|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended

December 31, 2018

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from to

|

|

Nevada

|

88-0320154

|

|

(State / other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

400 Birmingham Hwy.

|

|

|

Chattanooga, TN

|

37419

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

|

423 - 821-1212

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

$0.01 Par Value Class A Common Stock – The NASDAQ Global Select Market

|

|

|

(Title of class)

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[X]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[ ]

|

|

|

|

Emerging growth company

|

[ ]

|

|

Part I

|

|

|

|

|

|

Item 1.

|

4

|

|

|

|

Item 1A.

|

16

|

|

|

|

Item 1B.

|

32

|

|

|

|

Item 2.

|

32

|

|

|

|

Item 3.

|

32

|

|

|

|

Item 4.

|

33

|

|

|

|

|

|

|

|

Part II

|

|

|

|

|

|

Item 5.

|

34

|

|

|

|

Item 6.

|

35

|

|

|

|

Item 7.

|

36

|

|

|

|

Item 7A.

|

54

|

|

|

|

Item 8.

|

55

|

|

|

|

Item 9.

|

55

|

|

|

|

Item 9A.

|

55

|

|

|

|

Item 9B.

|

57

|

|

|

|

|

|

|

|

Part III

|

|

|

|

|

|

Item 10.

|

58

|

|

|

|

Item 11.

|

58

|

|

|

|

Item 12.

|

58

|

|

|

|

Item 13.

|

59

|

|

|

|

Item 14.

|

59

|

|

|

|

|

|

|

|

Part IV

|

|

|

|

|

|

Item 15.

|

60

|

|

|

|

Item 16.

|

62

|

|

|

|

|

||

|

63

|

|||

|

|

|

||

|

64

|

|||

|

|

|

||

| Report of Independent Registered Public Accounting Firm - Opinion on Internal Control Over Financial Reporting | 65 | ||

|

Financial Data

|

|

||

|

|

67

|

||

|

|

68

|

||

|

|

69

|

||

|

|

70

|

||

|

|

71

|

||

|

|

72

|

||

|

ITEM 1.

|

|

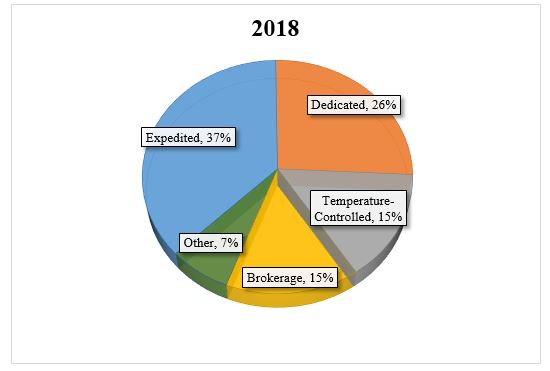

Distribution of Freight Revenue

Among Service Offerings

|

||||

|

Expedited

|

|

|

37

|

%

|

|

Dedicated

|

|

|

26

|

%

|

|

Temperature-Controlled

|

|

|

15

|

%

|

|

Brokerage

|

|

|

15

|

%

|

|

Other

|

|

|

7

|

%

|

|

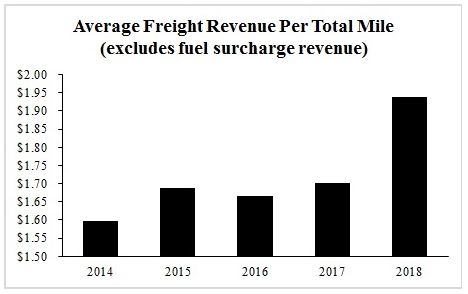

Average Freight Revenue Per Total Mile.

Our average freight revenue per total mile is primarily a function of 1) the allocation of assets among our subsidiaries and 2) the macro U.S. economic environment including supply/demand of freight and carriers. The year-over-year increase from 2014 to 2015 is a result of allocating more tractors to our niche/specialized service offerings that provide higher rates (including expedited/critical freight, high-value/constant security, and temperature-controlled). The 2017 recovery of the weaker 2016 pricing environment, due to the more favorable supply and demand balance, resulted in the slight increase in 2017. A strong economic environment, as well as the Landair Acquisition, contributed to the increases in

2018.

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2017

|

|

|

2018

|

|

|

$1.60

|

|

|

$1.69

|

|

|

$1.67

|

|

|

$1.70

|

|

|

$1.94

|

|

|

Average Miles Per Tractor.

Average miles per tractor reflect economic demand, driver availability, regulatory constraints, and the allocation of tractors among the service offerings. Utilization declined gradually from 2014 to 2017 primarily due to a softer freight market and the increase in certain e-commerce freight that has a shorter length of haul, partially offset by the increase in the portion of tractors operated by teams during that time. In 2018, our increased emphasis on shorter-haul dedicated freight, a reduction in tractors operated by teams, as well as the Landair Acquisition, reduced ou

r average miles per tractor to the lowest we have seen in our recent history.

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2017

|

|

|

2018

|

|

|

123,275

|

|

|

122,508

|

|

|

121,782

|

|

|

120,043

|

|

|

112,736

|

|

|

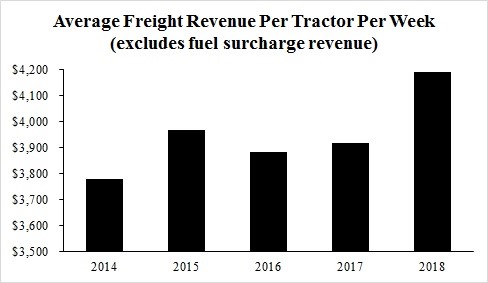

Average Freight Revenue Per Tractor Per Week.

We use average freight revenue per tractor per week as our main measure of asset productivity. This operating metric takes into account the effects of freight rates, non-revenue miles, and miles per tractor. In addition, because we calculate average freight revenue per tractor using all of our tractors, it takes into account the percentage of our fleet that is unproductive due to lack of drivers, repairs, and other factors. The changes in average freight revenue per tractor per week from 2015 to 2017 are primarily due to the 2016 deterioration and 2017 recovery of the percentage of our unseated tractors, specifically at SRT, and the increase in 2018 is primarily due to the aforementioned increase in rates, partially offset by the decrease in utilization.

