Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-35505

Brookfield Property Partners L.P.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Bermuda

(Jurisdiction of incorporation or organization)

73 Front Street Hamilton, HM 12 Bermuda

(Address of principal executive office)

Steven J. Douglas

Brookfield Property Partners L.P.

Brookfield Place

250 Vesey Street, 15 th Floor

New York, NY 10281-1023

Tel: 212-417-7000

Fax: 212-417-7196

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Table of Contents

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class

|

Name of each exchange on which registered

|

|||

|

Limited Partnership Units Limited Partnership Units |

New York Stock Exchange Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 0 Limited Partnership Units as of December 31, 2012.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ¨ | No x |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| Yes ¨ | No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes x | No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes ¨ | No ¨ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ |

International Financial Reporting Standards as

issued by the International Accounting Standards Board |

x | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| Item 17 ¨ | Item 18 ¨ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ¨ | No x |

Table of Contents

| Page | ||||||||||

| INTRODUCTION AND USE OF CERTAIN TERMS | 1 | |||||||||

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 4 | |||||||||

| PART I | 6 | |||||||||

| ITEM 1. | 6 | |||||||||

| ITEM 2. | 6 | |||||||||

| ITEM 3. | 6 | |||||||||

| 3.A. | 6 | |||||||||

| 3.B. | 6 | |||||||||

| 3.C. | 6 | |||||||||

| 3.D. | 7 | |||||||||

| ITEM 4. | 37 | |||||||||

| 4.A. | 37 | |||||||||

| 4.B. | 37 | |||||||||

| 4.C. | 59 | |||||||||

| 4.D. | 64 | |||||||||

| ITEM 5. | 65 | |||||||||

| 5.A. | 65 | |||||||||

| 5.B. | 99 | |||||||||

| 5.C. | 100 | |||||||||

| 5.D. | 101 | |||||||||

| 5.E. | 101 | |||||||||

| 5.F. | 101 | |||||||||

| ITEM 6. | 102 | |||||||||

| 6.A. | 102 | |||||||||

| 6.B. | 104 | |||||||||

| 6.C. | 105 | |||||||||

| 6.D. | 109 | |||||||||

| 6.E. | 109 | |||||||||

| ITEM 7. | 109 | |||||||||

| 7.A. | 109 | |||||||||

| 7.B. | 110 | |||||||||

| 7.C. | 124 | |||||||||

| ITEM 8. | 124 | |||||||||

| 8.A. | 124 | |||||||||

| 8.B. | 124 | |||||||||

| ITEM 9. | 124 | |||||||||

| 9.A. | 124 | |||||||||

| 9.B. | 125 | |||||||||

| 9.C. | 125 | |||||||||

| 9.D. | 125 | |||||||||

| 9.E. | 125 | |||||||||

| 9.F. | 125 | |||||||||

-i-

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||||||||

| ITEM 10. | 125 | |||||||||

| 10.A. | 125 | |||||||||

| 10.B. | 125 | |||||||||

| 10.C. | 150 | |||||||||

| 10.D. | 151 | |||||||||

| 10.E. | 151 | |||||||||

| 10.F. | 176 | |||||||||

| 10.G. | 176 | |||||||||

| 10.H. | 176 | |||||||||

| 10.I. | 177 | |||||||||

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 177 | ||||||||

| ITEM 12. | 177 | |||||||||

| PART II | 178 | |||||||||

| ITEM 13. | 178 | |||||||||

| ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY

HOLDERS AND USE OF PROCEEDS |

178 | ||||||||

| ITEM 15. | 178 | |||||||||

| ITEM 16. | 178 | |||||||||

| 16.A. | 178 | |||||||||

| 16.B. | 179 | |||||||||

| 16.C. | 179 | |||||||||

| 16.D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 179 | ||||||||

| 16.E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND

AFFILIATED PURCHASERS |

179 | ||||||||

| 16.F. | 179 | |||||||||

| 16.G. | 179 | |||||||||

| 16.H | 180 | |||||||||

| PART III | 181 | |||||||||

| ITEM 17. | 181 | |||||||||

| ITEM 18. | 181 | |||||||||

| ITEM 19. | 181 | |||||||||

| SIGNATURES | 182 | |||||||||

| INDEX TO FINANCIAL STATEMENTS | F-1 | |||||||||

| PF-1 | ||||||||||

-ii-

Table of Contents

INTRODUCTION AND USE OF CERTAIN TERMS

We have prepared this Form 20-F using a number of conventions, which you should consider when reading the information contained herein. Unless otherwise indicated or the context otherwise requires, in this Form 20-F:

| • |

all operating and other statistical information is presented as if we own 100% of each property in our portfolio, regardless of whether we own all of the interests in each property, but unless otherwise specified excludes interests in Brookfield-sponsored real estate opportunity and finance funds and our interest in Canary Wharf Group plc, or Canary Wharf; |

| • |

all financial information is presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, or IFRS, other than certain non-IFRS financial measures which are defined under “Use of Non-IFRS Measures”; and |

| • |

the disclosure on Brookfield Asset Management’s ownership in our business does not reflect the portion of our units that Brookfield Asset Management withheld in connection with the satisfaction of Canadian federal and U.S. “backup” withholding tax requirements for non-Canadian registered shareholders. |

In this Form 20-F, unless the context suggests otherwise, references to “we”, “us” and “our” are to our company, the Property Partnership, the Holding Entities and the operating entities, each as defined below, taken together. Unless the context suggests otherwise, in this Form 20-F references to:

| • |

an “affiliate” of any person are to any other person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such person; |

| • |

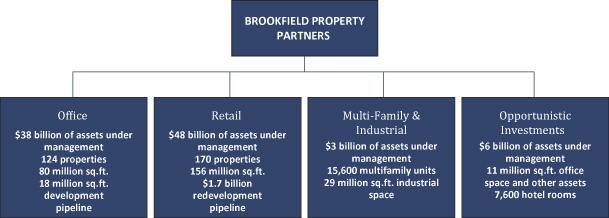

“assets under management” are to assets managed by us or by Brookfield on behalf of our third party investors, as well as our own assets, and also include capital commitments that have not yet been drawn. Our calculation of assets under management may differ from that employed by other asset managers and, as a result, this measure may not be comparable to similar measures presented by other asset managers; |

| • |

“Australia” are to Australia and New Zealand; |

| • |

the “BPY General Partner” are to the general partner of our company, which is Brookfield Property Partners Limited, a wholly-owned subsidiary of Brookfield Asset Management; |

| • |

“Brookfield” are to Brookfield Asset Management and any subsidiary of Brookfield Asset Management, other than us; |

| • |

“Brookfield Asset Management” are to Brookfield Asset Management Inc.; |

| • |

“our business” are to our business of owning, operating and investing in commercial property, both directly and through our operating entities; |

| • |

“our company” or “our partnership” are to Brookfield Property Partners L.P., a Bermuda exempted limited partnership; |

| • |

“commercial property” or “commercial properties” are to commercial and other real property which generates or has the potential to generate income, including office, retail, multi-family and industrial assets, but does not include, among other things, residential land development, home building, construction, real estate advisory and other similar operations or services; |

| • |

“Holding Entities” are to the primary holding subsidiaries of the Property Partnership, from time to time, through which it indirectly holds all of our interests in our operating entities; |

| • |

“our limited partnership agreement” are to the amended and restated limited partnership agreement of our company entered into on April 10, 2013; |

| • |

the “Managers” are to the affiliates of Brookfield that provide services to us pursuant to our Master Services Agreement, which is currently Brookfield Global Management Limited, a subsidiary of Brookfield Asset Management, and unless the context otherwise requires, any other affiliate of Brookfield that is appointed by Brookfield Global Management Limited from time to |

