|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

27-0162450

(I.R.S. Employer

Identification No.)

|

|

14817 Oak Lane, Miami Lakes, FL

(Address of principal executive offices)

|

|

33016

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

New York Stock Exchange

|

|

Large accelerated filer

ý

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

|

Smaller reporting company

o

|

|

|

|

Page

|

|

|

||

|

|

||

|

ACI

|

Loans acquired with evidence of deterioration in credit quality since origination (Acquired Credit Impaired)

|

|

|

ALCO

|

Asset/Liability Committee

|

|

|

ALLL

|

Allowance for loan and lease losses

|

|

|

AOCI

|

Accumulated other comprehensive income

|

|

|

ARM

|

Adjustable rate mortgage

|

|

|

ASC

|

Accounting Standards Codification

|

|

|

ASU

|

Accounting Standards Update

|

|

|

ATM

|

Automated teller machine

|

|

|

BHC Act

|

Bank Holding Company Act of 1956

|

|

|

BHC

|

Bank holding company

|

|

|

BKU

|

BankUnited, Inc.

|

|

|

BankUnited

|

BankUnited, National Association

|

|

|

The Bank

|

BankUnited, National Association

|

|

|

Bridge

|

Bridge Funding Group, Inc.

|

|

|

CDO

|

Collateralized debt obligation

|

|

|

CET1

|

Common Equity Tier 1 capital

|

|

|

CECL

|

Current expected credit losses

|

|

|

CFPB

|

Consumer Financial Protection Bureau

|

|

|

CFTC

|

Commodity Futures Trading Commission

|

|

|

CMOs

|

Collateralized mortgage obligations

|

|

|

Commercial Shared-Loss Agreement

|

A commercial and other loans shared-loss agreement entered into with the FDIC in connection with the FSB Acquisition

|

|

|

Covered assets

|

Assets covered under the Loss Sharing Agreements

|

|

|

Covered loans

|

Loans covered under the Loss Sharing Agreements

|

|

|

CRA

|

Community Reinvestment Act

|

|

|

DIF

|

Deposit insurance fund

|

|

|

Dodd-Frank Act

|

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

|

|

|

EPS

|

Earnings per common share

|

|

|

EVE

|

Economic value of equity

|

|

|

Failed Bank

|

BankUnited, FSB

|

|

|

FASB

|

Financial Accounting Standards Board

|

|

|

FDIA

|

Federal Deposit Insurance Act

|

|

|

FDIC

|

Federal Deposit Insurance Corporation

|

|

|

FHLB

|

Federal Home Loan Bank

|

|

|

FICO

|

Fair Isaac Corporation (credit score)

|

|

|

FRB

|

Federal Reserve Bank

|

|

|

FSB Acquisition

|

Acquisition of substantially all of the assets and assumption of all of the non-brokered deposits and substantially all of the other liabilities of BankUnited, FSB from the FDIC on May 21, 2009

|

|

|

GAAP

|

U.S. generally accepted accounting principles

|

|

|

GDP

|

Gross Domestic Product

|

|

|

GLB Act

|

The Gramm-Leach-Bliley Financial Modernization Act of 1999

|

|

|

HAMP

|

Home Affordable Modification Program

|

|

|

IPO

|

Initial public offering

|

|

|

IRS

|

Internal Revenue Service

|

|

|

ISDA

|

International Swaps and Derivatives Association

|

|

|

LCR

|

Liquidity coverage ratio

|

|

|

LIBOR

|

London InterBank Offered Rate

|

|

|

Loss Sharing Agreements

|

Two loss sharing agreements entered into with the FDIC in connection with the FSB Acquisition

|

|

|

LTV

|

Loan-to-value

|

|

|

MBS

|

Mortgage-backed securities

|

|

|

MSA

|

Metropolitan Statistical Area

|

|

|

MSRs

|

Mortgage servicing rights

|

|

|

New Loans

|

Loans originated or purchased since the FSB Acquisition

|

|

|

Non-ACI

|

Loans acquired without evidence of deterioration in credit quality since origination

|

|

|

OCC

|

Office of the Comptroller of the Currency

|

|

|

OFAC

|

U.S. Department of the Treasury's Office of Foreign Assets Control

|

|

|

OREO

|

Other real estate owned

|

|

|

OTTI

|

Other-than-temporary impairment

|

|

|

Proxy Statement

|

Definitive proxy statement for the Company's 2017 annual meeting of stockholders

|

|

|

PSU

|

Performance Share Unit

|

|

|

Pinnacle

|

Pinnacle Public Finance, Inc.

|

|

|

QRMs

|

Qualified residential mortgages

|

|

|

Re-Remics

|

Resecuritized real estate mortgage investment conduits

|

|

|

RSU

|

Restricted Share Unit

|

|

|

SAR

|

Share Appreciation Right

|

|

|

SBA

|

U.S. Small Business Administration

|

|

|

SBF

|

Small Business Finance Unit

|

|

|

SEC

|

Securities and Exchange Commission

|

|

|

SIFIs

|

Systemically important financial institutions

|

|

|

Single Family Shared-Loss Agreement

|

A single-family loan shared-loss agreement entered into with the FDIC in connection with the FSB Acquisition

|

|

|

TDR

|

Troubled-debt restructuring

|

|

|

Tri-State

|

New York, New Jersey and Connecticut

|

|

|

UPB

|

Unpaid principal balance

|

|

|

USDA

|

U.S. Department of Agriculture

|

|

|

VIEs

|

Variable interest entities

|

|

|

2010 Plan

|

2010 Omnibus Equity Incentive Plan

|

|

|

2014 Plan

|

2014 Omnibus Equity Incentive Plan

|

|

|

401(k) Plan

|

BankUnited 401(k) Plan

|

|

|

•

|

the impact of conditions in the financial markets and economic conditions generally;

|

|

•

|

credit risk, relating to our portfolios of loans, leases and investments overall, as well as loans and leases exposed to specific industry conditions;

|

|

•

|

real estate market conditions and other risks related to holding loans secured by real estate or real estate received in satisfaction of loans;

|

|

•

|

an inability to successfully execute our fundamental growth strategy;

|

|

•

|

geographic concentration of the Company's markets in Florida and the New York metropolitan area;

|

|

•

|

natural or man-made disasters;

|

|

•

|

risks related to the regulation of our industry;

|

|

•

|

inadequate allowance for credit losses;

|

|

•

|

interest rate risk;

|

|

•

|

liquidity risk;

|

|

•

|

loss of executive officers or key personnel;

|

|

•

|

competition;

|

|

•

|

dependence on information technology and third party service providers and the risk of systems failures, interruptions or breaches of security;

|

|

•

|

failure to comply with the terms of the Company's Loss Sharing Agreements (as defined below) with the FDIC (as defined below);

|

|

•

|

inadequate or inaccurate forecasting tools and models;

|

|

•

|

ineffective risk management or internal controls;

|

|

•

|

a variety of operational, compliance and legal risks; and

|

|

•

|

the selection and application of accounting methods and related assumptions and estimates.

|

|

•

|

enjoin "unsafe or unsound" practices;

|

|

•

|

require affirmative actions to correct any violation or practice;

|

|

•

|

issue administrative orders that can be judicially enforced;

|

|

•

|

direct increases in capital;

|

|

•

|

direct the sale of subsidiaries or other assets;

|

|

•

|

limit dividends and distributions;

|

|

•

|

restrict growth;

|

|

•

|

assess civil monetary penalties;

|

|

•

|

remove officers and directors; and

|

|

•

|

terminate deposit insurance.

|

|

•

|

Source of strength

. The Dodd-Frank Act and Federal Reserve Board policy require all companies, including BHCs, that directly or indirectly control an insured depository institution to serve as a source of strength for the institution. Under this requirement, BankUnited, Inc. in the future could be required to provide financial assistance to BankUnited should it experience financial distress. Such support may be required at times when, absent this statutory and Federal Reserve Policy requirement, a BHC may not be inclined to provide it.

|

|

•

|

Limitation on federal preemption

. The Dodd-Frank Act significantly reduces the ability of national banks to rely on federal preemption of state consumer financial laws. Although the OCC, as the primary regulator of national banks, will have the ability to make preemption determinations where certain conditions are met, the broad rollback of federal preemption has the potential to create a patchwork of federal and state compliance obligations. This could, in turn, result in significant new regulatory requirements applicable to BankUnited, with potentially significant changes in our operations and increases in our compliance costs. It could also result in uncertainty concerning compliance, with attendant regulatory and litigation risks.

