|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the fiscal year ended June 28, 2017

|

Commission File No. 1-10275

|

|

|

DELAWARE

|

75-1914582

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

6820 LBJ Freeway, Dallas, Texas

|

75240

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

(972) 980-9917

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

Title of Each Class

Common Stock, $0.10 par value

|

Name of each exchange

on which registered

New York Stock Exchange

|

|

|

Large accelerated filer

|

x

|

Accelerated filer

|

¨

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

|

(Do not check if a smaller reporting company)

|

Emerging growth company

|

¨

|

||

|

Class

|

Outstanding at August 14, 2017

|

|

Common Stock, $0.10 par value

|

48,454,974 shares

|

|

Item 1

|

BUSINESS.

|

|

Fiscal 2017

Openings

|

Fiscal 2018

Projected Openings

|

||

|

Chili’s domestic:

|

|||

|

Company-owned

|

7

|

5-6

|

|

|

Franchise

|

6

|

6-8

|

|

|

Maggiano’s:

|

|||

|

Company-owned

|

2

|

1

|

|

|

Chili's international:

|

|||

|

Company-owned

|

1

|

0

|

|

|

Franchise

|

30

|

38-43

|

|

|

Total

|

46

|

50-58

|

|

|

Percentage of Franchise

Operated Restaurants

|

||||||||

|

Domestic(1)

|

International(2)

|

Overall(3)

|

||||||

|

Brinker

|

24

|

%

|

96

|

%

|

40

|

%

|

||

|

Chili’s

|

25

|

%

|

96

|

%

|

41

|

%

|

||

|

Maggiano’s

|

—

|

%

|

—

|

%

|

—

|

%

|

||

|

(1)

|

The percentages in this column are based on number of domestic franchised restaurants versus total domestic restaurants.

|

|

(2)

|

The percentages in this column are based on number of international franchised restaurants versus total international restaurants. Restaurants operated by our Mexican joint venture are included as international franchised restaurants.

|

|

(3)

|

The percentages in this column are based on the total number of franchised restaurants (domestic and international) versus total system-wide number of restaurants.

|

|

Item 1A.

|

RISK FACTORS.

|

|

Ÿ

|

inaccurate assessment of the value, future growth potential, strengths, weaknesses, contingent and other liabilities and potential profitability of such strategic initiatives;

|

|

Ÿ

|

damaging our reputation if the strategic initiatives result in products or services that are not of the same quality that our customers associate with our brands;

|

|

Ÿ

|

diversion of management’s attention and focus from existing operations to the strategic initiative;

|

|

Ÿ

|

inability to achieve projected economic and operating synergies;

|

|

Ÿ

|

challenges in successfully integrating an acquired business and instilling our company culture in new management and team members;

|

|

Ÿ

|

potential loss of key personnel of any acquired business; and

|

|

Ÿ

|

unanticipated changes in business and economic conditions affecting an acquired business or the completion of a divestiture.

|

|

Ÿ

|

increase gross sales and operating profits at existing restaurants with food and beverage options desired by our guests;

|

|

Ÿ

|

evolve our marketing and branding strategies in order to appeal to guests;

|

|

Ÿ

|

innovate and implement technology initiatives that provide a unique digital guest experience;

|

|

Ÿ

|

identify adequate sources of capital to fund and finance strategic initiatives, including reimaging of existing restaurants, new restaurant development and new restaurant equipment;

|

|

Ÿ

|

grow and expand operations, including identifying available, suitable and economically viable locations for new restaurants; and

|

|

Ÿ

|

improve the speed and quality of our service.

|

|

Ÿ

|

difficulties in achieving consistency of product quality and service as compared to U.S. operations;

|

|

Ÿ

|

changes to recipes and menu offerings to meet cultural norms;

|

|

Ÿ

|

challenges to obtain adequate and reliable supplies necessary to provide menu items and maintain food quality; and

|

|

Ÿ

|

differences, changes or uncertainties in economic, regulatory, legal, cultural, social and political conditions.

