|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

o

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Delaware

|

75-3108137

|

|

|

State of Incorporation

|

IRS Employer Identification No.

|

|

|

11825 N. Pennsylvania Street

|

|

|

|

Carmel, Indiana 46032

|

(317) 817-6100

|

|

|

Address of principal executive offices

|

Telephone

|

|

|

Title of each class

|

Name of Each Exchange on which Registered

|

|

|

Common Stock, par value $0.01 per share

|

New York Stock Exchange

|

|

|

Rights to purchase Series C Junior Participating Preferred Stock

|

New York Stock Exchange

|

|

|

PART I

|

Page

|

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

PART III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

PART IV

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

•

|

Bankers Life,

which markets and distributes Medicare supplement insurance, interest-sensitive life insurance, traditional life insurance, fixed annuities and long-term care insurance products to the middle-income senior market through a dedicated field force of career agents, financial and investment advisors, and sales managers supported by a network of community-based sales offices. The Bankers Life segment includes primarily the business of Bankers Life and Casualty Company ("Bankers Life"). Bankers Life also has various distribution and marketing agreements with other insurance companies to use Bankers Life's career agents to distribute Medicare Advantage and prescription drug plans ("PDP") products in exchange for a fee.

|

|

•

|

Washington National,

which markets and distributes supplemental health (including specified disease, accident and hospital indemnity insurance products) and life insurance to middle-income consumers at home and at the worksite. These products are marketed through Performance Matters Associates, Inc. ("PMA", a wholly owned subsidiary) and through independent marketing organizations and insurance agencies including worksite marketing. The products being marketed are underwritten by Washington National Insurance Company ("Washington National"). This segment's business also includes certain closed blocks of annuities and Medicare supplement policies which are no longer being actively marketed by this segment and were primarily issued or acquired by Washington National.

|

|

•

|

Colonial Penn

,

which markets primarily graded benefit and simplified issue life insurance directly to customers in the senior middle-income market through television advertising, direct mail, the internet and telemarketing. The Colonial Penn segment includes primarily the business of Colonial Penn Life Insurance Company ("Colonial Penn").

|

|

•

|

Long-term care in run-off

consists of the long-term care business that was recaptured due to the termination of certain reinsurance agreements effective September 30, 2016. This business is not actively marketed and was issued or acquired by Washington National and Bankers Conseco Life Insurance Company ("BCLIC").

|

|

•

|

Maximize our product portfolio to ensure it meets our customers’ needs for integrated products and advice covering a broad range of their financial needs

|

|

•

|

Position marketing and our distribution channels to better respond to evolving customer preferences

|

|

•

|

Expand and enhance elements of our broker-dealer and registered investment advisor program

|

|

•

|

Expand our reach within certain demographics of the middle-income market based on our improved customer segmentation analytics

|

|

•

|

Maintain our strong capital position and favorable financial metrics

|

|

•

|

Work to increase our return on equity

|

|

•

|

Maintain pricing discipline

|

|

•

|

Active enterprise risk management process

|

|

•

|

Continue to cost effectively repurchase our common stock, absent compelling alternatives

|

|

•

|

Maintain a competitive dividend payout ratio

|

|

•

|

Reduce relative legacy long-term care exposure

|

|

•

|

Leverage our recent investments to identify opportunities, drive increased productivity, improve efficiencies and profitability, and increase the speed-to-market for new products

|

|

•

|

Create a strong enterprise data strategy using our platforms and state-of-the-art tools to drive growth on a cost-effective basis

|

|

•

|

Continue to invest in technology partnerships that will support our field force and relationships with our customers, and leverage data to run our business profitably

|

|

•

|

Pilot various models across the agent lifecycle to drive increased growth, productivity and retention

|

|

•

|

Attract, retain and develop the best talent to help us drive sustainable growth, and provide them with development opportunities

|

|

•

|

Recruit, develop and retain our agent force

|

|

2016

|

2015

|

2014

|

|||||||||

|

Health:

|

|||||||||||

|

Bankers Life

|

$

|

1,235.3

|

|

$

|

1,242.3

|

|

$

|

1,275.1

|

|

||

|

Washington National

|

628.4

|

|

619.6

|

|

603.0

|

|

|||||

|

Colonial Penn

|

2.4

|

|

3.0

|

|

3.4

|

|

|||||

|

Long-term care in run-off

|

4.7

|

|

—

|

|

—

|

|

|||||

|

Total health

|

1,870.8

|

|

1,864.9

|

|

1,881.5

|

|

|||||

|

Annuities:

|

|||||||||||

|

Bankers Life

|

970.0

|

|

803.0

|

|

782.3

|

|

|||||

|

Washington National

|

1.5

|

|

2.4

|

|

2.6

|

|

|||||

|

Total annuities

|

971.5

|

|

805.4

|

|

784.9

|

|

|||||

|

Life:

|

|||||||||||

|

Bankers Life

|

461.1

|

|

446.0

|

|

424.9

|

|

|||||

|

Washington National

|

29.4

|

|

27.7

|

|

25.9

|

|

|||||

|

Colonial Penn

|

277.8

|

|

259.9

|

|

241.7

|

|

|||||

|

Total life

|

768.3

|

|

733.6

|

|

692.5

|

|

|||||

|

Total premium collections from business segments excluding the business of CLIC prior to being sold

|

3,610.6

|

|

3,403.9

|

|

3,358.9

|

|

|||||

|

Premium collections related to business of CLIC prior to being sold (primarily life products)

|

—

|

|

—

|

|

71.2

|

|

|||||

|

Total premium collections

|

$

|

3,610.6

|

|

$

|

3,403.9

|

|

$

|

3,430.1

|

|

||

|

2016

|

2015

|

2014

|

|||||||||

|

Medicare supplement:

|

|||||||||||

|

Bankers Life

|

$

|

739.3

|

|

$

|

739.4

|

|

$

|

743.3

|

|

||

|

Washington National

|

61.0

|

|

72.6

|

|

85.2

|

|

|||||

|

Colonial Penn

|

2.3

|

|

2.7

|

|

3.2

|

|

|||||

|

Total

|

802.6

|

|

814.7

|

|

831.7

|

|

|||||

|

Long-term care:

|

|||||||||||

|

Bankers Life

|

468.6

|

|

476.6

|

|

500.6

|

|

|||||

|

Long-term care in run-off

|

4.7

|

|

—

|

|

—

|

|

|||||

|

Total

|

473.3

|

|

476.6

|

|

500.6

|

|

|||||

|

Prescription Drug Plan products included in Bankers Life

|

—

|

|

—

|

|

6.8

|

|

|||||

|

Supplemental health:

