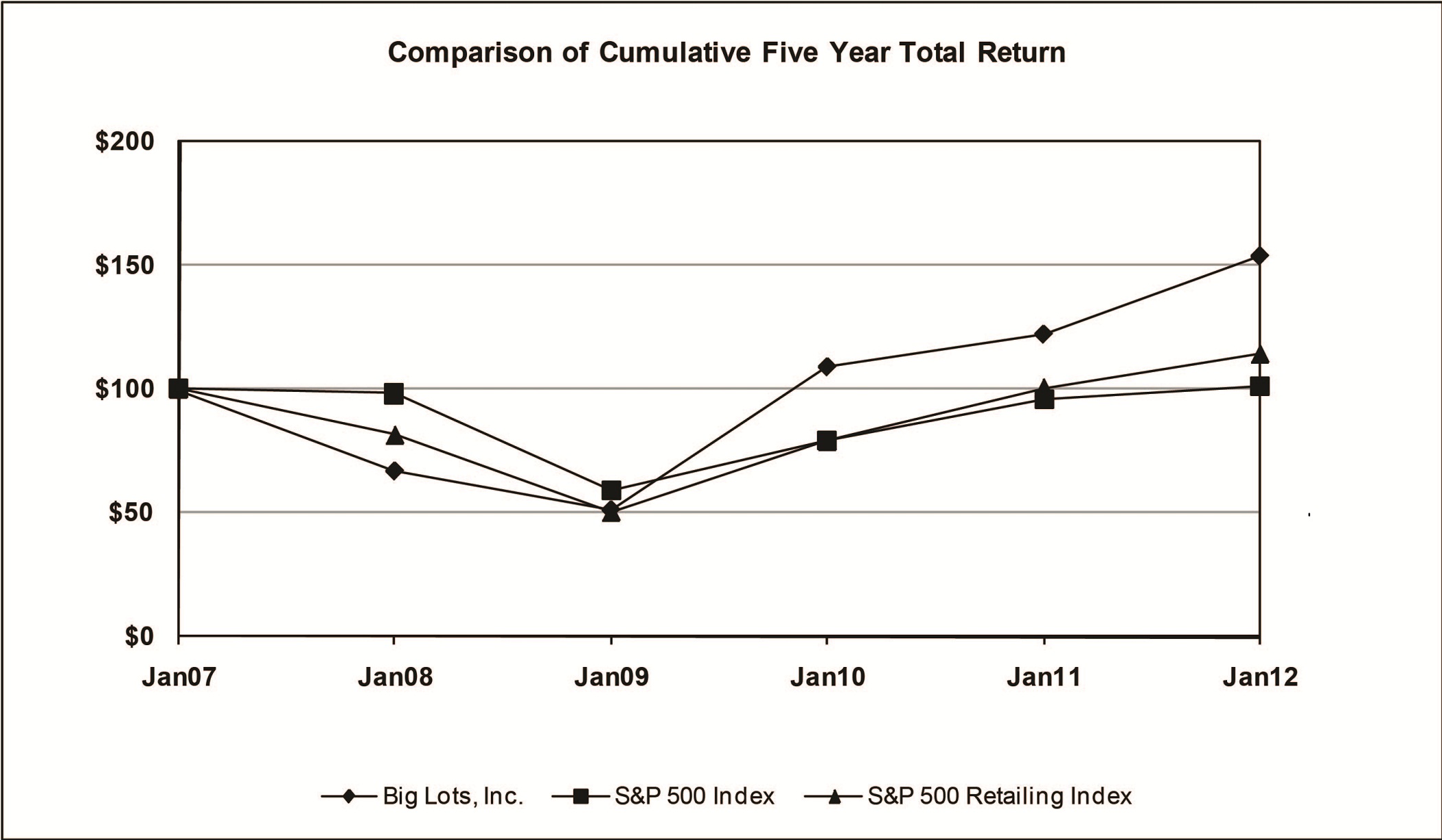

Indexed Returns

|

||||||||||||||||||

|

Years Ended

|

||||||||||||||||||

|

Base

|

||||||||||||||||||

|

Period

|

||||||||||||||||||

|

January

|

January

|

January

|

January

|

January

|

January

|

|||||||||||||

|

Company / Index

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

||||||||||||

|

Big Lots, Inc.

|

$

|

100.00

|

|

$

|

67.35

|

|

$

|

51.73

|

|

$

|

109.27

|

|

$

|

122.38

|

|

$

|

153.85

|

|

|

S&P 500 Index

|

100.00

|

|

98.20

|

|

59.54

|

|

79.27

|

|

96.12

|

|

101.24

|

|

||||||

|

S&P 500 Retailing Index

|

$

|

100.00

|

|

$

|

81.62

|

|

$

|

50.84

|

|

$

|

79.07

|

|

$

|

100.55

|

|

$

|

114.05

|

|

|

Fiscal Year

(a)

|

|||||||||||||||

|

2011

(e)

|

2010

|

2009

|

2008

(b)

|

2007

(c)

|

|||||||||||

|

(In thousands, except per share amounts and store counts)

|

|||||||||||||||

|

Net sales

|

$

|

5,202,269

|

|

$

|

4,952,244

|

|

$

|

4,726,772

|

|

$

|

4,645,283

|

|

$

|

4,656,302

|

|

|

Cost of sales (exclusive of depreciation expense shown separately below)

