|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

FOR THE FISCAL YEAR ENDED DECEMBER 29, 2018

|

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

FOR THE TRANSITION PERIOD FROM TO

|

|

|

Delaware

|

|

06-1397316

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

251 Ballardvale Street

Wilmington, Massachusetts

|

|

01887

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

Title of each class

|

Name of each exchange

on which registered

|

|

|

Common Stock, $0.01 par value

|

New York Stock Exchange

|

|

|

Large accelerated filer

ý

|

Accelerated filer

o

|

Non-accelerated filer

o

|

||

|

Smaller reporting company

o

|

Emerging growth company

o

|

|||

|

Item

|

|

Page

|

|

PART I

|

|

|

|

1

|

||

|

1A

|

||

|

1B

|

||

|

2

|

||

|

3

|

||

|

4

|

Mine Safety Disclosures

|

|

|

PART II

|

||

|

5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

6

|

||

|

7

|

||

|

7A

|

Quantitative and Qualitative Disclosures

about Market Risk

|

|

|

8

|

||

|

9

|

||

|

9A

|

||

|

9B

|

||

|

PART III

|

||

|

10

|

||

|

11

|

||

|

12

|

||

|

13

|

||

|

14

|

||

|

PART IV

|

||

|

15

|

||

|

16

|

Form 10-K Summary

|

|

|

Signatures

|

||

|

Exhibit Index

|

||

|

•

|

inbred, which are bred to be homogeneous;

|

|

•

|

outbred, which are purposefully bred for heterogeneity;

|

|

•

|

hybrid, which are the offspring of two different inbred parents;

|

|

•

|

spontaneous mutant, whose genotype results in a naturally occurring genetic mutation (such as immune deficiency); and

|

|

•

|

other genetically modified research models, such as knock-out models with one or more disabled genes and transgenic models.

|

|

•

|

target discovery and validation;

|

|

•

|

hit identification and optimization to deliver candidate molecules; and

|

|

•

|

target engagement biomarker development to support pre-clinical and potentially downstream clinical studies.

|

|

•

|

a broad offering of

in vitro

and

in vivo

capabilities and study types designed to identify possible safety risks;

|

|

•

|

a broad offering of

in vitro

and

in vivo

studies in support of general toxicology (acute, sub-acute, and chronic studies), genetic toxicology, safety pharmacology, and carcinogenicity bioassays that are required for regulatory submissions supporting “first-in-human” to “first-to-the-market” strategies for potential human therapeutics;

|

|

•

|

a broad offering of

in vitro

and

in vivo

studies in support of general toxicology (acute, sub-acute, and chronic studies), genetic toxicology, reproductive and developmental toxicology, environmental toxicology, and carcinogenicity bioassays that are required for regulatory submissions supporting the registration of industrial chemicals, agrochemicals, and biocides;

|

|

•

|

expertise in standard and specialty routes of administration (e.g., infusion, intravitreal, intrathecal, and inhalation) that are important not only for the testing of potential pharmaceuticals and biopharmaceuticals, but also for the safety testing of medical devices, nutraceuticals, animal health products, and other materials;

|

|

•

|

expertise in the conduct and assessment of reproductive, developmental, and juvenile toxicology studies (in support of larger-scale and later-stage human clinical trials or chemical registration);

|

|

•

|

expertise in environmental toxicology (aquatic and terrestrial) and regulatory submissions required for chemical and agrochemical registration;

|

|

•

|

services in important specialty areas such as ocular, bone, juvenile/neonatal, immune-toxicology, ototoxicology, photobiology, inhalation, drug abuse liability, surgery, imaging capabilities and dermal testing;

|

|

•

|

expertise in determining the potential for abuse of human pharmaceuticals (Drug Abuse Liability Testing);

|

|

•

|

expertise in testing of medical devices in the assessment of those devices and surrounding tissues;

|

|

•

|

expertise and experience and expertise in immunology and immunotoxicology;

|

|

•

|

expertise in all major therapeutic areas, particularly in stem and gene therapy, and orphan drugs;

|

|

•

|

study design and strategic advice to our clients based on our wealth of experience and scientific expertise in support of drug development and chemical registration; and

|

|

•

|

a strong history of assisting our clients in achieving their regulatory and/or internal milestones for the safety testing of numerous therapy types including stem cells, vaccines, proteins, antibodies, drug conjugates, oligonucleotide biotherapeutics, small molecules, medical devices, chemicals, and agrochemicals.

|

|

•

|

For RMS, we have five main competitors of which one is a government funded, not-for-profit entity; one is part of a large public company; two are privately held in Europe and one is privately held in the U.S. We believe that none of these competitors compares to us in global reach, financial strength, breadth of product and services offerings, technical expertise, or pharmaceutical and biotechnology industry relationships.

|

|

•

|

For DSA, both our Discovery Services and Safety Assessment businesses have numerous competitors. Discovery has hundreds of competitors, as it is a highly competitive and fragmented market; Safety Assessment has dozens of competitors of varying size, but it has five main competitors; one is part of a large public company in the U.S.; one is a public company in China; one is privately held in Canada; and two are privately held in Europe. Our DSA segment also competes with in-house departments of pharmaceutical and biotechnology companies, universities, and teaching hospitals.

|

|

•

|

For Manufacturing, each of our underlying businesses has several competitors. In addition to many smaller competitors, Biologics has five main competitors, of which four are public companies in Europe and one is a public company in China. Avian has one main competitor to its SPF eggs business, which is privately held in Europe, and numerous competitors for specialized avian laboratory services. Microbial Solutions has four main competitors, of which three are public companies in Europe and one is privately held in the U.S.

|

|

•

|

the surface and air transportation of chemicals, biological reagents and laboratory specimens;

|

|

•

|

the handling, use, storage, and disposal of chemicals (including narcotics and psychotropic drugs), biological reagents, laboratory specimens, hazardous waste, and radioactive materials;

|

|

•

|

the procurement, handling, use, storage, and disposal of human cells, tissues, and cellular and tissue-based products for research purposes;

|

|

•

|

the safety and health of employees and visitors to our facilities; and

|

|

•

|

protection of the environment and general public.

|

|

•

|

the products being tested fail to satisfy safety requirements;

|

|

•

|

unexpected or undesired study results;

|

|

•

|

production problems resulting in shortages of the drug being tested;

|

|

•

|

a client's decision to forego or terminate a particular study;

|

|

•

|

establishment of alternative distribution channels by our competitors;

|

|

•

|

the loss of funding for the particular research study; or

|

|

•

|

general convenience/counterparty preference.

