|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

94-0890210

|

6001 Bollinger Canyon Road,

San Ramon, California 94583-2324 |

||

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

(Address of principal executive offices) (Zip Code)

|

||

|

Title of Each Class

|

Name of Each Exchange

on Which Registered |

|

|

Common stock, par value $.75 per share

|

New York Stock Exchange, Inc.

|

|

|

Large accelerated filer

þ

|

Accelerated filer

|

o

|

||||

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

||||||

|

Smaller reporting company

o

|

Emerging growth company

|

o

|

||||

|

ITEM

|

PAGE

|

|

|

4.

|

Mine Safety Disclosures

|

|

|

16.

|

Form 10-K Summary

|

|

|

EX-10.6

|

EX-24.9

|

|

EX-10.7

|

EX-24.10

|

|

EX-10.23

|

EX-31.1

|

|

EX-12.1

|

EX-31.2

|

|

EX-21.1

|

EX-32.1

|

|

EX-23.1

|

EX-32.2

|

|

EX-24.1

|

EX-99.1

|

|

EX-24.2

|

EX-101 INSTANCE DOCUMENT

|

|

EX-24.3

|

EX-101 SCHEMA DOCUMENT

|

|

EX-24.4

|

EX-101 CALCULATION LINKBASE DOCUMENT

|

|

EX-24.5

|

EX-101 LABELS LINKBASE DOCUMENT

|

|

EX-24.6

|

EX-101 PRESENTATION LINKBASE DOCUMENT

|

|

EX-24.7

|

EX-101 DEFINITION LINKBASE DOCUMENT

|

|

EX-24.8

|

|

FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

|

At December 31

|

|||||||||

|

2017

|

|

2016

|

|

2015

|

|

||||

|

Liquids — Millions of barrels

|

|||||||||

|

Consolidated Companies

|

4,530

|

|

4,131

|

|

4,262

|

|

|||

|

Affiliated Companies

|

2,012

|

|

2,197

|

|

2,000

|

|

|||

|

Total Liquids

|

6,542

|

|

6,328

|

|

6,262

|

|

|||

|

Natural Gas — Billions of cubic feet

|

|||||||||

|

Consolidated Companies

|

27,514

|

|

25,432

|

|

25,946

|

|

|||

|

Affiliated Companies

|

3,222

|

|

3,328

|

|

3,491

|

|

|||

|

Total Natural Gas

|

30,736

|

|

28,760

|

|

29,437

|

|

|||

|

Oil-Equivalent — Millions of barrels

*

|

|||||||||

|

Consolidated Companies

|

9,116

|

|

8,369

|

|

8,586

|

|

|||

|

Affiliated Companies

|

2,549

|

|

2,752

|

|

2,582

|

|

|||

|

Total Oil-Equivalent

|

11,665

|

|

11,121

|

|

11,168

|

|

|||

|

*

|

As used in this report, the term “project” may describe new upstream development activity, individual phases in a multiphase development, maintenance activities, certain existing assets, new investments in downstream and chemicals capacity, investments in emerging and sustainable energy activities, and certain other activities. All of these terms are used for convenience only and are not intended as a precise description of the term “project” as it relates to any specific governmental law or regulation.

|

|

Components of Oil-Equivalent

|

|||||||||||||||

|

Oil-Equivalent

|

Liquids

|

Natural Gas

|

|||||||||||||

|

Thousands of barrels per day (MBPD)

|

(MBPD)

1

|

(MBPD)

|

(MMCFPD)

|

||||||||||||

|

Millions of cubic feet per day (MMCFPD)

|

2017

|

|

2016

|

|

2017

|

|

2016

|

|

2017

|

|

2016

|

|

|||

|

United States

|

681

|

|

691

|

|

519

|

|

504

|

|

970

|

|

1,120

|

|

|||

|

Other Americas

|

|||||||||||||||

|

Argentina

|

23

|

|

26

|

|

19

|

|

20

|

|

27

|

|

32

|

|

|||

|

Brazil

|

13

|

|

16

|

|

12

|

|

16

|

|

4

|

|

5

|

|

|||

|

Canada

2

|

98

|

|

92

|

|

87

|

|

83

|

|

65

|

|

55

|

|

|||

|

Colombia

|

16

|

|

21

|

|

—

|

|

—

|

|

96

|

|

127

|

|

|||

|

Trinidad and Tobago

3

|

5

|

|

12

|

|

—

|

|

—

|

|

29

|

|

74

|

|

|||

|

Total Other Americas

|

155

|

|

167

|

|

118

|

|

119

|

|

221

|

|

293

|

|

|||

|

Africa

|

|||||||||||||||

|

Angola

|

112

|

|

114

|

|

103

|

|

106

|

|

57

|

|

52

|

|

|||

|

Democratic Republic of the Congo

|

2

|

|

2

|

|

2

|

|

2

|

|

1

|

|

1

|

|

|||

|

Nigeria

|

250

|

|

235

|

|

213

|

|

208

|

|

223

|

|

159

|

|

|||

|

Republic of Congo

|

38

|

|

25

|

|

36

|

|

23

|

|

14

|

|

11

|

|

|||

|

Total Africa

|

402

|

|

376

|

|

354

|

|

339

|

|

295

|

|

223

|

|

|||

|

Asia

|

|||||||||||||||

|

Azerbaijan

|

25

|

|

32

|

|

23

|

|

30

|

|

11

|

|

13

|

|

|||

|

Bangladesh

|

111

|

|

114

|

|

4

|

|

4

|

|

642

|

|

658

|

|

|||

|

China

|

30

|

|

27

|

|

17

|

|

18

|

|

81

|

|

51

|

|

|||

|

Indonesia

|

164

|

|

203

|

|

137

|

|

173

|

|

163

|

|

182

|

|

|||

|

Kazakhstan

|

55

|

|

62

|

|

33

|

|

37

|

|

132

|

|

154

|

|

|||

|

Myanmar

|

19

|

|

21

|

|

—

|

|

—

|

|

116

|

|

128

|

|

|||

|

Partitioned Zone

4

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||

|

Philippines

|

25

|

|

26

|

|

3

|

|

3

|

|

129

|

|

138

|

|

|||

|

Thailand

|

241

|

|

245

|

|

69

|

|

71

|

|

1,031

|

|

1,051

|

|

|||

|

Total Asia

|

670

|

|

730

|

|

286

|

|

336

|

|

2,305

|

|

2,375

|

|

|||

|

Australia/Oceania

|

|||||||||||||||

|

Australia

|

256

|

|

124

|

|

27

|

|

21

|

|

1,372

|

|

615

|

|

|||

|

Total Australia/Oceania

|

256

|

|

124

|

|

27

|

|

21

|

|

1,372

|

|

615

|

|

|||

|

Europe

|

|||||||||||||||

|

Denmark

|

23

|

|

22

|

|

14

|

|

14

|

|

53

|

|

48

|

|

|||

|

United Kingdom

|

75

|

|

64

|

|

50

|

|

43

|

|

155

|

|

122

|

|

|||

|

Total Europe

|

98

|

|

86

|

|

64

|

|

57

|

|

208

|

|

170

|

|

|||

|

Total Consolidated Companies

|

2,262

|

|

2,174

|

|

1,368

|

|

1,376

|

|

5,371

|

|

4,796

|

|

|||

|

Affiliates

2,5

|

466

|

|

420

|

|

355

|

|

343

|

|

661

|

|

456

|

|

|||

|

Total Including Affiliates

6

|

2,728

|

|

2,594

|

|

1,723

|

|

1,719

|

|

6,032

|

|

5,252

|

|

|||

|

1

Oil-equivalent conversion ratio is 6,000 cubic feet of natural gas = 1 barrel of crude oil.