|

|

•

|

Company-Run Stress Testing

. Under Section 165(i) of the Dodd-Frank Act and the stress testing rules of the Federal Reserve Board and OCC, each BHC and national bank with more than $10 billion and less than $50 billion in total consolidated assets must annually conduct a company-run stress test to estimate the potential impact of three scenarios provided by the agencies on its regulatory capital ratios and certain other financial metrics. BankUnited, Inc. and the Bank are required to publicly disclose a summary of the results of these forward looking, company-run stress tests that assesses the impact of hypothetical macroeconomic baseline, adverse and severely adverse economic scenarios. In

2017

, BankUnited, Inc. and the Bank will submit the results of their company-run stress test to the Federal Reserve Board and OCC by July 31 and will publish a public summary of the results between October 15 and October 30.

|

|

•

|

Mortgage loan origination and risk retention

. The Dodd-Frank Act imposes new standards for mortgage loan originations on all lenders, including banking organizations, by requiring that lenders be able to substantiate they have made a good faith determination of a borrower's ability to repay a mortgage. The ability to repay requirement mandates specific factors that a lender must consider in evaluating a borrower's ability to repay. In 2013, federal regulators released the "qualified mortgage" rule. The qualified mortgage rule is intended to clarify the application of the Dodd-Frank Act requirement that mortgage lenders have a reasonable belief that borrowers have the ability to repay their mortgages. For mortgages meeting the regulatory definition of qualified mortgages, lenders generally enjoy a safe harbor with respect to compliance with the ability to repay rules. Generally, to be considered qualified mortgages, loans must meet all requirements set forth in the ability to repay rules and have debt-to-income ratios and closing costs not exceeding specified levels. Any prepayment penalties must fall within defined constraints. Loans meeting the regulatory definition of higher priced loans, or those with balloon, negative amortization or interest-only features do not meet the definition of qualified mortgages. While lenders are permitted to originate mortgages that do not meet the definition of qualified mortgages, the burden of demonstrating compliance with the ability to repay rules with respect to such mortgages is greater, possibly impeding a lender's ability to foreclose on such mortgages. Any loans that we make outside of the “qualified mortgage” criteria could expose us to an increased risk of liability and reduce or delay our ability to foreclose on the underlying property. The CFPB’s “qualified mortgage” rule could limit our ability or desire to make certain types of loans or loans to certain borrowers, or could make it more expensive or time consuming to make these loans. Any decreases in loan origination volume or increases in compliance and foreclosure costs caused by the rule could negatively affect our business, operating results and financial condition.

|

|

•

|

Expanded FDIC resolution authority.

While insured depository institutions have long been subject to the FDIC's resolution process, the Dodd-Frank Act creates a new mechanism for the FDIC to conduct the orderly liquidation of certain "covered financial companies," including bank and thrift holding companies and systemically significant non-bank financial companies. Upon certain findings being made, the FDIC may be appointed receiver for a covered financial company, and would conduct an orderly liquidation of the entity. The FDIC liquidation process is modeled on the existing FDIA bank resolution process, and generally gives the FDIC more discretion than in the traditional bankruptcy context. The FDIC has issued final rules implementing the orderly liquidation authority.

|

|

•

|

CFPB.

The Dodd-Frank Act created a new independent CFPB. The CFPB is tasked with establishing and implementing rules and regulations under certain federal consumer protection laws with respect to the conduct of providers of certain consumer financial products and services. The CFPB has rulemaking authority over many of the statutes governing products and services offered to bank and thrift consumers. For banking organizations with assets of $10 billion or more, such as BankUnited, Inc. and the Bank, the CFPB has exclusive rule making and examination, and primary enforcement authority under federal consumer financial law. In addition, the Dodd-Frank Act permits states to adopt consumer protection laws and regulations that are stricter than those regulations promulgated by the

|

|

•

|

Deposit insurance.

The Dodd-Frank Act made permanent the general $250,000 deposit insurance limit for insured deposits. Amendments to the FDIA also revised the assessment base against which an insured depository institution's deposit insurance premiums paid to the DIF of the FDIC are calculated. Under the amendments, the assessment base is the institution's average consolidated total assets less its average tangible equity. Additionally, the Dodd-Frank Act made changes to the minimum designated reserve ratio of the DIF, increasing the minimum from 1.15 percent to 1.35 percent of the estimated amount of total insured deposits, and eliminating the requirement that the FDIC pay dividends to depository institutions when the reserve ratio exceeds certain thresholds.

|

|

•

|

Transactions with affiliates and insiders.

The Dodd-Frank Act generally enhanced the restrictions on transactions with affiliates under Section 23A and 23B of the Federal Reserve Act, including an expansion of the definition of "covered transactions" and clarification regarding the amount of time for which collateral requirements regarding covered credit transactions must be satisfied. Insider transaction limitations are expanded through the strengthening of loan restrictions to insiders and the expansion of the types of transactions subject to the various limits, including derivatives transactions, repurchase agreements, reverse repurchase agreements and securities lending or borrowing transactions. Restrictions are also placed on certain asset sales to and from an insider to an institution, including requirements that such sales be on market terms and, in certain circumstances, approved by the institution's board of directors.

|

|

•

|

Enhanced lending limits.

The Dodd-Frank Act strengthens the existing limits on a depository institution's credit exposure to one borrower. The OCC published a final rule in 2013 amending its existing lending limits to incorporate changes made by the Dodd-Frank Act. The Dodd-Frank Act and the final rule amend the OCC's lending limit regulation to include credit exposures arising from derivative transactions and repurchase agreements, reverse repurchase agreements, securities lending transactions, and securities borrowing transactions. The final rule exempts certain types of transactions, and outlines the methods that banks can choose from to measure credit exposures of derivative transactions and securities financing transactions. In most cases, a bank may choose which method it will use; the OCC, however, may specify that a bank use a particular method for safety and soundness reasons.

|

|

•

|

Corporate governance.

The Dodd-Frank Act addresses many investor protection, corporate governance and executive compensation matters that affect most U.S. publicly traded companies, including BankUnited, Inc. The Dodd-Frank Act (1) grants stockholders of U.S. publicly traded companies an advisory vote on executive compensation; (2) enhances independence requirements for compensation committee members; (3) requires companies listed on national securities exchanges to adopt incentive-based compensation claw-back policies for executive officers; and (4) provides the SEC with authority to adopt proxy access rules that would allow stockholders of publicly traded companies to nominate candidates for election as a director and have those nominees included in a company's proxy materials.

|

|

•

|

Interchange Fees.

The Dodd-Frank Act gave the Federal Reserve Board the authority to establish rules regarding interchange fees charged for electronic debit transactions by a payment card issuer that, together with its affiliates, has assets of $10 billion or more and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer. The Federal Reserve Board has adopted rules under this provision that limit the swipe fees that a debit card issuer can charge a merchant for a transaction to the sum of 21 cents and five basis points times the value of the transaction, plus up to one cent for fraud prevention costs.

|

|

•

|

control of any other bank or BHC or all or substantially all the assets thereof; or

|

|

•

|

more than 5% of the voting shares of a bank or BHC which is not already a subsidiary.

|

|

(i)

|

4.5% based upon CET1;

|

|

(ii)

|

6.0% based upon tier 1 capital; and

|

|

(iii)

|

8.0% based upon total regulatory capital.

|

|

•

|

Truth in Lending Act;

|

|

•

|

Truth in Savings Act;

|

|

•

|

Electronic Funds Transfer Act;

|

|

•

|

Expedited Funds Availability Act;

|

|

•

|

Equal Credit Opportunity Act;

|

|

•

|

Fair and Accurate Credit Transactions Act;

|

|

•

|

Fair Housing Act;

|

|

•

|

Fair Credit Reporting Act;

|

|

•

|

Fair Debt Collection Act;

|

|

•

|

Gramm-Leach-Bliley Act;

|

|

•

|

Home Mortgage Disclosure Act;

|

|

•

|

Right to Financial Privacy Act;

|

|

•

|

Real Estate Settlement Procedures Act;

|

|

•

|

laws regarding unfair and deceptive acts and practices; and

|

|

•

|

usury laws.

|

|

•

|

A decrease in demand for our loan and deposit products;

|

|

•

|

An increase in delinquencies and defaults by borrowers or counterparties;

|

|

•

|

A decrease in the value of our assets;

|

|

•

|

A decrease in our earnings;

|

|

•

|

A decrease in liquidity; and

|

|

•

|

A decrease in our ability to access the capital markets.

|

|

•

|

an increase in loan delinquencies;

|

|

•

|

an increase in problem assets and foreclosures;

|

|

•

|

a decrease in the demand for our products and services; or

|

|

•

|

a decrease in the value of collateral for loans, especially real estate, in turn reducing customers' borrowing power, the value of assets associated with problem loans and collateral coverage.

|

|

•

|

general or local economic conditions;

|

|

•

|

environmental cleanup liability;

|

|

•

|

neighborhood values;

|

|

•

|

interest rates;

|

|

•

|

commercial real estate rental and vacancy rates;

|

|

•

|

real estate tax rates;

|

|

•

|

operating expenses of the mortgaged properties;

|

|

•

|

supply of and demand for properties;

|

|

•

|

ability to obtain and maintain adequate occupancy of the properties;

|

|

•

|

zoning laws;

|

|

•

|

governmental rules, regulations and fiscal policies; and

|

|

•

|

hurricanes or other natural or man-made disasters.

|

|

•

|

the ability to develop, maintain and build upon long-term customer relationships based on quality service, high ethical standards and safe and sound banking practices;

|

|

•

|

the ability to attract and retain qualified employees to operate our business effectively;

|

|

•

|

the ability to expand our market position;

|

|

•

|

the scope, relevance and pricing of products and services offered to meet customer needs and demands;

|

|

•

|

the rate at which we introduce new products and services relative to our competitors;

|

|

•

|

customer satisfaction with our level of service; and

|

|

•

|

industry and general economic trends.