|

|

•

|

difficulties in achieving business and financial success;

|

|

•

|

difficulties and expenses incurred in assimilating and integrating operations, services, products, technologies, or pre-existing relationships with our clients, distributors, and suppliers;

|

|

•

|

challenges with developing and operating new businesses, including those which are materially different from our existing businesses and which may require the development or acquisition of new internal capabilities and expertise;

|

|

•

|

potential losses resulting from undiscovered liabilities of acquired companies that are not covered by the indemnification we may obtain from the seller or the insurance we acquire in connection with the transaction;

|

|

•

|

loss of key employees;

|

|

•

|

the presence or absence of adequate internal controls and/or significant fraud in the financial systems of acquired companies;

|

|

•

|

diversion of management's attention from other business concerns;

|

|

•

|

becoming subject to a more expansive regulatory environment;

|

|

•

|

acquisitions could be dilutive to earnings, or in the event of acquisitions made through the issuance of our common stock to the shareholders of the acquired company, dilutive to the percentage of ownership of our existing shareholders;

|

|

•

|

risks of not being able to overcome differences in foreign business practices, customs, and importation regulations, language, and other cultural barriers in connection with the acquisition of foreign companies;

|

|

•

|

new technologies and products may be developed which cause businesses or assets we acquire to become less valuable; and

|

|

•

|

risks that disagreements or disputes with prior owners of an acquired business, technology, service, or product may result in litigation expenses and diversion of our management's attention.

|

|

•

|

difficulties in the separation of operations, services, products, and personnel;

|

|

•

|

diversion of management's attention from other business concerns; and

|

|

•

|

the need to agree to retain or assume certain current or future liabilities in order to complete the divestiture.

|

|

•

|

foreign currencies we receive for sales and in which we record expenses outside the U.S. could be subject to unfavorable exchange rates with the U.S. dollar and reduce the amount of revenue and cash flow (and increase the amount of expenses) that we recognize and cause fluctuations in reported financial results.

The favorable effects of changes in currency exchange rates increased our 2018 revenue

by approximately $24 million, or

1.3%

, while unfavorable foreign currency effects decreased our 2017 revenues by less than $1 million, or less than 1%, respectively;

|

|

•

|

foreign currency exposure associated with differences between where we conduct business, our exposure to currency exchange rate fluctuations results from the currency translation exposure associated with the preparation of our consolidated financial statements, as well as from the exposure associated with transactions of our subsidiaries that are denominated in a currency other than the respective subsidiary's functional currency. While our financial results are reported in U.S. Dollars, the financial statements of many of our subsidiaries outside the U.S. are prepared using the local currency as the functional currency. During consolidation, these results are translated into U.S. Dollars by applying appropriate exchange rates. As a result, fluctuations in the exchange rate of the U.S. Dollar relative to the local currencies in which our foreign subsidiaries report could cause significant fluctuations in our reported results. Moreover, as exchange rates vary, revenue and other operating results may differ materially from our expectations.

Adjustments resulting from financial statement translations are included as a separate component of shareholders' equity. In the year ended December 29, 2018, we recorded net losses from currency translation adjustments of

$27.4 million

. In the year ended December 30, 2017, we recorded net gains from currency translation adjustments of

$77.1 million

;

|

|

•

|

certain contracts, particularly in Canada, are frequently denominated in currencies other than the currency in which we incur expenses related to those contracts, and where expenses are incurred in currencies other than those in which contracts are priced, fluctuations in the relative value of those currencies could have a material adverse effect on our results of operations;

|

|

•

|

potentially negative consequences from changes in U.S. and/or foreign tax laws, or interpretations thereof, notably tax regulations issued and to-be-issued with respect to U.S. Tax Reform and the EU Anti-Tax Avoidance Directives I and II;

|

|

•

|

general economic and political conditions in the markets in which we operate, including possible implications of Brexit;

|

|

•

|

potential international conflicts, including terrorist acts;

|

|

•

|

exchange controls, adverse tax consequences, and legal restrictions on the repatriation of funds into the U.S.;

|

|

•

|

difficulties and costs associated with staffing and managing foreign operations, including risks of work stoppages and/or strikes, as well as violations of local laws or anti-bribery laws such as the U.S. Foreign Corrupt Practices Act (FCPA), the U.K. Bribery Act, and the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions;

|

|

•

|

unexpected changes in regulatory requirements;

|

|

•

|

the difficulties of compliance with a wide variety of foreign laws and regulations;

|

|

•

|

unfavorable labor regulations in foreign jurisdictions;

|

|

•

|

exposure to business disruption or property damage due to geographically unique natural disasters (including within the U.S.);

|

|

•

|

longer accounts receivable cycles in certain foreign countries; and

|

|

•

|

compliance with export controls, import requirements and other trade regulations.

|

|

•

|

reputation for on-time quality performance;

|

|

•

|

reputation for regulatory compliance;

|

|

•

|

expertise and experience in multiple specialized areas;

|

|

•

|

scope and breadth of service and product offerings across the drug discovery and development spectrum;

|

|

•

|

scope and breadth of service and product offerings across the manufacturing support spectrum;

|

|

•

|

ability to provide flexible and customized solutions to support our clients' drug discovery, non-clinical development, and manufacturing support needs;

|

|

•

|

broad geographic availability (with consistent quality);

|

|

•

|

price/value, spend and flexibility;

|

|

•

|

technological and scientific expertise and efficient drug development processes;

|

|

•

|

quality of facilities;

|

|

•

|

financial stability;

|

|

•

|

size;

|

|

•

|

ability to acquire, process, analyze, and report data in an accurate manner; and

|

|

•

|

accessibility of client data through secure portals.

|

|

•

|

errors or omissions in reporting of study detail in non-clinical studies that may lead to inaccurate reports, which may undermine the usefulness of a study or data from the study, or which may potentially advance studies absent the necessary support or inhibit studies from proceeding to the next level of testing;

|

|

•

|

risks associated with our possible failure to properly care for our clients' property, such as research models and samples, study compounds, records, work in progress, other archived materials, or goods and materials in transit, while in our possession;

|

|

•

|

risks that models in our breeding facilities or in facilities that we manage may be infected with diseases that may be harmful and even lethal to them or humans, despite preventive measures contained in our policies for the quarantine and handling of imported animals; and

|

|

•

|

risks that we may have errors and omissions and/or product liabilities related to our products designed to conduct lot release testing of medical devices, injectable drugs, food, beverages, and home and beauty products (primarily through our Microbial Solutions business), or in the testing of biologics and other services performed by our Biologics business, which could result in us or our clients failing to identify unsafe or contaminated materials.

