|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

20-1180098

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

3 Bethesda Metro Center, Suite 1500, Bethesda, Maryland

|

|

20814

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

Name of Exchange on Which Registered

|

|

Common Stock, $.01 par value

|

New York Stock Exchange

|

|

Large accelerated filer

þ

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

|

|

|

|

(Do not check if a smaller reporting company)

|

||||

|

|

|

|

|

Page No.

|

|

|

|

|

•

|

provides capacity to fund attractive acquisitions;

|

|

•

|

provides optionality to fund acquisitions with the most efficient funding source;

|

|

•

|

enhances our ability to maintain a sustainable dividend;

|

|

•

|

enables us to opportunistically repurchase shares during periods of stock price dislocation; and

|

|

•

|

provides capacity to fund late-cycle capital needs.

|

|

•

|

refinancing proceeds on existing encumbered hotels;

|

|

•

|

proceeds from new mortgage loans on existing unencumbered hotels;

|

|

•

|

proceeds from the disposition of non-core hotels;

|

|

•

|

existing cash balances;

|

|

•

|

capacity under our $200 million senior unsecured credit facility; and

|

|

•

|

annual cash flow from operations.

|

|

•

|

dependence on business and commercial travelers and tourism, both of which vary with consumer and business confidence in the strength of the economy;

|

|

•

|

competition from other hotels and alternative lodging located in the markets in which we own properties;

|

|

•

|

an over-supply or over-building of hotels in the markets in which we own properties which could adversely affect occupancy rates, revenues and profits at our hotels;

|

|

•

|

increases in energy and transportation costs and other expenses affecting travel, which may affect travel patterns and reduce the number of business and commercial travelers and tourists;

|

|

•

|

increases in operating costs due to inflation and other factors that may not be offset by increased room rates; and

|

|

•

|

changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance.

|

|

•

|

adverse changes in international, national, regional and local economic and market conditions;

|

|

•

|

changes in supply of competitive hotels;

|

|

•

|

changes in interest rates and in the availability, cost and terms of debt financing;

|

|

•

|

changes in tax laws and property taxes, or an increase in the assessed valuation of a property for real estate tax purposes;

|

|

•

|

changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and ordinances;

|

|

•

|

the ongoing need for capital improvements, particularly in older structures;

|

|

•

|

changes in operating expenses; and

|

|

•

|

civil unrest, acts of God, including earthquakes, floods, hurricanes and other natural disasters and acts of war or terrorism, including the consequences of terrorist acts such as those that occurred on September 11, 2001, which may result in uninsured losses.

|

|

•

|

certain competitors of the manager;

|

|

•

|

purchasers who are insufficiently capitalized; or

|

|

•

|

purchasers who might jeopardize certain liquor or gaming licenses.

|

|

•

|

a possible shortage of available cash to fund capital improvements and the related possibility that financing for these capital improvements may not be available to us on affordable terms;

|

|

•

|

the renovation investment failing to produce the returns on investment that we expect;

|

|

•

|

disruptions in the operations of the hotel as well as in demand for the hotel while capital improvements are underway; and

|

|

•

|

we may not possess the same level of familiarity with the dynamics and market conditions of any new markets that we may enter, which could result in us paying too much for hotels in new markets;

|

|

•

|

market conditions may result in lower than expected occupancy and room rates;

|

|

•

|

we may acquire hotels without any recourse, or with only limited recourse, for liabilities, whether known or unknown, such as clean-up of environmental contamination, claims by tenants, vendors or other persons against the former owners of the hotels and claims for indemnification by general partners, directors officers and others indemnified by the former owners of the hotels;

|

|

•

|

we may need to spend more than underwritten amounts to make necessary improvements or renovations to our newly acquired hotels; and

|

|

•

|

we may be unable to quickly and efficiently integrate new acquisitions into our existing operations.

|

|

•

|

our cash flow from operations will be insufficient to make required payments of principal and interest or to make cash distributions necessary to maintain our tax status as a REIT;

|

|

•

|

we may be vulnerable to adverse economic and industry conditions;

|

|

•

|

we may be required to dedicate a substantial portion of our cash flow from operations to the repayment of our debt, thereby reducing the cash available for distribution to our stockholders, operations and capital expenditures, future investment opportunities or other purposes;

|

|

•

|

the terms of any refinancing might not be as favorable as the terms of the debt being refinanced; and

|

|

•

|

the use of leverage could adversely affect our stock price and our ability to make distributions to our stockholders.

|

|

•

|

the extent of investor interest in our securities;

|

|

•

|

the general reputation of REITs and the attractiveness of our equity securities in comparison to other equity securities, including securities issued by other real estate-based companies;

|

|

•

|

the underlying asset value of our hotels;

|

|

•

|

investor confidence in the stock and bond markets, generally;

|

|

•

|

national and local economic conditions;

|

|

•

|

changes in tax laws;

|

|

•

|

our financial performance; and

|

|

•

|

general stock and bond market conditions.

|

|

Hotel

|

City

|

State

|

Chain Scale Segment (1)

