|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-15341

DONEGAL GROUP INC.

(Exact name of registrant as specified in its charter)

| Delaware | 23-2424711 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| 1195 River Road, Marietta, Pennsylvania | 17547 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code:

(800) 877-0600

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange on Which Registered |

|

| Class A Common Stock, $.01 par value | The NASDAQ Global Select Market | |

| Class B Common Stock, $.01 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act: Yes ☐. No ☒.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐. No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒. No ☐.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒. No ☐.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements we incorporate by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” or “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company. Yes ☐. No ☒.

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $181,795,992.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 21,545,628 shares of Class A common stock and 5,576,775 shares of Class B common stock outstanding on March 3, 2017.

Documents Incorporated by Reference

The registrant incorporates by reference portions of the registrant’s definitive proxy statement relating to registrant’s annual meeting of stockholders to be held April 20, 2017 into Part III of this report.

Table of Contents

DONEGAL GROUP INC.

| Page | ||||||

|

Item 1. |

1 | |||||

|

Item 1A. |

23 | |||||

|

Item 1B. |

34 | |||||

|

Item 2. |

34 | |||||

|

Item 3. |

34 | |||||

|

Item 4. |

34 | |||||

| 35 | ||||||

|

Item 5. |

36 | |||||

|

Item 6. |

38 | |||||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | ||||

|

Item 7A. |

54 | |||||

|

Item 8. |

56 | |||||

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

101 | ||||

|

Item 9A. |

101 | |||||

|

Item 9B. |

101 | |||||

|

Item 10. |

103 | |||||

|

Item 11. |

103 | |||||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

103 | ||||

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

103 | ||||

|

Item 14. |

103 | |||||

|

Item 15. |

104 | |||||

(i)

Table of Contents

| Item 1. | Business. |

Introduction

Donegal Group Inc., or DGI, is an insurance holding company whose insurance subsidiaries offer personal and commercial lines of property and casualty insurance to businesses and individuals in 21 Mid-Atlantic, Midwestern, New England and Southern states. As used in this Form 10-K Report, the terms “we,” “us” and “our” refer to Donegal Group Inc. and its subsidiaries.

Donegal Mutual Insurance Company, or Donegal Mutual, organized us as an insurance holding company on August 26, 1986. At December 31, 2016, Donegal Mutual held approximately 46% of our outstanding Class A common stock and approximately 83% of our outstanding Class B common stock. Donegal Mutual’s ownership provides Donegal Mutual with approximately 73% of the combined voting power of our outstanding shares of Class A common stock and our outstanding shares of Class B common stock. Our insurance subsidiaries and Donegal Mutual have interrelated operations due to an intercompany pooling agreement and other intercompany agreements and transactions we describe in Note 3 of the Notes to Consolidated Financial Statements. While maintaining the separate corporate existence of each company, our insurance subsidiaries and Donegal Mutual conduct business together as the Donegal Insurance Group. As such, Donegal Mutual and our insurance subsidiaries share the same business philosophy, the same management, the same employees and the same facilities and offer the same types of insurance products.

We have been an effective consolidator of smaller “main street” property and casualty insurance companies, and we expect to pursue opportunities to acquire other insurance companies to expand our business in a given region or to commence operations in a new region. Since 1995, we have completed six acquisitions of property and casualty insurance companies or began to participate in their business through Donegal Mutual’s entry into quota-share reinsurance agreements with them.

Our insurance subsidiaries and Donegal Mutual provide their policyholders with a selection of insurance products at competitive rates, while pursuing profitability by adhering to a strict underwriting discipline. Our insurance subsidiaries derive a substantial portion of their insurance business from smaller to mid-sized regional communities. We believe this focus provides our insurance subsidiaries with competitive advantages in terms of local market knowledge, marketing, underwriting, claims servicing and policyholder service. At the same time, we believe our insurance subsidiaries have cost advantages over many smaller regional insurers that result from economies of scale our insurance subsidiaries realize through centralized accounting, administrative, data processing, investment and other services.

We believe we have a substantial opportunity, as a well-capitalized regional insurance holding company with a solid business strategy, to grow profitably and compete effectively with national property and casualty insurers. Our downstream holding company structure, with Donegal Mutual holding approximately 73% of the combined voting power of our common stock, has proven its effectiveness and success over the 30 years of our existence. Over that time period, we have grown significantly in terms of revenue and financial strength, and the Donegal Insurance Group has developed an excellent reputation as a regional group of property and casualty insurers.

We own 48.2% of Donegal Financial Services Corporation, or DFSC. DFSC is a grandfathered unitary savings and loan holding company that owns all of the outstanding capital stock of Union Community Bank, a state savings bank, or UCB. UCB has 15 banking offices, substantially all of which are located in Lancaster County, Pennsylvania. Donegal Mutual owns the remaining 51.8% of DFSC. For further information regarding DFSC, we refer to “Business - Donegal Financial Services Corporation” in this Form 10-K Report.

We have four segments: our investment function, our personal lines of insurance, our commercial lines of insurance and our investment in DFSC. We set forth financial information about these segments in Note 19 of the Notes to Consolidated Financial Statements. The personal lines products of our insurance subsidiaries consist primarily of homeowners and private passenger automobile policies. The commercial lines products of our insurance subsidiaries consist primarily of commercial automobile, commercial multi-peril and workers’ compensation policies.

1

Table of Contents

Available Information

You may obtain our Annual Reports on Form 10-K, including this Form 10-K Report, our quarterly reports on Form 10-Q, our current reports on Form 8-K, our proxy statement and our other filings pursuant to the Securities Exchange Act of 1934, or the Exchange Act, without charge by viewing our website at www.donegalgroup.com . You may also view on our website our Code of Business Conduct and Ethics and the charters of the executive committee, the audit committee, the compensation committee and the nominating committee of our board of directors. Upon request to our corporate secretary, we will also provide printed copies of any of these documents to you without charge. We have provided the address of our website solely for the information of investors. We do not intend the reference to our website address to be an active link or to otherwise incorporate the contents of our website into this Form 10-K Report.

History and Organizational Structure

In the mid-1980’s, Donegal Mutual, as a mutual insurance company, recognized the desirability of developing additional sources of capital and surplus so it could remain competitive and have the surplus to expand its business and ensure its long-term viability. Accordingly, Donegal Mutual determined to implement a downstream holding company structure as one of its business strategies. Thus, in 1986, Donegal Mutual formed us as a downstream holding company. Initially, Donegal Mutual owned all of our outstanding common stock. After Donegal Mutual formed us, we in turn formed Atlantic States as our wholly owned property and casualty insurance company subsidiary.

In connection with the formation of Atlantic States and the establishment of our downstream insurance holding company system, Donegal Mutual and DGI entered into a proportional reinsurance agreement, or pooling agreement, that became effective October 1, 1986. Under the pooling agreement, Donegal Mutual and Atlantic States pool substantially all of their respective premiums, losses and loss expenses to the reinsurance pool, and the reinsurance pool, acting through Donegal Mutual, then cedes a portion of the pooled business, currently 80%, to Atlantic States. Donegal Mutual and Atlantic States share the underwriting results in proportion to their respective participation in the underwriting pool.