1

Table of Contents

|

time to act as a Manager pursuant to our Master Services Agreement or to whom the Managers have subcontracted for the provision of such services; |

| • |

“Master Services Agreement” are to the master services agreement among the Service Recipients, the Managers, and certain other subsidiaries of Brookfield Asset Management who are parties thereto; |

| • |

“operating entities” are to the entities in which the Holding Entities hold interests and that directly or indirectly hold our real estate assets other than entities in which the Holding Entities hold interests for investment purposes only of less than 5% of the equity securities; |

| • |

“our portfolio” are to the commercial property assets in our office, retail, multi-family and industrial and opportunistic investment platforms, as applicable; |

| • |

the “Property General Partner” are to the general partner of the Property GP LP, which is Brookfield Property General Partner Limited, a wholly-owned subsidiary of Brookfield Asset Management; |

| • |

the “Property GP LP” are to Brookfield Property GP L.P., a wholly-owned subsidiary of Brookfield Asset Management, which serves as the general partner of the Property Partnership; |

| • |

the “Property Partnership” are to Brookfield Property L.P.; |

| • |

the “Redemption-Exchange Mechanism” are to the mechanism by which Brookfield may request redemption of its Redemption-Exchange Units in whole or in part in exchange for cash, subject to the right of our company to acquire such interests (in lieu of such redemption) in exchange for units of our company, as more fully described in Item 10.B. “Additional Information — Memorandum and Articles of Association — Description of the Property Partnership Limited Partnership Agreement — Redemption-Exchange Mechanism”; |

| • |

the “Redemption-Exchange Units” are to the non-voting limited partnership interests in the Property Partnership that are redeemable for cash, subject to the right of our company to acquire such interests (in lieu of such redemption) in exchange for units of our company, pursuant to the Redemption-Exchange Mechanism; |

| • |

“Service Recipients” are to our company, the Property Partnership, the Holding Entities and, at the option of the Holding Entities, any wholly-owned subsidiary of a Holding Entity excluding any operating entity; |

| • |

“spin-off” are to the special dividend of our units by Brookfield Asset Management on April 15, 2013 as described under Item 4.A. “Information on the Company — History and Development of the Company”; and |

| • |

“our units” and “units of our company” are to the non-voting limited partnership units in our company and references to “our unitholders” and “our limited partners” are to the holders of our units. |

Historical Performance and Market Data

This Form 20-F contains information relating to our business as well as historical performance and market data for Brookfield Asset Management and certain of its operating platforms. When considering this data, you should bear in mind that historical results and market data may not be indicative of the future results that you should expect from us.

Financial Information

The financial information contained in this Form 20-F is presented in U.S. Dollars and, unless otherwise indicated, has been prepared in accordance with IFRS. All figures are unaudited unless otherwise

2

Table of Contents

indicated. In this Form 20-F, all references to “$” are to U.S. Dollars. Canadian Dollars, Australian Dollars, New Zealand Dollars, British Pounds, Euros and Brazilian Reais are identified as “C$”, “A$”, “NZ$”, “£”, “€” and “R$”, respectively.

Use of Non-IFRS Measures

In addition to results reported in accordance with IFRS, we use certain non-IFRS financial measures, such as property net operating income (“NOI”), funds from operations (“FFO”) and total return (“Total Return”) to evaluate our performance and to determine the net asset values of our business. These terms do not have standard meanings prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. NOI, FFO and Total Return should not be regarded as alternatives to other financial reporting measures prepared in accordance with IFRS and should not be considered in isolation or as substitutes for measures prepared in accordance with IFRS.

We define NOI as revenues from commercial and hospitality operations of consolidated properties less direct commercial property and hospitality expenses, with the exception of depreciation and amortization of real estate assets. NOI is used as a key indicator of performance as it represents a measure over which management has a certain degree of control. We evaluate the performance of our office segment by evaluating NOI from “Existing properties”, or “same store” basis, and NOI from “Additions, dispositions and other” due to, among other things, the consolidation of the U.S. Office Fund during the period as discussed in Item 5.A. “Operating and Financial Review and Prospects — Operating Results — Overview of Our Business”. NOI from existing properties compares the performance of the property portfolio by excluding the effect of current and prior period dispositions and acquisitions, including developments, and “one-time items ”, which for the historical periods presented consists primarily of lease termination income. NOI presented within “Additions, dispositions and other” includes the results of current and prior period acquired, developed and sold properties, as well as the one-time items excluded from the “Existing properties” portion of NOI. We do not evaluate the performance of the operating results of the retail segment on a similar basis as the majority of our investments in the retail segment are accounted for under the equity method and, as a result, are not included in NOI. Similarly, we do not evaluate the operating results of our other segments on a same store basis based on the nature of the investments as the variances between same store and total NOI are not material.

Our definition of FFO includes all of the adjustments that are outlined in the National Association of Real Estate Investment Trusts, or NAREIT, definition of funds from operations, including the exclusion of gains (or losses) from the sale of real estate property, the add back of any depreciation and amortization related to real estate assets and the adjustment for unconsolidated partnerships and joint ventures. In addition to the adjustments prescribed by NAREIT, we also make adjustments to exclude any unrealized fair value gains (or losses) that arise as a result of reporting under IFRS, and income taxes that arise as certain of our subsidiaries are structured as corporations as opposed to real estate investment trusts, or REITs. These additional adjustments result in an FFO measure that is similar to that which would result if the company was organized as a REIT that determined net income in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, which is the type of organization on which the NAREIT definition is premised. Our FFO measure will differ from other organizations applying the NAREIT definition to the extent of certain differences between the IFRS and U.S. GAAP reporting frameworks, principally related to the recognition of lease termination income, which do not have a significant impact on the FFO measure reported. Because FFO excludes fair value gains (losses) (including equity accounted fair value gains (losses)), realized gains (losses), depreciation and amortization of real estate assets and income tax expense (benefits), it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs and interest costs, providing perspective not immediately apparent from net income. We reconcile FFO to net income attributable to Brookfield rather than cash flow from operating activities as we believe net income is the most comparable measure.

