|

þ

|

|

Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended May 31, 2018.

|

|

|

or

|

|||

|

o

|

|

Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to

|

|

|

Minnesota

(State or other jurisdiction of

incorporation or organization)

|

|

41-0251095

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

5500 Cenex Drive Inver Grove Heights, Minnesota 55077

(Address of principal executive offices,

including zip code)

|

|

(651) 355-6000

(Registrant’s telephone number,

including area code)

|

|

Large accelerated filer

o

|

Accelerated filer

o

|

Non-accelerated filer

þ

|

Smaller reporting company

o

|

Emerging growth company

o

|

|

(Do not check if a smaller reporting company)

|

||||

|

|

|

|

|

Page

No.

|

||

|

|

May 31,

2018 |

August 31,

2017 |

|||||

|

|

(Dollars in thousands)

|

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|

|

|

|

|||

|

Cash and cash equivalents

|

$

|

533,887

|

|

$

|

181,379

|

|

|

|

Receivables

|

2,198,211

|

|

1,869,632

|

|

|||

|

Inventories

|

2,940,907

|

|

2,576,585

|

|

|||

|

Derivative assets

|

483,794

|

|

232,017

|

|

|||

|

Margin and related deposits

|

253,141

|

|

206,062

|

|

|||

|

Supplier advance payments

|

426,607

|

|

249,234

|

|

|||

|

Other current assets

|

198,078

|

|

299,618

|

|

|||

|

Total current assets

|

7,034,625

|

|

5,614,527

|

|

|||

|

Investments

|

3,787,163

|

|

3,750,993

|

|

|||

|

Property, plant and equipment

|

5,140,106

|

|

5,356,434

|

|

|||

|

Other assets

|

973,885

|

|

1,251,802

|

|

|||

|

Total assets

|

$

|

16,935,779

|

|

$

|

15,973,756

|

|

|

|

LIABILITIES AND EQUITIES

|

|||||||

|

Current liabilities:

|

|

|

|

|

|||

|

Notes payable

|

$

|

2,819,086

|

|

$

|

1,988,215

|

|

|

|

Current portion of long-term debt

|

53,056

|

|

156,345

|

|

|||

|

Customer margin deposits and credit balances

|

137,999

|

|

157,914

|

|

|||

|

Customer advance payments

|

372,616

|

|

413,163

|

|

|||

|

Accounts payable

|

1,904,819

|

|

1,951,292

|

|

|||

|

Derivative liabilities

|

344,973

|

|

316,018

|

|

|||

|

Accrued expenses

|

538,249

|

|

437,527

|

|

|||

|

Dividends and equities payable

|

209,718

|

|

12,121

|

|

|||

|

Total current liabilities

|

6,380,516

|

|

5,432,595

|

|

|||

|

Long-term debt

|

1,905,515

|

|

2,023,448

|

|

|||

|

Long-term deferred tax liabilities

|

207,912

|

|

333,221

|

|

|||

|

Other liabilities

|

279,303

|

|

278,667

|

|

|||

|

Commitments and contingencies (Note 13)

|

|

|

|

|

|||

|

Equities:

|

|

|

|

|

|||

|

Preferred stock

|

2,264,038

|

|

2,264,038

|

|

|||

|

Equity certificates

|

4,253,414

|

|

4,341,649

|

|

|||

|

Accumulated other comprehensive loss

|

(169,726

|

)

|

(183,670

|

)

|

|||

|

Capital reserves

|

1,803,078

|

|

1,471,217

|

|

|||

|

Total CHS Inc. equities

|

8,150,804

|

|

7,893,234

|

|

|||

|

Noncontrolling interests

|

11,729

|

|

12,591

|

|

|||

|

Total equities

|

8,162,533

|

|

7,905,825

|

|

|||

|

Total liabilities and equities

|

$

|

16,935,779

|

|

$

|

15,973,756

|

|

|

|

|

For the Three Months Ended

May 31, |

For the Nine Months Ended

May 31, |

|||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

|||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||

|

Revenues

|

$

|

9,027,525

|

|

$

|

8,614,090

|

|

$

|

23,927,508

|

|

$

|

23,982,746

|

|

|||

|

Cost of goods sold

|

8,728,914

|

|

8,366,988

|

|

23,173,151

|

|

23,142,205

|

|

|||||||

|

Gross profit

|

298,611

|

|

247,102

|

|

754,357

|

|

840,541

|

|

|||||||

|

Marketing, general and administrative

|

161,578

|

|

153,498

|

|

488,459

|

|

459,831

|

|

|||||||

|

Reserve and impairment charges (recoveries), net

|

(3,811

|

)

|

323,901

|

|

(18,944

|

)

|

414,009

|

|

|||||||

|

Operating earnings (loss)

|

140,844

|

|

(230,297

|

)

|

284,842

|

|

(33,299

|

)

|

|||||||

|

(Gain) loss on disposal of business

|

(124,050

|

)

|

—

|

|

(131,755

|

)

|

—

|

|

|||||||

|

Interest expense

|

49,340

|

|

39,201

|

|

130,218

|

|

117,411

|

|

|||||||

|

Other (income) loss

|

(14,622

|

)

|

(11,947

|

)

|

(51,000

|

)

|

(66,183

|

)

|

|||||||

|

Equity (income) loss from investments

|

(59,308

|

)

|

(48,393

|

)

|

(137,111

|

)

|

(124,521

|

)

|

|||||||

|

Income (loss) before income taxes

|

289,484

|

|

(209,158

|

)

|

474,490

|

|

39,994

|

|

|||||||

|

Income tax expense (benefit)

|

60,338

|

|

(163,018

|

)

|

(100,901

|

)

|

(137,781

|

)

|

|||||||

|

Net income (loss)

|

229,146

|

|

(46,140

|

)

|

575,391

|

|

177,775

|

|

|||||||

|

Net income (loss) attributable to noncontrolling interests

|

(187

|

)

|

(955

|

)

|

(699

|

)

|

(757

|

)

|

|||||||

|

Net income (loss) attributable to CHS Inc.

