|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Nevada

|

|

88-0242733

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, par value of $0.01 per share

|

New York Stock Exchange

|

|

Large accelerated filer

|

|

x

|

Accelerated filer

|

|

o

|

|

|

Non-accelerated filer

|

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

|

o

|

|

|

Emerging growth company

|

o

|

|||||

|

Class

|

Outstanding as of February 21, 2018

|

|||

|

Common stock, $0.01 par value

|

112,507,885

|

|||

|

|

|

Page No.

|

|

|

PART I

|

|

|

ITEM 1.

|

||

|

ITEM 1A.

|

||

|

ITEM 1B.

|

||

|

ITEM 2.

|

||

|

ITEM 3.

|

||

|

ITEM 4.

|

||

|

|

PART II

|

|

|

ITEM 5.

|

||

|

ITEM 6.

|

||

|

ITEM 7.

|

||

|

ITEM 7A.

|

||

|

ITEM 8.

|

||

|

ITEM 9.

|

||

|

ITEM 9A.

|

||

|

ITEM 9B

.

|

||

|

|

PART III

|

|

|

ITEM 10.

|

||

|

ITEM 11.

|

||

|

ITEM 12.

|

||

|

ITEM 13.

|

||

|

ITEM 14.

|

||

|

|

PART IV

|

|

|

ITEM 15.

|

||

|

ITEM 16.

|

||

|

|

||

|

•

|

nine of our Las Vegas properties are well-positioned to capitalize on the attractive Las Vegas locals market;

|

|

•

|

our three downtown Las Vegas properties focus a majority of their marketing programs on, and derive a majority of their revenues from, a unique niche - Hawaiian customers;

|

|

•

|

our operations are geographically diversified within the United States;

|

|

•

|

we have strengthened our balance sheet and have increasing free cash flow;

|

|

•

|

we have the ability to expand certain existing properties and make opportunistic and strategic acquisitions; and

|

|

•

|

we have an experienced management team.

|

|

Year Opened or Acquired

|

Casino Space (Sq. ft.)

|

Slot Machines

|

Table Games

|

Hotel Rooms

|

Hotel Occupancy

|

Average Daily Rate

|

||||||||||||

|

Las Vegas Locals

|

||||||||||||||||||

|

Las Vegas, Nevada

|

||||||||||||||||||

|

Gold Coast Hotel and Casino

|

2004

|

88,915

|

|

1,768

|

|

49

|

|

712

|

|

81

|

%

|

$ 58

|

||||||

|

The Orleans Hotel and Casino

|

2004

|

137,000

|

|

2,407

|

|

60

|

|

1,885

|

|

84

|

%

|

$ 66

|

||||||

|

Sam's Town Hotel and Gambling Hall

|

1979

|

120,681

|

|

1,876

|

|

28

|

|

645

|

|

87

|

%

|

$ 60

|

||||||

|

Suncoast Hotel and Casino

|

2004

|

95,898

|

|

1,830

|

|

32

|

|

427

|

|

84

|

%

|

$ 80

|

||||||

|

Eastside Cannery Casino and Hotel

|

2016

|

63,879

|

|

1,170

|

|

13

|

|

306

|

|

78

|

%

|

$ 62

|

||||||

|

North Las Vegas, Nevada

|

||||||||||||||||||

|

Aliante Casino + Hotel + Spa

|

2016

|

125,000

|

|

1,825

|

|

37

|

|

202

|

|

91

|

%

|

$ 101

|

||||||

|

Cannery Casino Hotel

|

2016

|

86,000

|

|

1,531

|

|

22

|

|

200

|

|

91

|

%

|

$ 66

|

||||||

|

Henderson, Nevada

|

||||||||||||||||||

|

Eldorado Casino

|

1993

|

17,756

|

|

310

|

|

—

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Jokers Wild Casino

|

1993

|

23,698

|

|

394

|

|

6

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Downtown Las Vegas

|

||||||||||||||||||

|

Las Vegas, Nevada

|

||||||||||||||||||

|

California Hotel and Casino

|

1975

|

35,848

|

|

985

|

|

28

|

|

781

|

|

84

|

%

|

$ 45

|

||||||

|

Fremont Hotel and Casino

|

1985

|

30,244

|

|

944

|

|

26

|

|

447

|

|

91

|

%

|

$ 49

|

||||||

|

Main Street Station Casino, Brewery and Hotel

|

1993

|

26,918

|

|

824

|

|

19

|

|

406

|

|

94

|

%

|

$ 48

|

||||||

|

Midwest and South

|

||||||||||||||||||

|

East Peoria, Illinois

|

||||||||||||||||||

|

Par-A-Dice Hotel Casino

|

1996

|

26,116

|

|

907

|

|

25

|

|

202

|

|

80

|

%

|

$ 68

|

||||||

|

Michigan City, Indiana

|

||||||||||||||||||

|

Blue Chip Casino, Hotel & Spa

|

1999

|

65,000

|

|

1,690

|

|

40

|

|

486

|

|

79

|

%

|

$ 78

|

||||||

|

Dubuque, Iowa

|

||||||||||||||||||

|

Diamond Jo Dubuque

|

2012

|

43,495

|

|

918

|

|

20

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Northwood, Iowa

|

||||||||||||||||||

|

Diamond Jo Worth

|

2012

|

38,721

|

|

915

|

|

32

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Mulvane, Kansas

|

||||||||||||||||||

|

Kansas Star Casino

|

2012

|

70,010

|

|

1,769

|

|

52

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Amelia, Louisiana

|

||||||||||||||||||

|

Amelia Belle Casino

|

2012

|

27,484

|

|

838

|

|

15

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Vinton, Louisiana

|

||||||||||||||||||

|

Delta Downs Racetrack Casino & Hotel

|

2001

|

15,000

|

|

1,632

|

|

—

|

|

370

|

|

68

|

%

|

$ 72

|

||||||

|

Opelousas, Louisiana

|

||||||||||||||||||

|

Evangeline Downs Racetrack and Casino

|

2012

|

39,208

|

|

1,360

|

|

—

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Shreveport, Louisiana

|

||||||||||||||||||

|

Sam's Town Hotel and Casino

|

2004

|

29,285

|

|

999

|

|

25

|

|

514

|

|

73

|

%

|

$ 74

|

||||||

|

Kenner, Louisiana

|

||||||||||||||||||

|

Treasure Chest Casino

|

1997

|

25,000

|

|

1,016

|

|

32

|

|

N/A

|

|

N/A

|

|

N/A

|

||||||

|

Biloxi, Mississippi

|

||||||||||||||||||

|

IP Casino Resort Spa

|

2011

|

81,700

|

|

1,538

|

|

52

|

|

1,089

|

|

85

|

%

|

$ 69

|

||||||

|

Tunica, Mississippi

|

||||||||||||||||||

|

Sam's Town Hotel and Gambling Hall

|

1994

|

46,000

|

|

821

|

|

19

|

|

700

|

|

52

|

%

|

$ 56

|

||||||

|

Total

|

1,358,856

|

|

30,267

|

|

632

|

|

9,372

|

|

||||||||||

|

N/A = Not Applicable

|

||||||||||||||||||

|

•

|

The risk that the conditions to the closing of the Penn National Purchase or the Valley Forge Merger are not satisfied, that we fail to consummate such acquisitions, when anticipated, or at all, or that we fail to complete financing activities to obtain funds for such acquisitions.

