|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

|

|

For the fiscal year ended December 31, 2012

|

|

|

Or

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

|

|

For the transition period from _____________ to _____________

|

|

Kentucky

|

61-0979818

|

|

(State or other jurisdiction of incorporation or organization)

|

IRS Employer Identification No.

|

|

346 North Mayo Trail

Pikeville, Kentucky

(address of principal executive offices)

|

41501

(Zip Code)

|

|

Yes

|

No

ü

|

|

Yes

|

No

ü

|

|

Yes

ü

|

No

|

|

Yes

ü

|

No

|

|

Large accelerated filer

|

Accelerated filer

ü

|

Non-accelerated filer

|

Smaller reporting company

|

|

(Do not check if a smaller reporting company)

|

|

Yes

|

No

ü

|

|

Document

|

Form 10-K

|

|

(1) Proxy statement for the annual meeting of shareholders to be held April 23, 2013

|

Part III

|

|

·

|

Broadened the base for FDIC insurance assessments, eliminated the ceiling and increased the size of the floor of the Deposit Insurance Fund, and offset the impact of the minimum floor on institutions with less than $10 billion in assets. Assessments are now based on the average consolidated total assets less tangible equity capital of a financial institution.

|

|

·

|

Removed the federal prohibition on payment of interest on demand deposits, thereby permitting businesses to have interest bearing checking accounts.

|

|

·

|

Require capital regulations which call for higher levels of capital. The same leverage and risk based capital requirements that apply to depository institutions now apply to holding companies. New issuances of trust preferred securities are no longer eligible to qualify as Tier 1 capital. However, CTBI’s currently outstanding trust preferred securities are grandfathered and are still considered in Tier 1 capital under the regulations. Under Dodd-Frank, and previously under Federal Reserve policy, we are required to act as a source of financial strength for our bank subsidiary and to commit sufficient resources to support it.

|

|

·

|

Created an agency, the Consumer Financial Protection Bureau (Bureau), responsible for the implementation of federal consumer protection laws. The Bureau has broad rule-making authority for a wide range of consumer protection laws that apply to all banks, including the authority to prohibit “unfair, deceptive or abusive” acts and practices. The term “abusive” is relatively new and untested, and we cannot predict how it will be interpreted and enforced. Although insured depository institutions with assets of $10 billion or less (such as CTB) will continue to be supervised and examined by their primary federal regulators, rather than the Bureau, with respect to compliance with federal consumer protection laws, any change in regulatory environment may have a negative impact on all financial institutions. In February 2012, the Bureau announced that it was launching an inquiry into industry checking account overdraft programs to determine how these practices are impacting consumers. The full reach and the impact of the Bureau’s inquiries and rulemaking powers on the operations of financial institutions are currently unknown.

|

|

·

|

Permanently increased the maximum amount of deposit insurance for banks, savings institutions and credit unions to $250,000 per depositor, retroactive to January 1, 2008, with noninterest bearing transaction accounts and IOLTA accounts having unlimited deposit insurance through December 31, 2012

. Effective

January 1, 2013, money in noninterest-bearing transaction accounts (including IOLTA/IOLA) no longer receive unlimited deposit insurance coverage from the FDIC, but will be FDIC-insured up to the legal maximum of $250,000 for each ownership category.

|

|

·

|

Increased the authority of the Federal Reserve Board to examine CTBI and its non-bank subsidiaries and gave the Federal Reserve Board the authority to establish rules regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer. Under the final rule, the maximum permissible interchange fee that an issuer may receive for an electronic debit transaction is the sum of 21 cents per transaction and 5 basis points multiplied by the value of the transaction.

|

|

·

|

Restrict proprietary trading by banks, bank holding companies and others, and their acquisition and retention of ownership interests in and sponsorship of hedge funds and private equity funds, subject to an exception allowing a bank to organize and offer hedge funds and private equity funds to customers if certain conditions are met, including, among others, a requirement that the bank limit its ownership interest in any single fund to 3%, and its aggregate investment in all funds to 3%, of Tier 1 capital, with no director or employee of the bank holding an ownership interest in the fund unless he or she provides services directly to the funds.

|

|

·

|

Require publicly traded companies to give stockholders a non-binding vote on executive compensation and so-called “golden parachute” payments in mergers and acquisitions. The legislation also directs the federal banking regulators to issue rules prohibiting incentive compensation that encourages inappropriate risks.

|

|

·

|

Imposed restrictions related to mortgage lending, such as minimum underwriting standards, requiring certain loan provision qualifications, limitations on mortgage terms, and additional disclosures to mortgage borrowers and prohibits certain yield-spread compensation to mortgage originators. Proposed new rules under this requirement have been issued for comment.

|

|

·

|

Permits banks to establish de novo interstate branches at a location where a bank based in that state could establish a branch, and requires banks and bank holding companies to be well-capitalized and well-managed in order to acquire banks outside their home state.

|

|

·

|

Clients may not want, need, or qualify for our products and services;

|

|

·

|

Borrowers may not be able to repay their loans;

|

|

·

|

The value of the collateral securing our loans to borrowers may decline; and

|

|

·

|

The quality of our loan portfolio may decline.

|

|

·

|

The rate of inflation;

|

|

·

|

The rate of economic growth;

|

|

·

|

Employment levels;

|

|

·

|

Monetary policies; and

|

|

·

|

Instability in domestic and foreign financial markets.

|

|

·

|

The length and severity of downturns in the local economies in which we operate or the national economy;

|

|

·

|

The length and severity of downturns in one or more of the business sectors in which our customers operate, particularly the automobile, hotel/motel, coal, and residential development industries; or

|

|

·

|

A rapid increase in interest rates.

|

|

·

|

Commercial Real Estate Loans.

Repayment is dependent on income being generated in amounts sufficient to cover operating expenses and debt service. As of December 31, 2012, commercial real estate loans, including multi-family loans, comprised approximately 36% of our total loan portfolio.

|

|

·

|

Other Commercial Loans.

Repayment is generally dependent upon the successful operation of the borrower’s business. In addition, the collateral securing the loans may depreciate over time, be difficult to appraise, be illiquid, or fluctuate in value based on the success of the business. As of December 31, 2012, other commercial loans comprised approximately 15% of our total loan portfolio.

|

|

·

|

Construction and Development Loans.

The risk of loss is largely dependent on our initial estimate of whether the property’s value at completion equals or exceeds the cost of property construction and the availability of take-out financing. During the construction phase, a number of factors can result in delays or cost overruns. If our estimate is inaccurate or if actual construction costs exceed estimates, the value of the property securing our loan may be insufficient to ensure full repayment when completed through a permanent loan, sale of the property, or by seizure of collateral. As of December 31, 2012, construction and development loans comprised approximately 7% of our total loan portfolio.

|

|

·

|

Safety and soundness guidelines;

|

|

·

|

Compliance with all laws including the USA Patriot Act, the International Money Laundering Abatement and Anti-Terrorist Financing Act, the Sarbanes-Oxley Act and the related rules and regulations promulgated under such Act or the Exchange Act, the Equal Credit Opportunity Act, the Fair Housing Act, the Community Reinvestment Act, the Home Mortgage Disclosure Act, and all other applicable fair lending laws and other laws relating to discriminatory business practices; and

|

|

·

|

Anti-competitive concerns with the proposed transaction.

|

|

·

|

Actual or anticipated variations in earnings;

|

|

·

|

Changes in analysts' recommendations or projections;

|

|

·

|

CTBI's announcements of developments related to our businesses;

|

|

·

|

Operating and stock performance of other companies deemed to be peers;

|

|

·

|

New technology used or services offered by traditional and non-traditional competitors;

|

|

·

|

News reports of trends, concerns, and other issues related to the financial services industry; and

|

|

·

|

Additional governmental policies and enforcement of current laws.

|

|

2012

|

2011

|

2010

|

||||||||||||||||||||||||||||||||||

|

(in thousands)

|

Average

Balances

|

Interest

|

Average

Rate

|

Average

Balances

|

Interest

|

Average

Rate

|

Average

Balances

|

Interest

|

Average

Rate

|

|||||||||||||||||||||||||||

|

Earning assets:

|

||||||||||||||||||||||||||||||||||||

|

Loans (1)(2)(3)

|

$ | 2,549,459 | $ | 138,172 | 5.42 | % | $ | 2,580,351 | $ | 145,178 | 5.63 | % | $ | 2,461,225 | $ | 142,519 | 5.79 | % | ||||||||||||||||||

|

Loans held for sale

|

1,434 | 198 | 13.81 | 749 | 112 | 14.95 | 1,040 | 111 | 10.67 | |||||||||||||||||||||||||||

|

Securities:

|

||||||||||||||||||||||||||||||||||||

|

U.S. Treasury and agencies

|

480,562 | 10,292 | 2.14 | 350,612 | 8,992 | 2.56 | 249,835 | 7,983 | 3.20 | |||||||||||||||||||||||||||

|

Tax exempt state and political subdivisions (3)

|

69,773 | 3,191 | 4.57 | 51,565 | 2,634 | 5.11 | 43,128 | 2,456 | 5.69 | |||||||||||||||||||||||||||

|

Other securities

|

54,664 | 1,717 | 3.14 | 30,492 | 1,141 | 3.74 | 36,927 | 951 | 2.58 | |||||||||||||||||||||||||||

