| |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| R |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

☐

Large Accelerated filer

|

☐

Accelerated filer

|

T

Non-accelerated filer

|

|

T

US GAAP

|

☐

International Financial Reporting

Standards as issued by the International Accounting Standards Board |

☐

Other

|

|

Page

|

|||

| PART I | |||

|

4

|

|||

|

4

|

|||

|

4

|

|||

|

A.

|

Selected financial data

|

4

|

|

|

B.

|

Capitalization and indebtedness

|

6

|

|

|

C.

|

Reasons for the offer and use of proceeds

|

6

|

|

|

D.

|

Risk factors

|

6

|

|

|

41

|

|||

|

A.

|

History and Development of the Company

|

41

|

|

|

B.

|

Business Overview

|

42

|

|

|

C.

|

Organizational Structure

|

68

|

|

|

D.

|

Property, Plants and Equipment

|

68

|

|

|

68

|

|||

|

68

|

|||

|

A.

|

Operating Results

|

71

|

|

|

B.

|

Liquidity and Capital Resources

|

77

|

|

|

C.

|

Research and development, patents and licenses, etc.

|

85

|

|

|

D.

|

Trend Information

|

85

|

|

|

E.

|

Off-balance Sheet Arrangements

|

85

|

|

|

F.

|

Tabular Disclosure of Contractual Obligations.

|

85

|

|

|

86

|

|||

|

A.

|

Directors and senior management

|

86

|

|

|

B.

|

Compensation

|

90

|

|

|

C.

|

Board Practices

|

94

|

|

|

D.

|

Employees

|

110

|

|

|

E.

|

Share Ownership

|

110

|

|

|

115

|

|||

|

A.

|

Major shareholders

|

115

|

|

|

B.

|

Related party transactions

|

117

|

|

|

C.

|

Interests of experts and counsel

|

121

|

|

|

121

|

|||

|

A.

|

Statements and Other Financial Information

|

121

|

|

|

B.

|

Significant Changes

|

121

|

|

|

122

|

|||

|

A.

|

Offer and listing details

|

122

|

|

|

B.

|

Plan of distribution

|

122

|

|

|

C.

|

Markets

|

122

|

|

|

D.

|

Selling shareholders

|

122

|

|

|

E.

|

Dilution

|

123

|

|

|

F.

|

Expenses of the issue

|

123

|

|

|

123

|

|||

|

A.

|

Share capital

|

123

|

|

|

B.

|

Memorandum and articles of association

|

123

|

|

|

C.

|

Material contracts

|

129

|

|

|

D.

|

Exchange controls

|

129

|

|

|

E.

|

Taxation

|

129

|

|

|

F.

|

Dividends and paying agents

|

142

|

|

|

G.

|

Statement by experts

|

143

|

|

|

H.

|

Documents on display

|

143

|

|

|

I.

|

Subsidiary Information

|

143

|

|

|

143

|

|||

|

144

|

|||

|

PART II

|

|||

|

144

|

|||

|

144

|

|||

|

144

|

|||

|

145

|

|||

|

145

|

|||

|

145

|

|||

|

146

|

|||

|

146

|

|||

|

146

|

|||

|

146

|

|||

|

146

|

|||

|

148

|

|||

|

PART III

|

|||

|

148

|

|||

|

148

|

|||

|

148

|

|||

|

150

|

|||

| • |

our goals, targets and strategies;

|

| • |

the timing and conduct of the clinical trials for our C-Scan system, including statements regarding the timing, progress and results of current and future preclinical studies and clinical trials, and our research and development programs;

|

| • |

timing or likelihood of regulatory filings, approvals and required licenses for our C-Scan system;

|

| • |

our future business development, results of operations and financial condition;

|

| • |

our ability to adequately protect our intellectual property rights and enforce such rights and to avoid violation of the intellectual property rights of others;

|

| • |

our plans to develop, launch and commercialize our C-Scan system and any future products;

|

| • |

the timing, cost or other aspects of the commercial launch of our C-Scan system;

|

| • |

our estimates regarding expenses, future revenues, capital requirements and our need for additional financing and strategic partnerships;

|

| • |

our estimates regarding the market opportunity, clinical utility, potential advantages, and market acceptance of our C-Scan system.

|

| • |

the impact of government laws and regulations;

|

| • |

our ability to recruit and retain qualified clinical, regulatory and research and development personnel;

|

| • |

the availability of reimbursement or other forms of funding for our products from government and commercial payors;

|

| • |

difficulties in maintaining commercial scale manufacturing capacity and capability and our ability to generate growth;

|

| • |

our failure to comply with regulatory guidelines;

|

| • |

uncertainty in industry demand and patient wellness behavior;

|

| • |

general economic conditions and market conditions in the medical device industry;

|

| • |

future sales of large blocks of our securities, which may adversely impact our share price;

|

| • |

depth of the trading market in our securities; and

|

| • |

our expectations regarding the use of proceeds of our initial public offering and the concurrent private placement as well as our August 2016 registered direct offering.

|

|

A.

|

Directors and Senior Management

|

|

B.

|

Advisers

|

|

C.

|

Auditors

|

| A. |

Selected financial data

|

|

|

Year Ended December 31,

|

|||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

|

(US$ in thousands, except per share data)

|

|||||||||||||||||||

|

Operating expenses

(1)

|

||||||||||||||||||||

|

Research and development expenses, net

(2)

|

$

|

5,491

|

$

|

5,837

|

$

|

2,832

|

$

|

2,893

|

$

|

2,377

|

||||||||||

|

General and administrative expenses

|

3,571

|

6,626

|

1,703

|

1,090

|

1,118

|

|||||||||||||||

|

Other income (expenses)

|

-

|

-

|

-

|

11

|

(14

|

)

|

||||||||||||||

|

Operating loss

|

9,062

|

12,463

|

4,535

|

3,972

|

3,509

|

|||||||||||||||

|

Finance income (expenses), net

|

244

|

173

|

3,925

|

604

|

(841

|

)

|

||||||||||||||

|

Loss before income tax

|

8,818

|

12,290

|

610

|

3,368

|

4,350

|

|||||||||||||||

|

Taxes on income

|

8

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Net loss

|

$

|

8,826

|

$

|

12,290

|

$

|

610

|

$

|

3,368

|

$

|

4,350

|

||||||||||

|

Net loss per ordinary share of NIS 0.20 par value, basic and diluted

(3)

|

$

|

0.61

|

$

|

1.06

|

$

|

1.18

|

$

|

3.27

|

$

|

3.88

|

||||||||||

|

Weighted average number of ordinary shares outstanding – basic and diluted (in thousands)

(3)

|

14,499

|

11,918

|

2,181

|

1,627

|

1,627

|

|||||||||||||||

|

|

As of December 31,

|

|||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

|

(US$ in thousands, except per share data)

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$

|

11,639

|

9,392

|

1,075

|

4,975

|

4,579

|

||||||||||||||

|

Working capital

(4)

|

$

|

10,514

|

$

|

12,856

|

$

|

(1,622

|

)

|

$

|

4,134

|

$

|

7,931

|

|||||||||

|

Total assets

|

12,295

|

15,298

|

2,985

|

5,374

|

8,975

|

|||||||||||||||

|

Capital stock

|

53,348

|

46,763

|

20,999

|

20,687

|

20,631

|

|||||||||||||||

|

Total shareholders’ equity (deficiency)

|

$

|

10,407

|

$

|

12,648

|

$

|

(826

|

)

|

$

|

(528

|

)

|

$

|

2,782

|

||||||||

| (1) |

Includes share-based compensation expense in the total amount of $1.2 million, $3.7 million, $312,000, $56,000 and 31,000 for the years ended December 31, 2016, 2015, 2014, 2013 and 2012, respectively. For additional information, see Item 5B “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Application of Critical Accounting Policies and Estimates-Share-based compensation.”

