|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

36-4459170

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(IRS Employer

Identification No.)

|

|

20 South Wacker Drive, Chicago, Illinois

|

|

60606

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title Of Each Class

|

|

Name Of Each Exchange On Which Registered

|

|

Class A Common Stock $0.01 par value

|

|

NASDAQ GLOBAL SELECT MARKET

|

|

Large accelerated filer

x

|

Accelerated filer

o

|

|

|

Non-accelerated filer

o

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

Emerging growth company

o

|

|

Documents

|

|

Form 10-K Reference

|

|

Portions of the CME Group Inc.’s Proxy Statement for the 2018 Annual Meeting of Shareholders

|

|

Part III

|

|

|

|

Page

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

•

|

increasing competition by foreign and domestic entities, including increased competition from new entrants into our markets and consolidation of existing entities;

|

|

•

|

our ability to keep pace with rapid technological developments, including our ability to complete the development, implementation and maintenance of the enhanced functionality required by our customers while maintaining reliability and ensuring that such technology is not vulnerable to security risks;

|

|

•

|

our ability to continue introducing competitive new products and services on a timely, cost-effective basis, including through our electronic trading capabilities, and our ability to maintain the competitiveness of our existing products and services, including our ability to provide effective services to the swaps market;

|

|

•

|

our ability to adjust our fixed costs and expenses if our revenues decline;

|

|

•

|

our ability to maintain existing customers, develop strategic relationships and attract new customers;

|

|

•

|

our ability to expand and offer our products outside the United States;

|

|

•

|

changes in regulations, including the impact of any changes in laws or government policy with respect to our industry, such as any changes to regulations and policies that require increased financial and operational resources from us or our customers;

|

|

•

|

the costs associated with protecting our intellectual property rights and our ability to operate our business without violating the intellectual property rights of others;

|

|

•

|

decreases in revenue from our market data as a result of decreased demand;

|

|

•

|

changes in our rate per contract due to shifts in the mix of the products traded, the trading venue and the mix of customers (whether the customer receives member or non-member fees or participates in one of our various incentive programs) and the impact of our tiered pricing structure;

|

|

•

|

the ability of our financial safeguards package to adequately protect us from the credit risks of clearing members;

|

|

•

|

the ability of our compliance and risk management methods to effectively monitor and manage our risks, including our ability to prevent errors and misconduct and protect our infrastructure against security breaches and misappropriation of our intellectual property assets;

|

|

•

|

changes in price levels and volatility in the derivatives markets and in underlying equity, foreign exchange, interest rate and commodities markets;

|

|

•

|

economic, political and market conditions, including the volatility of the capital and credit markets and the impact of economic conditions on the trading activity of our current and potential customers;

|

|

•

|

our ability to accommodate increases in contract volume and order transaction traffic and to implement enhancements without failure or degradation of the performance of our trading and clearing systems;

|

|

•

|

our ability to execute our growth strategy and maintain our growth effectively;

|

|

•

|

our ability to manage the risks and control the costs associated with our strategy for acquisitions, investments and alliances;

|

|

•

|

our ability to continue to generate funds and/or manage our indebtedness to allow us to continue to invest in our business;

|

|

•

|

industry and customer consolidation;

|

|

•

|

decreases in trading and clearing activity;

|

|

•

|

the imposition of a transaction tax or user fee on futures and options on futures transactions and/or repeal of the 60/40 tax treatment of such transactions;

|

|

•

|

the unfavorable resolution of material legal proceedings; and

|

|

•

|

the uncertainties of the ultimate impact of the Tax Cuts and Jobs Act (2017 Tax Act).

|

|

ITEM 1.

|

BUSINESS

|

|

Product Line

|

2017

|

2016

|

2015

|

||||||

|

Interest rate

|

33

|

%

|

32

|

%

|

31

|

%

|

|||

|

Equity

|

16

|

|

18

|

|

19

|

|

|||

|

Foreign exchange

|

6

|

|

6

|

|

7

|

|

|||

|

Agricultural commodity

|

14

|

|

15

|

|

15

|

|

|||

|

Energy

|

24

|

|

23

|

|

23

|

|

|||

|

Metal

|

7

|

|

6

|

|

5

|

|

|||

|

Trading Venue

|

2017

|

2016

|

2015

|

||||||

|

Electronic

|

83

|

%

|

82

|

%

|

81

|

%

|

|||

|

Open outcry

(1)

|

5

|

|

5

|

|

6

|

|

|||

|

Privately negotiated

(2)

|

12

|

|

13

|

|

13

|

|

|||

|

•

|

certainty of execution;

|

|

•

|

vast capabilities to facilitate complex and demanding trading;

|

|

•

|

direct market access;

|

|

•

|

fairness, price transparency and anonymity;

|

|

•

|

convenience and efficiency; and

|

|

•

|

global distribution, including connectivity through high-speed international telecommunications hubs in key financial centers or order routing to our global partner exchanges.

|

|

•

|

brand and reputation;

|

|

•

|

efficient and secure settlement, clearing and support services;

|

|

•

|

depth and liquidity of markets;

|

|

•

|

diversity of product offerings and rate and quality of new product development and innovative services;

|

|

•

|

ability to position and expand upon existing products to address changing market needs;

|

|

•

|

efficient and seamless customer experience;

|

|

•

|

transparency, reliability, anonymity and security in transaction processing;

|

|

•

|

regulatory environment;

|

|

•

|

connectivity, accessibility and distribution;

|

|

•

|

technological capability and innovation; and

|

|

•

|

overall transaction costs.

|

|

•

|

The adoption and implementation of position limit rules, which could have a significant impact on our commodities business if comparable trading venues in foreign jurisdictions are not subject to equivalent limitations.

|

|

•

|

Rules respecting capital charges under Basel III with respect to clearing members of central counterparties. There is a risk that these new standards may impose overly burdensome capital requirements on our clearing members and customers. Additional risks could arise through inconsistent adoption of the Basel III capital charges globally, potentially leading to disparate impacts on our customers.

|

|

•

|

The potential impact of the E.U. equivalence and recognition regime on non-European Union clearing houses and exchanges with customers based in Europe, which could require us to allocate increased amounts of contributed capital to the default waterfall and make changes to our governance structure. A failure of our clearing house to retain its recognition may result in our clearing members and certain customers in Europe being subject to higher capital costs thus creating a disincentive to use our markets.

|

|

•

|

The potential for further regulation stemming from industry performance disruptions and residual concerns around electronic trading activity and, in particular, "high frequency trading."

|

|

•

|

The potential elimination of the 60/40 tax treatment of certain of our futures and options contracts, which would impose a significant increase in tax rates applicable to certain market participants and could result in a decrease in their trading activity.

|

|

•

|

The implementation of a transaction tax or user fee in the United States or European Union, which could discourage institutions and individuals from using our markets or products or encourage them to trade in another less costly jurisdiction. From time to time, the proposed Presidential budget has, including the currently proposed budget, included a proposal to impose a user fee to fund the CFTC.

|

|

•

|

Regulations implementing the core principles for designated contract markets, including any changes to the rules implementing the competitive execution requirements of Core Principle 9

.