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2017

|

|

|

2018

|

|

|

$3,777

|

|

|

$3,967

|

|

|

$3,881

|

|

|

$3,917

|

|

|

$4,191

|

|

|

ITEM 1A.

|

|

|

●

|

we may experience a reduction in overall freight levels, which may impair our asset utilization;

|

|

|

●

|

certain of our customers may face credit issues and could experience cash flow problems that may lead to payment delays, increased credit risk, bankruptcies, and other financial hardships that could result in even lower freight demand and may require us to increase our allowance for doubtful accounts;

|

|

|

●

|

freight patterns may change as supply chains are redesigned, resulting in an imbalance between our capacity and our customers' freight demand;

|

|

|

●

|

customers may solicit bids for freight from multiple trucking companies or select competitors that offer lower rates from among existing choices in an attempt to lower their costs, and we might be forced to lower our rates or lose freight;

|

|

|

●

|

we may be forced to accept more freight from freight brokers, where freight rates are typically lower, or may be forced to incur more non-revenue miles to obtain loads; and

|

|

|

●

|

lack of access to current sources of credit or lack of lender access to capital, leading to an inability to secure credit financing on satisfactory terms, or at all.

|

|

|

●

|

we compete with many other truckload carriers of varying sizes and, to a lesser extent, with (i) less-than-truckload carriers, (ii) railroads, intermodal companies, and (iii) other transportation and logistics companies, many of which have access to more equipment and greater capital resources than we do;

|

|

|

●

|

many of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth in the economy, which may limit our ability to maintain or increase freight rates or to maintain or expand our business or may require us to reduce our freight rates in order to maintain business and keep our equipment productive;

|

|

|

●

|

many of our customers, including several in our top ten, are other transportation companies or also operate their own private trucking fleets, and they may decide to transport more of their own freight;

|

|

|

●

|

we may increase the size of our fleet during periods of high freight demand during which our competitors also increase their capacity, and we may experience losses in greater amounts than such competitors during subsequent cycles of softened freight demand if we are required to dispose of assets at a loss to match reduced customer demand;

|

|

|

●

|

a significant portion of our business is in the retail industry, which continues to undergo a shift away from the traditional brick and mortar model towards e-commerce, and this shift could impact the manner in which our customers source or utilize our services;

|

|

|

●

|

many customers reduce the number of carriers they use by selecting so-called "core carriers" as approved service providers or by engaging dedicated providers, and we may not be selected;

|

|

|

●

|

many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some of our business to competitors;

|

|

|

●

|

the trend toward consolidation in the trucking industry may create large carriers with greater financial resources and other competitive advantages relating to their size, and we may have difficulty competing with these larger carriers;

|

|

|

●

|

the market for qualified drivers is increasingly competitive, and our inability to attract and retain drivers could reduce our equipment utilization or cause us to increase compensation to our drivers and independent contractors we engage, both of which would adversely affect our profitability;

|

|

|

●

|

competition from freight logistics and freight brokerage companies may adversely affect our customer relationships and freight rates;

|

|

|

●

|

economies of scale that procurement aggregation providers may pass on to smaller carriers may improve such carriers’ ability to compete with us;

|

|

|

●

|

advances in technology may require us to increase investments in order to remain competitive, and our customers may not be willing to accept higher freight rates to cover the cost of these investments;

|

|

|

●

|

the Covenant brand name is a valuable asset that is subject to the risk of adverse publicity (whether or not justified),which could result in the loss of value attributable to our brand and reduced demand for our services; and

|

|

|

●

|

higher fuel prices and, in turn, higher fuel surcharges to our customers may cause some of our customers to consider freight transportation alternatives, including rail transportation.

|

|

|

●

|

finance working capital requirements, capital investments, or refinance existing indebtedness;

|

|

|

●

|

develop or enhance our technological infrastructure and our existing products and services;

|

|

|

●

|

fund strategic relationships;

|

|

|

●

|

respond to competitive pressures; and

|

|

|

●

|

acquire complementary businesses, technologies, products, or services.

|

|

|

●

|

approval of premium rates for insurance;

|

|

|

●

|

standards of solvency;

|

|

|

●

|

minimum amounts of statutory capital surplus that must be maintained;

|

|

|

●

|

limitations on types and amounts of investments;

|

|

|

●

|

regulation of dividend payments and other transactions between affiliates;

|

|

|

●

|

regulation of reinsurance;

|

|

|

●

|

regulation of underwriting and marketing practices;

|

|

|

●

|

approval of policy forms;

|

|

|

●

|

methods of accounting; and

|

|

|

●

|

filing of annual and other reports with respect to financial condition and other matters.

|

|

|

●

|

our vulnerability to adverse economic and industry conditions and competitive pressures is heightened;

|

|

|

●

|

we will continue to be required to dedicate a substantial portion of our cash flows from operations to lease payments and repayment of debt, limiting the availability of cash for our operations, capital expenditures, and future business opportunities;

|

|

|

●

|

our flexibility in planning for, or reacting to, changes in our business and industry will be limited;

|

|

|

●

|

our profitability is sensitive to fluctuations in interest rates because some of our debt obligations are subject to variable interest rates, and future borrowings and lease financing arrangements will be affected by any such fluctuations;

|

|

|

●

|

our ability to obtain additional financing in the future for working capital, capital expenditures, debt service requirements, acquisitions, or other purposes may be limited;

|

|

|

●

|

it may be difficult for us to comply with the multitude of financial covenants, borrowing conditions, or other obligations contained in our debt agreements, thereby increasing the risk that we trigger certain cross-default provisions; and

|

|

|

●

|

we may be required to issue additional equity securities to raise funds, which would dilute the ownership position of our stockholders.

|

|

|

•

|

some of the acquired businesses may not achieve anticipated revenue, earnings or cash flows;

|

|

|

•

|

we may assume liabilities that were not disclosed to us or otherwise exceed our estimates;

|

|

|

•

|

we may be unable to integrate acquired businesses successfully, or at all, and realize anticipated economic, operational and other benefits in a timely manner, which could result in substantial costs and delays or other operational, technical, or financial problems;

|

|

|

•

|

transaction costs and acquisition-related integration costs could adversely affect our results of operations in the period in which such charges are recorded;

|

|

|

•

|

we may incur future impairment charges, write-offs, write-downs, or restructuring charges that could adversely impact our results of operations;

|

|

|

•

|

acquisitions could disrupt our ongoing business, distract our management and divert our resources;

|

|

|

•

|

we may experience difficulties operating in markets in which we have had no or only limited direct experience;

|

|

|

•

|

we could lose customers, employees and drivers of any acquired company; and

|

|

|

•

|

we may incur additional indebtedness.