|

| (2) |

Research and development expenses, net is presented net of amount of grants received from the National Authority for Technological Innovation, or NATI, of the Ministry of Economy and Industry, or NATI, (formerly known as the Office of the Chief Scientist of the Ministry of Economy and Industry, or the OCS), and the Israel-United States Binational Industrial Research and Development Foundation, or the BIRD Foundation. The effect of the participation by NATI and the BIRD Foundation totaled $1.1 million, $354,000, $643,000, $148,000 and 1.0 million for the years ended December 31, 2016, 2015, 2014, 2013 and 2012, respectively. See Item 5A “Operating and Financial Review and Prospects—Operating Results - Financial Operations Overview—Research and Development, Expenses, Net” for more information.

|

| (3) |

Basic and diluted loss per ordinary share is computed based on the basic and diluted weighted average number of ordinary shares outstanding during each period. For purposes of these calculations, the following ordinary shares were deemed to be outstanding: (i) 99,774 ordinary shares that were issuable to Mr. Guy Neev upon exercise of options, referred to as the Neev Options, which options were exercised immediately prior to the consummation of our initial public offering on February 24, 2015; (ii) 375,204 ordinary shares that were issuable under warrants that were subject to automatic exercise, for no consideration (unless the holder thereof objected to such exercise), upon the exercise by Mr. Guy Neev of the Neev Options, of which warrants to purchase 195,012

and 653 ordinary shares were exercised during the years ended December 31, 2015 and 2016, respectively;

(iii) since October 14, 2014, 2,658,463 ordinary shares issuable upon the exercise of outstanding warrants with an exercise price of NIS 0.20 per share, of which warrants to purchase 524,818 and 1,557,507ordinary shares were exercised during the years ended December 31, 2016 and 2015, respectively

,

and warrants to purchase 9,091 and 24,277 ordinary shares expired during the years ended December 31, 2016 and 2015, respectively

; and (iv) since August 11, 2016, 2,514,281 ordinary shares issuable upon the exercise of outstanding pre-funded warrants with an exercise price of NIS 0.20 per share, of which pre-funded warrants to purchase 2,224,281 ordinary shares were exercised during the year ended December 31, 2016.

For additional information, see Note 15 to our Consolidated Financial Statements for the year ended December 31, 2016 included elsewhere in this Annual Report.

|

| (4) |

Working capital is defined as total current assets minus total current liabilities.

|

|

B.

|

Capitalization and Indebtedness

|

|

C.

|

Reasons for the Offer and Use of Proceeds

|

|

D.

|

Risk factors

|

| • |

we may not have adequate financial or other resources to complete the development of our product, demonstrate adequate clinical results, attain regulatory approvals and licensures, and begin the commercialization efforts for our C-Scan system;

|

| • |

we may fail to obtain or maintain regulatory approvals and licensures for our C-Scan system in our target markets or may face adverse regulatory or legal actions relating to our system even if regulatory approval is obtained;

|

| • |

we may not demonstrate adequate clinical safety and clinical effectiveness results to support regulatory body approval or market acceptance and adoption;

|

| • |

we may not be able to manufacture our products in commercial quantities, at an adequate quality or at an acceptable cost;

|

| • |

we may not be able to establish adequate sales, marketing and distribution channels;

|

| • |

healthcare professionals and patients may not accept our C-Scan system;

|

| • |

we may not be aware of possible complications from the continued use of our C-Scan system because we have limited clinical experience with respect to the actual use of our C-Scan system;

|

| • |

other technological breakthroughs in CRC screening, treatment and prevention may reduce the demand for our C-Scan system;

|

| • |

changes in the market for CRC screening, new alliances between existing market participants and the entrance of new market participants may interfere with our market penetration efforts;

|

| • |

government and private third-party payors may not agree to provide coding, coverage and payment adequate to reimburse healthcare providers and patients for any or all of the purchase price of our C-Scan system, which may adversely affect healthcare providers’ and patients’ willingness to purchase our C-Scan system;

|

| • |

uncertainty as to market demand may result in inefficient pricing of our C-Scan system;

|

| • |

we may not be able to adequately protect our intellectual property or may face third-party claims of intellectual property infringement; and

|

| • |

we are dependent upon the results of ongoing clinical studies relating to our C-Scan system and the products of our competitors.

|

| • |

market acceptance of a new product, including healthcare professionals’ and patients’ preferences;

|

| • |

market acceptance of the clinical safety and performance of our C-Scan system;

|

| • |

development of similarly cost-effective products by our competitors;

|

| • |

development delays of our C-Scan system;

|

| • |

technological innovations in CRC screening, treatment and prevention;

|

| • |

adverse medical side effects suffered by patients using our C-Scan system, whether actually resulting from the use of our C-Scan system or not;

|

| • |

changes in regulatory policies toward CRC screening or imaging technologies;

|

| • |

changes in regulatory approval, clearance requirements and licensure for our product;

|

| • |

third-party claims of intellectual property infringement;

|

| • |

budget constraints and the availability of reimbursement or insurance coverage from third-party payors for our C-Scan system;

|

| • |

increases in market acceptance of other technologies;

|

| • |

adverse responses from certain of our competitors to the offering of our C-Scan system;

|

| • |

licensure and perceived risk of manufacturing and using a product containing a radioactive source; and

|

| • |

the shelf life of our C-Scan Cap.

|

| • |

there is sufficient long-term clinical and health-economic evidence to convince them to alter their existing screening methods and device recommendations;

|

| • |

there are recommendations from other prominent physicians, educators and/or associations that our C-Scan system is safe and effective;

|

| • |

we obtain favorable data from clinical and health-economic studies for our C-Scan system;

|

| • |

reimbursement or insurance coverage from government and private third-party payors is available;

|

| • |

healthcare professionals obtain required approvals and licensures for the handling, storage, dispensing, and disposal of our C-Scan system; and

|

| • |

healthcare professionals become familiar with the complexities of our C-Scan system.

|

| • |

foreign certification, registration and other regulatory requirements;

|

| • |

customs clearance and shipping delays;

|

| • |

import and export controls;

|

| • |

trade restrictions;

|

| • |

multiple and possibly overlapping tax structures;

|

| • |

difficulty forecasting the results of our international operations and managing our inventory due to our reliance on third-party distributors;

|

| • |

differing laws and regulations, business and clinical practices, licensures, government and private third-party payor reimbursement policies and patient preferences;

|

| • |

differing standards of intellectual property protection among countries;

|

| • |

difficulties in staffing and managing our international operations;

|

| • |

difficulties in penetrating markets in which our competitors’ products are more established;

|

| • |

currency exchange rate fluctuations and foreign currency exchange controls and tax rates; and

|

| • |

political and economic instability, war or acts of terrorism.