We define Total Return as income before income tax expense (benefit) and the related non-controlling interests. Total Return is used as a key indicator of performance as we believe that our performance is best

3

Table of Contents

assessed by considering FFO plus the increase or decrease in the value of our assets over a period of time because that is the basis on which we make investment decisions and operate our business.

On page 87 of this Form 20-F, we provide reconciliation of NOI, FFO and Total Return to net income (loss) attributable to parent company for the period presented. We urge you to review the IFRS financial measures in this Form 20-F, including the financial statements, the notes thereto, our pro forma financial statements and the other financial information contained herein, and not to rely on any single financial measure to evaluate our company.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements in this Form 20-F include statements regarding the quality of our assets, our anticipated financial performance, our company’s future growth prospects, our ability to make distributions and the amount of such distributions and our company’s access to capital. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negative of those terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. The following factors, among others, could cause our actual results to vary from our forward-looking statements:

| • |

changes in the general economy; |

| • |

the cyclical nature of the real estate industry; |

| • |

actions of competitors; |

| • |

failure to attract new tenants and enter into renewal or new leases with tenants on favorable terms; |

| • |

our ability to derive fully anticipated benefits from future or existing acquisitions, joint ventures, investments or dispositions; |

| • |

actions or potential actions that could be taken by our co-venturers, partners, fund investors or co-tenants; |

| • |

the bankruptcy, insolvency, credit deterioration or other default of our tenants; |

| • |

actions or potential actions that could be taken by Brookfield; |

| • |

the departure of some or all of Brookfield’s key professionals; |

| • |

the threat of litigation; |

| • |

changes to legislation and regulations; |

| • |

possible environmental liabilities and other possible liabilities; |

| • |

our ability to obtain adequate insurance at commercially reasonable rates; |

| • |

our financial condition and liquidity; |

| • |

downgrading of credit ratings and adverse conditions in the credit markets; |

| • |

changes in financial markets, foreign currency exchange rates, interest rates or political conditions; |

4

Table of Contents

| • |

the general volatility of the capital markets and the market price of our units; and |

| • |

other factors described in this Form 20-F, including those set forth under Item 3.D. “Key Information — Risk Factors”, Item 5. “Operating and Financial Review and Prospects” and Item 4.B. “Information on the Company — Business Overview”. |

Except as required by applicable law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. We qualify any and all of our forward-looking statements by these cautionary factors. Please keep this cautionary note in mind as you read this Form 20-F.

5

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

The following tables present selected financial data for Brookfield’s commercial property operations and are derived from, and should be read in conjunction with, the carve-out financial statements of Brookfield’s commercial property operations as at December 31, 2012 and 2011, and for the years ended December 31, 2012, 2011 and 2010, and the notes thereto, each of which is included elsewhere in this Form 20-F. The information in this section should also be read in conjunction with our unaudited pro forma financial statements (“Unaudited Pro Forma Financial Statements”) as at and for the year ended December 31, 2012 included elsewhere in this Form 20-F.

| (US$ Millions) Years ended December 31, | 2012 | 2011 | 2010 | |||||||||

|

Total revenue |

$ | 3,801 | $ | 2,820 | $ | 2,270 | ||||||

|

Net income |

2,708 | 3,745 | 2,109 | |||||||||

|

Net income attributable to parent company |

1,499 | 2,323 | 1,026 | |||||||||

|

FFO (1) |

642 | 576 | 426 | |||||||||

| (1) | FFO is a non-IFRS measure. See page 87 of this Form 20-F for a reconciliation of FFO to net income (loss) attributable to parent company. |

| (US$ Millions) | Dec. 31, 2012 | Dec. 31, 2011 | ||||||

|

Investment properties |

$ | 31,859 | $ | 27,594 | ||||

|

Equity accounted investments |

8,110 | 6,888 | ||||||

|

Total assets |

48,020 | 40,317 | ||||||

|

Property debt |

19,724 | 15,387 | ||||||

|

Total equity |

24,245 | 21,494 | ||||||

|

Equity in net assets attributable to parent company |

13,375 | 11,881 | ||||||

Not applicable.

3.C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

6

Table of Contents

Your holding of units of our company will involve substantial risks. You should carefully consider the following factors in addition to the other information set forth in this Form 20-F. If any of the following risks actually occur, our business, financial condition and results of operations and the value of your units would likely suffer.

Risks Relating to Us and Our Company

Our company is a newly formed partnership with no separate operating history and the historical and pro forma financial information included herein does not reflect the financial condition or operating results we would have achieved during the periods presented, and therefore may not be a reliable indicator of our future financial performance.

Our company was formed on January 3, 2013 and has only recently commenced its activities and has not generated any significant net income to date. Our limited operating history will make it difficult to assess our ability to operate profitably and make distributions to unitholders. Although most of our assets and operations have been under Brookfield’s control prior to our acquisition of such assets and operations, their combined results have not previously been reported on a stand-alone basis and the historical and pro forma financial statements included in this Form 20-F may not be indicative of our future financial condition or operating results. We urge you to carefully consider the basis on which the historical and pro forma financial information included herein was prepared and presented.

Our company relies on the Property Partnership and, indirectly, the Holding Entities and our operating entities to provide us with the funds necessary to pay distributions and meet our financial obligations.

Our company’s sole direct investment is its limited partnership interest in the Property Partnership, which owns all of the common shares or equity interests, as applicable, of the Holding Entities, through which we hold all of our interests in the operating entities. Our company has no independent means of generating revenue. As a result, we depend on distributions and other payments from the Property Partnership and, indirectly, the Holding Entities and our operating entities to provide us with the funds necessary to pay distributions on our units and to meet our financial obligations. The Property Partnership, the Holding Entities and our operating entities are legally distinct from our company and they will generally be required to service their debt obligations before making distributions to us or their parent entity, as applicable, thereby reducing the amount of our cash flow available to pay distributions on our units, fund working capital and satisfy other needs. Any other entities through which we may conduct operations in the future will also be legally distinct from our company and may be restricted in their ability to pay dividends and distributions or otherwise make funds available to our company under certain conditions.

We anticipate that the only distributions our company will receive in respect of our limited partnership interests in the Property Partnership will consist of amounts that are intended to assist our company in making distributions to our unitholders in accordance with our company’s distribution policy and to allow our company to pay expenses as they become due.

We may not be able to make distributions to holders of our units in amounts intended or at all.

Our company intends to make quarterly cash distributions in an initial amount currently anticipated to be approximately $1.00 per unit on an annualized basis. However, despite our projections, there can be no assurance that we will be able to make such distributions or meet our target growth rate range of 3% to 5% annually. Based on amounts received in distributions from our operating entities and our projected operating cash flow from our direct investments, our proposed distributions would be significantly greater than such amounts.