|

Federal Reserve Bank and Federal Home Loan Bank stock

|

30,557 | 1,433 | 4.69 | 30,412 | 1,374 | 4.52 | 29,183 | 1,351 | 4.63 | |||||||||||||||||||||||||||

|

Federal funds sold

|

3,372 | 11 | 0.33 | 31,000 | 84 | 0.27 | 89,598 | 234 | 0.26 | |||||||||||||||||||||||||||

|

Interest bearing deposits

|

155,233 | 379 | 0.24 | 132,269 | 315 | 0.24 | 37,989 | 85 | 0.22 | |||||||||||||||||||||||||||

|

Other investments

|

10,229 | 91 | 0.89 | 12,342 | 87 | 0.70 | 11,190 | 77 | 0.69 | |||||||||||||||||||||||||||

|

Investment in unconsolidated subsidiaries

|

1,851 | 72 | 3.89 | 1,856 | 120 | 6.47 | 1,856 | 120 | 6.47 | |||||||||||||||||||||||||||

|

Total earning assets

|

3,357,134 | $ | 155,556 | 4.63 | % | 3,221,648 | $ | 160,037 | 4.97 | % | 2,961,971 | $ | 155,887 | 5.26 | % | |||||||||||||||||||||

|

Allowance for loan and lease losses

|

(33,781 | ) | (35,808 | ) | (35,741 | ) | ||||||||||||||||||||||||||||||

| 3,323,353 | 3,185,840 | 2,926,230 | ||||||||||||||||||||||||||||||||||

|

Nonearning assets:

|

||||||||||||||||||||||||||||||||||||

|

Cash and due from banks

|

62,807 | 70,239 | 66,740 | |||||||||||||||||||||||||||||||||

|

Premises and equipment, net

|

54,962 | 55,445 | 49,468 | |||||||||||||||||||||||||||||||||

|

Other assets

|

200,538 | 194,379 | 177,649 | |||||||||||||||||||||||||||||||||

|

Total assets

|

$ | 3,641,660 | $ | 3,505,903 | $ | 3,220,087 | ||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||||||

| (in thousands) | Average Balances | Interest |

Average

Rate

|

Average Balances | Interest | Average Rate | Average Balances | Interest | Average Rate | |||||||||||||||||||||||||||

|

Interest bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||||||||||||||

|

Savings and demand deposits

|

$ | 878,825 | $ | 2,894 | 0.33 | % | $ | 777,639 | $ | 2,824 | 0.36 | % | $ | 668,255 | $ | 3,074 | 0.46 | % | ||||||||||||||||||

|

Time deposits

|

1,445,018 | 15,017 | 1.04 | 1,460,627 | 18,458 | 1.26 | 1,392,510 | 26,078 | 1.87 | |||||||||||||||||||||||||||

|

Repurchase agreements and federal funds purchased

|

222,872 | 1,240 | 0.56 | 219,040 | 1,625 | 0.74 | 198,880 | 2,027 | 1.02 | |||||||||||||||||||||||||||

|

Advances from Federal Home Loan Bank

|

2,439 | 34 | 1.39 | 21,670 | 99 | 0.46 | 20,286 | 79 | 0.39 | |||||||||||||||||||||||||||

|

Long-term debt

|

61,341 | 2,403 | 3.92 | 61,341 | 3,999 | 6.52 | 61,341 | 3,999 | 6.52 | |||||||||||||||||||||||||||

|

Total interest bearing liabilities

|

2,610,495 | $ | 21,588 | 0.83 | % | 2,540,317 | $ | 27,005 | 1.06 | % | 2,341,272 | $ | 35,257 | 1.51 | % | |||||||||||||||||||||

|

Noninterest bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

Demand deposits

|

604,736 | 573,067 | 514,196 | |||||||||||||||||||||||||||||||||

|

Other liabilities

|

37,052 | 36,746 | 30,974 | |||||||||||||||||||||||||||||||||

|

Total liabilities

|

3,252,283 | 3,150,130 | 2,886,442 | |||||||||||||||||||||||||||||||||

|

Shareholders’ equity

|

389,377 | 355,773 | 333,645 | |||||||||||||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$ | 3,641,660 | $ | 3,505,903 | $ | 3,220,087 | ||||||||||||||||||||||||||||||

|

Net interest income, tax equivalent

|

$ | 133,968 | $ | 133,032 | $ | 120,630 | ||||||||||||||||||||||||||||||

|

Less tax equivalent interest income

|

1,834 | 1,577 | 1,376 | |||||||||||||||||||||||||||||||||

|

Net interest income

|

$ | 132,134 | $ | 131,455 | $ | 119,254 | ||||||||||||||||||||||||||||||

|

Net interest spread

|

3.80 | % | 3.91 | % | 3.75 | % | ||||||||||||||||||||||||||||||

|

Benefit of interest free funding

|

0.19 | 0.22 | 0.32 | |||||||||||||||||||||||||||||||||

|

Net interest margin

|

3.99 | % | 4.13 | % | 4.07 | % | ||||||||||||||||||||||||||||||

|

Total Change

|

Change Due to

|

Total Change

|

Change Due to

|

|||||||||||||||||||||

|

(in thousands)

|

2012/2011 |

Volume

|

Rate

|

2011/2010 |

Volume

|

Rate

|

||||||||||||||||||

|

Interest income:

|

||||||||||||||||||||||||

|

Loans

|

$ | (7,006 | ) | $ | (1,754 | ) | $ | (5,252 | ) | $ | 2,659 | $ | 6,775 | $ | (4,116 | ) | ||||||||

|

Loans held for sale

|

86 | 95 | (9 | ) | 1 | (26 | ) | 27 | ||||||||||||||||

|

U.S. Treasury and agencies

|

1,300 | 2,952 | (1,652 | ) | 1,009 | 2,793 | (1,784 | ) | ||||||||||||||||

|

Tax exempt state and political subdivisions

|

557 | 855 | (298 | ) | 178 | 448 | (270 | ) | ||||||||||||||||

|

Other securities

|

576 | 784 | (208 | ) | 190 | (145 | ) | 335 | ||||||||||||||||

|

Federal Reserve Bank and Federal Home Loan Bank stock

|

59 | 7 | 52 | 23 | 56 | (33 | ) | |||||||||||||||||

|

Federal funds sold

|

(73 | ) | (62 | ) | (11 | ) | (150 | ) | (148 | ) | (2 | ) | ||||||||||||

|

Interest bearing deposits

|

64 | 56 | 8 | 230 | 224 | 6 | ||||||||||||||||||

|

Other investments

|

4 | (13 | ) | 17 | 10 | 8 | 2 | |||||||||||||||||

|

Investment in unconsolidated subsidiaries

|

(48 | ) | 0 | (48 | ) | 0 | 0 | 0 | ||||||||||||||||

|

Total interest income

|

(4,481 | ) | 2,920 | (7,401 | ) | 4,150 | 9,985 | (5,835 | ) | |||||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

Savings and demand deposits

|

70 | 348 | (278 | ) | (250 | ) | 457 | (707 | ) | |||||||||||||||

|

Time deposits

|

(3,441 | ) | (199 | ) | (3,242 | ) | (7,620 | ) | 1,221 | (8,841 | ) | |||||||||||||

|

Repurchase agreements and federal funds purchased

|

(385 | ) | 28 | (413 | ) | (402 | ) | 190 | (592 | ) | ||||||||||||||

|

Advances from Federal Home Loan Bank

|

(65 | ) | (33 | ) | (32 | ) | 20 | 6 | 14 | |||||||||||||||

|

Long-term debt

|

(1,596 | ) | 0 | (1,596 | ) | 0 | 0 | 0 | ||||||||||||||||

|

Total interest expense

|

(5,417 | ) | 144 | (5,561 | ) | (8,252 | ) | 1,874 | (10,126 | ) | ||||||||||||||

|

Net interest income

|

$ | 936 | $ | 2,776 | $ | (1,840 | ) | $ | 12,402 | $ | 8,111 | $ | 4,291 | |||||||||||

|

Estimated Maturity at December 31, 2012

|

||||||||||||||||||||||||||||||||||||||||||||

|

Within 1 Year

|

1-5 Years

|

5-10 Years

|

After 10 Years

|

Total Fair Value

|

Amortized Cost

|

|||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

|||||||||||||||||||||||||||||||||

|

U.S. Treasury, government agencies, and government sponsored agency mortgage-backed securities

|

$ | 517 | 0.99 | % | $ | 22,504 | 2.71 | % | $ | 97,933 | 2.14 | % | $ | 323,542 | 2.39 | % | $ | 444,496 | 2.35 | % | $ | 430,871 | ||||||||||||||||||||||

|

State and political subdivisions

|

5,968 | 5.17 | 15,501 | 3.53 | 53,826 | 4.03 | 37,926 | 4.52 | 113,221 | 4.18 | 107,987 | |||||||||||||||||||||||||||||||||

|

Other securities

|

0 | 0.00 | 45,626 | 3.38 | 0 | 0.00 | 0 | 0.00 | 45,626 | 3.38 | 45,000 | |||||||||||||||||||||||||||||||||

|

Total

|

$ | 6,485 | 4.84 | % | $ | 83,631 | 3.23 | % | $ | 151,759 | 2.81 | % | $ | 361,468 | 2.61 | % | $ | 603,343 | 2.77 | % | $ | 583,858 | ||||||||||||||||||||||

