|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

FOR THE TRANSITION PERIOD FROM TO

|

|

|

Delaware

|

|

06-1397316

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

251 Ballardvale Street

Wilmington, Massachusetts

(Address of Principal Executive Offices)

|

|

01887

(Zip Code)

|

|

Title of each class

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

New York Stock Exchange

|

|

Large accelerated filer

ý

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if smaller

reporting company)

|

|

Smaller reporting company

o

|

|

Item

|

|

Page

|

|

PART I

|

|

|

|

1

|

||

|

1A

|

||

|

1B

|

||

|

2

|

||

|

3

|

||

|

4

|

Not Applicable

|

|

|

PART II

|

|

|

|

5

|

||

|

6

|

||

|

7

|

||

|

7A

|

||

|

8

|

||

|

9

|

||

|

9A

|

||

|

9B

|

||

|

PART III

|

|

|

|

10

|

||

|

11

|

||

|

12

|

||

|

13

|

||

|

14

|

||

|

PART IV

|

|

|

|

15

|

||

|

•

|

outbred, which are genetically heterogeneous;

|

|

•

|

inbred, which are genetically identical;

|

|

•

|

hybrid, which are the offspring of two different inbred parents;

|

|

•

|

spontaneous mutant, which contain a naturally occurring genetic mutation (such as immune deficiency); and

|

|

•

|

other genetically modified research models, including knock-out models with one or more disabled genes and transgenic models.

|

|

•

|

bone disease (using our state-of-the-art imaging and pathology capabilities);

|

|

•

|

ophthalmology (using our models of neovascularization);

|

|

•

|

general cardiovascular and device testing (using our surgical models); and

|

|

•

|

oncology.

|

|

•

|

all the standard protocols for general toxicity testing (genotoxicity, safety pharmacology, acute, sub-acute, chronic toxicity and carcinogenicity bioassays) required for regulatory submissions supporting “first-in-human” to “first-to-the-market” strategies;

|

|

•

|

expertise in specialty routes of administration and modes of administration (e.g., infusion, intravitreal, intrathecal, and inhalation), which are important not only for the testing of potential pharmaceuticals, but also for the safety testing of medical devices, industrial chemicals, food additives, agrochemicals, biocides, nutraceuticals, animal

|

|

•

|

expertise in the conduct and assessment of reproductive and developmental toxicology studies (in support of larger scale and later-stage human clinical trials);

|

|

•

|

services in important specialty areas such as ocular, bone, juvenile/neonatal, immuno-toxicity, photobiology and dermal testing;

|

|

•

|

work in all major therapeutic areas;

|

|

•

|

study design and strategic advice to our clients based on our wealth of experience and scientific expertise in support of drug development; and

|

|

•

|

a strong history of assisting our clients in achieving their regulatory or internal milestones for safety testing, including studies addressing stem cell therapies, DNA vaccines, protein biotherapeutics, small molecules and medical devices.

|

|

•

|

Integrated Early-Stage Portfolio.

We are the only large, global contract research organization (CRO) with a portfolio of products and services that focuses almost exclusively on the early-stage drug development platform (from research models and associated services, to non-regulated discovery services, to regulated safety assessment). As such, we are able to collaborate with clients at the earliest stages, when critical decisions are made regarding which molecules will remain in development, and to work alongside them as drug candidates move downstream through the nonclinical development process. In particular, our recognized expertise in

in vivo

biology provides us with a competitive advantage in understanding our client's molecules, and the challenges faced during the discovery and development process, including non-GLP efficacy and safety assessment testing critical for making “go/no-go” decisions.

|

|

•

|

Deep Scientific Expertise.

We are able to provide extensive scientific expertise which may be too costly for our clients to build and/or maintain in-house. Our capabilities allow us to address our clients' demands for “non-core” but strategically important

in vivo

biology activities and specialty services, such as certain specialty toxicology offerings that are prohibitive for clients to maintain in-house. We have also increasingly aligned our services portfolio along therapeutic lines to simulate many of our clients' internal drug development organizations, particularly in therapeutic areas subject to major research funding or focus, such as oncology, metabolism and obesity, autoimmune/inflammation, cardiovascular, infectious disease and central nervous system.

|

|

•

|

Superior Quality and Client Support.

We maintain high quality standards through rigorous management of key performance indicators and an intense focus on biosecurity. These standards allow clients to access products and services throughout our global network, with the confidence that they will obtain consistent results no matter where they choose to obtain their products or conduct their research.

|

|

•

|

Flexible and Customized Solutions.

We recognize that clients have individual needs and specific requirements, which increases the importance of flexibility when working with them. We deliver that flexibility through relationships that may take various and customized forms, and which tap into the broad array of physical and/or service resources that we provide. We can help clients better balance their workload/staff requirements by drawing upon the higher utilization and efficiencies of our facilities, often allowing them to reduce their internal capacity and/or staff. We can leverage the expertise embedded in our integrated early-stage portfolio to provide customized arrangements tailored to fit the specific need or therapeutic area focus of a particular client. We are also able to provide additional value to those clients who choose broad based, multi-year partnerships across the breadth of our early-stage portfolio.

|

|

•

|

Large, Global Partner.

We believe there is a particular advantage in being a full service, high-quality provider of non-clinical

in vivo

products and services on a global scale. Many of our clients, especially large pharmaceutical companies, have limited the number of suppliers with which they work, preferring to partner with Tier 1 CROs with a full breadth of capabilities. Large CROs, like Charles River, can present clients with access to greater value through the benefits of economies of scale and scope, extensive therapeutic area expertise, a global footprint, and simplified communications and relationship management. We are focused on leveraging our competitive advantages to ensure we are recognized as a premier preferred provider and building broader and deeper long-term strategic partnerships with our clients.

|

|

•

|

patent expirations of blockbuster drugs;

|

|

•

|

intensified cost-saving and efficiency actions designed to improve research and development productivity;

|

|

•

|

a stronger emphasis on later-stage programs to accelerate drugs in clinical trials to market;

|

|

•

|

increased pharmaceutical merger activity and the associated integration issues;

|

|

•

|

rationalization of drug pipelines to focus on a smaller number of high-potential therapeutic areas;

|

|

•

|

fluctuations in the biotech funding environment; and

|

|

•

|

an uncertain global economy.

|

|

Initiative

|

2011 Progress

|

|

Improve our consolidated operating margin

|

Improved consolidated operating margin from continuing operations achieved due to:

|

|

Ÿ

increased RMS margin,

|

|

|

Ÿ

stable Corporate costs,

|

|

|

Ÿ

November 2010 cost-savings actions, and

|

|

|

Ÿ

six-sigma and other process improvement initiatives

|

|

|

Improve our free cash flow generation

|

Ÿ

Free cash flow increased in 2011 to a per-share yield we believe was the highest among public CROs.