|

|||||||||||

|

Bankers Life

|

21.2

|

|

19.2

|

|

16.3

|

|

|||||

|

Washington National

|

565.5

|

|

544.8

|

|

515.4

|

|

|||||

|

Total

|

586.7

|

|

564.0

|

|

531.7

|

|

|||||

|

Other:

|

|||||||||||

|

Bankers Life

|

6.2

|

|

7.1

|

|

8.1

|

|

|||||

|

Washington National

|

1.9

|

|

2.2

|

|

2.4

|

|

|||||

|

Colonial Penn

|

.1

|

|

.3

|

|

.2

|

|

|||||

|

Total

|

8.2

|

|

9.6

|

|

10.7

|

|

|||||

|

Total health premium collections

|

$

|

1,870.8

|

|

$

|

1,864.9

|

|

$

|

1,881.5

|

|

||

|

2016

|

2015

|

2014

|

|||||||||

|

Fixed index annuity:

|

|||||||||||

|

Bankers Life

|

$

|

868.1

|

|

$

|

706.6

|

|

$

|

646.2

|

|

||

|

Washington National

|

1.2

|

|

1.9

|

|

2.0

|

|

|||||

|

Total fixed index annuity premium collections

|

869.3

|

|

708.5

|

|

648.2

|

|

|||||

|

Other fixed interest annuity:

|

|||||||||||

|

Bankers Life

|

101.9

|

|

96.4

|

|

136.1

|

|

|||||

|

Washington National

|

.3

|

|

.5

|

|

.6

|

|

|||||

|

Total fixed interest annuity premium collections

|

102.2

|

|

96.9

|

|

136.7

|

|

|||||

|

Total annuity premium collections from business segments excluding the business of CLIC prior to being sold

|

971.5

|

|

805.4

|

|

784.9

|

|

|||||

|

Premium collections related to business of CLIC prior to being sold

|

—

|

|

—

|

|

.2

|

|

|||||

|

Total annuity premium collections

|

$

|

971.5

|

|

$

|

805.4

|

|

$

|

785.1

|

|

||

|

•

|

The index to be used.

|

|

•

|

The time period during which the change in the index is measured. At the end of the time period, the change in the index is applied to the account value. The time period of the contract ranges from 1 to 4 years.

|

|

•

|

The method used to measure the change in the index.

|

|

•

|

The measured change in the index is multiplied by a "participation rate" (percentage of change in the index) before the credit is applied. Some policies guarantee the initial participation rate for the life of the contract, and some vary the rate for each period.

|

|

•

|

The measured change in the index may also be limited by a "cap" before the credit is applied. Some policies guarantee the initial cap for the life of the contract, and some vary the cap for each period.

|

|

•

|

The measured change in the index may also be limited to the excess in the measured change over a "margin" before the credit is applied. Some policies guarantee the initial margin for the life of the contract, and some vary the margin for each period.

|

|

2016

|

2015

|

2014

|

|||||||||

|

Interest-sensitive life products:

|

|||||||||||

|

Bankers Life

|

$

|

175.0

|

|

$

|

169.1

|

|

$

|

169.8

|

|

||

|

Washington National

|

18.0

|

|

15.6

|

|

13.0

|

|

|||||

|

Colonial Penn

|

.3

|

|

.2

|

|

.4

|

|

|||||

|

Total interest-sensitive life premium collections

|

193.3

|

|

184.9

|

|

183.2

|

|

|||||

|

Traditional life:

|

|||||||||||

|

Bankers Life

|

286.1

|

|

276.9

|

|

255.1

|

|

|||||

|

Washington National

|

11.4

|

|

12.1

|

|

12.9

|

|

|||||

|

Colonial Penn

|

277.5

|

|

259.7

|

|

241.3

|

|

|||||

|

Total traditional life premium collections

|

575.0

|

|

548.7

|

|

509.3

|

|

|||||

|

Total life premium collections from business segments excluding the business of CLIC prior to being sold

|

768.3

|

|

733.6

|

|

692.5

|

|

|||||

|

Premium collections related to business of CLIC prior to being sold on July 1, 2014:

|

|||||||||||

|

Interest-sensitive life

|

—

|

|

—

|

|

61.3

|

|

|||||

|

Traditional life

|

—

|

|

—

|

|

9.7

|

|

|||||

|

Total premium collections related to business of CLIC prior to being sold

|

—

|

|

—

|

|

71.0

|

|

|||||

|

Total life insurance premium collections

|

$

|

768.3

|

|

$

|

733.6

|

|

$

|

763.5

|

|

||

|

•

|

provide largely stable investment income from a diversified high quality fixed income portfolio;

|

|

•

|

maximize and maintain a stable spread between our investment income and the yields we pay on insurance products;

|

|

•

|

sustain adequate liquidity levels to meet operating cash requirements, including a margin for potential adverse developments;

|

|

•

|

continually monitor and manage the relationship between our investment portfolio and the financial characteristics of our insurance liabilities such as durations and cash flows; and

|

|

•

|

maximize total return through active investment management.

|

|

•

|

purchasing options on equity indices with similar payoff characteristics; and

|

|

•

|

adjusting the participation rate to reflect the change in the cost of such options (such cost varies based on market conditions).

|

|

Name of Reinsurer

|

Reinsurance receivables

|

Ceded life insurance inforce

|

A.M. Best rating

|

||||||

|

Jackson National Life Insurance Company ("Jackson") (a)

|

$

|

1,482.4

|

|

$

|

755.1

|

|

A+

|

||

|

Wilton Reassurance Company ("Wilton Re")

|

320.2

|

|

1,309.0

|

|

A

|

||||

|

RGA Reinsurance Company (b)

|

200.3

|

|

102.6

|

|

A+

|

||||

|

Munich American Reassurance Company

|

3.4

|

|

476.6

|

|

A+

|

||||

|

Swiss Re Life and Health America Inc.

|

3.0

|

|

611.0

|

|

A+

|

||||

|

SCOR Global Life USA Reinsurance Company

|

1.4

|

|

95.0

|

|

A

|

||||

|

All others (c)

|

249.7

|

|

254.7

|

|

|||||

|

$

|

2,260.4

|

|

$

|

3,604.0

|

|

||||

|

(a)

|

In addition to the life insurance business, Jackson has assumed certain annuity business from our insurance subsidiaries through a coinsurance agreement. Such business had total insurance policy liabilities of $1.1 billion at

December 31, 2016

.

|

|

(b)

|

RGA Reinsurance Company has assumed a portion of the long-term care business of Bankers Life on a coinsurance basis.

|

|

(c)

|

No other single reinsurer represents more than 3 percent of the reinsurance receivables balance or has assumed greater than 2 percent of the total ceded life insurance business inforce.

