|

☑

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

For the quarterly period ended March 31, 2018

|

|

☐

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

Florida

|

27-2977890

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

|

6400 Congress Avenue, Suite 2050, Boca Raton, Florida

|

33487

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

561-998-2440

|

|

(Registrant's telephone number, including area code)

|

|

not applicable

|

|

(

Former name, former address and former fiscal

year, if changed since last report)

|

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☑

|

|

|

|

Emerging growth company

|

☑

|

|

|

|

Page No.

|

|

|

PART I - FINANCIAL INFORMATION

|

|

|

|

|

|

|

ITEM 1.

|

FINANCIAL STATEMENTS.

|

4

|

|

|

|

|

|

ITEM 2.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS.

|

|

|

|

|

|

|

ITEM 3.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK.

|

29

|

|

|

|

|

|

ITEM 4.

|

CONTROLS AND PROCEDURES.

|

29

|

|

|

|

|

|

|

PART II - OTHER INFORMATION

|

|

|

|

|

|

|

ITEM 1.

|

LEGAL PROCEEDINGS.

|

31

|

|

|

|

|

|

ITEM 1A.

|

RISK FACTORS.

|

31

|

|

|

|

|

|

ITEM 2.

|

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF

PROCEEDS.

|

31

|

|

|

|

|

|

ITEM 3.

|

DEFAULTS UPON SENIOR SECURITIES.

|

31

|

|

|

|

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES.

|

31

|

|

|

|

|

|

ITEM 5.

|

OTHER INFORMATION.

|

31

|

|

|

|

|

|

ITEM 6.

|

EXHIBITS.

|

33

|

|

|

March

31,

|

December

31,

|

|

|

2018

|

2017

|

|

|

(unaudited)

|

|

|

ASSETS

|

|

|

|

Current assets

|

|

|

|

Cash

and Cash Equivalents

|

$

166,267

|

$

140,022

|

|

Accounts

Receivable, net

|

878,879

|

879,770

|

|

Inventories,

net

|

511,925

|

611,468

|

|

Prepaid

Expenses and Other Current Assets

|

109,001

|

145,732

|

|

Total current

assets

|

1,666,072

|

1,776,992

|

|

Property and Equipment, net

|

84,186

|

89,500

|

|

Website

Acquisition Assets, net

|

332,795

|

393,417

|

|

Intangible

Assets, net

|

915,673

|

967,774

|

|

Goodwill

|

446,426

|

446,426

|

|

Other

Assets

|

46,588

|

44,608

|

|

Total Assets

|

$

3,491,740

|

$

3,718,717

|

|

|

|

|

|

LIABILITIES

AND SHAREHOLDERS' EQUITY

|

|

|

|

Current Liabilities

|

|

|

|

Accounts

Payable

|

$

1,098,766

|

$

1,172,827

|

|

Accrued

Expenses

|

85,185

|

90,000

|

|

Premium

Finance Loan Payable

|

40,909

|

63,133

|

|

Deferred

Rent - Short Term

|

3,779

|

2,468

|

|

Deferred

Revenues

|

8,236

|

9,735

|

|

Long Term Debt, Current Portion

|

769,527

|

767,071

|

|

Total Current

Liabilities

|

2,006,402

|

2,105,234

|

|

|

|

|

|

Long

term Deferred Rent

|

15,184

|

16,418

|

|

Long

Term Debt to Related Parties, net

|

1,249,100

|

1,198,893

|

|

Long

Term Debt, net

of current portion

|

-

|

54,950

|

|

Total Liabilities

|

3,270,686

|

3,375,495

|

|

Commitments and contingencies

|

|

|

|

Shareholders' Equity

|

|

|

|

Preferred

Stock, par value $0.01, 20,000,000 shares authorized,

|

|

|

|

600,000

and 100,000 shares issued and outstanding

|

|

|

|

Series

A, 2,000,000 shares designated, 100,000 and

|

|

|

|

100,000

shares issued and outstanding

|

1,000

|

1,000

|

|

Series

B, 1,000,000 shares designated, 0 and

|

|

|

|

0

shares issued and outstanding

|

—

|

—

|

|

Series

C, 2,000,000 shares designated, 0 and

|

|

|

|

0

shares issued and outstanding

|

—

|

—

|

|

Series

D, 2,000,000 shares designated, 0 and

|

|

|

|

0

shares issued and outstanding

|

—

|

—

|

|

Series

E, 2,500,000 shares designated, 1,875,000 and

|

|

|

|

1,375,000

issued and outstanding

|

18,750

|

13,750

|

|

Common

Stock, par value $0.01, 324,000,000 shares authorized,

|

|

|

|

47,941,364

and 44,901,531 issued and outstanding

|

479,414

|

461,689

|

|

Additional

Paid-in Capital

|

12,585,594

|

11,685,685

|

|

Accumulated

Deficit

|

(12,863,704

)