|

$

|

229,333

|

|

$

|

(45,185

|

)

|

$

|

576,090

|

|

$

|

178,532

|

|

|||

|

For the Three Months Ended

May 31, |

For the Nine Months Ended

May 31, |

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||

|

Net income (loss)

|

$

|

229,146

|

|

$

|

(46,140

|

)

|

$

|

575,391

|

|

$

|

177,775

|

|

|||

|

Other comprehensive income (loss), net of tax:

|

|||||||||||||||

|

Postretirement benefit plan activity, net of tax expense (benefit) of $1,424, $2,257, $5,353 and $6,580, respectively

|

3,417

|

|

3,635

|

|

10,755

|

|

10,599

|

|

|||||||

|

Unrealized net gain (loss) on available for sale investments, net of tax expense (benefit) of $2,620, $(72), $4,505 and $1,010, respectively

|

6,286

|

|

(117

|

)

|

13,480

|

|

1,627

|

|

|||||||

|

Cash flow hedges, net of tax expense (benefit) of $172, $233, $613 and $1,238, respectively

|

413

|

|

375

|

|

1,472

|

|

1,993

|

|

|||||||

|

Foreign currency translation adjustment, net of tax expense (benefit) of $(254), $(334), $(275) and $(329), respectively

|

(11,617

|

)

|

(2,151

|

)

|

(11,763

|

)

|

(12,193

|

)

|

|||||||

|

Other comprehensive income (loss), net of tax

|

(1,501

|

)

|

1,742

|

|

13,944

|

|

2,026

|

|

|||||||

|

Comprehensive income (loss)

|

227,645

|

|

(44,398

|

)

|

589,335

|

|

179,801

|

|

|||||||

|

Less: comprehensive income (loss) attributable to noncontrolling interests

|

(187

|

)

|

(955

|

)

|

(699

|

)

|

(757

|

)

|

|||||||

|

Comprehensive income (loss) attributable to CHS Inc.

|

$

|

227,832

|

|

$

|

(43,443

|

)

|

$

|

590,034

|

|

$

|

180,558

|

|

|||

|

|

For the Nine Months Ended May 31,

|

||||||

|

|

2018

|

2017

|

|||||

|

|

(Dollars in thousands)

|

||||||

|

Cash flows from operating activities:

|

|

|

|

|

|||

|

Net income (loss)

|

$

|

575,391

|

|

$

|

177,775

|

|

|

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities:

|

|

|

|

|

|||

|

Depreciation and amortization

|

358,134

|

|

362,118

|

|

|||

|

Amortization of deferred major repair costs

|

43,908

|

|

50,565

|

|

|||

|

Equity (income) loss from investments

|

(137,111

|

)

|

(124,521

|

)

|

|||

|

Distributions from equity investments

|

97,665

|

|

105,558

|

|

|||

|

Provision for doubtful accounts

|

(4,145

|

)

|

198,304

|

|

|||

|

Gain on disposal of business

|

(131,755

|

)

|

—

|

|

|||

|

Unrealized (gain) loss on crack spread contingent liability

|

—

|

|

(13,273

|

)

|

|||

|

Long-lived asset impairment, net of recoveries

|

(12,368

|

)

|

85,431

|

|

|||

|

Reserve against supplier advance payments

|

—

|

|

130,705

|

|

|||

|

Deferred taxes

|

(135,560

|

)

|

(145,357

|

)

|

|||

|

Other, net

|

30,640

|

|

25,559

|

|

|||

|

Changes in operating assets and liabilities, net of acquisitions:

|

|

|

|

|

|||

|

Receivables

|

(216,501

|

)

|

(55,498

|

)

|

|||

|

Inventories

|

(366,858

|

)

|

(344,914

|

)

|

|||

|

Derivative assets

|

(86,910

|

)

|

120,294

|

|

|||

|

Margin and related deposits

|

(47,079

|

)

|

58,581

|

|

|||

|

Supplier advance payments

|

(177,373

|

)

|

(214,538

|

)

|

|||

|

Other current assets and other assets

|

75,191

|

|

19,289

|

|

|||

|

Customer margin deposits and credit balances

|

(19,914

|

)

|

(76,355

|

)

|

|||

|

Customer advance payments

|

(40,547

|

)

|

(23,700

|

)

|

|||

|

Accounts payable and accrued expenses

|

73,745

|

|

152,094

|

|

|||

|

Derivative liabilities

|

23,758

|

|

(229,881

|

)

|

|||

|

Other liabilities

|

(49,842

|

)

|

(53,471

|

)

|

|||

|

Net cash provided by (used in) operating activities

|

(147,531

|

)

|

204,765

|

|

|||

|

Cash flows from investing activities:

|

|

|

|

|

|||

|

Acquisition of property, plant and equipment

|

(249,078

|

)

|

(298,015

|

)

|

|||

|

Proceeds from disposition of property, plant and equipment

|

80,045

|

|

17,702

|

|

|||

|

Proceeds from sale of business

|

234,914

|

|

—

|

|

|||

|

Expenditures for major repairs

|

(39,363

|

)

|

(1,146

|

)

|

|||

|

Investments in joint ventures and other

|

(20,606

|

)

|

(13,853

|

)

|

|||

|

Investments redeemed

|

6,607

|

|

7,698

|

|

|||

|

Proceeds from sale of investments

|

25,444

|

|

6,170

|

|

|||

|

Changes in CHS Capital notes receivable, net

|

(83,908

|

)

|

(104,773

|

)

|

|||

|

Financing extended to customers

|

(72,106

|

)

|

(57,783

|

)

|

|||

|

Payments from customer financing

|

38,725

|

|

67,126

|

|

|||

|

Other investing activities, net

|

7,539

|

|

2,722

|

|

|||

|

Net cash provided by (used in) investing activities

|

(71,787

|

)

|

(374,152

|

)

|

|||

|

Cash flows from financing activities:

|

|

|

|

|

|||

|

Proceeds from lines of credit and long-term borrowings

|

29,802,708

|

|

29,890,570

|

|

|||

|

Payments on lines of credit, long term-debt and capital lease obligations

|

(29,028,104

|

)

|

(29,362,970

|

)

|

|||

|

Changes in checks and drafts outstanding

|

(59,358

|

)

|

(118,844

|

)

|

|||

|

Preferred stock dividends paid

|

(126,501

|

)

|

(125,475

|

)

|

|||

|

Retirements of equities

|

(6,391

|

)

|

(25,503

|

)

|

|||

|

Cash patronage dividends paid

|

—

|

|

(103,879

|

)

|

|||

|

Other financing activities, net

|

(11,558

|

)

|

1,539

|

|

|||

|

Net cash provided by (used in) financing activities

|

570,796

|

|

155,438

|

|

|||

|

Effect of exchange rate changes on cash and cash equivalents

|

1,030

|

|

1,865

|

|

|||

|

Net increase (decrease) in cash and cash equivalents

|

352,508

|

|

(12,084

|

)

|

|||

|

Cash and cash equivalents at beginning of period

|

181,379

|

|

279,313

|

|

|||

|

Cash and cash equivalents at end of period

|

$

|

533,887

|

|

$

|

267,229

|

|

|

|

May 31, 2018

|

August 31, 2017

|

||||||

|

(Dollars in thousands)

