|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

|

46-0687599

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

53 Forest Avenue, Old Greenwich, Connecticut 06870

|

||

|

(Address of Principal Executive Office) (Zip Code)

|

||

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Shares of Beneficial Interest, $0.01 par value per share

|

New York Stock Exchange

|

|

|

Large Accelerated Filer

|

¨

|

Accelerated Filer

|

¨

|

|

Non-Accelerated Filer

|

x

|

Smaller Reporting Company

|

¨

|

|

Item No.

|

Form 10-K Report Page

|

|

|

PART I

|

||

|

1.

|

||

|

1A.

|

||

|

1B.

|

||

|

2.

|

||

|

3.

|

||

|

4.

|

||

|

Part II

|

||

|

5.

|

||

|

6.

|

||

|

7.

|

||

|

7A.

|

||

|

8.

|

||

|

9.

|

||

|

9A.

|

||

|

9B.

|

||

|

Part III

|

||

|

10.

|

||

|

11.

|

||

|

12.

|

||

|

13.

|

||

|

14.

|

||

|

Part IV

|

||

|

15.

|

||

|

•

|

utilizing an investment model that focuses on security selection and allocates capital to assets that balance a range of mortgage-related risks;

|

|

•

|

constructing and actively managing a hybrid investment portfolio comprised primarily of Agency RMBS and, to a lesser extent, non-Agency RMBS, designed to:

|

|

•

|

take advantage of opportunities in the Agency RMBS market by acquiring Agency RMBS on a leveraged basis; and

|

|

•

|

take advantage of opportunities in the non-Agency residential mortgage market by purchasing investment grade and non-investment grade non-Agency RMBS, including senior and subordinated securities;

|

|

•

|

opportunistically acquiring and managing other mortgage- and real estate-related assets, such as MSRs and residential mortgage loans, that we would hold for appreciation and/or current income; and

|

|

•

|

opportunistically mitigating our interest rate and prepayment risk and, to a lesser extent, credit risk, by using a variety of hedging instruments.

|

|

Asset Class

|

Principal Assets

|

||

|

Agency RMBS

|

ž

|

Agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans, or "ARMs," or hybrid mortgage loans, reverse mortgages, or derivatives thereof, including:

|

|

|

ž

|

whole and partial pool mortgage pass-through certificates;

|

||

|

ž

|

Agency collateralized mortgage obligations, or "CMOs," including interest only securities, or "IOs," principal only securities, or "POs," inverse interest only securities, or "IIOs," and inverse floaters; and

|

||

|

ž

|

To-Be-Announced mortgage pass-through certificates, or "TBAs."

|

||

|

Non-Agency RMBS

|

ž

|

RMBS backed by prime jumbo, Alt-A, manufactured housing, and subprime mortgages;

|

|

|

ž

|

RMBS backed by fixed rate mortgages, ARMs, Option-ARMs, and residential mortgage loans that have interest rates that are fixed for a specified period of time (typically three, five, seven, or ten years) and, thereafter, adjust to an increment over a specified interest rate index, or "hybrid ARMs";

|

||

|

ž

|

RMBS backed by first lien and second lien mortgages;

|

||

|

ž

|

Investment grade and non-investment grade securities;

|

||

|

ž

|

Senior and subordinated securities; and

|

||

|

ž

|

Non-Agency CMOs, including IOs, POs, IIOs, and inverse floaters.

|

||

|

Other

|

ž

|

Residential mortgage loans;

|

|

|

ž

|

MSRs; and

|

||

|

ž

|

Other mortgage- and real estate-related assets, including asset-backed securities and certain hedging transactions.

|

||

|

($ in thousands)

|

Gross Unrealized

|

Weighted Average

|

|||||||||||||||||||||||||||

|

Current Principal

|

Unamortized Premium (Discount)

|

Amortized

Cost

|

Gains

|

Losses

|

Fair Value

|

Coupon

|

Yield

|

Weighted Average Life(Years)

(1)

|

|||||||||||||||||||||

|

Agency RMBS:

|

|||||||||||||||||||||||||||||

|

15-year fixed rate mortgages

|

$

|

179,906

|

|

$

|

7,153

|

|

$

|

187,059

|

|

$

|

65

|

|

$

|

(3,252

|

)

|

$

|

183,872

|

|

3.09%

|

2.52%

|

5.76

|

||||||||

|

30-year fixed rate mortgages

|

1,029,629

|

|

41,565

|

|

1,071,194

|

|

490

|

|

(28,111

|

)

|

1,043,573

|

|

3.79%

|

3.30%

|

9.80

|

||||||||||||||

|

ARMs

|

43,525

|

|

2,647

|

|

46,172

|

|

46

|

|

(103

|

)

|

46,115

|

|

4.72%

|

3.24%

|

3.79

|

||||||||||||||

|

Reverse mortgages

|

7,581

|

|

673

|

|

8,254

|

|

16

|

|

(2

|

)

|

8,268

|

|

4.85%

|

2.90%

|

3.41

|

||||||||||||||

|

IOs

|

n/a

|

n/a

|

10,718

|

|

2,841

|

|

(32

|

)

|

13,527

|

|

3.97%

|

11.79%

|

5.02

|

||||||||||||||||

|

Total Agency RMBS

|

1,260,641

|

|

52,038

|

|

1,323,397

|

|

3,458

|

|

(31,500

|

)

|

1,295,355

|

|

3.75%

|

3.26%

|

8.67

|

||||||||||||||

|

Non-Agency RMBS

|

50,006

|

|

(21,327

|

)

|

28,679

|

|

2,196

|

|

(194

|

)

|

30,681

|

|

2.84%

|

9.12%

|

5.54

|

||||||||||||||

|

Total Real Estate Securities

|

$

|

1,310,647

|

|

$

|

30,711

|

|

$

|

1,352,076

|

|

$

|

5,654

|

|

$

|

(31,694

|

)

|

$

|

1,326,036

|

|

3.72%

|

3.38%

|

8.56

|

||||||||

|

(1)

|

Average lives of RMBS are generally shorter than stated contractual maturities. Average lives are affected by the contractual maturities of the underlying mortgages, scheduled periodic payments of principal, and unscheduled prepayments of principal.

|

|

($ in thousands)

|

Gross Unrealized

|

Weighted Average

|

|||||||||||||||||||||||||||

|

Current Principal

|

Unamortized Premium (Discount)

|

Amortized

Cost

|

Gains

|

Losses

|

Fair Value

|

Coupon

|

Yield

|

Weighted Average Life(Years)

(1)

|

|||||||||||||||||||||

|

Non-Agency RMBS

|

$

|

26,890

|

|

$

|

(13,400

|

)

|

$

|

13,490

|

|

$

|

117

|

|

$

|

(11

|

)

|

$

|

13,596

|

|

2.20%

|

8.50%

|

7.80

|

||||||||

|

(1)

|

Average lives of RMBS are generally shorter than stated contractual maturities. Average lives are affected by the contractual maturities of the underlying mortgages, scheduled periodic payments of principal, and unscheduled prepayments of principal.

