|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

33-0112644

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

|

(Do not check if a smaller reporting company)

|

||

|

|

|

Page

|

|

PART I —

FINANCIAL INFORMATION

|

||

|

Item 1.

|

Financial Statements (unaudited)

|

|

|

Certain totals may not sum due to rounding.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II —

OTHER INFORMATION

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 2.

|

||

|

Item 6.

|

||

|

•

|

the anticipated amount, timing and accounting of revenues, contingent payments, milestone, royalty and other payments under licensing, collaboration or acquisition agreements, tax positions and contingencies, collectability of receivables, pre-approval inventory, cost of sales, research and development costs, compensation and other selling, general and administrative expenses, amortization of intangible assets, foreign currency exchange risk, estimated fair value of assets and liabilities and impairment assessments;

|

|

•

|

expectations, plans and prospects relating to sales, pricing, growth and launch of our marketed and pipeline products;

|

|

•

|

the potential impact of increased product competition in the markets in which we compete;

|

|

•

|

the proposed spin off of our hemophilia business, including the completion and timing of the spin off and its anticipated benefits, costs and tax treatment;

|

|

•

|

the costs and timing of potential clinical trials, filing and approvals, and the potential therapeutic scope of the development and commercialization of our and our collaborators’ pipeline products;

|

|

•

|

the drivers for growing our business, including our plans and intent to commit resources relating to research and development programs;

|

|

•

|

our manufacturing capacity, use of third-party contract manufacturing organizations and plans and timing relating to the expansion of our manufacturing capabilities, including investments and activities in new manufacturing facilities;

|

|

•

|

the expected financial impact of ceasing manufacturing activities and fully or partially vacating our biologics manufacturing facility in Cambridge, MA and warehouse space in Somerville, MA;

|

|

•

|

the impact of the continued uncertainty of the credit and economic conditions in certain countries in Europe and our collection of accounts receivable in such countries;

|

|

•

|

the potential impact on our results of operations and liquidity of the United Kingdom's (U.K.'s) intent to voluntarily depart from the European Union (E.U.);

|

|

•

|

the potential impact of healthcare reform in the United States (U.S.) and measures being taken worldwide designed to reduce healthcare costs to constrain the overall level of government expenditures, including the impact of pricing actions and reduced reimbursement for our products;

|

|

•

|

the timing, outcome and impact of administrative, regulatory, legal and other proceedings related to patents and other proprietary and intellectual property rights, tax audits, assessments and settlements, pricing matters, sales and promotional practices, product liability and other matters;

|

|

•

|

lease commitments, purchase obligations and the timing and satisfaction of other contractual obligations;

|

|

•

|

potential costs and expenses incurred to execute business transformation and optimization initiatives;

|

|

•

|

our ability to finance our operations and business initiatives and obtain funding for such activities; and

|

|

•

|

the impact of new laws and accounting standards.

|

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||

|

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Revenues:

|

|||||||||||||||

|

Product, net

|

$

|

2,466.0

|

|

$

|

2,198.6

|

|

$

|

4,775.4

|

|

$

|

4,370.9

|

|

|||

|

Revenues from anti-CD20 therapeutic programs

|

349.2

|

|

337.5

|

|

678.7

|

|

668.1

|

|

|||||||

|

Other

|

79.0

|

|

55.6

|

|

166.9

|

|

107.6

|

|

|||||||

|

Total revenues

|

2,894.2

|

|

2,591.6

|

|

5,621.0

|

|

5,146.6

|

|

|||||||

|

Cost and expenses:

|

|||||||||||||||

|

Cost of sales, excluding amortization of acquired intangible assets

|

370.3

|

|

286.1

|

|

683.3

|

|

598.6

|

|

|||||||

|

Research and development

|

473.1

|

|

490.7

|

|

910.4

|

|

951.3

|

|

|||||||

|

Selling, general and administrative

|

492.4

|

|

491.9

|

|

989.7

|

|

1,052.3

|

|

|||||||

|

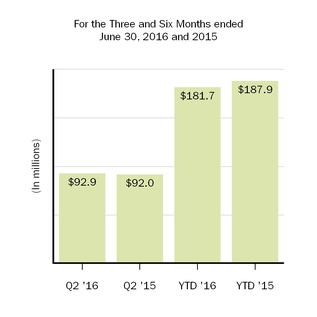

Amortization of acquired intangible assets

|

92.9

|

|

92.0

|

|

181.7

|

|

187.9

|

|

|||||||

|

(Gain) loss on fair value remeasurement of contingent consideration

|

10.6

|

|

(2.2

|

)

|

12.9

|

|

5.6

|

|

|||||||

|

Restructuring charges

|

—

|

|

—

|

|

9.7

|

|

—

|

|

|||||||

|

Collaboration profit (loss) sharing

|

(5.6

|

)

|

—

|

|

(5.6

|

)

|

—

|

|

|||||||

|

Total cost and expenses

|

1,433.7

|

|

1,358.5

|

|

2,782.1

|

|

2,795.6

|

|

|||||||

|

Income from operations

|

1,460.5

|

|

1,233.1

|

|

2,838.9

|

|

2,351.0

|

|

|||||||

|

Other income (expense), net

|

(58.5

|

)

|

(10.9

|

)

|

(111.3

|

)

|

(25.9

|

)

|

|||||||

|

Income before income tax expense and equity in loss of investee, net of tax

|

1,402.0

|

|

1,222.2

|

|

2,727.6

|

|

2,325.1

|

|

|||||||

|

Income tax expense

|

353.6

|

|

292.5

|

|

710.0

|

|

574.4

|

|

|||||||

|

Equity in loss of investee, net of tax

|

—

|

|

4.9

|

|

—

|

|

5.7

|

|

|||||||

|

Net income

|

1,048.4

|

|

924.8

|

|

2,017.6

|

|

1,745.0

|

|

|||||||

|

Net income (loss) attributable to noncontrolling interests, net of tax

|

(1.4

|

)

|

(2.5

|

)

|

(3.1

|

)

|

(4.8

|

)

|

|||||||

|

Net income attributable to Biogen Inc.

|

$

|

1,049.8

|

|

$

|

927.3

|

|

$

|

2,020.7

|

|

$

|

1,749.8

|

|

|||

|

Net income per share:

|

|||||||||||||||

|

Basic earnings per share attributable to Biogen Inc.

|

$

|

4.79

|

|

$

|

3.94

|

|

$

|

9.23

|

|

$

|

7.44

|

|

|||

|

Diluted earnings per share attributable to Biogen Inc.

