|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

[X]

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

For the fiscal year ended:

December 31, 2017

|

|

|

Or

|

|

[ ]

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

For the transition period from ______ to ______

|

|

Delaware

|

20-8023465

|

|||

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|||

|

Title of each class

|

Name of each exchange on which registered

|

|||

|

Common Stock, $0.01 par value

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

|||

|

PAGE NO.

|

|

|

PART I

|

|

|

PART II

|

|

|

PART III

|

|

|

PART IV

|

|

|

(i)

|

Consumer reactions to public health and food safety issues;

|

|

(ii)

|

Our ability to compete in the highly competitive restaurant industry with many well-established competitors and new market entrants;

|

|

(iii)

|

Minimum wage increases and additional mandated employee benefits;

|

|

(iv)

|

Economic conditions and their effects on consumer confidence and discretionary spending, consumer traffic, the cost and availability of credit and interest rates;

|

|

(v)

|

Fluctuations in the price and availability of commodities;

|

|

(vi)

|

Our ability to effectively respond to changes in patterns of consumer traffic, consumer tastes and dietary habits;

|

|

(vii)

|

Our ability to comply with governmental laws and regulations, the costs of compliance with such laws and regulations and the effects of changes to applicable laws and regulations, including tax laws and unanticipated liabilities;

|

|

(viii)

|

Our ability to implement our expansion, remodeling and relocation plans due to uncertainty in locating and acquiring attractive sites on acceptable terms, obtaining required permits and approvals, recruiting and training necessary personnel, obtaining adequate financing and estimating the performance of newly opened, remodeled or relocated restaurants;

|

|

(ix)

|

Our ability to protect our information technology systems from interruption or security breach, including cyber security threats, and to protect consumer data and personal employee information;

|

|

(x)

|

The effects of international economic, political and social conditions and legal systems on our foreign operations and on foreign currency exchange rates;

|

|

(xi)

|

Our ability to preserve and grow the reputation and value of our brands, particularly in light of changes in consumer engagement with social media platforms;

|

|

(xii)

|

Any impairment in the carrying value of our goodwill or other intangible or long-lived assets and its effect on our financial condition and results of operations;

|

|

(xiii)

|

Strategic actions, including acquisitions and dispositions, and our success in implementing these initiatives or integrating any acquired or newly created businesses;

|

|

(xiv)

|

Seasonal and periodic fluctuations in our results and the effects of significant adverse weather conditions and other disasters or unforeseen events;

|

|

(xv)

|

The effects of our substantial leverage and restrictive covenants in our various credit facilities on our ability to raise additional capital to fund our operations, to make capital expenditures to invest in new or renovate restaurants and to react to changes in the economy or our industry, and our exposure to interest rate risk in connection with our variable-rate debt; and

|

|

(xvi)

|

The adequacy of our cash flow and earnings and other conditions which may affect our ability to pay dividends and repurchase shares of our common stock.

|

|

SEGMENT (1)

|

CONCEPT

|

GEOGRAPHIC LOCATION

|

||

|

U.S.

|

Outback Steakhouse

|

United States of America

|

||

|

Carrabba’s Italian Grill

|

||||

|

Bonefish Grill

|

||||

|

Fleming’s Prime Steakhouse & Wine Bar

|

||||

|

International

|

Outback Steakhouse

|

Brazil, Hong Kong, China

|

||

|

Carrabba’s Italian Grill (Abbraccio)

|

Brazil

|

|||

|

(1)

|

Includes franchise locations. See Item 2 -

Properties

for disclosure of our restaurant count by state, territory and country.

|

|

U.S.

|

INTERNATIONAL

|

||||||||||||||||||

|

Outback

Steakhouse

|

Carrabba’s

Italian Grill

|

Bonefish Grill

|

Fleming’s

Prime Steakhouse & Wine Bar |

Outback

Steakhouse

Brazil

|

|||||||||||||||

|

Food & non-alcoholic beverage

|

90

|

%

|

85

|

%

|

78

|

%

|

74

|

%

|

84

|

%

|

|||||||||

|

Alcoholic beverage

|

10

|

%

|

15

|

%

|

22

|

%

|

26

|

%

|

16

|

%

|

|||||||||

|

100

|

%

|

100

|

%

|

100

|

%

|

100

|

%

|

100

|

%

|

||||||||||

|

Average check per person ($USD)

|

$

|

23

|

|

$

|

23

|

|

$

|

26

|

|

$

|

80

|

|

$

|

18

|

|

||||

|

Average check per person (LC)

|

R$

|

56

|

|

||||||||||||||||

|

DECEMBER 25,

2016 |

2017 ACTIVITY

|

DECEMBER 31,

2017 |

U.S. STATE

|

|||||||||||||

|

OPENED

|

CLOSED

|

OTHER

|

COUNT

|

|||||||||||||

|

Number of restaurants:

|

||||||||||||||||

|

U.S.

|

||||||||||||||||

|

Outback Steakhouse

|

||||||||||||||||

|

Company-owned (1)

|

650

|

|

1

|

|

(13

|

)

|

(53

|

)

|

585

|

|

||||||

|

Franchised (1)

|

105

|

|

1

|

|

(4

|

)

|

53

|

|

155

|

|

||||||

|

Total

|

755

|

|

2

|

|

(17

|

)

|

—

|

|

740

|

|

48

|

|||||

|

Carrabba’s Italian Grill

|

||||||||||||||||

|

Company-owned (1)

|

242

|

|

—

|

|

(16

|

)

|

(1

|

)

|

225

|

|

||||||

|

Franchised (1)

|

2

|

|

—

|

|

—

|

|

1

|

|

3

|

|

||||||

|

Total

|

244

|

|

—

|

|

(16

|

)

|

—

|

|

228

|

|

31

|

|||||

|

Bonefish Grill

|

||||||||||||||||

|

Company-owned

|

204

|

|

1

|

|

(11

|

)

|

—

|

|

194

|

|

||||||

|

Franchised

|

6

|

|

1

|

|

—

|

|

—

|

|

7

|

|

||||||

|

Total

|

210

|

|

2

|

|

(11

|

)

|

—

|

|

201

|

|

33

|

|||||

|

Fleming’s Prime Steakhouse & Wine Bar

|

||||||||||||||||

|

Company-owned

|

68

|

|

2

|

|

(1

|

)

|

—

|

|

69

|

|

28

|

|||||

|

Express

|

||||||||||||||||

|

Company-owned

|

—

|

|

2

|

|

—

|

|

—

|

|

2

|

|

1

|

|||||

|

U.S. Total

|

1,277

|

|

8

|

|

(45

|

)

|

—

|

|

1,240

|

|

||||||

|

International

|

||||||||||||||||

|

Company-owned

|

||||||||||||||||

|

Outback Steakhouse - Brazil (2)

|

83

|

|

4

|

|

—

|

|

—

|

|

87

|

|

||||||

|

Other

|

29

|

|

11

|

|

(3

|

)

|

—

|

|

37

|

|

||||||

|

Franchised

|

||||||||||||||||

|

Outback Steakhouse - South Korea

|

73

|

|

5

|

|

(6

|

)

|

—

|

|

72

|

|

||||||

|

Other

|

54

|

|

3

|

|

(4

|

)

|

—

|

|

53

|

|

||||||

|

International Total

|

239

|

|

23

|

|

(13

|

)

|

—

|

|

249

|

|

||||||

|

System-wide total

|

1,516

|

|

31

|

|

(58

|

)

|

—

|

|

1,489

|

|

||||||

|

(1)

|

In April 2017, we sold 53 Outback Steakhouse restaurants and one Carrabba’s Italian Grill restaurant, which are now operated as franchises. See Note

