false--12-31FY20190000927066P6M275000002022-12-310.01000P0Y1005605000246373000P4YP3YP2YP1Y0.0010.0014500000004500000001663873071258428531663873071258428530.020004833000952900001293210000124188000117795000275000002750000027500000275000002036-12-312028-12-312021-12-312039-12-3100.0010.0015000000500000000000080.0150.0170.0160.0190.0060.0080.0070.000.512024-12-31

0000927066

2019-01-01

2019-12-31

0000927066

2019-06-28

0000927066

2020-01-31

0000927066

2017-01-01

2017-12-31

0000927066

2018-01-01

2018-12-31

0000927066

2018-12-31

0000927066

2019-12-31

0000927066

us-gaap:SegmentDiscontinuedOperationsMember

2017-01-01

2017-12-31

0000927066

us-gaap:SegmentContinuingOperationsMember

2019-01-01

2019-12-31

0000927066

us-gaap:SegmentContinuingOperationsMember

2018-01-01

2018-12-31

0000927066

us-gaap:SegmentDiscontinuedOperationsMember

2019-01-01

2019-12-31

0000927066

2016-12-31

0000927066

2017-12-31

0000927066

us-gaap:SegmentDiscontinuedOperationsMember

2018-01-01

2018-12-31

0000927066

us-gaap:SegmentContinuingOperationsMember

2017-01-01

2017-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:ParentMember

2019-01-01

2019-12-31

0000927066

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0000927066

us-gaap:TreasuryStockMember

2019-01-01

2019-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0000927066

us-gaap:ParentMember

2019-01-01

2019-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2019-01-01

2019-12-31

0000927066

us-gaap:TreasuryStockMember

2019-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-01-01

2019-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ParentMember

2019-01-01

2019-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0000927066

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2018-12-31

0000927066

us-gaap:RetainedEarningsMember

2018-12-31

0000927066

us-gaap:ParentMember

2019-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2019-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0000927066

us-gaap:RetainedEarningsMember

2019-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0000927066

us-gaap:CommonStockMember

2019-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2019-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2018-12-31

0000927066

us-gaap:ParentMember

2018-12-31

0000927066

us-gaap:TreasuryStockMember

2017-01-01

2017-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:CommonStockMember

2017-01-01

2017-12-31

0000927066

us-gaap:TreasuryStockMember

2018-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0000927066

us-gaap:RetainedEarningsMember

2017-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2018-01-01

2018-12-31

0000927066

us-gaap:ParentMember

2018-01-01

2018-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2016-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2018-01-01

2018-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2016-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2017-01-01

2017-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2017-01-01

2017-12-31

0000927066

us-gaap:TreasuryStockMember

2018-01-01

2018-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2016-12-31

0000927066

us-gaap:CommonStockMember

2017-01-01

2017-12-31

0000927066

us-gaap:CommonStockMember

2018-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:AdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ParentMember

2017-01-01

2017-12-31

0000927066

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0000927066

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0000927066

us-gaap:ParentMember

2017-01-01

2017-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:ParentMember

2017-01-01

2017-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0000927066

us-gaap:NoncontrollingInterestMember

2017-12-31

0000927066

us-gaap:CommonStockMember

2017-12-31

0000927066

us-gaap:TreasuryStockMember

2016-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ParentMember

2018-01-01

2018-12-31

0000927066

us-gaap:ParentMember

2016-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:ParentMember

2018-01-01

2018-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0000927066

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-01-01

2018-12-31

0000927066

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:AdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0000927066

us-gaap:RetainedEarningsMember

2016-12-31

0000927066

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0000927066

dva:TemporaryEquityRedeemableNoncontrollingInterestsMember

2017-12-31

0000927066

us-gaap:CommonStockMember

2016-12-31

0000927066

us-gaap:TreasuryStockMember

2017-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

us-gaap:CommonStockMember

2017-01-01

2017-12-31

0000927066

us-gaap:ParentMember

2017-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-01-01

2017-12-31

0000927066

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-12-31

0000927066

dva:InternationalOperationsMember

2019-12-31

0000927066

country:US

2019-12-31

0000927066

srt:MaximumMember

us-gaap:BuildingMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

2019-01-01

2019-12-31

0000927066

country:US

2019-01-01

2019-12-31

0000927066

srt:MaximumMember

us-gaap:MachineryAndEquipmentMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

us-gaap:BuildingMember

2019-01-01

2019-12-31

0000927066

us-gaap:AccountingStandardsUpdate201602Member

dva:LeaseAssetsMember

2019-01-01

2019-01-01

0000927066

dva:InternationalOperationsMember

2019-01-01

2019-12-31

0000927066

dva:CashFlowEffectMember

us-gaap:AccountingStandardsUpdate201602Member

2019-01-01

2019-01-01

0000927066

srt:MinimumMember

us-gaap:LeaseholdImprovementsMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

us-gaap:NoncompeteAgreementsMember

2019-01-01

2019-12-31

0000927066

srt:MaximumMember

us-gaap:NoncompeteAgreementsMember

2019-01-01

2019-12-31

0000927066

us-gaap:AccountingStandardsUpdate201602Member

dva:LeaseLiabilitiesMember

2019-01-01

2019-01-01

0000927066

us-gaap:AccountsReceivableMember

dva:PatientServicesCustomerConcentrationRiskMember

2019-01-01

2019-12-31

0000927066

dva:MedicareMember

2019-12-31

0000927066

dva:MedicareMember

2018-12-31

0000927066

us-gaap:AccountsReceivableMember

2019-12-31

0000927066

us-gaap:AccountsReceivableMember

2018-12-31

0000927066

us-gaap:AccountsReceivableMember

dva:PatientServicesCustomerConcentrationRiskMember

2019-12-31

0000927066

us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member

2019-01-01

2019-12-31

0000927066

us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member

2018-01-01

2018-12-31

0000927066

us-gaap:AccountsReceivableMember

2019-01-01

2019-12-31

0000927066

us-gaap:IntersegmentEliminationMember

2017-01-01

2017-12-31

0000927066

dva:CommercialPayorsMember

2017-01-01

2017-12-31

0000927066

us-gaap:IntersegmentEliminationMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

dva:OtherSourcesofRevenueMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

dva:CommercialPayorsMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

dva:CommercialPayorsMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

2017-01-01

2017-12-31

0000927066

dva:OtherSourcesofRevenueMember

2017-01-01

2017-12-31

0000927066

dva:OtherGovernmentPayorsMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

us-gaap:IntersegmentEliminationMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:OtherGovernmentPayorsMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:OtherSourcesofRevenueMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:OtherGovernmentPayorsMember