|

|

ITEM 1B.

|

|

ITEM 2.

|

|

Locations

|

|

Terminal

|

|

Recruiting/

Orientation

|

|

Sales

|

|

Warehouse

|

|

Ownership

|

|

|

Chattanooga, Tennessee

|

|

x

|

|

x

|

|

x

|

|

|

|

Owned

|

|

|

Texarkana, Arkansas

|

|

x

|

|

x

|

|

x

|

|

|

|

Owned

|

|

|

Hutchins, Texas

|

|

x

|

|

x

|

|

|

|

|

|

Owned

|

|

|

Pomona, California

|

|

x

|

|

x

|

|

|

|

|

|

Owned

|

|

|

Allentown, Pennsylvania

|

|

x

|

|

|

|

|

|

|

|

Owned

|

|

|

LaVergne, Tennessee

|

|

x

|

|

x

|

|

x

|

|

|

|

Owned

|

|

|

Orlando, Florida

|

|

x

|

|

|

|

|

|

|

|

Owned

|

|

|

Fayetteville, North Carolina

|

|

|

|

|

|

|

|

x

|

|

Leased

|

|

|

Greeneville, Tennessee

|

|

x

|

|

x

|

|

x

|

|

x

|

|

Leased

|

|

|

Rancho Cucamonga, California

|

|

|

|

|

|

|

|

x

|

|

Leased

|

|

|

Warsaw, North Carolina

|

|

|

|

|

|

|

|

x

|

|

Leased

|

|

|

Hartsville, South Carolina

|

|

x

|

|

|

|

|

|

|

|

Leased

|

|

|

ITEM 3.

|

|

ITEM 4.

|

|

ITEM 6.

|

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Freight revenue

|

$

|

779,729

|

$

|

626,809

|

$

|

610,845

|

$

|

640,120

|

$

|

578,204

|

||||||||||

|

Fuel surcharge revenue

|

105,726

|

78,198

|

59,806

|

84,120

|

140,776

|

|||||||||||||||

|

Total revenue

|

$

|

885,455

|

$

|

705,007

|

$

|

670,651

|

$

|

724,240

|

$

|

718,980

|

||||||||||

|

|

||||||||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Salaries, wages, and related expenses

|

304,447

|

241,784

|

234,526

|

244,779

|

231,761

|

|||||||||||||||

|

Fuel expense

|

121,264

|

103,139

|

103,108

|

122,160

|

168,856

|

|||||||||||||||

|

Operations and maintenance

|

55,505

|

48,774

|

45,864

|

46,458

|

47,251

|

|||||||||||||||

|

Revenue equipment rentals and purchased transportation

|

183,645

|

141,954

|

117,472

|

118,583

|

111,772

|

|||||||||||||||

|

Operating taxes and licenses

|

11,831

|

9,878

|

11,712

|

11,016

|

10,960

|

|||||||||||||||

|

Insurance and claims (1)

|

43,333

|

33,155

|

32,596

|

31,909

|

39,594

|

|||||||||||||||

|

Communications and utilities

|

7,061

|

6,938

|

6,057

|

6,162

|

5,806

|

|||||||||||||||

|

General supplies and expenses

|

23,227

|

14,783

|

14,413

|

14,007

|

16,950

|

|||||||||||||||

|

Depreciation and amortization, including gains and losses on disposition of equipment and impairment of assets

|

76,156

|

76,447

|

72,456

|

61,384

|

46,384

|

|||||||||||||||

|

Total operating expenses

|

826,469

|

676,852

|

638,204

|

656,458

|

679,334

|

|||||||||||||||

|

Operating income

|

58,986

|

28,155

|

32,447

|

67,782

|

39,646

|

|||||||||||||||

|

Interest expense, net

|

8,708

|

8,258

|

8,226

|

8,445

|

10,794

|

|||||||||||||||

|

Income from equity method investment

|

(7,732

|

)

|

(3,400

|

)

|

(3,000

|

)

|

(4,570

|

)

|

(3,730

|

)

|

||||||||||

|

Income before income taxes

|

58,010

|

23,297

|

27,221

|

63,907

|

32,582

|

|||||||||||||||

|

Income tax expense (benefit)

|

15,507

|

(32,142

|

)

|

10,386

|

21,822

|

14,774

|

||||||||||||||

|

Net income

|

$

|

42,503

|

$

|

55,439

|

$

|

16,835

|

$

|

42,085

|

$

|

17,808

|

||||||||||

|

|

||||||||||||||||||||

|

Basic income per share

|

$

|

2.32

|

$

|

3.03

|

$

|

0.93

|

$

|

2.32

|

$

|

1.17

|

||||||||||

|

|

||||||||||||||||||||

|

Diluted income per share

|

$

|

2.30

|

$

|

3.02

|

$

|

0.92

|

$

|

2.30

|

$

|

1.15

|

||||||||||

|

|

||||||||||||||||||||

|

Basic weighted average common shares outstanding

|

18,340

|

18,279

|

18,182

|

18,145

|

15,250

|

|||||||||||||||

|

|

||||||||||||||||||||

|

Diluted weighted average common shares outstanding

|

18,469

|

18,372

|

18,266

|

18,311

|

15,517

|

|||||||||||||||

|

|

Years Ended December 31,

|

|||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Selected Balance Sheet Data:

|

||||||||||||||||||||

|

Net property and equipment

|

$

|

450,595

|

$

|

464,072

|

$

|

465,471

|

$

|

454,049

|

$

|

382,491

|

||||||||||

|

Total assets (2)

|

$

|

773,524

|

$

|

649,668

|

$

|

620,538

|

$

|

646,717

|

$

|

539,304

|

||||||||||

|

Long-term debt and capital lease obligations, less current maturities

|

$

|

201,754

|

$

|

186,242

|

$

|

188,437

|

$

|

206,604

|

$

|

172,903

|

||||||||||

|

Total stockholders' equity

|

$

|

343,142

|

$

|

295,201

|

$

|

236,414

|

$

|

202,160

|

$

|

169,204

|

||||||||||

|

|

||||||||||||||||||||

|

Selected Operating Data:

|

||||||||||||||||||||

|

Capital expenditures (proceeds), net (3)

|

$

|

33,093

|

$

|

72,006

|

$

|

59,052

|

$

|

148,994

|

$

|

89,455

|

||||||||||

|

Average freight revenue per loaded mile (4)

|

$

|

2.13

|

$

|

1.89

|

$

|

1.86

|

$

|

1.89

|

$

|

1.77

|

||||||||||

|

Average freight revenue per total mile (4)

|

$

|

1.94

|

$

|

1.70

|

$

|

1.67

|

$

|

1.69

|

$

|

1.60

|

||||||||||

|

Average freight revenue per tractor per week (4)

|

$

|

4,191

|

$

|

3,917

|

$

|

3,881

|

$

|

3,967

|

$

|

3,777

|

||||||||||

|

Average miles per tractor per year

|

112,736

|

120,043

|

121,782

|

122,508

|

123,275

|

|||||||||||||||

|

Weighted average tractors for year (5)

|

2,843

|

2,557

|

2,593

|

2,700

|

2,609

|

|||||||||||||||

|

Total tractors at end of period (5)

|

3,154

|

2,559

|

2,535

|

2,656

|

2,665

|

|||||||||||||||

|

Total trailers at end of period (6)

|

6,950

|

6,846

|

7,389

|

6,978

|

6,722

|

|||||||||||||||

|

Team-driven tractors as percentage of fleet

|

30.8

|

%

|

38.1

|

%

|

38.7

|

%

|

35.3

|

%

|

32.1

|

%

|

||||||||||

|

(1)

|

2017 and 2014 insurance and claims expense includes $0.9 million and $7.5 million of additional reserves for 2008 cargo claim, respectively.

|

|

(2)

|

Adjusted for retrospective adoption of ASU 2015-17.

|

|

(3)

|

Includes equipment purchased under capital leases.

|

|

(4)

|

Excludes fuel surcharge revenue.

|

|

(5)

|

Includes monthly rental tractors and tractors provided by independent contractors.

|

|

(6)

|

Excludes monthly rental trailers.

|

|

ITEM 7.

|

|

|

●

|

Total revenue was

$885.5 million, compared with

$705.0 million for 2017, and freight revenue (which excludes revenue from fuel surcharges) was

$779.7 million, compared with

$626.8 million for 2017;

|

|

|

●

|

Operating income was

$59.0 million, compared with operating income of

$28.2 million for 2017;

|

|

|

●

|

Net income was

$42.5 million, or

$2.30 per diluted share, compared with net income of

$55.4 million, or

$3.02 per diluted share, for 2017. Net income for 2017 included

$40.1 million, or $2.18 per diluted share, of income tax benefit resulting primarily from the reevaluation of our net deferred tax balances at December 31, 2017 as a result of the enactment of the Tax Act, signed into law on December 22, 2017;

|

|

●

|

With available borrowing capacity of $54.8 million under our Credit Facility as of December 31, 2018, we do not expect to be required to test our fixed charge covenant in the foreseeable future;

|

|

|

●

|

Our equity investment in TEL provided

$7.7 million of pre-tax earnings in

2018, compared to

$3.4 million for 2017;

|

|

|

●

|

Since December 31, 2017, aggregate lease adjusted indebtedness (which includes the present value of off-balance sheet lease obligations), net of cash, increased by $35.5 million to $255.7 million; and

|

|

|

●

|

Stockholders' equity at

December 31, 2018 was

$343.1 million, and tangible book value was

$269.0 million, or

$14.65 per basic share.

|

|

GAAP Operating Ratio:

|

2018

|

OR %

|

2017

|

OR %

|

2016

|

OR %

|

||||||||||||||||||

|

Total revenue

|

$

|

885,455

|

$

|

705,007

|

$

|

670,651

|

||||||||||||||||||

|

Total operating expenses

|

826,469

|

93.3

|

%

|

676,852

|

96.0

|

%

|

638,204

|

95.2

|

%

|

|||||||||||||||

|

Operating income

|

$

|

58,986

|

$

|

28,155

|

$

|

32,447

|

||||||||||||||||||

| Adjusted Operating Ratio: | 2018 | Adj. OR % | 2017 | Adj. OR % | 2016 | Adj. OR % | ||||||||||||||||||

|

Total revenue

|

885,455 | 705,007 | 670,651 | |||||||||||||||||||||

| Fuel surcharge revenue | (105,726 | ) | (78,198 | ) | (59,806 | ) | ||||||||||||||||||

| Freight revenue (total revenue, excluding fuel surcharge) | 779,729 | 626,809 | 610,845 | |||||||||||||||||||||

| Total operating expenses | 826,469 | 676,852 | 638,204 | |||||||||||||||||||||

| Adjusted for: | ||||||||||||||||||||||||

| Fuel surcharge revenue | (105,726 | ) | (78,198 | ) | (59,806 | ) | ||||||||||||||||||

| Amortization of intangibles | (1,462 | ) | - | (169 | ) | |||||||||||||||||||

| Adjusted operating expenses | 719,281 | 92.2 | % | 598,654 | 95.5 | % | 578,229 | 94.7 | % | |||||||||||||||

| Adjusted operating income | 60,448 | 28,155 | 32,447 | |||||||||||||||||||||

|

|

Year ended December 31,

|

|||||||||||

|

(in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Revenue:

|

||||||||||||

|

Freight revenue

|

$

|

779,729

|

$

|

626,809

|

$

|

610,845

|

||||||

|

Fuel surcharge revenue

|

105,726

|

78,198

|

59,806

|

|||||||||

|

Total revenue

|

$

|

885,455

|

$

|

705,007

|

$

|

670,651

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Salaries, wages, and related expenses

|

$

|

304,447

|

$

|

241,784

|

$

|

234,526

|

||||||

|

% of total revenue

|

34.4

|

%

|

34.3

|

%

|

35.0

|

%

|

||||||

|

% of freight revenue

|

39.0

|

%

|

38.6

|

%

|

38.4

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Fuel expense

|

$

|

121,264

|

$

|

103,139

|

$

|

103,108

|

||||||

|

% of total revenue

|

13.7

|

%

|

14.6

|

%

|

15.4

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Total fuel surcharge

|

$

|

105,726

|

$

|

78,198

|

$

|

59,806

|

||||||

|

Less: Fuel surcharge revenue reimbursed to independent contractors and other third parties

