|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Ohio

|

31-0958666

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer

Identification No.)

|

|

7000 Cardinal Place, Dublin, Ohio

|

43017

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(614) 757-5000

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of class

|

Name of each exchange on which registered

|

|

Common shares (without par value)

|

New York Stock Exchange

|

|

Securities registered pursuant to Section 12(g) of the Act: None

|

|

|

Large accelerated filer

þ

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

Emerging growth company

o

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

o

|

|

|

Cardinal Health

Fiscal 2017 Form 10-K

|

|

Page

|

|

|

1

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Introduction

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

2

|

|

|

MD&A

|

Results of Operations

|

|

|

3

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Results of Operations

|

|

|

(in millions)

|

2017

|

2016

|

Change

|

|||||||

|

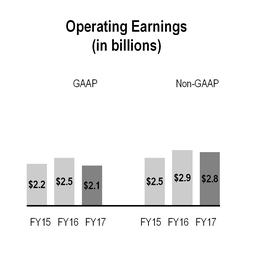

GAAP

|

$

|

2,120

|

|

$

|

2,459

|

|

(14

|

)%

|

||

|

Restructuring and employee severance

|

56

|

|

25

|

|

||||||

|

Amortization and other acquisition-related costs

|

527

|

|

459

|

|

||||||

|

Impairments and (gain)/loss on disposal of assets

|

18

|

|

21

|

|

||||||

|

Litigation (recoveries)/charges, net

|

48

|

|

(69

|

)

|

||||||

|

Non-GAAP

|

$

|

2,769

|

|

$

|

2,895

|

|

(4

|

)%

|

||

|

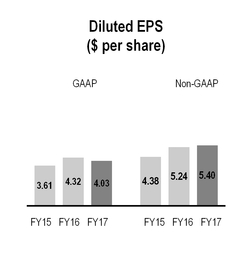

($ per share)

|

2017

|

2016

|

Change

|

|||||||

|

GAAP

|

$

|

4.03

|

|

$

|

4.32

|

|

(7

|

)%

|

||

|

Restructuring and employee severance

|

0.11

|

|

0.05

|

|

||||||

|

Amortization and other acquisition-related costs

|

1.13

|

|

0.96

|

|

||||||

|

Impairments and (gain)/loss on disposal of assets

|

0.04

|

|

0.04

|

|

||||||

|

Litigation (recoveries)/charges, net

|

0.09

|

|

(0.13

|

)

|

||||||

|

Non-GAAP

|

$

|

5.40

|

|

$

|

5.24

|

|

3

|

%

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

4

|

|

|

MD&A

|

Results of Operations

|

|

|

5

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Results of Operations

|

|

|

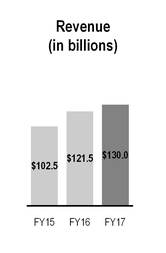

Revenue

|

Change

|

||||||||||||||||

|

(in millions)

|

2017

|

2016

|

2015

|

2017

|

2016

|

||||||||||||

|

Pharmaceutical

|

$

|

116,463

|

|

$

|

109,131

|

|

$

|

91,116

|

|

7

|

%

|

20

|

%

|

||||

|

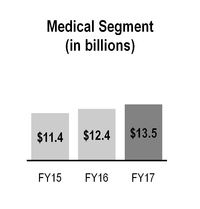

Medical

|

13,524

|

|

12,430

|

|

11,395

|

|

9

|

%

|

9

|

%

|

|||||||

|

Total segment revenue

|

129,987

|

|

121,561

|

|

102,511

|

|

7

|

%

|

19

|

%

|

|||||||

|

Corporate

|

(11

|

)

|

(15

|

)

|

20

|

|

N.M.

|

|

N.M.

|

|

|||||||

|

Total revenue

|

$

|

129,976

|

|

$

|

121,546

|

|

$

|

102,531

|

|

7

|

%

|

19

|

%

|

||||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

6

|

|

|

MD&A

|

Results of Operations

|

|

|

Consolidated Gross Margin

|

Change

|

|||||||||||||||

|

(in millions)

|

2017

|

2016

|

2015

|

2017

|

2016

|

|||||||||||

|

Gross margin

|

$

|

6,544

|

|

$

|

6,543

|

|

$

|

5,712

|

|

N.M.

|

15

|

%

|

||||

|

SG&A Expenses

|

Change

|

||||||||||||||||

|

(in millions)

|

2017

|

2016

|

2015

|

2017

|

2016

|

||||||||||||

|

SG&A expenses

|

$

|

3,775

|

|

$

|

3,648

|

|

$

|

3,240

|

|

3

|

%

|

13

|

%

|

||||

|

7

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Results of Operations

|

|

|

Segment Profit and Operating Earnings

|

Change

|

||||||||||||||||

|

(in millions)

|

2017

|

2016

|

2015

|

2017

|

2016

|

||||||||||||

|

Pharmaceutical

|

$

|

2,187

|

|

$

|

2,488

|

|

$

|

2,094

|

|

(12

|

)%

|

19

|

%

|

||||

|

Medical

|

572

|

|

457

|

|

433

|

|

25

|

%

|

6

|

%

|

|||||||

|

Total segment profit

|

2,759

|

|

2,945

|

|

2,527

|

|

(6

|

)%

|

17

|

%

|

|||||||

|

Corporate

|

(639

|

)

|

(486

|

)

|

(366

|

)

|

31

|

%

|

33

|

%

|

|||||||

|

Total consolidated operating earnings

|

$

|

2,120

|

|

$

|

2,459

|

|

$

|

2,161

|

|

(14

|

)%

|

14

|

%

|

||||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

8

|

|

|

MD&A

|

Results of Operations

|

|

|

(in millions)

|

2017

|

2016

|

2015

|

||||||||

|

Restructuring and employee severance

|

$

|

56

|

|

$

|

25

|

|

$

|

44

|

|

||

|

Amortization and other acquisition-related costs

|

527

|

|

459

|

|

281

|

|

|||||

|

Impairments and (gain)/loss on disposal of assets, net

|

18

|

|

21

|

|

(19

|

)

|

|||||

|

Litigation (recoveries)/charges, net

|

48

|

|

(69

|

)

|

5

|

|

|||||

|

|

|

Earnings from Continuing

Operations Before Income Taxes

|

Change

|

||||||||||||||||

|

(in millions)

|

2017

|

2016

|

2015

|

2017

|

2016

|

||||||||||||

|

Other (income)/expense, net

|

$

|

(5

|

)

|

$

|

5

|

|

$

|

(7

|

)

|

N.M.