2017-01-01

2017-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

2017-01-01

2017-12-31

0000927066

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

dva:CommercialPayorsMember

2019-01-01

2019-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

2019-01-01

2019-12-31

0000927066

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

dva:OtherGovernmentPayorsMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

2019-01-01

2019-12-31

0000927066

dva:OtherSourcesofRevenueMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:CommercialPayorsMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

dva:CommercialPayorsMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:OtherSourcesofRevenueMember

2019-01-01

2019-12-31

0000927066

us-gaap:IntersegmentEliminationMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

dva:OtherGovernmentPayorsMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:OtherSourcesofRevenueMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

us-gaap:IntersegmentEliminationMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:OtherGovernmentPayorsMember

2019-01-01

2019-12-31

0000927066

us-gaap:IntersegmentEliminationMember

2019-01-01

2019-12-31

0000927066

dva:CommercialPayorsMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

us-gaap:IntersegmentEliminationMember

2018-01-01

2018-12-31

0000927066

us-gaap:IntersegmentEliminationMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

dva:CommercialPayorsMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

dva:CommercialPayorsMember

2018-01-01

2018-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

2018-01-01

2018-12-31

0000927066

dva:OtherGovernmentPayorsMember

2018-01-01

2018-12-31

0000927066

dva:OtherGovernmentPayorsMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

2018-01-01

2018-12-31

0000927066

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

dva:OtherSourcesofRevenueMember

2018-01-01

2018-12-31

0000927066

dva:MedicareandMedicareAdvantageMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

dva:OtherGovernmentPayorsMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

dva:OtherSourcesofRevenueMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

us-gaap:IntersegmentEliminationMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

dva:MedicaidandManagedMedicaidMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

dva:OtherSourcesofRevenueMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccountsReceivableMember

dva:PatientServicesCustomerConcentrationRiskMember

2018-01-01

2018-12-31

0000927066

us-gaap:AllOtherSegmentsMember

2019-12-31

0000927066

dva:MutualFundsAndCommonStockMember

2019-01-01

2019-12-31

0000927066

dva:MutualFundsAndCommonStockMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