|

| • |

we may not be able to demonstrate to FDA’s satisfaction that our products are safe and effective for their intended use;

|

| • |

the data from our pre-clinical studies and clinical trials may be insufficient to support clearance or approval;

|

| • |

in the case of a PMA submission, that the manufacturing process or facilities we use may not meet applicable requirements; and

|

| • |

changes in FDA’s 510(k) clearance, de novo reclassification, or PMA approval processes and policies, or the adoption of new regulations may require additional data.

|

| • |

patients do not enroll in the clinical trial at the rate we expect;

|

| • |

patients do not comply with trial protocols;

|

| • |

patient follow-up is not at the rate we expect;

|

| • |

undetected capsule retention in patients

|

| • |

patients experience adverse side effects, including related to excessive radiation exposure as a result of capsule malfunction or break down;

|

| • |

patient death during a clinical trial, even though their death may be unrelated to our product;

|

| • |

FDA, institutional review boards, or IRBs, or other regulatory authorities do not approve a clinical trial protocol or a clinical trial, or place a clinical trial on hold;

|

| • |

IRBs, Ethics Committees and third-party clinical investigators may delay or reject our trial protocol and Informed Consent Form;

|

| • |

third-party clinical investigators decline to participate in a study or trial or do not perform a study or trial on our anticipated schedule or consistent with the investigator agreements, study or trial protocol, good clinical practices or other FDA or IRBs, Ethics Committees, or any other applicable requirements;

|

| • |

third-party organizations do not perform data collection, monitoring and analysis in a timely or accurate manner or consistent with the study or trial protocol or investigational or statistical plans;

|

| • |

regulatory inspections of our studies, trials or manufacturing facilities may require us to, among other things, undertake corrective action or suspend or terminate our studies or clinical trials;

|

| • |

changes in governmental regulations or administrative actions;

|

| • |

we may not be able to develop our C-Scan system at the rate or to the stage we desire:

|

| • |

the interim or final results of the study or clinical trial are inconclusive or unfavorable as to safety or efficacy;

|

| • |

a regulatory agency or our Notified Body concludes that our trial design is or was inadequate to demonstrate safety and efficacy; and

|

| • |

If we do not continue to retain a permit to employ Jewish employees on Saturdays and Jewish holidays to conduct our clinical trials, as required under the Israeli Hours of Work and Rest Law, 1951, and we are unsuccessful in employing only non-Jewish employees on Jewish rest days and holidays, we may be compelled to cease or halt our clinical trials during Saturdays and Jewish holidays, which could decrease our clinical capacity.

|

| • |

untitled letters, warning letters, fines, injunctions, corporate integrity agreements, consent decrees and civil penalties;

|

| • |

unanticipated expenditures to address or defend such actions;

|

| • |

customer notifications for repair, replacement or refunds;

|

| • |

recall, detention or seizure of our products;

|

| • |

operating restrictions or partial suspension or total shutdown of production;

|

| • |

refusing or delaying our requests for 510(k) clearance or premarket approval of new products or modified products;

|

| • |

operating restrictions;

|

| • |

withdrawing 510(k) clearances on PMA approvals that have already been granted;

|

| • |

suspension or withdrawal of our CE Certificates of Conformity;

|

| • |

refusal to grant export approval for our products; or

|

| • |

criminal prosecution.

|

| • |

pending and future patent applications may not result in the issuance of patents or, if issued, may not be issued in a form that will be advantageous to us;

|

| • |

our issued patents may be challenged, invalidated or legally circumvented by third parties;

|

| • |

our patents may not be upheld as valid and enforceable or prevent the development of competitive products;

|

| • |

the eligibility of certain inventions related to diagnostic medicine, more specifically diagnostic methods and processes, for patent protection in the United States has been limited recently which may affect our ability to enforce our issued patents in the United States or may make it difficult to obtain broad patent protection going forward in the United States;

|

| • |

for a variety of reasons, we may decide not to file for patent protection on various improvements or additional features; and

|

| • |

intellectual property protection and/or enforcement may be unavailable or limited in some countries where laws or law enforcement practices may not protect our proprietary rights to the same extent as the laws of the United States, the European Union, Canada or Israel.

|

| • |

the agreements may be breached, may not provide the scope of protection we believe they provide or may be determined to be unenforceable;

|

| • |

we may have inadequate remedies for any breach;

|

| • |

proprietary information could be disclosed to our competitors; or

|

| • |

others may independently develop substantially equivalent or superior proprietary information and techniques or otherwise gain access to our trade secrets or disclose such technologies.

|

| • |

we may not be able to develop our C-Scan system at the rate or to the stage we desire;

|

| • |

inability to obtain the approvals necessary to commence further clinical trials;

|

| • |

unsatisfactory results of clinical trials;

|

| • |

announcements of regulatory approval or the failure to obtain it, or specific label indications or patient populations for its use, or changes or delays in the regulatory review process;

|

| • |

any intellectual property infringement actions in which we may become involved;

|

| • |

announcements concerning our competitors or the medical device industry in general;

|

| • |

achievement of expected product sales and profitability or our failure to meet expectations;

|

| • |

our commencement of, or involvement in, litigation;

|

| • |

any major changes in our board of directors or management;

|

| • |

legislation in the United States relating to the sale or pricing of medical device;

|

| • |

future substantial sales of our ordinary shares;

|

| • |

changes in earnings estimates or recommendations by securities analysts, if our ordinary shares are covered by analysts; or

|

| • |

the trading volume of our ordinary shares.

|

|

A.

|

History and Development of the Company

|

|

B.

|

Business Overview

|

| • |

eliminating the need for fasting and prior bowel preparation, which would differentiate our system from every other currently available structural screening exam;

|

| • |

providing patients with a procedure that requires them to swallow our C-Scan Cap and small amounts of a contrast agent, thereby minimizing any disruption to their normal activities;

|

| • |

eliminating the need to sedate patients;

|

| • |

obviating the requirement for the insufflation (the forcing of air into the gastrointestinal tract) of patients; and

|

| • |

providing digital reporting, storage and remote consulting capabilities.

|

| • |

obtaining CE marking for the marketing and sale of our C-Scan system in the European Union, followed by obtaining regulatory approvals for the sale of our C-Scan system initially in the United States and Japan;

|

| • |

In Europe and Japan, we intend to offer our C-Scan system as an imaging and screening tool for the general population. In the United States, we may choose to first obtain regulatory clearance/approval for our C-Scan system in a screening sub-population, and after we have conducted more extensive clinical studies in the United States, we would anticipate applying to the FDA for the use of our C-Scan system as a primary screening tool;

|

| • |

obtaining government and private third-party reimbursement for our technology;

|

| • |

improving and enhancing our existing technology portfolio and developing new technologies; and

|

| • |

successfully marketing our product to establish a large customer base.

|

| • |

X-ray Source – Including radioactive material sealed in a cylindrical housing.

|

| • |

Collimator – Radiation shield around the source, which absorbs most of the radiation. Several radial holes enable emission of radiation in defined directions.

|

| • |

X-ray Sensor – Comprised of several solid state X-ray detectors for measuring the scattered radiation intensity.

|

| • |

Tilt Sensor – Indication of capsule motion (3D acceleration).

|

| • |

Rotation Motor – For rotating the collimator and X-ray Source.

|

| • |

Compass sensor – Indication of true north (reference coordinate system).

|

| • |

Source Concealment Mechanism – Conceals the source inside the radiation shield.

|

| • |

R-T – Radio frequency transceiver device to communicate with the receiver.