|

|

N.M.

|

|

||||

|

Interest expense, net

|

201

|

|

178

|

|

141

|

|

13

|

%

|

26

|

%

|

|||||||

|

Loss on extinguishment of debt

|

—

|

|

—

|

|

60

|

|

N.M.

|

|

(100

|

)%

|

|||||||

|

9

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Results of Operations

|

|

|

|

2017

|

2016

|

2015

|

|||||

|

Provision at Federal statutory rate

|

35.0

|

%

|

35.0

|

%

|

35.0

|

%

|

||

|

State and local income taxes, net of federal benefit

|

1.0

|

|

1.5

|

|

4.1

|

|

||

|

Foreign tax rate differential

|

(0.2

|

)

|

(0.6

|

)

|

(2.4

|

)

|

||

|

Nondeductible/nontaxable items

|

0.2

|

|

1.0

|

|

0.7

|

|

||

|

Other

|

(3.3

|

)

|

0.2

|

|

1.0

|

|

||

|

Effective income tax rate

|

32.7

|

%

|

37.1

|

%

|

38.4

|

%

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

10

|

|

|

MD&A

|

Liquidity and Capital Resources

|

|

|

11

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Liquidity and Capital Resources

|

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

12

|

|

|

MD&A

|

Other

|

|

|

(in millions)

|

2018

|

2019 to 2020

|

2021 to 2022

|

There-after

|

Total

|

||||||||||||||

|

Long-term debt and short-term borrowings (1)

|

$

|

1,328

|

|

$

|

1,950

|

|

$

|

1,750

|

|

$

|

5,424

|

|

$

|

10,452

|

|

||||

|

Interest on long-term debt

|

320

|

|

590

|

|

542

|

|

2,250

|

|

3,702

|

|

|||||||||

|

Capital lease obligations (2)

|

2

|

|

5

|

|

2

|

|

2

|

|

11

|

|

|||||||||

|

Other liabilities (3)

|

4

|

|

—

|

|

—

|

|

—

|

|

4

|

|

|||||||||

|

Operating leases (4)

|

110

|

|

171

|

|

100

|

|

107

|

|

488

|

|

|||||||||

|

Purchase obligations and other payments (5)

|

341

|

|

331

|

|

234

|

|

244

|

|

1,150

|

|

|||||||||

|

Total contractual obligations (6)

|

$

|

2,105

|

|

$

|

3,047

|

|

$

|

2,628

|

|

$

|

8,027

|

|

$

|

15,807

|

|

||||

|

(1)

|

Represents maturities of our long-term debt obligations and other short-term borrowings excluding capital lease obligations described below. See

Note 6

of the “Notes to Consolidated Financial Statements” for further information.

|

|

(2)

|

Represents maturities of our capital lease obligations included within long-term obligations in our consolidated balance sheets.

|

|

(3)

|

Represents cash outflows by period for certain of our liabilities in which cash outflows could be reasonably estimated. Long-term liabilities, such as unrecognized tax benefits and deferred taxes, have been excluded from the

|

|

(4)

|

Represents minimum rental payments for operating leases having initial or remaining non-cancelable lease terms as described in

Note 8

of the “Notes to Consolidated Financial Statements.”

|

|

(5)

|

A purchase obligation is defined as an agreement to purchase goods or services that is legally enforceable and specifies all significant terms, including fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and approximate timing of the transaction. The purchase obligation amounts disclosed above represent estimates of the minimum for which we are obligated and the time period in which cash outflows will occur. Purchase orders and authorizations to purchase that involve no firm commitment from either party are excluded from the above table. In addition, contracts that can be unilaterally canceled with no termination fee or with proper notice are excluded from our total purchase obligations except for the amount of the termination fee or the minimum amount of goods that must be purchased during the requisite notice period. Purchase obligations and other payments also includes quarterly payments of $45.6 million that we are required to pay CVS Health Corporation ("CVS"), in connection with the establishment of Red Oak Sourcing and will be in place for the remaining seven years of the agreement. See

Note 8

of the “Notes to Consolidated Financial Statements” for additional information.

|

|

(6)

|

Excludes obligations from acquisitions not closed as of June 30, 2017.

|

|

13

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Critical Accounting Policies and Sensitive Accounting Estimates

|

|

|

(in millions, except percentages)

|

2017

|

2016

|

2015

|

||||||||

|

Allowance for doubtful accounts

|

$

|

137

|

|

$

|

135

|

|

$

|

135

|

|

||

|

Reduction to allowance for customer deductions and write-offs

|

58

|

|

74

|

|

66

|

|

|||||

|

Charged to costs and expenses

|

60

|

|

74

|

|

64

|

|

|||||

|

Allowance as a percentage of customer receivables

|

1.7

|

%

|

1.8

|

%

|

2.0

|

%

|

|||||

|

Allowance as a percentage of revenue

|

0.11

|

%

|

0.11

|

%

|

0.13

|

%

|

|||||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

14

|

|

|

MD&A

|

Critical Accounting Policies and Sensitive Accounting Estimates

|

|

|

15

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

MD&A

|

Critical Accounting Policies and Sensitive Accounting Estimates

|

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

16

|

|

|

MD&A

|

Critical Accounting Policies and Sensitive Accounting Estimates

|

|

|

(in millions)

|

2017

|

2016

|

|||||

|

Total deferred income tax assets (1)

|

$

|

692

|

|

$

|

567

|

|

|

|

Valuation allowance for deferred income tax assets (2)

|

(237

|

)

|

(93

|

)

|

|||

|

Net deferred income tax assets

|

455

|

|

474

|

|

|||

|

Total deferred income tax liabilities

|

(2,331

|

)

|

(2,130

|

)

|

|||

|

Net deferred income tax liability

|

$

|

(1,876

|

)

|

$

|

(1,656

|

)

|

|

|

(1)

|

Total deferred income tax assets included

$378 million

and

$193 million

of loss and tax credit carryforwards at

June 30, 2017

and

2016

, respectively.

|

|

(2)

|

The valuation allowance primarily relates to federal, state and international loss carryforwards for which the ultimate realization of future benefits is uncertain.