|

Service Category

|

Rooms

|

Manager

|

|||||||

|

Chicago Marriott

|

Chicago

|

Illinois

|

Upper Upscale

|

Full Service

|

1,198

|

|

Marriott

|

||||||

|

Hilton Minneapolis

|

Minneapolis

|

Minnesota

|

Upper Upscale

|

Full Service

|

821

|

|

Hilton

|

||||||

|

Westin Boston Waterfront Hotel

|

Boston

|

Massachusetts

|

Upper Upscale

|

Full Service

|

793

|

|

Starwood

|

||||||

|

Lexington Hotel New York

|

New York

|

New York

|

Upper Upscale

|

Full Service

|

725

|

|

Highgate Hotels

|

||||||

|

Salt Lake City Marriott Downtown

|

Salt Lake City

|

Utah

|

Upper Upscale

|

Full Service

|

510

|

|

Marriott

|

||||||

|

Renaissance Worthington

|

Fort Worth

|

Texas

|

Upper Upscale

|

Full Service

|

504

|

|

Marriott

|

||||||

|

Frenchman’s Reef & Morning Star Marriott Beach Resort

|

St. Thomas

|

U.S. Virgin Islands

|

Upper Upscale

|

Full Service

|

502

|

|

Marriott

|

||||||

|

Orlando Airport Marriott

|

Orlando

|

Florida

|

Upper Upscale

|

Full Service

|

485

|

|

Marriott

|

||||||

|

Westin San Diego

|

San Diego

|

California

|

Upper Upscale

|

Full Service

|

436

|

|

Interstate Hotels & Resorts

|

||||||

|

Westin Fort Lauderdale Beach Resort

|

Fort Lauderdale

|

Florida

|

Upper Upscale

|

Full Service

|

432

|

|

HEI Hotels & Resorts

|

||||||

|

Westin Washington, D.C. City Center

|

Washington

|

District of Columbia

|

Upper Upscale

|

Full Service

|

406

|

|

Interstate Hotels & Resorts

|

||||||

|

Hilton Boston Downtown

|

Boston

|

Massachusetts

|

Upper Upscale

|

Full Service

|

362

|

|

Davidson Hotels & Resorts

|

||||||

|

Vail Marriott Mountain Resort & Spa

|

Vail

|

Colorado

|

Upper Upscale

|

Full Service

|

344

|

|

Vail Resorts

|

||||||

|

Marriott Atlanta Alpharetta

|

Atlanta

|

Georgia

|

Upper Upscale

|

Full Service

|

318

|

|

Marriott

|

||||||

|

Courtyard Manhattan/Midtown East

|

New York

|

New York

|

Upscale

|

Select Service

|

317

|

|

Marriott

|

||||||

|

Conrad Chicago

|

Chicago

|

Illinois

|

Upper Upscale

|

Full Service

|

312

|

|

Hilton

|

||||||

|

Hilton Garden Inn Times Square Central

|

New York

|

New York

|

Upscale

|

Select Service

|

282

|

|

Highgate Hotels

|

||||||

|

Bethesda Marriott Suites

|

Bethesda

|

Maryland

|

Upper Upscale

|

Full Service

|

272

|

|

Marriott

|

||||||

|

Hilton Burlington

|

Burlington

|

Vermont

|

Upper Upscale

|

Full Service

|

258

|

|

Interstate Hotels & Resorts

|

||||||

|

JW Marriott Denver at Cherry Creek

|

Denver

|

Colorado

|

Upper Upscale

|

Full Service

|

196

|

|

Sage Hospitality

|

||||||

|

Courtyard Manhattan/Fifth Avenue

|

New York

|

New York

|

Upscale

|

Select Service

|

185

|

|

Marriott

|

||||||

|

The Lodge at Sonoma, a Renaissance Resort & Spa

|

Sonoma

|

California

|

Upper Upscale

|

Full Service

|

182

|

|

Marriott

|

||||||

|

Courtyard Denver Downtown

|

Denver

|

Colorado

|

Upscale

|

Full Service

|

177

|

|

Sage Hospitality

|

||||||

|

Hilton Garden Inn Chelsea/New York City

|

New York

|

New York

|

Upscale

|

Full Service

|

169

|

|

Alliance Hospitality Management

|

||||||

|

Renaissance Charleston

|

Charleston

|

South Carolina

|

Upper Upscale

|

Full Service

|

166

|

|

Marriott

|

||||||

|

Inn at Key West

|

Key West

|

Florida

|

Upscale

|

Select Service

|

106

|

|

Remington Hotels

|

||||||

|

Hotel Rex

|

San Francisco

|

California

|

Upper Upscale

|

Full Service

|

94

|

|

Joie de Vivre Hotels

|

||||||

|

Total

|

|

10,552

|

|

||||||||||

|

Item 4.

|

Mine Safety Disclosures

|

|

Price Range

|

||||||||

|

High

|

Low

|

|||||||

|

Year Ended December 31, 2013:

|

||||||||

|

First Quarter

|

$

|

9.53

|

|

$

|

8.71

|

|

||

|

Second Quarter

|

10.31

|

|

8.81

|

|

||||

|

Third Quarter

|

10.89

|

|

9.27

|

|

||||

|

Fourth Quarter

|

11.78

|

|

10.56

|

|

||||

|

Year Ended December 31, 2014:

|

||||||||

|

First Quarter

|

12.66

|

|

11.22

|

|

||||

|

Second Quarter

|

13.00

|

|

11.51

|

|

||||

|

Third Quarter

|

13.58

|

|

12.26

|

|

||||

|

Fourth Quarter

|

15.45

|

|

12.52

|

|

||||

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

||||||||||||||||||

|

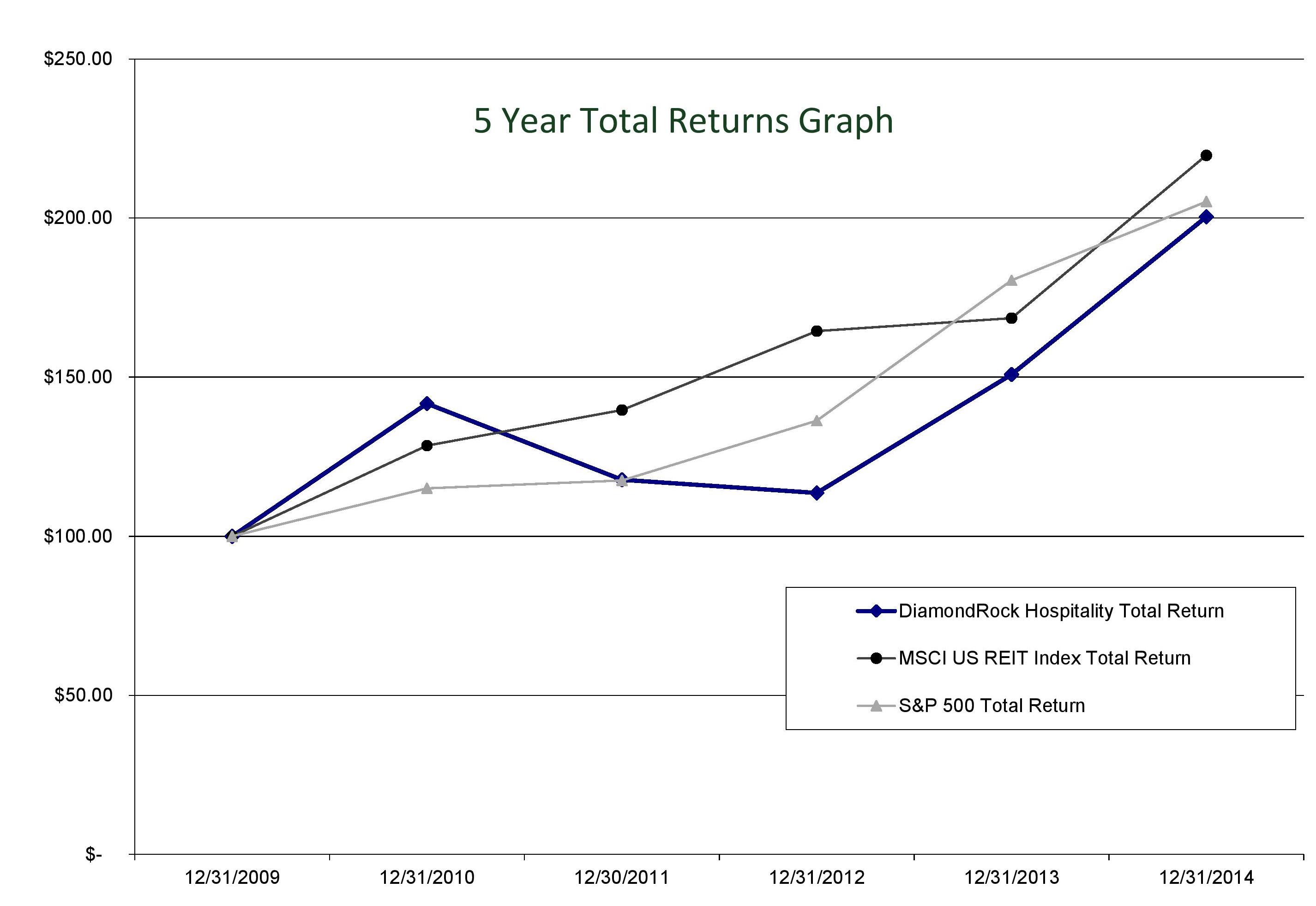

DiamondRock Hospitality Company Total Return

|

|

$100.00

|

|

|

$141.68

|

|

|

$117.78

|

|

|

$113.62

|

|

|

$150.84

|

|

|

$200.37

|

|

|||||

|

RMZ Total Return

|

|

$100.00

|

|

|

$128.48

|

|

|

$139.65

|

|

|

$164.46

|

|

|

$168.52

|

|

|

$219.72

|

|

|||||

|

S&P 500 Total Return

|

|

$100.00

|

|

|

$115.06

|

|

|

$117.49

|

|

|

$136.30

|

|

|

$180.44

|

|

|

$205.14

|

|

|||||

|

•

|

90% of our REIT taxable income, determined without regard to the dividends paid deduction and excluding net capital gains, plus

