|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

(Mark One)

|

|||

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the fiscal year ended December 31, 2012

|

|||

|

OR

|

|||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

for the transition period from _________ to __________

|

|||

(Exact name of registrant as specified in its charter)

|

Delaware

(State of incorporation) |

99-0148992

(I.R.S. Employer Identification No.) |

|

|

130 Merchant Street, Honolulu, Hawaii

(Address of principal executive offices) |

96813

(Zip Code) |

|

(Registrant's telephone number, including area code)

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, $.01 Par Value

|

New York Stock Exchange

|

|

None

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

2012 Form 10-K Annual Report

Table of Contents

|

Item Number

|

Page

|

|||||

|

Part I

|

Item 1.

|

|||||

|

Item 1A.

|

||||||

|

Item 1B.

|

||||||

|

Item 2.

|

||||||

|

Item 3.

|

||||||

|

Item 4.

|

||||||

|

Part II

|

Item 5.

|

|||||

|

Item 6.

|

||||||

|

Item 7.

|

||||||

|

Item 7A.

|

||||||

|

Item 8.

|

||||||

|

Item 9.

|

||||||

|

Item 9A.

|

||||||

|

Item 9B.

|

||||||

|

Part III

|

Item 10.

|

|||||

|

Item 11.

|

||||||

|

Item 12.

|

||||||

|

Item 13.

|

||||||

|

Item 14.

|

||||||

|

Part IV

|

Item 15.

|

|||||

|

Signatures

|

||||||

Chairman and Chief Executive Officer since July 2010 and President since April 2008; Vice Chairman and Chief Banking Officer from January 2006 to April 2008.

Vice Chairman and Chief Financial Officer since April 2008; Trustee, C. Brewer & Co., Ltd. from April 2006 to December 2007.

|

Market Price Range

|

Book Value

|

Dividends

Declared |

||||||||||||||||||

|

Year/Period

|

High

|

Low

|

Close

|

|||||||||||||||||

|

2012

|

$

|

49.99

|

|

$

|

41.41

|

|

$

|

44.05

|

|

$

|

22.83

|

|

$

|

1.80

|

|

|||||

|

First Quarter

|

48.75

|

|

44.08

|

|

48.35

|

|

0.45

|

|

||||||||||||

|

Second Quarter

|

49.99

|

|

44.02

|

|

45.95

|

|

0.45

|

|

||||||||||||

|

Third Quarter

|

48.92

|

|

45.29

|

|

45.62

|

|

0.45

|

|

||||||||||||

|

Fourth Quarter

|

46.38

|

|

41.41

|

|

44.05

|

|

0.45

|

|

||||||||||||

|

2011

|

$

|

49.26

|

|

$

|

34.50

|

|

$

|

44.49

|

|

$

|

21.82

|

|

$

|

1.80

|

|

|||||

|

First Quarter

|

49.23

|

|

44.32

|

|

47.82

|

|

0.45

|

|

||||||||||||

|

Second Quarter

|

49.26

|

|

44.90

|

|

46.52

|

|

0.45

|

|

||||||||||||

|

Third Quarter

|

47.10

|

|

35.30

|

|

36.40

|

|

0.45

|

|

||||||||||||

|

Fourth Quarter

|

45.13

|

|

34.50

|

|

44.49

|

|

0.45

|

|

||||||||||||

|

Period

|

Total Number of

Shares Purchased 1 |

Average Price

Paid Per Share |

Total Number of

Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value

of Shares that May Yet Be Purchased Under the Plans or Programs 2 |

||||||||

|

October 1 - 31, 2012

|

130,000

|

$

|

44.69

|

|

130,000

|

$

|

78,647,890

|

|

||||

|

November 1 - 30, 2012

|

168,830

|

43.68

|

|

163,000

|

71,535,420

|

|

||||||

|

December 1 - 31, 2012

|

46,000

|

43.81

|

|

46,000

|

69,520,078

|

|

||||||

|

Total

|

344,830

|

$

|

44.08

|

|

339,000

|

|||||||

|

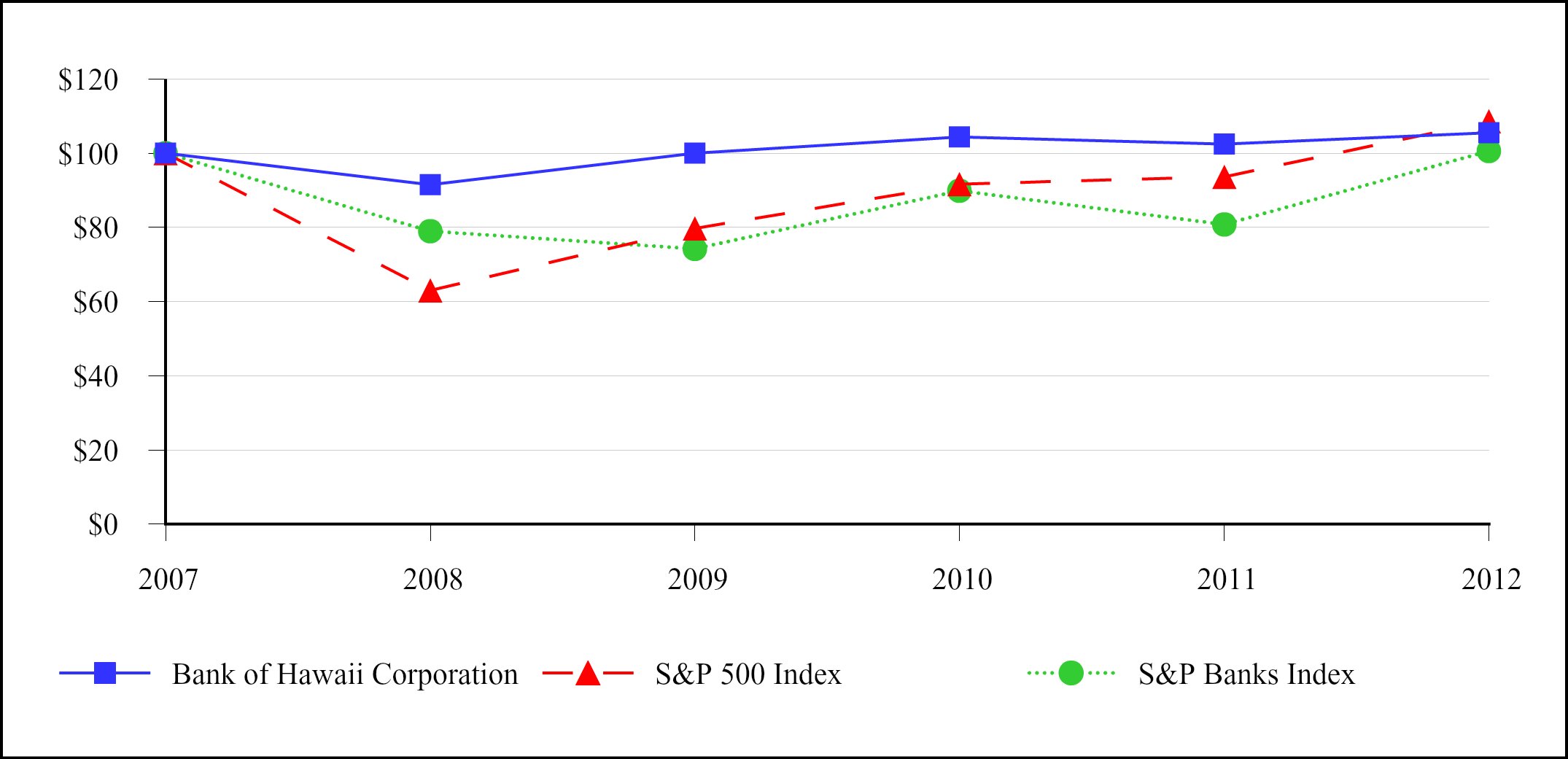

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

|

|

Bank of Hawaii Corporation

|

$100

|

$92

|

$100

|

$104

|

$103

|

$106

|

|

S&P 500 Index

|

100

|

63

|

80

|

92

|

94

|

109

|

|

S&P Banks Index

|

100

|

79

|

74

|

90

|

81

|

101

|

|

(dollars in millions, except per share amounts)