Rules promulgated under this provision may require us to make modifications to the manner in which certain of our contracts trade and/or require that such products be de-listed as futures and re-listed as swaps after a specified compliance period.

|

|

•

|

The implementation of legislation in the European Union impacting how benchmark index prices are formed, including new requirements for price submitters, price aggregators and markets that list contracts that reference index prices.

|

|

•

|

Concerns that legislators will prohibit or restrict exclusive licenses for benchmark indexes, which might impact the profitability of several of our most popular contracts.

|

|

•

|

The implementation of rules resulting in negative treatment of the liquidity profile of U.S. Treasury securities, including as qualifying liquidity resources, or any potential limitation on the use of U.S. Treasury securities as collateral could result in increased costs to us and our clearing firms.

|

|

•

|

economic, political and geopolitical market conditions;

|

|

•

|

legislative and regulatory changes, including any direct or indirect restrictions on or increased costs associated with trading in our markets;

|

|

•

|

broad trends in the industry and financial markets;

|

|

•

|

changes in price levels, contract volumes and volatility in the derivatives markets and in underlying equity, foreign exchange, interest rate and commodity markets;

|

|

•

|

shifts in global or regional demand or supply in commodities underlying our products;

|

|

•

|

competition;

|

|

•

|

changes in government monetary policies, especially central bank decisions related to quantitative easing;

|

|

•

|

availability of capital to our market participants and their appetite for risk-taking;

|

|

•

|

levels of assets under management;

|

|

•

|

volatile weather patterns, droughts, natural disasters and other catastrophes;

|

|

•

|

pandemics affecting our customer base or our ability to operate our markets; and

|

|

•

|

consolidation or expansion in our customer base and within our industry.

|

|

•

|

respond more quickly to competitive pressures, including responses based upon their corporate governance structures, which may be more flexible and efficient than our corporate governance structure;

|

|

•

|

develop products that are preferred by our customers;

|

|

•

|

develop risk transfer products that compete with our products;

|

|

•

|

price their products and services more competitively;

|

|

•

|

develop and expand their network infrastructure and service offerings more efficiently;

|

|

•

|

utilize better, more user-friendly and more reliable technology;

|

|

•

|

take greater advantage of acquisitions, alliances and other opportunities;

|

|

•

|

more effectively market, promote and sell their products and services;

|

|

•

|

better leverage existing relationships with customers and alliance partners or exploit better recognized brand names to market and sell their services; and

|

|

•

|

exploit regulatory disparities between traditional, regulated exchanges and alternative markets that benefit from a reduced regulatory burden and lower-cost business model.

|

|

•

|

provide reliable and cost-effective services to our customers;

|

|

•

|

develop, in a timely manner, the required functionality to support electronic trading in our key products in a manner that is competitive with the functionality supported by other electronic markets;

|

|

•

|

maintain the competitiveness of our fee structure;

|

|

•

|

attract independent software vendors to write front-end software that will effectively access our electronic trading system and automated order routing system;

|

|

•

|

respond to technological developments or service offerings by competitors; and

|

|

•

|

generate sufficient revenue to justify the substantial capital investment we have made and will continue to make to enhance our electronic trading platform and other technology offerings.

|

|

•

|

unanticipated disruptions in service to our customers;

|

|

•

|

slower response times and delays in our customers' trade execution and processing;

|

|

•

|

failed settlement of trades;

|

|

•

|

incomplete or inaccurate accounting, recording or processing of trades;

|

|

•

|

financial losses;

|

|

•

|

security breaches;

|

|

•

|

litigation or other customer claims;

|

|

•

|

loss of customers; and

|

|

•

|

regulatory sanctions.

|

|

•

|

becoming subject to extensive regulations and oversight;

|

|

•

|

difficulties in staffing and managing foreign operations;

|

|

•

|

general economic and political conditions in the countries from which our markets are accessed, which may have an adverse effect on our volume from those countries; and

|

|

•

|

potentially adverse tax consequences.

|

|

•

|

require us to dedicate a significant portion of our cash flow from operations to payments on our debt, thereby reducing the availability of cash flows to fund capital expenditures, to pursue acquisitions or investments, to pay dividends and for general corporate purposes;

|

|

•

|

increase our vulnerability to general adverse economic conditions;

|

|

•

|

limit our flexibility in planning for, or reacting to, changes in or challenges relating to our business and industry; and

|

|

•

|

place us at a competitive disadvantage against any less leveraged competitors.

|

|

Location

|

Primary Use

|

Owned/Leased

|

Lease Expiration

|

Approximate Size

(in square feet)

(1)

|

|

|

20 South Wacker Drive Chicago, Illinois

|

Global headquarters and office space

|

Leased

|

2032

(2)

|

512,000

|

|

|

141 West Jackson

Chicago, Illinois

|

Trading floor and office space

|

Leased

|

2027

(3)

|

150,000

|

|

|

333 S. LaSalle

Chicago, Illinois

|

Trading floor and office space

|

Owned

|

N/A

|

300,000

|

|

|

550 West Washington

Chicago, Illinois

|

Office space

|

Leased

|

2023

|

250,000

|

|

|

One North End

New York, New York

|

Trading floor and office space

|

Leased

|

2028

(4)

|

240,000

|

|

|

One New Change London

|

Office space

|

Leased

|

2026

|

58,000

|

|

|

Data Center 3

Chicagoland area

|

Business continuity and co-location

|

Leased

|

2031

(5)

|

83,000

|

|

|

Bagmane Tech Park Bangalore, India

|

Office space

|

Leased

|

2020

(6)

|

72,000

|

|

|

(1)

|

Size represents the amount of space leased or owned by us unless otherwise noted.

|

|

(2)

|

The initial lease expires in 2032 with two consecutive options to extend the term for five years each.

|

|

(3)

|

The initial lease expires in 2027 and contains options to extend the term and expand the premises.

|

|

(4)

|

The initial lease expires in 2028 and contains options to extend the term and expand the premises. In 2019, the premises will be reduced to 225,000 square feet.

|

|

(5)

|

In March 2016, the company sold its datacenter in the Chicago area for $130.0 million. At the time of the sale, the company leased back a portion of the property.

|

|

(6)

|

The initial lease expires in 2020 and contains an option to extend the term as well as an option to terminate early.