|

3,131,862

|

|

2,939,793

|

|

2,807,466

|

|

2,787,854

|

|

2,815,959

|

|

|||||

|

Gross margin

|

2,070,407

|

|

2,012,451

|

|

1,919,306

|

|

1,857,429

|

|

1,840,343

|

|

|||||

|

Selling and administrative expenses

|

1,634,532

|

|

1,576,500

|

|

1,532,356

|

|

1,523,882

|

|

1,515,379

|

|

|||||

|

Depreciation expense

|

90,280

|

|

78,606

|

|

74,904

|

|

78,624

|

|

88,484

|

|

|||||

|

Gain on sale of real estate

|

—

|

|

—

|

|

(12,964

|

)

|

—

|

|

—

|

|

|||||

|

Operating profit

|

345,595

|

|

357,345

|

|

325,010

|

|

254,923

|

|

236,480

|

|

|||||

|

Interest expense

|

(3,530

|

)

|

(2,573

|

)

|

(1,840

|

)

|

(5,282

|

)

|

(2,513

|

)

|

|||||

|

Other income (expense)

|

(173

|

)

|

612

|

|

175

|

|

65

|

|

5,236

|

|

|||||

|

Income from continuing operations before income taxes

|

341,892

|

|

355,384

|

|

323,345

|

|

249,706

|

|

239,203

|

|

|||||

|

Income tax expense

|

134,657

|

|

132,837

|

|

121,975

|

|

94,908

|

|

88,023

|

|

|||||

|

Income from continuing operations

|

207,235

|

|

222,547

|

|

201,370

|

|

154,798

|

|

151,180

|

|

|||||

|

Income (loss) from discontinued operations, net of tax

|

(171

|

)

|

(23

|

)

|

(1,001

|

)

|

(3,251

|

)

|

7,281

|

|

|||||

|

Net income

|

$

|

207,064

|

|

$

|

222,524

|

|

$

|

200,369

|

|

$

|

151,547

|

|

$

|

158,461

|

|

|

Earnings per common share - basic:

|

|||||||||||||||

|

Continuing operations

|

$

|

3.03

|

|

$

|

2.87

|

|

$

|

2.47

|

|

$

|

1.91

|

|

$

|

1.49

|

|

|

Discontinued operations

|

—

|

|

—

|

|

(0.01

|

)

|

(0.04

|

)

|

0.07

|

|

|||||

|

$

|

3.03

|

|

$

|

2.87

|

|

$

|

2.45

|

|

$

|

1.87

|

|

$

|

1.56

|

|

|

|

Earnings per common share - diluted:

|

|

||||||||||||||

|

Continuing operations

|

$

|

2.99

|

|

$

|

2.83

|

|

$

|

2.44

|

|

$

|

1.89

|

|

$

|

1.47

|

|

|

Discontinued operations

|

—

|

|

—

|

|

(0.01

|

)

|

(0.04

|

)

|

0.07

|

|

|||||

|

$

|

2.98

|

|

$

|

2.83

|

|

$

|

2.42

|

|

$

|

1.85

|

|

$

|

1.55

|

|

|

|

Weighted-average common shares outstanding:

|

|||||||||||||||

|

Basic

|

68,316

|

|

77,596

|

|

81,619

|

|

81,111

|

|

101,393

|

|

|||||

|

Diluted

|

69,419

|

|

78,581

|

|

82,681

|

|

82,076

|

|

102,542

|

|

|||||

|

Balance sheet data:

|

|||||||||||||||

|

Total assets

|

$

|

1,641,310

|

|

$

|

1,619,599

|

|

$

|

1,669,493

|

|

$

|

1,432,458

|

|

$

|

1,443,815

|

|

|

Working capital

(d)

|

421,836

|

|

509,788

|

|

580,446

|

|

355,776

|

|

390,766

|

|

|||||

|

Cash and cash equivalents

|

68,547

|

|

177,539

|

|

283,733

|

|

34,773

|

|

37,131

|

|

|||||

|

Long-term obligations under bank credit facility

|

65,900

|

|

—

|

|

—

|

|

—

|

|

163,700

|

|

|||||

|

Shareholders’ equity

|

$

|

823,233

|

|

$

|

946,793

|

|

$

|

1,001,412

|

|

$

|

774,845

|

|

$

|

638,486

|

|

|

Cash flow data:

|

|||||||||||||||

|

Cash provided by operating activities

|

$

|

318,471

|

|

$

|

315,257

|

|

$

|

392,026

|

|

$

|

211,063

|

|

$

|

307,932

|

|

|

Cash used in investing activities

|

$

|

(120,712

|

)

|

$

|

(114,552

|

)

|

$

|

(77,937

|

)

|

$

|

(88,192

|

)

|

$

|

(58,764

|

)

|

|

Store data:

|

|||||||||||||||

|

Total gross square footage

|

45,780

|

|

42,037

|

|

40,591

|

|

39,888

|

|

40,195

|

|

|||||

|

Total selling square footage

|

33,119

|

|

30,210

|

|

29,176

|

|

28,674

|

|

28,902

|

|

|||||

|

Stores opened during the fiscal year

|

92

|

|

80

|

|

52

|

|

21

|

|

7

|

|

|||||

|

Stores acquired during the fiscal year

|

89

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Stores closed during the fiscal year

|

(46

|

)

|

(43

|

)

|

(30

|

)

|

(35

|

)

|

(29

|

)

|

|||||

|

Stores open at end of the fiscal year

|

1,533

|

|

1,398

|

|

1,361

|

|

1,339

|

|

1,353

|

|

|||||

|

(a)

|

All periods presented are comprised of 52 weeks.