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

2008

|

|

|||||||||||

|

Year Ended December 31,

|

|||||||||||||||||||||

|

Operating Results

|

|||||||||||||||||||||

|

Net Interest Income

|

$

|

377.3

|

|

$

|

390.2

|

|

$

|

406.5

|

|

$

|

412.3

|

|

$

|

418.8

|

|

||||||

|

Provision for Credit Losses

|

1.0

|

12.7

|

55.3

|

107.9

|

60.5

|

||||||||||||||||

|

Total Noninterest Income

|

200.3

|

197.7

|

255.3

|

267.8

|

258.1

|

||||||||||||||||

|

Total Noninterest Expense

|

334.3

|

348.2

|

346.2

|

350.0

|

346.8

|

||||||||||||||||

|

Net Income

|

166.1

|

160.0

|

183.9

|

144.0

|

192.2

|

||||||||||||||||

|

Basic Earnings Per Share

|

3.68

|

3.40

|

3.83

|

3.02

|

4.03

|

||||||||||||||||

|

Diluted Earnings Per Share

|

3.67

|

3.39

|

3.80

|

3.00

|

3.99

|

||||||||||||||||

|

Dividends Declared Per Share

|

1.80

|

1.80

|

1.80

|

1.80

|

1.77

|

||||||||||||||||

|

Performance Ratios

|

|||||||||||||||||||||

|

Net Income to Average Total Assets (ROA)

|

1.22

|

|

%

|

1.22

|

|

%

|

1.45

|

|

%

|

1.22

|

|

%

|

1.84

|

|

%

|

||||||

|

Net Income to Average Shareholders' Equity (ROE)

|

16.23

|

15.69

|

18.16

|

16.42

|

24.54

|

||||||||||||||||

|

Efficiency Ratio

1

|

57.88

|

59.23

|

52.32

|

51.46

|

51.23

|

||||||||||||||||

|

Net Interest Margin

2

|

2.97

|

3.13

|

3.41

|

3.72

|

4.33

|

||||||||||||||||

|

Dividend Payout Ratio

3

|

48.91

|

52.94

|

47.00

|

59.60

|

43.92

|

||||||||||||||||

|

Average Shareholders' Equity to Average Assets

|

7.52

|

7.78

|

7.98

|

7.44

|

7.50

|

||||||||||||||||

|

Average Balances

|

|||||||||||||||||||||

|

Average Loans and Leases

|

$

|

5,680.3

|

|

$

|

5,349.9

|

|

$

|

5,472.5

|

|

$

|

6,145.0

|

|

$

|

6,542.2

|

|

||||||

|

Average Assets

|

13,609.2

|

13,105.0

|

12,687.7

|

11,783.4

|

10,448.2

|

||||||||||||||||

|

Average Deposits

|

10,935.0

|

9,924.7

|

9,509.1

|

9,108.4

|

7,851.3

|

||||||||||||||||

|

Average Shareholders' Equity

|

1,023.3

|

1,020.1

|

1,012.7

|

877.2

|

783.1

|

||||||||||||||||

|

Weighted Average Shares Outstanding

|

|||||||||||||||||||||

|

Basic Weighted Average Shares

|

45,115,441

|

47,064,925

|

48,055,025

|

47,702,500

|

47,674,000

|

||||||||||||||||

|

Diluted Weighted Average Shares

|

45,249,300

|

47,224,981

|

48,355,965

|

48,009,277

|

48,200,650

|

||||||||||||||||

|

As of December 31,

|

|||||||||||||||||||||

|

|

|||||||||||||||||||||

|

Loans and Leases

|

$

|

5,854.5

|

|

$

|

5,538.3

|

|

$

|

5,335.8

|

|

$

|

5,759.8

|

|

$

|

6,530.2

|

|

||||||

|

Total Assets

|

13,728.4

|

13,846.4

|

13,126.8

|

12,414.8

|

10,763.5

|

||||||||||||||||

|

Total Deposits

|

11,529.5

|

10,592.6

|

9,889.0

|

9,409.7

|

8,292.1

|

||||||||||||||||

|

Long-Term Debt

|

128.1

|

30.7

|

32.7

|

90.3

|

203.3

|

||||||||||||||||

|

Total Shareholders' Equity

|

1,021.7

|

1,002.7

|

1011.1

|

896.0

|

790.7

|

||||||||||||||||

|

Asset Quality

|

|||||||||||||||||||||

|

Allowance for Loan and Lease Losses

|

$

|

128.9

|

|

$

|

138.6

|

|

$

|

147.4

|

|

$

|

143.7

|

|

$

|

123.5

|

|

||||||

|

Non-Performing Assets

4

|

37.1

|

40.8

|

37.8

|

48.3

|

14.9

|

||||||||||||||||

|

Financial Ratios

|

|||||||||||||||||||||

|

Allowance to Loans and Leases Outstanding

|

2.20

|

|

%

|

2.50

|

|

%

|

2.76

|

|

%

|

2.49

|

|

%

|

1.89

|

|

%

|

||||||

|

Tier 1 Capital Ratio

|

16.13

|

16.68

|

18.28

|

14.84

|

11.24

|

||||||||||||||||

|

Total Capital Ratio

|

17.39

|

17.95

|

19.55

|

16.11

|

12.49

|

||||||||||||||||

|

Tier 1 Leverage Ratio

|

6.83

|

6.73

|

7.15

|

6.76

|

7.30

|

||||||||||||||||

|

Total Shareholders' Equity to Total Assets

|

7.44

|

7.24

|

7.70

|

7.22

|

7.35

|

||||||||||||||||

|

Tangible Common Equity to Tangible Assets

5

|

7.23

|

7.03

|

7.48

|

6.98

|

7.04

|

||||||||||||||||

|

Tangible Common Equity to Risk-Weighted Assets

5

|

17.24

|

17.93

|

19.29

|

15.45

|

11.28

|

||||||||||||||||

|

Non-Financial Data

|

|||||||||||||||||||||

|

Full-Time Equivalent Employees

|

2,276

|

2,370

|

2,399

|

2,418

|

2,581

|

||||||||||||||||

|

Branches and Offices

|

76

|

81

|

82

|

83

|

85

|

||||||||||||||||

|

ATMs

|

494

|

506

|

502

|

485

|

462

|

||||||||||||||||

|

Common Shareholders of Record

|

6,775

|

6,977

|

7,128

|

7,323

|

7,523

|

||||||||||||||||

|

1

|

Efficiency ratio is defined as noninterest expense divided by total revenue (net interest income and noninterest income).

