|

|

|

|

SECURITIES EXCHANGE ACT OF 1934

|

|

DYNAGAS LNG PARTNERS LP

|

|

(Exact name of Registrant as specified in its charter)

|

|

Republic of the Marshall Islands

|

|

(Jurisdiction of incorporation or organization)

|

|

97 Poseidonos Avenue & 2 Foivis Street, Glyfada, 16674, Greece

|

|

(Address of principal executive offices)

|

|

Michael Gregos

97 Poseidonos Avenue & 2 Foivis Street, Glyfada, 16674, Greece

Tel:

011 30 210 8917 260

, Facsimile: 011 30 210 894 7275

|

|

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person

|

|

|

Common units representing limited partnership interests

|

|

NASDAQ Global Select Market

|

|

|

|

Title of class

|

|

Name of exchange on which registered

|

|

|

[_] Yes

|

[X] No

|

|

|

|

|

[_] Yes

|

[X] No

|

|

|

|

|

[X] Yes

|

[_] No

|

|

|

|

|

[_] Yes

|

[_] No

|

|

Large accelerated filer [_]

|

Accelerated filer [_]

|

|

Non-accelerated filer [X]

(Do not check if a smaller reporting company)

|

Smaller reporting company [_]

|

|

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

|

|

|

|

[X] U.S. GAAP

|

|

|

|

[_] International Financial Reporting Standards as issued by the International Accounting Standards Board

|

|

|

|

[_] Other

|

|

|

|

If "Other" has been checked in response to the previous question, indicate by check mark which

financial statement item the Registrant has elected to follow.

|

|

|

|

[_] Item 17

|

|

|

|

[_] Item 18

|

|

[_] Yes

|

[X] No

|

|

|

|

|

|

·

|

LNG market trends, including charter rates, factors affecting supply and demand, and opportunities for the profitable operations of LNG carriers;

|

|

|

·

|

our anticipated growth strategies;

|

|

|

·

|

the effect of the worldwide economic slowdown;

|

|

|

·

|

turmoil in the global financial markets;

|

|

|

·

|

fluctuations in currencies and interest rates;

|

|

|

·

|

general market conditions, including fluctuations in charter hire rates and vessel values;

|

|

|

·

|

changes in our operating expenses, including drydocking and insurance costs and bunker prices;

|

|

|

forecasts of our ability to make cash distributions on the units or any increases in our cash distributions;

|

|

|

·

|

our future financial condition or results of operations and our future revenues and expenses;

|

|

|

·

|

the repayment of debt and settling of interest rate swaps;

|

|

|

·

|

our ability to make additional borrowings and to access debt and equity markets;

|

|

|

·

|

planned capital expenditures and availability of capital resources to fund capital expenditures;

|

|

|

·

|

our ability to maintain long-term relationships with major LNG traders;

|

|

|

·

|

our ability to leverage our Sponsor's relationships and reputation in the shipping industry;

|

|

|

·

|

our ability to realize the expected benefits from acquisitions;

|

|

|

·

|

our ability to purchase vessels from our Sponsor in the future, including the Optional Vessels (defined later);

|

|

|

·

|

our continued ability to enter into long-term time charters;

|

|

|

·

|

our ability to maximize the use of our vessels, including the re-deployment or disposition of vessels no longer under long-term time charter;

|

|

|

·

|

future purchase prices of newbuildings and secondhand vessels and timely deliveries of such vessels;

|

|

|

·

|

our ability to compete successfully for future chartering and newbuilding opportunities;

|

|

|

·

|

acceptance of a vessel by its charterer;

|

|

|

·

|

termination dates and extensions of charters;

|

|

|

·

|

the expected cost of, and our ability to comply with, governmental regulations, maritime self-regulatory organization standards, as well as standard regulations imposed by our charterers applicable to our business;

|

|

|

·

|

availability of skilled labor, vessel crews and management;

|

|

|

·

|

our anticipated incremental general and administrative expenses as a publicly traded limited partnership and our fees and expenses payable under the fleet management agreements and the administrative services agreement with our Manager;

|

|

|

·

|

the anticipated taxation of our partnership and distributions to our unitholders;

|

|

|

·

|

estimated future maintenance and replacement capital expenditures;

|

|

|

·

|

our ability to retain key employees;

|

|

|

·

|

customers' increasing emphasis on environmental and safety concerns;

|

|

|

·

|

potential liability from any pending or future litigation;

|

|

|

·

|

potential disruption of shipping routes due to accidents, political events, piracy or acts by terrorists;

|

|

|

·

|

future sales of our common units in the public market;

|

|

|

·

|

our business strategy and other plans and objectives for future operations; and

|

|

|

·

|

other factors detailed in this Annual Report and from time to time in our periodic reports.

|

|

TABLE OF CONTENTS

|

||

|

|

|

Page

|

|

PART I

|

|

|

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

1

|

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

1

|

|

ITEM 3

|

KEY INFORMATION

|

1

|

|

ITEM 4.

|

INFORMATION ON THE PARTNERSHIP

|

26

|

|

ITEM 4A

|

UNRESOLVED STAFF COMMENTS

|

47

|

|

ITEM 5.

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

48

|

|

ITEM 6.

|

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

66

|

|

ITEM 7.

|

MAJOR UNITHOLDERS AND RELATED PARTY TRANSACTIONS

|

69

|

|

ITEM 8

|

FINANCIAL INFORMATION

|

77

|

|

ITEM 9.

|

THE OFFER AND LISTING

|

79

|

|

ITEM 10.

|

ADDITIONAL INFORMATION

|

80

|

|

ITEM 11.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

87

|

|

ITEM 12.

|

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

88

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

ITEM 13.

|

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

88

|

|

ITEM 14.

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

89

|

|

ITEM 15

|

CONTROLS AND PROCEDURES

|

89

|

|

ITEM 16.

|

RESERVED

|

90

|

|

ITEM 16A.

|

AUDIT COMMITTEE FINANCIAL EXPERT

|

90

|

|

ITEM 16B.

|

CODE OF ETHICS

|

90

|

|

ITEM 16C.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

90

|

|

ITEM 16D.

|

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

90

|

|

ITEM 16E.