|

|

17

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Explanation and Reconciliation of Non-GAAP Financial Measures

|

||

|

•

|

LIFO charges and credits

are excluded because the factors that drive last-in first-out ("LIFO") inventory charges or credits, such as pharmaceutical manufacturer price appreciation or deflation and year-end inventory levels (which can be meaningfully influenced by customer buying behavior immediately preceding our fiscal year-end), are largely out of our control and cannot be accurately predicted. The exclusion of LIFO charges from non-GAAP metrics allows for a better comparison of our current financial results to our historical financial results and to our peer group companies’ financial results.

|

|

•

|

Restructuring and employee severance costs

are excluded because they relate to programs in which we fundamentally change our operations and because they are not part of the ongoing operations of our underlying business.

|

|

•

|

Amortization and other acquisition-related costs

are excluded primarily for consistency with the presentation of the financial results of our peer group companies. Additionally, costs for amortization of acquisition-related intangible assets are non-cash amounts, which are variable in amount and frequency and are significantly impacted by the timing and size of acquisitions, so their exclusion allows for better comparison of historical, current and forecasted financial results. We also exclude other acquisition-related costs, which are directly related to an acquisition but do not meet the criteria to be recognized on the acquired entity’s initial balance sheet as part of the purchase price allocation. These costs are also significantly impacted by the timing, complexity and size of acquisitions.

|

|

•

|

Impairments and gain or loss on disposal of assets

are excluded because they do not occur in or reflect the ordinary course of our ongoing business operations and their exclusion results in a metric that more meaningfully reflects the sustainability of our operating performance.

|

|

•

|

Litigation recoveries or charges, net

are excluded because they often relate to events that may have occurred in prior or multiple periods, do not occur in or reflect the ordinary course of our business and are inherently unpredictable in timing and amount. Beginning in the third quarter of fiscal 2017, consistent with the presentation of financial results by peer medical device companies, in litigation recoveries or charges, net we began to classify accrued losses and legal fees, net of expected recoveries, related to mass tort product liability claims, including claims for injuries allegedly caused by Cordis OptEase and TrapEase inferior vena cava (IVC) filter products. Such amounts would not have materially affected litigation recoveries or charges, net in prior periods, so have not been reclassified for those periods.

|

|

•

|

Loss on extinguishment of debt

is excluded because it does not typically occur in the normal course of business and may obscure analysis of trends and financial performance. Additionally, the amount and frequency of this type of charge is not consistent and is significantly impacted by the timing and size of debt financing transactions.

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

18

|

|

|

Explanation and Reconciliation of Non-GAAP Financial Measures

|

||

|

19

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Explanation and Reconciliation of Non-GAAP Financial Measures

|

||

|

(in millions, except per common share amounts)

|

Operating Earnings

|

Operating Earnings Growth Rate

|

Earnings Before Income Taxes

|

Provision for Income Taxes

|

Net Earnings

1,2

|

Net Earnings

1,2

Growth Rate

|

Diluted EPS

1,2

|

Diluted EPS

1,2

Growth Rate

|

|||||||||||||

|

Fiscal Year 2017

|

|||||||||||||||||||||

|

GAAP

|

$

|

2,120

|

|

(14

|

)%

|

$

|

1,924

|

|

$

|

630

|

|

$

|

1,288

|

|

(10

|

)%

|

$

|

4.03

|

|

(7

|

)%

|

|

Restructuring and employee severance

|

56

|

|

56

|

|

20

|

|

36

|

|

0.11

|

|

|||||||||||

|

Amortization and other acquisition-related costs

|

527

|

|

527

|

|

165

|

|

362

|

|

1.13

|

|

|||||||||||

|

Impairments and loss on disposal of assets

|

18

|

|

18

|

|

6

|

|

12

|

|

0.04

|

|

|||||||||||

|

Litigation (recoveries)/charges, net

|

48

|

|

48

|

|

19

|

|

29

|

|

0.09

|

|

|||||||||||

|

Non-GAAP

|

$

|

2,769

|

|

(4

|

)%

|

$

|

2,572

|

|

$

|

839

|

|

$

|

1,727

|

|

—

|

%

|

$

|

5.40

|

|

3

|

%

|

|

Fiscal Year 2016

|

|||||||||||||||||||||

|

GAAP

|

$

|

2,459

|

|

14

|

%

|

$

|

2,276

|

|

$

|

845

|

|

$

|

1,427

|

|

18

|

%

|

$

|

4.32

|

|

20

|

%

|

|

Restructuring and employee severance

|

25

|

|

25

|

|

9

|

|

16

|

|

0.05

|

|

|||||||||||

|

Amortization and other acquisition-related costs

|

459

|

|

459

|

|

143

|

|

316

|

|

0.96

|

|

|||||||||||

|

Impairments and loss on disposal of assets

|

21

|

|

21

|

|

6

|

|

15

|

|

0.04

|

|

|||||||||||

|

Litigation (recoveries)/charges, net

|

(69

|

)

|

(69

|

)

|

(27

|

)

|

(42

|

)

|

(0.13

|

)

|

|||||||||||

|

Non-GAAP

|

$

|

2,895

|

|

17

|

%

|

$

|

2,711

|

|

$

|

976

|

|

$

|

1,732

|

|

18

|

%

|

$

|

5.24

|

|

20

|

%

|

|

Fiscal Year 2015

|

|||||||||||||||||||||

|

GAAP

|

$

|

2,161

|

|

15

|

%

|

$

|

1,967

|

|

$

|

755

|

|

$

|

1,212

|

|

4

|

%

|

$

|

3.61

|

|

7

|

%

|

|

Restructuring and employee severance

|

44

|

|

44

|

|

15

|

|

29

|

|

0.09

|

|

|||||||||||

|

Amortization and other acquisition-related costs

|

281

|

|

281

|

|

100

|

|

181

|

|

0.54

|

|

|||||||||||

|

Impairments and (gain)/loss on disposal of assets

|

(19

|

)

|

(19

|

)

|

(10

|

)

|

(9

|

)

|

(0.03

|

)

|

|||||||||||

|

Litigation (recoveries)/charges, net

|

5

|

|

5

|

|

(14

|

)

