|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2016

|

||

|

OR

|

||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from to

|

||

DineEquity, Inc.

DineEquity, Inc.

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

95-3038279

(I.R.S. Employer

Identification No.)

|

|

|

450 North Brand Boulevard, Glendale, California

(Address of principal executive offices)

|

91203-2306

(Zip Code)

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|||

|

Common Stock, $.01 Par Value

|

New York Stock Exchange

|

|||

|

Large accelerated filer

x

|

Accelerated filer

o

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

Smaller reporting company

o

|

|||

|

Class

|

Outstanding as of February 24, 2017

|

|||

|

Common Stock, $.01 par value

|

17,845,014

|

|||

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

Franchise operations - primarily royalties, fees and other income from

2,016

Applebee’s franchised restaurants and

1,723

IHOP franchised and area licensed restaurants;

|

|

•

|

Rental operations - primarily rental income derived from lease or sublease agreements covering

691

IHOP franchised restaurants and one Applebee’s franchised restaurant;

|

|

•

|

Company restaurant operations - retail sales from

10

IHOP company-operated restaurants; and

|

|

•

|

Financing operations - primarily interest income from approximately $88 million of receivables for equipment leases and franchise fee notes generally associated with IHOP franchised restaurants developed before 2003.

|

|

•

|

make it more difficult for us to satisfy our obligations with respect to our debt or refinance any of our debt on attractive terms, commercially reasonable terms, or at all;

|

|

•

|

increase our vulnerability to general adverse economic and industry conditions or a downturn in our business;

|

|

•

|

require us to dedicate a substantial portion of our cash flow from operations to debt service, thereby reducing the availability of our cash flow to pay dividends to our stockholders, repurchase shares of our common stock, fund working capital, capital expenditures and other general corporate purposes;

|

|

•

|

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

|

|

•

|

place us at a competitive disadvantage compared to our competitors that are not as highly leveraged;

|

|

•

|

limit, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds; and

|

|

•

|

result in an event of default if we fail to satisfy our obligations under our debt or fail to comply with the financial and other restrictive covenants contained in our debt documents, which event of default could result in all of our debt becoming immediately due and payable and could permit certain of our lenders to foreclose on our assets securing such debt.

|

|

•

|

the demand for Applebee’s and IHOP restaurants and the selection of appropriate franchisee candidates;

|

|

•

|

costs of construction, permit issuance and regulatory compliance;

|

|

•

|

the availability of suitable locations and terms for potential development sites, including lease or purchase terms for new locations;

|

|

•

|

the availability of financing, at acceptable rates and terms, to both franchisees and third-party landlords, for restaurant development and/or implementation of our business strategy through new remodel programs and other operational changes;

|

|

•

|

delays in obtaining construction permits and in completion of construction;

|

|

•

|

competition for suitable development sites;

|

|

•

|

changes in governmental rules, regulations, and interpretations (including interpretations of the requirements of the Americans with Disabilities Act); and

|

|

•

|

general economic and business conditions.

|

|

•

|

inability or unwillingness of franchisees to participate in implementing changes or to participate in business strategy changes;

|

|

•

|

inability or unwillingness of franchisees to support our marketing programs and strategic initiatives;

|

|

•

|

inability to participate in business strategy changes due to financial constraints;

|

|

•

|

failure of franchisees to report sales information accurately;

|

|

•

|

greater proportional impact of general and administrative expenses on our business and financial condition; and

|

|

•

|

inability to retain franchisees in the future, both in terms of number and quality, and inability to attract, retain and motivate sufficient numbers of franchisees of the same caliber, including top performing franchisees.

|

|

•

|

changes in consumer behavior driven by macro-level shifts in technology, media, e-commerce, global safety and demography which may impact where, when, whether and how often customers visit full-service restaurants;

|

|

•

|

declines in comparable-restaurant sales growth rates due to: (i) failure to meet or adequately adapt to changing customer expectations for food quality and taste, or to innovate and develop new menu items to retain existing customers and attract new customers; (ii) competitive intrusions in our markets, including competitive pricing initiatives; (iii) opening new restaurants that cannibalize the sales of existing restaurants; (iv) failure of national or local marketing to be effective; and (v) natural or man-made disasters or adverse weather conditions;

|

|

•

|

negative trends in operating expenses such as: (i) increases in food and other commodity costs; (ii) increases in labor costs due to minimum wage and other employment laws or regulations, immigration reform, the potential impact of union organizing efforts, tight labor market conditions and the Patient Protection and Affordable Care Act; and (iii) increases in other operating costs including advertising, utilities, lease-related expenses and credit card processing fees;

|

|

•

|

the highly competitive nature of the restaurant and related industries with respect to, among other things: (i) price, service, location, personnel and the type and quality of food; (ii) the trend toward convergence in grocery, deli, retail and restaurant services, as well as the continued expansion of restaurants into the breakfast daypart; (iii) the entry of major market players in non-competing industries into the food services market; (iv) the decline in the price of groceries which may increase the attractiveness of dining at home versus dining out; and (v) the emergence of new or improved technologies such as table top devices and mobile or online ordering and consumer behavior facilitated by such technology;

|

|

•

|

the inability to increase menu pricing to offset increased operating expenses; and

|

|

•

|

failure to effectively manage further penetration into mature markets.

|

|

|

Applebee's (a)

|

IHOP (a)

|

||||||||||||||||||

|

|

Franchise

|

Company

|

Total

|

Franchise

|

Company

|

Area License

|

Total

|

|||||||||||||

|

United States

|

|

|

|

|

|

|

|

|||||||||||||

|

Alabama

|

30

|

|

—

|

|

30

|

|

21

|

|

—

|

|

—

|

|

21

|

|

||||||

|

Alaska

|

1

|

|

—

|

|

1

|

|

4

|

|

—

|

|

—

|

|

4

|

|

||||||

|

Arizona

|

28

|

|

—

|

|

28

|

|

41

|

|

—

|

|

—

|

|

41

|

|

||||||

|

Arkansas

|

10

|

|

—

|

|

10

|

|

16

|

|

—

|

|

—

|

|

16

|

|

||||||

|

California

|

121

|

|

—

|

|

121

|

|

231

|

|

—

|

|

—

|

|

231

|

|

||||||

|

Colorado

|

26

|

|

—

|

|

26

|

|

35

|

|

—

|

|

—

|

|

35

|

|

||||||

|

Connecticut

|

6

|

|

—

|

|

6

|

|

9

|

|

—

|

|

—

|

|

9

|

|

||||||

|

Delaware

|

12

|

|

—

|

|

12

|

|

7

|

|

—

|

|

—

|

|

7

|

|

||||||

|

District of Columbia

|

—

|

|

—

|

|

—

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

Florida

|

110

|

|

—

|

|

110

|

|

—

|

|

—

|

|

149

|

|

(b)