|

| • |

Batteries – Electrical power supply for the capsule.

|

| • |

Memory – Data storage. The capsule should be able to store up to an hour of measured data.

|

| • |

C-Scan Track Coil – Transmits a continuous electromagnetic filed utilized by an external localization system to track 3D position.

|

| • |

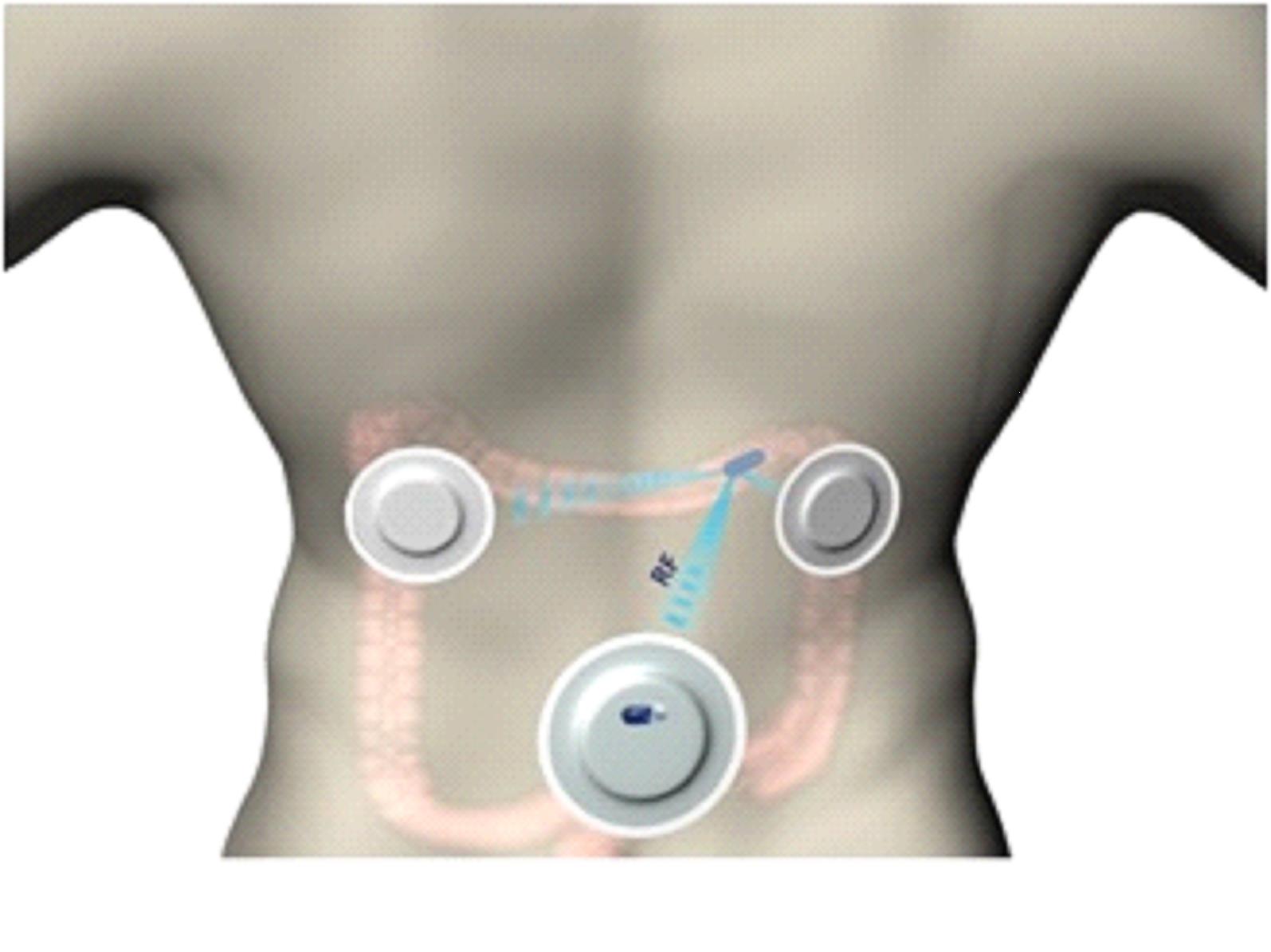

Sticker Housings – Biocompatible and water-resistant stickers and housing integrating all functional components, attached to the patient’s back, enabling five days of continuous operation.

|

| • |

Recorder – Consists of receiver electronics embedded software and nonvolatile memory.

|

| • |

Antennas – Radio frequency antennas are embedded into the sticker housings and used to communicate with the capsule.

|

| • |

Activation/Deactivation Circuit – Used to activate/deactivate the C-Scan Track through a specialized protocol.

|

| • |

UI Indicators – Provides user with vocal, light or vibration indication as required.

|

| • |

PCB – Electronics’ printed circuit boards.

|

| • |

Microcontroller – Runs embedded software, logic that manages the C-Scan Track and SCA.

|

| • |

RF Transceivers – Several transceivers used to communicate with the capsule.

|

| • |

TILT/Compass Sensors – To determine the patient’s body movements.

|

| • |

Batteries – Electrical power supply for the C-Scan Track.

|

| • |

Memory – Non-volatile data storage to store data acquired by the system.

|

| • |

Communication Driver Software – to communicate with the C-Scan Track and retrieve collected data following procedure completion.

|

| • |

Data Processing Software – to process and reconstruct clinical data into a 3D structure.

|

| • |

Data Display and Management Software – includes the following functions:

|

| ○ |

3D visualization of the reconstructed colon surface.

|

| ○ |

Annotation tools.

|

| ○ |

Registration of patient and capsule data and management of the patient database.

|

| ○ |

Report – to enable generation of clinical results report out.

|

| • |

The number of photons hitting the detector per time frame.

|

| • |

The angular spread of the photon beam coming out of the capsule collimator.

|

| • |

our technology has been tested on a limited basis and therefore we cannot assure the product’s clinical value;

|

| • |

we need to receive CE Mark of conformity for the C-Scan system in the European Union and obtain the requisite regulatory approvals in the United States, Japan and other markets where we plan to focus our commercialization efforts;

|

| • |

we need to raise an amount of capital sufficient to complete the development of our technology, obtain the requisite regulatory approvals and commercialize our current and future products;

|

| • |

we need to obtain reimbursement coverage from third-party payors for procedures using our C-Scan system;

|

| • |

we need to increase our manufacturing capabilities; and

|

| • |

we need to establish and expand our user base while competing against other sellers of capsule endoscopy systems as well as other current and future CRC screening technologies and methods.

|

| • |

product design and development;

|

| • |

product testing;

|

| • |

validation and verifications;

|

| • |

product manufacturing;

|

| • |

product labeling;

|

| • |

product storage, shipping and handling;

|

| • |

premarket clearance or approval;

|

| • |

advertising and promotion;

|

| • |

product marketing, sales and distribution; and

|

| • |

post-market surveillance reporting death or serious injuries and medical device reporting.

|

| • |

Class I devices, which are subject to only general controls (

e.g.