0000927066

us-gaap:OtherLongTermInvestmentsMember

2019-12-31

0000927066

us-gaap:OtherLongTermInvestmentsMember

2018-12-31

0000927066

dva:MutualFundsAndCommonStockMember

2018-12-31

0000927066

dva:CertificatesOfDepositCommercialPaperAndMoneyMarketFundsMember

2018-12-31

0000927066

dva:CertificatesOfDepositCommercialPaperAndMoneyMarketFundsMember

2019-12-31

0000927066

us-gaap:ShortTermInvestmentsMember

2019-12-31

0000927066

dva:MutualFundsAndCommonStockMember

2019-12-31

0000927066

us-gaap:ShortTermInvestmentsMember

2018-12-31

0000927066

dva:SupplierRebatesAndOtherNonTradeReceivablesMember

2019-12-31

0000927066

dva:SupplierRebatesAndOtherNonTradeReceivablesMember

2018-12-31

0000927066

dva:MedicareMember

2019-12-31

0000927066

dva:MedicareMember

2018-12-31

0000927066

naics:ZZ446110

2018-01-01

2018-12-31

0000927066

us-gaap:OtherIntangibleAssetsMember

2019-12-31

0000927066

us-gaap:NoncompeteAgreementsMember

2019-12-31

0000927066

us-gaap:OtherOwnershipInterestMember

2018-12-31

0000927066

us-gaap:EquitySecuritiesMember

2018-12-31

0000927066

dva:DeconsolidatedNoncontrollingEntityMember

2019-12-31

0000927066

dva:DeconsolidatedNoncontrollingEntityMember

2018-12-31

0000927066

us-gaap:OtherOwnershipInterestMember

2019-12-31

0000927066

us-gaap:EquitySecuritiesMember

2019-12-31

0000927066

dva:DeconsolidatedNoncontrollingEntityMember

2019-01-01

2019-12-31

0000927066

dva:DeconsolidatedNoncontrollingEntityMember

2017-01-01

2017-12-31

0000927066

srt:MinimumMember

2019-12-31

0000927066

srt:MaximumMember

2019-12-31

0000927066

dva:DeconsolidatedNoncontrollingEntityMember

2018-01-01

2018-12-31

0000927066

dva:ParentCompanyAndRestrictedSubsidiariesMember

2018-12-31

0000927066

dva:ParentCompanyAndRestrictedSubsidiariesMember

2019-12-31

0000927066

country:DE

dva:KidneyCareMember

2019-01-01

2019-12-31

0000927066

country:DE

dva:OtherReportingUnitsMember

2019-01-01

2019-12-31

0000927066

country:DE

dva:OtherReportingUnitsMember

2018-01-01

2018-12-31

0000927066

dva:OtherReportingUnitsMember

2019-01-01

2019-12-31

0000927066

country:DE

dva:KidneyCareMember

2019-01-01

2019-03-31

0000927066

dva:InternationalOperationsMember

2017-01-01

2017-12-31

0000927066

country:DE

dva:KidneyCareMember

2019-07-01

2019-09-30

0000927066

dva:VascularAccessClinicMember

2017-01-01

2017-12-31

0000927066

dva:VascularAccessClinicMember

2017-12-31

0000927066

dva:USDialysisAndRelatedLabServicesMember

2017-12-31

0000927066

dva:USDialysisAndRelatedLabServicesMember

2019-12-31

0000927066

us-gaap:AllOtherSegmentsMember

2017-12-31

0000927066

us-gaap:AllOtherSegmentsMember

2018-12-31

0000927066

dva:USDialysisAndRelatedLabServicesMember

2018-12-31

0000927066

country:BR

dva:KidneyCareMember

2019-01-01

2019-12-31

0000927066

country:BR

dva:KidneyCareMember

2019-12-31

0000927066

country:DE

dva:KidneyCareMember

2019-12-31

0000927066

us-gaap:StateAndLocalJurisdictionMember

2019-12-31

0000927066

us-gaap:ForeignCountryMember

2019-12-31

0000927066

us-gaap:CapitalLossCarryforwardMember

2019-12-31

0000927066

us-gaap:DomesticCountryMember

2019-12-31

0000927066

us-gaap:CapitalLossCarryforwardMember

2019-01-01

2019-12-31

0000927066

us-gaap:DomesticCountryMember

2019-01-01

2019-12-31

0000927066

us-gaap:DomesticCountryMember

dva:TaxYear2028Member

2019-01-01

2019-12-31

0000927066

us-gaap:StateAndLocalJurisdictionMember

2019-01-01

2019-12-31

0000927066

us-gaap:ForeignCountryMember

2019-01-01

2019-12-31

0000927066

dva:InterestRateCapAgreementsEffectiveJuneTwentyNineTwoThousandEighteenMember

us-gaap:CashFlowHedgingMember

dva:DebtExpenseMember

2019-01-01

2019-12-31

0000927066

srt:MaximumMember

dva:TermLoanFacilityMember

dva:InterestRateCapAgreementsMemberEffectiveJune302019Member

2019-12-31

0000927066

dva:InterestRateCapAgreementsMemberEffectiveJune302019Member

2019-01-01

2019-12-31

0000927066

dva:InterestRateCapAgreementsEffectiveJuneTwentyNineTwoThousandEighteenMember

2019-01-01

2019-12-31

0000927066

srt:MaximumMember

dva:TermLoanFacilityMember

dva:InterestRateCapAgreementsMemberEffectiveJune302019Member

2019-01-01

2019-12-31

0000927066

us-gaap:OtherNoncurrentAssetsMember

dva:InterestRateCapAgreementsEffectiveJuneTwentyNineTwoThousandEighteenMember

2018-12-31

0000927066

srt:MaximumMember

dva:TermLoanFacilityMember

dva:InterestRateCapAgreementsEffectiveJuneTwentyNineTwoThousandEighteenMember

2019-01-01

2019-12-31

0000927066

dva:InterestRateCapAgreementsMemberEffectiveJune302019Member

us-gaap:CashFlowHedgingMember

dva:DebtExpenseMember

2019-01-01

2019-12-31

0000927066

srt:MaximumMember

dva:TermLoanFacilityMember

dva:InterestRateCapAgreementsEffectiveJuneTwentyNineTwoThousandEighteenMember

2019-12-31

0000927066

us-gaap:OtherNoncurrentAssetsMember

dva:InterestRateCapAgreementsEffectiveJuneTwentyNineTwoThousandEighteenMember

2019-12-31

0000927066

us-gaap:OtherNoncurrentAssetsMember

dva:InterestRateCapAgreementsMemberEffectiveJune302019Member

2019-12-31

0000927066

dva:SeniorNotesFivePointZeroPercentDueTwentyTwentyFiveMember

2019-12-31

0000927066

us-gaap:NotesPayableOtherPayablesMember

2019-12-31

0000927066

dva:NewTermLoanBMember

2019-01-01

2019-12-31

0000927066

dva:SeniorNotesFivePointZeroPercentDueTwentyTwentyFiveMember

2018-12-31

0000927066

us-gaap:RevolvingCreditFacilityMember

2019-12-31

0000927066

dva:NewTermLoanAMember

2019-12-31

0000927066

dva:PriorTermLoanBMember

2019-01-01

2019-12-31

0000927066

dva:PriorTermLoanA2Member

2018-12-31

0000927066

dva:FinanceLeaseMember

2019-12-31

0000927066

dva:SeniorNotesFivePointZeroPercentDueTwentyTwentyFiveMember

2019-01-01

2019-12-31

0000927066

dva:SeniorNotesFivePointOneTwoFivePercentDueTwentyTwentyFourMember

2019-01-01

2019-12-31

0000927066

dva:PriorTermLoanBMember

2019-12-31

0000927066

dva:NewTermLoanBMember

2019-12-31

0000927066

dva:FinanceLeaseMember

2019-01-01

2019-12-31

0000927066

dva:SeniorNotesFivePointSevenFivePercentageSeniorNotesMember

2018-12-31

0000927066

dva:FinanceLeaseMember

2018-12-31

0000927066

dva:NewTermLoanAMember

2019-01-01

2019-12-31

0000927066

us-gaap:RevolvingCreditFacilityMember

2018-12-31

0000927066

dva:PriorTermLoanAMember

2019-12-31

0000927066

dva:SeniorNotesFivePointOneTwoFivePercentDueTwentyTwentyFourMember

2018-12-31

0000927066

dva:PriorTermLoanAMember

2018-12-31

0000927066

us-gaap:RevolvingCreditFacilityMember

2019-01-01

2019-12-31

0000927066

dva:PriorTermLoanBMember

2018-12-31

0000927066

dva:SeniorNotesFivePointOneTwoFivePercentDueTwentyTwentyFourMember

2019-12-31

0000927066

dva:PriorTermLoanA2Member

2019-01-01

2019-12-31

0000927066

dva:PriorTermLoanAMember

2019-01-01

2019-12-31

0000927066

us-gaap:NotesPayableOtherPayablesMember

2019-01-01

2019-12-31

0000927066

dva:NewTermLoanBMember

2018-12-31

0000927066

us-gaap:NotesPayableOtherPayablesMember

2018-12-31

0000927066

dva:SeniorNotesFivePointSevenFivePercentageSeniorNotesMember

2019-12-31

0000927066

dva:NewTermLoanAMember

2018-12-31

0000927066

dva:PriorTermLoanA2Member

2019-12-31

0000927066

dva:SeniorNotesFivePointSevenFivePercentageSeniorNotesMember

2019-01-01

2019-12-31

0000927066

dva:NewTermLoanBMember

2019-08-12

0000927066

dva:NewrevolvinglineofcreditMember

2019-08-12

0000927066

dva:NewrevolvinglineofcreditMember

2019-12-31

0000927066

dva:NewTermLoanB1Member

us-gaap:SubsequentEventMember

2020-02-13

2020-02-13

0000927066

dva:NewrevolvinglineofcreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000927066