|

|||||||||||||||

|

2

Includes synthetic oil: Canada, net

|

51

|

|

50

|

|

51

|

|

50

|

|

—

|

|

—

|

|

|||

|

Venezuelan affiliate, net

|

28

|

|

28

|

|

28

|

|

28

|

|

—

|

|

—

|

|

|||

|

3

Producing fields in Trinidad and Tobago were sold in August 2017.

|

|||||||||||||||

|

4

Located between Saudi Arabia and Kuwait. Production has been shut-in since May 2015.

|

|||||||||||||||

|

5

Volumes represent Chevron’s share of production by affiliates, including Tengizchevroil in Kazakhstan; Petroboscan, Petroindependiente and Petropiar in Venezuela; and Angola LNG in Angola.

|

|||||||||||||||

|

6

Volumes include natural gas consumed in operations of 565 million and 486

million cubic feet per day in 2017 and 2016, respectively. Total “as sold” natural gas volumes were 5,467 million and 4,766 million cubic feet per day for 2017 and 2016, respectively.

|

|||||||||||||||

|

At December 31, 2017

|

|||||||||||

|

Productive Oil Wells*

|

Productive Gas Wells *

|

||||||||||

|

Gross

|

|

Net

|

|

Gross

|

|

Net

|

|

||||

|

United States

|

43,170

|

|

29,690

|

|

3,273

|

|

2,380

|

|

|||

|

Other Americas

|

1,049

|

|

644

|

|

129

|

|

76

|

|

|||

|

Africa

|

1,683

|

|

639

|

|

20

|

|

8

|

|

|||

|

Asia

|

14,958

|

|

12,891

|

|

3,780

|

|

2,182

|

|

|||

|

Australia/Oceania

|

564

|

|

315

|

|

95

|

|

26

|

|

|||

|

Europe

|

325

|

|

71

|

|

170

|

|

36

|

|

|||

|

Total Consolidated Companies

|

61,749

|

|

44,250

|

|

7,467

|

|

4,708

|

|

|||

|

Affiliates

|

1,583

|

|

550

|

|

7

|

|

2

|

|

|||

|

Total Including Affiliates

|

63,332

|

|

44,800

|

|

7,474

|

|

4,710

|

|

|||

|

Multiple completion wells included above

|

819

|

|

551

|

|

38

|

|

32

|

|

|||

|

* Gross wells represent the total number of wells in which Chevron has an ownership interest. Net wells represent the sum of Chevron's ownership interest in gross wells.

|

|||||||||||

|

Undeveloped

2

|

Developed

|

Developed and Undeveloped

|

||||||||||||||||

|

Thousands of acres

1

|

Gross

|

|

Net

|

|

Gross

|

|

Net

|

|

Gross

|

|

Net

|

|

||||||

|

United States

|

4,004

|

|

3,415

|

|

4,189

|

|

2,966

|

|

8,193

|

|

6,381

|

|

||||||

|

Other Americas

|

26,249

|

|

14,635

|

|

1,183

|

|

264

|

|

27,432

|

|

14,899

|

|

||||||

|

Africa

|

8,432

|

|

3,474

|

|

2,243

|

|

933

|

|

10,675

|

|

4,407

|

|

||||||

|

Asia

|

23,243

|

|

11,637

|

|

1,720

|

|

975

|

|

24,963

|

|

12,612

|

|

||||||

|

Australia/Oceania

|

25,947

|

|

17,198

|

|

2,002

|

|

803

|

|

27,949

|

|

18,001

|

|

||||||

|

Europe

|

2,004

|

|

1,004

|

|

407

|

|

53

|

|

2,411

|

|

1,057

|

|

||||||

|

Total Consolidated Companies

|

89,879

|

|

51,363

|

|

11,744

|

|

5,994

|

|

101,623

|

|

57,357

|

|

||||||

|

Affiliates

|

513

|

|

224

|

|

291

|

|

112

|

|

804

|

|

336

|

|

||||||

|

Total Including Affiliates

|

90,392

|

|

51,587

|

|

12,035

|

|

6,106

|

|

102,427

|

|

57,693

|

|

||||||

|

1

Gross acres represent the total number of acres in which Chevron has an ownership interest. Net acres represent the sum of Chevron's ownership interest in gross acres.

|

||||||||||||||||||

|

2

The gross undeveloped acres that will expire in 2018, 2019 and 2020 if production is not established by certain required dates are 4,353, 1,695 and 1,321, respectively.

|

||||||||||||||||||

|

Wells Drilling*

|

Net Wells Completed

|

|||||||||||||||||||

|

at 12/31/17

|

2017

|

2016

|

2015

|

|||||||||||||||||

|

Gross

|

|

Net

|

|

Prod.

|

|

Dry

|

|

Prod.

|

|

Dry

|

|

Prod.

|

|

Dry

|

|

|||||

|

United States

|

220

|

|

167

|

|

435

|

|

4

|

|

420

|

|

4

|

|

873

|

|

3

|

|

||||

|

Other Americas

|

30

|

|

13

|

|

40

|

|

—

|

|

45

|

|

—

|

|

99

|

|

—

|

|

||||

|

Africa

|

4

|

|

1

|

|

34

|

|

—

|

|

17

|

|

—

|

|

9

|

|

—

|

|

||||

|

Asia

|

9

|

|

1

|

|

246

|

|

2

|

|

470

|

|

6

|

|

828

|

|

5

|

|

||||

|

Australia/Oceania

|

—

|

|

—

|

|

—

|

|

—

|

|

4

|

|

—

|

|

4

|

|

—

|

|

||||

|

Europe

|

2

|

|

—

|

|

4

|

|

—

|

|

3

|

|

—

|

|

2

|

|

—

|

|

||||

|

Total Consolidated Companies

|

265

|

|

182

|

|

759

|

|

6

|

|

959

|

|

10

|

|

1,815

|

|

8

|

|

||||

|

Affiliates

|

41

|

|

17

|

|

36

|

|

—

|

|

38

|

|

—

|

|

26

|

|

—

|

|

||||

|

Total Including Affiliates

|

306

|

|

199

|

|

795

|

|

6

|

|

997

|

|

10

|

|

1,841

|

|

8

|

|

||||

|

* Gross wells represent the total number of wells in which Chevron has an ownership interest. Net wells represent the sum of Chevron's ownership interest in gross wells.