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

2016

|

2015

|

|||||||||||||

|

|

High

|

Low

|

High

|

Low

|

|||||||||||

|

1st Quarter

|

$

|

35.94

|

|

$

|

29.72

|

|

$

|

33.69

|

|

$

|

26.69

|

|

|||

|

2nd Quarter

|

$

|

36.28

|

|

$

|

27.85

|

|

$

|

36.95

|

|

$

|

32.13

|

|

|||

|

3rd Quarter

|

$

|

33.06

|

|

$

|

28.64

|

|

$

|

37.92

|

|

$

|

33.07

|

|

|||

|

4th Quarter

|

$

|

38.47

|

|

$

|

28.13

|

|

$

|

39.97

|

|

$

|

34.05

|

|

|||

|

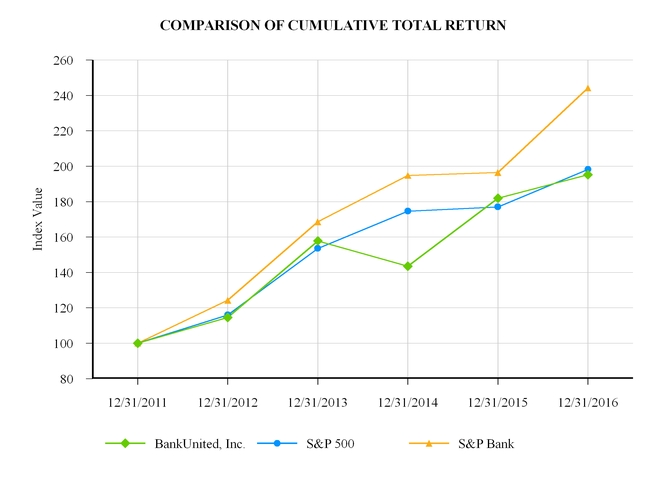

Index

|

12/31/2011

|

|

12/31/2012

|

|

12/31/2013

|

|

12/31/2014

|

|

12/31/2015

|

|

12/31/2016

|

|

|

BankUnited, Inc.

|

100.00

|

|

114.52

|

|

157.82

|

|

143.52

|

|

181.92

|

|

195.22

|

|

|

S&P 500

|

100.00

|

|

116.00

|

|

153.57

|

|

174.60

|

|

177.01

|

|

198.18

|

|

|

S&P Bank

|

100.00

|

|

124.23

|

|

168.61

|

|

194.76

|

|

196.42

|

|

244.17

|

|

|

|

At December 31,

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

|

(dollars in thousands)

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Cash and cash equivalents

|

$

|

448,313

|

|

$

|

267,500

|

|

$

|

187,517

|

|

$

|

252,749

|

|

$

|

495,353

|

|

||||

|

Investment securities available for sale, at fair value

|

6,073,584

|

|

4,859,539

|

|

4,585,694

|

|

3,637,124

|

|

4,172,412

|

|

|||||||||

|

Investment securities held to maturity

|

10,000

|

|

10,000

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Loans, net

|

19,242,441

|

|

16,510,775

|

|

12,319,227

|

|

8,983,884

|

|

5,512,618

|

|

|||||||||

|

FDIC indemnification asset

|

515,933

|

|

739,880

|

|

974,704

|

|

1,205,117

|

|

1,457,570

|

|

|||||||||

|

Total assets

|

27,880,151

|

|

23,883,467

|

|

19,210,529

|

|

15,046,649

|

|

12,375,953

|

|

|||||||||

|

Deposits

|

19,490,890

|

|

16,938,501

|

|

13,511,755

|

|

10,532,428

|

|

8,538,073

|

|

|||||||||

|

Federal Home Loan Bank advances

|

5,239,348

|

|

4,008,464

|

|

3,307,932

|

|

2,412,050

|

|

1,916,919

|

|

|||||||||

|

Notes and other borrowings

|

402,809

|

|

402,545

|

|

10,627

|

|

2,263

|

|

8,175

|

|

|||||||||

|

Total liabilities

|

25,461,722

|

|

21,639,569

|

|

17,157,995

|

|

13,117,951

|

|

10,569,273

|

|

|||||||||

|

Total stockholder's equity

|

2,418,429

|

|

2,243,898

|

|

2,052,534

|

|

1,928,698

|

|

1,806,680

|

|

|||||||||

|

Covered assets

|

616,600

|

|

813,525

|

|

1,053,317

|

|

1,730,182

|

|

2,149,009

|

|

|||||||||

|

|

Years Ended December 31,

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

|

(dollars in thousands, except per share data)

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Interest income

|

$

|

1,059,217

|

|

$

|

880,816

|

|

$

|

783,744

|

|

$

|

738,821

|

|

$

|

720,856

|

|

||||

|

Interest expense

|

188,832

|

|

135,164

|

|

106,651

|

|

92,611

|

|

123,269

|

|

|||||||||

|

Net interest income

|

870,385

|

|

745,652

|

|

677,093

|

|

646,210

|

|

597,587

|

|

|||||||||

|

Provision for loan losses

|

50,911

|

|

44,311

|

|

41,505

|

|

31,964

|

|

18,896

|

|

|||||||||

|

Net interest income after provision for loan losses

|

819,474

|

|

701,341

|

|

635,588

|

|

614,246

|

|

578,691

|

|

|||||||||

|

Non-interest income

|

106,417

|

|

102,224

|

|

84,165

|

|

68,049

|

|

73,941

|

|

|||||||||

|

Non-interest expense

|

590,447

|

|

506,672

|

|

426,503

|

|

364,293

|

|

307,767

|

|

|||||||||

|

Income before income taxes

|

335,444

|

|

296,893

|

|

293,250

|

|

318,002

|

|

344,865

|

|

|||||||||

|

Provision for income taxes

(1)

|

109,703

|

|

45,233

|

|

89,035

|

|

109,066

|

|

133,605

|

|

|||||||||

|

Net income

|

$

|

225,741

|

|

$

|

251,660

|

|

$

|

204,215

|

|

$

|

208,936

|

|

$

|

211,260

|

|

||||

|

Share Data:

|

|

|

|

|

|

|

|||||||||||||

|

Earnings per common share, basic

|

$

|

2.11

|

|

$

|

2.37

|

|

$

|

1.95

|

|

$

|

2.03

|

|

$

|

2.05

|

|

||||

|

Earnings per common share, diluted

|

$

|

2.09

|

|

$

|

2.35

|

|

$

|

1.95

|

|

$

|

2.01

|

|

$

|

2.05

|

|

||||

|

Cash dividends declared per common share

|

$

|

0.84

|

|

$

|

0.84

|

|

$

|

0.84

|

|

$

|

0.84

|

|

$

|

0.72

|

|

||||

|

Dividend payout ratio

|

40.19

|

%

|

35.75

|

%

|

43.06

|

%

|

41.73

|

%

|

35.13

|

%

|

|||||||||

|

Other Data (unaudited):

|

|

|

|

|

|

|

|||||||||||||

|

Financial ratios

|

|

|

|

|

|

|

|||||||||||||

|

Return on average assets

|

0.87

|

%

|

1.18

|

%

|

1.21

|

%

|

1.55

|

%

|

1.71

|

%

|

|||||||||

|

Return on average common equity

|

9.64

|

%

|

11.62

|

%

|

10.13

|

%

|

11.16

|

%

|

12.45

|

%

|

|||||||||

|

Yield on earning assets

(2)