|

$

|

4.79

|

|

$

|

3.93

|

|

$

|

9.21

|

|

$

|

7.42

|

|

|||

|

Weighted-average shares used in calculating:

|

|||||||||||||||

|

Basic earnings per share attributable to Biogen Inc.

|

219.1

|

|

235.3

|

|

219.0

|

|

235.1

|

|

|||||||

|

Diluted earnings per share attributable to Biogen Inc.

|

219.4

|

|

235.7

|

|

219.3

|

|

235.7

|

|

|||||||

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||

|

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Net income attributable to Biogen Inc.

|

$

|

1,049.8

|

|

$

|

927.3

|

|

$

|

2,020.7

|

|

$

|

1,749.8

|

|

|||

|

Other comprehensive income:

|

|||||||||||||||

|

Unrealized gains (losses) on securities available for sale, net of tax

|

4.5

|

|

(0.2

|

)

|

7.0

|

|

1.1

|

|

|||||||

|

Unrealized gains (losses) on cash flow hedges, net of tax

|

29.3

|

|

(96.2

|

)

|

(18.3

|

)

|

(8.9

|

)

|

|||||||

|

Unrealized gains (losses) on pension benefit obligation

|

0.7

|

|

2.9

|

|

0.9

|

|

4.1

|

|

|||||||

|

Currency translation adjustment

|

(58.0

|

)

|

63.0

|

|

(48.4

|

)

|

(37.8

|

)

|

|||||||

|

Total other comprehensive income (loss), net of tax

|

(23.5

|

)

|

(30.5

|

)

|

(58.8

|

)

|

(41.5

|

)

|

|||||||

|

Comprehensive income attributable to Biogen Inc.

|

1,026.3

|

|

896.8

|

|

1,961.9

|

|

1,708.3

|

|

|||||||

|

Comprehensive income (loss) attributable to noncontrolling interests, net of tax

|

(1.4

|

)

|

(2.3

|

)

|

(3.1

|

)

|

(4.5

|

)

|

|||||||

|

Comprehensive income

|

$

|

1,024.9

|

|

$

|

894.5

|

|

$

|

1,958.8

|

|

$

|

1,703.7

|

|

|||

|

As of June 30,

2016 |

As of December 31,

2015 |

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

1,362.0

|

|

$

|

1,308.0

|

|

|

|

Marketable securities

|

2,434.8

|

|

2,120.5

|

|

|||

|

Accounts receivable, net

|

1,293.0

|

|

1,227.0

|

|

|||

|

Due from anti-CD20 therapeutic programs

|

334.1

|

|

314.5

|

|

|||

|

Inventory

|

996.4

|

|

893.4

|

|

|||

|

Other current assets

|

1,027.4

|

|

836.9

|

|

|||

|

Total current assets

|

7,447.7

|

|

6,700.3

|

|

|||

|

Marketable securities

|

3,477.6

|

|

2,760.4

|

|

|||

|

Property, plant and equipment, net

|

2,301.8

|

|

2,187.6

|

|

|||

|

Intangible assets, net

|

3,967.6

|

|

4,085.1

|

|

|||

|

Goodwill

|

3,167.1

|

|

2,663.8

|

|

|||

|

Investments and other assets

|

1,153.0

|

|

1,107.6

|

|

|||

|

Total assets

|

$

|

21,514.8

|

|

$

|

19,504.8

|

|

|

|

LIABILITIES AND EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Current portion of notes payable and other financing arrangements

|

$

|

4.8

|

|

$

|

4.8

|

|

|

|

Taxes payable

|

212.8

|

|

208.7

|

|

|||

|

Accounts payable

|

225.9

|

|

267.4

|

|

|||

|

Accrued expenses and other

|

2,072.7

|

|

2,096.8

|

|

|||

|

Total current liabilities

|

2,516.2

|

|

2,577.7

|

|

|||

|

Notes payable and other financing arrangements

|

6,538.3

|

|

6,521.5

|

|

|||

|

Long-term deferred tax liability

|

105.6

|

|

124.9

|

|

|||

|

Other long-term liabilities

|

951.0

|

|

905.8

|

|

|||

|

Total liabilities

|

10,111.1

|

|

10,129.9

|

|

|||

|

Commitments and contingencies

|

|

|

|

|

|||

|

Equity:

|

|||||||

|

Biogen Inc. shareholders’ equity

|

|||||||

|

Preferred stock, par value $0.001 per share

|

—

|

|

—

|

|

|||

|

Common stock, par value $0.0005 per share

|

0.1

|

|

0.1

|

|

|||

|

Additional paid-in capital

|

69.1

|

|

—

|

|

|||

|

Accumulated other comprehensive loss

|

(282.8

|

)

|

(224.0

|

)

|

|||

|

Retained earnings

|

14,229.1

|

|

12,208.4

|

|

|||

|

Treasury stock, at cost

|

(2,611.7

|

)

|

(2,611.7

|

)

|

|||

|

Total Biogen Inc. shareholders’ equity

|

11,403.8

|

|

9,372.8

|

|

|||

|

Noncontrolling interests

|

(0.1

|

)

|

2.1

|

|

|||

|

Total equity

|

11,403.7

|

|

9,374.9

|

|

|||

|

Total liabilities and equity

|

$

|

21,514.8

|

|

$

|

19,504.8

|

|

|

|

|

For the Six Months

Ended June 30, |

||||||

|

|

2016

|

2015

|

|||||

|

Cash flows from operating activities:

|

|||||||

|

Net income

|

$

|

2,017.6

|

|

$

|

1,745.0

|

|

|

|

Adjustments to reconcile net income to net cash flows from operating activities:

|

|||||||

|

Depreciation and amortization

|

325.1

|

|

292.5

|

|

|||

|

Share-based compensation

|

84.1

|

|

93.7

|

|

|||

|

Deferred income taxes

|

(30.2

|

)

|

(90.6

|

)

|

|||

|

Other

|

19.8

|

|

(5.8

|

)

|

|||

|

Changes in operating assets and liabilities, net:

|

|||||||

|

Accounts receivable

|

(65.0

|

)

|

(38.9

|

)

|

|||

|

Inventory

|

(128.3

|

)

|

(81.3

|

)

|

|||

|

Accrued expenses and other current liabilities

|

(162.3

|

)

|

(169.9

|

)

|

|||

|

Current taxes payable

|

(151.7

|

)

|

102.0

|

|

|||

|

Other changes in operating assets and liabilities, net

|

50.1

|

|

(66.4

|

)

|

|||

|

Net cash flows provided by operating activities

|

1,959.2

|

|

1,780.3

|

|

|||

|

Cash flows from investing activities:

|

|||||||

|

Proceeds from sales and maturities of marketable securities

|

2,823.6

|

|

975.5

|

|

|||

|

Purchases of marketable securities

|

(3,833.3

|

)

|

(2,045.0

|

)

|

|||

|

Acquisitions of business, net of cash acquired

|

—

|

|

(198.8

|

)

|

|||

|

Purchases of property, plant and equipment

|

(263.7

|

)

|

(227.7

|

)

|

|||

|

Contingent consideration related to Fumapharm AG acquisition

|

(600.0

|

)

|

(250.0

|

)

|

|||

|

Other

|

(65.9

|

)

|

(10.1

|

)

|

|||

|

Net cash flows used in investing activities

|

(1,939.3

|

)

|

(1,756.1

|

)

|

|||

|

Cash flows from financing activities:

|

|||||||

|

Purchase of treasury stock

|

—

|

|

(42.2

|

)

|

|||

|

Proceeds from issuance of stock for share-based compensation arrangements

|

23.9

|

|

34.7

|

|

|||

|

Excess tax benefit from share-based awards

|

9.0

|

|

69.7

|

|

|||

|

Other

|

1.1

|

|

15.0

|

|

|||

|

Net cash flows provided by financing activities

|

34.0

|

|

77.2

|

|

|||

|

Net increase in cash and cash equivalents

|

53.9

|

|

101.4

|

|

|||

|

Effect of exchange rate changes on cash and cash equivalents

|

0.1

|

|

(24.2

|

)

|

|||

|

Cash and cash equivalents, beginning of the period

|

1,308.0

|

|

1,204.9

|

|

|||

|

Cash and cash equivalents, end of the period

|

$

|

1,362.0

|

|

$

|

1,282.1

|

|

|

|

•

|

ASU No. 2015-05, Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer's Accounting for Fees Paid in a Cloud Computing Arrangement.

|

|

•

|

ASU No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory.

|

|

•

|

ASU No. 2015-16, Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments.

|

|

(In millions)

|

Workforce

Reduction

|

Pipeline

Programs

|

Total

|

||||||||

|

Restructuring reserve as of December 31, 2015

|

$

|

33.7

|

|

$

|

3.6

|

|

$

|

37.3

|

|

||

|

Expense

|

4.9

|

|

5.4

|

|

10.3

|

|

|||||

|

Payments

|

(28.7

|

)

|

(6.0

|

)

|

(34.7

|

)

|

|||||

|

Adjustments to previous estimates, net

|

(3.5

|

)

|

2.9

|

|

(0.6

|

)

|

|||||

|

Restructuring reserve as of June 30, 2016

|

$

|

6.4

|

|

$

|

5.9

|

|

$

|

12.3

|

|

||

|

(In millions)

|

Discounts

|

Contractual

Adjustments

|

Returns

|

Total

|

|||||||||||

|

Balance, as of December 31, 2015

|

$

|

56.1

|

|

$

|

548.7

|

|

$

|

57.9

|

|

$

|

662.7

|

|

|||

|

Current provisions relating to sales in current year

|

266.8

|

|

973.8

|

|

17.6

|

|

1,258.2

|

|

|||||||

|

Adjustments relating to prior years

|

(2.4

|

)

|

1.6

|

|

(5.5

|

)

|

(6.3

|

)

|

|||||||

|

Payments/credits relating to sales in current year

|

(210.2

|

)

|

(605.1

|

)

|

(0.7

|

)

|

(816.0

|

)

|

|||||||

|

Payments/credits relating to sales in prior years

|

(51.5

|

)

|

(384.9

|

)

|

(10.4

|

)

|

(446.8

|

)

|

|||||||

|

Balance, as of June 30, 2016

|

$

|

58.8

|

|

$

|

534.1

|

|

$

|

58.9

|

|

$

|

651.8

|

|

|||

|

(In millions)

|

As of

June 30, 2016 |

As of

December 31, 2015 |

|||||

|

Reduction of accounts receivable

|

$

|

161.3

|

|

$

|

144.6

|

|

|

|

Component of accrued expenses and other

|

490.5

|

|

518.1

|

|

|||

|

Total reserves

|

$

|

651.8

|

|

$

|

662.7

|

|

|

|

(In millions)

|

As of

June 30, 2016 |

As of

December 31, 2015 |

|||||

|

Raw materials

|

$

|

235.0

|

|

$

|

213.0

|

|

|

|

Work in process

|

654.6

|

|

577.6

|

|

|||

|

Finished goods

|

139.1

|

|

143.0

|

|

|||

|

Total inventory

|

$

|

1,028.7

|

|

$

|

933.6

|

|

|

|

Balance Sheet Classification:

|

|||||||

|

Inventory

|

$

|

996.4

|

|

$

|

893.4

|

|

|

|

Investments and other assets

|

32.3

|

|

40.2

|

|

|||

|

Total inventory

|

$

|

1,028.7

|

|

$

|

933.6

|

|

|

|

|

|

As of June 30, 2016

|

As of December 31, 2015

|

||||||||||||||||||||||

|

(In millions)

|

Estimated

Life

|

Cost

|

Accumulated

Amortization

|

Net

|

Cost

|

Accumulated

Amortization

|

Net

|

||||||||||||||||||

|

Out-licensed patents

|

13-23 years

|

$

|

543.3

|

|

$

|

(514.9

|

)

|

$

|

28.4

|

|

$

|

543.3

|

|

$

|

(506.0

|

)

|

$

|

37.3

|

|

||||||

|

Developed

technology

|

15-23 years

|

3,005.3

|

|

(2,604.5

|

)

|

400.8

|

|

3,005.3

|

|

(2,552.9

|

)

|

452.4

|

|

||||||||||||

|

In-process research and development

|

Indefinite until commercialization

|

692.3

|

|

—

|

|

692.3

|

|

730.5

|

|

—

|

|

730.5

|

|

||||||||||||

|

Trademarks and

tradenames

|

Indefinite

|

64.0

|

|

—

|

|

64.0

|

|

64.0

|

|

—

|

|

64.0

|

|

||||||||||||

|

Acquired and in-licensed rights

and patents

|

6-18 years

|

3,405.4

|

|

(623.3

|

)

|

2,782.1

|

|

3,303.2

|

|

(502.3

|

)

|

2,800.9

|

|

||||||||||||

|

Total intangible assets

|

$

|

7,710.3

|

|

$

|

(3,742.7

|

)

|

$

|

3,967.6

|

|

$

|

7,646.3

|

|

$

|

(3,561.2

|

)

|

$

|

4,085.1

|

|

|||||||

|

•

|

$50.0 million

in total milestone payments due to Samsung Bioepis, which became payable upon the approval of BENEPALI and FLIXABI in the E.U. in January 2016 and May 2016, respectively;

|

|

•

|

$20.0 million

milestone payment due to AbbVie Biotherapeutics, Inc. (AbbVie), which became payable upon the regulatory approval of ZINBRYTA in the U.S. in May 2016; and

|

|

•

|

$26.5 million

upon the approval of ALPROLIX in the E.U. in May 2016, which is comprised of a

$20.0 million

contingent payment due to the former owners of Syntonix Pharmaceuticals, Inc. (Syntonix) and