|

||||||||||||||||||||

|

Wells Drilling*

|

Net Wells Completed

|

|||||||||||||||||||||||

|

at 12/31/17

|

2017

|

2016

|

2015

|

|||||||||||||||||||||

|

Gross

|

|

Net

|

|

Prod.

|

|

Dry

|

|

Prod.

|

|

Dry

|

|

Prod.

|

|

Dry

|

|

|||||||||

|

United States

|

6

|

|

|

3

|

|

|

7

|

|

|

1

|

|

|

4

|

|

|

1

|

|

|

16

|

|

|

4

|

|

|

|

Other Americas

|

1

|

|

|

1

|

|

|

—

|

|

|

—

|

|

|

4

|

|

|

—

|

|

|

5

|

|

|

1

|

|

|

|

Africa

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1

|

|

|

1

|

|

|

3

|

|

|

—

|

|

|

|

Asia

|

1

|

|

|

1

|

|

|

—

|

|

|

—

|

|

|

3

|

|

|

—

|

|

|

5

|

|

|

1

|

|

|

|

Australia/Oceania

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1

|

|

|

4

|

|

|

|

Europe

|

—

|

|

|

—

|

|

|

—

|

|

|

1

|

|

|

—

|

|

|

—

|

|

|

3

|

|

|

—

|

|

|

|

Total Consolidated Companies

|

8

|

|

|

5

|

|

|

7

|

|

|

2

|

|

|

12

|

|

|

2

|

|

|

33

|

|

|

10

|

|

|

|

Affiliates

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

Total Including Affiliates

|

8

|

|

|

5

|

|

|

7

|

|

|

2

|

|

|

12

|

|

|

2

|

|

|

33

|

|

|

10

|

|

|

|

* Gross wells represent the total number of wells in which Chevron has an ownership interest. Net wells represent the sum of Chevron's ownership interest in gross wells.

|

||||||||||||||||||||||||

|

Capacities and inputs in thousands of barrels per day

|

December 31, 2017

|

Refinery Inputs

|

||||||||||

|

Locations

|

Number

|

|

Operable Capacity

|

|

2017

|

|

2016

|

|

2015

|

|

||

|

Pascagoula

|

Mississippi

|

1

|

|

340

|

|

349

|

|

355

|

|

322

|

|

|

|

El Segundo

|

California

|

1

|

|

269

|

|

251

|

|

267

|

|

258

|

|

|

|

Richmond

|

California

|

1

|

|

257

|

|

248

|

|

188

|

|

245

|

|

|

|

Kapolei

1

|

Hawaii

|

—

|

|

—

|

|

—

|

|

37

|

|

47

|

|

|

|

Salt Lake City

|

Utah

|

1

|

|

53

|

|

53

|

|

53

|

|

52

|

|

|

|

Total Consolidated Companies — United States

|

4

|

|

919

|

|

901

|

|

900

|

|

924

|

|

||

|

Map Ta Phut

|

Thailand

|

1

|

|

165

|

|

152

|

|

162

|

|

164

|

|

|

|

Cape Town

2

|

South Africa

|

1

|

|

110

|

|

68

|

|

78

|

|

69

|

|

|

|

Burnaby, B.C.

3

|

Canada

|

—

|

|

—

|

|

40

|

|

51

|

|

46

|

|

|

|

Total Consolidated Companies — International

|

2

|

|

275

|

|

260

|

|

291

|

|

279

|

|

||

|

Affiliates

|

Various Locations

|

3

|

|

544

|

|

500

|

|

497

|

|

499

|

|

|

|

Total Including Affiliates — International

|

5

|

|

819

|

|

760

|

|

788

|

|

778

|

|

||

|

Total Including Affiliates — Worldwide

|

9

|

|

1,738

|

|

1,661

|

|

1,688

|

|

1,702

|

|

||

|

1

|

In November 2016, the company sold the Hawaii Refinery.

|

|

2

|

Chevron holds a 75 percent controlling interest in the shares issued by Chevron South Africa (Pty) Limited, which owns the Cape Town Refinery. A consortium of South African partners, along with the employees of Chevron South Africa (Pty) Limited, own the remaining 25 percent.

|

|

3

|

In September 2017, the company sold the Burnaby, B.C. refinery.

|

|

Thousands of barrels per day

|

2017

|

|

2016

|

|

2015

|

|

|

|

United States

|

|||||||

|

Gasoline

|

625

|

|

631

|

|

621

|

|

|

|

Jet Fuel

|

242

|

|

242

|

|

232

|

|

|

|

Diesel/Gas Oil

|

179

|

|

182

|

|

215

|

|

|

|

Residual Fuel Oil

|

48

|

|

59

|

|

59

|

|

|

|

Other Petroleum Products

1

|

103

|

|

99

|

|

101

|

|

|

|

Total United States

|

1,197

|

|

1,213

|

|

1,228

|

|

|

|

International

2

|

|||||||

|

Gasoline

|

365

|

|

382

|

|

389

|

|

|

|

Jet Fuel

|

274

|

|

261

|

|

271

|

|

|

|

Diesel/Gas Oil

|

490

|

|

468

|

|

478

|

|

|

|

Residual Fuel Oil

|

162

|

|

144

|

|

159

|

|

|

|

Other Petroleum Products

1

|

202

|

|

207

|

|

210

|

|

|

|

Total International

|

1,493

|

|

1,462

|

|

1,507

|

|

|

|

Total Worldwide

2

|

2,690

|

|

2,675

|

|

2,735

|

|

|

|

1

Principally naphtha, lubricants, asphalt and coke.

|

|||||||

|

2

Includes share of affiliates’ sales:

|

366

|

|

377

|

|

420

|

|

|

|

Total Number

|

|

Average

|

|

Total Number of Shares

|

|

Maximum Number of Shares

|

|

||

|

of Shares

|

|

Price Paid

|

|

Purchased as Part of Publicly

|

|

That May Yet be Purchased

|

|

||

|

Period

|

Purchased

1,2

|

|

per Share

|

|

Announced Program

|

|

Under the Program

2

|

|

|

|

Oct. 1 – Oct. 31, 2017

|

312

|

|

|

$117.42

|

|

—

|

|

—

|

|

|

Nov. 1 – Nov. 30, 2017

|

—

|

|

|

|

—

|

|

—

|

|

|

|

Dec. 1 – Dec. 31, 2017

|

—

|

|

|

|

—

|

|

—

|

|

|

|

Total Oct. 1 – Dec. 31, 2017

|

312

|

|

|

$117.42

|

|

—

|

|

—

|

|

|

1

|

Includes common shares repurchased from company employees and directors for required personal income tax withholdings on the exercise of the stock options and shares delivered or attested to in satisfaction of the exercise price by holders of the employee and director stock options. The options were issued to and exercised by management under Chevron long-term incentive plans.