|

19

|

|

0.06

|

|

|||||||||||

|

Loss on extinguishment of debt

|

—

|

|

60

|

|

23

|

|

37

|

|

0.11

|

|

|||||||||||

|

Non-GAAP

|

$

|

2,472

|

|

16

|

%

|

$

|

2,339

|

|

$

|

870

|

|

$

|

1,469

|

|

11

|

%

|

$

|

4.38

|

|

14

|

%

|

|

Fiscal Year 2014

|

|||||||||||||||||||||

|

GAAP

|

$

|

1,885

|

|

89

|

%

|

$

|

1,798

|

|

$

|

635

|

|

$

|

1,163

|

|

247

|

%

|

$

|

3.37

|

|

247

|

%

|

|

Restructuring and employee severance

|

31

|

|

31

|

|

11

|

|

20

|

|

0.06

|

|

|||||||||||

|

Amortization and other acquisition-related costs

|

223

|

|

223

|

|

79

|

|

144

|

|

0.42

|

|

|||||||||||

|

Impairments and (gain)/loss on disposal of assets

|

15

|

|

15

|

|

5

|

|

10

|

|

0.03

|

|

|||||||||||

|

Litigation (recoveries)/charges, net

|

(21

|

)

|

(21

|

)

|

(8

|

)

|

(13

|

)

|

(0.04

|

)

|

|||||||||||

|

Non-GAAP

|

$

|

2,133

|

|

4

|

%

|

$

|

2,047

|

|

$

|

722

|

|

$

|

1,324

|

|

3

|

%

|

$

|

3.84

|

|

3

|

%

|

|

Fiscal Year 2013

|

|||||||||||||||||||||

|

GAAP

|

$

|

996

|

|

(44

|

)%

|

$

|

888

|

|

$

|

553

|

|

$

|

335

|

|

(69

|

)%

|

$

|

0.97

|

|

(68

|

)%

|

|

Restructuring and employee severance

|

71

|

|

71

|

|

27

|

|

44

|

|

0.13

|

|

|||||||||||

|

Amortization and other acquisition-related costs

|

158

|

|

158

|

|

52

|

|

106

|

|

0.31

|

|

|||||||||||

|

Impairments and (gain)/loss on disposal of assets

|

859

|

|

859

|

|

37

|

|

822

|

|

2.39

|

|

|||||||||||

|

Litigation (recoveries)/charges, net

|

(38

|

)

|

(38

|

)

|

(15

|

)

|

(23

|

)

|

(0.07

|

)

|

|||||||||||

|

Non-GAAP

|

$

|

2,046

|

|

10

|

%

|

$

|

1,938

|

|

$

|

654

|

|

$

|

1,284

|

|

15

|

%

|

$

|

3.73

|

|

16

|

%

|

|

1

|

from continuing operations

|

|

2

|

attributable to Cardinal Health, Inc.

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

20

|

|

|

Selected Financial Data

|

||

|

(in millions, except per common share amounts)

|

2017

|

2016

|

2015

|

2014

|

2013 (1)

|

||||||||||||||

|

Earnings Data:

|

|||||||||||||||||||

|

Revenue

|

$

|

129,976

|

|

$

|

121,546

|

|

$

|

102,531

|

|

$

|

91,084

|

|

$

|

101,093

|

|

||||

|

Operating earnings

|

2,120

|

|

2,459

|

|

2,161

|

|

1,885

|

|

996

|

|

|||||||||

|

Earnings from continuing operations

|

1,294

|

|

1,431

|

|

1,212

|

|

1,163

|

|

335

|

|

|||||||||

|

Earnings/(loss) from discontinued operations, net of tax

|

—

|

|

—

|

|

3

|

|

3

|

|

(1

|

)

|

|||||||||

|

Net earnings

|

1,294

|

|

1,431

|

|

1,215

|

|

1,166

|

|

334

|

|

|||||||||

|

Less: Net earnings attributable to noncontrolling interests

|

(6

|

)

|

(4

|

)

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Net earnings attributable to Cardinal Health, Inc.

|

$

|

1,288

|

|

$

|

1,427

|

|

$

|

1,215

|

|

$

|

1,166

|

|

$

|

334

|

|

||||

|

Basic earnings per common share attributable to Cardinal Health, Inc.:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

4.06

|

|

$

|

4.36

|

|

$

|

3.65

|

|

$

|

3.41

|

|

$

|

0.98

|

|

||||

|

Discontinued operations

|

—

|

|

—

|

|

0.01

|

|

0.01

|

|

—

|

|

|||||||||

|

Net basic earnings per common share attributable to Cardinal Health, Inc.

|

$

|

4.06

|

|

$

|

4.36

|

|

$

|

3.66

|

|

$

|

3.42

|

|

$

|

0.98

|

|

||||

|

Diluted earnings per common share attributable to Cardinal Health, Inc.:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

4.03

|

|

$

|

4.32

|

|

$

|

3.61

|

|

$

|

3.37

|

|

$

|

0.97

|

|

||||

|

Discontinued operations

|

—

|

|

—

|

|

0.01

|

|

0.01

|

|

—

|

|

|||||||||

|

Net diluted earnings per common share attributable to Cardinal Health, Inc.

|

$

|

4.03

|

|

$

|

4.32

|

|

$

|

3.62

|

|

$

|

3.38

|

|

$

|

0.97

|

|

||||

|

Cash dividends declared per common share

|

$

|

1.8091

|

|

$

|

1.6099

|

|

$

|

1.4145

|

|

$

|

1.2500

|

|

$

|

1.0900

|

|

||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Total assets

|

$

|

40,112

|

|

$

|

34,122

|

|

$

|

30,142

|

|

$

|

26,033

|

|

$

|

25,819

|

|

||||

|

Long-term obligations, less current portion

|

9,068

|

|

4,952

|

|

5,211

|

|

3,171

|

|

3,686

|

|

|||||||||

|

Total Cardinal Health, Inc. shareholders' equity

|

6,808

|

|

6,554

|

|

6,256

|

|

6,401

|

|

5,975

|

|

|||||||||

|

(1)

|

During fiscal 2013, we recognized a non-cash goodwill impairment charge of $829 million ($799 million, net of tax) related to our Nuclear Pharmacy Services division.

|

|

21

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Disclosures about Market Risk

|

|

|

June 30

|

|||||||

|

(in millions)

|

2017 (1)

|

2016

|

|||||

|

Net hypothetical transactional exposure

|

$

|

638

|

|

$

|

621

|

|

|

|

Sensitivity gain/loss

|

$

|

64

|

|

$

|

62

|

|

|

|

Estimated offsetting impact of hedges

|

(16

|

)

|

(18

|

)

|

|||

|

Hypothetical

net gain/loss

|

$

|

48

|

|

$

|

44

|

|

|

|

(1)

|

This analysis excludes exposures that may be added as a result of acquisitions that have not yet closed as of June 30, 2017.

|

|

June 30

|

|||||||

|

(in millions)

|

2017 (1)

|

2016

|

|||||

|

Net hypothetical translational exposure

|

$

|

199

|

|

$

|

201

|

|

|

|

Sensitivity gain/loss

|

20

|

|

20

|

|

|||

|

(1)

|

This analysis excludes exposures that may be added as a result of acquisitions that have not yet closed as of June 30, 2017.

