|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

þ

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the fiscal year ended August 31, 2013

|

|

or

|

||

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the transition period from to

|

|

Delaware

|

|

75-0725338

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

6565 MacArthur Blvd,

Irving, TX

(Address of principal executive offices)

|

|

75039

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value

|

|

New York Stock Exchange

|

|

Preferred Stock Purchase Rights

|

|

New York Stock Exchange

|

|

Large accelerated filer

þ

|

Accelerated filer

o

|

Non-accelerated filer

o

|

Smaller reporting company

o

|

|

3

|

|

|

|

|

|

|

|

3

|

|

|

|

10

|

|

|

|

17

|

|

|

|

17

|

|

|

|

18

|

|

|

|

18

|

|

|

|

|

|

|

|

19

|

|

|

|

|

|

|

|

19

|

|

|

|

21

|

|

|

|

Item 7: Management's Discussion and Analysis of Financial Condition and Results of Operations

|

21

|

|

|

37

|

|

|

|

39

|

|

|

|

67

|

|

|

|

67

|

|

|

|

68

|

|

|

|

|

|

|

|

68

|

|

|

|

|

|

|

|

68

|

|

|

|

69

|

|

|

|

69

|

|

|

|

69

|

|

|

|

69

|

|

|

|

|

|

|

|

70

|

|

|

|

|

|

|

|

70

|

|

|

|

78

|

|

|

|

79

|

|

|

|

(in short tons)

|

2013

|

2012

|

2011

|

||||||

|

Tons melted

|

2,407,000

|

|

2,568,000

|

|

2,470,000

|

|

|||

|

Tons rolled

|

2,295,000

|

|

2,206,000

|

|

2,088,000

|

|

|||

|

Tons shipped

|

2,561,000

|

|

2,682,000

|

|

2,518,000

|

|

|||

|

•

|

a melt shop with an electric arc furnace that melts ferrous scrap metal;

|

|

•

|

continuous casting equipment that shapes the molten metal into billets;

|

|

•

|

a reheating furnace that prepares billets for rolling;

|

|

•

|

a rolling mill that forms products from heated billets;

|

|

•

|

a mechanical cooling bed that receives hot product from the rolling mill;

|

|

•

|

finishing facilities that cut, straighten, bundle and prepare products for shipping; and

|

|

•

|

supporting facilities such as maintenance, warehouse and office areas.

|

|

•

|

political, military, terrorist or major pandemic events;

|

|

•

|

legal and regulatory requirements or limitations imposed by foreign governments (particularly those with significant steel consumption or steel related production including China, Brazil, Russia and India) including quotas, tariffs or other protectionist trade barriers, adverse tax law changes, nationalization or currency restrictions;

|

|

•

|

disruptions or delays in shipments caused by customs compliance or government agencies; and

|

|

•

|

potential difficulties in staffing and managing local operations.

|

|

2013

FISCAL QUARTER |

HIGH

|

LOW

|

CASH DIVIDENDS

|

|||||||||

|

1st

|

$

|

15.10

|

|

$

|

12.63

|

|

$

|

0.12

|

|

|||

|

2nd

|

17.47

|

|

13.15

|

|

0.12

|

|

||||||

|

3rd

|

17.25

|

|

13.33

|

|

0.12

|

|

||||||

|

4th

|

16.25

|

|

13.43

|

|

0.12

|

|

||||||

|

2012

FISCAL QUARTER |

HIGH

|

LOW

|

CASH DIVIDENDS

|

|||||||||

|

1st

|

$

|

14.50

|

|

$

|

8.64

|

|

$

|

0.12

|

|

|||

|

2nd

|

16.48

|

|

12.57

|

|

0.12

|

|

||||||

|

3rd

|

15.40

|

|

11.50

|

|

0.12

|

|

||||||

|

4th

|

14.09

|

|

11.30

|

|

0.12

|

|

||||||

|

A.

|

B.

|

C.

|

||||

|

PLAN CATEGORY

|

NUMBER OF SECURITIES

TO BE ISSUED UPON EXERCISE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS |

WEIGHTED-AVERAGE

EXERCISE PRICE OF OUTSTANDING OPTIONS, WARRANTS AND RIGHTS |

NUMBER OF SECURITIES

REMAINING AVAILABLE FOR FUTURE ISSUANCE UNDER EQUITY COMPENSATION PLANS (EXCLUDING SECURITIES REFLECTED IN COLUMN (A)) |

|||

|

Equity

|

|

|

|

|||

|

Compensation plans

approved by security holders |

2,653,430

|

$24.07

|

17,781,754

|

|||

|

Equity

|

|

|

|

|||

|

Compensation plans not approved by security holders

|

—

|

—

|

—

|

|||

|

TOTAL

|

2,653,430

|

24.07

|

17,781,754

|

|||

|

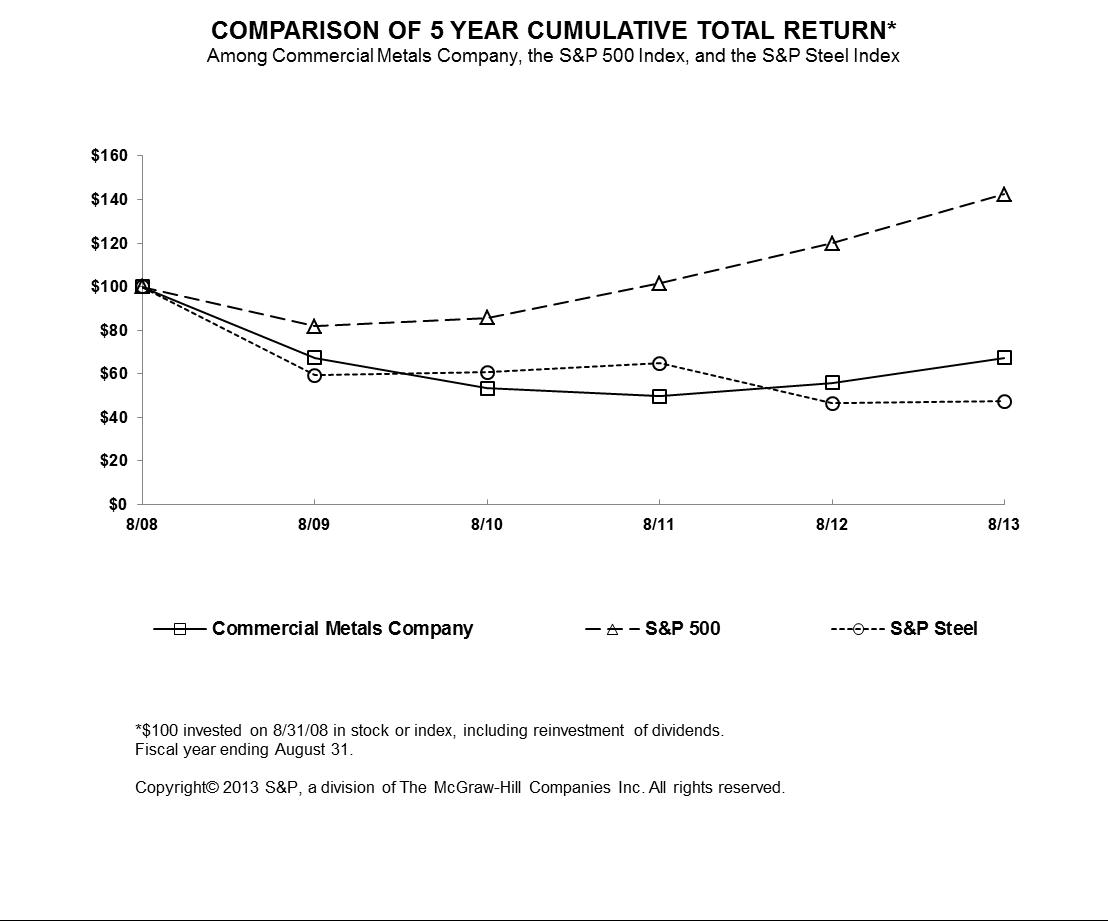

8/08

|

8/09

|

8/10

|

8/11

|

8/12

|

8/13

|

|||||||||||||

|

Commercial Metals Company

|

100.00

|

|

67.27

|

|

53.38

|

|

49.67

|

|

55.91

|

|

67.47

|

|

||||||

|

S&P 500

|

100.00

|

|

81.75

|

|

85.76

|

|

101.63

|

|

119.92

|

|

142.35

|

|

||||||

|

S&P Steel

|

100.00

|

|

59.34

|

|

60.82

|

|

64.81

|

|

46.45

|

|

47.49

|

|

||||||

|

2013

|

2012

|

2011

|

2010

|

2009

|

|||||||||||||||

|

Net sales*

|

$

|

6,889,575

|

|

$

|

7,656,375

|

|

$

|

7,666,773

|

|

$

|

6,119,628

|

|

$

|

6,228,343

|

|

||||

|

Net earnings (loss) attributable to CMC*

|

74,953

|

|

210,543

|

|

11,326

|

|

(101,260

|

)

|

25,608

|

|

|||||||||

|

Diluted earnings (loss) per share attributable to CMC*

|

$

|

0.64

|

|

$

|

1.80

|

|

$

|

0.09

|

|

$

|

(0.89

|

)

|

$

|

0.22

|

|

||||

|

Total assets

|

3,494,801

|

|

3,441,246

|

|

3,683,131

|

|

3,706,153

|

|

3,687,556

|

|

|||||||||

|

Stockholders’ equity attributable to CMC

|

1,269,999

|

|

1,246,368

|

|

1,160,425

|

|

1,250,736

|

|

1,529,693

|

|

|||||||||

|

Long-term debt

|

1,278,814

|

|

1,157,073

|

|

1,167,497

|

|

1,197,282

|

|

1,181,740

|

|

|||||||||

|

Cash dividends per share

|

0.48

|

|

0.48

|

|

0.48

|

|

0.48

|

|

0.48

|

|

|||||||||

|

Ratio of earnings to fixed charges

|

2.56

|

|

2.94

|

|

1.32

|

|

**

|

|

1.13

|

|

|||||||||

|

•

|

absence of global economic recovery or possible recession relapse and the pace of overall global economic activity;

|

|

•

|

solvency of financial institutions and their ability or willingness to lend;

|

|

•

|

success or failure of governmental efforts to stimulate the economy including restoring credit availability and confidence in a recovery;

|

|

•

|

continued sovereign debt problems in the Euro-zone;

|

|

•

|

construction activity or lack thereof;

|

|

•

|

availability and pricing of raw materials over which we exert little influence, including scrap metal, energy, insurance and supply prices;

|

|

•

|

increased capacity and product availability from competing steel minimills and other steel suppliers including import quantities and pricing;

|

|

•

|

decisions by governments affecting the level of steel imports;

|

|

•

|

passage of new, or interpretation of existing, environmental laws and regulations;

|

|

•

|

customers' inability to obtain credit and non-compliance with contracts;

|

|

•

|

financial covenants and restrictions on the operation of our business contained in agreements governing our debt;

|

|

•

|

currency fluctuations;

|

|

•

|

global factors including political and military uncertainties;

|

|

•

|

difficulties or delays in the execution of construction contracts, resulting in cost overruns or contract disputes;

|

|

•

|

ability to retain key executives;

|

|

•

|

execution of cost reduction strategies;

|

|

•

|

industry consolidation or changes in production capacity or utilization;

|

|

•

|

ability to make necessary capital expenditures;

|

|

•

|

unexpected equipment failures;

|

|

•

|

competition from other materials;

|

|

•

|

losses or limited potential gains due to hedging transactions;

|

|

•

|

litigation claims and settlements, court decisions and regulatory rulings;

|

|

•

|

risk of injury or death to employees, customers or other visitors to our operations; and

|

|

•

|

increased costs related to health care reform legislation.

|

|

|

Year Ended August 31,

|

|||||||||||

|

(in thousands except per share data)

|

2013

|

2012

|

2011

|

|||||||||

|

Net sales*

|

$

|

6,889,575

|

|

$

|

7,656,375

|

|

$

|

7,666,773

|

|

|||

|

Earnings from continuing operations

|

74,957

|

|

210,549

|

|

11,539

|

|

||||||

|

Per diluted share

|

$

|

0.64

|

|

$

|

1.80

|

|

$

|

0.09

|

|

|||

|

Adjusted EBITDA*

|

353,542

|

|

368,710

|

|

271,199

|

|

||||||

|

International net sales*

|

2,782,344

|

|

3,152,589

|

|

3,499,813

|

|

||||||

|

As % of total sales

|

40

|

%

|

41

|

%

|

46

|

%

|

||||||

|

LIFO income (expense)** effect on net earnings (loss) attributable to CMC*

|

34,393

|

|

27,149

|

|

(46,712

|

)

|

||||||

|

Per diluted share

|

0.29

|

|

0.23

|

|

(0.40

|

)

|

||||||

|

|

Year Ended August 31,

|

|||||||||||

|

(in thousands)

|

2013

|

2012

|

2011

|

|||||||||

|

Earnings from continuing operations

|

$

|

74,957

|

|

$

|

210,549

|

|

$

|

11,539

|

|

|||

|

Less net earnings attributable to noncontrolling interests

|

4

|

|

6

|

|

213

|

|

||||||

|

Interest expense

|

69,608

|

|

69,487

|

|

69,814

|

|

||||||

|

Income taxes (benefit)

|

57,979

|

|

(45,762

|

)

|

14,592

|

|

||||||

|

Depreciation, amortization and impairment charges

|

151,002

|

|

134,442

|

|

175,467

|

|

||||||

|

Adjusted EBITDA

|

$

|

353,542

|

|

$

|

368,710

|

|

$

|

271,199

|

|

|||

|

•

|

Our Americas Recycling segment was negatively impacted by declining ferrous and non-ferrous volumes and margins, when compared to the prior fiscal year.