Since we established Atlantic States in 1986, Donegal Mutual and our insurance subsidiaries have conducted business together as the Donegal Insurance Group. As the Donegal Insurance Group, Donegal Mutual and our insurance subsidiaries share a combined business plan to enhance market penetration and underwriting profitability objectives. We believe Donegal Mutual’s majority interest in the combined voting power of our Class A common stock and of our Class B common stock fosters our ability to implement our business philosophies, enjoy management continuity, maintain superior employee relations and provide a stable environment within which we can grow our businesses.

The products Donegal Mutual and our insurance subsidiaries offer are generally complementary, which permits the Donegal Insurance Group to offer a broad range of products in a given market and to expand the Donegal Insurance Group’s ability to service an entire personal lines or commercial lines account. Distinctions within the products Donegal Mutual and our insurance subsidiaries offer generally relate to specific risk profiles within similar classes of business, such as preferred tier products versus standard tier products. Donegal Mutual and we do not allocate all of the standard risk gradients to one company. As a result, the underwriting profitability of the business the individual companies write directly will vary. However, the underwriting pool homogenizes the risk characteristics of all business Donegal Mutual and Atlantic States write directly. We receive 80% of the results of the underwriting pool because Atlantic States has an 80% participation in the pool. The business Atlantic States derives from the underwriting pool represents a significant percentage of our total consolidated revenues. However, that percentage has gradually decreased over the past few years as we have acquired a number of other property and casualty insurance companies that do not participate in the underwriting pool.

As the capital of Atlantic States and our other insurance subsidiaries has increased, the underwriting capacity of our insurance subsidiaries has increased proportionately. The size of the underwriting pool has also increased substantially. Therefore, as we originally planned in the mid-1980s, Atlantic States has successfully raised the capital necessary to support the growth of its direct business as well as to accept increases in its allocation of business from the underwriting pool. The portion of the underwriting pool allocated to Atlantic States has increased from an initial allocation of 35% in 1986 to an 80% allocation since March 1, 2008. We do not anticipate any further change in the pooling agreement between Atlantic States and Donegal Mutual, including any change in the percentage participation of Atlantic States in the underwriting pool.

In addition to Atlantic States, our insurance subsidiaries are Southern Insurance Company of Virginia, or Southern, Le Mars Insurance Company, or Le Mars, The Peninsula Insurance Company and its wholly owned subsidiary, Peninsula Indemnity Company, or collectively, Peninsula, Sheboygan Falls Insurance Company, or Sheboygan, and Michigan Insurance Company, or MICO. We also benefit from Donegal Mutual’s 100% quota-share reinsurance agreement with Southern Mutual Insurance Company, or Southern Mutual, and Donegal Mutual’s placement of its assumed business from Southern Mutual into the underwriting pool.

2

Table of Contents

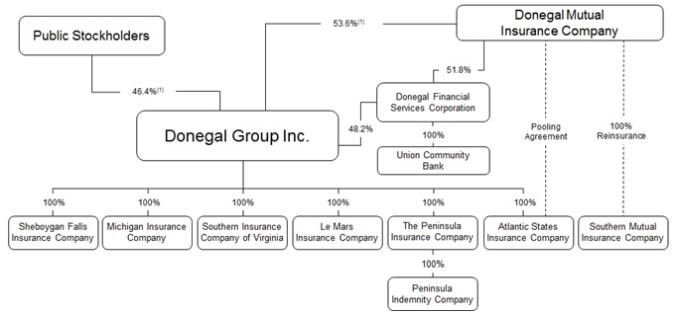

The following chart depicts our organizational structure, including all of our property and casualty insurance subsidiaries, Southern Mutual and our interest in DFSC:

| (1) | Because of the different relative voting power of our Class A common stock and our Class B common stock, our public stockholders hold approximately 27% of the combined voting power of our Class A common stock and our Class B common stock and Donegal Mutual holds approximately 73% of the combined voting power of our Class A common stock and our Class B common stock. |

Relationship with Donegal Mutual

Donegal Mutual provides facilities, personnel and other services to us and our insurance subsidiaries. Donegal Mutual allocates certain related expenses to Atlantic States in relation to the relative participation of Donegal Mutual and Atlantic States in the underwriting pool they maintain. Our insurance subsidiaries other than Atlantic States reimburse Donegal Mutual for their respective personnel costs and bear their proportionate share of information services costs based on each subsidiaries’ respective percentage of the total net written premiums of the Donegal Insurance Group. Charges for these services to Atlantic States and our other insurance subsidiaries totaled $122.4 million, $108.5 million and $98.6 million for 2016, 2015 and 2014, respectively.

Our insurance subsidiaries have various reinsurance arrangements with Donegal Mutual. These agreements include:

| • | excess of loss reinsurance agreements with Le Mars, MICO, Peninsula, Sheboygan and Southern; |

| • | catastrophe reinsurance agreements with Atlantic States, Le Mars and Southern; and |

| • | quota-share reinsurance agreements with MICO and Peninsula. |

The purpose of the excess of loss and catastrophe reinsurance agreements is to lessen the effects of a single large loss, or an accumulation of smaller losses arising from one event, to levels that are appropriate given each subsidiary’s size, underwriting profile and amount of surplus.

The purpose of the quota-share reinsurance agreement with Peninsula is to transfer to Donegal Mutual 100% of the premiums and losses related to the workers’ compensation product line of Peninsula in certain states, which provides the availability of an additional workers’ compensation tier for Donegal Mutual’s commercial accounts. Donegal Mutual places its assumed business from Peninsula into the underwriting pool.

The purpose of the quota-share reinsurance agreement with MICO is to transfer to Donegal Mutual 25% of the premiums and losses related to MICO’s business. Donegal Mutual places its assumed business from MICO into the underwriting pool.

3

Table of Contents

We and Donegal Mutual have maintained a coordinating committee since our formation in 1986. The coordinating committee consists of two members of our board of directors, neither of whom is a member of Donegal Mutual’s board of directors, and two members of Donegal Mutual’s board of directors, neither of whom is a member of our board of directors. The purpose of the coordinating committee is to establish and maintain a process for an annual evaluation of the transactions between Donegal Mutual, our insurance subsidiaries and us. The coordinating committee considers the fairness of each intercompany transaction to Donegal Mutual and its policyholders and to us and our stockholders.

A new agreement or any change to a previously approved agreement must receive coordinating committee approval. The approval process for a new agreement between Donegal Mutual and us or one of our insurance subsidiaries or a change in such an agreement is as follows:

| • | both of our members on the coordinating committee must determine that the new agreement or the change in an existing agreement is fair and equitable to us and in the best interests of our stockholders; |

| • | both of Donegal Mutual’s members on the coordinating committee must determine that the new agreement or the change in an existing agreement is fair and equitable to Donegal Mutual and in the best interests of its policyholders; |

| • | our board of directors must approve the new agreement or the change in an existing agreement; and |

| • | Donegal Mutual’s board of directors must approve the new agreement or the change in an existing agreement. |

The coordinating committee also meets annually to review each existing agreement between Donegal Mutual and us or our insurance subsidiaries, including all reinsurance agreements between Donegal Mutual and our insurance subsidiaries. The purpose of this annual review is to examine the results of the agreements over the past year and, in the case of reinsurance agreements, over several years and to determine if the results of the existing agreements remain fair and equitable to us and our stockholders and fair and equitable to Donegal Mutual and its policyholders or if Donegal Mutual and we should mutually agree to certain adjustments to the terms of the agreements. In the case of these reinsurance agreements, the annual adjustments typically relate to the reinsurance premiums, losses and reinstatement premiums. These agreements are ongoing in nature and will continue in effect throughout 2017 in the ordinary course of our business.