|

|||||||

|

Trade accounts receivable

|

$

|

1,505,273

|

|

$

|

1,234,500

|

|

|

|

CHS Capital notes receivable

|

143,038

|

|

164,807

|

|

|||

|

Deferred purchase price receivable

|

177,827

|

|

202,947

|

|

|||

|

Other

|

589,637

|

|

493,104

|

|

|||

|

2,415,775

|

|

2,095,358

|

|

||||

|

Less allowances and reserves

|

217,564

|

|

225,726

|

|

|||

|

Total receivables

|

$

|

2,198,211

|

|

$

|

1,869,632

|

|

|

|

(Dollars in thousands)

|

||||

|

Balance - as of August 31, 2017

|

$

|

548,602

|

|

|

|

Monthly settlements, net

|

(89,160

|

)

|

||

|

Cash collections on DPP

|

(9,612

|

)

|

||

|

Fair value adjustment

|

14,686

|

|

||

|

Balance - as of May 31, 2018

|

$

|

464,516

|

|

|

|

May 31, 2018

|

August 31, 2017

|

||||||

|

(Dollars in thousands)

|

|||||||

|

Grain and oilseed

|

$

|

1,436,568

|

|

$

|

1,145,285

|

|

|

|

Energy

|

663,111

|

|

755,886

|

|

|||

|

Crop nutrients

|

199,246

|

|

248,699

|

|

|||

|

Feed and farm supplies

|

479,621

|

|

353,130

|

|

|||

|

Processed grain and oilseed

|

152,465

|

|

49,723

|

|

|||

|

Other

|

9,896

|

|

23,862

|

|

|||

|

Total inventories

|

$

|

2,940,907

|

|

$

|

2,576,585

|

|

|

|

May 31, 2018

|

August 31, 2017

|

||||||

|

|

(Dollars in thousands)

|

||||||

|

Equity method investments:

|

|||||||

|

CF Industries Nitrogen, LLC

|

$

|

2,786,806

|

|

$

|

2,756,076

|

|

|

|

Ventura Foods, LLC

|

354,588

|

|

347,016

|

|

|||

|

Ardent Mills, LLC

|

205,805

|

|

206,529

|

|

|||

|

TEMCO, LLC

|

37,769

|

|

41,323

|

|

|||

|

Other equity method investments

|

271,229

|

|

268,444

|

|

|||

|

Cost method investments

|

130,966

|

|

131,605

|

|

|||

|

Total investments

|

$

|

3,787,163

|

|

$

|

3,750,993

|

|

|

|

For the Nine Months Ended

May 31, |

|||||||

|

2018

|

2017

|

||||||

|

(Dollars in thousands)

|

|||||||

|

Net sales

|

$

|

6,238,495

|

|

$

|

5,807,777

|

|

|

|

Gross profit

|

719,555

|

|

651,705

|

|

|||

|

Net earnings

|

435,192

|

|

317,674

|

|

|||

|

Earnings attributable to CHS Inc.

|

109,266

|

|

104,568

|

|

|||

|

Energy

|

Ag

|

Corporate

and Other |

Total

|

||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

Balances, August 31, 2017

|

$

|

552

|

|

$

|

142,929

|

|

$

|

10,574

|

|

$

|

154,055

|

|

|||

|

Effect of foreign currency translation adjustments

|

—

|

|

(1,709

|

)

|

—

|

|

(1,709

|

)

|

|||||||

|

Balances, May 31, 2018

|

$

|

552

|

|

$

|

141,220

|

|

$

|

10,574

|

|

$

|

152,346

|

|

|||

|

May 31,

2018 |

August 31,

2017 |

||||||||||||||||||||||

|

Gross Carrying Amount

|

Accumulated Amortization

|

Net

|

Gross Carrying Amount

|

Accumulated Amortization

|

Net

|

||||||||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||||||||

|

Customer lists

|

$

|

41,077

|

|

$

|

(12,328

|

)

|

$

|

28,749

|

|

$

|

46,180

|

|

$

|

(14,695

|

)

|

$

|

31,485

|

|

|||||

|

Trademarks and other intangible assets

|

6,536

|

|

(4,871

|

)

|

1,665

|

|

23,623

|

|

(21,778

|

)

|

1,845

|

|

|||||||||||

|

Total intangible assets

|

$

|

47,613

|

|

$

|

(17,199

|

)

|

$

|

30,414

|

|

$

|

69,803

|

|

$

|

(36,473

|

)

|

$

|

33,330

|

|

|||||

|

(Dollars in thousands)

|

|||

|

Year 1

|

$

|

3,290

|

|

|

Year 2

|

3,125

|

|

|

|

Year 3

|

2,981

|

|

|

|

Year 4

|

2,856

|

|

|

|

Year 5

|

2,671

|

|

|

|

|

May 31, 2018

|

|

August 31, 2017

|

||||

|

|

(Dollars in thousands)

|

||||||

|

Notes payable

|

$

|

2,650,859

|

|

|

$

|

1,695,423

|

|

|

CHS Capital notes payable

|

168,227

|

|

|

292,792

|

|

||

|

Total notes payable

|

$

|

2,819,086

|

|

|

$

|

1,988,215

|

|

|

|

Equity Certificates

|

|

Accumulated

Other Comprehensive Loss |

|

|

|

|||||||||||||||||||||||||

|

Capital

Equity Certificates |

Nonpatronage

Equity Certificates |

Nonqualified Equity Certificates

|

Preferred

Stock |

Capital

Reserves |

Noncontrolling

Interests |

Total

Equities |

|||||||||||||||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||

|

Balance, August 31, 2017

|

$

|

3,906,426

|

|

$

|

29,836

|

|

$

|

405,387

|

|

$

|

2,264,038

|

|

$

|

(183,670

|

)

|

$

|

1,471,217

|

|

$

|

12,591

|

|

$

|

7,905,825

|

|

|||||||

|

Reversal of prior year patronage and redemption estimates

|

4,270

|

|

—

|

|

(126,333

|

)

|

—

|

|

—

|

|

126,333

|

|

—

|

|

4,270

|

|

|||||||||||||||

|

Distribution of 2017 patronage refunds

|

—

|

|

—

|

|

128,831

|

|

—

|

|

—

|

|

(128,831

|

)

|

—

|

|

—

|

|

|||||||||||||||

|

Redemptions of equities

|

(3,814

|

)

|

(86

|

)

|

(369

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(4,269

|

)

|

|||||||||||||||

|

Preferred stock dividends

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(126,501

|

)

|

—

|

|

(126,501

|

)