|

12,635

|

7,997

|

6,250

|

|||||||||

|

Company fuel surcharge revenue

|

$

|

93,091

|

$

|

70,201

|

$

|

53,556

|

||||||

|

Total fuel expense

|

$

|

121,264

|

$

|

103,139

|

$

|

103,108

|

||||||

|

Less: Company fuel surcharge revenue

|

93,091

|

70,201

|

53,556

|

|||||||||

|

Net fuel expense

|

$

|

28,173

|

$

|

32,938

|

$

|

49,552

|

||||||

|

% of freight revenue

|

3.6

|

%

|

5.3

|

%

|

8.1

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Operations and maintenance

|

$

|

55,505

|

$

|

48,774

|

$

|

45,864

|

||||||

|

% of total revenue

|

6.3

|

%

|

6.9

|

%

|

6.8

|

%

|

||||||

|

% of freight revenue

|

7.1

|

%

|

7.8

|

%

|

7.5

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Revenue equipment rentals and purchased transportation

|

$

|

183,645

|

$

|

141,954

|

$

|

117,472

|

||||||

|

% of total revenue

|

20.7

|

%

|

20.1

|

%

|

17.5

|

%

|

||||||

|

% of freight revenue

|

23.6

|

%

|

22.6

|

%

|

19.2

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Operating taxes and licenses

|

$

|

11,831

|

$

|

9,878

|

$

|

11,712

|

||||||

|

% of total revenue

|

1.3

|

%

|

1.4

|

%

|

1.7

|

%

|

||||||

|

% of freight revenue

|

1.5

|

%

|

1.6

|

%

|

1.9

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Insurance and claims

|

$

|

43,333

|

$

|

33,155

|

$

|

32,596

|

||||||

|

% of total revenue

|

4.9

|

%

|

4.7

|

%

|

4.9

|

%

|

||||||

|

% of freight revenue

|

5.6

|

%

|

5.3

|

%

|

5.3

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Communications and utilities

|

$

|

7,061

|

$

|

6,938

|

$

|

6,057

|

||||||

|

% of total revenue

|

0.8

|

%

|

1.0

|

%

|

0.9

|

%

|

||||||

|

% of freight revenue

|

0.9

|

%

|

1.1

|

%

|

1.0

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

General supplies and expenses

|

$

|

23,227

|

$

|

14,783

|

$

|

14,413

|

||||||

|

% of total revenue

|

2.6

|

%

|

2.1

|

%

|

2.1

|

%

|

||||||

|

% of freight revenue

|

3.0

|

%

|

2.4

|

%

|

2.4

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Depreciation and amortization

|

$

|

76,156

|

$

|

76,447

|

$

|

72,456

|

||||||

|

% of total revenue

|

8.6

|

%

|

10.8

|

%

|

10.8

|

%

|

||||||

|

% of freight revenue

|

9.8

|

%

|

12.2

|

%

|

11.9

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Interest expense, net

|

$

|

8,708

|

$

|

8,258

|

$

|

8,226

|

||||||

|

% of total revenue

|

1.0

|

%

|

1.2

|

%

|

1.2

|

%

|

||||||

|

% of freight revenue

|

1.1

|

%

|

1.3

|

%

|

1.3

|

%

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Income from equity method investment

|

$

|

7,732

|

$

|

3,400

|

$

|

3,000

|

||||||

|

|

Year ended December 31,

|

|||||||||||

|

(dollars in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Income tax expense (benefit)

|

$

|

15,507

|

$

|

(32,142

|

)

|

$

|

10,386

|

|||||

|

% of total revenue

|

1.8

|

%

|

(4.6

|

%)

|

1.5

|

%

|

||||||

|

% of freight revenue

|

2.0

|

%

|

(5.1

|

%)

|

1.7

|

%

|

||||||

|

|

Year ended

|

|||||||||||

|

|

December 31,

|

|||||||||||

|

(in thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Revenues:

|

||||||||||||

|

Truckload

|

$

|

727,046

|

$

|

612,834

|

$

|

601,226

|

||||||

|

Managed Freight

|

158,409

|

92,173

|

69,425

|

|||||||||

|

Total

|

$

|

885,455

|

$

|

705,007

|

$

|

670,651

|

||||||

|

Operating Income:

|

||||||||||||

|

Truckload

|

$

|

45,392

|

$

|

19,567

|

$

|

24,816

|

||||||

|

Managed Freight

|

13,594

|

8,588

|

7,631

|

|||||||||

|

Total

|

$

|

58,986

|

$

|

28,155

|

$

|

32,447

|

||||||

|

Payments due by period:

|

2019

|

2020

|

2021

|

2022

|

2023

|

More than

|

||||||||||||||||||||||

|

(in thousands)

|

Total

|

(less than

1 year)

|

(1-3 years)

|

(1-3 years)

|

(3-5 years)

|

(3-5 years)

|

5 years

|

|||||||||||||||||||||

|

Credit Facility (1)

|

$

|

3,911

|

$

|

-

|

$

|

-

|

$

|

3,911

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||||

|

Revenue equipment and property installment notes, including interest (2)

|

$

|

215,405

|

$

|

35,554

|

$

|

44,688

|

$

|

60,777

|

$

|

45,085

|

$

|

5,069

|

$

|

24,232

|

||||||||||||||

|

Operating leases (3)

|

$

|

42,545

|

$

|

16,331

|

$

|

11,726

|

$

|

7,973

|

$

|

6,272

|

$

|

208

|

$

|

35

|

||||||||||||||

|

Capital leases (4)

|

$

|

44,035

|

$

|

6,511

|

$

|

9,748

|

$

|

7,721

|

$

|

9,487

|

$

|

9,148

|

$

|

1,420

|

||||||||||||||

|

Lease residual value guarantees

|

$

|

1,007

|

$

|

1,007

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||||

|

Purchase obligations (5)

|

$

|

156,338

|

$

|

156,338

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||||

|

Total contractual cash obligations (6)

|

$

|

463,241

|

$

|

215,741

|

$

|

66,162

|

$

|

80,382

|

$

|

60,844

|

$

|

14,425

|

$

|

25,687

|

||||||||||||||

|

(1)

|

Represents principal owed at

December 31, 2018 and interest on such principal amount through maturity. The borrowings consist of draws under our Credit Facility, with fluctuating borrowing amounts and variable interest rates. In determining future contractual interest and principal obligations, for variable interest rate debt, the interest rate and principal amount in place at