|

|

2

|

In July 2010, the Board of Directors approved an ongoing share repurchase program with no set term or monetary limits, under which common shares would be acquired by the company through open market purchases or in negotiated transactions at prevailing prices, as permitted by securities laws and other legal requirements and subject to market conditions and other factors. From inception of the program through 2014, the company had purchased

180,886,291

shares under this program (some pursuant to a Rule 10b5-1 plan and some pursuant to accelerated share repurchase plans) for

$20 billion

at an average price of approximately

$111

per share. The company did not acquire any shares under the program in 2015, 2016 or 2017.

|

|

Name

|

Age

|

Current and Prior Positions (up to five years)

|

Current Areas of Responsibility

|

|

M.K. Wirth

|

57

|

Chairman of the Board and Chief Executive Officer (since February

2018)

Vice Chairman of the Board and Executive Vice President, Midstream

and Development (February 2017 to January 2018)

Executive Vice President, Midstream and Development (February 2016

through January 2017)

Executive Vice President, Downstream (2006 through 2015)

|

Chairman of the Board and

Chief Executive Officer

|

|

J.W. Johnson

|

58

|

Executive Vice President, Upstream (since 2015)

Senior Vice President, Upstream (2014)

President, Europe, Eurasia and Middle East Exploration and

Production (2011 through 2013) |

Worldwide Exploration and Production Activities

|

|

P.R. Breber

|

53

|

Executive Vice President, Downstream (since 2016)

Corporate Vice President and President, Gas and Midstream

(2014 through 2015)

Managing Director, Asia South Business Unit (2012 through 2013)

|

Worldwide Refining, Marketing and Lubricants; Chemicals

|

|

J.C. Geagea

|

58

|

Executive Vice President, Technology, Projects and Services

(since 2015)

Senior Vice President, Technology, Projects and Services (2014)

Corporate Vice President and President, Gas and Midstream

(2012 through 2013) |

Technology; Health, Environment and Safety; Project Resources Company; Procurement

|

|

M.A. Nelson

|

54

|

Vice President, Midstream, Strategy and Policy (since February 2018)

Vice President, Strategic Planning (May 2016 through January 2018)

President, International Products (2010 through April 2016)

|

Corporate Strategy; Policy, Government and Public Affairs; Supply and Trading Activities; Shipping; Pipeline; Power and Energy Management

|

|

P.E. Yarrington

|

61

|

Vice President and Chief Financial Officer (since 2009)

|

Finance

|

|

R.H. Pate

|

55

|

Vice President and General Counsel (since 2009)

|

Law, Governance and Compliance

|

|

Off-Balance-Sheet Arrangements, Contractual Obligations,

Guarantees and Other Contingencies

|

||

|

Consolidated Financial Statements

|

||

|

Note

2

|

Changes in Accumulated Other

Comprehensive Losses

|

|

|

Note

3

|

||

|

Note 4

|

Information Relating to the Consolidated

|

|

|

Note

5

|

||

|

Note

6

|

||

|

Note

7

|

||

|

Note

8

|

||

|

Note

9

|

Summarized Financial Data - Chevron Phillips

Chemical Company LLC |

|

|

Note

10

|

||

|

Note

11

|

||

|

Note 1

2

|

Assets Held for Sale

|

|

|

Note 1

3

|

||

|

Note 14

|

||

|

Note 15

|

||

|

Note 16

|

||

|

Note 17

|

||

|

Note 18

|

||

|

Note 19

|

Short

-Term Debt

|

|

|

Note 20

|

Long

-Term Debt

|

|

|

Note 21

|

||

|

Note 22

|

||

|

Note 23

|

||

|

Note 24

|

Properties, Plant and Equipment

|

|

|

Note 25

|

||

|

Note 26

|

||

|

Note 27

|

||

|

Millions of dollars, except per-share amounts

|

2017

|

|

2016

|

|

2015

|

|

|||||

|

Net Income (Loss) Attributable to Chevron Corporation

|

$

|

9,195

|

|

$

|

(497

|

)

|

$

|

4,587

|

|

||

|

Per Share Amounts:

|

|

|

|

|

|||||||

|

Net Income (Loss) Attributable to Chevron Corporation

|

|

|

|

|

|||||||

|

– Basic

|

$

|

4.88

|

|

$

|

(0.27

|

)

|

$

|

2.46

|

|

||

|

– Diluted

|

$

|

4.85

|

|

$

|

(0.27

|

)

|

$

|

2.45

|

|

||

|

Dividends

|

$

|

4.32

|

|

$

|

4.29

|

|

$

|

4.28

|

|

||

|

Sales and Other Operating Revenues

|

$

|

134,674

|

|

$

|

110,215

|

|

$

|

129,925

|

|

||

|

Return on:

|

|

|

|

|

|||||||

|

Capital Employed

|

5.0

|

%

|

(0.1

|

)%

|

2.5

|

%

|

|||||

|

Stockholders’ Equity

|

6.3

|

%

|

(0.3

|

)%

|

3.0

|

%

|

|||||

|

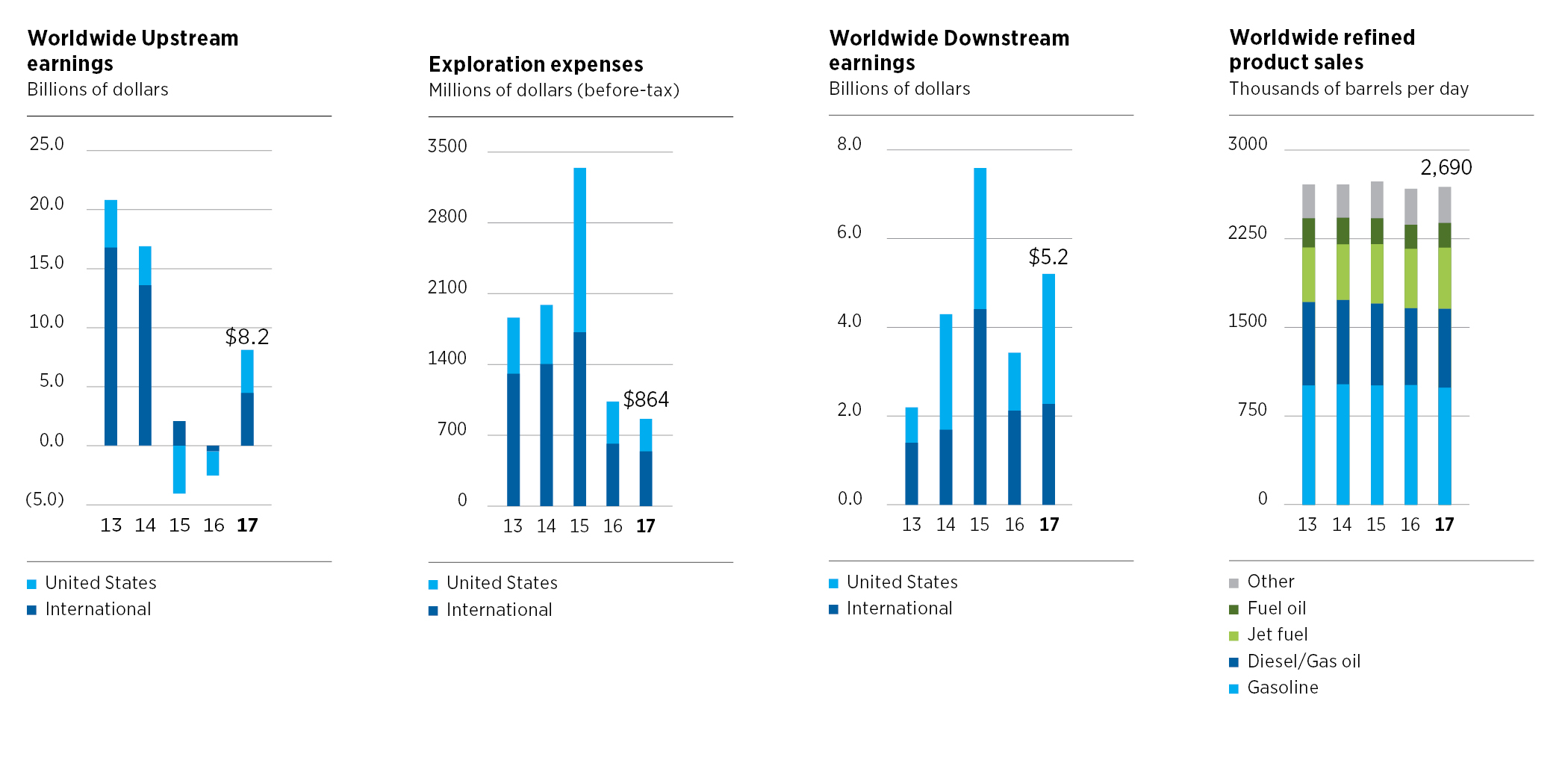

Earnings by Major Operating Area

|

|||||||||||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

|||||

|

Upstream

|

|||||||||||

|

United States

|

$

|

3,640

|

|

$

|

(2,054

|

)

|

$

|

(4,055

|

)

|

||

|

International

|

4,510

|

|

(483

|

)

|

2,094

|

|

|||||

|

Total Upstream

|

8,150

|

|

(2,537

|

)

|

(1,961

|

)

|

|||||

|

Downstream

|

|||||||||||

|

United States

|

2,938

|

|

1,307

|

|

3,182

|

|

|||||

|

International

|

2,276

|

|

2,128

|

|

4,419

|

|

|||||

|

Total Downstream

|

5,214

|

|

3,435

|

|

7,601

|

|

|||||

|

All Other

|

(4,169

|

)

|

(1,395

|

)

|

(1,053

|

)

|

|||||

|

Net Income (Loss) Attributable to Chevron Corporation

1,2

|

$

|

9,195

|

|

$

|

(497

|

)

|

$

|

4,587

|

|

||

|

1

Includes foreign currency effects:

|

$

|

(446

|

)

|

$

|

58

|

|

$

|

769

|

|

||

|

2

Income net of tax, also referred to as “earnings” in the discussions that follow.

|

|||||||||||

|

|

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Earnings

|

$

|

3,640

|

|

$

|

(2,054

|

)

|

$

|

(4,055

|

)

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Earnings

*

|

$

|

4,510

|

|

$

|

(483

|

)

|

$

|

2,094

|

|

|||

|

*

Includes foreign currency effects:

|

$

|

(456

|

)

|

$

|

122

|

|

$

|

725

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Earnings

|

$

|

2,938

|

|

$

|

1,307

|

|

$

|

3,182

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Earnings

*

|

$

|

2,276

|

|

$

|

2,128

|

|

$

|

4,419

|

|

|||

|

*

Includes foreign currency effects:

|

$

|

(90

|

)

|

$

|

(25

|

)

|

$

|

47

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Net charges

*

|

$

|

(4,169

|

)

|

$

|

(1,395

|

)

|

$

|

(1,053

|

)

|

|||

|

*

Includes foreign currency effects:

|

$

|

100

|

|

$

|

(39

|

)

|

$

|

(3

|

)

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Sales and other operating revenues

|

$

|

134,674

|

|

$

|

110,215

|

|

$

|

129,925

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Income from equity affiliates

|

$

|

4,438

|

|

$

|

2,661

|

|

$

|

4,684

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Other income

|

$

|

2,610

|

|

$

|

1,596

|

|

$

|

3,868

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Purchased crude oil and products

|

$

|

75,765

|

|

$

|

59,321

|

|

$

|

69,751

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Operating, selling, general and administrative expenses

|

$

|

23,885

|

|

$

|

24,952

|

|

$

|

27,477

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Exploration expense

|

$

|

864

|

|

$

|

1,033

|

|

$

|

3,340

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Depreciation, depletion and amortization

|

$

|

19,349

|

|

$

|

19,457

|

|

$

|

21,037

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Taxes other than on income

|

$

|

12,331

|

|

$

|

11,668

|

|

$

|

12,030

|

|

|||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

Income tax (benefit) expense

|

$

|

(48

|

)

|

$

|

(1,729

|

)

|

$

|

132

|

|

|||

|

2017

|

|

2016

|

|

2015

|

|

||||||

|

U.S. Upstream

|

|||||||||||

|

Net Crude Oil and Natural Gas Liquids Production (MBPD)

|

519

|

|

504

|

|

501

|

|

|||||

|

Net Natural Gas Production (MMCFPD)

3

|

970

|

|

1,120

|

|

1,310

|

|

|||||

|

Net Oil-Equivalent Production (MBOEPD)

|

681

|

|

691

|

|

720

|

|

|||||

|

Sales of Natural Gas (MMCFPD)

|

3,331

|

|

3,317

|

|

3,913

|

|

|||||

|

Sales of Natural Gas Liquids (MBPD)

|

30

|

|

30

|

|

26

|

|

|||||

|

Revenues from Net Production

|

|

||||||||||

|

Liquids ($/Bbl)

|

$

|

44.53

|

|

$

|

35.00

|

|

$

|

42.70

|

|

||

|

Natural Gas ($/MCF)

|

$

|

2.10

|

|

$

|

1.59

|

|

$

|

1.92

|

|

||

|

International Upstream

|

|||||||||||

|

Net Crude Oil and Natural Gas Liquids Production (MBPD)