Our members on the coordinating committee, as of the date of this Form 10-K Report, are Robert S. Bolinger and Richard D. Wampler, II. Donegal Mutual’s members on the coordinating committee as of such date are Dennis J. Bixenman and John E. Hiestand. We refer to our proxy statement for our annual meeting of stockholders to be held on April 20, 2017 for further information about the members of the coordinating committee.

We believe our relationships with Donegal Mutual offer us and our insurance subsidiaries a number of competitive advantages, including the following:

| • | enabling our stable management, the consistent underwriting discipline of our insurance subsidiaries, external growth, long-term profitability and financial strength; |

| • | creating operational and expense synergies from the combination of resources and integrated operations of Donegal Mutual and our insurance subsidiaries; |

| • | enhancing our opportunities to expand by acquisition because of the ability of Donegal Mutual to affiliate with and acquire control of other mutual insurance companies and, thereafter, demutualize them and allow us to acquire all of their outstanding stock; |

| • | producing more stable and uniform underwriting results for our insurance subsidiaries over extended periods of time than we could achieve without our relationship with Donegal Mutual; |

| • | providing opportunities for growth because of the ability of Donegal Mutual to enter into reinsurance agreements with other mutual insurance companies and place the business it assumes into the pooling agreement; and |

| • | providing Atlantic States with a significantly larger underwriting capacity because of the underwriting pool Donegal Mutual and Atlantic States have maintained since 1986. |

4

Table of Contents

In the first quarter of 2017, our board of directors and the board of directors of Donegal Mutual each undertook a review of the relationships between Donegal Mutual and DGI and determined that continuing the current relationships and the current corporate structure of Donegal Mutual and DGI is in the best interests of DGI and its various constituencies.

Business Strategy

Our strategy is designed to allow our insurance subsidiaries to achieve their longstanding goal of outperforming the United States property and casualty insurance industry in terms of profitability and service, thereby providing value to the policyholders of our insurance subsidiaries and, ultimately, providing value to our stockholders. The annual net premiums earned of our insurance subsidiaries have increased from $301.5 million in 2006 to $656.2 million in 2016, a compound annual growth rate of 8.1%.

The combined ratio of our insurance subsidiaries and that of the United States property and casualty insurance industry as computed using United States generally accepted accounting principles, or GAAP, and statutory accounting principles, or SAP, for the years 2012 through 2016 are shown in the following table:

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

|

Our GAAP combined ratio |

98.1 | % | 99.0 | % | 101.7 | % | 98.8 | % | 101.6 | % | ||||||||||

|

Our SAP combined ratio |

96.8 | 97.4 | 100.5 | 97.4 | 99.8 | |||||||||||||||

|

Industry SAP combined ratio (1) |

100.7 | 98.3 | 97.4 | 96.4 | 102.5 | |||||||||||||||

| (1) | As reported (projected for 2016) by A.M. Best Company. |

We and Donegal Mutual believe we can continue to expand our insurance operations over time through organic growth and acquisitions of, or affiliations with, other insurance companies. We and Donegal Mutual have enhanced the performance of companies we have acquired, while leveraging the acquired companies’ core strengths and local market knowledge to expand their operations. Our insurance subsidiaries and Donegal Mutual also seek to increase their premium base by making quality independent agency appointments, enhancing their competitive position within each agency, introducing new and enhanced insurance products and developing and maintaining automated systems to improve service, communications and efficiency.

We translate these initiatives into our book value growth in a number of ways, including the following:

| • | maintaining a conservative underwriting culture and pricing discipline to sustain our record of underwriting profitability; |

| • | continuing our investment in technology to achieve operating efficiencies that lower expenses, enhance the service we provide to agencies and policyholders and increase the speed of our communications with agencies and policyholders; and |

| • | maintaining a conservative investment approach. |

A detailed review of our business strategies follows:

| • | Achieving underwriting profitability. |

Our insurance subsidiaries focus on achieving a combined ratio of less than 100%. We remain committed to achieving consistent underwriting profitability. We believe that underwriting profitability is a fundamental component of our long-term financial strength because it allows our insurance subsidiaries to generate profits without relying exclusively on their investment income. Our insurance subsidiaries seek to enhance their underwriting results by:

| • | carefully selecting the product lines they underwrite; |

| • | carefully selecting the individual risks they underwrite; |

| • | minimizing their individual exposure to catastrophe-prone areas; and |

| • | evaluating their claims history on a regular basis to ensure the adequacy of their underwriting guidelines and product pricing. |

5

Table of Contents

Our insurance subsidiaries have no material exposures to asbestos and environmental liabilities. Our insurance subsidiaries seek to provide more than one policy to a given personal lines or commercial lines customer because this “account selling” strategy diversifies their risk and has historically improved their underwriting results. Our insurance subsidiaries also use reinsurance to manage their exposure and limit their maximum net loss from large single risks or risks in concentrated areas.

| • | Pursuing profitable growth by organic expansion within the traditional operating territories of our insurance subsidiaries through developing and maintaining quality agency representation. |

We believe that continued expansion of our insurance subsidiaries within their existing markets will be a key source of their continued premium growth and that maintaining an effective and growing network of independent agencies is integral to their expansion. Our insurance subsidiaries seek to be among the top three insurers within each of the independent agencies for the lines of business our insurance subsidiaries write by providing a consistent, competitive and stable market for their products. We believe that the consistency of the product offerings of our insurance subsidiaries enables our insurance subsidiaries to compete effectively for independent agents with other insurers whose product offerings may fluctuate based on industry conditions. Our insurance subsidiaries offer a competitive compensation program to their independent agents that rewards them for producing profitable growth for our insurance subsidiaries. Our insurance subsidiaries provide their independent agents with ongoing support to enable them to better attract and service customers, including:

| • | fully automated underwriting and policy issuance systems for both personal, commercial and farm lines of insurance; |

| • | training programs; |

| • | marketing support; |

| • | availability of a service center that provides comprehensive service for our personal lines policyholders; and |

| • | field visitations by marketing and underwriting personnel and senior management of our insurance subsidiaries. |

Our insurance subsidiaries appoint independent agencies with a strong underwriting and growth track record. We believe that our insurance subsidiaries, by carefully selecting, motivating and supporting their independent agencies, will drive continued long-term growth.

| • | Acquiring property and casualty insurance companies to augment the organic growth of our insurance subsidiaries in existing markets and to expand into new geographic regions. |

We have been an effective consolidator of smaller “main street” property and casualty insurance companies, and we expect to continue to acquire other insurance companies to expand our business in a given region or to commence operations in a new region.

Since 1995, we have completed six acquisitions of property and casualty insurance companies or participated in their business through Donegal Mutual’s entry into quota-share reinsurance agreements with them. We intend to continue our growth by pursuing affiliations and acquisitions that meet our criteria. Our primary criteria are:

| • | location in regions where our insurance subsidiaries are currently conducting business or that offer an attractive opportunity to conduct profitable business; |

| • | a mix of business similar to the mix of business of our insurance subsidiaries; |

| • | annual premium volume up to $100.0 million; and |

| • | fair and reasonable transaction terms. |

We believe that our relationship with Donegal Mutual assists us in pursuing affiliations with, and subsequent acquisitions of, mutual insurance companies because, through Donegal Mutual, we understand the concerns and issues that mutual insurance companies face. In particular, Donegal Mutual has had success affiliating with underperforming mutual insurance companies, and we have either acquired them following their conversion to a stock company or benefited from their underwriting results as a result of Donegal Mutual’s entry into a 100% quota-share reinsurance agreement with them and

6

Table of Contents

placement of its assumed business into the pooling agreement. We have utilized our strengths and financial position to improve the operations of those underperforming insurance companies. We evaluate a number of areas for operational synergies when considering acquisitions, including product underwriting, expenses, the cost of reinsurance and technology.