7

Table of Contents

Although we may use distributions from our operating entities, the proceeds of sales of certain of our direct investments and/or borrowings to fund any shortfall in distributions, we may not be able to do so on a consistent and sustainable basis. Our ability to make distributions will depend on several other factors, some of which are out of our control, including, among other things, general economic conditions, our results of operations and financial condition, the amount of cash that is generated by our operations and investments, restrictions imposed by the terms of any indebtedness that is incurred to finance our operations and investments or to fund liquidity needs, levels of operating and other expenses, and contingent liabilities, any or all of which could prevent us from meeting our anticipated distribution levels. Finally, the BPY General Partner has sole authority to determine when and if our distributions will be made in respect of our units, and there can be no assurance that the BPY General Partner will declare and pay the distributions on our units as intended or at all.

We are subject to foreign currency risk and our risk management activities may adversely affect the performance of our operations.

Some of our assets and operations are in countries where the U.S. Dollar is not the functional currency. These operations pay distributions in currencies other than the U.S. Dollar which we must convert to U.S. Dollars prior to making distributions on our units. A significant depreciation in the value of such foreign currencies may have a material adverse effect on our business, financial condition and results of operations.

When managing our exposure to such market risks, we may use forward contracts, options, swaps, caps, collars and floors or pursue other strategies or use other forms of derivative instruments. The success of any hedging or other derivative transactions that we enter into generally will depend on our ability to structure contracts that appropriately offset our risk position. As a result, while we may enter into such transactions in order to reduce our exposure to market risks, unanticipated market changes may result in poorer overall investment performance than if the transaction had not been executed. Such transactions may also limit the opportunity for gain if the value of a hedged position increases.

Our company is not, and does not intend to become, regulated as an investment company under the U.S. Investment Company Act of 1940 (and similar legislation in other jurisdictions) and if our company were deemed an “investment company” under the U.S. Investment Company Act of 1940, applicable restrictions would make it impractical for us to operate as contemplated.

The U.S. Investment Company Act of 1940 and the rules thereunder (and similar legislation in other jurisdictions) provide certain protections to investors and impose certain restrictions on companies that are registered as investment companies. Among other things, such rules limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities and impose certain governance requirements. Our company has not been and does not intend to become regulated as an investment company and our company intends to conduct its activities so it will not be deemed to be an investment company under the U.S. Investment Company Act of 1940 (and similar legislation in other jurisdictions). In order to ensure that our company is not deemed to be an investment company, we may be required to materially restrict or limit the scope of our operations or plans, we will be limited in the types of acquisitions that we may make and we may need to modify our organizational structure or dispose of assets that we would not otherwise dispose of. Moreover, if anything were to happen which would potentially cause our company to be deemed an investment company under the U.S. Investment Company Act of 1940, it would be impractical for us to operate as intended, agreements and arrangements between and among us and Brookfield would be impaired and our business, financial condition and results of operations would be materially adversely affected. Accordingly, we would be required to take extraordinary steps to address the situation, such as the amendment or termination of our Master Services Agreement, the restructuring of our company and the Holding Entities, the amendment of our limited partnership agreement or the termination of our company, any of which would materially adversely affect the value of our units. In addition, if our company were deemed to be an investment company under the U.S. Investment Company Act of 1940, it would be taxable as a corporation for U.S. federal income tax purposes, and such treatment would materially adversely affect the value of our units. See Item 10.E. “Additional Information — Taxation — U.S. Tax Considerations — Partnership Status of Our Company and the Property Partnership”.

8

Table of Contents

Our company is a “foreign private issuer” under U.S. securities laws and as a result is subject to disclosure obligations different from requirements applicable to U.S. domestic registrants listed on the New York Stock Exchange, or NYSE.

Although our company is subject to the periodic reporting requirement of the U.S. Securities Exchange Act, as amended, or the Exchange Act, the periodic disclosure required of foreign private issuers under the Exchange Act is different from periodic disclosure required of U.S. domestic registrants. Therefore, there may be less publicly available information about us than is regularly published by or about other public companies in the United States and our company is exempt from certain other sections of the Exchange Act that U.S. domestic registrants would otherwise be subject to, including the requirement to provide our unitholders with information statements or proxy statements that comply with the Exchange Act. In addition, insiders and large unitholders of our company will not be obligated to file reports under Section 16 of the Exchange Act and certain of the governance rules imposed by the NYSE will be inapplicable to our company.

Our company is a “SEC foreign issuer” under Canadian securities regulations and is exempt from certain requirements of Canadian securities laws.

Although our company is a reporting issuer in Canada, we are a “SEC foreign issuer” and exempt from certain Canadian securities laws relating to continuous disclosure obligations and proxy solicitation as long as we comply with certain reporting requirements applicable in the United States, provided that the relevant documents filed with the U.S. Securities and Exchange Commission, or the SEC, are filed in Canada and sent to our company’s unitholders in Canada to the extent and in the manner and within the time required by applicable U.S. requirements. Therefore, there may be less publicly available information in Canada about us than is regularly published by or about other reporting issuers in Canada.

We may be subject to the risks commonly associated with a separation of economic interest from control or the incurrence of debt at multiple levels within an organizational structure.

Our ownership and organizational structure is similar to structures whereby one company controls another company which in turn holds controlling interests in other companies; thereby, the company at the top of the chain may control the company at the bottom of the chain even if its effective equity position in the bottom company is less than a controlling interest. Brookfield is the sole shareholder of the BPY General Partner and, as a result of such ownership of the BPY General Partner, Brookfield controls the appointment and removal of the BPY General Partner’s directors and, accordingly, exercises substantial influence over us. In turn, we often have a majority controlling interest or a significant influence in our investments. Even though at the time of the spin-off Brookfield had an effective economic interest in our business of approximately 92.44% as a result of its ownership of our units and the Redemption-Exchange Units, over time Brookfield may reduce this economic interest while still maintaining its controlling interest, and therefore Brookfield may use its control rights in a manner that conflicts with the economic interests of our other unitholders. For example, despite the fact that our company has a conflicts policy in place which addresses the requirement for independent approval and other requirements for transactions in which there is greater potential for a conflict of interest to arise, including transactions with affiliates of Brookfield, because Brookfield exerts substantial influence over us, and, in turn, over our investments, there is a greater risk of transfer of assets of our investments at non-arm’s length values to Brookfield and its affiliates. In addition, debt incurred at multiple levels within the chain of control could exacerbate the separation of economic interest from controlling interest at such levels, thereby creating an incentive to leverage our company and our investments. Any such increase in debt would also make us more sensitive to declines in revenues, increases in expenses and interest rates, and adverse market conditions. The servicing of any such debt would also reduce the amount of funds available to pay distributions to our company and ultimately to our unitholders.

9

Table of Contents

Risks Relating to Our Business

Our economic performance and the value of our assets are subject to the risks incidental to the ownership and operation of real estate assets.