|

|

(In thousands)

|

Fair Value

|

|||

|

Financial derivatives–assets, at fair value:

|

||||

|

TBA securities purchase contracts

|

$

|

1

|

|

|

|

TBA securities sale contracts

|

2,262

|

|

||

|

Fixed payer interest rate swaps

|

32,700

|

|

||

|

Total financial derivatives–assets, at fair value:

|

34,963

|

|

||

|

Financial derivatives–liabilities, at fair value:

|

||||

|

TBA securities sale contracts

|

(28

|

)

|

||

|

Fixed payer interest rate swaps

|

(956

|

)

|

||

|

Swaptions

|

(85

|

)

|

||

|

Total financial derivatives–liabilities, at fair value:

|

(1,069

|

)

|

||

|

Total

|

$

|

33,894

|

|

|

|

•

|

interest rate swaps (floating-to-fixed, fixed-to-floating, or more complex swaps such as floating-to-inverse floating, callable or non-callable);

|

|

•

|

TBAs;

|

|

•

|

CMOs;

|

|

•

|

U.S. Treasury securities;

|

|

•

|

futures and forward contracts; and

|

|

•

|

other derivatives on interest rates, including swaptions and other options on any of the foregoing.

|

|

•

|

the selection, purchase, and sale of our portfolio investments;

|

|

•

|

our financing and risk management activities;

|

|

•

|

providing us with advisory services; and

|

|

•

|

providing us with a management team, inclusive of a dedicated or partially dedicated CFO and appropriate support personnel as necessary.

|

|

•

|

Cross Transactions—

defined as transactions between us or one of our subsidiaries, on the one hand, and an account (other than us or one of our subsidiaries) managed by Ellington or our Manager, on the other hand. It is Ellington's policy to engage in a cross transaction only when the transaction is in the best interests of, and is consistent with the objectives and policies of, both accounts involved in the transaction. Pursuant to the terms of the management agreement, our Manager may enter into cross transactions where it acts on our behalf and where Ellington or our Manager acts on behalf of the other party to the transaction; provided, however, that our Manager will not enter into any cross transactions on our behalf unless the cross transaction involves a "level one" asset for GAAP accounting purposes which is being crossed at market prices, or the cross transaction has received approval of a majority of our independent trustees. Although we believe such restrictions on our Manager's ability to engage in cross transactions on our behalf mitigate many risks, cross transactions, even at market prices, may potentially create a conflict of interest between our Manager's and our officers' duties to and interests in us and their duties to and interests in the other party. Subject to our Board of Trustees authorizing such action and upon written notice to our Manager, we may at any time revoke our consent to our Manager's executing cross transactions. Additionally, unless approved in advance by a majority of our independent trustees or pursuant to and in accordance with a policy that has been approved by a majority of our independent trustees, all cross transactions must be effected at the then-prevailing market prices. Pursuant to our Manager's current policies and procedures, assets for which there are no readily observable market prices may be purchased or sold in cross transactions (i) at prices based upon third-party bids received through auction, (ii) at the average of the highest bid and lowest offer quoted by third-party dealers, or (iii) according to another pricing methodology approved by our Manager's Chief Compliance Officer.

|

|

•

|

Principal Transactions—

defined as transactions between Ellington or our Manager (or any related party of Ellington or our Manager, which includes employees of Ellington and our Manager and their families), on the one hand, and us or one of our subsidiaries, on the other hand. Certain cross transactions may also be considered principal transactions whenever our Manager or Ellington (or any related party of Ellington or our Manager, which includes employees of Ellington and our Manager and their families) have a substantial ownership interest in one of the transacting parties. Our Manager is only authorized to execute principal transactions with the prior approval of a majority of our independent trustees and in accordance with applicable law. Such prior approval includes approval of the pricing methodology to be used, including with respect to assets for which there are no readily observable market prices.

|

|

•

|

Investment in Other Ellington Accounts—

pursuant to our management agreement, if we invest in any other investment fund or other investment for which Ellington or one of its affiliates receives management, origination, or structuring fees, the management fee payable by us to our Manager will be reduced by an amount equal to the applicable portion (as described in the management agreement) of any such management, origination, or structuring fees.

|

|

•

|

Split Price Executions—

pursuant to our management agreement, our Manager is authorized to combine purchase or sale orders on our behalf together with orders for other accounts managed by Ellington, our Manager or their affiliates and allocate the securities or other assets so purchased or sold, on an average price basis or other fair and consistent basis, among such accounts.

|

|

•

|

continued declines in the value of real estate;

|

|

•

|

acts of God, including earthquakes, floods, and other natural disasters, which may result in uninsured losses;

|

|

•

|

acts of war or terrorism, including the consequences of terrorist attacks, such as those that occurred on September 11, 2001;

|

|

•

|

adverse changes in national and local economic and market conditions;

|

|

•

|

changes in governmental laws and regulations, fiscal policies and zoning ordinances and the related costs of compliance with laws and regulations, fiscal policies and zoning ordinances;

|

|

•

|

costs of remediation and liabilities associated with environmental conditions such as indoor mold;

|

|

•

|

potential liabilities for other legal actions related to property ownership including tort claims; and

|

|

•

|

the potential for uninsured or under-insured property losses.

|

|

•

|

collateral cash flows and/or liability structures may be incorrectly modeled in all or only certain scenarios, or may be modeled based on simplifying assumptions that lead to errors;

|

|

•

|

information about collateral may be incorrect, incomplete, or misleading;

|

|

•

|

collateral or RMBS historical performance (such as historical prepayments, defaults, cash flows, etc.) may be incorrectly reported, or subject to interpretation (e.g. different RMBS issuers may report delinquency statistics based on different definitions of what constitutes a delinquent loan); and

|

|

•

|

collateral or RMBS information may be outdated, in which case the models may contain incorrect assumptions as to what has occurred since the date information was last updated.

|

|

•

|

interest rate hedging can be expensive, particularly during periods of rising and volatile interest rates;

|

|

•

|

available interest rate hedges may not correspond directly with the interest rate risk for which protection is sought;

|

|

•

|

the duration of the hedge may not match the duration of the related assets or liabilities being hedged;

|

|

•

|

most hedges are structured as over-the-counter contracts with private counterparties, raising the possibility that the hedging counterparty may default on their obligations;

|

|

•

|

to the extent that the creditworthiness of a hedging counterparty deteriorates, it may be difficult or impossible to terminate or assign any hedging transactions with such counterparty to another counterparty;

|

|

•

|

to the extent hedging transactions do not satisfy certain provisions of the Code and are not made through a TRS, the amount of income that a REIT may earn from hedging transactions to offset interest rate losses is limited by U.S. federal tax provisions governing REITs;

|

|

•

|

the value of derivatives used for hedging may be adjusted from time to time in accordance with accounting rules to reflect changes in fair value. Downward adjustments, or "mark-to-market losses," would reduce our earnings and our shareholders' equity;

|

|

•

|

we may fail to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the assets in the portfolio being hedged;

|

|

•

|

our Manager may fail to recalculate, re-adjust, and execute hedges in an efficient and timely manner; and

|

|

•

|

the hedging transactions may actually result in poorer over-all performance for us than if we had not engaged in the hedging transactions.