3

-

Disposals

of our Notes to Consolidated Financial Statements in Part II, Item 8 for additional information.

|

|

(2)

|

The restaurant counts for Brazil are reported as of November 30, 2017 and 2016, respectively, to correspond with the balance sheet dates of this subsidiary.

|

|

(as a % of gross Restaurant sales)

|

MONTHLY ROYALTY FEE PERCENTAGE

|

|

U.S. franchisees (1)

|

3.50% - 5.75%

|

|

International franchisees (2)

|

3.00% - 6.00%

|

|

(1)

|

U.S. franchisees must also contribute a percentage of gross sales for national marketing programs and also spend a certain percentage of gross sales on local advertising. For U.S. franchisees, there is a maximum of 8.0% of gross restaurant sales for combined national marketing and local advertising.

|

|

(2)

|

International franchisees must also spend a certain percentage of gross sales on local advertising, which varies depending on the market.

|

|

•

|

immigration, employment, minimum wages, overtime, tip credits, worker conditions and health care;

|

|

•

|

nutritional labeling, nutritional content, menu labeling and food safety;

|

|

•

|

the Americans with Disabilities Act, which, among other things, requires our restaurants to meet federally mandated requirements for the disabled; and

|

|

•

|

information security, privacy, cashless payments, gift cards and consumer credit, protection and fraud.

|

|

NAME

|

AGE

|

POSITION

|

||

|

Elizabeth A. Smith

|

54

|

Chairman of the Board of Directors and Chief Executive Officer

|

||

|

David J. Deno

|

60

|

Executive Vice President and Chief Financial and Administrative Officer

|

||

|

Donagh M. Herlihy

|

54

|

Executive Vice President and Chief Technology Officer

|

||

|

Joseph J. Kadow

|

61

|

Executive Vice President and Chief Legal Officer

|

||

|

Michael Kappitt

|

48

|

Executive Vice President and President of Carrabba’s Italian Grill

|

||

|

Gregg Scarlett

|

56

|

Executive Vice President and President of Outback Steakhouse

|

||

|

David P. Schmidt

|

47

|

Executive Vice President and President of Bonefish Grill

|

||

|

Sukhdev Singh

|

54

|

Executive Vice President and Global Chief Development and Franchising Officer

|

||

|

•

|

the availability of attractive sites for new restaurants;

|

|

•

|

acquiring or leasing those sites at acceptable prices and other terms;

|

|

•

|

funding or financing our development;

|

|

•

|

obtaining all required permits, approvals and licenses on a timely basis;

|

|

•

|

recruiting and training skilled management and restaurant employees and retaining those employees on acceptable terms;

|

|

•

|

weather, natural disasters and other events or factors beyond our control resulting in construction or other delays; and

|

|

•

|

consumer tastes in new geographic regions and acceptance of our restaurant concepts and awareness of our brands in those regions.

|

|

•

|

making it more difficult for us to make payments on indebtedness;

|

|

•

|

increasing our vulnerability to general economic, industry and competitive conditions and the various risks we face in our business;

|

|

•

|

increasing our cost of borrowing;

|

|

•

|

requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, thereby reducing our ability to use our cash flow to fund our operations, capital expenditures, dividend payments, share repurchases and future business opportunities;

|

|

•

|

exposing us to the risk of increased interest rates because certain of our borrowings are at variable rates of interest;

|

|

•

|

restricting us from making strategic acquisitions or causing us to make non-strategic divestitures;

|

|

•

|

limiting our ability to obtain additional financing for working capital, capital expenditures, restaurant development, debt service requirements, acquisitions and general corporate or other purposes; and

|

|

•

|

limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who may not be as highly leveraged.

|

|

COMPANY-OWNED

|

||||||||||||||

|

U.S.

|

INTERNATIONAL

|

|||||||||||||

|

Alabama

|

19

|

|

Kentucky

|

17

|

|

Ohio

|

49

|

|

Brazil (1)

|

104

|

|

|||

|

Arizona

|

13

|

|

Louisiana

|

23

|

|

Oklahoma

|

11

|

|

China (Mainland)

|

9

|

|

|||

|

Arkansas

|

11

|

|

Maryland

|

40

|

|

Pennsylvania

|

46

|

|

Hong Kong

|

11

|

|

|||

|

California

|

15

|

|

Massachusetts

|

17

|

|

Rhode Island

|

3

|

|

||||||

|

Colorado

|

14

|

|

Michigan

|

34

|

|

South Carolina

|

37

|

|

||||||

|

Connecticut

|

11

|

|

Minnesota

|

8

|

|

South Dakota

|

1

|

|

||||||

|

Delaware

|

4

|

|

Mississippi

|

1

|

|

Tennessee

|

36

|

|

||||||

|

Florida

|

219

|

|

Missouri

|

14

|

|

Texas

|

70

|

|

||||||

|

Georgia

|

49

|

|

Nebraska

|

7

|

|

Utah

|

1

|

|

||||||

|

Hawaii

|

6

|

|

Nevada

|

6

|

|

Vermont

|

1

|

|

||||||

|

Illinois

|

25

|

|

New Hampshire

|

3

|

|

Virginia

|

60

|

|

||||||

|

Indiana

|

23

|

|

New Jersey

|

39

|

|

West Virginia

|

8

|

|

|

|

||||

|

Iowa

|

7

|

|

New York

|

43

|

|

Wisconsin

|

12

|

|

||||||

|

Kansas

|

7

|

|

North Carolina

|

65

|

|

|||||||||

|

Total U.S. company-owned

|

1,075

|

|

Total International company-owned

|

124

|

|

|||||||||

|

FRANCHISE

|

||||||||||||||

|

U.S.