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

90

|

|

ITEM 16F.

|

CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT

|

90

|

|

ITEM 16G.

|

CORPORATE GOVERNANCE

|

91

|

|

ITEM 16H.

|

MINE SAFETY DISCLOSURE

|

91

|

|

|

|

|

|

PART III

|

|

|

|

ITEM 17.

|

FINANCIAL STATEMENTS

|

91

|

|

ITEM 18.

|

FINANCIAL STATEMENTS

|

91

|

|

ITEM 19.

|

EXHIBITS

|

92

|

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

|

ITEM 3.

|

KEY INFORMATION

|

|

A.

|

SELECTED FINANCIAL DATA

|

|

Year Ended December 31,

|

||||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

Income Statement Data

|

(In thousands of Dollars, except for unit and per unit data )

|

|||||||||||

|

Voyage revenues

|

$ | 85,679 | $ | 77,498 | $ | 52,547 | ||||||

|

Voyage expenses

(1)

|

(1,686 | ) | (3,468 | ) | (1,353 | ) | ||||||

|

Vessel operating expenses

|

(11,909 | ) | (15,722 | ) | (11,350 | ) | ||||||

|

General and administrative expenses

|

(387 | ) | (278 | ) | (54 | ) | ||||||

|

Management fees

|

(2,737 | ) | (2,638 | ) | (2,529 | ) | ||||||

|

Depreciation

|

(13,579 | ) | (13,616 | ) | (13,579 | ) | ||||||

|

Dry-docking and special survey costs

|

- | (2,109 | ) | - | ||||||||

|

Operating income

|

$ | 55,381 | $ | 39,667 | $ | 23,682 | ||||||

|

Interest income

|

- | 1 | 4 | |||||||||

|

Interest and finance costs

|

(9,732 | ) | (9,576 | ) | (3,977 | ) | ||||||

|

Loss on derivative financial instruments

|

- | (196 | ) | (824 | ) | |||||||

|

Other, net

|

(29 | ) | (60 | ) | (65 | ) | ||||||

|

Net Income

|

$ | 45,620 | $ | 29,836 | $ | 18,820 | ||||||

|

Earnings per Unit (basic and diluted):

|

||||||||||||

|

Common Units (basic and diluted)

|

$ | 2.95 | $ | 1.37 | $ | 0.87 | ||||||

|

Subordinated Units (basic and diluted)

|

$ | 1.52 | $ | 1.37 | $ | 0.87 | ||||||

|

General Partner Units (basic and diluted):

|

$ | 1.52 | $ | 1.37 | $ | 0.87 | ||||||

|

Weighted average number of units outstanding (basic and diluted):

|

||||||||||||

|

Common units

|

7,729,521 | 6,735,000 | 6,735,000 | |||||||||

|

Subordinated units

|

14,985,000 | 14,985,000 | 14,985,000 | |||||||||

|

General Partner units

|

30,000 | 30,000 | 30,000 | |||||||||

|

Cash dividends per unit

(2)

|

$ | 0.1746 | $ | - | $ | - | ||||||

|

Balance Sheet Data:

|

||||||||||||

|

Total current assets

|

$ | 7,606 | $ | 8,981 | $ | 3,453 | ||||||

|

Vessels, net

|

453,175 | 466,754 | 480,370 | |||||||||

|

Total assets

|

488,735 | 476,275 | 484,363 | |||||||||

|

Total current liabilities

|

14,903 | 398,434 | 439,024 | |||||||||

|

Total long term debt, including current portion

|

219,585 | 380,715 | 402,189 | |||||||||

|

Total partners' equity

|

257,699 | 75,175 | 45,339 | |||||||||

|

Cash Flow Data:

|

||||||||||||

|

Net cash provided by operating activities

|

$ | 44,204 | $ | 27,902 | $ | 28,974 | ||||||

|

Net cash provided by investing activities

|

- | - | - | |||||||||

|

Net cash used in financing activities

|

(38,527 | ) | (27,902 | ) | (28,974 | ) | ||||||

|

Fleet Data:

|

||||||||||||

|

Number of vessels at the end of the year

|

3 | 3 | 3 | |||||||||

|

Average number of vessels in operation

(3)

|

3 | 3 | 3 | |||||||||

|

Average age of vessels in operation at end of period (years)

|

6.4 | 5.4 | 4.4 | |||||||||

|

Available days

(4)

|

1,095 | 1,056 | 1,095 | |||||||||

|

Time Charter Equivalent (in US dollars)

(5)

|

$ | 76,706 | $ | 70 , 104 | $ | 46,753 | ||||||

|

Fleet utilization

(6)

|

100 | % | 99.5 | % | 99.5 | % | ||||||

|

Other Financial Data:

|

||||||||||||

|

Adjusted EBITDA

(7)

|

$ | 68,931 | $ | 53,223 | $ | 37,196 | ||||||

|

(1)

|

Voyage expenses include commissions of 1.25% paid to our Manager and third party ship brokers.

|

|

(2)

|

Corresponds to a prorated fourth quarter distribution for the period beginning on November 18, 2013 and ending on December 31, 2013. The prorated cash distribution was declared on January 31, 2013 and paid on February 14, 2014.

|

|

(3)

|

Represents the number of vessels that constituted our fleet for the relevant period, as measured by the sum of the number of days each vessel was a part of our fleet during the period divided by the number of calendar days in the period.

|

|

(4)

|

Available days are the total number of calendar days our vessels were in our possession during a period, less the total number of scheduled off-hire days during the period associated with major repairs, or drydockings.

|

|

(5)

|

Time charter equivalent rates, or TCE rates, is a measure of the average daily revenue performance of a vessel. For time charters, this is calculated by dividing total voyage revenues, less any voyage expenses, by the number of Available days during that period. Under a time charter, the charterer pays substantially all of the vessel voyage related expenses. However, we may incur voyage related expenses when positioning or repositioning vessels before or after the period of a time charter, during periods of commercial waiting time or while off-hire during dry-docking or due to other unforeseen circumstances. The TCE rate is not a measure of financial performance under U.S. GAAP (non-GAAP measure), and should not be considered as an alternative to voyage revenues, the most directly comparable GAAP measure, or any other measure of financial performance presented in accordance with U.S. GAAP. However, TCE rate is standard shipping industry performance measure used primarily to compare period-to-period changes in a company's performance and assists our management in making decisions regarding the deployment and use of our vessels and in evaluating their financial performance. Our calculation of TCE rates may not be comparable to that reported by other companies. The following table reflects the calculation of our TCE rates for the years ended December 31, 2013, 2012 and 2011 (amounts in thousands of U.S. dollars, except for TCE rates, which are expressed in U.S. dollars and Available days):

|

|

Year Ended December 31,

|

||||||||||||

|

2013

|

2012

|

2011

|

||||||||||

|

(In thousands of Dollars)

|

||||||||||||

|

Voyage revenues

|

$ | 85,679 | $ | 77,498 | $ | 52,547 | ||||||

|

Voyage expenses

|

(1,686 | ) | (3,468 | ) | (1,353 | ) | ||||||

|

Time charter equivalent revenues

|

83,993 | 74,030 | 51,194 | |||||||||

|

Total Available days

|

1,095 | 1,056 | 1,095 | |||||||||

|

Time charter equivalent (TCE) rate

|

$ | 76,706 | 70,104 | $ | 46,753 | |||||||

|

(6)

|

We calculate fleet utilization by dividing the number of our revenue earning days, which are the total number of Available days of our vessels net of unscheduled off-hire days, during a period, by the number of our Available days during that period. The shipping industry uses fleet utilization to measure a company's efficiency in finding employment for its vessels and minimizing the amount of days that its vessels are offhire for reasons other than scheduled off-hires for vessel upgrades, drydockings or special or intermediate surveys.