December 31, 2018, was utilized. The table assumes long-term debt is held to maturity. Refer to Note 6, "Debt" of the accompanying consolidated financial statements for further information.

|

|

(2)

|

Represents principal and interest payments owed at

December 31, 2018. The borrowings consist of installment notes with finance companies, with fixed borrowing amounts and fixed interest rates, except for a variable rate real estate note, for which the interest rate is effectively fixed through an interest rate swap. The table assumes these installment notes are held to maturity. Refer to Note 6, "Debt" of the accompanying consolidated financial statements for further information.

|

|

(3)

|

Represents future monthly rental payment obligations under operating leases for tractors, trailers, and terminal properties, and computer and office equipment. Substantially all lease agreements for revenue equipment have fixed payment terms based on the passage of time. The tractor lease agreements generally stipulate maximum miles and provide for mileage penalties for excess miles. These leases generally run for a period of three to five years for tractors and five to seven years for trailers. Refer to Note 7, "Leases" of the accompanying consolidated financial statements for further information.

|

|

(4)

|

Represents principal and interest payments owed at

December 31, 2018. The borrowings consist of capital leases with one finance company, with fixed borrowing amounts and fixed interest rates or rates that are floating but effectively fixed through related interest rate swaps. Borrowings in 2019 and thereafter include the residual value guarantees on the related equipment as balloon payments. Refer to Note 6, "Debt" of the accompanying consolidated financial statements for further information.

|

|

(5)

|

Represents purchase obligations for revenue equipment totaling approximately

$156.3 million in

2018. These commitments are cancelable, subject to certain adjustments in the underlying obligations and benefits. These purchase commitments are expected to be financed by operating leases, capital leases, long-term debt, proceeds from sales of existing equipment, and/or cash flows from operations. Refer to Notes 6 and 7, "Debt" and "Leases," respectively, of the accompanying consolidated financial statements for further information.

|

|

(6)

|

Excludes any amounts accrued for unrecognized tax benefits as we are unable to reasonably predict the ultimate amount or timing of settlement of such unrecognized tax benefits.

|

|

|

●

|

auto liability - $1.0 million

|

|

|

●

|

workers' compensation - $1.3 million

|

|

|

●

|

cargo - $0.3 million

|

|

|

●

|

employee medical - $0.4 million

|

|

|

●

|

physical damage - 100%

|

|

|

Twelve Months Ended December 31, 2018

|

|||||||||||

|

|

Balances without

|

|||||||||||

|

|

adoption of Topic

|

|||||||||||

|

Financial Statement Line Item (in thousands)

|

As reported

|

Adjustments

|

606 | |||||||||

|

Consolidated Balance Sheet

|

||||||||||||

|

Accounts receivable, net of allowances

|

$

|

151,093

|

$

|

(1,244

|

)

|

$

|

149,849

|

|||||

|

Total assets

|

773,524

|

(1,244

|

)

|

772,280

|

||||||||

|

Accrued expenses

|

49,503

|

(277

|

)

|

49,226

|

||||||||

|

Deferred income taxes

|

77,467

|

(266

|

)

|

77,201

|

||||||||

|

Total liabilities

|

430,382

|

(543

|

)

|

429,839

|

||||||||

|

Retained earnings

|

200,566

|

(701

|

)

|

199,865

|

||||||||

|

Total stockholders’ equity

|

343,142

|

(701

|

)

|

342,441

|

||||||||

|

Total liabilities and stockholders’ equity

|

773,524

|

(1,244

|

)

|

772,280

|

||||||||

|

Consolidated Statement of Operations

|

||||||||||||

|

Freight revenue

|

779,729

|

(234

|

)

|

779,495

|

||||||||

|

Total revenue

|

885,455

|

(234

|

)

|

885,221

|

||||||||

|

Salaries, wages and related expenses

|

304,447

|

13

|

304,460

|

|||||||||

|

Revenue equipment rentals and purchased transportation

|

183,645

|

(95

|

)

|

183,550

|

||||||||

|

Total operating expenses

|

826,469

|

(82

|

)

|

826,387

|

||||||||

|

Income tax expense (benefit)

|

15,507

|

(41

|

)

|

15,466

|

||||||||

|

Net income

|

42,503

|

(111

|

)

|

42,392

|

||||||||

|

Consolidated Statement of Comprehensive Income

|

||||||||||||

|

Net income

|

42,503

|

(111

|

)

|

42,392

|

||||||||

|

Comprehensive income

|

42,414

|

(111

|

)

|

42,303

|

||||||||

|

Consolidated Statement of Cash Flows

|

||||||||||||

|

Operating Cash Flows

|

||||||||||||

|

Net income

|

42,503

|

(111

|

)

|

42,392

|

||||||||

|

Deferred income tax expense (benefit)

|

13,840

|

(41

|

)

|

13,799

|

||||||||

|

Change in: Receivables and advances

|

(27,199

|

)

|

234

|

(26,965

|

)

|

|||||||

|

Change in: Accounts payable and accrued expenses

|

19,232

|

(82

|

)

|

19,150

|

||||||||

|

Net cash flows provided by operating activities

|

124,800

|

-

|

124,800

|

|||||||||

|

ITEM 7A.

|

|

ITEM 8.

|

|

ITEM 9.

|

|

ITEM 9A.

|

|

|

●

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company;

|

|||

| ● |

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and

|

||||

| ● | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements. | ||||

|

ITEM 9B.

|

| ITEM 10. |

|

ITEM 11.

|

|

ITEM 12.