|

|

•

|

changes in the general global economy;

|

|

•

|

the number and scope of ongoing client engagements;

|

|

•

|

the commencement, postponement, delay, progress, completion, or cancellation of client contracts in the quarter;

|

|

•

|

changes in the mix of our products and services;

|

|

•

|

competitive pricing pressures;

|

|

•

|

the extent of cost overruns;

|

|

•

|

holiday buying patterns of our clients;

|

|

•

|

budget cycles of our clients;

|

|

•

|

changes in tax laws, rules, regulations, and tax rates in the locations in which we operate;

|

|

•

|

the timing and charges associated with completed acquisitions and other events;

|

|

•

|

the financial performance of our venture capital investments;

|

|

•

|

the occasional extra week (“53

rd

week”) that we recognize in a fiscal year (and fourth fiscal quarter thereof) due to our fiscal year ending on the last Saturday in December; and

|

|

•

|

exchange rate fluctuations.

|

|

|

Total Number

of Shares Purchased |

|

Average

Price Paid per Share |

|

Total Number of

Shares Purchased as Part of Publicly Announced Plans or Programs |

|

Approximate Dollar

Value of Shares That May Yet Be Purchased Under the Plans or Programs |

||||||

|

(in thousands)

|

|||||||||||||

|

September 30, 2018 to October 27, 2018

|

173

|

|

$

|

133.55

|

|

—

|

|

$

|

129,105

|

|

|||

|

October 28, 2018 to November 24, 2018

|

46

|

|

121.82

|

|

—

|

|

129,105

|

|

|||||

|

November 25, 2018 to December 29, 2018

|

194

|

|

134.85

|

|

—

|

|

129,105

|

|

|||||

|

Total

|

413

|

|

—

|

|

|

|

|||||||

|

Fiscal Year

|

|||||||||||||||||||||||

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

||||||||||||||||||

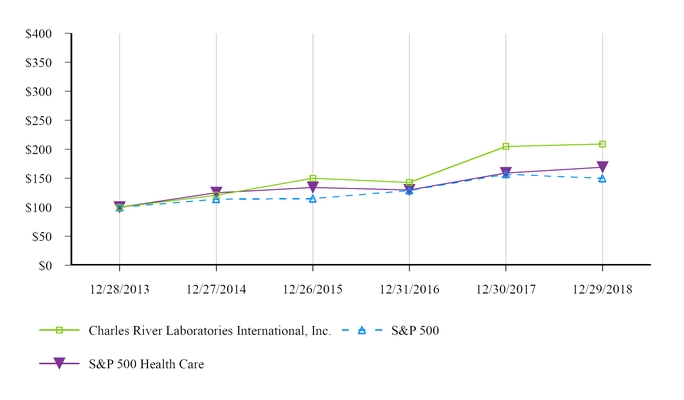

|

Charles River Laboratories International, Inc.

|

$

|

100

|

|

$

|

121

|

|

$

|

150

|

|

$

|

143

|

|

$

|

205

|

|

$

|

209

|

|

|||||

|

S&P 500

|

100

|

|

114

|

|

115

|

|

129

|

|

157

|

|

150

|

|

|||||||||||

|

S&P 500 Health Care

|

100

|

|

125

|

|

134

|

|

130

|

|

159

|

|

169

|

|

|||||||||||

|

|

Fiscal Year

|

||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

|

(in thousands, except per share amounts)

|

||||||||||||||||||

|

Statement of Income Data

|

|

|

|

|

|

||||||||||||||

|

Total revenue

|

$

|

2,266,096

|

|

$

|

1,857,601

|

|

$

|

1,681,432

|

|

$

|

1,363,302

|

|

$

|

1,297,662

|

|

||||

|

Income from continuing operations, net of income taxes

|

227,218

|

|

125,586

|

|

156,086

|

|

152,037

|

|

129,924

|

|

|||||||||

|

Income (loss) from discontinued operations, net of income taxes

|

1,506

|

|

(137

|

)

|

280

|

|

(950

|

)

|

(1,726

|

)

|

|||||||||

|

Common Share Data

|

|

|

|

|

|

||||||||||||||

|

Earnings per common share from continuing operations:

|

|

|

|

|

|

||||||||||||||

|

Basic

|

$

|

4.69

|

|

$

|

2.60

|

|

$

|

3.28

|

|

$

|

3.23

|

|

$

|

2.76

|

|

||||

|

Diluted

|

$

|

4.59

|

|

$

|

2.54

|

|

$

|

3.22

|

|

$

|

3.15

|

|

$

|

2.70

|

|

||||

|

Other Data

|

|

|

|||||||||||||||||

|

Depreciation and amortization

|

$

|

161,779

|

|

$

|

131,159

|

|

$

|

126,658

|

|

$

|

94,881

|

|

$

|

96,445

|

|

||||

|

Capital expenditures

|

140,054

|

|

82,431

|

|

55,288

|

|

63,252

|

|

56,925

|

|

|||||||||

|

Balance Sheet Data (as of period end)

|

|

|

|||||||||||||||||

|

Cash and cash equivalents

|

$

|

195,442

|

|

$

|

163,794

|

|

$

|

117,626

|

|

$

|

117,947

|

|

$

|

160,023

|

|

||||

|

Total assets

|

3,855,879

|

|

2,929,922

|

|

2,711,800

|

|

2,068,497

|

|

1,870,578

|

|

|||||||||

|

Long-term debt, net and capital leases

|

1,636,598

|

|

1,114,105

|

|

1,207,696

|

|

845,997

|

|

740,557

|

|

|||||||||

|

Redeemable noncontrolling interest

|

18,525

|

|

16,609

|

|

14,659

|

|

28,008

|

|

28,419

|

|

|||||||||

|

•

|

significant underperformance relative to expected historical or projected future operating results;

|

|

•

|

significant negative industry or economic trends; or

|

|

•

|

significant changes or developments in strategy or operations that negatively affect the utilization of our long-lived assets.