|

|

Ÿ

Divested non-strategic / underperforming PCS assets (U.S. Phase 1 clinical and China preclinical facility)

|

|

|

Disciplined investment in growth businesses

|

Capital projects invested in growth business:

|

|

Ÿ

Diagnostic laboratories opening in 2012,

|

|

|

Ÿ

In Vitro production facility in China, and

|

|

|

Ÿ

Capacity expansion in Finland Discovery Services business.

|

|

|

Return value to shareholders

|

Ÿ

Repurchased 8.4 million shares of common stock for a total purchase price of approximately $300 million.

|

|

•

|

global biopharmaceutical companies;

|

|

•

|

small and mid-sized pharmaceutical companies and biotechnology companies; and

|

|

•

|

academic and government clients.

|

|

•

|

For RMS, our main competitors include three smaller companies in North America (each of whom has a global scope), and several smaller competitors in Europe and in Japan. Of our main U.S. competitors, two are privately held businesses and the third is a government funded, not-for-profit institution. We believe that none of our main competitors in RMS has our comparable global reach, financial strength, breadth of product and services offerings, technical expertise or pharmaceutical and biotechnology industry relationships.

|

|

•

|

For PCS, we believe we are one of the two largest providers of preclinical services in the world, based on net service revenue. Our commercial competitors for preclinical services consist of both publicly held and privately owned companies, and it is estimated that the top ten participants (including Charles River) account for a significant portion of the global outsourced preclinical market, with the rest of the market remaining highly fragmented. Our PCS segment also competes with in-house departments of pharmaceutical and biotechnology companies, universities and teaching hospitals.

|

|

•

|

the products being tested fail to satisfy safety requirements;

|

|

•

|

unexpected or undesired study results;

|

|

•

|

production problems resulting in shortages of the drug being tested;

|

|

•

|

the client's decision to forego or terminate a particular study;

|

|

•

|

the loss of funding for the particular research study; or

|

|

•

|

general convenience/client preference.

|

|

•

|

foreign currencies we receive for sales and in which we record expenses outside the U.S. could be subject to unfavorable exchange rates with the U.S. dollar and reduce the amount of revenue and cash flow (and increase the amount of expenses) that we recognize and cause fluctuations in reported financial results;

|

|

•

|

certain contracts, particularly in Canada, are frequently denominated in currencies other than the currency in which we incur expenses related to those contracts and where expenses are incurred in currencies other than those in which contracts are priced, fluctuations in the relative value of those currencies could have a material adverse effect on our results of operations;

|

|

•

|

general economic and political conditions in the markets in which we operate;

|

|

•

|

potential international conflicts, including terrorist acts;

|

|

•

|

potential trade restrictions, exchange controls and legal restrictions on the repatriation of funds into the U.S.;

|

|

•

|

difficulties and costs associated with staffing and managing foreign operations, including risks of violations of local laws or anti-bribery laws such as the U.S. Foreign Corrupt Practices Act, the UK Bribery Act, and the OECD

|

|

•

|

unexpected changes in regulatory requirements;

|

|

•

|

the difficulties of compliance with a wide variety of foreign laws and regulations;

|

|

•

|

unfavorable labor regulations in foreign jurisdictions;

|

|

•

|

potentially negative consequences from changes in or interpretations of US and foreign tax laws;

|

|

•

|

exposure to business disruption or property damage due to geographically unique natural disasters;

|

|

•

|

longer accounts receivable cycles in certain foreign countries; and

|

|

•

|

import and export licensing requirements.

|

|

•

|

reputation for on-time quality performance;

|

|

•

|

reputation for regulatory compliance;

|

|

•

|

expertise and experience in multiple specialized areas;

|

|

•

|

scope and breadth of service and product offerings across the drug discovery and development spectrum;

|

|

•

|

ability to provide flexible and customized solutions to support our clients' drug discovery and development needs;

|

|

•

|

broad geographic availability (with consistent quality);

|

|

•

|

price/value;

|

|

•

|

technological expertise and efficient drug development processes;

|

|

•

|

quality of facilities;

|

|

•

|

financial stability;

|

|

•

|

size; and

|

|

•

|

ability to acquire, process, analyze and report data in an accurate manner.

|

|

•

|

errors or omissions in reporting of study detail in preclinical studies that may lead to inaccurate reports, which may undermine the usefulness of a study or data from the study, or which may potentially advance studies absent the necessary support or inhibit studies from proceeding to the next level of testing;

|

|

•

|

risks associated with our possible failure to properly care for our clients' property, such as research models and samples, study compounds, records, work in progress, other archived materials, or goods and materials in transit,

|

|

•

|

risks that models in our breeding facilities or in facilities that we manage may be infected with diseases that may be harmful and even lethal to themselves or humans despite preventive measures contained in our policies for the quarantine and handling of imported animals; and

|

|

•

|

risks that we may have errors and omissions related to our products designed to conduct lot release testing of medical devices and injectable drugs (primarily through our

In Vitro

business) or in the testing of biologics and other services performed by our biopharmaceutical services business, which could result in us or our clients failing to identify unsafe or contaminated materials.

|

|

•

|

difficulties and expenses incurred in assimilating and integrating operations, services, products or technologies;

|

|

•

|

challenges with developing and operating new businesses, including those which are materially different from our existing businesses and which may require the development or acquisition of new internal capabilities and expertise;

|

|

•

|

diversion of management's attention from other business concerns;

|

|

•

|

potential losses resulting from undiscovered liabilities of acquired companies that are not covered by the indemnification we may obtain from the seller;

|

|

•

|

acquisitions could be dilutive to earnings, or in the event of acquisitions made through the issuance of our common stock to the shareholders of the acquired company, dilutive to the percentage of ownership of our existing stockholders;

|

|

•

|

loss of key employees;

|

|

•

|

risks of not being able to overcome differences in foreign business practices, customs and importation regulations, language and other cultural barriers in connection with the acquisition of foreign companies;

|

|

•

|

risks that disagreements or disputes with prior owners of an acquired business, technology, service or product may result in litigation expenses and distribution of our management's attention;

|

|

•

|

the presence or absence of adequate internal controls and/or significant fraud in the financial systems of acquired companies; and

|

|

•

|

difficulties in achieving business and financial success.

|

|

•

|

difficulties in the separation of operations, services, products and personnel; and

|

|

•

|

the need to agree to retain or assume certain current or future liabilities in order to complete the divestiture.

|

|

•

|

changes in the general global economy;

|

|

•

|

the number and scope of ongoing client engagements;

|

|

•

|

the commencement, postponement, delay, progress, completion or cancellation of client contracts in the quarter;

|

|

•

|

changes in the mix of our products and services;

|

|

•

|

the extent of cost overruns;

|

|

•

|

holiday buying patterns of our clients;

|

|

•

|

budget cycles of our clients;

|

|

•

|

the timing and charges associated with completed acquisitions and other events;

|

|

•

|

the occasional extra “53

rd

week” that we recognize in a fiscal year (and 4

th

fiscal quarter thereof) due to our fiscal year ending on the last Saturday in December; and

|

|

•

|

exchange rate fluctuations.