|

Estimated Maturity at December 31, 2012

|

||||||||||||||||||||||||||||||||||||||||||||

|

Within 1 Year

|

1-5 Years

|

5-10 Years

|

After 10 Years

|

Total

Amortized Cost

|

Fair

Value

|

|||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

|||||||||||||||||||||||||||||||||

|

U.S. Treasury, government agencies, and government sponsored agency mortgage-backed securities

|

$ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 480 | 2.48 | % | $ | 480 | 2.48 | % | $ | 476 | ||||||||||||||||||||||

|

State and political subdivisions

|

0 | 0.00 | 0 | 0.00 | 1,182 | 4.30 | 0 | 0.00 | 1,182 | 4.30 | 1,183 | |||||||||||||||||||||||||||||||||

|

Total

|

$ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 1,182 | 4.30 | % | $ | 480 | 2.48 | % | $ | 1,662 | 3.78 | % | $ | 1,659 | ||||||||||||||||||||||

|

Estimated Maturity at December 31, 2012

|

||||||||||||||||||||||||||||||||||||||||||||

|

Within 1 Year

|

1-5 Years

|

5-10 Years

|

After 10 Years

|

Total

Book Value

|

Fair

Value

|

|||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

Yield

|

Amount

|

|||||||||||||||||||||||||||||||||

|

Total

|

$ | 6,485 | 4.84 | % | $ | 83,631 | 3.23 | % | $ | 152,941 | 2.82 | % | $ | 361,948 | 2.61 | % | $ | 605,005 | 2.77 | % | $ | 605,002 | ||||||||||||||||||||||

|

(in thousands)

|

Available-for-Sale

|

Held-to-Maturity

|

||||||

|

U.S. Treasury and government agencies

|

$ | 29,154 | $ | 480 | ||||

|

State and political subdivisions

|

52,017 | 1,182 | ||||||

|

U.S. government sponsored agency mortgage-backed securities

|

230,905 | 0 | ||||||

|

Total debt securities

|

312,076 | 1,662 | ||||||

|

Marketable equity securities

|

20,582 | 0 | ||||||

|

Total securities

|

$ | 332,658 | $ | 1,662 | ||||

|

(in thousands)

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

Commercial:

|

||||||||||||||||||||

|

Construction

|

$ | 119,447 | $ | 120,577 | $ | 135,091 | $ | 141,440 | $ | 156,425 | ||||||||||

|

Secured by real estate

|

807,213 | 798,887 | 807,049 | 707,500 | 663,663 | |||||||||||||||

|

Equipment lease financing

|

9,246 | 9,706 | 14,151 | 20,048 | 12,343 | |||||||||||||||

|

Commercial other

|

376,348 | 374,597 | 388,746 | 373,829 | 365,685 | |||||||||||||||

|

Total commercial

|

1,312,254 | 1,303,767 | 1,345,037 | 1,242,817 | 1,198,116 | |||||||||||||||

|

Residential:

|

||||||||||||||||||||

|

Real estate construction

|

55,041 | 53,534 | 56,910 | 51,311 | 56,298 | |||||||||||||||

|

Real estate mortgage

|

696,928 | 650,075 | 623,851 | 528,592 | 524,827 | |||||||||||||||

|

Home equity

|

82,292 | 84,841 | 85,103 | 82,135 | 84,567 | |||||||||||||||

|

Total residential

|

834,261 | 788,450 | 765,864 | 662,038 | 665,692 | |||||||||||||||

|

Consumer:

|

||||||||||||||||||||

|

Consumer direct

|

122,581 | 123,949 | 126,046 | 115,555 | 117,186 | |||||||||||||||

|

Consumer indirect

|

281,477 | 340,382 | 368,233 | 415,350 | 367,657 | |||||||||||||||

|

Total consumer

|

404,058 | 464,331 | 494,279 | 530,905 | 484,843 | |||||||||||||||

|

Total loans

|

$ | 2,550,573 | $ | 2,556,548 | $ | 2,605,180 | $ | 2,435,760 | $ | 2,348,651 | ||||||||||

|

Percent of total year-end loans

|

||||||||||||||||||||

|

Commercial:

|

||||||||||||||||||||

|

Construction

|

4.68 | % | 4.72 | % | 5.19 | % | 5.80 | % | 6.65 | % | ||||||||||

|

Secured by real estate

|

31.65 | 31.25 | 30.98 | 29.05 | 28.26 | |||||||||||||||

|

Equipment lease financing

|

0.36 | 0.38 | 0.54 | 0.82 | 0.53 | |||||||||||||||

|

Commercial other

|

14.76 | 14.65 | 14.92 | 15.35 | 15.57 | |||||||||||||||

|

Total commercial

|

51.45 | 51.00 | 51.63 | 51.02 | 51.01 | |||||||||||||||

|

Residential:

|

||||||||||||||||||||

|

Real estate construction

|

2.16 | 2.09 | 2.18 | 2.11 | 2.40 | |||||||||||||||

|

Real estate mortgage

|

27.32 | 25.43 | 23.95 | 21.70 | 22.35 | |||||||||||||||

|

Home equity

|

3.23 | 3.32 | 3.27 | 3.37 | 3.60 | |||||||||||||||

|

Total residential

|

32.71 | 30.84 | 29.40 | 27.18 | 28.35 | |||||||||||||||

|

Consumer:

|

||||||||||||||||||||

|

Consumer direct

|

4.80 | 4.85 | 4.84 | 4.74 | 4.99 | |||||||||||||||

|

Consumer indirect

|

11.04 | 13.31 | 14.13 | 17.06 | 15.65 | |||||||||||||||

|

Total consumer

|

15.84 | 18.16 | 18.97 | 21.80 | 20.64 | |||||||||||||||

|

Total loans

|

100.00 | % | 100.00 | % | 100.00 | % | 100.00 | % | 100.00 | % | ||||||||||

|

Maturity at December 31, 2012

|

||||||||||||||||

|

(in thousands)

|

Within One Year

|

After One but Within Five Years

|

After Five Years

|

Total

|

||||||||||||

|

Commercial secured by real estate and commercial other

|

$ | 236,194 | $ | 232,935 | $ | 714,432 | $ | 1,183,561 | ||||||||

|

Commercial and real estate construction

|

92,995 | 22,136 | 59,357 | 174,488 | ||||||||||||

| $ | 329,189 | $ | 255,071 | $ | 773,789 | $ | 1,358,049 | |||||||||

|

Rate sensitivity:

|

||||||||||||||||

|

Fixed rate

|

$ | 69,997 | $ | 49,044 | $ | 103,689 | $ | 222,730 | ||||||||

|

Adjustable rate

|

259,192 | 206,027 | 670,100 | 1,135,319 | ||||||||||||

| $ | 329,189 | $ | 255,071 | $ | 773,789 | $ | 1,358,049 | |||||||||

|

(in thousands)

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

Nonaccrual loans

|

$ | 16,791 | $ | 25,753 | $ | 45,021 | $ | 32,247 | $ | 40,945 | ||||||||||

|

90 days or more past due and still accruing interest

|

19,215 | 11,515 | 17,014 | 9,067 | 11,245 | |||||||||||||||

|

Total nonperforming loans

|

36,006 | 37,268 | 62,035 | 41,314 | 52,190 | |||||||||||||||

|

Other repossessed assets

|

5 | 58 | 129 | 276 | 239 | |||||||||||||||

|

Foreclosed properties

|

46,986 | 56,545 | 42,935 | 37,333 | 10,425 | |||||||||||||||

|

Total nonperforming assets

|

$ | 82,997 | $ | 93,871 | $ | 105,099 | $ | 78,923 | $ | 62,854 | ||||||||||

|

Nonperforming assets to total loans and foreclosed properties

|

3.20 | % | 3.59 | % | 3.97 | % | 3.19 | % | 2.66 | % | ||||||||||

|

Allowance to nonperforming loans

|

92.33 | % | 89.01 | % | 56.10 | % | 79.01 | % | 59.06 | % | ||||||||||

|

(in thousands)