|

|

2

|

Net interest margin is defined as net interest income, on a fully taxable-equivalent basis, as a percentage of average earning assets.

|

|

3

|

Dividend payout ratio is defined as dividends declared per share divided by basic earnings per share.

|

|

4

|

Excluded from non-performing assets are contractually binding non-accrual loans held for sale of $4.2 million as of December 31, 2009.

|

|

5

|

Tangible common equity to tangible assets and tangible common equity to risk-weighted assets are Non-GAAP financial measures. See the "Use of Non-GAAP Financial Measures" section below.

|

|

December 31,

|

||||||||||||||||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

2008

|

|

||||||||||

|

Total Shareholders' Equity

|

$

|

1,021,665

|

|

$

|

1,002,667

|

|

$

|

1,011,133

|

|

$

|

895,973

|

|

$

|

790,704

|

|

|||||

|

Less: Goodwill

|

31,517

|

|

31,517

|

|

31,517

|

|

31,517

|

|

34,959

|

|

||||||||||

|

Intangible Assets

|

33

|

|

83

|

|

154

|

|

233

|

|

978

|

|

||||||||||

|

Tangible Common Equity

|

$

|

990,115

|

|

$

|

971,067

|

|

$

|

979,462

|

|

$

|

864,223

|

|

$

|

754,767

|

|

|||||

|

Total Assets

|

$

|

13,728,372

|

|

$

|

13,846,391

|

|

$

|

13,126,787

|

|

$

|

12,414,827

|

|

$

|

10,763,475

|

|

|||||

|

Less: Goodwill

|

31,517

|

|

31,517

|

|

31,517

|

|

31,517

|

|

34,959

|

|

||||||||||

|

Intangible Assets

|

33

|

|

83

|

|

154

|

|

233

|

|

978

|

|

||||||||||

|

Tangible Assets

|

$

|

13,696,822

|

|

$

|

13,814,791

|

|

$

|

13,095,116

|

|

$

|

12,383,077

|

|

$

|

10,727,538

|

|

|||||

|

Risk-Weighted Assets, determined in accordance with prescribed regulatory requirements

|

$

|

5,744,722

|

|

$

|

5,414,481

|

|

$

|

5,076,909

|

|

$

|

5,594,532

|

|

$

|

6,688,530

|

|

|||||

|

Total Shareholders' Equity to Total Assets

|

7.44

|

%

|

7.24

|

%

|

7.70

|

%

|

7.22

|

%

|

7.35

|

%

|

||||||||||

|

Tangible Common Equity to

Tangible Assets (Non-GAAP) |

7.23

|

%

|

7.03

|

%

|

7.48

|

%

|

6.98

|

%

|

7.04

|

%

|

||||||||||

|

Tier 1 Capital Ratio

|

16.13

|

%

|

16.68

|

%

|

18.28

|

%

|

14.84

|

%

|

11.24

|

%

|

||||||||||

|

Tangible Common Equity to

Risk-Weighted Assets (Non-GAAP) |

17.24

|

%

|

17.93

|

%

|

19.29

|

%

|

15.45

|

%

|

11.28

|

%

|

||||||||||

|

•

|

The provision for credit losses (the "Provision") was

$1.0 million

in

2012

, a decrease of

$11.7 million

or

92%

compared to

2011

. Although loan balances have grown in

2012

, credit quality trends and the underlying risk profile of our loan and lease portfolio continued to improve, with lower levels of net charge-offs, non-performing assets, and higher risk loans and leases outstanding.

|

|

•

|

Mortgage banking income was

$35.6 million

in

2012

, an increase of

$21.0 million

compared to

2011

. This increase was primarily due to higher loan originations and sales activity in 2012, a result of low interest rates. Residential mortgage loan originations were $1.2 billion in 2012, a $256.9 million or 28% increase compared to 2011. Residential mortgage loan sales were $600.9 million in 2012, a $166.7 million or 38% increase from 2011. Also contributing to the increase in mortgage banking income was the increase in margins at which we were able to sell loans in the secondary market.

|

|

•

|

Other noninterest expense was

$69.7 million

in 2012, a decrease of

$15.7 million

or

18%

compared to

2011

. Our financial results for

2011

included a $9.0 million accrual related to the settlement of overdraft litigation recorded in the second quarter of

2011

. Also contributing to the decrease in other noninterest expense in

2012

was a $2.2 million decrease in mileage program travel expenses, a $1.5 million credit for the reduction in insurance reserves, and a $1.5 million decrease in operational losses.

|

|

•

|

Net interest income was

$377.3 million

in

2012

, a decrease of

$12.9 million

or

3%

compared to

2011

. This decrease was primarily due to lower yields on loans and investment securities. During this period of low interest rates over the past several years, we have maintained discipline in our loan underwriting and have also invested conservatively.

|

|

•

|

Debit card income, recorded as a component of fees, exchange, and other services charges in the consolidated statements of income, was $14.9 million in

2012

, a decrease of $10.9 million or 42% compared to

2011

. This decrease was primarily due to changes in debit card interchange rules as a result of the pricing restrictions imposed by the Durbin Amendment which was effective October 1, 2011.

|

|

•

|

We recorded a nominal amount of net investment securities losses in

2012

, while net investment securities gains were

$6.4 million

in

2011

. The amount and timing of our sale of investment securities are dependent on a number of factors, including our efforts to preserve capital levels while managing duration and extension risk.

|

|

•

|

The provision for income taxes was

$76.2 million

in

2012

, an increase of

$9.3 million

or

14%

compared to

2011

. We recorded credits to the provision for income taxes of $10.5 million in

2011

related to the reversal of liabilities for unrecognized state tax benefits, the release of general reserves due to the closing of certain IRS audit tax years, and the release of a valuation allowance related to the expected utilization of capital losses on the future sale of a low-income housing investment.

|

|

•

|

The allowance for loan and lease losses (the "Allowance") was

$128.9 million

as of

December 31, 2012

, a decrease of

$9.7 million

or

7%

from

December 31, 2011

. The ratio of our Allowance to total loans and leases outstanding decreased to 2.20% as of

December 31, 2012

, compared to 2.50% as of

December 31, 2011

. The decrease in the level of the Allowance was consistent with improving credit quality metrics and an improving Hawaii economy. Absent significant deterioration in the economy and assuming continued improvement and/or stability in credit quality, we may decrease the level of the Allowance in future periods.

|

|

•

|

Total deposits were

$11.5 billion

as of

December 31, 2012

, an increase of

$936.9 million

or

9%

from

December 31, 2011

. We believe that our strong brand continues to play a key role in new account acquisitions. During 2012, we continued to grow our deposit balances while reducing associated funding costs. The growth in deposit balances was due, in part, to local government entities transferring funds from repurchase agreements to time deposits during 2012.

|

|

•

|

We continued to invest excess liquidity in high-grade investment securities. As of

December 31, 2012

, the total carrying value of our investment securities portfolio was

$7.0 billion

, a slight decrease from

$7.1 billion

as of

December 31, 2011

. In

2012

, we reduced our positions in U.S. Treasury Notes and mortgage-backed securities issued by the Government National Mortgage Association ("Ginnie Mae"). We re-invested these proceeds, in part, into state and municipal bond holdings.