dva:SeniorSecuredCreditFacilitiesMember

2019-12-31

0000927066

dva:TenderOfferMember

2019-01-01

2019-12-31

0000927066

us-gaap:SeniorNotesMember

2018-12-31

0000927066

dva:NewTermLoanBMember

us-gaap:SubsequentEventMember

2020-02-13

0000927066

dva:PriorTermLoanBandPriorRevolvingLineOfCreditMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

dva:NewTermLoanBMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000927066

srt:MaximumMember

dva:NewCreditAgreementMember

2019-08-12

0000927066

dva:SeniorSecuredCreditFacilitiesMember

2018-12-31

0000927066

dva:TermLoanASubjectToUncappedPortionOfVariabilityOfLIBORMember

2019-12-31

0000927066

srt:MaximumMember

dva:IncrementalRevolvingLineOfCreditMember

2019-08-12

0000927066

dva:NewCreditAgreementMember

2019-08-12

0000927066

dva:IncrementalRevolvingLineOfCreditMember

2019-08-12

0000927066

dva:NewrevolvinglineofcreditMember

2019-01-01

2019-12-31

0000927066

2019-07-01

2019-09-30

0000927066

us-gaap:LetterOfCreditMember

2019-12-31

0000927066

2019-04-01

2019-06-30

0000927066

us-gaap:DiscontinuedOperationsHeldforsaleMember

dva:DaVitaMedicalGroupMember

2019-06-19

2019-06-19

0000927066

srt:MinimumMember

dva:NewTermLoanAMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000927066

dva:SeniorSecuredCreditFacilitiesMember

2019-12-31

0000927066

2019-05-06

2019-05-06

0000927066

us-gaap:SeniorNotesMember

2019-12-31

0000927066

dva:NewTermLoanAMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

dva:NewTermLoanB1Member

us-gaap:SubsequentEventMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2020-02-13

2020-02-13

0000927066

dva:NewTermLoanB1Member

us-gaap:SubsequentEventMember

2020-02-13

0000927066

srt:MinimumMember

dva:PriorTermLoanA2Member

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-06-30

0000927066

srt:MinimumMember

dva:PriorTermLoanBMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-06-30

0000927066

srt:MaximumMember

dva:NewTermLoanAMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-12-31

0000927066

dva:NewTermLoanAMember

2019-08-12

0000927066

srt:MinimumMember

dva:PriorTermLoanAMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-06-30

0000927066

us-gaap:InterestRateCapMember

us-gaap:CashFlowHedgingMember

dva:DebtExpenseMember

2019-01-01

2019-12-31

0000927066

us-gaap:CashFlowHedgingMember

2018-01-01

2018-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:CashFlowHedgingMember

dva:DebtExpenseMember

2018-01-01

2018-12-31

0000927066

us-gaap:CashFlowHedgingMember

dva:IncomeTaxExpenseBenefitMember

2017-01-01

2017-12-31

0000927066

us-gaap:CashFlowHedgingMember

2017-01-01

2017-12-31

0000927066

us-gaap:CashFlowHedgingMember

2019-01-01

2019-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:CashFlowHedgingMember

dva:DebtExpenseMember

2017-01-01

2017-12-31

0000927066

us-gaap:CashFlowHedgingMember

dva:IncomeTaxExpenseBenefitMember

2018-01-01

2018-12-31

0000927066

us-gaap:CashFlowHedgingMember

dva:IncomeTaxExpenseBenefitMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-01-01

2019-06-30

0000927066

us-gaap:OtherPensionPlansDefinedBenefitMember

2019-01-01

2019-12-31

0000927066

dva:AllTrustsMember

us-gaap:OtherPensionPlansDefinedBenefitMember

2018-12-31

0000927066

us-gaap:OtherPensionPlansDefinedBenefitMember

2017-01-01

2017-12-31

0000927066

us-gaap:OtherPensionPlansDefinedBenefitMember

2019-12-31

0000927066

dva:AllTrustsMember

us-gaap:OtherPensionPlansDefinedBenefitMember

2019-12-31

0000927066

us-gaap:OtherPensionPlansDefinedBenefitMember

2018-01-01

2018-12-31

0000927066

srt:MaximumMember

2019-01-01

2019-12-31

0000927066

srt:MinimumMember

2019-01-01

2019-12-31

0000927066

dva:USAttorneyPrescriptionDrugInvestigationMember

dva:CashPaidForPortionPreviouslyRefundedMember

2017-12-01

2017-12-31

0000927066

dva:USAttorneyPrescriptionDrugInvestigationMember

dva:IncrementalCashPortionMember

2017-12-01

2017-12-31

0000927066

dva:USAttorneyPrescriptionDrugInvestigationMember

2017-12-01

2017-12-31

0000927066

dva:CommitmentsToProvideOperatingCapitalMember

2019-12-31

0000927066

srt:MinimumMember

dva:EpogenMember

2019-01-01

2019-12-31

0000927066

dva:DialysisEquipmentPartsAndSuppliesMember

2019-01-01

2019-12-31

0000927066

dva:EpogenMember

2019-01-01

2019-12-31

0000927066

dva:HemodialysisProductsSuppliesAndEquipmentMember

2019-01-01

2019-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2017-01-01

2017-12-31

0000927066

dva:PremiumPricedStockSettledStockAppreciationRightsMember

2019-11-04

0000927066

dva:StockIncentivePlanTwentyElevenMember

2019-01-01

2019-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2017-12-31

0000927066

us-gaap:GeneralAndAdministrativeExpenseMember

2019-01-01

2019-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2018-01-01

2018-12-31

0000927066

dva:PremiumPricedStockSettledStockAppreciationRightsMember

2019-11-04

2019-11-04

0000927066

srt:MinimumMember

dva:StockIncentivePlanTwentyElevenMember

2019-01-01

2019-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2019-01-01

2019-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2019-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2019-01-01

2019-01-01

0000927066

dva:PremiumPricedStockSettledStockAppreciationRightsMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-11-04

2019-11-04

0000927066

us-gaap:GeneralAndAdministrativeExpenseMember

2017-01-01

2017-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2018-12-31

0000927066

us-gaap:GeneralAndAdministrativeExpenseMember

2018-01-01

2018-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2019-12-31

2019-12-31

0000927066

dva:PremiumPricedStockSettledStockAppreciationRightsMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2019-11-04