|

|

Ÿ

|

limit our ability to access capital or otherwise adversely affect the availability of other new financing on favorable terms, if at all;

|

|

Ÿ

|

result in more restrictive covenants in agreements governing the terms of any future indebtedness that we may incur;

|

|

Ÿ

|

cause us to refinance indebtedness with less favorable terms and conditions, which debt may require collateral and restrict, among other things, our ability to pay distributions or repurchase shares;

|

|

Ÿ

|

increase our cost of borrowing;

|

|

Ÿ

|

adversely affect the market price of our outstanding debt securities; and

|

|

Ÿ

|

impair our business, financial condition and results of operations.

|

|

Item 1B.

|

UNRESOLVED STAFF COMMENTS.

|

|

Item 2.

|

PROPERTIES.

|

|

Chili’s

|

||

|

Company-owned (domestic)

|

937

|

|

|

Company-owned (international)

|

14

|

|

|

Franchise

|

671

|

|

|

Maggiano’s

|

||

|

Company-owned

|

52

|

|

|

Total

|

1,674

|

|

|

Domestic

(No. of States)

|

Foreign

(No. of countries

and U.S. territories)

|

|||

|

Chili’s

|

1,252(49)

|

370(32)

|

|

|

|

Maggiano’s

|

52(22 & D.C.)

|

—

|

|

|

|

Chili’s

|

Maggiano’s

|

||

|

Square Feet

|

4,500-6,000

|

8,500 - 24,000

|

|

|

Dining Seats

|

150-252

|

240-700

|

|

|

Dining Tables

|

35-54

|

35-150

|

|

|

Item 3.

|

LEGAL PROCEEDINGS.

|

|

Item 4.

|

MINE SAFETY DISCLOSURES.

|

|

Item 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

|

High

|

Low

|

||||||

|

First Quarter

|

$

|

54.74

|

|

$

|

45.03

|

|

|

|

Second Quarter

|

$

|

55.19

|

|

$

|

47.64

|

|

|

|

Third Quarter

|

$

|

50.03

|

|

$

|

41.14

|

|

|

|

Fourth Quarter

|

$

|

45.46

|

|

$

|

36.93

|

|

|

|

High

|

Low

|

||||||

|

First Quarter

|

$

|

59.90

|

|

$

|

52.50

|

|

|

|

Second Quarter

|

$

|

52.67

|

|

$

|

43.42

|

|

|

|

Third Quarter

|

$

|

51.12

|

|

$

|

45.68

|

|

|

|

Fourth Quarter

|

$

|

47.68

|

|

$

|

43.83

|

|

|

|

Dividend Per Share

of Common Stock

|

Declaration Date

|

Record Date

|

Payment Date

|

|||

|

$0.34

|

August 18, 2016

|

September 9, 2016

|

September 29, 2016

|

|||

|

$0.34

|

November 15, 2016

|

December 9, 2016

|

December 29, 2016

|

|||

|

$0.34

|

February 9, 2017

|

March 10, 2017

|

March 30, 2017

|

|||

|

$0.34

|

May 25, 2017

|

June 12, 2017

|

June 29, 2017

|

|||

|

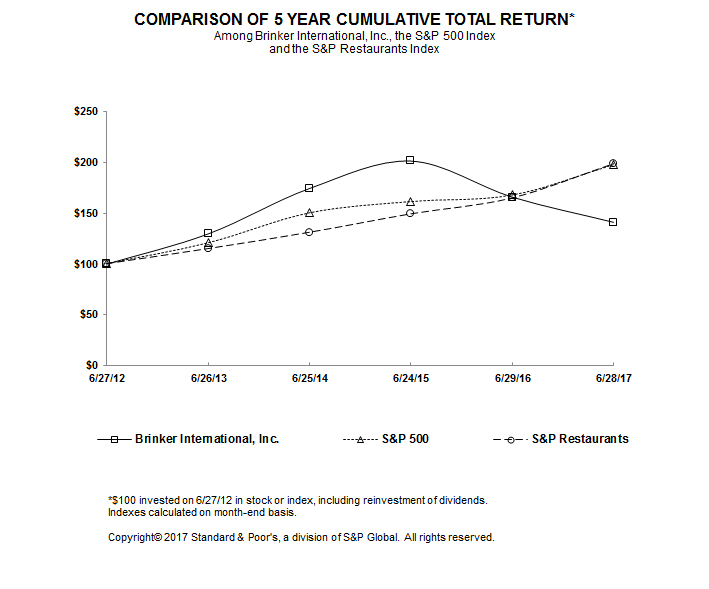

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

||||||||||||||||||

|

Brinker International

|

$

|

100.00

|

|

$

|

129.67

|

|

$

|

174.36

|

|

$

|

201.23

|

|

$

|

165.78

|

|

$

|

140.99

|

|

|||||

|

S&P 500

|

$

|

100.00

|

|

$

|

120.60

|

|

$

|

150.27

|

|

$

|

161.43

|

|

$

|

167.87

|

|

$

|

197.92

|

|

|||||

|

S&P Restaurants(1)