|

|

•

|

Total shareholders' equity was

$1.0 billion

as of

December 31, 2012

, an increase of

$19.0 million

or

2%

from

December 31, 2011

. We continued to return capital to our shareholders in the form of share repurchases and dividends. During

2012

, we repurchased 1.7 million shares of common stock at a total cost of $79.5 million under our share repurchase program. We also paid cash dividends of

$81.6 million

during

2012

.

|

|

Average Balances and Interest Rates – Taxable-Equivalent Basis

|

Table 1

|

||||||||||||||||||||||||||||||

|

2012

|

2011

|

2010

|

|||||||||||||||||||||||||||||

|

(dollars in millions)

|

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

||||||||||||||||

|

Earning Assets

|

|||||||||||||||||||||||||||||||

|

Interest-Bearing Deposits

|

$

|

3.7

|

|

$

|

—

|

|

0.26

|

%

|

$

|

4.2

|

|

$

|

—

|

|

0.19

|

%

|

$

|

4.7

|

|

$

|

—

|

|

0.59

|

%

|

|||||||

|

Funds Sold

|

263.5

|

|

0.5

|

|

0.20

|

380.2

|

|

0.8

|

|

0.22

|

390.2

|

|

1.1

|

|

0.28

|

||||||||||||||||

|

Investment Securities

|

|||||||||||||||||||||||||||||||

|

Available-for-Sale

|

3,346.3

|

|

75.0

|

|

2.24

|

4,439.8

|

|

105.4

|

|

2.37

|

5,854.1

|

|

170.1

|

|

2.91

|

||||||||||||||||

|

Held-to-Maturity

|

3,636.7

|

|

95.0

|

|

2.61

|

2,279.6

|

|

72.2

|

|

3.16

|

154.2

|

|

6.5

|

|

4.22

|

||||||||||||||||

|

Loans Held for Sale

|

14.7

|

|

0.6

|

|

4.29

|

11.0

|

|

0.5

|

|

4.54

|

10.8

|

|

0.9

|

|

8.51

|

||||||||||||||||

|

Loans and Leases

1

|

|||||||||||||||||||||||||||||||

|

Commercial and Industrial

|

800.2

|

|

31.3

|

|

3.91

|

790.6

|

|

31.8

|

|

4.02

|

764.2

|

|

33.7

|

|

4.41

|

||||||||||||||||

|

Commercial Mortgage

|

988.2

|

|

42.9

|

|

4.34

|

887.1

|

|

42.8

|

|

4.82

|

827.7

|

|

42.0

|

|

5.07

|

||||||||||||||||

|

Construction

|

101.9

|

|

5.1

|

|

5.04

|

80.1

|

|

4.0

|

|

5.06

|

95.4

|

|

4.8

|

|

5.08

|

||||||||||||||||

|

Commercial Lease Financing

|

283.3

|

|

6.8

|

|

2.39

|

322.1

|

|

8.7

|

|

2.71

|

385.1

|

|

11.3

|

|

2.92

|

||||||||||||||||

|

Residential Mortgage

|

2,349.6

|

|

111.3

|

|

4.74

|

2,126.9

|

|

111.5

|

|

5.24

|

2,105.6

|

|

118.7

|

|

5.64

|

||||||||||||||||

|

Home Equity

|

773.2

|

|

33.4

|

|

4.31

|

784.9

|

|

37.4

|

|

4.76

|

863.7

|

|

43.2

|

|

4.99

|

||||||||||||||||

|

Automobile

|

196.8

|

|

11.7

|

|

5.96

|

194.4

|

|

13.2

|

|

6.78

|

241.2

|

|

18.3

|

|

7.58

|

||||||||||||||||

|

Other

2

|

187.1

|

|

15.2

|

|

8.11

|

163.8

|

|

12.4

|

|

7.57

|

189.6

|

|

14.5

|

|

7.66

|

||||||||||||||||

|

Total Loans and Leases

|

5,680.3

|

|

257.7

|

|

4.54

|

5,349.9

|

|

261.8

|

|

4.89

|

5,472.5

|

|

286.5

|

|

5.23

|

||||||||||||||||

|

Other

|

79.9

|

|

1.1

|

|

1.41

|

79.9

|

|

1.1

|

|

1.40

|

79.8

|

|

1.1

|

|

1.39

|

||||||||||||||||

|

Total Earning Assets

3

|

13,025.1

|

|

429.9

|

|

3.30

|

12,544.6

|

|

441.8

|

|

3.52

|

11,966.3

|

|

466.2

|

|

3.90

|

||||||||||||||||

|

Cash and Noninterest-Bearing Deposits

|

137.2

|

|

135.3

|

|

229.6

|

|

|||||||||||||||||||||||||

|

Other Assets

|

446.9

|

|

425.1

|

|

491.8

|

|

|||||||||||||||||||||||||

|

Total Assets

|

$

|

13,609.2

|

|

$

|

13,105.0

|

|

$

|

12,687.7

|

|

||||||||||||||||||||||

|

Interest-Bearing Liabilities

|

|||||||||||||||||||||||||||||||

|

Interest-Bearing Deposits

|

|||||||||||||||||||||||||||||||

|

Demand

|

$

|

1,938.6

|

|

$

|

0.5

|

|

0.03

|

%

|

$

|

1,786.7

|

|

$

|

0.7

|

|

0.04

|

%

|

$

|

1,715.8

|

|

$

|

1.1

|

|

0.06

|

%

|

|||||||

|

Savings

|

4,447.8

|

|

4.5

|

|

0.10

|

4,501.0

|

|

7.3

|

|

0.16

|

4,465.0

|

|

14.7

|

|

0.33

|

||||||||||||||||

|

Time

|

1,524.6

|

|

7.4

|

|

0.48

|

1,067.8

|

|

10.3

|

|

0.96

|

1,088.7

|

|

13.4

|

|

1.23

|

||||||||||||||||

|

Total Interest-Bearing Deposits

|

7,911.0

|

|

12.4

|

|

0.16

|

7,355.5

|

|

18.3

|

|

0.25

|

7,269.5

|

|

29.2

|

|

0.40

|

||||||||||||||||

|

Short-Term Borrowings

|

15.1

|

|

—

|

|

0.14

|

18.2

|

|

—

|

|

0.11

|

23.3

|

|

—

|

|

0.13

|

||||||||||||||||

|

Securities Sold Under

Agreements to Repurchase

|

1,335.7

|

|

28.9

|

|

2.16

|

1,845.8

|

|

29.2

|

|

1.58

|

1,700.2

|

|

26.0

|

|

1.53

|

||||||||||||||||

|

Long-Term Debt

|

31.5

|

|

1.9

|

|

6.10

|

31.6

|

|

2.0

|

|

6.23

|

61.0

|

|

3.5

|

|

5.81

|

||||||||||||||||

|

Total Interest-Bearing Liabilities

|

9,293.3

|

|

43.2

|

|

0.47

|

9,251.1

|

|

49.5

|

|

0.53

|

9,054.0

|

|

58.7

|

|

0.65

|

||||||||||||||||

|

Net Interest Income

|

$

|

386.7

|

|

$

|

392.3