|

|

•

|

90% of the excess of our net income from foreclosure property over the tax imposed on such income by the Code, minus

|

|

•

|

any excess non-cash income.

|

|

Payment Date

|

Record Date

|

Dividend

per Share

|

||||

|

April 12, 2013

|

March 28, 2013

|

|

$0.085

|

|

||

|

July 11, 2013

|

June 28, 2013

|

|

$0.085

|

|

||

|

October 10, 2013

|

September 30, 2013

|

|

$0.085

|

|

||

|

January 10, 2014

|

December 31, 2013

|

|

$0.085

|

|

||

|

April 10, 2014

|

March 31, 2014

|

|

$0.1025

|

|

||

|

July 10, 2014

|

June 30, 2014

|

|

$0.1025

|

|

||

|

October 10, 2014

|

September 30, 2014

|

|

$0.1025

|

|

||

|

January 12, 2015

|

December 31, 2014

|

|

$0.1025

|

|

||

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

|

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans

(Excluding Securities Reflected in Column (a))

|

|||

|

(a)

|

(b)

|

(c)

|

||||

|

Equity compensation plans approved by security holders

|

20,770

|

$12.59

|

4,304,250

|

|||

|

Equity compensation plans not approved by security holders

|

—

|

—

|

—

|

|||

|

Total

|

20,770

|

$12.59

|

4,304,250

|

|||

|

Period

|

(a)

Total Number of Shares Purchased (1)

|

(b)

Average Price Paid per Share

|

(c)

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

(d)

Maximum Dollar Amount that May Yet be Purchased Under the Plans or Programs (in thousands) (2)

|

||||||||||

|

October 1 - October 31, 2014

|

—

|

|

$

|

—

|

|

$

|

100,000

|

|

||||||

|

November 1 - November 30, 2014

|

26,795

|

|

$

|

14.44

|

|

—

|

|

$

|

100,000

|

|

||||

|

December 1 - December 31, 2014

|

7,416

|

|

$

|

15.06

|

|

—

|

|

$

|

100,000

|

|

||||

|

(1)

|

Reflects shares surrendered to the Company for payment of tax withholding obligations in connection with the vesting of restricted stock and exercise of stock appreciation rights.

|

|

(2)

|

Represents amounts available under the Company's previously announced $100 million share repurchase program. The share repurchase program may be suspended or terminated at any time without prior notice. We have not repurchased any shares of our common stock under the program.

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||

|

Rooms

|

$

|

628,870

|

|

$

|

558,751

|

|

$

|

509,902

|

|

$

|

416,028

|

|

$

|

334,365

|

|

|||||

|

Food and beverage

|

195,077

|

|

193,043

|

|

174,963

|

|

154,006

|

|

143,690

|

|

||||||||||

|

Other

|

48,915

|

|

47,894

|

|

42,022

|

|

30,049

|

|

25,558

|

|

||||||||||

|

Total revenues

|

872,862

|

|

799,688

|

|

726,887

|

|

600,083

|

|

503,613

|

|

||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Rooms

|

162,870

|

|

151,040

|

|

135,437

|

|

111,378

|

|

89,131

|

|

||||||||||

|

Food and beverage

|

135,402

|

|

136,454

|

|

124,890

|

|

110,013

|

|

101,945

|

|

||||||||||

|

Other hotel expenses and management fees

|

325,853

|

|

310,069

|

|

278,572

|

|

234,860

|

|

198,646

|

|

||||||||||

|

Impairment losses

|

—

|

|

—

|

|

30,844

|

|

—

|

|

—

|

|

||||||||||

|

Hotel acquisition costs

|

2,177

|

|

—

|

|

10,591

|

|

2,521

|

|

1,436

|

|

||||||||||

|

Corporate expenses (1)

|

22,267

|

|

23,072

|

|

21,095

|

|

21,247

|

|

16,384

|

|

||||||||||

|

Depreciation and amortization

|

99,650

|

|

103,895

|

|

97,004

|

|

82,187

|

|

71,240

|

|

||||||||||

|

Gain on insurance proceeds

|

(1,825

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Gain on litigation settlement, net

|

(10,999

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Total operating expenses

|

735,395

|

|

724,530

|

|

698,433

|

|

562,206

|

|

478,782

|

|

||||||||||

|

Operating income

|

137,467

|

|

75,158

|

|

28,454

|

|

37,877

|

|

24,831

|

|

||||||||||

|

Interest income

|

(3,027

|

)

|

(6,328

|

)

|

(305

|

)

|

(612

|

)

|

(781

|

)

|

||||||||||

|

Interest expense

|

58,278

|

|

57,279

|

|

53,771

|

|

45,406

|

|

35,425

|

|

||||||||||

|

Other income, net

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Gain on prepayment of note receivable

|

(13,550

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Gain on sale of hotel properties

|

(50,969

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Gain on hotel property acquisition

|

(23,894

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Loss (gain) on early extinguishment of debt

|

1,616

|

|

1,492

|

|

(144

|

)

|

—

|

|

—

|

|

||||||||||

|

Income (loss) from continuing operations before income taxes

|

169,013

|

|

22,715

|

|

(24,868

|

)

|

(6,917

|

)

|

(9,813

|

)

|

||||||||||

|

Income tax (expense) benefit

|

(5,636

|

)

|

1,113

|

|

6,793

|

|

(2,521

|

)

|

(674

|

)

|

||||||||||

|

Income (loss) from continuing operations

|

163,377

|

|

23,828

|

|

(18,075

|

)

|

(9,438

|

)

|

(10,487

|

)

|

||||||||||

|

Income from discontinued operations

|

—

|

|

25,237

|

|

1,483

|

|

1,760

|

|

1,315

|

|

||||||||||

|

Net income (loss)

|

$

|

163,377

|

|

$

|

49,065

|

|

$

|

(16,592

|

)

|

$

|

(7,678

|

)

|

$

|

(9,172

|

)

|

|||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||||

|

(in thousands, except for per share data)

|

||||||||||||||||||||

|

Earnings (loss) per share:

|

||||||||||||||||||||

|

Continuing operations

|

$

|

0.83

|

|

$

|

0.12

|

|

$

|

(0.10

|

)

|

$

|

(0.06

|

)

|

$

|

(0.07

|

)

|

|||||

|

Discontinued operations

|

—

|

|

0.13

|

|

0.01

|

|

0.01

|

|

0.01

|

|

||||||||||

|

Basic and diluted earnings (loss) per share

|

$

|

0.83

|

|

$

|

0.25

|

|

$

|

(0.09

|

)

|

$

|

(0.05

|

)

|

$

|

(0.06

|

)

|

|||||

|

Other data:

|

||||||||||||||||||||

|

Dividends declared per common share

|

$

|

0.41

|

|

$

|

0.34

|

|

$

|

0.32

|

|

$

|

0.32

|

|

$

|

—

|

|

|||||

|

FFO (2)

|

$

|

212,058

|

|

$

|

131,987

|

|

$

|

120,961

|

|

$

|

91,546

|

|

$

|

79,292

|

|

|||||

|

Adjusted FFO (2)

|

$

|

171,507

|

|

$

|

139,301

|

|

$

|

140,163

|

|

$

|

103,643

|

|

$

|

90,297

|

|

|||||

|

EBITDA (3)

|

$

|

326,941

|

|

$

|

211,983

|

|

$

|

134,928

|

|

$

|

149,676

|

|

$

|

127,458

|

|

|||||

|

Adjusted EBITDA (3)

|

$

|

235,776

|

|

$

|

196,862

|

|

$

|

189,714

|

|

$

|

162,146

|

|

$

|

138,463

|

|

|||||

|

As of December 31,

|

||||||||||||||||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Balance sheet data:

|

||||||||||||||||||||

|

Property and equipment, net

|

$

|

2,764,393

|

|

$

|

2,567,533

|

|

$

|

2,611,454

|

|

$

|

2,234,504

|

|

$

|

2,071,603

|

|

|||||

|

Cash and cash equivalents

|

144,365

|

|

144,584

|

|

9,623

|

|

26,291

|

|

84,201

|

|

||||||||||

|

Total assets

|

3,158,351

|

|

3,047,772

|

|

2,944,042

|

|

2,798,635

|

|

2,414,609

|

|

||||||||||

|

Total debt

|

1,038,330

|

|

1,091,861

|

|

988,731

|

|

1,042,933

|

|

780,880

|

|

||||||||||

|

Total other liabilities

|

291,034

|

|

275,220

|

|

260,198

|

|

253,545

|

|

220,212

|

|

||||||||||

|

Stockholders' equity

|

1,828,987

|

|

1,680,691

|

|

1,695,113

|

|

1,502,157

|

|

1,413,517

|

|

||||||||||

|

(1)

|

Corporate expenses for the year ended December 31, 2014 include reimbursement of $1.8 million of previously incurred legal fees and other costs from the proceeds of the Westin Boston Waterfront litigation settlement in 2014. Corporate expenses for the year ended December 31, 2013 include approximately $3.1 million of costs related to the departure of our former President and Chief Operating Officer. Corporate expenses for the year ended December 31, 2012 and 2011 include legal fees of approximately $2.5 million and $2.3 million, respectively, related to the Allerton bankruptcy proceedings. Corporate expenses for the year ended December 31, 2011 include an accrual of $1.7 million for the settlement of the Los Angeles Airport Marriott litigation.

|

|

(2)

|

See "Non-GAAP Financial Measures" below in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for a detailed description of FFO and Adjusted FFO and a discussion of why we believe that they are useful supplemental measures of our operating performance.

|

|

(3)

|

See "Non-GAAP Financial Measures" below in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for a detailed description of EBITDA and Adjusted EBITDA and why we believe that they are useful supplemental measures of our operating performance.

|

|

•

|

provides capacity to fund attractive acquisitions;

|

|

•

|

provides optionality to fund acquisitions with the most efficient funding source;

|

|

•

|

enhances our ability to maintain a sustainable dividend;

|

|

•

|

enables us to opportunistically repurchase shares during periods of stock price dislocation; and

|

|

•

|

provides capacity to fund late-cycle capital needs.

|

|

•

|

refinancing proceeds on existing encumbered hotels;

|

|

•

|

proceeds from new mortgage loans on existing unencumbered hotels;

|

|

•

|

proceeds from the disposition of non-core hotels;

|

|

•

|

existing cash balances;

|

|

•

|

capacity under our $200 million senior unsecured credit facility; and

|

|

•

|

annual cash flow from operations.

|

|

•

|

Occupancy percentage;

|

|

•

|

Average Daily Rate (or ADR);

|

|

•

|

Revenue per Available Room (or RevPAR);

|

|

•

|

Earnings Before Interest, Income Taxes, Depreciation and Amortization (or EBITDA) and Adjusted EBITDA; and

|

|

•

|

Funds From Operations (or FFO) and Adjusted FFO.

|

|

•

|

Increased internal growth from the continuation of our asset management initiatives and the recent portfolio renovations;

|

|

Property

|

Location

|

Number of

Rooms |

Occupancy (%)

|

ADR($)

|

RevPAR($)

|

% Change

from 2013 RevPAR (1) |

|||||||||||||

|

Chicago Marriott

|

Chicago, Illinois

|

1,198

|

|

75.0

|

%

|

$

|

209.77

|

|

$

|

157.30

|

|

0.3

|

%

|

||||||

|

Los Angeles Airport Marriott (2)

|

Los Angeles, California

|

1,004

|

|

89.1

|

%

|

131.39

|

|

117.05

|

|

18.6

|

%

|

||||||||

|

Hilton Minneapolis

|

Minneapolis, Minnesota

|

821

|

|

73.6

|

%

|

146.15

|

|

107.56

|

|

2.2

|

%

|

||||||||

|

Westin Boston Waterfront Hotel

|

Boston, Massachusetts

|

793

|

|

75.3

|

%

|

231.05

|

|

174.09

|

|

12.6

|

%

|

||||||||

|

Lexington Hotel New York

|

New York, New York

|

725

|

|

92.3

|

%

|

246.72

|

|

227.67

|

|

62.3

|

%

|

||||||||

|

Salt Lake City Marriott Downtown

|

Salt Lake City, Utah

|

510

|

|

68.5

|

%

|

146.54

|

|

100.44

|

|

5.2

|

%

|

||||||||

|

Renaissance Worthington

|

Fort Worth, Texas

|

504

|

|

68.3

|

%

|

176.19

|

|

120.35

|

|

7.7

|

%

|

||||||||

|

Frenchman’s Reef & Morning Star Marriott Beach Resort

|

St. Thomas, U.S. Virgin Islands

|

502

|

|

84.8

|

%

|

242.12

|

|

205.28

|

|

4.3

|

%

|

||||||||

|

Orlando Airport Marriott

|

Orlando, Florida

|

485

|

|

78.7

|

%

|

106.86

|

|

84.09

|

|

11.6

|

%

|

||||||||

|

Westin San Diego

|

San Diego, California

|

436

|

|

82.8

|

%

|

166.12

|

|

137.62

|

|

8.4

|

%

|

||||||||

|

Westin Fort Lauderdale Beach Resort (3)

|

Fort Lauderdale, Florida

|

432

|

|

90.6

|

%

|

189.18

|

|

171.39

|

|

25.4

|

%

|

||||||||

|

Westin Washington, D.C. City Center

|

Washington, D.C.