|

|

•

|

whether the market price of our shares will reflect our actual financial performance;

|

|

•

|

the liquidity of our common shares;

|

|

•

|

the ability of any holder to sell common shares; or

|

|

•

|

the prices that may be obtained for our common shares.

|

|

•

|

actual or anticipated variations in our quarterly operating results or dividends;

|

|

•

|

changes in our earnings estimates, failure to meet earnings or operating results expectations of public market analysts and investors, or publication of research reports about us or the real estate specialty finance industry;

|

|

•

|

increases in market interest rates that lead purchasers of our common shares to demand a higher yield;

|

|

•

|

passage of legislation, changes in applicable law, court rulings, enforcement actions or other regulatory developments that adversely affect us or our industry;

|

|

•

|

changes in government policies or changes in timing of implementation of government policies, including with respect Fannie Mae, Freddie Mac, and Ginnie Mae;

|

|

•

|

changes in market valuations of similar companies;

|

|

•

|

adverse market reaction to any increased indebtedness we incur in the future;

|

|

•

|

additions or departures of key management personnel;

|

|

•

|

actions by shareholders;

|

|

•

|

speculation in the press or investment community;

|

|

•

|

general market and economic conditions;

|

|

•

|

our operating performance and the performance of other similar companies; and

|

|

•

|

changes in accounting principles.

|

|

•

|

our inability to realize positive or attractive returns on our portfolio, whether because of defaults in our portfolio, decreases in the value of our portfolio, or otherwise;

|

|

•

|

margin calls or other expenditures that reduce our cash flow and impact our liquidity; and

|

|

•

|

increases in actual or estimated operating expenses.

|

|

•

|

actual receipt of an improper benefit or profit in money, property or services;

|

|

•

|

or active and deliberate dishonesty by the trustee or officer that was established by a final judgment and is material to the cause of action.

|

|

•

|

85% of our REIT ordinary income for that year;

|

|

•

|

95% of our REIT capital gain net income for that year; and

|

|

•

|

any undistributed taxable income from prior years.

|

|

Common Stock Sales Price

|

||||||||

|

2013:

|

High

|

Low

|

||||||

|

For the period from May 1, 2013 to June 30, 2013

|

$

|

19.85

|

|

$

|

16.50

|

|

||

|

Third Quarter

|

$

|

17.98

|

|

$

|

13.94

|

|

||

|

Fourth Quarter

|

$

|

16.55

|

|

$

|

14.26

|

|

||

|

Dividend Per Share

|

Record Date

|

Payment Date

|

||||||

|

For the year ended December 31, 2013:

|

||||||||

|

First Quarter

(1)

|

$

|

—

|

|

N/A

|

N/A

|

|||

|

Second Quarter

|

$

|

0.14

|

|

June 28, 2013

|

July 26, 2013

|

|||

|

Third Quarter

|

$

|

0.50

|

|

September 27, 2013

|

October 25, 2013

|

|||

|

Fourth Quarter

|

$

|

0.50

|

|

December 31, 2013

|

January 27, 2014

|

|||

|

(1)

|

On April 18, 2013, the Company's Board of Trustees declared a 3.7066% stock dividend (58,378 shares) distributable to shareholders of record as of March 31, 2013, using a price of $20.38 per share. The stock dividend was retrospectively applied to the periods reflected in the consolidated financial statements included in this Annual Report on Form 10-K.

|

|

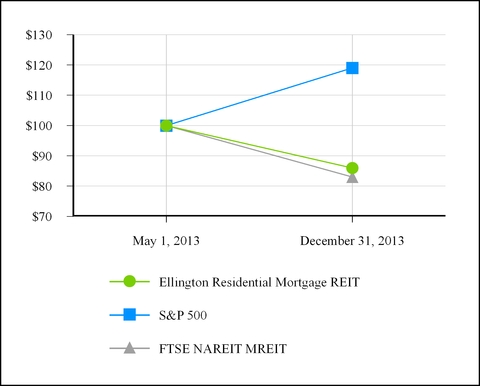

May 1, 2013

|

December 31, 2013

|

||||||

|

Ellington Residential Mortgage REIT

|

$

|

100.00

|

|

$

|

85.95

|

|

|

|

S&P 500

|

$

|

100.00

|

|

$

|

118.52

|

|

|

|

FTSE NAREIT MREIT

|

$

|

100.00

|

|

$

|

83.44

|

|

|

|

(In thousands except for per share amounts)

|

Year Ended

December 31, 2013

|

September 25, 2012 (commencement of operations) to

December 31, 2012

|

||||||

|

Net Interest Income

|

||||||||

|

Net interest income

|

$

|

24,810

|

|

$

|

239

|

|

||

|

Expenses

|

||||||||

|

Management fees

|

2,066

|

|

124

|

|

||||

|

Professional fees

|

624

|

|

125

|

|

||||

|

Organizational expenses

|

—

|

|

568

|

|

||||

|

Other operating expenses

|

1,636

|

|

45

|

|

||||

|

Total Expenses

|

4,326

|

|

862

|

|

||||

|

Other Income (Loss)

|

||||||||

|

Net realized and change in net unrealized gains (losses) on real estate securities

|

(63,602

|

)

|

87

|

|

||||

|

Net realized and change in net unrealized gains (losses) on financial derivatives

|

41,204

|

|

—

|

|

||||

|

Total Other Income (Loss)

|

(22,398

|

)

|

87

|

|

||||

|

Net Loss

|

$

|

(1,914

|

)

|

$

|

(536

|

)

|

||

|

Net Loss Per Common Share

|

$

|

(0.29

|

)

|

$

|

(0.33

|

)

|

||

|

(In thousands except share amounts)

|

December 31, 2013

|

December 31, 2012

|

||||||

|

Assets

|

Expressed in U.S. Dollars

|

|||||||

|

Cash and cash equivalents

|

$

|

50,112

|

|

$

|

18,161

|

|

||

|

Real estate securities, at fair value

|

1,326,036

|

|

13,596

|

|

||||

|

Due from brokers

|

18,347

|

|

—

|

|

||||

|

Financial derivatives–assets, at fair value

|

34,963

|

|

—

|

|

||||

|

Receivable for securities sold

|

76,692

|

|

—

|

|

||||

|

Interest receivable

|

4,766

|

|

39

|

|

||||

|

Other assets

|

174

|

|

360

|

|

||||

|

Total Assets

|

$

|

1,511,090

|

|

$

|

32,156

|

|

||

|

Liabilities and Shareholders' Equity

|

||||||||

|

Liabilities

|

||||||||

|

Repurchase agreements

|

$

|

1,310,347

|

|

$

|

—

|

|

||

|

Payable for securities purchased

|

2,776

|

|

—

|

|

||||

|

Due to brokers

|

22,788

|

|

—

|

|

||||

|

Financial derivatives–liabilities, at fair value

|

1,069

|

|

—

|

|

||||

|

Dividend payable

|

4,570

|

|

—

|

|

||||

|

Accrued expenses

|

996

|

|

1,076

|

|

||||

|

Management fee payable

|

600

|

|

116

|

|

||||

|

Interest payable

|

764

|

|

—

|

|

||||

|

Total Liabilities

|

1,343,910

|

|

1,192

|

|

||||

|

Shareholders' Equity

|

||||||||

|

Preferred shares, par value $0.01 per share, 100,000,000 shares authorized;