|

|

(b)

|

We adopted the measurement date provisions of guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 715-30-35,

Defined Benefit Plans-Pension

(Statement of Financial Accounting Standard (“SFAS”) No. 158,

Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans)

in 2008, which resulted in an adjustment to accumulated other comprehensive loss of $66 ($40 net of tax).

|

|

(c)

|

We adopted guidance under ASC 740,

Income Taxes

(FIN No. 48,

Accounting for Uncertainty in Income Taxes an interpretation of SFAS No. 109),

in the first fiscal quarter of 2007, on a prospective basis.

|

|

(d)

|

For 2008, working capital included $61.7 million for current maturities under bank credit facility because the 2004 Credit Agreement terminated in 2009.

|

|

(e)

|

On July 18, 2011, the Company completed its acquisition of Liquidation World Inc., whose results are included in the consolidated results since that date.

|

|

•

|

Net sales increased $250.0 million, or 5.0%.

|

|

•

|

Diluted earnings per share from continuing operations increased from $2.83 per share to $2.99 per share.

|

|

•

|

Inventory increased by 8.3%, or $63.1 million, to $825.2 million from

2010

.

|

|

•

|

We acquired Liquidation World Inc.

|

|

•

|

We acquired 11.0 million of our outstanding common shares for $359.3 million under the 2011 Repurchase Program.

|

|

•

|

Comparable store sales for stores open at least two years at the beginning of

2011

increased 0.1%.

|

|

•

|

Gross margin dollars increased $33.6 million, while gross margin rate decreased 80 basis points from 40.6% to 39.8% of sales.

|

|

•

|

Selling and administrative expenses increased $23.3 million. As a percentage of net sales, selling and administrative expenses improved by decreasing 70 basis points to 31.1% of sales.

|

|

•

|

Operating profit rate decreased 20 basis points to 7.0%.

|

|

•

|

Net sales from the date of acquisition (July 18, 2012) through January 28, 2012 were $62.1 million.

|

|

•

|

Operating loss was $12.2 million.

|

|

2011

|

2010

|

2009

|

||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|

Cost of sales (exclusive of depreciation expense shown separately below)

|

60.2

|

|

59.4

|

|

59.4

|

|

|

Gross margin

|

39.8

|

|

40.6

|

|

40.6

|

|

|

Selling and administrative expenses

|

31.4

|

|

31.8

|

|

32.4

|

|

|

Depreciation expense

|

1.7

|

|

1.6

|

|

1.6

|

|

|

Gain on sale of real estate

|

0.0

|

|

0.0

|

|

(0.3

|

)

|

|

Operating profit

|

6.6

|

|

7.2

|

|

6.9

|

|

|

Interest expense

|

(0.1

|

)

|

(0.1

|

)

|

(0.0

|

)

|

|

Other income (expense)

|

(0.0

|

)

|

0.0

|

|

0.0

|

|

|

Income from continuing operations before income taxes

|

6.6

|

|

7.2

|

|

6.8

|

|

|

Income tax expense

|

2.6

|

|

2.7

|

|

2.6

|

|

|

Income from continuing operations

|

4.0

|

|

4.5

|

|

4.3

|

|

|

Loss from discontinued operations, net of tax

|

(0.0

|

)

|

(0.0

|

)

|

(0.0

|

)

|

|

Net income

|

4.0

|

%

|

4.5

|

%

|

4.2

|

%

|

|

First

|

Second

|

Third

|

Fourth

|

|||||

|

Fiscal Year 2011

|

||||||||

|

Net sales as a percentage of full year

|

23.6

|

%

|

22.4

|

%

|

21.9

|

%

|

32.1

|

%

|

|

Operating profit as a percentage of full year

|

25.0

|

|

17.3

|

|

2.6

|

|

55.1

|

|

|

Fiscal Year 2010

|

||||||||

|

Net sales as a percentage of full year

|

24.9

|

%

|

23.1

|

%

|

21.3

|

%

|

30.7

|

%

|

|

Operating profit as a percentage of full year

|

25.2

|

|

17.7

|

|

7.5

|

|

49.6

|

|

|

Fiscal Year 2009

|

||||||||

|

Net sales as a percentage of full year

|

24.1

|

%

|

23.0

|

%

|

21.9

|

%

|

31.0

|

%

|

|

Operating profit as a percentage of full year

|

18.5

|

|

14.7

|

|

14.6

|

|

52.2

|

|

|

•

|

Earnings per diluted share from continuing operations to be $3.35 to $3.45, including the expected impact of a non-cash, non-recurring charge of $0.05 per diluted share related to a change in accounting principle associated with the implementation of our new retail inventory systems in the U.S. during the first quarter of 2012.