|

406

|

|

74.0

|

%

|

208.35

|

|

154.18

|

|

9.2

|

%

|

||||||||

|

Oak Brook Hills Resort Chicago (4)

|

Oak Brook, Illinois

|

386

|

|

25.1

|

%

|

101.88

|

|

25.57

|

|

(51.3

|

)%

|

||||||||

|

Hilton Boston Downtown

|

Boston, Massachusetts

|

362

|

|

87.6

|

%

|

257.70

|

|

225.75

|

|

23.9

|

%

|

||||||||

|

Vail Marriott Mountain Resort & Spa

|

Vail, Colorado

|

344

|

|

65.2

|

%

|

251.62

|

|

164.10

|

|

(0.7

|

)%

|

||||||||

|

Marriott Atlanta Alpharetta

|

Atlanta, Georgia

|

318

|

|

71.2

|

%

|

162.70

|

|

115.77

|

|

5.9

|

%

|

||||||||

|

Courtyard Manhattan/Midtown East

|

New York, New York

|

317

|

|

91.2

|

%

|

284.04

|

|

259.12

|

|

14.2

|

%

|

||||||||

|

Conrad Chicago

|

Chicago, Illinois

|

312

|

|

83.4

|

%

|

226.27

|

|

188.77

|

|

6.3

|

%

|

||||||||

|

Hilton Garden Inn New York City/Times Square Central (5)

|

New York, New York

|

282

|

|

92.1

|

%

|

284.97

|

|

262.43

|

|

N/A

|

|

||||||||

|

Bethesda Marriott Suites

|

Bethesda, Maryland

|

272

|

|

66.3

|

%

|

165.09

|

|

109.43

|

|

9.7

|

%

|

||||||||

|

Hilton Burlington

|

Burlington, Vermont

|

258

|

|

75.4

|

%

|

169.05

|

|

127.47

|

|

7.9

|

%

|

||||||||

|

JW Marriott Denver at Cherry Creek

|

Denver, Colorado

|

196

|

|

82.4

|

%

|

254.30

|

|

209.64

|

|

9.0

|

%

|

||||||||

|

Courtyard Manhattan/Fifth Avenue

|

New York, New York

|

185

|

|

89.8

|

%

|

280.14

|

|

251.54

|

|

13.3

|

%

|

||||||||

|

The Lodge at Sonoma, a Renaissance Resort & Spa

|

Sonoma, California

|

182

|

|

78.7

|

%

|

267.50

|

|

210.59

|

|

11.7

|

%

|

||||||||

|

Courtyard Denver Downtown

|

Denver, Colorado

|

177

|

|

83.7

|

%

|

188.52

|

|

157.72

|

|

12.3

|

%

|

||||||||

|

Hilton Garden Inn Chelsea/New York City

|

New York, New York

|

169

|

|

94.3

|

%

|

227.49

|

|

214.59

|

|

(3.6

|

)%

|

||||||||

|

Renaissance Charleston

|

Charleston, South Carolina

|

166

|

|

90.8

|

%

|

205.00

|

|

186.23

|

|

11.3

|

%

|

||||||||

|

Inn at Key West (6)

|

Key West, Florida

|

106

|

|

83.4

|

%

|

187.79

|

|

156.63

|

|

13.0

|

%

|

||||||||

|

Hotel Rex

|

San Francisco, California

|

94

|

|

85.4

|

%

|

214.57

|

|

183.20

|

|

15.5

|

%

|

||||||||

|

Total/Weighted Average

|

|

11,942

|

|

79.0

|

%

|

$

|

199.13

|

|

$

|

157.33

|

|

12.5

|

%

|

||||||

|

Year Ended December 31,

|

||||||||||

|

2014

|

2013

|

% Change

|

||||||||

|

Rooms

|

$

|

628.9

|

|

$

|

558.8

|

|

12.5

|

%

|

||

|

Food and beverage

|

195.1

|

|

193.0

|

|

1.1

|

|

||||

|

Other

|

48.9

|

|

47.9

|

|

2.1

|

|

||||

|

Total revenues

|

$

|

872.9

|

|

$

|

799.7

|

|

9.2

|

%

|

||

|

•

|

$9.1 million increase from the Hilton Garden Inn Times Square Central, which was purchased on August 29, 2014 and opened for business on September 1, 2014.

|

|

Year Ended December 31,

|

||||||||||

|

2014

|

2013

|

% Change

|

||||||||

|

Occupancy %

|

78.7

|

%

|

75.0

|

%

|

3.7 percentage points

|

|

||||

|

ADR

|

$

|

205.09

|

|

$

|

192.86

|

|

6.3

|

%

|

||

|

RevPAR

|

$

|

161.44

|

|

$

|

144.67

|

|

11.6

|

%

|

||

|

Year Ended December 31,

|

||||||||||

|

2014

|

2013

|

% Change

|

||||||||

|

Rooms departmental expenses

|

$

|

162.9

|

|

$

|

151.0

|

|

7.9

|

%

|

||

|

Food and beverage departmental expenses

|

135.4

|

|

136.5

|

|

(0.8

|

)

|

||||

|

Other departmental expenses

|

20.1

|

|

21.9

|

|

(8.2

|

)

|

||||

|

General and administrative

|

68.5

|

|

64.2

|

|

6.7

|

|

||||

|

Utilities

|

27.8

|

|

28.2

|

|

(1.4

|

)

|

||||

|

Repairs and maintenance

|

36.7

|

|

36.8

|

|

(0.3

|

)

|

||||

|

Sales and marketing

|

60.4

|

|

56.2

|

|

7.5

|

|

||||

|

Franchise fees

|

15.3

|

|

11.4

|

|

34.2

|

|

||||

|

Base management fees

|

21.5

|

|

19.3

|

|

11.4

|

|

||||

|

Incentive management fees

|

8.5

|

|

6.2

|

|

37.1

|

|

||||

|

Property taxes

|

39.8

|

|

40.0

|

|

(0.5

|

)

|

||||

|

Other fixed charges

|

12.2

|

|

10.9

|

|

11.9

|

|

||||

|

Ground rent—Contractual

|

8.9

|

|

8.5

|

|

4.7

|

|

||||

|

Ground rent—Non-cash

|

6.1

|

|

6.5

|

|

(6.2

|

)

|

||||

|

Total hotel operating expenses

|

$

|

624.1

|

|

$

|

597.6

|

|

4.4

|

%

|

||

|

Year Ended December 31,

|

|||||||

|

2014

|

2013

|

||||||

|

Mortgage debt interest

|

$

|

55.7

|

|

$

|

54.9

|

|

|

|

Credit facility interest and unused fees

|

0.9

|

|

1.0

|

|

|||

|

Amortization of deferred financing costs and debt premium

|

2.6

|

|

2.7

|

|

|||

|

Capitalized interest

|

(0.9

|

)