|

|

•

|

grant and revoke business licenses;

|

|

•

|

regulate and supervise sales practices and market conduct;

|

|

•

|

establish guaranty associations;

|

|

•

|

license agents;

|

|

•

|

approve policy forms;

|

|

•

|

approve premium rates and premium rate increases for some lines of business such as long-term care and Medicare supplement;

|

|

•

|

establish reserve requirements;

|

|

•

|

prescribe the form and content of required financial statements and reports;

|

|

•

|

determine the reasonableness and adequacy of statutory capital and surplus;

|

|

•

|

perform financial, market conduct and other examinations;

|

|

•

|

define acceptable accounting principles; and

|

|

•

|

regulate the types and amounts of permitted investments.

|

|

•

|

reserve requirements;

|

|

•

|

risk-based capital ("RBC") standards;

|

|

•

|

codification of insurance accounting principles;

|

|

•

|

investment restrictions;

|

|

•

|

restrictions on an insurance company's ability to pay dividends;

|

|

•

|

credit for reinsurance; and

|

|

•

|

product illustrations.

|

|

•

|

statutory net gain from operations or statutory net income for the prior year; or

|

|

•

|

10 percent of statutory capital and surplus at the end of the preceding year.

|

|

•

|

between the current year and the prior year; and

|

|

•

|

for the average of the last 3 years.

|

|

Guaranteed

|

Fixed interest and fixed

|

Universal

|

||||||||||

|

rate

|

index annuities

|

life

|

Total

|

|||||||||

|

> 5.0% to 6.0%

|

$

|

.3

|

|

$

|

14.4

|

|

$

|

14.7

|

|

|||

|

> 4.0% to 5.0%

|

35.3

|

|

288.6

|

|

323.9

|

|

||||||

|

> 3.0% to 4.0%

|

1,018.8

|

|

50.0

|

|

1,068.8

|

|

||||||

|

> 2.0% to 3.0%

|

2,406.4

|

|

196.0

|

|

2,602.4

|

|

||||||

|

> 1.0% to 2.0%

|

882.3

|

|

18.5

|

|

900.8

|

|

||||||

|

1.0% and under

|

3,866.2

|

|

297.3

|

|

4,163.5

|

|

||||||

|

$

|

8,209.3

|

|

$

|

864.8

|

|

$

|

9,074.1

|

|

||||

|

Weighted average

|

1.91

|

%

|

2.91

|

%

|

2.01

|

%

|

||||||

|

•

|

The first hypothetical scenario assumes immediate and permanent reductions to current interest rate spreads on interest-sensitive products. We estimate that a pre-tax charge of approximately $35 million would occur if assumed spreads related to our interest-sensitive life and annuity products immediately and permanently decreased by 10 basis points.

|

|

•

|

A second scenario assumes that new money rates remain at their current level indefinitely. We estimate that this scenario would result in a pre-tax charge of approximately $20 million related to an increase in deficiency reserves related to the long-term care block in run-off and life contingent payout annuities.

|

|

•

|

The third hypothetical scenario assumes current new money rates increase such that our current portfolio yield remains level. We estimate that this scenario would result in a pre-tax charge of approximately $15 million related to an increase in deficiency reserves related to the long-term care in run-off block and life contingent payout annuities.

|

|

•

|

One scenario assumes that the new money rates available to invest cash flows from our long-term care block in the Bankers Life segment remain at their current level of 5.42 percent indefinitely. This scenario would reduce margins by approximately $110 million but would not result in a charge because margins would continue to be positive (based on our 2016 comprehensive actuarial review).

|

|

•

|

An additional scenario assumes that current new money rates available to invest cash flows from our long-term care block in the Bankers Life segment immediately decrease to approximately 3.5 percent and remain at that level indefinitely. This scenario would reduce margins in this block by approximately $405 million and would result in a pre-tax charge of approximately $85 million (based on our 2016 comprehensive actuarial review).

|

|

•

|

The value of our investment portfolio has been materially affected in the past by changes in market conditions which resulted in substantial changes in realized and/or unrealized losses. Future adverse capital market conditions could result in additional realized and/or unrealized losses.

|

|

•

|

Changes in interest rates also affect our investment portfolio. In periods of increasing interest rates, life insurance policy loans, surrenders and withdrawals could increase as policyholders seek higher returns. This could require us to sell invested assets at a time when their prices may be depressed by the increase in interest rates, which could cause us to realize investment losses. Conversely, during periods of declining interest rates, we could experience increased premium payments on products with flexible premium features, repayment of policy loans and increased percentages of policies remaining inforce. We could obtain lower returns on investments made with these cash flows. In addition, prepayment rates on investments may increase so that we might have to reinvest those proceeds in lower-yielding investments. As a consequence of these factors, we could experience a decrease in the spread between the returns on our investment portfolio and amounts to be credited to policyholders and contractholders, which could adversely affect our profitability.

|

|

•

|

The attractiveness of certain of our insurance products may decrease because they are linked to the equity markets and assessments of our financial strength, resulting in lower profits. Increasing consumer concerns about the returns and features of our insurance products or our financial strength may cause existing customers to surrender policies or withdraw assets, and diminish our ability to sell policies and attract assets from new and existing customers, which would result in lower sales and fee revenues.

|

|

•

|

changes in interest rates and credit spreads, which can reduce the value of our investments as further discussed in the risk factor entitled "Changing interest rates may adversely affect our results of operations";

|

|

•

|

changes in patterns of relative liquidity in the capital markets for various asset classes;

|

|

•

|

changes in the perceived or actual ability of issuers to make timely repayments, which can reduce the value of our investments. This risk is significantly greater with respect to below-investment grade securities, which comprised 16 percent of the cost basis of our available for sale fixed maturity investments as of

December 31, 2016

; and

|

|

•

|

changes in the estimated timing of receipt of cash flows. For example, our structured securities, which comprised

26 percent

of our available for sale fixed maturity investments at

December 31, 2016

, are subject to variable prepayment on the assets underlying such securities, such as mortgage loans. When asset-backed securities, collateralized debt obligations, commercial mortgage-backed securities, mortgage pass-through securities and collateralized mortgage obligations (collectively referred to as "structured securities") prepay faster than expected, investment income may be adversely affected due to the acceleration of the amortization of purchase premiums or the inability to reinvest at comparable yields in lower interest rate environments.

|

|

•

|

subsidiary debt;

|

|

•

|

liens;

|

|

•

|

restrictive agreements;

|

|

•

|

restricted payments during the continuance of an event of default;

|

|

•

|

disposition of assets and sale and leaseback transactions;

|

|

•

|

transactions with affiliates;

|

|

•

|

change in business;

|

|

•

|

fundamental changes;

|

|

•

|

modification of certain agreements; and

|

|

•

|

changes to fiscal year.