|

4.51

|

%

|

4.64

|

%

|

5.33

|

%

|

6.54

|

%

|

7.28

|

%

|

|||||||||

|

Cost of interest bearing liabilities

|

0.93

|

%

|

0.84

|

%

|

0.87

|

%

|

0.94

|

%

|

1.33

|

%

|

|||||||||

|

Equity to assets ratio

|

8.67

|

%

|

9.40

|

%

|

10.68

|

%

|

12.82

|

%

|

14.60

|

%

|

|||||||||

|

Interest rate spread

(2)

|

3.58

|

%

|

3.80

|

%

|

4.46

|

%

|

5.60

|

%

|

5.95

|

%

|

|||||||||

|

Net interest margin

(2)

|

3.73

|

%

|

3.94

|

%

|

4.61

|

%

|

5.73

|

%

|

6.05

|

%

|

|||||||||

|

Loan to deposit ratio

(3)

|

99.72

|

%

|

98.50

|

%

|

91.89

|

%

|

85.96

|

%

|

65.28

|

%

|

|||||||||

|

Tangible book value per common share

|

$

|

22.47

|

|

$

|

20.90

|

|

$

|

19.52

|

|

$

|

18.41

|

|

$

|

17.71

|

|

||||

|

Asset quality ratios

|

|

|

|

|

|

|

|||||||||||||

|

Non-performing loans to total loans

(3) (4)

|

0.70

|

%

|

0.44

|

%

|

0.32

|

%

|

0.39

|

%

|

0.62

|

%

|

|||||||||

|

Non-performing assets to total assets

(5)

|

0.53

|

%

|

0.35

|

%

|

0.28

|

%

|

0.51

|

%

|

0.89

|

%

|

|||||||||

|

Non-performing non-covered assets to total assets

(5) (6)

|

0.51

|

%

|

0.26

|

%

|

0.17

|

%

|

0.16

|

%

|

0.13

|

%

|

|||||||||

|

ALLL to total loans

|

0.79

|

%

|

0.76

|

%

|

0.77

|

%

|

0.77

|

%

|

1.06

|

%

|

|||||||||

|

ALLL to non-performing loans

(4)

|

112.55

|

%

|

172.23

|

%

|

239.24

|

%

|

195.52

|

%

|

171.21

|

%

|

|||||||||

|

Non-covered ALLL to non-covered non-performing loans

(4)

|

113.68

|

%

|

199.82

|

%

|

275.47

|

%

|

246.73

|

%

|

256.65

|

%

|

|||||||||

|

Net charge-offs to average loans

|

0.13

|

%

|

0.10

|

%

|

0.15

|

%

|

0.31

|

%

|

0.17

|

%

|

|||||||||

|

Non-covered net charge-offs to average non-covered loans

|

0.13

|

%

|

0.09

|

%

|

0.08

|

%

|

0.34

|

%

|

0.09

|

%

|

|||||||||

|

|

At December 31,

|

|||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||

|

Capital ratios

|

|

|

|

|

|

|

|

|

||||||

|

Tier 1 leverage

|

8.41

|

%

|

9.35

|

%

|

10.70

|

%

|

12.42

|

%

|

13.16

|

%

|

||||

|

CET1 risk-based capital

|

11.63

|

%

|

12.58

|

%

|

N/A

|

|

N/A

|

|

N/A

|

|

||||

|

Tier 1 risk-based capital

|

11.63

|

%

|

12.58

|

%

|

15.45

|

%

|

21.06

|

%

|

33.60

|

%

|

||||

|

Total risk-based capital

|

12.45

|

%

|

13.36

|

%

|

16.27

|

%

|

21.93

|

%

|

34.88

|

%

|

||||

|

(1)

|

Includes a discrete income tax benefit of

$49.3 million

recognized during the year ended December 31, 2015.

|

|

(2)

|

On a tax-equivalent basis.

|

|

(3)

|

Total loans include premiums, discounts, deferred fees and costs and loans held for sale.

|

|

(4)

|

We define non-performing loans to include non-accrual loans, loans, other than ACI loans, that are past due 90 days or more and still accruing and certain loans modified in troubled debt restructurings. Contractually delinquent ACI loans on which interest continues to be accreted are excluded from non-performing loans. Effective January 1, 2016, we are no longer reporting accruing TDRs as non-performing.

|

|

(5)

|

Non-performing assets include non-performing loans, OREO and other repossessed assets.

|

|

(6)

|

Ratio for non-covered assets is calculated as non-performing non-covered assets to total assets.

|

|

•

|

Net income for the

year ended December 31, 2016

was

$225.7 million

, or

$2.09

per diluted share, compared to

$251.7 million

, or

$2.35

per diluted share for the

year ended December 31, 2015

. Earnings for

2016

generated a return on average stockholders' equity of

9.64%

and a return on average assets of

0.87%

.

|

|

•

|

Earnings for the

year ended December 31, 2015

benefited from a discrete income tax benefit of

$49.3 million

. Non-interest expense for

2015

included $1.3 million in professional fees related to this tax benefit. Excluding the impact of this discrete income tax benefit and related professional fees, net income for

2015

was

$203.1 million

, diluted earnings per share was

$1.90

, return on average stockholders' equity was 9.38% and return on average assets was 0.95%.

|

|

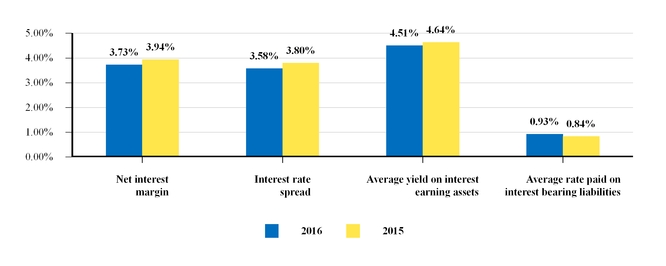

•

|

Net interest income for the

year ended December 31, 2016

was

$870.4 million

, an increase of

$124.7 million

over the prior year. The net interest margin, calculated on a tax-equivalent basis, decreased to

3.73%

for

2016

from

3.94%

for

2015

. The origination of new loans at current market yields lower than those on loans acquired in the FSB Acquisition and the cost of the senior notes issued in November 2015 were the most significant contributors to the decline in the net interest margin. The following chart provides a comparison of net interest margin, the interest rate spread, the average yield on interest earning assets and the average rate paid on interest bearing liabilities for the years ended

December 31, 2016

and

2015

(on a tax-equivalent basis):