$6.5 million

related to the establishment of a corresponding deferred tax liability.

|

|

(In millions)

|

As of

June 30, 2016 |

||

|

2016 (remaining six months)

|

$

|

181.6

|

|

|

2017

|

325.1

|

|

|

|

2018

|

298.2

|

|

|

|

2019

|

282.7

|

|

|

|

2020

|

277.1

|

|

|

|

2021

|

265.0

|

|

|

|

(In millions)

|

As of

June 30, 2016 |

||

|

Goodwill, beginning of period

|

$

|

2,663.8

|

|

|

Increase to goodwill

|

515.0

|

|

|

|

Other

|

(11.7

|

)

|

|

|

Goodwill, end of period

|

$

|

3,167.1

|

|

|

As of June 30, 2016 (In millions)

|

Total

|

Quoted Prices

in Active

Markets

(Level 1)

|

Significant Other

Observable Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

|||||||||||

|

Assets:

|

|||||||||||||||

|

Cash equivalents

|

$

|

874.6

|

|

$

|

—

|

|

$

|

874.6

|

|

$

|

—

|

|

|||

|

Marketable debt securities:

|

|||||||||||||||

|

Corporate debt securities

|

2,290.3

|

|

—

|

|

2,290.3

|

|

—

|

|

|||||||

|

Government securities

|

2,973.4

|

|

—

|

|

2,973.4

|

|

—

|

|

|||||||

|

Mortgage and other asset backed securities

|

648.7

|

|

—

|

|

648.7

|

|

—

|

|

|||||||

|

Marketable equity securities

|

32.4

|

|

32.4

|

|

—

|

|

—

|

|

|||||||

|

Derivative contracts

|

30.1

|

|

—

|

|

30.1

|

|

—

|

|

|||||||

|

Plan assets for deferred compensation

|

35.6

|

|

—

|

|

35.6

|

|

—

|

|

|||||||

|

Total

|

$

|

6,885.1

|

|

$

|

32.4

|

|

$

|

6,852.7

|

|

$

|

—

|

|

|||

|

Liabilities:

|

|||||||||||||||

|

Derivative contracts

|

$

|

24.8

|

|

$

|

—

|

|

$

|

24.8

|

|

$

|

—

|

|

|||

|

Contingent consideration obligations

|

515.7

|

|

—

|

|

—

|

|

515.7

|

|

|||||||

|

Total

|

$

|

540.5

|

|

$

|

—

|

|

$

|

24.8

|

|

$

|

515.7

|

|

|||

|

As of December 31, 2015 (In millions)

|

Total

|

Quoted Prices

in Active

Markets

(Level 1)

|

Significant Other

Observable Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

|||||||||||

|

Assets:

|

|||||||||||||||

|

Cash equivalents

|

$

|

909.5

|

|

$

|

—

|

|

$

|

909.5

|

|

$

|

—

|

|

|||

|

Marketable debt securities:

|

|||||||||||||||

|

Corporate debt securities

|

1,510.9

|

|

—

|

|

1,510.9

|

|

—

|

|

|||||||

|

Government securities

|

2,875.9

|

|

—

|

|

2,875.9

|

|

—

|

|

|||||||

|

Mortgage and other asset backed securities

|

494.1

|

|

—

|

|

494.1

|

|

—

|

|

|||||||

|

Marketable equity securities

|

37.5

|

|

37.5

|

|

—

|

|

—

|

|

|||||||

|

Derivative contracts

|

27.2

|

|

—

|

|

27.2

|

|

—

|

|

|||||||

|

Plan assets for deferred compensation

|

40.1

|

|

—

|

|

40.1

|

|

—

|

|

|||||||

|

Total

|

$

|

5,895.2

|

|

$

|

37.5

|

|

$

|

5,857.7

|

|

$

|

—

|

|

|||

|

Liabilities:

|

|||||||||||||||

|

Derivative contracts

|

$

|

14.7

|

|

$

|

—

|

|

$

|

14.7

|

|

$

|

—

|

|

|||

|

Contingent consideration obligations

|

506.0

|

|

—

|

|

—

|

|

506.0

|

|

|||||||

|

Total

|

$

|

520.7

|

|

$

|

—

|

|

$

|

14.7

|

|

$

|

506.0

|

|

|||

|

|

As of June 30, 2016

|

As of December 31, 2015

|

|||||||||||||

|

(In millions)

|

Fair

Value

|

Carrying

Value

|

Fair

Value

|

Carrying

Value

|

|||||||||||

|

Notes payable to Fumedica

|

$

|

6.4

|

|

$

|

6.1

|

|

$

|

9.4

|

|

$

|

9.0

|

|

|||

|

6.875% Senior Notes due March 1, 2018

|

598.2

|

|

561.9

|

|

602.6

|

|

565.3

|

|

|||||||

|

2.900% Senior Notes due September 15, 2020

|

1,561.7

|

|

1,507.9

|

|

1,497.5

|

|

1,485.5

|

|

|||||||

|

3.625% Senior Notes due September 15, 2022

|

1,061.0

|

|

992.7

|

|

1,014.2

|

|

992.2

|

|

|||||||

|

4.050% Senior Notes due September 15, 2025

|

1,887.3

|

|

1,734.1

|

|

1,764.6

|

|

1,733.4

|

|

|||||||

|

5.200% Senior Notes due September 15, 2045

|

1,996.3

|

|

1,721.3

|

|

1,757.6

|

|

1,721.1

|

|

|||||||

|

Total

|

$

|

7,110.9

|

|

$

|

6,524.0

|

|

$

|

6,645.9

|

|

$

|

6,506.5

|

|

|||

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Fair value, beginning of period

|

$

|

508.3

|

|

$

|

461.8

|

|

$

|

506.0

|

|

$

|

215.5

|

|

|||

|

Additions

|

—

|

|

36.0

|

|

—

|

|

274.5

|

|

|||||||

|

Changes in fair value

|

10.6

|

|

(2.2

|

)