, labeling, medical devices reporting, and prohibitions against adulteration and misbranding) and, in some cases, to the 510(k) premarket clearance requirements;

|

| • |

Class II devices, generally requiring 510(k) premarket clearance before they may be commercially marketed in the United States; and

|

| • |

Class III devices, consisting of devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a predicate device, generally requiring the submission of a PMA approval supported by clinical trial data.

|

| • |

product listing and establishment registration, which helps facilitate FDA inspections and other regulatory action;

|

| • |

Quality System Regulation, or QSR, and current good manufacturing practices, or cGMP, which require manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the manufacturing process;

|

| • |

labeling regulations and FDA prohibitions against the promotion of products for uncleared, unapproved or off-label use or indication;

|

| • |

clearance of product modifications that could significantly affect safety or efficacy or that would constitute a major change in intended use of one of our cleared devices;

|

| • |

approval of product modifications that affect the safety or effectiveness of one of our approved devices;

|

| • |

medical device reporting regulations, which require that manufacturers comply with FDA requirements to report if their device may have caused or contributed to a death or serious injury, or has malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction of the device or a similar device were to recur;

|

| • |

post-approval restrictions or conditions, including post-approval study commitments;

|

| • |

post-market surveillance regulations, which apply when necessary to protect the public health or to provide additional safety and effectiveness data for the device;

|

| • |

FDA’s recall authority, whereby it can ask, or under certain conditions order, device manufacturers to recall from the market a product that is in violation of governing laws and regulations;

|

| • |

regulations pertaining to voluntary recalls; and

|

| • |

notices of corrections or removals.

|

| • |

untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties;

|

| • |

unanticipated expenditures to address or defend such actions;

|

| • |

customer notifications for repair, replacement, refunds;

|

| • |

recall, detention or seizure of our products;

|

| • |

operating restrictions or partial suspension or total shutdown of production;

|

| • |

refusing or delaying our requests for 510(k) clearance or premarket approval of new products or modified products;

|

| • |

operating restrictions;

|

| • |

withdrawing 510(k) clearances on PMA approvals that have already been granted;

|

| • |

refusal to grant export approval for our products; or

|

| • |

criminal prosecution.

|

| • |

The federal Anti-Kickback Statute, which prohibits, among other things, knowingly or willingly offering, paying, soliciting or receiving remuneration, directly or indirectly, in cash or in kind, to induce or reward the purchasing, leasing, ordering or arranging for or recommending the purchase, lease or order of any health care items or service for which payment may be made, in whole or in part, by federal healthcare programs such as Medicare and Medicaid. This statute has been interpreted to apply to arrangements between medical device manufacturers on one hand and prescribers, purchasers and formulary managers on the other. Further, PPACA, among other things, clarified that a person or entity needs not to have actual knowledge of the federal Anti-Kickback Statute or specific intent to violate it. Although there are a number of statutory exemptions and regulatory safe harbors to the federal Anti-Kickback Statute protecting certain common business arrangements and activities from prosecution or regulatory sanctions, the exemptions and safe harbors are drawn narrowly, and practices that do not fit squarely within an exemption or safe harbor may be subject to scrutiny;

|

| • |

The federal civil False Claims Act, which prohibits, among other things, individuals or entities from knowingly presenting, or causing to be presented, a false or fraudulent claim for payment of government funds or knowingly making, using or causing to be made or used, a false record or statement material to an obligation to pay money to the government or knowingly concealing or knowingly and improperly avoiding, decreasing, or concealing an obligation to pay money to the federal government. In addition, PPACA amended the Social Security Act to provide that the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the federal civil False Claims Act. Many medical device manufacturers and other healthcare companies have been investigated and have reached substantial financial settlements with the federal government under the civil False Claims Act for a variety of alleged improper marketing activities, including providing free product to customers with the expectation that the customers would bill federal programs for the product; providing consulting fees, grants, free travel, and other benefits to physicians to induce them to use the company’s products. In addition, in recent years the government has pursued civil False Claims Act cases against a number of manufacturers for causing false claims to be submitted as a result of the marketing of their products for unapproved, and thus non-reimbursable, uses. Device manufacturers also are subject to other federal false claim laws, including, among others, federal criminal healthcare fraud and false statement statutes that extend to non-government health benefit programs;

|

| • |

Analogous state laws and regulations, such as state anti-kickback and false claims laws, may apply to items or services reimbursed under Medicaid and other state programs or, in several states, apply regardless of the payor. Several states now require medical device manufacturers to report expenses relating to the marketing and promotion or require them to implement compliance programs or marketing codes. For example, California, Connecticut and Nevada mandate the implementation of corporate compliance programs, while Massachusetts and Vermont impose more detailed restrictions on device manufacturers' marketing practices and tracking and reporting of gifts, compensation and other remuneration to healthcare providers;

|

| • |

The federal Foreign Corrupt Practices Act of 1997 and other similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from providing money or anything of value to officials of foreign governments, foreign political parties, or international organizations with the intent to obtain or retain business or seek a business advantage. Recently, there has been a substantial increase in anti-bribery law enforcement activity by U.S. regulators, with more frequent and aggressive investigations and enforcement proceedings by both the Department of Justice and the U.S. Securities and Exchange Commission. Violations of these laws can result in the imposition of substantial fines, interruptions of business, loss of supplier, vendor or other third-party relationships, termination of necessary licenses and permits, and other legal or equitable sanctions. Other internal or government investigations or legal or regulatory proceedings, including lawsuits brought by private litigants, may also follow as a consequence; and

|

| • |

The federal Physician Payment Sunshine Act, being implemented as the Open Payments Program, requires manufacturers of “covered products” (drugs, devices, biologics, or medical supplies for which payment is available under Medicare, Medicaid, or the Children’s Health Insurance Program) to track and publicly report payments and other transfers of value that they provide to U.S. physicians and teaching hospitals, as well as any ownership interests that U.S. physicians hold in applicable manufacturer. Applicable manufacturers must submit a report to the Centers for Medicare & Medicaid Services, or CMS, by the 90th day of each calendar year disclosing payments and transfers of value made in the preceding calendar year.

|

| • |

No. 1 type license for marketing – Specially controlled medical devices (Class III, IV)

|

| • |

No. 2 type license for marketing – Controlled medical devices (Class II)

|

| • |

No. 3 type license for marketing – General medical devices (Class I)

|

|

C.

|

Organizational Structure

|

|

D.

|

Property, Plants and Equipment

|

|

A.

|

Operating Results

|

| • |

employee-related expenses for research and development staff, including salaries, benefits and related expenses, including share-based compensation and travel expenses;

|

| • |

payments made to third-party contract research organizations, contract manufacturers, investigative sites and consultants;

|

| • |

manufacturing development costs;

|

| • |

costs associated with preclinical and clinical activities and regulatory operations;

|

| • |

facilities, depreciation and other expenses, which include direct and allocated expenses for rent and maintenance of facilities; and

|

| • |

costs associated with obtaining and maintaining patents.