(0 shares issued and outstanding, respectively)

|

—

|

|

—

|

|

||||

|

Common shares, par value $0.01 per share, 500,000,000 shares authorized;

(9,139,842 and 1,633,378 shares issued and outstanding, respectively)

|

91

|

|

16

|

|

||||

|

Additional paid-in-capital

|

181,147

|

|

32,674

|

|

||||

|

Accumulated deficit

|

(14,058

|

)

|

(1,726

|

)

|

||||

|

Total Shareholders' Equity

|

167,180

|

|

30,964

|

|

||||

|

Total Liabilities and Shareholders' Equity

|

$

|

1,511,090

|

|

$

|

32,156

|

|

||

|

•

|

Federal Reserve and Monetary Policy—

In December 2013, the U.S. Federal Reserve, or the "Federal Reserve," announced its intention to reduce, beginning in January 2014, the pace of its asset purchases under its accommodative monetary policies; the timing and degree of the Federal Reserve's reduction in asset purchases, or "taper," had been the subject of heightened market speculation since mid-2013;

|

|

•

|

Housing and Mortgage Market Statistics—

Data released by S&P Indices for its S&P/Case-Shiller Home Price Indices for December 2013 showed that, on average, home prices had increased from December 2012 by 13.6% for its 10-City Composite and by 13.4% for its 20-City Composite, resulting in its best calendar year return since 2005; meanwhile, the Freddie Mac survey 30-year mortgage rate ended the year at 4.48%, up 34% from its 3.35% level at the end of 2012;

|

|

•

|

Prepayment Rate Trends—

As mortgage rates have risen over the course of the last half of 2013, Agency prepayment rates have declined

;

|

|

•

|

Government Sponsored Enterprise, or "GSE," Developments—

On December 10, 2013, the U.S. Senate confirmed Mel Watt as the next head of the Federal Housing Finance Agency, or "FHFA,";

|

|

•

|

Bank Regulatory Capital—

Recent proposed changes, if finalized, will increase regulatory capital requirements for the largest, most systemically significant U.S. banks and their holdings companies; this could potentially alter these institutions' appetite for various risk-taking activities, and could ultimately affect the terms and availability of our repurchase agreement, or "repo," financing; and

|

|

•

|

Portfolio Overview, Liquidity, and Valuations—

During 2013, Agency RMBS experienced a heightened level of volatility as uncertainty and speculation around future actions of the Federal Reserve dominated the market, while non-Agency RMBS rallied for most of 2013 as underlying strength in housing market data continued to provide support to valuations.

|

|

As of

|

||||||

|

Number of Units

(In thousands)

|

December 2013

|

December 2012

|

||||

|

Seriously Delinquent Mortgages

(1)

|

1,978

|

|

2,637

|

|

||

|

Foreclosure Inventory

|

837

|

|

1,217

|

|

||

|

(1)

|

Seriously Delinquent Mortgages are ninety days and over in delinquency and include foreclosures and REO property.

|

|

As of

|

||||||

|

Roll Rates (3 Month Moving Average)

|

October 2013

|

July 2013

|

||||

|

Current to 90+

|

0.37

|

%

|

0.35

|

%

|

||

|

90+ to Foreclosure

|

5.06

|

%

|

4.51

|

%

|

||

|

Foreclosure to Current

|

1.80

|

%

|

1.07

|

%

|

||

|

($ in thousands)

|

Gross Unrealized

|

Weighted Average

|

|||||||||||||||||||||||||||

|

Current Principal

|

Unamortized Premium (Discount)

|

Amortized

Cost

|

Gains

|

Losses

|

Fair Value

|

Coupon

|

Yield

|

Weighted Average Life(Years)

(1)

|

|||||||||||||||||||||

|

Agency RMBS:

|

|||||||||||||||||||||||||||||

|

15-year fixed rate mortgages

|

$

|

179,906

|

|

$

|

7,153

|

|

$

|

187,059

|

|

$

|

65

|

|

$

|

(3,252

|

)

|

$

|

183,872

|

|

3.09%

|

2.52%

|

5.76

|

||||||||

|

30-year fixed rate mortgages

|

1,029,629

|

|

41,565

|

|

1,071,194

|

|

490

|

|

(28,111

|

)

|

1,043,573

|

|

3.79%

|

3.30%

|

9.80

|

||||||||||||||

|

ARMs

|

43,525

|

|

2,647

|

|

46,172

|

|

46

|

|

(103

|

)

|

46,115

|

|

4.72%

|

3.24%

|

3.79

|

||||||||||||||

|

Reverse mortgages

|

7,581

|

|

673

|

|

8,254

|

|

16

|

|

(2

|

)

|

8,268

|

|

4.85%

|

2.90%

|

3.41

|

||||||||||||||

|

Interest only securities

|

n/a

|

n/a

|

10,718

|

|

2,841

|

|

(32

|

)

|

13,527

|

|

3.97%

|

11.79%

|

5.02

|

||||||||||||||||

|

Total Agency RMBS

|

1,260,641

|

|

52,038

|

|

1,323,397

|

|

3,458

|

|

(31,500

|

)

|

1,295,355

|

|

3.75%

|

3.26%

|

8.67

|

||||||||||||||

|

Non-Agency RMBS

|

50,006

|

|

(21,327

|

)

|

28,679

|

|

2,196

|

|

(194

|

)

|

30,681

|

|

2.84%

|

9.12%

|

5.54

|

||||||||||||||

|

Total Real Estate Securities

|

$

|

1,310,647

|

|

$

|

30,711

|

|

$

|

1,352,076

|

|

$

|

5,654

|

|

$

|

(31,694

|

)

|

$

|

1,326,036

|

|

3.72%

|

3.38%

|

8.56

|

||||||||

|

($ in thousands)

|

Gross Unrealized

|

Weighted Average

|

|||||||||||||||||||||||||||

|

Current Principal

|

Unamortized Premium (Discount)

|

Amortized

Cost

|

Gains

|

Losses

|

Fair Value

|

Coupon

|

Yield

|

Weighted Average Life(Years)