|

12.9

|

|

5.6

|

|

|||||||

|

Payments

|

(3.2

|

)

|

—

|

|

(3.2

|

)

|

—

|

|

|||||||

|

Fair value, end of period

|

$

|

515.7

|

|

$

|

495.6

|

|

$

|

515.7

|

|

$

|

495.6

|

|

|||

|

(In millions)

|

As of

June 30, 2016 |

As of

December 31, 2015 |

|||||

|

Commercial paper

|

$

|

56.9

|

|

$

|

21.9

|

|

|

|

Overnight reverse repurchase agreements

|

66.3

|

|

134.7

|

|

|||

|

Money market funds

|

531.5

|

|

673.8

|

|

|||

|

Short-term debt securities

|

219.9

|

|

79.1

|

|

|||

|

Total

|

$

|

874.6

|

|

$

|

909.5

|

|

|

|

As of June 30, 2016 (In millions)

|

Fair

Value

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Amortized

Cost

|

|||||||||||

|

Corporate debt securities

|

|||||||||||||||

|

Current

|

$

|

913.4

|

|

$

|

0.3

|

|

$

|

(0.2

|

)

|

$

|

913.3

|

|

|||

|

Non-current

|

1,376.9

|

|

7.8

|

|

(0.4

|

)

|

1,369.5

|

|

|||||||

|

Government securities

|

|||||||||||||||

|

Current

|

1,521.3

|

|

0.6

|

|

—

|

|

1,520.7

|

|

|||||||

|

Non-current

|

1,452.1

|

|

3.1

|

|

(0.6

|

)

|

1,449.6

|

|

|||||||

|

Mortgage and other asset backed securities

|

|||||||||||||||

|

Current

|

0.1

|

|

—

|

|

—

|

|

0.1

|

|

|||||||

|

Non-current

|

648.6

|

|

1.4

|

|

(0.9

|

)

|

648.1

|

|

|||||||

|

Total marketable debt securities

|

$

|

5,912.4

|

|

$

|

13.2

|

|

$

|

(2.1

|

)

|

$

|

5,901.3

|

|

|||

|

Marketable equity securities, non-current

|

$

|

32.4

|

|

$

|

0.9

|

|

$

|

(2.1

|

)

|

$

|

33.6

|

|

|||

|

As of December 31, 2015 (In millions)

|

Fair

Value

|

Gross

Unrealized

Gains

|

Gross

Unrealized

Losses

|

Amortized

Cost

|

|||||||||||

|

Corporate debt securities

|

|||||||||||||||

|

Current

|

$

|

394.3

|

|

$

|

—

|

|

$

|

(0.5

|

)

|

$

|

394.8

|

|

|||

|

Non-current

|

1,116.6

|

|

0.1

|

|

(4.1

|

)

|

1,120.6

|

|

|||||||

|

Government securities

|

|||||||||||||||

|

Current

|

1,723.4

|

|

0.1

|

|

(1.1

|

)

|

1,724.4

|

|

|||||||

|

Non-current

|

1,152.5

|

|

—

|

|

(3.1

|

)

|

1,155.6

|

|

|||||||

|

Mortgage and other asset backed securities

|

|||||||||||||||

|

Current

|

2.8

|

|

—

|

|

—

|

|

2.8

|

|

|||||||

|

Non-current

|

491.3

|

|

0.1

|

|

(1.8

|

)

|

493.0

|

|

|||||||

|

Total marketable debt securities

|

$

|

4,880.9

|

|

$

|

0.3

|

|

$

|

(10.6

|

)

|

$

|

4,891.2

|

|

|||

|

Marketable equity securities, non-current

|

$

|

37.5

|

|

$

|

9.2

|

|

$

|

—

|

|

$

|

28.3

|

|

|||

|

|

As of June 30, 2016

|

As of December 31, 2015

|

|||||||||||||

|

(In millions)

|

Estimated

Fair Value

|

Amortized

Cost

|

Estimated

Fair Value

|

Amortized

Cost

|

|||||||||||

|

Due in one year or less

|

$

|

2,434.8

|

|

$

|

2,434.1

|

|

$

|

2,120.5

|

|

$

|

2,122.0

|

|

|||

|

Due after one year through five years

|

3,255.9

|

|

3,245.4

|

|

2,575.9

|

|

2,583.9

|

|

|||||||

|

Due after five years

|

221.7

|

|

221.8

|

|

184.5

|

|

185.3

|

|

|||||||

|

Total available-for-sale securities

|

$

|

5,912.4

|

|

$

|

5,901.3

|

|

$

|

4,880.9

|

|

$

|

4,891.2

|

|

|||

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Proceeds from maturities and sales

|

$

|

1,642.5

|

|

$

|

601.9

|

|

$

|

2,823.6

|

|

$

|

975.5

|

|

|||

|

Realized gains

|

$

|

0.6

|

|

$

|

0.3

|

|

$

|

1.0

|

|

$

|

0.5

|

|

|||

|

Realized losses

|

$

|

(1.2

|

)

|

$

|

(0.5

|

)

|

$

|

(1.6

|

)

|

$

|

(0.8

|

)

|

|||

|

|

Notional Amount

|

||||||

|

Foreign Currency: (In millions)

|

As of

June 30, 2016 |

As of

December 31, 2015 |

|||||

|

Euro

|

$

|

1,126.5

|

|

$

|

945.5

|

|

|

|

Swiss francs

|

43.5

|

|

80.8

|

|

|||

|

Canadian dollar

|

39.9

|

|

76.7

|

|

|||

|

Total foreign currency forward contracts

|

$

|

1,209.9

|

|

$

|

1,103.0

|

|

|

|

For the Three Months Ended June 30,

|

||||||||||||||||||

|

Net Gains/(Losses)

Reclassified from AOCI into Operating Income

(Effective Portion)

|

Net Gains/(Losses)

Recognized into Net Income

(Ineffective Portion)

|

|||||||||||||||||

|

Location

|

2016

|

2015

|

Location

|

2016

|

2015

|

|||||||||||||

|

Revenue

|

$

|

(4.3

|

)

|

$

|

40.4

|

|

Other income (expense)

|

$

|

2.1

|

|

$

|

1.2

|

|

|||||

|

Operating expenses

|

$

|

(0.1

|

)

|

$

|

—

|

|

Other income (expense)

|

$

|

—

|

|

$

|

—

|

|

|||||

|

For the Six Months Ended June 30,

|

||||||||||||||||||

|

Net Gains/(Losses)

Reclassified from AOCI into Operating Income

(Effective Portion)

|

Net Gains/(Losses)