|

|

(7)

|

Adjusted EBITDA is defined as earnings before interest and finance costs, net of interest income, gains/losses on derivative financial instruments, taxes (when incurred), depreciation and amortization (when incurred). Adjusted EBITDA is used as a supplemental financial measure by management and external users of financial statements, such as our investors, to assess our operating performance. We believe that Adjusted EBITDA assists our management and investors by providing useful information that increases the comparability of our performance operating from period to period and against the operating performance of other companies in our industry that provide Adjusted EBITDA information. This increased comparability is achieved by excluding the potentially disparate effects between periods or companies of interest, other financial items, depreciation and amortization and taxes, which items are affected by various and possibly changing financing methods, capital structure and historical cost basis and which items may significantly affect net income between periods. We believe that including Adjusted EBITDA as a measure of operating performance benefits investors in (a) selecting between investing in us and other investment alternatives and (b) monitoring our ongoing financial and operational strength in assessing whether to continue to hold common units.

|

|

|

Adjusted EBITDA is not a measure of financial performance under U.S. GAAP, does not represent and should not be considered as an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance presented in accordance with U.S. GAAP. Adjusted EBITDA excludes some, but not all, items that affect net income and these measures may vary among other companies. Therefore, Adjusted EBITDA as presented below may not be comparable to similarly titled measures of other companies. The following table reconciles Adjusted EBITDA to net income, the most directly comparable U.S. GAAP financial measure, for the periods presented:

|

|

Year Ended December 31,

|

||||||||||||

|

2013

|

2012

|

2011

|

||||||||||

|

Reconciliation to Net Income

|

||||||||||||

|

Net Income

|

$ | 45,620 | $ | 29,836 | $ | 18,820 | ||||||

|

Net interest expense (including loss from derivative instruments)

|

8,682 | 9,181 | 4,697 | |||||||||

|

Depreciation

|

13,579 | 13,616 | 13,579 | |||||||||

|

Amortization and write-off of deferred finance fees

|

1,050 | 590 | 100 | |||||||||

|

Adjusted EBITDA

|

$ | 68,931 | $ | 53,223 | $ | 37,196 | ||||||

|

B.

|

CAPITALIZATION AND INDEBTEDNESS

|

|

C.

|

REASONS FOR THE OFFER AND USE OF PROCEEDS

|

|

D.

|

RISK FACTORS

|

|

|

·

|

the vessel suffers a total loss or is damaged beyond repair;

|

|

|

·

|

we default on our obligations under the charter, including prolonged periods of vessel off-hire;

|

|

|

·

|

war or hostilities significantly disrupt the free trade of the vessel;

|

|

|

·

|

the vessel is requisitioned by any governmental authority; or

|

|

|

·

|

a prolonged force majeure event occurs, such as war or political unrest, which prevents the chartering of the vessel.

|

|

|

·

|

the rates we obtain from our charters;

|

|

|

·

|

the level of our operating costs, such as the cost of crews and insurance;

|

|

|

·

|

the continued availability of natural gas production;

|

|

|

·

|

demand for LNG;

|

|

|

·

|

supply of LNG carriers;

|

|

|

·

|

prevailing global and regional economic and political conditions;

|

|

|

·

|

currency exchange rate fluctuations; and

|

|

|

·

|

the effect of governmental regulations and maritime self-regulatory organization standards on the conduct of our business.

|

|

|

·

|

the level of capital expenditures we make, including for maintaining or replacing vessels, building new vessels, acquiring secondhand vessels and complying with regulations;

|

|

|

·

|

the number of unscheduled off-hire days for our fleet and the timing of, and number of days required for, scheduled drydocking of our vessels;

|

|

|

·

|

our debt service requirements and restrictions on distributions contained in our debt instruments;

|

|

|

·

|

the level of debt we will incur to fund future acquisitions, including if we exercise our option to purchase any or all of the seven identified LNG Carriers of our Sponsor, which we refer to as the Optional Vessels that we have the right to purchase pursuant to the terms and subject to the conditions of the Omnibus Agreement. See "Item 7. Major Unitholders and Related Party Transactions—B. Related Party Transactions";

|

|

|

·

|

fluctuations in interest rates;

|

|

|

·

|

fluctuations in our working capital needs;

|

|

|

·

|

variable tax rates;

|

|

|

·

|

our ability to make, and the level of, working capital borrowings; and

|

|

|

·

|

the amount of any cash reserves established by our Board of Directors.

|

|

|

·

|

size, age, technical specifications and condition of the ship;

|

|

|

·

|

efficiency of ship operation;

|

|

|

·

|

LNG shipping experience and quality of ship operations;

|

|

|

·

|

shipping industry relationships and reputation for customer service;

|

|

|

·

|

technical ability and reputation for operation of highly specialized ships;

|

|

|

·

|

quality and experience of officers and crew;

|

|

|

·

|

safety record;

|

|

|

·

|

the ability to finance ships at competitive rates and financial stability generally;

|

|

|

·

|

relationships with shipyards and the ability to get suitable berths;

|

|

|

·

|

construction management experience, including the ability to obtain on-time delivery of new ships according to customer specifications; and

|

|

|

·

|

competitiveness of the bid in terms of overall price.

|

|

|

·

|

fail to realize anticipated benefits, such as new customer relationships, cost-savings or cash flow enhancements;

|

|

|

·

|

be unable to hire, train or retain qualified shore and seafaring personnel to manage and operate our growing business and fleet;

|

|

|

·

|

decrease our liquidity by using a significant portion of our available cash or borrowing capacity to finance acquisitions;

|

|

|

·

|

significantly increase our interest expense or financial leverage if we incur additional debt to finance acquisitions;

|

|

|

·

|

incur or assume unanticipated liabilities, losses or costs associated with the business or vessels acquired; or

|

|

|

·

|

incur other significant charges, such as impairment of goodwill or other intangible assets, asset devaluation or restructuring charges.

|

|

|

·

|

obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes on favorable terms, or at all;

|

|

|

·

|

make distributions to unitholders or pay dividends to unitholders when an event of default exists, as applicable;

|

|

|

·

|

incur additional indebtedness, create liens or issue guarantees;

|

|

|

·

|

charter our vessels or change the terms of our existing charter agreements;

|

|

|

·

|

sell, transfer or lease our assets or vessels or the shares of our vessel-owning subsidiaries;

|

|

|

·

|

make investments and capital expenditures;

|

|

|

·

|

reduce our share capital; and

|

|

|

·

|

undergo a change in ownership or Manager.