|

|

•

|

The effects of intense competition that exists in the gaming industry.

|

|

•

|

The risk that our acquisitions and other expansion opportunities divert management’s attention or incur substantial costs, or that we are otherwise unable to develop, profitably manage or successfully integrate the businesses we acquire.

|

|

•

|

The fact that our expansion, development and renovation projects (including enhancements to improve property performance) are subject to many risks inherent in expansion, development or construction of a new or existing project.

|

|

•

|

The risk that any of our projects may not be completed, if at all, on time or within established budgets, or that any project will not result in increased earnings to us.

|

|

•

|

The risk that significant delays, cost overruns, or failures of any of our projects to achieve market acceptance could have a material adverse effect on our business, financial condition and results of operations.

|

|

•

|

The risk that new gaming licenses or jurisdictions become available (or offer different gaming regulations or taxes) that results in increased competition to us.

|

|

•

|

The risk that negative industry or economic trends, reduced estimates of future cash flows, disruptions to our business, slower growth rates or lack of growth in our business, may result in significant write-downs or impairments in future periods.

|

|

•

|

The risk that regulatory authorities may revoke, suspend, condition or limit our gaming or other licenses, impose substantial fines and take other adverse actions against any of our casino operations.

|

|

•

|

The risk that we may be unable to refinance our outstanding indebtedness as it comes due, or that if we do refinance, the terms are not favorable to us.

|

|

•

|

The effects of the extensive governmental gaming regulation and taxation policies that we are subject to, as well as any changes in laws and regulations, including increased taxes, which could harm our business.

|

|

•

|

The effects of federal, state and local laws affecting our business such as the regulation of smoking, the regulation of directors, officers, key employees and partners and regulations affecting business in general.

|

|

•

|

The effects of extreme weather conditions or natural disasters on our facilities and the geographic areas from which we draw our customers, and our ability to recover insurance proceeds (if any).

|

|

•

|

The effects of events adversely impacting the economy or the regions from which we draw a significant percentage of our customers, including the effects of economic recession, war, terrorist or similar activity or disasters in, at, or around our properties.

|

|

•

|

The risk that we fail to adapt our business and amenities to changing customer preferences.

|

|

•

|

Financial community and rating agency perceptions of us, and the effect of economic, credit and capital market conditions on the economy and the gaming and hotel industry.

|

|

•

|

The effect of the expansion of legalized gaming in the regions in which we operate.

|

|

•

|

The risk of failing to maintain the integrity of our information technology infrastructure causing the unintended distribution of our customer data to third parties and access by third parties to our customer data.

|

|

•

|

Our estimated effective income tax rates, estimated tax benefits, and merits of our tax positions.

|

|

•

|

Our ability to utilize our net operating loss carryforwards and certain other tax attributes.

|

|

•

|

The risks relating to owning our equity, including price and volume fluctuations of the stock market that may harm the market price of our common stock and the potential of certain of our stockholders owning large interest in our capital stock to significantly influence our affairs.

|

|

•

|

Other statements regarding our future operations, financial condition and prospects, and business strategies.

|

|

•

|

the inability to successfully incorporate the assets in a manner that permits us to achieve the full revenue and other benefits anticipated to result from the Pending Acquisitions;

|

|

•

|

complexities associated with managing the combined business, including difficulty addressing possible differences in cultures and management philosophies and the challenge of integrating complex systems, technology, networks and other assets of each of the companies in a seamless manner that minimizes any adverse impact on customers, suppliers, employees and other constituencies; and

|

|

•

|

potential unknown liabilities and unforeseen increased expenses associated with the Pending Acquisitions.

|

|

•

|

diversion of the attention of our management; and

|

|

•

|

the disruption of, or the loss of momentum in, each our ongoing business or inconsistencies in standards, controls, procedures and policies,

|

|

•

|

changes to plans and specifications;

|

|

•

|

delays and significant cost increases;

|

|

•

|

shortages of materials;

|

|

•

|

shortages of skilled labor or work stoppages for contractors and subcontractors;

|

|

•

|

labor disputes or work stoppages;

|

|

•

|

disputes with and defaults by contractors and subcontractors;

|

|

•

|

health and safety incidents and site accidents;

|

|

•

|

engineering problems, including defective plans and specifications;

|

|

•

|

poor performance or nonperformance by any of our joint venture partners or other third parties on whom we place reliance;

|

|

•

|

changes in laws and regulations, or in the interpretation and enforcement of laws and regulations, applicable to gaming facilities, real estate development or construction projects;

|

|

•

|

unforeseen construction scheduling, engineering, environmental, permitting, construction or geological problems;

|

|

•

|

environmental issues, including the discovery of unknown environmental contamination;

|

|

•

|

weather interference, floods, fires or other casualty losses;

|

|

•

|

other unanticipated circumstances or cost increases; and

|

|

•

|

failure to obtain necessary licenses, permits, entitlements or other governmental approvals.

|

|

•

|

difficulty in satisfying our obligations under our current indebtedness;

|

|

•

|

increasing our vulnerability to general adverse economic and industry conditions;

|

|

•

|

requiring us to dedicate a substantial portion of our cash flows from operations to payments on our indebtedness, which would reduce the availability of our cash flows to fund working capital, capital expenditures, expansion efforts and other general corporate purposes;

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

•

|

placing us at a disadvantage compared to our competitors that have less debt; and

|

|

•

|

limiting, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds.

|

|

•

|

incur additional debt, including providing guarantees or credit support;

|

|

•

|

incur liens securing indebtedness or other obligations;

|

|

•

|

make certain investments;

|

|

•

|

dispose of assets;

|

|

•

|

make certain acquisitions;

|

|

•

|

pay dividends or make distributions and make other restricted payments;

|

|

•

|

enter into sale and leaseback transactions;

|

|

•

|

engage in any new businesses; and

|

|

•

|

enter into transactions with our stockholders and our affiliates.