|

|

•

|

Our Americas Fabrication segment showed the most progress when compared to the prior year, recording adjusted operating profit of

$28.0 million

, compared with an adjusted operating loss of

$15.7 million

in fiscal 2012. In our rebar and structural fabrication businesses, selling prices increased while raw material input prices for steel declined, enabling margin expansion for this segment.

|

|

•

|

Our International Mill segment recorded a significant decline in adjusted operating profit in fiscal 2013 when compared to the prior year. The decline in profitability was primarily a result of

17%

lower shipments when compared to fiscal 2012, as business conditions in the Eurozone remain challenged.

|

|

•

|

We recorded impairments related to long-lived assets of

$17.3 million

. Of this amount, approximately $12.7 million related to our Australian operations, as market conditions in Australia continued to show weakness in general and specifically in the steel construction market.

|

|

•

|

Our year-to-date effective tax rate was negatively impacted by the recognition of a full valuation allowance on the deferred tax assets related to our Australian operations as well as lower earnings by our foreign subsidiaries.

|

|

•

|

Pre-tax LIFO income was

$52.9 million

,

$11.1 million

more than LIFO income of

$41.8 million

in 2012.

|

|

•

|

During the first quarter of fiscal 2013, we completed the sale of our

11%

ownership interest in Trinecke Zelezarny, a.s. ("Trinecke"), a Czech Republic joint-stock company, for

$29.0 million

resulting in a pre-tax gain of

$26.1 million

. This gain was recorded in our International Marketing and Distribution segment.

|

|

|

Year Ended August 31,

|

|||||||||||

|

(in thousands)

|

2013

|

2012

|

2011

|

|||||||||

|

Net sales:

|

|

|

|

|||||||||

|

Americas Recycling

|

$

|

1,391,749

|

|

$

|

1,606,161

|

|

$

|

1,829,537

|

|

|||

|

Americas Mills

|

1,819,520

|

|

1,983,721

|

|

1,839,718

|

|

||||||

|

Americas Fabrication

|

1,442,691

|

|

1,381,638

|

|

1,225,722

|

|

||||||

|

International Mill

|

826,044

|

|

1,033,357

|

|

1,046,233

|

|

||||||

|

International Marketing and Distribution

|

2,355,572

|

|

2,727,319

|

|

2,650,899

|

|

||||||

|

Corporate

|

11,832

|

|

8,033

|

|

6,882

|

|

||||||

|

Eliminations

|

(957,833

|

)

|

(1,083,854

|

)

|

(932,218

|

)

|

||||||

|

Net sales

|

$

|

6,889,575

|

|

$7,656,375

|

$7,666,773

|

|||||||

|

Adjusted operating profit (loss):

|

|

|

|

|||||||||

|

Americas Recycling

|

$

|

3,170

|

|

$

|

39,446

|

|

$

|

43,059

|

|

|||

|

Americas Mills

|

204,333

|

|

235,918

|

|

149,213

|

|

||||||

|

Americas Fabrication

|

28,033

|

|

(15,697

|

)

|

(129,141

|

)

|

||||||

|

International Mill

|

890

|

|

23,044

|

|

47,594

|

|

||||||

|

International Marketing and Distribution

|

35,617

|

|

47,287

|

|

76,337

|

|

||||||

|

Corporate

|

(66,453

|

)

|

(83,035

|

)

|

(84,729

|

)

|

||||||

|

Eliminations

|

848

|

|

(6,251

|

)

|

(1,275

|

)

|

||||||

|

Adjusted operating profit

|

$

|

206,438

|

|

$

|

240,712

|

|

$

|

101,058

|

|

|||

|

Year Ended August 31,

|

||||||||||||

|

(in thousands)

|

2013

|

2012

|

2011

|

|||||||||

|

Americas Recycling

|

$

|

7,423

|

|

$

|

7,007

|

|

$

|

(12,980

|

)

|

|||

|

Americas Mills

|

7,166

|

|

16,629

|

|

(48,023

|

)

|

||||||

|

Americas Fabrication

|

12,177

|

|

15,248

|

|

(6,644

|

)

|

||||||

|

International Marketing and Distribution

|

26,146

|

|

2,884

|

|

(4,217

|

)

|

||||||

|

Pre-tax LIFO income (expense)

|

$

|

52,912

|

|

$

|

41,768

|

|

$

|

(71,864

|

)

|

|||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

|

2013

|

2012

|

Amount

|

%

|

|||||||||||

|

Average ferrous selling price

|

$

|

327

|

|

$

|

345

|

|

$

|

(18

|

)

|

(5

|

)%

|

||||

|

Average nonferrous selling price

|

$

|

2,729

|

|

$

|

2,823

|

|

$

|

(94

|

)

|

(3

|

)%

|

||||

|

Ferrous tons shipped

|

2,078

|

|

2,196

|

|

(118

|

)

|

(5

|

)%

|

|||||||

|

Nonferrous tons shipped

|

234

|

|

243

|

|

(9

|

)

|

(4

|

)%

|

|||||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

|

2013

|

2012

|

Amount

|

%

|

|||||||||||

|

Tons melted

|

2,407

|

|

2,568

|

|

(161

|

)

|

(6

|

)%

|

|||||||

|

Tons rolled

|

2,295

|

|

2,206

|

|

89

|

|

4

|

%

|

|||||||

|

Tons shipped

|

2,561

|

|

2,682

|

|

(121

|

)

|

(5

|

)%

|

|||||||

|

Average mill selling price (finished goods)

|

$

|

683

|

|

$

|

730

|

|

$

|

(47

|

)

|

(6

|

)%

|

||||

|

Average mill selling price (total sales)

|

669

|

|

706

|

|

(37

|

)

|

(5

|

)%

|

|||||||

|

Average cost of ferrous scrap consumed

|

343

|

|

379

|

|

(36

|

)

|

(9

|

)%

|

|||||||

|

Average metal margin

|

326

|

|

327

|

|

(1

|

)

|

—

|

%

|

|||||||

|

Average ferrous scrap purchase price

|

299

|

|

339

|

|

(40

|

)

|

(12

|

)%

|

|||||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

Average selling price (excluding stock and buyout sales)

|

2013

|

2012

|

Amount

|

%

|

|||||||||||

|

Rebar

|

$

|

901

|

|

$

|

864

|

|

$

|

37

|

|

4

|

%

|

||||

|

Structural

|

2,580

|

|

2,342

|

|

238

|

|

10

|

%

|

|||||||

|

Post

|

914

|

|

949

|

|

(35

|

)

|

(4

|

)%

|

|||||||

|

|

|

|

Increase (Decrease)

|

|||||||||

|

Tons shipped (in thousands)

|

2013

|

2012

|

Amount

|

%

|

||||||||

|

Rebar

|

902

|

|

911

|

|

(9

|

)

|

(1

|

)%

|

||||

|

Structural

|

53

|

|

60

|

|

(7

|

)