|

|

|

·

|

neither our Partnership Agreement nor any other agreement requires our Sponsor or our General Partner or their respective affiliates to pursue a business strategy that favors us or utilizes our assets, and their officers and directors have a fiduciary duty to make decisions in the best interests of their respective unitholders, which may be contrary to our interests;

|

|

|

·

|

our Partnership Agreement provides that our General Partner may make determinations or take or decline to take actions without regard to our or our unitholders' interests. Specifically, our General Partner may exercise its call right, pre-emptive rights, registration rights or right to make a determination to receive common units in exchange for resetting the target distribution levels related to the incentive distribution rights, consent or withhold consent to any merger or consolidation of the Partnership, appoint any directors or vote for the election of any director, vote or refrain from voting on amendments to our Partnership Agreement that require a vote of the outstanding units, voluntarily withdraw from the Partnership, transfer (to the extent permitted under our Partnership Agreement) or refrain from transferring its units, the General Partner interest or incentive distribution rights or vote upon the dissolution of the Partnership;

|

|

|

·

|

our General Partner and our directors and officers have limited their liabilities and any fiduciary duties they may have under the laws of the Marshall Islands, while also restricting the remedies available to our unitholders, and, as a result of purchasing common units, unitholders are treated as having agreed to the modified standard of fiduciary duties and to certain actions that may be taken by the General Partner and our directors and officers, all as set forth in the Partnership Agreement;

|

|

|

·

|

our General Partner and our Manager are entitled to reimbursement of all reasonable costs incurred by them and their respective affiliates for our benefit; our Partnership Agreement does not restrict us from paying our General Partner and our Manager or their respective affiliates for any services rendered to us on terms that are fair and reasonable or entering into additional contractual arrangements with any of these entities on our behalf;

|

|

|

·

|

our General Partner may exercise its right to call and purchase our common units if it and its affiliates own more than 80% of our common units; and is not obligated to obtain a fairness opinion regarding the value of the common units to be repurchased by it upon the exercise of its limited call right.

|

|

|

·

|

Although a majority of our directors will over time be elected by common unitholders, our General Partner will likely have substantial influence on decisions made by our Board of Directors.

|

|

|

·

|

provides that our General Partner may make determinations or take or decline to take actions without regard to our or our unitholders' interests. Our General Partner may consider only the interests and factors that it desires, and it has no duty or obligation to give any consideration to any interest of, or factors affecting us, our affiliates or our unitholders. Decisions made by our General Partner will be made by its sole owner. Specifically, our General Partner may decide to exercise its right to make a determination to receive common units in exchange for resetting the target distribution levels related to the incentive distribution rights, call right, pre-emptive rights or registration rights, consent or withhold consent to any merger or consolidation of the Partnership, appoint any directors or vote for the election of any director, vote or refrain from voting on amendments to our Partnership Agreement that require a vote of the outstanding units, voluntarily withdraw from the Partnership, transfer (to the extent permitted under our Partnership Agreement) or refrain from transferring its units, the general partner interest or incentive distribution rights or vote upon the dissolution of the Partnership;

|

|

|

·

|

provides that our directors and officers are entitled to make other decisions in "good faith," meaning they reasonably believe that the decision is in our best interests;

|

|

|

·

|

generally provides that affiliated transactions and resolutions of conflicts of interest not approved by our conflicts committee of our Board of Directors and not involving a vote of unitholders must be on terms no less favorable to us than those generally being provided to or available from unrelated third parties or be "fair and reasonable" to us and that, in determining whether a transaction or resolution is "fair and reasonable," our Board of Directors may consider the totality of the relationships between the parties involved, including other transactions that may be particularly advantageous or beneficial to us; and

|

|

|

·

|

provides that neither our General Partner nor our officers or our directors will be liable for monetary damages to us, our members or assignees for any acts or omissions unless there has been a final and non-appealable judgment entered by a court of competent jurisdiction determining that our General Partner, our directors or officers or those other persons engaged in actual fraud or willful misconduct.

|

|

|

·

|

The unitholders are unable to remove our General Partner without its consent because our General Partner and its affiliates, including our Sponsor, own sufficient units to be able to prevent its removal. The vote of the holders of at least 66 2/3% of all outstanding common and subordinated units voting together as a single class is required to remove our General Partner. Our Sponsor owns 610,000 of our common units and all of our subordinated units, representing approximately 52% of the outstanding common and subordinated units.

|

|

|

·

|

If our General Partner is removed without "cause" during the subordination period and units held by our General Partner and our Sponsor are not voted in favor of that removal, all remaining subordinated units will automatically convert into common units, any existing arrearages on the common units will be extinguished, and our General Partner will have the right to convert its incentive distribution rights into common units or to receive cash in exchange for those interests based on the fair market value of those interests at the time. A removal of our General Partner under these circumstances would adversely affect the common units by prematurely eliminating their distribution and liquidation preference over the subordinated units, which would otherwise have continued until we had met certain distribution and performance tests. Any conversion of our General Partner's interest or incentive distribution rights would be dilutive to existing unitholders. Furthermore, any cash payment in lieu of such conversion could be prohibitively expensive. "Cause" is narrowly defined to mean that a court of competent jurisdiction has entered a final, non-appealable judgment finding our General Partner liable for actual fraud or willful or wanton misconduct. Cause does not include most cases of charges of poor business decisions, such as charges of poor management of our business by the directors appointed by our General Partner, so the removal of our General Partner because of the unitholders' dissatisfaction with our General Partner's decisions in this regard would most likely result in the termination of the subordination period.

|

|

|

·

|

Common unitholders will be entitled to elect only three of the five members of our Board of Directors. Our General Partner in its sole discretion will appoint the remaining two directors.

|

|

|

·

|

Election of the three directors elected by unitholders is staggered, meaning that the members of only one of three classes of our elected directors will be selected each year. In addition, the directors appointed by our General Partner will serve for terms determined by our General Partner.

|

|

|

·

|

Our Partnership Agreement contains provisions limiting the ability of unitholders to call meetings of unitholders, to nominate directors and to acquire information about our operations as well as other provisions limiting the unitholders' ability to influence the manner or direction of management.

|

|

|

·

|

Unitholders' voting rights are further restricted by the Partnership Agreement provision providing that if any person or group owns beneficially more than 4.9% of any class of units then outstanding, any such units owned by that person or group in excess of 4.9% may not be voted on any matter and will not be considered to be outstanding when sending notices of a meeting of unitholders, calculating required votes (except for purposes of nominating a person for election to our board), determining the presence of a quorum or for other similar purposes under our Partnership Agreement, unless required by law. The voting rights of any such unitholders in excess of 4.9% will effectively be redistributed

pro rata

among the other common unitholders holding less than 4.9% of the voting power of all classes of units entitled to vote. Our General Partner, its affiliates and persons who acquired common units with the prior approval of our Board of Directors will not be subject to this 4.9% limitation except with respect to voting their common units in the election of the elected directors.

|

|

|

·

|

There are no restrictions in our Partnership Agreement on our ability to issue additional equity securities.

|

|

|

·

|

renew existing charters upon their expiration;

|

|

|

·

|

obtain new charters;

|

|

|

·

|

successfully interact with shipyards;

|

|

|

·

|

obtain financing on commercially acceptable terms;

|

|

|

·

|

maintain access to capital under the Sponsor credit facility; or

|

|

|

·

|

maintain satisfactory relationships with suppliers and other third parties.