|

149

|

|

|||||

|

Georgia

|

71

|

|

—

|

|

71

|

|

75

|

|

—

|

|

5

|

|

(b)

|

80

|

|

|||||

|

Hawaii

|

1

|

|

—

|

|

1

|

|

6

|

|

—

|

|

—

|

|

6

|

|

||||||

|

Idaho

|

12

|

|

—

|

|

12

|

|

8

|

|

—

|

|

—

|

|

8

|

|

||||||

|

Illinois

|

47

|

|

—

|

|

47

|

|

52

|

|

—

|

|

—

|

|

52

|

|

||||||

|

Indiana

|

64

|

|

—

|

|

64

|

|

24

|

|

—

|

|

—

|

|

24

|

|

||||||

|

Iowa

|

26

|

|

—

|

|

26

|

|

10

|

|

—

|

|

—

|

|

10

|

|

||||||

|

Kansas

|

33

|

|

—

|

|

33

|

|

23

|

|

—

|

|

—

|

|

23

|

|

||||||

|

Kentucky

|

34

|

|

—

|

|

34

|

|

8

|

|

1

|

|

—

|

|

9

|

|

||||||

|

Louisiana

|

16

|

|

—

|

|

16

|

|

31

|

|

—

|

|

—

|

|

31

|

|

||||||

|

Maine

|

12

|

|

—

|

|

12

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

Maryland

|

25

|

|

—

|

|

25

|

|

44

|

|

—

|

|

—

|

|

44

|

|

||||||

|

Massachusetts

|

29

|

|

—

|

|

29

|

|

18

|

|

—

|

|

—

|

|

18

|

|

||||||

|

Michigan

|

88

|

|

—

|

|

88

|

|

24

|

|

—

|

|

—

|

|

24

|

|

||||||

|

Minnesota

|

58

|

|

—

|

|

58

|

|

9

|

|

—

|

|

—

|

|

9

|

|

||||||

|

Mississippi

|

22

|

|

—

|

|

22

|

|

15

|

|

—

|

|

—

|

|

15

|

|

||||||

|

Missouri

|

56

|

|

—

|

|

56

|

|

30

|

|

—

|

|

—

|

|

30

|

|

||||||

|

Montana

|

8

|

|

—

|

|

8

|

|

5

|

|

—

|

|

—

|

|

5

|

|

||||||

|

Nebraska

|

19

|

|

—

|

|

19

|

|

7

|

|

—

|

|

—

|

|

7

|

|

||||||

|

Nevada

|

14

|

|

—

|

|

14

|

|

24

|

|

—

|

|

—

|

|

24

|

|

||||||

|

New Hampshire

|

14

|

|

—

|

|

14

|

|

6

|

|

—

|

|

—

|

|

6

|

|

||||||

|

New Jersey

|

60

|

|

—

|

|

60

|

|

44

|

|

—

|

|

—

|

|

44

|

|

||||||

|

New Mexico

|

21

|

|

—

|

|

21

|

|

21

|

|

—

|

|

—

|

|

21

|

|

||||||

|

New York

|

114

|

|

—

|

|

114

|

|

54

|

|

—

|

|

—

|

|

54

|

|

||||||

|

North Carolina

|

56

|

|

—

|

|

56

|

|

54

|

|

—

|

|

—

|

|

54

|

|

||||||

|

North Dakota

|

12

|

|

—

|

|

12

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

Ohio

|

89

|

|

—

|

|

89

|

|

26

|

|

9

|

|

—

|

|

35

|

|

||||||

|

Oklahoma

|

20

|

|

—

|

|

20

|

|

33

|

|

—

|

|

—

|

|

33

|

|

||||||

|

Oregon

|

21

|

|

—

|

|

21

|

|

7

|

|

—

|

|

—

|

|

7

|

|

||||||

|

Pennsylvania

|

81

|

|

—

|

|

81

|

|

23

|

|

—

|

|

—

|

|

23

|

|

||||||

|

Rhode Island

|

8

|

|

—

|

|

8

|

|

4

|

|

—

|

|

—

|

|

4

|

|

||||||

|

South Carolina

|

39

|

|

—

|

|

39

|

|

31

|

|

—

|

|

—

|

|

31

|

|

||||||

|

South Dakota

|

6

|

|

—

|

|

6

|

|

3

|

|

—

|

|

—

|

|

3

|

|

||||||

|

Tennessee

|

39

|

|

—

|

|

39

|

|

40

|

|

—

|

|

—

|

|

40

|

|

||||||

|

Texas

|

107

|

|

—

|

|

107

|

|

203

|

|

—

|

|

—

|

|

203

|

|

||||||

|

Utah

|

12

|

|

—

|

|

12

|

|

19

|

|

—

|

|

—

|

|

19

|

|

||||||

|

Vermont

|

3

|

|

—

|

|

3

|

|

1

|

|

—

|

|

—

|

|

1

|

|

||||||

|

Virginia

|

72

|

|

—

|

|

72

|

|

63

|

|

—

|

|

—

|

|

63

|

|

||||||

|

Washington

|

42

|

|

—

|

|

42

|

|

32

|

|

—

|

|

—

|

|

32

|

|

||||||

|

West Virginia

|

17

|

|

—

|

|

17

|

|

9

|

|

—

|

|

—

|

|

9

|

|

||||||

|

Wisconsin

|

41

|

|

—

|

|

41

|

|

14

|

|

—

|

|

—

|

|

14

|

|

||||||

|

Wyoming

|

5

|

|

—

|

|

5

|

|

3

|

|

—

|

|

—

|

|

3

|

|

||||||

|

Total Domestic

|

1,858

|

|

—

|

|

1,858

|

|

1,473

|

|

10

|

|

154

|

|

1,637

|

|

||||||

|

|

Applebee's (a)

|

IHOP (a)

|

||||||||||||||||||

|

|

Franchise

|

Company

|

Total

|

Franchise

|

Company

|

Area License

|

Total

|

|||||||||||||

|

International

|

|

|

|

|

|

|

|

|||||||||||||

|

Bahrain

|

—

|

|

—

|

|

—

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

Brazil

|

12

|

|

—

|

|

12

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Canada

|

16

|

|

—

|

|

16

|

|

12

|

|

—

|

|

13

|

|

(b)