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

22

|

|

|

Disclosures about Market Risk

|

|

|

June 30

|

|||||||

|

(in millions)

|

2017 (1)

|

2016

|

|||||

|

Hypothetical commodity exposure

|

$

|

411

|

|

$

|

417

|

|

|

|

Sensitivity gain/loss

|

$

|

41

|

|

$

|

42

|

|

|

|

Hypothetical offsetting impact of hedges

|

(1

|

)

|

(1

|

)

|

|||

|

Hypothetical net gain/loss

|

$

|

40

|

|

$

|

41

|

|

|

|

(1)

|

This analysis excludes exposures that may be added as a result of acquisitions that have not yet closed as of June 30, 2017.

|

|

23

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Business

|

||

|

•

|

distributes branded and generic pharmaceutical and over-the-counter healthcare and consumer products through its Pharmaceutical Distribution division to retailers (including chain and independent drug stores and pharmacy departments of supermarkets and mass merchandisers), hospitals and other healthcare providers. This division:

|

|

•

|

maintains prime vendor relationships that streamline the purchasing process resulting in greater efficiency and lower costs for our retail, hospital and other healthcare provider customers;

|

|

•

|

provides services to pharmaceutical manufacturers, including distribution, inventory management, data reporting, new product launch support and chargeback administration;

|

|

•

|

provides pharmacy management services to hospitals as well as medication therapy management and patient outcomes services to hospitals, other healthcare providers and payers, and operates pharmacies in community health centers; and

|

|

•

|

repackages generic pharmaceuticals and over-the-counter healthcare products;

|

|

•

|

distributes specialty pharmaceutical products to hospitals and other healthcare providers; provides consulting, patient support and other services for specialty pharmaceutical products to pharmaceutical manufacturers and healthcare providers; and provides specialty pharmacy services through its Specialty Solutions division; and

|

|

•

|

operates nuclear pharmacies and manufacturing facilities through its Nuclear Pharmacy Services division, which manufactures, prepares and delivers radiopharmaceuticals for use in nuclear imaging and other procedures in hospitals and physician offices. During fiscal 2017, this division also began operating a facility to contract manufacture a radiopharmaceutical treatment (Xofigo) and acquired the North American rights to Lymphoseek, a radiopharmaceutical diagnostic imaging agent.

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

24

|

|

|

Business

|

||

|

Date

|

Company

|

Location

|

Lines

of Business

|

Acquisition

Price

(in millions)

|

|

|

10/15

|

Cordis business of Johnson & Johnson

|

Fremont, CA

|

Cardiovascular and endovascular products

|

$1,944

|

|

|

07/15

|

The Harvard Drug Group

|

Livonia, MI

|

Pharmaceutical product distribution

|

$1,115

|

|

|

03/13

|

AssuraMed, Inc.

|

Twinsburg, OH

|

Medical product distribution to patients' homes

|

$2,070

|

|

|

25

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Business

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

26

|

|

|

Business

|

||

|

•

|

the U.S. Drug Enforcement Administration (the “DEA”);

|

|

•

|

state controlled substance authorities and boards of pharmacy;

|

|

•

|

certain agencies within the U.S. Department of Health and Human Services, including the U.S. Food and Drug Administration (the “FDA”), the Centers for Medicare and Medicaid Services, the Office of Inspector General and the Office for Civil Rights;

|

|

•

|

state health departments, insurance departments, Medicaid departments or other comparable state agencies;

|

|

•

|

the U.S. Nuclear Regulatory Commission (the “NRC”);

|

|

•

|

the U.S. Federal Trade Commission (the "FTC");

|

|

•

|

U.S. Customs and Border Protection; and

|

|

•

|

agencies comparable to those listed above in markets outside the United States.

|

|

27

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Business

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

28

|

|

|

Business

|

||

|

29

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Risk Factors

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

30

|

|

|

Risk Factors

|

||

|

•

|

facilitate the purchase and distribution of inventory items from numerous distribution centers;

|

|

31

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Risk Factors

|

||

|

•

|

receive, process and ship orders on a timely basis;

|

|

•

|

manage accurate billing and collections for thousands of customers;

|

|

•

|

process payments to suppliers;

|

|

•

|

facilitate manufacturing and assembly of medical products; and

|

|

•

|

generate financial information.

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

32

|

|

|

Risk Factors

|

||

|

33

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Properties and Legal Proceedings

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

34

|

|

|

Market for Registrant's Common Equity

|

||

|

High

|

Low

|

Dividends Declared

|

|||||||||

|

Fiscal 2016

|

|||||||||||

|

Quarter Ended:

|

|||||||||||

|

September 30, 2015

|

$

|

87.02

|

|

$

|

76.72

|

|

$

|

0.3870

|

|

||

|

December 31, 2015

|

90.85

|

|

77.12

|

|

0.3870

|

|

|||||

|

March 31, 2016

|

89.68

|

|

76.16

|

|

0.3870

|

|

|||||

|

June 30, 2016

|

87.20

|

|

73.69

|

|

0.4489

|

|

|||||

|

Fiscal 2017

|

|||||||||||

|

Quarter Ended:

|

|||||||||||

|

September 30, 2016

|

$

|

84.92

|

|

$

|

75.26

|

|

$

|

0.4489

|

|

||

|

December 31, 2016

|

76.71

|

|

65.17

|

|

0.4489

|

|

|||||

|

March 31, 2017

|

83.80

|

|

72.47

|

|

0.4489

|

|

|||||

|

June 30, 2017

|

82.71

|

|

71.18

|

|

0.4624

|

|

|||||

|

Fiscal 2018

|

$

|

78.69

|

|

$

|

76.29

|

|

$

|

—

|

|

||

|

Period

|

Total Number

of Shares Purchased (1) |

Average Price Paid per Share

|

Total Number of Shares

Purchased as Part of Publicly Announced Programs (2) |

Approximate

Dollar Value of

Shares That May

Yet be Purchased

Under the Programs (2)