|

(1.4

|

)

|

|||

|

Interest rate cap fair value adjustment

|

0.0

|

|

0.1

|

|

|||

|

|

$

|

58.3

|

|

$

|

57.3

|

|

|

|

Year Ended December 31,

|

||||||||||

|

2013

|

2012

|

% Change

|

||||||||

|

Rooms

|

$

|

558.8

|

|

$

|

509.9

|

|

9.6

|

%

|

||

|

Food and beverage

|

193.0

|

|

175.0

|

|

10.3

|

|

||||

|

Other

|

47.9

|

|

42.0

|

|

14.0

|

|

||||

|

Total revenues

|

$

|

799.7

|

|

$

|

726.9

|

|

10.0

|

%

|

||

|

Year Ended December 31,

|

||||||||||

|

2013

|

2012

|

% Change

|

||||||||

|

Occupancy %

|

75.1

|

%

|

76.3

|

%

|

(1.2) percentage points

|

|

||||

|

ADR

|

$

|

183.85

|

|

$

|

178.50

|

|

3.0

|

%

|

||

|

RevPAR

|

$

|

138.11

|

|

$

|

136.27

|

|

1.4

|

%

|

||

|

Year Ended December 31,

|

||||||||||

|

2013

|

2012

|

% Change

|

||||||||

|

Rooms departmental expenses

|

$

|

151.0

|

|

$

|

135.4

|

|

11.5

|

%

|

||

|

Food and beverage departmental expenses

|

136.5

|

|

124.9

|

|

9.3

|

|

||||

|

Other departmental expenses

|

21.9

|

|

19.4

|

|

12.9

|

|

||||

|

General and administrative

|

64.2

|

|

59.1

|

|

8.6

|

|

||||

|

Utilities

|

28.2

|

|

26.1

|

|

8.0

|

|

||||

|

Repairs and maintenance

|

36.8

|

|

32.4

|

|

13.6

|

|

||||

|

Sales and marketing

|

56.2

|

|

50.2

|

|

12.0

|

|

||||

|

Franchise fees

|

11.4

|

|

8.4

|

|

35.7

|

|

||||

|

Base management fees

|

19.3

|

|

18.8

|

|

2.7

|

|

||||

|

Incentive management fees

|

6.2

|

|

5.5

|

|

12.7

|

|

||||

|

Property taxes

|

40.0

|

|

33.2

|

|

20.5

|

|

||||

|

Other fixed charges

|

10.9

|

|

10.9

|

|

—

|

|

||||

|

Ground rent—Contractual

|

8.5

|

|

8.2

|

|

3.7

|

|

||||

|

Ground rent—Non-cash

|

6.5

|

|

6.4

|

|

1.6

|

|

||||

|

Total hotel operating expenses

|

$

|

597.6

|

|

$

|

538.9

|

|

10.9

|

%

|

||

|

Year Ended December 31,

|

|||||||

|

2013

|

2012

|

||||||

|

Mortgage debt interest

|

$

|

54.9

|

|

$

|

48.7

|

|

|

|

Credit facility interest and unused fees

|

1.0

|

|

2.7

|

|

|||

|

Amortization of deferred financing costs and debt premium

|

2.7

|

|

2.7

|

|

|||

|

Capitalized interest

|

(1.4

|

)

|

(1.2

|

)

|

|||

|

Interest rate cap fair value adjustment

|

0.1

|

|

0.9

|

|

|||

|

|

$

|

57.3

|

|

$

|

53.8

|

|

|

|

•

|

refinancing proceeds on existing encumbered hotels;

|

|

•

|

borrowing capacity on our existing unencumbered hotels;

|

|

•

|

proceeds from the disposition of non-core hotels;

|

|

•

|

capacity under our $200 million senior unsecured credit facility; and

|

|

•

|

annual free cash flow from operations.

|

|

•

|

90% of our REIT taxable income determined without regard to the dividends paid deduction and excluding net capital gains, plus

|

|

•

|

90% of the excess of our net income from foreclosure property over the tax imposed on such income by the Code, minus

|

|

•

|

any excess non-cash income.

|

|

Payment Date

|

Record Date

|

Dividend

per Share

|

|

|||

|

April 12, 2013

|

March 28, 2013

|

|

$0.085

|

|

||

|

July 11, 2013

|

June 28, 2013

|

|

$0.085

|

|

||

|

October 10, 2013

|

September 30, 2013

|

|

$0.085

|

|

||

|

January 10, 2014

|

December 31, 2013

|

|

$0.085

|

|

||

|

April 10, 2014

|

March 31, 2014

|

|

$0.1025

|

|

||

|

July 10, 2014

|

June 30, 2014

|

|

$0.1025

|

|

||

|

October 10, 2014

|

September 30, 2014

|

|

$0.1025

|

|

||

|

January 12, 2015

|

December 31, 2014

|

|

$0.1025

|

|

||

|

Payments Due by Period

|

||||||||||||||||||||

|

Total

|

Less Than 1 Year

|

1 to 3 Years

|

4 to 5 Years

|

After 5 Years

|

||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Long-Term Debt Obligations Including Interest

|

$

|

1,218,490

|

|

$

|

207,421

|

|

$

|

373,207

|

|

$

|

232,690

|

|

$

|

405,172

|

|

|||||

|

Operating Lease Obligations - Ground Leases and Office Space

|

670,285

|

|

10,393

|

|

21,600

|

|

14,367

|

|

623,925

|

|

||||||||||

|

Total

|

$

|

1,888,775

|

|

$

|

217,814

|

|

$

|

394,807

|

|

$

|

247,057

|

|

$

|

1,029,097

|

|

|||||

|

•

|

Non-Cash Ground Rent

: We exclude the non-cash expense incurred from the straight line recognition of rent from our ground lease obligations and the non-cash amortization of our favorable lease assets.

|

|

•

|

Non-Cash Amortization of Favorable and Unfavorable Contracts

: We exclude the non-cash amortization of the favorable management contract assets recorded in conjunction with our acquisitions of the Westin Washington D.C. City Center, Westin San Diego and Hilton Burlington and the non-cash amortization of the unfavorable contract liabilities recorded in conjunction with our acquisitions of the Bethesda Marriott Suites, the Chicago Marriott Downtown, the Renaissance Charleston and the Lexington Hotel New York. The amortization of the favorable and unfavorable contracts does not reflect the underlying operating performance of our hotels.

|

|

•

|

Cumulative Effect of a Change in Accounting Principle

: Infrequently, the Financial Accounting Standards Board (FASB) promulgates new accounting standards that require the consolidated statement of operations to reflect the cumulative effect of a change in accounting principle. We exclude the effect of these one-time adjustments because they do not reflect our actual performance for that period.

|

|

•

|

Gains or Losses from Early Extinguishment of Debt

: We exclude the effect of gains or losses recorded on the early extinguishment of debt because we believe they do not accurately reflect the underlying performance of the Company.

|

|

•

|

Acquisition Costs

: We exclude acquisition transaction costs expensed during the period because we believe they do not reflect the underlying performance of the Company.