2019-11-04

0000927066

us-gaap:PerformanceSharesMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-01-01

2019-12-31

0000927066

dva:StockIncentivePlanTwentyElevenMember

2019-12-31

0000927066

srt:MaximumMember

dva:StockIncentivePlanTwentyElevenMember

2019-01-01

2019-12-31

0000927066

dva:RangeTwoMember

2019-12-31

0000927066

dva:RangeThreeMember

2019-12-31

0000927066

dva:RangeFourMember

2019-12-31

0000927066

dva:RangeOneMember

2019-12-31

0000927066

dva:StockOptionProgramAndStockAppreciationRightProgramMember

2019-01-01

2019-12-31

0000927066

dva:StockOptionProgramAndStockAppreciationRightProgramMember

2017-01-01

2017-12-31

0000927066

dva:StockOptionProgramAndStockAppreciationRightProgramMember

2018-01-01

2018-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

2017-01-01

2017-12-31

0000927066

dva:StockUnitMember

2019-01-01

2019-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

2019-01-01

2019-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

2018-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

2019-12-31

0000927066

dva:StockUnitMember

2019-12-31

0000927066

dva:StockUnitMember

2017-01-01

2017-12-31

0000927066

dva:StockUnitMember

2018-12-31

0000927066

us-gaap:StockAppreciationRightsSARSMember

2018-01-01

2018-12-31

0000927066

dva:StockUnitMember

2018-01-01

2018-12-31

0000927066

dva:EmployeeStockPurchasePlanMember

2019-07-01

2019-07-01

0000927066

dva:RangeFourMember

2019-01-01

2019-12-31

0000927066

dva:RangeThreeMember

2019-01-01

2019-12-31

0000927066

dva:RangeOneMember

2019-01-01

2019-12-31

0000927066

dva:RangeTwoMember

2019-01-01

2019-12-31

0000927066

dva:TenderOfferMember

2018-01-01

2018-12-31

0000927066

dva:OpenMarketPurchasesMember

2017-01-01

2017-12-31

0000927066

dva:TenderOfferMember

2017-01-01

2017-12-31

0000927066

dva:OpenMarketPurchasesMember

2019-01-01

2019-12-31

0000927066

dva:OpenMarketPurchasesMember

2018-01-01

2018-12-31

0000927066

us-gaap:SubsequentEventMember

2020-01-01

2020-02-20

0000927066

2019-07-17

0000927066

2019-11-04

0000927066

2018-07-11

0000927066

us-gaap:SubsequentEventMember

2020-02-20

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2017-01-01

2017-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2016-12-31

0000927066

dva:RenalVenturesLimitedLLCMember

2019-01-01

2019-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2019-01-01

2019-12-31

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2019-01-01

2019-12-31

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2016-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2019-01-01

2019-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2017-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2017-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2019-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2016-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2019-01-01

2019-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

2018-12-31

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2017-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2018-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2019-12-31

0000927066

us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember

2017-01-01

2017-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2019-01-01

2019-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2017-01-01

2017-12-31

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2017-01-01

2017-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2019-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2018-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2018-12-31

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2019-12-31

0000927066

us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember

2017-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2016-12-31

0000927066

us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember

2018-01-01

0000927066

us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember

2018-12-31

0000927066

dva:RenalVenturesLimitedLLCMember

2017-05-01

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2017-01-01

2017-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2018-12-31

0000927066

dva:RenalVenturesLimitedLLCMember

2019-12-31

0000927066

dva:OperatingDialysisCenterMember

dva:RenalVenturesLimitedLLCMember

2017-05-01

2017-05-01

0000927066

dva:RenalVenturesLimitedLLCMember

2017-05-01

2017-05-01

0000927066

dva:OperatingDialysisCenterMember

2017-05-01

2017-05-01

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:ForeignDialysisCentersMember

2019-01-01

2019-12-31

0000927066

dva:RenalVenturesLimitedLLCMember

2017-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2018-01-01

2018-12-31

0000927066

dva:HomeDialysisClinicMember

dva:RenalVenturesLimitedLLCMember

2017-05-01

2017-05-01

0000927066

dva:NewCenterUnderConstructionMember

dva:RenalVenturesLimitedLLCMember

2017-05-01

2017-05-01

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

dva:OtherCompaniesMember

2019-12-31

0000927066

dva:OtherAccruedLiabilitiesMember

2019-12-31

0000927066

srt:MinimumMember

dva:EBITDAOperatingIncomePerformanceTargetsOrQualityMarginsMember

dva:OtherCompaniesMember

2019-01-01

2019-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

srt:MaximumMember

dva:EBITDAOperatingIncomePerformanceTargetsOrQualityMarginsMember

dva:OtherCompaniesMember

2019-01-01

2019-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

us-gaap:OtherNoncurrentLiabilitiesMember

2019-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2019-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:ForeignDialysisCentersMember

2018-01-01

2018-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2017-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:ForeignDialysisCentersMember

2017-01-01

2017-12-31

0000927066

2019-06-19

2019-06-19

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:DMGAcquisitionsMember

2018-01-01

2018-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:DMGAcquisitionsMember

2017-01-01

2017-12-31

0000927066

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

dva:DMGAcquisitionsMember

2019-01-01

2019-06-18

0000927066

us-gaap:DiscontinuedOperationsHeldforsaleMember

dva:DaVitaMedicalGroupMember

2019-01-01

2019-12-31

0000927066

us-gaap:DiscontinuedOperationsHeldforsaleMember

dva:DaVitaMedicalGroupMember

2017-12-05

2017-12-05

0000927066

us-gaap:DiscontinuedOperationsHeldforsaleMember

dva:DaVitaMedicalGroupMember

2018-01-01

2018-12-31

0000927066

us-gaap:DiscontinuedOperationsHeldforsaleMember

dva:DaVitaMedicalGroupMember

2017-01-01

2017-12-31

0000927066

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

us-gaap:InterestRateCapMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-12-31