|

|

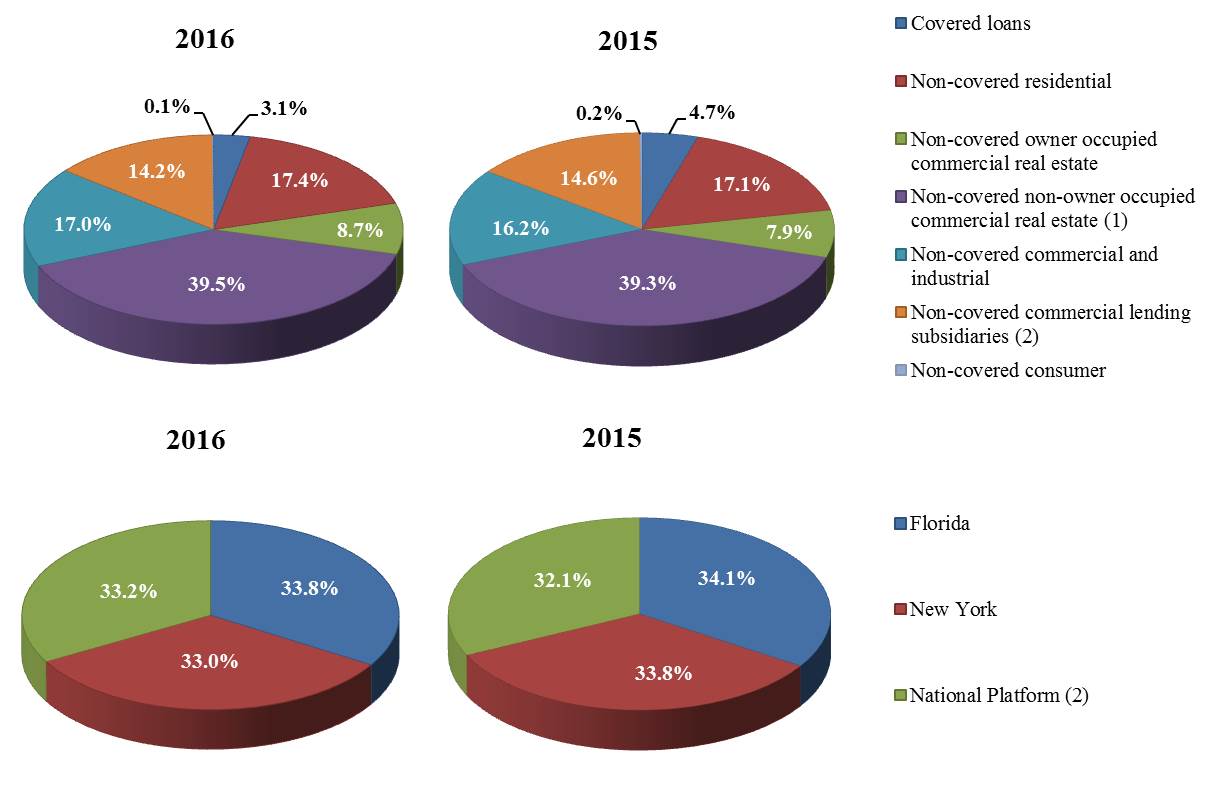

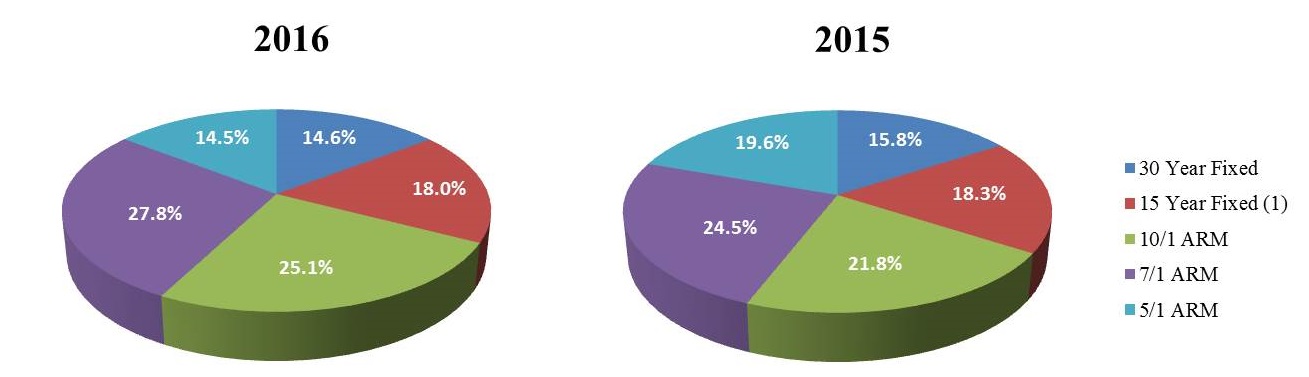

•

|

Total interest earning assets increased by

$4.2 billion

for the year ended December 31, 2016. New loans and leases, including equipment under operating lease, grew by

$3.0 billion

to

$19.3 billion

for the

year ended December 31, 2016

. New loan growth was concentrated in commercial portfolio segments, commensurate with our core business strategy. During the

year ended December 31, 2016

, new commercial loans grew by

$2.4 billion

; equipment under operating lease grew by

$56 million

; and new residential loans grew by

$546 million

. The New York region, the Florida region and our national platforms contributed

$878 million

,

$985 million

and

$1.1 billion

, respectively, to new loan growth for the

year ended December 31, 2016

. The following charts compare the composition of our loan and lease portfolio by portfolio segment and of our new loan and lease portfolio by region at

December 31, 2016

and

2015

:

|

|

(1)

|

Commercial real estate loans include multifamily, non-owner occupied commercial real estate and construction and land loans.

|

|

(2)

|

Includes equipment under operating leases.

|

|

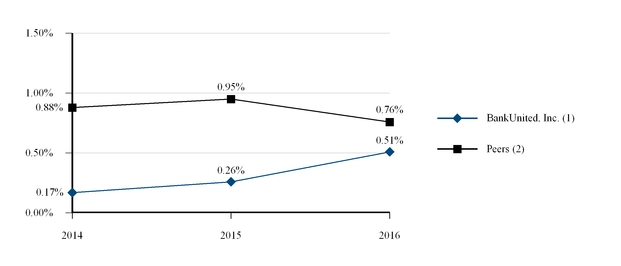

•

|

Asset quality remained strong. At

December 31, 2016

,

97.5%

of the new commercial loan portfolio was rated "pass" and substantially all of the new residential portfolio was current. The ratio of non-performing, non-covered loans to total non-covered loans was

0.71%

and the ratio of non-covered non-performing assets to total assets was

0.51%

at

December 31, 2016

. Non-performing taxi medallion loans comprised

0.32%

of total non-covered loans and

0.22%

of total assets at

December 31, 2016

. Credit risk related to the covered assets is significantly mitigated by the Loss Sharing Agreements. A comparison of our non-covered, non-performing assets ratio to that of our peers at

December 31, 2016

,

2015

and

2014

is presented in the chart below:

|

|

(1)

|

Calculated as non-covered non-performing assets as a percentage of total assets.

|

|

(2)

|

Source: SNL Financial. Peer data reflects median values for publicly traded U.S. banks and thrifts with assets between $10-50 billion.