We and Donegal Mutual have the ability to employ a number of acquisition and affiliation methods. Our prior acquisitions and affiliations have taken one of the following forms:

| • | purchase of all of the outstanding stock of a stock insurance company; |

| • | purchase of a book of business; |

| • | quota-share reinsurance transaction; or |

| • | two-step acquisition of a mutual insurance company in which: |

| • | as the first step, Donegal Mutual purchases a surplus note from the mutual insurance company, Donegal Mutual enters into a services agreement with the mutual insurance company and Donegal Mutual’s designees become a majority of the members of the board of directors of the mutual insurance company; and |

| • | as the second step, the mutual insurance company enters into a quota-share reinsurance agreement with Donegal Mutual or demutualizes, or converts, into a stock insurance company. Upon the demutualization or conversion, we purchase the surplus note from Donegal Mutual and exchange it for all of the stock of the stock insurance company resulting from the demutualization or conversion. |

We believe that our ability to make direct acquisitions of stock insurance companies and to make indirect acquisitions of mutual insurance companies through a sponsored conversion or a quota-share reinsurance agreement provides us with flexibility that is a competitive advantage in making acquisitions. We also believe our historic record clearly demonstrates our ability to acquire control of an underperforming insurance company, re-underwrite its book of business, reduce its cost structure and return it to sustained profitability.

While Donegal Mutual and we generally engage in preliminary discussions with potential direct or indirect acquisition candidates on an almost continuous basis and are so engaged at the date of this Form 10-K Report, neither Donegal Mutual nor we make any public disclosure regarding a proposed acquisition until Donegal Mutual or we have entered into a definitive acquisition agreement.

On December 16, 2016, Donegal Mutual and Mountain States Mutual Casualty Company (“Mountain States”) announced the execution of an agreement whereby, subject to applicable regulatory approvals and the approval of the policyholders of Mountain States, Mountain States will merge with and into Donegal Mutual. We are not a party to the agreement. Donegal Mutual will be the surviving company in the merger, and the insurance subsidiaries of Mountain States, Mountain States Indemnity Company and Mountain States Commercial Insurance Company, will become insurance subsidiaries of Donegal Mutual. Mountain States and its insurance subsidiaries currently conduct business together as the Mountain States Insurance Group and offer commercial insurance products in the states of Colorado, New Mexico, Texas and Utah. Following the completion of the merger, Donegal Mutual, Mountain States Indemnity Company and Mountain States Commercial Insurance Company will market their products together as the Mountain States Insurance Group in the Southwestern region of the United States as they seek profitable growth in the region. For an indefinite period of time following the completion of the merger, Donegal Mutual will exclude the business of the Mountain States Insurance Group from the pooling agreement with Atlantic States. As a result, Donegal Mutual’s merger with Mountain States will have no impact on our results of operations. At some undetermined point in the future, we and Donegal Mutual may consider including the business of the Mountain States Insurance Group in the pooling agreement between Donegal Mutual and Atlantic States. Donegal Mutual’s merger with Mountain States therefore represents a future growth opportunity for us, consistent with the acquisition strategy we and Donegal Mutual have shared since our inception.

7

Table of Contents

The following table highlights our history of insurance company acquisitions and affiliations since 1988:

|

Company Name |

State of Domicile |

Year Control

Acquired |

Method of Acquisition/Affiliation |

|||||

|

Southern Mutual Insurance Company and now Southern Insurance Company of Virginia |

Virginia |

1984 | Surplus note investment by Donegal Mutual in 1984; demutualization in 1988; acquisition of stock by us in 1988. | |||||

|

Pioneer Mutual Insurance Company and then Pioneer Insurance Company (1)(2) |

Ohio |

1992 | Surplus note investment by Donegal Mutual in 1992; demutualization in 1993; acquisition of stock by us in 1997. | |||||

|

Delaware Mutual Insurance Company and then Delaware Atlantic Insurance Company (1)(2) |

Delaware |

1993 | Surplus note investment by Donegal Mutual in 1993; demutualization in 1994; acquisition of stock by us in 1995. | |||||

|

Pioneer Mutual Insurance Company and then Pioneer Insurance Company (1)(2) |

New York |

1995 | Surplus note investment by Donegal Mutual in 1995; demutualization in 1998; acquisition of stock by us in 2001. | |||||

|

Southern Heritage Insurance Company (2) |

Georgia |

1998 | Purchase of stock by us in 1998. | |||||

|

Le Mars Mutual Insurance Company of Iowa and now Le Mars Insurance Company (1) |

Iowa |

2002 | Surplus note investment by Donegal Mutual in 2002; demutualization in 2004; acquisition of stock by us in 2004. | |||||

|

Peninsula Insurance Group |

Maryland |

2004 | Purchase of stock by us in 2004. | |||||

|

Sheboygan Falls Mutual Insurance Company and now Sheboygan Falls Insurance Company (1) |

Wisconsin |

2007 | Contribution note investment by Donegal Mutual in 2007; demutualization in 2008; acquisition of stock by us in 2008. | |||||

|

Southern Mutual Insurance Company (3) |

Georgia |

2009 | Surplus note investment by Donegal Mutual and quota-share reinsurance in 2009. | |||||

|

Michigan Insurance Company |

Michigan |

2010 | Purchase of stock by us and surplus note investment by Donegal Mutual in 2010. | |||||

| (1) | Each of these acquisitions initially took the form of an affiliation with Donegal Mutual. Donegal Mutual provided surplus note financing to the insurance company, and, in connection with that financing, sufficient designees of Donegal Mutual were appointed so as to constitute a majority of the members of the board of directors of the insurance company. Donegal Mutual and the insurance company simultaneously entered into a services agreement whereby Donegal Mutual provided services to improve the operations of the insurance company. Once the insurance company’s results of operations improved to the satisfaction of Donegal Mutual, Donegal Mutual sponsored the demutualization of the insurance company. Upon the consummation of the demutualization, Donegal Mutual converted the surplus note to capital stock of the newly demutualized insurance company. We then purchased all of the capital stock of the insurance company from Donegal Mutual and made an additional capital contribution in cash to provide adequate surplus to support the insurance company’s planned premium growth. |

| (2) | To reduce administrative and compliance costs and expenses, these subsidiaries subsequently merged into one of our existing insurance subsidiaries. |

| (3) | Control acquired by Donegal Mutual. |

| • | Providing responsive and friendly customer and agent service to enable our insurance subsidiaries to attract new policyholders and retain existing policyholders. |

We believe that excellent policyholder service is important in attracting new policyholders and retaining existing policyholders. Our insurance subsidiaries work closely with their independent agents to provide a consistently responsive level of claims service, underwriting and customer support. Our insurance subsidiaries seek to respond expeditiously and effectively to address customer and independent agent inquiries in a number of ways, including:

| • | availability of a customer call center for claims reporting; |

8

Table of Contents

| • | availability of a secure website for access to policy information and documents, payment processing and other features; |

| • | timely replies to information requests and policy submissions; and |

| • | prompt responses to, and processing of, claims. |

Our insurance subsidiaries periodically conduct policyholder surveys to evaluate the effectiveness of their service to policyholders. The management of our insurance subsidiaries meets on a regular basis with the personnel of the independent insurance agents our insurance subsidiaries appoint to seek service improvement recommendations, react to service issues and better understand local market conditions.