|

(12

|

)%

|

||||

|

Post

|

99

|

|

90

|

|

9

|

|

10

|

%

|

||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

|

2013

|

2012

|

Amount

|

%

|

|||||||||||

|

Tons melted

|

1,386

|

|

1,638

|

|

(252

|

)

|

(15

|

)%

|

|||||||

|

Tons rolled

|

1,244

|

|

1,395

|

|

(151

|

)

|

(11

|

)%

|

|||||||

|

Tons shipped

|

1,318

|

|

1,584

|

|

(266

|

)

|

(17

|

)%

|

|||||||

|

Average mill selling price (total sales)

|

$

|

589

|

|

$

|

601

|

|

$

|

(12

|

)

|

(2

|

)%

|

||||

|

Average cost of ferrous scrap consumed

|

360

|

|

385

|

|

(25

|

)

|

(6

|

)%

|

|||||||

|

Average metal margin

|

229

|

|

216

|

|

13

|

|

6

|

%

|

|||||||

|

Average ferrous scrap purchase price

|

289

|

|

315

|

|

(26

|

)

|

(8

|

)%

|

|||||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

|

2012

|

2011

|

Amount

|

%

|

|||||||||||

|

Average ferrous selling price

|

$

|

345

|

|

$

|

340

|

|

$

|

5

|

|

1

|

%

|

||||

|

Average nonferrous selling price

|

$

|

2,823

|

|

$

|

3,292

|

|

$

|

(469

|

)

|

(14

|

)%

|

||||

|

Ferrous tons shipped

|

2,196

|

|

2,202

|

|

(6

|

)

|

—

|

%

|

|||||||

|

Nonferrous tons shipped

|

243

|

|

267

|

|

(24

|

)

|

(9

|

)%

|

|||||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

|

2012

|

2011

|

Amount

|

%

|

|||||||||||

|

Tons melted

|

2,568

|

|

2,470

|

|

98

|

|

4

|

%

|

|||||||

|

Tons rolled

|

2,206

|

|

2,088

|

|

118

|

|

6

|

%

|

|||||||

|

Tons shipped

|

2,682

|

|

2,518

|

|

164

|

|

7

|

%

|

|||||||

|

Average mill selling price (finished goods)

|

$

|

730

|

|

$

|

696

|

|

$

|

34

|

|

5

|

%

|

||||

|

Average mill selling price (total sales)

|

706

|

|

669

|

|

37

|

|

6

|

%

|

|||||||

|

Average cost of ferrous scrap consumed

|

379

|

|

364

|

|

15

|

|

4

|

%

|

|||||||

|

Average metal margin

|

327

|

|

305

|

|

22

|

|

7

|

%

|

|||||||

|

Average ferrous scrap purchase price

|

339

|

|

329

|

|

10

|

|

3

|

%

|

|||||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

Average selling price (excluding stock and buyout sales)

|

2012

|

2011

|

Amount

|

%

|

|||||||||||

|

Rebar

|

$

|

864

|

|

$

|

773

|

|

$

|

91

|

|

12

|

%

|

||||

|

Structural

|

2,342

|

|

1,980

|

|

362

|

|

18

|

%

|

|||||||

|

Post

|

949

|

|

928

|

|

21

|

|

2

|

%

|

|||||||

|

|

|

|

|

|

Increase (Decrease)

|

|||||||

|

Tons shipped (in thousands)

|

2012

|

2011

|

Amount

|

%

|

||||||||

|

Rebar

|

911

|

|

851

|

|

60

|

|

7

|

%

|

||||

|

Structural

|

60

|

|

56

|

|

4

|

|

7

|

%

|

||||

|

Post

|

90

|

|

99

|

|

(9

|

)

|

(9

|

)%

|

||||

|

|

|

|

Increase (Decrease)

|

||||||||||||

|

|

2012

|

2011

|

Amount

|

%

|

|||||||||||

|

Tons melted

|

1,638

|

|

1,585

|

|

53

|

|

3

|

%

|

|||||||

|

Tons rolled

|

1,395

|

|

1,334

|

|

61

|

|

5

|

%

|

|||||||

|

Tons shipped

|

1,584

|

|

1,494

|

|

90

|

|

6

|

%

|

|||||||

|

Average mill selling price (total sales)

|

$

|

601

|

|

$

|

638

|

|

$

|

(37

|

)

|

(6

|

)%

|

||||

|

Average ferrous scrap production cost

|

385

|

|

389

|

|

(4

|

)

|

(1

|

)%

|

|||||||

|

Average metal margin

|

216

|

|

249

|

|

(33

|

)

|

(13

|

)%

|

|||||||

|

Average ferrous scrap purchase price

|

315

|

|

325

|

|

(10

|

)

|

(3

|

)%

|

|||||||

|

(in thousands)

|

Total Facility

|

Availability

|

|||||

|

Cash and cash equivalents

|

$

|

378,770

|

|

$ N/A

|

|

||

|

Revolving credit facility

|

300,000

|

|

271,743

|

|

|||

|

Domestic receivable sales facility

|

200,000

|

|

200,000

|

|

|||

|

International accounts receivable sales facilities

|

126,428

|

|

101,891

|

|

|||

|

Bank credit facilities — uncommitted

|

107,856

|

|

107,856

|

|

|||

|

Notes due from 2017 to 2023

|

1,230,000

|

|

*

|

|

|||

|

Equipment notes

|

19,594

|

|

*

|

|

|||

|

•

|

Net earnings for fiscal 2013 declined by $130.2 million when compared to 2012. See further discussion under the Consolidated Results of Operations above.

|

|

•

|

Deferred income taxes changed by $114.7 million from 2012 from a benefit of

$60.0 million

in 2012 to an expense of

$54.7 million

in 2013.

|

|

•

|

The net change in operating assets and liabilities was a reduced cash inflow of $35.6 million during fiscal 2013 compared to fiscal 2012. The most significant components of change within the operating assets and liabilities are as follows:

|

|

◦

|

Accounts receivable - Excluding the impacts of our accounts receivable sales program, cash inflows from accounts receivable decreased in

2013

when compared to

2012

, as a result of an increase in our days' sales outstanding from 44 days at August 31,

2012

to 52 days at

August 31, 2013

. The increase in days sales outstanding is primarily due to higher sales volume in our Americas Fabrication segment, which typically has longer customer payment terms than our other segments.

|

|

◦

|

Inventory - Cash generated from inventory during

2013

was lower when compared to

2012

. As overall net sales declined year-over-year, we continue to adjust our operating levels to reflect changing market demands, while maintaining stocking levels that allow us to meet our customers' needs. Furthermore, our days' sales in inventory increased three days in

2013

from 41 days in

2012

.

|

|

◦

|

Accounts payable, accrued expenses and other payables - Cash outflows from payables and accrued expenses declined $69.7 million during

2013

when compared to fiscal 2012. The decline is a reflection of the overall reduction in net sales as well as lower accruals for compensation and benefits when compared to the prior year.