|

|

•

|

non-payment;

|

|

•

|

breach of representations, warranties or covenants;

|

|

•

|

cross-default and cross-acceleration;

|

|

•

|

bankruptcy and insolvency events;

|

|

•

|

judgment defaults;

|

|

•

|

actual or asserted invalidity of documentation with respect to the Revolving Credit Agreement;

|

|

•

|

change of control; and

|

|

•

|

customary ERISA defaults.

|

|

•

|

incur certain subsidiary indebtedness without also guaranteeing the Notes;

|

|

•

|

create liens;

|

|

•

|

enter into sale and leaseback transactions;

|

|

•

|

issue, sell, transfer or otherwise dispose of any shares of capital stock of any Insurance Subsidiary (as defined in the Indenture); and

|

|

•

|

consolidate or merge with or into other companies or transfer all or substantially all of the Company’s assets.

|

|

•

|

statutory net gain from operations or statutory net income for the prior year, or

|

|

•

|

10 percent of statutory capital and surplus as of the end of the preceding year.

|

|

Officer

|

With CNO

|

Positions with CNO, Principal

|

|

Name and Age (a)

|

Since

|

Occupation and Business Experience (b)

|

|

Bruce Baude, 52

|

2012

|

Since July 2012, executive vice president, chief operations and technology officer. From 2008 to 2012, Mr. Baude was chief operating officer at Univita Health.

|

|

Gary C. Bhojwani, 49

|

2016

|

Since April 2016, president of CNO. From April 2015 until joining CNO, chief executive officer of GCB, LLC, an insurance and financial services consulting company that he founded. Mr. Bhojwani served as a member of the board of management at Allianz SE, Chairman of Allianz of America, Allianz Life Insurance Company, and Fireman’s Fund Insurance Company from 2012 to January 1, 2015. From 2007 to 2012, he served as president of Allianz Life Insurance Company of North America.

|

|

Edward J. Bonach, 62

|

2007

|

Since October 2011, chief executive officer. From May 2007 to January 2012, chief financial officer of CNO.

|

|

Erik M. Helding, 44

|

2004

|

Since April 2016, executive vice president and chief financial officer. From August 2012 to April 2016, senior vice president, treasury and investor relations. Prior to August 2012, Mr. Helding was vice president, financial planning and analysis and he has held various finance positions since joining CNO in 2004.

|

|

Eric R. Johnson, 56

|

1997

|

Since September 2003, chief investment officer of CNO and president and chief executive officer of 40|86 Advisors, CNO's wholly-owned registered investment advisor. Mr. Johnson has held various investment management positions since joining CNO in 1997.

|

|

John R. Kline, 59

|

1990

|

Since July 2002, senior vice president and chief accounting officer. Mr. Kline has served in various accounting and finance capacities with CNO since 1990.

|

|

Susan L. Menzel, 51

|

2005

|

Since May 2005, executive vice president, human resources.

|

|

Christopher J. Nickele, 60

|

2005

|

Since August 2014, executive vice president and chief actuary. From October 2005 until August 2014, executive vice president, product management and from May 2010 until March 2014, president, Other CNO Business.

|

|

Matthew J. Zimpfer, 49

|

1998

|

Since June 2008, executive vice president and general counsel. Mr. Zimpfer has held various legal positions since joining CNO in 1998.

|

|

(a)

|

The executive officers serve as such at the discretion of the Board of Directors and are elected annually.

|

|

(b)

|

Business experience is given for at least the last five years.

|

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

|

Period

|

Market price

|

Dividends

|

|||||||||

|

High

|

Low

|

declared and paid

|

|||||||||

|

2015:

|

|||||||||||

|

First Quarter

|

$

|

17.53

|

|

$

|

14.89

|

|

$

|

0.06

|

|

||

|

Second Quarter

|

19.49

|

|

16.88

|

|

0.07

|

|

|||||

|

Third Quarter

|

19.28

|

|

16.06

|

|

0.07

|

|

|||||

|

Fourth Quarter

|

20.88

|

|

17.93

|

|

0.07

|

|

|||||

|

2016:

|

|||||||||||

|

First Quarter

|

$

|

18.71

|

|

$

|

14.66

|

|

$

|

0.07

|

|

||

|

Second Quarter

|

20.55

|

|

16.00

|

|

0.08

|

|

|||||

|

Third Quarter

|

18.70

|

|

14.30

|

|

0.08

|

|

|||||

|

Fourth Quarter

|

19.89

|

|

14.65

|

|

0.08

|

|

|||||

|

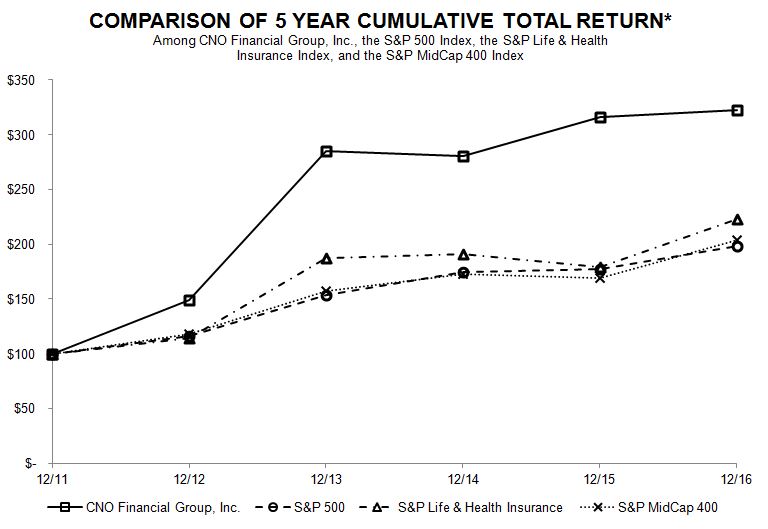

12/11

|

12/12

|

12/13

|

12/14

|

12/15

|

12/16

|

|||||||||||||

|

CNO Financial Group, Inc.

|

$

|

100.00

|

|

$

|

148.93

|

|

$

|

284.65

|

|

$

|

280.92

|

|

$

|

316.09

|

|

$

|

322.60

|

|

|

S&P 500 Index

|

100.00

|

|

116.00

|

|

153.57

|

|

174.60

|

|

177.01

|

|

198.18

|

|

||||||

|

S&P Life & Health Insurance Index

|

100.00

|

|

114.59

|

|

187.33

|

|

190.98

|

|

178.93

|

|

223.41

|

|

||||||

|

S&P MidCap 400 Index

|

100.00

|

|

117.88

|

|

157.37

|

|

172.74

|

|

168.98

|

|

204.03

|

|

||||||

|

Period (in 2016)

|

Total number of shares (or units)

|

Average price paid per share (or unit)

|

Total number of shares (or units) purchased as part of publicly announced plans or programs

|

Maximum number (or approximate dollar value) of shares (or units) that may yet be purchased under the plans or programs(a)

|

||||||||||

|

(dollars in millions)

|

||||||||||||||

|

October 1 through October 31

|

—

|

|

$

|

—

|

|

—

|

|

$

|

252.7

|

|

||||

|

November 1 through November 30

|

276

|

|

15.06

|

|

—

|

|

252.7

|

|

||||||

|

December 1 through December 31

|

936

|

|

19.56

|

|

—

|

|

252.7

|

|

||||||

|

Total

|

1,212

|

|

18.54

|

|

—

|

|

252.7

|

|

||||||

|

(a)

|

In May 2011, the Company announced a securities repurchase program of up to

$100.0 million

. In February 2012, June 2012, December 2012, December 2013, November 2014 and November 2015, the Company's Board of Directors approved, in aggregate, an additional