|

|

Fiscal Year

|

||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

|||||||||||

|

(in millions, except percentages)

|

||||||||||||||

|

Service revenue

|

$

|

1,687.9

|

|

$

|

1,298.3

|

|

$

|

389.6

|

|

30.0

|

%

|

|||

|

Product revenue

|

578.2

|

|

559.3

|

|

18.9

|

|

3.4

|

%

|

||||||

|

Total revenue

|

$

|

2,266.1

|

|

$

|

1,857.6

|

|

$

|

408.5

|

|

22.0

|

%

|

|||

|

Fiscal Year

|

|||||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

RMS

|

$

|

519.7

|

|

$

|

493.6

|

|

$

|

26.1

|

|

5.3

|

%

|

1.6

|

%

|

||||

|

DSA

|

1,316.9

|

|

980.0

|

|

336.9

|

|

34.4

|

%

|

1.1

|

%

|

|||||||

|

Manufacturing

|

429.5

|

|

384.0

|

|

45.5

|

|

11.9

|

%

|

1.4

|

%

|

|||||||

|

Total revenue

|

$

|

2,266.1

|

|

$

|

1,857.6

|

|

$

|

408.5

|

|

22.0

|

%

|

1.3

|

%

|

||||

|

Fiscal Year

|

||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

|||||||||||

|

(in millions, except percentages)

|

||||||||||||||

|

RMS

|

$

|

136.5

|

|

$

|

114.6

|

|

$

|

21.9

|

|

19.1

|

%

|

|||

|

DSA

|

227.6

|

|

182.8

|

|

44.8

|

|

24.5

|

%

|

||||||

|

Manufacturing

|

136.2

|

|

123.9

|

|

12.3

|

|

9.9

|

%

|

||||||

|

Unallocated corporate

|

(168.9

|

)

|

(133.0

|

)

|

(35.9

|

)

|

27.0

|

%

|

||||||

|

Total operating income

|

$

|

331.4

|

|

$

|

288.3

|

|

$

|

43.1

|

|

15.0

|

%

|

|||

|

Fiscal Year

|

|||||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

Revenue

|

$

|

519.7

|

|

$

|

493.6

|

|

$

|

26.1

|

|

5.3

|

%

|

1.6

|

%

|

||||

|

Cost of revenue (excluding amortization of intangible assets)

|

319.8

|

|

317.1

|

|

2.7

|

|

0.9

|

%

|

|||||||||

|

Selling, general and administrative

|

61.8

|

|

60.2

|

|

1.6

|

|

2.7

|

%

|

|||||||||

|

Amortization of intangible assets

|

1.6

|

|

1.7

|

|

(0.1

|

)

|

(5.4

|

)%

|

|||||||||

|

Operating income

|

$

|

136.5

|

|

$

|

114.6

|

|

$

|

21.9

|

|

19.1

|

%

|

||||||

|

Operating income % of revenue

|

26.3

|

%

|

23.2

|

%

|

|

|

3.1

|

%

|

|||||||||

|

Fiscal Year

|

|||||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

Revenue

|

$

|

1,316.9

|

|

$

|

980.0

|

|

$

|

336.9

|

|

34.4

|

%

|

1.1

|

%

|

||||

|

Cost of revenue (excluding amortization of intangible assets)

|

903.9

|

|

661.7

|

|

242.2

|

|

36.6

|

%

|

|||||||||

|

Selling, general and administrative

|

131.2

|

|

105.6

|

|

25.6

|

|

24.3

|

%

|

|||||||||

|

Amortization of intangible assets

|

54.2

|

|

29.9

|

|

24.3

|

|

81.4

|

%

|

|||||||||

|

Operating income

|

$

|

227.6

|

|

$

|

182.8

|

|

$

|

44.8

|

|

24.5

|

%

|

||||||

|

Operating income % of revenue

|

17.3

|

%

|

18.7

|

%

|

(1.4

|

)%

|

|||||||||||

|

Fiscal Year

|

|||||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

Revenue

|

$

|

429.5

|

|

$

|

384.0

|

|

$

|

45.5

|

|

11.9

|

%

|

1.4

|

%

|

||||

|

Cost of revenue (excluding amortization of intangible assets)

|

202.3

|

|

177.8

|

|

24.5

|

|

13.8

|

%

|

|||||||||

|

Selling, general and administrative

|

82.0

|

|

72.5

|

|

9.5

|

|

13.0

|

%

|

|||||||||

|

Amortization of intangible assets

|

9.0

|

|

9.8

|

|

(0.8

|

)

|

(7.9

|

)%

|

|||||||||

|

Operating income

|

$

|

136.2

|

|

$

|

123.9

|

|

$

|

12.3

|

|

9.9

|

%

|

||||||

|

Operating income % of revenue

|

31.7

|

%

|

32.3

|

%

|

(0.6

|

)%

|

|||||||||||

|

Fiscal Year

|

||||||||||||||

|

2018

|

2017

|

$ change

|

% change

|

|||||||||||

|

(in millions, except percentages)

|

||||||||||||||

|

Unallocated corporate

|

$

|

168.9

|

|

$

|

133.0

|

|

$

|

35.9

|

|

27.0

|

%

|

|||

|

Fiscal Year

|

||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

|||||||||||

|

(in millions, except percentages)

|

||||||||||||||

|

Service revenue

|

$

|

1,298.3

|

|

$

|

1,130.7

|

|

$

|

167.6

|

|

14.8

|

%

|

|||

|

Product revenue

|

559.3

|

|

550.7

|

|

8.6

|

|

1.6

|

%

|

||||||

|

Total revenue

|

$

|

1,857.6

|

|

$

|

1,681.4

|

|

$

|

176.2

|

|

10.5

|

%

|

|||

|

Fiscal Year

|

|||||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

RMS

|

$

|

493.6

|

|

$

|

494.0

|

|

$

|

(0.4

|

)

|

(0.1

|

)%

|

(0.2

|

)%

|

||||

|

DSA

|

980.0

|

|

836.6

|

|

143.4

|

|

17.1

|

%

|

(0.2

|

)%

|

|||||||

|

Manufacturing

|

384.0

|

|

350.8

|

|

33.2

|

|

9.5

|

%

|

0.7

|

%

|

|||||||

|

Total revenue

|

$

|

1,857.6

|

|

$

|

1,681.4

|

|

$

|

176.2

|

|

10.5

|

%

|

0.0

|

%

|

||||

|

Fiscal Year

|

||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

|||||||||||

|

(in millions, except percentages)

|

||||||||||||||

|

RMS

|

$

|

114.6

|

|

$

|

136.4

|

|

$

|

(21.8

|

)