Recognized into Net Income

(Ineffective Portion)

|

|||||||||||||||||

|

Location

|

2016

|

2015

|

Location

|

2016

|

2015

|

|||||||||||||

|

Revenue

|

$

|

4.5

|

|

$

|

75.4

|

|

Other income (expense)

|

$

|

4.0

|

|

$

|

3.4

|

|

|||||

|

Operating expenses

|

$

|

(0.2

|

)

|

$

|

—

|

|

Other income (expense)

|

$

|

(0.3

|

)

|

$

|

—

|

|

|||||

|

Fair Value

|

||||

|

(In millions)

|

Balance Sheet Location

|

As of June 30, 2016

|

||

|

Hedging Instruments:

|

||||

|

Asset derivatives

|

Other current assets

|

$

|

2.0

|

|

|

Investments and other assets

|

$

|

23.6

|

|

|

|

Liability derivatives

|

Accrued expenses and other

|

$

|

14.8

|

|

|

Other long-term liabilities

|

$

|

—

|

|

|

|

Other Derivatives:

|

||||

|

Asset derivatives

|

Other current assets

|

$

|

4.5

|

|

|

Liability derivatives

|

Accrued expenses and other

|

$

|

10.0

|

|

|

Fair Value

|

||||

|

(In millions)

|

Balance Sheet Location

|

As of December 31, 2015

|

||

|

Hedging Instruments:

|

||||

|

Asset derivatives

|

Other current assets

|

$

|

16.6

|

|

|

Investments and other assets

|

$

|

0.3

|

|

|

|

Liability derivatives

|

Accrued expenses and other

|

$

|

10.2

|

|

|

Other long-term liabilities

|

$

|

2.5

|

|

|

|

Other Derivatives:

|

||||

|

Asset derivatives

|

Other current assets

|

$

|

10.3

|

|

|

Liability derivatives

|

Accrued expenses and other

|

$

|

2.0

|

|

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

NCI, beginning of period

|

$

|

1.3

|

|

$

|

2.7

|

|

$

|

2.1

|

|

$

|

5.0

|

|

|||

|

Net income (loss) attributable to NCI, net of tax

|

(1.4

|

)

|

(2.5

|

)

|

(3.1

|

)

|

(4.8

|

)

|

|||||||

|

Fair value of net assets and liabilities acquired and assigned to NCI

|

—

|

|

—

|

|

0.9

|

|

—

|

|

|||||||

|

Translation adjustment and other

|

—

|

|

0.2

|

|

—

|

|

0.2

|

|

|||||||

|

NCI, end of period

|

$

|

(0.1

|

)

|

$

|

0.4

|

|

$

|

(0.1

|

)

|

$

|

0.4

|

|

|||

|

(In millions)

|

Unrealized Gains (Losses) on Securities Available for Sale

|

Unrealized Gains (Losses) on Cash Flow Hedges

|

Unfunded Status of Postretirement Benefit Plans

|

Translation Adjustments

|

Total

|

||||||||||||||

|

Balance, as of December 31, 2015

|

$

|

(0.8

|

)

|

$

|

10.2

|

|

$

|

(37.8

|

)

|

$

|

(195.6

|

)

|

$

|

(224.0

|

)

|

||||

|

Other comprehensive income (loss) before reclassifications

|

6.6

|

|

(13.9

|

)

|

0.9

|

|

(48.4

|

)

|

(54.8

|

)

|

|||||||||

|

Amounts reclassified from accumulated other comprehensive income (loss)

|

0.4

|

|

(4.4

|

)

|

—

|

|

—

|

|

(4.0

|

)

|

|||||||||

|

Net current period other comprehensive income (loss)

|

7.0

|

|

(18.3

|

)

|

0.9

|

|

(48.4

|

)

|

(58.8

|

)

|

|||||||||

|

Balance, as of June 30, 2016

|

$

|

6.2

|

|

$

|

(8.1

|

)

|

$

|

(36.9

|

)

|

$

|

(244.0

|

)

|

$

|

(282.8

|

)

|

||||

|

(In millions)

|

Unrealized Gains (Losses) on Securities Available for Sale

|

Unrealized Gains (Losses) on Cash Flow Hedges

|

Unfunded Status of Postretirement Benefit Plans

|

Translation Adjustments

|

Total

|

||||||||||||||

|

Balance, as of December 31, 2014

|

$

|

(0.4

|

)

|

$

|

71.7

|

|

$

|

(31.6

|

)

|

$

|

(99.2

|

)

|

$

|

(59.5

|

)

|

||||

|

Other comprehensive income (loss) before reclassifications

|

0.9

|

|

66.1

|

|

4.1

|

|

(37.8

|

)

|

33.3

|

|

|||||||||

|

Amounts reclassified from accumulated other comprehensive income (loss)

|

0.2

|

|

(75.0

|

)

|

—

|

|

—

|

|

(74.8

|

)

|

|||||||||

|

Net current period other comprehensive income (loss)

|

1.1

|

|

(8.9

|

)

|

4.1

|

|

(37.8

|

)

|

(41.5

|

)

|

|||||||||

|

Balance, as of June 30, 2015

|

$

|

0.7

|

|

$

|

62.8

|

|

$

|

(27.5

|

)

|

$

|

(137.0

|

)

|

$

|

(101.0

|

)

|

||||

|

(In millions)

|

Income Statement Location

|

Amounts Reclassified from Accumulated Other Comprehensive Income

|

||||||||||||||

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||||

|

2016

|

2015

|

2016

|

2015

|

|||||||||||||

|

Gains (losses) on securities available for sale

|

Other income (expense)

|

$

|

(0.6

|

)

|

$

|

(0.2

|

)

|

$

|

(0.6

|

)

|

$

|

(0.3

|

)

|

|||

|

Income tax benefit (expense)

|

0.2

|

|

0.1

|

|

0.2

|

|

0.1

|

|

||||||||

|

Gains (losses) on cash flow hedges

|

Revenues

|

(4.3

|

)

|

40.4

|

|

4.5

|

|

75.4

|

|

|||||||

|

Operating expenses

|

(0.1

|

)

|

—

|

|

(0.2

|

)

|

—

|

|

||||||||

|

Other income (expense)

|

—

|

|

—

|

|

0.1

|

|

—

|

|

||||||||

|

Income tax benefit (expense)

|

0.1

|

|

(0.2

|

)

|

—

|

|

(0.4

|

)

|

||||||||

|

Total reclassifications, net of tax

|

$

|

(4.7

|

)

|

$

|

40.1

|

|

$

|

4.0

|

|

$

|

74.8

|

|

||||

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

||||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Numerator:

|

|||||||||||||||

|

Net income attributable to Biogen Inc.