Our economic performance, the value of our assets and, therefore, the value of our units are subject to the risks normally associated with the ownership and operation of real estate assets, including but not limited to:

| • |

downturns and trends in the national, regional and local economic conditions where our properties and other assets are located; |

| • |

the cyclical nature of the real estate industry; |

| • |

local real estate market conditions, such as an oversupply of commercial properties, including space available by sublease, or a reduction in demand for such properties; |

| • |

changes in interest rates and the availability of financing; |

| • |

competition from other properties; |

| • |

changes in market rental rates and our ability to rent space on favorable terms; |

| • |

the bankruptcy, insolvency, credit deterioration or other default of our tenants; |

| • |

the need to periodically renovate, repair and re-lease space and the costs thereof; |

| • |

increases in maintenance, insurance and operating costs; |

| • |

civil disturbances, earthquakes and other natural disasters, or terrorist acts or acts of war which may result in uninsured or underinsured losses; |

| • |

the decrease in the attractiveness of our properties to tenants; |

| • |

the decrease in the underlying value of our properties; and |

| • |

certain significant expenditures, including property taxes, maintenance costs, mortgage payments, insurance costs and related charges that must be made regardless of whether a property is producing sufficient income to service these expenses. |

We are dependent upon the economic conditions of the markets where our assets are located.

We are affected by local, regional, national and international economic conditions and other events and occurrences that affect the markets in which we own assets. A protracted decline in economic conditions will cause downward pressure on our operating margins and asset values as a result of lower demand for space.

Substantially all of our properties are located in North America, Europe, Australia and Brazil. A prolonged downturn in one or more of these economies or the economy of any other country where we own property would result in reduced demand for space and number of prospective tenants and will affect the ability of our properties to generate significant revenue. If there is an increase in operating costs resulting from inflation and other factors, we may not be able to offset such increases by increasing rents.

Additionally, as part of our strategy for our office property platform is to focus on markets underpinned by major financial, energy and professional services businesses, a significant downturn in one or more of the industries in which these businesses operate would also adversely affect our results of operations.

10

Table of Contents

We face risks associated with the use of debt to finance our business, including refinancing risk.

We incur debt in the ordinary course of our business and therefore are subject to the risks associated with debt financing. These risks, including the following, may adversely affect our financial condition and results of operations:

| • |

cash flows may be insufficient to meet required payments of principal and interest; |

| • |

payments of principal and interest on borrowings may leave insufficient cash resources to pay operating expenses; |

| • |

we may not be able to refinance indebtedness on our properties at maturity due to business and market factors, including: disruptions in the capital and credit markets; the estimated cash flows of our properties and other assets; the value of our properties and other assets; and financial, competitive, business and other factors, including factors beyond our control; and |

| • |

if refinanced, the terms of a refinancing may not be as favorable as the original terms of the related indebtedness. |

Our operating entities have a significant degree of leverage on their assets. Highly leveraged assets are inherently more sensitive to declines in revenues, increases in expenses and interest rates, and adverse market conditions. A leveraged company’s income and net assets also tend to increase or decrease at a greater rate than would otherwise be the case if money had not been borrowed. As a result, the risk of loss associated with a leveraged company, all other things being equal, is generally greater than for companies with comparatively less debt.

We rely on our operating entities to provide our company with the funds necessary to make distributions on our units and meet our financial obligations. The leverage on our assets may affect the funds available to our company if the terms of the debt impose restrictions on the ability of our operating entities to make distributions to our company. In addition, our operating entities will generally have to service their debt obligations before making distributions to our company or their parent entity.

Leverage may also result in a requirement for liquidity, which may force the sale of assets at times of low demand and/or prices for such assets.

On April 15, 2013, the Holding Entities entered into a credit agreement with Brookfield US Holdings Inc. whereby Brookfield US Holdings Inc. agreed to provide the Holding Entities with a $500 million revolving credit facility. We may also incur indebtedness under future credit facilities or other debt-like instruments, in addition to any asset-level indebtedness. We may also issue debt or debt-like instruments in the market in the future, which may or may not be rated. Should such debt or debt-like instruments be rated, a credit downgrade will have an adverse impact on the cost of such debt.

In addition, Brookfield holds $1.25 billion of redeemable preferred shares of one of our Holding Entities, which it received as partial consideration for causing the Property Partnership to acquire substantially all of Brookfield Asset Management’s commercial property operations. We have agreed to use our commercially reasonable efforts to, as soon as reasonably practical, issue debt or equity securities or borrow money from one or more financial institutions or other lenders, on terms reasonably acceptable to us, in an aggregate amount sufficient to fund the redemption of $500 million of the preferred shares. The terms of any such financing may be less favorable to us than the terms of the preferred shares.

If we are unable to refinance our indebtedness on acceptable terms, or at all, we may need to dispose of one or more of our properties or other assets upon disadvantageous terms. In addition, prevailing interest rates or

11

Table of Contents

other factors at the time of refinancing could increase our interest expense, and if we mortgage property to secure payment of indebtedness and are unable to make mortgage payments, the mortgagee could foreclose upon such property or appoint a receiver to receive an assignment of our rents and leases. This may adversely affect our ability to make distributions or payments to our unitholders and lenders.

Restrictive covenants in our indebtedness may limit management’s discretion with respect to certain business matters.

Instruments governing any of our indebtedness or indebtedness of our operating entities or their subsidiaries may contain restrictive covenants limiting our discretion with respect to certain business matters. These covenants could place significant restrictions on, among other things, our ability to create liens or other encumbrances, to make distributions to our unitholders or make certain other payments, investments, loans and guarantees and to sell or otherwise dispose of assets and merge or consolidate with another entity. These covenants could also require us to meet certain financial ratios and financial condition tests. A failure to comply with any such covenants could result in a default which, if not cured or waived, could permit acceleration of the relevant indebtedness.

If we are unable to manage our interest rate risk effectively, our cash flows and operating results may suffer.

Advances under credit facilities and certain property-level mortgage debt bear interest at a variable rate. We may incur further indebtedness in the future that also bears interest at a variable rate or we may be required to refinance our debt at higher rates. In addition, though we attempt to manage interest rate risk, there can be no assurance that we will hedge such exposure effectively or at all in the future. Accordingly, increases in interest rates above that which we anticipate based upon historical trends would adversely affect our cash flows.

We face potential adverse effects from tenant defaults, bankruptcies or insolvencies.

A commercial tenant may experience a downturn in its business, which could cause the loss of that tenant or weaken its financial condition and result in the tenant’s inability to make rental payments when due or, for retail tenants, a reduction in percentage rent payable. If a tenant defaults, we may experience delays and incur costs in enforcing our rights as landlord and protecting our investments.