|

Nonaccrual loans

|

As a % of Loan Balances by Category

|

Accruing Loans Past Due 90 Days or More

|

As a % of Loan Balances by Category

|

Balances

|

|||||||||||||||

|

December 31, 2012

|

||||||||||||||||||||

|

Commercial construction

|

$ | 5,955 | 4.99 | % | $ | 3,778 | 3.16 | % | $ | 119,447 | ||||||||||

|

Commercial secured by real estate

|

5,572 | 0.69 | 5,943 | 0.74 | 807,213 | |||||||||||||||

|

Equipment lease financing

|

0 | 0.00 | 0 | 0.00 | 9,246 | |||||||||||||||

|

Commercial other

|

1,655 | 0.44 | 3,867 | 1.03 | 376,348 | |||||||||||||||

|

Real estate construction

|

315 | 0.57 | 196 | 0.36 | 55,041 | |||||||||||||||

|

Real estate mortgage

|

3,153 | 0.45 | 4,511 | 0.65 | 696,928 | |||||||||||||||

|

Home equity

|

141 | 0.17 | 441 | 0.54 | 82,292 | |||||||||||||||

|

Consumer direct

|

0 | 0.00 | 98 | 0.08 | 122,581 | |||||||||||||||

|

Consumer indirect

|

0 | 0.00 | 381 | 0.14 | 281,477 | |||||||||||||||

|

Total

|

$ | 16,791 | 0.66 | % | $ | 19,215 | 0.75 | % | $ | 2,550,573 | ||||||||||

|

December 31, 2011

|

||||||||||||||||||||

|

Commercial construction

|

$ | 7,029 | 5.83 | % | $ | 3,292 | 2.73 | % | $ | 120,577 | ||||||||||

|

Commercial secured by real estate

|

9,810 | 1.23 | 3,969 | 0.50 | 798,887 | |||||||||||||||

|

Equipment lease financing

|

0 | 0.00 | 0 | 0.00 | 9,706 | |||||||||||||||

|

Commercial other

|

3,914 | 1.04 | 619 | 0.17 | 374,597 | |||||||||||||||

|

Real estate construction

|

607 | 1.13 | 16 | 0.03 | 53,534 | |||||||||||||||

|

Real estate mortgage

|

4,204 | 0.65 | 2,719 | 0.42 | 650,075 | |||||||||||||||

|

Home equity

|

189 | 0.22 | 346 | 0.41 | 84,841 | |||||||||||||||

|

Consumer direct

|

0 | 0.00 | 71 | 0.06 | 123,949 | |||||||||||||||

|

Consumer indirect

|

0 | 0.00 | 483 | 0.14 | 340,382 | |||||||||||||||

|

Total

|

$ | 25,753 | 1.01 | % | $ | 11,515 | 0.45 | % | $ | 2,556,548 | ||||||||||

|

(in thousands)

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

Allowance for loan and lease losses, beginning of year

|

$ | 33,171 | $ | 34,805 | $ | 32,643 | $ | 30,821 | $ | 28,054 | ||||||||||

|

Loans charged off:

|

||||||||||||||||||||

|

Commercial construction

|

1,034 | 2,510 | 1,695 | 3,435 | 1,491 | |||||||||||||||

|

Commercial secured by real estate

|

2,035 | 4,018 | 3,826 | 3,192 | 914 | |||||||||||||||

|

Commercial other

|

3,233 | 4,092 | 5,184 | 4,342 | 2,080 | |||||||||||||||

|

Real estate construction

|

189 | 319 | 22 | 330 | 125 | |||||||||||||||

|

Real estate mortgage

|

1,123 | 1,589 | 684 | 858 | 458 | |||||||||||||||

|

Home equity

|

248 | 171 | 358 | 223 | 288 | |||||||||||||||

|

Consumer direct

|

1,245 | 961 | 1,256 | 1,892 | 1,891 | |||||||||||||||

|

Consumer indirect

|

3,483 | 3,874 | 4,611 | 4,587 | 4,051 | |||||||||||||||

|

Total charge-offs

|

12,590 | 17,534 | 17,636 | 18,859 | 11,298 | |||||||||||||||

|

Recoveries of loans previously charged off:

|

||||||||||||||||||||

|

Commercial construction

|

35 | 30 | 6 | 204 | 25 | |||||||||||||||

|

Commercial secured by real estate

|

303 | 140 | 163 | 415 | 177 | |||||||||||||||

|

Commercial other

|

764 | 441 | 688 | 350 | 534 | |||||||||||||||

|

Real estate construction

|

28 | 26 | 19 | 7 | 5 | |||||||||||||||

|

Real estate mortgage

|

151 | 82 | 99 | 132 | 50 | |||||||||||||||

|

Home equity

|

11 | 16 | 23 | 18 | 10 | |||||||||||||||

|

Consumer direct

|

538 | 452 | 635 | 792 | 654 | |||||||||||||||

|

Consumer indirect

|

1,384 | 1,451 | 1,681 | 1,295 | 1,158 | |||||||||||||||

|

Total recoveries

|

3,214 | 2,638 | 3,314 | 3,213 | 2,613 | |||||||||||||||

|

Net charge-offs:

|

||||||||||||||||||||

|

Commercial construction

|

999 | 2,480 | 1,689 | 3,231 | 1,466 | |||||||||||||||

|

Commercial secured by real estate

|

1,732 | 3,878 | 3,663 | 2,777 | 737 | |||||||||||||||

|

Commercial other

|

2,469 | 3,651 | 4,496 | 3,992 | 1,546 | |||||||||||||||

|

Real estate construction

|

161 | 293 | 3 | 323 | 120 | |||||||||||||||

|

Real estate mortgage

|

972 | 1,507 | 585 | 726 | 408 | |||||||||||||||

|

Home equity

|

237 | 155 | 335 | 205 | 278 | |||||||||||||||

|

Consumer direct

|

707 | 509 | 621 | 1,100 | 1,237 | |||||||||||||||

|

Consumer indirect

|

2,099 | 2,423 | 2,930 | 3,292 | 2,893 | |||||||||||||||

|

Total net charge-offs

|

9,376 | 14,896 | 14,322 | 15,646 | 8,685 | |||||||||||||||

|

Provisions charged against operations

|

9,450 | 13,262 | 16,484 | 17,468 | 11,452 | |||||||||||||||

|

Balance, end of year

|

$ | 33,245 | $ | 33,171 | $ | 34,805 | $ | 32,643 | $ | 30,821 | ||||||||||

|

Allocation of allowance, end of year:

|

||||||||||||||||||||

|

Commercial construction

|

$ | 4,033 | $ | 4,023 | $ | 4,332 | $ | 3,381 | $ | 3,645 | ||||||||||

|

Commercial secured by real estate

|

13,541 | 11,753 | 12,327 | 10,961 | 11,304 | |||||||||||||||

|

Equipment lease financing

|

126 | 112 | 148 | 221 | 191 | |||||||||||||||

|

Commercial other

|

5,469 | 5,608 | 7,392 | 7,472 | 5,782 | |||||||||||||||

|

Real estate construction

|

376 | 354 | 271 | 291 | 281 | |||||||||||||||

|

Real estate mortgage

|

4,767 | 4,302 | 2,982 | 3,041 | 2,616 | |||||||||||||||

|

Home equity

|

563 | 562 | 407 | 455 | 422 | |||||||||||||||

|

Consumer direct

|

1,102 | 917 | 1,169 | 1,258 | 1,590 | |||||||||||||||

|

Consumer indirect

|

3,268 | 5,540 | 5,777 | 5,563 | 4,990 | |||||||||||||||

|

Balance, end of year

|

$ | 33,245 | $ | 33,171 | $ | 34,805 | $ | 32,643 | $ | 30,821 | ||||||||||

| (in thousands) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

|

Average loans outstanding, net of deferred loan costs and fees

|

$ | 2,549,459 | $ | 2,580,351 | $ | 2,461,225 | $ | 2,383,875 | $ | 2,283,180 | ||||||||||

|

Loans outstanding at end of year, net of deferred loan costs and fees

|

$ | 2,550,573 | $ | 2,556,548 | $ | 2,605,180 | $ | 2,435,760 | $ | 2,348,651 | ||||||||||

|

Net charge-offs to average loan type:

|

||||||||||||||||||||

|

Commercial construction

|

0.86 | % | 1.93 | % | 1.20 | % | 2.22 | % | 0.98 | % | ||||||||||

|

Commercial secured by real estate

|

0.21 | 0.48 | 0.48 | 0.40 | 0.11 | |||||||||||||||

|

Commercial other

|

0.64 | 0.95 | 1.24 | 1.07 | 0.43 | |||||||||||||||

|

Real estate construction

|

0.30 | 0.58 | 0.01 | 0.64 | 0.19 | |||||||||||||||

|

Real estate mortgage

|

0.15 | 0.24 | 0.11 | 0.14 | 0.08 | |||||||||||||||

|

Home equity

|

0.28 | 0.18 | 0.40 | 0.25 | 0.33 | |||||||||||||||

|

Consumer direct

|

0.57 | 0.41 | 0.53 | 0.95 | 1.04 | |||||||||||||||

|

Consumer indirect

|

0.67 | 0.68 | 0.75 | 0.84 | 0.87 | |||||||||||||||

|

Total

|

0.37 | % | 0.58 | % | 0.58 | % | 0.66 | % | 0.38 | % | ||||||||||

|

Other ratios:

|

||||||||||||||||||||

|

Allowance to net loans, end of year

|

1.30 | % | 1.30 | % | 1.34 | % | 1.34 | % | 1.31 | % | ||||||||||

|

Provision for loan losses to average loans

|

0.37 | % | 0.51 | % | 0.67 | % | 0.73 | % | 0.50 | % | ||||||||||

|

(in thousands)

|

2012

|

2011

|

2010

|

|||||||||

|

Deposits:

|

||||||||||||

|

Noninterest bearing deposits

|

$ | 604,736 | $ | 573,067 | $ | 514,196 | ||||||

|

NOW accounts

|

23,678 | 21,622 | 20,919 | |||||||||

|

Money market accounts

|

568,217 | 500,179 | 422,329 | |||||||||

|

Savings accounts

|

286,930 | 255,838 | 225,007 | |||||||||

|

Certificates of deposit of $100,000 or more

|

648,035 | 632,961 | 576,382 | |||||||||

|

Certificates of deposit < $100,000 and other time deposits

|

796,983 | 827,666 | 816,128 | |||||||||

|

Total deposits

|

2,928,579 | 2,811,333 | 2,574,961 | |||||||||

|

Other borrowed funds:

|

||||||||||||

|

Repurchase agreements and federal funds purchased

|

222,872 | 219,040 | 198,880 | |||||||||

|

Advances from Federal Home Loan Bank

|

2,439 | 21,670 | 20,286 | |||||||||

|

Long-term debt

|

61,341 | 61,341 | 61,341 | |||||||||

|

Total other borrowed funds

|

286,652 | 302,051 | 280,507 | |||||||||

|

Total deposits and other borrowed funds

|

$ | 3,215,231 | $ | 3,113,384 | $ | 2,855,468 | ||||||

|

(in thousands)

|

Certificates of Deposit

|

Other Time Deposits

|

Total

|

|||||||||

|

Three months or less

|

$ | 146,910 | $ | 10,026 | $ | 156,936 | ||||||

|

Over three through six months

|

110,335 | 8,524 | 118,859 | |||||||||

|

Over six through twelve months

|

306,877 | 17,033 | 323,910 | |||||||||

|

Over twelve through sixty months

|

79,507 | 13,455 | 92,962 | |||||||||

|

Over sixty months

|

0 | 0 | 0 | |||||||||

| $ | 643,629 | $ | 49,038 | $ | 692,667 | |||||||

|

Location

|

Owned

|

Leased

|

Total

|

||

|

Banking locations:

|

|||||

|

Community Trust Bank, Inc.

|

|||||

|

*

|

Pikeville Market (lease land to 3 owned locations)

|

9

|

1

|

10

|

|

|

10 locations in Pike County, Kentucky

|

|||||

|

Floyd/Knott/Johnson Market (lease land to 1 owned location)

|

3

|

1

|

4

|

||

|

2 locations in Floyd County, Kentucky, 1 location in Knott County, Kentucky, and 1 location in Johnson County, Kentucky

|

|||||

|

Tug Valley Market (lease land to 1 owned location)

|

2

|

0

|

2

|

||

|

1 location in Pike County, Kentucky, 1 location in Mingo County, West Virginia

|

|||||

|

Whitesburg Market (lease land to 1 owned location)

|

4

|

1

|

5

|

||

|

5 locations in Letcher County, Kentucky

|

|||||

|

Hazard Market (lease land to 2 owned locations)

|

4

|

0

|

4

|

||

|

4 locations in Perry County, Kentucky

|

|||||

|

*

|

Lexington Market (lease land to 3 owned locations)

|

4

|

2

|

6

|

|

|

6 locations in Fayette County, Kentucky

|

|||||

|

Winchester Market

|

2

|

0

|

2

|

||

|

2 locations in Clark County, Kentucky

|

|||||

|

Richmond Market (lease land to 1 owned location)

|

3

|

0

|

3

|

||

|

3 locations in Madison County, Kentucky

|

|||||

|

Mt. Sterling Market

|

2

|

0

|

2

|

||

|

2 locations in Montgomery County, Kentucky

|

|||||

|

*

|

Versailles Market (lease land to 1 owned locations)

|

2

|

3

|

5

|

|

|

2 locations in Woodford County, Kentucky, 2 locations in Franklin County, Kentucky, and 1 location in Scott County, Kentucky

|

|||||

|

Danville Market (lease land to 1 owned location)

|

3

|

0

|

3

|

||

|

2 locations in Boyle County, Kentucky and 1 location in Mercer County, Kentucky

|

|||||

|

*

|

Ashland Market (lease land to 1 owned location)

|

5

|

0

|

5

|

|

|

4 locations in Boyd County, Kentucky and 1 location in Greenup County, Kentucky

|

|||||

|

Flemingsburg Market

|

3

|

0

|

3

|

||

|

3 locations in Fleming County, Kentucky

|

|||||

|

Advantage Valley Market

|

3

|

1

|

4

|

||

|

2 locations in Lincoln County, West Virginia, 1 location in Wayne County, West Virginia, and 1 location in Cabell County, West Virginia

|

|||||

|

Summersville Market

|

1

|

0

|

1

|

||

|

1 location in Nicholas County, West Virginia

|

|||||

|

Middlesboro Market (lease land to 1 owned location)

|

3

|

0

|

3

|

||

|

3 locations in Bell County, Kentucky

|

|||||

|

Williamsburg Market

|

5

|

0

|

5

|

||

|

2 locations in Whitley County, Kentucky and 3 locations in Laurel County, Kentucky

|

|||||

|

Campbellsville Market (lease land to 2 owned locations)

|

8

|

0

|

8

|

||

|

2 locations in Taylor County, Kentucky, 2 locations in Pulaski County, Kentucky, 1 location in Adair County, Kentucky, 1 location in Green County, Kentucky, 1 location in Russell County, Kentucky, and 1 location in Marion County, Kentucky

|

|||||

|

Mt. Vernon Market

|

2

|

0

|

2

|

||

|

2 locations in Rockcastle County, Kentucky

|

|||||

|

*

|

LaFollette Market

|

3

|

1

|

4

|

|

|

3 locations in Campbell County, Tennessee and 1 location in Anderson County, Tennessee

|

|||||

|

Total banking locations

|

71

|

10

|

81

|

||

|

Operational locations:

|

|||||

|

Community Trust Bank, Inc.

|

|||||

|

Pikeville (Pike County, Kentucky) (lease land to 1 owned location)

|

1

|

0

|

1

|

||

|

Lexington (Fayette County, Kentucky)

|

0

|

1

|

1

|

||

|

Total operational locations

|

1

|

1

|

2

|

||

|

Total locations

|

72

|

11

|

83

|

||

|

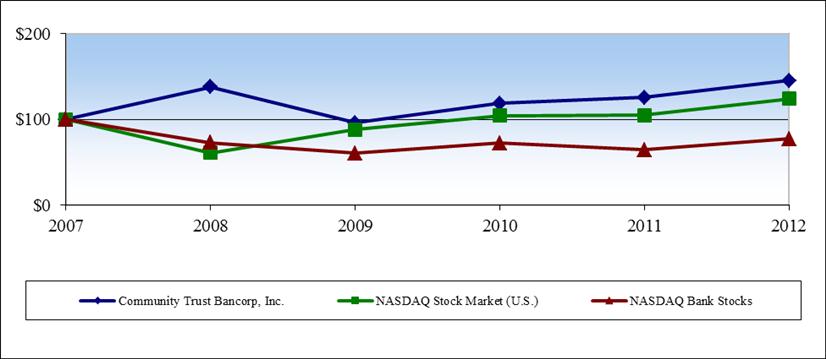

Fiscal Year Ending December 31 ($)

|

||||||

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

|

|

Community Trust Bancorp, Inc.

|

100.00

|

137.74

|

96.14

|

118.63

|

125.55

|

145.22

|

|

NASDAQ Stock Market (U.S.)

|

100.00

|

61.17

|

87.93

|

104.13

|

104.69

|

123.85

|

|

NASDAQ Bank Stocks

|

100.00

|

72.91

|

60.66

|

72.13

|

64.51

|

77.18

|

|

Year Ended December 31

|

2012

|

2011

|

2010

|

2009

|

2008

|

|||||||||||||||

|

Interest income

|

$ | 153,722 | $ | 158,460 | $ | 154,511 | $ | 153,050 | $ | 167,611 | ||||||||||

|

Interest expense

|

21,588 | 27,005 | 35,257 | 47,540 | 63,974 | |||||||||||||||

|

Net interest income

|

132,134 | 131,455 | 119,254 | 105,510 | 103,637 | |||||||||||||||

|

Provision for loan losses

|

9,450 | 13,262 | 16,484 | 17,468 | 11,452 | |||||||||||||||

|

Noninterest income

|

45,957 | 43,832 | 40,926 | 41,420 | 21,767 | |||||||||||||||

|

Noninterest expense

|

103,554 | 106,387 | 96,050 | 93,801 | 82,532 | |||||||||||||||

|

Income before income taxes

|

65,087 | 55,638 | 47,646 | 35,661 | 31,420 | |||||||||||||||

|

Income taxes

|

20,225 | 16,811 | 14,612 | 10,602 | 8,347 | |||||||||||||||

|

Net income

|

$ | 44,862 | $ | 38,827 | $ | 33,034 | $ | 25,059 | $ | 23,073 | ||||||||||

|

Per common share:

|

||||||||||||||||||||

|

Basic earnings per share

|

$ | 2.90 | $ | 2.54 | $ | 2.17 | $ | 1.66 | $ | 1.54 | ||||||||||

|

Diluted earnings per share

|

$ | 2.89 | $ | 2.53 | $ | 2.16 | $ | 1.65 | $ | 1.52 | ||||||||||

|

Cash dividends declared-

|

$ | 1.25 | $ | 1.23 | $ | 1.21 | $ | 1.20 | $ | 1.17 | ||||||||||

|

as a % of net income

|

43.10 | % | 48.43 | % | 55.76 | % | 72.29 | % | 75.97 | % | ||||||||||

|

Book value, end of year

|

$ | 25.64 | $ | 23.78 | $ | 22.08 | $ | 21.15 | $ | 20.44 | ||||||||||

|

Market price, end of year

|

$ | 32.78 | $ | 29.42 | $ | 28.96 | $ | 24.45 | $ | 36.75 | ||||||||||

|

Market to book value, end of year

|

1.28 | x | 1.24 | x | 1.31 | x | 1.16 | x | 1.80 | x | ||||||||||

|

Price/earnings ratio, end of year

|

11.30 | x | 11.58 | x | 13.35 | x | 14.73 | x | 23.86 | x | ||||||||||

|

Cash dividend yield, end of year

|

3.81 | % | 4.18 | % | 4.18 | % | 4.91 | % | 3.18 | % | ||||||||||

|

At year-end:

|

||||||||||||||||||||

|

Total assets

|

$ | 3,635,664 | $ | 3,591,179 | $ | 3,355,872 | $ | 3,086,659 | $ | 2,954,531 | ||||||||||

|

Long-term debt

|

61,341 | 61,341 | 61,341 | 61,341 | 61,341 | |||||||||||||||

|

Shareholders’ equity

|

400,344 | 366,866 | 338,638 | 321,457 | 308,206 | |||||||||||||||

|

Averages:

|

||||||||||||||||||||

|

Assets

|

$ | 3,641,660 | $ | 3,505,903 | $ | 3,220,087 | $ | 3,047,100 | $ | 2,921,217 | ||||||||||

|

Deposits

|

2,928,579 | 2,811,333 | 2,574,961 | 2,409,848 | 2,303,720 | |||||||||||||||

|

Earning assets

|

3,357,134 | 3,221,648 | 2,961,971 | 2,830,701 | 2,703,054 | |||||||||||||||

|

Loans

|

2,549,459 | 2,580,351 | 2,461,225 | 2,383,875 | 2,283,180 | |||||||||||||||

|

Shareholders’ equity

|

389,377 | 355,773 | 333,645 | 317,711 | 308,401 | |||||||||||||||

|

Profitability ratios:

|

||||||||||||||||||||

|

Return on average assets

|

1.23 | % | 1.11 | % | 1.03 | % | 0.82 | % | 0.79 | % | ||||||||||

|

Return on average equity

|

11.52 | 10.91 | 9.90 | 7.89 | 7.48 | |||||||||||||||

|

Capital ratios:

|

||||||||||||||||||||

|

Equity to assets, end of year

|

11.01 | % | 10.22 | % | 10.09 | % | 10.41 | % | 10.43 | % | ||||||||||

|

Average equity to average assets

|

10.69 | 10.15 | 10.36 | 10.43 | 10.56 | |||||||||||||||

|

Risk based capital ratios:

|

||||||||||||||||||||

|

Tier 1 capital

|

||||||||||||||||||||

|

(to average assets)

|

10.65 | % | 9.89 | % | 10.16 | % | 10.38 | % | 10.37 | % | ||||||||||

|

Tier 1 capital

|

||||||||||||||||||||

|

(to risk weighted assets)

|

15.23 | 13.88 | 12.90 | 12.90 | 13.05 | |||||||||||||||

|

Total capital

|

||||||||||||||||||||

|

(to risk weighted assets)

|

16.49 | 15.14 | 14.10 | 14.15 | 14.30 | |||||||||||||||

|

Other significant ratios:

|

||||||||||||||||||||

|

Allowance to net loans, end of year

|

1.30 | % | 1.30 | % | 1.34 | % | 1.34 | % | 1.31 | % | ||||||||||

|

Allowance to nonperforming loans, end of year

|

92.33 | 89.01 | 56.10 | 79.01 | 59.06 | |||||||||||||||

|

Nonperforming assets to loans and foreclosed properties, end of year

|

3.20 | 3.59 | 3.97 | 3.19 | 2.66 | |||||||||||||||

|

Net interest margin

|

3.99 | 4.13 | 4.07 | 3.77 | 3.88 | |||||||||||||||

|

Efficiency ratio

|

57.93 | 60.23 | 59.45 | 63.56 | 58.39 | |||||||||||||||

|

Other statistics:

|

||||||||||||||||||||

|

Average common shares outstanding

|

15,466 | 15,313 | 15,234 | 15,129 | 15,017 | |||||||||||||||

|

Number of full-time equivalent employees, end of year

|

1,035 | 1,015 | 1,041 | 982 | 986 | |||||||||||||||

|

Three Months Ended

|

December 31

|

September 30

|

June 30

|

March 31

|

||||||||||||

|

2012

|

||||||||||||||||

|

Net interest income

|

$ | 33,763 | $ | 33,046 | $ | 32,319 | $ | 33,006 | ||||||||

|

Net interest income, taxable equivalent basis

|

34,221 | 33,518 | 32,785 | 33,444 | ||||||||||||

|

Provision for loan losses

|

2,946 | 2,919 | 2,425 | 1,160 | ||||||||||||

|

Noninterest income

|

11,943 | 10,838 | 11,989 | 11,187 | ||||||||||||

|

Noninterest expense

|

27,843 | 25,813 | 24,148 | 25,750 | ||||||||||||

|

Net income

|

10,552 | 10,209 | 12,232 | 11,869 | ||||||||||||

|

Per common share:

|

||||||||||||||||

|

Basic earnings per share

|

$ | 0.68 | $ | 0.66 | $ | 0.79 | $ | 0.77 | ||||||||

|

Diluted earnings per share

|

0.68 | 0.66 | 0.79 | 0.77 | ||||||||||||

|

Dividends declared

|

0.315 | 0.315 | 0.31 | 0.31 | ||||||||||||

|

Common stock price:

|

||||||||||||||||

|

High

|

$ | 36.40 | $ | 36.92 | $ | 33.68 | $ | 32.67 | ||||||||

|

Low

|

29.60 | 33.15 | 30.25 | 29.13 | ||||||||||||

|

Last trade

|

32.78 | 35.53 | 33.49 | 32.07 | ||||||||||||

|

Selected ratios:

|

||||||||||||||||

|

Return on average assets, annualized

|

1.15 | % | 1.11 | % | 1.35 | % | 1.32 | % | ||||||||

|

Return on average common equity, annualized

|

10.47 | 10.26 | 12.77 | 12.72 | ||||||||||||

|

Net interest margin, annualized

|

4.03 | 3.96 | 3.93 | 4.05 | ||||||||||||

|

Three Months Ended

|

December 31

|

September 30

|

June 30

|

March 31

|

||||||||||||

|

2011

|

||||||||||||||||

|

Net interest income

|

$ | 32,908 | $ | 33,095 | $ | 32,878 | $ | 32,574 | ||||||||

|

Net interest income, taxable equivalent basis

|

33,325 | 33,509 | 33,258 | 32,940 | ||||||||||||

|

Provision for loan losses

|

3,040 | 2,515 | 3,320 | 4,387 | ||||||||||||

|

Noninterest income

|

11,559 | 10,942 | 10,593 | 10,738 | ||||||||||||

|

Noninterest expense

|

26,867 | 25,827 | 27,146 | 26,547 | ||||||||||||

|

Net income

|

9,888 | 10,665 | 8,970 | 9,304 | ||||||||||||

|

Per common share:

|

||||||||||||||||

|

Basic earnings per share

|

$ | 0.64 | $ | 0.70 | $ | 0.59 | $ | 0.61 | ||||||||

|

Diluted earnings per share

|

0.64 | 0.70 | 0.58 | 0.61 | ||||||||||||

|

Dividends declared

|

0.31 | 0.31 | 0.305 | 0.305 | ||||||||||||

|

Common stock price:

|

||||||||||||||||

|

High

|

$ | 29.99 | $ | 28.82 | $ | 28.74 | $ | 30.35 | ||||||||

|

Low

|

22.28 | 22.64 | 26.00 | 27.03 | ||||||||||||

|

Last trade

|

29.42 | 23.29 | 27.72 | 27.67 | ||||||||||||

|

Selected ratios:

|

||||||||||||||||

|

Return on average assets, annualized

|

1.09 | % | 1.20 | % | 1.03 | % | 1.11 | % | ||||||||

|

Return on average common equity, annualized

|

10.71 | 11.75 | 10.23 | 10.96 | ||||||||||||

|

Net interest margin, annualized

|

3.98 | 4.11 | 4.17 | 4.27 | ||||||||||||

|

v

|

Our Business

|

|

v

|

Financial Goals and Performance

|

|

v

|

Results of Operations and Financial Condition

|

|

v

|

Contractual Obligations and Commitments

|

|

v

|

Liquidity and Market Risk

|

|

v

|

Interest Rate Risk

|

|

v

|

Capital Resources

|

|

v

|

Impact of Inflation, Changing Prices, and Economic Conditions

|

|

v

|

Stock Repurchase Program

|

|

v

|

Critical Accounting Policies and Estimates

|

| 2012 Goals | 2012 Performance | Variance | 2013 Goals | |

|

Earnings per share

|

$2.63

|

$2.90

|

$0.27

|

$2.90 - $3.06

|

|

Net income

|

$40.7 million

|

$44.9 million

|

$4.2 million

|

$45.2 - $48.0 million

|

|

ROAA

|

1.11%

|

1.23%

|

0.12%

|

1.22% - 1.28%

|

|

ROAE

|

10.74%

|

11.52%

|

0.78%

|

11.15% - 11.21%

|

|

Revenues

|

$182.6 million

|

$178.1 million

|

($4.5 million)

|

$180.6 - $190.6 million

|

|

Noninterest revenue

as of % of total revenue

|

22.3%

|

25.8%

|

3.5%

|

22.0% - 27.0%

|

|

Assets

|

$3.7 billion

|

$3.6 billion

|

($0.1 billion)

|

$3.6 - $3.8 billion

|

|

Loans

|

$2.7 billion

|

$2.6 billion

|

($0.1 billion)

|

$2.6 - $2.8 billion

|

|

Deposits

,

including repurchase agreements

|

$3.2 billion

|

$3.1 billion

|

($0.1 billion)

|

$3.1 - $3.3 billion

|

|

Shareholders’ equity

|

$388.2 million

|

$400.3 million

|

$12.1 million

|

$425 - $431 million

|

|

v

|

Basic earnings per share for the year 2012 increased $0.36 per share from prior year. The increase in earnings from prior year was supported by increased net interest income and noninterest income and decreased provision for loan loss and noninterest expense.