|

|

•

|

actual or anticipated fluctuations in our results of operations;

|

|

•

|

announcements of significant acquisitions or other agreements by us or by our competitors;

|

|

•

|

our sale of common stock or other securities in the future;

|

|

•

|

trading volume of our common stock;

|

|

•

|

conditions and trends in the gaming and destination entertainment industries;

|

|

•

|

changes in the estimation of the future size and growth of our markets; and

|

|

•

|

general economic conditions, including, without limitation, changes in the cost of fuel and air travel.

|

|

•

|

Suncoast, located on 49 acres of leased land.

|

|

•

|

Eastside Cannery, located on 30 acres of leased land.

|

|

•

|

California, located on 13.9 acres of owned land and 1.6 acres of leased land.

|

|

•

|

Fremont, located on 1.4 acres of owned land and 0.9 acres of leased land.

|

|

•

|

IP, located on 24 acres of owned land and 3.9 acres of leased land.

|

|

•

|

Treasure Chest, located on 14 acres of leased land.

|

|

•

|

Sam's Town Shreveport, located on 18 acres of leased land.

|

|

•

|

Diamond Jo Dubuque, located on 7 acres of owned land and leases approximately 2.0 acres of parking surfaces.

|

|

•

|

Diamond Jo Worth, which leases 33 acres of land in Emmons, Minnesota that is used as a nine-hole golf course and a nine-station sporting clay course and hunting facility.

|

|

•

|

Evangeline Downs, which leases the facilities that comprise the Henderson, Eunice and St. Martinville OTBs.

|

|

ITEM 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

High

|

Low

|

|||||

|

Year Ended December 31, 2017

|

|

|

|||||

|

First Quarter

|

$

|

22.01

|

|

$

|

19.34

|

|

|

|

Second Quarter

|

25.93

|

|

21.32

|

|

|||

|

Third Quarter

|

26.79

|

|

24.40

|

|

|||

|

Fourth Quarter

|

35.81

|

|

25.58

|

|

|||

|

Year Ended December 31, 2016

|

|

|

|||||

|

First Quarter

|

$

|

20.74

|

|

$

|

14.96

|

|

|

|

Second Quarter

|

21.35

|

|

17.45

|

|

|||

|

Third Quarter

|

20.26

|

|

18.13

|

|

|||

|

Fourth Quarter

|

21.46

|

|

17.00

|

|

|||

|

Declaration date

|

Record date

|

Payment date

|

Amount per share

|

|||

|

May 2, 2017

|

June 15, 2017

|

July 15, 2017

|

$0.05

|

|||

|

September 6, 2017

|

September 18, 2017

|

October 15, 2017

|

0.05

|

|||

|

December 7, 2017

|

December 28, 2017

|

January 15, 2018

|

0.05

|

|||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid Per Share

|

Total Number of Shares Purchased as Part of a Publicly Announced Plan

|

Approximate Dollar Value That May Yet Be Purchased Under the Plan

|

||||||||||

|

October 1, 2017 through October 31, 2017

|

114,706

|

|

$

|

27.38

|

|

114,706

|

|

$

|

66,748,649

|

|

||||

|

November 1, 2017 through November 30, 2017

|

120,290

|

|

29.61

|

|

120,290

|

|

63,187,372

|

|

||||||

|

December 1, 2017 through December 31, 2017

|

93,119

|

|

32.92

|

|

93,119

|

|

60,122,294

|

|

||||||

|

Totals

|

328,115

|

|

328,115

|

|

$

|

60,122,294

|

|

|||||||

|

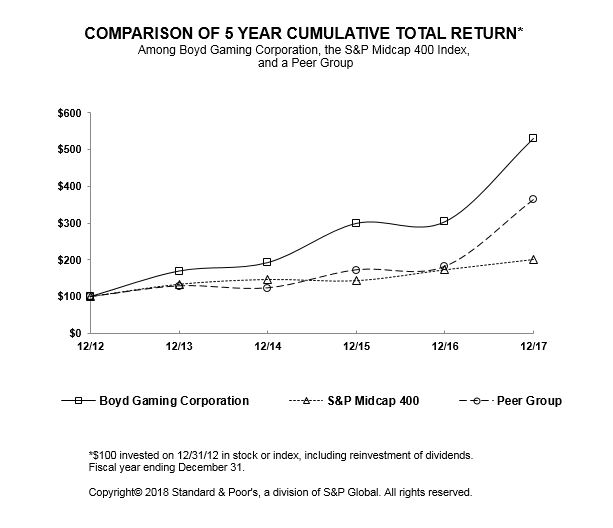

Indexed Returns

|

|||||||||||

|

|

Boyd Gaming Corp.

|

S&P 400

|

Peer Group

|

||||||||

|

December 2013

|

$

|

169.58

|

|

$

|

133.50

|

|

$

|

129.09

|

|

||

|

December 2014

|

192.47

|

|

146.54

|

|

123.68

|

|

|||||

|

December 2015

|

299.25

|

|

143.35

|

|

172.72

|

|

|||||

|

December 2016

|

303.77

|

|

173.08

|

|

182.10

|

|

|||||

|

December 2017

|

530.67

|

|

201.20

|

|

363.48

|

|

|||||

|

Year Ended December 31,

|

|||||||||||||||||||

|

(In thousands, except per share data)

|

2017 (a)

|

2016 (b)

|

2015 (c)

|

2014 (d)

|

2013 (e)

|

||||||||||||||

|

|

|||||||||||||||||||

|

Net revenues

|

$

|

2,383,707

|

|

$

|

2,183,976

|

|

$

|

2,199,432

|

|

$

|

2,142,255

|

|

$

|

2,198,738

|

|

||||

|

Operating income

|

343,495

|

|

260,627

|

|

271,202

|

|

173,732

|

|

231,217

|

|

|||||||||

|

Income (loss) from continuing operations before income taxes

|

170,807

|

|

7,987

|

|

4,061

|

|

(56,033

|

)

|

(55,887

|

)

|

|||||||||

|

Income (loss) from continuing operations, net of tax

|

167,801

|

|

205,473

|

|

10,695

|

|

(50,625

|

)

|

(63,571

|

)

|

|||||||||

|

Income (loss) from discontinued operations, net of tax

|

21,392

|

|

212,530

|

|

36,539

|

|

8,987

|

|

(44,983

|

)

|

|||||||||

|

Net income (loss) attributable to Boyd Gaming Corporation

|

189,193

|

|

418,003

|

|

47,234

|

|

(53,041

|

)

|

(80,264

|

)