|

|

$

|

407.5

|

|

||||||||||||||||||||||

|

Interest Rate Spread

|

2.83

|

%

|

2.99

|

%

|

3.25

|

%

|

|||||||||||||||||||||||||

|

Net Interest Margin

|

2.97

|

%

|

3.13

|

%

|

3.41

|

%

|

|||||||||||||||||||||||||

|

Noninterest-Bearing Demand Deposits

|

3,024.0

|

|

2,569.2

|

|

2,239.6

|

|

|||||||||||||||||||||||||

|

Other Liabilities

|

268.6

|

|

264.6

|

|

381.4

|

|

|||||||||||||||||||||||||

|

Shareholders' Equity

|

1,023.3

|

|

1,020.1

|

|

1,012.7

|

|

|||||||||||||||||||||||||

|

Total Liabilities and

Shareholders' Equity

|

$

|

13,609.2

|

|

$

|

13,105.0

|

|

$

|

12,687.7

|

|

||||||||||||||||||||||

|

Analysis of Change in Net Interest Income – Taxable-Equivalent Basis

|

Table 2

|

|||||||||||||||||||||||

|

Year Ended December 31,

2012 Compared to 2011 |

Year Ended December 31,

2011 Compared to 2010 |

|||||||||||||||||||||||

|

(dollars in millions)

|

Volume

1

|

|

Rate

1

|

|

Total

|

|

Volume

1

|

|

Rate

1

|

|

Total

|

|

||||||||||||

|

Change in Interest Income:

|

||||||||||||||||||||||||

|

Funds Sold

|

$

|

(0.2

|

)

|

$

|

(0.1

|

)

|

$

|

(0.3

|

)

|

$

|

—

|

|

$

|

(0.3

|

)

|

$

|

(0.3

|

)

|

||||||

|

Investment Securities

|

||||||||||||||||||||||||

|

Available-for-Sale

|

(24.8

|

)

|

(5.6

|

)

|

(30.4

|

)

|

(36.5

|

)

|

(28.2

|

)

|

(64.7

|

)

|

||||||||||||

|

Held-to-Maturity

|

37.1

|

|

(14.3

|

)

|

22.8

|

|

67.7

|

|

(2.0

|

)

|

65.7

|

|

||||||||||||

|

Loans Held for Sale

|

0.1

|

|

—

|

|

0.1

|

|

—

|

|

(0.4

|

)

|

(0.4

|

)

|

||||||||||||

|

Loans and Leases

|

||||||||||||||||||||||||

|

Commercial and Industrial

|

0.4

|

|

(0.9

|

)

|

(0.5

|

)

|

1.1

|

|

(3.0

|

)

|

(1.9

|

)

|

||||||||||||

|

Commercial Mortgage

|

4.6

|

|

(4.5

|

)

|

0.1

|

|

2.9

|

|

(2.1

|

)

|

0.8

|

|

||||||||||||

|

Construction

|

1.1

|

|

0.0

|

|

1.1

|

|

(0.8

|

)

|

0.0

|

|

(0.8

|

)

|

||||||||||||

|

Commercial Lease Financing

|

(1.0

|

)

|

(0.9

|

)

|

(1.9

|

)

|

(1.8

|

)

|

(0.8

|

)

|

(2.6

|

)

|

||||||||||||

|

Residential Mortgage

|

11.1

|

|

(11.3

|

)

|

(0.2

|

)

|

1.2

|

|

(8.4

|

)

|

(7.2

|

)

|

||||||||||||

|

Home Equity

|

(0.5

|

)

|

(3.5

|

)

|

(4.0

|

)

|

(3.8

|

)

|

(2.0

|

)

|

(5.8

|

)

|

||||||||||||

|

Automobile

|

0.1

|

|

(1.6

|

)

|

(1.5

|

)

|

(3.3

|

)

|

(1.8

|

)

|

(5.1

|

)

|

||||||||||||

|

Other

2

|

1.9

|

|

0.9

|

|

2.8

|

|

(1.9

|

)

|

(0.2

|

)

|

(2.1

|

)

|

||||||||||||

|

Total Loans and Leases

|

17.7

|

|

(21.8

|

)

|

(4.1

|

)

|

(6.4

|

)

|

(18.3

|

)

|

(24.7

|

)

|

||||||||||||

|

Total Change in Interest Income

|

29.9

|

|

(41.8

|

)

|

(11.9

|

)

|

24.8

|

|

(49.2

|

)

|

(24.4

|

)

|

||||||||||||

|

Change in Interest Expense:

|

||||||||||||||||||||||||

|

Interest-Bearing Deposits

|

||||||||||||||||||||||||

|

Demand

|

0.1

|

|

(0.3

|

)

|

(0.2

|

)

|

—

|

|

(0.4

|

)

|

(0.4

|

)

|

||||||||||||

|

Savings

|

(0.1

|

)

|

(2.7

|

)

|

(2.8

|

)

|

0.1

|

|

(7.5

|

)

|

(7.4

|

)

|

||||||||||||

|

Time

|

3.4

|

|

(6.3

|

)

|

(2.9

|

)

|

(0.2

|

)

|

(2.9

|

)

|

(3.1

|

)

|

||||||||||||

|

Total Interest-Bearing Deposits

|

3.4

|

|

(9.3

|

)

|

(5.9

|

)

|

(0.1

|

)

|

(10.8

|

)

|

(10.9

|

)

|

||||||||||||

|

Securities Sold Under Agreements to Repurchase

|

(9.4

|

)

|

9.1

|

|

(0.3

|

)

|

2.3

|

|

0.9

|

|

3.2

|

|

||||||||||||

|

Long-Term Debt

|

—

|

|

(0.1

|

)

|

(0.1

|

)

|

(1.8

|

)

|

0.3

|

|

(1.5

|

)

|

||||||||||||

|

Total Change in Interest Expense

|

(6.0

|

)

|

(0.3

|

)

|

(6.3

|

)

|

0.4

|

|

(9.6

|

)

|

(9.2

|

)

|

||||||||||||

|

Change in Net Interest Income

|

$

|

35.9

|

|

$

|

(41.5

|

)

|

$

|

(5.6

|

)

|

$

|

24.4

|

|

$

|

(39.6

|

)

|

$

|

(15.2

|

)

|

||||||

|

Noninterest Income

|

Table 3

|

||||||||||||||||||||||||

|

Year Ended December 31,

|

Dollar Change

|

Percent Change

|

|||||||||||||||||||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

2010

|

|

2012

to 2011 |

|

2011

to 2010 |

|

2012

to 2011 |

|

2011

to 2010 |

|

|||||||||||

|

Trust and Asset Management

|

$

|

45,229

|

|

$

|

45,046

|

|

$

|

44,889

|

|

$

|

183

|

|

$

|

157

|

|

—

|

%

|

—

|

%

|

||||||

|

Mortgage Banking

|

35,644

|

|

14,664

|

|

18,576

|

|

20,980

|

|

(3,912

|

)

|

143

|

|

(21

|

)

|

|||||||||||

|

Service Charges on Deposit Accounts

|

37,621

|

|

38,733

|

|

53,039

|

|

(1,112

|

)

|

(14,306

|

)

|

(3

|

)

|

(27

|

)

|

|||||||||||

|

Fees, Exchange, and Other Service Charges

|

48,965

|

|

60,227

|

|

61,006

|

|

(11,262

|

)