|

25

|

|

|||||

|

Chile

|

4

|

|

—

|

|

4

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Costa Rica

|

3

|

|

—

|

|

3

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Dominican Republic

|

2

|

|

—

|

|

2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Egypt

|

1

|

|

—

|

|

1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Guam

|

1

|

|

—

|

|

1

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

Guatemala

|

5

|

|

—

|

|

5

|

|

3

|

|

—

|

|

—

|

|

3

|

|

||||||

|

Indonesia

|

2

|

|

—

|

|

2

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Jordan

|

1

|

|

—

|

|

1

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||

|

Kuwait

|

8

|

|

—

|

|

8

|

|

5

|

|

—

|

|

—

|

|

5

|

|

||||||

|

Mexico

|

59

|

|

—

|

|

59

|

|

35

|

|

—

|

|

—

|

|

35

|

|

||||||

|

Northern Mariana Islands

|

—

|

|

—

|

|

—

|

|

1

|

|

—

|

|

—

|

|

1

|

|

||||||

|

Panama

|

—

|

|

—

|

|

—

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

Philippines

|

2

|

|

—

|

|

2

|

|

7

|

|

—

|

|

—

|

|

7

|

|

||||||

|

Puerto Rico

|

5

|

|

—

|

|

5

|

|

5

|

|

—

|

|

—

|

|

5

|

|

||||||

|

Qatar

|

7

|

|

—

|

|

7

|

|

1

|

|

—

|

|

—

|

|

1

|

|

||||||

|

Saudi Arabia

|

20

|

|

—

|

|

20

|

|

2

|

|

—

|

|

—

|

|

2

|

|

||||||

|

United Arab Emirates

|

10

|

|

—

|

|

10

|

|

6

|

|

—

|

|

—

|

|

6

|

|

||||||

|

Total International

|

158

|

|

—

|

|

158

|

|

83

|

|

—

|

|

13

|

|

96

|

|

||||||

|

Totals

|

2,016

|

|

—

|

|

2,016

|

|

1,556

|

|

10

|

|

167

|

|

1,733

|

|

||||||

|

|

Fiscal Year 2016

|

Fiscal Year 2015

|

|||||||||||||

|

|

Prices

|

Prices

|

|||||||||||||

|

Quarter

|

High

|

Low

|

High

|

Low

|

|||||||||||

|

First

|

$

|

98.82

|

|

$

|

77.36

|

|

$

|

114.23

|

|

$

|

100.16

|

|

|||

|

Second

|

$

|

94.30

|

|

$

|

80.07

|

|

$

|

107.55

|

|

$

|

93.98

|

|

|||

|

Third

|

$

|

85.79

|

|

$

|

75.05

|

|

$

|

106.09

|

|

$

|

91.32

|

|

|||

|

Fourth

|

$

|

88.00

|

|

$

|

76.36

|

|

$

|

93.22

|

|

$

|

80.56

|

|

|||

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

||||||

|

(a)

|

(b)

|

(c)

|

|||||||

|

Equity compensation plans approved by security holders

|

701,134

|

|

$

|

80.04

|

|

3,726,832

|

|

||

|

Equity compensation plans not approved by security holders

|

—

|

|

—

|

|

—

|

|

|||

|

Total

|

701,134

|

|

$

|

80.04

|

|

3,726,832

|

|

||

|

Purchases of Equity Securities by the Company

|

||||||||||||

|

Period

|

Total number of

shares

purchased (b)

|

Average price

paid per

share (b)

|

Total number of

shares purchased as

part of publicly

announced plans or

programs (c)

|

Approximate dollar value of

shares that may yet be

purchased under the

plans or programs (c)

|

||||||||

|

October 3, 2016 – October 30, 2016

(a)

|

816

|

|

$78.60

|

—

|

|

$

|

87,500,000

|

|

||||

|

October 31, 2016 – November 27, 2016

(b)

|

86,627

|

|

$81.57

|

86,445

|

|

$

|

80,400,000

|

|

||||

|

November 28, 2016 – January 1, 2017

(b)

|

39,587

|

|

$85.43

|

38,389

|

|

$

|

77,100,000

|

|

||||

|

Total

|

127,030

|

|

$82.75

|

124,834

|

|

$

|

77,100,000

|

|

||||

|

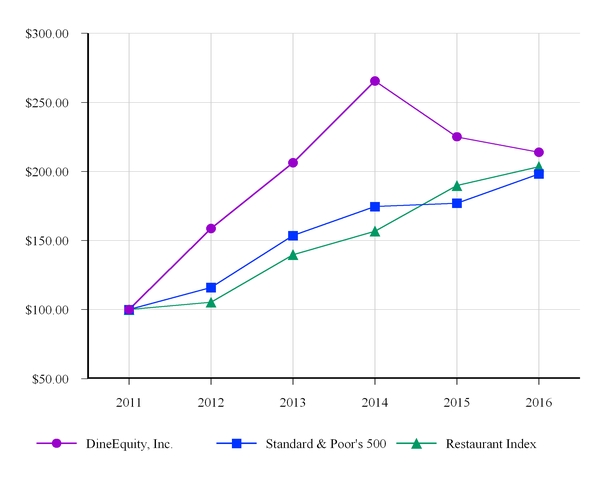

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

||||||||||||||||||

|

DineEquity, Inc.

|

$

|

100.00

|

|

$

|

158.73

|

|

$

|

206.30

|

|

$

|

265.50

|

|

$

|

225.04

|

|

$

|

213.94

|

|

|||||

|

Standard & Poor's 500

|

100.00

|

|

116.00

|

|

153.57

|

|

174.60

|

|

177.05

|

|

198.22

|

|

|||||||||||

|

Restaurant Index

|

100.00

|

|

105.33

|

|

139.74

|

|

156.80

|

|

189.80

|

|

203.46

|

|

|||||||||||

|

|

Fiscal Year Ended December 31,

|

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

|

(In millions, except per share amounts and restaurant data)

|

||||||||||||||||||

|

Revenues:

|

|

|

|

|

|

||||||||||||||

|

Franchise and restaurant revenues (a)