We cannot evict a tenant solely because of its bankruptcy. In addition, in certain jurisdictions where we own properties, a court may authorize a tenant to reject and terminate its lease. In such a case, our claim against the tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In any event, it is unlikely that a bankrupt or insolvent tenant will pay the full amount it owes under a lease. The loss of rental payments from tenants and costs of re-leasing would adversely affect our cash flows and results of operations. In the case of our retail properties, the bankruptcy or insolvency of an anchor tenant or tenant with stores at many of our properties would cause us to suffer lower revenues and operational difficulties, including difficulties leasing the remainder of the property. Significant expenses associated with each property, such as mortgage payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the property. In the event of a significant number of lease defaults and/or tenant bankruptcies, our cash flows may not be sufficient to pay cash distributions to our unitholders and repay maturing debt or other obligations.

Reliance on significant tenants could adversely affect our results of operations.

Many of our properties are occupied by one or more significant tenants and, therefore, our revenues from those properties are materially dependent on the creditworthiness and financial stability of those tenants. Our business would be adversely affected if any of those tenants failed to renew certain of their significant leases, became insolvent, declared bankruptcy or otherwise refused to pay rent in a timely fashion or at all. In the event of a default by one or more significant tenants, we may experience delays in enforcing our rights as

12

Table of Contents

landlord and may incur substantial costs in protecting our investment and re-leasing the property. If a lease of a significant tenant is terminated, it may be difficult, costly and time consuming to attract new tenants and lease the property for the rent previously received.

Our inability to enter into renewal or new leases with tenants on favorable terms or at all for all or a substantial portion of space that is subject to expiring leases would adversely affect our cash flows and operating results.

Our properties generate revenue through rental payments made by tenants of the properties. Upon the expiry of any lease, there can be no assurance that the lease will be renewed or the tenant replaced. The terms of any renewal or replacement lease may be less favorable to us than the existing lease. We would be adversely affected, in particular, if any major tenant ceases to be a tenant and cannot be replaced on similar or better terms or at all. Additionally, we may not be able to lease our properties to an appropriate mix of tenants. Retail tenants may negotiate leases containing exclusive rights to sell particular types of merchandise or services within a particular retail property. When leasing other space after the vacancy of a retail tenant, these provisions may limit the number and types of prospective tenants for the vacant space.

Our competitors may adversely affect our ability to lease our properties which may cause our cash flows and operating results to suffer.

Each segment of the real estate industry is competitive. Numerous other developers, managers and owners of commercial properties compete with us in seeking tenants and, in the case of our multi-family properties, there are numerous housing alternatives which compete with our properties in attracting residents. Some of the properties of our competitors may be newer, better located or better capitalized. These competing properties may have vacancy rates higher than our properties, which may result in their owners being willing to make space available at lower prices than the space in our properties, particularly if there is an oversupply of space available in the market. Competition for tenants could have an adverse effect on our ability to lease our properties and on the rents that we may charge or concessions that we must grant. If our competitors adversely impact our ability to lease our properties, our cash flows and operating results may suffer.

Our ability to realize our strategies and capitalize on our competitive strengths are dependent on the ability of our operating entities to effectively operate our large group of commercial properties, maintain good relationships with tenants, and remain well-capitalized, and our failure to do any of the foregoing would affect our ability to compete effectively in the markets in which we do business.

Our insurance may not cover some potential losses or may not be obtainable at commercially reasonable rates, which could adversely affect our financial condition and results of operations.

We maintain insurance on our properties in amounts and with deductibles that we believe are in line with what owners of similar properties carry; however, our insurance may not cover some potential losses or may not be obtainable at commercially reasonable rates in the future.

There also are certain types of risks (such as war, environmental contamination such as toxic mold, and lease and other contract claims) which are either uninsurable or not economically insurable. Should any uninsured or underinsured loss occur, we could lose our investment in, and anticipated profits and cash flows from, one or more properties, and we would continue to be obligated to repay any recourse mortgage indebtedness on such properties.

Possible terrorist activity could adversely affect our financial condition and results of operations and our insurance may not cover some losses due to terrorism or may not be obtainable at commercially reasonable rates.

Possible terrorist attacks in the markets where our properties are located may result in declining economic activity, which could reduce the demand for space at our properties, reduce the value of our properties and could harm the demand for goods and services offered by our tenants.

13

Table of Contents

Additionally, terrorist activities could directly affect the value of our properties through damage, destruction or loss. Our office portfolio is concentrated in large metropolitan areas, some of which have been or may be perceived to be subject to terrorist attacks. Many of our office properties consist of high-rise buildings, which may also be subject to this actual or perceived threat. Our insurance may not cover some losses due to terrorism or may not be obtainable at commercially reasonable rates.

We are subject to risks relating to development and redevelopment projects.

On a strategic and selective basis, we may develop and redevelop properties. The real estate development and redevelopment business involves significant risks that could adversely affect our business, financial condition and results of operations, including the following:

| • |

we may not be able to complete construction on schedule or within budget, resulting in increased debt service expense and construction costs and delays in leasing the properties; |

| • |

we may not have sufficient capital to proceed with planned redevelopment or expansion activities; |

| • |

we may abandon redevelopment or expansion activities already under way, which may result in additional cost recognition; |

| • |

we may not be able to obtain, or may experience delays in obtaining, all necessary zoning, land-use, building, occupancy and other governmental permits and authorizations; |

| • |

we may not be able to lease properties at all or on favorable terms, or occupancy rates and rents at a completed project might not meet projections and, therefore, the project might not be profitable; |

| • |

construction costs, total investment amounts and our share of remaining funding may exceed our estimates and projects may not be completed and delivered as planned; and |

| • |

upon completion of construction, we may not be able to obtain, or obtain on advantageous terms, permanent financing for activities that we have financed through construction loans. |

We are subject to risks that affect the retail environment.

We are subject to risks that affect the retail environment, including unemployment, weak income growth, lack of available consumer credit, industry slowdowns and plant closures, low consumer confidence, increased consumer debt, poor housing market conditions, adverse weather conditions, natural disasters and the need to pay down existing obligations. All of these factors could negatively affect consumer spending and adversely affect the sales of our retail tenants. This could have an unfavorable effect on our operations and our ability to attract new retail tenants.

In addition, our retail tenants face competition from retailers at other regional malls, outlet malls and other discount shopping centers, discount shopping clubs, catalogue companies, and through internet sales and telemarketing. Competition of these types could reduce the percentage rent payable by certain retail tenants and adversely affect our revenues and cash flows. Additionally, our retail tenants are dependent on perceptions by retailers and shoppers of the safety, convenience and attractiveness of our retail properties. If retailers and shoppers perceive competing properties and other retailing options such as the internet to be more convenient or of a higher quality, our revenues may be adversely affected.

Some of our retail lease agreements include a co-tenancy provision which allows the mall tenant to pay a reduced rent amount and, in certain instances, terminate the lease, if we fail to maintain certain occupancy levels at the mall. In addition, certain of our tenants have the ability to terminate their leases prior to the lease expiration date if their sales do not meet agreed upon thresholds. Therefore, if occupancy, tenancy or sales fall below certain thresholds, rents we are entitled to receive from our retail tenants would be reduced and our ability to attract new tenants may be limited.