(in millions)

|

|||||||||

|

April 2017

|

104

|

|

$

|

72.21

|

|

—

|

|

$

|

443

|

|

|||

|

May 2017

|

104

|

|

72.33

|

|

—

|

|

443

|

|

|||||

|

June 2017

|

104

|

|

75.55

|

|

—

|

|

443

|

|

|||||

|

Total

|

312

|

|

$

|

73.36

|

|

—

|

|

$

|

443

|

|

|||

|

(1)

|

Reflects

104

,

104

and

104

common shares purchased in April, May and June

2017

, respectively, through a rabbi trust as investments of participants in our Deferred Compensation Plan.

|

|

(2)

|

On May 4, 2016, our Board of Directors approved a $1.0 billion share repurchase program that expires on December 31, 2019. During the three months ended

June 30, 2017

, we repurchased

no

common shares under this program. We have

$443 million

available under this program.

|

|

35

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Market for Registrant's Common Equity

|

||

|

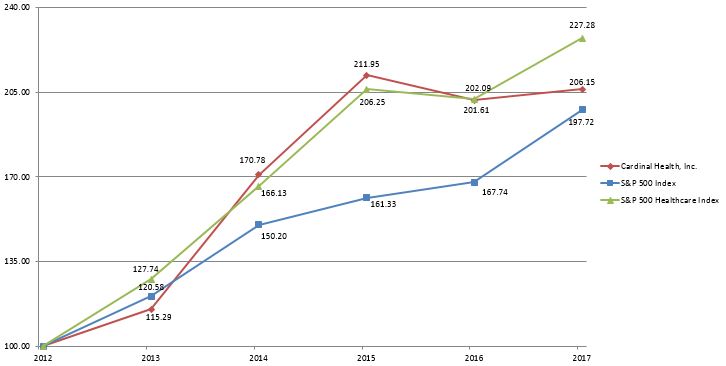

June 30

|

||||||||||||||||||

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

|||||||||||||

|

Cardinal Health, Inc.

|

$

|

100.00

|

|

$

|

115.29

|

|

$

|

170.78

|

|

$

|

211.95

|

|

$

|

201.61

|

|

$

|

206.15

|

|

|

S&P 500 Index

|

100.00

|

|

120.58

|

|

150.20

|

|

161.33

|

|

167.74

|

|

197.72

|

|

||||||

|

S&P 500 Healthcare Index

|

100.00

|

|

127.74

|

|

166.13

|

|

206.25

|

|

202.09

|

|

227.28

|

|

||||||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

36

|

|

|

Reports

|

||

|

37

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Reports

|

||

|

/s/ Ernst & Young LLP

|

|

Columbus, Ohio

|

|

August 10, 2017

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

38

|

|

|

Reports

|

||

|

/s/ Ernst & Young LLP

|

|

Columbus, Ohio

|

|

August 10, 2017

|

|

39

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Financial Statements

|

||

|

Page

|

|

|

Consolidated Financial Statements and Schedule:

|

|

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

40

|

|

|

Financial Statements

|

||

|

(in millions, except per common share amounts)

|

2017

|

2016

|

2015

|

||||||||

|

Revenue

|

$

|

129,976

|

|

$

|

121,546

|

|

$

|

102,531

|

|

||

|

Cost of products sold

|

123,432

|

|

115,003

|

|

96,819

|

|

|||||

|

Gross margin

|

6,544

|

|

6,543

|

|

5,712

|

|

|||||

|

Operating expenses:

|

|||||||||||

|

Distribution, selling, general and administrative expenses

|

3,775

|

|

3,648

|

|

3,240

|

|

|||||

|

Restructuring and employee severance

|

56

|

|

25

|

|

44

|

|

|||||

|

Amortization and other acquisition-related costs

|

527

|

|

459

|

|

281

|

|

|||||

|

Impairments and (gain)/loss on disposal of assets, net

|

18

|

|

21

|

|

(19

|

)

|

|||||

|

Litigation (recoveries)/charges, net

|

48

|

|

(69

|

)

|

5

|

|

|||||

|

Operating earnings

|

2,120

|

|

2,459

|

|

2,161

|

|

|||||

|

Other (income)/expense, net

|

(5

|

)

|

5

|

|

(7

|

)

|

|||||

|

Interest expense, net

|

201

|

|

178

|

|

141

|

|

|||||

|

Loss on extinguishment of debt

|

—

|

|

—

|

|

60

|

|

|||||

|

Earnings from continuing operations before income taxes

|

1,924

|

|

2,276

|

|

1,967

|

|

|||||

|

Provision for income taxes

|

630

|

|

845

|

|

755

|

|

|||||

|

Earnings from continuing operations

|

1,294

|

|

1,431

|

|

1,212

|

|

|||||

|

Earnings from discontinued operations, net of tax

|

—

|

|

—

|

|

3

|

|

|||||

|

Net earnings

|

1,294

|

|

1,431

|

|

1,215

|

|

|||||

|

Less: Net earnings attributable to noncontrolling interests

|

(6

|

)

|

(4

|

)

|

—

|

|

|||||

|

Net earnings attributable to Cardinal Health, Inc.

|

$

|

1,288

|

|

$

|

1,427

|

|

$

|

1,215

|

|

||

|

Basic earnings per common share attributable to Cardinal Health, Inc.:

|

|||||||||||

|

Continuing operations

|

$

|

4.06

|

|

$

|

4.36

|

|

$

|

3.65

|

|

||

|

Discontinued operations

|

—

|

|

—

|

|

0.01

|

|

|||||

|

Net basic earnings per common share attributable to Cardinal Health, Inc.

|

$

|

4.06

|

|

$

|

4.36

|

|

$

|

3.66

|

|

||

|

Diluted earnings per common share attributable to Cardinal Health, Inc.:

|

|||||||||||

|

Continuing operations

|

$

|

4.03

|

|

$

|

4.32

|

|

$

|

3.61

|

|

||

|

Discontinued operations

|

—

|

|

—

|

|

0.01

|

|

|||||

|

Net diluted earnings per common share attributable to Cardinal Health, Inc.