|

|||||||||||||||

|

Other, net

|

(5,999

|

)

|

(113

|

)

|

(381

|

)

|

—

|

|

—

|

|

4,517

|

|

(163

|

)

|

(2,139

|

)

|

|||||||||||||||

|

Net income (loss)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

576,090

|

|

(699

|

)

|

575,391

|

|

|||||||||||||||

|

Other comprehensive income (loss), net of tax

|

—

|

|

—

|

|

—

|

|

—

|

|

13,944

|

|

—

|

|

—

|

|

13,944

|

|

|||||||||||||||

|

Estimated 2018 cash patronage refunds

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(119,747

|

)

|

—

|

|

(119,747

|

)

|

|||||||||||||||

|

Estimated 2018 equity redemptions

|

(84,241

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(84,241

|

)

|

|||||||||||||||

|

Balance, May 31, 2018

|

$

|

3,816,642

|

|

$

|

29,637

|

|

$

|

407,135

|

|

$

|

2,264,038

|

|

$

|

(169,726

|

)

|

$

|

1,803,078

|

|

$

|

11,729

|

|

$

|

8,162,533

|

|

|||||||

|

Pension and Other Postretirement Benefits

|

Unrealized Net Gain on Available for Sale Investments

|

Cash Flow Hedges

|

Foreign Currency Translation Adjustment

|

Total

|

|||||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||||

|

Balance as of August 31, 2017, net of tax

|

$

|

(135,046

|

)

|

$

|

10,041

|

|

$

|

(6,954

|

)

|

$

|

(51,711

|

)

|

$

|

(183,670

|

)

|

||||

|

Other comprehensive income (loss), before tax:

|

|||||||||||||||||||

|

Amounts before reclassifications

|

—

|

|

19,512

|

|

806

|

|

(9,996

|

)

|

10,322

|

|

|||||||||

|

Amounts reclassified out

|

16,108

|

|

(1,527

|

)

|

1,279

|

|

(2,042

|

)

|

13,818

|

|

|||||||||

|

Total other comprehensive income (loss), before tax

|

16,108

|

|

17,985

|

|

2,085

|

|

(12,038

|

)

|

24,140

|

|

|||||||||

|

Tax effect

|

(5,353

|

)

|

(4,505

|

)

|

(613

|

)

|

275

|

|

(10,196

|

)

|

|||||||||

|

Other comprehensive income (loss), net of tax

|

10,755

|

|

13,480

|

|

1,472

|

|

(11,763

|

)

|

13,944

|

|

|||||||||

|

Balance as of May 31, 2018, net of tax

|

$

|

(124,291

|

)

|

$

|

23,521

|

|

$

|

(5,482

|

)

|

$

|

(63,474

|

)

|

$

|

(169,726

|

)

|

||||

|

Pension and Other Postretirement Benefits

|

Unrealized Net Gain on Available for Sale Investments

|

Cash Flow Hedges

|

Foreign Currency Translation Adjustment

|

Total

|

|||||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||||

|

Balance as of August 31, 2016, net of tax

|

$

|

(165,146

|

)

|

$

|

5,656

|

|

$

|

(9,196

|

)

|

$

|

(43,040

|

)

|

$

|

(211,726

|

)

|

||||

|

Other comprehensive income (loss), before tax:

|

|||||||||||||||||||

|

Amounts before reclassifications

|

(500

|

)

|

2,637

|

|

1,920

|

|

(12,537

|

)

|

(8,480

|

)

|

|||||||||

|

Amounts reclassified out

|

17,679

|

|

—

|

|

1,311

|

|

15

|

|

19,005

|

|

|||||||||

|

Total other comprehensive income (loss), before tax

|

17,179

|

|

2,637

|

|

3,231

|

|

(12,522

|

)

|

10,525

|

|

|||||||||

|

Tax effect

|

(6,580

|

)

|

(1,010

|

)

|

(1,238

|

)

|

329

|

|

(8,499

|

)

|

|||||||||

|

Other comprehensive income (loss), net of tax

|

10,599

|

|

1,627

|

|

1,993

|

|

(12,193

|

)

|

2,026

|

|

|||||||||

|

Balance as of May 31, 2017, net of tax

|

$

|

(154,547

|

)

|

$

|

7,283

|

|

$

|

(7,203

|

)

|

$

|

(55,233

|

)

|

$

|

(209,700

|

)

|

||||

|

Qualified

Pension Benefits

|

Non-Qualified

Pension Benefits

|

Other Benefits

|

|||||||||||||||||||||

|

|

2018

|

2017

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||||||

|

Components of net periodic benefit costs for the three months ended May 31 are as follows:

|

(Dollars in thousands)

|

||||||||||||||||||||||

|

Service cost

|

$

|

9,920

|

|

$

|

10,537

|

|

$

|

137

|

|

$

|

302

|

|

$

|

236

|

|

$

|

290

|

|

|||||

|

Interest cost

|

5,997

|

|

5,753

|

|

177

|

|

210

|

|

227

|

|

232

|

|

|||||||||||

|

Expected return on assets

|

(12,044

|

)

|

(12,058

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Prior service cost (credit) amortization

|

360

|

|

385

|

|

7

|

|

4

|

|

(142

|

)

|

(141

|

)

|

|||||||||||

|

Actuarial (gain) loss amortization

|

4,905

|

|

5,708

|

|

16

|

|

136

|

|

(306

|

)

|

(199

|

)

|

|||||||||||

|

Net periodic benefit cost

|

$

|

9,138

|

|

$

|

10,325

|

|

$

|

337

|

|

$

|

652

|

|

$

|

15

|

|

$

|

182

|

|

|||||

|

Components of net periodic benefit costs for the nine months ended May 31 are as follows:

|

|||||||||||||||||||||||

|

Service cost

|

$

|

29,758

|

|

$

|

31,612

|

|

$

|

411

|

|

$

|

905

|

|

$

|

707

|

|

$

|

870

|

|

|||||

|

Interest cost

|

17,988

|

|

17,257

|

|

533

|

|

632

|

|

681

|

|

698

|

|

|||||||||||

|

Expected return on assets

|

(36,133

|

)

|

(36,173

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||

|

Prior service cost (credit) amortization

|

1,078

|

|

1,155

|

|

23

|

|

14

|

|

(424

|

)

|

(424

|

)

|

|||||||||||

|

Actuarial (gain) loss amortization

|

16,304

|

|

17,123

|

|

46

|

|

409

|

|

(918

|

)

|

(598

|

)