| • | Maintaining premium rate adequacy to enhance the underwriting results of our insurance subsidiaries, while maintaining their existing book of business and preserving their ability to write new business. |

Our insurance subsidiaries maintain discipline in their pricing by effecting rate increases to sustain or improve their underwriting profitability without unduly affecting their customer retention. In addition to appropriate pricing, our insurance subsidiaries seek to ensure that their premium rates are adequate relative to the amount of risk they insure. Our insurance subsidiaries review loss trends on a periodic basis to identify changes in the frequency and severity of their claims and to assess the adequacy of their rates and underwriting standards. Our insurance subsidiaries also carefully monitor and audit the information they use to price their policies for the purpose of enabling them to receive an adequate level of premiums for the risk they assume. For example, our insurance subsidiaries inspect substantially all commercial lines risks and a substantial number of personal lines property risks before they commit to insure them to determine the adequacy of the insured amount to the value of the insured property, assess property conditions and identify any liability exposures. Our insurance subsidiaries audit the payroll data of their workers’ compensation customers to verify that the assumptions used to price a particular policy were accurate. By implementing appropriate rate increases and understanding the risks our insurance subsidiaries agree to insure, our insurance subsidiaries are generally able to achieve consistent underwriting profitability.

| • | Focusing on expense controls and utilization of technology to increase the operating efficiency of our insurance subsidiaries. |

Our insurance subsidiaries maintain stringent expense controls under direct supervision of their senior management. We centralize many processing and administrative activities of our insurance subsidiaries to realize operating synergies and better expense control. Our insurance subsidiaries utilize technology to automate much of their underwriting and to facilitate agency and policyholder communications on an efficient, timely and cost-effective basis. We operate on a paperless basis. Our insurance subsidiaries have increased their annual premium per employee, a measure of efficiency that our insurance subsidiaries use to evaluate their operations, from approximately $470,000 in 1999 to approximately $1.0 million in 2016.

Our insurance subsidiaries maintain technology comparable to that of the largest of their competitors. “Ease of doing business” is an increasingly important component of an insurer’s value to an independent agency. Our insurance subsidiaries provide a fully automated personal lines underwriting and policy issuance system called “WritePro ® .” WritePro ® is a web-based user interface that substantially eases data entry and facilitates the quoting and issuance of policies for the independent agents of our insurance subsidiaries. Our insurance subsidiaries also provide a similar commercial business system called “WriteBiz ® .” WriteBiz ® is a web-based user interface that provides the independent agents of our insurance subsidiaries with an online ability to quote and issue commercial automobile, workers’ compensation, business owners and tradesman policies automatically. WriteFarm ® is a web-based user interface that provides the independent agents of our insurance subsidiaries with an online ability to quote and issue farm policies. As a result, applications of the independent agents for our insurance subsidiaries can result in policy issuance without further re-entry of information. These systems also interface with the policy management systems of the independent agents of our insurance subsidiaries.

| • | Maintaining a conservative investment approach. |

Return on invested assets is an important element of the financial results of our insurance subsidiaries. The investment strategy of our insurance subsidiaries is to generate an appropriate amount of after-tax income on invested assets while minimizing credit risk through investments in high-quality securities. As a result, our insurance subsidiaries seek to invest a high percentage of their assets in diversified, highly rated and marketable fixed-maturity instruments. The fixed-maturity portfolios of our insurance subsidiaries consist of both taxable and tax-exempt securities. Our insurance subsidiaries maintain a portion of their portfolios in short-term securities to provide liquidity for the payment of claims and operation of their respective businesses. Our insurance subsidiaries maintain a small percentage (5.0% at December 31, 2016) of their portfolios in equity securities.

9

Table of Contents

Competition

The property and casualty insurance industry is highly competitive on the basis of both price and service. Numerous companies compete for business in the geographic areas where our insurance subsidiaries operate. Many of these other insurance companies are substantially larger and have greater financial resources than those of our insurance subsidiaries. In addition, because our insurance subsidiaries and Donegal Mutual market their respective insurance products exclusively through independent insurance agencies, most of which represent more than one insurance company, our insurance subsidiaries face competition within agencies, as well as competition to retain qualified independent agents.

Products and Underwriting

We report the results of our insurance operations in two segments: personal lines of insurance and commercial lines of insurance. The personal lines our insurance subsidiaries write consist primarily of private passenger automobile and homeowners insurance. The commercial lines our insurance subsidiaries write consist primarily of commercial automobile, commercial multi-peril and workers’ compensation insurance. We describe these lines of insurance in greater detail below:

Personal

| • | Private passenger automobile — policies that provide protection against liability for bodily injury and property damage arising from automobile accidents and protection against loss from damage to automobiles owned by the insured. |

| • | Homeowners — policies that provide coverage for damage to residences and their contents from a broad range of perils, including fire, lightning, windstorm and theft. These policies also cover liability of the insured arising from injury to other persons or their property while on the insured’s property and under other specified conditions. |

Commercial

| • | Commercial automobile — policies that provide protection against liability for bodily injury and property damage arising from automobile accidents and protection against loss from damage to automobiles owned by the insured. |

| • | Commercial multi-peril — policies that provide protection to businesses against many perils, usually combining liability and physical damage coverages. |

| • | Workers’ compensation — policies employers purchase to provide benefits to employees for injuries sustained during employment. The workers’ compensation laws of each state determine the extent of the coverage we provide. |

10

Table of Contents

The following table sets forth the net premiums written of our insurance subsidiaries by line of insurance for the periods indicated:

| Year Ended December 31, | ||||||||||||||||||||||||

| 2016 | 2015 | 2014 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

|

Personal lines: |

||||||||||||||||||||||||

|

Automobile |

$ | 229,789 | 33.7 | % | $ | 214,610 | 34.1 | % | $ | 204,174 | 35.3 | % | ||||||||||||

|

Homeowners |

122,811 | 18.0 | 119,541 | 19.0 | 113,576 | 19.6 | ||||||||||||||||||

|

Other |

19,057 | 2.8 | 18,176 | 2.9 | 16,989 | 2.9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total personal lines |

371,657 | 54.5 | 352,327 | 56.0 | 334,739 | 57.8 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Commercial lines: |

||||||||||||||||||||||||

|

Automobile |

87,849 | 12.9 | 76,729 | 12.2 | 65,552 | 11.3 | ||||||||||||||||||

|

Commercial multi-peril |

104,728 | 15.4 | 94,219 | 15.0 | 83,413 | 14.4 | ||||||||||||||||||

|

Workers’ compensation |

108,349 | 15.9 | 98,079 | 15.6 | 88,739 | 15.3 | ||||||||||||||||||

|

Other |

9,451 | 1.3 | 7,483 | 1.2 | 6,758 | 1.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total commercial lines |

310,377 | 45.5 | 276,510 | 44.0 | 244,462 | 42.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total business |

$ | 682,034 | 100.0 | % | $ | 628,837 | 100.0 | % | $ | 579,201 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The personal lines and commercial lines underwriting departments of our insurance subsidiaries evaluate and select those risks that they believe will enable our insurance subsidiaries to achieve an underwriting profit. The underwriting departments have significant interaction with the independent agents regarding the underwriting philosophy and the underwriting guidelines of our insurance subsidiaries. Our underwriting personnel also assist the research and development department in the development of quality products at competitive prices to promote growth and profitability.