|

INTERNATIONAL

|

|||||||||||||

|

Alabama

|

1

|

|

Nevada

|

10

|

|

Australia

|

8

|

|

Malaysia

|

2

|

|

|||

|

Alaska

|

1

|

|

New Mexico

|

5

|

|

Bahamas

|

1

|

|

Mexico

|

5

|

|

|||

|

Arizona

|

14

|

|

Ohio

|

1

|

|

Brazil

|

1

|

|

Philippines

|

4

|

|

|||

|

California

|

59

|

|

Oregon

|

7

|

|

Canada

|

2

|

|

Puerto Rico

|

4

|

|

|||

|

Colorado

|

16

|

|

South Dakota

|

1

|

|

Costa Rica

|

1

|

|

Qatar

|

1

|

|

|||

|

Florida

|

1

|

|

Tennessee

|

3

|

|

Dominican Republic

|

2

|

|

Saudi Arabia

|

6

|

|

|||

|

Georgia

|

1

|

|

Utah

|

5

|

|

Ecuador

|

1

|

|

Singapore

|

1

|

|

|||

|

Idaho

|

6

|

|

Virginia

|

1

|

|

Guam

|

1

|

|

South Korea

|

72

|

|

|||

|

Mississippi

|

7

|

|

Washington

|

21

|

|

Indonesia

|

3

|

|

Thailand

|

1

|

|

|||

|

Montana

|

3

|

|

Wyoming

|

2

|

|

Japan

|

9

|

|

||||||

|

Total U.S. franchise

|

|

|

165

|

|

Total International franchise

|

125

|

|

|||||||

|

(1)

|

The restaurant count for Brazil is reported as of November 2017 to correspond with the balance sheet date of this subsidiary.

|

|

LOCATION (1)

|

USE

|

SQUARE FEET

|

LEASE EXPIRATION

|

||||

|

Tampa, Florida

|

Corporate Headquarters

|

168,000

|

|

1/31/2025

|

|||

|

São Paulo, Brazil

|

Brazil Operations Center

|

17,000

|

|

7/31/2021

|

|||

|

(1)

|

We also have other smaller office locations regionally in China (mainland) and Hong Kong.

|

|

SALES PRICE

|

DIVIDENDS DECLARED

AND PAID (1)

|

||||||||||||||||||||||

|

2017

|

2016

|

||||||||||||||||||||||

|

HIGH

|

LOW

|

HIGH

|

LOW

|

2017

|

2016

|

||||||||||||||||||

|

First Quarter

|

$

|

19.64

|

|

$

|

16.58

|

|

$

|

18.09

|

|

$

|

14.91

|

|

$

|

0.08

|

|

$

|

0.07

|

|

|||||

|

Second Quarter

|

22.16

|

|

18.60

|

|

19.83

|

|

16.01

|

|

0.08

|

|

0.07

|

|

|||||||||||

|

Third Quarter

|

21.70

|

|

16.11

|

|

19.89

|

|

17.21

|

|

0.08

|

|

0.07

|

|

|||||||||||

|

Fourth Quarter

|

22.47

|

|

16.30

|

|

19.99

|

|

15.82

|

|

0.08

|

|

0.07

|

|

|||||||||||

|

(1)

|

See Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations -

DIVIDENDS AND SHARE REPURCHASES

.”

|

|

(shares in thousands)

|

(a)

|

(b)

|

(c)

|

|||||||

|

PLAN CATEGORY

|

NUMBER OF SECURITIES TO BE ISSUED UPON EXERCISE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS

|

WEIGHTED-AVERAGE EXERCISE PRICE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS

|

NUMBER OF SECURITIES REMAINING AVAILABLE FOR FUTURE ISSUANCE UNDER EQUITY COMPENSATION PLANS (EXCLUDING SECURITIES REFLECTED IN COLUMN (a)) (1)

|

|||||||

|

Equity compensation plans approved by security holders

|

10,051

|

|

$

|

14.89

|

|

5,063

|

|

|||

|

(1)

|

The shares remaining available for issuance may be issued in the form of stock options, restricted stock, restricted stock units or other stock awards under the 2016 Omnibus Incentive Compensation Plan.

|

|

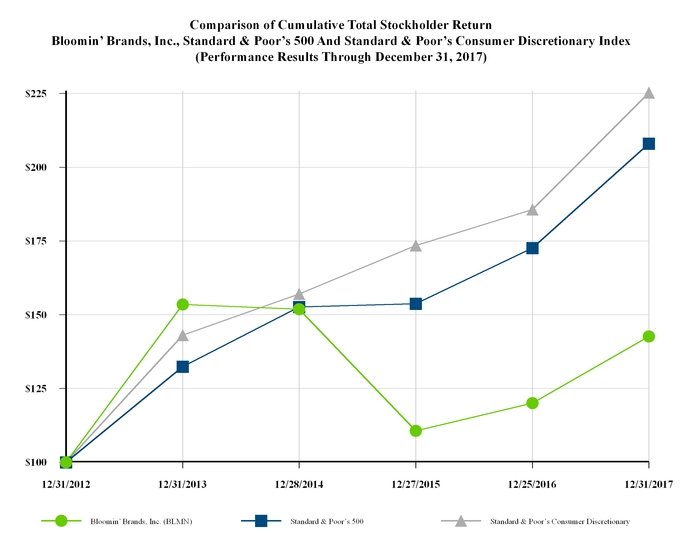

|

DECEMBER 31,

2012 |

DECEMBER 31,

2013 |

|

DECEMBER 28,

2014 |

|

DECEMBER 27,

2015 |

|

DECEMBER 25,

2016 |

|

DECEMBER 31,

2017 |

|||||||||||||

|

Bloomin’ Brands, Inc. (BLMN)

|

$

|

100.00

|

|

$

|

153.52

|

|

|

$

|

151.85

|

|

|

$

|

110.60

|

|

|

$

|

120.02

|

|

|

$

|

142.69

|

|

|

|

Standard & Poor’s 500

|

100.00

|

|

132.37

|

|

|

152.62

|

|

|

153.78

|

|

|

172.64

|

|

|

208.05

|

|

|||||||

|

Standard & Poor’s Consumer Discretionary

|

100.00

|

|

143.08

|

|

|

157.03

|

|

|

173.43

|

|

|

185.67

|

|

|

225.30

|

|

|||||||

|

PERIOD

|

TOTAL NUMBER OF SHARES PURCHASED

|

AVERAGE PRICE PAID PER SHARE

|

TOTAL NUMBER OF SHARES PURCHASED AS PART OF PUBLICLY ANNOUNCED PLANS OR PROGRAMS

|

APPROXIMATE DOLLAR VALUE OF SHARES THAT MAY YET BE PURCHASED UNDER THE PLANS OR PROGRAMS (1)

|

||||||||||

|

September 25, 2017 through October 22, 2017

|

—

|

|

$

|

—

|

|

—

|

|

$

|

55,000,223

|

|

||||

|

October 23, 2017 through November 19, 2017

|

—

|

|

$

|

—

|

|

—

|

|

$

|

55,000,223

|

|

||||

|

November 20, 2017 through December 31, 2017

|

—

|

|

$

|

—

|

|

—

|

|

$

|

55,000,223

|

|

||||

|

Total

|

—

|

|

—

|

|

|

|

||||||||

|

(1)

|

On

April 21, 2017

, the Board of Directors authorized the repurchase of

$250.0 million

of our outstanding common stock as announced in our press release issued on April 26, 2017 (the “2017 Share Repurchase Program”). On