|

$

|

501.7

|

|

$

|

542.6

|

|

$

|

518.6

|

|

$

|

502.6

|

|

$

|

712.6

|

|

||||

|

Rental revenues

|

123.0

|

|

127.7

|

|

122.9

|

|

124.8

|

|

122.9

|

|

|||||||||

|

Financing revenues

|

9.2

|

|

10.8

|

|

13.5

|

|

13.1

|

|

14.5

|

|

|||||||||

|

Total revenues

|

634.0

|

|

681.1

|

|

655.0

|

|

640.5

|

|

849.9

|

|

|||||||||

|

Cost of revenues:

|

|

|

|

|

|

||||||||||||||

|

Franchise and restaurant expenses (a)

|

162.9

|

|

187.0

|

|

184.4

|

|

173.2

|

|

359.2

|

|

|||||||||

|

Rental expenses

|

91.5

|

|

94.6

|

|

94.6

|

|

97.3

|

|

97.2

|

|

|||||||||

|

Financing expenses

|

0.2

|

|

0.5

|

|

0.8

|

|

0.2

|

|

1.6

|

|

|||||||||

|

Total cost of revenues

|

254.6

|

|

282.1

|

|

279.9

|

|

270.8

|

|

458.0

|

|

|||||||||

|

Gross profit

|

379.4

|

|

399.0

|

|

375.1

|

|

369.7

|

|

391.9

|

|

|||||||||

|

General and administrative expenses

|

148.9

|

|

155.4

|

|

145.9

|

|

143.6

|

|

163.2

|

|

|||||||||

|

Interest expense

|

61.5

|

|

63.3

|

|

96.6

|

|

100.3

|

|

114.3

|

|

|||||||||

|

Closure and impairment charges

|

5.1

|

|

2.6

|

|

3.7

|

|

1.8

|

|

4.2

|

|

|||||||||

|

Loss on extinguishment of debt and temporary equity

|

—

|

|

—

|

|

64.9

|

|

0.1

|

|

5.6

|

|

|||||||||

|

Loss (gain) on disposition of assets (a)

|

0.8

|

|

(0.9

|

)

|

0.3

|

|

(0.2

|

)

|

(102.6

|

)

|

|||||||||

|

Other expense (b)

|

10.0

|

|

10.0

|

|

12.1

|

|

13.6

|

|

12.3

|

|

|||||||||

|

Income before income taxes

|

153.1

|

|

168.6

|

|

51.6

|

|

110.6

|

|

194.9

|

|

|||||||||

|

Income tax provision

|

(55.1

|

)

|

(63.7

|

)

|

(15.1

|

)

|

(38.6

|

)

|

(67.2

|

)

|

|||||||||

|

Net income

|

98.0

|

|

104.9

|

|

36.5

|

|

72.0

|

|

127.7

|

|

|||||||||

|

Less: Accretion of Series B preferred stock

|

—

|

|

—

|

|

—

|

|

—

|

|

(2.5

|

)

|

|||||||||

|

Less: Net income allocated to unvested participating restricted stock

|

(1.4

|

)

|

(1.4

|

)

|

(0.5

|

)

|

(1.2

|

)

|

(2.7

|

)

|

|||||||||

|

Net income available to common stockholders

|

$

|

96.6

|

|

$

|

103.5

|

|

$

|

35.9

|

|

$

|

70.8

|

|

$

|

122.5

|

|

||||

|

Net income available to common stockholders per share:

|

|

|

|

|

|

||||||||||||||

|

Basic

|

$

|

5.36

|

|

$

|

5.55

|

|

$

|

1.92

|

|

$

|

3.75

|

|

$

|

6.81

|

|

||||

|

Diluted

|

$

|

5.33

|

|

$

|

5.52

|

|

$

|

1.90

|

|

$

|

3.70

|

|

$

|

6.63

|

|

||||

|

Weighted average shares outstanding:

|

|

|

|

|

|||||||||||||||

|

Basic

|

18.0

|

|

18.6

|

|

18.8

|

|

18.9

|

|

18.0

|

|

|||||||||

|

Diluted

|

18.1

|

|

18.8

|

|

19.0

|

|

19.1

|

|

18.9

|

|

|||||||||

|

Dividends declared per common share

|

$

|

3.73

|

|

$

|

3.545

|

|

$

|

3.125

|

|

$

|

3.00

|

|

$

|

—

|

|

||||

|

Dividends paid per common share

|

$

|

3.68

|

|

$

|

3.50

|

|

$

|

2.25

|

|

$

|

3.00

|

|

$

|

—

|

|

||||

|

Balance Sheet Data (end of year):

|

|

|

|

|

|||||||||||||||

|

Cash and cash equivalents

|

$

|

140.5

|

|

$

|

144.8

|

|

$

|

104.0

|

|

$

|

106.0

|

|

$

|

64.5

|

|

||||

|

Restricted cash—short-term and long-term (c)

|

45.0

|

|

47.2

|

|

67.0

|

|

0.7

|

|

1.9

|

|

|||||||||

|

Property and equipment, net (a)

|

205.1

|

|

219.6

|

|

241.2

|

|

274.3

|

|

294.4

|

|

|||||||||

|

Total assets (d)

|

2,278.6

|

|

2,331.9

|

|

2,393.7

|

|

2,366.8

|

|

2,376.8

|

|

|||||||||

|

Long-term debt, less current maturities (d)

|

1,282.7

|

|

1,279.5

|

|

1,276.5

|

|

1,189.5

|

|

1,185.3

|

|

|||||||||

|

Capital lease obligations, less current maturities

|

74.7

|

|

84.8

|

|

98.1

|

|

111.7

|

|

124.4

|

|

|||||||||

|

Financing obligations, less current maturities

|

39.5

|

|

42.4

|

|

42.5

|

|

48.8

|

|

52.0

|

|

|||||||||

|

Stockholders' equity

|

252.8

|

|

267.2

|

|

279.1

|

|

315.2

|

|

308.8

|

|

|||||||||

|

Other Financial Data:

|

|||||||||||||||||||

|

Cash flows provided by operating activities

|

$

|

118.1

|

|

$

|

135.5

|

|

$

|

118.5

|

|

$

|

127.8

|

|

$

|

52.9

|

|

||||

|

Capital expenditures

|

5.6

|

|

6.6

|

|

5.9

|

|

7.0

|

|

17.0

|

|

|||||||||

|

Domestic system-wide same-restaurant sales percentage change:

|

|||||||||||||||||||

|

Applebee's

|

(5.0

|

)%

|

0.2

|

%

|

1.1

|

%

|

(0.3

|

)%

|

1.2

|

%

|

|||||||||

|

IHOP

|

(0.1

|

)%

|

4.5

|

%

|

3.9

|

%

|

2.4

|

%

|

(1.6

|

)%

|

|||||||||

|

Total restaurants (end of year):

|

|||||||||||||||||||

|

Applebee's

|

2,016

|

|

2,033

|

|

2,017

|

|

2,011

|

|

2,034

|

|

|||||||||

|

IHOP

|

1,733

|

|

1,683

|

|

1,650

|

|

1,620

|

|

1,581

|

|

|||||||||

|

Total restaurants

|

3,749

|

|

3,716

|

|

3,667

|

|

3,631

|

|

3,615

|

|

|||||||||

|

(a)

|

We refranchised 23 Applebee's company-operated restaurants in 2015 and 154 Applebee's company-operated restaurants in 2012.