14

Table of Contents

The computation of cost reimbursements from our retail tenants for common area maintenance, insurance and real estate taxes is complex and involves numerous judgments including interpretation of lease terms and other tenant lease provisions. Most tenants make monthly fixed payments of common area maintenance, insurance, real estate taxes and other cost reimbursements and, after the end of the calendar year, we compute each tenant’s final cost reimbursements and issue a bill or credit for the full amount, after considering amounts paid by the tenant during the year. The billed amounts could be disputed by the tenant or become the subject of a tenant audit or even litigation. There can be no assurance that we will collect all or any portion of these amounts.

We are subject to risks associated with the multi-family residential industry.

We are subject to risks associated with the multi-family residential industry, including the level of mortgage interest rates which may encourage tenants to purchase rather than lease and housing and governmental programs that provide assistance and rent subsidies to tenants. If the demand for multi-family properties is reduced, income generated from our multi-family residential properties and the underlying value of such properties may be adversely affected.

In addition, certain jurisdictions regulate the relationship of an owner and its residential tenants. Commonly, these laws require a written lease, good cause for eviction, disclosure of fees, and notification to residents of changed land use, while prohibiting unreasonable rules, retaliatory evictions, and restrictions on a resident’s choice of landlords. Apartment building owners have been the subject of lawsuits under various “Landlord and Tenant Acts” and other general consumer protection statutes for coercive, abusive or unconscionable leasing and sales practices. If we become subject to litigation, the outcome of any such proceedings may materially adversely affect us and may continue for long periods of time. A few jurisdictions may offer more significant protection to residential tenants. In addition to state or provincial regulation of the landlord-tenant relationship, numerous towns and municipalities impose rent control on apartment buildings. The imposition of rent control on our multi-family residential units could have a materially adverse effect on our results of operations.

If we are unable to recover from a business disruption on a timely basis our financial condition and results of operations could be adversely affected.

Our business is vulnerable to damages from any number of sources, including computer viruses, unauthorized access, energy blackouts, natural disasters, terrorism, war and telecommunication failures. Any system failure or accident that causes interruptions in our operations could result in a material disruption to our business. If we are unable to recover from a business disruption on a timely basis, our financial condition and results of operations would be adversely affected. We may also incur additional costs to remedy damages caused by such disruptions.

Because certain of our assets are illiquid, we may not be able to sell these assets when appropriate or when desired.

Large commercial properties like the ones that we own can be hard to sell, especially if local market conditions are poor. Such illiquidity could limit our ability to diversify our assets promptly in response to changing economic or investment conditions.

Additionally, financial difficulties of other property owners resulting in distressed sales could depress real estate values in the markets in which we operate in times of illiquidity. These restrictions reduce our ability to respond to changes in the performance of our assets and could adversely affect our financial condition and results of operations.

15

Table of Contents

We face risks associated with property acquisitions.

Competition from other well-capitalized real estate investors, including both publicly traded real estate investment trusts and institutional investment funds, may significantly increase the purchase price of, or prevent us from acquiring, a desired property. Acquisition agreements will typically contain conditions to closing, including completion of due diligence to our satisfaction or other conditions that are not within our control, which may not be satisfied. Acquired properties may be located in new markets where we may have limited knowledge and understanding of the local economy, an absence of business relationships in the area or unfamiliarity with local government and applicable laws and regulations. We may be unable to finance acquisitions on favorable terms or newly acquired properties may fail to perform as expected. We may underestimate the costs necessary to bring an acquired property up to standards established for its intended market position or we may be unable to quickly and efficiently integrate new acquisitions into our existing operations. We may also acquire properties subject to liabilities and without any recourse, or with only limited recourse, with respect to unknown liabilities. Each of these factors could have an adverse effect on our results of operations and financial condition.

We do not control certain of our operating entities, including General Growth Properties, Inc., or GGP, and Canary Wharf, and therefore we may not be able to realize some or all of the benefits that we expect to realize from those entities.

We do not have control of certain of our operating entities, including GGP and Canary Wharf. Our interests in those entities subject us to the operating and financial risks of their businesses, the risk that the relevant company may make business, financial or management decisions that we do not agree with, and the risk that we may have differing objectives than the entities in which we have interests. Because we do not have the ability to exercise control over those entities, we may not be able to realize some or all of the benefits that we expect to realize from those entities. For example, we may not be able to cause such operating entities to make distributions to us in the amount or at the time that we need or want such distributions. In addition, we rely on the internal controls and financial reporting controls of the public companies in which we invest and the failure of such companies to maintain effective controls or comply with applicable standards may adversely affect us.

We do not have sole control over the properties that we own with co-venturers, partners, fund investors or co-tenants or over the revenues and certain decisions associated with those properties, which may limit our flexibility with respect to these investments.

We participate in joint ventures, partnerships, funds and co-tenancies affecting many of our properties. Such investments involve risks not present were a third party not involved, including the possibility that our co-venturers, partners, fund investors or co-tenants might become bankrupt or otherwise fail to fund their share of required capital contributions. The bankruptcy of one of our co-venturers, partners, fund investors or co-tenants could materially and adversely affect the relevant property or properties. Pursuant to bankruptcy laws, we could be precluded from taking some actions affecting the estate of the other investor without prior court approval which would, in most cases, entail prior notice to other parties and a hearing. At a minimum, the requirement to obtain court approval may delay the actions we would or might want to take. If the relevant joint venture or other investment entity has incurred recourse obligations, the discharge in bankruptcy of one of the other investors might result in our ultimate liability for a greater portion of those obligations than would otherwise be required.

Additionally, our co-venturers, partners, fund investors or co-tenants might at any time have economic or other business interests or goals which are inconsistent with those of our company, and we could become engaged in a dispute with any of them that might affect our ability to develop or operate a property. In addition, we do not have sole control of certain major decisions relating to these properties, including decisions relating to: the sale of the properties; refinancing; timing and amount of distributions of cash from such properties; and capital improvements.

16

Table of Contents

In some instances where we are the property manager for a joint venture, the joint venture retains joint approval rights over various material matters such as the budget for the property, specific leases and our leasing plan. Moreover, in certain property management arrangements the other venturer can terminate the property management agreement in limited circumstances relating to enforcement of the property managers’ obligations. In addition, the sale or transfer of interests in some of our joint ventures and partnerships is subject to rights of first refusal or first offer and some joint venture and partnership agreements provide for buy-sell or similar arrangements. Such rights may be triggered at a time when we may not want to sell but we may be forced to do so because we may not have the financial resources at that time to purchase the other party’s interest. Such rights may also inhibit our ability to sell an interest in a property or a joint venture or partnership within our desired time frame or on any other desired basis.

We are subject to risks associated with commercial property loans.