|

|

v

|

Net interest income for the year increased 0.5% while our net interest margin declined 14 basis points.

|

|

v

|

Our nonperforming loans at $36.0 million decreased $1.3 million from December 31, 2011. Nonperforming assets at $83.0 million were a $10.9 million decrease from prior year.

|

|

v

|

Net loan charge-offs for the year 2012 were $9.4 million, or 0.37% of average loans, compared to $14.9 million, or 0.58% of average loans, for the year 2011.

|

|

v

|

Our loan loss provision for the year 2012 was $3.8 million below 2011 as net charge-offs declined $5.5 million and loans declined $6.0 million.

|

|

v

|

Our loan loss reserve as a percentage of total loans outstanding remained at 1.30% from December 31, 2011 to December 31, 2012. Our reserve coverage (allowance for loan loss reserve to nonperforming loans) at December 31, 2012 was 92.3% compared to 89.0% at December 31, 2011.

|

|

v

|

Noninterest income for the year 2012 increased 4.8% as a result of increased gains on sales of loans, trust revenue, and loan related fees, as well as a $1.0 million increase in net securities gains.

|

|

v

|

Noninterest expense for the year decreased 2.7% from prior year as a result of decreases in FDIC insurance premiums, legal fees, other real estate owned expense, and repossession expense, partially offset by an increase in personnel expense.

|

|

v

|

Our loan portfolio decreased $6.0 million from prior year.

|

|

v

|

Our investment portfolio increased $75.9 million from prior year.

|

|

v

|

Deposits, including repurchase agreements, increased $18.4 million from prior year.

|

|

v

|

Our tangible common equity/tangible assets ratio remains strong at 9.36%.

|

|

(

dollars in thousands)

|

Change 2012 vs. 2011

|

|||||||||||||||||||

|

Year Ended December 31

|

2012

|

2011

|

2010

|

Amount

|

Percent

|

|||||||||||||||

|

Net interest income

|

$ | 132,134 | $ | 131,455 | $ | 119,254 | $ | 679 | 0.5 | % | ||||||||||

|

Provision for loan losses

|

9,450 | 13,262 | 16,484 | (3,812 | ) | (28.7 | ) | |||||||||||||

|

Noninterest income

|

45,957 | 43,832 | 40,926 | 2,125 | 4.8 | |||||||||||||||

|

Noninterest expense

|

103,554 | 106,387 | 96,050 | (2,833 | ) | (2.7 | ) | |||||||||||||

|

Income taxes

|

20,225 | 16,811 | 14,612 | 3,414 | 20.3 | |||||||||||||||

|

Net income

|

$ | 44,862 | $ | 38,827 | $ | 33,034 | $ | 6,035 | 15.5 | % | ||||||||||

|

Average earning assets

|

$ | 3,357,134 | $ | 3,221,648 | $ | 2,961,971 | $ | 135,486 | 4.2 | % | ||||||||||

|

Yield on average earnings assets

|

4.63 | % | 4.97 | % | 5.26 | % | (0.34 | )% | (6.8 | )% | ||||||||||

|

Cost of interest bearing funds

|

0.83 | % | 1.06 | % | 1.51 | % | (0.23 | )% | (21.7 | )% | ||||||||||

|

Net interest margin

|

3.99 | % | 4.13 | % | 4.07 | % | (0.14 | %) | (3.4 | %) | ||||||||||

|

(in thousands)

|

December 31, 2012

|

|||||||||||||||||||

|

Loan Category

|

Balance

|

Variance from Prior Year

|

Net Charge-Offs

|

Nonperforming

|

ALLL

|

|||||||||||||||

|

Commercial:

|

||||||||||||||||||||

|

Construction

|

$ | 119,447 | (0.9 | )% | $ | 999 | $ | 9,733 | $ | 4,033 | ||||||||||

|

Secured by real estate

|

807,213 | 1.0 | 1,732 | 11,515 | 13,541 | |||||||||||||||

|

Equipment lease financing

|

9,246 | (4.7 | ) | 0 | 0 | 126 | ||||||||||||||

|

Other commercial

|

376,348 | 0.5 | 2,469 | 5,522 | 5,469 | |||||||||||||||

|

Total commercial

|

1,312,254 | 0.7 | 5,200 | 26,770 | 23,169 | |||||||||||||||

|

Residential:

|

||||||||||||||||||||

|

Real estate construction

|

55,041 | 2.8 | 161 | 511 | 376 | |||||||||||||||

|

Real estate mortgage

|

696,928 | 7.2 | 972 | 7,664 | 4,767 | |||||||||||||||

|

Home equity

|

82,292 | (3.0 | ) | 237 | 582 | 563 | ||||||||||||||

|

Total residential

|

834,261 | 5.8 | 1,370 | 8,757 | 5,706 | |||||||||||||||

|

Consumer:

|

||||||||||||||||||||

|

Consumer direct

|

122,581 | (1.1 | ) | 707 | 98 | 1,102 | ||||||||||||||

|

Consumer indirect

|

281,477 | (17.3 | ) | 2,099 | 381 | 3,268 | ||||||||||||||

|

Total consumer

|

404,058 | (13.0 | ) | 2,806 | 479 | 4,370 | ||||||||||||||

|

Total loans

|

$ | 2,550,573 | (0.2 | )% | $ | 9,376 | $ | 36,006 | $ | 33,245 | ||||||||||

|

(in thousands)

December 31

|

2012

|

2011

|

||||||

|

1-4 family

|

$ | 12,381 | $ | 20,065 | ||||

|

Agricultural/farmland

|

653 | 652 | ||||||

|

Construction/land development/other

|

23,823 | 23,006 | ||||||

|

Multifamily

|

1,281 | 1,841 | ||||||

|

Non-farm/non-residential

|

8,848 | 10,981 | ||||||

|

Total foreclosed properties

|

$ | 46,986 | $ | 56,545 | ||||

|

(in thousands)

|

|||||||||

|

Appraisal Aging Analysis

|

Holding Period Analysis

|

||||||||

|

Days Since Last Appraisal

|

Current Book Value

|

Holding Period

|

Current Book Value

|

||||||

|

Up to 90 days

|

$ | 17,006 |

Less than one year

|

$ | 7,676 | ||||

|

91 to 180 days

|

2,343 |

1 to 2 years

|

19,625 | ||||||

|

181 to 270 days

|

6,207 |

2 to 3 years

|

4,430 | ||||||

|

271 to 365 days

|

3,315 |

3 to 4 years

|

13,092 | ||||||

|

Over one year

|

18,115 |

Over 4 years

|

2,163 | ||||||

|

Total

|

$ | 46,986 |

Total

|

$ | 46,986 | ||||

|

Contractual Obligations:

|

Payments Due by Period

|

|||||||||||||||

|

(in thousands)

|

Total

|

1 Year

|

2-5 Years

|

After 5 Years

|

||||||||||||

|

Deposits without stated maturity

|

$ | 1,488,881 | $ | 1,488,881 | $ | 0 | $ | 0 | ||||||||

|

Certificates of deposit and other time deposits

|

1,414,967 | 1,241,997 | 172,604 | 366 | ||||||||||||

|

Repurchase agreements and other short-term borrowings

|

222,434 | 222,434 | 0 | 0 | ||||||||||||

|

Advances from Federal Home Loan Bank

|

1,429 | 152 | 439 | 838 | ||||||||||||

|

Interest on advances from Federal Home Loan Bank*

|

102 | 28 | 65 | 9 | ||||||||||||

|

Long-term debt

|

61,341 | 0 | 0 | 61,341 | ||||||||||||

|

Interest on long-term debt*

|

59,245 | 1,193 | 9,063 | 48,989 | ||||||||||||

|

Annual rental commitments under leases

|

7,284 | 1,607 | 3,074 | 2,603 | ||||||||||||

|

Total contractual obligations

|

$ | 3,255,683 | $ | 2,956,292 | $ | 185,245 | $ | 114,146 | ||||||||

|

Other Commitments:

|

Amount of Commitment - Expiration by Period

|

|||||||||||||||

|

(in thousands)

|

Total

|

1 Year

|

2-5 Years

|

After 5 Years

|

||||||||||||

|

Standby letters of credit

|

$ | 41,207 | $ | 33,435 | $ | 7,772 | $ | 0 | ||||||||

|

Commitments to extend credit

|

386,293 | 309,691 | 63,595 | 13,007 | ||||||||||||

|

Total other commitments

|

$ | 427,500 | $ | 343,126 | $ | 71,367 | $ | 13,007 | ||||||||

|

Change in Interest Rates

(basis points)