|

|

•

|

Net sales increase in both the U.S. and Canada:

|

|

◦

|

U.S. comparable stores sales increase of 2% to 3% and an increase of 8% to 9% in total net sales in the U.S.

|

|

◦

|

Canada sales of $140 million to $150 million, a $78 million to $88 million increase from 2011, which was a partial year.

|

|

•

|

Opening 90 new stores and closing 45 stores, for net growth of 45 stores or 3%, in the U.S.

|

|

•

|

Cash provided by operating activities of approximately $330 million to $335 million less capital expenditures of approximately $130 million to $135 million resulting in approximately $200 million of cash available for further investment in our business.

|

|

•

|

The remaining $98.5 million of share purchase authorization under the 2011 Repurchase Program may be utilized in the open market and/or in privately negotiated transactions at our discretion, subject to market conditions and other factors.

|

|

•

|

Manufacturers and vendors have closeout merchandise for a number of different reasons including other retailers canceling orders, other retailers going out of business, marketing or packaging changes, a new product launch that has failed, and various other reasons. In these situations, we are able to source product at a discounted cost and offer significant value to our customers. We currently have thousands of vendor relationships for closeout inventory that have been developed over many years. We believe these relationships and the size and financial strength of our company limit the opportunities for other competitors to enter our retail segment.

|

|

•

|

For certain merchandise categories, there is not always an abundant supply of closeout inventory. In these situations, we may work with vendors to develop product, some of which is imported. Imports total approximately 25% to 30%

of our merchandise sales annually. Categories with the highest concentration of imports include Seasonal, Furniture, and to a lesser extent the Home category and the toys department.

|

|

•

|

Our merchandise mix also includes replenishable and private or captive label products. This type of merchandise is consistently available, and as a result, it can be offered in our stores on a regular basis. This merchandise has many of the same characteristics as our closeout merchandise but is reorderable upon demand. Our prices for replenishable and private or captive label products are generally positioned below our competition, but to a lesser extent than our closeout sourced merchandise.

|

|

•

|

First, using our printed advertising circulars and promotional pricing to create excitement surrounding the deals that we offer. The excitement created by such deals is predominantly achieved through price but the uniqueness of an item may also be a factor.

|

|

•

|

Second, through the use of television commercials displayed nationwide on both national and cable networks, we will promote our brand and, from time to time, promote items or special discounts in our stores.

|

|

•

|

Next, our signage initiatives that focus on value and extreme price savings are designed to continue our effort to reinforce our niche in low everyday price retailing.

|

|

•

|

Finally, the use of our Buzz Club Rewards program is a key driver to furthering our focus on our core shoppers and expanding our customer base. We believe we are gaining insights about communication with this customer segment and will increase our digital communication in 2012 through weekend specials or shop early offers to enjoy early discounts. Additionally, we continue to pursue new customer sign-ups at our stores in order to grow our base of members. At January 28, 2012, our Buzz Club Rewards program membership totaled 11.5 million members.

|

|

•

|

Controlled inventory levels at our stores and regional distribution centers.

|

|

•

|

Purchased and distributed merchandise to our stores in more optimal quantities and pack sizes to minimize handling in our distribution centers and stores.

|

|

•

|

Timed receipt of merchandise in stores closer to the expected display dates in order to avoid excessive handling of merchandise.

|

|

•

|

Increased the percentage of merchandise that arrives in our stores pre-ticketed and pre-packaged for efficient display and sale.

|

|

•

|

Refined our staffing and payroll scheduling models in our stores.

|

|

•

|

Invested in energy management systems to actively control utility costs, while reducing energy consumption.

|

|

•

|

Implemented several initiatives which lowered our distribution and outbound transportation expenses, including re-negotiating carrier contracts or changing carriers and expanding our back haul volumes.

|

|

2011

|

2010

|

Change

|

|||||||||||||||

|

($ in thousands)

|

|||||||||||||||||

|

Consumables

|

$

|

1,571,771

|

|

30.6

|

%

|

$

|

1,452,783

|

|

29.3

|

%

|

$

|

118,988

|

|

8.2

|

%

|

||

|

Furniture

|

883,341

|

|

17.2

|

|

829,725

|

|

16.8

|

|

53,616

|

|

6.5

|

|

|||||

|

Home

|

799,494

|

|

15.5

|

|

783,860

|

|

15.8

|

|

15,634

|

|

2.0

|

|

|||||

|

Play n' Wear

|

776,445

|

|

15.1

|

|

811,750

|

|

16.4

|

|

(35,305

|

)

|

(4.3

|

)

|

|||||

|

Seasonal

|

683,498

|

|

13.3

|

|

642,220

|

|

13.0

|

|

41,278

|

|

6.4

|

|

|||||

|

Hardlines & Other

|

425,615

|

|

8.3

|

|

431,906

|

|

8.7

|

|

(6,291

|

)

|

(1.5

|

)

|

|||||

|

Net sales

|

$

|

5,140,164

|

|

100.0

|

%

|

$

|

4,952,244

|

|

100.0

|

%

|

$

|

187,920

|

|

3.8

|

%

|

||

|

|

2010

|

2009

|

Change

|

||||||||||||||

|

(in thousands)