|

(779

|

)

|

(19

|

)

|

(1

|

)

|

|||||||||||

|

Investment Securities Gains (Losses), Net

|

(77

|

)

|

6,366

|

|

42,848

|

|

(6,443

|

)

|

(36,482

|

)

|

(101

|

)

|

(85

|

)

|

|||||||||||

|

Insurance

|

9,553

|

|

10,957

|

|

9,961

|

|

(1,404

|

)

|

996

|

|

(13

|

)

|

10

|

|

|||||||||||

|

Other Income:

|

|

|

|

|

|

|

|||||||||||||||||||

|

Income from Bank-Owned Life Insurance

|

6,805

|

|

6,329

|

|

6,357

|

|

476

|

|

(28

|

)

|

8

|

|

—

|

|

|||||||||||

|

Gain on Mutual Fund Sale

|

489

|

|

1,956

|

|

2,852

|

|

(1,467

|

)

|

(896

|

)

|

(75

|

)

|

(31

|

)

|

|||||||||||

|

Gain on the Sale of Leased Assets

|

3,335

|

|

1,001

|

|

1,126

|

|

2,334

|

|

(125

|

)

|

233

|

|

(11

|

)

|

|||||||||||

|

Other

|

12,722

|

|

12,376

|

|

14,604

|

|

346

|

|

(2,228

|

)

|

3

|

|

(15

|

)

|

|||||||||||

|

Total Other Income

|

23,351

|

|

21,662

|

|

24,939

|

|

1,689

|

|

(3,277

|

)

|

8

|

|

(13

|

)

|

|||||||||||

|

Total Noninterest Income

|

$

|

200,286

|

|

$

|

197,655

|

|

$

|

255,258

|

|

$

|

2,631

|

|

$

|

(57,603

|

)

|

1

|

%

|

(23

|

)%

|

||||||

|

Noninterest Expense

|

Table 4

|

||||||||||||||||||||||||

|

Year Ended December 31,

|

Dollar Change

|

Percent Change

|

|||||||||||||||||||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

2010

|

|

2012

to 2011 |

|

2011

to 2010 |

|

2012

to 2011 |

|

2011

to 2010 |

|

|||||||||||

|

Salaries and Benefits:

|

|||||||||||||||||||||||||

|

Salaries

|

$

|

115,208

|

|

$

|

115,512

|

|

$

|

119,515

|

|

$

|

(304

|

)

|

$

|

(4,003

|

)

|

—

|

%

|

(3

|

)%

|

||||||

|

Incentive Compensation

|

16,926

|

|

16,367

|

|

15,544

|

|

559

|

|

823

|

|

3

|

|

5

|

|

|||||||||||

|

Share-Based Compensation and

Cash Grants for the Purchase of Company Stock |

6,961

|

|

5,720

|

|

6,805

|

|

1,241

|

|

(1,085

|

)

|

22

|

|

(16

|

)

|

|||||||||||

|

Commission Expense

|

6,993

|

|

6,489

|

|

6,666

|

|

504

|

|

(177

|

)

|

8

|

|

(3

|

)

|

|||||||||||

|

Retirement and Other Benefits

|

16,014

|

|

16,829

|

|

15,708

|

|

(815

|

)

|

1,121

|

|

(5

|

)

|

7

|

|

|||||||||||

|

Payroll Taxes

|

10,593

|

|

10,645

|

|

10,084

|

|

(52

|

)

|

561

|

|

—

|

|

6

|

|

|||||||||||

|

Medical, Dental, and Life Insurance

|

9,319

|

|

9,039

|

|

8,242

|

|

280

|

|

797

|

|

3

|

|

10

|

|

|||||||||||

|

Separation Expense

|

2,394

|

|

2,215

|

|

3,149

|

|

179

|

|

(934

|

)

|

8

|

|

(30

|

)

|

|||||||||||

|

Total Salaries and Benefits

|

184,408

|

|

182,816

|

|

|

185,713

|

|

1,592

|

|

(2,897

|

)

|

1

|

|

(2

|

)

|

||||||||||

|

Net Occupancy

|

42,965

|

|

43,169

|

|

40,988

|

|

(204

|

)

|

2,181

|

|

—

|

|

5

|

|

|||||||||||

|

Net Equipment

|

19,723

|

|

18,849

|

|

19,371

|

|

874

|

|

(522

|

)

|

5

|

|

(3

|

)

|

|||||||||||

|

Professional Fees

|

9,623

|

|

8,623

|

|

7,104

|

|

1,000

|

|

1,519

|

|

12

|

|

21

|

|

|||||||||||

|

FDIC Insurance

|

7,873

|

|

9,346

|

|

12,564

|

|

(1,473

|

)

|

(3,218

|

)

|

(16

|

)

|

(26

|

)

|

|||||||||||

|

Other Expense:

|

|

|

|

|

|

|

|||||||||||||||||||

|

Data Services

|

13,202

|

|

14,067

|

|

13,812

|

|

(865

|

)

|

255

|

|

(6

|

)

|

2

|

|

|||||||||||

|

Delivery and Postage Services

|

8,612

|

|

8,955

|

|

9,072

|

|

(343

|

)

|

(117

|

)

|

(4

|

)

|

(1

|

)

|

|||||||||||

|

Mileage Program Travel

|

6,741

|

|

8,910

|

|

8,055

|

|

(2,169

|

)

|

855

|

|

(24

|

)

|

11

|

|

|||||||||||

|

Merchant Transaction and Card Processing Fees

|

4,895

|

|

5,162

|

|

5,203

|

|

(267

|

)

|

(41

|

)

|

(5

|

)

|

(1

|

)

|

|||||||||||

|

Advertising

|

4,659

|

|

5,484

|

|

5,010

|

|

(825

|

)

|

474

|

|

(15

|

)

|

9

|

|

|||||||||||

|

Stationery and Supplies

|

3,972

|

|

4,275

|

|

4,587

|

|

(303

|

)

|

(312

|

)

|

(7

|

)

|

(7

|

)

|

|||||||||||

|

Donations

|

1,033

|

|

2,075

|

|

1,146

|

|

(1,042

|

)

|

929

|

|

(50

|

)

|

81

|

|

|||||||||||

|

Repurchase Agreement

Early Termination Expense |

—

|

|

—

|

|

5,189

|

|

—

|

|

(5,189

|

)

|

n.m.

|

|

n.m.

|

|

|||||||||||

|

Settlement Related to Overdraft Claims

|

—

|

|

9,000

|

|

—

|

|

(9,000

|

)

|

9,000

|

|

n.m.

|

|

n.m.