|

Percentage Change in Net Interest Income

(12 Months)

|

|

+400

|

3.28%

|

|

+300

|

2.02%

|

|

+200

|

0.95%

|

|

+100

|

0.40%

|

|

-25

|

(0.16)%

|

|

Change in Interest Rates

(basis points)

|

Percentage Change in Net Interest Income

(12 Months)

|

|

+400

|

3.32%

|

|

+300

|

2.08%

|

|

+200

|

1.03%

|

|

+100

|

0.46%

|

|

-25

|

(0.25)%

|

|

(dollars in thousands)

|

1-3 Months

|

4-6 Months

|

7-9 Months

|

10-12 Months

|

2-3

Years

|

4-5

Years

|

> 5

Years

|

|||||||||||||||||||||

|

Assets

|

$ | 1,542,534 | $ | 206,889 | $ | 167,737 | $ | 146,998 | $ | 515,436 | $ | 225,432 | $ | 830,637 | ||||||||||||||

|

Liabilities and

Equity

|

882,147 | 353,677 | 416,304 | 609,180 | 872,467 | 53,951 | 447,937 | |||||||||||||||||||||

|

Repricing difference

|

660,388 | (146,788 | ) | (248,566 | ) | (462,182 | ) | (357,031 | ) | 171,480 | 382,699 | |||||||||||||||||

|

Cumulative GAP

|

660,388 | 513,599 | 265,033 | (197,149 | ) | (554,179 | ) | (382,699 | ) | 0 | ||||||||||||||||||

|

RSA/RSL

|

1.75 | x | 0.58 | x | 0.40 | x | 0.24 | x | 0.59 | x | 4.18 | x | 1.85 | x | ||||||||||||||

|

Cumulative GAP to total assets

|

18.16 | % | 14.13 | % | 7.29 | % | (5.42 | )% | (15.24 | )% | (10.53 | )% | 0.00 | % | ||||||||||||||

|

Board Authorizations

|

Repurchases*

|

Shares Available for Repurchase

|

||

|

Average Price ($)

|

# of Shares

|

|||

|

1998

|

500,000

|

-

|

0

|

|

|

1999

|

0

|

15.89

|

131,517

|

|

|

2000

|

1,000,000

|

11.27

|

694,064

|

|

|

2001

|

0

|

14.69

|

444,945

|

|

|

2002

|

0

|

19.48

|

360,287

|

|

|

2003

|

1,000,000

|

21.58

|

235,668

|

|

|

2004

|

0

|

25.45

|

55,000

|

|

|

2005

|

0

|

-

|

0

|

|

|

2006

|

0

|

-

|

0

|

|

|

2007

|

0

|

31.42

|

196,500

|

|

|

2008

|

0

|

28.08

|

93,500

|

|

|

2009

|

0

|

-

|

0

|

|

|

2010

|

0

|

-

|

0

|

|

|

2011

|

0

|

-

|

0

|

|

|

2012

|

0

|

-

|

0

|

|

|

Total

|

2,500,000

|

17.52

|

2,211,481

|

288,519

|

|

(dollars in thousands)

December 31

|

2012

|

2011

|

||||||

|

Assets:

|

||||||||

|

Cash and due from banks

|

$ | 73,451 | $ | 69,723 | ||||

|

Interest bearing deposits

|

127,438 | 166,057 | ||||||

|

Federal funds sold

|

6,671 | 2,701 | ||||||

|

Cash and cash equivalents

|

207,560 | 238,481 | ||||||

|

Certificates of deposit in other banks

|

5,336 | 11,875 | ||||||

|

Securities available-for-sale at fair value (amortized cost of $583,858 and $511,731, respectively)

|

603,343 | 527,398 | ||||||

|

Securities held-to-maturity at amortized cost (fair value of $1,659 and $1,661, respectively)

|

1,662 | 1,662 | ||||||

|

Loans held for sale

|

22,486 | 536 | ||||||

|

Loans

|

2,550,573 | 2,556,548 | ||||||

|

Allowance for loan losses

|

(33,245 | ) | (33,171 | ) | ||||

|

Net loans

|

2,517,328 | 2,523,377 | ||||||

|

Premises and equipment, net

|

54,321 | 54,297 | ||||||

|

Federal Home Loan Bank stock

|

25,673 | 25,673 | ||||||

|

Federal Reserve Bank stock

|

4,885 | 4,883 | ||||||

|

Goodwill

|

65,490 | 65,490 | ||||||

|

Core deposit intangible (net of accumulated amortization of $7,712 and $7,499, respectively)

|

904 | 1,117 | ||||||

|

Bank owned life insurance

|

44,893 | 43,483 | ||||||

|

Mortgage servicing rights

|

2,364 | 2,282 | ||||||

|

Other real estate owned

|

47,537 | 56,965 | ||||||

|

Other assets

|

31,882 | 33,660 | ||||||

|

Total assets

|

$ | 3,635,664 | $ | 3,591,179 | ||||

|

Liabilities and shareholders’ equity:

|

||||||||

|

Deposits

|

||||||||

|

Noninterest bearing

|

$ | 606,448 | $ | 584,735 | ||||

|

Interest bearing

|

2,297,400 | 2,293,624 | ||||||

|

Total deposits

|

2,903,848 | 2,878,359 | ||||||

|

Repurchase agreements

|

210,120 | 217,177 | ||||||

|

Federal funds purchased and other short-term borrowings

|

12,314 | 13,104 | ||||||

|

Advances from Federal Home Loan Bank

|

1,429 | 21,609 | ||||||

|

Long-term debt

|

61,341 | 61,341 | ||||||

|

Other liabilities

|

46,268 | 32,723 | ||||||

|

Total liabilities

|

3,235,320 | 3,224,313 | ||||||

|

Shareholders’ equity:

|

||||||||

|

Preferred stock, 300,000 shares authorized and unissued

|

- | - | ||||||

|

Common stock, $5 par value, shares authorized 25,000,000; shares outstanding 2012 – 15,612,935; 2011 – 15,429,992

|

78,065 | 77,151 | ||||||

|

Capital surplus

|

160,670 | 156,101 | ||||||

|

Retained earnings

|

148,944 | 123,431 | ||||||

|

Accumulated other comprehensive income, net of tax

|

12,665 | 10,183 | ||||||

|

Total shareholders’ equity

|

400,344 | 366,866 | ||||||

|

Total liabilities and shareholders’ equity

|

$ | 3,635,664 | $ | 3,591,179 | ||||

|

(in thousands except per share data)

Year Ended December 31

|

2012

|

2011

|

2010

|

|||||||||

|

Interest income:

|

||||||||||||

|

Interest and fees on loans, including loans held for sale

|

$ | 137,653 | $ | 144,635 | $ | 142,109 | ||||||

|

Interest and dividends on securities:

|

||||||||||||

|

Taxable

|

12,009 | 10,133 | 8,934 | |||||||||

|

Tax exempt

|

2,074 | 1,712 | 1,601 | |||||||||

|

Interest and dividends on Federal Reserve Bank and Federal Home Loan Bank stock

|

1,433 | 1,374 | 1,351 | |||||||||

|

Other, including interest on federal funds sold

|

553 | 606 | 516 | |||||||||

|

Total interest income

|

153,722 | 158,460 | 154,511 | |||||||||

|

Interest expense:

|

||||||||||||

|

Interest on deposits

|

17,911 | 21,282 | 29,152 | |||||||||

|

Interest on repurchase agreements and other short-term borrowings

|

1,240 | 1,625 | 2,027 | |||||||||

|

Interest on advances from Federal Home Loan Bank

|

34 | 99 | 79 | |||||||||

|

Interest on long-term debt

|

2,403 | 3,999 | 3,999 | |||||||||

|

Total interest expense

|

21,588 | 27,005 | 35,257 | |||||||||

|

Net interest income

|

132,134 | 131,455 | 119,254 | |||||||||

|

Provision for loan losses

|

9,450 | 13,262 | 16,484 | |||||||||

|

Net interest income after provision for loan losses

|

122,684 | 118,193 | 102,770 | |||||||||

|

Noninterest income:

|

||||||||||||

|

Service charges on deposit accounts

|

23,996 | 25,576 | 23,255 | |||||||||

|

Gains on sales of loans, net

|

2,562 | 1,749 | 1,642 | |||||||||

|

Trust income

|

6,918 | 6,354 | 5,846 | |||||||||

|

Loan related fees

|

4,042 | 2,372 | 3,247 | |||||||||

|

Bank owned life insurance

|

1,760 | 1,721 | 1,676 | |||||||||

|

Securities gains

|

1,155 | 218 | 0 | |||||||||

|

Other noninterest income

|

5,524 | 5,842 | 5,260 | |||||||||

|

Total noninterest income

|

45,957 | 43,832 | 40,926 | |||||||||

|

Noninterest expense:

|

||||||||||||

|

Officer salaries and employee benefits

|

10,561 | 8,379 | 8,244 | |||||||||

|

Other salaries and employee benefits

|

41,327 | 40,416 | 39,020 | |||||||||

|

Occupancy, net

|