|

|

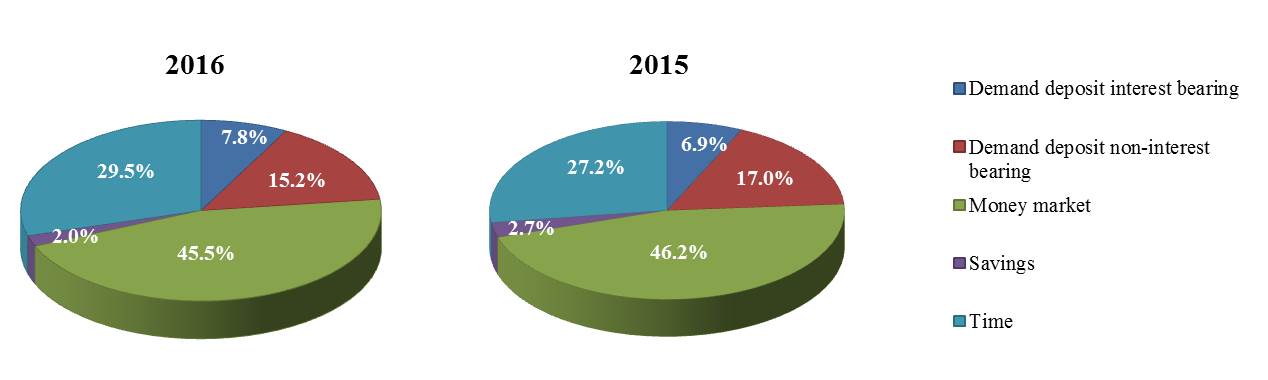

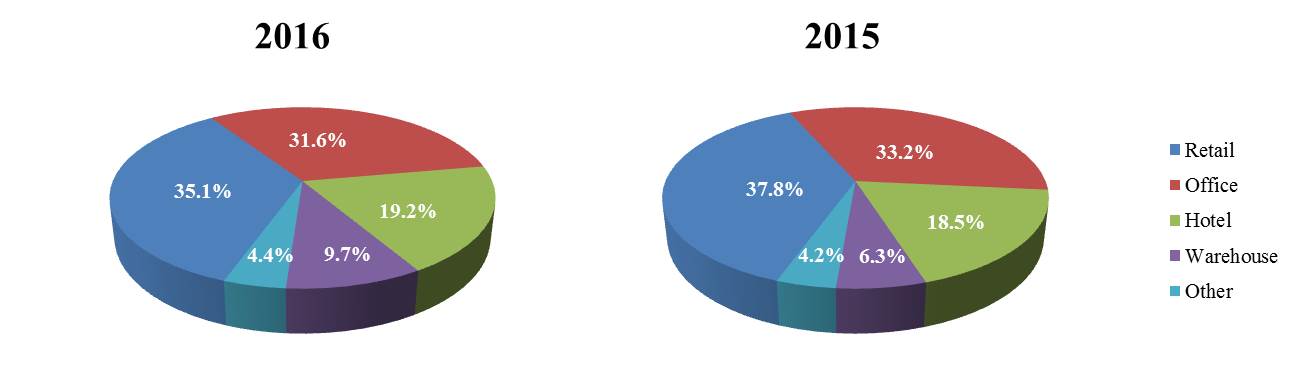

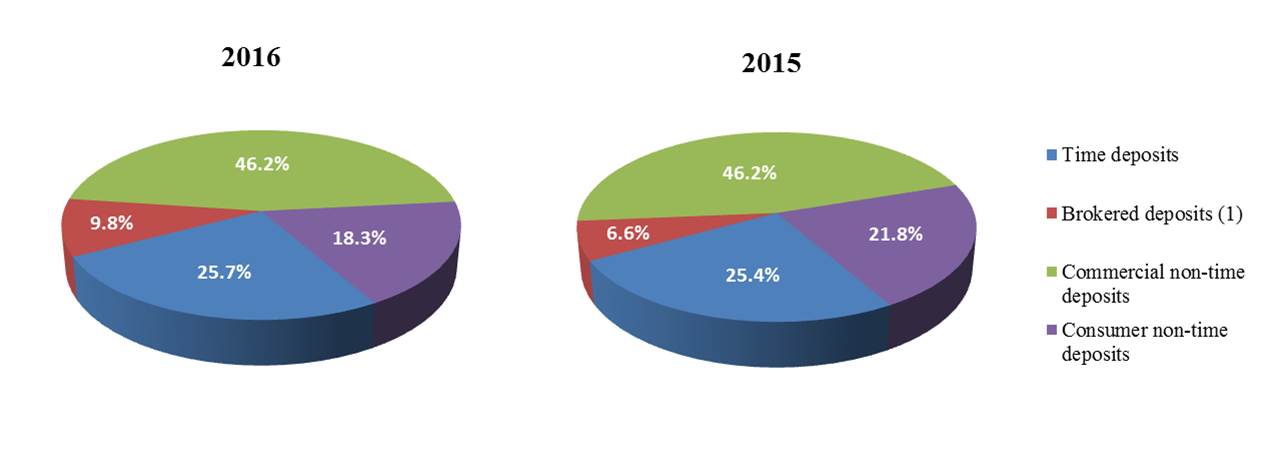

•

|

Total deposits grew by

$2.6 billion

for the

year ended December 31, 2016

to $

19.5 billion

. The average cost of total deposits increased to

0.66%

for the

year ended December 31, 2016

from

0.61%

for

2015

. The following charts illustrate the composition of deposits at

December 31, 2016

and

2015

:

|

|

•

|

Tangible book value per common share increased to

$22.47

at December 31, 2016 from $20.90 at December 31, 2015.

|

|

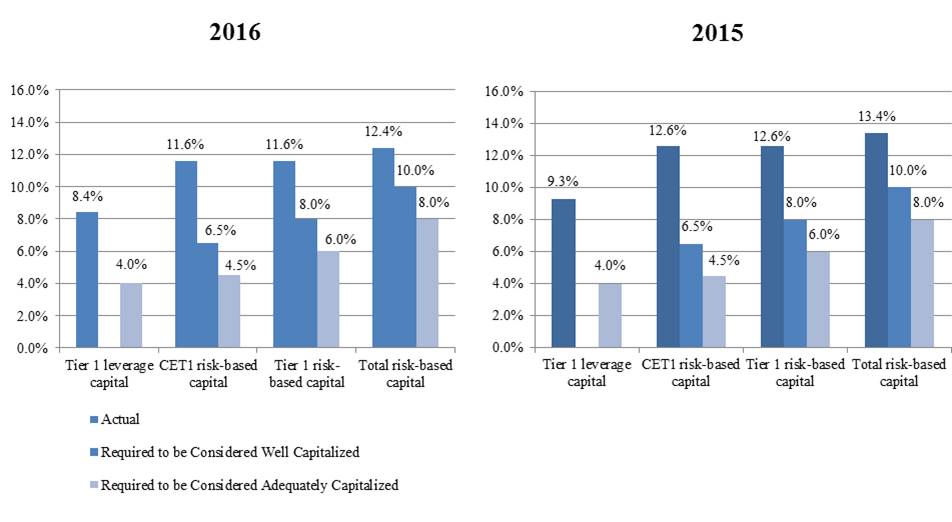

•

|

The Company’s and the Bank's capital ratios exceeded all regulatory “well capitalized” guidelines. The charts below present the Company's and the Bank's regulatory capital ratios compared to regulatory guidelines as of

December 31, 2016

and

2015

:

|

|

•

|

Our strategic focus emphasizes safety and soundness, long-term profitability and sustainable balance sheet growth.

|

|

•

|

Growth in core deposit relationships, further optimization of our deposit mix and management of the cost of funds, while targeting a loan to deposit ratio of under 100%. We anticipate deposit growth exceeding loan growth for 2017.

|

|

•

|

Continued organic loan growth in Florida and the Tri-State market, both of which we believe to be attractive banking markets, as well as across our national lending platforms. We seek to maintain a loan portfolio diversified across geographies and product classes, predicated on a culture of disciplined credit underwriting.

|

|

•

|

Focus on a scalable and efficient operating model.

|

|

•

|

We will opportunistically evaluate potential strategic acquisitions of financial institutions and complementary businesses.

|

|

•

|

Competitive market conditions for both loans and deposits in our primary geographic footprint may impact our ability to execute our balance sheet growth and profitability strategy. Managing the cost of funds while growing deposits in a competitive and, potentially, rising interest rate environment presents a strategic challenge.

|

|

•

|

Originating assets in the current market interest rate environment is likely to continue to put pressure on our net interest margin, particularly as higher yielding covered assets are liquidated or mature.

|

|

•

|

Uncertainty about fiscal and monetary policy may impact our business strategy and the business and economic environment in which we operate.

|

|

•

|

Uncertainty about the regulatory environment may present challenges in the execution of our business strategy and the management of non-interest expense. For additional discussion, see "Item 1. Business—Regulation and Supervision."

|

|

•

|

the amount and timing of expected future cash flows from ACI loans and impaired loans;

|

|

•

|

the value of underlying collateral, which impacts loss severity and certain cash flow assumptions;

|

|

•

|

the selection of proxy data used to calculate loss factors;

|

|

•

|

our evaluation of loss emergence and historical loss experience periods;

|

|

•

|

our evaluation of the risk profile of various loan portfolio segments, including internal risk ratings; and

|

|

•

|

our selection and evaluation of qualitative factors.

|

|

•

|

Under the acquisition method of accounting, all of the assets acquired and liabilities assumed in the FSB Acquisition were initially recorded on the consolidated balance sheet at their estimated fair values as of May 21, 2009. These estimated fair values differed materially from the carrying amounts of many of the assets acquired and liabilities assumed as reflected in the financial statements of the Failed Bank immediately prior to the FSB Acquisition. In particular, the acquisition date carrying amount of investment securities, loans, the FDIC indemnification asset, goodwill, net deferred tax assets, deposit liabilities, and FHLB advances were materially impacted by acquisition accounting adjustments. The reported amounts of many of the acquired assets continue to be affected by the adjustments;

|

|

•

|

Interest income and the net interest margin reflect the impact of accretion of the fair value adjustments made to the carrying amounts of interest earning assets in conjunction with the FSB Acquisition;

|

|

•

|

The estimated fair value at which the acquired loans were initially recorded by the Company was significantly less than the UPB of the loans. No ALLL was recorded with respect to acquired loans at the FSB Acquisition date. The write-down of loans to fair value in conjunction with the application of acquisition accounting and credit protection provided by the Loss Sharing Agreements reduce the impact of any provision for loan losses related to the acquired loans on the results of operations;

|

|

•

|

Acquired investment securities were recorded at their estimated fair values at the FSB Acquisition date, significantly reducing the potential for other-than-temporary impairment charges in periods subsequent to the FSB Acquisition for the acquired securities;

|

|

•

|

An indemnification asset related to the Loss Sharing Agreements with the FDIC was recorded in conjunction with the FSB Acquisition. The Loss Sharing Agreements afford the Company significant protection against future credit losses related to covered assets, including up to 90 days of past due interest, as well as reimbursement of certain expenses;

|

|

•

|

Non-interest expense includes the effect of amortization of the indemnification asset;

|

|

•

|

Non-interest income includes gains and losses associated with the resolution of covered assets and the related effect of indemnification under the terms of the Loss Sharing Agreements. The impact of gains or losses related to transactions in covered assets is significantly mitigated by FDIC indemnification; and

|

|

•

|

ACI loans that are contractually delinquent may not be reflected as non-accrual loans or non-performing assets due to the accounting treatment accorded such loans under ASC section 310-30, "Loans and Debt Securities Acquired with Deteriorated Credit Quality."