|

|

•

|

Inventory - Inventory decreased during the year ended 2012 as compared to the fourth quarter of 2011 as inventory levels were matched to lower sales in the fourth quarter 2012 as compared to fourth quarter 2011. Days sales in inventory was 41 days and 45 days as of

August 31, 2012

and 2011, respectively.

|

|

•

|

Accounts payable and accrued expenses — Accounts payable and accrued expenses decreased as our expenses were lower from decreased sales in the fourth quarter of 2012 as compared to the fourth quarter of 2011.

|

|

|

Payments Due By Period*

|

|||||||||||||||||||

|

Contractual Obligations (in thousands)

|

Total

|

Less than

1 Year |

1-3 Years

|

3-5 Years

|

More than

5 Years |

|||||||||||||||

|

Long-term debt(1)

|

$

|

1,249,594

|

|

$

|

5,228

|

|

$

|

8,444

|

|

$

|

905,164

|

|

$

|

330,758

|

|

|||||

|

Interest(2)

|

441,176

|

|

79,653

|

|

158,579

|

|

127,174

|

|

75,770

|

|

||||||||||

|

Operating leases(3)

|

123,497

|

|

35,430

|

|

51,543

|

|

24,606

|

|

11,918

|

|

||||||||||

|

Purchase obligations(4)

|

1,024,401

|

|

716,238

|

|

163,121

|

|

106,906

|

|

38,136

|

|

||||||||||

|

Total contractual cash obligations

|

$

|

2,838,668

|

|

$

|

836,549

|

|

$

|

381,687

|

|

$

|

1,163,850

|

|

$

|

456,582

|

|

|||||

|

(1)

|

Total amounts are included in the

August 31, 2013

consolidated balance sheet. See Note 11, Credit Arrangements, to the consolidated financial statements included in this report for more information regarding scheduled maturities of our long-term debt.

|

|

(2)

|

Interest payments related to our short-term debt are not included in the table as they do not represent a significant obligation as of

August 31, 2013

.

|

|

(3)

|

Includes minimum lease payment obligations for noncancelable equipment and real estate leases in effect as of

August 31, 2013

. See Note 18, Commitments and Contingencies, to the consolidated financial statements included in this report for more information regarding minimum lease commitments payable for noncancelable operating leases.

|

|

(4)

|

Approximately 74% of these purchase obligations are for inventory items to be sold in the ordinary course of business. Purchase obligations include all enforceable, legally binding agreements to purchase goods or services that specify all significant terms, regardless of the duration of the agreement. Agreements with variable terms are excluded because we are unable to estimate the minimum amounts. Another significant obligation relates to capital expenditures.

|

|

Functional Currency

|

Foreign Currency

|

|

||||||||||||

|

Type

|

Amount

(in thousands) |

Type

|

Amount

(in thousands) |

Range of

Hedge Rates (1) |

U.S.

Equivalent (in thousands) |

|||||||||

|

AUD

|

94

|

|

EUR

|

67

|

|

0.67 — 0.76

|

$

|

89

|

|

|||||

|

AUD

|

1,240

|

|

NZD (2)

|

1,438

|

|

1.13 — 1.20

|

1,124

|

|

||||||

|

AUD

|

76,296

|

|

USD

|

69,121

|

|

0.88 — 1.01

|

69,121

|

|

||||||

|

AUD

|

240

|

|

CNY (3)

|

1,313

|

|

5.46

|

214

|

|

||||||

|

GBP

|

1,437

|

|

EUR

|

1,669

|

|

0.85 — 0.87

|

2,213

|

|

||||||

|

GBP

|

18,844

|

|

USD

|

29,039

|

|

1.51 — 1.57

|

29,039

|

|

||||||

|

PLN

|

284,936

|

|

EUR

|

66,873

|

|

4.16 — 4.41

|

88,954

|

|

||||||

|

PLN

|

1,447

|

|

USD

|

442

|

|

3.26 — 3.32

|

442

|

|

||||||

|

SGD

|

7,206

|

|

USD

|

5,654

|

|

1.27 — 1.28

|

5,654

|

|

||||||

|

USD

|

38,700

|

|

EUR

|

29,173

|

|

1.27 — 1.34

|

38,700

|

|

||||||

|

USD

|

46,879

|

|

GBP

|

30,286

|

|

1.55

|

46,879

|

|

||||||

|

USD

|

1,375

|

|

JPY

|

137,974

|

|

100.33

|

1,375

|

|

||||||

|

USD

|

10,556

|

|

PLN

|

33,594

|

|

3.18 — 3.23

|

10,556

|

|

||||||

|

USD

|

14,610

|

|

SGD

|

18,279

|

|

1.23 — 1.26

|

14,610

|

|

||||||

|

USD

|

2,186

|

|

CHF

|

2,055

|

|

0.92 — 0.96

|

2,186

|

|

||||||

|

USD

|

19,196

|

|

AUD

|

21,500

|

|

0.89 — 0.90

|

19,196

|

|

||||||

|

USD

|

648

|

|

THB

|

20,000

|

|

30.88

|

648

|

|

||||||

|

|

|

|

|

|

$

|

331,000

|

|

|||||||

|

Terminal Exchange

|

Metal

|

Long/

Short |

# of

Lots |

Standard

Lot Size |

Total

Weight |

Range or

Amount of Hedge Rates Per MT/lb. |

Total Contract

Value at Inception (in thousands) |

||||||||||

|

London Metal Exchange

|

Aluminum

|

Long

|

123

|

|

25 MT

|

3,063 MT

|

1,895.00 — 2,028.00

|

$

|

5,862

|

|

|||||||

|

|

Aluminum

|

Short

|

4

|

|

25 MT

|

100 MT

|

1,896.50 — 1,907.75

|

190

|

|

||||||||

|

Copper

|

Long

|

1.31

|

|

25 MT

|

33 MT

|

8,025.00 — 8,055.00

|

263

|

|

|||||||||

|

Zinc

|

Long

|

0.87

|

|

25 MT

|

22 MT

|

2,247.00 — 2,259.00

|

49

|

|

|||||||||

|

New York Mercantile Exchange

|

Copper

|

Long

|

86

|

|

25,000 lbs.

|

2,150,000 lbs.

|

309.95 — 350.15

|

7,098

|

|

||||||||

|

|

Copper

|

Short

|

441

|

|

25,000 lbs.

|

11,025,000 lbs.