|

(16.0

|

)%

|

|||

|

DSA

|

182.8

|

|

135.4

|

|

47.4

|

|

35.0

|

%

|

||||||

|

Manufacturing

|

123.9

|

|

104.6

|

|

19.3

|

|

18.5

|

%

|

||||||

|

Unallocated corporate

|

(133.0

|

)

|

(138.8

|

)

|

5.8

|

|

4.2

|

%

|

||||||

|

Total operating income

|

$

|

288.3

|

|

$

|

237.6

|

|

$

|

50.7

|

|

21.3

|

%

|

|||

|

Fiscal Year

|

|||||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

Revenue

|

$

|

493.6

|

|

$

|

494.0

|

|

$

|

(0.4

|

)

|

(0.1

|

)%

|

(0.2

|

)%

|

||||

|

Cost of revenue (excluding amortization of intangible assets)

|

317.1

|

|

292.8

|

|

24.3

|

|

8.3

|

%

|

|||||||||

|

Selling, general and administrative

|

60.2

|

|

62.5

|

|

(2.3

|

)

|

(3.7

|

)%

|

|||||||||

|

Amortization of intangible assets

|

1.7

|

|

2.3

|

|

(0.6

|

)

|

(26.1

|

)%

|

|||||||||

|

Operating income

|

$

|

114.6

|

|

$

|

136.4

|

|

$

|

(21.8

|

)

|

(16.0

|

)%

|

||||||

|

Operating income % of revenue

|

23.2

|

%

|

27.6

|

%

|

(4.4

|

)%

|

|||||||||||

|

Fiscal Year

|

|||||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

DSA

|

$

|

980.0

|

|

$

|

836.6

|

|

$

|

143.4

|

|

17.1

|

%

|

(0.2

|

)%

|

||||

|

Cost of revenue (excluding amortization of intangible assets)

|

661.7

|

|

575.1

|

|

86.6

|

|

15.1

|

%

|

|||||||||

|

Selling, general and administrative

|

105.6

|

|

98.3

|

|

7.3

|

|

7.4

|

%

|

|||||||||

|

Amortization of intangible assets

|

29.9

|

|

27.8

|

|

2.1

|

|

7.6

|

%

|

|||||||||

|

Operating income

|

$

|

182.8

|

|

$

|

135.4

|

|

$

|

47.4

|

|

35.0

|

%

|

||||||

|

Operating income % of revenue

|

18.7

|

%

|

16.2

|

%

|

2.5

|

%

|

|||||||||||

|

Fiscal Year

|

|||||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

Impact of FX

|

|||||||||||||

|

(in millions, except percentages)

|

|||||||||||||||||

|

Revenue

|

$

|

384.0

|

|

$

|

350.8

|

|

$

|

33.2

|

|

9.5

|

%

|

0.7

|

%

|

||||

|

Cost of revenue (excluding amortization of intangible assets)

|

177.8

|

|

169.5

|

|

8.3

|

|

4.9

|

%

|

|||||||||

|

Selling, general and administrative

|

72.5

|

|

65.1

|

|

7.4

|

|

11.4

|

%

|

|||||||||

|

Amortization of intangible assets

|

9.8

|

|

11.6

|

|

(1.8

|

)

|

(15.5

|

)%

|

|||||||||

|

Operating income

|

$

|

123.9

|

|

$

|

104.6

|

|

$

|

19.3

|

|

18.5

|

%

|

||||||

|

Operating income % of revenue

|

32.3

|

%

|

29.8

|

%

|

2.5

|

%

|

|||||||||||

|

Fiscal Year

|

||||||||||||||

|

2017

|

2016

|

$ change

|

% change

|

|||||||||||

|

(in millions, except percentages)

|

||||||||||||||

|

Unallocated corporate

|

$

|

133.0

|

|

$

|

138.8

|

|

$

|

(5.8

|

)

|

(4.2

|

)%

|

|||

|

December 29, 2018

|

December 30, 2017

|

||||||

|

(in millions)

|

|||||||

|

Cash and cash equivalents:

|

|||||||

|

Held in U.S. entities

|

$

|

67.3

|

|

$

|

30.6

|

|

|

|

Held in non-U.S. entities

|

128.1

|

|

133.2

|

|

|||

|

Total cash and cash equivalents

|

195.4

|

|

163.8

|

|

|||

|

Investments:

|

|||||||

|

Held in non-U.S. entities

|

0.9

|

|

28.5

|

|

|||

|

Total cash, cash equivalents and investments

|

$

|

196.3

|

|

$

|

192.3

|

|

|

|

December 29, 2018

|

December 30, 2017

|

||||||

|

(in millions)

|

|||||||

|

Term loans

|

$

|

731.3

|

|

$

|

601.3

|

|

|

|

Revolving facility

|

397.5

|

|

501.0

|

|

|||

|

Senior Notes

|

500.0

|

|

—

|

|

|||

|

Total

|

$

|

1,628.8

|

|

$

|

1,102.3

|

|

|

|

Fiscal Year

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

(in millions)

|

|||||||||||

|

Income from continuing operations

|

$

|

227.2

|

|

$

|

125.6

|

|

$

|

156.1

|

|

||

|

Adjustments to reconcile net income from continuing operations to net cash provided by operating activities

|

199.1

|

|

186.6

|

|

174.3

|

|

|||||

|

Changes in assets and liabilities

|

14.8

|

|

5.9

|

|

(13.5

|

)

|

|||||

|

Net cash provided by operating activities

|

$

|

441.1

|

|

$

|

318.1

|

|

$

|

316.9

|

|

||

|

Fiscal Year

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

(in millions)

|

|||||||||||

|

Acquisition of businesses and assets, net of cash acquired

|

$

|

(824.9

|

)

|

$

|

(25.0

|

)

|

$

|

(648.5

|

)

|

||

|

Capital expenditures

|

(140.1

|

)

|

(82.4

|

)

|

(55.3

|

)

|

|||||

|

Investments, net

|

10.7

|

|

(37.2

|

)

|

7.4

|

|

|||||

|

Proceeds from divestiture

|

—

|

|

72.5

|

|

—

|

|

|||||

|

Other, net

|

(0.7

|

)

|

(0.5

|

)

|

3.7

|

|

|||||

|

Net cash used in investing activities

|

$

|

(955.0

|

)

|

$

|

(72.6

|

)

|

$

|

(692.7

|

)

|

||

|

Fiscal Year

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

(in millions)