|

|

|

|

|

|

|

|||||||||||

|

Consumables

|

$

|

1,452,783

|

|

29.3

|

%

|

$

|

1,456,370

|

|

30.8

|

%

|

$

|

(3,587

|

)

|

(0.2

|

)%

|

||

|

Furniture

|

829,725

|

|

16.8

|

|

716,785

|

|

15.2

|

|

112,940

|

|

15.8

|

|

|||||

|

Play n' Wear

|

811,750

|

|

16.4

|

|

806,247

|

|

17.1

|

|

5,503

|

|

0.7

|

|

|||||

|

Home

|

783,860

|

|

15.8

|

|

717,744

|

|

15.2

|

|

66,116

|

|

9.2

|

|

|||||

|

Seasonal

|

642,220

|

|

13.0

|

|

591,321

|

|

12.5

|

|

50,899

|

|

8.6

|

|

|||||

|

Hardlines & Other

|

431,906

|

|

8.7

|

|

438,305

|

|

9.2

|

|

(6,399

|

)

|

(1.5

|

)

|

|||||

|

Net sales

|

$

|

4,952,244

|

|

100.0

|

%

|

$

|

4,726,772

|

|

100.0

|

%

|

$

|

225,472

|

|

4.8

|

%

|

||

|

Payments Due by Period

(1)

|

|||||||||||||||

|

Less than

|

More than

|

||||||||||||||

|

Total

|

1 year

|

1 to 3 years

|

3 to 5 years

|

5 years

|

|||||||||||

|

(In thousands)

|

|||||||||||||||

|

Obligations under bank credit facility

(2)

|

$

|

65,975

|

|

$

|

75

|

|

$

|

—

|

|

$

|

65,900

|

|

$

|

—

|

|

|

Operating lease obligations

(3) (4)

|

1,208,513

|

|

311,751

|

|

481,978

|

|

257,859

|

|

156,925

|

|

|||||

|

Capital lease obligations

(4)

|

3,162

|

|

1,340

|

|

1,791

|

|

31

|

|

—

|

|

|||||

|

Purchase obligations

(4) (5)

|

815,971

|

|

713,495

|

|

84,932

|

|

17,544

|

|

—

|

|

|||||

|

Other long-term liabilities

(6)

|

48,190

|

|

5,307

|

|

5,391

|

|

11,017

|

|

26,475

|

|

|||||

|

Total contractual obligations

(7)

|

$

|

2,141,811

|

|

$

|

1,031,968

|

|

$

|

574,092

|

|

$

|

352,351

|

|

$

|

183,400

|

|

|

(1)

|

The disclosure of contractual obligations in this table is based on assumptions and estimates that we believe to be reasonable as of the date of this report. Those assumptions and estimates may prove to be inaccurate; consequently, the amounts provided in the table may differ materially from those amounts that we ultimately incur. Variables that may cause the stated amounts to vary from the amounts actually incurred include, but are not limited to: the termination of a contractual obligation prior to its stated or anticipated expiration; fees or damages incurred as a result of the premature termination or breach of a contractual obligation; the acquisition of more or less services or goods under a contractual obligation than are anticipated by us as of the date of this report; fluctuations in third party fees, governmental charges, or market rates that we are obligated to pay under contracts we have with certain vendors; and the exercise of renewal options under, or the automatic renewal of, contracts that provide for the same.

|

|

(2)

|

Obligations under the bank credit facility consist of the borrowings outstanding under the 2011 Credit Agreement, and the associated accrued interest of $0.1 million. In addition, we had outstanding letters of credit totaling

$55.2 million

at

January 28, 2012

. Approximately $51.3 million of the outstanding letters of credit represent stand-by letters of credit and we do not expect to meet the conditions requiring significant cash payments on these letters of credit; accordingly, they have been excluded from this table. The remaining outstanding letters of credit represent commercial letters of credit whereby the related obligation is included in the purchase obligations. For a further discussion, see

|

|

(3)

|

Operating lease obligations include, among other items, leases for retail stores, warehouse space, offices, and certain computer and other business equipment. The future minimum commitments for retail store, office, and warehouse space operating leases are

$927.4 million

. For a further discussion of leases, see note 5 to the accompanying consolidated financial statements. Many of the store lease obligations require us to pay for our applicable portion of CAM, real estate taxes, and property insurance. In connection with our store lease obligations, we estimated that future obligations for CAM, real estate taxes, and property insurance were $269.5 million at

January 28, 2012

. We have made certain assumptions and estimates in order to account for our contractual obligations relative to CAM, real estate taxes, and property insurance. Those assumptions and estimates include, but are not limited to: use of historical data to estimate our future obligations; calculation of our obligations based on comparable store averages where no historical data is available for a particular leasehold; and assumptions related to average expected increases over historical data. The remaining lease obligation of $11.6 million relates primarily to operating leases for computer and other business equipment, including data center related costs.

|

|

(4)

|

For purposes of the lease and purchase obligation disclosures, we have assumed that we will make all payments scheduled or reasonably estimated to be made under those obligations that have a determinable expiration date, and we disregarded the possibility that such obligations may be prematurely terminated or extended, whether automatically by the terms of the obligation or by agreement between us and the counterparty, due to the speculative nature of premature termination or extension. Where an operating lease or purchase obligation is subject to a month-to-month term or another automatically renewing term, we included in the table our minimum commitment under such obligation, such as one month in the case of a month-to-month obligation and the then-current term in the case of another automatically renewing term, due to the uncertainty of future decisions to exercise options to extend or terminate any existing leases.