(1)

|

|||||||||||||||||||||

|

Non-Agency RMBS

|

$

|

26,890

|

|

$

|

(13,400

|

)

|

$

|

13,490

|

|

$

|

117

|

|

$

|

(11

|

)

|

$

|

13,596

|

|

2.20%

|

8.50%

|

7.80

|

||||||||

|

(1)

|

Average lives of MBS are generally shorter than stated contractual maturities. Average lives are affected by the contractual lives of the underlying mortgages, scheduled periodic payments of principal, and unscheduled prepayments of principal.

|

|

(In thousands)

|

Fair Value

|

|||

|

Financial derivatives–assets, at fair value:

|

||||

|

TBA securities purchase contracts

|

$

|

1

|

|

|

|

TBA securities sale contracts

|

2,262

|

|

||

|

Fixed payer interest rate swaps

|

32,700

|

|

||

|

Total financial derivatives–assets, at fair value:

|

34,963

|

|

||

|

Financial derivatives–liabilities, at fair value:

|

||||

|

TBA securities sale contracts

|

(28

|

)

|

||

|

Fixed payer interest rate swaps

|

(956

|

)

|

||

|

Swaptions

|

(85

|

)

|

||

|

Total financial derivatives–liabilities, at fair value:

|

(1,069

|

)

|

||

|

Total

|

$

|

33,894

|

|

|

|

Weighted Average

|

|||||||||

|

Remaining Days to Maturity

|

Borrowings Outstanding

|

Interest Rate

|

Remaining Days to Maturity

|

||||||

|

(In thousands)

|

|||||||||

|

30 days or less

|

$

|

338,700

|

|

0.35

|

%

|

14

|

|||

|

31-60 days

|

531,799

|

|

0.39

|

|

46

|

||||

|

61-90 days

|

326,386

|

|

0.38

|

|

72

|

||||

|

91-120 days

|

109,476

|

|

0.45

|

|

100

|

||||

|

121-150 days

|

3,986

|

|

0.56

|

|

136

|

||||

|

Total

|

$

|

1,310,347

|

|

0.38

|

%

|

49

|

|||

|

(In thousands except for per share amounts)

|

Year Ended

December 31, 2013

|

September 25, 2012 (commencement of operations) to December 31, 2012

|

||||||

|

Net Interest income

|

||||||||

|

Net interest income

|

$

|

24,810

|

|

$

|

239

|

|

||

|

Expenses

|

||||||||

|

Management fees

|

2,066

|

|

124

|

|

||||

|

Organizational expense

|

—

|

|

568

|

|

||||

|

Other operating expenses

|

2,260

|

|

170

|

|

||||

|

Total expenses

|

4,326

|

|

862

|

|

||||

|

Other Income (Loss)

|

||||||||

|

Net realized and change in net unrealized gains (losses) on real estate securities

|

(63,602

|

)

|

87

|

|

||||

|

Net realized and change in net unrealized gains (losses) on financial derivatives

|

41,204

|

|

—

|

|

||||

|

Total Other Income (Loss)

|

(22,398

|

)

|

87

|

|

||||

|

Net Loss

|

$

|

(1,914

|

)

|

$

|

(536

|

)

|

||

|

Net Loss Per Common Share

|

$

|

(0.29

|

)

|

$

|

(0.33

|

)

|

||

|

(In thousands except share amounts)

|

Year Ended

December 31, 2013

|

|||

|

Net Loss

|

$

|

(1,914

|

)

|

|

|

Less:

|

||||

|

Net realized losses on real estate securities

|

(37,456

|

)

|

||

|

Net realized gains on financial derivatives, excluding periodic payments

(1)

|

12,510

|

|

||

|

Change in net unrealized gains (losses) on real estate securities

|

(26,146

|

)

|

||

|

Change in net unrealized gains (losses) on financial derivatives, excluding accrued periodic payments

(2)

|

35,432

|

|

||

|

Subtotal

|

(15,660

|

)

|

||

|

Core Earnings

|

$

|

13,746

|

|

|

|

Weighted Average Shares Outstanding

|

6,566,656

|

|

||

|

Core Earnings Per Share

|

$

|

2.09

|

|

|

|

(1)

|

For the year ended December 31, 2013, represents Net realized gains on financial derivatives of $7,310 less Net realized gains (losses) on periodic settlements of interest rate swaps of $(5,200). See Note 5 in the notes to the consolidated financial statements.

|

|

(2)

|

For the year ended December 31, 2013, represents Net change in unrealized gains (losses) on financial derivatives of $33,894 less Change in net unrealized gains (losses) on accrued periodic settlements of interest rate swaps of $(1,538). See Note 5 in the notes to the consolidated financial statements.

|

|

($ in thousands)

|

Average Borrowed Funds

|

Interest Expense

|

Average Cost of Funds

|

Average One-Month LIBOR

|

Average Six-Month LIBOR

|

||||||||||||

|

Year Ended December 31, 2013

|

$

|

792,797

|

|

$

|

3,035

|

|

0.38

|

%

|

0.19

|

%

|

0.41

|

%

|

|||||

|

Counterparty

|

Amount at Risk

(1)

|

Weighted Average Remaining Days to Maturity

|

Percentage of Shareholders' Equity

|

||||||

|

(In thousands)

|

|||||||||

|

Deutsche Bank Securities

|

$

|

20,180

|

|

29

|

12.1

|

%

|

|||

|

J.P. Morgan Securities Inc.

|

$

|

13,919

|

|

54

|

8.3

|

%

|

|||

|

Bank of America Securities

|

$

|

11,588

|

|

69

|

6.9

|

%

|

|||

|

(1)

|

Amounts at risk exclude aggregate accrued interest of $2.3 million of net accrued interest, defined as accrued interest on securities held as collateral less interest payable on cash borrowed.

|

|

(In thousands)

|

Estimated Change in Value for a Decrease in Interest Rates by

|

Estimated Change in Value for an Increase in Interest Rates by

|

||||||||||||||

|

Category of Instruments

|

50 Basis Points

|

100 Basis Points

|

50 Basis Points

|

100 Basis Points

|

||||||||||||

|

Agency RMBS, excluding TBAs

|

$

|

35,198

|

|

$

|

65,779

|

|

$

|

(39,818

|

)

|

$

|

(84,255

|

)

|

||||

|

TBAs

|

(10,630

|

)

|

(19,779

|

)

|

12,116

|

|

25,715

|

|

||||||||

|

Non-Agency RMBS

|

447

|

|

921

|

|

(421

|

)

|

(816

|

)

|

||||||||

|

Interest Rate Swaps and Swaptions

|

(24,856

|

)

|

(50,636

|

)

|

23,932

|

|

46,940

|

|

||||||||

|

Repurchase Agreements

|

(702

|

)

|

(703

|

)

|

893

|

|

1,787

|

|

||||||||

|

Total

|

$

|

(543

|

)