|

$

|

100.00

|

|

$

|

114.93

|

|

$

|

131.02

|

|

$

|

149.24

|

|

$

|

165.00

|

|

$

|

198.83

|

|

|||||

|

(1)

|

The S&P Restaurants Index is comprised of Chipotle Mexican Grill, Inc., Darden Restaurants, Inc., McDonald’s Corp., Starbucks Corporation and Yum! Brands, Inc.

|

|

Total

Number

of Shares

Purchased(a)

|

Average

Price Paid

per Share

|

Total Number

of Shares

Purchased as

Part of Publicly

Announced

Program

|

Approximate Dollar

Value that May Yet be

Purchased

Under the Program(b)

|

||||||||||

|

March 30, 2017 through May 3, 2017

|

2,089

|

|

$

|

43.90

|

|

—

|

|

$

|

135,800

|

|

|||

|

May 4, 2017 through May 31, 2017

|

—

|

|

$

|

—

|

|

—

|

|

$

|

135,800

|

|

|||

|

June 1, 2017 through June 28, 2017

|

530,169

|

|

$

|

37.74

|

|

529,648

|

|

$

|

115,804

|

|

|||

|

Total

|

532,258

|

|

$

|

37.76

|

|

529,648

|

|

||||||

|

(a)

|

These amounts include shares purchased as part of our publicly announced programs and shares owned and tendered by team members to satisfy tax withholding obligations on the vesting of restricted share awards, which are not deducted from shares available to be purchased under publicly announced programs. Unless otherwise indicated, shares owned and tendered by team members to satisfy tax withholding obligations were purchased at the average of the high and low prices of the Company’s shares on the date of vesting. During the fourth quarter of fiscal year 2017, 2,610 shares were tendered by team members at an average price of $43.50.

|

|

(b)

|

The final amount shown is as of June 28, 2017.

|

|

Item 6.

|

SELECTED FINANCIAL DATA.

|

|

Item 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

|

Item 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

|

Item 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

|

Item 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

|

Item 9A.

|

CONTROLS AND PROCEDURES.

|

|

(1)

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

|

|

(2)

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

|

|

(3)

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements.

|

|

•

|

Engaging external tax advisors to assist with the design and implementation of a remediation plan that will enhance internal control over financial reporting for income taxes;

|

|

•

|

Designing and implementing process and system improvements in our tax department that will simplify and improve manual reconciliation controls and enhance our ability to effectively train tax department personnel;

|

|

•

|

Ensuring that tax department personnel effectively collaborate with financial reporting and other key departments to gain a detailed understanding of the information, analysis, and documentation necessary for the accurate presentation of deferred income taxes.

|

|

Item 9B.

|

OTHER INFORMATION.

|

|

Item 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

|

•

|

our executive officers,

|

|

•

|

our Board of Directors, including its committees, and

|

|

•

|

our Section 16(a) reporting compliance,

|

|

Item 11.

|

EXECUTIVE COMPENSATION.

|

|

Item 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

|

Item 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

|

Item 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES.

|

|

Item 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

|

|

BRINKER INTERNATIONAL, INC.,

a Delaware corporation

|

|||

|

By:

|

/S/ JOSEPH G. TAYLOR

|

||

|

Joseph G. Taylor

Senior Vice President and Chief Financial Officer

|

|||

|

Name

|

Title

|

|

|

/S/ WYMAN T. ROBERTS

|

President and Chief Executive Officer of Brinker International (Principal Executive Officer) and Director

|

|

|

Wyman T. Roberts

|

||

|

/S/ JOSEPH G. TAYLOR

|

Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer)