|

|

Plan category

|

Number of securities to be issued upon exercise

of outstanding options,

warrants and rights

|

Weighted average

exercise price of

outstanding options,

warrants and rights

|

Number of securities

remaining eligible for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

|

||||||||||

|

|

(a)

|

(b)

|

(c)

|

||||||||||

|

Equity compensation plans approved by security holders

|

675,437

|

(1) |

0

|

50,960

|

|||||||||

|

Equity compensation plans not approved by security holders

|

0

|

0

|

0

|

||||||||||

|

Total

|

675,437

|

0

|

50,960

|

||||||||||

|

(1)

|

Represents unvested restricted shares granted under the 2006 Omnibus Incentive Plan, as amended. The weighted average stock price on the date of grant for outstanding restricted stock awards was

$ 20.08, which is not reflected in column (b), because restricted stock awards do not have an exercise price.

|

|

ITEM 13.

|

|

ITEM 14.

|

|

ITEM 15.

|

|

||

|

|

|

|

|

|

(a)

|

1.

|

Financial Statements.

|

|

|

|

|

|

|

|

|

|

Our audited consolidated financial statements are set forth at the following pages of this report:

|

|

|

|

|

64

|

|

| Report of Independent Registered Public Accounting Firm - Opinion on Internal Control Over Financial Reporting | 65 | ||

|

|

|

67

|

|

|

|

|

68

|

|

|

|

|

69

|

|

|

|

|

70

|

|

|

|

|

71

|

|

|

|

|

72

|

|

|

|

|

|

|

|

|

2.

|

Financial Statement Schedules.

|

|

|

|

|

|

|

|

|

|

Financial statement schedules are not required because all required information is included in the financial statements or is not applicable.

|

|

|

|

|

|

|

|

|

3.

|

Exhibits.

|

|

|

|

|

|

|

|

|

|

The exhibits required to be filed by Item 601 of Regulation S-K are listed under paragraph (b) below and on the Exhibit Index appearing at the end of this report. Management contracts and compensatory plans or arrangements are indicated by an asterisk.

|

|

|

|

|

|

|

|

(b)

|

|

Exhibits.

|

|

|

|

|

The following exhibits are filed with this Form 10-K or incorporated by reference to the document set forth next to the exhibit listed below.

|

|

|

Exhibit Number

|

Reference

|

Description

|

|

|

Stock Purchase Agreement, dated July 3, 2018, by and among Landair Holdings, Inc., the Stockholders of Landair Holdings, Inc. and Covenant Transportation Group, Inc. (Incorporated by reference to Exhibit 2.1 to the Company's Form 10-Q, filed November 9, 2018)

|

|

|

|

Amended and Restated Articles of Incorporation (Incorporated by reference to Exhibit 99.2 to the Company's Report on Form 8-K, filed May 29, 2007)

|

|

|

|

Second Amended and Restated Bylaws (Incorporated by reference to Exhibit 3.2 to the Company's Form 10-Q, filed May 13, 2011)

|

|

|

|

Amended and Restated Articles of Incorporation (Incorporated by reference to Exhibit 99.2 to the Company's Report on Form 8-K, filed May 29, 2007)

|

|

|

|

Second Amended and Restated Bylaws (Incorporated by reference to Exhibit 3.2 to the Company's Form 10-Q, filed May 13, 2011)

|

|

|

*

|

Form of Indemnification Agreement between Covenant Transport, Inc. and each officer and director, effective May 1, 2004 (Incorporated by reference to Exhibit 10.2 to the Company's Form 10-Q, filed August 5, 2004)

|

|

|

*

|

Form of Restricted Stock Award Notice under the 2006 Omnibus Incentive Plan (Incorporated by reference to Exhibit 10.22 to the Company's Form 10-Q, filed August 9, 2006)

|

|

|

*

|

Form of Restricted Stock Special Award Notice under the 2006 Omnibus Incentive Plan (Incorporated by reference to Exhibit 10.23 to the Company's Form 10-Q, filed August 9, 2006)

|

|

|

|

Third Amended and Restated Credit Agreement, dated September 23, 2008, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., JPMorgan Chase Bank, N.A., and Textron Financial Corporation (Incorporated by reference to Exhibit 10.14 to the Company's Form 10-K, filed March 30, 2010)

|

|

|

*

|

Covenant Transportation Group, Inc. Third Amended and Restated 2006 Omnibus Incentive Plan (Incorporated by reference to Appendix A to the Company's Schedule 14A, filed April 19, 2013)

|

|

|

|

Amendment No. 1 to Third Amended and Restated Credit Agreement, dated March 27, 2009, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., JPMorgan Chase Bank, N.A., and Textron Financial Corporation (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed May 15, 2009)

|

|

|

Second Amendment to Third Amended and Restated Credit Agreement, dated February 25, 2010, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., JPMorgan Chase Bank, N.A., and Textron Financial Corporation (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed May 17, 2010)

|

|

|

|

Third Amendment to Third Amended and Restated Credit Agreement, dated July 30, 2010, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JP Morgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed November 9, 2010)

|

|

|

|

Fourth Amendment to Third Amended and Restated Credit Agreement, dated August 31, 2010, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JP Morgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.2 to the Company's Form 10-Q, filed November 9, 2010)

|

|

|

|

Fifth Amendment to Third Amended and Restated Credit Agreement, dated September 1, 2011, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JP Morgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Report on Form 8-K, filed October 28, 2011)

|

|

|

|

Sixth Amendment to Third Amended and Restated Credit Agreement, dated effective as of October 24, 2011, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JP Morgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.2 to the Company's Report on Form 8-K, filed October 28, 2011)

|

|

|

|

Seventh Amendment to Third Amended and Restated Credit Agreement, dated effective as of March 29, 2012, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JP Morgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Report on Form 8-K, filed April 2, 2012)

|

|

|

|

Eighth Amendment to Third Amended and Restated Credit Agreement, dated effective as of December 31, 2012, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JP Morgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Report on Form 8-K, filed January 31, 2013)

|

|

|

|

Ninth Amendment to Third Amended and Restated Credit Agreement and Related Security Documents, dated effective as of August 6, 2014, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed November 13, 2014)

|

|

|

|

Tenth Amendment to Third Amended and Restated Credit Agreement and Related Security Documents, dated effective as of September 8, 2014, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, Inc., Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.2 to the Company's Form 10-Q, filed November 13, 2014)

|

|

|

*

|

Consulting Agreement (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed November 9, 2016)