|

|

|||||||||||

|

Other

|

26,582

|

|

27,462

|

|

28,422

|

|

(880

|

)

|

(960

|

)

|

(3

|

)

|

(3

|

)

|

|||||||||||

|

Total Other Expense

|

69,696

|

|

85,390

|

|

|

80,496

|

|

|

(15,694

|

)

|

|

4,894

|

|

(18

|

)

|

6

|

|

||||||||

|

Total Noninterest Expense

|

$

|

334,288

|

|

$

|

348,193

|

|

|

$

|

346,236

|

|

|

$

|

(13,905

|

)

|

|

$

|

1,957

|

|

(4

|

)%

|

1

|

%

|

|||

|

Provision for Income Taxes and Effective Tax Rates

|

Table 5

|

|

|||||

|

(dollars in thousands)

|

Provision for Income Taxes

|

Effective Tax Rates

|

|

||||

|

2012

|

$

|

76,214

|

|

31.46

|

%

|

||

|

2011

|

66,937

|

|

29.49

|

%

|

|||

|

2010

|

76,273

|

|

29.31

|

%

|

|||

|

Business Segment Net Income

|

Table 6

|

|

|||||||||

|

Year Ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

2010

|

|

|||||

|

Retail Banking

|

$

|

37,403

|

|

$

|

30,919

|

|

$

|

47,579

|

|

||

|

Commercial Banking

|

51,349

|

|

53,203

|

|

52,737

|

|

|||||

|

Investment Services

|

8,923

|

|

9,943

|

|

11,452

|

|

|||||

|

Total

|

97,675

|

|

94,065

|

|

111,768

|

|

|||||

|

Treasury and Other

|

68,401

|

|

65,978

|

|

72,174

|

|

|||||

|

Consolidated Total

|

$

|

166,076

|

|

$

|

160,043

|

|

$

|

183,942

|

|

||

|

Contractual Maturity Distribution, Weighted-Average Yield to Maturity, and Fair Value of Investment Securities

|

Table 7

|

|||||||||||||||||||||||||||||||||||||

|

(dollars in millions)

|

1 Year

or Less |

|

Weighted

Average Yield |

|

After 1

Year-5 Years |

|

Weighted

Average Yield |

|

After 5

Years-10 Years |

|

Weighted

Average Yield |

|

Over 10

Years |

|

Weighted

Average Yield |

|

Total

|

|

Weighted

Average Yield |

|

Fair

Value |

|

||||||||||||||||

|

As of December 31, 2012

|

||||||||||||||||||||||||||||||||||||||

|

Investment Securities Available-for-Sale

1

|

||||||||||||||||||||||||||||||||||||||

|

Debt Securities Issued by the U.S. Treasury and Government Agencies

|

$

|

401.8

|

|

0.9

|

%

|

$

|

66.7

|

|

2.3

|

%

|

$

|

67.2

|

|

2.6

|

%

|

$

|

319.4

|

|

2.3

|

%

|

$

|

855.1

|

|

1.6

|

%

|

$

|

870.0

|

|

||||||||||

|

Debt Securities Issued by States and Political Subdivisions

2

|

34.9

|

|

1.7

|

|

48.5

|

|

2.7

|

|

360.6

|

|

3.2

|

|

309.2

|

|

5.0

|

|

753.2

|

|

3.8

|

|

782.4

|

|

||||||||||||||||

|

Debt Securities Issued by Corporations

|

—

|

|

—

|

|

82.4

|

|

2.2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

82.4

|

|

2.2

|

|

84.5

|

|

||||||||||||||||

|

Mortgage-Backed Securities Issued by

3

|

||||||||||||||||||||||||||||||||||||||

|

Government Agencies

|

—

|

|

—

|

|

—

|

|

—

|

|

42.0

|

|

3.5

|

|

1,523.7

|

|

2.5

|

|

1,565.7

|

|

2.5

|

|

1,593.4

|

|

||||||||||||||||

|

U.S. Government-Sponsored Enterprises

|

0.2

|

|

4.5

|

|

0.1

|

|

4.5

|

|

7.4

|

|

4.5

|

|

27.6

|

|

3.2

|

|

35.3

|

|

3.5

|

|

37.3

|

|

||||||||||||||||

|

Total Mortgage-Backed Securities

|

0.2

|

|

4.5

|

|

0.1

|

|

4.5

|

|

49.4

|

|

3.7

|

|

1,551.3

|

|

2.5

|

|

1,601.0

|

|

2.6

|

|

1,630.7

|

|

||||||||||||||||

|

Total Investment Securities

Available-for-Sale |

$

|

436.9

|

|

1.0

|

%

|

$

|

197.7

|

|

2.4

|

%

|

$

|

477.2

|

|

3.1

|

%

|

$

|

2,179.9

|

|

2.8

|

%

|

$

|

3,291.7

|

|

2.6

|

%

|

$

|

3,367.6

|

|

||||||||||

|

Investment Securities Held-to-Maturity

|

||||||||||||||||||||||||||||||||||||||

|

Debt Securities Issued by the U.S. Treasury and Government Agencies

|

$

|

50.1

|

|

1.1

|

%

|

$

|

140.1

|

|

1.8

|

%

|

$

|

—

|

|

—

|

%

|

$

|

—

|

|

—

|

%

|

$

|

190.2

|

|

1.6

|

%

|

$

|

195.4

|

|

||||||||||

|

Debt Securities Issued by Corporations

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

24

|

|

1.5

|

|

24.0

|

|

1.5

|

|

24.0

|

|

||||||||||||||||

|

Mortgage-Backed Securities Issued by

3

|

||||||||||||||||||||||||||||||||||||||

|

Government Agencies

|

—

|

|

—

|

|

—

|

|

—

|

|

30.9

|

|

3.7

|

|

3,318.5

|

|

2.9

|

|

3,349.4

|

|

2.9

|

|

3,434.7

|

|

||||||||||||||||

|

U.S. Government-Sponsored Enterprises

|

—

|

|

—

|

|

1.5

|

|

3.5

|

|

4.0

|

|

3.8

|

|

26.0

|

|

3.8

|

|

31.5

|

|

3.8

|

|

33.6

|

|

||||||||||||||||

|

Total Mortgage-Backed Securities

|

—

|

|

—

|

|

1.5

|

|

3.5

|

|

34.9

|

|

3.7

|

|

3,344.5

|

|

2.9

|

|

3,380.9

|

|

2.9

|

|

3,468.3

|

|

||||||||||||||||

|

Total Investment Securities

Held-to-Maturity |

$

|

50.1

|

|

1.1

|

%

|

$

|

141.6

|

|

1.8

|

%

|

$

|

34.9

|

|

3.7

|

%

|

$

|

3,368.5

|

|

2.9

|

%

|

$

|

3,595.1

|

|

2.9

|

%

|

$

|

3,687.7

|

|

||||||||||

|

Total Investment Securities

|

||||||||||||||||||||||||||||||||||||||

|

As of December 31, 2012

|

$

|

487.0

|

|

$

|

339.3

|

|

$

|

512.1

|

|

$

|

5,548.4

|

|

$

|

6,886.8

|

|

$

|

7,055.3

|

|

||||||||||||||||||||

|

As of December 31, 2011

|

$

|

427.3

|

|

$

|

791.5

|

|

$

|

200.8

|

|

$

|

5,625.1

|

|

$

|

7,044.7

|

|

$

|

7,206.1

|

|

||||||||||||||||||||

|

As of December 31, 2010

|

$

|

172.2

|

|

$

|

180.0

|

|

$

|

195.1

|

|

$

|

6,037.1

|

|

$

|

6,584.4

|

|

$

|

6,667.9

|

|

||||||||||||||||||||

|

1

|

Weighted-average yields on available-for-sale investment securities are based on amortized cost.

|

|

2

|

Weighted-average yields on obligations of states and political subdivisions are generally tax-exempt and are computed on a taxable-equivalent basis using a federal statutory tax rate of 35%.

|

|

Geographic Distribution of Loan and Lease Portfolio

|

Table 8

|

||||||||||||||||||||||

|

December 31, 2012

|

|||||||||||||||||||||||

|

(dollars in thousands)

|

Hawaii

|

|

U.S.