|

|

|

·

|

increases in interest rates or other events that may affect the availability of sufficient financing for LNG projects on commercially reasonable terms;

|

|

|

·

|

increases in the cost of natural gas derived from LNG relative to the cost of natural gas generally;

|

|

|

·

|

increases in the production levels of low-cost natural gas in domestic natural gas consuming markets, which could further depress prices for natural gas in those markets and make LNG uneconomical;

|

|

|

·

|

increases in the production of natural gas in areas linked by pipelines to consuming areas, the extension of existing, or the development of new pipeline systems in markets we may serve, or the conversion of existing non-natural gas pipelines to natural gas pipelines in those markets;

|

|

|

·

|

decreases in the consumption of natural gas due to increases in its price, decreases in the price of alternative energy sources or other factors making consumption of natural gas less attractive;

|

|

|

·

|

any significant explosion, spill or other incident involving an LNG facility or carrier;

|

|

|

·

|

infrastructure constraints such as delays in the construction of liquefaction facilities, the inability of project owners or operators to obtain governmental approvals to construct or operate LNG facilities, as well as community or political action group resistance to new LNG infrastructure due to concerns about the environment, safety and terrorism;

|

|

|

·

|

labor or political unrest or military conflicts affecting existing or proposed areas of LNG production or regasification;

|

|

|

·

|

decreases in the price of LNG, which might decrease the expected returns relating to investments in LNG projects;

|

|

|

·

|

new taxes or regulations affecting LNG production or liquefaction that make LNG production less attractive; or

|

|

|

·

|

negative global or regional economic or political conditions, particularly in LNG consuming regions, which could reduce energy consumption or its growth.

|

|

|

·

|

worldwide demand for natural gas;

|

|

|

·

|

the cost of exploration, development, production, transportation and distribution of natural gas;

|

|

|

·

|

expectations regarding future energy prices for both natural gas and other sources of energy;

|

|

|

·

|

the level of worldwide LNG production and exports;

|

|

|

·

|

government laws and regulations, including but not limited to environmental protection laws and regulations;

|

|

|

·

|

local and international political, economic and weather conditions;

|

|

|

·

|

political and military conflicts; and

|

|

|

·

|

the availability and cost of alternative energy sources, including alternate sources of natural gas in gas importing and consuming countries.

|

|

|

·

|

prevailing economic conditions in the natural gas and energy markets;

|

|

|

·

|

a substantial or extended decline in demand for LNG;

|

|

|

·

|

increases in the supply of vessel capacity;

|

|

|

·

|

the size and age of a vessel; and

|

|

|

·

|

the cost of retrofitting or modifying secondhand vessels, as a result of technological advances in vessel design or equipment, changes in applicable environmental or other regulations or standards, customer requirements or otherwise.

|

|

|

·

|

marine disasters;

|

|

|

·

|

piracy;

|

|

|

·

|

environmental accidents

|

|

|

·

|

bad weather;

|

|

|

·

|

mechanical failures;

|

|

|

·

|

grounding, fire, explosions and collisions;

|

|

|

·

|

human error; and

|

|

|

·

|

war and terrorism.

|

|

|

·

|

death or injury to persons, loss of property or environmental damage;

|

|

|

·

|

delays or failure in the delivery of cargo;

|

|

|

·

|

loss of revenues from or termination of charter contracts;

|

|

|

·

|

governmental fines, penalties or restrictions on conducting business;

|

|

|

·

|

spills, pollution and the liability associated with the same;

|

|

|

·

|

higher insurance rates; and

|

|

|

·

|

damage to our reputation and customer relationships generally.

|

|

|

·

|

our payment of cash distributions to our unitholders;

|

|

|

·

|

actual or anticipated fluctuations in quarterly and annual results;

|

|

|

·

|

fluctuations in the seaborne transportation industry, including fluctuations in the LNG carrier market;

|

|

|

·

|

mergers and strategic alliances in the shipping industry;

|

|

|

·

|

changes in governmental regulations or maritime self-regulatory organization standards;

|

|

|

·

|

shortfalls in our operating results from levels forecasted by securities analysts; announcements concerning us or our competitors;

|

|

|

·

|

the failure of securities analysts to publish research about us, or analysts making changes in their financial estimates;

|

|

|

·

|

general economic conditions;

|

|

|

·

|

terrorist acts;

|

|

|

·

|

future sales of our units or other securities;

|

|

|

·

|

investors' perception of us and the LNG shipping industry;

|

|

|

·

|

the general state of the securities market; and

|

|

|

·

|

other developments affecting us, our industry or our competitors.

|

|

|

·

|

arise out of or relate in any way to the Partnership Agreement (including any claims, suits or actions to interpret, apply or enforce the provisions of the Partnership Agreement or the duties, obligations or liabilities among limited partners or of limited partners to us, or the rights or powers of, or restrictions on, the limited partners or us);

|

|

|

·

|

are brought in a derivative manner on our behalf;

|

|

|

·

|

assert a claim of breach of a fiduciary duty owed by any director, officer or other employee of us or our General Partner, or owed by our General Partner, to us or the limited partners;

|

|

|

·

|

assert a claim arising pursuant to any provision of the Partnership Act; or

|

|

|

·

|

assert a claim governed by the internal affairs doctrine

|

|

|

·

|

our existing unitholders' proportionate ownership interest in us will decrease;

|

|

|

·

|

the dividend amount payable per unit on our common units may be lower;

|

|

|

·

|

the relative voting strength of each previously outstanding common share may be diminished; and

|

|

|

·

|

the market price of our common units may decline.

|

|

ITEM 4.

|

INFORMATION ON THE PARTNERSHIP

|

|

A.

|

HISTORY AND DEVELOPMENT OF THE PARTNERSHIP

|

|

B.

|

BUSINESS OVERVIEW

|

|

|

·

|

optimal sizing with a carrying capacity of approximately 150,000 cbm (which is a medium- to large-size class of LNG carrier) that maximizes its operational flexibility as such vessel is compatible with most existing LNG terminals around the world;

|

|

|

·

|

each vessel is a sister vessel, which are vessels built by the same yard that shares (i) a near-identical hull and superstructure layout, (ii) similar displacement, and (iii) roughly comparable features and equipment;

|

|

|

·

|

utilization of a "membrane containment system" that uses insulation built directly into the hull of the vessel with a membrane covering inside the tanks designed to maintain integrity and that uses the vessel's hull to directly support the pressure of the LNG cargo (see "The International Liquefied Natural Gas (LNG) Shipping Industry—The LNG Fleet" for a description of the types of LNG containment systems); and

|

|

|

·

|

double hull construction, based on the current LNG shipping industry standard.

|

|

Vessel Name

|

Shipyard

|

Year

Built

|

Capacity

(cbm)

|

Ice

Class

|

Flag

State

|

Charterer

|

Charter

Commencement

Date

|

Earliest

Charter

Expiration

|

Latest Charter

Expiration

Including

Non-Exercised

Options

|

|

Clean Energy

|

HHI

|

2007

|

149,700

|

No

|

Marshall

Islands

|

BG Group

|

February 2012

|

April 2017

|

August 2020

(1)

|

|

Ob River

|

HHI

|

2007

|

149,700

|

Yes

|

Marshall

Islands

|

Gazprom

|

September 2012

|

September 2017

|

May 2018

(2)

|

|

Clean Force

|

HHI

|

2008

|

149,700

|

Yes

|

Marshall

Islands

|

BG Group

|

October 2010

|

September 2016

|

January 2020

(3)

|

|

(1)

|

BG Group has the option to extend the duration of the charter for an additional three-year term until August 2020 at an escalated daily rate, upon notice to us before January 2016.

|

|

(2)

|

Gazprom has the option to extend the duration of the charter until May 2018 on identical terms, upon notice to us before March 2017.