|

|

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||

|

|

Average

Balance

|

Interest

(1)

|

Yield/Rate

(1)

|

Average

Balance

|

Interest

(1)

|

Yield/

Rate

(1)

|

Average

Balance

|

Interest

(1)

|

Yield/

Rate

(1)

|

|||||||||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||||||||||

|

Interest earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

New loans

|

$

|

17,229,089

|

|

$

|

609,573

|

|

3.54

|

%

|

$

|

13,260,683

|

|

$

|

466,038

|

|

3.50

|

%

|

$

|

9,247,229

|

|

$

|

329,023

|

|

3.56

|

%

|

||||||||

|

Loans acquired in FSB acquisition

|

775,065

|

|

309,904

|

|

39.98

|

%

|

1,002,934

|

|

303,751

|

|

30.29

|

%

|

1,289,058

|

|

349,251

|

|

27.09

|

%

|

||||||||||||||

|

Total loans

|

18,004,154

|

|

919,477

|

|

5.11

|

%

|

14,263,617

|

|

769,789

|

|

5.40

|

%

|

10,536,287

|

|

678,274

|

|

6.44

|

%

|

||||||||||||||

|

Investment securities

(2)

|

5,691,617

|

|

161,385

|

|

2.84

|

%

|

4,672,032

|

|

121,221

|

|

2.59

|

%

|

3,984,543

|

|

111,471

|

|

2.80

|

%

|

||||||||||||||

|

Other interest earning assets

|

541,816

|

|

12,204

|

|

2.25

|

%

|

481,716

|

|

10,098

|

|

2.10

|

%

|

453,252

|

|

7,845

|

|

1.73

|

%

|

||||||||||||||

|

Total interest earning assets

|

24,237,587

|

|

1,093,066

|

|

4.51

|

%

|

19,417,365

|

|

901,108

|

|

4.64

|

%

|

14,974,082

|

|

797,590

|

|

5.33

|

%

|

||||||||||||||

|

Allowance for loan and lease losses

|

(139,469

|

)

|

(108,875

|

)

|

(76,606

|

)

|

||||||||||||||||||||||||||

|

Non-interest earning assets

|

1,923,298

|

|

1,985,421

|

|

1,928,564

|

|

||||||||||||||||||||||||||

|

Total assets

|

$

|

26,021,416

|

|

$

|

21,293,911

|

|

$

|

16,826,040

|

|

|||||||||||||||||||||||

|

Liabilities and Stockholders' Equity:

|

||||||||||||||||||||||||||||||||

|

Interest bearing liabilities:

|

||||||||||||||||||||||||||||||||

|

Interest bearing demand deposits

|

$

|

1,382,717

|

|

8,343

|

|

0.60

|

%

|

$

|

1,169,921

|

|

5,782

|

|

0.49

|

%

|

$

|

773,655

|

|

3,254

|

|

0.42

|

%

|

|||||||||||

|

Savings and money market deposits

|

8,361,652

|

|

51,774

|

|

0.62

|

%

|

6,849,366

|

|

37,744

|

|

0.55

|

%

|

5,092,444

|

|

25,915

|

|

0.51

|

%

|

||||||||||||||

|

Time deposits

|

5,326,630

|

|

59,656

|

|

1.12

|

%

|

4,305,857

|

|

47,625

|

|

1.11

|

%

|

3,716,611

|

|

43,792

|

|

1.18

|

%

|

||||||||||||||

|

Total interest bearing deposits

|

15,070,999

|

|

119,773

|

|

0.79

|

%

|

12,325,144

|

|

91,151

|

|

0.74

|

%

|

9,582,710

|

|

72,961

|

|

0.76

|

%

|

||||||||||||||

|

FHLB advances

|

4,801,406

|

|

47,773

|

|

0.99

|

%

|

3,706,288

|

|

40,328

|

|

1.09

|

%

|

2,613,156

|

|

32,412

|

|

1.24

|

%

|

||||||||||||||

|

Notes and other borrowings

|

403,197

|

|

21,287

|

|

5.28

|

%

|

58,791

|

|

3,685

|

|

6.27

|

%

|

10,768

|

|

1,278

|

|

11.87

|

%

|

||||||||||||||

|

Total interest bearing liabilities

|

20,275,602

|

|

188,833

|

|

0.93

|

%

|

16,090,223

|

|

135,164

|

|

0.84

|

%

|

12,206,634

|

|

106,651

|

|

0.87

|

%

|

||||||||||||||

|

Non-interest bearing demand deposits

|

2,968,192

|

|

2,732,654

|

|

2,366,621

|

|

||||||||||||||||||||||||||

|

Other non-interest bearing liabilities

|

435,645

|

|

305,519

|

|

235,930

|

|

||||||||||||||||||||||||||

|

Total liabilities

|

23,679,439

|

|

19,128,396

|

|

14,809,185

|

|

||||||||||||||||||||||||||

|

Stockholders' equity

|

2,341,977

|

|

2,165,515

|

|

2,016,855

|

|

||||||||||||||||||||||||||

|

Total liabilities and stockholders' equity

|

$

|

26,021,416

|

|

$

|

21,293,911

|

|

$

|

16,826,040

|

|

|||||||||||||||||||||||

|

Net interest income

|

$

|

904,233

|

|

$

|

765,944

|

|

$

|

690,939

|

|

|||||||||||||||||||||||

|

Interest rate spread

|

3.58

|

%

|

3.80

|

%

|

4.46

|

%

|

||||||||||||||||||||||||||

|

Net interest margin

|

3.73

|

%

|

3.94

|

%

|

4.61

|

%

|

||||||||||||||||||||||||||

|

(1)

|

On a tax-equivalent basis. The tax-equivalent adjustment for tax-exempt loans was

$23.3 million

,

$15.9 million

and

$11.0 million

, and the tax-equivalent adjustment for tax-exempt investment securities was

$10.5 million

,

$4.4 million

and

$2.8 million

, for the years ended

December 31, 2016

,

2015

and

2014

, respectively.

|

|

(2)

|

At fair value except for securities held to maturity

|

|

2016 Compared to 2015

|

2015 Compared to 2014

|

||||||||||||||||||||||

|

Change Due

to Volume

|

Change Due

to Rate

|

Increase

|

Change Due

to Volume

|

Change Due

to Rate

|

Increase

(Decrease)

|

||||||||||||||||||

|

Interest Income Attributable to:

|

|||||||||||||||||||||||

|

Loans

|

$

|

191,052

|

|

$

|

(41,364

|

)

|

$

|

149,688

|

|

$

|

201,092

|

|

$

|

(109,577

|

)

|

$

|

91,515

|

|

|||||

|

Investment securities

|

28,484

|

|

11,680

|

|

40,164

|

|

18,118

|

|

(8,368

|

)

|

9,750

|

|

|||||||||||

|

Other interest earning assets

|

1,383

|

|

723

|

|

2,106

|

|

576

|

|

1,677

|

|

2,253

|

|

|||||||||||

|

Total interest income

|

220,919

|

|

(28,961

|

)

|

191,958

|

|

219,786

|

|

(116,268

|

)

|

103,518

|

|

|||||||||||

|

Interest Expense Attributable to:

|

|||||||||||||||||||||||

|

Interest bearing demand deposits

|

1,274

|

|

1,287

|

|

2,561

|

|

1,986

|

|

542

|

|

2,528

|

|

|||||||||||

|

Savings and money market deposits

|

9,235

|

|

4,795

|

|

14,030

|

|

9,792

|

|

2,037

|

|

11,829

|

|

|||||||||||

|

Time deposits

|

11,600

|

|

431

|

|

12,031

|

|

6,435

|

|

(2,602

|

)

|

3,833

|

|

|||||||||||

|

Total interest bearing deposits

|

22,109

|

|

6,513

|

|

28,622

|

|

18,213

|

|

(23

|

)

|

18,190

|

|

|||||||||||

|

FHLB advances

|

11,151

|

|

(3,706

|

)

|

7,445

|

|

11,836

|

|

(3,920

|

)

|

7,916

|

|

|||||||||||

|

Notes and other borrowings

|

18,184

|

|

(582

|

)

|

17,602

|

|

3,010

|

|

(603

|

)

|

2,407

|

|

|||||||||||

|

Total interest expense

|

51,444

|

|

2,225

|

|

53,669

|

|

33,059

|

|

(4,546

|

)

|

28,513

|

|

|||||||||||

|

Increase (decrease) in net interest income

|

$

|

169,475

|

|

$

|

(31,186

|

)

|

$

|

138,289

|

|

$

|

186,727

|

|

$

|

(111,722

|

)

|

$

|

75,005

|

|

|||||

|

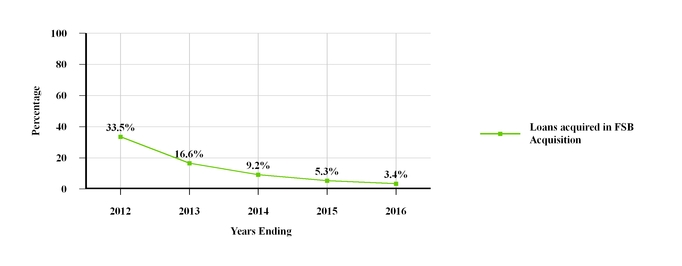

•

|

New loans originated at lower market rates of interest comprised a greater percentage of the portfolio for the

year ended December 31, 2016

than for

2015

. New loans represented

95.7%

of the average balance of loans outstanding for the

year ended December 31, 2016

compared to

93.0%

for the

year ended December 31, 2015

. We would expect the impact of growth of the new loan portfolio to lead to further declines in the overall yield on loans, given an otherwise stable interest rate environment.