|

|

Year Ended December 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

(US$ in thousands, except

per share data) |

||||||||

|

Research and development expenses, net

|

$

|

5,491

|

$

|

5,837

|

||||

|

General and administrative expenses

|

3,571

|

6,626

|

||||||

|

Operating loss

|

9,062

|

12,463

|

||||||

|

Finance income, net

|

244

|

173

|

||||||

|

Loss before income tax

|

8,818

|

12,290

|

||||||

|

Taxes on income

|

8

|

-

|

||||||

|

Net loss

|

$

|

8,826

|

$

|

12,290

|

||||

|

2016

|

2015

|

Change

|

||||||||||

|

(US$ in thousands)

|

||||||||||||

|

Salaries and related expenses

|

$

|

4,683

|

$

|

3,585

|

$

|

1,098

|

||||||

|

Share-based compensation

|

234

|

790

|

(556

|

)

|

||||||||

|

Materials

|

596

|

608

|

(12

|

)

|

||||||||

|

Subcontractors and consultants

|

320

|

688

|

(368

|

)

|

||||||||

|

Depreciation

|

121

|

85

|

36

|

|||||||||

|

Cost for registration of patents

|

150

|

153

|

(3

|

)

|

||||||||

|

Other research and development expenses

|

511

|

282

|

229

|

|||||||||

|

6,615

|

6,191

|

424

|

||||||||||

|

Less participation of NATI (formerly known as the OCS) and the BIRD Foundation

|

(1,124

|

)

|

(354

|

)

|

(770

|

)

|

||||||

|

Total research and development expenses, net

|

$

|

5,491

|

$

|

5,837

|

$

|

(346

|

)

|

|||||

| • |

The absence in 2016 of a

$2.0 million

share-based compensation

expense that we recorded in 2015 relating to the one-time grant of options

to certain of our management and warrants to Pontifax entities

(for additional information see Item 7B “Major Shareholders and Related Party Transactions—Related Party Transactions—Pontifax Warrants”)

.

|

| • |

A $419,000 decrease in salaries and related expenses, due

to the absence in 2016 of

a

$140,000 one-time severance payment to our former chief executive officer that we recorded in 2015 and a $109,000 decrease in provision for bonuses to certain members of our management in 2016.

|

| • |

A $715,000 decrease in professional services and other general and administrative expenses, primarily relating to a $248,000 decrease in recruiting expenses as in 2015 we recruited a new chief executive officer and a large number of research, development and clinical employees,

a $155,000 decrease in legal fees due to our recruitment of an in-house counsel, as well as reduced rates or services of certain other professional service providers.

|

|

2016

|

2015

|

Change

|

||||||||||

|

(US$ in thousands)

|

||||||||||||

|

Salaries and related expenses

|

$

|

1,411

|

$

|

1,830

|

$

|

(419

|

)

|

|||||

|

Share-based compensation

|

975

|

2,934

|

(1,959

|

)

|

||||||||

|

Professional services

|

354

|

609

|

(255

|

)

|

||||||||

|

Office rent and maintenance

|

144

|

108

|

36

|

|||||||||

|

Depreciation

|

9

|

7

|

2

|

|||||||||

|

Other general and administrative expenses

|

678

|

1,138

|

(460

|

)

|

||||||||

|

Total general and administrative expenses

|

$

|

3,571

|

$

|

6,626

|

$

|

(3,055

|

)

|

|||||

| · |

The absence in 2016 of $174,000 of finance income that we recorded in 2015 relating to changes in fair value of the warrants to purchase Series D-1 and D-2 preferred shares issued to investors and service providers in connection with our Series D-1 investment round and the warrants to purchase Series C-1 and C-2 preferred shares issued to Pontifax.

|

| · |

For the year ended December 31, 2016, we recorded $139,000 of interest income on short-term deposits and $56,000 of finance income as a result of exchange rate differences, as compared to $61,000 and $18,000, respectively, for the year ended December 31, 2015.

|

| · |

For the year ended December 31, 2016, we recorded finance income of $56,000 as a result of changes in provision for royalties, as compared to a finance expense of $33,000 in the year ended December 31, 2015.

|

| · |

for the year ended December 31, 2016, we had bank fees of $7,000 and interest expenses and fess relating to a loan of $40,000, as compared to bank fees of $7,000 in the year ended December 31, 2015.

|

|

Year Ended December 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

(US$ in thousands, except

per share data) |

||||||||

|

Research and development expenses, net

|

$

|

5,837

|

$

|

2,832

|

||||

|

General and administrative expenses

|

6,626

|

1,703

|

||||||

|

Operating loss

|

12,463

|

4,535

|

||||||

|

Finance income, net

|

173

|

3,925

|

||||||

|

Loss before income tax

|

12,290

|

610

|

||||||

|

Taxes on income

|

-

|

-

|

||||||

|

Net loss

|

$

|

12,290

|

$

|

610

|

||||

|

2015

|

2014

|

Change

|

||||||||||

|

(US$ in thousands)

|

||||||||||||

|

Salaries and related expenses

|

$

|

3,585

|

$

|

2,425

|

$

|

1,160

|

||||||

|

Share-based compensation

|

790

|

104

|

686

|

|||||||||

|

Materials

|

608

|

385

|

223

|

|||||||||

|

Subcontractors and consultants

|

688

|

294

|

394

|

|||||||||

|

Depreciation

|

85

|

72

|

13

|

|||||||||

|

Cost for registration of patents

|

153

|

72

|

81

|

|||||||||

|

Other research and development expenses

|

282

|

123

|

159

|

|||||||||

|

6,191

|

3,475

|

2,716

|

||||||||||

|

Less participation of NATI (formerly known as the OCS) and the BIRD Foundation

|

(354

|

)

|

(643

|

)

|

289

|

|||||||

|

Total research and development expenses, net

|

$

|

5,837

|

$

|

2,832

|

$

|

3,005

|

||||||

| • |

a $2.7 million increase in share-based compensation, of which $2.0 million relates to the grant of options to purchase 581,542 ordinary shares from October 14, 2015 to our management and warrants to purchase 221,539 ordinary shares to Pontifax in consideration of their commitment to provide us, for no additional consideration, business development services and a representative designated by Pontifax to serve as the chairman of our board of directors (for additional information see Item 7B “Major Shareholders and Related Party Transactions—Related Party Transactions—Pontifax Warrants”).

|

| • |

a $2.2 million increase in salaries and related expenses, professional services and other general administrative expenses incurred in connection with our initial public offering and concurrent private placement and other public company costs.

|

|

2015

|

2014

|

Change

|

||||||||||

|

(US$ in thousands)

|

||||||||||||

|

Salaries and related expenses

|

$

|

1,830

|

$

|

952

|

$

|

878

|

||||||

|

Share-based compensation

|

2,934

|

208

|

2,726

|

|||||||||

|

Professional services

|

609

|

114

|

495

|

|||||||||

|

Office rent and maintenance

|

108

|

105

|

3

|

|||||||||

|

Depreciation

|

7

|

7

|

-

|

|||||||||

|

Other general and administrative expenses

|

1,138

|

317

|

821

|

|||||||||

|

Total general and administrative expenses

|

$

|

6,626

|

$

|

1,703

|

$

|

4,923

|

||||||

| • |

For the year ended December 31, 2014, we recorded finance income of $3.5 million compared to finance income of $174,000 for the year ended December 31, 2015. This finance income is a result of changes in fair value of the warrants to purchase Series D-1 and D-2 preferred shares issued to investors and service providers in connection with our Series D-1 investment round and the warrants to purchase Series C-1 and C-2 preferred shares issued to Pontifax.

|

| • |

For the year ended December 31, 2014, we recorded finance income of $415,000 as a result of changes in provision for royalties, as compared to a finance expense of $33,000 for the year ended December 31, 2015.

|

|

B.

|

Liquidity and Capital Resources

|

|

Year Ended December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

(US$ in thousands)

|

||||||||||||

|

Net cash used in operating activities

|

$

|

(7,923

|

)

|

$

|

(8,628

|

)

|

$

|

(3,855

|

)

|

|||

|

Net cash provided by (used in) investing activities

|

$

|

4,691

|

$

|

(5,070

|

)

|

$

|

(46

|

)

|

||||

|

Net cash provided by financing activities

|

$

|

5,424

|

$

|

22,013

|

$

|

-

|

||||||

| • |

completion of the clinical development of our C-Scan system;

|

| • |

conducting clinical trials in Europe, the United States and other territories for purposes of regulatory approval and post-marketing validation;

|

| • |

development of future generations of our C-Scan system and future products;

|

| • |

FDA and additional regulatory filing activities in countries we intend to commercialize our system; and

|

| • |

patent maintenance fees.

|

| • |

Fair Value of our Ordinary Shares.