|

|

(3)

|

On January 2, 2013, BG Group exercised its option to extend the duration of the charter by an additional three-year term at an escalated daily rate, commencing on October 5, 2013. BG Group has the option to extend the duration of the charter by an additional three-year term at a further escalated daily rate, which would commence on October 5, 2016, upon notice to us before January 5, 2016. The latest expiration date upon the exercise of all options is January 2020.

|

|

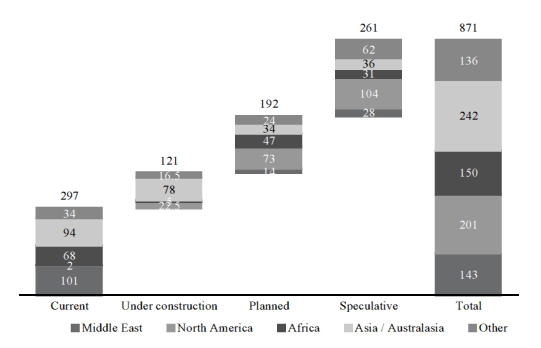

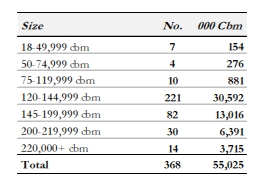

(1)

|

Provisional assessment

Source: Industry sources, Drewry

|

|

|

·

|

Bay and Gulf of Bothnia, Gulf of Finland—Finnish-Swedish Ice Class Rules (FSICR)

|

|

|

·

|

Gulf of Finland (Russia territorial waters)—Russian Maritime Register (RMR) Ice Class Rules

|

|

|

·

|

Barents, Kara, Laptev, East Siberian and Chukchi Seas—Russian Maritime Register (RMR) Ice Class Rules

|

|

|

·

|

Beaufort Sea, Baffin Bay, etc—Canadian Arctic Shipping Pollution Prevention Rules (CASPPR)

|

|

|

·

|

RMR Ice Class Rules

|

|

Class

|

Standard

|

|

1A Super (1AS)

|

Design notional level ice thickness of 1.0m. For extreme harsh ice conditions.

|

|

1A

|

Design notional level ice thickness of 0.8m. For harsh ice conditions.

|

|

1B

|

Design notional level ice thickness of 0.6m. For medium ice conditions.

|

|

1C

|

Design notional level ice thickness of 0.4m. For mild ice conditions.

|

|

|

·

|

Ice class merchant vessels (compliant with the FSICR for navigation in the northern Baltic);

|

|

|

·

|

Fairway navigation channels; and

|

|

|

·

|

Ice breaker assistance.

|

|

|

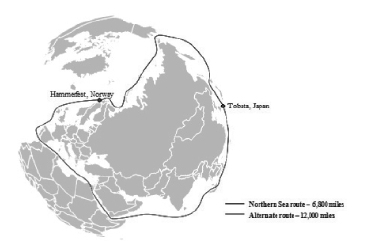

·

|

decreased level of sea ice has lengthened the summer shipping season in the Arctic and is making some areas more navigable;

|

|

|

·

|

increase in mineral resource development in the Arctic;

|

|

|

·

|

commodity demand growth in Asia and high commodity prices;

|

|

|

·

|

technological developments which have made NSR a more feasible shipping route than in the past; and

|

|

|

·

|

chronic political problems in the Middle East, piracy in North Africa and non-transparent commercial disputes over the Suez in Egypt.

|

|

2010

|

2011

|

2012

|

||||||||||

|

Number of Vessels

|

4 | 34 | 46 | |||||||||

|

Total Cargo Volume (tons)

|

111,000 | 820,789 | 1,261,545 | |||||||||

|

Dry Bulk Volume (tons)

|

N/A | 108,344 | 322,956 | |||||||||

|

Dry Bulk Share %

|

N/A | 13.2 | 25.6 | |||||||||

|

|

·

|

The Moss Rosenberg spherical system, which was designed in the 1970s and is used by a large portion of the existing LNG fleet. In this system, multiple self-supporting, spherical tanks are built independent of the carrier and arranged inside its hull.

|

|

|

·

|

The Gaz Transport membrane system, which is built inside the carrier and consists of insulation between thin primary and secondary barriers. The membrane is designed to accommodate thermal expansion and contraction without overstressing the membrane.

|

|

|

·

|

LNG projects are expensive and typically involve an integrated chain of dedicated facilities. Accordingly, the overall success of an LNG project depends heavily on long-term planning and coordination of project activities, including marine transportation.

|

|

|

·

|

LNG carriers are expensive to build, and the cash-flow from long-term fixed-rate charters supports vessel financing.

|

|

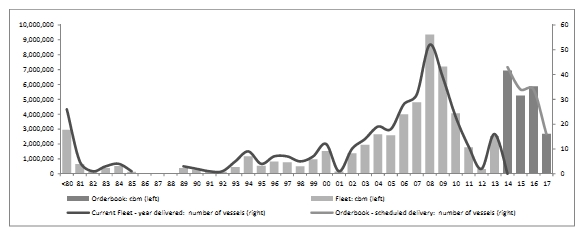

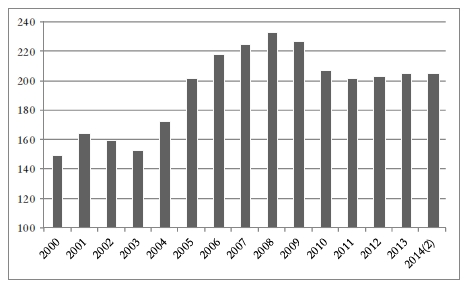

(1)

|

Price for 160-173,000 cbm ship from 2009 to 2013, prior prices based on 125-155,000 cbm ship

|

|

(2)

|

End February 2014

Source: Drewry

|

|

|

·

|

natural resource damages and related assessment costs;

|

|

|

·

|

real and personal property damages;

|

|

|

·

|

net loss of taxes, royalties, rents, profits or earnings capacity;

|

|

|

·

|

net cost of public services necessitated by a spill response, such as protection from fire, safety or health hazards; and

|

|

|

·

|

loss of subsistence use of natural resources.

|

|

|

·

|

on-board installation of automatic identification systems to provide a means for the automatic transmission of safety-related information from among similarly equipped ships and shore stations, including information on a ship's identity, position, course, speed and navigational status;

|

|

|

·

|

on-board installation of ship security alert systems, which do not sound on the vessel but only alerts the authorities on shore

;

|

|

|

·

|

the development of vessel security plans;

|

|

|

·

|

ship identification number to be permanently marked on a vessel's hull;

|

|

|

·

|

a continuous synopsis record kept onboard showing a vessel's history including, the name of the ship and of the state whose flag the ship is entitled to fly, the date on which the ship was registered with that state, the ship's identification number, the port at which the ship is registered and the name of the registered owner(s) and their registered address; and

|

|

|

·

|

compliance with flag state security certification requirements.

|

|

C.

|

ORGANIZATIONAL STRUCTURE

|

|

D.

|

PROPERTY, PLANT AND EQUIPMENT

|

|

ITEM 4A.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 5.