$1,600.0 million

to repurchase the Company's outstanding securities.

|

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column)

|

||||||||

|

Equity compensation plans approved by security holders

|

5,353,758

|

|

$

|

14.73

|

|

4,620,199

|

|

|||

|

Equity compensation plans not approved by security holders

|

—

|

|

—

|

|

—

|

|

||||

|

Total

|

5,353,758

|

|

$

|

14.73

|

|

4,620,199

|

|

|||

|

Years ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

(Amounts in millions, except per share data)

|

||||||||||||||||||||

|

STATEMENT OF OPERATIONS DATA

|

||||||||||||||||||||

|

Insurance policy income

|

$

|

2,601.1

|

|

$

|

2,556.0

|

|

$

|

2,629.7

|

|

$

|

2,744.7

|

|

$

|

2,755.4

|

|

|||||

|

Net investment income

|

1,325.2

|

|

1,233.6

|

|

1,427.4

|

|

1,664.0

|

|

1,486.4

|

|

||||||||||

|

Net realized investment gains (losses)

|

8.3

|

|

(36.6

|

)

|

36.7

|

|

33.4

|

|

81.1

|

|

||||||||||

|

Total revenues

|

3,985.1

|

|

3,811.9

|

|

4,144.7

|

|

4,476.1

|

|

4,342.7

|

|

||||||||||

|

Interest expense

|

116.4

|

|

94.9

|

|

92.8

|

|

105.3

|

|

114.6

|

|

||||||||||

|

Total benefits and expenses

|

3,631.9

|

|

3,444.2

|

|

3,969.6

|

|

4,171.3

|

|

4,187.0

|

|

||||||||||

|

Income before income taxes

|

353.2

|

|

367.7

|

|

175.1

|

|

304.8

|

|

155.7

|

|

||||||||||

|

Income tax expense (benefit)

|

(5.0

|

)

|

97.0

|

|

123.7

|

|

(173.2

|

)

|

(65.3

|

)

|

||||||||||

|

Net income

|

358.2

|

|

270.7

|

|

51.4

|

|

478.0

|

|

221.0

|

|

||||||||||

|

PER SHARE DATA

|

||||||||||||||||||||

|

Net income, basic

|

$

|

2.03

|

|

$

|

1.40

|

|

$

|

.24

|

|

$

|

2.16

|

|

$

|

.95

|

|

|||||

|

Net income, diluted

|

2.01

|

|

1.39

|

|

.24

|

|

2.06

|

|

.83

|

|

||||||||||

|

Dividends declared per common share

|

.31

|

|

.27

|

|

.24

|

|

.11

|

|

.06

|

|

||||||||||

|

Book value per common share outstanding

|

25.82

|

|

22.49

|

|

23.06

|

|

22.49

|

|

22.80

|

|

||||||||||

|

Weighted average shares outstanding for basic earnings

|

176.6

|

|

193.1

|

|

212.9

|

|

221.6

|

|

233.7

|

|

||||||||||

|

Weighted average shares outstanding for diluted earnings

|

178.3

|

|

195.2

|

|

217.7

|

|

232.7

|

|

281.4

|

|

||||||||||

|

Shares outstanding at period-end

|

173.8

|

|

184.0

|

|

203.3

|

|

220.3

|

|

221.5

|

|

||||||||||

|

BALANCE SHEET DATA

-

AT PERIOD END

|

||||||||||||||||||||

|

Total investments

|

$

|

26,237.6

|

|

$

|

24,487.1

|

|

$

|

24,908.3

|

|

$

|

27,151.7

|

|

$

|

27,959.3

|

|

|||||

|

Total assets

|

31,975.2

|

|

31,125.1

|

|

31,155.9

|

|

34,750.2

|

|

34,103.7

|

|

||||||||||

|

Corporate notes payable

|

912.9

|

|

911.1

|

|

780.3

|

|

838.0

|

|

986.1

|

|

||||||||||

|

Total liabilities

|

27,488.3

|

|

26,986.6

|

|

26,467.7

|

|

29,795.0

|

|

29,054.4

|

|

||||||||||

|

Shareholders' equity

|

4,486.9

|

|

|

4,138.5

|

|

4,688.2

|

|

4,955.2

|

|

5,049.3

|

|

|||||||||

|

STATUTORY DATA - AT PERIOD END (a)

|

||||||||||||||||||||

|

Statutory capital and surplus

|

$

|

1,956.8

|

|

$

|

1,739.2

|

|

$

|

1,654.4

|

|

$

|

1,711.9

|

|

$

|

1,560.4

|

|

|||||

|

Asset valuation reserve ("AVR")

|

253.3

|

|

196.9

|

|

203.1

|

|

233.9

|

|

222.2

|

|

||||||||||

|

Total statutory capital and surplus and AVR

|

2,210.1

|

|

1,936.1

|

|

1,857.5

|

|

1,945.8

|

|

1,782.6

|

|

||||||||||

|

(a)

|

We have derived the statutory data from statements filed by our insurance subsidiaries with regulatory authorities which are prepared in accordance with statutory accounting principles, which vary in certain respects from GAAP.