|

$

|

1,049.8

|

|

$

|

927.3

|

|

$

|

2,020.7

|

|

$

|

1,749.8

|

|

|||

|

Denominator:

|

|||||||||||||||

|

Weighted average number of common shares outstanding

|

219.1

|

|

235.3

|

|

219.0

|

|

235.1

|

|

|||||||

|

Effect of dilutive securities:

|

|||||||||||||||

|

Stock options and employee stock purchase plan

|

0.1

|

|

0.1

|

|

0.1

|

|

0.1

|

|

|||||||

|

Time-vested restricted stock units

|

0.1

|

|

0.2

|

|

0.1

|

|

0.3

|

|

|||||||

|

Market stock units

|

0.1

|

|

0.1

|

|

0.1

|

|

0.2

|

|

|||||||

|

Dilutive potential common shares

|

0.3

|

|

0.4

|

|

0.3

|

|

0.6

|

|

|||||||

|

Shares used in calculating diluted earnings per share

|

219.4

|

|

235.7

|

|

219.3

|

|

235.7

|

|

|||||||

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

||||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Research and development

|

$

|

21.5

|

|

$

|

22.1

|

|

$

|

42.9

|

|

$

|

57.5

|

|

|||

|

Selling, general and administrative

|

28.7

|

|

26.2

|

|

63.4

|

|

81.8

|

|

|||||||

|

Restructuring charges

|

—

|

|

—

|

|

(1.8

|

)

|

—

|

|

|||||||

|

Subtotal

|

50.2

|

|

48.3

|

|

104.5

|

|

139.3

|

|

|||||||

|

Capitalized share-based compensation costs

|

(4.4

|

)

|

(2.2

|

)

|

(7.5

|

)

|

(5.6

|

)

|

|||||||

|

Share-based compensation expense included in total cost and expenses

|

45.8

|

|

46.1

|

|

97.0

|

|

133.7

|

|

|||||||

|

Income tax effect

|

(12.7

|

)

|

(12.9

|

)

|

(27.9

|

)

|

(39.6

|

)

|

|||||||

|

Share-based compensation expense included in net income attributable to Biogen Inc.

|

$

|

33.1

|

|

$

|

33.2

|

|

$

|

69.1

|

|

$

|

94.1

|

|

|||

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

||||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Market stock units

|

$

|

7.9

|

|

$

|

9.1

|

|

$

|

21.3

|

|

26.1

|

|

||||

|

Time-vested restricted stock units

|

33.9

|

|

31.8

|

|

64.0

|

|

63.7

|

|

|||||||

|

Cash settled performance units

|

4.6

|

|

3.2

|

|

4.8

|

|

27.0

|

|

|||||||

|

Performance units

|

1.3

|

|

1.2

|

|

8.2

|

|

14.4

|

|

|||||||

|

Employee stock purchase plan

|

2.5

|

|

3.0

|

|

6.2

|

|

8.1

|

|

|||||||

|

Subtotal

|

50.2

|

|

48.3

|

|

104.5

|

|

139.3

|

|

|||||||

|

Capitalized share-based compensation costs

|

(4.4

|

)

|

(2.2

|

)

|

(7.5

|

)

|

(5.6

|

)

|

|||||||

|

Share-based compensation expense included in total cost and expenses

|

$

|

45.8

|

|

$

|

46.1

|

|

$

|

97.0

|

|

$

|

133.7

|

|

|||

|

For the Six Months

Ended June 30, |

|||||

|

|

2016

|

2015

|

|||

|

Market stock units

|

166,000

|

|

179,000

|

|

|

|

Cash settled performance shares

|

86,000

|

|

115,000

|

|

|

|

Performance units

|

56,000

|

|

89,000

|

|

|

|

Time-vested restricted stock units

|

594,000

|

|

375,000

|

|

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

||||||||||

|

|

2016

|

2015

|

2016

|

2015

|

|||||||

|

Statutory rate

|

35.0

|

%

|

35.0

|

%

|

35.0

|

%

|

35.0

|

%

|

|||

|

State taxes

|

1.0

|

|

0.4

|

|

1.0

|

|

—

|

|

|||

|

Taxes on foreign earnings

|

(10.0

|

)

|

(11.1

|

)

|

(9.0

|

)

|

(9.8

|

)

|

|||

|

Credits and net operating loss utilization

|

(1.2

|

)

|

(0.7

|

)

|

(1.2

|

)

|

(0.7

|

)

|

|||

|

Purchased intangible assets

|

1.1

|

|

1.1

|

|

1.1

|

|

1.0

|

|

|||

|

Manufacturing deduction

|

(1.6

|

)

|

(2.1

|

)

|

(1.7

|

)

|

(1.8

|

)

|

|||

|

Other permanent items

|

0.6

|

|

0.9

|

|

0.6

|

|

0.7

|

|

|||

|

Other

|

0.3

|

|

0.4

|

|

0.2

|

|

0.3

|

|

|||

|

Effective tax rate

|

25.2

|

%

|

23.9

|

%

|

26.0

|

%

|

24.7

|

%

|

|||

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

||||||||||||||

|

(In millions)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||

|

Interest income

|

$

|

15.4

|

|

$

|

4.3

|

|

$

|

26.6

|

|

$

|

7.6

|

|

|||

|

Interest expense

|

(65.9

|

)

|

(5.8

|

)

|

(129.2

|

)

|

(12.5

|

)

|

|||||||

|

Gain (loss) on investments, net

|

(2.7

|

)

|

0.3

|

|

(1.1

|

)

|

(1.4

|

)

|

|||||||

|

Foreign exchange gains (losses), net

|

0.2

|

|

(1.5

|

)

|

2.3

|

|

(14.5

|

)

|

|||||||

|

Other, net

|

(5.5

|

)

|

(8.2

|

)

|

(9.9

|

)

|

(5.1

|

)

|

|||||||

|

Total other income (expense), net

|

$

|

(58.5

|

)

|

$

|

(10.9

|

)

|

$

|

(111.3

|

)

|

$

|

(25.9

|

)

|

|||

|

(In millions)