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

|

A.

|

RESULTS OF OPERATIONS

|

|

Vessel

Name

|

Shipyard

|

Year Built

|

Capacity

(cbm)

|

Ice Class

|

Flag State

|

Charterer

|

|

Clean Energy

|

HHI

|

2007

|

149,700

|

No

|

Marshall Islands

|

BG Group

|

|

Ob River

|

HHI

|

2007

|

149,700

|

Yes

|

Marshall Islands

|

Gazprom

|

|

Clean Force

|

HHI

|

2008

|

149,700

|

Yes

|

Marshall Islands

|

BG Group

|

|

Vessel

Name

|

Charterer

|

Contract

Backlog

(in millions)

|

Charter

Commencement Date

|

Earliest Charter Expiration

Date

|

Latest Charter

Expiration Including

Non-Exercised

Options

|

|

Clean Energy

|

BG Group

|

$95.2

|

February 2012

|

April 2017

|

August 2020

(2)

|

|

Ob River

|

Gazprom

|

$110.0

|

September 2012

|

September 2017

|

May 2018

(3)

|

|

Clean Force

|

BG Group

|

$57.5

|

October 2010

|

September 2016

|

January 2020

(4)

|

|

(2)

|

BG Group has the option to extend the duration of the charter for an additional three-year term until August 2020 at an escalated daily rate, upon notice to us before January 2016.

|

|

(3)

|

Gazprom has the option to extend the duration of the charter until May 2018 on identical terms, upon notice to us before March 2017.

|

|

(4)

|

On January 2, 2013, BG Group exercised its option to extend the duration of the charter by an additional three-year term at an escalated daily rate, commencing on October 5, 2013. BG Group has the option to extend the duration of the charter by an additional three-year term at a further escalated daily rate, which would commence on October 5, 2016, upon notice to us before January 5, 2016. The latest expiration date upon the exercise of all options is January 2020.

|

|

(in millions of U.S. Dollars, except days and percentages)

|

2014

|

2015

|

2016

|

2017

|

|||||||||||||

|

No. of Vessels whose contracts expire (1)

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1

|

|

|

|

2

|

|

|

Contracted Time Charter Revenues (1)

|

|

|

|

85.8

|

|

|

|

85.8

|

|

|

|

78.4

|

|

|

|

31.5

|

|

|

Contracted Days

|

|

|

|

1,095

|

|

|

|

1,095

|

|

|

|

979

|

|

|

|

368

|

|

|

Available Days

|

|

|

|

1,095

|

|

|

|

1,095

|

|

|

|

1,095

|

|

|

|

1,051

|

|

|

Contracted/Available Days

|

|

|

|

100%

|

|

|

|

100%

|

|

|

|

89%

|

|

|

|

35%

|

|

|

(1)

|

Annual revenue calculations are based on: (a) an assumed 365 revenue days per vessel per annum, (b) the earliest redelivery dates possible under our LNG carrier charters, and (c) no exercise of any option to extend the terms of those charters except for the option regarding the

Clean Force

exercised on January 2, 2013.

|

|

|

·

|

Number of Vessels in Our Fleet. The number of vessels in our fleet is a key factor in determining the level of our revenues. Aggregate expenses also increase as the size of our fleet increases. As of December 31, 2013, our fleet consisted of the same three LNG carriers we acquired from our Sponsor in connection with the closing of our IPO.

|

|

|

·

|

Charter Rates. Our revenue is dependent on the charter rates we are able to obtain on our vessels.

|

|

|

·

|

Charter rates on our vessels are based primarily on demand for and supply of LNG carrier capacity at the time we enter into the charters for our vessels, which is influenced by demand and supply for natural gas and in particular LNG as well as the supply of LNG carriers available for employment. The charter rates we obtain are also dependent on whether we employ our vessels under multi-year charters or charters with initial terms of less than two years. The vessels in our fleet are currently employed under multiyear time charters with staggered maturities, which will make us less susceptible to cyclical fluctuations in charter rates than vessels operated on charters of less than two years. However, we will be exposed to fluctuations in prevailing charter rates when we seek to recharter our vessels upon the expiry of their respective current charters and when we seek to charter vessels that we may acquire in the future.

|

|

|

·

|

BG Group's potential exercise of charter extension. In 2010, we entered into the time charter contract for the

Clean Force

with the BG Group at a time when time charter rates were significantly lower than prevailing time charter rates for equivalent periods. On January 2, 2013, BG Group exercised its option to extend the charter of the

Clean Force

until 2016 and currently holds another option to extend the duration of the charter until 2019 at a further increased daily rate. BG also holds an option to extend the time charter of the

Clean Energy

for an additional three years until 2020 at an increased daily rate;

|

|

|

·

|

Utilization of Our Fleet. Historically, our fleet has had a limited number of unscheduled off-hire days. In the years ended December 31, 2013 and 2012 our fleet utilization was 100% and 99.5%, respectively. However, an increase in annual off-hire days would reduce our utilization. The efficiency with which suitable employment is secured, the ability to minimize off-hire days and the amount of time spent positioning vessels also affects our results of operations. If the utilization pattern of our fleet changes, our financial results would be affected;

|

|

|

·

|

The level of our vessel operating expenses, including crewing costs, insurance and maintenance costs. Our ability to control our vessel operating expenses also affects our financial results. These expenses include commission expenses, crew wages and related costs, the cost of insurance, expenses for repairs and maintenance, the cost of spares and consumable stores, lubricating oil costs, tonnage taxes and other miscellaneous expenses. In addition, factors beyond our control, such as developments relating to market premiums for insurance and the value of the U.S. dollar compared to currencies in which certain of our expenses, primarily crew wages, are paid, can cause our vessel operating expenses to increase;

|

|

|

·

|

The timely delivery of the Optional Vessels (four of which are currently under construction and three of which were delivered in 2013) to our Sponsor and our ability to exercise the options to purchase the seven Optional Vessels. See

"Item 7. Major Unitholders and Related Party Transactions—B. Related Party Transactions;"

|

|

|

·

|

The timely delivery of the vessels we may acquire in the future;

|

|

|

·

|

Our ability to maintain solid working relationships with our existing charterers and our ability to increase the number of our charterers through the development of new working relationships;

|

|

|

·

|

The performance of our charterer's obligations under their charter agreements;

|

|

|

·

|

The effective and efficient technical management of the vessels under our management agreements;

|

|

|

·

|

Our ability to obtain acceptable debt financing to fund our capital commitments;

|

|

|

·

|

The ability of our Sponsor to fund its capital commitments and take delivery of the Optional Vessels under construction;

|

|

|

·

|

Our ability to obtain and maintain regulatory approvals and to satisfy technical, health, safety and compliance standards that meet our charterer's requirements;

|

|

|

·

|

Economic, regulatory, political and governmental conditions that affect shipping and the LNG industry, which includes changes in the number of new LNG importing countries and regions, as well as structural LNG market changes impacting LNG supply that may allow greater flexibility and competition of other energy sources with global LNG use;

|

|

|

·

|

Our ability to successfully employ our vessels at economically attractive rates, as our charters expire or are otherwise terminated;

|

|

|

·

|

Our access to capital required to acquire additional ships and/or to implement our business strategy;

|

|

|

·

|

Our level of debt, the related interest expense and the timing of required payments of principal;

|

|

|

·

|

The level of our general and administrative expenses, including salaries and costs of consultants;

|

|

|

·

|

Our charterer's right for early termination of the charters under certain circumstances;

|

|

|

·

|

Performance of our counterparties and our charterer's ability to make charter payments to us; and

|

|

|

·

|

The level of any distribution on our common and subordinated units.