|

|

(5)

|

Purchase obligations include outstanding purchase orders for merchandise issued in the ordinary course of our business that are valued at

$514.0 million

, the entirety of which represents obligations due within one year of

January 28, 2012

. In addition, we have a purchase commitment for future inventory purchases totaling

$80.8 million

at

January 28, 2012

. While we are not required to meet any periodic minimum purchase requirements under this commitment, we have included, for purposes of this tabular disclosure, the value of the purchases that we anticipate making during each of the reported periods as purchases that will count toward our fulfillment of the aggregate obligation. The remaining

$221.2 million

of purchase obligations is primarily related to distribution and transportation, information technology, print advertising, energy procurement, and other store security, supply, and maintenance commitments.

|

|

(6)

|

Other long-term liabilities include $23.8 million for expected contributions to the Pension Plan and our nonqualified, unfunded supplemental defined benefit pension plan (“Supplemental Pension Plan”), $20.4 million for obligations related to our nonqualified deferred compensation plan, $2.3 million for unrecognized tax benefits, and $0.6 million for closed store lease termination costs related to stores closed in 2011. Pension contributions are equal to expected benefit payments for the nonqualified plan plus expected contributions to the qualified plan using actuarial estimates and assuming that we only make the minimum required contributions (see note 8 to the accompanying consolidated financial statements for additional information about our employee benefit plans). We have estimated the payments due by period for the nonqualified deferred compensation plan based on an average of historical distributions. We have included unrecognized tax benefits of $1.5 million for payments expected in 2012 and $0.8 million of timing-related income tax uncertainties anticipated to reverse in 2012. Unrecognized tax benefits in the amount of $20.2 million have been excluded from the table because we are unable to make a reasonably reliable estimate of the timing of future payments. Our closed store lease termination cost payments are based on contractual terms.

|

|

(7)

|

The obligations disclosed in this table are exclusive of the contingent liabilities, guarantees, and indemnities related to the KB Toys business. For further discussion, see note 13 to the accompanying consolidated financial statements.

|

|

Consolidated Statements of Operations (In thousands, except per share amounts) |

|

|

2011

|

2010

|

2009

|

||||||

|

Net sales

|

$

|

5,202,269

|

|

$

|

4,952,244

|

|

$

|

4,726,772

|

|

|

Cost of sales (exclusive of depreciation expense shown separately below)

|

3,131,862

|

|

2,939,793

|

|

2,807,466

|

|

|||

|

Gross margin

|

2,070,407

|

|

2,012,451

|

|

1,919,306

|

|

|||

|

Selling and administrative expenses

|

1,634,532

|

|

1,576,500

|

|

1,532,356

|

|

|||

|

Depreciation expense

|

90,280

|

|

78,606

|

|

74,904

|

|

|||

|

Gain on sale of real estate

|

—

|

|

—

|

|

(12,964

|

)

|

|||

|

Operating profit

|

345,595

|

|

357,345

|

|

325,010

|

|

|||

|

Interest expense

|

(3,530

|

)

|

(2,573

|

)

|

(1,840

|

)

|

|||

|

Other income (expense)

|

(173

|

)

|

612

|

|

175

|

|

|||

|

Income from continuing operations before income taxes

|

341,892

|

|

355,384

|

|

323,345

|

|

|||

|

Income tax expense

|

134,657

|

|

132,837

|

|

121,975

|

|

|||

|

Income from continuing operations

|

207,235

|

|

222,547

|

|

201,370

|

|

|||

|

Loss from discontinued operations, net of tax benefit of $112, $14 and $656 in fiscal years 2011, 2010 and 2009, respectively

|

(171

|

)

|

(23

|

)

|

(1,001

|

)

|

|||

|

Net income

|

$

|

207,064

|

|

$

|

222,524

|

|

$

|

200,369

|

|

|

Earnings per common share - basic

|

|

|

|

|

|

|

|||

|

Continuing operations

|

$

|

3.03

|

|

$

|

2.87

|

|

$

|

2.47

|

|

|

Discontinued operations

|

—

|

|

—

|

|

(0.01

|

)

|

|||

|

|

$

|

3.03

|

|

$

|

2.87

|

|

$

|

2.45

|

|

|

Earnings per common share - diluted

|

|

|

|

|

|

|

|||

|

Continuing operations

|

$

|

2.99

|

|

$

|

2.83

|

|

$

|

2.44

|

|

|

Discontinued operations

|

—

|

|

—

|

|

(0.01

|

)

|

|||

|

|

$

|

2.98

|

|

$

|

2.83

|

|

$

|

2.42

|

|

|

Consolidated Balance Sheets

(In thousands, except par value)