|

As of

June 30, 2016 |

As of

December 31, 2015 |

|||||

|

Current portion of contingent consideration obligations and milestones

|

$

|

556.7

|

|

$

|

504.7

|

|

|

|

Revenue-related reserves for discounts and allowances

|

490.5

|

|

518.1

|

|

|||

|

Employee compensation and benefits

|

228.4

|

|

270.8

|

|

|||

|

Royalties and licensing fees

|

183.7

|

|

167.9

|

|

|||

|

Other

|

613.4

|

|

635.3

|

|

|||

|

Total accrued expenses and other

|

$

|

2,072.7

|

|

$

|

2,096.8

|

|

|

|

|

|

Rates post Sobi Opt-In

(3)

|

|||

|

Royalty and Net Revenue Share Rates:

|

Method

|

Base Rate following

1st commercial sale in

the Sobi Territory:

|

Rate during the

Reimbursement

Period:

|

||

|

Sobi rate to Biogen on net sales in the Sobi Territory

|

Royalty

|

12%

|

Base Rate

plus 5% |

||

|

Biogen rate to Sobi on net sales in the Biogen North America Territory

|

Royalty

|

12%

|

Base Rate

less 5% |

||

|

Biogen rate to Sobi on net sales in the Biogen Direct Territory

|

Royalty

|

17%

|

Base Rate

less 5% |

||

|

Biogen rate to Sobi on net revenue

(1)

from the Biogen Distributor Territory

(2)

|

Net

Revenue Share |

50%

|

Base Rate

less 15% |

||

|

(1)

|

Net revenue represents Biogen’s pre-tax receipts from third-party distributors, less expenses incurred by Biogen in the conduct of commercialization activities supporting the distributor activities.

|

|

(2)

|

The Biogen Distributor Territory represents Biogen territories where sales are derived utilizing a third-party distributor.

|

|

(3)

|

A credit will be issued to Sobi against its reimbursement of the Opt-in Consideration in an amount equal to the difference in the rate paid by Biogen to Sobi on sales in the Biogen territories for certain periods prior to the first commercial sale in the Sobi Territory versus the rate that otherwise would have been payable on such sales.

|

|

•

|

Total revenues were

$2,894.2 million

for the

second

quarter of

2016

, representing an increase of 11.7% over the same period in

2015

.

|

|

•

|

Product revenues, net totaled

$2,466.0 million

for the

second

quarter of

2016

, representing an increase of 12.2% over the same period in

2015

. This increase was driven by an 11.7% increase in worldwide TECFIDERA revenues, a 7.4% increase in worldwide TYSABRI revenues, a 5.6% increase in worldwide Interferon revenues and revenues from ELOCTATE, ALPROLIX and BENEPALI. Product revenues, net for the

second

quarter of

2016

, compared to the same period in

2015

, were also negatively impacted by a $44.7 million change in hedge results under our hedging program in the comparative period.

|

|

•

|

Revenues from anti-CD20 therapeutic programs totaled

$349.2 million

for the

second

quarter of

2016

, representing an increase of 3.5% over the same period in

2015

.

|

|

•

|

Other revenues totaled $79.0 million for the

second

quarter of

2016

, representing an increase of 42.1% from the same period in

2015

. This increase was primarily driven by an increase in other corporate revenue.

|

|

•

|

Total cost and expenses totaled

$1,433.7 million

for the

second

quarter of

2016

, representing an increase of

5.5%

compared to the same period in

2015

. This increase was driven by a

29.4%

increase in cost of sales and the recognition of a loss on fair value remeasurement of contingent consideration, partially offset by a

3.6%

decrease in research and development expense.

|

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||||||||||||||

|

(In millions, except percentages)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||||||||||||||

|

Product revenues:

|

|||||||||||||||||||||||||||

|

United States

|

$

|

1,777.5

|

|

61.4

|

%

|

$

|

1,565.4

|

|

60.4

|

%

|

$

|

3,440.8

|

|

61.2

|

%

|

$

|

3,099.1

|

|

60.2

|

%

|

|||||||

|

Rest of world

|

688.5

|

|

23.8

|

%

|

633.2

|

|

24.4

|

%

|

1,334.6

|

|

23.7

|

%

|

1,271.8

|

|

24.7

|

%

|

|||||||||||

|

Total product revenues

|

2,466.0

|

|

85.2

|

%

|

2,198.6

|

|

84.8

|

%

|

4,775.4

|

|

85.0

|

%

|

4,370.9

|

|

84.9

|

%

|

|||||||||||

|

Revenues from anti-CD20 therapeutic programs

|

349.2

|

|

12.1

|

%

|

337.5

|

|

13.0

|

%

|

678.7

|

|

12.1

|

%

|

668.1

|

|

13.0

|

%

|

|||||||||||

|

Other revenues

|

79.0

|

|

2.7

|

%

|

55.6

|

|

2.1

|

%

|

166.9

|

|

3.0

|

%

|

107.6

|

|

2.1

|

%

|

|||||||||||

|

Total revenues

|

$

|

2,894.2

|

|

100.0

|

%

|

$

|

2,591.6

|

|

100.0

|

%

|

$

|

5,621.0

|

|

100.0

|

%

|

$

|

5,146.6

|

|

100.0

|

%

|

|||||||

|

|

For the Three Months

Ended June 30, |

For the Six Months

Ended June 30, |

|||||||||||||||||||||||||

|

(In millions, except percentages)

|

2016

|

2015

|

2016

|

2015

|

|||||||||||||||||||||||

|

Multiple Sclerosis:

|

|||||||||||||||||||||||||||

|

TECFIDERA

|

$

|

986.5

|

|

40.0

|

%

|

$

|

883.3

|

|

40.2

|

%

|

$

|

1,932.4

|

|

40.5

|

%

|

$

|

1,708.2

|

|

39.1

|

%

|

|||||||

|

Interferon*

|

728.3

|

|

29.5

|

%

|

689.7

|

|

31.4

|

%

|

1,398.7

|

|

29.3

|

%

|

1,444.2

|

|

33.0

|

%

|

|||||||||||

|

TYSABRI

|

497.4

|

|

20.1

|

%

|

463.1

|

|

21.1

|

%

|

974.4

|

|

20.4

|

%

|

925.7

|

|

21.2

|

%

|

|||||||||||

|

FAMPYRA

|

21.6

|

|

0.9

|

%

|

21.1

|

|

1.0

|

%

|

41.8

|

|

0.9

|

%

|

41.1

|

|

0.9

|

%

|

|||||||||||

|

Hemophilia:

|

|

|

|

|

|||||||||||||||||||||||

|

ELOCTATE

|

124.7

|

|

5.1

|

%

|

74.3

|

|

3.4

|

%

|

232.4

|

|

4.9

|

%

|

127.9

|

|

2.9

|

%

|

|||||||||||

|

ALPROLIX

|

80.3

|

|

3.3

|

%

|

54.4

|