|

|

•

|

Allerton Loan

: We exclude the gain from the prepayment of the loan in 2014. Prior to the prepayment, cash payments received during 2010 and 2011 that were included in Adjusted EBITDA and Adjusted FFO and reduced the carrying basis of the loan were deducted from Adjusted EBITDA and Adjusted FFO, calculated based on a straight-line basis over the anticipated term of the loan.

|

|

•

|

Other Non-Cash and /or Unusual Items

: From time to time we incur costs or realize gains that we do not believe reflect the underlying performance of the Company. Such items include, but are not limited to, pre-opening costs, contract termination fees, severance costs, gains from legal settlements, bargain purchase gains and insurance proceeds.

|

|

Year Ended December 31,

|

||||||||||||

|

2014

|

2013

|

2012

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Net income (loss)

|

$

|

163,377

|

|

$

|

49,065

|

|

$

|

(16,592

|

)

|

|||

|

Interest expense (1)

|

58,278

|

|

57,279

|

|

56,068

|

|

||||||

|

Income tax expense (benefit) (2)

|

5,636

|

|

(16

|

)

|

(6,046

|

)

|

||||||

|

Real estate related depreciation (3)

|

99,650

|

|

105,655

|

|

101,498

|

|

||||||

|

EBITDA

|

326,941

|

|

211,983

|

|

134,928

|

|

||||||

|

Non-cash ground rent

|

6,453

|

|

6,787

|

|

6,694

|

|

||||||

|

Non-cash amortization of favorable and unfavorable contracts, net

|

(1,410

|

)

|

(1,487

|

)

|

(1,653

|

)

|

||||||

|

Gain on sale of hotel properties, net (4)

|

(50,969

|

)

|

(22,733

|

)

|

(9,479

|

)

|

||||||

|

Gain on hotel property acquisition

|

(23,894

|

)

|

—

|

|

—

|

|

||||||

|

Loss (gain) on early extinguishment of debt

|

1,616

|

|

1,492

|

|

(144

|

)

|

||||||

|

Gain on insurance proceeds

|

(1,825

|

)

|

—

|

|

—

|

|

||||||

|

Gain on litigation settlement (5)

|

(10,999

|

)

|

—

|

|

—

|

|

||||||

|

Gain on prepayment of note receivable

|

(13,550

|

)

|

—

|

|

—

|

|

||||||

|

Hotel acquisition costs

|

2,177

|

|

—

|

|

10,591

|

|

||||||

|

Hotel pre-opening costs

|

953

|

|

—

|

|

—

|

|

||||||

|

Reversal of previously recognized Allerton income

|

(453

|

)

|

|

(1,163

|

)

|

|

—

|

|

||||

|

Allerton loan legal fees

|

—

|

|

—

|

|

2,493

|

|

||||||

|

Severance costs

|

736

|

|

3,065

|

|

—

|

|

||||||

|

Write-off of key money

|

—

|

|

(1,082

|

)

|

—

|

|

||||||

|

Franchise termination fee

|

—

|

|

—

|

|

750

|

|

||||||

|

Impairment losses (6)

|

—

|

|

—

|

|

45,534

|

|

||||||

|

Adjusted EBITDA

|

$

|

235,776

|

|

$

|

196,862

|

|

$

|

189,714

|

|

|||

|

(1)

|

Includes $2.3 million of interest expense reported in discontinued operations 2012.

|

|

|

(2)

|

Includes income tax expense reported in discontinued operations as follows: $1.1 million in 2013 and $0.7 million in 2012.

|

|

|

(3)

|

Includes depreciation expense reported in discontinued operations as follows: $1.8 million in 2013 and $4.5 million in 2012.

|

|

|

(4)

|

Gains on sale of hotel properties, net for the years ended December 31, 2013 and 2012 are reported in discontinued operations.

|

|

|

(5)

|

Includes $14.0 million of settlement proceeds, net of a $1.2 million contingency fee paid to our legal counsel and $1.8 million of legal fees and

other costs incurred over the course of the legal proceedings for the year ended December 31, 2014. The $1.8 million of legal fees and

other costs were previously recorded as corporate expenses and the repayment of those costs through the settlement proceeds is recorded as a

reduction of corporate expenses.

|

|

|

(6)

|

Includes $14.7 million of impairment losses reported in discontinued operations in 2012.

|

|

|

Year Ended December 31,

|

||||||||||||

|

2014

|

2013

|

2012

|

||||||||||

|

(in thousands)

|

||||||||||||

|

Net income (loss)

|

$

|

163,377

|

|

$

|

49,065

|

|

$

|

(16,592

|

)

|

|||

|

Real estate related depreciation (1)

|

99,650

|

|

105,655

|

|

101,498

|

|

||||||

|

Impairment losses (2)

|

—

|

|

—

|

|

45,534

|

|

||||||

|

Gain on sale of hotel properties, net (3)

|

(50,969

|

)

|

(22,733

|

)

|

(9,479

|

)

|

||||||

|

FFO

|

212,058

|

|

131,987

|

|

120,961

|

|

||||||

|

Non-cash ground rent

|

6,453

|

|

6,787

|

|

6,694

|

|

||||||

|

Non-cash amortization of favorable and unfavorable contracts, net

|

(1,410

|

)

|

(1,487

|

)

|

(1,653

|

)

|

||||||

|

Gain on hotel property acquisition

|

(23,894

|

)

|

—

|

|

—

|

|

||||||

|

Loss (gain) on early extinguishment of debt

|

1,616

|

|

1,492

|

|

(144

|

)

|

||||||

|

Gain on insurance proceeds

|

(1,825

|

)

|

—

|

|

—

|

|

||||||

|

Gain on litigation settlement (4)

|

(10,999

|

)

|

—

|

|

—

|

|

||||||

|

Gain on prepayment of note receivable

|

(13,550

|

)

|

—

|

|

—

|

|

||||||

|

Hotel acquisition costs

|

2,177

|

|

—

|

|

10,591

|

|

||||||

|

Hotel pre-opening costs

|

953

|

|

—

|

|

—

|

|

||||||

|

Reversal of previously recognized Allerton income

|

(453

|

)

|

(1,163

|

)

|

—

|

|

||||||

|

Allerton loan legal fees

|

—

|

|

—

|

|

2,493

|

|

||||||

|

Severance costs

|

736

|

|

3,065

|

|

—

|

|

||||||

|

Write-off of key money

|

—

|

|

(1,082

|

)

|

—

|

|

||||||

|

Franchise termination fee

|

—

|

|

—

|

|

750

|

|

||||||

|

Fair value adjustments to debt instruments

|

(355

|

)

|

(298

|

)

|

471

|

|

||||||

|

Adjusted FFO

|

$

|

171,507

|

|

$

|

139,301

|

|

$

|

140,163

|

|

|||

|

(1)

|

Includes depreciation expense reported in discontinued operations as follows: $1.8 million in 2013 and $4.5 million in 2012.

|

|

|

(2)

|

Includes $14.7 million of impairment losses reported in discontinued operations in 2012.

|

|

|

(3)

|

Gains on sale of hotel properties, net for the years ended December 31, 2013 and 2012 are reported in discontinued operations.