|

|||||||||||

|

Net periodic benefit cost

|

$

|

28,995

|

|

$

|

30,974

|

|

$

|

1,013

|

|

$

|

1,960

|

|

$

|

46

|

|

$

|

546

|

|

|||||

|

|

Energy

|

Ag

|

Nitrogen Production

|

Corporate

and Other |

Reconciling

Amounts |

Total

|

|||||||||||||||||

|

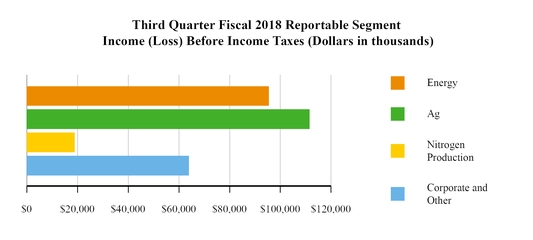

For the Three Months Ended May 31, 2018:

|

(Dollars in thousands)

|

||||||||||||||||||||||

|

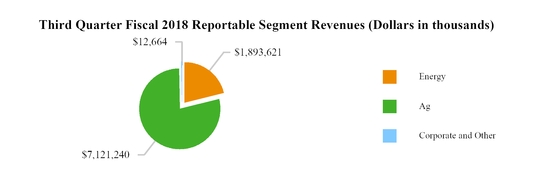

Revenues

|

$

|

2,009,907

|

|

|

$

|

7,125,024

|

|

|

$

|

—

|

|

$

|

14,074

|

|

|

$

|

(121,480

|

)

|

|

$

|

9,027,525

|

|

|

|

Operating earnings (loss)

|

31,525

|

|

|

115,052

|

|

|

(4,153

|

)

|

(1,580

|

)

|

|

—

|

|

|

140,844

|

|

|||||||

|

(Gain) loss on disposal of business

|

(65,903

|

)

|

5

|

|

—

|

|

(58,152

|

)

|

—

|

|

(124,050

|

)

|

|||||||||||

|

Interest expense

|

3,496

|

|

|

28,854

|

|

|

13,119

|

|

4,324

|

|

|

(453

|

)

|

|

49,340

|

|

|||||||

|

Other (income) loss

|

(472

|

)

|

(13,891

|

)

|

(441

|

)

|

(271

|

)

|

453

|

|

(14,622

|

)

|

|||||||||||

|

Equity (income) loss from investments

|

(967

|

)

|

|

(11,359

|

)

|

|

(35,639

|

)

|

(11,343

|

)

|

|

—

|

|

|

(59,308

|

)

|

|||||||

|

Income (loss) before income taxes

|

$

|

95,371

|

|

|

$

|

111,443

|

|

|

$

|

18,808

|

|

$

|

63,862

|

|

|

$

|

—

|

|

|

$

|

289,484

|

|

|

|

Intersegment revenues

|

$

|

(116,286

|

)

|

|

$

|

(3,784

|

)

|

|

$

|

—

|

|

$

|

(1,410

|

)

|

|

$

|

121,480

|

|

|

$

|

—

|

|

|

|

Energy

|

Ag

|

Nitrogen Production

|

Corporate

and Other |

Reconciling

Amounts |

Total

|

||||||||||||||||||

|

For the Three Months Ended May 31, 2017:

|

(Dollars in thousands)

|

||||||||||||||||||||||

|

Revenues

|

$

|

1,638,107

|

|

$

|

7,053,991

|

|

$

|

—

|

|

$

|

26,820

|

|

$

|

(104,828

|

)

|

$

|

8,614,090

|

|

|||||

|

Operating earnings (loss)

|

(5,723

|

)

|

(226,668

|

)

|

(5,619

|

)

|

7,713

|

|

—

|

|

(230,297

|

)

|

|||||||||||

|

Interest expense

|

4,343

|

|

16,609

|

|

10,708

|

|

8,127

|

|

(586

|

)

|

39,201

|

|

|||||||||||

|

Other (income) loss

|

(332

|

)

|

(12,886

|

)

|

(477

|

)

|

1,162

|

|

586

|

|

(11,947

|

)

|

|||||||||||

|

Equity (income) loss from investments

|

(391

|

)

|

(9,199

|

)

|

(24,534

|

)

|

(14,269

|

)

|

—

|

|

(48,393

|

)

|

|||||||||||

|

Income (loss) before income taxes

|

$

|

(9,343

|

)

|

$

|

(221,192

|

)

|

$

|

8,684

|

|

$

|

12,693

|

|

$

|

—

|

|

$

|

(209,158

|

)

|

|||||

|

Intersegment revenues

|

$

|

(97,876

|

)

|

$

|

(7,545

|

)

|

$

|

—

|

|

$

|

593

|

|

$

|

104,828

|

|

$

|

—

|

|

|||||

|

Energy

|

Ag

|

Nitrogen Production

|

Corporate

and Other |

Reconciling

Amounts |

Total

|

||||||||||||||||||

|

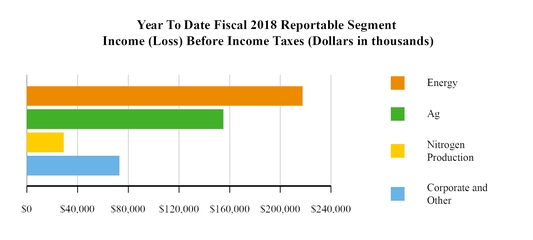

For the Nine Months Ended May 31, 2018:

|

(Dollars in thousands)

|

||||||||||||||||||||||

|

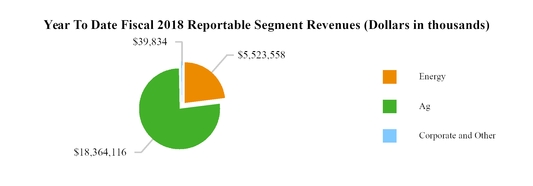

Revenues

|

$

|

5,878,657

|

|

$

|

18,375,507

|

|

$

|

—

|

|

$

|

46,018

|

|

$

|

(372,674

|

)

|

$

|

23,927,508

|

|

|||||

|

Operating earnings (loss)

|

159,070

|

|

145,907

|

|

(14,527

|

)

|

(5,608

|

)

|

—

|

|

284,842

|

|

|||||||||||

|

(Gain) loss on disposal of business

|

(65,903

|

)

|

(7,700

|

)

|

—

|

|

(58,152

|

)

|

—

|

|

(131,755

|

)

|

|||||||||||

|

Interest expense

|

11,760

|

|

69,242

|

|

39,067

|

|

11,569

|

|

(1,420

|

)

|

130,218

|

|

|||||||||||

|

Other (income) loss

|

(1,492

|

)

|

(45,511

|

)

|

(2,612

|

)

|

(2,805

|

)

|

1,420

|

|

(51,000

|

)