0000927066

dva:DaVitaMedicalGroupMember

2019-12-31

0000927066

dva:DaVitaMedicalGroupMember

2018-12-31

0000927066

us-gaap:NonUsMember

us-gaap:AllOtherSegmentsMember

2019-12-31

0000927066

us-gaap:NonUsMember

us-gaap:AllOtherSegmentsMember

2018-12-31

0000927066

dva:DaVitaMedicalGroupMember

2019-01-01

2019-12-31

0000927066

dva:DaVitaMedicalGroupMember

2018-01-01

2018-12-31

0000927066

dva:DaVitaMedicalGroupMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

dva:ExternalSourcesMember

2019-01-01

2019-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

us-gaap:IntersubsegmentEliminationsMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

dva:ExternalSourcesMember

2018-01-01

2018-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

2019-01-01

2019-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

us-gaap:AllOtherSegmentsMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

us-gaap:AllOtherSegmentsMember

us-gaap:IntersubsegmentEliminationsMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

us-gaap:IntersubsegmentEliminationsMember

2018-01-01

2018-12-31

0000927066

us-gaap:OperatingSegmentsMember

us-gaap:AllOtherSegmentsMember

us-gaap:IntersubsegmentEliminationsMember

2018-01-01

2018-12-31

0000927066

us-gaap:OperatingSegmentsMember

us-gaap:AllOtherSegmentsMember

2018-01-01

2018-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

2018-01-01

2018-12-31

0000927066

us-gaap:OperatingSegmentsMember

us-gaap:AllOtherSegmentsMember

2019-01-01

2019-12-31

0000927066

us-gaap:OperatingSegmentsMember

2018-01-01

2018-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

us-gaap:IntersubsegmentEliminationsMember

2019-01-01

2019-12-31

0000927066

us-gaap:OperatingSegmentsMember

dva:USDialysisAndRelatedLabServicesMember

dva:ExternalSourcesMember

2017-01-01

2017-12-31

0000927066

us-gaap:OperatingSegmentsMember

2019-01-01

2019-12-31

0000927066

us-gaap:OperatingSegmentsMember

us-gaap:AllOtherSegmentsMember

us-gaap:IntersubsegmentEliminationsMember

2019-01-01

2019-12-31

0000927066

2018-07-01

2018-09-30

0000927066

2018-04-01

2018-06-30

0000927066

2018-10-01

2018-12-31

0000927066

dva:PharmacyMember

2018-07-01

2018-09-30

0000927066

us-gaap:AllOtherSegmentsMember

2019-07-01

2019-09-30

0000927066

dva:DeconsolidatedNoncontrollingEntityMember

2018-10-01

2018-12-31

0000927066

dva:PaladinaMember

2018-07-01

2018-09-30

0000927066

dva:PaladinaMember

2018-04-01

2018-06-30

0000927066

2018-01-01

2018-03-31

0000927066

2019-01-01

2019-03-31

0000927066

2019-10-01

2019-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2019-12-31

0000927066

srt:ConsolidationEliminationsMember

2019-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2019-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2019-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2019-01-01

2019-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2019-01-01

2019-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2019-01-01

2019-12-31

0000927066

srt:ConsolidationEliminationsMember

2019-01-01

2019-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2019-01-01

2019-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2019-01-01

2019-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2019-01-01

2019-12-31

0000927066

srt:ConsolidationEliminationsMember

us-gaap:SegmentDiscontinuedOperationsMember

2019-01-01

2019-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2019-01-01

2019-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2019-01-01

2019-12-31

0000927066

srt:ConsolidationEliminationsMember

2018-12-31

0000927066

srt:ConsolidationEliminationsMember

us-gaap:SegmentContinuingOperationsMember

2019-01-01

2019-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2019-01-01

2019-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2018-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2018-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2018-12-31

0000927066

srt:ConsolidationEliminationsMember

2018-01-01

2018-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2018-01-01

2018-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2018-01-01

2018-12-31

0000927066

srt:ConsolidationEliminationsMember

2017-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2018-01-01

2018-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2017-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2018-01-01

2018-12-31

0000927066

srt:ConsolidationEliminationsMember

us-gaap:SegmentContinuingOperationsMember

2018-01-01

2018-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2018-01-01

2018-12-31

0000927066

srt:ConsolidationEliminationsMember

us-gaap:SegmentDiscontinuedOperationsMember

2018-01-01

2018-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2018-01-01

2018-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2018-01-01

2018-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2018-01-01

2018-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2017-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2018-01-01

2018-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2017-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2017-01-01

2017-12-31

0000927066

srt:ConsolidationEliminationsMember

2017-01-01

2017-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2017-01-01

2017-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2017-01-01

2017-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

2016-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2016-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2017-01-01

2017-12-31

0000927066

srt:ConsolidationEliminationsMember

2016-12-31

0000927066

srt:ConsolidationEliminationsMember

us-gaap:SegmentDiscontinuedOperationsMember

2017-01-01

2017-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2017-01-01

2017-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2017-01-01

2017-12-31

0000927066

srt:ConsolidationEliminationsMember

us-gaap:SegmentContinuingOperationsMember

2017-01-01

2017-12-31

0000927066

srt:GuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentDiscontinuedOperationsMember

2017-01-01

2017-12-31

0000927066

srt:ParentCompanyMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2017-01-01

2017-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

2016-12-31

0000927066

srt:NonGuarantorSubsidiariesMember

srt:ReportableLegalEntitiesMember

us-gaap:SegmentContinuingOperationsMember

2017-01-01

2017-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2018-01-01

2018-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2016-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2019-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2018-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2017-01-01

2017-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2019-01-01

2019-12-31

0000927066

us-gaap:AllowanceForCreditLossMember

2017-12-31

iso4217:USD

xbrli:shares

xbrli:pure

xbrli:shares

dva:patient

dva:state

dva:country

iso4217:USD

dva:clinic

dva:entity

dva:segment

dva:outpatient_dialysis_center

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2019

or

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File Number: 1-14106

DAVITA INC.

(Exact name of registrant as specified in charter)

|

| | |

Delaware | | 51-0354549 |

(State of incorporation) | | (I.R.S. Employer Identification No.) |

|

| | |

2000 16th Street |

Denver, | CO | 80202 |

Telephone number (720) 631-2100

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

Title of each class: | | Trading symbol(s): | | Name of each exchange on which registered: |

Common Stock, $0.001 par value | | DVA | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

| | | | | |

Large accelerated filer | ☒ | | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 28, 2019, the aggregate market value of the Registrant's common stock outstanding held by non-affiliates based upon the closing price on the New York Stock Exchange was approximately $9.3 billion.