February 16, 2018

, our Board of Directors canceled the remaining

$55.0 million

of authorization under the 2017 Share Repurchase Program and approved a new

$150.0 million

authorization (the “2018 Share Repurchase Program”), as announced in our press release issued on February 22, 2018. The 2018 Share Repurchase Program will expire on

August 16, 2019

.

|

|

FISCAL YEAR

|

|||||||||||||||||||

|

(dollars in thousands, except per share data)

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||||||

|

Operating Results:

|

|||||||||||||||||||

|

Revenues

|

|||||||||||||||||||

|

Restaurant sales

|

$

|

4,168,658

|

|

$

|

4,226,057

|

|

$

|

4,349,921

|

|

$

|

4,415,783

|

|

$

|

4,089,128

|

|

||||

|

Franchise and other revenues

|

44,688

|

|

26,255

|

|

27,755

|

|

26,928

|

|

40,102

|

|

|||||||||

|

Total revenues (1)

|

$

|

4,213,346

|

|

$

|

4,252,312

|

|

$

|

4,377,676

|

|

$

|

4,442,711

|

|

$

|

4,129,230

|

|

||||

|

Income from operations (2)

|

$

|

146,092

|

|

$

|

127,606

|

|

$

|

230,925

|

|

$

|

191,964

|

|

$

|

225,357

|

|

||||

|

Net income including noncontrolling interests (2) (3)

|

$

|

102,558

|

|

$

|

46,347

|

|

$

|

131,560

|

|

$

|

95,926

|

|

$

|

214,568

|

|

||||

|

Net income attributable to Bloomin’ Brands (2) (3)

|

$

|

100,243

|

|

$

|

41,748

|

|

$

|

127,327

|

|

$

|

91,090

|

|

$

|

208,367

|

|

||||

|

Basic earnings per share

|

$

|

1.04

|

|

$

|

0.37

|

|

$

|

1.04

|

|

$

|

0.73

|

|

$

|

1.69

|

|

||||

|

Diluted earnings per share (4)

|

$

|

1.01

|

|

$

|

0.37

|

|

$

|

1.01

|

|

$

|

0.71

|

|

$

|

1.63

|

|

||||

|

Cash dividends declared per common share

|

$

|

0.32

|

|

$

|

0.28

|

|

$

|

0.24

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Total assets

|

$

|

2,572,907

|

|

$

|

2,642,279

|

|

$

|

3,032,569

|

|

$

|

3,338,240

|

|

$

|

3,267,421

|

|

||||

|

Total debt, net

|

$

|

1,118,104

|

|

$

|

1,089,485

|

|

$

|

1,316,864

|

|

$

|

1,309,797

|

|

$

|

1,408,088

|

|

||||

|

Total stockholders’ equity (5)

|

$

|

49,471

|

|

$

|

195,353

|

|

$

|

421,900

|

|

$

|

556,449

|

|

$

|

482,709

|

|

||||

|

Common stock outstanding (5)

|

91,913

|

|

103,922

|

|

119,215

|

|

125,950

|

|

124,784

|

|

|||||||||

|

Cash Flow Data:

|

|||||||||||||||||||

|

Investing activities:

|

|||||||||||||||||||

|

Capital expenditures

|

$

|

260,589

|

|

$

|

260,578

|

|

$

|

210,263

|

|

$

|

237,868

|

|

$

|

237,214

|

|

||||

|

Proceeds from sale-leaseback transactions, net

|

98,840

|

|

530,684

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Financing activities:

|

|||||||||||||||||||

|

Repurchase of common stock (5)

|

$

|

272,916

|

|

$

|

310,334

|

|

$

|

170,769

|

|

$

|

930

|

|

$

|

436

|

|

||||

|

(1)

|

There were 53 operating weeks in 2017, versus 52 operating weeks for the other periods presented. This additional week resulted in an increase in Total revenues of

$80.4 million

during 2017. Due to the change in our fiscal year end, Total revenues for 2015 includes $24.3 million of higher restaurant sales and Total revenues in 2014 includes $46.0 million of lower restaurant sales.

|

|

(2)

|

2017 includes: (i)

$42.8 million

of asset impairments and closing costs primarily related to certain approved closure and restructuring initiatives, the remeasurement of certain surplus properties and for our China subsidiary, (ii)

$12.5 million

of asset impairments and restaurant closing costs related to the relocation of certain restaurants and (iii)

$11.0 million

of severance expense incurred as a result a restructuring event.

2016

results include: (i) $51.4 million of asset impairments and closing costs related to certain approved closure and restructuring initiatives, (ii) $43.1 million of asset impairments related to the refranchising of Outback Steakhouse South Korea and for our Puerto Rico subsidiary, (iii) $7.2 million of asset impairments and restaurant closing costs related to the relocation of certain restaurants and (iv) $5.5 million of severance related to a restructuring event and the relocation of our Fleming’s operations center to the corporate home office.

2015

results include $4.9 million of higher income from operations due to a change in our fiscal year end and $31.8 million of asset impairments and restaurant closing costs related to certain approved closure and restructuring initiatives. 2014 results include: (i) $9.2 million of lower income from operations due to a change in our fiscal year end, (ii) $26.8 million of asset impairments due to certain approved closure and restructuring initiatives, (iii) $24.0 million of asset impairments related to our Roy’s concept and corporate airplanes and (iv) $9.0 million of severance related to our organizational realignment. 2013 includes $18.7 million of asset impairments due to certain approved closure and restructuring initiatives.

|

|

(3)

|

Includes

$27.0 million

,

$11.1 million and $14.6 million in 2016, 2014 and 2013, respectively, of loss on defeasance, extinguishment and modification of debt. Includes a $36.6 million gain on remeasurement of a previously held equity investment related to our Brazil acquisition and a $52.0 million income tax benefit for a U.S. valuation allowance release in 2013.

|

|

(4)

|

Fiscal year 2017 includes

$0.11

of additional diluted earnings per share from a 53

rd

operating week.

|

|

(5)

|

During 2017, 2016 and 2015, we repurchased

13.8 million

,

16.6 million

and 7.6 million shares, respectively, of our outstanding common stock.

|

|

•

|

A decrease in total revenues of

0.9%

to

$4.2 billion

in

2017

as compared to

2016

, driven primarily by refranchising internationally and domestically. This decrease was partially offset by restaurant sales during the 53

rd

week of 2017, higher comparable restaurant sales and the effect of foreign currency translation.

|

|

•

|

Income from operations increased to

$146.1 million

in

2017

as compared to

$127.6 million

in

2016

, primarily due to lower impairment charges, the impact of the 53

rd

week in 2017, increases in franchise and other revenues and increases in average check per person. These increases were partially offset by higher general and administrative expense and labor costs.

|

|

•

|

Elevate the 360-Degree Customer Experience.