Prior to our initial public offering, due to the absence of a public market for our ordinary shares,

we estimated the fair value of our ordinary shares, as discussed below in “—Valuation of our ordinary shares.” Following our initial public offering, the fair value of our ordinary shares is determined based on the trading

price of our ordinary shares on the Nasdaq Capital Market.

|

| • |

Expected Volatility.

We estimated the expected share price volatility for our ordinary shares by considering the historic price volatility for industry peers based on price observations over a period equivalent to the expected term of the share option grants. Industry peers consist of public companies in the medical device and healthcare industries. We intend to continue to consistently apply this process using the same or similar industry peers until a sufficient amount of historical information regarding the volatility of our ordinary share price becomes available, or unless circumstances change such that the identified companies are no longer similar to us, in which case, more suitable companies whose share prices are publicly available would be utilized in the calculation.

|

| • |

Expected Term.

The expected term of options granted represents the period of time that options granted are expected to be outstanding, and is determined based on the simplified method in accordance with ASC No. 718-10-S99-1 (SAB No. 110), as adequate historical experience is not available to provide a reasonable estimate.

ASU 2016-09, Compensation-Stock Compensation (Topic 718) permits

forfeitures to be accounted for when they occur.

|

| • |

Risk-Free Rate.

The risk-free interest rate is based on the yield from U.S. Treasury zero-coupon bonds with a term equivalent to the contractual life of the options.

|

| • |

Expected Dividend Yield.

We have never declared or paid any cash dividends and do not presently plan to pay cash dividends in the foreseeable future. Consequently, we used an expected dividend yield of zero.

|

|

Parameters

|

Year 2016

Grants

|

February-

December 2015 Grants |

October 2014

Grant |

|||

|

Expected volatility (in %)

|

59-60

|

44-62

|

50-60

|

|||

|

Expected term (in years)

|

5-10

|

4-10

|

5-6

|

|||

|

Risk free interest rate (in %)

|

1.2-2.1

|

1.29-2.28

|

1.45-1.72

|

|||

|

Anticipated rate of dividends (in %)

|

0

|

0

|

0

|

|||

|

Share Price

|

$2.22-$3.2

|

$3-$5.12

|

$3.01

|

|

C.

|

Research and development, patents and licenses, etc.

|

|

D

.

|

Trend Information

|

|

E.

|

Off-balance Sheet Arrangements

|

|

F.

|

Tabular Disclosure of Contractual Obligations

|

|

Payments due by period

|

||||||||||||||||||||

|

(US$ in thousands)

|

||||||||||||||||||||

|

Total

|

Less than 1

year |

1-3 years

|

4-5 years

|

More than 5

years |

||||||||||||||||

|

Operating lease obligations

(1)

:

|

$

|

648

|

$

|

218

|

$

|

241

|

$

|

156

|

$

|

33

|

||||||||||

|

Other long term liabilities reflected on the Statements of Financial Position:

|

||||||||||||||||||||

|

Royalties to ASIC designer

(2)

|

$

|

139

|

$

|

-

|

$

|

119

|

$

|

20

|

$

|

-

|

||||||||||

|

Reimbursement liability to

Check-Cap LLC unitholders

(3)

|

382

|

-

|

24

|

127

|

231

|

|||||||||||||||

|

Total

|

$

|

521

|

$

|

-

|

$

|

143

|

$

|

147

|

$

|

231

|

||||||||||

| (1) |

Operating lease obligations consist of payments pursuant to a lease agreement for office facilities as well as lease agreements for vehicles, which generally run for a period of three years.

|

| (2) |

See Item 5B “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Application of Critical Accounting Policies and Estimates—Royalties provision—Provision for royalties to an ASIC designer.”

|

| (3) |

On May 31, 2009, we entered into an asset transfer agreement with Check-Cap LLC pursuant to which Check-Cap LLC transferred all of its business operations and substantially all of its assets to us, in connection with which we undertook to reimburse the unitholders of Check-Cap LLC for any tax burdens that may be imposed on them due to the reorganization. The reimbursement liability is calculated assuming deemed royalties are paid to the U.S. unitholders of Check-Cap LLC under Section 367(d) of the Code and is based in part on our forecasted sales. The liability is calculated based on expected cash outflows discounted using a 17.6% discount factor commensurate with our risk at the date of initial recognition of the liability. Any updates in the expected cash outflows and the liability will be recorded to profit and loss each period. As of December 31, 2016, it was probable that we will be required to reimburse the U.S. unitholders of Check-Cap LLC, and accordingly, a liability for this reimbursement has been accounted for in our financial statements for such period in the amount of $382,000. See Item 7B “Major Shareholders and Related Party Transactions—Related Party Transactions—Transactions with Check-Cap LLC and the Members and Manager of Check-Cap LLC.”

|

| A. |

Directors and senior management

|

|

Name

|

Age

|

Position(s)

|

||

|

William Densel

|

49

|

Chief Executive Officer and Director

|

||

|

Lior Torem

|

47

|

Chief Financial Officer

|

||

|

Yoav Kimchy

|

55

|

Chief Technology Officer

|

||

|

Alex Ovadia

|

55

|

Vice President, Research and Development, Israeli Site Manager and Chief Operating Officer

|

||

|

Tomer Kariv(1)

|

55

|

Chairman of the Board of Directors

|

||

|

Mary Jo Gorman

(2)

|

57

|

External Director

|

||

|

Steven Hanley(1)(2)

|

49

|

Director

|

||

|

XiangQian (XQ) Lin

|

33

|

Director

|

||

|

Walter L. Robb

|

88

|

Director

|

||

|

Yuval Yanai(1)(2)

|

64

|

External Director

|

| (1) |

Member of our

Nominating

Committee.

|

| (2) |

Member of our

Audit Committee,

Compensation Committee and Financing Committee.

|

|

B.

|

Compensation

of

Directors and Executive Officers

|

|

Salary Cost

(1)

|

Bonus

(2)

|

Share-Based

Compensation (3) |

Total

|

|||||||||||||

|

Name and Principal Position

|

US$

|

|||||||||||||||

|

William (Bill) Densel - chief executive officer and director

|

416,730

|

25,000

|

(4) |

735,960

|

1,177,690

|

|||||||||||

|

Lior Torem - chief financial officer

|

302,650

|

11,000

|

13,570

|

327,220

|

||||||||||||

|

Yoav Kimchy -

chief technology officer

|

284,370

|

--

|

13,570

|

297,940

|

||||||||||||

|

Alex Ovadia - chief operations officer and Israeli site manager

|

341,180

|

14,400

|

13,570

|

369,150

|

||||||||||||

| (1) |

“

Salary Cost” includes the Covered Executive’s gross salary plus payment of social benefits made by us on behalf of such Covered Executive. Such benefits may include, to the extent applicable to the Covered Executive, payments, contributions and/or allocations for savings funds, education funds, pension, severance, risk insurances, payments for social security and tax gross-up payments, vacation, car, medical insurances and benefits, convalescence or recreation pay and other benefits and perquisites consistent with our policies.