As of January 31, 2020, the number of shares of the Registrant’s common stock outstanding was approximately 125.6 million shares.

Documents incorporated by reference

Portions of the Registrant’s proxy statement for its 2020 annual meeting of stockholders are incorporated by reference in Part III of this Form 10-K.

DAVITA INC.

INDEX

|

| | | | |

| | | | Page No. |

| | PART I. | | |

Item 1. | | | | |

Item 1A. | | | | |

Item 1B. | | | | |

Item 2. | | | | |

Item 3. | | | | |

Item 4. | | | | |

| | | | |

| | PART II. | | |

Item 5. | | | | |

Item 6. | | | | |

Item 7. | | | | |

Item 7A. | | | | |

Item 8. | | | | |

Item 9. | | | | |

Item 9A. | | | | |

Item 9B. | | | | |

| | | | |

| | PART III. | | |

Item 10. | | | | |

Item 11. | | | | |

Item 12. | | | | |

Item 13. | | | | |

Item 14. | | | | |

| | | | |

| | PART IV. | | |

Item 15. | | | | |

Item 16. | | | | |

| | | | |

| | | | |

| | | | |

PART I

Item 1. Business

Unless otherwise indicated in this Annual Report on Form 10-K “DaVita”, “the Company” “we”, “us”, “our” and other similar terms refer to DaVita Inc. and its consolidated subsidiaries. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are made available free of charge through our website, located at http://www.davita.com, as soon as reasonably practicable after the reports are filed with or furnished to the Securities and Exchange Commission (SEC). The SEC also maintains a website at http://www.sec.gov where these reports and other information about us can be obtained. The contents of our website are not incorporated by reference into this report.

Overview of DaVita Inc.

DaVita is a leading healthcare provider focused on transforming care delivery to improve quality of life for patients globally. Incorporated as a Delaware corporation in 1994, we are one of the largest providers of kidney care services in the U.S. and have been a leader in clinical quality and innovation for over 20 years. DaVita is committed to bold, patient-centric care models, implementing the latest technologies and moving toward integrated care offerings. Over the years, we have established a value-based culture with a philosophy of caring that is focused on both our patients and teammates. This culture and philosophy fuel our continuous drive towards achieving our mission to be the provider, partner and employer of choice and fulfilling our vision to "build the greatest healthcare community the world has ever seen."

The loss of kidney function is normally irreversible. Kidney failure is typically caused by Type I and Type II diabetes, hypertension, polycystic kidney disease, long-term autoimmune attack on the kidneys and prolonged urinary tract obstruction. End stage renal disease or end stage kidney disease (ESRD or ESKD) is the stage of advanced kidney impairment that requires continued dialysis treatments or a kidney transplant to sustain life. Dialysis is the removal of toxins, fluids and salt from the blood of patients by artificial means. Patients suffering from ESRD generally require dialysis at least three times a week for the rest of their lives.

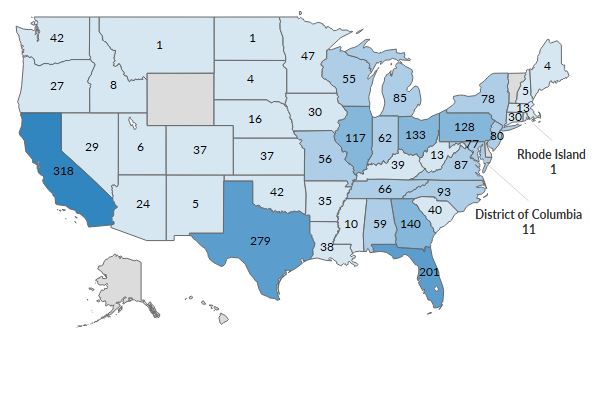

Our U.S. dialysis and related lab services (U.S. dialysis) business treats patients with chronic kidney failure and ESRD in the United States, and is our largest line of business. As of December 31, 2019, we provided dialysis and administrative services and related laboratory services throughout the U.S. via a network of 2,753 outpatient dialysis centers in 46 states and the District of Columbia, serving a total of approximately 206,900 patients and provided acute inpatient dialysis services in approximately 900 hospitals. Our robust platform to deliver kidney care services also includes established nephrology and payor relationships as well as home programs. In addition, as of December 31, 2019, we provided dialysis and administrative services to a total of 259 outpatient dialysis centers located in ten countries outside of the U.S., serving approximately 28,700 patients. The Company also consists of our ancillary services and strategic initiatives, which include the aforementioned international operations (collectively, our ancillary services), as well as our corporate administrative support.

Our patient-centric care model leverages our platform of kidney care services to maximize patient choice in both models and modalities of care. We believe that the flexibility we offer coupled with a focus on comprehensive kidney care supports our commitments to help improve clinical outcomes and quality of life for our patients. For the seventh consecutive year, we are an industry leader in the Centers for Medicare & Medicaid Services’ (CMS) Quality Incentive Program (QIP), which promotes high quality services in outpatient dialysis facilities treating patients with ESRD. We are also an industry leader for the sixth consecutive year under CMS’ Five-Star Quality Rating system, which rates eligible dialysis centers based on the quality of outcomes to help patients, their families, and caregivers make more informed decisions about where patients receive care. In addition, we are an industry leader for the total number of patients in home-based dialysis services.

Our quality clinical outcomes are driven by our experienced and knowledgeable teammates. We employ registered nurses, licensed practical or vocational nurses, patient care technicians, social workers, registered dietitians, biomedical technicians and other administrative and support teammates who strive to achieve superior clinical outcomes at our dialysis facilities. In addition to our teammates at our dialysis facilities, as of December 31, 2019, our Chief Medical Officer leads a team of 15 senior nephrologists in our physician leadership team as part of our Office of the Chief Medical Officer (OCMO). This team represents a variety of academic, clinical practice, and clinical research backgrounds. We also have a Physician Counsel that serves as an advisory body to senior management, which is composed of nine physicians with extensive experience in clinical practice, as well as eight Group Medical Directors as of December 31, 2019.