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

2017

|

High

|

Low

|

2016

|

High

|

Low

|

|||||||||||||

|

First Quarter

|

$

|

127.00

|

|

$

|

114.40

|

|

First Quarter

|

$

|

96.71

|

|

$

|

81.99

|

|

|||||

|

Second Quarter

|

127.44

|

|

115.12

|

|

Second Quarter

|

98.61

|

|

89.09

|

|

|||||||||

|

Third Quarter

|

135.86

|

|

120.17

|

|

Third Quarter

|

109.76

|

|

96.33

|

|

|||||||||

|

Fourth Quarter

|

153.41

|

|

133.85

|

|

Fourth Quarter

|

123.43

|

|

99.64

|

|

|||||||||

|

Record Date

|

Dividend per Share

|

Record Date

|

Dividend per Share

|

|||||||

|

March 10, 2017

|

$

|

0.66

|

|

March 10, 2016

|

$

|

0.60

|

|

|||

|

June 9, 2017

|

0.66

|

|

June 10, 2016

|

0.60

|

|

|||||

|

September 8, 2017

|

0.66

|

|

September 9, 2016

|

0.60

|

|

|||||

|

December 8, 2017

|

0.66

|

|

December 9, 2016

|

0.60

|

|

|||||

|

December 28, 2017

|

3.50

|

|

December 28, 2016

|

3.25

|

|

|||||

|

2013

|

2014

|

2015

|

2016

|

2017

|

|||||||||||||||

|

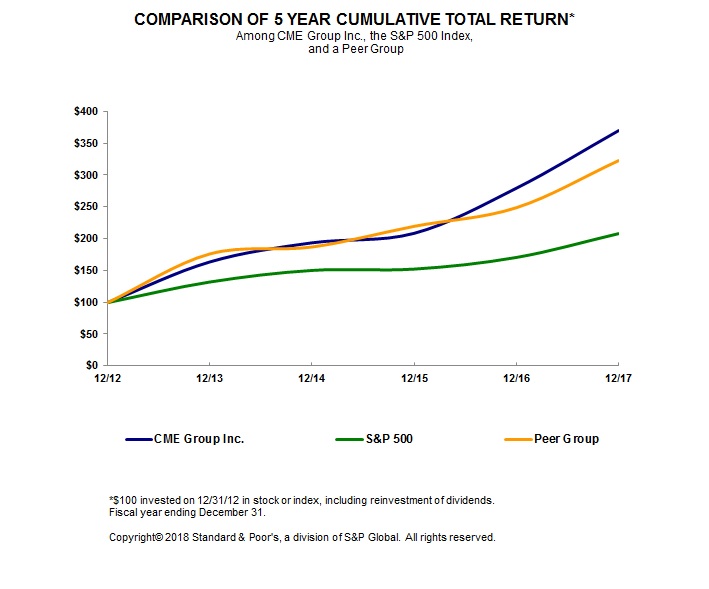

CME Group Inc.

|

$

|

164.01

|

|

$

|

194.06

|

|

$

|

208.95

|

|

$

|

279.85

|

|

$

|

370.32

|

|

||||

|

S&P 500

|

132.39

|

|

150.51

|

|

152.59

|

|

170.84

|

|

208.14

|

|

|||||||||

|

Peer Group

|

176.61

|

|

187.48

|

|

219.99

|

|

249.31

|

|

323.23

|

|

|||||||||

|

Period

|

Total Number

of Shares (or Units)

Purchased

(1)

|

Average Price

Paid Per Share (or Unit)

|

Total Number of

Shares (or Units) Purchased as

Part of Publicly

Announced

Plans or Programs

|

Maximum Number (or Approximate Dollar Value)

of Shares (or Units) that May Yet Be Purchased Under

the Plans or Programs

(in millions)

|

||||||||||

|

October 1 to October 31

|

119

|

|

$

|

137.17

|

|

—

|

|

$

|

—

|

|

||||

|

November 1 to November 30

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

December 1 to December 31

|

5,764

|

|

146.98

|

|

—

|

|

—

|

|

||||||

|

Total

|

5,883

|

|

—

|

|

||||||||||

|

(1)

|

Shares purchased consist of an aggregate of

5,883

shares of Class A common stock surrendered to satisfy employee tax obligations upon the vesting of restricted stock.

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

|

Year Ended or At December 31

|

|||||||||||||||||||

|

(in millions, except per share data)

|

2017

|

2016

|

2015

|

2014

|

2013

|

|||||||||||||||

|

Income Statement Data:

|

||||||||||||||||||||

|

Total revenues

|

$

|

3,644.7

|

|

$

|

3,595.2

|

|

$

|

3,326.8

|

|

$

|

3,112.5

|

|

$

|

2,936.3

|

|

|||||

|

Operating income

|

2,312.0

|

|

2,202.7

|

|

1,988.7

|

|

1,768.4

|

|

1,637.0

|

|

||||||||||

|

Non-operating income (expense)

|

214.3

|

|

84.9

|

|

(31.9

|

)

|

3.0

|

|

(36.0

|

)

|

||||||||||

|

Income before income taxes

|

2,526.3

|

|

2,287.6

|

|

1,956.8

|

|

1,771.4

|

|

1,601.0

|

|

||||||||||

|

Net income attributable to CME Group

|

4,063.4

|

|

1,534.1

|

|

1,247.0

|

|

1,127.1

|

|

976.8

|

|

||||||||||

|

Earnings per common share attributable to CME Group:

|

||||||||||||||||||||

|

Basic

|

$

|

12.00

|

|

$

|

4.55

|

|

$

|

3.71

|

|

$

|

3.37

|

|

$

|

2.94

|

|

|||||

|

Diluted

|

11.94

|

|

4.53

|

|

3.69

|

|

3.35

|

|

2.92

|

|

||||||||||

|

Cash dividends per share

|

6.14

|

|

5.65

|

|

4.90

|

|

3.88

|

|

4.40

|

|

||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Total assets

|

$

|

75,791.2

|

|

$

|

69,369.4

|

|

$

|

67,359.4

|

|

$

|

72,228.6

|

|

$

|

54,263.8

|

|

|||||

|

Short-term debt

|

—

|

|

—

|

|

—

|

|

—

|

|

749.9

|

|

||||||||||

|

Long-term debt

|

2,233.1

|

|

2,231.2

|

|

2,229.3

|

|

2,095.0

|

|

2,093.2

|

|

||||||||||

|

CME Group shareholders’ equity

|

22,411.8

|

|

20,340.7

|

|

20,551.8

|

|

20,923.5

|

|

21,154.8

|

|

||||||||||

|

|

Year Ended or At December 31

|

||||||||||||||

|

(in thousands)