|

|||||||||

|

Income (loss) from continuing operations per common share

|

|||||||||||||||||||

|

Basic

|

$

|

1.46

|

|

$

|

1.79

|

|

$

|

0.10

|

|

$

|

(0.46

|

)

|

$

|

(0.65

|

)

|

||||

|

Diluted

|

$

|

1.45

|

|

$

|

1.78

|

|

$

|

0.10

|

|

$

|

(0.46

|

)

|

$

|

(0.65

|

)

|

||||

|

Dividends declared per common share

|

$

|

0.15

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

203,104

|

|

$

|

193,862

|

|

$

|

158,821

|

|

$

|

145,341

|

|

$

|

140,311

|

|

||||

|

Total assets

|

4,685,930

|

|

4,670,751

|

|

4,350,900

|

|

4,422,384

|

|

5,657,522

|

|

|||||||||

|

Long-term debt, net of current maturities

|

3,051,899

|

|

3,199,119

|

|

3,239,799

|

|

3,375,098

|

|

3,482,610

|

|

|||||||||

|

Total stockholders' equity

|

1,100,976

|

|

934,126

|

|

508,011

|

|

438,087

|

|

650,437

|

|

|||||||||

|

Other Data:

|

|||||||||||||||||||

|

Ratio of earnings to fixed charges (f)

|

1.9x

|

|

1.0x

|

|

1.0x

|

|

—

|

|

—

|

|

|||||||||

|

Las Vegas Locals

|

|

|

Gold Coast Hotel and Casino

|

Las Vegas, Nevada

|

|

The Orleans Hotel and Casino

|

Las Vegas, Nevada

|

|

Sam's Town Hotel and Gambling Hall

|

Las Vegas, Nevada

|

|

Suncoast Hotel and Casino

|

Las Vegas, Nevada

|

|

Eastside Cannery Casino and Hotel

|

Las Vegas, Nevada

|

|

Aliante Casino + Hotel + Spa

|

North Las Vegas, Nevada

|

|

Cannery Casino Hotel

|

North Las Vegas, Nevada

|

|

Eldorado Casino

|

Henderson, Nevada

|

|

Jokers Wild Casino

|

Henderson, Nevada

|

|

Downtown Las Vegas

|

|

|

California Hotel and Casino

|

Las Vegas, Nevada

|

|

Fremont Hotel and Casino

|

Las Vegas, Nevada

|

|

Main Street Station Casino, Brewery and Hotel

|

Las Vegas, Nevada

|

|

Midwest and South

|

|

|

Par-A-Dice Hotel and Casino

|

East Peoria, Illinois

|

|

Blue Chip Casino, Hotel & Spa

|

Michigan City, Indiana

|

|

Diamond Jo Dubuque

|

Dubuque, Iowa

|

|

Diamond Jo Worth

|

Northwood, Iowa

|

|

Kansas Star Casino

|

Mulvane, Kansas

|

|

Amelia Belle Casino

|

Amelia, Louisiana

|

|

Delta Downs Racetrack Casino & Hotel

|

Vinton, Louisiana

|

|

Evangeline Downs Racetrack and Casino

|

Opelousas, Louisiana

|

|

Sam's Town Hotel and Casino

|

Shreveport, Louisiana

|

|

Treasure Chest Casino

|

Kenner, Louisiana

|

|

IP Casino Resort Spa

|

Biloxi, Mississippi

|

|

Sam's Town Hotel and Gambling Hall

|

Tunica, Mississippi

|

|

•

|

Gaming revenue measures

:

slot handle

, which means the dollar amount wagered in slot machines, and

table game drop

, which means the total amount of cash deposited in table games drop boxes, plus the sum of markers issued at all table games, are measures of volume and/or market share.

Slot win

and

table game hold

, which mean the difference between customer wagers and customer winnings on slot machines and table games, respectively, represent the amount of wagers retained by us and recorded as gaming revenues. Slot win percentage and table game hold percentage, which are not fully

|

|

•

|

Food and beverage revenue measures

:

average guest check

, which means the average amount spent per customer visit and is a measure of volume and product offerings;

number of guests served

("food covers") is an indicator of volume; and the

cost per guest served

is a measure of operating margin.

|

|

•

|

Room revenue measures

:

hotel occupancy rate

, which measures the utilization of our available rooms; and

average daily rate

("ADR"), which is a price measure.