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

|

•

|

changes in or sustained low interest rates causing reductions in investment income, the margins of our fixed annuity and life insurance businesses, and sales of, and demand for, our products;

|

|

•

|

expectations of lower future investment earnings may cause us to accelerate amortization, write down the balance of insurance acquisition costs or establish additional liabilities for insurance products;

|

|

•

|

general economic, market and political conditions and uncertainties, including the performance of the financial markets which may affect the value of our investments as well as our ability to raise capital or refinance existing indebtedness and the cost of doing so;

|

|

•

|

the ultimate outcome of lawsuits filed against us and other legal and regulatory proceedings to which we are subject;

|

|

•

|

our ability to make anticipated changes to certain non-guaranteed elements of our life insurance products;

|

|

•

|

our ability to obtain adequate and timely rate increases on our health products, including our long-term care business;

|

|

•

|

the receipt of any required regulatory approvals for dividend and surplus debenture interest payments from our insurance subsidiaries;

|

|

•

|

mortality, morbidity, the increased cost and usage of health care services, persistency, the adequacy of our previous reserve estimates and other factors which may affect the profitability of our insurance products;

|

|

•

|

changes in our assumptions related to deferred acquisition costs or the present value of future profits;

|

|

•

|

the recoverability of our deferred tax assets and the effect of potential ownership changes and tax rate changes on their value;

|

|

•

|

our assumption that the positions we take on our tax return filings will not be successfully challenged by the IRS;

|

|

•

|

changes in accounting principles and the interpretation thereof;

|

|

•

|

our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our debt agreements;

|

|

•

|

our ability to achieve anticipated expense reductions and levels of operational efficiencies including improvements in claims adjudication and continued automation and rationalization of operating systems;

|

|

•

|

performance and valuation of our investments, including the impact of realized losses (including other-than-temporary impairment charges);

|

|

•

|

our ability to identify products and markets in which we can compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand recognition;

|

|

•

|

our ability to generate sufficient liquidity to meet our debt service obligations and other cash needs;

|

|

•

|

our ability to maintain effective controls over financial reporting;

|

|

•

|

our ability to continue to recruit and retain productive agents and distribution partners;

|

|

•

|

customer response to new products, distribution channels and marketing initiatives;

|

|

•

|

our ability to achieve additional upgrades of the financial strength ratings of CNO and our insurance company subsidiaries as well as the impact of our ratings on our business, our ability to access capital, and the cost of capital;

|

|

•

|

regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance companies, such as the payment of dividends and surplus debenture interest to us, regulation of the sale, underwriting and pricing of products, and health care regulation affecting health insurance products;

|

|

•

|

changes in the Federal income tax laws and regulations which may affect or eliminate the relative tax advantages of some of our products or affect the value of our deferred tax assets;

|

|

•

|

availability and effectiveness of reinsurance arrangements, as well as any defaults or failure of reinsurers to perform;

|

|

•

|

the amount we may need to pay to a reinsurer in connection with a long-term care reinsurance transaction;

|

|

•

|

the performance of third party service providers and potential difficulties arising from outsourcing arrangements;

|

|

•

|

the growth rate of sales, collected premiums, annuity deposits and assets;

|

|

•

|

interruption in telecommunication, information technology or other operational systems or failure to maintain the security, confidentiality or privacy of sensitive data on such systems;

|

|

•

|

events of terrorism, cyber attacks, natural disasters or other catastrophic events, including losses from a disease pandemic;

|

|

•

|

ineffectiveness of risk management policies and procedures in identifying, monitoring and managing risks; and

|

|

•

|

the risk factors or uncertainties listed from time to time in our filings with the SEC.

|

|

•

|

Bankers Life,

which markets and distributes Medicare supplement insurance, interest-sensitive life insurance, traditional life insurance, fixed annuities and long-term care insurance products to the middle-income senior market through a dedicated field force of career agents, financial and investment advisors, and sales managers supported by a network of community-based sales offices. The Bankers Life segment includes primarily the business of Bankers Life and Casualty Company. Bankers Life also has various distribution and marketing agreements with other insurance companies to use Bankers Life's career agents to distribute Medicare Advantage and PDP products in exchange for a fee.

|

|

•

|

Washington National,

which markets and distributes supplemental health (including specified disease, accident and hospital indemnity insurance products) and life insurance to middle-income consumers at home and at the worksite. These products are marketed through PMA and through independent marketing organizations and insurance agencies including worksite marketing. The products being marketed are underwritten by Washington National. This segment's business also includes certain closed blocks of annuities and Medicare supplement policies which are no longer being actively marketed by this segment and were primarily issued or acquired by Washington National.

|

|

•

|

Colonial Penn

, which markets primarily graded benefit and simplified issue life insurance directly to customers in the senior middle-income market through television advertising, direct mail, the internet and telemarketing. The Colonial Penn segment includes primarily the business of Colonial Penn.

|

|

•

|

Long-term care in run-off

consists of the long-term care business that was recaptured due to the termination of certain reinsurance agreements effective September 30, 2016. This business is not actively marketed and was issued or acquired by Washington National and BCLIC.

|

|

2016

|

2015

|

2014

|

|||||||||

|

Adjusted EBIT (a non-GAAP financial measure) (a):

|

|||||||||||

|

Bankers Life

|

$

|

397.9

|

|

$

|

369.6

|

|

$

|

386.9

|

|

||

|

Washington National

|

102.9

|

|

111.5

|

|

111.2

|

|

|||||

|

Colonial Penn

|

1.7

|

|

5.6

|

|

.8

|

|

|||||

|

Long-term care in run-off

|

(3.9

|

)

|

—

|

|

—

|

|

|||||

|

Adjusted EBIT from business segments

|

498.6

|

|

486.7

|

|

498.9

|

|

|||||

|

Corporate Operations, excluding corporate interest expense

|

(42.5

|

)

|

(18.9

|

)

|

(27.6

|

)

|

|||||

|

Adjusted EBIT

|

456.1

|

|

467.8

|

|

471.3

|

|

|||||

|

Corporate interest expense

|

(45.8

|

)

|

(45.0

|

)

|

(43.9

|

)

|

|||||

|

Operating earnings before taxes

|

410.3

|

|

422.8

|

|

427.4

|

|

|||||

|

Tax expense on operating income

|

147.8

|

|

148.1

|

|

150.5

|

|

|||||

|

Net operating income

|

262.5

|

|

274.7

|

|

276.9

|

|

|||||

|

Earnings of subsidiary prior to being sold

|

—

|

|

—

|

|

23.4

|

|

|||||

|

Loss on sale of subsidiary, gain (loss) on reinsurance transactions and transition expenses

|

—

|

|

—

|

|

(239.8

|

)

|

|||||

|

Net realized investment gains (losses) (net of related amortization)

|

7.6

|

|

(36.1

|

)

|

32.9

|

|

|||||

|

Fair value changes in embedded derivative liabilities (net of related amortization)

|

9.6

|

|

11.9

|

|

(36.0

|

)

|

|||||

|

Fair value changes and amendment related to agent deferred compensation plan

|

3.1

|

|

15.1

|

|

(26.8

|

)

|

|||||

|

Loss on reinsurance transaction (b)

|

(75.4

|

)

|

—

|

|

—

|

|

|||||

|

Loss on extinguishment or modification of debt

|

—

|

|

(32.8

|

)

|

(.6

|

)

|

|||||

|

Other

|

(2.0

|

)

|

(13.2

|

)

|

(5.4

|

)

|

|||||

|

Non-operating income (loss) before taxes

|

(57.1

|

)

|

(55.1

|

)

|

(252.3

|

)

|

|||||

|

Income tax expense (benefit):

|

|||||||||||

|

On non-operating income (loss)