|

|

2012

|

High

|

Low

|

|||||

|

First quarter (through February 17, 2012)

|

$

|

36.25

|

|

$

|

27.39

|

|

|

|

2011

|

High

|

Low

|

|||||

|

First quarter

|

$

|

39.39

|

|

$

|

35.54

|

|

|

|

Second quarter

|

42.47

|

|

37.38

|

|

|||

|

Third quarter

|

42.05

|

|

28.54

|

|

|||

|

Fourth quarter

|

33.57

|

|

25.95

|

|

|||

|

2010

|

High

|

Low

|

|||||

|

First quarter

|

$

|

39.75

|

|

$

|

32.74

|

|

|

|

Second quarter

|

41.65

|

|

28.00

|

|

|||

|

Third quarter

|

35.87

|

|

28.20

|

|

|||

|

Fourth quarter

|

36.10

|

|

30.70

|

|

|||

|

Total Number

of Shares

Purchased

|

Average

Price Paid

per Share

|

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

|

Approximate Dollar

Value of Shares

That May Yet Be

Purchased Under

the Plans or

Programs

|

||||||||||

|

September 25, 2011 to October 22, 2011

|

450,240

|

|

$

|

28.95

|

|

450,199

|

|

$

|

128,224

|

|

|||

|

October 23, 2011 to November 19, 2011

|

394,095

|

|

$

|

30.36

|

|

394,095

|

|

$

|

116,258

|

|

|||

|

November 20, 2011 to December 31, 2011

|

—

|

|

$

|

—

|

|

—

|

|

$

|

116,258

|

|

|||

|

Total:

|

844,335

|

|

|

|

844,294

|

|

|

|

|||||

|

Plan Category

|

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

|

|

Weighted-average

exercise price of

outstanding

options, warrants

and rights

|

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

|

|

|||||

|

|

(a)

|

|

(b)

|

(c)

|

|

|||||

|

Equity compensation plan approved by security holders:

|

|

|

|

|

|

|||||

|

Charles River 2000 Incentive Plan

|

2,322,927

|

|

|

$

|

41.20

|

|

1,083,653

|

|

|

|

|

Charles River 1999 Management Incentive Plan

|

1,000

|

|

|

$

|

31.12

|

|

6,000

|

|

|

|

|

Inveresk 2002 Stock Option Plan

|

72,041

|

|

|

$

|

26.20

|

|

—

|

|

|

|

|

2007 Incentive Plan

|

3,685,295

|

|

|

$

|

36.63

|

|

4,709,080

|

|

|

|

|

Equity compensation plans not approved by security holders

|

—

|

|

|

—

|

|

—

|

|

|

||

|

Total

|

6,081,263

|

|

(1)

|

|

|

5,798,733

|

|

(2)

|

||

|

(1)

|

None of the options outstanding under any of our equity compensation plans include rights to any dividend equivalents (i.e., a right to receive from us a payment commensurate to dividend payments received by holders of our common stock or our other equity instruments).

|

|

(2)

|

On March 22, 2007, the Board of Directors determined that, upon approval of the 2007 Incentive Plan, no future awards would be granted under the preexisting equity compensation plans, including the Charles River 1999 Management Incentive Plan and the Charles River 2000 Incentive Plan. Shareholder approval was obtained on May 8, 2007. Previously, on February 28, 2005, the Board of Directors terminated the Inveresk 2002 Stock Option Plan to the extent that no further awards would be granted thereunder.

|

|

Category

|

Number of securities

outstanding

|

Weighted average

exercise price

|

Weighted

average term

|

||||||

|

|

(a)

|

(b)

|

(c)

|

||||||

|

Total number of restricted shares outstanding(1)

|

703,011

|

|

$

|

—

|

|

—

|

|

||

|

Total number of options outstanding

|

6,081.263

|

|

$

|

38.25

|

|

3.67

|

|

||

|

(1)

|

For purposes of this table, only unvested restricted stock as of

December 31, 2011

is included. Also for purposes of this table only, the total includes 72,668 restricted stock units granted to certain of our employees outside of the United States.