We plan to continue to make investments to enhance our core guest experience, increase off-premise dining occasions, remodel and relocate restaurants, invest in digital marketing and data personalization and utilize the Dine Rewards loyalty program and multimedia marketing campaigns to drive traffic.

|

|

•

|

Optimize International Opportunities.

We continue to focus on existing geographic regions in South America, with strategic expansion in Brazil, and pursue franchise opportunities in Asia and the Middle East.

|

|

•

|

Engage with All Stakeholders Responsibly.

We take the responsibility to our people, customers and communities seriously and continue to invest in programs that support the wellbeing of those engaged with us.

|

|

•

|

Drive Long-Term Shareholder Value.

We plan to drive long-term shareholder value by reinvesting operational cash flow in our business, improving our credit profile and returning excess cash to shareholders through share repurchases and dividends.

|

|

•

|

Average restaurant unit volumes

—average sales per restaurant to measure changes in consumer traffic, pricing and development of the brand;

|

|

•

|

Comparable restaurant sales

—year-over-year comparison of sales volumes for Company-owned restaurants that are open 18 months or more in order to remove the impact of new restaurant openings in comparing the operations of existing restaurants;

|

|

•

|

System-wide sales

—total restaurant sales volume for all Company-owned, franchise and unconsolidated joint venture restaurants, regardless of ownership, to interpret the overall health of our brands;

|

|

•

|

Restaurant-level operating margin, Income from operations, Net income and Diluted earnings per share

— financial measures utilized to evaluate our operating performance.

|

|

(i)

|

Franchise and other revenues which are earned primarily from franchise royalties and other non-food and beverage revenue streams, such as rental and sublease income.

|

|

(ii)

|

Depreciation and amortization which, although substantially all is related to restaurant-level assets, represent historical sunk costs rather than cash outlays for the restaurants.

|

|

(iii)

|

General and administrative expense which includes primarily non-restaurant-level costs associated with support of the restaurants and other activities at our corporate offices.

|

|

(iv)

|

Asset impairment charges and restaurant closing costs which are not reflective of ongoing restaurant performance in a period.

|

|

•

|

Adjusted restaurant-level operating margin, Adjusted income from operations, Adjusted net income, Adjusted diluted earnings per share

—non-GAAP financial measures utilized to evaluate our operating performance, which definitions, usefulness and reconciliations are described in more detail in the “Non-GAAP Financial Measures” section below; and

|

|

•

|

Consumer satisfaction scores

—measurement of our consumers’ experiences in a variety of key areas.

|

|

DECEMBER 31,

2017 |

DECEMBER 25,

2016 |

DECEMBER 27,

2015 |

||||||

|

Number of restaurants (at end of the period):

|

||||||||

|

U.S.

|

||||||||

|

Outback Steakhouse

|

||||||||

|

Company-owned (1)

|

585

|

|

650

|

|

650

|

|

||

|

Franchised (1)

|

155

|

|

105

|

|

105

|

|

||

|

Total

|

740

|

|

755

|

|

755

|

|

||

|

Carrabba’s Italian Grill

|

||||||||

|

Company-owned (1)

|

225

|

|

242

|

|

244

|

|

||

|

Franchised (1)

|

3

|

|

2

|

|

3

|

|

||

|

Total

|

228

|

|

244

|

|

247

|

|

||

|

Bonefish Grill

|

||||||||

|

Company-owned

|

194

|

|

204

|

|

210

|

|

||

|

Franchised

|

7

|

|

6

|

|

5

|

|

||

|

Total

|

201

|

|

210

|

|

215

|

|

||

|

Fleming’s Prime Steakhouse & Wine Bar

|

||||||||

|

Company-owned

|

69

|

|

68

|

|

66

|

|

||

|

Express

|

||||||||

|

Company-owned

|

2

|

|

—

|

|

—

|

|

||

|

U.S. Total

|

1,240

|

|

1,277

|

|

1,283

|

|

||

|

International

|

||||||||

|

Company-owned

|

||||||||

|

Outback Steakhouse - Brazil (2)

|

87

|

|

83

|

|

75

|

|

||

|

Outback Steakhouse - South Korea (3)

|

—

|

|

—

|

|

75

|

|

||

|

Other

|

37

|

|

29

|

|

16

|

|

||

|

Franchised

|

||||||||

|

Outback Steakhouse - South Korea (3)

|

72

|

|

73

|

|

—

|

|

||

|

Other

|

53

|

|

54

|

|

58

|

|

||

|

International Total

|

249

|

|

239

|

|

224

|

|

||

|

System-wide total

|

1,489

|

|

1,516

|

|

1,507

|

|

||

|

(1)

|

In 2017, we sold 53 Outback Steakhouse restaurants and one Carrabba’s Italian Grill restaurant, which are now operated as franchises.

|

|

(2)

|

The restaurant counts for Brazil are reported as of November 30,

2017

,

2016

and

2015

, respectively, to correspond with the balance sheet dates of this subsidiary.

|

|

(3)

|

In 2016, we sold our restaurant locations in South Korea, converting all restaurants in that market to franchised locations.

|

|

FISCAL YEAR

|

||||||||

|

2017

|

2016

|

2015

|

||||||

|

Revenues

|

||||||||

|

Restaurant sales

|

98.9

|

%

|

99.4

|

%

|

99.4

|

%

|

||

|

Franchise and other revenues

|

1.1

|

|

0.6

|

|

0.6

|

|

||

|

Total revenues

|

100.0

|

|

100.0

|

|

100.0

|

|

||

|

Costs and expenses

|

||||||||

|

Cost of sales (1)

|

31.6

|

|

32.1

|

|

32.6

|

|

||

|

Labor and other related (1)

|

29.3

|

|

28.7

|

|

27.7

|

|

||

|

Other restaurant operating (1)

|

23.5

|

|

23.5

|

|

23.1

|

|

||

|

Depreciation and amortization

|

4.6

|

|

4.6

|

|

4.3

|

|

||

|

General and administrative

|

7.3

|

|

6.3

|

|

6.6

|

|

||

|

Provision for impaired assets and restaurant closings

|

1.2

|

|

2.5

|

|

0.8

|

|

||

|

Total costs and expenses

|

96.5

|

|

97.0

|

|

94.7

|

|

||

|

Income from operations

|

3.5

|

|

3.0

|

|

5.3

|

|

||

|

Loss on defeasance, extinguishment and modification of debt

|

(*)

|

|

(0.6

|

)

|

(0.1

|

)

|

||

|

Other income (expense), net

|

0.4

|

|

*

|

|

(*)

|

|

||

|

Interest expense, net

|

(1.1

|

)

|

(1.1

|

)

|

(1.3

|

)

|

||

|

Income before provision for income taxes

|

2.8

|

|

1.3

|

|

3.9

|

|

||

|

Provision for income taxes

|

0.4

|

|

0.2

|

|

0.9

|

|

||

|

Net income

|

2.4

|

|

1.1

|

|

3.0

|

|

||

|

Less: net income attributable to noncontrolling interests

|

0.1

|

|

0.1

|

|

0.1

|

|

||

|

Net income attributable to Bloomin’ Brands

|

2.3

|

%

|

1.0

|

%

|

2.9

|

%

|

||

|

(1)

|

As a percentage of Restaurant sales.