|

|

|

Joseph G. Taylor

|

||

|

/S/ JOSEPH M. DEPINTO

|

Chairman of the Board

|

|

|

Joseph M. DePinto

|

||

|

/S/ ELAINE L. BOLTZ

|

Director

|

|

|

Elaine L. Boltz

|

||

|

/S/ HARRIET EDELMAN

|

Director

|

|

|

Harriet Edelman

|

||

|

/S/ MICHAEL A. GEORGE

|

Director

|

|

|

Michael A. George

|

||

|

/S/ WILLIAM T. GILES

|

Director

|

|

|

William T. Giles

|

||

|

/S/ GERARDO I. LOPEZ

|

Director

|

|

|

Gerardo I. Lopez

|

||

|

/S/ GEORGE R. MRKONIC

|

Director

|

|

|

George R. Mrkonic

|

||

|

/S/ JOSE LUIS PRADO

|

Director

|

|

|

Jose Luis Prado

|

||

|

|

Page

|

|

Selected Financial Data

|

F-1

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

F-2

|

|

Consolidated Statements of Comprehensive Income—Fiscal Years Ended June 28, 2017, June 29, 2016 and June 24, 2015

|

F-15

|

|

Consolidated Balance Sheets— June 28, 2017 and June 29, 2016

|

F-16

|

|

Consolidated Statements of Shareholders’ (Deficit) Equity—Fiscal Years Ended June 28, 2017, June 29, 2016 and June 24, 2015

|

F-17

|

|

Consolidated Statements of Cash Flows—Fiscal Years Ended June 28, 2017, June 29, 2016 and June 24, 2015

|

F-18

|

|

Notes to Consolidated Financial Statements

|

F-19

|

|

Reports of Independent Registered Public Accounting Firm

|

F-41

|

|

Management’s Responsibility for Consolidated Financial Statements

|

F-43

|

|

Management’s Report on Internal Control over Financial Reporting

|

F-43

|

|

Exhibit

|

||

|

3(a)

|

Certificate of Incorporation of the Registrant, as amended.(1)

|

|

|

3(b)

|

Bylaws of the Registrant.(2)

|

|

|

4(a)

|

Form of 2.600% Note due 2018.(3)

|

|

|

4(b)

|

Form of 3.875% Note due 2023.(3)

|

|

|

4(c)

|

Indenture between the Registrant and Wilmington Trust, National Association, as Trustee.(4)

|

|

|

4(d)

|

First Supplemental Indenture between Registrant and Wilmington Trust, National Association.(3)

|

|

|

4(e)

|

Second Supplemental Indenture between Registrant and Wilmington Trust, National Association.(3)

|

|

|

4(f)

|

Form of 5.000% Senior Note due 2024.(5)

|

|

|

4(g)

|

Indenture dated as of September 23, 2016, by and among the Company, the Guarantors named therein and U.S. Bank National Association, as trustee.(5)

|

|

|

10(a)

|

Registrant’s Stock Option and Incentive Plan.(6)

|

|

|

10(b)

|

Registrant’s 1999 Stock Option and Incentive Plan for Non-Employee Directors and Consultants.(7)

|

|

|

10(c)

|

Registrant’s Performance Share Plan Description.(8)

|

|

|

10(d)

|

Credit Agreement dated as of March 12, 2015, by and among Registrant, Brinker Restaurant Corporation, Bank of America, N.A., Merrill Lynch, Pierce, Fenner & Smith Incorporated, J.P. Morgan Securities, LLC, Regions Capital Markets, a Division of Regions Bank, Wells Fargo Securities, LLC, J.P. Morgan Chase Bank, N.A., Regions Bank, Compass Bank, Wells Fargo Bank, National Association, The Bank of Tokyo - Mitsubishi UFJ, Ltd., U.S. Bank National Association and Greenstone Farm Credit Services.(9)

|

|

|

10(e)

|

Second Amendment to Credit Agreement dated September 13, 2016, by and among Registrant and its wholly-owned subsidiaries, Brinker Restaurant Corporation, Brinker Florida, Inc., Brinker Texas, Inc., Bank of America, N.A., JPMorgan Chase Bank, N.A., Wells Fargo Bank, N.A., The Bank of Tokyo-Mitsubishi UFJ, Ltd., U.S. Bank National Association, Regions Bank, Compass Bank, Greenstone Farm Credit Services ACA, SunTrust Bank, and Barclays Bank PLC.(10)

|

|

|

10(f)

|

Registrant's 2017 Performance Share Plan Description.(11)