|

|

Vessel

|

Capacity

(cbm)

|

Year

Purchased

|

Acquisition

Cost

|

Carrying Value

(in millions of US dollars)

|

||||

|

December 31, 2013

|

December 31,2012

|

|||||||

|

LNG

|

|

|

||||||

|

Clean Energy

|

149,700

|

2007

|

$178.2

|

$147.5

|

$152.0

|

|||

|

Ob River

|

149,700

|

2007

|

176.0

|

147.3

|

151.7

|

|||

|

Clean Force

|

149,700

|

2008

|

186.3

|

158.4

|

163.1

|

|||

|

TOTAL Capacity

|

449,100

|

|

$540.5

|

$453.2

|

$466.8

|

|||

|

|

·

|

reports by industry analysts and data providers that focus on our industry and related dynamics affecting vessel values;

|

|

|

·

|

news and industry reports of similar vessel sales;

|

|

|

·

|

news and industry reports of sales of vessels that are not similar to our vessels where we have made certain adjustments in an attempt to derive information that can be used as part of our estimates;

|

|

|

·

|

approximate market values for our vessels or similar vessels that we have received from shipbrokers, whether solicited or unsolicited, or that shipbrokers have generally disseminated;

|

|

|

·

|

offers that we may have received from potential purchasers of our vessels; and

|

|

|

·

|

vessel sale prices and values of which we are aware through both formal and informal communications with ship-owners, shipbrokers, industry analysts and various other shipping industry participants and observers.

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

|

|||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Time charter revenues

|

|

$

|

85,679

|

|

|

$

|

77,498

|

|

|

$

|

8,181

|

|

|

|

10.6

|

%

|

|

|

Year Ended December 31,

|

|

|

|||||||||||||

|

|

2013

|

2012

|

Change

|

% Change

|

||||||||||||

|

|

(in thousands of U.S. dollars)

|

|

||||||||||||||

|

Commissions

|

618 | 819 | (201 | ) | (24.5 | %) | ||||||||||

|

Bunkers

|

- | 1,361 | (1,361 | ) | (100 | %) | ||||||||||

|

Port Expenses

|

57 | 307 | (250 | ) | (81.4 | %) | ||||||||||

|

Voyage Expenses

|

$ | 675 | $ | 2,487 | $ | (1,812 | ) | (72.9 | %) | |||||||

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

|

|||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

%Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Voyage Expenses – related party (commissions)

|

|

|

1,011

|

|

|

|

981

|

|

|

|

30

|

|

|

|

3.1

|

%

|

|

|

Year Ended December 31,

|

|

|

|||||||||||||

|

|

2013

|

2012

|

Change

|

% Change

|

||||||||||||

|

|

(in thousands of U.S. dollars)

|

|

||||||||||||||

|

Crew wages and related costs

|

8,618 | 9,755 | (1,137 | ) | (11.7 | %) | ||||||||||

|

Insurance

|

1,554 | 1,488 | 66 | 4.4 | % | |||||||||||

|

Spares and consumable stores

|

1,086 | 2,561 | (1,475 | ) | (57.6 | %) | ||||||||||

|

Repairs and maintenance

|

323 | 1,340 | (1,017 | ) | (75.9 | %) | ||||||||||

|

Tonnage taxes

|

96 | 18 | 78 | 433.3 | % | |||||||||||

|

Other operating expenses

|

232 | 560 | (328 | ) | (5 8 .6 | %) | ||||||||||

|

Total

|

$ | 11,909 | $ | 15,722 | $ | (3,813 | ) | (24.3 | %) | |||||||

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

General and administrative costs

|

|

$

|

387

|

|

|

$

|

278

|

|

|

$

|

109

|

|

|

|

39.2

|

%

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Management fees

|

|

$

|

2,737

|

|

|

$

|

2,638

|

|

|

$

|

99

|

|

|

|

3.8

|

%

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Depreciation

|

|

$

|

13,579

|

|

|

$

|

13,616

|

|

|

$

|

(37

|

)

|

|

|

(0.3)

|

%

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Drydocking and Special Survey Costs

|

|

$

|

-

|

|

|

$

|

2,109

|

|

|

$

|

(2,109

|

)

|

|

|

(100)

|

%

|

|

|

Year Ended December 31,

|

|

|

|||||||||||||

|

|

2013

|

2012

|

Change

|

% Change

|

||||||||||||

|

|

(in thousands of U.S. dollars)

|

|

||||||||||||||

|

Interest on long-term debt

|

8,248 | 8,551 | (303 | ) | (3.5 | )% | ||||||||||

|

Amortization and write-off of financing fees

|

1,050 | 590 | 460 | 78.0 | % | |||||||||||

|

Commitment fees

|

327 | 372 | (45 | ) | (12.1 | )% | ||||||||||

|

Other

|

107 | 63 | 44 | 69.8 | % | |||||||||||

|

Total

|

$ | 9,732 | $ | 9,576 | $ | 156 | 1.6 | % | ||||||||

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Realized and Unrealized Loss on Derivative Financial Instruments

|

|

$

|

-

|

|

|

$

|

196

|

|

|

$

|

(196

|

)

|

|

|

(100)

|

%

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2012

|

|

|

2011

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Time charter revenues

|

|

$

|

77,498

|

|

|

$

|

52,547

|

|

|

$

|

24,951

|

|

|

|

47.5

|

%

|

|

|

Year Ended December 31,

|

|

|

|||||||||||||

|

|

2012

|

2011

|

Change

|

% Change

|

||||||||||||

|

|

(in thousands of U.S. dollars)

|

|

||||||||||||||

|

Commissions

|

819 | 446 | 373 | 83.6 | % | |||||||||||

|

Bunkers

|

1,361 | 117 | 1,244 | 1,063.2 | % | |||||||||||

|

Port Expenses

|

307 | 152 | 155 | 102.0 | % | |||||||||||

|

Voyage Expenses

|

$ | 2,487 | $ | 715 | $ | 1,772 | 247.8 | % | ||||||||

|

|

|

Year Ended December 31,

|

|

|

|

|

|

|

||||||||

|

|

|

2012

|

|

|

2011

|

|

|

Change

|

|

|

% Change

|

|

||||

|

|

|

(in thousands of U.S. dollars)

|

|

|

|

|

||||||||||

|

Voyage Expenses – related party (commissions)

|

|

$

|

981

|

|

|

$

|

638

|

|

|

$

|

343

|

|

|

|

53.8

|

%

|

|

|

Year Ended December 31,

|

|

|

|||||||||||||

|

|

2012

|

2011

|

Change

|

% Change

|