|

|

*

|

Less than 1/10

th

of one percent of Total revenues.

|

|

FISCAL YEAR

|

|||||||

|

(dollars in millions):

|

2017 (1)

|

2016

|

|||||

|

For fiscal years 2016 and 2015

|

$

|

4,226.0

|

|

$

|

4,349.9

|

|

|

|

Change from:

|

|||||||

|

Divestiture of restaurants through refranchising transactions (2)

|

(209.4

|

)

|

(86.9

|

)

|

|||

|

Restaurant closings

|

(84.2

|

)

|

(33.9

|

)

|

|||

|

Restaurant openings (3)

|

75.6

|

|

86.2

|

|

|||

|

Comparable restaurant sales (3)

|

124.7

|

|

(57.7

|

)

|

|||

|

Effect of foreign currency translation

|

36.0

|

|

(31.6

|

)

|

|||

|

For fiscal years 2017 and 2016

|

$

|

4,168.7

|

|

$

|

4,226.0

|

|

|

|

(1)

|

Includes $79.9 million of additional restaurant sales from the 53

rd

week of 2017.

|

|

(2)

|

Includes $5.7 million related to divestiture of Roy’s in 2016.

|

|

(3)

|

Summation of quarterly changes for restaurant openings and comparable restaurant sales will not total to annual amounts as the restaurants that meet the definition of a comparable restaurant will differ each period based on when the restaurant opened.

|

|

FISCAL YEAR

|

||||||||

|

2017 (1)

|

2016

|

2015 (2)

|

||||||

|

Year over year percentage change:

|

||||||||

|

Comparable restaurant sales (stores open 18 months or more) (3):

|

||||||||

|

U.S.

|

||||||||

|

Outback Steakhouse

|

1.8

|

%

|

(2.3

|

)%

|

1.8

|

%

|

||

|

Carrabba’s Italian Grill

|

(1.2

|

)%

|

(2.7

|

)%

|

(0.7

|

)%

|

||

|

Bonefish Grill

|

(1.7

|

)%

|

(0.5

|

)%

|

(3.3

|

)%

|

||

|

Fleming’s Prime Steakhouse & Wine Bar

|

(0.4

|

)%

|

(0.2

|

)%

|

1.3

|

%

|

||

|

Combined U.S.

|

0.5

|

%

|

(1.9

|

)%

|

0.5

|

%

|

||

|

International

|

||||||||

|

Outback Steakhouse - Brazil (4)

|

6.3

|

%

|

6.7

|

%

|

6.3

|

%

|

||

|

Traffic:

|

||||||||

|

U.S.

|

||||||||

|

Outback Steakhouse

|

0.3

|

%

|

(5.7

|

)%

|

(1.5

|

)%

|

||

|

Carrabba’s Italian Grill

|

(4.2

|

)%

|

(2.7

|

)%

|

(0.1

|

)%

|

||

|

Bonefish Grill

|

(2.8

|

)%

|

(3.7

|

)%

|

(6.2

|

)%

|

||

|

Fleming’s Prime Steakhouse & Wine Bar

|

(5.5

|

)%

|

(2.2

|

)%

|

(0.2

|

)%

|

||

|

Combined U.S.

|

(1.3

|

)%

|

(4.7

|

)%

|

(1.8

|

)%

|

||

|

International

|

||||||||

|

Outback Steakhouse - Brazil

|

(0.2

|

)%

|

0.2

|

%

|

0.5

|

%

|

||

|

Average check per person increases (decreases) (5):

|

|

|

||||||

|

U.S.

|

||||||||

|

Outback Steakhouse

|

1.5

|

%

|

3.4

|

%

|

3.3

|

%

|

||

|

Carrabba’s Italian Grill

|

3.0

|

%

|

—

|

%

|

(0.6

|

)%

|

||

|

Bonefish Grill

|

1.1

|

%

|

3.2

|

%

|

2.9

|

%

|

||

|

Fleming’s Prime Steakhouse & Wine Bar

|

5.1

|

%

|

2.0

|

%

|

1.5

|

%

|

||

|

Combined U.S.

|

1.8

|

%

|

2.8

|

%

|

2.3

|

%

|

||

|

International

|

||||||||

|

Outback Steakhouse - Brazil

|

6.3

|

%

|

6.5

|

%

|

6.0

|

%

|

||

|

(1)

|

For 2017, comparable restaurant sales compare the 53 weeks from December 26, 2016 through December 31, 2017 to the 53 weeks from December 28, 2015 through January 1, 2017.

|

|

(2)

|

Includes $24.3 million higher restaurant sales recognized in 2015 due to a change in our fiscal year end.

|

|

(3)

|

Comparable restaurant sales exclude the effect of fluctuations in foreign currency rates. Relocated international restaurants closed more than 30 days and relocated U.S. restaurants closed more than 60 days are excluded from comparable restaurant sales until at least 18 months after reopening.

|

|

(4)

|

Includes trading day impact from calendar period reporting.

|

|

(5)

|

Average check per person increases (decreases) includes the impact of menu pricing changes, product mix and discounts.

|

|

FISCAL YEAR

|

|||||||||||

|

(dollars in thousands)

|

2017

|

2016

|

2015

|

||||||||

|

Average restaurant unit volumes:

|

|||||||||||

|

U.S.

|

|||||||||||

|

Outback Steakhouse

|

$

|

3,542

|

|

$

|

3,354

|

|

$

|

3,430

|

|

||

|

Carrabba’s Italian Grill

|

$

|

2,960

|

|

$

|

2,857

|

|

$

|

2,954

|

|

||

|

Bonefish Grill

|

$

|

3,079

|

|

$

|

3,007

|

|

$

|

3,019

|

|

||

|

Fleming’s Prime Steakhouse & Wine Bar

|

$

|

4,436

|

|

$

|

4,277

|

|

$

|

4,247

|

|

||

|

International

|

|||||||||||

|

Outback Steakhouse - Brazil (1)

|

$

|

4,429

|

|

$

|

3,856

|

|

$

|

4,137

|

|

||

|

Operating weeks:

|

|

|

|

|

|

|

|||||

|

U.S.