|

2017

|

2016

|

2015

|

2014

|

2013

|

||||||||||

|

Average Daily Volume:

|

|||||||||||||||

|

Product Lines:

|

|||||||||||||||

|

Interest rate

|

8,189

|

|

7,517

|

|

6,720

|

|

7,009

|

|

5,903

|

|

|||||

|

Equity

|

2,682

|

|

3,061

|

|

2,792

|

|

2,764

|

|

2,642

|

|

|||||

|

Foreign exchange

|

922

|

|

858

|

|

872

|

|

803

|

|

886

|

|

|||||

|

Agricultural commodity

|

1,353

|

|

1,321

|

|

1,265

|

|

1,120

|

|

1,053

|

|

|||||

|

Energy

|

2,578

|

|

2,432

|

|

1,970

|

|

1,630

|

|

1,676

|

|

|||||

|

Metal

|

568

|

|

460

|

|

344

|

|

337

|

|

386

|

|

|||||

|

Total Average Daily Volume

|

16,292

|

|

15,649

|

|

13,963

|

|

13,663

|

|

12,546

|

|

|||||

|

Method of Trade:

|

|||||||||||||||

|

Electronic

|

14,513

|

|

13,766

|

|

12,185

|

|

11,805

|

|

10,826

|

|

|||||

|

Open outcry

|

1,107

|

|

1,149

|

|

1,139

|

|

1,176

|

|

1,040

|

|

|||||

|

Privately negotiated

|

672

|

|

734

|

|

639

|

|

682

|

|

680

|

|

|||||

|

Total Average Daily Volume

|

16,292

|

|

15,649

|

|

13,963

|

|

13,663

|

|

12,546

|

|

|||||

|

Other Data:

|

|||||||||||||||

|

Total Contract Volume (round turn trades)

|

4,089,175

|

|

3,943,670

|

|

3,532,521

|

|

3,443,051

|

|

3,161,477

|

|

|||||

|

Open Interest at Year End (contracts)

|

108,043

|

|

102,930

|

|

91,369

|

|

93,664

|

|

83,726

|

|

|||||

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

•

|

Executive Summary

: Includes an overview of our business; current economic, competitive and regulatory trends relevant to our business; our current business strategy; and our primary sources of operating and non-operating revenues and expenses.

|

|

•

|

Critical Accounting Policies

: Provides an explanation of accounting policies which may have a significant impact on our financial results and the estimates, assumptions and risks associated with those policies.

|

|

•

|

Recent Accounting Pronouncements

: Includes an evaluation of recent accounting pronouncements and the potential impact of their future adoption on our financial results.

|

|

•

|

Results of Operations

: Includes an analysis of our

2017

,

2016

and

2015

financial results and a discussion of any known events or trends which are likely to impact future results.

|

|

•

|

Liquidity and Capital Resources

: Includes a discussion of our future cash requirements, capital resources, significant planned expenditures and financing arrangements.

|

|

•

|

rate structure;

|

|

•

|

product mix;

|

|

•

|

venue, and

|

|

•

|

the percentage of trades executed by customers who are members compared with non-member customers.

|

|

•

|

Communications expense includes costs for network connections for our electronic platforms and some market data customers; telecommunications costs of our exchange, and fees paid for access to external market data. This expense may be impacted by growth in electronic contract volume, our capacity requirements and changes in the number of telecommunications hubs and connections which allow customers outside the United States to access our electronic platforms directly.

|

|

•

|

Technology support services expense consists of costs related to maintenance of the hardware and software required to support our technology. Our technology support services costs are driven by system capacity, functionality and redundancy requirements.

|

|

•

|

Amortization of purchased intangibles includes amortization of intangible assets obtained in our mergers with CBOT Holdings, Inc. and NYMEX Holdings, Inc. as well as other asset and business acquisitions. Intangible assets subject to amortization consist primarily of clearing firm, market data and other customer relationships.

|

|

•

|

Occupancy and building operations expense consists of costs related to leased property including rent, maintenance, real estate taxes, utilities and other related costs. We have significant operations located in Chicago, New York, India and the United Kingdom as well as other smaller offices located throughout the world.

|

|

•

|

Licensing and other fee agreements expense includes license fees paid as a result of contract volume in equity index products. This expense also includes royalty fees and broker rebates on energy and metals products as well as revenue sharing on cleared swaps contracts and some new product launches. This expense fluctuates with changes in contract volumes as well as changes in fee structures.

|

|

•

|

Other expenses include marketing and travel-related expenses as well as general and administrative costs. Marketing, advertising and public relations expense includes media, print and other advertising costs, as well as costs associated with our product promotion. Other expenses also include litigation and customer settlements, impairment charges on operating assets, gains and losses on disposals of operating assets, and foreign currency transaction gains and losses resulting from changes in exchange rates on certain foreign deposits.

|

|

•

|

Investment income includes income from short-term investment of clearing firms' cash performance bonds and guaranty fund contributions as well as excess operating cash; interest income and realized gains and losses from our marketable securities; realized gains and losses as well as dividend income from our strategic equity investments, and gains and losses on trading securities in our non-qualified deferred compensation plans. Investment income is influenced by market interest rates, changes in the levels of cash performance bonds deposited by clearing firms, the amount of dividends distributed by our strategic investments and the availability of funds generated by operations.

|

|

•

|

Interest and other borrowing costs expense includes charges associated with various short-term and long-term funding facilities, including commitment fees on lines of credit agreements.

|

|

•

|

Equity in net earnings (losses) of unconsolidated subsidiaries includes income and losses from our investments in S&P/Dow Jones Indices LLC (S&P/DJI), Dubai Mercantile Exchange and Bursa Malaysia Derivatives Berhad.

|

|

•

|

Other income (expense) includes expenses related to the distribution of interest earned on performance bond collateral reinvestment to the clearing firms as well as other various income and expenses outside our core operations.

|

|

•

|

Level 1—Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

|

|

•

|

Level 2—Inputs are either directly or indirectly observable and corroborated by market data or are based on quoted prices in markets that are not active.