|

$

|

(4,418

|

)

|

$

|

(3,298

|

)

|

$

|

(10,629

|

)

|

||||

|

Page

|

||

|

CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2013 AND DECEMBER 31, 2012, AND FOR THE YEAR ENDED DECEMBER 31, 2013 AND THE PERIOD SEPTEMBER 25, 2012 (COMMENCEMENT OF OPERATIONS) TO DECEMBER 31, 2012:

|

||

|

December 31, 2013

|

December 31, 2012

|

||||||

|

(In thousands except share amounts)

|

Expressed in U.S. Dollars

|

||||||

|

ASSETS

|

|||||||

|

Cash and cash equivalents

|

$

|

50,112

|

|

$

|

18,161

|

|

|

|

Real estate securities, at fair value

|

1,326,036

|

|

13,596

|

|

|||

|

Due from brokers

|

18,347

|

|

—

|

|

|||

|

Financial derivatives–assets, at fair value

|

34,963

|

|

—

|

|

|||

|

Receivable for securities sold

|

76,692

|

|

—

|

|

|||

|

Interest receivable

|

4,766

|

|

39

|

|

|||

|

Other assets

|

174

|

|

360

|

|

|||

|

Total Assets

|

$

|

1,511,090

|

|

$

|

32,156

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|||||||

|

LIABILITIES

|

|

||||||

|

Repurchase agreements

|

$

|

1,310,347

|

|

$

|

—

|

|

|

|

Payable for securities purchased

|

2,776

|

|

—

|

|

|||

|

Due to brokers

|

22,788

|

|

—

|

|

|||

|

Financial derivatives–liabilities, at fair value

|

1,069

|

|

—

|

|

|||

|

Dividend payable

|

4,570

|

|

—

|

|

|||

|

Accrued expenses

|

996

|

|

1,076

|

|

|||

|

Management fee payable

|

600

|

|

116

|

|

|||

|

Interest payable

|

764

|

|

—

|

|

|||

|

Total Liabilities

|

1,343,910

|

|

1,192

|

|

|||

|

SHAREHOLDERS' EQUITY

|

|||||||

|

Preferred shares, par value $0.01 per share, 100,000,000 shares authorized;

(0 shares issued and outstanding, respectively)

|

—

|

|

—

|

|

|||

|

Common shares, par value $0.01 per share, 500,000,000 shares authorized;

(9,139,842 and 1,633,378 shares issued and outstanding, respectively)

|

91

|

|

16

|

|

|||

|

Additional paid-in-capital

|

181,147

|

|

32,674

|

|

|||

|

Accumulated deficit

|

(14,058

|

)

|

(1,726

|

)

|

|||

|

Total Shareholders' Equity

|

167,180

|

|

30,964

|

|

|||

|

Total Liabilities and Shareholders' Equity

|

$

|

1,511,090

|

|

$

|

32,156

|

|

|

CONSOLIDATED STATEMENT OF OPERATIONS

|

Year Ended

December 31, 2013 |

September 25, 2012 (commencement of operations) to

December 31, 2012 |

|||||||

|

(In thousands except per share amounts)

|

Expressed in U.S. Dollars

|

|||||||

|

INTEREST INCOME (EXPENSE)

|

||||||||

|

Interest income

|

$

|

27,866

|

|

$

|

239

|

|

||

|

Interest expense

|

(3,056

|

)

|

—

|

|

||||

|

Total net interest income

|

24,810

|

|

239

|

|

||||

|

EXPENSES

|

||||||||

|

Management fees

|

2,066

|

|

124

|

|

||||

|

Professional fees

|

624

|

|

125

|

|

||||

|

Organizational expense

|

—

|

|

568

|

|

||||

|

Other operating expenses

|

1,636

|

|

45

|

|

||||

|

Total expenses

|

4,326

|

|

862

|

|

||||

|

OTHER INCOME (LOSS)

|

||||||||

|

Net realized losses on real estate securities

|

(37,456

|

)

|

(19

|

)

|

||||

|

Net realized gains on financial derivatives

|

7,310

|

|

—

|

|

||||

|

Change in net unrealized gains (losses) on real estate securities

|

(26,146

|

)

|

106

|

|

||||

|

Change in net unrealized gains (losses) on financial derivatives

|

33,894

|

|

—

|

|

||||

|

Total other income (loss)

|

(22,398

|

)

|

87

|

|

||||

|

NET LOSS

|

$

|

(1,914

|

)

|

$

|

(536

|

)

|

||

|

NET LOSS PER COMMON SHARE:

|

||||||||

|

Basic

|

$

|

(0.29

|

)

|

$

|

(0.33

|

)

|

||

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY

|

Common Shares

|

Common

Shares,

par value

|

Preferred Shares

|

Preferred Shares,

par value

|

Additional Paid-in-Capital

|

Receivable from Shareholders

|

Accumulated Deficit

|

Total

|

||||||||||||||||||||||

|

(In thousands except share amounts)

|

Expressed in U.S. Dollars

|

||||||||||||||||||||||||||||

|

BALANCE, September 25, 2012

|

100

|

|

$

|

—

|

|

—

|

|

$

|

—

|

|

$

|

1

|

|

$

|

(1

|

)

|

$

|

—

|

|

$

|

—

|

|

|||||||

|

Issuance of shares

|

1,575,000

|

|

16

|

|

—

|

|

—

|

|

31,484

|

|

31,500

|

|

|||||||||||||||||

|

Stock dividend

(1)

|

58,378

|

|

—

|

|

—

|

|

—

|

|

1,190

|

|

(1,190

|

)

|

—

|

|

|||||||||||||||

|

Repurchase of shares

|

(100

|

)

|

—

|

|

—

|

|

—

|

|

(1

|

)

|

1

|

|

—

|

|

|||||||||||||||

|

Net loss

|

(536

|

)

|

(536

|

)

|

|||||||||||||||||||||||||

|

BALANCE, December 31, 2012

|

1,633,378

|

|

$

|

16

|

|

—

|

|

$

|

—

|

|

$

|

32,674

|

|

$

|

—

|

|

$

|

(1,726

|

)

|

$

|

30,964

|

|

|||||||

|

Issuance of shares

|

7,500,000

|

|

75

|

|

—

|

|

—

|

|

149,925

|

|

150,000

|

|

|||||||||||||||||

|

Issuance of restricted shares

|

6,464

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||||||

|

Share based compensation

|

46

|

|

46

|

|

|||||||||||||||||||||||||

|

Offering costs

|

(1,498

|

)

|

(1,498

|

)

|

|||||||||||||||||||||||||

|

Dividends declared

(2)

|

(10,418

|

)

|

(10,418

|

)

|

|||||||||||||||||||||||||

|

Net loss

|

(1,914

|

)

|

(1,914

|

)

|

|||||||||||||||||||||||||

|

BALANCE, December 31, 2013

|

9,139,842

|

|

$

|

91

|

|

—

|

|

$

|

—

|

|

$

|

181,147

|

|

$

|

—

|

|

$

|

(14,058

|

)

|

$

|

167,180

|

|

|||||||

|

(1)

|

Stock dividend was declared on April 18, 2013 and was retroactively applied.