|

$

|

4.03

|

|

$

|

4.32

|

|

$

|

3.62

|

|

||

|

Weighted-average number of common shares outstanding:

|

|||||||||||

|

Basic

|

317

|

|

327

|

|

332

|

|

|||||

|

Diluted

|

320

|

|

330

|

|

335

|

|

|||||

|

41

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Financial Statements

|

||

|

(in millions)

|

2017

|

2016

|

2015

|

||||||||

|

Net earnings

|

$

|

1,294

|

|

$

|

1,431

|

|

$

|

1,215

|

|

||

|

Other comprehensive income/(loss):

|

|||||||||||

|

Foreign currency translation adjustments and other

|

(25

|

)

|

(82

|

)

|

(104

|

)

|

|||||

|

Net unrealized gain/(loss) on derivative instruments, net of tax

|

16

|

|

(11

|

)

|

11

|

|

|||||

|

Total other comprehensive loss, net of tax

|

(9

|

)

|

(93

|

)

|

(93

|

)

|

|||||

|

Total comprehensive income

|

1,285

|

|

1,338

|

|

1,122

|

|

|||||

|

Less: comprehensive income attributable to noncontrolling interests

|

(6

|

)

|

(4

|

)

|

—

|

|

|||||

|

Total comprehensive income attributable to Cardinal Health, Inc.

|

$

|

1,279

|

|

$

|

1,334

|

|

$

|

1,122

|

|

||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

42

|

|

|

Financial Statements

|

||

|

June 30

|

|||||||

|

(in millions)

|

2017

|

2016

|

|||||

|

Assets

|

|||||||

|

Current assets:

|

|||||||

|

Cash and equivalents

|

$

|

6,879

|

|

$

|

2,356

|

|

|

|

Trade receivables, net

|

8,048

|

|

7,405

|

|

|||

|

Inventories, net

|

11,301

|

|

10,615

|

|

|||

|

Prepaid expenses and other

|

2,117

|

|

1,580

|

|

|||

|

Total current assets

|

28,345

|

|

21,956

|

|

|||

|

Property and equipment, net

|

1,879

|

|

1,796

|

|

|||

|

Goodwill and other intangibles, net

|

9,207

|

|

9,426

|

|

|||

|

Other assets

|

681

|

|

944

|

|

|||

|

Total assets

|

$

|

40,112

|

|

$

|

34,122

|

|

|

|

Liabilities, Redeemable Noncontrolling Interests and Shareholders’ Equity

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

17,906

|

|

$

|

17,306

|

|

|

|

Current portion of long-term obligations and other short-term borrowings

|

1,327

|

|

587

|

|

|||

|

Other accrued liabilities

|

1,988

|

|

1,808

|

|

|||

|

Total current liabilities

|

21,221

|

|

19,701

|

|

|||

|

Long-term obligations, less current portion

|

9,068

|

|

4,952

|

|

|||

|

Deferred income taxes and other liabilities

|

2,877

|

|

2,781

|

|

|||

|

Redeemable noncontrolling interests

|

118

|

|

117

|

|

|||

|

Shareholders’ equity:

|

|||||||

|

Preferred shares, without par value:

|

|||||||

|

Authorized—

500 thousand

shares, Issued—

none

|

—

|

|

—

|

|

|||

|

Common shares, without par value:

|

|||||||

|

Authorized—

755 million

shares, Issued—

327 million

shares and 364 million shares at

June 30, 2017

and 2016, respectively

|

2,697

|

|

3,010

|

|

|||

|

Retained earnings

|

4,967

|

|

6,419

|

|

|||

|

Common shares in treasury, at cost:

11 million

shares and 42 million shares at

June 30, 2017

and 2016, respectively

|

(731

|

)

|

(2,759

|

)

|

|||

|

Accumulated other comprehensive loss

|

(125

|

)

|

(116

|

)

|

|||

|

Total Cardinal Health, Inc. shareholders' equity

|

6,808

|

|

6,554

|

|

|||

|

Noncontrolling interests

|

20

|

|

17

|

|

|||

|

Total shareholders’ equity

|

6,828

|

|

6,571

|

|

|||

|

Total liabilities, redeemable noncontrolling interests and shareholders’ equity

|

$

|

40,112

|

|

$

|

34,122

|

|

|

|

43

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

|

|

Financial Statements

|

||

|

Common Shares

|

Treasury Shares

|

Accumulated Other

Comprehensive Income/(Loss) |

Noncontrolling Interests

|

Total

Shareholders’ Equity |

|||||||||||||||||||||||||

|

(in millions)

|

Shares Issued

|

Amount

|

Retained

Earnings |

Shares

|

Amount

|

||||||||||||||||||||||||

|

Balance at June 30, 2014

|

364

|

|

$

|

2,980

|

|

$

|

4,774

|

|

(27

|

)

|

$

|

(1,423

|

)

|

$

|

70

|

|

$

|

—

|

|

$

|

6,401

|

|

|||||||

|

Net earnings

|

1,215

|

|

1,215

|

|

|||||||||||||||||||||||||

|

Other comprehensive loss, net of tax

|

(93

|

)

|

(93

|

)

|

|||||||||||||||||||||||||

|

Employee stock plans activity, including tax impact of $52 million

|

—

|

|

23

|

|

4

|

|

214

|

|

237

|

|

|||||||||||||||||||

|

Treasury shares acquired

|

(13

|

)

|

(1,036

|

)

|

(1,036

|

)

|

|||||||||||||||||||||||

|

Dividends declared

|

(471

|

)

|

(471

|

)

|

|||||||||||||||||||||||||

|

Other

|

3

|

|

3

|

|

|||||||||||||||||||||||||

|

Balance at June 30, 2015

|

364

|

|

3,003

|

|

5,521

|

|

(36

|

)

|

(2,245

|

)

|

(23

|

)

|

—

|

|

6,256

|

|

|||||||||||||

|

Net earnings

|

1,427

|

|

3

|

|

1,430

|

|

|||||||||||||||||||||||

|

Other comprehensive loss, net of tax

|

(93

|

)

|

(93

|

)

|

|||||||||||||||||||||||||

|

Purchase of noncontrolling interests

|

(7

|

)

|

(7

|

)

|

|||||||||||||||||||||||||

|

Employee stock plans activity, including tax benefit of $33 million

|

—

|

|

7

|

|

2

|

|

137

|

|

144

|

|

|||||||||||||||||||

|

Treasury shares acquired

|

(8

|

)

|

(651

|

)

|

(651

|

)

|

|||||||||||||||||||||||

|

Dividends declared

|

(529

|

)

|

(529

|

)

|

|||||||||||||||||||||||||

|

Other

|

—

|

|

21

|

|

21

|

|

|||||||||||||||||||||||

|

Balance at June 30, 2016

|

364

|

|

3,010

|

|

6,419

|

|

(42

|

)