On June 19, 2019, we completed the sale of our DaVita Medical Group (DMG) business, a patient and physician-focused integrated healthcare delivery and management company, to Collaborative Care Holdings, LLC (Optum), a subsidiary of UnitedHealth Group Inc. As a result, the DMG business has been classified as discontinued operations and its results of

operations are reported as discontinued operations for all periods presented in the consolidated financial statements included in this report.

For financial information about DMG, see Note 22 to the consolidated financial statements included in this report.

U.S. dialysis business

Our U.S. dialysis business is a leading provider of kidney dialysis services for patients suffering from ESRD. As of December 31, 2019, we provided dialysis and administrative services in the U.S. through a network of 2,753 outpatient dialysis centers in 46 states and the District of Columbia, serving a total of approximately 206,900 patients. We also provide acute inpatient dialysis services in approximately 900 hospitals and related laboratory services throughout the U.S.

According to the United States Renal Data System (USRDS), there were over 523,000 ESRD dialysis patients in the U.S. in 2017. Based on the most recent 2019 annual data report from the USRDS, the underlying ESRD dialysis patient population has grown at an approximate compound rate of 3.6% from 2007 to 2017 and a compound rate of 3.3% from 2012 to 2017, which suggests that the rate of growth of the ESRD patient population is declining. A number of factors may impact ESRD growth rates, including, among others, the aging of the U.S. population, transplant rates, incidence rates for diseases that cause kidney failure such as diabetes and hypertension, mortality rates for dialysis patients and growth rates of minority populations with higher than average incidence rates of ESRD.

Since 1972, the federal government has provided healthcare coverage for ESRD patients under the Medicare ESRD program regardless of age or financial circumstances. ESRD is the first and only disease state eligible for Medicare coverage both for dialysis and dialysis-related services and for all benefits available under the Medicare program. For patients with Medicare coverage, all ESRD payments for dialysis treatments are made under a single bundled payment rate. See page 5 for further details.

Although Medicare reimbursement limits the allowable charge per treatment, it provides industry participants with a relatively predictable and recurring revenue stream for dialysis services provided to patients without commercial insurance. For the year ended December 31, 2019, approximately 90% of our total dialysis patients were covered under some form of government-based program, with approximately 74% of our dialysis patients covered under Medicare and Medicare-assigned plans.

Treatment options for ESRD

Treatment options for ESRD are dialysis and kidney transplantation.

Dialysis options

Hemodialysis, the most common form of ESRD treatment, is usually performed at a freestanding outpatient dialysis center, at a hospital-based outpatient center, or at the patient’s home. The hemodialysis machine uses an artificial kidney, called a dialyzer, to remove toxins, fluids and salt from the patient’s blood. The dialysis process occurs across a semi-permeable membrane that divides the dialyzer into two distinct chambers. While blood is circulated through one chamber, a pre-mixed fluid is circulated through the other chamber. The toxins, salt and excess fluids from the blood cross the membrane into the fluid, allowing cleansed blood to return back into the patient’s body. Each hemodialysis treatment that occurs in the outpatient dialysis centers typically lasts approximately three and one-half hours and is usually performed three times per week.

Hospital inpatient hemodialysis services are required for patients with acute kidney failure primarily resulting from trauma, patients in early stages of ESRD and ESRD patients who require hospitalization for other reasons. Hospital inpatient hemodialysis is generally performed at the patient’s bedside or in a dedicated treatment room in the hospital, as needed.

Some ESRD patients who are healthier and more independent may perform home hemodialysis in their home or residence through the use of a hemodialysis machine designed specifically for home therapy that is portable, smaller and easier to use. Patients receive training, support and monitoring from registered nurses, usually in our outpatient dialysis centers, in connection with their home hemodialysis treatment. Home hemodialysis is typically performed with greater frequency than dialysis treatments performed in outpatient dialysis centers and on varying schedules.

Peritoneal dialysis uses the patient’s peritoneal or abdominal cavity to eliminate fluid and toxins and is typically performed at home. The most common methods of peritoneal dialysis are continuous ambulatory peritoneal dialysis (CAPD)

and continuous cycling peritoneal dialysis (CCPD). Because it does not involve going to an outpatient dialysis center three times a week for treatment, peritoneal dialysis is generally an alternative to hemodialysis for patients who are healthier, more independent and desire more flexibility in their lifestyle.

CAPD introduces dialysis solution into the patient’s peritoneal cavity through a surgically placed catheter. Toxins in the blood continuously cross the peritoneal membrane into the dialysis solution. After several hours, the patient drains the used dialysis solution and replaces it with fresh solution. This procedure is usually repeated four times per day.

CCPD is performed in a manner similar to CAPD, but uses a mechanical device to cycle dialysis solution through the patient’s peritoneal cavity while the patient is sleeping or at rest.

Kidney transplantation

Although kidney transplantation, when successful, is generally the most desirable form of therapeutic intervention, the shortage of suitable donors, side effects of immunosuppressive pharmaceuticals given to transplant recipients and dangers associated with transplant surgery for some patient populations have generally limited the use of this treatment option. An executive order signed in July 2019 (the 2019 Executive Order) directed the Department of Health and Human Services (HHS) to develop policies addressing, among other things, the goal of making more kidneys available for transplant. As directed by the 2019 Executive Order, the CMS, through its Center for Medicare and Medicaid Innovation (CMMI), subsequently released the framework for certain proposed voluntary payment models that would adjust payment incentives to encourage kidney transplants. For more information regarding the 2019 Executive Order and these payment models, please see the discussion below under the heading “-New models of care and Medicare and Medicaid program reforms.”

U.S. dialysis services we provide

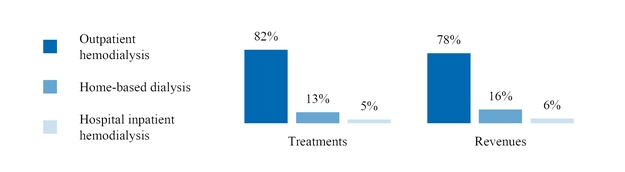

Outpatient hemodialysis services

As of December 31, 2019, we operated or provided administrative services through a network of 2,753 outpatient dialysis centers in the U.S. that are designed specifically for outpatient hemodialysis. In 2019, our overall network of U.S. outpatient dialysis centers increased by 89 primarily as a result of the opening of new dialysis centers and acquisitions, net of center closures, representing a total increase of approximately 3.3% from 2018.