|

|||||||||||

|

Outback Steakhouse

|

31,969

|

|

33,812

|

|

33,758

|

|

|||||

|

Carrabba’s Italian Grill

|

12,125

|

|

12,658

|

|

12,678

|

|

|||||

|

Bonefish Grill

|

10,411

|

|

10,667

|

|

10,731

|

|

|||||

|

Fleming’s Prime Steakhouse & Wine Bar

|

3,585

|

|

3,469

|

|

3,432

|

|

|||||

|

International

|

|||||||||||

|

Outback Steakhouse - Brazil

|

4,441

|

|

4,096

|

|

3,563

|

|

|||||

|

(1)

|

Translated at average exchange rates of

3.20

,

3.50

and

3.19

for 2017, 2016 and 2015, respectively.

|

|

FISCAL YEAR

|

|||||||||||

|

(dollars in millions)

|

2017

|

2016

|

2015

|

||||||||

|

Franchise revenues (1)

|

$

|

32.6

|

|

$

|

19.8

|

|

$

|

17.9

|

|

||

|

Other revenues

|

12.1

|

|

6.5

|

|

9.9

|

|

|||||

|

Franchise and other revenues

|

$

|

44.7

|

|

$

|

26.3

|

|

$

|

27.8

|

|

||

|

(1)

|

Represents franchise royalties and initial franchise fees.

|

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||

|

Cost of sales

|

$

|

1,317.1

|

|

$

|

1,354.9

|

|

$

|

1,354.9

|

|

$

|

1,419.7

|

|

|||||||||

|

% of Restaurant sales

|

31.6

|

%

|

32.1

|

%

|

(0.5

|

)%

|

32.1

|

%

|

32.6

|

%

|

(0.5

|

)%

|

|||||||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||

|

Labor and other related

|

$

|

1,219.6

|

|

$

|

1,211.3

|

|

$

|

1,211.3

|

|

$

|

1,205.6

|

|

|||||||||

|

% of Restaurant sales

|

29.3

|

%

|

28.7

|

%

|

0.6

|

%

|

28.7

|

%

|

27.7

|

%

|

1.0

|

%

|

|||||||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||

|

Other restaurant operating

|

$

|

979.0

|

|

$

|

992.2

|

|

$

|

992.2

|

|

$

|

1,006.8

|

|

|||||||||

|

% of Restaurant sales

|

23.5

|

%

|

23.5

|

%

|

—

|

%

|

23.5

|

%

|

23.1

|

%

|

0.4

|

%

|

|||||||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||

|

Depreciation and amortization

|

$

|

192.3

|

|

$

|

193.8

|

|

$

|

(1.5

|

)

|

$

|

193.8

|

|

$

|

190.4

|

|

$

|

3.4

|

|

|||||

|

FISCAL YEAR

|

|||||||

|

(dollars in millions):

|

2017

|

2016

|

|||||

|

For fiscal years 2016 and 2015

|

$

|

268.0

|

|

$

|

287.6

|

|

|

|

Change from:

|

|||||||

|

Incentive compensation (1)

|

23.0

|

|

(9.4

|

)

|

|||

|

Legal and professional fees

|

5.9

|

|

(5.2

|

)

|

|||

|

Severance

|

4.4

|

|

3.6

|

|

|||

|

Life insurance and deferred compensation

|

2.8

|

|

(10.2

|

)

|

|||

|

Foreign currency exchange

|

2.6

|

|

(3.4

|

)

|

|||

|

Computer expense

|

1.7

|

|

1.0

|

|

|||

|

Employee stock-based compensation

|

—

|

|

1.5

|

|

|||

|

Compensation, benefits and payroll tax

|

(4.9

|

)

|

—

|

|

|||

|

Other

|

3.5

|

|

2.5

|

|

|||

|

For fiscal years 2017 and 2016

|

$

|

307.0

|

|

$

|

268.0

|

|

|

|

(1)

|

The increase in incentive compensation was driven by improved sales and profit performance against current year objectives.

|

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||

|

Provision for impaired assets and restaurant closings

|

$

|

52.3

|

|

$

|

104.6

|

|

$

|

(52.3

|

)

|

$

|

104.6

|

|

$

|

36.7

|

|

$

|

67.9

|

|

|||||

|

FISCAL YEAR

|

|||||||||||

|

(dollars in millions)

|

2017

|

2016

|

2015

|

||||||||

|

Impairment, facility closure and other expenses

|

|||||||||||

|

2017 Closure Initiative (1)

|

$

|

20.4

|

|

$

|

46.5

|

|

$

|

—

|

|

||

|

Bonefish Restructuring (2)

|

3.8

|

|

4.9

|

|

24.2

|

|

|||||

|

Pre-2015 Closure Initiatives (3)

|

—

|

|

—

|

|

7.6

|

|

|||||

|

Impairment, facility closure and other expenses for Closure Initiatives

|

$

|

24.2

|

|

$

|

51.4

|

|

$

|

31.8

|

|

||

|

(1)

|

On

February 15, 2017

and

August 28, 2017

, we decided to close

43

underperforming restaurants in the U.S. and two Abbraccio restaurants outside of the core markets of São Paulo and Rio de Janeiro in Brazil (the “2017 Closure Initiative”). In connection with the 2017 Closure Initiative, we reassessed the future undiscounted cash flows of the impacted restaurants, and as a result, we recognized pre-tax asset impairments. We expect to incur additional charges of approximately

$2.9 million

to

$3.8 million

for the 2017 Closure Initiative over the next

two years

, including costs associated with lease obligations.

|

|

(2)

|

In February 2016, we decided to close

14

Bonefish restaurants (the “Bonefish Restructuring”). We expect to substantially complete these restaurant closings through the first quarter of 2019 and we expect to incur additional charges of approximately

$1.6 million

to

$2.3 million

for the Bonefish Restructuring over the next two years, including costs associated with lease obligations.

|

|

(3)

|

During 2014 and 2013, we decided to close

36

underperforming international locations, primarily in South Korea and

22

underperforming domestic locations (the “Pre-2015 Closure Initiatives”).

|

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||

|

Income from operations

|

$

|

146.1

|

|

$

|

127.6

|

|

$

|

127.6

|

|

$

|

230.9

|

|

|||||||||

|

% of Total revenues

|

3.5

|

%

|

3.0

|

%

|

0.5

|

%

|

3.0

|

%

|

5.3

|

%

|

(2.3

|

)%

|

|||||||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||||

|

(dollars in millions)

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||

|

Loss on defeasance, extinguishment and modification of debt

|

$

|

1.1

|

|

$

|

27.0

|

|

$

|

(25.9

|

)

|

$

|

27.0

|

|

$

|

3.0

|

|

$

|

24.0

|

|

|||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||

|

Other income (expense), net

|

$

|

14.9

|

|

$

|

1.6

|

|

$

|

13.3

|

|

$

|

1.6

|

|

$

|

(0.9

|

)

|

$

|

2.5

|

|

|||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||||||||

|

(dollars in millions):