|

|

|

January 28, 2012

|

January 29, 2011

|

|||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

68,547

|

|

$

|

177,539

|

|

|

|

Inventories

|

825,195

|

|

762,146

|

|

|||

|

Deferred income taxes

|

42,784

|

|

50,252

|

|

|||

|

Other current assets

|

70,130

|

|

61,782

|

|

|||

|

Total current assets

|

1,006,656

|

|

1,051,719

|

|

|||

|

Property and equipment - net

|

572,767

|

|

524,906

|

|

|||

|

Deferred income taxes

|

6,549

|

|

6,666

|

|

|||

|

Restricted cash

|

—

|

|

8,000

|

|

|||

|

Goodwill

|

12,282

|

|

—

|

|

|||

|

Other assets

|

43,056

|

|

28,308

|

|

|||

|

Total assets

|

$

|

1,641,310

|

|

$

|

1,619,599

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|||

|

Current liabilities:

|

|

|

|

|

|||

|

Accounts payable

|

$

|

350,117

|

|

$

|

302,818

|

|

|

|

Property, payroll, and other taxes

|

74,396

|

|

75,401

|

|

|||

|

Accrued operating expenses

|

56,088

|

|

53,771

|

|

|||

|

Insurance reserves

|

35,159

|

|

37,741

|

|

|||

|

KB bankruptcy lease obligation

|

3,115

|

|

3,552

|

|

|||

|

Accrued salaries and wages

|

29,170

|

|

43,433

|

|

|||

|

Income taxes payable

|

36,775

|

|

25,215

|

|

|||

|

Total current liabilities

|

584,820

|

|

541,931

|

|

|||

|

Long-term obligations

|

65,900

|

|

—

|

|

|||

|

Deferred rent

|

59,320

|

|

42,037

|

|

|||

|

Insurance reserves

|

49,794

|

|

46,145

|

|

|||

|

Unrecognized tax benefits

|

18,681

|

|

19,142

|

|

|||

|

Other liabilities

|

39,562

|

|

23,551

|

|

|||

|

Shareholders’ equity:

|

|

|

|

|

|||

|

Preferred shares - authorized 2,000 shares; $0.01 par value; none issued

|

—

|

|

—

|

|

|||

|

Common shares - authorized 298,000 shares; $0.01 par value; issued 117,495 shares; outstanding 63,609 shares and 73,894 shares, respectively

|

1,175

|

|

1,175

|

|

|||

|

Treasury shares - 53,886 shares and 43,601 shares, respectively, at cost

|

(1,423,524

|

)

|

(1,079,130

|

)

|

|||

|

Additional paid-in capital

|

542,160

|

|

523,341

|

|

|||

|

Retained earnings

|

1,718,941

|

|

1,511,877

|

|

|||

|

Accumulated other comprehensive loss

|

(15,519

|

)

|

(10,470

|

)

|

|||

|

Total shareholders' equity

|

823,233

|

|

946,793

|

|

|||

|

Total liabilities and shareholders' equity

|

$

|

1,641,310

|

|

$

|

1,619,599

|

|

|

|

BIG LOTS, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity (In thousands) |

|

|

Common

|

Treasury

|

Additional

Paid-In

Capital

|

Retained Earnings

|

Accumulated Other Comprehensive Loss

|

|

||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

Total

|

|||||||||||||||||

|

Balance - January 31, 2009

|

81,315

|

|

$

|

1,175

|

|

36,180

|

|

$

|

(804,561

|

)

|

$

|

504,552

|

|

$

|

1,088,984

|

|

$

|

(15,305

|

)

|

$

|

774,845

|

|

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

200,369

|

|

—

|

|

200,369

|

|

||||||

|

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Amortization of pension, net of tax of $(1,105)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,740

|

|

1,740

|

|

||||||

|

Valuation of adjustment of pensions, net of tax of $(273)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

430

|

|

430

|

|

||||||

|

Comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

202,539

|

|

||||||

|

Purchases of common shares

|

(87

|

)

|

—

|

|

87

|

|

(1,849

|

)

|

—

|

|

—

|

|

—

|

|

(1,849

|

)

|

||||||

|

Exercise of stock options

|

362

|

|

—

|

|

(362

|

)

|

8,045

|

|

(3,114

|

)

|

—

|

|

—

|

|

4,931

|

|

||||||

|

Restricted shares vested

|

328

|

|

—

|

|

(328

|

)

|

7,291

|

|

(7,291

|

)

|

—

|

|

—

|

|

—

|

|

||||||

|

Tax benefit from share-based awards

|

—

|

|

—

|

|

—

|

|

—

|

|

559

|

|

—

|

|

—

|

|

559

|

|

||||||

|

Share activity related to deferred compensation plan

|

4

|

|

—

|

|

(4

|

)

|

32

|

|

80

|

|

—

|

|

—

|

|

112

|

|

||||||

|

Share-based employee compensation expense

|

—

|

|

—

|

|

—

|

|

—

|

|

20,275

|

|

—

|

|

—

|

|

20,275

|

|

||||||

|

Balance - January 30, 2010

|

81,922

|

|

1,175

|

|

35,573

|

|

(791,042

|

)

|

515,061

|

|

1,289,353

|

|

(13,135

|

)

|

1,001,412

|

|

||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

222,524

|

|

—

|

|

222,524

|

|

||||||

|

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Amortization of pension, net of tax of $(869)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,328

|

|

1,328

|

|

||||||

|

Valuation adjustment of pension, net of tax of $(876)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,337