|

|

|

|

Joinder, Supplement and Eleventh Amendment to Third Amended and Restated Credit Agreement, dated effective as of August 6, 2015, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, LLC, Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Driven Analytic Solutions, LLC, Covenant Properties, LLC, Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed November 9, 2015)

|

|

|

|

Twelfth Amendment to Third Amended and Restated Credit Agreement, dated effective as of February 25, 2016, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, LLC, Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Driven Analytic Solutions, LLC, Covenant Properties, LLC, Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.2 to the Company's Form 10-Q, filed May 10, 2016)

|

|

|

|

Thirteenth Amendment to Third Amended and Restated Credit Agreement, dated effective as of December 16, 2016, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, LLC, Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Driven Analytic Solutions, LLC, Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.26 to the Company's Form 10-K, filed March 14, 2017)

|

|

*

|

First Amendment to Consulting Agreement (Incorporated by reference to Exhibit 10.27 to the Company's Form 10-K, filed March 14, 2017)

|

|

|

|

Fourteenth Amendment to Third Amended and Restated Credit Agreement, dated effective as of November 28, 2017, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, LLC, Southern Refrigerated Transport, Inc., Covenant Transport Solutions, Inc., Star Transportation, Inc., Driven Analytic Solutions, LLC, Transport Management Services, LLC, Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.27 to the Company's Form 10-K, filed February 28, 2018)

|

|

|

|

Fifteenth Amendment to Third Amended and Restated Credit Agreement, dated effective as of June 19, 2018, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, LLC, Southern Refrigerated Transport, Inc., Covenant Transport Solutions, LLC, Star Transportation, Inc., Covenant Logistics, Inc., Driven Analytic Solutions, LLC, Transport Management Services, LLC, Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed August 8, 2018)

|

|

|

|

Sixteenth Amendment to Third Amended and Restated Credit Agreement, dated effective as of July 3, 2018, among Covenant Transportation Group, Inc., Covenant Transport, Inc., CTG Leasing Company, Covenant Asset Management, LLC, Southern Refrigerated Transport, Inc., Covenant Transport Solutions, LLC, Star Transportation, Inc., Covenant Logistics, Inc., Driven Analytic Solutions, LLC, Transport Management Services, LLC, Landair Holdings, Inc., Landair Transport, Inc., Landair Logistics, Inc., Landair Leasing, Inc., Bank of America, N.A., and JPMorgan Chase Bank, N.A. (Incorporated by reference to Exhibit 10.1 to the Company's Form 10-Q, filed November 9, 2018)

|

|

|

#

|

List of Subsidiaries

|

|

|

#

|

Consent of Independent Registered Public Accounting Firm – KPMG LLP

|

|

|

#

|

Certification pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, by David R. Parker, the Company's Principal Executive Officer

|

|

|

#

|

Certification pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, by Richard B. Cribbs, the Company's Principal Financial Officer

|

|

|

#

|

Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, by David R. Parker, the Company's Chief Executive Officer

|

|

|

#

|

Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, by Richard B. Cribbs, the Company's Chief Financial Officer

|

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Labels Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

#

|

Filed herewith.

|

|

*

|

Management contract or compensatory plan or arrangement.

|

|

ITEM 16.

|

|

|

COVENANT TRANSPORTATION GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

March 13, 2019

|

By:

|

/s/ Richard B. Cribbs

|

|

|

|

|

Richard B. Cribbs

|

|

|

|

|

Executive Vice President and Chief Financial Officer in his capacity as such and on behalf of the issuer.

|

|

|

Signature and Title

|

|

Date

|

|

|

|

|

|

/s/ David R. Parker

|

|

March 13, 2019

|

|

David R. Parker

|

|

|

|

Chairman of the Board and Chief Executive Officer

(principal executive officer)

|

|

|

|

|

|

|

|

/s/ Richard B. Cribbs

|

|

March 13, 2019

|

|

Richard B. Cribbs

|

|

|

|

Executive Vice President and Chief Financial Officer

(principal financial officer)

|

|

|

|

|

|

|

|

/s/ M. Paul Bunn

|

|

March 13, 2019

|

|

M. Paul Bunn

|

|

|

|

Chief Accounting Officer

(principal accounting officer)

|

|

|

|

|

|

|

|

/s/ Bradley A. Moline

|

|

March 13, 2019

|

|

Bradley A. Moline

|

|

|

|

Director

|

|

|

|

|

|

|

|

/s/ William T. Alt

|

|

March 13, 2019

|

|

William T. Alt

|

|

|

|

Director

|

|

|

|

|

|

|

|

/s/ Robert E. Bosworth

|

|

March 13, 2019

|

|

Robert E. Bosworth

|

|

|

|

Director

|

|

|

|

|

|

|

|

/s/ Herbert J. Schmidt

|

|

March 13, 2019

|

|

Herbert J. Schmidt

|

|

|

|

Director

|

|

|

|

|

|

|

|

/s/ W. Miller Welborn

|

|

March 13, 2019

|

|

W. Miller Welborn

|

|

|

|

Director

|

|

|

Covenant Transportation Group, Inc.:

Covenant Transporation Group, Inc.:

March 13, 2019

|

CONSOLIDATED BALANCE SHEETS

|

|

DECEMBER 31, 2018 AND 2017

|

|

(In thousands, except share data)

|

|

|

2018

|

2017

|

||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

23,127

|

$

|

15,356

|

||||

|

Accounts receivable, net of allowance of $1,985 in 2018 and $1,456 in 2017

|

151,093

|

104,153

|

||||||

|

Drivers' advances and other receivables, net of allowance of $626 in 2018 and $556 in 2017

|

16,675

|

15,062

|

||||||

|

Inventory and supplies

|

4,067

|

4,232

|

||||||

|

Prepaid expenses

|

11,579

|

8,699

|

||||||

|

Assets held for sale

|

2,559

|

1,444

|

||||||

|

Income taxes receivable

|

1,109

|

11,551

|

||||||

|

Other short-term assets

|

1,435

|

1,817

|

||||||

|

Total current assets

|

211,644

|

162,314

|

||||||

|

|

||||||||

|

Property and equipment, at cost

|

638,770

|

650,988

|

||||||

|

Less: accumulated depreciation and amortization

|

(188,175

|

)

|

(186,916

|

)

|

||||

|

Net property and equipment

|

450,595

|

464,072

|

||||||