|

|||||||||||

|

Equity (income) loss from investments

|

(2,779

|

)

|

(25,180

|

)

|

(79,986

|

)

|

(29,166

|

)

|

—

|

|

(137,111

|

)

|

|||||||||||

|

Income (loss) before income taxes

|

$

|

217,484

|

|

$

|

155,056

|

|

$

|

29,004

|

|

$

|

72,946

|

|

$

|

—

|

|

$

|

474,490

|

|

|||||

|

Intersegment revenues

|

$

|

(355,099

|

)

|

$

|

(11,391

|

)

|

$

|

—

|

|

$

|

(6,184

|

)

|

$

|

372,674

|

|

$

|

—

|

|

|||||

|

Total assets at May 31, 2018

|

$

|

4,208,214

|

|

$

|

7,510,962

|

|

$

|

2,810,256

|

|

$

|

2,406,347

|

|

$

|

—

|

|

$

|

16,935,779

|

|

|||||

|

Energy

|

Ag

|

Nitrogen Production

|

Corporate

and Other |

Reconciling

Amounts |

Total

|

||||||||||||||||||

|

For the Nine Months Ended May 31, 2017:

|

(Dollars in thousands)

|

||||||||||||||||||||||

|

Revenues

|

$

|

4,867,321

|

|

$

|

19,345,316

|

|

$

|

—

|

|

$

|

85,691

|

|

$

|

(315,582

|

)

|

$

|

23,982,746

|

|

|||||

|

Operating earnings (loss)

|

86,563

|

|

(131,363

|

)

|

(14,033

|

)

|

25,534

|

|

—

|

|

(33,299

|

)

|

|||||||||||

|

Interest expense

|

12,176

|

|

49,798

|

|

35,626

|

|

27,512

|

|

(7,701

|

)

|

117,411

|

|

|||||||||||

|

Other (income) loss

|

(828

|

)

|

(41,801

|

)

|

(30,047

|

)

|

(1,208

|

)

|

7,701

|

|

(66,183

|

)

|

|||||||||||

|

Equity (income) loss from investments

|

(2,039

|

)

|

(18,071

|

)

|

(60,787

|

)

|

(43,624

|

)

|

—

|

|

(124,521

|

)

|

|||||||||||

|

Income (loss) before income taxes

|

$

|

77,254

|

|

$

|

(121,289

|

)

|

$

|

41,175

|

|

$

|

42,854

|

|

$

|

—

|

|

$

|

39,994

|

|

|||||

|

Intersegment revenues

|

$

|

(297,057

|

)

|

$

|

(16,068

|

)

|

$

|

—

|

|

$

|

(2,457

|

)

|

$

|

315,582

|

|

$

|

—

|

|

|||||

|

May 31, 2018

|

|||||||||||||||

|

Amounts Not Offset on the Consolidated Balance Sheet but Eligible for Offsetting

|

|||||||||||||||

|

Gross Amounts Recognized

|

Cash Collateral

|

Derivative Instruments

|

Net Amounts

|

||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||

|

Derivative Assets:

|

|||||||||||||||

|

Commodity and freight derivatives

|

$

|

473,418

|

|

$

|

—

|

|

$

|

33,979

|

|

$

|

439,439

|

|

|||

|

Foreign exchange derivatives

|

9,298

|

|

—

|

|

5,814

|

|

3,484

|

|

|||||||

|

Embedded derivative asset

|

23,145

|

|

—

|

|

—

|

|

23,145

|

|

|||||||

|

Total

|

$

|

505,861

|

|

$

|

—

|

|

$

|

39,793

|

|

$

|

466,068

|

|

|||

|

Derivative Liabilities:

|

|||||||||||||||

|

Commodity and freight derivatives

|

$

|

330,364

|

|

$

|

4,063

|

|

$

|

33,979

|

|

$

|

292,322

|

|

|||

|

Foreign exchange derivatives

|

23,084

|

|

—

|

|

5,814

|

|

17,270

|

|

|||||||

|

Interest rate derivatives - non-hedge

|

3

|

|

—

|

|

—

|

|

3

|

|

|||||||

|

Total

|

$

|

353,451

|

|

$

|

4,063

|

|

$

|

39,793

|

|

$

|

309,595

|

|

|||

|

August 31, 2017

|

|||||||||||||||

|

Amounts Not Offset on the Consolidated Balance Sheet but Eligible for Offsetting

|

|||||||||||||||

|

Gross Amounts Recognized

|

Cash Collateral

|

Derivative Instruments

|

Net Amounts

|

||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||

|

Derivative Assets:

|

|||||||||||||||

|

Commodity and freight derivatives

|

$

|

384,648

|

|

$

|

—

|

|

$

|

35,080

|

|

$

|

349,568

|

|

|||

|

Foreign exchange derivatives

|

8,771

|

|

—

|

|

3,636

|

|

5,135

|

|

|||||||

|

Embedded derivative asset

|

25,533

|

|

—

|

|

—

|

|

25,533

|

|

|||||||

|

Total

|

$

|

418,952

|

|

$

|

—

|

|

$

|

38,716

|

|

$

|

380,236

|

|

|||

|

Derivative Liabilities:

|

|||||||||||||||

|

Commodity and freight derivatives

|

$

|

309,762

|

|

$

|

3,898

|

|

$

|

35,080

|

|

$

|

270,784

|

|

|||

|

Foreign exchange derivatives

|

19,931

|

|

—

|

|

3,636

|

|

16,295

|

|

|||||||

|

Total

|

$

|

329,693

|

|

$

|

3,898

|

|

$

|

38,716

|

|

$

|

287,079

|

|

|||

|

For the Three Months Ended

May 31, |

For the Nine Months Ended

May 31, |

||||||||||||||||

|

Location of

Gain (Loss)