|

| (2) |

Represents bonuses for 2016 awarded to the Covered Executives, consistent with our Compensation Policy

.

|

| (3) |

Represents the share-based compensation expenses recorded in our consolidated financial statements for the year ended December 31, 2016 based on the fair value of the grant date of the options, in accordance with accounting guidance for equity-based compensation.

|

| (4) |

Mr. Densel’s bonus for 2016 is subject to shareholder approval at our 2017 annual general meeting of shareholders, in accordance with the Israeli Companies Law.

|

| (i) |

Options (the “Initial Grant Options”) to purchase 463,137 ordinary shares at an exercise price equal to the closing price of our ordinary shares on May 19, 2015 (the date on which Mr. Densel’s initial engagement with us was approved by our shareholders). The Initial Grant Options shall vest over a period of four years commencing on the date of grant (i.e., May 19, 2015), such that 25% of the options shall vest on the first anniversary of the date of Mr. Densel’s employment and thereafter, the remaining Initial Grant Options will vest in monthly installments, subject to Mr. Densel’s continuing employment with us or Check-Cap U.S., Inc. on each applicable vesting date. In the event of the consummation of an M&A Transaction (as defined in Mr. Densel’s Employment Agreement), subject to Mr. Densel’s continuing employment through the effective date of such M&A Transaction, any unvested Initial Grant Options shall automatically vest and become exercisable.

|

| (ii) |

Options (“Second Grant Options”) to purchase 324,750 ordinary shares at an exercise price equal to the higher of: (a) the average of the closing prices of our ordinary shares over the 30 trading days immediately prior to the date of grant (i.e., August 13, 2015); and (b) the closing price of our ordinary shares on the trading day immediately prior to the date of grant. The Second Grant Options shall vest over a period of four years commencing on their date of grant, such that 25% of the Second Grant Options shall vest on the first anniversary of the date of grant and thereafter, the remaining Second Grant Options will vest in monthly installments, subject to Mr. Densel’s continuing employment as our Chief Executive Officer on each applicable vesting date. In the event of consummation of an M&A Transaction, subject to Mr. Densel’s continuing employment with us or Check-Cap U.S., Inc. through the effective date of such M&A Transaction, any unvested Second Grant Options shall automatically vest and become exercisable.

|

| (iii) |

Options (“Third Grant Options”) to purchase 425,000 ordinary shares at an exercise price equal to the higher of: (a) the average of the closing prices of our ordinary shares over the 30 trading days immediately prior to the date of grant (i.e., August 13, 2015); and (ii) the closing price of our ordinary shares on the trading day immediately prior to the date of grant. The Third Grant Options shall vest over a period of four years commencing on their date of grant pursuant to a formula set forth in Mr. Densel’s Employment Agreement and subject to the attainment of certain 12-month milestones to be set by our Board of Directors. In the event of the consummation of an M&A Transaction, subject to Mr. Densel’s continuing employment with us or Check-Cap U.S., Inc. through the effective date of such M&A Transaction, any unvested Third Grant Options shall automatically vest and become exercisable.

|

| C. |

Bo

ard Practices

|

| • |

such majority includes a majority of the shares held by all shareholders who are non-controlling shareholders and shareholders who do not have a personal interest in the election of the external director (other than a personal interest not deriving from a relationship with a controlling shareholder) that are voted at the meeting, excluding abstentions; or

|

| • |

the total number of shares held by shareholders who are non-controlling shareholders and shareholders who do not have a personal interest in the election of the external director (other than a personal interest not derived from a relationship with a controlling shareholder) voted against the election of the external director does not exceed 2% of the aggregate voting rights in the company.

|

| • |

his or her service for each such additional term is recommended by one or more shareholders holding at least 1% of the company’s voting rights and is approved at a shareholders meeting by a disinterested majority, where the total number of shares held by non-controlling, disinterested shareholders voting for such reelection exceeds 2% of the aggregate voting rights in the company, and provided further that the external director is not an affiliated or competing shareholder, as defined in the Israeli Companies Law, or a relative of such a shareholder at the time of the appointment, and is not affiliated with such a shareholder at the time of appointment or within the two years preceding the date of appointment;

|

| • |

his or her service for each such additional term is recommended by the board of directors and is approved at a shareholders meeting by the same majority required for the initial election of an external director (as described above); or

|

| • |

such external director nominates himself or herself for each such additional term and his or her election is approved at a shareholders meeting by the same disinterested majority as required for the election of an external director nominated by a 1% or more shareholder (as described above).

|

| • |

the audit committee has determined that he or she meets the qualifications for being appointed as an external director, except for (i) the requirement that the director be an Israeli resident (which does not apply to companies such as ours whose securities have been offered outside of Israel or are listed outside of Israel); and (ii) the requirement for accounting and financial expertise or professional qualifications; and

|

| • |

he or she has not served as a director of the company for a period exceeding nine consecutive years. For this purpose, a break of less than two years in the service shall not be deemed to interrupt the continuation of the service.

|

| • |

oversight of our independent registered public accounting firm and recommending the engagement, compensation or termination of engagement of our independent registered public accounting firm to the board of directors or shareholders for their approval, as applicable, in accordance with the requirements of the Israeli Companies Law;

|

| • |

recommending the engagement or termination of the person filling the office of our internal auditor; and

|

| • |

recommending the terms of audit and non-audit services provided by the independent registered public accounting firm for pre-approval by our board of directors or shareholders for their approval, as applicable, in accordance with the requirements of the Israeli Companies Law.

|

| • |

determining whether there are deficiencies in the business management practices of our company, including in consultation with our internal auditor or the independent auditor, and making recommendations to the board of directors to improve such practices;

|

| • |

determining whether to approve certain related party transactions (including transactions in which an office holder has a personal interest) and whether such transaction is extraordinary or material under Israeli Companies Law (see “— Approval of Related Party Transactions under Israeli Law”);

|

| • |

determining whether a competitive process must be implemented for the approval of certain transactions with controlling shareholders or its relative or in which a controlling shareholder has a personal interest (whether or not the transaction is an extraordinary transaction), under the supervision of the audit committee or other party determined by the audit committee and in accordance with standards to be determined by the audit committee, or whether a different process determined by the audit committee should be implemented for the approval of such transactions;

|

| • |

determining the process for the approval of certain transactions with controlling shareholders or in which a controlling shareholder has a personal interest that the audit committee has determined are not extraordinary transactions but are not immaterial transactions;

|

| • |

where the board of directors approves the working plan of the internal auditor, to examine such working plan before its submission to the board of directors and proposing amendments thereto;

|

| • |

examining our internal controls and internal auditor’s performance, including whether the internal auditor has sufficient resources and tools to dispose of its responsibilities;

|

| • |

examining the scope of our auditor’s work and compensation and submitting a recommendation with respect thereto to our board of directors or shareholders, depending on which of them is considering the compensation of our auditor; and

|

| • |

establishing procedures for the handling of employees’ complaints as to the management of our business and the protection to be provided to such employees.

|

| • |