|

|

(2)

|

For the year ended December 31, 2013 cash dividends totaling

$1.14

per share were declared by the Board of Trustees.

|

|

Year Ended

December 31, 2013 |

September 25, 2012 (commencement of operations) to

December 31, 2012

|

|||||||

|

(In thousands)

|

Expressed in U.S. Dollars

|

|||||||

|

Cash flows provided by (used in) operating activities:

|

||||||||

|

Net loss

|

$

|

(1,914

|

)

|

$

|

(536

|

)

|

||

|

Reconciliation of net loss to net cash provided by (used in) operating activities:

|

||||||||

|

Net realized losses on real estate securities

|

37,456

|

|

19

|

|

||||

|

Change in net unrealized (gains) losses on real estate securities

|

26,146

|

|

(106

|

)

|

||||

|

Net realized gains on financial derivatives

|

(7,310

|

)

|

—

|

|

||||

|

Change in net unrealized (gains) losses on financial derivatives

|

(33,894

|

)

|

—

|

|

||||

|

Amortization of premiums and accretion of discounts (net)

|

3,911

|

|

(114

|

)

|

||||

|

Share based compensation

|

46

|

|

—

|

|

||||

|

(Increase) decrease in assets:

|

||||||||

|

Due from brokers

|

(18,347

|

)

|

—

|

|

||||

|

Interest receivable

|

(4,727

|

)

|

(39

|

)

|

||||

|

Other assets

|

(174

|

)

|

—

|

|

||||

|

Increase (decrease) in liabilities:

|

||||||||

|

Due to brokers

|

22,788

|

|

—

|

|

||||

|

Accrued expenses

|

281

|

|

716

|

|

||||

|

Interest payable

|

764

|

|

—

|

|

||||

|

Management fees payable

|

484

|

|

116

|

|

||||

|

Net cash provided by operating activities

|

25,510

|

|

56

|

|

||||

|

Cash flows provided by (used in) investing activities:

|

||||||||

|

Purchases of real estate securities

|

(2,889,912

|

)

|

(13,643

|

)

|

||||

|

Proceeds from sale of real estate securities

|

1,388,043

|

|

248

|

|

||||

|

Principal repayments of real estate securities

|

47,994

|

|

—

|

|

||||

|

Proceeds from investments sold short

|

2,043

|

|

—

|

|

||||

|

Repurchase of investments sold short

|

(2,036

|

)

|

—

|

|

||||

|

Proceeds from disposition of financial derivatives

|

31,276

|

|

—

|

|

||||

|

Purchase of financial derivatives

|

(23,967

|

)

|

—

|

|

||||

|

Payments made on reverse repurchase agreements

|

(4,098

|

)

|

—

|

|

||||

|

Proceeds from reverse repurchase agreements

|

4,098

|

|

—

|

|

||||

|

Net cash used in investing activities

|

(1,446,559

|

)

|

(13,395

|

)

|

||||

|

Cash flows provided by (used in) financing activities:

|

||||||||

|

Offering costs paid

|

(1,498

|

)

|

—

|

|

||||

|

Proceeds from issuance of shares

|

150,000

|

|

31,500

|

|

||||

|

Dividends

|

(5,849

|

)

|

—

|

|

||||

|

Borrowings under repurchase agreements

|

6,516,450

|

|

—

|

|

||||

|

Repayments of repurchase agreements

|

(5,206,103

|

)

|

—

|

|

||||

|

Cash provided by financing activities

|

1,453,000

|

|

31,500

|

|

||||

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

31,951

|

|

18,161

|

|

||||

|

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD

|

18,161

|

|

—

|

|

||||

|

CASH AND CASH EQUIVALENTS, END OF PERIOD

|

$

|

50,112

|

|

$

|

18,161

|

|

||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Interest paid

|

$

|

2,292

|

|

$

|

—

|

|

||

|

•

|

Level 1—inputs to the valuation methodology are observable and reflect quoted prices (unadjusted) for identical assets or liabilities in active markets,

|

|

•

|

Level 2—inputs to the valuation methodology other than quoted prices included in Level 1 are observable for the asset or liability, either directly or indirectly, and

|

|

•

|

Level 3—inputs to the valuation methodology are unobservable and significant to the fair value measurement.

|

|

($ in thousands)

|

Gross Unrealized

|

Weighted Average

|

|||||||||||||||||||||||||||

|

Current Principal

|

Unamortized Premium (Discount)

|

Amortized

Cost

|

Gains

|

Losses

|

Fair Value

|

Coupon

|

Yield

|

Weighted Average Life(Years)

(1)

|

|||||||||||||||||||||

|

Agency RMBS:

|

|||||||||||||||||||||||||||||

|

15-year fixed rate mortgages

|

$

|

179,906

|

|

$

|

7,153

|

|

$

|

187,059

|

|

$

|

65

|

|

$

|

(3,252

|

)

|

$

|

183,872

|

|

3.09%

|

2.52%

|

5.76

|

||||||||

|

30-year fixed rate mortgages

|

1,029,629

|

|

41,565

|

|

1,071,194

|

|

490

|

|

(28,111

|

)

|

1,043,573

|

|

3.79%

|

3.30%

|

9.80

|

||||||||||||||

|

Adjustable rate mortgages

|

43,525

|

|

2,647

|

|

46,172

|

|

46

|

|

(103

|

)

|

46,115

|

|

4.72%

|

3.24%

|

3.79

|

||||||||||||||

|

Reverse mortgages

|

7,581

|

|

673

|

|

8,254

|

|

16

|

|

(2

|

)

|

8,268

|

|

4.85%

|

2.90%

|

3.41

|

||||||||||||||

|

Interest only securities

|

n/a

|

n/a

|

10,718

|

|

2,841

|

|

(32

|

)

|

13,527

|

|

3.97%

|

11.79%

|

5.02

|

||||||||||||||||

|

Total Agency RMBS

|

1,260,641

|

|

52,038

|

|

1,323,397

|

|

3,458

|

|

(31,500

|

)

|

1,295,355

|

|

3.75%

|

3.26%

|

8.67

|

||||||||||||||

|

Non-Agency RMBS

|

50,006

|

|

(21,327

|

)

|

28,679

|

|

2,196

|

|

(194

|

)

|

30,681

|

|

2.84%

|

9.12%

|

5.54

|

||||||||||||||

|

Total Real Estate Securities

|

$

|

1,310,647

|

|

$

|

30,711

|

|

$

|

1,352,076

|

|

$

|

5,654

|

|

$

|

(31,694

|

)

|

$

|

1,326,036

|

|

3.72%

|

3.38%

|

8.56

|

||||||||

|

(1)

|

Average lives of RMBS are generally shorter than stated contractual maturities. Average lives are affected by the contractual maturities of the underlying mortgages, scheduled periodic payments of principal, and unscheduled prepayments of principal.