|

|

Year Ended December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

Net revenues

|

$

|

2,383.7

|

|

$

|

2,184.0

|

|

$

|

2,199.4

|

|

||

|

Operating income

|

343.5

|

|

260.6

|

|

271.2

|

|

|||||

|

Income from continuing operations, net of tax

|

167.8

|

|

205.5

|

|

10.7

|

|

|||||

|

Income from discontinued operations, net of tax

|

21.4

|

|

212.5

|

|

36.5

|

|

|||||

|

Net income

|

189.2

|

|

418.0

|

|

47.2

|

|

|||||

|

Year Ended December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

REVENUES

|

|||||||||||

|

Gaming

|

$

|

1,972.4

|

|

$

|

1,820.2

|

|

$

|

1,847.2

|

|

||

|

Food and beverage

|

349.3

|

|

306.1

|

|

307.4

|

|

|||||

|

Room

|

188.7

|

|

170.8

|

|

163.5

|

|

|||||

|

Other

|

132.7

|

|

122.5

|

|

124.0

|

|

|||||

|

Gross revenues

|

2,643.1

|

|

2,419.6

|

|

2,442.1

|

|

|||||

|

Less promotional allowances

|

259.4

|

|

235.6

|

|

242.7

|

|

|||||

|

Net revenues

|

$

|

2,383.7

|

|

$

|

2,184.0

|

|

$

|

2,199.4

|

|

||

|

COSTS AND EXPENSES

|

|||||||||||

|

Gaming

|

$

|

923.3

|

|

$

|

880.7

|

|

$

|

900.9

|

|

||

|

Food and beverage

|

194.5

|

|

170.1

|

|

168.1

|

|

|||||

|

Room

|

52.2

|

|

44.2

|

|

41.3

|

|

|||||

|

Other

|

77.1

|

|

76.7

|

|

80.5

|

|

|||||

|

Total costs and expenses

|

$

|

1,247.1

|

|

$

|

1,171.7

|

|

$

|

1,190.8

|

|

||

|

MARGINS

|

|||||||||||

|

Gaming

|

53.19

|

%

|

51.61

|

%

|

51.23

|

%

|

|||||

|

Food and beverage

|

44.32

|

%

|

44.45

|

%

|

45.32

|

%

|

|||||

|

Room

|

72.34

|

%

|

74.10

|

%

|

74.74

|

%

|

|||||

|

Other

|

41.90

|

%

|

37.33

|

%

|

35.05

|

%

|

|||||

|

Year Ended December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

Net Revenues by Reportable Segment

|

|||||||||||

|

Las Vegas Locals

|

$

|

858.9

|

|

$

|

647.9

|

|

$

|

610.1

|

|

||

|

Downtown Las Vegas

|

243.6

|

|

236.4

|

|

234.2

|

|

|||||

|

Midwest and South

|

1,281.2

|

|

1,299.7

|

|

1,355.1

|

|

|||||

|

Net revenues

|

$

|

2,383.7

|

|

$

|

2,184.0

|

|

$

|

2,199.4

|

|

||

|

Year Ended December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

Selling, general and administrative

|

$

|

362.0

|

|

$

|

322.0

|

|

$

|

322.4

|

|

||

|

Maintenance and utilities

|

109.5

|

|

100.0

|

|

104.5

|

|

|||||

|

Depreciation and amortization

|

217.5

|

|

196.2

|

|

207.1

|

|

|||||

|

Corporate expense

|

88.1

|

|

72.7

|

|

76.9

|

|

|||||

|

Project development, preopening and writedowns

|

14.5

|

|

22.1

|

|

6.9

|

|

|||||

|

Impairment of assets

|

(0.4

|

)

|

38.3

|

|

18.6

|

|

|||||

|

Other operating items, net

|

1.9

|

|

0.3

|

|

0.9

|

|

|||||

|

Year Ended December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

Interest Expense, net

|

$

|

171.3

|

|

$

|

209.7

|

|

$

|

222.7

|

|

||

|

Average Long-Term Debt Balance

|

3,207.2

|

|

3,337.0

|

|

3,416.5

|

|

|||||

|

Loss on Early Extinguishments and Modifications of Debt

|

1.6

|

|

42.4

|

|

40.7

|

|

|||||

|

Weighted Average Interest Rates

|

4.4

|

%

|

5.3

|

%

|

5.3

|

%

|

|||||

|

Mix of Boyd Gaming Corporation Debt at Year End

|

|||||||||||

|

Fixed rate debt

|

48.1

|

%

|

45.7

|

%

|

43.6

|

%

|

|||||

|

Variable rate debt

|

51.9

|

%

|

54.3

|

%

|

56.4

|

%

|

|||||

|

December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

Boyd Gaming Credit Facility deferred finance charges

|

$

|

1.1

|

|

$

|

6.6

|

|

$

|

2.0

|

|

||

|

Refinancing Amendment

|

0.5

|

|

—

|

|

—

|

|

|||||

|

9.00% Senior Notes premium and consent fees

|

—

|

|

15.8

|

|

—

|

|

|||||

|

9.00% Senior Notes deferred finance charges

|

—

|

|

6.0

|

|

—

|

|

|||||

|

8.375% Senior Notes deferred finance charges

|

—

|

|

4.5

|

|

—

|

|

|||||

|

9.125% Senior Notes premium and consent fees

|

—

|

|

—

|

|

24.0

|

|

|||||

|

9.125% Senior Notes deferred finance charges

|

—

|

|

—

|

|

4.9

|

|

|||||

|

HoldCo Note

|

—

|

|

—

|

|

7.8

|

|

|||||

|

Peninsula Credit Facility deferred finance charges

|

—

|

|

9.5

|

|

2.1

|

|

|||||

|

Total loss on early extinguishments and modifications of debt

|

$

|

1.6

|

|

$

|

42.4

|

|

$

|

40.8

|

|

||

|

Year Ended December 31,

|

|||||||||||

|

(In millions)

|

2017

|

2016

|

2015

|

||||||||

|

Net cash provided by operating activities

|

$

|

414.9

|

|

$

|

302.9

|

|

$

|

325.8

|

|

||

|

Cash Flows from Investing Activities

|

|||||||||||

|

Capital expenditures

|

(190.4

|

)

|

(160.4

|

)

|

(131.2

|

)

|

|||||

|

Cash paid for acquisitions, net of cash received

|

(1.2

|

)

|

(592.7

|

)

|

—

|

|

|||||

|

Advances pursuant to development agreement

|

(35.1

|

)

|

—

|

|

—

|

|

|||||

|

Other investing activities

|

0.7

|

|

14.1

|

|

4.5

|

|

|||||

|

Net cash used in investing activities

|

(226.0

|

)

|

(739.0

|

)

|

(126.7

|

)

|

|||||

|

Cash Flows from Financing Activities

|

|||||||||||

|

Net payments of debt

|

(161.5

|

)

|

(97.9

|

)

|

(203.4

|

)

|

|||||

|

Dividends paid

|

(11.3

|

)

|

—

|

|

—

|

|

|||||

|

Shares repurchased and retired

|

(31.9

|

)

|

—

|

|

—

|

|

|||||

|

Share-based compensation activities, net

|

(7.7

|

)

|

(1.3

|

)

|

3.7

|

|

|||||

|

Other financing activities

|

(2.9

|

)

|

—

|

|

—

|

|

|||||

|

Net cash used in financing activities

|

(215.3

|

)

|

(99.2

|

)

|

(199.7

|

)

|

|||||

|

Net cash provided by discontinued operations

|

35.7

|

|

570.3

|

|

14.1

|

|

|||||

|

Net increase in cash and cash equivalents

|

$

|

9.3

|

|

$

|

35.0

|

|

$

|

13.5

|

|

||

|

(In millions)

|

December 31, 2017

|

December 31, 2016

|

Decrease

|

||||||||

|

Bank credit facility

|

$

|

1,621.1

|

|

$

|

1,782.5

|

|

$

|

(161.4

|

)

|

||

|

6.875% senior notes due 2023

|

750.0

|

|

750.0

|

|

—

|

|

|||||

|

6.375% senior notes due 2026

|

750.0

|

|

750.0

|

|

—

|

|

|||||

|

Other

|

0.5

|

|

0.6

|

|

(0.1

|

)

|

|||||

|

Total long-term debt

|

3,121.6

|

|

3,283.1

|

|

(161.5

|

)

|

|||||

|

Less current maturities

|

24.0

|

|

30.3

|

|

(6.3

|

)

|

|||||

|

Long-term debt, net of current maturities

|

$

|

3,097.6

|

|

$

|

3,252.8

|

|

$

|

(155.2

|

)

|

||

|

December 31,

|

|||||||

|

(In millions)