|

|

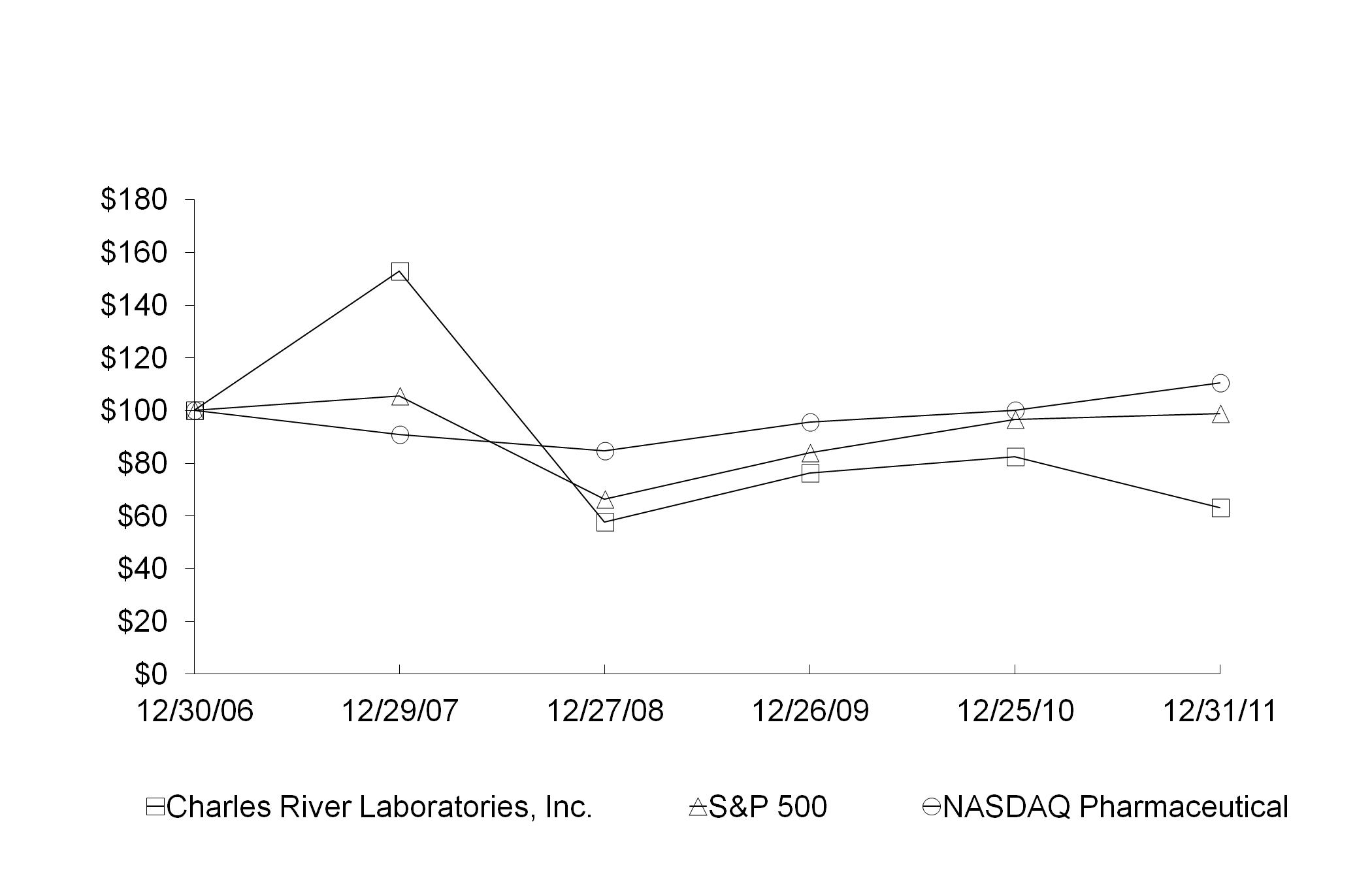

Dec. 30,

2006

|

Dec. 29,

2007

|

Dec. 27,

2008

|

Dec. 26,

2009

|

Dec. 25,

2010

|

Dec. 31,

2011

|

||||||||||||

|

Charles River Laboratories International, Inc.

|

100

|

|

152.88

|

|

57.85

|

|

76.21

|

|

82.54

|

|

63.19

|

|

|||||

|

S&P 500 Index

|

100

|

|

105.49

|

|

66.46

|

|

84.05

|

|

96.71

|

|

98.75

|

|

|||||

|

NASDAQ Pharmaceutical Index

|

100

|

|

90.99

|

|

84.71

|

|

95.64

|

|

100.1

|

|

110.44

|

|

|||||

|

|

Fiscal Year(1)

|

||||||||||||||||||

|

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||

|

|

(dollars in thousands)

|

||||||||||||||||||

|

Statement of Income Data:

|

|

|

|

|

|

||||||||||||||

|

Net sales

|

$

|

1,142,647

|

|

$

|

1,133,416

|

|

$

|

1,171,642

|

|

$

|

1,295,299

|

|

$

|

1,185,139

|

|

||||

|

Cost of products sold and services provided

|

740,405

|

|

748,656

|

|

748,650

|

|

796,478

|

|

720,254

|

|

|||||||||

|

Selling, general and administrative expenses

|

198,648

|

|

232,489

|

|

227,663

|

|

223,935

|

|

212,471

|

|

|||||||||

|

Goodwill impairment

|

—

|

|

305,000

|

|

—

|

|

700,000

|

|

—

|

|

|||||||||

|

Asset impairment

|

7,492

|

|

91,378

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Termination fee

|

—

|

|

30,000

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Amortization of intangibles

|

21,796

|

|

24,405

|

|

25,716

|

|

26,725

|

|

30,020

|

|

|||||||||

|

Operating income (loss)

|

174,306

|

|

(298,512

|

)

|

169,613

|

|

(451,839

|

)

|

222,394

|

|

|||||||||

|

Interest income

|

1,353

|

|

1,186

|

|

1,712

|

|

7,882

|

|

9,120

|

|

|||||||||

|

Interest expense

|

(42,586

|

)

|

(35,279

|

)

|

(21,682

|

)

|

(22,335

|

)

|

(24,453

|

)

|

|||||||||

|

Other, net

|

(411

|

)

|

(1,477

|

)

|

1,914

|

|

(5,154

|

)

|

(1,392

|

)

|

|||||||||

|

Income (loss) from continuing operations before income taxes

|

132,662

|

|

(334,082

|

)

|

151,557

|

|

(471,446

|

)

|

205,669

|

|

|||||||||

|

Provision for income taxes

|

17,140

|

|

23

|

|

40,354

|

|

57,029

|

|

56,023

|

|

|||||||||

|

Income (loss) from continuing operations net of income taxes

|

115,522

|

|

(334,105

|

)

|

111,203

|

|

(528,475

|

)

|

149,646

|

|

|||||||||

|

Income (loss) from discontinued businesses, net of tax

|

(5,545

|

)

|

(8,012

|

)

|

1,399

|

|

3,283

|

|

1,472

|

|

|||||||||

|

Net income (loss)

|

109,977

|

|

(342,117

|

)

|

112,602

|

|

(525,192

|

)

|

151,118

|

|

|||||||||

|

Net income (loss) attributable to noncontrolling interests

|

(411

|

)

|

5,448

|

|

1,839

|

|

687

|

|

(470

|

)

|

|||||||||

|

Net income (loss) attributable to common shareowners

|

$

|

109,566

|

|

$

|

(336,669

|

)

|

$

|

114,441

|

|

$

|

(524,505

|

)

|

$

|

150,648

|

|

||||

|

Common Share Data:

|

|

|

|

|

|

||||||||||||||

|

Earnings (loss) per common share

|

|

|

|

|

|

||||||||||||||

|

Basic

|

|

|

|

|

|

||||||||||||||

|

Continuing operations attributable to common shareowners

|

$

|

2.26

|

|

$

|

(5.25

|

)

|

$

|

1.73

|

|

$

|

(7.85

|

)

|

$

|

2.23

|

|

||||

|

Discontinued operations

|

$

|

(0.11

|

)

|

$

|

(0.13

|

)

|

$

|

0.02

|

|

$

|

0.05

|

|

$

|

(0.02

|

)

|

||||

|

Net income (loss) attributable to common shareowners

|

$

|

2.16

|

|

$

|

(5.38

|

)

|

$

|

1.75

|

|

$

|

(7.8

|

)

|

$

|

2.25

|

|

||||

|

Diluted

|

|

|

|

|

|

||||||||||||||

|

Continuing operations attributable to common shareowners

|

$

|

2.24

|

|

$

|

(5.25

|

)

|

$

|

1.72

|

|

$

|

(7.85

|

)

|

$

|

2.17

|

|

||||

|

Discontinued operations

|

$

|

(0.11

|

)

|

$

|

(0.13

|

)

|

$

|

0.02

|

|

$

|

0.05

|

|

$

|

(0.02

|

)

|

||||

|

Net income (loss) attributable to common shareowners

|

$

|

2.14

|

|

$

|

(5.38

|

)

|

$

|

1.74

|

|

$

|

(7.8

|

)

|

$

|

2.19

|

|

||||

|

Other Data:

|

|

|

|

|

|||||||||||||||

|

Depreciation and amortization

|

$

|

85,230

|

|

$

|

93,649

|

|

$

|

89,962

|

|

$

|

86,851

|

|

$

|

81,965

|

|

||||

|

Capital expenditures

|

49,143

|

|

42,860

|

|

79,853

|

|

198,642

|

|

230,754

|

|

|||||||||

|

Balance Sheet Data (at end of period):

|

|

|

|

|

|||||||||||||||

|

Cash and cash equivalents

|

$

|

68,905

|

|

$

|

179,160

|

|

$

|

182,574

|

|

$

|

243,592

|

|

$

|

225,449

|

|

||||

|

Working capital

|

209,046

|

|

293,114

|

|

345,828

|

|

317,141

|

|

299,587

|

|

|||||||||

|

Goodwill, net

|

197,561

|

|

198,438

|

|

508,235

|

|

457,578

|

|

1,120,540

|

|

|||||||||

|

Total assets

|

1,558,320

|

|

1,733,373

|

|

2,204,093

|

|

2,141,413

|

|

2,778,313

|

|

|||||||||

|

Total debt and capital lease obligations

|

717,945

|

|

700,852

|

|

492,832

|

|

515,332

|

|

437,902

|

|

|||||||||

|

Total shareowners' equity

|

525,583

|

|

687,423

|

|

1,375,243

|

|

1,241,286

|

|

1,905,390

|

|

|||||||||

|

(1)

|

Our fiscal year consists of 12 months ending on the last Saturday on, or prior to, December 31.