|

|

•

|

The tax-equivalent yield on new loans increased to

3.54%

for the

year ended December 31, 2016

from

3.50%

for the

year ended December 31, 2015

.

|

|

•

|

Interest income on loans acquired in the FSB Acquisition totaled

$309.4 million

and

$303.2 million

for the years ended

December 31, 2016

and

2015

, respectively. The tax-equivalent yield on those loans increased to

39.98%

for the

year ended December 31, 2016

from

30.29%

for the

year ended December 31, 2015

. The increase in the yield on loans acquired in the FSB Acquisition resulted primarily from improvements in expected cash flows for ACI loans.

|

|

•

|

New loans originated at lower market rates of interest comprised a greater percentage of the portfolio for the year ended December 31, 2015 than for 2014. New loans represented 93.0% of the average balance of loans outstanding for the year ended December 31, 2015 compared to 87.8% for the year ended December 31, 2014.

|

|

•

|

The tax-equivalent yield on new loans declined to 3.50% for the year ended December 31, 2015 from 3.56% for the year ended December 31, 2014.

|

|

•

|

Interest income on loans acquired in the FSB Acquisition totaled $303.2 million and $348.6 million for the years ended December 31, 2015 and 2014, respectively. The tax-equivalent yield on those loans increased to 30.29% for the year ended December 31, 2015 from 27.09% for the year ended December 31, 2014. Increases in the yield resulting from improvements in the timing and amount of expected cash flows were partially offset by a decrease in the amount of interest income recognized in connection with the sale of ACI residential loans from the pool with a carrying value of zero. Interest income on loans included $30.9 million in proceeds from sales of loans from the zero carrying value pool for the year ended December 31, 2014. No loans were sold from the zero carrying value pool in the year ended December 31, 2015.

|

|

|

2016

|

2015

|

2014

|

||||||||

|

Income from resolution of covered assets, net

|

$

|

36,155

|

|

$

|

50,658

|

|

$

|

49,082

|

|

||

|

Gain (loss) on sale of covered loans, net

|

(14,470

|

)

|

34,929

|

|

20,369

|

|

|||||

|

Net loss on FDIC indemnification

|

(17,759

|

)

|

(65,942

|

)

|

(46,396

|

)

|

|||||

|

Mortgage insurance income, modification incentives and expenses reimbursed by the FDIC

|

1,100

|

|

3,770

|

|

9,476

|

|

|||||

|

Non-interest income related to the covered assets

|

5,026

|

|

23,415

|

|

32,531

|

|

|||||

|

Service charges and fees

|

19,463

|

|

17,876

|

|

16,612

|

|

|||||

|

Gain on sale of non-covered loans

|

10,064

|

|

5,704

|

|

678

|

|

|||||

|

Gain on investment securities available for sale, net

|

14,461

|

|

8,480

|

|

3,859

|

|

|||||

|

Lease financing

|

44,738

|

|

35,641

|

|

21,601

|

|

|||||

|

Other non-interest income

|

12,665

|

|

11,108

|

|

8,884

|

|

|||||

|

$

|

106,417

|

|

$

|

102,224

|

|

$

|

84,165

|

|

|||

|

•

|

gains or losses from the resolution of covered assets;

|

|

•

|

provisions for (recoveries of) losses on covered loans;

|

|

•

|

gains or losses on the sale of covered loans; and

|

|

•

|

gains or losses on covered OREO.

|

|

|

2016

|

2015

|

2014

|

||||||||

|

Payments in full

|

$

|

37,117

|

|

$

|

47,238

|

|

$

|

47,855

|

|

||

|

Foreclosures

|

(119

|

)

|

476

|

|

(1,556

|

)

|

|||||

|

Short sales

|

(545

|

)

|

36

|

|

(388

|

)

|

|||||

|

Charge-offs

|

(542

|

)

|

(549

|

)

|

(1,016

|

)

|

|||||

|

Recoveries

|

244

|

|

3,457

|

|

4,187

|

|

|||||

|

Income from resolution of covered assets, net

|

$

|

36,155

|

|

$

|

50,658

|

|

$

|

49,082

|

|

||

|

2016

|

2015

|

2014

|

|||||||||

|

Gain (loss) on sale of covered loans

|

$

|

(14,470

|

)

|

$

|

34,929

|

|

$

|

2,398

|

|

||

|

Net gain (loss) on FDIC indemnification

|

11,615

|

|

(28,051

|

)

|

(809

|

)

|

|||||

|

Net

|

$

|

(2,855

|

)

|

$

|

6,878

|

|

$

|

1,589

|

|

||

|

|

2016

|

2015

|

2014

|

||||||||

|

Employee compensation and benefits

|

$

|

223,011

|

|

$

|

210,104

|

|

$

|

195,218

|

|

||

|

Occupancy and equipment

|

76,003

|

|

76,024

|

|

70,520

|

|

|||||

|

Amortization of FDIC indemnification asset

|

160,091

|

|

109,411

|

|

69,470

|

|

|||||

|

Deposit insurance expense

|

17,806

|

|

14,257

|

|

9,348

|

|

|||||

|

Professional fees

|

14,249

|

|

14,185

|

|

13,178

|

|

|||||

|

Telecommunications and data processing

|

14,343

|

|

13,613

|

|

13,381

|

|

|||||

|

Depreciation of equipment under operating lease

|

31,580

|

|

18,369

|

|

8,759

|

|

|||||

|

Other non-interest expense

|

53,364

|

|

50,709

|

|

46,629

|

|

|||||

|

$

|

590,447

|

|

$

|

506,672

|

|

$

|

426,503

|

|

|||

|

2016

|

2015

|

||||||

|

FDIC indemnification asset

|

$

|

515,933

|

|

$

|

739,880

|

|

|

|

Less expected amortization

|

(245,350

|

)

|

(342,317

|

)

|

|||

|

Amount expected to be collected from the FDIC

|

$

|

270,583

|

|

$

|

397,563

|

|

|

|

2016

|

2015

|

2014

|

|||||||||||||||||||||

|

|

Amortized

Cost

|

Fair

Value

|

Amortized

Cost

|

Fair

Value

|

Amortized

Cost

|

Fair

Value

|

|||||||||||||||||

|

U.S. Treasury securities

|

$

|

4,999

|

|

$

|

5,005

|

|

$

|

4,997

|

|

$

|

4,997

|

|

$

|

54,924

|

|

$

|

54,967

|

|

|||||

|

U.S. Government agency and sponsored enterprise residential MBS

|

1,513,028

|

|

1,527,242

|

|

1,167,197

|

|

1,178,318

|

|

1,501,504

|

|

1,524,716

|

|

|||||||||||

|

U.S. Government agency and sponsored enterprise commercial MBS

|

126,754

|

|

124,586

|

|

95,997

|

|

96,814

|

|

101,089

|

|

101,858

|

|

|||||||||||

|

Re-Remics

|

—

|

|

—

|

|

88,658

|

|

89,691

|

|

179,664

|

|

183,272

|

|

|||||||||||

|

Private label residential MBS and CMOs

|

334,167

|

|

375,098

|

|

502,723

|

|

544,612

|

|

350,300

|

|

403,979

|

|

|||||||||||

|

Private label commercial MBS

|

1,180,386

|

|

1,187,624

|

|

1,219,355

|

|

1,218,740

|

|

1,156,166

|

|

1,161,485

|

|

|||||||||||

|

Single family rental real estate-backed securities

|

858,339

|

|

861,251

|

|

646,156

|

|

636,705

|

|

446,079

|

|

443,017

|

|

|||||||||||

|

Collateralized loan obligations

|

487,678

|

|

487,296

|

|

309,615

|

|

306,877

|

|

174,767

|

|