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

|||||||||||||||||

|

Interest expense, net

|

$

|

41.4

|

|

$

|

45.7

|

|

$

|

(4.3

|

)

|

$

|

45.7

|

|

$

|

56.2

|

|

$

|

(10.5

|

)

|

|||||

|

FISCAL YEAR

|

FISCAL YEAR

|

||||||||||||||||

|

2017

|

2016

|

Change

|

2016

|

2015

|

Change

|

||||||||||||

|

Effective income tax rate

|

13.5

|

%

|

18.0

|

%

|

(4.5

|

)%

|

18.0

|

%

|

23.0

|

%

|

(5.0

|

)%

|

|||||

|

FISCAL YEAR

|

|||||||||||

|

(dollars in thousands)

|

2017

|

2016

|

2015

|

||||||||

|

Segment income (loss) from operations

|

|||||||||||

|

U.S.

|

$

|

297,260

|

|

$

|

286,683

|

|

$

|

348,731

|

|

||

|

International

|

28,916

|

|

(5,954

|

)

|

34,597

|

|

|||||

|

Total segment income from operations

|

326,176

|

|

280,729

|

|

383,328

|

|

|||||

|

Unallocated corporate operating expense

|

(180,084

|

)

|

(153,123

|

)

|

(152,403

|

)

|

|||||

|

Total income from operations

|

146,092

|

|

127,606

|

|

230,925

|

|

|||||

|

Loss on defeasance, extinguishment and modification of debt

|

(1,069

|

)

|

(26,998

|

)

|

(2,956

|

)

|

|||||

|

Other income (expense), net

|

14,912

|

|

1,609

|

|

(939

|

)

|

|||||

|

Interest expense, net

|

(41,392

|

)

|

(45,726

|

)

|

(56,176

|

)

|

|||||

|

Income before Provision for income taxes

|

$

|

118,543

|

|

$

|

56,491

|

|

$

|

170,854

|

|

||

|

FISCAL YEAR

|

|||||||||||

|

(dollars in thousands)

|

2017

|

2016

|

2015

|

||||||||

|

Revenues

|

|||||||||||

|

Restaurant sales

|

$

|

3,718,261

|

|

$

|

3,777,907

|

|

$

|

3,857,162

|

|

||

|

Franchise and other revenues

|

32,698

|

|

19,402

|

|

22,581

|

|

|||||

|

Total revenues

|

$

|

3,750,959

|

|

$

|

3,797,309

|

|

$

|

3,879,743

|

|

||

|

Restaurant-level operating margin

|

15.1

|

%

|

15.4

|

%

|

16.0

|

%

|

|||||

|

Income from operations

|

297,260

|

|

286,683

|

|

348,731

|

|

|||||

|

Operating income margin

|

7.9

|

%

|

7.5

|

%

|

9.0

|

%

|

|||||

|

FISCAL YEAR

|

|||||||

|

(dollars in millions)

|

2017 (1)

|

2016

|

|||||

|

For fiscal years 2016 and 2015

|

$

|

3,777.9

|

|

$

|

3,857.2

|

|

|

|

Change from:

|

|||||||

|

Divestiture of restaurants through refranchising transactions (2)

|

(118.9

|

)

|

(5.7

|

)

|

|||

|

Restaurant closings

|

(81.2

|

)

|

(25.1

|

)

|

|||

|

Restaurant openings (3)

|

33.7

|

|

24.0

|

|

|||

|

Comparable restaurant sales (3)

|

106.8

|

|

(72.5

|

)

|

|||

|

For fiscal years 2017 and 2016

|

$

|

3,718.3

|

|

$

|

3,777.9

|

|

|

|

(1)

|

Includes $79.9 million of additional restaurant sales from the 53

rd

week of 2017.

|

|

(2)

|

Fiscal year 2016 includes $5.7 million related to divestiture of Roy’s.

|

|

(3)

|

Summation of quarterly changes for restaurant openings and comparable restaurant sales will not total to annual amounts as the restaurants that meet the definition of a comparable restaurant will differ each period based on when the restaurant opened.

|

|

FISCAL YEAR

|

|||||||||||

|

(dollars in thousands)

|

2017

|

2016

|

2015

|

||||||||

|

Revenues

|

|||||||||||

|

Restaurant sales

|

$

|

450,397

|

|

$

|

448,150

|

|

$

|

492,759

|

|

||

|

Franchise and other revenues

|

11,990

|

|

6,853

|

|

5,174

|

|

|||||

|

Total revenues

|

$

|

462,387

|

|

$

|

455,003

|

|

$

|

497,933

|

|

||

|

Restaurant-level operating margin

|

20.6

|

%

|

18.8

|

%

|

19.3

|

%

|

|||||

|

Income (loss) from operations

|

28,916

|

|

(5,954

|

)

|

34,597

|

|

|||||

|

Operating income (loss) margin

|

6.3

|

%

|

(1.3

|

)%

|

6.9

|

%

|

|||||

|

FISCAL YEAR

|

|||||||

|

(dollars in millions)

|

2017

|

2016

|

|||||

|

For fiscal years 2016 and 2015

|

$

|

448.2

|

|

$

|

492.8

|

|

|

|

Change from:

|

|||||||

|

Restaurant openings (1)

|

41.9

|

|

62.2

|

|

|||

|

Effect of foreign currency translation

|

36.0

|

|

(31.6

|

)

|

|||

|

Comparable restaurant sales (1)

|

17.9

|

|

14.8

|

|

|||

|

Refranchising of Outback Steakhouse South Korea

|

(90.5

|

)

|

(81.2

|

)

|

|||

|

Restaurant closings

|

(3.1

|

)

|

(8.8

|

)

|

|||

|

For fiscal years 2017 and 2016

|

$

|

450.4

|

|

$

|

448.2

|

|

|

|

(1)

|

Summation of quarterly changes for restaurant openings and comparable restaurant sales will not total to annual amounts as the restaurants that meet the definition of a comparable restaurant will differ each period based on when the restaurant opened.

|

|

FISCAL YEAR

|

|||||||||||

|

COMPANY-OWNED RESTAURANT SALES (dollars in millions):

|

2017

|

2016

|

2015

|

||||||||

|

U.S.

|

|||||||||||

|

Outback Steakhouse (1)

|

$

|

2,136

|

|

$

|

2,180

|

|

$

|

2,226

|

|

||

|

Carrabba’s Italian Grill (1)

|

677

|

|

696

|

|

720

|

|

|||||

|

Bonefish Grill

|

605

|

|

617

|

|

623

|

|

|||||

|

Fleming’s Prime Steakhouse & Wine Bar

|

300

|

|

285

|

|

280

|

|

|||||

|

Other

|

1

|

|

—

|

|

8

|

|

|||||

|

U.S. Total

|

3,719

|

|

3,778

|

|

3,857

|

|

|||||