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||

|

Commodity and freight derivatives

|

Cost of goods sold

|

$

|

68,813

|

|

$

|

102,327

|

|

$

|

254

|

|

$

|

177,633

|

|

||||

|

Foreign exchange derivatives

|

Cost of goods sold

|

(16,549

|

)

|

(7,168

|

)

|

(15,600

|

)

|

(4,573

|

)

|

||||||||

|

Foreign exchange derivatives

|

Marketing, general and administrative

|

(1,109

|

)

|

22

|

|

(1,260

|

)

|

(784

|

)

|

||||||||

|

Interest rate derivatives

|

Interest expense

|

(2

|

)

|

—

|

|

(3

|

)

|

4

|

|

||||||||

|

Embedded derivative

|

Other income

|

441

|

|

477

|

|

2,612

|

|

30,051

|

|

||||||||

|

Total

|

$

|

51,594

|

|

$

|

95,658

|

|

$

|

(13,997

|

)

|

$

|

202,331

|

|

|||||

|

|

May 31, 2018

|

August 31, 2017

|

|||||||||

|

Long

|

Short

|

Long

|

Short

|

||||||||

|

|

(Units in thousands)

|

||||||||||

|

Grain and oilseed - bushels

|

852,993

|

|

1,097,748

|

|

570,673

|

|

768,540

|

|

|||

|

Energy products - barrels

|

18,425

|

|

12,383

|

|

15,072

|

|

18,252

|

|

|||

|

Processed grain and oilseed - tons

|

426

|

|

2,403

|

|

299

|

|

2,347

|

|

|||

|

Crop nutrients - tons

|

26

|

|

42

|

|

9

|

|

15

|

|

|||

|

Ocean and barge freight - metric tons

|

5,531

|

|

2,883

|

|

2,777

|

|

1,766

|

|

|||

|

Rail freight - rail cars

|

166

|

|

52

|

|

176

|

|

75

|

|

|||

|

Natural gas - MMBtu

|

1,220

|

|

—

|

|

500

|

|

—

|

|

|||

|

Derivative Assets

|

Derivative Liabilities

|

|||||||||||||||||||

|

Fair Value Hedges

|

Balance Sheet Location

|

May 31, 2018

|

August 31, 2017

|

Balance Sheet Location

|

May 31, 2018

|

August 31, 2017

|

||||||||||||||

|

(Dollars in thousands)

|

(Dollars in thousands)

|

|||||||||||||||||||

|

Interest rate swaps

|

Other assets

|

$

|

—

|

|

$

|

9,978

|

|

Other liabilities

|

$

|

8,847

|

|

$

|

707

|

|

||||||

|

For the Three Months Ended May 31,

|

For the Nine Months Ended May 31,

|

|||||||||||||||||

|

Gain (Loss) on Fair Value Hedging Relationships:

|

Location of

Gain (Loss)

|

2018

|

2017

|

2018

|

2017

|

|||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||

|

Interest rate swaps

|

Interest expense

|

$

|

(231

|

)

|

$

|

3,750

|

|

$

|

(18,118

|

)

|

$

|

(13,764

|

)

|

|||||

|

Hedged item

|

Interest expense

|

231

|

|

(3,750

|

)

|

18,118

|

|

13,764

|

|

|||||||||

|

Total

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

May 31, 2018

|

August 31, 2017

|

|||||||||||||||

|

Balance Sheet Location

|

Carrying Amount of Hedged Liabilities

|

Cumulative Amount of Fair Value Hedging Adjustments Included in the Carrying Amount of Hedged Liabilities

|

Carrying Amount of Hedged Liabilities

|

Cumulative Amount of Fair Value Hedging Adjustments Included in the Carrying Amount of Hedged Liabilities

|

||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||

|

Long-term debt

|

$

|

486,153

|

|

$

|

8,847

|

|

$

|

504,271

|

|

$

|

(9,271

|

)

|

||||

|

May 31, 2018

|

|||||||||||||||

|

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

|

Significant

Other

Observable

Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

Total

|

||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

Assets:

|

|

|

|

|

|

|

|

|

|||||||

|

Commodity and freight derivatives

|

$

|

44,456

|

|

$

|

428,962

|

|

$

|

—

|

|

$

|

473,418

|

|

|||

|

Foreign currency derivatives

|

—

|

|

9,298

|

|

—

|

|

9,298

|

|

|||||||

|

Deferred compensation assets

|

38,765

|

|

—

|

|

—

|

|

38,765

|

|

|||||||

|

Deferred purchase price receivable

|

—

|

|

—

|

|

464,516

|

|

464,516

|

|

|||||||

|

Embedded derivative asset

|

—

|

|

23,145

|

|

—

|

|

23,145

|

|

|||||||

|

Other assets

|

16,783

|

|

—

|

|

—

|

|

16,783

|

|

|||||||

|

Total

|

$

|

100,004

|

|

$

|

461,405

|

|

$

|

464,516

|

|

$

|

1,025,925

|

|

|||

|

Liabilities:

|

|

|

|

|

|

|

|

||||||||

|

Commodity and freight derivatives

|

$

|

37,294

|

|

$

|

293,070

|

|

$

|

—

|

|

$

|

330,364

|

|

|||

|

Foreign currency derivatives

|

—

|

|

23,084

|

|

—

|

|

23,084

|

|

|||||||

|

Interest rate swap derivatives

|

3

|

|

8,847

|

|

—

|

|

8,850

|

|

|||||||

|

Total

|

$

|

37,297

|

|

$

|

325,001

|

|

$

|

—

|

|

$

|

362,298

|

|

|||

|

August 31, 2017

|

|||||||||||||||

|

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

|

Significant

Other

Observable

Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

Total

|

||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

Assets:

|

|||||||||||||||

|

Commodity and freight derivatives

|

$

|

48,491

|

|

$

|

336,157

|

|

$

|

—

|

|

$

|

384,648

|

|

|||

|

Foreign currency derivatives

|

—

|

|

8,771

|

|

—

|

|

8,771

|

|

|||||||

|

Interest rate swap derivatives

|

—

|

|

9,978

|

|

—

|

|

9,978

|

|

|||||||

|

Deferred compensation assets

|

52,414

|

|

—

|

|

—

|

|

52,414

|

|

|||||||

|

Deferred purchase price receivable

|

—

|

|

—

|

|

548,602

|

|

548,602

|

|

|||||||

|

Embedded derivative asset

|

—

|

|

25,533

|

|

—

|

|

25,533

|

|

|||||||

|

Other assets

|

14,846

|

|

—

|

|

—

|

|

14,846

|

|

|||||||

|

Total

|

$

|

115,751

|

|

$

|

380,439

|

|

$

|

548,602

|

|

$

|

1,044,792

|

|

|||

|

Liabilities:

|

|||||||||||||||

|

Commodity and freight derivatives

|

$

|

31,189

|

|

$

|

278,573

|

|

$

|

—

|

|

$

|

309,762

|

|

|||

|

Foreign currency derivatives

|

—

|

|

19,931

|

|

—

|

|

19,931

|

|

|||||||

|

Interest rate swap derivatives

|

—

|

|

707

|

|

—

|

|

707

|

|

|||||||

|

Total

|

$

|

31,189

|

|

$

|

299,211

|

|

$

|

—

|

|

$

|

330,400

|

|

|||

|

•

|

Overview

|

|

•

|

Business Strategy

|

|

•

|

Fiscal

2018

Third Quarter Highlights

|

|

•

|

Fiscal

2018

Priorities Update

|

|

•

|

Fiscal

2018

Trends Update

|

|

•

|

Results of Operations

|

|

•

|

Liquidity and Capital Resources

|

|

•

|

Off Balance Sheet Financing Arrangements

|

|

•

|

Contractual Obligations

|

|

•

|

Critical Accounting Policies

|

|

•

|

Effect of Inflation and Foreign Currency Transactions

|

|

•

|

Recent Accounting Pronouncements

|

|

•

|

Energy -

produces and provides primarily for the wholesale distribution and transportation of petroleum products.