In order to achieve underwriting profitability on a consistent basis, our insurance subsidiaries:

| • | assess and select primarily standard and preferred risks; |

| • | adhere to disciplined underwriting guidelines; |

| • | inspect substantially all commercial lines risks and a substantial number of personal lines property risks; and |

| • | utilize various types of risk management and loss control services. |

Our insurance subsidiaries also review their existing policies and accounts to determine whether those risks continue to meet their underwriting guidelines. If a given policy or account no longer meets those underwriting guidelines, our insurance subsidiaries will take appropriate action regarding that policy or account, including raising premium rates or non-renewing the policy to the extent applicable law permits.

As part of the effort of our insurance subsidiaries to maintain acceptable underwriting results, they conduct annual reviews of agencies that have failed to meet their underwriting profitability criteria. The review process includes an analysis of the underwriting and re-underwriting practices of the agency, the completeness and accuracy of the applications the agency submits, the adequacy of the training of the agency’s staff and the agency’s record of adherence to the underwriting guidelines and service standards of our insurance subsidiaries. Based on the results of this review process, the marketing and underwriting personnel of our insurance subsidiaries develop, together with the agency, a plan to improve its underwriting profitability. Our insurance subsidiaries monitor the agency’s compliance with the plan and take other measures as required in the judgment of our insurance subsidiaries, including the termination to the extent applicable law permits of agencies that are unable to achieve acceptable underwriting profitability.

11

Table of Contents

Distribution

Our insurance subsidiaries market their products primarily in the Mid-Atlantic, Midwestern, New England and Southern regions through approximately 2,400 independent insurance agencies. At December 31, 2016, the Donegal Insurance Group actively wrote business in 21 states (Alabama, Delaware, Georgia, Indiana, Iowa, Maine, Maryland, Michigan, Nebraska, New Hampshire, New York, North Carolina, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Vermont, Virginia, West Virginia and Wisconsin). We believe the relationships of our insurance subsidiaries with their independent agents are valuable in identifying, obtaining and retaining profitable business. Our insurance subsidiaries maintain a stringent agency selection procedure that emphasizes appointing agencies with proven marketing strategies for the development of profitable business, and our insurance subsidiaries only appoint agencies with a strong underwriting history and potential growth capabilities. Our insurance subsidiaries also regularly evaluate the independent agencies that represent them based on their profitability and performance in relation to the objectives of our insurance subsidiaries. Our insurance subsidiaries seek to be among the top three insurers within each of their agencies for the lines of business our insurance subsidiaries write.

The following table sets forth the percentage of direct premiums our insurance subsidiaries write, including 80% of the direct premiums Donegal Mutual and Atlantic States write, in each of the states where they conducted a significant portion of their business in 2016:

|

Pennsylvania |

35.8 | % | ||

|

Michigan |

15.4 | |||

|

Maryland |

8.8 | |||

|

Virginia |

8.4 | |||

|

Georgia |

6.7 | |||

|

Delaware |

5.6 | |||

|

Wisconsin |

3.7 | |||

|

Ohio |

3.4 | |||

|

Iowa |

2.5 | |||

|

Tennessee |

2.4 | |||

|

Nebraska |

2.3 | |||

|

South Dakota |

1.1 | |||

|

Other |

3.9 | |||

|

|

|

|||

|

Total |

100.0 | % | ||

|

|

|

Our insurance subsidiaries employ a number of policies and procedures that we believe enable them to attract, retain and motivate their independent agents. We believe that the consistency of the product offerings of our insurance subsidiaries enables our insurance subsidiaries to compete effectively for independent agents with other insurers whose product offerings may fluctuate based upon industry conditions. Our insurance subsidiaries have a competitive profit-sharing plan for their independent agents, consistent with applicable state laws and regulations, under which the independent agents may earn additional commissions based upon the volume of premiums produced and the profitability of the business our insurance subsidiaries receive from that agency.

Our insurance subsidiaries encourage their independent agents to focus on “account selling,” or serving all of a particular insured’s property and casualty insurance needs, which our insurance subsidiaries believe generally results in more favorable loss experience than covering a single risk for an individual insured.

Technology

Donegal Mutual owns the majority of the technology systems our insurance subsidiaries use. The technology systems consist primarily of an integrated central processing computer system, a series of server-based computer networks and various communication systems that allow the home office of our insurance subsidiaries and their branch offices to utilize the same systems for the processing of business. Donegal Mutual maintains backup facilities and systems at the office of one of our insurance subsidiaries and tests these backup facilities and systems on a regular basis. Our insurance subsidiaries bear their proportionate share of information services expenses based on their respective percentage of the total net written premiums of the Donegal Insurance Group during the preceding calendar year.

12

Table of Contents

The business strategy of our insurance subsidiaries depends on the use, development and implementation of integrated technology systems. These systems enable our insurance subsidiaries to provide a high level of service to agents and policyholders by processing business in a timely and efficient manner, communicating and sharing data with agents, providing a variety of methods for the payment of premiums and allowing for the accumulation and analysis of information for the management of our insurance subsidiaries.

We believe the availability and use of these technology systems has resulted in improved service to agents and policyholders, increased efficiencies in processing the business of our insurance subsidiaries and lower operating costs. Key components of these integrated technology systems are the agency interface system, the WritePro ® , WriteBiz ® and WriteFarm ® systems, a claims processing system and an imaging system. The agency interface system provides our insurance subsidiaries with a high level of data sharing both to and from agents’ systems and also provides agents with an integrated means of processing new business. The WritePro ® , WriteBiz ® and WriteFarm ® systems are fully automated underwriting and policy issuance systems that provide agents with the ability to generate underwritten quotes and automatically issue policies that meet the underwriting guidelines of our insurance subsidiaries with limited or no intervention by their personnel. The claims processing system allows our insurance subsidiaries to process claims efficiently and in an automated environment. The imaging system eliminates the need to handle paper files, while providing greater access to the same information by a variety of personnel. We believe our technology systems compare favorably to those of many national property and casualty insurance carriers in terms of quality and service levels.

Claims

The management of claims is a critical component of the philosophy of our insurance subsidiaries to achieve underwriting profitability on a consistent basis and is fundamental to the successful operations of our insurance subsidiaries and their dedication to excellent service. Our senior claims management oversees the claims processing units of each of our insurance subsidiaries to assure consistency in the claims settlement process. The field office staff of our insurance subsidiaries receives support from home office technical, litigation, material damage, subrogation and medical audit personnel.

The claims departments of our insurance subsidiaries rigorously manage claims to assure that they settle legitimate claims quickly and fairly and that they identify questionable claims for defense. In the majority of cases, the personnel of our insurance subsidiaries, who have significant experience in the property and casualty insurance industry and know the service philosophy of our insurance subsidiaries, adjust claims. Our insurance subsidiaries provide various means of claims reporting on a 24-hours a day, seven-days a week basis, including toll-free numbers and electronic reporting through our website and mobile applications. Our insurance subsidiaries strive to respond to notifications of claims promptly, generally within the day reported. Our insurance subsidiaries believe that, by responding promptly to claims, they provide quality customer service and minimize the ultimate cost of the claims. Our insurance subsidiaries engage independent adjusters as needed to handle claims in areas in which the volume of claims is not sufficient to justify the hiring of internal claims adjusters by our insurance subsidiaries. Our insurance subsidiaries also employ private adjusters and investigators, structural experts and various outside legal counsel to supplement their internal staff and to assist in the investigation of claims. Our insurance subsidiaries have a special investigative unit staffed by former law enforcement officers that attempts to identify and prevent fraud and abuse and to investigate questionable claims.