|

(20.0

|

)

|

(18.6

|

)

|

8.7

|

|

|||||

|

Valuation allowance for deferred tax assets and other tax items

|

(132.8

|

)

|

(32.5

|

)

|

(35.5

|

)

|

|||||

|

Net non-operating income (loss)

|

95.7

|

|

(4.0

|

)

|

(225.5

|

)

|

|||||

|

Net income

|

$

|

358.2

|

|

$

|

270.7

|

|

$

|

51.4

|

|

||

|

Per diluted share:

|

|||||||||||

|

Net operating income

|

$

|

1.47

|

|

$

|

1.41

|

|

$

|

1.27

|

|

||

|

Earnings of subsidiary prior to being sold (net of taxes)

|

—

|

|

$

|

—

|

|

$

|

.07

|

|

|||

|

Loss on sale of subsidiary, gain (loss) on reinsurance transactions and transition expenses (including impact of taxes)

|

—

|

|

$

|

—

|

|

$

|

(1.24

|

)

|

|||

|

Net realized investment gains (losses) (net of related amortization and taxes)

|

.03

|

|

(.12

|

)

|

.10

|

|

|||||

|

Fair value changes in embedded derivative liabilities (net of related amortization and taxes)

|

.04

|

|

.04

|

|

(.11

|

)

|

|||||

|

Fair value changes and amendment related to agent deferred compensation plan (net of taxes)

|

.01

|

|

.05

|

|

(.08

|

)

|

|||||

|

Loss on reinsurance transaction (net of taxes)

|

(.27

|

)

|

—

|

|

—

|

|

|||||

|

Loss on extinguishment or modification of debt (net of taxes)

|

—

|

|

(.11

|

)

|

—

|

|

|||||

|

Valuation allowance for deferred tax assets and other tax items

|

.74

|

|

.17

|

|

.25

|

|

|||||

|

Other

|

(.01

|

)

|

(.05

|

)

|

(.02

|

)

|

|||||

|

Net income

|

$

|

2.01

|

|

$

|

1.39

|

|

$

|

.24

|

|

||

|

(a)

|

Management believes that an analysis of net operating income provides a clearer comparison of the operating results of the Company from period to period because it excludes: (i) the loss on the sale of a subsidiary, gain (loss) on reinsurance transactions and transition expenses, including impact of taxes; (ii) the earnings of subsidiary prior to being sold on July 1, 2014, net of taxes;

(iii)

net realized investment gains or losses, net of related amortization and taxes; (iv) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, net of related amortization and taxes; (v) fair value changes and amendment related to the agent deferred compensation plan, net of taxes; (vi) loss on extinguishment or modification of debt, net of taxes; (vii) changes in the valuation allowance for deferred tax assets and other tax items; and (viii)

other non-operating items consisting primarily of equity in earnings of certain non-strategic investments and earnings attributable to variable interest entities

. Net realized investment gains or losses include: (i) gains or losses on the sales of investments; (ii) other-than-temporary impairments recognized through net income; and (iii) changes in fair value of certain fixed maturity investments with embedded derivatives. EBIT is presented as net operating income excluding corporate interest expense and income tax expense. The table above reconciles the non-GAAP measure to the corresponding GAAP measure.

|

|

•

|

Maximize our product portfolio to ensure it meets our customers’ needs for integrated products and advice covering a broad range of their financial needs

|

|

•

|

Position marketing and our distribution channels to better respond to evolving customer preferences

|

|

•

|

Expand and enhance elements of our broker-dealer and registered investment advisor program

|

|

•

|

Expand our reach within certain demographics of the middle-income market based on our improved customer segmentation analytics

|

|

•

|

Maintain our strong capital position and favorable financial metrics

|

|

•

|

Work to increase our return on equity

|

|

•

|

Maintain pricing discipline

|

|

•

|

Active enterprise risk management process

|

|

•

|

Continue to cost effectively repurchase our common stock, absent compelling alternatives

|

|

•

|

Maintain a competitive dividend payout ratio

|

|

•

|

Reduce relative legacy long-term care exposure

|

|

•

|

Leverage our recent investments to identify opportunities, drive increased productivity, improve efficiencies and profitability, and increase the speed-to-market for new products

|

|

•

|

Create a strong enterprise data strategy using our platforms and state-of-the-art tools to drive growth on a cost-effective basis

|

|

•

|

Continue to invest in technology partnerships that will support our field force and relationships with our customers, and leverage data to run our business profitably

|

|

•

|

Pilot various models across the agent lifecycle to drive increased growth, productivity and retention

|

|

•

|

Attract, retain and develop the best talent to help us drive sustainable growth, and provide them with development opportunities

|

|

•

|

Recruit, develop and retain our agent force

|

|

•

|

Level 1 – includes assets and liabilities valued using inputs that are unadjusted quoted prices in active markets for identical assets or liabilities. Our Level 1 assets primarily include cash and cash equivalents and exchange traded securities.

|

|

•

|

Level 2 – includes assets and liabilities valued using inputs that are quoted prices for similar assets in an active market, quoted prices for identical or similar assets in a market that is not active, observable inputs, or observable inputs that can be corroborated by market data. Level 2 assets and liabilities include those financial instruments that are valued by independent pricing services using models or other valuation methodologies. These models consider various inputs such as credit rating, maturity, corporate credit spreads, reported trades and other inputs that are observable or derived from observable information in the marketplace or are supported by transactions executed in the marketplace. Financial assets in this category primarily include: certain publicly registered and privately placed corporate fixed maturity securities; certain government or agency securities; certain mortgage and asset-backed securities; certain equity securities; most investments held by our consolidated VIEs; certain mutual fund investments; most short-term investments; and non-exchange-traded derivatives such as call options. Financial liabilities in this category include investment borrowings, notes payable and borrowings related to VIEs.

|

|

•

|

Level 3 – includes assets and liabilities valued using unobservable inputs that are used in model-based valuations that contain management assumptions. Level 3 assets and liabilities include those financial instruments whose fair value is estimated based on broker/dealer quotes, pricing services or internally developed models or methodologies utilizing significant inputs not based on, or corroborated by, readily available market information. Financial assets in this category include certain corporate securities (primarily certain below-investment grade privately placed securities), certain structured securities, mortgage loans, and other less liquid securities. Financial liabilities in this category include our insurance liabilities for interest-sensitive products, which includes embedded derivatives (including embedded derivatives related to our fixed index annuity products and to a modified coinsurance arrangement) since their values include significant unobservable inputs including actuarial assumptions.