4

|

1,204

|

|

1,215

|

|

1,243

|

|

|||||

|

Net Natural Gas Production (MMCFPD)

3

|

5,062

|

|

4,132

|

|

3,959

|

|

|||||

|

Net Oil-Equivalent Production (MBOEPD)

4

|

2,047

|

|

1,903

|

|

1,902

|

|

|||||

|

Sales of Natural Gas (MMCFPD)

|

5,081

|

|

4,491

|

|

4,299

|

|

|||||

|

Sales of Natural Gas Liquids (MBPD)

|

29

|

|

24

|

|

24

|

|

|||||

|

Revenues from Liftings

|

|||||||||||

|

Liquids ($/Bbl)

|

$

|

49.46

|

|

$

|

38.61

|

|

$

|

46.52

|

|

||

|

Natural Gas ($/MCF)

|

$

|

4.62

|

|

$

|

4.02

|

|

$

|

4.53

|

|

||

|

Worldwide Upstream

|

|||||||||||

|

Net Oil-Equivalent Production (MBOEPD)

4

|

|||||||||||

|

United States

|

681

|

|

691

|

|

720

|

|

|||||

|

International

|

2,047

|

|

1,903

|

|

1,902

|

|

|||||

|

Total

|

2,728

|

|

2,594

|

|

2,622

|

|

|||||

|

U.S. Downstream

|

|||||||||||

|

Gasoline Sales (MBPD)

5

|

625

|

|

631

|

|

621

|

|

|||||

|

Other Refined Product Sales (MBPD)

|

572

|

|

582

|

|

607

|

|

|||||

|

Total Refined Product Sales (MBPD)

|

1,197

|

|

1,213

|

|

1,228

|

|

|||||

|

Sales of Natural Gas Liquids (MBPD)

|

109

|

|

115

|

|

127

|

|

|||||

|

Refinery Input (MBPD)

6

|

901

|

|

900

|

|

924

|

|

|||||

|

International Downstream

|

|||||||||||

|

Gasoline Sales (MBPD)

5

|

365

|

|

382

|

|

389

|

|

|||||

|

Other Refined Product Sales (MBPD)

|

1,128

|

|

1,080

|

|

1,118

|

|

|||||

|

Total Refined Product Sales (MBPD)

7

|

1,493

|

|

1,462

|

|

1,507

|

|

|||||

|

Sales of Natural Gas Liquids (MBPD)

|

64

|

|

61

|

|

65

|

|

|||||

|

Refinery Input (MBPD)

8

|

760

|

|

788

|

|

778

|

|

|||||

|

1

Includes company share of equity affiliates.

|

|||||||||||

|

2

MBPD – thousands of barrels per day; MMCFPD – millions of cubic feet per day; MBOEPD – thousands of barrels of oil-equivalents per day; Bbl – barrel; MCF - thousands of cubic feet. Oil-equivalent gas (OEG) conversion ratio is 6,000 cubic feet of natural gas = 1 barrel of crude oil.

|

|||||||||||

|

3

Includes natural gas consumed in operations (MMCFPD):

|

|||||||||||

|

United States

|

37

|

|

54

|

|

66

|

|

|||||

|

International

|

528

|

|

432

|

|

430

|

|

|||||

|

4

Includes net production of synthetic oil:

|

|||||||||||

|

Canada

|

51

|

|

50

|

|

47

|

|

|||||

|

Venezuela affiliate

|

28

|

|

28

|

|

29

|

|

|||||

|

5

Includes branded and unbranded gasoline.

|

|||||||||||

|

6

In November 2016, the company sold its interests in the Hawaii Refinery which included operable capacity of 54,000 barrels per day.

|

|||||||||||

|

7

Includes sales of affiliates (MBPD):

|

366

|

|

377

|

|

420

|

|

|||||

|

8

In 2017, the company sold the Burnaby Refinery in British Columbia, Canada, which had operable capacity of 55,000 barrels per day. In 2015, the company sold its interests in affiliates in Australia and New Zealand, which included operable refinery capacities of 55,000 and 12,000 barrels per day, respectively.

|

|||||||||||

|

•

|

Reducing cash capital expenditures to $13.4 billion, a 26 percent decrease compared to 2016,

|

|

•

|

Reducing operating and administrative expenses by $1.1 billion, a 4 percent decrease compared to 2016, and

|

|

•

|

Realizing net proceeds from asset sales of $5.2 billion during 2017.

|

|

|

2017

|

2016

|

2015

|

|||||||||||||||||||||||||||||

|

Millions of dollars

|

U.S.

|

|

Int’l.

|

|

Total

|

|

U.S.

|

|

Int’l.

|

|

Total

|

|

U.S.

|

|

Int’l.

|

|

Total

|

|

|||||||||||||

|

Upstream

|

$

|

5,145

|

|

$

|

11,243

|

|

$

|

16,388

|

|

$

|

4,713

|

|

$

|

15,403

|

|

$

|

20,116

|

|

$

|

7,582

|

|

$

|

23,535

|

|

$

|

31,117

|

|

||||

|

Downstream

|

1,656

|

|

534

|

|

2,190

|

|

1,545

|

|

527

|

|

2,072

|

|

1,923

|

|

513

|

|

2,436

|

|

|||||||||||||

|

All Other

|

239

|

|

4

|

|

243

|

|

235

|

|

5

|

|

240

|

|

418

|

|

8

|

|

426

|

|

|||||||||||||

|

Total

|

$

|

7,040

|

|

$

|

11,781

|

|

$

|

18,821

|

|

$

|

6,493

|

|

$

|

15,935

|

|

$

|

22,428

|

|

$

|

9,923

|

|

$

|

24,056

|

|

$

|

33,979

|

|

||||

|

Total, Excluding Equity in Affiliates

|

$

|

6,295

|

|

$

|

7,783

|

|

$

|

14,078

|

|

$

|

5,456

|

|

$

|

13,202

|

|

$

|

18,658

|

|

$

|

8,579

|

|

$

|

22,003

|

|

$

|

30,582

|

|

||||

|

At December 31

|

|||||||||||

|

2017

|

|

2016

|

|

2015

|

|||||||

|

Current Ratio

|

1.0

|

|

0.9

|

|

1.3

|

||||||

|

Interest Coverage Ratio

|

10.7

|

|

(2.6

|

)

|

9.9

|

||||||

|

Debt Ratio

|

20.7

|

|

%

|

24.1

|

|

%

|

20.2

|

%

|

|||

|

Payments Due by Period

|

|||||||||||||||||||

|

Millions of dollars

|

Total

1

|

|

2018

|

|

2019-2020

|

|

2021-2022

|

|

After 2022

|

|

|||||||||

|

On Balance Sheet:

2

|

|||||||||||||||||||

|

Short-Term Debt

3

|

$

|

5,194

|

|

$

|

5,194

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||

|

Long-Term Debt

3

|

33,512

|

|

—

|

|

20,054

|

|

6,104

|

|

7,354

|

|

|||||||||

|

Noncancelable Capital Lease Obligations

|

226

|

|

26

|

|

35

|

|

23

|

|

142

|

|

|||||||||

|

Interest

|

4,078

|

|

786

|

|

1,173

|

|

850

|

|

1,269

|

|

|||||||||

|

Off Balance Sheet:

|

|||||||||||||||||||

|

Noncancelable Operating Lease Obligations

|

2,895

|

|

693

|

|

1,102

|

|

562

|

|

538

|

|

|||||||||

|

Throughput and Take-or-Pay Agreements

4

|

5,277

|

|

655

|

|

1,285

|

|

866

|

|

2,471

|

|

|||||||||

|

Other Unconditional Purchase Obligations

4

|

2,560

|

|

747

|

|

1,109

|

|

609

|

|

95

|

|

|||||||||

|

1

|

Excludes contributions for pensions and other postretirement benefit plans. Information on employee benefit plans is contained in

Note 2

3

beginning on page

82

.

|

|

2

|

Does not include amounts related to the company’s income tax liabilities associated with uncertain tax positions. The company is unable to make reasonable estimates of the periods in which such liabilities may become payable. The company does not expect settlement of such liabilities to have a material effect on its consolidated financial position or liquidity in any single period.

|

|

3

|

$10.0 billion of short-term debt that the company expects to refinance is included in long-term debt. The repayment schedule above reflects the projected repayment of the entire amounts in the

2019

–

2020

period. The amounts represent only the principal balance.

|

|

4

|

Does not include commodity purchase obligations that are not fixed or determinable. These obligations are generally monetized in a relatively short period of time through sales transactions or similar agreements with third parties. Examples include obligations to purchase LNG, regasified natural gas and refinery products at indexed prices.

|

|

Commitment Expiration by Period

|

|||||||||||||||||||

|

Millions of dollars

|

Total

|

|

2018

|

|

2019-2020

|

|

2021-2022

|

|

After 2022

|

|

|||||||||

|

Guarantee of nonconsolidated affiliate or joint-venture obligations

|

$

|

1,082

|

|

$

|

114

|

|

$

|

577

|

|

$

|

214

|

|

$

|

177

|

|

||||

|

Millions of dollars

|

2017

|

|

2016

|

|

2015

|

|

|||||

|

Balance at January 1

|

$

|

1,467

|

|

$

|

1,578

|

|

$

|

1,683

|

|

||

|

Net Additions

|

323

|

|

260

|

|

365

|

|

|||||

|

Expenditures

|

(361

|

)

|

(371

|

)

|

(470

|

)

|

|||||

|

Balance at December 31

|

$

|

1,429

|

|

$

|

1,467

|

|

$

|

1,578

|

|

||

|

1.

|

the nature of the estimates and assumptions is material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters, or the susceptibility of such matters to change; and

|

|

2.

|

the impact of the estimates and assumptions on the company’s financial condition or operating performance is material.

|

|

1.

|

Amortization - Capitalized exploratory drilling and development costs are depreciated on a unit-of-production (UOP) basis using proved developed reserves. Acquisition costs of proved properties are amortized on a UOP basis using total proved reserves. During

2017

, Chevron's UOP Depreciation, Depletion and Amortization (DD&A) for oil and gas properties was

$14.8 billion

, and proved developed reserves at the beginning of

2017

were

6.2 billion

barrels for consolidated companies. If the estimates of proved reserves used in the UOP calculations for consolidated operations had been lower by 5 percent across all oil and gas properties, UOP DD&A in

2017

would have increased by approximately

$800 million

.

|

|

2.

|

Impairment - Oil and gas reserves are used in assessing oil and gas producing properties for impairment. A significant reduction in the estimated reserves of a property would trigger an impairment review. Proved reserves (and, in some cases, a portion of unproved resources) are used to estimate future production volumes in the cash flow model. For a further discussion of estimates and assumptions used in impairment assessments, see

Impairment of Properties, Plant and Equipment and Investments in Affiliates

below.

|

|

2017

|

2016

|

||||||||||||||||||||||||||||||||

|

Millions of dollars, except per-share amounts

|

4th Q

|

|

3rd Q

|

|

2nd Q

|

|

1st Q

|

|

4th Q

|

|

3rd Q

|

|

2nd Q

|

|

1st Q

|

|

|||||||||||||||||

|

Revenues and Other Income

|

|||||||||||||||||||||||||||||||||

|

Sales and other operating revenues

1

|

$

|

36,381

|

|

$

|

33,892

|

|

$

|

32,877

|

|

$

|

31,524

|

|

$

|

30,142

|

|

$

|

29,159

|

|

$

|

27,844

|

|

$

|

23,070

|

|

|||||||||

|

Income from equity affiliates

|

936

|

|

1,036

|

|

1,316

|

|

1,150

|

|

778

|

|

555

|

|

752

|

|

576

|

|

|||||||||||||||||

|

Other income

|

299

|

|

1,277

|

|

287

|

|

747

|

|

577

|

|

426

|

|

686

|

|

(93

|

)

|

|||||||||||||||||

|

Total Revenues and Other Income

|

37,616

|

|

36,205

|

|

34,480

|

|

33,421

|

|

31,497

|

|

30,140

|

|

29,282

|

|

23,553

|

|

|||||||||||||||||

|

Costs and Other Deductions

|

|||||||||||||||||||||||||||||||||

|

Purchased crude oil and products

|

21,158

|

|

18,776

|

|

18,325

|

|

17,506

|

|

16,976

|

|

15,842

|

|

15,278

|

|

11,225

|

|

|||||||||||||||||

|

Operating expenses

|

5,182

|

|

4,937

|

|

4,662

|

|

4,656

|

|

5,144

|

|

4,666

|

|

5,054

|

|

5,404

|

|

|||||||||||||||||

|

Selling, general and administrative expenses

|

1,349

|

|

1,238

|

|

991

|

|

870

|

|

1,544

|

|

1,109

|

|

1,033

|

|

998

|

|

|||||||||||||||||

|

Exploration expenses

|

356

|

|

239

|

|

125

|

|

144

|

|

191

|

|

258

|

|

214

|

|

370

|

|

|||||||||||||||||

|

Depreciation, depletion and amortization

|

4,735

|

|

5,109

|

|

5,311

|

|

4,194

|

|

4,203

|

|

4,130

|

|

6,721

|

|

4,403

|

|

|||||||||||||||||

|

Taxes other than on income

1

|

3,182

|

|

3,213

|

|

3,065

|

|

2,871

|

|

2,869

|

|

2,962

|

|

2,973

|

|

2,864

|

|

|||||||||||||||||

|

Interest and debt expense

|

173

|

|

35

|

|

48

|

|

51

|

|

58

|

|

64

|

|

79

|

|

—

|

|

|||||||||||||||||

|

Total Costs and Other Deductions

|

36,135

|

|

33,547

|

|

32,527

|

|

30,292

|

|

30,985

|

|

29,031

|

|

31,352

|

|

25,264

|

|

|||||||||||||||||

|

Income (Loss) Before Income Tax Expense

|

1,481

|

|

2,658

|

|

1,953

|

|

3,129

|

|

512

|

|

1,109

|

|

(2,070

|

)