The management of the claims departments of our insurance subsidiaries develops and implements policies and procedures for the establishment of adequate claim reserves. Our insurance subsidiaries employ an actuarial staff that regularly reviews their reserves for incurred but not reported claims. The management and staff of the claims departments resolve policy coverage issues, manage and process reinsurance recoveries and handle salvage and subrogation matters. The litigation and personal injury sections of our insurance subsidiaries manage all claims litigation. Branch office claims above certain thresholds require home office review and settlement authorization. Our insurance subsidiaries provide their claims adjusters reserving and settlement authority based upon their experience and demonstrated abilities. Larger or more complicated claims require consultation and approval of senior claims department management.

Liabilities for Losses and Loss Expenses

Liabilities for losses and loss expenses are estimates at a given point in time of the amounts an insurer expects to pay with respect to incurred policyholder claims based on facts and circumstances then known. At the time of establishing its estimates, an insurer recognizes that its ultimate liability for losses and loss expenses will exceed or be less than such estimates. Our insurance subsidiaries base their estimates of liabilities for losses and loss expenses on assumptions as to future loss trends and expected claims severity, judicial theories of liability and other factors. However, during the loss adjustment period, our insurance subsidiaries may learn additional facts regarding individual claims, and, consequently, it often becomes necessary for our insurance subsidiaries to refine and adjust their estimates of liability. We reflect any adjustments to our insurance subsidiaries’ liabilities for losses and loss expenses in our operating results in the period in which our insurance subsidiaries record the changes in their estimates.

13

Table of Contents

Our insurance subsidiaries maintain liabilities for the payment of losses and loss expenses with respect to both reported and unreported claims. Our insurance subsidiaries establish these liabilities for the purpose of covering the ultimate costs of settling all losses, including investigation and litigation costs. Our insurance subsidiaries base the amount of their liability for reported losses primarily upon a case-by-case evaluation of the type of risk involved, knowledge of the circumstances surrounding each claim and the insurance policy provisions relating to the type of loss their policyholder incurred. Our insurance subsidiaries determine the amount of their liability for unreported claims and loss expenses on the basis of historical information by line of insurance. Our insurance subsidiaries account for inflation in the reserving function through analysis of costs and trends and reviews of historical reserving results. Our insurance subsidiaries closely monitor their liabilities and recompute them periodically using new information on reported claims and a variety of statistical techniques. Our insurance subsidiaries do not discount their liabilities for losses.

Reserve estimates can change over time because of unexpected changes in assumptions related to our insurance subsidiaries’ external environment and, to a lesser extent, assumptions as to our insurance subsidiaries’ internal operations. For example, our insurance subsidiaries have experienced a decrease in claims frequency on workers’ compensation claims during the past several years while claims severity has gradually increased. These trend changes give rise to greater uncertainty as to the pattern of future loss settlements on workers’ compensation claims. Related uncertainties regarding future trends include the cost of medical technologies and procedures and changes in the utilization of medical procedures. Assumptions related to our insurance subsidiaries’ external environment include the absence of significant changes in tort law and legal decisions that increase liability exposure, consistency in judicial interpretations of insurance coverage and policy provisions and the rate of loss cost inflation. Internal assumptions include consistency in the recording of premium and loss statistics, consistency in the recording of claims, payment and case reserving methodology, accurate measurement of the impact of rate changes and changes in policy provisions, consistency in the quality and characteristics of business written within a given line of business and consistency in reinsurance coverage and the collectability of reinsured losses, among other items. To the extent our insurance subsidiaries determine that underlying factors impacting their assumptions have changed, our insurance subsidiaries attempt to make appropriate adjustments for such changes in their reserves. Accordingly, our insurance subsidiaries’ ultimate liability for unpaid losses and loss expenses will likely differ from the amount recorded at December 31, 2016. For every 1% change in our insurance subsidiaries’ loss and loss expense reserves, net of reinsurance recoverable, the effect on our pre-tax results of operations would be approximately $3.5 million.

The establishment of appropriate liabilities is an inherently uncertain process, and we can provide no assurance that our insurance subsidiaries’ ultimate liability will not exceed our insurance subsidiaries’ loss and loss expense reserves and have an adverse effect on our results of operations and financial condition. Furthermore, we cannot predict the timing, frequency and extent of adjustments to our insurance subsidiaries’ estimated future liabilities, since the historical conditions and events that serve as a basis for our insurance subsidiaries’ estimates of ultimate claim costs may change. As is the case for substantially all property and casualty insurance companies, our insurance subsidiaries have found it necessary in the past to increase their estimated future liabilities for losses and loss expenses in certain periods, and, in other periods, their estimates of future liabilities have exceeded their actual liabilities. Changes in our insurance subsidiaries’ estimates of their liability for losses and loss expenses generally reflect actual payments and the evaluation of information received since the prior reporting date. Our insurance subsidiaries recognized an increase in their liability for losses and loss expenses of prior years of $3.0 million, $7.2 million and $14.5 million in 2016, 2015 and 2014, respectively. Our insurance subsidiaries made no significant changes in their reserving philosophy, key reserving assumptions or claims management personnel, and they have made no significant offsetting changes in estimates that increased or decreased their loss and loss expense reserves in these years. The 2016 development represented 0.9% of the December 31, 2015 net carried reserves and resulted primarily from higher-than-expected severity in the commercial multiple peril and commercial automobile liability lines of business, offset by lower-than-expected severity in the workers’ compensation line of business, in accident years prior to 2016. The majority of the 2016 development related to increases in the liability for losses and loss expenses of prior years for Atlantic States and Southern. The 2015 development represented 2.5% of the December 31, 2014 net carried reserves and resulted primarily from higher-than-expected severity in the private passenger automobile liability, commercial multiple peril and commercial automobile lines of business in accident years prior to 2015. The majority of the 2015 development related to increases in the liability for losses and loss expenses of prior years for Atlantic States and Southern. The 2014 development represented 5.4% of the December 31, 2013 net carried reserves and resulted primarily from higher-than-expected severity in the private passenger automobile liability, commercial multiple peril and commercial automobile lines of business in accident years prior to 2014. The majority of the 2014 development related to increases in the liability for losses and loss expenses of prior years for Atlantic States and Southern.

Excluding the impact of catastrophic weather events, our insurance subsidiaries have noted stable amounts in the number of claims incurred and slight downward trends in the number of claims outstanding at period ends relative to their premium

14

Table of Contents

base in recent years across most of their lines of business. However, the amount of the average claim outstanding has increased gradually over the past several years as the property and casualty insurance industry has experienced increased litigation trends and economic conditions that have extended the estimated length of disabilities and contributed to increased medical loss costs and a general slowing of settlement rates in litigated claims. Our insurance subsidiaries could be required to make further adjustments to their estimates in the future. However, on the basis of our insurance subsidiaries’ internal procedures which analyze, among other things, their prior assumptions, their experience with similar cases and historical trends such as reserving patterns, loss payments, pending levels of unpaid claims and product mix, as well as court decisions, economic conditions and public attitudes, we believe that our insurance subsidiaries have made adequate provision for their liability for losses and loss expenses at December 31, 2016.