|

2017

|

2016

|

|||||

|

Revolving Credit Facility

|

$

|

170.0

|

|

$

|

245.0

|

|

|

|

Term A Loan

|

211.0

|

|

222.2

|

|

|||

|

Refinancing Term B Loans

|

1,170.0

|

|

—

|

|

|||

|

Term B-1 Loan

|

—

|

|

271.8

|

|

|||

|

Term B-2 Loan

|

—

|

|

997.5

|

|

|||

|

Swing Loan

|

70.1

|

|

46.0

|

|

|||

|

Total outstanding principal amounts under the Credit Facility

|

$

|

1,621.1

|

|

$

|

1,782.5

|

|

|

|

(In millions)

|

Total

|

||

|

For the year ending December 31,

|

|||

|

2018

|

$

|

24.0

|

|

|

2019

|

24.0

|

|

|

|

2020

|

24.0

|

|

|

|

2021

|

430.0

|

|

|

|

2022

|

12.8

|

|

|

|

Thereafter

|

2,606.8

|

|

|

|

Total outstanding principal of long-term debt

|

$

|

3,121.6

|

|

|

Declaration date

|

Record date

|

Payment date

|

Amount per share

|

|||

|

May 2, 2017

|

June 15, 2017

|

July 15, 2017

|

$0.05

|

|||

|

September 6, 2017

|

September 18, 2017

|

October 15, 2017

|

0.05

|

|||

|

December 7, 2017

|

December 28, 2017

|

January 15, 2018

|

0.05

|

|||

|

Year Ending December 31,

|

|||||||||||||||||||||||||||

|

(In millions)

|

Total

|

2018

|

2019

|

2020

|

2021

|

2022

|

Thereafter

|

||||||||||||||||||||

|

CONTRACTUAL OBLIGATIONS:

|

|||||||||||||||||||||||||||

|

Long-Term Debt

|

|||||||||||||||||||||||||||

|

Bank credit facility

|

$

|

1,621.1

|

|

$

|

23.9

|

|

$

|

23.9

|

|

$

|

23.9

|

|

$

|

429.9

|

|

$

|

12.7

|

|

$

|

1,106.8

|

|

||||||

|

6.375% senior notes due 2026

|

750.0

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

750.0

|

|

|||||||||||||

|

6.875% senior notes due 2023

|

750.0

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

750.0

|

|

|||||||||||||

|

Other

|

0.5

|

|

0.1

|

|

0.1

|

|

0.1

|

|

0.1

|

|

0.1

|

|

—

|

|

|||||||||||||

|

Total long-term debt

|

3,121.6

|

|

24.0

|

|

24.0

|

|

24.0

|

|

430.0

|

|

12.8

|

|

2,606.8

|

|

|||||||||||||

|

Interest on Fixed Rate Debt

|

669.6

|

|

99.4

|

|

99.4

|

|

99.4

|

|

99.4

|

|

99.4

|

|

172.6

|

|

|||||||||||||

|

Interest on Variable Rate Debt (1)

|

313.5

|

|

62.6

|

|

61.7

|

|

60.7

|

|

54.9

|

|

44.3

|

|

29.3

|

|

|||||||||||||

|

Operating Leases

|

396.4

|

|

20.7

|

|

17.8

|

|

15.3

|

|

14.3

|

|

13.9

|

|

314.4

|

|

|||||||||||||

|

Purchase Obligations (2)

|

48.9

|

|

13.9

|

|

6.9

|

|

4.2

|

|

3.7

|

|

3.6

|

|

16.6

|

|

|||||||||||||

|

TOTAL CONTRACTUAL OBLIGATIONS

|

$

|

4,550.0

|

|

|

$

|

220.6

|

|

|

$

|

209.8

|

|

|

$

|

203.6

|

|

|

$

|

602.3

|

|

|

$

|

174.0

|

|

|

$

|

3,139.7

|

|

|

(1)

|

Estimated interest payments are based on principal amounts and scheduled maturities of debt outstanding at

December 31, 2017

. Estimated interest payments for variable-rate debt are based on rates at

December 31, 2017

.

|

|

•

|

the outcome of gaming license selection processes;

|

|

•

|

the approval of gaming in jurisdictions where we have been active but where casino gaming is not currently permitted;

|

|

•

|

identification of additional suitable investment opportunities in current gaming jurisdictions; and

|

|

•

|

availability of acceptable financing.

|

|

i.

|

a significant decrease in the market price of a long-lived asset;

|

|

ii.

|

a significant adverse change in the extent or manner in which a long-lived asset is being used or in its physical condition;

|

|

iii.

|

a significant adverse change in legal factors or in the business climate that could affect the value of a long-lived asset, including an adverse action or assessment by a regulator;

|

|

iv.

|

an accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of a long-lived asset;

|

|

v.

|

a current-period operating or cash flow loss combined with a history of operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset; and/or

|

|

vi.

|

a current expectation that, more likely than not, a long-lived asset will be sold or otherwise disposed of significantly before the end of its previously estimated useful life.

|

|

|

Scheduled Maturity Date

|

||||||||||||||||||||||||||||||

|

|

Year Ending December 31,

|

||||||||||||||||||||||||||||||

|

(In millions, except percentages)

|

2018

|

2019

|

2020

|

2021

|

2022

|

Thereafter

|

Total

|

Fair

Value

|

|||||||||||||||||||||||

|

Long-term debt (including current portion):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Fixed-rate

|

$

|

0.1

|

|

$

|

0.1

|

|

$

|

0.1

|

|

$

|

0.1

|

|

$

|

0.1

|

|

$

|

1,500.0

|

|

$

|

1,500.5

|

|

$

|

1,609.2

|

|

|||||||

|

Average interest rate

|

6.6

|

%

|

6.6

|

%

|

6.6

|

%

|

6.6

|

%

|

6.6

|

%

|

6.4

|

%

|

6.6

|

%

|

|

|

|||||||||||||||

|

Variable-rate

|

$

|

23.9

|

|

$

|

23.9

|

|

$

|

23.9

|

|

$

|

429.9

|

|

$

|

12.7

|

|

$

|

1,106.8

|

|

$

|

1,621.1

|

|

$

|

1,625.2

|

|

|||||||

|

Average interest rate

|

3.9

|

%

|

3.9

|

%

|

3.9

|

%

|

3.9

|

%

|

4.0

|

%

|

4.0

|

%

|

3.9

|

%

|

|

|

|||||||||||||||

|

|

December 31, 2017

|

||||||||||||

|

(In millions)

|

Outstanding

Face

Amount

|

Carrying

Value

|

Estimated

Fair Value

|

Fair

Value

Hierarchy

|

|||||||||

|

Bank credit facility

|

$

|

1,621.1

|

|

$

|

1,595.7

|

|

$

|

1,625.2

|

|

Level 2

|

|||

|

6.875% senior notes due 2023

|

750.0

|

|

740.6

|

|

798.7

|

|

Level 1

|

||||||

|

6.375% senior notes due 2026

|

750.0

|

|

739.1

|

|

810.0

|

|

Level 1

|

||||||

|

Other

|

0.5

|

|

0.5

|

|

0.5

|

|

Level 3

|

||||||

|

Total long-term debt

|

$

|

3,121.6

|

|

$

|

3,075.9

|

|

$

|

3,234.4

|

|

||||

|

|

Page No.