|

|

|

(4)

|

Includes $14.0 million of settlement proceeds, net of a $1.2 million contingency fee paid to our legal counsel and $1.8 million of legal fees and

other costs incurred over the course of the legal proceedings for the year ended December 31, 2014. The $1.8 million of legal fees and other costs were previously recorded as corporate expenses and the repayment of those costs through the settlement proceeds is recorded as a reduction of corporate expenses. |

|

|

1.

|

Financial Statements

|

|

2.

|

Financial Statement Schedules

|

|

3.

|

Exhibits

|

|

DIAMONDROCK HOSPITALITY COMPANY

|

||

|

By:

|

/s/ WILLIAM J. TENNIS

|

|

|

Name:

|

William J. Tennis

|

|

|

Title:

|

Executive Vice President, General Counsel and Corporate Secretary

|

|

|

Signature

|

Title

|

Date

|

||

|

/s/ MARK W. BRUGGER

|

Chief Executive Officer and Director

|

February 27, 2015

|

||

|

Mark W. Brugger

|

(Principal Executive Officer)

|

|||

|

/s/ SEAN M. MAHONEY

|

Executive Vice President and Chief

|

February 27, 2015

|

||

|

Sean M. Mahoney

|

Financial Officer (Principal Financial Officer)

|

|||

|

/s/ BRIONY R. QUINN

|

Chief Accounting Officer and Corporate

|

February 27, 2015

|

||

|

Briony R. Quinn

|

Controller (Principal Accounting Officer)

|

|||

|

/s/ WILLIAM W. McCARTEN

|

Chairman

|

February 27, 2015

|

||

|

William W. McCarten

|

||||

|

/s/ DANIEL J. ALTOBELLO

|

Director

|

February 27, 2015

|

||

|

Daniel J. Altobello

|

||||

|

/s/ W. ROBERT GRAFTON

|

Director

|

February 27, 2015

|

||

|

W. Robert Grafton

|

||||

|

/s/ MAUREEN L. McAVEY

|

Director

|

February 27, 2015

|

||

|

Maureen L. McAvey

|

||||

|

/s/ GILBERT T. RAY

|

Director

|

February 27, 2015

|

||

|

Gilbert T. Ray

|

||||

|

/s/ BRUCE D. WARDINSKI

|

Director

|

February 27, 2015

|

||

|

Bruce D. Wardinski

|

||||

|

Exhibit Number

|

Description of Exhibit

|

|

|

3.1.1

|

Articles of Amendment and Restatement of the Articles of Incorporation of DiamondRock Hospitality Company (

incorporated by reference to the

Registrant's Registration Statement on

Form S-11 filed with the

Securities and Exchange Commission on March 1, 2005 (File

no. 333-123065)

)

|

|

|

3.1.2

|

Amendment to the Articles of Amendment and Restatement of the Articles of Incorporation of DiamondRock Hospitality Company (

incorporated by reference to

the Registrant's Current Report on

Form 8-K filed with the

Securities and Exchange Commission on

January 10, 2007

)

|

|

|

3.1.3

|

Amendment to the Articles of Amendment and Restatement of the Articles of Incorporation of DiamondRock Hospitality Company (

incorporated by reference to

the Registrant's Current Report on

Form 8-K filed with the

Securities and Exchange Commission on

July 9, 2012

)

|

|

|

3.1.4

|

Articles Supplementary Prohibiting DiamondRock Hospitality Company From Electing to be Subject to Section 3-803 of the Maryland General Corporation Law Absent Stockholder Approval

(incorporated by reference to the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 26, 2014).

|

|

|

3.2.1

|

Third Amended and Restated Bylaws of DiamondRock Hospitality Company (

incorporated by reference to the

Registrant's Current Report on

Form 8-K filed with the

Securities and Exchange Commission on

December 17, 2009

)

|

|

|

3.2.2

|

Amendment to the Third Amended and Restated Bylaws of DiamondRock Hospitality Company

(incorporated by reference to the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 3, 2014).

|

|

|

4.1

|

Form of Certificate for Common Stock for DiamondRock Hospitality Company (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 5, 2010

)

|

|

|

10.1

|

Agreement of Limited Partnership of DiamondRock Hospitality Limited Partnership, dated as of June 4, 2004 (

incorporated by reference to the

Registrant's Quarterly Report on

Form 10-Q/A filed with the

Securities and Exchange Commission on

December 7, 2009

)

|

|

|

10.2

|

Agreement of Purchase and Sale among the Sellers named therein and DiamondRock Hospitality Company, dated as of July 9, 2012 (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on July 25, 2012

)

|

|

|

10.3*

|

Amended and Restated 2004 Stock Option and Incentive Plan, as amended and restated on April 28, 2010 (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 5, 2010

)

|

|

|

10.4*

|

Amendment to DiamondRock Hospitality Company Amended and Restated 2004 Stock Option and Incentive Plan, approved by the Board of Directors on July 20, 2011

(incorporated by reference to the Registrant’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on October 19, 2011)

|

|

|

10.5*

|

DiamondRock Hospitality Company Deferred Compensation Plan

(incorporated by reference to the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on August 8, 2014)

|

|

|

10.6*†

|

First Amendment to DiamondRock Hospitality Company Deferred Compensation Plan, approved by the Compensation Committee of the Board of Directors on December 15, 2014

|

|

|

10.7*

|

Form of Restricted Stock Award Agreement (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 5, 2010

)

|

|

|

10.8*

|

Form of Market Stock Unit Agreement (

incorporated by reference to the Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on March 9, 2010

)

|

|

|

10.9*

|

Relative TSR Performance Stock Unit Agreement

(incorporated by reference to the Registrant’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 25, 2014)

|

|

|

10.10*

|

Form of Deferred Stock Unit Award Agreement (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 5, 2010

)

|

|

|

10.11*

|

Form of Director Election Form (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 5, 2010

)

|

|

|

10.12*

|

Form of Incentive Stock Option Agreement (

incorporated by reference to the

Registrant's Registration Statement on

Form S-11 filed with the

Securities and Exchange Commission (File

no. 333-123065)

)

|

|

|

10.13

|

Form of Non-Qualified Stock Option Agreement (

incorporated by reference to

the Registrant's Registration Statement

on Form S-11 filed with the

Securities and Exchange Commission (File

no. 333-123065)

)

|

|

|

10.14*

|

Third Amended and Restated Credit Agreement, dated as of November 20, 2012, by and among DiamondRock Hospitality Company, DiamondRock Hospitality Limited Partnership, Wells Fargo Bank, National Association, as Administrative Agent, Bank of America, N.A., as Syndication Agent, Citibank, N.A., as Documentation Agent, and each of Wells Fargo Securities, LLC and Merrill Lynch, Pierce Fenner and Smith Incorporated, as Joint Lead Arrangers and Joint Lead Bookrunners (

incorporated by reference to the Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on November 26, 2012

)

|

|

|

10.15*

|

Form of Severance Agreement (and schedule of material differences thereto) (

incorporated by reference to the Registrant's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on April 30, 2012

)

|

|

|

10.16*

|