|

|

1,337

|

|

||||||

|

Comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

225,189

|

|

||||||

|

Purchases of common shares

|

(10,686

|

)

|

—

|

|

10,686

|

|

(350,823

|

)

|

—

|

|

—

|

|

—

|

|

(350,823

|

)

|

||||||

|

Exercise of stock options

|

1,808

|

|

—

|

|

(1,808

|

)

|

42,285

|

|

(9,773

|

)

|

—

|

|

—

|

|

32,512

|

|

||||||

|

Restricted shares vested

|

847

|

|

—

|

|

(847

|

)

|

20,437

|

|

(20,437

|

)

|

—

|

|

—

|

|

—

|

|

||||||

|

Tax benefit from share-based awards

|

—

|

|

—

|

|

—

|

|

—

|

|

13,779

|

|

—

|

|

—

|

|

13,779

|

|

||||||

|

Share activity related to deferred compensation plan

|

3

|

|

—

|

|

(3

|

)

|

13

|

|

83

|

|

—

|

|

—

|

|

96

|

|

||||||

|

Share-based employee compensation expense

|

—

|

|

—

|

|

—

|

|

—

|

|

24,628

|

|

—

|

|

—

|

|

24,628

|

|

||||||

|

Balance - January 29, 2011

|

73,894

|

|

1,175

|

|

43,601

|

|

(1,079,130

|

)

|

523,341

|

|

1,511,877

|

|

(10,470

|

)

|

946,793

|

|

||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

207,064

|

|

—

|

|

207,064

|

|

||||||

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Foreign currency translation

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(1,050

|

)

|

(1,050

|

)

|

||||||

|

Amortization of pension, net of tax of $(703)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,066

|

|

1,066

|

|

||||||

|

Valuation adjustment of pension, net of tax of $3,337

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(5,065

|

)

|

(5,065

|

)

|

||||||

|

Comprehensive income

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

202,015

|

|

||||||

|

Purchases of common shares

|

(11,063

|

)

|

—

|

|

11,063

|

|

(363,957

|

)

|

—

|

|

—

|

|

—

|

|

(363,957

|

)

|

||||||

|

Exercise of stock options

|

500

|

|

—

|

|

(500

|

)

|

12,800

|

|

(2,391

|

)

|

—

|

|

—

|

|

10,409

|

|

||||||

|

Restricted shares vested

|

271

|

|

—

|

|

(271

|

)

|

6,731

|

|

(6,731

|

)

|

—

|

|

—

|

|

—

|

|

||||||

|

Tax benefit from share-based awards

|

—

|

|

—

|

|

—

|

|

—

|

|

2,701

|

|

—

|

|

—

|

|

2,701

|

|

||||||

|

Share activity related to deferred compensation plan

|

7

|

|

—

|

|

(7

|

)

|

32

|

|

247

|

|

—

|

|

—

|

|

279

|

|

||||||

|

Share-based employee compensation expense

|

—

|

|

—

|

|

—

|

|

—

|

|

24,993

|

|

—

|

|

—

|

|

24,993

|

|

||||||

|

Balance - January 28, 2012

|

63,609

|

|

$

|

1,175

|

|

53,886

|

|

$

|

(1,423,524

|

)

|

$

|

542,160

|

|

$

|

1,718,941

|

|

$

|

(15,519

|

)

|

$

|

823,233

|

|

|

Consolidated Statements of Cash Flows (In thousands) |

|

2011

|

2010

|

2009

|

|||||||||

|

Operating activities:

|

|||||||||||

|

Net income

|

$

|

207,064

|

|

$

|

222,524

|

|

$

|

200,369

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|||||||

|

Depreciation and amortization expense

|

82,851

|

|

74,041

|

|

71,501

|

|

|||||

|

Deferred income taxes

|

10,456

|

|

20,485

|

|

18,014

|

|

|||||

|

KB Toys matters

|

—

|

|

—

|

|

409

|

|

|||||

|

Non-cash share-based compensation expense

|

24,993

|

|

24,628

|

|

20,275

|

|

|||||

|

Excess tax benefit from share-based awards

|

(2,701

|

)

|

(13,779

|

)

|

(1,568

|

)

|

|||||

|

Non-cash impairment charge

|

2,242

|

|

18

|

|

358

|

|

|||||

|

Loss on disposition of equipment

|

1,376

|

|

639

|

|

1,072

|

|

|||||

|

Gain on sale of real estate

|

—

|

|

—

|

|

(12,964

|

)

|

|||||

|

Pension

|

2,023

|

|

4,479

|

|

(5,193

|

)

|

|||||

|

Change in assets and liabilities, excluding effects of acquisition:

|

|

|

|

|

|||||||

|

Inventories

|

(54,512

|

)

|

(30,809

|

)

|

5,279

|

|

|||||

|

Accounts payable

|

31,555

|

|

(7,045

|

)

|

73,889

|

|

|||||

|

Current income taxes

|

10,293

|

|

12,043

|

|

(2,791

|

)

|

|||||

|

Other current assets

|

(6,082

|

)

|

(5,250

|

)

|

(2,177

|

)

|

|||||

|

Other current liabilities

|

(16,465

|

)

|

(5,816

|

)