|

|

•

|

Level 3—Inputs are unobservable and reflect management’s best estimate of what market participants would use in pricing the asset or liability. Assets and liabilities carried at level 3 fair value generally include assets and liabilities with inputs that require management’s judgment.

|

|

|

|

|

|

Year-over-Year Change

|

||||||||||||||

|

(dollars in millions, except per share data)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||||||||

|

Total revenues

|

$

|

3,644.7

|

|

$

|

3,595.2

|

|

$

|

3,326.8

|

|

1

|

%

|

8

|

%

|

|||||

|

Total expenses

|

1,332.7

|

|

1,392.5

|

|

1,338.1

|

|

(4

|

)

|

4

|

|

||||||||

|

Operating margin

|

63

|

%

|

61

|

%

|

60

|

%

|

||||||||||||

|

Non-operating income (expense)

|

$

|

214.3

|

|

$

|

84.9

|

|

$

|

(31.9

|

)

|

n.m.

|

|

n.m.

|

|

|||||

|

Effective tax expense (benefit) rate

|

(61

|

)%

|

33

|

%

|

36

|

%

|

||||||||||||

|

Net income

|

$

|

4,063.4

|

|

$

|

1,534.1

|

|

$

|

1,247.0

|

|

165

|

|

23

|

|

|||||

|

Diluted earnings per common share

|

11.94

|

|

4.53

|

|

3.69

|

|

164

|

|

23

|

|

||||||||

|

Cash flows from operating activities

|

1,840.4

|

|

1,742.8

|

|

1,532.5

|

|

6

|

|

14

|

|

||||||||

|

|

|

|

|

Year-over-Year Change

|

||||||||||||||

|

(dollars in millions)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||||||||

|

Clearing and transaction fees

|

$

|

3,098.6

|

|

$

|

3,036.4

|

|

$

|

2,783.9

|

|

2

|

%

|

9

|

%

|

|||||

|

Market data and information services

|

391.8

|

|

406.5

|

|

399.4

|

|

(4

|

)

|

2

|

|

||||||||

|

Access and communication fees

|

100.8

|

|

91.4

|

|

86.1

|

|

10

|

|

6

|

|

||||||||

|

Other

|

53.5

|

|

60.9

|

|

57.4

|

|

(12

|

)

|

6

|

|

||||||||

|

Total Revenues

|

$

|

3,644.7

|

|

$

|

3,595.2

|

|

$

|

3,326.8

|

|

1

|

|

8

|

|

|||||

|

|

|

|

|

Year-over-Year Change

|

|||||||||||||

|

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

||||||||||||

|

Total contract volume (in millions)

|

4,089.2

|

|

3,943.7

|

|

3,532.5

|

|

4

|

%

|

12

|

%

|

|||||||

|

Clearing and transaction fees (in millions)

|

$

|

3,029.9

|

|

$

|

2,974.4

|

|

$

|

2,716.9

|

|

2

|

|

9

|

|

||||

|

Average rate per contract

|

0.741

|

|

0.754

|

|

0.769

|

|

(2

|

)

|

(2

|

)

|

|||||||

|

|

Year-over-Year Change

|

|||||||

|

(in millions)

|

2017-2016

|

2016-2015

|

||||||

|

Increases due to change in total contract volume

|

$

|

109.8

|

|

$

|

316.2

|

|

||

|

Increase (decrease) due to change in average rate per contract

|

(54.3

|

)

|

(58.7

|

)

|

||||

|

Net increases in clearing and transaction fees

|

$

|

55.5

|

|

$

|

257.5

|

|

||

|

|

|

|

|

Year-over-Year Change

|

|||||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

||||||||||

|

Average Daily Volume by Product Line:

|

|||||||||||||||

|

Interest rate

|

8,189

|

|

7,517

|

|

6,720

|

|

9

|

%

|

12

|

%

|

|||||

|

Equity

|

2,682

|

|

3,061

|

|

2,792

|

|

(12

|

)

|

10

|

|

|||||

|

Foreign exchange

|

922

|

|

858

|

|

872

|

|

7

|

|

(2

|

)

|

|||||

|

Agricultural commodity

|

1,353

|

|

1,321

|

|

1,265

|

|

2

|

|

4

|

|

|||||

|

Energy

|

2,578

|

|

2,432

|

|

1,970

|

|

6

|

|

23

|

|

|||||

|

Metal

|

568

|

|

460

|

|

344

|

|

23

|

|

34

|

|

|||||

|

Aggregate average daily volume

|

16,292

|

|

15,649

|

|

13,963

|

|

4

|

|

12

|

|

|||||

|

Average Daily Volume by Venue:

|

|||||||||||||||

|

Electronic

|

14,513

|

|

13,766

|

|

12,185

|

|

5

|

|

13

|

|

|||||

|

Open outcry

|

1,107

|

|

1,149

|

|

1,139

|

|

(4

|

)

|

1

|

|

|||||

|

Privately negotiated

|

672

|

|

734

|

|

639

|

|

(9

|

)

|

15

|

|

|||||

|

Aggregate average daily volume

|

16,292

|

|

15,649

|

|

13,963

|

|

4

|

|

12

|

|

|||||

|

Electronic Volume as a Percentage of Total Volume

|

89

|

%

|

88

|

%

|

87

|

%

|

|||||||||

|

|

|

|

|

Year-over-Year Change

|

||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||

|

Eurodollar futures and options:

|

||||||||||||

|

Front 8 futures

|

1,745

|

1,828

|

1,580

|

(5

|

)%

|

16

|

%

|

|||||

|

Back 32 futures

|

769

|

729

|

724

|

5

|

|

1

|

|

|||||

|

Options

|

1,368

|

1,225

|

963

|

12

|

|

27

|

|

|||||

|

U.S. Treasury futures and options:

|

||||||||||||

|

10-Year

|

1,914

|

1,717

|

1,613

|

11

|

|

6

|

|

|||||

|

5-Year

|

1,003

|

886

|

830

|

13

|

|

7

|

|

|||||

|

2-Year

|

396

|

331

|

338

|

20

|

|

(2

|

)

|

|||||

|

Treasury bond

|

380

|

347

|

355

|

9

|

|

(2

|

)