|

|

(b)

|

Includes amortization of intangible assets in each year as well as $1.3 of debt modification costs in 2013.

|

|

(c)

|

Restricted cash increased in 2014 due to refinancing of long-term debt. See Note 7 of Notes to Consolidated Financial Statements

|

|

(d)

|

Amounts for 2014, 2013 and 2012 were restated in 2015 to reflect accounting standards adopted in that year.

|

|

•

|

Generated cash provided by operating activities of over $118 million in 2016;

|

|

•

|

Generated adjusted free cash flow (cash provided by operating activities, plus receipts from notes and equipment contract receivables, less additions to property and equipment) of approximately

$123 million

in 2016;

|

|

•

|

Returned over $122 million to our stockholders, comprised of

$67.4 million

in cash dividends and

$55.3 million

in the form of stock repurchases;

|

|

•

|

Updated our capital allocation strategy, increasing our quarterly dividend on common stock by 5.4%, effective with the fourth quarter 2016 dividend, from $0.92 per share to $0.97 per share;

|

|

•

|

Opened 66 new restaurants worldwide by IHOP franchisees and area licensees, with net development (openings less closures) of 50 restaurants, the highest single-year net development total for the brand since 2009;

|

|

•

|

IHOP franchisees remodeled 300 restaurants under our new

Rise N' Shine

design;

|

|

•

|

Completed the consolidation of our restaurant support centers, enabling cross-brand collaboration to provide for faster innovation and effective implementation to the benefit of both domestic and international franchisees; and

|

|

•

|

Entered into four multi-unit international development agreements in 2016, two agreements for the development of 30 IHOP restaurants in Asia Pacific and two agreements for the development of 11 Applebee's restaurants in the Middle East and Latin America.

|

|

Financial Overview

|

Favorable

(Unfavorable) Variance |

Favorable

(Unfavorable) Variance |

||||||||||||||||||

|

|

2016

|

2015

|

2014

|

|||||||||||||||||

|

|

(In millions, except per share amounts)

|

|||||||||||||||||||

|

Income before income taxes

|

$

|

153.1

|

|

$

|

(15.5

|

)

|

$

|

168.6

|

|

$

|

117.0

|

|

$

|

51.6

|

|

|||||

|

Income tax provision

|

(55.1

|

)

|

8.6

|

|

(63.7

|

)

|

(48.6

|

)

|

(15.1

|

)

|

||||||||||

|

Net income

|

$

|

98.0

|

|

$

|

(6.9

|

)

|

$

|

104.9

|

|

$

|

68.4

|

|

$

|

36.5

|

|

|||||

|

Net income per diluted share

|

$

|

5.33

|

|

$

|

(0.19

|

)

|

$

|

5.52

|

|

$

|

3.62

|

|

$

|

1.90

|

|

|||||

|

Weighted average diluted shares outstanding

|

18.1

|

|

(0.7

|

)

|

18.8

|

|

(0.2

|

)

|

19.0

|

|

||||||||||

|

|

(In millions)

|

Discussion reference

|

|||

|

Franchise operations gross profit

|

$

|

(8.2

|

)

|

Pg. 38, Franchise operations

|

|

|

53rd calendar week in 2015

|

(6.8

|

)

|

Pg. 35, Events Impacting Comparability of Financial Information

|

||

|

Kansas City lease exit costs

|

(2.9

|

)

|

Pg. 42, Closure and Impairment Charges

|

||

|

Rental and financing interest income

|

(2.1

|

)

|

Pg. 39, Rental Operations and pg. 40, Financing Operations

|

||

|

General and Administrative expenses (“G&A”)

|

5.0

|

|

Pg. 41, General and Administrative Expenses

|

||

|

All other income/expense items, net

|

(0.5

|

)

|

|||

|

$

|

(15.5

|

)

|

|||

|

|

(In millions)

|

Discussion reference

|

|||

|

Loss on extinguishment of debt in 2014

|

$

|

64.9

|

|

Pg. 37, Events Impacting Comparability of Financial Information

|

|

|

Interest expense

|

35.6

|

|

Pg. 37, Events Impacting Comparability of Financial Information

|

||

|

Franchise operations gross profit

|

13.6

|

|

Pg. 38, Franchise operations

|

||

|

53rd calendar week in 2015

|

6.8

|

|

Pg. 35, Events Impacting Comparability of Financial Information

|

||

|

Kansas City consolidation costs

|

(5.9

|

)

|

Pg. 36, Events Impacting Comparability of Financial Information

|

||

|

Rental and financing interest income

|

(2.0

|

)

|

Pg. 39, Rental Operations and pg. 40, Financing Operations

|

||

|

All other income/expense items, net

|

4.0

|

|

|||

|

$

|

117.0

|

|

|||

|

Applebee's

|

IHOP

|

||||||||||||||||

|

2016

|

2015

|

2014

|

2016

|

2015

|

2014

|

||||||||||||

|

Net franchise restaurant (reduction) development

(1)

|

(17

|

)

|

16

|

|

6

|

|

50

|

|

33

|

|

30

|

|

|||||

|

% (decrease) increase in domestic system-wide same-restaurant sales

|

(5.0

|

)%

|

0.2

|

%

|

1.1

|

%

|

(0.1

|

)%

|

4.5

|

%

|

3.9

|

%

|

|||||

|

|

Year Ended December 31,

|

|||||||

|

|

2016

|

2015

|

2014

|

|||||

|

Applebee's Restaurant Development Activity

|

|

|

||||||

|

Summary - beginning of period:

|

||||||||

|

Franchise

|

2,033

|

|

1,994

|

|

1,988

|

|

||

|

Company

|

—

|

|

23

|

|

23

|

|

||

|

Total Applebee's restaurants, beginning of period

|

2,033

|

|

2,017

|

|

2,011

|

|

||

|

Franchise restaurants opened:

|

||||||||

|

Domestic

|

19

|

|

27

|

|

29

|

|

||

|

International

|

10

|

|

17

|

|

7

|

|

||

|

Total franchise restaurants opened

|

29

|

|

44

|

|

36

|

|

||

|

Franchise restaurants closed:

|

|

|

||||||

|

Domestic

|

(39

|

)

|

(19

|

)

|

(20

|

)

|

||

|

International

|

(7

|

)

|

(9

|

)

|

(10

|

)

|

||

|

Total franchise restaurants closed

|

(46

|

)

|

(28

|

)

|

(30

|

)

|

||

|

Net franchise restaurant (reduction) development

|

(17

|

)

|

16

|

|

6

|

|

||

|

Refranchised from Company restaurants

|

—

|

|

23

|

|

—

|

|

||

|

Net franchise restaurant (decrease) increase

|

(17

|

)

|

39

|

|

6

|

|

||

|

Summary - end of period:

|

|

|

||||||

|

Franchise

|

2,016

|

|

2,033

|

|

1,994

|

|

||

|

Company restaurants

|

—

|

|

—

|

|

23

|

|

||

|

Total Applebee's restaurants, end of period

|

2,016

|

|

2,033

|

|

2,017

|

|

||

|

Change over prior year

|

(0.8

|

)%

|

0.8

|

%

|

0.3

|

%

|

||

|

Year Ended December 31,

|

||||||||

|

|

2016

|

2015

|

2014

|

|||||

|

IHOP Restaurant Development Activity

|

|

|

|

|||||

|

Summary - beginning of period:

|

||||||||

|

Franchise

|

1,507

|

|

1,472

|

|

1,439

|

|

||

|

Area license

|

165

|

|

167

|

|

168

|

|

||

|

Company

|

11

|

|

11

|

|

13

|

|

||

|

Total IHOP restaurants, beginning of period

|

1,683

|

|

1,650

|

|

1,620

|

|

||

|

|

|

|

||||||

|

Franchise/area license restaurants opened:

|

||||||||

|

Domestic franchise

|

43

|

|

44

|

|

34

|

|

||

|

Domestic area license

|

3

|

|

3

|

|

4

|

|

||

|

International franchise

|

20

|

|

8

|

|

18

|

|

||

|

International area license

|

—

|

|

—

|

|

—

|

|

||

|

Total franchise/area license restaurants opened

|

66

|

|

55

|

|

56

|

|

||

|

Franchise/area license restaurants closed:

|

||||||||

|

Domestic franchise

|

(12

|

)

|

(17

|

)

|

(19

|

)

|

||

|

Domestic area license

|

(1

|

)

|

(5

|

)

|

(4

|

)

|

||

|

International franchise

|

(3

|

)

|

—

|

|

(2

|

)

|

||

|

International area license

|

—

|

|

—

|

|

(1

|

)

|

||

|

Total franchise/area license restaurants closed

|

(16

|

)

|

(22

|

)

|

(26

|

)

|

||

|

Net franchise/area license restaurant development

|

50

|

|

33

|

|

30

|

|

||

|

Refranchised from Company restaurants

|

1

|

|

3

|

|

4

|

|

||

|

Franchise restaurants reacquired by the Company

|

—

|

|

(3

|

)

|

(2

|

)

|

||

|

Net franchise/area license restaurant additions

|

51

|

|

33

|

|

32

|

|

||

|

Summary - end of period:

|

||||||||

|

Franchise

|

1,556

|

|

1,507

|

|

1,472

|

|

||

|

Area license

|

167

|

|

165

|

|

167

|

|

||

|

Company

|

10

|

|

11

|

|

11

|

|

||

|

Total IHOP restaurants, end of period

|

1,733

|

|

1,683

|

|

1,650

|

|

||

|

Change over prior year

|

3.0

|

%

|

2.0

|

%

|

1.9

|

%

|

||

|

Applebee's Restaurant Data

|

Year Ended December 31,

|

||||||||||

|

Effective Restaurants:

(a)

|

2016

|

2015

|

2014

|

||||||||

|

Franchise

|

2,027

|

|

2,004

|

|

1,986

|

|

|||||

|

Company

|

—

|

|

13

|

|

23

|

|

|||||

|

Total

|

2,027

|

|

2,017

|

|

2,009

|

|

|||||

|

System-wide:

(b)

|

|||||||||||

|

Domestic sales percentage change

(c)

|

(6.8

|

)%

|

3.4

|

%

|

1.3

|

%

|

|||||

|

Domestic same-restaurant sales percentage change

(d)

|

(5.0

|

)%

|

0.2

|

%

|

1.1

|

%

|

|||||

|

Franchise:

(b)(e)

|

|||||||||||

|

Domestic sales percentage change

(c)

|

(6.2

|

)%

|

3.9

|

%

|

1.4

|

%

|

|||||

|

Domestic same-restaurant sales percentage change

(d)

|

(5.0

|

)%

|

0.2

|

%

|

1.1

|

%

|

|||||

|

Domestic average weekly unit sales (in thousands)

|

$

|

45.3

|

|

$

|

47.8

|

|

$

|

47.4

|

|

||

|

IHOP Restaurant Data

|

|

|

|||||||||

|

Effective Restaurants:

(a)

|

|

|

|||||||||

|

Franchise

|

1,517

|

|

1,481

|

|

1,454

|

|

|||||

|

Area license

|

166

|

|

166

|

|

167

|

|

|||||

|

Company

|

10

|

|

12

|

|

11

|

|

|||||

|

Total

|

1,693

|

|

1,659

|

|

1,632

|

|

|||||

|

System-wide:

(b)

|

|

||||||||||

|

Sales percentage change

(c)

|

(0.3

|

)%

|

8.1

|

%

|

6.6

|

%

|

|||||

|

Domestic same-restaurant sales percentage change

(d)

|

(0.1

|

)%

|

4.5

|

%

|

3.9

|

%

|

|||||

|

Franchise:

(b)

|

|

||||||||||

|

Sales percentage change

(c)

|

(0.3

|

)%

|

8.2

|

%

|

6.7

|

%

|

|||||

|

Domestic same-restaurant sales percentage change

(d)

|

(0.1

|

)%

|

4.5

|

%

|

3.9

|

%

|

|||||

|

Average weekly unit sales (in thousands)

|

$

|

37.3

|

|

$

|

37.6

|

|

$

|

36.0

|

|

||

|

Area License:

(b)

|

|

|

|||||||||

|

IHOP sales percentage change

(c)

|

0.6

|

%

|

5.9

|

%

|

6.3

|

%

|

|||||

|

(a)

|

“Effective Restaurants” are the weighted average number of restaurants open in a given fiscal period, adjusted to account for restaurants open for only a portion of the period. Information is presented for all Effective Restaurants in the Applebee’s and IHOP systems, which includes restaurants owned by franchisees and area licensees as well as those owned by the Company.

|

|

(b)

|

“System-wide sales” are retail sales at Applebee’s restaurants operated by franchisees and IHOP restaurants operated by franchisees and area licensees, as reported to the Company, in addition to retail sales at company-operated restaurants. Sales at restaurants that are owned by franchisees and area licensees are not attributable to the Company. An increase in franchisees' reported sales will result in a corresponding increase in our royalty revenue, while a decrease in franchisees' reported sales will result in a corresponding decrease in our royalty revenue. Unaudited reported sales for Applebee's domestic franchise restaurants, IHOP franchise restaurants and IHOP area license restaurants for the years ended

December 31, 2016

,

2015

and

2014

were as follows:

|

|

|

Year Ended December 31,

|

||||||||||

|

Reported sales (unaudited)

|

2016

|

2015

|

2014

|

||||||||

|

|

(In millions)

|

||||||||||

|

Applebee's domestic franchise restaurant sales

|

$

|

4,418.6

|

|

$

|

4,711.9

|

|

$

|

4,535.1

|

|

||

|

IHOP franchise restaurant sales

|

2,939.9

|

|

2,948.3

|

|

2,725.7

|

|

|||||

|

IHOP area license restaurant sales

|

282.5

|

|

280.9

|

|

265.2

|

|

|||||

|

Total

|

$

|

7,641.0

|

|

$

|

7,941.1

|

|

$

|

7,526.0

|

|

||

|

(c)

|

“Sales percentage change” reflects, for each category of restaurants, the percentage change in sales in any given fiscal year compared to the prior fiscal year for all restaurants in that category. The sales percentage change for the year ended December 31, 2015 was impacted by a 53rd calendar week in fiscal year 2015.

|

|

(d)

|

“Domestic same-restaurant sales percentage change” reflects the percentage change in sales in any given fiscal year, compared to the same weeks in the prior year, for domestic restaurants that have been operated throughout both fiscal years that are being compared and have been open for at least 18 months. Because of new unit openings and restaurant closures, the domestic restaurants open throughout the fiscal years being compared may be different from year to year. Domestic same-restaurant sales percentage change does not include data on IHOP area license restaurants.

|

|

(e)

|

The 2015 sales percentage change was impacted by the refranchising of 23 Applebee's company-operated restaurants during 2015.

|

|

Favorable

(Unfavorable) Variance |

Favorable

(Unfavorable) Variance |

|||||||||||||||||||

|

2016

|

2015

|

2014

|

||||||||||||||||||

|

(In millions)

|

||||||||||||||||||||

|

Company restaurant revenue

|

$

|

—

|

|

$

|

(27.5

|

)

|

$

|

27.5

|

|

$

|

(18.8

|

)

|

$

|

46.3

|

|

|||||

|

Royalty revenue

|

1.7

|

|

0.9

|

|

0.8

|

|

0.8

|

|

—

|

|

||||||||||

|

Total revenue impact

|

1.7

|

|

(26.6

|

)

|

28.3

|

|

(18.0

|

)

|

46.3

|

|

||||||||||

|

Operating costs

|

—

|

|

26.0

|

|

26.0

|

|

19.0

|

|

45.0

|

|

||||||||||

|

Gross profit impact

|

$

|

1.7

|

|

$

|

(0.6

|

)

|

$

|

2.3

|

|

$

|

1.0

|

|

$

|

1.3

|

|

|||||

|

Year ended December 31,

|

Cumulative Costs

|

|||||||||||

|

|

2016

|

2015

|

||||||||||

|

|

(In millions)

|

|||||||||||

|

Termination benefits and other personnel-related costs

|

$

|

3.1

|

|

$

|

4.9

|

|

$

|

8.0

|

|

|||

|

Facility costs:

|

||||||||||||

|

Lease termination costs

|

2.9

|

|

—

|

|

2.9

|

|

||||||

|

Depreciation

|

0.2

|

|

1.0

|

|

1.2

|

|

||||||

|

Total facility costs

|

3.1

|

|

1.0

|

|

4.1

|

|

||||||

|

Total consolidation costs

|

$

|

6.2

|

|

$

|

5.9

|

|

$

|

12.1

|

|

|||

|

Variance (1)

|

2015

|

Variance (1)

|

||||||||||||||||||||||||||

|

Revenue

|

2016

|

52 weeks

|

53rd week

|

Total

|

2014

|

|||||||||||||||||||||||

|

(In millions)

|

||||||||||||||||||||||||||||

|

Franchise operations

|

$

|

484.4

|

|

$

|

0.4

|

|

$

|

484.0

|

|

$

|

10.7

|

|

$

|

494.7

|

|

$

|

27.9

|

|

$

|

456.1

|

|

|||||||

|

Rental operations

|

123.0

|

|

(2.2

|

)

|

125.2

|

|

2.5

|

|

127.7

|

|

2.3

|

|

122.9

|

|

||||||||||||||

|

Company restaurant operations

|

17.4

|

|

(30.1

|

)

|

47.5

|

|

0.4

|

|

47.9

|

|

(15.0

|

)

|

62.5

|

|

||||||||||||||

|

Financing operations

|

9.2

|

|

(1.4

|

)

|

10.6

|

|

0.2

|

|

10.8

|

|

(2.9

|

)

|

13.5

|

|

||||||||||||||

|

Total revenue

|

$

|

634.0

|

|

$

|

(33.3

|

)

|

$

|

667.3

|

|

$

|

13.8

|

|

$

|

681.1

|

|

$

|

12.3

|

|

$

|

655.0

|

|

|||||||

|

Change vs. prior year

(1)

|

(5.0

|

)%

|

1.9

|

%

|

2.3

|

%

|

||||||||||||||||||||||

|

•

|

Company restaurant revenue declined primarily due to the refranchising of 23 Applebee's restaurants as noted under “Events Impacting Comparability of Financial Information.”

|

|

•

|

Rental and financing revenues decreased primarily due to the progressive decline in interest income as financed receivables are repaid.