|

|

•

|

Improving the consolidated operating margin.

We continue to aggressively manage our cost structure and drive operating efficiencies which are expected to generate improving operating margins. We have already implemented significant actions to reduce costs during the last two years to manage challenging industry-wide preclinical market conditions. These actions have favorably impacted our margins in 2011. In the fourth quarter of 2011, we implemented a headcount reduction of approximately 2%, primarily in the Preclinical Services (PCS) business. This action is expected to generate annual savings of approximately $7.5 million beginning in 2012.

|

|

•

|

Improving free cash flow generation.

We believe we have adequate capacity to support revenue growth in both business segments without significant additional investment for expansion. Improved operating margins, elimination of operating losses with the sale of our Phase I clinical business in 2011 and the closure of our PCS China facility in 2011, and minimal requirements for capital expansion, should contribute to strong cash flow generation. We expect capital expenditures to be approximately $50 million in 2012.

|

|

•

|

Disciplined investment in growth businesses.

We continue to maintain a disciplined focus on deployment of capital, investing in those areas of our existing business which will generate the greatest sales growth and profitability, such as Genetically Engineered Models and Services (GEMS), Discovery Services (DS),

In Vitro

products and Biopharmaceutical Services.

|

|

•

|

Returning value to shareholders.

We are repurchasing our stock with the intent to drive immediate shareholder value and earnings per share accretion. During 2011, we repurchased 8.4 million shares. Our weighted average shares outstanding for 2011 has decreased to 51.3 million shares from 62.6 million shares for 2010. As of December 31, 2011, we had $116.3 million remaining on our $750.0 million stock repurchase authorization.

|

|

•

|

significant underperformance relative to expected historical or projected future operating results;

|

|

•

|

significant negative industry or economic trends; or

|

|

•

|

significant changes or developments in strategy or operations that negatively affect the utilization of our long-lived assets.

|

|

|

Fiscal Year Ended

|

|||||||

|

|

December 31, 2011

|

December 25, 2010

|

December 26, 2009

|

|||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of products sold and services provided

|

64.8

|

%

|

66.1

|

%

|

63.9

|

%

|

||

|

Selling, general and administrative expenses

|

17.4

|

%

|

20.5

|

%

|

19.4

|

%

|

||

|

Goodwill impairment

|

—

|

%

|

26.9

|

%

|

—

|

%

|

||

|

Asset impairments

|

0.7

|

%

|

8.1

|

%

|

—

|

%

|

||

|

Termination fee

|

—

|

%

|

2.6

|

%

|

—

|

%

|

||

|

Amortization of other intangibles

|

1.9

|

%

|

2.2

|

%

|

2.2

|

%

|

||

|

Operating income (loss)

|

15.3

|

%

|

(26.3

|

)%

|

14.5

|

%

|

||

|

Interest income

|

0.1

|

%

|

0.1

|

%

|

0.1

|

%

|

||

|

Interest expense

|

3.7

|

%

|

3.1

|

%

|

1.9

|

%

|

||

|

Provision for income taxes

|

1.5

|

%

|

—

|

%

|

3.4

|

%

|

||

|

Discontinued operations

|

(0.5

|

)%

|

(0.7

|

)%

|

0.1

|

%

|

||

|

Noncontrolling interests

|

—

|

%

|

0.5

|

%

|

0.2

|

%

|

||

|

Net income (loss) attributable to common shareowners

|

9.6

|

%

|

(29.7

|

)%

|

9.8

|

%

|

||

|

|

Fiscal Year Ended

|

||||||||||

|

|

December 31, 2011

|

December 25,

2010

|

December 26,

2009

|

||||||||

|

|

(dollars in millions)

|

||||||||||

|

Net sales:

|

|

|

|

||||||||

|

Research models and services

|

$

|

705.4

|

|

$

|

667.0

|

|

$

|

659.9

|

|

||

|

Preclinical services

|

437.2

|

|

466.4

|

|

511.7

|

|

|||||

|

Cost of products sold and services provided:

|

|

|

|

||||||||

|

Research models and services

|

408.1

|

|

388.6

|

|

381.2

|

|

|||||

|

Preclinical services

|

332.3

|

|

360.0

|

|

367.4

|

|

|||||

|

Goodwill impairment:

|

|

|

|

||||||||

|

Preclinical services

|

—

|

|

305.0

|

|

—

|

|

|||||

|

Termination fee

|

—

|

|

30.0

|

|

—

|

|

|||||

|

Asset impairment

|

|

|

|

||||||||

|

Research models and services

|

0.7

|

|

0.8

|

|

—

|

|

|||||

|

Preclinical services

|

6.8

|

|

90.6

|

|

—

|

|

|||||

|

Selling, general and administrative expenses:

|

|

|

|

||||||||

|

Research models and services

|

83.6

|

|

85.8

|

|

79.1

|

|

|||||

|

Preclinical services

|

58.1

|

|

73.4

|

|

85.1

|

|

|||||

|

Unallocated corporate overhead

|

56.9

|

|

73.3

|

|

63.5

|

|

|||||

|

Amortization of other intangibles:

|

|

|

|

||||||||

|

Research models and services

|

6.7

|

|

7.3

|

|

6.3

|

|

|||||

|

Preclinical services

|

15.0

|

|

17.1

|

|

19.4

|

|

|||||

|

Operating income (loss):

|

|

|

|

||||||||

|

Research models and services

|

206.3

|

|

184.5

|

|

$

|

193.3

|

|

||||

|

Preclinical services

|

24.9

|

|

(379.7

|

)

|

39.8

|

|

|||||

|

Unallocated corporate overhead

|

(56.9

|

)

|

(103.3

|

)

|

(63.5

|

)

|

|||||

|

|

Fiscal Year Ended

|

|||||||

|

|

December 31, 2011

|

December 25,

2010

|

December 26,

2009

|

|||||

|

Net sales:

|

|

|

|

|||||

|

Research models and services

|

61.7

|

%

|

58.8

|

%

|

56.3

|

%

|

||

|

Preclinical services

|

38.3

|

%

|

41.2

|

%

|

43.7

|

%

|

||

|

Cost of products sold and services provided:

|

|

|

||||||

|

Research models and services

|

57.9

|

%

|

58.3

|

%

|

57.8

|

%

|

||

|

Preclinical services

|

76.0

|

%

|

77.2

|

%

|

71.8

|

%

|

||

|

Goodwill impairment:

|

|

|

||||||

|

Preclinical services

|

—

|

%

|

65.4

|

%

|

—

|

%

|

||

|

Asset impairment:

|

|

|

||||||

|

Research models and services

|

0.1

|

%

|

0.1

|

%

|

—

|

%

|

||

|

Preclinical services

|

1.6

|

%

|

19.4

|

%

|

—

|

%

|

||

|

Termination fee

|

—

|

%

|

—

|

%

|

—

|

%

|

||

|

Selling, general and administrative expenses:

|

|

|

||||||

|

Research models and services

|

11.8

|

%

|

12.9

|

%

|

12.0

|

%

|

||

|

Preclinical services

|

13.3

|

%

|

15.8

|

%

|

16.6

|

%

|

||

|

Unallocated corporate overhead

|

—

|

%

|

—

|

%

|

—

|

%

|

||

|

Amortization of other intangibles:

|

|

|

||||||

|

Research models and services

|

1.0

|

%

|

1.1

|

%

|

1.0

|

%

|

||

|

Preclinical services

|

3.4

|

%

|

3.7

|

%

|

3.8

|

%

|

||

|

Operating income:

|

|

|

||||||

|

Research models and services

|

29.2

|

%

|

27.7

|

%

|

29.3

|

%

|

||

|

Preclinical services

|

5.7

|

%

|

(81.4

|

)%

|

7.8

|

%

|

||

|

Unallocated corporate overhead

|

(5.0

|

)%

|

(9.1

|

)%

|

(5.4

|

)%

|

||

|

Contractual Obligations (in millions)

|

Total

|

Less than

1 Year

|

1 - 3 Years

|

3 - 5 Years

|

After

5 Years

|

||||||||||||||

|

Debt

|

$

|

739.4

|

|

$

|

14.7

|

|

$

|

447.4

|

|

$

|

277.3

|

|

$

|

—

|

|

||||

|

Interest payments

|

82.0

|

|

31.5

|

|

36.0

|

|

14.5

|

|

—

|

|

|||||||||

|

Operating leases

|

60.2

|

|

14.7

|

|

20.4

|

|

10.9

|

|

14.1

|

|

|||||||||

|

Pension and supplemental retirement benefits

|

107.0

|

|

6.7

|

|

25.1

|

|

21.9

|

|

53.3

|

|

|||||||||

|

Total contractual cash obligations

|

$

|

988.6

|

|

$

|

67.6

|

|

$

|

528.9

|

|

$

|

324.6

|

|

$

|

67.4

|

|

||||

|

|

|

|

|

Consolidated Financial Statements:

|

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

Supplementary Data:

|

|

|

|

|

||

|

|

Fiscal Year Ended

|

||||||||||

|

|

December 31,

2011 |

December 25,

2010 |

December 26,

2009 |

||||||||

|

Net sales related to products

|

$

|

483,309

|

|

$

|

458,623

|

|

$

|

465,268

|

|

||

|

Net sales related to services

|

659,338

|

|

674,793

|

|

706,374

|

|

|||||

|

Net sales

|

1,142,647

|

|

1,133,416

|

|

1,171,642

|

|

|||||

|

Costs and expenses

|

|

|

|

||||||||

|

Cost of products sold

|

267,966

|

|

252,962

|

|

255,682

|

|

|||||

|

Cost of services provided

|

472,439

|

|

495,694

|

|

492,968

|

|

|||||

|

Selling, general and administrative

|

198,648

|

|

232,489

|

|

227,663

|

|

|||||

|

Goodwill impairment

|

—

|

|

305,000

|

|

—

|

|

|||||

|

Asset impairments

|

7,492

|

|

91,378

|

|

—

|

|

|||||

|

Termination fee

|

—

|

|

30,000

|

|

—

|

|

|||||

|

Amortization of other intangibles

|

21,796

|

|

24,405

|

|

25,716

|

|

|||||

|

Operating income (loss)

|

174,306

|

|

(298,512

|

)

|

169,613

|

|

|||||

|

Other income (expense)

|

|

|

|

||||||||

|

Interest income

|

1,353

|

|

1,186

|

|

1,712

|

|

|||||

|

Interest expense

|

(42,586

|

)

|

(35,279

|

)

|

(21,682

|

)

|

|||||

|

Other, net

|

(411

|

)

|

(1,477

|

)

|

1,914

|

|

|||||

|

Income (loss) from continuing operations, before income taxes

|

132,662

|

|

(334,082

|

)

|

151,557

|

|

|||||

|

Provision for income taxes

|

17,140

|

|

23

|

|

40,354

|

|

|||||

|

Income (loss) from continuing operations, net of income taxes

|

115,522

|

|

(334,105

|

)

|

111,203

|

|

|||||

|

Income (loss) from discontinued operations, net of taxes

|

(5,545

|

)

|

(8,012

|

)

|

1,399

|

|

|||||

|

Net income (loss)

|

109,977

|

|

(342,117

|

)

|

112,602

|

|

|||||

|

Less: Net loss (income) attributable to noncontrolling interests

|

(411

|

)

|

5,448

|

|

1,839

|

|

|||||

|

Net income (loss) attributable to common shareowners

|

$

|

109,566

|

|

$

|

(336,669

|

)

|

$

|

114,441

|

|

||

|

Earnings (loss) per common share

|

|

|

|

||||||||

|

Basic:

|

|

|

|

||||||||

|

Continuing operations attributable to common shareowners

|

$

|

2.26

|

|

$

|

(5.25

|

)

|

$

|

1.73

|

|

||

|

Discontinued operations

|

$

|

(0.11

|

)

|

$

|

(0.13

|

)

|

$

|

0.02

|

|

||

|

Net income (loss) attributable to common shareowners

|

$

|

2.16

|

|

$

|

(5.38

|

)

|

$

|

1.75

|

|

||

|

Diluted:

|

|

|

|

||||||||

|

Continuing operations attributable to common shareowners

|

$

|

2.24

|

|

$

|

(5.25

|

)

|

$

|

1.72

|

|

||

|

Discontinued operations

|

$

|

(0.11

|

)

|

$

|

(0.13

|

)

|

$

|

0.02

|

|

||

|

Net income (loss) attributable to common shareowners

|

$

|

2.14

|

|

$

|

(5.38

|

)