|

|

December 31,

|

|||||||

|

(In thousands, except share data)

|

2017

|

2016

|

|||||

|

ASSETS

|

|||||||

|

Current assets

|

|||||||

|

Cash and cash equivalents

|

$

|

203,104

|

|

$

|

193,862

|

|

|

|

Restricted cash

|

24,175

|

|

16,488

|

|

|||

|

Accounts receivable, net

|

40,322

|

|

30,371

|

|

|||

|

Inventories

|

18,004

|

|

18,568

|

|

|||

|

Prepaid expenses and other current assets

|

37,873

|

|

46,214

|

|

|||

|

Income taxes receivable

|

5,185

|

|

2,444

|

|

|||

|

Total current assets

|

328,663

|

|

307,947

|

|

|||

|

Property and equipment, net

|

2,539,786

|

|

2,605,169

|

|

|||

|

Other assets, net

|

81,128

|

|

49,205

|

|

|||

|

Intangible assets, net

|

842,946

|

|

881,954

|

|

|||

|

Goodwill, net

|

888,224

|

|

826,476

|

|

|||

|

Other long-term tax assets

|

5,183

|

|

—

|

|

|||

|

Total assets

|

$

|

4,685,930

|

|

$

|

4,670,751

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|||||||

|

Current liabilities

|

|||||||

|

Accounts payable

|

$

|

106,323

|

|

$

|

84,086

|

|

|

|

Current maturities of long-term debt

|

23,981

|

|

30,336

|

|

|||

|

Accrued liabilities

|

248,979

|

|

251,082

|

|

|||

|

Income tax payable

|

21

|

|

—

|

|

|||

|

Total current liabilities

|

379,304

|

|

365,504

|

|

|||

|

Long-term debt, net of current maturities and debt issuance costs

|

3,051,899

|

|

3,199,119

|

|

|||

|

Deferred income taxes

|

89,075

|

|

83,980

|

|

|||

|

Other long-term tax liabilities

|

3,447

|

|

3,307

|

|

|||

|

Other liabilities

|

61,229

|

|

84,715

|

|

|||

|

Commitments and contingencies (Note 9)

|

|

|

|||||

|

Stockholders’ equity

|

|||||||

|

Preferred stock, $0.01 par value, 5,000,000 shares authorized

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value, 200,000,000 shares authorized; 112,634,418 and 112,896,377 shares outstanding

|

1,126

|

|

1,129

|

|

|||

|

Additional paid-in capital

|

931,858

|

|

953,440

|

|

|||

|

Retained earnings (accumulated deficit)

|

168,174

|

|

(19,878

|

)

|

|||

|

Accumulated other comprehensive income (loss)

|

(182

|

)

|

(615

|

)

|

|||

|

Total Boyd Gaming Corporation stockholders’ equity

|

1,100,976

|

|

934,076

|

|

|||

|

Noncontrolling interest

|

—

|

|

50

|

|

|||

|

Total stockholders’ equity

|

1,100,976

|

|

934,126

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

4,685,930

|

|

$

|

4,670,751

|

|

|

|

Year Ended December 31,

|

|||||||||||

|

(In thousands, except per share data)

|

2017

|

2016

|

2015

|

||||||||

|

Revenues

|

|||||||||||

|

Gaming

|

$

|

1,972,422

|

|

$

|

1,820,176

|

|

$

|

1,847,167

|

|

||

|

Food and beverage

|

349,271

|

|

306,145

|

|

307,442

|

|

|||||

|

Room

|

188,689

|

|

170,816

|

|

163,509

|

|

|||||

|

Other

|

132,695

|

|

122,416

|

|

123,959

|

|

|||||

|

Gross revenues

|

2,643,077

|

|

2,419,553

|

|

2,442,077

|

|

|||||

|

Less promotional allowances

|

259,370

|

|

235,577

|

|

242,645

|

|

|||||

|

Net revenues

|

2,383,707

|

|

2,183,976

|

|

2,199,432

|

|

|||||

|

Operating costs and expenses

|

|||||||||||

|

Gaming

|

923,266

|

|

880,716

|

|

900,922

|

|

|||||

|

Food and beverage

|

194,524

|

|

170,053

|

|

168,096

|

|

|||||

|

Room

|

52,196

|

|

44,245

|

|

41,298

|

|

|||||

|

Other

|

77,129

|

|

76,719

|

|

80,508

|

|

|||||

|

Selling, general and administrative

|

362,037

|

|

322,009

|

|

322,420

|

|

|||||

|

Maintenance and utilities

|

109,462

|

|

100,020

|

|

104,548

|

|

|||||

|

Depreciation and amortization

|

217,522

|

|

196,226

|

|

207,118

|

|

|||||

|

Corporate expense

|

88,148

|

|

72,668

|

|

76,941

|

|

|||||

|

Project development, preopening and writedowns

|

14,454

|

|

22,107

|

|

6,907

|

|

|||||

|

Impairments of assets

|

(426

|

)

|

38,302

|

|

18,565

|

|

|||||

|

Other operating items, net

|

1,900

|

|

284

|

|

907

|

|

|||||

|

Total operating costs and expenses

|

2,040,212

|

|

1,923,349

|

|

1,928,230

|

|

|||||

|

Operating income

|

343,495

|

|

260,627

|

|

271,202

|

|

|||||

|

Other expense (income)

|

|||||||||||

|

Interest income

|

(1,818

|

)

|

(2,961

|

)

|

(1,858

|

)

|

|||||

|

Interest expense, net of amounts capitalized

|

173,108

|

|

212,692

|

|

224,590

|

|

|||||

|

Loss on early extinguishments and modifications of debt

|

1,582

|

|

42,364

|

|

40,733

|

|

|||||

|

Other, net

|

(184

|

)

|

545

|

|

3,676

|

|

|||||

|

Total other expense, net

|

172,688

|

|

252,640

|

|

267,141

|

|

|||||

|

Income from continuing operations before income taxes

|

170,807

|

|

7,987

|

|

4,061

|

|

|||||

|

Income tax (provision) benefit

|

(3,006

|

)