|

|||||||||||

|

Proceeds from long-term debt and revolving credit facility

|

$

|

2,755.0

|

|

$

|

236.8

|

|

$

|

1,044.7

|

|

||

|

Proceeds from exercises of stock options

|

37.7

|

|

38.9

|

|

23.2

|

|

|||||

|

Payments on long-term debt, revolving credit facility, and capital lease obligations

|

(2,201.0

|

)

|

(372.4

|

)

|

(656.6

|

)

|

|||||

|

Payments on debt financing costs

|

(18.3

|

)

|

—

|

|

(3.7

|

)

|

|||||

|

Purchase of treasury stock

|

(13.8

|

)

|

(106.9

|

)

|

(12.3

|

)

|

|||||

|

Other, net

|

(1.5

|

)

|

(4.9

|

)

|

(14.5

|

)

|

|||||

|

Net cash provided by (used in) financing activities

|

$

|

558.1

|

|

$

|

(208.5

|

)

|

$

|

380.8

|

|

||

|

Payments Due by Period

|

|||||||||||||||||||

|

Total

|

Less than

1 Year |

1 - 3 Years

|

3 - 5 Years

|

More Than

5 Years |

|||||||||||||||

|

(in millions)

|

|||||||||||||||||||

|

Notes payable

(1)

|

$

|

1,628.8

|

|

$

|

28.2

|

|

$

|

103.1

|

|

$

|

997.5

|

|

$

|

500.0

|

|

||||

|

Operating leases

(2)

|

170.1

|

|

25.4

|

|

43.9

|

|

33.9

|

|

66.9

|

|

|||||||||

|

Capital leases

|

40.1

|

|

4.0

|

|

6.6

|

|

5.2

|

|

24.3

|

|

|||||||||

|

Redeemable noncontrolling interest

(3)

|

18.5

|

|

18.5

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Venture capital investment commitments

(4)

|

55.7

|

|

39.8

|

|

15.9

|

|

|

|

—

|

|

|||||||||

|

Contingent payments

(5)

|

17.7

|

|

3.7

|

|

14.0

|

|

—

|

|

—

|

|

|||||||||

|

Unconditional purchase obligations

(6)

|

145.9

|

|

106.7

|

|

27.9

|

|

11.3

|

|

—

|

|

|||||||||

|

Total contractual cash obligations

|

$

|

2,076.8

|

|

$

|

226.3

|

|

$

|

211.4

|

|

$

|

1,047.9

|

|

$

|

591.2

|

|

||||

|

(1)

|

Notes payable includes the principal payments on our debt, which include our $2.3B Credit Facility and our Senior Notes.

|

|

(2)

|

We lease properties and equipment for use in our operations. In addition to rent, the leases may require us to pay additional amounts for taxes, insurance, maintenance, and other operating expenses. Amounts reflected within the table detail future minimum rental commitments under non-cancellable operating leases, net of income from subleases, for each of the periods presented.

|

|

(3)

|

The estimated cash obligation for redeemable noncontrolling interest is based on the amount that would be paid if settlement occurred as of the balance sheet date based on the contractually defined redemption value as of

December 29, 2018

.

|

|

(4)

|

The timing of the remaining capital commitment payments to venture capital funds is subject to the procedures of the limited liability partnerships and limited liability companies; the above table reflects the earliest possible date the payment can be required under the relevant agreements.

|

|

(5)

|

In connection with certain business and asset acquisitions, we agreed to make additional payments aggregating to

$17.7 million

based upon the achievement of certain financial targets in connection with each acquisition. The contingent payment obligations included in the table above have not been probability adjusted or discounted.

|

|

(6)

|

Unconditional purchase obligations include agreements to purchase goods or services that are enforceable and legally binding and that specify all significant terms, including fixed or minimum quantities to be purchased, fixed, minimum or variable price provisions, and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancellable at any time without penalty.

|

|

Consolidated Statements of Income for fiscal years 2018, 2017 and 2016

|

|

|

Consolidated Statements of Comprehensive Income for fiscal years 2018, 2017 and 2016

|

|

|

Consolidated Balance Sheets as of December 29, 2018 and December 30, 2017

|

|

|

Consolidated Statements of Cash Flows for fiscal years 2018, 2017 and 2016

|

|

|

Consolidated Statements of Changes in Equity for fiscal years 2018, 2017 and 2016

|

|

|

|

Fiscal Year

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Service revenue

|

$

|

1,687,941

|

|

$

|

1,298,298

|

|

$

|

1,130,733

|

|

||

|

Product revenue

|

578,155

|

|

559,303

|

|

550,699

|

|

|||||

|

Total revenue

|

2,266,096

|

|

1,857,601

|

|

1,681,432

|

|

|||||

|

Costs and expenses:

|

|

|

|

||||||||

|

Cost of services provided (excluding amortization of intangible assets)

|

1,150,371

|

|

867,014

|

|

760,439

|

|

|||||

|

Cost of products sold (excluding amortization of intangible assets)

|

275,658

|

|

289,669

|

|

277,034

|

|

|||||

|

Selling, general and administrative

|

443,854

|

|

371,266

|

|

364,708

|

|

|||||

|

Amortization of intangible assets

|

64,830

|

|

41,370

|

|

41,699

|

|

|||||

|

Operating income

|

331,383

|

|

288,282

|

|

237,552

|

|

|||||

|

Other income (expense):

|

|

|

|

||||||||

|

Interest income

|

812

|

|

690

|

|

1,314

|

|

|||||

|

Interest expense

|

(63,772

|

)

|

(29,777

|

)

|

(27,709

|

)

|

|||||

|

Other income, net

|

13,258

|

|

37,760

|

|

11,764

|

|

|||||

|

Income from continuing operations, before income taxes

|

281,681

|

|

296,955

|

|

222,921

|

|

|||||

|

Provision for income taxes

|

54,463

|

|

171,369

|

|

66,835

|

|

|||||

|

Income from continuing operations, net of income taxes

|

227,218

|

|

125,586

|

|

156,086

|

|

|||||

|

Income (loss) from discontinued operations, net of income taxes

|

1,506

|

|

(137

|

)

|

280

|

|

|||||

|

Net income

|

228,724

|

|

125,449

|

|

156,366

|

|

|||||

|

Less: Net income attributable to noncontrolling interests

|

2,351

|

|

2,094

|

|

1,601

|

|

|||||

|

Net income attributable to common shareholders

|

$

|

226,373

|

|

$

|

123,355

|

|

$

|

154,765

|

|

||

|

Earnings per common share

|

|

|

|

||||||||

|

Basic:

|

|

|

|

||||||||

|

Continuing operations attributable to common shareholders

|

$

|

4.69

|

|

$

|

2.60

|

|

$

|

3.28

|

|

||

|

Discontinued operations

|

$

|

0.03

|

|

$

|

—

|

|

$

|

0.01

|

|

||

|

Net income attributable to common shareholders

|

$

|

4.72

|

|

$

|

2.60

|

|

$

|

3.29

|

|

||

|

Diluted:

|

|

|

|

||||||||

|

Continuing operations attributable to common shareholders

|

$

|

4.59

|

|

$

|

2.54

|

|

$

|

3.22

|

|

||

|

Discontinued operations

|

$

|

0.03

|

|

$

|

—

|

|

$

|

0.01

|

|

||

|

Net income attributable to common shareholders

|

$

|

4.62

|

|

$

|

2.54

|

|

$

|

3.23

|

|

||

|

Weighted-average number of common shares outstanding:

|

|||||||||||

|

Basic

|

47,947

|

|

47,481

|

|

47,014

|

|

|||||

|

Diluted

|

49,018

|

|

48,564

|

|

47,958

|

|

|||||

|

See Notes to Consolidated Financial Statements.

|

|||||||||||

|

Fiscal Year

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

Net income

|

$

|

228,724

|

|

$

|

125,449

|

|

$

|

156,366

|

|

||

|

Other comprehensive income (loss):

|

|||||||||||

|

Foreign currency translation adjustment and other

|

(28,305

|

)

|

78,084

|

|

(73,243

|

)

|

|||||

|

Pension and other post-retirement benefit plans (Note 12):

|

|||||||||||

|

Prior service cost and (losses) gains arising during the period

|

(1,659

|

)

|

36,593

|

|

(60,678

|

)

|

|||||

|

Amortization of net loss and prior service benefit included in net periodic cost for pension and other post-retirement benefit plans

|

2,477

|

|

3,344

|

|

1,711

|

|

|||||

|

Comprehensive income, before income taxes

|

201,237

|

|

243,470

|

|

24,156

|

|

|||||

|

Less: Income tax (benefit) expense related to items of other comprehensive income

(Note 10) |

(1,892

|

)

|

7,954

|

|

(12,369

|

)

|

|||||

|

Comprehensive income, net of income taxes

|

203,129

|

|

235,516

|

|

36,525

|

|

|||||

|

Less: Comprehensive income (loss) related to noncontrolling interests, net of income taxes

|

1,398

|

|

3,128

|

|

(24

|

)

|

|||||

|

Comprehensive income attributable to common shareholders, net of income taxes

|

$

|

201,731

|

|

$

|

232,388

|

|

$

|

36,549

|

|

||

|

See Notes to Consolidated Financial Statements.

|

|||||||||||

|

December 29, 2018

|

December 30, 2017

|

||||||

|

Assets

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

195,442

|

|

$

|

163,794

|

|

|

|

Trade receivables, net

|

472,248

|

|

430,016

|

|

|||

|

Inventories

|

127,892

|

|

114,956

|

|

|||

|

Prepaid assets

|

53,447

|

|

36,544

|

|

|||

|

Other current assets

|

48,807

|

|

81,315

|

|

|||

|

Total current assets

|

897,836

|

|

826,625

|

|

|||

|

Property, plant and equipment, net

|

932,877

|

|

781,973

|

|

|||

|

Goodwill

|

1,247,133

|

|

804,906

|

|

|||

|

Client relationships, net

|

537,945

|

|

301,891

|

|

|||

|

Other intangible assets, net

|

72,943

|

|

67,871

|

|

|||

|

Deferred tax assets

|

23,386

|

|

22,654

|

|

|||

|

Other assets

|

143,759

|

|

124,002

|

|

|||

|

Total assets

|

$

|

3,855,879

|

|

$

|

2,929,922

|

|

|

|

Liabilities, Redeemable Noncontrolling Interest and Equity

|

|

|

|||||

|

Current liabilities:

|

|

|

|||||

|

Current portion of long-term debt and capital leases

|

$

|

31,416

|

|

$

|

30,998

|

|

|

|

Accounts payable

|

66,250

|

|

77,838

|

|

|||

|

Accrued compensation

|

137,212

|

|

101,044

|

|

|||

|

Deferred revenue

|

145,139

|

|

117,569

|

|

|||

|

Accrued liabilities

|

106,925

|

|

89,780

|

|

|||

|

Other current liabilities

|

71,280

|

|

44,460

|

|

|||

|

Current liabilities of discontinued operations

|

—

|

|

1,815

|

|

|||

|

Total current liabilities

|

558,222

|

|

463,504

|

|

|||

|

Long-term debt, net and capital leases

|

1,636,598

|

|

1,114,105

|

|

|||

|

Deferred tax liabilities

|

143,635

|

|

89,540

|

|

|||

|

Other long-term liabilities

|

179,121

|

|

194,815

|

|

|||

|

Long-term liabilities of discontinued operations

|

—

|

|

3,942

|

|

|||

|

Total liabilities

|

2,517,576

|

|

1,865,906

|

|

|||

|

Commitments and contingencies (Notes 2, 9, 11, 12, and 16)

|

|

|

|||||

|

Redeemable noncontrolling interest

|

18,525

|

|

16,609

|

|

|||

|

Equity:

|

|

|

|||||

|

Preferred stock, $0.01 par value; 20,000 shares authorized; no shares issued and outstanding

|

—

|

|

—

|

|

|||

|

Common stock, $0.01 par value; 120,000 shares authorized; 48,210 shares issued and 48,209 shares outstanding as of December 29, 2018 and 87,495 shares issued and 47,402 shares outstanding as of December 30, 2017

|

482

|

|

875

|

|

|||

|

Additional paid-in capital

|

1,447,512

|

|

2,560,192

|

|

|||

|

Retained earnings

|

42,096

|

|

288,658

|

|

|||

|

Treasury stock, at cost, 1 and 40,093 shares as of December 29, 2018 and December 30, 2017, respectively

|

(55

|

)

|

(1,659,914

|

)

|

|||

|

Accumulated other comprehensive loss

|

(172,703

|

)

|

(144,731

|

)

|

|||

|

Total equity attributable to common shareholders

|

1,317,332

|

|

1,045,080

|

|

|||

|

Noncontrolling interest

|

2,446

|

|

2,327

|

|

|||

|

Total equity

|

1,319,778

|

|

1,047,407

|

|

|||

|

Total liabilities, redeemable noncontrolling interest and equity

|

$

|

3,855,879

|

|

$

|

2,929,922

|

|

|

|

See Notes to Consolidated Financial Statements.