|

(11,818,902

)

|

|

Total

Shareholders' Equity

|

221,054

|

343,222

|

|

Total Liabilities and Shareholders' Equity

|

$

3,491,740

|

$

3,718,717

|

|

|

For the Three Months Ended

|

|

|

|

March 31,

|

|

|

|

2018

|

2017

|

|

Revenues

|

|

|

|

Product

|

$

375,286

|

$

551,355

|

|

Advertising

|

683,058

|

109,743

|

|

Total

revenues

|

1,058,344

|

661,098

|

|

|

|

|

|

Cost

of revenue

|

|

|

|

Products

|

291,565

|

372,546

|

|

Advertising

|

510,704

|

3,510

|

|

Total

Cost of revenue

|

802,269

|

376,056

|

|

Gross

profit

|

256,075

|

285,042

|

|

|

|

|

|

Selling,

general and administrative expenses

|

1,185,954

|

884,203

|

|

|

|

|

|

Loss

from operations

|

(929,879

)

|

(599,161

)

|

|

|

|

|

|

Other

income (expense)

|

|

|

|

Interest

income

|

288

|

82

|

|

Interest

expense

|

(15,353

)

|

(35,160

)

|

|

Interest

expense - related party

|

(99,858

)

|

(49,008

)

|

|

Total

other income (expense)

|

(114,923

)

|

(84,086

)

|

|

|

|

|

|

|

|

|

|

Net

Loss

|

(1,044,802

)

|

(683,247

)

|

|

|

|

|

|

Preferred

stock dividends

|

|

|

|

Series

A and Series E preferred stock

|

14,763

|

1,973

|

|

|

|

|

|

Net

loss attributable to common shareholders

|

$

(1,059,565

)

|

$

(685,220

)

|

|

|

|

|

|

|

|

|

|

Basic

and diluted net loss per share

|

$

(0.02

)

|

$

(0.02

)

|

|

|

|

|

|

Weighted

average shares O/S - basic and diluted

|

45,807,289

|

44,913,531

|

|

|

|

|

|

|

Additional

|

|

Total

|

|

|

Preferred Stock

|

Common Stock

|

Paid-in

|

Accumulated

|

Shareholders'

|

||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Deficit

|

Equity

|

|

Balance -

December 31, 2017

|

1,475,000

|

$

14,750

|

46,168,864

|

$

461,689

|

$

11,685,685

|

$

(11,818,902

)

|

$

343,222

|

|

|

|

|

|

|

|

|

|

|

Common stock

issued for 10% dividend payment pursuant

to Series A

preferred stock Subscription Agreements

|

|

|

10,000

|

100

|

(100

)

|

|

-

|

|

Issuance of

Series E preferred stock ($0.40/share)

|

500,000

|

5,000

|

|

|

195,000

|

|

200,000

|

|

Series E 10%

preferred stock dividend

|

|

|

|

|

(14,763

)

|

|

(14,763

)

|

|

Stock option

vesting expense

|

|

|

|

|

7,344

|

|

7,344

|

|

Warrants

issued for services

|

|

|

|

|

95,552

|

|

95,552

|

|

Units issued

for cash ($0.40/share)

|

|

|

1,762,500

|

17,625

|

616,876

|

|

634,501

|

|

Net loss for

the three months ended March 31, 2018

|

|

|

|

|

|

(1,044,802

)

|

(1,044,802

)

|

|

Balance -

March 31, 2018

|

1,975,000

|

$

19,750

|

47,941,364

|

$

479,414

|

$

12,585,594

|

$

(12,863,704

)

|

$

221,054

|

|

|

For

the Three months ended

|

|

|

|

March

31, 2018

|

|

|

|

2018

|

2017

|

|

Cash flows from operating activities:

|

|

|

|

Net

loss

|

$

(1,044,802

)

|

$

(683,247

)

|

|

Adjustments

to reconcile net loss to net cash and cash equivalents used in

operations:

|

|

|

|

Depreciation

|

6,339

|

5,489

|

|

Amortization

of debt discount

|

47,712

|

28,887

|

|

Amortization

|

112,723

|

75,806

|

|

Stock

option compensation expense

|

7,344

|

38,259

|

|

Common

stock and warrants issued for services

|

95,552

|

3,060

|

|

Provision

for bad debts

|

(26,281

)

|

—

|

|

Changes in operating assets and liabilities:

|

|

|

|

Accounts

receivable

|

27,172

|

88,667

|

|

Inventories

|

99,543

|

(82,021

)

|

|

Prepaid

expenses and other current assets

|

36,731

|

63,077

|

|

Other

assets

|

(1,980

)

|

(36,332

)

|

|

Accounts

payable and accrued expense

|

(78,876

)

|

42,105

|

|

Deferred

rents

|

77

|

11,192

|

|

Deferred

revenues

|

(1,499

)

|

—

|

|

Net

cash used in operating activities

|

(720,245

)

|

(445,058

)

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

Purchase

of property and equipment

|

(1,023

)

|

(8,035

)

|

|

Net

cash used in investing activities

|

(1,023

)

|

(8,035

)

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

Proceeds

from issuance of common units, net

|

634,501

|

—

|

|

Proceeds

from issuance of preferred stock

|

200,000

|

—

|

|

Repayments

on insurance premium notes payable

|

(22,224

)

|

(25,242

)

|

|

Dividend

payments

|

(14,763

)

|

—

|

|

Principal

payment on long-term debt - Non-Related party

|

(50,000

)

|

—

|

|

Long-term

debt - Related parties

|

—

|

350,000

|

|

Net

cash provided by financing activities

|

747,513

|

324,758

|

|

|

|

|

|

Net

increase (decrease) in cash

|

26,245

|

(128,335

)

|

|

Cash

and cash equivalents at beginning of period

|

140,022

|

162,795

|

|

Cash

and cash equivalents at end of period

|

$

166,267

|

$

34,460

|

|

|

|

|

|

Supplemental disclosure of cash flow information

|

|

|

|

Cash

paid for:

|

|

|

|

Interest

|

$

51,647

|

$

20,216

|

|

Income

taxes

|

$

—

|

$

—

|

|

|

|

|

|

Non-cash investing and financing activities

|

|

|

|

Premium

finance loan payable recorded as prepaid

|

$

66,131

|

$

28,401

|

|

Debt

discount on convertible notes payable

|

$

—

|

$

245,000

|

|

Tangible

assets acquired

|

$

361,770

|

|

Liabilities

assumed

|

(562,006

)

|

|

Net

liabilities assumed

|

$

(200,236

)

|

|

|

|

|

Exchange

platform

|

$

50,000

|

|

Tradename

|

150,000

|

|

Customer

relationships

|

250,000

|

|

Non-compete

agreements

|

192,000

|

|

Goodwill

|

446,426

|

|

Total

purchase price

|

$

1,088,426

|

|

|

Three Months Ended

|

|

|

March 31, 2017

|

|

Total

revenue

|

$

1,224,716

|

|

Total

expenses

|

(1,871,679

)

|

|

Preferred

stock dividend

|

(1,973

)

|

|

Net

loss attributable to common shareholders

|

$

(648,936

)

|

|

Basic

and diluted net loss per share

|

$

(0.01

)

|

|

|

March 31,

2018

|

December 31,

2017

|

|

Product

inventory: clocks and watches

|

$

351,361

|

$

453,852

|

|

Product

inventory: other inventory

|

183,012

|

180,064

|

|

Total

inventory balance

|

534,373

|

633,916

|

|

Less:

Inventory allowance for slow moving

|

(22,448

)

|

(22,448

)

|

|

Total

inventory balance, net

|

$

511,925

|

$

611,468

|

|

|

March

31,

2018

|

December

31,

2017

|

|

Prepaid

rent

|

$

39,877

|

$

50,417

|

|

Prepaid

insurance

|

66,131

|

92,322

|

|

Prepaid

inventory

|

2,993

|

2,993

|

|

Prepaid

expenses and other current assets

|

$

109,001

|

$

145,732

|

|

|

Useful Lives

|

March 31, 2018

|

December 31, 2017

|

|

Furniture

and fixtures

|

3-5

years

|

$

79,993

|

$

78,994

|

|

Computer

equipment

|

3

years

|

59,510

|

59,511

|

|

Leasehold

improvements

|

5

years

|

39,385

|

39,384

|

|

Total

fixed assets

|

|

178,888

|

177,889

|

|

Less:

accumulated depreciation

|

|

(94,702

)

|

(88,389

)

|

|

Total

fixed assets, net

|

|

$

84,186

|

$

89,500

|

|

|

March 31,

2018

|

December 31,

2017

|

|

Website

Acquisition Assets

|

$

1,417,189

|

$

1,417,189

|

|

Less:

accumulated amortization

|

(873,197

)

|

(812,575

)

|

|

Less:

accumulated impairment loss

|

(211,197

)

|

(211,197

)

|

|

Website

Acquisition Assets, net

|

$

332,795

|

$

393,417

|

|

|

Useful Lives

|

March 31, 2018

|

December 31, 2017

|

|

Tradename

|

5

years

|

$

300,000

|

$

300,000

|

|

Customer

relationships

|

5

years

|

502,000

|

502,000

|

|

Non-compete

agreements

|

5-8

years

|

312,000

|

312,000

|

|

Total

Intangible Assets

|

|

$

1,114,000

|

$

1,114,000

|

|

Less:

accumulated amortization

|

|

(148,100

)

|

(95,999

)

|

|

Less:

accumulated impairment loss

|

|

(50,227

)

|

(50,227

)

|

|

Intangible

assets, net

|

|

$

915,673

|

$

967,774

|

|

|

As of and for the three months ended

|

As of and for the three months ended

|

||||

|

|

March 31, 2018

|

March 31, 2017

|

||||

|

|

Products

|

Services

|

Total

|

Products

|

Services

|

Total

|

|

Revenues

|

$

375,286

|

$

683,058

|

$

1,058,344

|

$

551,355

|

$

109,743

|

$

661,098

|

|

Website

amortization

|

26,615

|

86,108

|

112,723

|

—

|

75,806

|

75,806

|

|

Depreciation

|

2,248

|

4,091

|

6,339

|

4,578

|

911

|

5,489

|

|

Loss

from operations

|

(336,815

)

|

(593,064

)

|

(929,879

)

|

(461,912

)

|

(137,249

)

|

(599,161

)

|

|

Segment

assets

|

1,128,652

|

2,363,088

|

3,491,740

|

1,438,646

|

1,306,714

|

2,745,360

|

|

Purchase

of assets

|

$

—

|

$

1,023

|

$

1,023

|

$

8,035

|

$

—

|

$

8,035

|

|

|

Number of

Options

|

Weighted Average

Exercise

Price

|

Weighted Average

Remaining

Contractual

Term

|

Aggregate

Intrinsic

Value

|

|

Balance

Outstanding, December 31, 2017

|

2,027,000

|

$

0.37

|

6.8

|

$

73,770

|

|

Granted

|

—

|

—

|

—

|

—

|

|

Exercised

|

—

|

—

|

—

|

—

|

|

Forfeited

|

—

|

—

|

—

|

—

|

|

Expired

|

—

|

—

|

—

|

—

|

|

Balance

Outstanding, March 31, 2018

|

2,027,000

|

$

0.37

|

5.2

|

$

82,735

|

|

Exercisable

at March 31, 2018

|

1,801,500

|

$

0.31

|

3.8

|

|

|

|

Options Outstanding

|

Options Exercisable

|

||||

|

Range or

Exercise Price

|

Number

Outstanding

|

Remaining

Average

Contractual Life (In Years)

|

Weighted

Average

Exercise

Price

|

Number

Exercisable

|

Weighted

Average

Exercise

Price

|

Remaining Average Conversion Life (In Years)