We have interests in loans or participations in loans, or securities whose underlying performance depends on loans made with respect to a variety of commercial real estate. Such interests are subject to normal credit risks as well as those generally not associated with traditional debt securities. The ability of the borrowers to repay the loans will typically depend upon the successful operation of the related real estate project and the availability of financing. Any factors which affect the ability of the project to generate sufficient cash flow could have a material effect on the value of these interests. Such factors include, but are not limited to: the uncertainty of cash flow to meet fixed obligations; adverse changes in general and local economic conditions, including interest rates and local market conditions; tenant credit risks; the unavailability of financing, which may make the operation, sale, or refinancing of a property difficult or unattractive; vacancy and occupancy rates; construction and operating costs; regulatory requirements, including zoning, rent control and real and personal property tax laws, rates and assessments; environmental concerns; project and borrower diversification; and uninsured losses. Security underlying such interests will generally be in a junior or subordinate position to senior financing. In certain circumstances, in order to protect our interest, we may decide to repay all or a portion of the senior indebtedness relating to the particular interests or to cure defaults with respect to such senior indebtedness.

We invest in mezzanine debt, which can rank below other senior lenders.

We invest in mezzanine debt interests in real estate companies and properties whose capital structures have significant debt ranking ahead of our investments. Our investments will not always benefit from the same or similar financial and other covenants as those enjoyed by the debt ranking ahead of our investments or benefit from cross-default provisions. Moreover, it is likely that we will be restricted in the exercise of our rights in respect of our investments by the terms of subordination agreements with the debt ranking ahead of the mezzanine capital. Accordingly, we may not be able to take the steps necessary to protect our investments in a timely manner or at all and there can be no assurance that the rate of return objectives of any particular investment will be achieved. To protect our original investment and to gain greater control over the underlying assets, we may elect to purchase the interest of a senior creditor or take an equity interest in the underlying assets, which may require additional investment requiring us to expend additional capital.

We are subject to risks related to syndicating or selling participations in our interests.

The strategy of the finance funds in which we have interests depends, in part, upon syndicating or selling participations in senior interests, either through capital markets collateralized debt obligation transactions or otherwise. If the finance funds cannot do so on terms that are favorable to us, we may not make the returns we anticipate.

We face risks relating to the legal aspects of mortgage loans and may be subject to liability as a lender.

Certain interests acquired by us are subject to risks relating to the legal aspects of mortgage loans. Depending upon the applicable law governing mortgage loans (which laws may differ substantially), we may be

17

Table of Contents

adversely affected by the operation of law (including state or provincial law) with respect to our ability to foreclose mortgage loans, the borrower’s right of redemption, the enforceability of assignments of rents, due on sale and acceleration clauses in loan instruments, as well as other creditors’ rights provided in such documents. In addition, we may be subject to liability as a lender with respect to our negotiation, administration, collection and/or foreclosure of mortgage loans. As a lender, we may also be subject to penalties for violation of usury limitations, which penalties may be triggered by contracting for, charging or receiving usurious interest. Bankruptcy laws may delay our ability to realize on our collateral or may adversely affect the priority thereof through doctrines such as equitable subordination or may result in a restructuring of the debt through principles such as the “cramdown” provisions of applicable bankruptcy laws.

We have significant interests in public companies, and changes in the market prices of the stock of such public companies, particularly during times of increased market volatility, could have a negative impact on our financial condition and results of operations.

We hold significant interests in public companies, and changes in the market prices of the stock of such public companies could have a material impact on our financial condition and results of operations. Global securities markets have been highly volatile, and continued volatility may have a material negative impact on our consolidated financial position and results of operations.

We have significant interests in Brookfield-sponsored real estate opportunity and finance funds, and poor investment returns in these funds could have a negative impact on our financial condition and results of operations.

We have, and expect to continue to have in the future, significant interests in Brookfield-sponsored real estate opportunity and finance funds, and poor investment returns in these funds, due to either market conditions or underperformance (relative to their competitors or to benchmarks), would negatively affect our financial condition and results of operations. In addition, interests in such funds are subject to the risks inherent in the ownership and operation of real estate and real estate-related businesses and assets generally.

Our ownership of underperforming real estate properties involves significant risks and potential additional liabilities.

We hold interests in certain real estate properties with weak financial conditions, poor operating results, substantial financial needs, negative net worth or special competitive problems, or that are over-leveraged. Our ownership of underperforming real estate properties involves significant risks and potential additional liabilities. Our exposure to such underperforming properties may be substantial in relation to the market for those interests and distressed assets may be illiquid and difficult to sell or transfer. As a result, it may take a number of years for the fair value of such interests to ultimately reflect their intrinsic value as perceived by us.

We face risks relating to the jurisdictions of our operations.

We own and operate commercial properties in a number of jurisdictions, including but not limited to North America, Europe, Australia and Brazil. Our operations are subject to significant political, economic and financial risks, which vary by jurisdiction, and may include:

| • |

changes in government policies or personnel; |

| • |

restrictions on currency transfer or convertibility; |

| • |

changes in labor relations; |

| • |

political instability and civil unrest; |

| • |

fluctuations in foreign exchange rates; |

18

Table of Contents

| • |

challenges of complying with a wide variety of foreign laws including corporate governance, operations, taxes and litigation; |

| • |

differing lending practices; |

| • |

differences in cultures; |

| • |

changes in applicable laws and regulations that affect foreign operations; |

| • |

difficulties in managing international operations; |

| • |

obstacles to the repatriation of earnings and cash; and |

| • |

breach or repudiation of important contractual undertakings by governmental entities and expropriation and confiscation of assets and facilities for less than fair market value. |

We are subject to possible environmental liabilities and other possible liabilities.

As an owner and manager of real property, we are subject to various laws relating to environmental matters. These laws could hold us liable for the costs of removal and remediation of certain hazardous substances or wastes released or deposited on or in our properties or disposed of at other locations. These costs could be significant and would reduce cash available for our business. The failure to remove or remediate such substances could adversely affect our ability to sell our properties or our ability to borrow using real estate as collateral, and could potentially result in claims or other proceedings against us. Environmental laws and regulations can change rapidly and we may become subject to more stringent environmental laws and regulations in the future. Compliance with more stringent environmental laws and regulations could have an adverse effect on our business, financial condition or results of operations.

Regulations under building codes and human rights codes generally require that public buildings be made accessible to disabled persons. Non-compliance could result in the imposition of fines by the government or the award of damages to private litigants. If we are required to make substantial alterations or capital expenditures to one or more of our properties, it could adversely affect our financial condition and results of operations.

We may also incur significant costs complying with other regulations. Our properties are subject to various federal, state, provincial and local regulatory requirements, such as state, provincial and local fire and life safety requirements. If we fail to comply with these requirements, we could incur fines or be subject to private damage awards. Existing requirements may change and compliance with future requirements may require significant unanticipated expenditures that may affect our cash flows and results from operations.