|

|||||||

|

|

Fiscal Year

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Cash flows relating to operating activities

|

|

|

|

||||||||

|

Net income

|

$

|

228,724

|

|

$

|

125,449

|

|

$

|

156,366

|

|

||

|

Less: Income (loss) from discontinued operations, net of income taxes

|

1,506

|

|

(137

|

)

|

280

|

|

|||||

|

Income from continuing operations, net of income taxes

|

227,218

|

|

125,586

|

|

156,086

|

|

|||||

|

Adjustments to reconcile net income from continuing operations to net cash provided by operating activities:

|

|||||||||||

|

Depreciation and amortization

|

161,779

|

|

131,159

|

|

126,658

|

|

|||||

|

Stock-based compensation

|

47,346

|

|

44,003

|

|

43,642

|

|

|||||

|

Deferred income taxes

|

(9,702

|

)

|

28,254

|

|

1,945

|

|

|||||

|

Gain on venture capital investments

|

(15,928

|

)

|

(22,867

|

)

|

(10,284

|

)

|

|||||

|

Gain on divestiture

|

—

|

|

(10,577

|

)

|

—

|

|

|||||

|

Impairment charges

|

—

|

|

17,239

|

|

6,717

|

|

|||||

|

Other, net

|

15,613

|

|

(666

|

)

|

5,629

|

|

|||||

|

Changes in assets and liabilities:

|

|

|

|

||||||||

|

Trade receivables, net

|

(21,196

|

)

|

(48,279

|

)

|

(52,780

|

)

|

|||||

|

Inventories

|

(13,338

|

)

|

(17,838

|

)

|

(4,021

|

)

|

|||||

|

Accounts payable

|

(12,732

|

)

|

34

|

|

22,076

|

|

|||||

|

Accrued compensation

|

31,616

|

|

3,666

|

|

9,298

|

|

|||||

|

Long-term payable on Transition Tax (Notes 5 and 11)

|

(8,974

|

)

|

61,038

|

|

—

|

|

|||||

|

Deferred revenue

|

36,072

|

|

(8,466

|

)

|

14,580

|

|

|||||

|

Customer contract deposits

|

28,115

|

|

—

|

|

—

|

|

|||||

|

Other assets and liabilities, net

|

(24,749

|

)

|

15,788

|

|

(2,647

|

)

|

|||||

|

Net cash provided by operating activities

|

441,140

|

|

318,074

|

|

316,899

|

|

|||||

|

Cash flows relating to investing activities

|

|

|

|

||||||||

|

Acquisition of businesses and assets, net of cash acquired

|

(824,868

|

)

|

(25,012

|

)

|

(648,482

|

)

|

|||||

|

Capital expenditures

|

(140,054

|

)

|

(82,431

|

)

|

(55,288

|

)

|

|||||

|

Purchases of investments and contributions to venture capital investments

|

(25,125

|

)

|

(46,217

|

)

|

(40,248

|

)

|

|||||

|

Proceeds from sale of investments

|

35,849

|

|

9,128

|

|

47,652

|

|

|||||

|

Proceeds from divestiture

|

—

|

|

72,462

|

|

—

|

|

|||||

|

Other, net

|

(805

|

)

|

(516

|

)

|

3,694

|

|

|||||

|

Net cash used in investing activities

|

(955,003

|

)

|

(72,586

|

)

|

(692,672

|

)

|

|||||

|

Cash flows relating to financing activities

|

|

|

|

||||||||

|

Proceeds from long-term debt and revolving credit facility

|

2,755,028

|

|

236,856

|

|

1,044,666

|

|

|||||

|

Proceeds from exercises of stock options

|

37,657

|

|

38,870

|

|

23,197

|

|

|||||

|

Payments on long-term debt, revolving credit facility, and capital lease obligations

|

(2,201,003

|

)

|

(372,435

|

)

|

(656,636

|

)

|

|||||

|

Payments on debt financing costs

|

(18,337

|

)

|

—

|

|

(3,659

|

)

|

|||||

|

Purchase of treasury stock

|

(13,846

|

)

|

(106,909

|

)

|

(12,267

|

)

|

|||||

|

Other, net

|

(1,440

|

)

|

(4,858

|

)

|

(14,545

|

)

|

|||||

|

Net cash provided by (used in) financing activities

|

558,059

|

|

(208,476

|

)

|

380,756

|

|

|||||

|

Discontinued operations

|

|

|

|

||||||||

|

Net cash used in operating activities from discontinued operations

|

(3,735

|

)

|

(1,809

|

)

|

(2,056

|

)

|

|||||

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash

|

(9,474

|

)

|

11,234

|

|

(2,996

|

)

|

|||||

|

Net change in cash, cash equivalents, and restricted cash

|

30,987

|

|

46,437

|

|

(69

|

)

|

|||||

|

Cash, cash equivalents, and restricted cash, beginning of period

|

166,331

|

|

119,894

|

|

119,963

|

|

|||||

|

Cash, cash equivalents, and restricted cash, end of period

|

$

|

197,318

|

|

$

|

166,331

|

|

$

|

119,894

|

|

||

|

See Notes to Consolidated Financial Statements.

|

|||||||||||

|

|

Fiscal Year

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Supplemental cash flow information:

|

|

|

|

||||||||

|

Cash and cash equivalents

|

$

|

195,442

|

|

$

|

163,794

|

|

$

|

117,626

|

|

||

|

Restricted cash included in Other current assets

|

465

|

|

592

|

|

532

|

|

|||||

|

Restricted cash included in Other assets

|

1,411

|

|

1,945

|

|

1,736

|

|

|||||

|

Cash, cash equivalents, and restricted cash, end of period

|

$

|

197,318

|

|

$

|

166,331

|

|

$

|

119,894

|

|

||

|

Cash paid for income taxes

|

$

|

67,600

|

|

$

|

60,377

|

|

$

|

42,868

|

|

||

|

Cash paid for interest

|

$

|

47,540

|

|

$

|

27,417

|

|

$

|

22,756

|

|

||

|

Non-cash investing and financing activities:

|

|||||||||||

|

Additions to property, plant and equipment, net

|

$

|

18,212

|

|

$

|

38,199

|

|

$

|

5,333

|

|

||

|

Assets acquired under capital lease

|

$

|

1,473

|

|

$

|

722

|

|

|

$

|

1,335

|

|

|

|