|

(2,759

|

)

|

(116

|

)

|

17

|

|

6,571

|

|

|||||||||||||

|

Net earnings

|

1,288

|

|

2

|

|

1,290

|

|

|||||||||||||||||||||||

|

Other comprehensive loss, net of tax

|

(9

|

)

|

(9

|

)

|

|||||||||||||||||||||||||

|

Purchase of noncontrolling interests

|

(1

|

)

|

(1

|

)

|

|||||||||||||||||||||||||

|

Employee stock plans activity, including tax benefit of $34 million

|

—

|

|

(11

|

)

|

2

|

|

167

|

|

156

|

|

|||||||||||||||||||

|

Treasury shares acquired

|

(8

|

)

|

(600

|

)

|

(600

|

)

|

|||||||||||||||||||||||

|

Dividends declared

|

(580

|

)

|

(580

|

)

|

|||||||||||||||||||||||||

|

Other

|

(1

|

)

|

2

|

|

1

|

|

|||||||||||||||||||||||

|

Retirement of Treasury Shares

|

(37

|

)

|

(302

|

)

|

(2,159

|

)

|

37

|

|

2,461

|

|

—

|

|

|||||||||||||||||

|

Balance at June 30, 2017

|

327

|

|

$

|

2,697

|

|

$

|

4,967

|

|

(11

|

)

|

$

|

(731

|

)

|

$

|

(125

|

)

|

$

|

20

|

|

$

|

6,828

|

|

|||||||

|

Cardinal Health

|

Fiscal 2017 Form 10-K

|

44

|

|

|

Financial Statements

|

||

|

(in millions)

|

2017

|

2016

|

2015

|

||||||||

|

Cash flows from operating activities:

|

|||||||||||

|

Net earnings

|

$

|

1,294

|

|

$

|

1,431

|

|

$

|

1,215

|

|

||

|

Earnings from discontinued operations, net of tax

|

—

|

|

—

|

|

(3

|

)

|

|||||

|

Earnings from continuing operations

|

1,294

|

|

1,431

|

|

1,212

|

|

|||||

|

Adjustments to reconcile earnings from continuing operations to net cash provided by operating activities:

|

|||||||||||

|

Depreciation and amortization

|

717

|

|

641

|

|

451

|

|

|||||

|

Loss on extinguishment of debt

|

—

|

|

—

|

|

60

|

|

|||||

|

(Gain)/Loss on sale of other investments

|

4

|

|

—

|

|

(5

|

)

|

|||||

|

Impairments and (gain)/loss on disposal of assets, net

|

18

|

|

21

|

|

(19

|

)

|

|||||

|

Share-based compensation

|

96

|

|

111

|

|

110

|

|

|||||

|

Provision for deferred income taxes

|

291

|

|

87

|

|

219

|

|

|||||

|

Provision for bad debts

|

63

|

|

73

|

|

52

|

|

|||||

|

Change in fair value of contingent consideration obligation

|

(5

|

)

|

(16

|

)

|

8

|

|

|||||

|

Change in operating assets and liabilities, net of effects from acquisitions:

|

|

||||||||||

|

Increase in trade receivables

|

(665

|

)

|

(866

|

)

|

(870

|

)

|

|||||

|

Increase in inventories

|

(673

|

)

|

(1,179

|

)

|

(779

|

)

|

|||||

|

Increase in accounts payable

|

564

|

|

2,815

|

|

1,948

|

|

|||||

|

Other accrued liabilities and operating items, net

|

(520

|

)

|

(147

|

)

|

153

|

|

|||||

|

Net cash provided by operating activities

|

1,184

|

|

2,971

|

|

2,540

|

|

|||||

|

Cash flows from investing activities:

|

|||||||||||

|

Acquisition of subsidiaries, net of cash acquired

|

(132

|

)

|

(3,614

|

)

|

(503

|

)

|

|||||

|

Additions to property and equipment

|

(387

|

)

|

(465

|

)

|

(300

|

)

|

|||||

|

Purchase of available-for-sale securities and other investments

|

(194

|

)

|

(200

|

)

|

(342

|

)

|

|||||

|

Proceeds from sale of available-for-sale securities and other investments

|

228

|

|

136

|

|

206

|

|

|||||

|

Proceeds from maturities of available-for-sale securities

|

77

|

|

50

|

|

37

|

|

|||||

|

Proceeds from divestitures and disposal of property and equipment and held for sale assets

|

3

|

|

13

|

|

53

|

|

|||||

|

Net cash used in investing activities

|

(405

|

)

|

(4,080

|

)

|

(849

|

)

|

|||||

|

Cash flows from financing activities:

|

|||||||||||

|

Payment of contingent consideration obligation

|

(3

|

)

|

(25

|

)

|

(7

|

)

|

|||||

|

Net change in short-term borrowings

|

3

|

|

26

|

|

(12

|

)

|

|||||

|

Net purchase of noncontrolling interests

|

(12

|

)

|

(10

|

)

|

—

|

|

|||||

|

Reduction of long-term obligations

|

(310

|

)

|

(6

|

)

|

(1,221

|

)

|

|||||

|

Proceeds from interest rate swap terminations

|

14

|

|

—

|

|

—

|

|

|||||

|

Proceeds from long-term obligations, net of issuance costs

|

5,171

|

|

—

|

|

2,672

|

|

|||||

|

Net tax proceeds/(withholding) from share-based compensation

|

26

|

|

6

|

|

72

|

|

|||||

|

Excess tax benefits from share-based compensation

|

34

|

|

33

|

|

52

|

|

|||||

|

Dividends on common shares

|

(577

|

)

|

(512

|

)

|

(460

|

)

|

|||||

|

Purchase of treasury shares

|

(600

|

)

|

(651

|

)

|

(1,036

|

)

|

|||||

|

Net cash provided by/(used in) financing activities

|

3,746

|

|

(1,139

|

)

|

60

|

|

|||||

|

Effect of exchange rates changes on cash and equivalents

|

(2

|

)

|

(12

|

)

|

—

|

|

|||||

|

Net increase/(decrease) in cash and equivalents

|

4,523

|

|

(2,260

|

)

|

1,751

|

|

|||||

|

Cash and equivalents at beginning of period

|

2,356

|

|

4,616

|

|

2,865

|

|

|||||

|

Cash and equivalents at end of period

|

$

|

6,879

|

|

$

|

2,356

|

|