|

$

|

1.74

|

|

||

|

December 31,

2011 |

December 25,

2010 |

||||||

|

Assets

|

|

|

|||||

|

Current assets

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

68,905

|

|

$

|

179,160

|

|

|

|

Trade receivables, net

|

184,810

|

|

192,972

|

|

|||

|

Inventories

|

92,969

|

|

100,297

|

|

|||

|

Other current assets

|

79,052

|

|

76,603

|

|

|||

|

Current assets of discontinued businesses

|

107

|

|

3,862

|

|

|||

|

Total current assets

|

425,843

|

|

552,894

|

|

|||

|

Property, plant and equipment, net

|

738,030

|

|

752,657

|

|

|||

|

Goodwill, net

|

197,561

|

|

198,438

|

|

|||

|

Other intangibles, net

|

93,437

|

|

121,236

|

|

|||

|

Deferred tax asset

|

44,804

|

|

45,003

|

|

|||

|

Other assets

|

57,659

|

|

62,323

|

|

|||

|

Long-term assets of discontinued businesses

|

986

|

|

822

|

|

|||

|

Total assets

|

$

|

1,558,320

|

|

$

|

1,733,373

|

|

|

|

Liabilities and Equity

|

|

|

|||||

|

Current liabilities

|

|

|

|||||

|

Current portion of long-term debt and capital leases

|

$

|

14,758

|

|

$

|

30,582

|

|

|

|

Accounts payable

|

34,332

|

|

30,627

|

|

|||

|

Accrued compensation

|

41,602

|

|

48,918

|

|

|||

|

Deferred revenue

|

56,530

|

|

66,905

|

|

|||

|

Accrued liabilities

|

54,377

|

|

59,369

|

|

|||

|

Other current liabilities

|

14,033

|

|

20,095

|

|

|||

|

Current liabilities of discontinued businesses

|

1,165

|

|

3,284

|

|

|||

|

Total current liabilities

|

216,797

|

|

259,780

|

|

|||

|

Long-term debt and capital leases

|

703,187

|

|

670,270

|

|

|||

|

Other long-term liabilities

|

108,451

|

|

114,596

|

|

|||

|

Long-term liabilities of discontinued businesses

|

2,522

|

|

—

|

|

|||

|

Total liabilities

|

1,030,957

|

|

1,044,646

|

|

|||

|

Commitments and contingencies

|

|

|

|||||

|

Shareowners' equity

|

|

|

|||||

|

Preferred stock, $0.01 par value; 20,000,000 shares authorized; no shares issued and outstanding

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value; 120,000,000 shares authorized; 78,473,888 issued and 48,875,715 shares outstanding at December 31, 2011 and 77,531,056 issued and 56,441,081 shares outstanding at December 25, 2010

|

785

|

|

775

|

|

|||

|

Capital in excess of par value

|

2,056,921

|

|

1,996,874

|

|

|||

|

Accumulated deficit

|

(465,596

|

)

|

(575,162

|

)

|

|||

|

Treasury stock, at cost, 29,598,173 shares and 21,089,975 shares at December 31, 2011 and December 25, 2010, respectively

|

(1,071,120

|

)

|

(768,699

|

)

|

|||

|

Accumulated other comprehensive income

|

4,593

|

|

33,635

|

|

|||

|

Total shareowners' equity

|

525,583

|

|

687,423

|

|

|||

|

Noncontrolling interests

|

1,780

|

|

1,304

|

|

|||

|

Total equity

|

527,363

|

|

688,727

|

|

|||

|

Total liabilities and equity

|

$

|

1,558,320

|

|

$

|

1,733,373

|

|

|

|

|

Fiscal Year Ended

|

||||||||||

|

|

December 31,

2011 |

December 25,

2010 |

December 26,

2009 |

||||||||

|

Cash flows relating to operating activities

|

|

|

|

||||||||

|

Net income (loss)

|

$

|

109,977

|

|

$

|

(342,117

|

)

|

$

|

112,602

|

|

||

|

Less: Income (loss) from discontinued operations

|

(5,545

|

)

|

(8,012

|

)

|

1,399

|

|

|||||

|

Income (loss) from continuing operations

|

115,522

|

|

(334,105

|

)

|

111,203

|

|

|||||

|

Adjustments to reconcile net income from continuing operations to net cash provided by operating activities:

|

|

|

|

||||||||

|

Depreciation and amortization

|

85,230

|

|

93,649

|

|

89,962

|

|

|||||

|

Amortization of debt issuance costs and discounts

|

20,010

|

|

19,777

|

|

13,798

|

|

|||||

|

Goodwill impairment

|

—

|

|

305,000

|

|

—

|

|

|||||

|

Impairment charges

|

7,492

|

|

91,378

|

|

3,460

|

|

|||||

|

Pension curtailment

|

—

|

|

—

|

|

(674

|

)

|

|||||

|

Non-cash compensation

|

21,706

|

|

25,526

|

|

23,652

|

|

|||||

|

Deferred income taxes

|

(8,668

|

)

|

(42,342

|

)

|

16,845

|

|

|||||

|

Other, net

|

(7,436

|

)

|

1,797

|

|

906

|

|

|||||

|

Changes in assets and liabilities:

|

|

|

|

||||||||

|

Trade receivables

|

7,669

|

|

(5,640

|

)

|

21,082

|

|

|||||

|

Inventories

|

3,766

|

|

1,989

|

|

(4,376

|

)

|

|||||

|

Other assets

|

505

|

|

(2,131

|

)

|

1,461

|

|

|||||

|

Accounts payable

|

2,208

|

|

71

|

|

(11,349

|

)

|

|||||

|

Accrued compensation

|

(7,412

|

)

|

4,482

|

|

(9,545

|

)

|

|||||

|

Deferred revenue

|

(9,515

|

)

|

(4,209

|

)

|

(14,468

|

)

|

|||||

|

Accrued liabilities

|

(1,355

|

)

|

5,501

|

|

(6,671

|

)

|

|||||

|

Taxes payable and prepaid taxes

|

(13,782

|

)

|

13,087

|

|

(15,095

|

)

|

|||||

|

Other liabilities

|

(9,098

|

)

|

(5,594

|

)

|

(4,614

|

)

|

|||||

|

Net cash provided by operating activities

|

206,842

|

|

168,236

|

|

215,577

|

|

|||||

|

Cash flows relating to investing activities

|

|

|

|

||||||||

|

Acquisition of businesses and assets, net of cash acquired

|

—

|

|

—

|

|

(83,347

|

)

|

|||||

|

Capital expenditures

|

(49,143

|

)

|

(42,860

|

)

|

(79,853

|

)

|

|||||

|

Purchases of investments

|

(24,556

|

)

|

(27,600

|

)

|

(98,991

|

)

|

|||||

|

Proceeds from sale of investments

|

31,607

|

|

72,464

|

|

50,484

|

|

|||||

|

Other, net

|

5,447

|

|

950

|

|

2,623

|

|

|||||

|

Net cash provided by (used in) investing activities

|

(36,645

|

)

|

2,954

|

|

(209,084

|

)