|

|||||

|

Federal Funds futures and options

|

191

|

133

|

81

|

44

|

|

63

|

|

|||||

|

|

|

|

|

Year-over-Year Change

|

||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||

|

E-mini S&P 500 futures and options

|

2,062

|

2,449

|

2,200

|

(16

|

)%

|

11

|

%

|

|||||

|

E-mini NASDAQ 100 futures and options

|

289

|

271

|

272

|

6

|

|

—

|

|

|||||

|

|

|

|

|

Year-over-Year Change

|

||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||

|

Euro

|

261

|

226

|

307

|

15

|

%

|

(26

|

)%

|

|||||

|

Japanese yen

|

181

|

159

|

154

|

14

|

|

3

|

|

|||||

|

British pound

|

137

|

125

|

106

|

10

|

|

18

|

|

|||||

|

Australian dollar

|

102

|

106

|

98

|

(4

|

)

|

8

|

|

|||||

|

Canadian dollar

|

84

|

80

|

74

|

5

|

|

9

|

|

|||||

|

|

|

|

|

Year-over-Year Change

|

||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||

|

Corn

|

449

|

424

|

415

|

6

|

%

|

2

|

%

|

|||||

|

Soybean

|

283

|

323

|

284

|

(12

|

)

|

14

|

|

|||||

|

Wheat

|

217

|

191

|

183

|

14

|

|

4

|

|

|||||

|

Soybean Oil

|

129

|

126

|

123

|

2

|

|

3

|

|

|||||

|

|

|

|

|

Year-over-Year Change

|

||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||

|

WTI crude oil

|

1,442

|

1,321

|

994

|

9

|

%

|

33

|

%

|

|||||

|

Natural gas

|

597

|

549

|

468

|

9

|

|

17

|

|

|||||

|

Refined products

|

392

|

363

|

328

|

8

|

|

11

|

|

|||||

|

Brent crude oil

|

94

|

98

|

108

|

(4

|

)

|

(10

|

)

|

|||||

|

Year-over-Year Change

|

||||||||||||

|

(amounts in thousands)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||

|

Gold

|

335

|

273

|

197

|

23

|

%

|

38

|

%

|

|||||

|

Copper

|

108

|

86

|

67

|

26

|

|

27

|

|

|||||

|

Silver

|

98

|

78

|

58

|

25

|

|

34

|

|

|||||

|

|

|

|

|

Year-over-Year Change

|

||||||||||||||

|

(dollars in millions)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||||||||

|

Compensation and benefits

|

$

|

562.5

|

|

$

|

541.0

|

|

$

|

553.7

|

|

4

|

%

|

(2

|

)%

|

|||||

|

Communications

|

24.3

|

|

26.8

|

|

27.8

|

|

(9

|

)

|

(4

|

)

|

||||||||

|

Technology support services

|

77.3

|

|

70.8

|

|

64.5

|

|

9

|

|

10

|

|

||||||||

|

Professional fees and outside services

|

117.6

|

|

144.4

|

|

122.8

|

|

(19

|

)

|

18

|

|

||||||||

|

Amortization of purchased intangibles

|

95.5

|

|

96.1

|

|

99.4

|

|

(1

|

)

|

(3

|

)

|

||||||||

|

Depreciation and amortization

|

113.0

|

|

129.2

|

|

129.2

|

|

(13

|

)

|

—

|

|

||||||||

|

Occupancy and building operations

|

80.2

|

|

86.7

|

|

92.5

|

|

(8

|

)

|

(6

|

)

|

||||||||

|

Licensing and other fee agreements

|

146.3

|

|

135.8

|

|

123.8

|

|

8

|

|

10

|

|

||||||||

|

Other

|

116.0

|

|

161.7

|

|

124.4

|

|

(28

|

)

|

30

|

|

||||||||

|

Total Expenses

|

$

|

1,332.7

|

|

$

|

1,392.5

|

|

$

|

1,338.1

|

|

(4

|

)

|

4

|

|

|||||

|

(dollars in millions)

|

Year-

Over-Year

Change

|

Change as a

Percentage of

2016 Expenses

|

|||||

|

Foreign currency exchange rate fluctuation

|

$

|

(33.9

|

)

|

(2

|

)%

|

||

|

Loss on datacenter and related legal fees

|

(28.6

|

)

|

(2

|

)

|

|||

|

Professional fees and outside services

|

(26.8

|

)

|

(2

|

)

|

|||

|

Licensing and other fee agreements

|

10.5

|

|

1

|

|

|||

|

Salaries, benefits and employer taxes

|

19.6

|

|

1

|

|

|||

|

Other expenses, net

|

(0.6

|

)

|

—

|

|

|||

|

Total

|

$

|

(59.8

|

)

|

(4

|

)%

|

||

|

•

|

In 2017, we recognized a net gain of $9.4 million due to a favorable change in exchange rates on foreign cash balances, compared with a net loss of $24.5 million in 2016. Gains and losses from exchange rate fluctuations result when subsidiaries with a U.S. dollar functional currency hold cash as well as certain other monetary assets and liabilities denominated in foreign currencies.

|

|

•

|

In the first quarter of 2016, we sold and leased back our datacenter in the Chicago area. The transaction was recognized under the financing method under generally accepted accounting principles. We recognized total losses and expenses of $28.6 million, including a net loss on write-down to fair value of the assets and certain other transaction fees of $27.1 million within other expenses and $1.5 million of legal and other fees.

|

|

•

|

Professional fees and outside services expense decreased in 2017 compared to 2016, largely due to higher legal and regulatory fees in 2016 related to our business activities and product offerings as well as higher professional fees related to a greater reliance on consultants for security and systems enhancement work.

|

|

•

|

Licensing and other fee sharing agreements expense increased due to higher expense resulting from incentive payments made to facilitate the transition of the Russell contract open interest, as well as increased costs of revenue sharing agreements for certain licensed products. The overall increase in 2017 was partially offset by lower expense related to revenue sharing agreements for certain equity and energy contracts due to lower volume for these products compared to 2016.

|

|

•

|

Compensation and benefits expense increased as a result of higher average headcount primarily in our international locations as well as normal cost of living adjustments.

|

|

(dollars in millions)

|

Year-

Over-Year Change |

Change as a

Percentage of 2015 Expenses |

|||||

|

Loss on datacenter and related legal fees

|

$

|

28.6

|

|

2

|

%

|

||

|

Professional fees and outside services

|

24.4

|

|

2

|

|

|||

|

Foreign currency exchange rate fluctuation

|

13.2

|

|

1

|

|

|||

|

Licensing and other fee agreements

|

12.0

|

|

1

|

|

|||

|

Reorganization, severance and retirement costs

|

(8.1

|

)

|

(1

|

)

|

|||

|

Real estate taxes and fees

|

(10.0

|

)

|

(1

|

)

|

|||

|

Other expenses, net

|

(5.7

|

)

|

—

|

|

|||

|

Total

|

$

|

54.4

|

|

4

|

%

|

||

|

•

|

In 2016, we recognized total losses and expenses of $28.6 million, including a net loss on write-down to fair value of the assets and certain other transaction fees of $27.1 million within other expenses and $1.5 million of legal and other fees as a result of our sale and leaseback of our datacenter.