Differences between liabilities reported in our financial statements prepared on a GAAP basis and our insurance subsidiaries’ financial statements prepared on a SAP basis result from anticipating salvage and subrogation recoveries for GAAP but not for SAP. These differences amounted to $16.8 million, $15.3 million and $14.2 million at December 31, 2016, 2015 and 2014, respectively.

The following table sets forth a reconciliation of the beginning and ending GAAP net liability of our insurance subsidiaries for unpaid losses and loss expenses for the periods indicated:

| Year Ended December 31, | ||||||||||||

| (in thousands) | 2016 | 2015 | 2014 | |||||||||

|

Gross liability for unpaid losses and loss expenses at beginning of year |

$ | 578,205 | $ | 538,258 | $ | 495,619 | ||||||

|

Less reinsurance recoverable |

256,151 | 245,957 | 230,014 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Net liability for unpaid losses and loss expenses at beginning of year |

322,054 | 292,301 | 265,605 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Provision for net losses and loss expenses for claims incurred in the current year |

420,327 | 391,167 | 373,932 | |||||||||

|

Change in provision for estimated net losses and loss expenses for claims incurred in prior years |

2,989 | 7,200 | 14,469 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Total incurred |

423,316 | 398,367 | 388,401 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Net losses and loss payments for claims incurred during: |

||||||||||||

|

The current year |

248,106 | 236,835 | 229,939 | |||||||||

|

Prior years |

149,746 | 131,779 | 131,766 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Total paid |

397,852 | 368,614 | 361,705 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Net liability for unpaid losses and loss expenses at end of year |

347,518 | 322,054 | 292,301 | |||||||||

|

Plus reinsurance recoverable |

259,147 | 256,151 | 245,957 | |||||||||

|

|

|

|

|

|

|

|||||||

|

Gross liability for unpaid losses and loss expenses at end of year |

$ | 606,665 | $ | 578,205 | $ | 538,258 | ||||||

|

|

|

|

|

|

|

|||||||

The following table sets forth the development of the liability for net unpaid losses and loss expenses of our insurance subsidiaries from 2006 to 2016. Loss data in the table includes business Atlantic States received from the underwriting pool.

“Net liability at end of year for unpaid losses and loss expenses” sets forth the estimated liability for net unpaid losses and loss expenses recorded at the balance sheet date for each of the indicated years. This liability represents the estimated amount of net losses and loss expenses for claims arising in the current and all prior years that are unpaid at the balance sheet date, including losses incurred but not reported.

The “Net liability re-estimated as of” portion of the table shows the re-estimated amount of the previously recorded liability based on experience for each succeeding year. The estimate increases or decreases as payments are made and more information becomes known about the severity of the remaining unpaid claims. For example, the 2006 liability has developed a redundancy after ten years because we expect the re-estimated net losses and loss expenses to be $12.5 million less than the estimated liability we initially established in 2006 of $163.3 million.

The “Cumulative (excess) deficiency” shows the cumulative excess or deficiency at December 31, 2016 of the liability estimate shown on the top line of the corresponding column. An excess in liability means that the liability established in prior years exceeded the amount of actual payments and currently re-estimated unpaid liability remaining. A deficiency in liability means that the liability established in prior years was less than the amount of actual payments and currently re-estimated remaining unpaid liability.

15

Table of Contents

The “Cumulative amount of liability paid through” portion of the table shows the cumulative net losses and loss expense payments made in succeeding years for net losses incurred prior to the balance sheet date. For example, the 2006 column indicates that at December 31, 2016 payments equal to $147.2 million of the currently re-estimated ultimate liability for net losses and loss expenses of $150.8 million had been made.

Amounts shown in the 2008 column of the table include information for Sheboygan for all accident years prior to 2008. Amounts shown in the 2010 column of the table include information for MICO for all accident years prior to 2010.

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||||||||||||||||

|

Net liability at end of year for unpaid losses and loss expenses |

$ | 163,312 | $ | 150,152 | $ | 161,307 | $ | 180,262 | $ | 217,896 | $ | 243,015 | $ | 250,936 | $ | 265,605 | $ | 292,301 | $ | 322,054 | $ | 347,518 | ||||||||||||||||||||||

|

Net liability re-estimated as of: |

||||||||||||||||||||||||||||||||||||||||||||

|

One year later |

153,299 | 152,836 | 171,130 | 177,377 | 217,728 | 250,611 | 261,294 | 280,074 | 299,501 | 325,043 | ||||||||||||||||||||||||||||||||||

|

Two years later |

150,934 | 154,435 | 167,446 | 177,741 | 217,355 | 255,612 | 268,877 | 281,782 | 299,919 | |||||||||||||||||||||||||||||||||||

|

Three years later |

150,078 | 152,315 | 166,756 | 178,403 | 218,449 | 257,349 | 270,473 | 281,666 | ||||||||||||||||||||||||||||||||||||

|

Four years later |

148,745 | 151,120 | 166,852 | 179,909 | 218,514 | 256,460 | 270,794 | |||||||||||||||||||||||||||||||||||||

|

Five years later |

148,407 | 151,287 | 166,788 | 179,961 | 218,202 | 255,660 | ||||||||||||||||||||||||||||||||||||||

|

Six years later |

149,031 | 151,739 | 166,964 | 179,858 | 217,430 | |||||||||||||||||||||||||||||||||||||||

|

Seven years later |

149,487 | 151,790 | 167,425 | 179,996 | ||||||||||||||||||||||||||||||||||||||||

|

Eight years later |

149,700 | 152,240 | 167,732 | |||||||||||||||||||||||||||||||||||||||||

|

Nine years later |

150,241 | 152,760 | ||||||||||||||||||||||||||||||||||||||||||

|

Ten years later |

150,839 | |||||||||||||||||||||||||||||||||||||||||||

|

Cumulative (excess) deficiency |

(12,473 | ) | 2,608 | 6,425 | (266 | ) | (466 | ) | 12,645 | 19,858 | 16,061 | 7,618 | 2,989 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Cumulative amount of liability paid through: |

||||||||||||||||||||||||||||||||||||||||||||

|

One year later |

$ | 72,499 | $ | 71,950 | $ | 79,592 | $ | 84,565 | $ | 96,202 | $ | 119,074 | $ | 126,677 | $ | 131,766 | $ | 131,779 | $ | 149,746 | ||||||||||||||||||||||||

|

Two years later |

104,890 | 105,576 | 116,035 | 123,204 | 148,140 | 181,288 | 191,208 | 194,169 | 206,637 | |||||||||||||||||||||||||||||||||||

|

Three years later |

121,711 | 124,659 | 136,837 | 147,165 | 178,073 | 217,138 | 225,956 | 233,371 | ||||||||||||||||||||||||||||||||||||

|

Four years later |

132,698 | 135,392 | 148,243 | 161,363 | 195,948 | 234,392 | 245,094 | |||||||||||||||||||||||||||||||||||||

|

Five years later |

138,878 | 140,280 | 155,331 | 169,452 | 203,633 | 241,538 | ||||||||||||||||||||||||||||||||||||||

|

Six years later |

141,752 | 143,778 | 160,324 | 173,153 | 206,731 | |||||||||||||||||||||||||||||||||||||||

|

Seven years later |