|

|

•

|

Ag

- purchases and further processes or resells grains and oilseeds originated by our country operations business, by our member cooperatives and by third parties and also serves as a wholesaler and retailer of crop inputs.

|

|

•

|

Nitrogen Production

- consists solely of our equity method investment in CF Nitrogen and produces and distributes nitrogen fertilizer, a commodity chemical.

|

|

•

|

Margins were higher in our Ag and Energy segments compared to prior year results due to higher margins for feed and farm supplies, crop nutrients, processing and food ingredients and refined fuels.

|

|

•

|

Higher volumes in our Ag segment compared to prior year results driven by increased volumes of feed and farm supplies and processing and food ingredients.

|

|

•

|

We completed the disposal of certain assets within our Energy segment and Corporate and Other resulting in cash proceeds of approximately

$181.4 million

and a gain of approximately

$124.1 million

. The cash proceeds were used to optimize our debt levels by reducing our need for incremental debt and minimizing existing funded debt.

|

|

For the Three Months Ended May 31,

|

For the Nine Months Ended May 31,

|

||||||||||||||

|

2018

|

2017

|

2018

|

2017

|

||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

Revenues

|

$

|

9,027,525

|

|

$

|

8,614,090

|

|

$

|

23,927,508

|

|

$

|

23,982,746

|

|

|||

|

Cost of goods sold

|

8,728,914

|

|

8,366,988

|

|

23,173,151

|

|

23,142,205

|

|

|||||||

|

Gross profit

|

298,611

|

|

247,102

|

|

754,357

|

|

840,541

|

|

|||||||

|

Marketing, general and administrative

|

161,578

|

|

153,498

|

|

488,459

|

|

459,831

|

|

|||||||

|

Reserve and impairment charges (recoveries), net

|

(3,811

|

)

|

323,901

|

|

(18,944

|

)

|

414,009

|

|

|||||||

|

Operating earnings (loss)

|

140,844

|

|

(230,297

|

)

|

284,842

|

|

(33,299

|

)

|

|||||||

|

(Gain) loss on disposal of business

|

(124,050

|

)

|

—

|

|

(131,755

|

)

|

—

|

|

|||||||

|

Interest expense

|

49,340

|

|

39,201

|

|

130,218

|

|

117,411

|

|

|||||||

|

Other (income) loss

|

(14,622

|

)

|

(11,947

|

)

|

(51,000

|

)

|

(66,183

|

)

|

|||||||

|

Equity (income) loss from investments

|

(59,308

|

)

|

(48,393

|

)

|

(137,111

|

)

|

(124,521

|

)

|

|||||||

|

Income (loss) before income taxes

|

289,484

|

|

(209,158

|

)

|

474,490

|

|

39,994

|

|

|||||||

|

Income tax expense (benefit)

|

60,338

|

|

(163,018

|

)

|

(100,901

|

)

|

(137,781

|

)

|

|||||||

|

Net income (loss)

|

229,146

|

|

(46,140

|

)

|

575,391

|

|

177,775

|

|

|||||||

|

Net income (loss) attributable to noncontrolling interests

|

(187

|

)

|

(955

|

)

|

(699

|

)

|

(757

|

)

|

|||||||

|

Net income (loss) attributable to CHS Inc.

|

$

|

229,333

|

|

$

|

(45,185

|

)

|

$

|

576,090

|

|

$

|

178,532

|

|

|||

|

For the Three Months Ended May 31,

|

Change

|

For the Nine Months Ended May 31,

|

Change

|

||||||||||||||||||||||||||

|

2018

|

2017

|

Dollars

|

Percent

|

2018

|

2017

|

Dollars

|

Percent

|

||||||||||||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||

|

Income (loss) before income taxes

|

$

|

95,371

|

|

$

|

(9,343

|

)

|

$

|

104,714

|

|

1,120.8

|

%

|

$

|

217,484

|

|

$

|

77,254

|

|

$

|

140,230

|

|

181.5

|

%

|

|||||||

|

Year-Over-Year Change

|

||||||||

|

Three Months Ended May 31,

|

Nine Months Ended May 31,

|

|||||||

|

(Dollars in millions)

|

||||||||

|

Volume

|

$

|

—

|

|

$

|

(4

|

)

|

||

|

Price

|

12

|

|

55

|

|

||||

|

Other*

|

(3

|

)

|

(1

|

)

|

||||

|

Change in reserves and impairments (recoveries), net

+

|

33

|

|

33

|

|

||||

|

Non-gross profit related activity

+

|

63

|

|

57

|

|

||||

|

Total change in Energy IBIT

|

$

|

105

|

|

$

|

140

|

|

||

|

•

|

Improved market conditions in our refined fuels business, primarily driven by higher crack spreads and the associated higher margins.

|

|

•

|

Gains totaling

$65.9 million

recorded in other income in connection with the sale of certain assets, including the sale of 34 Zip Trip stores located in the Pacific Northwest, United States ("Pacific Northwest") and the sale of the Council Bluffs pipeline and refined fuels terminal in Council Bluffs, Iowa.

|

|

•

|

During the third quarter of fiscal 2017, an impairment charge of $32.7 million was recorded related to the cancellation of a capital project which did not reoccur in the current fiscal year.

|

|

For the Three Months Ended May 31,

|

Change

|

For the Nine Months Ended May 31,

|

Change

|

||||||||||||||||||||||||||

|

2018

|

2017

|

Dollars

|

Percent

|

2018

|

2017

|

Dollars

|

Percent

|

||||||||||||||||||||||

|

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||

|

Income (loss) before income taxes

|

$

|

111,443

|

|

$

|

(221,192

|

)

|

$

|

332,635

|

|

150.4

|

%

|

$

|

155,056

|

|

$

|

(121,289

|

)

|

$

|

276,345

|

|

227.8

|

%

|

|||||||

|

Year-Over-Year Change

|

||||||||

|

Three Months Ended May 31,

|

Nine Months Ended May 31,

|

|||||||

|

(Dollars in millions)

|

||||||||

|

Volume

|

$

|

14

|

|

$

|

1

|

|