|

|

0.14 - 0.24

|

720,000

|

1.0

|

$

0.14

|

720,000

|

$

0.14

|

1.1

|

|

0.25 - 0.49

|

351,000

|

0.9

|

$

0.28

|

351,000

|

$

0.28

|

1.6

|

|

0.50 - 0.85

|

956,000

|

3.3

|

$

0.67

|

730,500

|

$

0.66

|

1.2

|

|

|

2,027,000

|

5.2

|

|

1,801,500

|

|

3.8

|

|

|

Three months ended

March 31,

2018

|

Three months ended

March 31,

2017

|

% Change

|

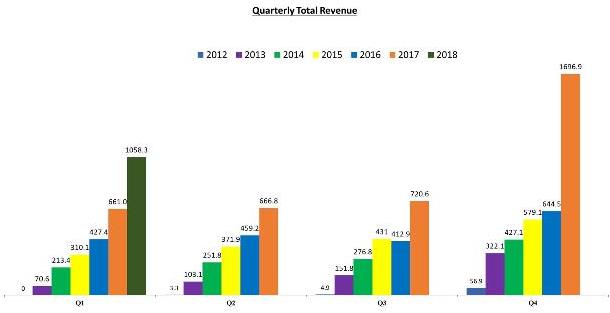

|

Product

sales revenue

|

$

375,286

|

$

551,355

|

(32

)

|

|

Advertising

revenue

|

683,058

|

109,743

|

522

|

|

Total

revenues

|

$

1,058,344

|

$

661,098

|

60

|

|

Cost

of

revenue

– products

|

291,565

|

372,546

|

(22

)

|

|

Cost

of

revenue

- products as a percentage of product

sales

|

78

%

|

68

%

|

|

|

Cost

of

revenue

- advertising

|

510,704

|

3,510

|

|

|

Cost

of

revenue

– advertising as a percent of advertising

revenue

|

75

%

|

3

%

|

|

|

Gross

profit

|

$

256,075

|

$

285,042

|

(10

)

|

|

Gross

profit as a percentage of total revenues

|

24

%

|

43

%

|

|

|

Selling,

general and administrative expenses

|

$

1,185,954

|

$

884,203

|

34

|

|

(Loss)

from operations

|

$

(929,879

)

|

$

(599,161

)

|

55

|

|

|

|

|

|

|

|

For

the three months ended

|

For

the three months ended

|

||||

|

|

March

31, 2018

|

March

31, 2017

|

||||

|

|

Products

|

Services

|

Total

|

Products

|

Services

|

Total

|

|

Revenue

|

$

375,286

|

$

683,058

|

$

1,058,344

|

$

551,355

|

$

109,743

|

$

661,098

|

|

Cost

of Revenue

|

291,565

|

510,704

|

802,269

|

372,546

|

3,510

|

376,056

|

|

Gross

Profit

|

$

83,721

|

$

172,354

|

$

256,075

|

$

178,809

|

$

106,233

|

$

285,042

|

|

|

For

the Three Months Ended

|

|

|

|

March

31,

|

|

|

unaudited

|

2018

|

2017

|

|

Net

(loss)

|

$

(1,044,802

)

|

$

(683,247

)

|

|

plus:

|

|

|

|

Stock

compensation expense

|

7,344

|

38,259

|

|

Stock

issued for services

|

95,552

|

3,060

|

|

Adjusted

net (loss):

|

$

(941,906

)

|

$

(641,928

)

|

|

Depreciation

expense

|

6,339

|

5,489

|

|

Amortization

expense

|

112,723

|

75,806

|

|

Amortization

on debt discount

|

47,712

|

28,887

|

|

Interest

Expense

|

12,347

|

55,281

|

|

Adjusted

EBITDA:

|

(762,785

)

|

$

(476,465

)

|

|

No.

|

|

Description

|

|

|

Letter dated

April 25, 2018 from Liggett & Webb, P.A. (incorporated by

reference to the Current Report on Form 8-K as filed on April 26,

2018).

|

|

|

|

Rule

13a-14(a)/ 15d-14(a) Certification of Chief Executive Officer

*

|

|

|

|

Rule

13a-14(a)/ 15d-14(a) Certification of principal financial and

accounting officer*

|

|

|

|

Section 1350

Certification of Chief Executive Officer and principal financial

and accounting officer*

|

|

|

|

|

|

|

101.INS

|

|

XBRL Instance Document *

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase *

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase *

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase *

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema *

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase *

|

|

|

BRIGHT MOUNTAIN MEDIA, INC.

|

|

|

|

|

|

|

May 21, 2018

|

By:

|

/s/ W. Kip Speyer

|

|

|

|

W. Kip Speyer, Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|