|

|

($ in thousands)

|

Gross Unrealized

|

Weighted Average

|

|||||||||||||||||||||||||||

|

Current Principal

|

Unamortized Premium (Discount)

|

Amortized

Cost

|

Gains

|

Losses

|

Fair Value

|

Coupon

|

Yield

|

Weighted Average Life(Years)

(1)

|

|||||||||||||||||||||

|

Non-Agency RMBS

|

$

|

26,890

|

|

$

|

(13,400

|

)

|

$

|

13,490

|

|

$

|

117

|

|

$

|

(11

|

)

|

$

|

13,596

|

|

2.20%

|

8.50%

|

7.80

|

||||||||

|

(1)

|

Average lives of RMBS are generally shorter than stated contractual maturities. Average lives are affected by the contractual maturities of the underlying mortgages, scheduled periodic payments of principal, and unscheduled prepayments of principal.

|

|

($ in thousands)

|

Agency RMBS

|

Agency Interest Only Securities

|

Non-Agency RMBS

|

||||||||||||||||||||||||||||||

|

Estimated Weighted Average Life

|

Fair

Value

|

Amortized Cost

|

Weighted Average Coupon

|

Fair Value

|

Amortized Cost

|

Weighted Average Coupon

|

Fair Value

|

Amortized Cost

|

Weighted Average Coupon

|

||||||||||||||||||||||||

|

Less than three years

|

$

|

5,554

|

|

$

|

5,518

|

|

5.68

|

%

|

$

|

955

|

|

$

|

762

|

|

6.48

|

%

|

$

|

1,715

|

|

$

|

1,216

|

|

2.38

|

%

|

|||||||||

|

Greater than three years and less than seven years

|

243,120

|

|

246,342

|

|

3.48

|

%

|

7,643

|

|

6,198

|

|

3.31

|

%

|

16,488

|

|

15,950

|

|

3.42

|

%

|

|||||||||||||||

|

Greater than seven years and less than eleven years

|

1,031,552

|

|

1,059,223

|

|

3.79

|

%

|

4,929

|

|

3,758

|

|

4.91

|

%

|

11,656

|

|

10,708

|

|

1.43

|

%

|

|||||||||||||||

|

Greater than eleven years

|

1,602

|

|

1,596

|

|

4.50

|

%

|

—

|

|

—

|

|

0.00

|

%

|

822

|

|

805

|

|

7.69

|

%

|

|||||||||||||||

|

Total

|

$

|

1,281,828

|

|

$

|

1,312,679

|

|

3.73

|

%

|

$

|

13,527

|

|

$

|

10,718

|

|

3.97

|

%

|

$

|

30,681

|

|

$

|

28,679

|

|

2.84

|

%

|

|||||||||

|

($ in thousands)

|

Non-Agency RMBS

|

|||||||||||

|

Estimated Weighted Average Life

|

Fair Value

|

Amortized Cost

|

Weighted Average Coupon

|

|||||||||

|

Less than three years

|

$

|

3,036

|

|

$

|

3,001

|

|

5.57

|

%

|

||||

|

Greater than three years and less than seven years

|

3,994

|

|

3,978

|

|

0.61

|

%

|

||||||

|

Greater than seven years and less than eleven years

|

3,601

|

|

3,608

|

|

1.10

|

%

|

||||||

|

Greater than eleven years

|

2,965

|

|

2,903

|

|

2.49

|

%

|

||||||

|

Total

|

$

|

13,596

|

|

$

|

13,490

|

|

2.20

|

%

|

||||

|

Year Ended

December 31, 2013

|

September 25, 2012

(commencement of operations) to

December 31, 2012 |

|||||||||||||||||||||||

|

($ in thousands)

|

Coupon Interest

|

Net Amortization

|

Interest

Income

|

Coupon Interest

|

Net Amortization

|

Interest

Income

|

||||||||||||||||||

|

Agency RMBS

|

$

|

30,504

|

|

$

|

(4,863

|

)

|

$

|

25,641

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Non-Agency RMBS

|

1,185

|

|

952

|

|

2,137

|

|

125

|

|

114

|

|

239

|

|

||||||||||||

|

Total

|

$

|

31,689

|

|

$

|

(3,911

|

)

|

$

|

27,778

|

|

$

|

125

|

|

$

|

114

|

|

$

|

239

|

|

||||||

|

(In thousands)

|

||||||||||||||||

|

Description

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Real estate securities, at fair value:

|

||||||||||||||||

|

Agency RMBS:

|

||||||||||||||||

|

15-year fixed rate mortgages

|

$

|

—

|

|

$

|

183,872

|

|

$

|

—

|

|

$

|

183,872

|

|

||||

|

30-year fixed rate mortgages

|

—

|

|

1,043,573

|

|

—

|

|

1,043,573

|

|

||||||||

|

Adjustable rate mortgages

|

—

|

|

46,115

|

|

—

|

|

46,115

|

|

||||||||

|

Reverse mortgages

|

—

|

|

8,268

|

|

—

|

|

8,268

|

|

||||||||

|

Interest only securities

|

—

|

|

—

|

|

13,527

|

|

13,527

|

|

||||||||

|

Non-Agency RMBS

|

—

|

|

—

|

|

30,681

|

|

30,681

|

|

||||||||

|

Real estate securities, at fair value

|

—

|

|

1,281,828

|

|

44,208

|

|

1,326,036

|

|

||||||||

|

Financial derivatives–assets, at fair value:

|

||||||||||||||||

|

TBAs

|

—

|

|

2,263

|

|

—

|

|

2,263

|

|

||||||||

|

Fixed payer interest rate swaps

|

—

|

|

32,700

|

|

—

|

|

32,700

|

|

||||||||

|

Total financial derivatives–assets, at fair value

|

—

|

|

34,963

|

|

—

|

|

34,963

|

|

||||||||

|

Total real estate securities and financial derivatives–assets, at fair value

|

$

|

—

|

|

$

|

1,316,791

|

|

$

|

44,208

|

|

$

|

1,360,999

|

|

||||

|

Liabilities:

|

||||||||||||||||

|

Financial derivatives–liabilities, at fair value:

|

||||||||||||||||

|

TBAs

|

$

|

—

|

|

$

|

(28

|

)

|

$

|

—

|

|

$

|

(28

|

)

|

||||

|

Fixed payer interest rate swaps

|

—

|

|

(956

|

)

|

—

|

|

(956

|

)

|

||||||||

|

Fixed payer swaptions

|

—

|

|

(85

|

)

|

—

|

|

(85

|

)

|

||||||||

|

Total financial derivatives–liabilities, at fair value

|

$

|

—

|

|

$

|

(1,069

|

)

|

$

|

—

|

|

$

|

(1,069

|

)

|

||||