|

|

•

|

Professional fees and outside services expense increased in 2016 largely due to an increase in legal and regulatory efforts related to our business activities and product offerings as well as an increase in professional fees related to a greater reliance on consultants for security and systems enhancement work.

|

|

•

|

In 2016, we recognized a net loss of $24.5 million due to an unfavorable change in exchange rates on foreign cash balances, compared with a net loss of $11.3 million in 2015.

|

|

•

|

Licensing and other fee sharing agreements expense increased due to higher expense related to revenue sharing agreements for certain equity and energy contracts due to both higher volume and an increase in license rates for certain equity and energy products.

|

|

•

|

Severance and other costs related to the reorganization announced in October 2014 and the reduction of our trading floors in mid-2015 were recognized in the first quarter of 2015, in addition to costs related to a reorganization in the third quarter of 2015. At the end of 2016, our CEO announced his retirement, leading to additional compensation and stock-based compensation expense in 2016. We also recognized additional severance and other costs related to the reduction of our New York trading floors in 2016. These factors resulted in a net decrease in compensation and benefits expense in 2016 when compared with the same period in 2015.

|

|

•

|

In 2015, we recognized additional real estate taxes and fees related to the transfer of the ownership of the NYMEX building.

|

|

|

|

|

|

Year-over-Year Change

|

|||||||||||||

|

(dollars in millions)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

||||||||||||

|

Investment income

|

$

|

531.7

|

|

$

|

141.8

|

|

$

|

30.1

|

|

n.m.

|

|

n.m.

|

|||||

|

Gains (losses) on derivative investments

|

—

|

|

—

|

|

(1.8

|

)

|

—

|

|

n.m.

|

||||||||

|

Interest and other borrowing costs

|

(117.0

|

)

|

(123.5

|

)

|

(117.4

|

)

|

(5

|

)

|

5

|

||||||||

|

Equity in net earnings (losses) of unconsolidated subsidiaries

|

129.2

|

|

110.2

|

|

100.0

|

|

17

|

|

10

|

||||||||

|

Other income (expense)

|

(329.6

|

)

|

(43.6

|

)

|

(42.8

|

)

|

n.m.

|

|

2

|

||||||||

|

Total Non-Operating

|

$

|

214.3

|

|

$

|

84.9

|

|

$

|

(31.9

|

)

|

n.m.

|

|

n.m.

|

|||||

|

|

2017

|

2016

|

2015

|

Year-over-Year Change

|

|||||||||

|

2017-2016

|

2016-2015

|

||||||||||||

|

Year ended December 31

|

(60.8

|

)%

|

32.9

|

%

|

36.3

|

%

|

n.m.

|

(3.4

|

)%

|

||||

|

(in millions)

|

Operating

Leases

|

Purchase

Obligations

|

Debt Obligations

|

Other

Long-Term

Liabilities

|

Total

(1)

|

|||||||||||||||

|

Year

|

||||||||||||||||||||

|

2018

|

$

|

64.3

|

|

$

|

23.8

|

|

$

|

84.8

|

|

$

|

36.2

|

|

$

|

209.1

|

|

|||||

|

2019-2020

|

125.4

|

|

23.7

|

|

169.5

|

|

—

|

|

318.6

|

|

||||||||||

|

2021-2022

|

113.3

|

|

15.3

|

|

169.5

|

|

—

|

|

298.1

|

|

||||||||||

|

Thereafter

|

435.2

|

|

5.4

|

|

3,141.0

|

|

—

|

|

3,581.6

|

|

||||||||||

|

Total

|

$

|

738.2

|

|

$

|

68.2

|

|

$

|

3,564.8

|

|

$

|

36.2

|

|

$

|

4,407.4

|

|

|||||

|

(1)

|

The liability for gross unrecognized income tax benefits, including interest and penalties, of

$342.8 million

for uncertain tax positions are not included in the table due to uncertainty about the date of their settlement.

|

|

|

|

|

|

Year-over-Year Change

|

||||||||||||||

|

(dollars in millions)

|

2017

|

2016

|

2015

|

2017-2016

|

2016-2015

|

|||||||||||||

|

Net cash provided by operating activities

|

$

|

1,840.4

|

|

$

|

1,742.8

|

|

$

|

1,532.5

|

|

6

|

%

|

14

|

%

|

|||||

|

Net cash provided by investing activities

|

179.9

|

|

53.7

|

|

17.9

|

|

n.m.

|

|

n.m.

|

|

||||||||

|

Net cash used in financing activities

|

(1,985.3

|

)

|

(1,620.5

|

)

|

(1,223.9

|

)

|

23

|

|

32

|

|

||||||||

|

(in millions)

|

Par Value

|

||

|

Fixed rate notes due September 2022, stated rate of 3.00%

(1)

|

$

|

750.0

|

|

|

Fixed rate notes due March 2025, stated rate of 3.00%

(2)

|

750.0

|

|

|

|

Fixed rate notes due September 2043, stated rate of 5.30%

(3)

|

750.0

|

|

|

|

(1)

|

In August 2012, we entered into a forward-starting interest rate swap agreement that modified the interest obligation associated with these notes so that the interest payable on the notes effectively became fixed at a rate of 3.32%.

|

|

(2)

|

In December 2014, we entered into a forward-starting interest rate swap agreement that modified the interest obligation associated with these notes so that the interest payable on the notes effectively became fixed at a rate of 3.11%.

|

|

(3)

|

In August 2012, we entered into a forward-starting interest rate swap agreement that modified the interest obligation associated with these notes so that the interest payable effectively became fixed at a rate of 4.73%.

|

|

Rating Agency

|

|

Short-Term

Debt Rating

|

|

Long-Term

Debt Rating

|

|

Outlook

|

|

Standard & Poor’s

|

|

A1+

|

|

AA-

|

|

Stable

|

|

Moody’s Investors Service

|

|

P1

|

|

Aa3

|

|

Stable

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

•

|

a financial safeguard package for all futures and options contracts other than cleared interest rate swap and credit default swap contracts (base package);

|

|

•

|

a financial safeguard package for cleared interest rate swap contracts; and

|

|

•

|

a financial safeguard package for cleared credit default swap contracts.