Mainland 1 |

|

Guam

|

|

Other

Pacific Islands |

|

Foreign

2

|

|

Total

|

|

|||||||||||

|

Commercial

|

|||||||||||||||||||||||

|

Commercial and Industrial

|

$

|

726,401

|

|

$

|

29,571

|

|

$

|

70,622

|

|

$

|

2,213

|

|

$

|

705

|

|

$

|

829,512

|

|

|||||

|

Commercial Mortgage

|

988,165

|

|

33,240

|

|

76,020

|

|

—

|

|

—

|

|

1,097,425

|

|

|||||||||||

|

Construction

|

109,956

|

|

—

|

|

4,031

|

|

—

|

|

—

|

|

113,987

|

|

|||||||||||

|

Lease Financing

|

31,871

|

|

207,236

|

|

13,070

|

|

—

|

|

22,792

|

|

274,969

|

|

|||||||||||

|

Total Commercial

|

1,856,393

|

|

270,047

|

|

163,743

|

|

2,213

|

|

23,497

|

|

2,315,893

|

|

|||||||||||

|

Consumer

|

|||||||||||||||||||||||

|

Residential Mortgage

|

2,209,882

|

|

—

|

|

135,491

|

|

4,543

|

|

—

|

|

2,349,916

|

|

|||||||||||

|

Home Equity

|

740,939

|

|

7,784

|

|

19,682

|

|

1,971

|

|

—

|

|

770,376

|

|

|||||||||||

|

Automobile

|

152,031

|

|

4,068

|

|

50,716

|

|

3,017

|

|

—

|

|

209,832

|

|

|||||||||||

|

Other

3

|

148,724

|

|

—

|

|

23,867

|

|

35,904

|

|

9

|

|

208,504

|

|

|||||||||||

|

Total Consumer

|

3,251,576

|

|

11,852

|

|

229,756

|

|

45,435

|

|

9

|

|

3,538,628

|

|

|||||||||||

|

Total Loans and Leases

|

$

|

5,107,969

|

|

$

|

281,899

|

|

$

|

393,499

|

|

$

|

47,648

|

|

$

|

23,506

|

|

$

|

5,854,521

|

|

|||||

|

Percentage of Total Loans and Leases

|

87

|

%

|

5

|

%

|

7

|

%

|

1

|

%

|

—

|

%

|

100

|

%

|

|||||||||||

|

1

|

For secured loans and leases, classification as U.S. Mainland is made based on where the collateral is located. For unsecured loans and leases, classification as U.S. Mainland is made based on the location where the majority of the borrower's business operations are conducted.

|

|

2

|

Loans classified as Foreign represent those which are recorded in the Company's international business units. Lease financing classified as Foreign represent those with air transportation carriers based outside the United States.

|

|

3

|

Comprised of other revolving credit, installment, and lease financing.

|

|

Maturities for Selected Loan Categories

1

|

Table 9

|

||||||||||||||

|

December 31, 2012

|

|||||||||||||||

|

(dollars in thousands)

|

Due in

One Year or Less |

|

Due After One

to Five Years 2 |

|

Due After

Five Years 2 |

|

Total

|

|

|||||||

|

Commercial and Industrial

|

$

|

328,979

|

|

$

|

288,768

|

|

$

|

211,765

|

|

$

|

829,512

|

|

|||

|

Construction

|

40,837

|

|

65,430

|

|

7,720

|

|

113,987

|

|

|||||||

|

Total

|

$

|

369,816

|

|

$

|

354,198

|

|

$

|

219,485

|

|

$

|

943,499

|

|

|||

|

Savings Deposits

|

Table 10

|

||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

|||

|

Money Market

|

$

|

1,605,597

|

|

$

|

1,732,999

|

|

|

|

Regular Savings

|

2,793,719

|

|

2,665,639

|

|

|||

|

Total Savings Deposits

|

$

|

4,399,316

|

|

$

|

4,398,638

|

|

|

|

Discount Rate Sensitivity Analysis

|

Table 11

|

|

|||||||||||||

|

Impact of

|

|||||||||||||||

|

Discount Rate

25 Basis Point Increase |

Discount Rate

25 Basis Point Decrease |

||||||||||||||

|

(dollars in thousands)

|

Base Discount Rate

|

|

Pension Benefits

|

|

Postretirement Benefits

|

|

Pension Benefits

|

|

Postretirement Benefits

|

|

|||||

|

2012 Net Periodic Benefit Cost

|

5.04

|

%

|

$

|

4

|

|

$

|

(11

|

)

|

$

|

(7

|

)

|

$

|

1

|

|

|

|

Benefit Plan Obligations as of December 31, 2012

|

4.29

|

%

|

(3,097

|

)

|

(857

|

)

|

3,243

|

|

902

|

|

|||||

|

Estimated 2013 Net Periodic Benefit Cost

|

4.29

|

%

|

14

|

|

1

|

|

(19

|

)

|

(2

|

)

|

|||||

|

Higher Risk Loans and Leases Outstanding

|

Table 12

|

||||||

|

December 31,

|

|||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

|||

|

Residential Land Loans

|

$

|

14,984

|

|

$

|

18,163

|

|

|

|

Home Equity Loans

|

19,914

|

|

21,413

|

|

|||

|

Air Transportation Leases

|

27,782

|

|

36,144

|

|

|||

|

Total

|

$

|

62,680

|

|

$

|

75,720

|

|

|

|

Non-Performing Assets and Accruing Loans and Leases Past Due 90 Days or More

|

Table 13

|

||||||||||||||||||

|

December 31,

|

|||||||||||||||||||

|

(dollars in thousands)

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

2008

|

|

|||||||||

|

Non-Performing Assets

1

|

|||||||||||||||||||

|

Non-Accrual Loans and Leases

|

|||||||||||||||||||

|

Commercial

|

|||||||||||||||||||

|

Commercial and Industrial

|

$

|

5,534

|

|

$

|

6,243

|

|

$

|

1,642

|

|

$

|

6,646

|

|

$

|

3,869

|

|

||||

|

Commercial Mortgage

|

3,030

|

|

2,140

|

|

3,503

|

|

1,167

|

|

—

|

|

|||||||||

|

Construction

|

833

|

|

2,080

|

|

288

|

|

8,154

|

|

5,001

|

|

|||||||||

|

Lease Financing

|

—

|

|

5

|

|

19

|

|

631

|

|

133

|

|

|||||||||

|

Total Commercial

|

9,397

|

|

10,468

|

|

5,452

|

|

16,598

|

|

9,003

|

|

|||||||||

|

Consumer

|

|||||||||||||||||||

|

Residential Mortgage

|

21,725

|

|

25,256

|

|

28,152

|

|

19,893

|

|

3,904

|

|

|||||||||

|

Home Equity

|

2,074

|

|

2,024

|

|

2,254

|

|

5,153

|

|

1,614

|

|

|||||||||

|

Other

2

|

—

|

|

—

|

|

—

|

|

550

|

|

—

|

|

|||||||||

|

Total Consumer

|

23,799

|

|

27,280

|

|

30,406

|

|

25,596

|

|

5,518

|

|

|||||||||

|