|

|

Change in assumptions

|

Estimated adjustment to income before income taxes based on revisions to certain assumptions

|

|||

|

(dollars in millions)

|

||||

|

Interest-sensitive life products:

|

||||

|

5% increase to assumed mortality

|

$

|

(18

|

)

|

|

|

5% decrease to assumed mortality

|

19

|

|

||

|

15% increase to assumed expenses

|

(6

|

)

|

||

|

15% decrease to assumed expenses

|

6

|

|

||

|

10 basis point decrease to assumed spread

|

(5

|

)

|

||

|

10 basis point increase to assumed spread

|

5

|

|

||

|

20% increase to assumed lapses

|

(5

|

)

|

||

|

20% decrease to assumed lapses

|

6

|

|

||

|

Fixed index and fixed interest annuity products:

|

||||

|

20% increase to assumed surrenders

|

(113

|

)

|

||

|

20% decrease to assumed surrenders

|

90

|

|

||

|

15% increase to assumed expenses

|

(6

|

)

|

||

|

15% decrease to assumed expenses

|

6

|

|

||

|

10 basis point decrease to assumed spread

|

(30

|

)

|

||

|

10 basis point increase to assumed spread

|

30

|

|

||

|

Other than interest-sensitive life and annuity products (a):

|

||||

|

5% increase to assumed morbidity

|

(330

|

)

|

||

|

50 basis point decrease to investment earnings rate

|

(5

|

)

|

||

|

5% decrease to assumed mortality

|

(4

|

)

|

||

|

(a)

|

We have excluded the effect of reasonably likely changes in lapse, surrender and expense assumptions for policies other than interest-sensitive life and annuity products.

|

|

Years ended December 31,

|

||||||||

|

2016

|

2015

|

2014

|

||||||

|

Bankers Life:

|

||||||||

|

Medicare supplement (1)

|

85.9

|

%

|

86.3

|

%

|

82.8

|

%

|

||

|

Long-term care (1)

|

90.0

|

%

|

90.4

|

%

|

91.1

|

%

|

||

|

Fixed index annuities (2)

|

91.5

|

%

|

91.2

|

%

|

90.8

|

%

|

||

|

Other annuities (2)

|

85.8

|

%

|

85.1

|

%

|

85.2

|

%

|

||

|

Life (1)

|

87.1

|

%

|

87.3

|

%

|

87.3

|

%

|

||

|

Washington National:

|

||||||||

|

Medicare supplement (1)

|

85.8

|

%

|

83.7

|

%

|

84.2

|

%

|

||

|

Supplemental health (1)

|

89.2

|

%

|

89.0

|

%

|

88.4

|

%

|

||

|

Life (1)

|

91.2

|

%

|

91.8

|

%

|

92.5

|

%

|

||

|

Colonial Penn:

|

||||||||

|

Life (1)

|

83.0

|

%

|

82.6

|

%

|

83.2

|

%

|

||

|

(1)

|

Based on number of inforce policies.

|

|

(2)

|

Based on the percentage of the inforce block persisting.

|

|

2016

|

2015

|

|||||||

|

(Dollars in millions)

|

||||||||

|

Amounts classified as future policy benefits:

|

||||||||

|

Active life reserves

|

$

|

3,816.4

|

|

$

|

3,707.8

|

|

||

|

Reserves for the present value of amounts not yet due on claims

|

1,338.4

|

|

1,306.1

|

|

||||

|

Future loss reserves

|

191.3

|

|

158.3

|

|

||||

|

Amounts classified as liability for policy and contract claims:

|

||||||||

|

Liability for due and unpaid claims, claims in the course of settlement and incurred but not reported claims

|

187.5

|

|

194.1

|

|

||||

|

Total

|

5,533.6

|

|

5,366.3

|

|

||||

|

Reinsurance receivables

|

194.3

|

|

657.4

|

|

||||

|

Long-term care reserves, net of reinsurance receivables

|

$

|

5,339.3

|

|

$

|

4,708.9

|

|

||

|

•

|

We recognize fee income based on either: (i) a fixed fee per contract sold; or (ii) a percentage of premiums collected. This fee income is recognized over the calendar year term of the contract.

|

|

•

|

We also pay commissions to our agents who sell the plans. These payments are deferred and amortized over the term of the contract.

|

|

2016

|

2015

|

2014

|

|||||||||

|

Fee revenue:

|

|||||||||||

|

Medicare Advantage contracts

|

$

|

23.2

|

|

$

|

23.1

|

|

$

|

22.4

|

|

||

|

PDP contracts

|

3.1

|

|

3.2

|

|

3.0

|

|

|||||

|

Total revenue

|

26.3

|

|

26.3

|

|

25.4

|

|

|||||

|

Distribution expenses

|

9.3

|

|

9.4

|

|

10.4

|

|

|||||

|

Fee revenue, net of distribution expenses

|

$

|

17.0

|

|

$

|

16.9

|

|

$

|

15.0

|

|

||

|

Balance, December 31, 2013

|

$

|

294.8

|

|

|

|

Decrease in 2014

|

(48.8

|

)

|

(a)

|

|

|

Balance, December 31, 2014

|

246.0

|

|

||

|

Decrease in 2015

|

(32.5

|

)

|

(b)

|

|

|

Balance, December 31, 2015

|

213.5

|

|

||

|

Increase in 2016

|

26.7

|

|

(c)

|

|

|

Balance, December 31, 2016

|

$

|

240.2

|

|

|

|

(a)

|

The

2014

reduction to the deferred tax valuation allowance primarily resulted from tax examination adjustments and the tax gain on the sale of CLIC.

|

|

(b)

|

The

2015

reduction to the deferred tax valuation allowance primarily resulted from higher actual and projected non-life income.

|

|

(c)

|

The

2016

increase to the deferred tax valuation allowance primarily resulted from additional non-life NOLs due to the settlement with the IRS.

|

|

Net operating loss

|

||||

|

Year of expiration

|

carryforwards

|

|||

|

2023

|

$

|

1,936.0

|

|

|

|

2025

|

85.2

|

|

||

|

2026

|

149.9

|

|

||

|

2027

|

10.8

|

|

||

|

2028

|

80.3

|

|

||

|

2029

|

213.2

|

|

||

|

2030

|

.3

|

|

||

|

2031

|

.2

|

|

||

|

2032

|

44.4

|

|

||

|

2033

|

.6

|

|

||

|

2034

|

1.7

|

|

||

|

Total federal NOLs

|

$

|

2,522.6

|

|

|

|

Years ended December 31,

|

|||||||

|

2016

|

2015

|

||||||

|

Balance at beginning of year

|

$

|

234.2

|

|

$

|

228.7

|

|

|

|

Increase based on tax positions taken in prior years

|

3.4

|

|

5.5

|

|

|||

|

Decrease in unrecognized tax benefits related to settlements with taxing authorities

|

(237.6

|

)

|

—

|

|

|||

|

Balance at end of year

|

$

|

—

|

|

$

|

234.2

|

|

|

|

•

|