|

|

(in millions)

|

CME Clearing

Available Assets

|

|||

|

Designated corporate contributions for futures and options

(1)

|

$

|

100.0

|

|

|

|

Guaranty fund contributions

(2)

|

4,635.8

|

|

||

|

Assessment powers

(3)

|

12,748.4

|

|

||

|

(1)

|

CME Clearing designates $100.0 million of corporate contributions to satisfy a clearing firm default in the event that the defaulting clearing firm's guaranty contributions and performance bonds do not satisfy the deficit.

|

|

(2)

|

Guaranty fund contributions of clearing firms include guaranty fund contributions required of clearing firms, but do not include any excess deposits held by us at the direction of clearing firms.

|

|

(3)

|

In the event of a clearing firm default, if a loss continues to exist after the utilization of the assets of the defaulted firm, our corporate contribution and the non-defaulting clearing firms' guaranty fund contributions, we would assess all non-defaulting clearing members as provided in the rules governing the guaranty fund. We could assess non-defaulting clearing members 275% of their existing guaranty fund requirements up to a maximum of 550% of their existing guaranty fund requirements as provided in the rules. Assessment powers are calculated to reflect the potential obligation that each clearing member could be called for in the event clearing member defaults exhaust the guaranty fund, however the total amount available would be reduced by the defaulted clearing members assessment obligations since they would no longer be able to satisfy their obligations.

|

|

(in millions)

|

CME Clearing

Available Assets

|

|||

|

Designated corporate contributions for interest rate swap contracts

(1)

|

$

|

150.0

|

|

|

|

Guaranty fund contributions

(2)

|

2,571.7

|

|

||

|

Assessment powers

(3)

|

1,292.1

|

|

||

|

(1)

|

CME Clearing designates $150.0 million of corporate contributions to satisfy a clearing firm default in the event that the defaulting clearing firm's guaranty contributions and performance bonds do not satisfy the deficit.

|

|

(2)

|

Guaranty fund contributions of clearing firms for interest rate swap contracts include guaranty fund contributions required of those clearing firms.

|

|

(3)

|

In the event of a clearing firm default, if a loss continues to exist after the utilization of the assets of the defaulted firm, our corporate contribution and the non-defaulting firms' guaranty fund contributions, we would assess non-defaulting clearing members as provided in the rules governing the interest rate swap guaranty fund.

|

|

(in millions)

|

CME Clearing

Available Assets

|

|||

|

Designated corporate contributions for credit default swap contracts

(1)

|

$

|

50.0

|

|

|

|

Guaranty fund contributions

(2)

|

600.0

|

|

||

|

Assessment powers

(3)

|

86.4

|

|

||

|

(1)

|

CME Clearing designates corporate contributions to satisfy a clearing firm default in the event that the defaulting clearing firm's guaranty contributions and performance bonds do not satisfy the deficit. The working capital contributed by us would be equal to the greater of $50.0 million and 5% of the credit default swap guaranty fund, up to a maximum of $100.0 million.

|

|

(2)

|

Guaranty fund contributions of clearing firms for credit default swap contracts include guaranty fund contributions required of those clearing firms.

|

|

(3)

|

In the event of a clearing firm default, if a loss continues to exist after the utilization of the assets of the defaulted firm, our corporate contribution and the non-defaulting firms' guaranty fund contributions, we would assess non-defaulting clearing members as provided in the rules governing the credit default swap guaranty fund.

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

|

December 31,

|

||||||

|

|

2017

|

2016

|

|||||

|

Assets

|

|||||||

|

Current Assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

1,903.6

|

|

$

|

1,868.6

|

|

|

|

Marketable securities

|

90.1

|

|

83.3

|

|

|||

|

Accounts receivable, net of allowance of $2.2 and $3.5

|

359.7

|

|

364.4

|

|

|||

|

Other current assets (includes $0 and $30.0 in restricted cash)

|

367.8

|

|

171.7

|

|

|||

|

Performance bonds and guaranty fund contributions

|

44,185.3

|

|

37,543.5

|

|

|||

|

Total current assets

|

46,906.5

|

|

40,031.5

|

|

|||

|

Property, net

|

399.7

|

|

425.2

|

|

|||

|

Intangible assets—trading products

|

17,175.3

|

|

17,175.3

|

|

|||

|

Intangible assets—other, net

|

2,346.3

|

|

2,441.8

|

|

|||

|

Goodwill

|

7,569.0

|

|

7,569.0

|

|

|||

|

Other assets (includes $2.4 and $61.7 in restricted cash)

|

1,394.4

|

|

1,726.6

|

|

|||

|

Total Assets

|

$

|

75,791.2

|

|

$

|

69,369.4

|

|

|

|

Liabilities and Equity

|

|||||||

|

Current Liabilities:

|

|||||||

|

Accounts payable

|

$

|

31.3

|

|

$

|

26.2

|

|

|

|

Other current liabilities

|

1,456.3

|

|

1,376.7

|

|

|||

|

Performance bonds and guaranty fund contributions

|

44,185.3

|

|

37,542.7

|

|

|||

|

Total current liabilities

|

45,672.9

|

|

38,945.6

|

|

|||

|

Long-term debt

|

2,233.1

|

|

2,231.2

|

|

|||

|

Deferred income tax liabilities, net

|

4,857.7

|

|

7,291.0

|

|

|||

|

Other liabilities

|

615.7

|

|

560.9

|

|

|||

|

Total Liabilities

|

53,379.4

|

|

49,028.7

|

|

|||

|

Shareholders’ Equity:

|

|||||||

|

Preferred stock, $0.01 par value, 10,000 shares authorized as of December 31, 2017 and 2016; none issued

|

—

|

|

—

|

|

|||

|

Class A common stock, $0.01 par value, 1,000,000 shares authorized as of December 31, 2017 and 2016, 339,235 and 338,240 shares issued and outstanding as of December 31, 2017 and 2016, respectively

|

3.4

|

|

3.4

|

|

|||

|

Class B common stock, $0.01 par value, 3 shares authorized, issued and outstanding as of December 31, 2017 and 2016

|

—

|

|

—

|

|

|||

|

Additional paid-in capital

|

17,896.9

|

|

17,826.9

|

|

|||

|

Retained earnings

|

4,497.2

|

|

2,524.5

|

|

|||

|

Accumulated other comprehensive income (loss)

|

14.3

|

|

(14.1

|

)

|

|||

|

Total shareholders’ equity

|

22,411.8

|

|

20,340.7

|

|

|||

|

Total Liabilities and Equity

|

$

|

75,791.2

|

|

$