|

(1,711

|

)

|

|||||||||||||||||

|

Income Tax Expense (Benefit)

|

(1,637

|

)

|

672

|

|

487

|

|

430

|

|

74

|

|

(192

|

)

|

(607

|

)

|

(1,004

|

)

|

|||||||||||||||||

|

Net Income (Loss)

|

$

|

3,118

|

|

$

|

1,986

|

|

$

|

1,466

|

|

$

|

2,699

|

|

$

|

438

|

|

$

|

1,301

|

|

$

|

(1,463

|

)

|

$

|

(707

|

)

|

|||||||||

|

Less: Net income attributable to

noncontrolling interests |

7

|

|

34

|

|

16

|

|

17

|

|

23

|

|

18

|

|

7

|

|

18

|

|

|||||||||||||||||

|

Net Income (Loss) Attributable to Chevron Corporation

|

$

|

3,111

|

|

$

|

1,952

|

|

$

|

1,450

|

|

$

|

2,682

|

|

$

|

415

|

|

$

|

1,283

|

|

$

|

(1,470

|

)

|

$

|

(725

|

)

|

|||||||||

|

Per Share of Common Stock

|

|||||||||||||||||||||||||||||||||

|

Net Income (Loss) Attributable to Chevron Corporation

|

|||||||||||||||||||||||||||||||||

|

– Basic

|

$

|

1.65

|

|

$

|

1.03

|

|

$

|

0.77

|

|

$

|

1.43

|

|

$

|

0.22

|

|

$

|

0.68

|

|

$

|

(0.78

|

)

|

$

|

(0.39

|

)

|

|||||||||

|

– Diluted

|

$

|

1.64

|

|

$

|

1.03

|

|

$

|

0.77

|

|

$

|

1.41

|

|

$

|

0.22

|

|

$

|

0.68

|

|

$

|

(0.78

|

)

|

$

|

(0.39

|

)

|

|||||||||

|

Dividends

|

$

|

1.08

|

|

$

|

1.08

|

|

$

|

1.08

|

|

$

|

1.08

|

|

$

|

1.08

|

|

$

|

1.07

|

|

$

|

1.07

|

|

$

|

1.07

|

|

|||||||||

|

Common Stock Price Range – High

2

|

$

|

126.20

|

|

$118.33

|

$

|

110.67

|

|

$

|

119.00

|

|

$

|

119.00

|

|

$

|

107.58

|

|

$

|

105.00

|

|

$

|

97.91

|

|

|||||||||||

|

– Low

2

|

$

|

112.57

|

|

$102.55

|

$

|

102.55

|

|

$

|

105.85

|

|

$

|

99.61

|

|

$

|

97.53

|

|

$

|

92.43

|

|

$

|

75.33

|

|

|||||||||||

|

1

Includes excise, value-added and similar taxes:

|

$

|

1,874

|

|

$

|

1,867

|

|

$

|

1,771

|

|

$

|

1,677

|

|

$

|

1,697

|

|

$

|

1,772

|

|

$

|

1,784

|

|

$

|

1,652

|

|

|||||||||

|

2

Intraday price.

|

|||||||||||||||||||||||||||||||||

|

The company’s common stock is listed on the New York Stock Exchange (trading symbol: CVX). As of February 12, 2018, stockholders of record numbered approximately 131,000. There are no restrictions on the company’s ability to pay dividends.

|

|||||||||||||||||||||||||||||||||

|

Management’s Responsibility for Financial Statements

|

||||||

|

To the Stockholders of Chevron Corporation

Management of Chevron Corporation is responsible for preparing the accompanying consolidated financial statements and the related information appearing in this report. The statements were prepared in accordance with accounting principles generally accepted in the United States of America and fairly represent the transactions and financial position of the company. The financial statements include amounts that are based on management’s best estimates and judgments.

As stated in its report included herein, the independent registered public accounting firm of PricewaterhouseCoopers LLP has audited the company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States).

The Board of Directors of Chevron has an Audit Committee composed of directors who are not officers or employees of the company. The Audit Committee meets regularly with members of management, the internal auditors and the independent registered public accounting firm to review accounting, internal control, auditing and financial reporting matters. Both the internal auditors and the independent registered public accounting firm have free and direct access to the Audit Committee without the presence of management.

The company's management has evaluated, with the participation of the Chief Executive Officer and Chief Financial Officer, the effectiveness of the company's disclosure controls and procedures (as defined in the Exchange Act Rules 13a-15(e) and 15d-15(e)) as of December 31, 2017. Based on that evaluation, management concluded that the company's disclosure controls are effective in ensuring that information required to be recorded, processed, summarized and reported, are done within the time periods specified in the U.S. Securities and Exchange Commission's rules and forms.

|

||||||

|

Management’s Report on Internal Control Over Financial Reporting

|

||||||

|

The company’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in the Exchange Act Rules 13a-15(f) and 15d-15(f). The company’s management, including the Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the effectiveness of the company’s internal control over financial reporting based on the

Internal Control – Integrated Framework

(2013)

issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on the results of this evaluation, the company’s management concluded that internal control over financial reporting was effective as of December 31, 2017.

The effectiveness of the company’s internal control over financial reporting as of December 31, 2017, has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in its report included herein.

|

||||||

|

/s/ MICHAEL K. WIRTH

|

/s/ PATRICIA E. YARRINGTON

|

/s/ JEANETTE L. OURADA

|

||||

|

Michael K. Wirth

|

Patricia E. Yarrington

|

Jeanette L. Ourada

|

||||

|

Chairman of the Board

|

Vice President

|

Vice President

|

||||

|

and Chief Executive Officer

|

and Chief Financial Officer

|

and Comptroller

|

||||

|

February 22, 2018

|

||||||

|

Report of Independent Registered Public Accounting Firm

|

||

|

To the

Board of Directors and Shareholders of Chevron Corporation:

|

||

|

Opinions on the Financial Statements and Internal Control over Financial Reporting