|

302.45 — 340.70

|

35,808

|

|

||||||||

|

|

|

|

|

|

|

|

$

|

49,270

|

|

||||||||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

|

|||||||||||

|

|

Year Ended August 31,

|

||||||||||

|

(in thousands, except share data)

|

2013

|

2012

|

2011

|

||||||||

|

Net sales

|

$

|

6,889,575

|

|

$

|

7,656,375

|

|

$

|

7,666,773

|

|

||

|

Costs and expenses:

|

|

|

|

||||||||

|

Cost of goods sold

|

6,227,238

|

|

6,939,748

|

|

7,037,446

|

|

|||||

|

Selling, general and administrative expenses

|

468,611

|

|

481,746

|

|

508,916

|

|

|||||

|

Impairment of assets

|

17,270

|

|

607

|

|

24,466

|

|

|||||

|

Gain on sale of cost method investment

|

(26,088

|

)

|

—

|

|

—

|

|

|||||

|

Interest expense

|

69,608

|

|

69,487

|

|

69,814

|

|

|||||

|

6,756,639

|

|

7,491,588

|

|

7,640,642

|

|

||||||

|

Earnings from continuing operations before income taxes

|

132,936

|

|

164,787

|

|

26,131

|

|

|||||

|

Income taxes (benefit)

|

57,979

|

|

(45,762

|

)

|

14,592

|

|

|||||

|

Earnings from continuing operations

|

74,957

|

|

210,549

|

|

11,539

|

|

|||||

|

Earnings (loss) from discontinued operations before income taxes

|

3,672

|

|

(11,906

|

)

|

(139,195

|

)

|

|||||

|

Income taxes (benefit)

|

1,310

|

|

(8,847

|

)

|

1,748

|

|

|||||

|

Earnings (loss) from discontinued operations

|

2,362

|

|

(3,059

|

)

|

(140,943

|

)

|

|||||

|

Net earnings (loss)

|

77,319

|

|

207,490

|

|

(129,404

|

)

|

|||||

|

Less net earnings attributable to noncontrolling interests

|

4

|

|

6

|

|

213

|

|

|||||

|

Net earnings (loss) attributable to CMC

|

$

|

77,315

|

|

$

|

207,484

|

|

$

|

(129,617

|

)

|

||

|

Basic earnings (loss) per share attributable to CMC:

|

|||||||||||

|

Earnings from continuing operations

|

$

|

0.64

|

|

$

|

1.82

|

|

$

|

0.10

|

|

||

|

Earnings (loss) from discontinued operations

|

0.02

|

|

(0.03

|

)

|

(1.23

|

)

|

|||||

|

Net earnings (loss)

|

$

|

0.66

|

|

$

|

1.79

|

|

$

|

(1.13

|

)

|

||

|

Diluted earnings (loss) per share attributable to CMC:

|

|

|

|

||||||||

|

Earnings from continuing operations

|

$

|

0.64

|

|

$

|

1.80

|

|

$

|

0.09

|

|

||

|

Earnings (loss) from discontinued operations

|

0.02

|

|

(0.02

|

)

|

(1.21

|

)

|

|||||

|

Net earnings (loss)

|

$

|

0.66

|

|

$

|

1.78

|

|

$

|

(1.12

|

)

|

||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

|

|||||||||||

|

Year Ended August 31,

|

|||||||||||

|

(in thousands)

|

2013

|

2012

|

2011

|

||||||||

|

Net earnings (loss)

|

$

|

77,319

|

|

$

|

207,490

|

|

$

|

(129,404

|

)

|

||

|

Other comprehensive income (loss), net of income taxes:

|

|

|

|

||||||||

|

Foreign currency translation adjustment and other:

|

|||||||||||

|

Foreign currency translation adjustment and other during the year, net of income taxes of $(925), $(41,752) and $39,301

|

(10,108

|

)

|

(71,631

|

)

|

72,987

|

|

|||||

|

Reclassification for translation gain realized upon sale of investments in foreign entities, net of income taxes of $0, $664 and $0

|

—

|

|

(4,675

|

)

|

—

|

|

|||||

|

Foreign currency translation adjustment and other, net of income taxes of $(925), $(41,088) and $39,301

|

(10,108

|

)

|

(76,306

|

)

|

72,987

|

|

|||||

|

Net unrealized gain (loss) on derivatives:

|

|

|

|

||||||||

|

Unrealized holding gain (loss), net of income taxes of $2, $(604) and $135

|

221

|

|

(1,545

|

)

|

823

|

|

|||||

|

Reclassification for loss (gain) included in net earnings, net of income taxes of $(128), $132 and $(254)

|

(337

|

)

|

578

|

|

(1,018

|

)

|

|||||

|

Net unrealized loss on derivatives, net of income taxes of $(126), $(472) and $(119)

|

(116

|

)

|

(967

|

)

|

(195

|

)

|

|||||

|

Defined benefit obligation:

|

|

|

|

||||||||

|

Net loss, net of income taxes of $(51), $(425) and $(48)

|

(168

|

)

|

(410

|

)

|

(1,118

|

)

|

|||||

|

Prior service credit (cost), net of income taxes of $0, $0 and $(9)

|

—

|

|

—

|

|

(34

|

)

|

|||||

|

Amortization of net loss, net of income taxes of $45, $40 and $74

|

207

|

|

188

|

|

261

|

|

|||||

|

Amortization of prior service credit, net of income taxes of $(38), $(2) and $(2)

|

(170

|

)

|

(15

|

)

|

(18

|

)

|

|||||

|

Amortization of transition asset, net of income taxes of $0, $0 and $13

|

—

|

|

—

|

|

116

|

|

|||||

|

Adjustment from plan changes, net of income taxes of $309, $(26) and $0

|

1,315

|

|

(99

|

)

|

—

|

|

|||||

|

Defined benefit obligation, net of income taxes of $265, $(413) and $28

|

1,184

|

|

(336

|

)

|

(793

|

)

|

|||||

|

Other comprehensive income (loss)

|

(9,040

|

)

|

(77,609

|

)

|

71,999

|

|

|||||

|

Comprehensive income (loss)

|

$

|

68,279

|

|

$

|

129,881

|

|

$

|

(57,405

|

)

|

||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

|

|||||||

|

August 31,

|

|||||||

|

(in thousands, except share data)

|

2013

|

2012

|

|||||

|

Assets

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

378,770

|

|

$

|

262,422

|

|

|

|

Accounts receivable (less allowance for doubtful accounts of $10,042 and $9,480)

|

989,694

|

|

958,364

|

|

|||

|

Inventories, net

|

757,417

|

|

807,923

|

|

|||

|

Other

|

240,314

|

|

211,122

|

|

|||

|

Total current assets

|

2,366,195

|

|

2,239,831

|

|

|||

|

Property, plant and equipment:

|

|||||||

|

Land

|

80,764

|

|

79,123

|

|

|||

|

Buildings and improvements

|

486,494

|

|

483,708

|

|

|||

|

Equipment

|

1,666,250

|

|

1,656,328

|

|

|||

|

Construction in process

|

18,476

|

|

41,036

|

|

|||

|

|

2,251,984

|

|

2,260,195

|

|

|||

|

Less accumulated depreciation and amortization

|

(1,311,747

|

)

|

(1,265,891

|

)