|

|

|

10(g)

|

Severance and Change in Control Agreement.(12)

|

|

|

10(h)

|

Executive Severance Benefits Plan and Summary Plan Description.(12)

|

|

|

10(i)

|

Change in Control Severance Agreement.(12)

|

|

|

10(j)

|

Registrant's 2018 Performance Share Plan.(13)

|

|

|

10(k)

|

Registrant's Terms of F2018 Stock Option Award.(14)

|

|

|

10(l)

|

Registrant's Terms of F2018 Retention Stock Unit Award.(15)

|

|

|

10(m)

|

Registrant's Terms of F2018 Restricted Stock Unit Award.(16)

|

|

|

10(n)

|

Registrant's Terms of CEO Special Equity Award.(17)

|

|

|

13

|

2017 Annual Report to Shareholders.(18)

|

|

|

21

|

Subsidiaries of the Registrant.(19)

|

|

|

23

|

Consent of Independent Registered Public Accounting Firm.(19)

|

|

|

31(a)

|

Certification by Wyman T. Roberts, President and Chief Executive Officer of the Registrant, pursuant to 17 CFR 240.13a-14(a) or 17 CFR 240.15d-14(a).(19)

|

|

|

31(b)

|

Certification by Joseph G. Taylor, Senior Vice President and Chief Financial Officer of the Registrant, pursuant to 17 CFR 240.13a-14(a) or 17 CFR 240.15d-14(a).(19)

|

|

|

32(a)

|

Certification by Wyman T. Roberts, President and Chief Executive Officer of the Registrant, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.(19)

|

|

|

32(b)

|

Certification by Joseph G. Taylor, Senior Vice President and Chief Financial Officer of the Registrant, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.(19)

|

|

|

99(a)

|

Proxy Statement of Registrant.(20)

|

|

|

101.INS

|

XBRL Instance Document

|

|

|

101.SCH

|

XBRL Schema Document

|

|

|

101.CAL

|

XBRL Calculation Linkbase Document

|

|

|

101.DEF

|

XBRL Definition Linkbase Document

|

|

|

101.LAB

|

XBRL Label Linkbase Document

|

|

|

101.PRE

|

XBRL Presentation Linkbase

|

|

|

(1)

|

Filed as an exhibit to annual report on Form 10-K for year ended June 28, 1995 and incorporated herein by reference.

|

|

(2)

|

Filed as an exhibit to current report on Form 8-K dated August 26, 2014 and incorporated herein by reference.

|

|

(3)

|

Filed as an exhibit to current report on Form 8-K dated May 15, 2013 and incorporated herein by reference.

|

|

(4)

|

Filed as an exhibit to registration statement on Form S-3 filed April 30, 2013, SEC File No. 333-188252, and incorporated herein by reference.

|

|

(5)

|

Filed as an exhibit to current report on Form 8-K dated September 23, 2016 and incorporated herein by reference.

|

|

(6)

|

Filed as an Appendix A to Proxy Statement of Registrant filed on September 17, 2013 and incorporated herein by reference.

|

|

(7)

|

Filed as an exhibit to quarterly report on Form 10-Q for the quarter ended December 28, 2005 and incorporated herein by reference.

|

|

(8)

|

Filed as an exhibit to quarterly report on Form 10-Q for the quarter ended March 29, 2006 and incorporated herein by reference.

|

|

(9)

|

Filed as an exhibit to current report on Form 8-K dated March 12, 2015 and incorporated herein by reference.

|

|

(10)

|

Filed as an exhibit to quarterly report on Form 10-Q for quarter ended September 28, 2016 and incorporated herein by reference.

|

|

(11)

|

Filed as an exhibit to current report on Form 8-K dated August 18, 2016 and incorporated herein by reference.

|

|

(12)

|

Filed as an exhibit to quarterly report on Form 10-Q for the quarter ended March 29, 2017 and incorporated herein by reference.

|

|

(13)

|

Filed herewith.

|

|

(14)

|

Filed herewith.

|

|

(15)

|

Filed herewith.

|

|

(16)

|

Filed herewith.

|

|

(17)

|

Filed herewith.

|

|

(18)

|

Portions filed herewith, to the extent indicated herein.

|

|

(19)

|

Filed herewith.

|

|

(20)

|

To be filed on or about September 27, 2017.

|