|

|||||

|

Cash flows relating to financing activities

|

|

|

|

||||||||

|

Proceeds from long-term debt and revolving credit agreement

|

250,708

|

|

579,372

|

|

18,000

|

|

|||||

|

Proceeds from exercises of stock options and warrants

|

20,625

|

|

4,492

|

|

819

|

|

|||||

|

Payments on long-term debt, capital lease obligation and revolving credit agreement

|

(252,965

|

)

|

(381,535

|

)

|

(54,130

|

)

|

|||||

|

Purchase of treasury stock and Accelerated Stock Repurchase Program

|

(283,795

|

)

|

(356,527

|

)

|

(45,897

|

)

|

|||||

|

Other, net

|

(6,359

|

)

|

(13,697

|

)

|

231

|

|

|||||

|

Net cash used in financing activities

|

(271,786

|

)

|

(167,895

|

)

|

(80,977

|

)

|

|||||

|

Discontinued operations

|

|

|

|

||||||||

|

Net cash provided by (used in) operating activities

|

(1,559

|

)

|

777

|

|

9,467

|

|

|||||

|

Net cash provided by investing activities

|

—

|

|

2,807

|

|

263

|

|

|||||

|

Net cash provided by financing activities

|

—

|

|

—

|

|

—

|

|

|||||

|

Net cash provided by (used in) discontinued operations

|

(1,559

|

)

|

3,584

|

|

9,730

|

|

|||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(7,107

|

)

|

(10,293

|

)

|

3,736

|

|

|||||

|

Net change in cash and cash equivalents

|

(110,255

|

)

|

(3,414

|

)

|

(61,018

|

)

|

|||||

|

Cash and cash equivalents, beginning of period

|

179,160

|

|

182,574

|

|

243,592

|

|

|||||

|

Cash and cash equivalents, end of period

|

$

|

68,905

|

|

$

|

179,160

|

|

$

|

182,574

|

|

||

|

Supplemental cash flow information

|

|

|

|

||||||||

|

Cash paid for interest

|

$

|

22,231

|

|

$

|

16,140

|

|

$

|

8,104

|

|

||

|

Cash paid for taxes

|

$

|

29,124

|

|

$

|

22,068

|

|

$

|

27,180

|

|

||

|

Capitalized interest

|

$

|

298

|

|

$

|

56

|

|

$

|

2,496

|

|

||

|

Total

|

Accumulated

(Deficit)

Earnings

|

Accumulated

Other

Comprehensive

Income

|

Common

Stock

|

Capital in

Excess

of Par

|

Treasury

Stock

|

Non-controlling

Interest

|

|||||||||||||||||||||

|

Balance at December 27, 2008

|

$

|

1,241,708

|

|

$

|

(352,934

|

)

|

$

|

3,347

|

|

$

|

766

|

|

$

|

2,016,031

|

|

$

|

(425,924

|

)

|

$

|

422

|

|

||||||

|

Components of comprehensive income, net of tax:

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Net income

|

112,602

|

|

114,441

|

|

(1,839

|

)

|

|||||||||||||||||||||

|

Foreign currency translation adjustment

|

47,248

|

|

47,250

|

|

(2

|

)

|

|||||||||||||||||||||

|

Net decrease in unrecognized pension net gain/loss and prior service costs

|

(6,328

|

)

|

(6,328

|

)

|

—

|

|

|||||||||||||||||||||

|

Unrealized gain on marketable securities

|

768

|

|

768

|

|

—

|

|

|||||||||||||||||||||

|

Total comprehensive income

|

154,290

|

|

(1,841

|

)

|

|||||||||||||||||||||||

|

Tax detriment associated with stock issued under employee compensation plans

|

(2,203

|

)

|

(2,203

|

)

|

|||||||||||||||||||||||

|

Exercise of warrants

|

22

|

|

22

|

|

|||||||||||||||||||||||

|

Issuance of stock under employee compensation plans

|

797

|

|

5

|

|

792

|

|

|||||||||||||||||||||

|

Acquisition of treasury shares

|

(44,603

|

)

|

—

|

|

—

|

|

(44,603

|

)

|

|||||||||||||||||||

|

Stock-based compensation

|

23,813

|

|

23,813

|

|

|||||||||||||||||||||||

|

Balance at December 26, 2009

|

$

|

1,373,824

|

|

$

|

(238,493

|

)

|

$

|

45,037

|

|

$

|

771

|

|

$

|

2,038,455

|

|

$

|

(470,527

|

)

|

$

|

(1,419

|

)

|

||||||

|

Components of comprehensive income, net of tax:

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Net loss

|

(342,117

|

)

|

(336,669

|

)

|

(5,448

|

)

|

|||||||||||||||||||||

|

Foreign currency translation adjustment

|

(4,985

|

)

|

(4,803

|

)

|

(182

|

)

|

|||||||||||||||||||||

|

Net decrease in unrecognized pension net gain/loss and prior service costs

|

(7,452

|

)

|

(7,452

|

)

|

—

|

|

|||||||||||||||||||||

|

Unrealized gain on marketable securities

|

853

|

|

853

|

|

—

|

|

|||||||||||||||||||||

|

Total comprehensive income

|

(353,701

|

)

|

(5,630

|

)

|

|||||||||||||||||||||||

|

Dividends paid noncontrolling interest

|

(270

|

)

|

(270

|

)

|

|||||||||||||||||||||||

|

Purchase of noncontrolling interest in PCS-China

|

(4,000

|

)

|

(12,623

|

)

|

8,623

|

|

|||||||||||||||||||||

|

Tax detriment associated with stock issued under employee compensation plans

|

(926

|

)

|

(926

|

)

|

|||||||||||||||||||||||

|

Issuance of stock under employee compensation plans

|

4,590

|

|

4

|

|

4,586

|

|

|||||||||||||||||||||

|

Acquisition of treasury shares

|

(298,172

|

)

|

—

|

|

(298,172

|

)

|

|||||||||||||||||||||

|

Accelerated Stock Repurchase equity instrument

|

(58,355

|

)

|

(58,355

|

)

|

|||||||||||||||||||||||

|

Stock-based compensation

|

25,737

|

|

25,737

|

|

|||||||||||||||||||||||

|

Balance at December 25, 2010

|

$

|

688,727

|

|

$

|

(575,162

|

)

|

$

|

33,635

|

|

$

|

775

|

|

$

|

1,996,874

|

|

$

|

(768,699

|

)

|

$

|

1,304

|

|

||||||

|

Components of comprehensive income, net of tax:

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Net income

|

109,977

|

|

109,566

|

|

411

|

|

|||||||||||||||||||||

|

Foreign currency translation adjustment

|

(13,084

|

)

|

(13,149

|

)

|

65

|

|

|||||||||||||||||||||

|

Net decrease in unrecognized pension net gain/loss and prior service costs

|

(15,568

|

)

|

(15,568

|

)

|

—

|

|

|||||||||||||||||||||

|

Unrealized gain on marketable securities

|

(325

|

)

|

(325

|

)

|

—

|

|