|

|||

|

|

940,237

|

|

994,304

|

|

|||

|

Goodwill

|

69,579

|

|

76,897

|

|

|||

|

Other assets

|

118,790

|

|

130,214

|

|

|||

|

Total assets

|

$

|

3,494,801

|

|

$

|

3,441,246

|

|

|

|

Liabilities and stockholders’ equity

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable-trade

|

$

|

342,678

|

|

$

|

433,132

|

|

|

|

Accounts payable-documentary letters of credit

|

112,281

|

|

95,870

|

|

|||

|

Accrued expenses and other payables

|

314,949

|

|

343,337

|

|

|||

|

Notes payable

|

5,973

|

|

24,543

|

|

|||

|

Current maturities of long-term debt

|

5,228

|

|

4,252

|

|

|||

|

Total current liabilities

|

781,109

|

|

901,134

|

|

|||

|

Deferred income taxes

|

46,558

|

|

20,271

|

|

|||

|

Other long-term liabilities

|

118,165

|

|

116,261

|

|

|||

|

Long-term debt

|

1,278,814

|

|

1,157,073

|

|

|||

|

Total liabilities

|

2,224,646

|

|

2,194,739

|

|

|||

|

Commitments and contingencies

|

|

|

|||||

|

Stockholders’ equity:

|

|||||||

|

Preferred stock

|

—

|

|

—

|

|

|||

|

Common stock, par value $0.01 per share; authorized 200,000,000 shares; issued 129,060,664 shares; outstanding 117,010,990 and 116,351,424 shares

|

1,290

|

|

1,290

|

|

|||

|

Additional paid-in capital

|

363,772

|

|

365,778

|

|

|||

|

Accumulated other comprehensive loss

|

(27,176

|

)

|

(18,136

|

)

|

|||

|

Retained earnings

|

1,166,732

|

|

1,145,445

|

|

|||

|

Less treasury stock, 12,049,674 and 12,709,240 shares at cost

|

(234,619

|

)

|

(248,009

|

)

|

|||

|

Stockholders’ equity attributable to CMC

|

1,269,999

|

|

1,246,368

|

|

|||

|

Stockholders’ equity attributable to noncontrolling interests

|

156

|

|

139

|

|

|||

|

Total equity

|

1,270,155

|

|

1,246,507

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

3,494,801

|

|

$

|

3,441,246

|

|

|

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

|

|||||||||||

|

|

Year Ended August 31,

|

||||||||||

|

(in thousands)

|

2013

|

2012

|

2011

|

||||||||

|

Cash flows from (used by) operating activities:

|

|||||||||||

|

Net earnings (loss)

|

$

|

77,319

|

|

$

|

207,490

|

|

$

|

(129,404

|

)

|

||

|

Adjustments to reconcile net earnings (loss) to cash flows from (used by) operating activities:

|

|||||||||||

|

Depreciation and amortization

|

136,548

|

|

137,310

|

|

159,576

|

|

|||||

|

Provision for losses (recoveries) on receivables, net

|

4,430

|

|

(2,463

|

)

|

306

|

|

|||||

|

Share-based compensation

|

18,693

|

|

13,125

|

|

12,893

|

|

|||||

|

Amortization of interest rate swaps termination gain

|

(12,470

|

)

|

(5,815

|

)

|

—

|

|

|||||

|

Loss on debt extinguishment

|

4,758

|

|

—

|

|

—

|

|

|||||

|

Deferred income taxes (benefit)

|

54,655

|

|

(59,999

|

)

|

(19,856

|

)

|

|||||

|

Tax expense (benefit) from stock plans

|

1,444

|

|

(1,968

|

)

|

(2,355

|

)

|

|||||

|

Net gain on sale of assets and other

|

(25,371

|

)

|

(11,932

|

)

|

(1,315

|

)

|

|||||

|

Write-down of inventory

|

3,003

|

|

13,917

|

|

25,503

|

|

|||||

|

Asset impairments

|

17,270

|

|

3,316

|

|

120,145

|

|

|||||

|

Changes in operating assets and liabilities, net of acquisitions:

|

|

||||||||||

|

Accounts receivable

|

11,065

|

|

68,260

|

|

(168,779

|

)

|

|||||

|

Accounts receivable sold (repurchased), net

|

(80,580

|

)

|

(77,116

|

)

|

78,297

|

|

|||||

|

Inventories

|

26,459

|

|

53,449

|

|

(200,204

|

)

|

|||||

|

Other assets

|

2,894

|

|

5,001

|

|

73,382

|

|

|||||

|

Accounts payable, accrued expenses and other payables

|

(87,375

|

)

|

(157,025

|

)

|

82,642

|

|

|||||

|

Other long-term liabilities

|

(5,010

|

)

|

10,443

|

|

(3,084

|

)

|

|||||

|

Net cash flows from operating activities

|

147,732

|

|

195,993

|

|

27,747

|

|

|||||

|

Cash flows from (used by) investing activities:

|

|||||||||||

|

Capital expenditures

|

(89,035

|

)

|

(113,853

|

)

|

(73,215

|

)

|

|||||

|

Proceeds from the sale of property, plant and equipment and other

|

13,904

|

|

55,360

|

|

53,394

|

|

|||||

|

Proceeds from the sale of equity method investments

|

—

|

|

—

|

|

10,802

|

|

|||||

|

Proceeds from the sale of cost method investment

|

28,995

|

|

—

|

|

—

|

|

|||||

|

Acquisitions, net of cash acquired

|

—

|

|

—

|

|

(48,386

|

)

|

|||||

|

Decrease (increase) in deposit for letters of credit

|

—

|

|

31,053

|

|

(4,123

|

)

|

|||||

|

Net cash flows used by investing activities

|

(46,136

|

)

|

(27,440

|

)

|

(61,528

|

)

|

|||||

|

Cash flows from (used by) financing activities:

|

|||||||||||

|

Increase (decrease) in documentary letters of credit

|

(6,221

|

)

|

(74,493

|

)

|

(55,950

|

)

|

|||||

|

Short-term borrowings, net change

|

(19,524

|

)

|

18,607

|

|

(10,253

|

)

|

|||||

|

Repayments on long-term debt

|

(204,856

|

)

|

(64,801

|

)

|

(33,577

|

)

|

|||||

|

Proceeds from termination of interest rate swaps

|

—

|

|

52,733

|

|

—

|

|

|||||

|

Proceeds from issuance of long-term debt

|

330,000

|

|

—

|

|

—

|

|

|||||

|

Payments for debt issuance costs

|

(4,684

|

)

|

—

|

|

—

|

|

|||||

|

Debt extinguishment costs

|

(4,557

|

)

|

—

|

|

—

|

|

|||||

|

Increase in restricted cash

|

(18,620

|

)

|

—

|

|

—

|

|

|||||

|

Stock issued under incentive and purchase plans, net of forfeitures

|

951

|

|

(81

|

)

|

9,615

|

|

|||||

|

Cash dividends

|

(56,028

|

)

|

(55,617

|

)

|

(55,177

|

)

|

|||||

|

Tax benefit (expense) from stock plans

|

(1,444

|

)

|

1,968

|

|

2,355

|

|

|||||

|

Contribution from (purchase of) noncontrolling interests

|

13

|

|

(55

|

)

|

(4,027

|

)

|

|||||

|

Net cash flows from (used by) financing activities

|

15,030

|

|

(121,739

|

)