|

|

•

|

Increased franchise revenues due to IHOP restaurant development and sales of pancake and waffle dry mix were offset by a decrease in Applebee's franchise royalties primarily due to a 5.0% decline in same-restaurant sales and to lower franchise, extension and termination fees from both brands.

|

|

•

|

Franchise revenues improved due to an increase in contributions to the IHOP NAF by the large majority of IHOP franchisees, the impact of a 4.5% increase in IHOP domestic franchise same-restaurant sales on franchise royalties, and new restaurant development by franchisees of both brands.

|

|

•

|

Company-operated restaurant revenue declined primarily due to the refranchising of 23 Applebee's company-operated restaurants noted above.

|

|

•

|

Rental revenue increased due to an increase in rental income based on a percentage of franchisees' retail sales and a decrease in write-offs of deferred lease revenue associated with lease agreements that were prematurely terminated, partially offset by the progressive decline in interest income as financed receivables are repaid.

|

|

•

|

Financing revenue declined primarily due to the progressive decline in interest income as financed receivables are repaid and a $1.4 million lease termination payment received in 2014 that did not recur in 2015.

|

|

Variance (1)

|

2015

|

Variance (1)

|

||||||||||||||||||||||||||

|

Gross Profit (Loss)

|

2016

|

52 weeks

|

53rd week

|

Total

|

2014

|

|||||||||||||||||||||||

|

(In millions)

|

||||||||||||||||||||||||||||

|

Franchise operations

|

$

|

339.7

|

|

$

|

(8.2

|

)

|

$

|

347.9

|

|

$

|

7.8

|

|

$

|

355.7

|

|

$

|

13.6

|

|

$

|

334.3

|

|

|||||||

|

Rental operations

|

31.5

|

|

(0.3

|

)

|

31.8

|

|

1.3

|

|

33.1

|

|

3.5

|

|

28.3

|

|

||||||||||||||

|

Company restaurant operations

|

(0.8

|

)

|

(0.6

|

)

|

(0.2

|

)

|

0.1

|

|

(0.1

|

)

|

0.0

|

|

(0.2

|

)

|

||||||||||||||

|

Financing operations

|

9.0

|

|

(1.1

|

)

|

10.1

|

|

0.2

|

|

10.3

|

|

(2.6

|

)

|

12.7

|

|

||||||||||||||

|

Total gross profit

|

$

|

379.4

|

|

$

|

(10.2

|

)

|

$

|

389.6

|

|

$

|

9.4

|

|

$

|

399.0

|

|

$

|

14.5

|

|

$

|

375.1

|

|

|||||||

|

Change vs. prior year

(1)

|

(2.6

|

)%

|

3.9

|

%

|

1.5

|

%

|

||||||||||||||||||||||

|

•

|

Franchise gross profit declined primarily due to a 5.0% decrease in Applebee's domestic franchise same-restaurant sales as well as lower franchise, extension and termination fees from both brands. These unfavorable items were partially offset by IHOP restaurant development and favorability in pancake and waffle dry mix.

|

|

•

|

Rental and financing gross profit was adversely impacted by the progressive decline in interest income as financed receivables are repaid.

|

|

•

|

Company-operated restaurant gross profit declined primarily due to the refranchising of 23 Applebee's company-operated restaurants noted above.

|

|

•

|

Franchise gross profit improved primarily due to a 4.5% increase in IHOP's domestic franchise same-restaurant sales, franchise restaurant development by both brands, higher franchise, extension and termination fees and favorability in pancake and waffle dry mix.

|

|

•

|

Rental gross profit increased because of the favorable impact of the 4.5% increase in IHOP's domestic franchise same-restaurant sales on rental income based on a percentage of franchisees' retail sales as well as a decrease in write-offs of deferred lease revenue associated with lease agreements that were prematurely terminated. This was partially offset by the progressive decline in interest income as financed receivables are repaid.

|

|

•

|

Financing gross profit was adversely impacted by the progressive decline in interest income as financed receivables are repaid and a $1.4 million lease termination payment received in 2014 that did not recur in 2015.

|

|

Effective Franchise Restaurants:

(1)

|

Favorable

(Unfavorable) Variance |

Favorable

(Unfavorable) Variance |

||||||||

|

|

2016

|

2015

|

2014

|

|||||||

|

Applebee’s

|

2,027

|

23

|

2,004

|

18

|

1,986

|

|||||

|

IHOP

|

1,683

|

36

|

1,647

|

26

|

1,621

|

|||||

|

Variance (2)

|

2015

|

Variance (2)

|

||||||||||||||||||||||||||

|

|

2016

|

52 weeks

|

53rd week

|

Total

|

2014

|

|||||||||||||||||||||||

|

|

(In millions)

|

|||||||||||||||||||||||||||

|

Franchise revenues:

|

||||||||||||||||||||||||||||

|

Applebee's

|

$

|

188.3

|

|

$

|

(9.7

|

)

|

$

|

198.0

|

|

$

|

4.3

|

|

$

|

202.3

|

|

$

|

2.4

|

|

195.6

|

|

||||||||

|

IHOP

|

184.8

|

|

4.4

|

|

180.4

|

|

3.9

|

|

184.3

|

|

10.2

|

|

170.2

|

|

||||||||||||||

|

Advertising

|

111.3

|

|

5.7

|

|

105.6

|

|

2.5

|

|

108.1

|

|

15.3

|

|

90.3

|

|

||||||||||||||

|

Total franchise revenues

|

484.4

|

|

0.4

|

|

484.0

|

|

10.7

|

|

494.7

|

|

27.9

|

|

456.1

|

|

||||||||||||||

|

Franchise Expenses:

|

||||||||||||||||||||||||||||

|

Applebee’s

|

10.2

|

|

(4.6

|

)

|

5.6

|

|

—

|

|

5.6

|

|

(0.3

|

)

|

5.3

|

|

||||||||||||||

|

IHOP

|

23.2

|

|

1.7

|

|

24.9

|

|

0.4

|

|

25.3

|

|

1.3

|

|

26.2

|

|

||||||||||||||

|

Advertising

|

111.3

|

|

(5.7

|

)

|

105.6

|

|

2.5

|

|

108.1

|

|

(15.3

|

)

|

90.3

|

|

||||||||||||||

|

Total franchise expenses

|

144.6

|

|

(8.6

|

)

|

136.1

|

|

2.9

|

|

139.0

|

|

(14.3

|

)

|

121.8

|

|

||||||||||||||

|

Franchise Segment Profit:

|

||||||||||||||||||||||||||||

|

Applebee’s

|

178.2

|

|

(14.3

|

)

|