|

197,486

|

|

6,634

|

|

|||||

|

Income from continuing operations, net of tax

|

167,801

|

|

205,473

|

|

10,695

|

|

|||||

|

Income from discontinued operations, net of tax

|

21,392

|

|

212,530

|

|

36,539

|

|

|||||

|

Net income

|

$

|

189,193

|

|

$

|

418,003

|

|

$

|

47,234

|

|

||

|

Basic net income per common share

|

|

|

|

|

|

|

|||||

|

Continuing operations

|

$

|

1.46

|

|

$

|

1.79

|

|

$

|

0.10

|

|

||

|

Discontinued operations

|

0.19

|

|

1.86

|

|

0.32

|

|

|||||

|

Basic net income per common share

|

$

|

1.65

|

|

$

|

3.65

|

|

$

|

0.42

|

|

||

|

Weighted average basic shares outstanding

|

114,957

|

|

114,507

|

|

112,789

|

|

|||||

|

Diluted net income per common share

|

|

|

|

|

|

|

|||||

|

Continuing operations

|

$

|

1.45

|

|

$

|

1.78

|

|

$

|

0.10

|

|

||

|

Discontinued operations

|

0.19

|

|

1.85

|

|

0.32

|

|

|||||

|

Diluted net income per common share

|

$

|

1.64

|

|

$

|

3.63

|

|

$

|

0.42

|

|

||

|

Weighted average diluted shares outstanding

|

115,628

|

|

115,189

|

|

113,676

|

|

|||||

|

Dividends per common share

|

$

|

0.15

|

|

$

|

—

|

|

$

|

—

|

|

||

|

Year Ended December 31,

|

|||||||||||

|

(In thousands)

|

2017

|

2016

|

2015

|

||||||||

|

Net income

|

$

|

189,193

|

|

$

|

418,003

|

|

$

|

47,234

|

|

||

|

Other comprehensive income (loss), net of tax:

|

|||||||||||

|

Fair value of adjustments to available-for-sale securities

|

433

|

|

(299

|

)

|

(263

|

)

|

|||||

|

Comprehensive income

|

$

|

189,626

|

|

$

|

417,704

|

|

$

|

46,971

|

|

||

|

Boyd Gaming Corporation Stockholders’ Equity

|

||||||||||||||||||||||||||

|

Retained

|

Accumulated

|

|||||||||||||||||||||||||

|

Additional

|

Earnings/

|

Other

|

Total

|

|||||||||||||||||||||||

|

Common Stock

|

Paid-in

|

(Accumulated

|

Comprehensive

|

Noncontrolling

|

Stockholders'

|

|||||||||||||||||||||

|

(In thousands, except share data)

|

Shares

|

Amount

|

Capital

|

Deficit)

|

Income (Loss), Net

|

Interest

|

Equity

|

|||||||||||||||||||

|

Balances, January 1, 2015

|

109,277,060

|

|

$

|

1,093

|

|

$

|

922,112

|

|

$

|

(485,115

|

)

|

$

|

(53

|

)

|

$

|

50

|

|

$

|

438,087

|

|

||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

47,234

|

|

—

|

|

—

|

|

47,234

|

|

||||||||||||

|

Comprehensive loss attributable to Boyd

|

—

|

|

—

|

|

—

|

|

—

|

|

(263

|

)

|

—

|

|

(263

|

)

|

||||||||||||

|

Stock options exercised

|

1,301,789

|

|

13

|

|

9,794

|

|

—

|

|

—

|

|

—

|

|

9,807

|

|

||||||||||||

|

Release of restricted stock units, net of tax

|

553,822

|

|

6

|

|

(3,678

|

)

|

—

|

|

—

|

|

—

|

|

(3,672

|

)

|

||||||||||||

|

Release of performance stock units, net of tax

|

481,749

|

|

5

|

|

(2,451

|

)

|

—

|

|

—

|

|

—

|

|

(2,446

|

)

|

||||||||||||

|

Share-based compensation costs

|

—

|

|

—

|

|

19,264

|

|

—

|

|

—

|

|

—

|

|

19,264

|

|

||||||||||||

|

Balances, December 31, 2015

|

111,614,420

|

|

1,117

|

|

945,041

|

|

(437,881

|

)

|

(316

|

)

|

50

|

|

508,011

|

|

||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

418,003

|

|

—

|

|

—

|

|

418,003

|

|

||||||||||||

|

Comprehensive loss attributable to Boyd

|

—

|

|

—

|

|

—

|

|

—

|

|

(299

|

)

|

—

|

|

(299

|

)

|

||||||||||||

|

Stock options exercised

|

452,898

|

|

4

|

|

2,936

|

|

—

|

|

—

|

|

—

|

|

2,940

|

|

||||||||||||

|

Release of restricted stock units, net of tax

|

670,032

|

|

6

|

|

(3,374

|

)

|

—

|

|

—

|

|

—

|

|

(3,368

|

)

|

||||||||||||

|

Release of performance stock units, net of tax

|

159,027

|

|

2

|

|

(869

|

)

|

—

|

|

—

|

|

—

|

|

(867

|

)

|

||||||||||||

|

Tax effect from share-based compensation arrangements

|

—

|

|

—

|

|

(5,812

|

)

|

—

|

|

—

|

|

—

|

|

(5,812

|

)

|

||||||||||||

|

Share-based compensation costs

|

—

|

|

—

|

|

15,518

|

|

—

|

|

—

|

|

—

|

|

15,518

|

|

||||||||||||

|

Balances, December 31, 2016

|

112,896,377

|

|

1,129

|

|

953,440

|

|

(19,878

|

)

|

(615

|

)

|

50

|

|

934,126

|

|

||||||||||||

|

Cumulative effect of change in accounting principle, adoption of Update 2016-09

|

—

|

|

—

|

|

—

|

|

15,777

|

|

—

|

|

—

|

|

15,777

|

|

||||||||||||

|

Net income

|

—

|

|

—

|

|

—

|

|

189,193

|

|

—

|

|

—

|

|

189,193

|

|

||||||||||||

|

Comprehensive income attributable to Boyd

|

—

|

|

—

|

|

—

|

|

—

|

|

433

|

|

—

|

|

433

|

|

||||||||||||

|

Stock options exercised

|

241,964

|

|

2

|

|

2,082

|

|

—

|

|

—

|

|

—

|

|

2,084

|

|

||||||||||||

|

Release of restricted stock units, net of tax

|

520,854

|

|

5

|

|

(8,009

|

)

|

—

|

|

—

|

|

—

|

|

(8,004

|

)

|

||||||||||||

|

Release of performance stock units, net of tax