|

(147,014

|

)

|

|||||

|

Effect of exchange rate changes on cash

|

(278

|

)

|

(6,782

|

)

|

3,872

|

|

|||||

|

Increase (decrease) in cash and cash equivalents

|

116,348

|

|

40,032

|

|

(176,923

|

)

|

|||||

|

Cash and cash equivalents at beginning of year

|

262,422

|

|

222,390

|

|

399,313

|

|

|||||

|

Cash and cash equivalents at end of year

|

$

|

378,770

|

|

$

|

262,422

|

|

$

|

222,390

|

|

||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

|

|||||||||||||||||||||||||

|

|

Common Stock

|

Additional

|

Accumulated

Other |

|

Treasury Stock

|

Non-

|

|

||||||||||||||||||

|

(in thousands, except share data)

|

Number of

Shares |

Amount

|

Paid-In

Capital |

Comprehensive

Income (Loss) |

Retained

Earnings |

Number of

Shares |

Amount

|

Controlling

Interests |

Total

|

||||||||||||||||

|

Balance at September 1, 2010

|

129,060,664

|

|

$

|

1,290

|

|

$

|

373,308

|

|

$

|

(12,526

|

)

|

$

|

1,178,372

|

|

(14,735,315

|

)

|

$

|

(289,708

|

)

|

$

|

2,638

|

|

$

|

1,253,374

|

|

|

Net earnings (loss)

|

|

|

|

|

(129,617

|

)

|

|

|

213

|

|

(129,404

|

)

|

|||||||||||||

|

Other comprehensive income

|

|

|

|

71,999

|

|

|

|

|

|

71,999

|

|

||||||||||||||

|

Cash dividends

|

|

|

|

|

(55,177

|

)

|

|

|

|

(55,177

|

)

|

||||||||||||||

|

Issuance of stock under incentive and purchase plans, net of forfeitures

|

|

|

(14,561

|

)

|

|

|

1,208,414

|

|

24,176

|

|

|

9,615

|

|

||||||||||||

|

Share-based compensation

|

|

|

11,913

|

|

|

|

|

|

|

11,913

|

|

||||||||||||||

|

Tax benefits from stock plans

|

|

|

2,355

|

|

|

|

|

|

|

|

2,355

|

|

|||||||||||||

|

Purchase of noncontrolling interest

|

|

|

(1,399

|

)

|

|

|

|

|

(2,628

|

)

|

(4,027

|

)

|

|||||||||||||

|

Balance at August 31, 2011

|

129,060,664

|

|

$

|

1,290

|

|

$

|

371,616

|

|

$

|

59,473

|

|

$

|

993,578

|

|

(13,526,901

|

)

|

$

|

(265,532

|

)

|

$

|

223

|

|

$

|

1,160,648

|

|

|

Net earnings

|

|

|

|

|

207,484

|

|

|

|

6

|

207,490

|

|

||||||||||||||

|

Other comprehensive loss

|

|

|

|

(77,609

|

)

|

|

|

|

|

(77,609

|

)

|

||||||||||||||

|

Cash dividends

|

|

|

|

|

(55,617

|

)

|

|

|

|

(55,617

|

)

|

||||||||||||||

|

Issuance of stock under incentive and purchase plans, net of forfeitures

|

|

|

(17,604

|

)

|

|

|

817,661

|

|

17,523

|

|

|

(81

|

)

|

||||||||||||

|

Share-based compensation

|

|

|

9,763

|

|

|

|

|

|

|

9,763

|

|

||||||||||||||

|

Tax benefits from stock plans

|

|

|

1,968

|

|

|

|

|

|

|

|

1,968

|

|

|||||||||||||

|

Purchase of noncontrolling interests

|

|

|

35

|

|

|

|

|

|

(90

|

)

|

(55

|

)

|

|||||||||||||

|

Balance at August 31, 2012

|

129,060,664

|

|

$

|

1,290

|

|

$

|

365,778

|

|

$

|

(18,136

|

)

|

$

|

1,145,445

|

|

(12,709,240

|

)

|

$

|

(248,009

|

)

|

$

|

139

|

|

$

|

1,246,507

|

|

|

Net earnings

|

|

|

|

|

77,315

|

|

|

|

4

|

|

77,319

|

|

|||||||||||||

|

Other comprehensive loss:

|

|

|

|

(9,040

|

)

|

|

|

|

|

(9,040

|

)

|

||||||||||||||

|

Cash dividends

|

|

|

|

|

(56,028

|

)

|

|

|

|

(56,028

|

)

|

||||||||||||||

|

Issuance of stock under incentive and purchase plans, net of forfeitures

|

|

|

(12,439

|

)

|

|

|

659,566

|

|

13,390

|

|

|

951

|

|

||||||||||||

|

Share-based compensation

|

|

|

11,877

|

|

|

|

|

|

|

11,877

|

|

||||||||||||||

|

Tax benefits from stock plans

|

|

|

(1,444

|

)

|

|

|

|

|

|

|

(1,444

|

)

|

|||||||||||||

|

Purchase of noncontrolling interests

|

|

|

|

|

|

|

|

|

13

|

|

13

|

|

|||||||||||||

|

Balance at August 31, 2013

|

129,060,664

|

|

$

|

1,290

|

|

$

|

363,772

|

|

$

|

(27,176

|

)

|

$

|

1,166,732

|

|

(12,049,674

|

)

|

$

|

(234,619

|

)

|

$

|

156

|

|

$

|

1,270,155

|

|

|

Buildings

|

7

|

to

|

40

|

years

|

|

Land improvements

|

3

|

to

|

25

|

years

|

|

Leasehold improvements

|

3

|

to

|

15

|

years

|

|

Equipment

|

3

|

to

|

25

|

years

|

|

(in thousands)

|

Foreign Currency Translation

|

Unrealized Gain (Loss) on Derivatives

|

Defined Benefit Obligation

|

Total Accumulated Other Comprehensive Income (Loss)

|

||||||||||||

|

Balance at August 31, 2012

|

$

|

(17,369

|

)

|

$

|

3,710

|

|

$

|

(4,477

|

)

|

$

|

(18,136

|

)

|

||||

|

Other comprehensive income (loss) before reclassifications

|

(10,108

|

)

|

221

|

|

1,147

|

|

(8,740

|

)

|

||||||||

|

Amounts reclassified from AOCI

|

—

|

|

(337

|

)

|

37

|

|

(300

|

)

|

||||||||

|

Net other comprehensive income (loss)

|

(10,108

|

)

|

(116

|

)

|

1,184

|

|

(9,040

|

)

|

||||||||

|

Balance at August 31, 2013

|

$

|

(27,477

|

)

|

$

|

3,594

|

|

$

|

(3,293

|

)

|

$

|

(27,176

|

)

|

||||

|

Components of AOCI

|

Location

|

(in thousands)

|

|

|||

|

Unrealized gain (loss) on derivatives:

|

|

|

|

|||

|

Commodity

|

Cost of goods sold

|

$

|

(260

|